Exhibit 15.3

| | | | | | | | | | | | | | |

| | | | |  |

| | | In the Strategic report | |  |

| | | | | | | | | | | | |

| | | Our new CEO discusses 2017 performance and our new long-term priorities | |  | | | | Measuring performance and managing risk | |  | |

| | | > See pages 05–07 | | | | | > See pages 18–21 | | |

| | | | | | | | | | | | | |

| | | How we createlong-term value | |  | | | | Innovation and Performance in each of our three businesses | |  | | |

| | | > See pages 08–09 | | | | | > See pages 22–41 | | | |

| | | | | | | | | | | | | |

| | | Industry trends | |  | | | | How our three businesses together contribute to our Trust priority | |  | | |

| | | > See pages 10–11 | | | | | > See pages 42–51 | | | |

| | | | | | | | | | | | | |

| | | Our new long-term priorities: Innovation, Performance and Trust | |  | | | | Financial review | |  | | |

| | | > See pages 12–17 | | | | | > See pages 52–78 | | | |

| | | Cover image | | Cautionary statement | | |

| | | 30 years after developing the first HIV medicine, our research into treatment and prevention of HIV continues. We remain at the forefront of helping people living with HIV, driving innovation and working with communities all over the world. | | See the inside back cover of this document for the cautionary statement regarding forward- looking statements. | | |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | | | |

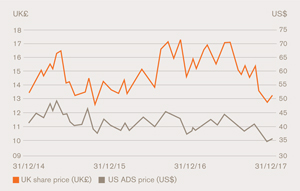

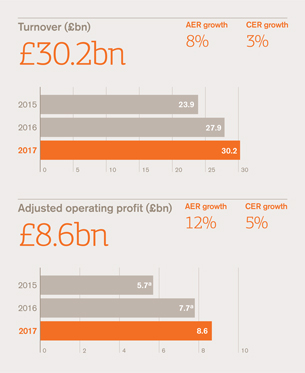

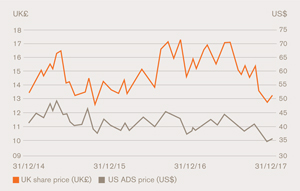

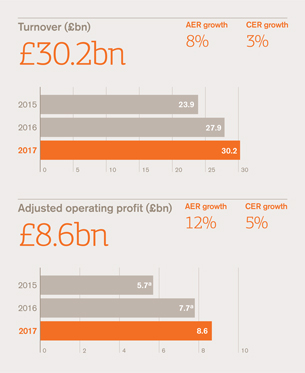

Our financial performance in 2017a |

| | | |

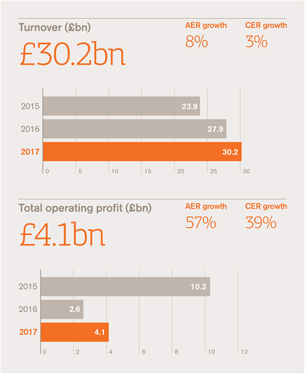

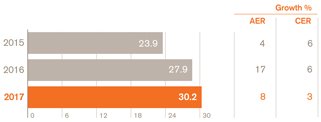

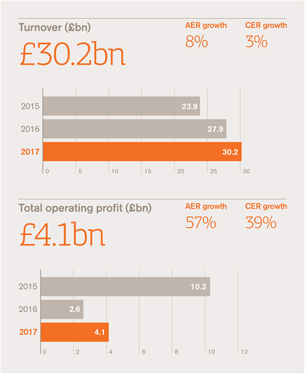

| £30.2bn | | AER +8% CER +3% | | £6.7bn | | AER +51% CER +44% |

Group turnover | | | New product salesb | |

| | |

| | | |

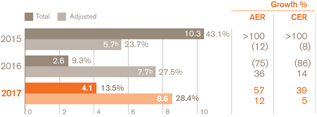

| £4.1bn | | AER +57% CER +39% | | £8.6bn | | AER +12% CER +5% |

Total operating profit | | | Adjusted operating profit | |

| | |

| | | |

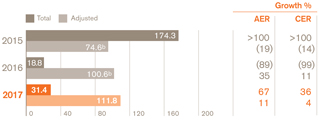

| 31.4p | | AER +67% CER +36% | | 111.8p | | AER +11% CER +4% |

Total earnings per share | | | Adjusted earnings per share | |

| | | | | | |

| | | |

| £6.9bn | | £3.4bn | | £3.9bn | | 80p |

Net cash flow from operating activities | | Free cash flow | | Dividends declared for 2017 | | 2017 dividend per share |

| | | | | | | | | | | | | | |

Strategic report | | | | Remuneration report | | | | Investor information |

At a glance Chairman’s statement CEO’s statement How we create long-term value Industry trends Our long-term priorities How we measure success How we manage risk Pharmaceuticals Vaccines Consumer Healthcare Trust Group financial review | | 02 04 05 08 10 12 18 20 22 30 36 42 52 | | | | Chairman’s annual statement | | 114 | | | | Quarterly trend Five year record Product development pipeline Product, competition and intellectual property Principal risks and uncertainties Share capital and control Dividends Financial calendar Annual General Meeting 2018 Tax information for shareholders Shareholder services and contacts US law and regulation Group companies Glossary of terms | | 244 248 251 254 257 267 269 269 270 270 272 274 276 287 |

| | | | | Annual report on remuneration | | 116 | | | | |

| | | | | 2017 Remuneration policy summary | | 142 | | | | |

| | | | | | | | | | | |

| | | | | Financial statements | | | | |

| | | | | Directors’ statement of | | | | | | |

| | | | | responsibilities | | 148 | | | | |

| | | | | Independent Auditor’s report | | 149 | | | | |

| | | | | Financial statements | | 158 | | | | |

| | | | | Notes to the financial statements | | 162 | | | | |

| | | | | Financial statements of | | | | | | |

| | | | | GlaxoSmithKline plc prepared | | | | | | |

| | | | | under UK GAAP | | 233 | | | | |

| | | | | | | | | | | | |

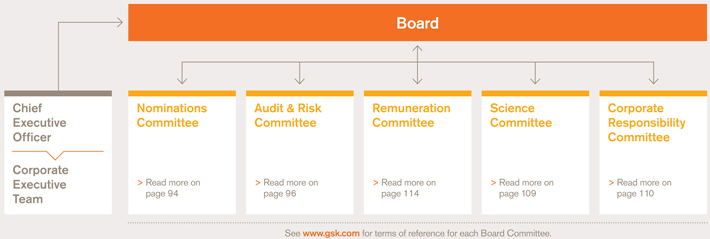

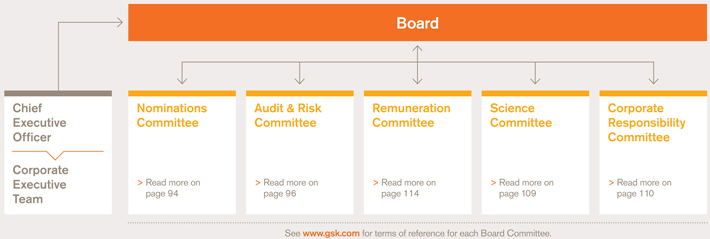

Governance | | | | | | | | |

| | | | | | | | | |

Chairman’s Governance statement | | 80 | | | | Footnotes a AER growth rates represent growth at actual exchange rates. We use a number of adjusted,non-IFRS, measures to report the performance of our business, as described on page 58, including Adjusted results, free cash flow and CER growth rates. These measures are used by management for planning and reporting purposes and may not be directly comparable with similarly described measures used by other companies. Adjusted results exclude a number of items and are presented as management believes that Adjusted results allow the key trends and factors driving that performance to be more easily and clearly identified by shareholders.Non-IFRS measures may be considered in addition to, but not as a substitute for or superior to, information presented in accordance with IFRS. A reconciliation of Total results to Adjusted results is set out on page 67. b As defined in 2015, new products are as follows: Pharmaceuticals:Relvar/Breo Ellipta, Incruse Ellipta, Anoro Ellipta, Arnuity Ellipta, Eperzan/Tanzeum, Nucala, Tivicay, Triumeq. Vaccines: Menveo, Bexsero, Shingrix. |

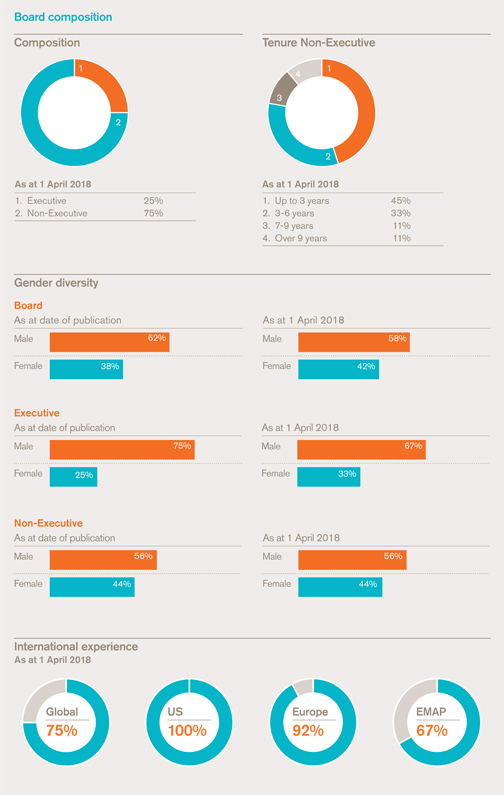

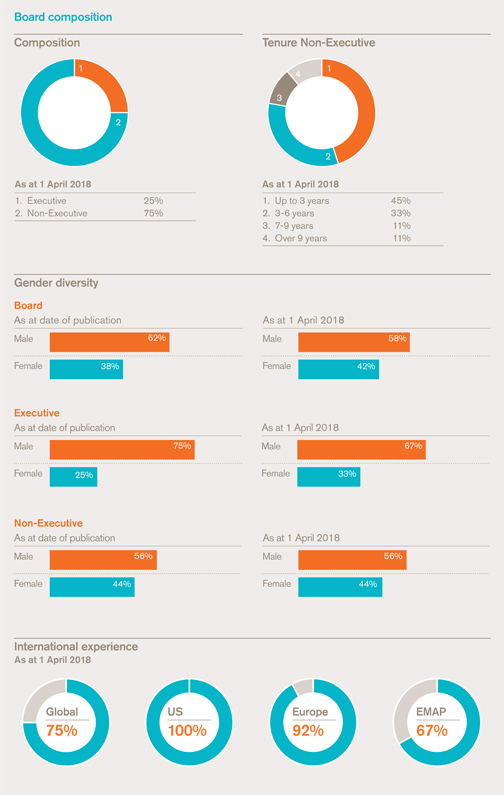

Our Board | | 82 | | | |

Our Corporate Executive Team | | 86 | | | |

Leadership and effectiveness | | 88 | | | |

Nominations Committee report | | 94 | | | |

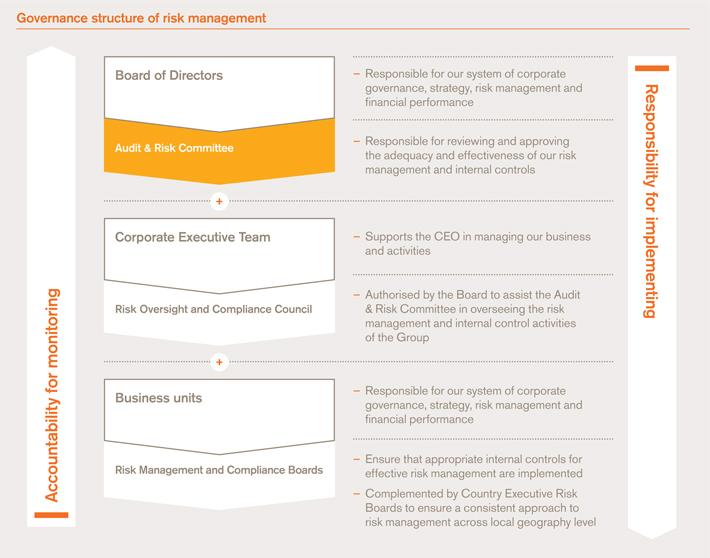

Accountability | | 96 | | | |

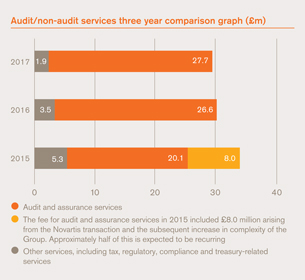

Audit & Risk Committee report | | 96 | | | |

Relations with stakeholders | | 107 | | | |

Science Committee report | | 109 | | | |

Corporate Responsibility | | | | | |

Committee report | | 110 | | | |

| | |

| 02 | | |

GSK Annual Report 2017 | | |

| | |

| | |

GSK at a glance

|

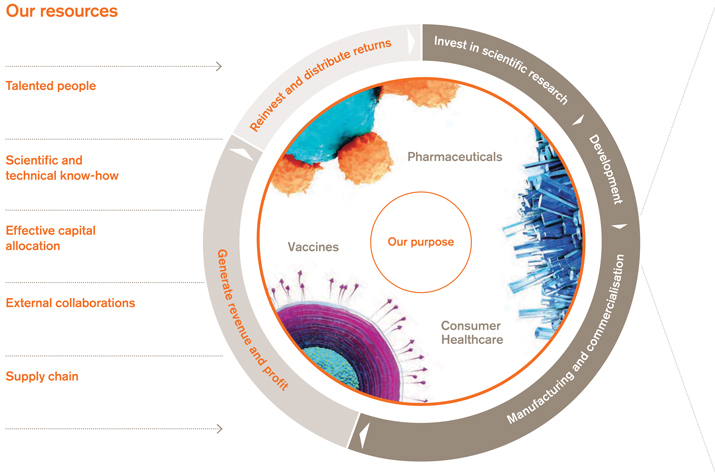

Our purpose |

|

| To help people do more, feel better and live longer. |

|

Our goal |

|

| To be one of the world’s most innovative, best performing and trusted healthcare companies. |

|

Our strategy |

|

| Bring differentiated, high-quality and needed healthcare products to as many people as possible, with our three global businesses, scientific and technicalknow-how and talented people. |

|

Our values and expectations |

|

| Our values and expectations are at the heart of everything we do and form an important part of our culture. |

| | |

Our values | | Our expectations |

Patient focus | | Courage |

Transparency | | Accountability |

Respect | | Development |

Integrity | | Teamwork |

| | | | |

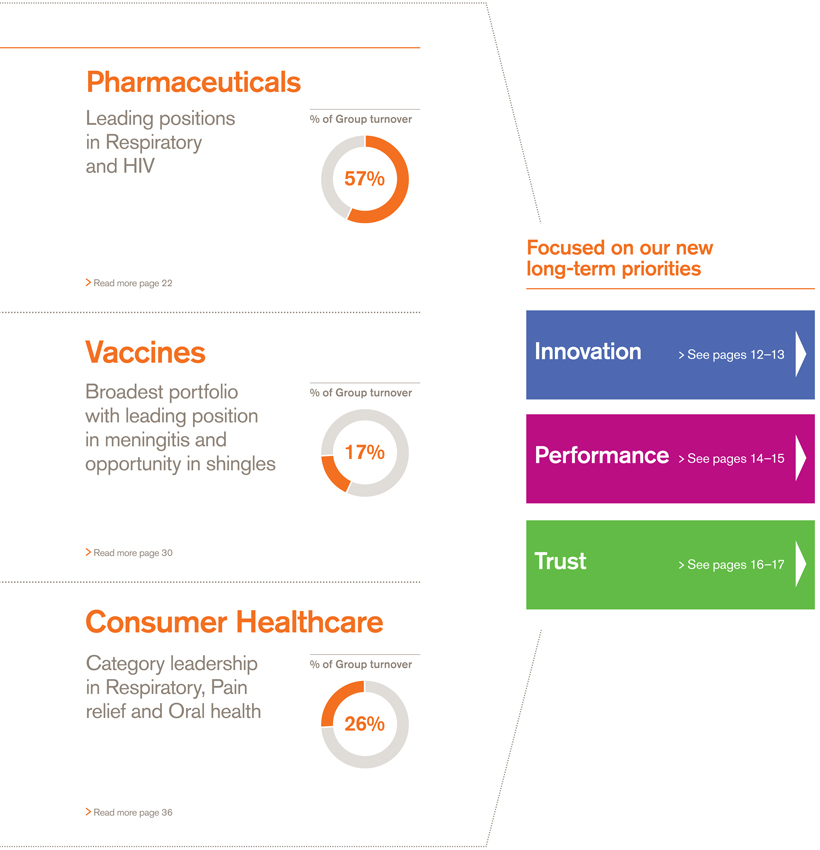

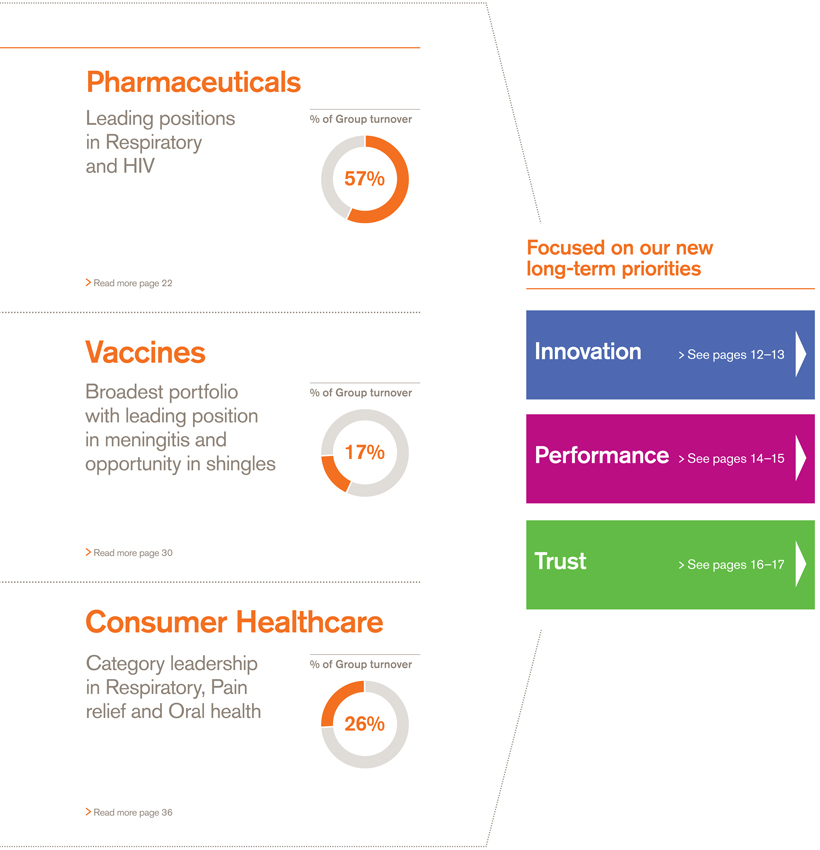

| | | | Three global businesses |

| | | |

| | |

Immune system T-cells attacking a cancer cell |

| | |

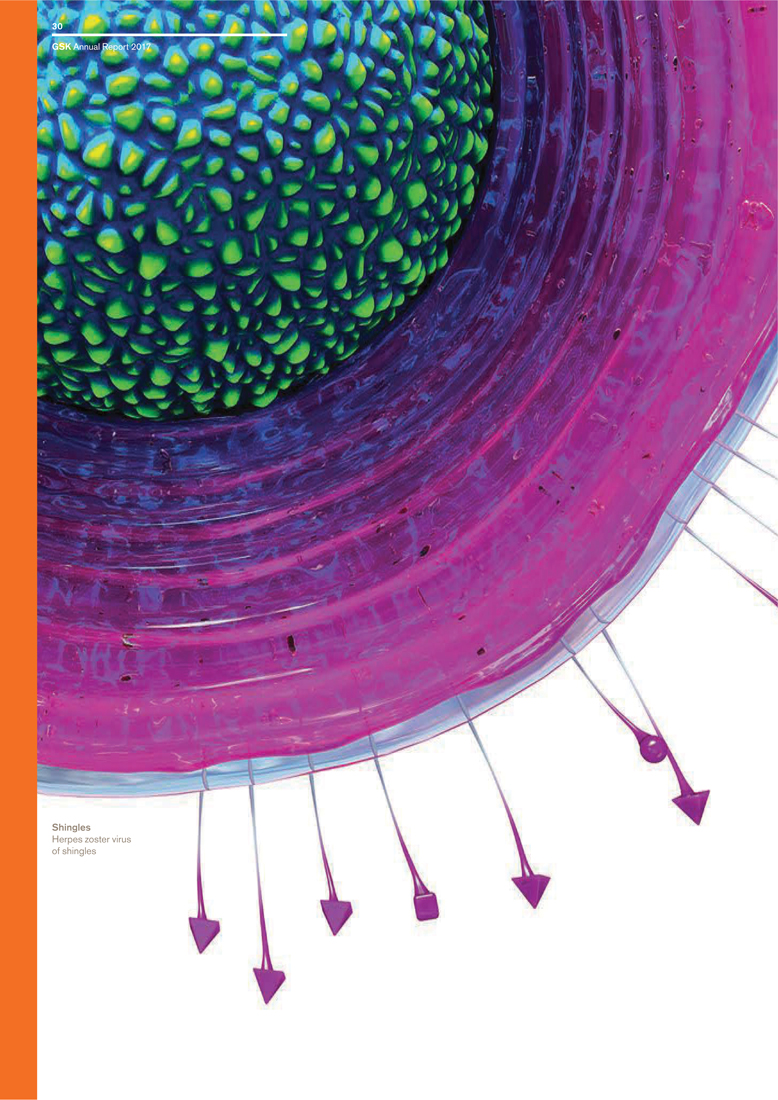

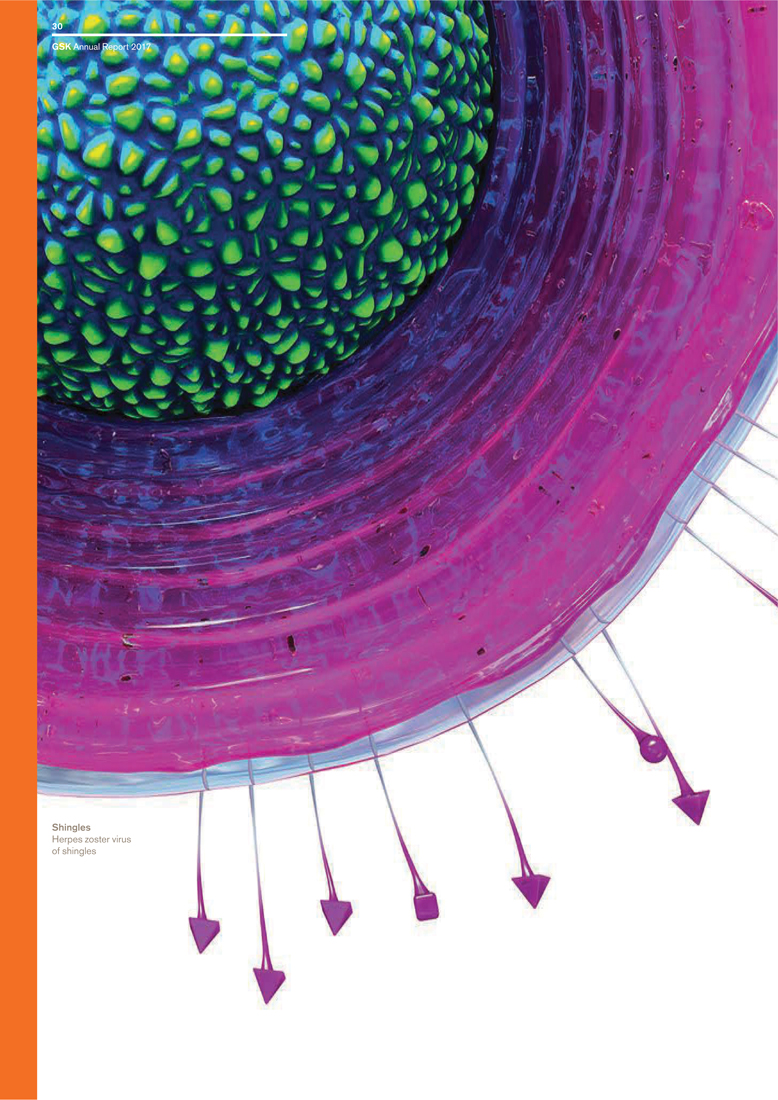

Herpes zoster virus of shingles |

| | |

Novamin, a Key technology in Sensodyne Repair and Protect |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | |

| 04 | | |

GSK Annual Report 2017 | | |

| | |

| | |

Chairman’s statement

| | |

| | “The Board believes the renewed focus on innovation will enable GSK to capitalise on the opportunities in our industry to drive long-term value for investors.” Philip Hampton Chairman |

I am pleased to report another year of good performance with sales and earnings growth, some important new product approvals and continued cash returns to shareholders in line with expectations.

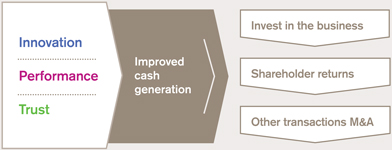

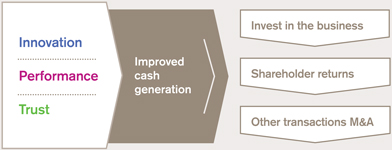

Following Emma Walmsley’s appointment as CEO, from April 2017, the Board conducted a review of the company’s strategy with management in the context of the operating environment and industry dynamics in global healthcare. In July, Emma presented the new strategy to investors setting out long-term priorities under three main headings – Innovation, Performance and Trust. Our top priority is to improve performance in the pharmaceuticals business and to seek more growth from pharmaceuticals R&D. The Board believes the renewed focus on innovation will enable GSK to capitalise on the opportunities in our industry to drive long-term value for investors.

Early progress against the strategy has been encouraging and the Board is closely engaged with management on its delivery.

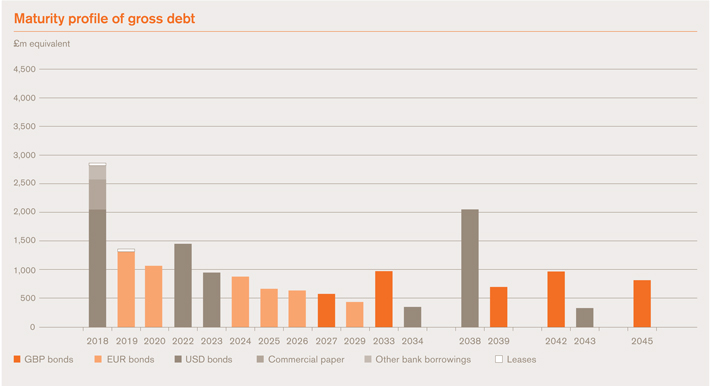

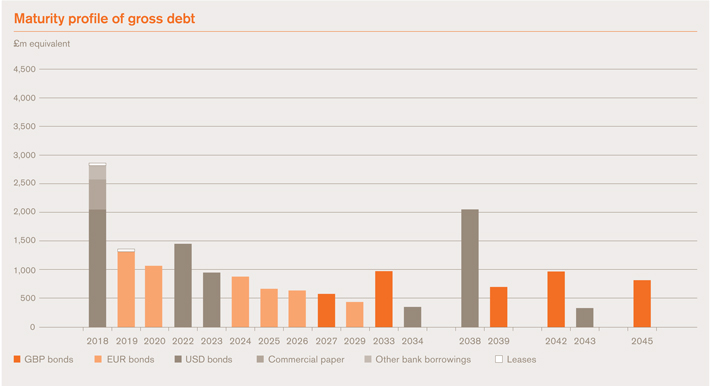

Capital allocation

The company now has a new capital allocation framework to help shape our strategic priorities. Improving our pipeline of new pharmaceutical products is our main priority and the company has the potential for a marked improvement in performance. We will also invest behind key products in our vaccines business which we expect to drive growth in the coming years. In addition, we may invest further in our Consumer joint venture if our partner Novartis decides to exercise their option to sell their interests to us. Dividends represent an allocation of capital and the Board is mindful of the value that many shareholders attach to dividends. Under our framework, any material acquisitions have a lower priority and would have to meet our strict returns criteria.

Cash generation remains a key focus for the Board and we were pleased to see increased free cash flow for the year. We approved a dividend of 80p per share for 2017 and expect the same for 2018.

I noted in my first letter to shareholders two years ago that cash dividends were in excess of free cash flow generation and that is still the case. The Board has, over time, established a policy of achieving cash dividend cover in the range 1.25x – 1.5x, since investment in growth opportunities should be funded at least in part by cash retentions in the business.

Culture

Central to ensuring long-term delivery against the strategy is developing a culture which rewards high performance but also seeks to build on the values of the company. The Board was pleased to see employees support this, with a marked increase in employee engagement scores. In the past, there have been some instances where our commercial practices have been disappointing, leading to regulatory intervention. The Board has focused on improving both the framework and the culture for our control environment.

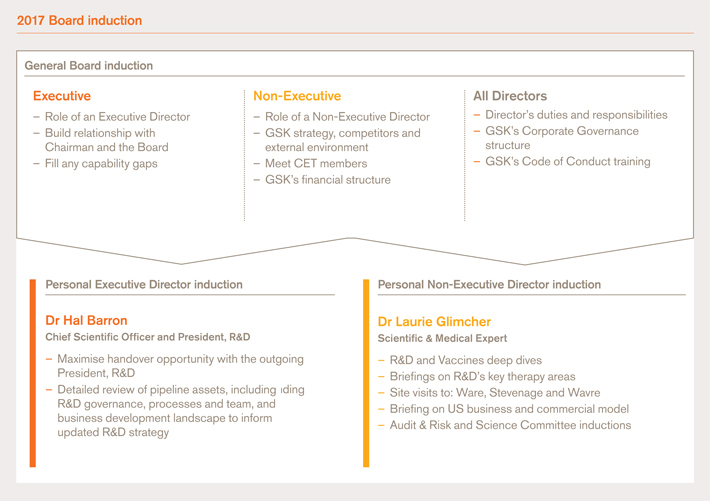

Executive team

Following the announcement of Emma as our new CEO, the Board was involved with other top executive appointments. Dr Hal Barron, our new Chief Scientific Officer and President, R&D, has joined the Board. We have a new President, Global Pharmaceuticals, Luke Miels; and a new Chief Digital and Technology Officer, Karenann Terrell. The Board has taken a keen interest in the balance between external recruits, and the development of internal succession planning.

Financial reporting

The Board is mindful of the need to provide clear financial reports. In 2017 we reviewed aspects of our financial reporting framework and made changes to ensure we remain in line with both the latest regulatory requirements and best practice in the industry. Commercial structures and reporting requirements sometimes lead to more complexity in reporting than we would like but we make great efforts to simplify and clarify where possible.

Board changes during the year

We continue to bring in new skills and capabilities to the Board. During the year, we welcomed Dr Laurie Glimcher as an IndependentNon-Executive Director and Scientific and Medical Expert. At this year’s AGM, Professor Sir Roy Anderson, who joined the Board in 2007, will step-down. I thank Roy for his excellent contribution, both in his special areas of scientific knowledge, but also more broadly. Dr Patrick Vallance will also step down from the Board at the end of March and leave GSK to become the Chief Scientific Adviser to the UK Government. Patrick has been a fine leader and Board colleague. Sir Andrew Witty and Dr Moncef Slaoui both stepped down after long careers with the company. I thanked them both in my last letter.

The new Science Committee made good progress last year. This is crucial as we enter an important phase for the pipeline in our pharmaceutical and vaccines activities over the next 2 to 3 years. Dr Barron will be working closely with the Committee.

I would like to thank all of GSK’s employees and partners for their hard work throughout 2017 and our shareholders and customers for their continued support and look forward to a successful 2018.

Philip Hampton

Chairman

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

CEO’s statement

| | |

| | “Our ambition is to drive a high-performance culture, putting science at the heart of GSK, remaining true to our values and our purpose: to help people do more, feel better, live longer.” Emma Walmsley Chief Executive Officer |

| | | | |

| | | Our long-term priorities | | |

| | | |

| | | Innovation | | > See page 12 |

| | | |

| | | Performance | | > See page 14 |

| | | |

| | | Trust | | > See page 16 |

| | |

| | |

| | | | |

| | | Our three businesses |

| | | |

| | | Pharmaceuticals | | > See page 22 |

| | | |

| | | Vaccines | | > See page 30 |

| | | |

| | | Consumer Healthcare | | > See page 36 |

| | | |

I’m delighted to be introducing GSK’s 2017 Annual Report; my first as CEO.

Since starting in this role it has become increasingly clear to me that while the healthcare industry remains an attractive sector, it is entering a period of significant change bringing both challenges and opportunities. In addition, despite improved delivery in recent years, it is also clear there are several areas of the company that need to be strengthened.

That’s why, in July, I set out three long-term priorities which everyone in the company is focused on: Innovation, Performance and Trust. I believe these priorities enable us to focus on areas we can improve and allow us to respond more effectively to our operating environment. They will focus us on delivering improved performance and better returns for shareholders over both the short and long term, as well as a broader societal contribution.

2017 performance

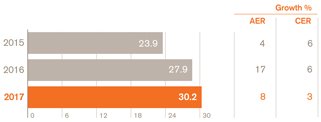

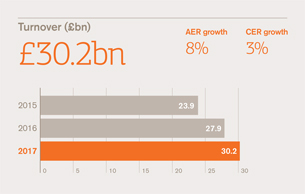

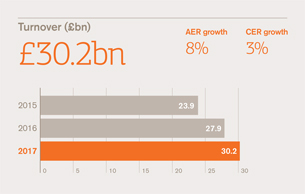

Group sales were £30.2 billion, up 8% at actual rates and 3% at constant exchange rates (CER), with growth across all three businesses. This is the first time Group sales have reached more than £30 billion in a year.

New Pharmaceutical and Vaccine product sales were £6.7 billion, with continued strong performances from our HIV medicines,Tivicay andTriumeq, ourEllipta portfolio and biologic medicine Nucala in Respiratory, and our meningitis vaccines.

The performance of these new products is a great demonstration of what we can achieve when our commercial organisation has clear focus.

Footnote

We use a number of adjusted,non-IFRS, measures to report performance, as described on page 58.

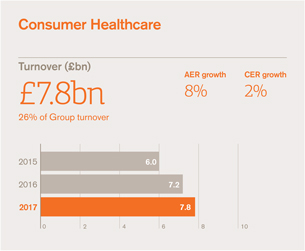

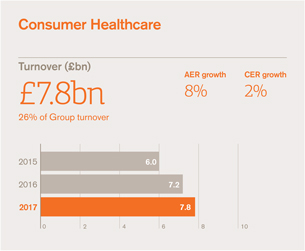

Consumer Healthcare sales were driven by our power brands which continued to outpace market growth. Sales from new GSK innovations represented approximately 13% of turnover.

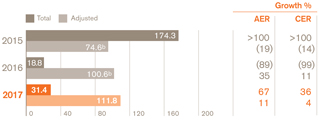

Total earnings per share were 31.4p after accounting charges of £1.6 billion related to US tax reform, with Adjusted earnings per share up 11% AER, 4% CER to 111.8p.

Group Adjusted operating margin improved, reflecting effective management of costs and successful integrations of our new businesses in Vaccines and Consumer Healthcare.

We have renewed our emphasis on cost and cash discipline and I was pleased to see our free cash flow for the year was £3.4 billion, an improvement of over £400 million on the previous year. We met our expectation of paying a dividend of 80 pence per share for 2017 and we expect to deliver the same for 2018.

Pipeline progress

Towards the end of 2017 we received approvals for three key new products:Shingrix, our new vaccine which represents a new standard for the prevention of shingles;Juluca, the first in a series of2-drug regimens for HIV which reduces the number of drugs patients take as they are now living longer with what is becoming a more chronic disease; andTrelegy Ellipta, which is the first once a day inhaler to combine three medicines in one device to treat chronic obstructive pulmonary disease (COPD).

Our focus in 2018 is to successfully launch these new products which bring significant benefits to patients, and to continue to maximise our current portfolio.

| | |

| 06 | | |

GSK Annual Report 2017 | | |

| | |

| | |

CEO’S statementcontinued

I have been clear that we need to strengthen our Pharmaceutical business and pipeline as this will ultimately drive sustainable, long-term growth for the company.

During 2017, we set out how we are refocusing our R&D organisation on four areas: two where we are a world leader – Respiratory and HIV; and two potential areas – Oncology and Immuno-inflammation. Our pipeline in these potential areas is innovative but early, and over the next 2 to 3 years we will continue to receive data from a number of key assets which will inform how we progress them.

New external appointments

I am delighted that we appointed Dr Hal Barron to be our Chief Scientific Officer and President, R&D. He joins us from Calico, an Alphabet-funded company, and before that spent many years at Roche and Genentech where he gained an exceptional reputation for leading highly productive R&D teams. I would like to thank Dr Patrick Vallance, our outgoing President of R&D, for his contribution over the last 12 years and for ensuring a smooth transition with Hal. I wish him well in his new role as the UK Government’s Chief Scientific Adviser, for which he is uniquely qualified.

Hal is one of three senior leaders we appointed to the executive team last year. Luke Miels joined as our new President, Pharmaceuticals and is responsible for driving performance in the commercial organisation and will work closely with Hal to ensure alignment with R&D. Karenann Terrell also joined us in a new role as Chief Digital and Technology Officer. Karenann joins at a time when the overlap between healthcare and technology has never been more apparent and potentially transformative. Her role is to ensure GSK is at the forefront of this exciting new opportunity.

We have made a number of other changes in our senior leadership through the year, promoting great internal talent and bringing in fresh expertise from outside the company.

Performance and values based culture

Our ambition is to drive a high-performance culture, putting science at the heart of GSK, remaining true to our values and our purpose: to help people do more, feel better, live longer. We have a long history in tackling some of the world’s biggest health challenges. Our commitment to improving global health and being a responsible business will continue under my leadership.

Corporate Executive Team

| | | | | | | | |

| | | |

| |

1 2 | |

3 4 | |

5 6 7 |

| |

8 9 | |

10 11 | |

12 13 | | |

| | | | |

| | 1. Emma Walmsley | | 5. Simon Dingemans | | 10. Karenann Terrell | | |

| | Chief Executive Officer | | Chief Financial Officer | | Chief Digital & Technology Officer | | |

| | 2. Dr Hal Barron | | 6. Nick Hirons | | 11. Claire Thomas | | |

| | Chief Scientific Officer and | | Senior Vice President, Global Ethics | | Senior Vice President, | | |

| | President, R&D | | and Compliance | | Human Resources | | |

| | 3. Roger Connor | | 7. Brian McNamara | | 12. Phil Thomson | | |

| | President, Global Manufacturing | | CEO, GSK Consumer Healthcare | | President, Global Affairs | | |

| | and Supply | | 8. Luke Miels | | 13. Dan Troy | | |

| | 4. Luc Debruyne | | President, Global Pharmaceuticals | | Senior Vice President | | |

| | President, Global Vaccines | | 9. David Redfern | | and General Counsel | | |

| | | | Chief Strategy Officer | | | | |

| | >See pages 86 to 87 | | | | | | |

| | | | | | | | |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | |

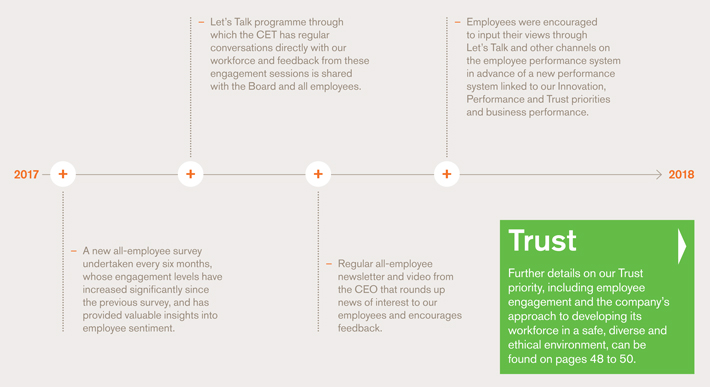

Our great people and their commitment are foundational for GSK’s culture. During the year, we conducted a new global employee survey, aligned to our priorities, and I was pleased to see a meaningful improvement in employee engagement scores, which are an important driver of performance. Outlook Given the momentum we are seeing in our new products and recent launches, the operating performance improvements we are driving and the benefit of US tax reform, we are increasingly confident in our ability to deliver our 2020 outlook of mid to high single digit growth in Adjusted EPS CAGR (2016–2020 at 2015 CER). While we could see generic competition toAdvair in the US in 2018 our guidance for the year reflects this. Aside fromAdvair we do not expect to face significant generic erosion in the US until themid-2020s. Finally, I want to say thank you to GSK employees, partners and customers for their work in 2017 and especially for their support to me in my first year as CEO. I very much look forward to working with them in 2018 and beyond to deliver our long-term priorities and improved performance for GSK.

Emma Walmsley Chief Executive Officer | | Technology is revolutionising healthcare New frontiers of innovation, such as genomics, are creating major opportunities for us – and patients. |

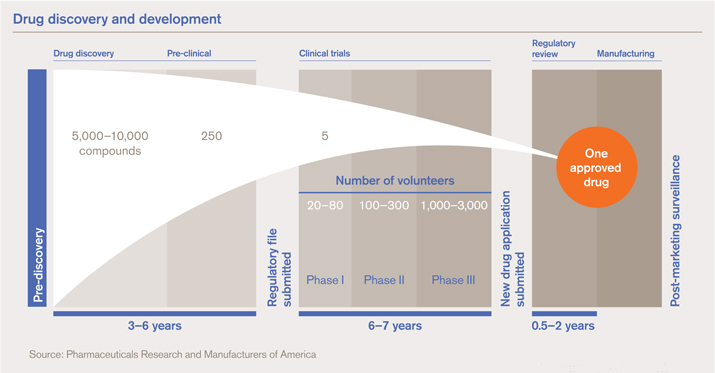

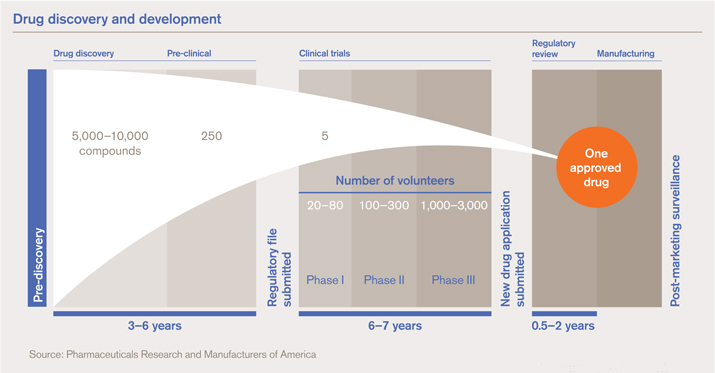

| | The ability to apply new technology across our R&D activities is creating a major opportunity for GSK. Currently, across the industry almost 90% of medicines entering trials fail and never reach patients. In part this is because we have an incomplete understanding of the link between the biological target of a drug and human disease. Pursuing drug targets with human genetic evidence to support the indication is estimated to double the probability of developing safe and effective medicines, and improve research and development productivity. In recent years, approximately 60% of GSK’s new targets have been supported by human genetic evidence. It is also why GSK was one of the first companies to make a multi-million pound investment in UK Biobank to support the generation of new genetic sequencing data from half a million volunteers. The information generated from this ground-breaking health resource will provide vital insights that we hope will inform and support the development of transformative medicines. | | We are also maximising the huge amount of data within GSK by applying artificial intelligence and machine learning to allow us to identify patterns that would have been almost impossible to identify using traditional methods. We can now model the right patient population and where to find them for our clinical trials, reduce or eliminate the need for some studies, and in some cases predict outcomes in a virtual patient. It is allowing us to more effectively manage diversity within our clinical trials to align with population demographics by analysing our clinical trials from the last ten years. GSK is connecting and bringing to life patient data from genomics, wearable devices, social media and other emerging sources, ensuring we can leverage the opportunities presented by these. |

Footnote We use a number of adjusted, non-IFRS, measures to report performance, as described on page 58. | |  |

| | |

| 08 | | |

GSK Annual Report 2017 | | |

| | |

| | |

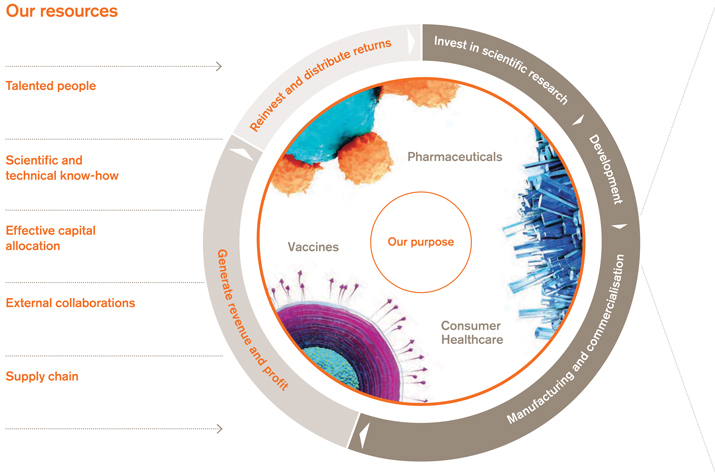

How we create long-term value

As ascience-led global healthcare company our three businesses have the common aim of improving health. On this page we describe the resources we rely on, how our business activities span the lifecycle of a product, and how we create long-term value for shareholders and society.

| | | | | | | | | | | | |

| | | | | | | |

| | | Our long-term priorities | | Our values | | | | Our expectations | | | | |

| | | Innovation Performance Trust | | Patient focus Transparency Respect Integrity | | | | Courage Accountability Development Teamwork | | | | |

| | | | | | | | | | | | | |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | |

| | |

| |

| | |

| | |

| | |

| |

| How we create value | | |

| |

Invest in scientific research | | |

| |

We invested £3.9 billion in research and development to bring new medicines, vaccines and consumer healthcare products to patients, payers and consumers. Strategic business development, including external partnerships and joint ventures, supports our in-house scientific research. | | |

| |

| |

| |

| |

| |

Generate revenue and profit | | |

We generate revenue by executing new product launches brilliantly and from the sales of our existing portfolios. Each of our three businesses now has an integrated strategy with one P&L, which enables us to drive competitive costs, margins and cash flow across the company. | | |

| |

| |

| |

| |

Reinvest and distribute returns | | |

As part of our capital allocation framework we reinvest in our three businesses and also provide returns to shareholders in the form of dividends. | | |

| |

| | | | | | |

| | | The value we create |

| | |

| | | For shareholders |

| | | We aim to deliver sustained industry-leading growth with competitive costs, margins and cash flow. We distribute capital to shareholders in the form of dividends. |

| | | | | | | |

| | | 31.4p | | | | 111.8p |

| | | Total earnings per share | | | | Adjusted earnings per share |

| | | | |

| | | | | | | |

| | | £3.9bn | | | | 80p |

| | | 2017 dividends declared | | | | 2017 dividend per share |

| | | | | | | | | | |

| | |

| | | For patients and consumers |

| | | We aim to bring our differentiated, high-quality and needed healthcare products to as many people as possible. |

| | | | | | |

| | | | | | | | | | | |

| | | 1.9bn | | | | 798m | | | | 6.2bn |

| | | Packs of medicine sold | | | | Vaccines sold | | | | Consumer Healthcare

products made |

| | | | | | |

| | |

| | | For employees and society |

| | | We want to run our company responsibly and ethically, and be a modern employer with strong employee engagement. We make a positive contribution to communities in which we operate through creating employment, working with suppliers and paying tax. |

| | |

| | | | | | | |

| | | 98,462 | | | | £1.34bn |

| | | Employees | | | | Cash tax paid |

| | | | |

| | | Footnote | | | | |

| | | We use a number of adjusted, non-IFRS, measures to report performance, as described on page 58. |

| | |

| | |

| 10 | | |

GSK Annual Report 2017 | | |

| | |

| | |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | |

12 | | |

GSK Annual Report 2017 | | |

| | |

| | |

Our long-term priorities

Innov

A strong patient and payer focused pipeline, with the most competitive claims and labels, and brilliant execution of our launches.

| | | | |

13 | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

ation

| | | | |

Read more about Innovation | | |

| | | | |

| | | |

| Innovation in | |

| | |

| Pharmaceuticals | | |

| | | |

> See pages 24–27 | | |

| | | | |

| | �� | |

| Innovation in | |

| | |

| Vaccines | | |

| | | |

> See pages 32–33 | | |

| | | | |

| | | |

| Innovation in | |

| | |

| Consumer Healthcare | | |

> See pages 38–39 | | |

| | |

14 | | |

GSK Annual Report 2017 | | |

| | |

| | |

Our long-term priorities

Perfor

Sustained industry-leading growth with competitive costs, margin and cash flow.

| | | | |

15 | | |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

mance

| | | | |

Read more about Performance | | |

| | | | |

Performance in | |

| | |

| Pharmaceuticals | | |

> See pages 28–29 | | |

| | | | |

Performance in | |

| | |

| Vaccines | | |

> See pages 34–35 | | |

| | | | |

Performance in | |

| | |

| Consumer Healthcare | | |

> See pages 40–41 | | |

| | | | |

| | 16 | | |

| | GSK Annual Report 2017 | | |

| | | | |

| | | | |

Our long-term priorities

Trust

Maximising our social impact, ensuring the reliable supply of our high-quality products to as many people as possible, and having highly engaged employees.

| | | | |

17 | | |

| | | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | | | | | |

Read about Trust across all three businesses |

| | | | | | | | |

Addressing global health through science > See pages 44–45 | |  | | | | Sustainable access to our high-quality products > See pages 46–47 | |  |

| | | | | | | |

Modern employer > See pages 48–49 | |  | | | | Ethical conduct and environmental sustainability > See pages 50–51 | |  |

| | | | | | | | |

| | |

| 18 | | |

GSK Annual Report 2017 | | |

| | |

| | |

How we measure success

| | | | |

We have identified ten operating Key Performance Indicators (KPIs) to track progress against our new long-term priorities: | | |

Innovation | | Innovation sales, pipeline value and progress | | |

Performance | | Turnover, profit, cash flow, market share, top talent in key roles | | |

Trust | | Supply service levels, employee engagement, corporate reputation | | |

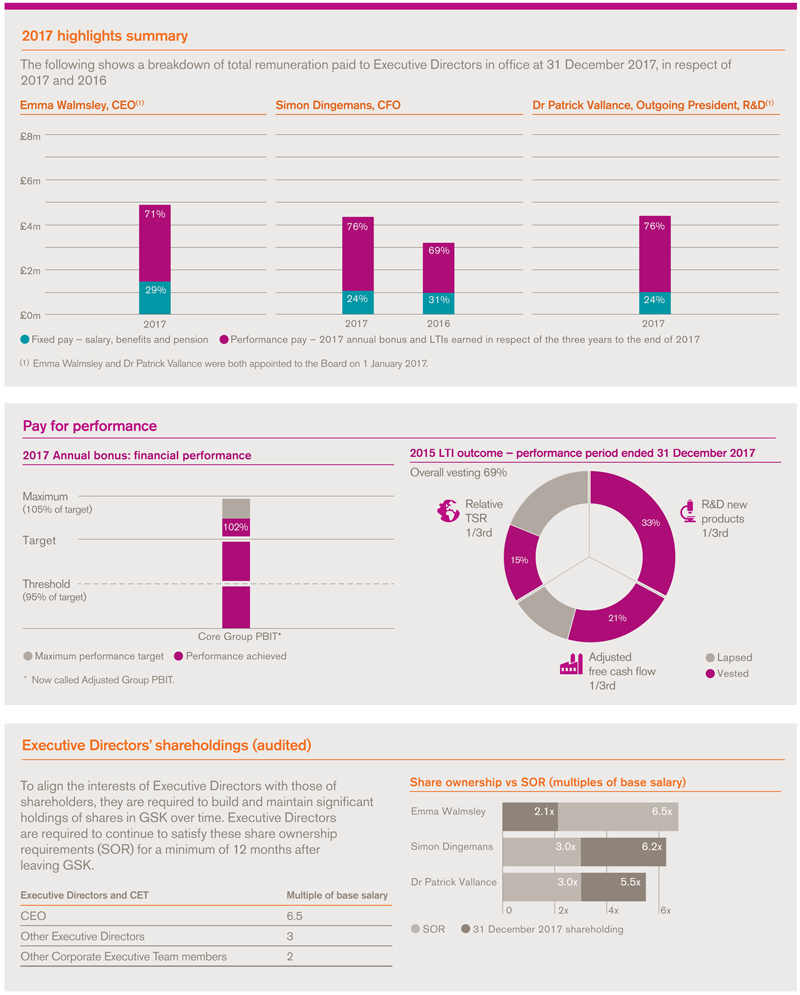

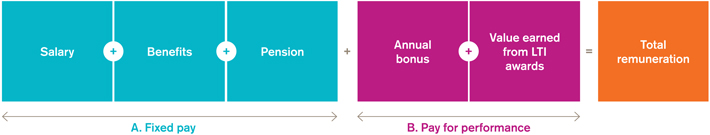

Here we provide performance data for the operating KPIs we are reporting externally. Due to commercial sensitivities, we are not planning to publish data for all operating KPIs. Pay for performance The Remuneration policy used to reward the performance of our executives includes measures linked to our KPIs (see pages 116, 120 and 122). | | |

| | | | | | |

| | | Group turnover | | | | |

| | | £30.2bn | | AER +8% | | |

| | | CER +3% | | |

| | | |

| | |  | | |

| | | How we performed Group turnover for the year increased 8% AER, 3% CER to £30.2 billion, with growth delivered by all three businesses. Pharmaceuticals sales were up 7% AER, 3% CER reflecting the continued strong growth of the new Respiratory and HIV products, partly offset by declines in older Respiratory products. Vaccines sales were up 12% AER, 6% CER, reflecting a strong performance from meningitis and influenza vaccines. Consumer Healthcare sales grew 8% AER, 2% CER reflecting a strong performance from power brands in the Pain and Oral health categories, partly offset by the impact of continued competitive pressures in the US allergy category and a broader market slowdown. | | |

| | | | | | |

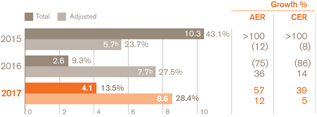

| | | Operating profit and margin | | | | |

| | | | |

| | | Total £4.1bn | | | | |

| | | Adjustedc £8.6bn | | | | |

| | | | |

| | |

How we performed Total operating profit was £4.1 billion, 57% higher on an AER basis, 39% higher CER. Adjusted operating profit was £8.6 billion, 12% higher on a AER basis, 5% higher CER. The Adjusted operating margin of 28.4% was 0.9 percentage points higher than in 2016 and 0.4 percentage points higher on a CER basis. This reflected improved operating leverage driven by sales growth together with a more favourable mix and continued tight control of ongoing costs across all three businesses. Linked to remuneration | | | | |

| | | | |

| | | Earnings per share | | |

| | | |

| | | Total 31.4p | | |

| | | Adjustedc 111.8p | | |

| | | |

| | |

How we performed The increase in total earnings per share reflected the reduced impact of charges arising from the revaluations of the liabilities for contingent consideration and the put options associated with the Group’s HIV and Consumer Healthcare businesses, the benefit from Swiss tax reform and improved performance by the relevant businesses, partly offset by charges arising from US tax reform. Adjusted earnings per share of 111.8p was up 11% at AER, 4% CER in line with guidance provided in July 2017. | | |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | |

| | |

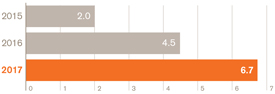

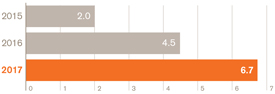

New product/innovation sales | | | | |

£6.7bn | | | | |

| | | | |

Definition | | | | |

| In 2015, we identified a series of New Pharmaceutical and Vaccine products that were expected to deliver at least £6 billion of revenues per annum on a CER basis by 2020. A full list of the products included in this definition is provided on page 60. | | | | |

| | |

How we performed Sales of New Pharmaceutical and Vaccine products were £6.7 billion, an increase of 51% at AER, 44% CER and represented approximately 30% of Pharmaceuticals and Vaccines turnover in the year. At 2015 exchange rates, the equivalent value of the 2017 sales was £5.7 billion. Linked to remuneration | | | | |

| | |

| | |

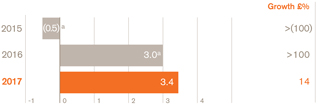

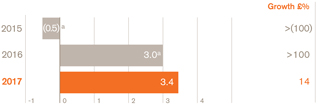

Free cash flow | | |

£3.4bn | | |

| | |

Definition | | |

The calculation of free cash flow is described on page 58 and a reconciliation is provided on page 71. How we performed We have increased free cash flow by over £400 million after investing in the Priority Review Voucher and approximately £450 million into inventory, primarily to support the new launches. Linked to remuneration | | |

| | |

| | |

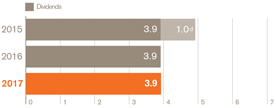

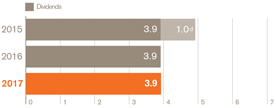

Dividends declared £3.9bn | | |

|

How we performed For both 2016 and 2017 we declared dividends to shareholders of 80p per share, giving a total return of £3.9 billion in each year. | | |

| | | | |

| | | | | |

| | |

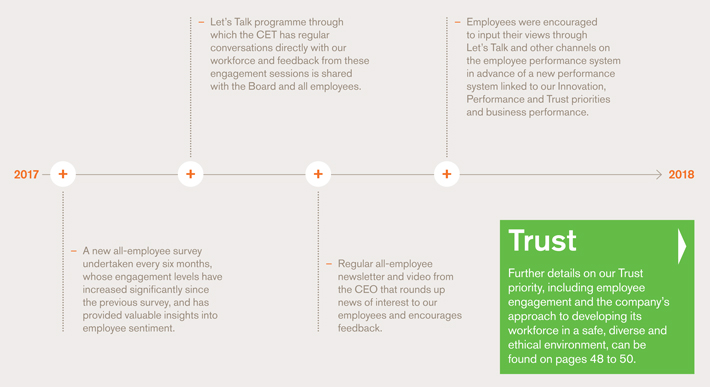

| Employee engagement | | |

| 79% | | |

favourable responses to our global employee survey Description We now measure employee engagement twice annually by inviting all GSK employees to participate in a global employee survey. Our engagement KPI is based on favourable responses to four questions: pride in the company, feeling valued as an employee, having the opportunity to do meaningful and challenging work, and recommending GSK as a great place to work. In 2017, 83% of employees participated in our new survey; our engagement score was 79% and we have set this as the baseline for future improvement. The score represented a 10% increase from 2015 for three of the four questions directly comparable. | | |

Footnotes

| a | | Revised to include all contingent consideration payments. |

| b | | Adjusted results now exclude only significant legal charges per revised definition on page 58. Prior year figures have been revised. |

| c | | We use a number of adjusted,non-IFRS, measures to report the performance of our business, as described on page 58, including Adjusted results, free cash flow and CER growth rates.Non-IFRS measures may be considered in addition to, but not as a substitute for or superior to, information presented in accordance with IFRS. |

| d | | 2015 includes special dividend. |

| | |

| 20 | | |

GSK Annual Report 2017 | | |

| | |

| | |

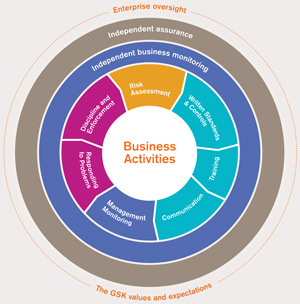

How we manage risk

Our principal risks are regularly reviewed by the CET. Below we list the principal risks managed across the Group in 2017, including our assessment of any change in the risk during the year due to macro events or mitigating GSK activities.

| | | | | | | | | | |

Risk description | | | | Assessment and mitigating activities | | | | Macro

environment | | GSK

exposure post mitigation |

| | | | | | | | |

Patient Safety Failure to appropriately collect, review, follow up, or report adverse events from all potential sources, and to act on any relevant findings in a timely manner. | | | | – The macro environment remained unchanged, with patient safety regulation and Good Pharmacovigilance Practices remaining consistent. – The GSK exposure level remained unchanged. The risk has been maintained at an appropriate level through continued strong oversight, by further developing our capabilities to detect safety issues, and by making key safety processes and standards simpler and more effective. | | | |  | |  |

| | | | | | | | |

Product Quality Failure to comply with current Good Manufacturing Practices or inadequate controls and governance of quality in the supply chain covering supplier standards, manufacturing and distribution of products. | | | | – The macro risk level remained unchanged, with continuing industry-level regulatory scrutiny of data integrity, drug shortages, and an expectation of timely communication of issues with authorities. – The GSK exposure level remained unchanged. The risk has been maintained at an appropriate level through our effective response to external inspections in 2017 and continuous improvement in data integrity programmes and our quality management system. | | | |  | |  |

| | | | | | | | |

Financial Controls & Reporting Failure to comply with current tax law or incurring significant losses due to treasury activities; failure to report accurate financial information in compliance with accounting standards and applicable legislation. | | | | – The macro risk level remained unchanged, due to no material increase in financial reporting requirements. – The GSK exposure level reduced due to our strong risk management and governance approach and further embedding of system changes, controls standardisation and process simplification. | | | |  | |  |

| | | | | | | | |

Anti-bribery & Corruption (ABAC) Failure of GSK employees, complementary workers and third parties to comply with our ABAC principles and standards, as well as with all applicable legislation. | | | | – The macro risk level increased due to more stringent ABAC laws and a rise in enforcement by regulators. – The GSK exposure level remained unchanged as we enhanced our use of data to better inform business decisions, strengthened our management of ABAC risk in our third party network and introduced an improved ABAC standard further clarifying our stance on expected behaviours. Government investigations regarding our China and other business operations are ongoing (see page 230). | | | |  | |  |

| | | | | | | | |

Commercial Practices Failure to engage in commercial activities that are consistent with the letter and spirit of the law, industry, or the Group’s requirements relating to marketing and communications about our medicines and associated therapeutic areas; appropriate interactions with healthcare professionals (HCPs) and patients; and legitimate and transparent transfer of value. | | | | – The macro risk level increased due to greater competitive pressure, increased regulatory enforcement and an expansion of digital marketing, where laws and regulations are still evolving. – The GSK exposure level remained unchanged as we continued to develop robust controls over mature commercial practices in order to apply appropriate oversight and assurance across markets. In 2017, as we increased digital capability across GSK, we enhanced our internal controls to mitigate risk. | | | |  | |  |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | | | | | | | | | |

Arrows key | | | | | | | | | | |

| | | | | | |

| | Increased risk | |  | | No change to risk | |  | | Decreased risk | | |

| | | | | | | | | | | | | | |

Risk description | | | | | | Assessment and mitigating activities | | | | | | Macro

environment | | GSK

exposure post mitigation |

Research practices Failure to adequately conduct ethical and soundpre-clinical and clinical research. In addition, failure to engage in scientific activities that are consistent with the letter and spirit of the law, industry, or the Group’s requirements, and failure to secure adequate patent protection for GSK’s products. | | | | | | – The macro risk level remained unchanged despite evolving regulation, and continuing industry-level regulatory scrutiny of data integrity. – The GSK exposure level remained unchanged. The risk has been maintained at an appropriate level through our strengthened governance structure, which includes enterprise-wide management of risk and enables better information sharing, and an increased focus on IT systems, data and analytics. | | | | | |

| |

|

| | | | | | | | | | | | | | | |

Third party oversight (TPO) Failure to maintain adequate governance and oversight over third-party relationships and failure of third parties to meet their contractual, regulatory, confidentiality or other obligations. | | | | | | – The macro environment has remained unchanged as the industry continues to be vigilant about third-party risks in global sourcing and supply, and consumer and investor expectations mature. – The GSK exposure level reduced following theroll-out of our TPO programme, which risk assessed over 95% of our third parties with whom we directly engage. This will enable us to identify and manage risks consistently and proportionately. Improvement plans are in place where required and the insights from the programme have informed sourcing processes to further mitigate risk. | | | | | |

| |

|

| | | | | | | | | | | | | | | |

Environment, health & safety and sustainability (EHS&S) Failure to manage environment, health and safety and sustainability risks in line with our objectives and policies and with relevant laws and regulations. | | | | | | – The macro risk level increased due to greater emphasis on the environment and antimicrobial resistance, increasing emerging market regulation, the potential impact of EU chemicals legislation and the greater use of third parties to develop pipeline assets. – The GSK exposure level remained unchanged due to continued execution of our enterprise strategy and our strengthening of EHS&S controls. | | | | | |

| |

|

| | | | | | | | | | | | | | | |

Information protection The risk to GSK business activities if information becomes disclosed to those not authorised to see it, or if information or systems fail to be available or are corrupted, typically because of cybersecurity threats, although accident or malicious insider action may be contributory causes. This also includes the risk of failure to collect, secure, and use personal information in accordance with data privacy laws. | | | | | | – The macro risk level continued to increase as the threat against the pharmaceutical business and industry generally became more sophisticated and targeted, as evidenced by the Wannacry and NotPetya global incidents, and new regulations were introduced, including the EU General Data Protection Regulation. – Despite this, the GSK exposure level remained unchanged due to further development of our programme to safeguard against cyber-attacks and protect critical information and systems, and our ability to balance the demands of regulation with our digital transformation, which involves increased data collection and analysis. | | | | | |

| |

|

| | | | | | | | | | | | | | | |

Supply chain & crisis management Failure to deliver a continuous supply of compliant finished products; inability to respond effectively to a crisis incident in a timely manner to recover and sustain critical operations, including key supply chains. | | | | | | – The macro risk level remained unchanged with ongoing stringent regulation, a continued US focus on contract manufacturers outside the US/EU, and increasing data integrity expectations. – The GSK exposure level reduced due to improved risk management of our supplier portfolio, progress in completing supply remediation programmes, and improvements to our crisis and continuity management framework. | | | | | |

| |

|

| > | For more information see pages 257 to 266 |

| > | See page 57 for our viability statement |

| | | | |

| 23 | | |

| | | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | |

| | Financial statements | |

| | Investor information | | |

Pharmaceuticals

Our Pharmaceuticals business has a broad portfolio of innovative and established medicines. We are focused on developing new medicines in respiratory, HIV, oncology andimmuno-inflammation, with discovery research exploring these and other areas.

| | | | | | | | |

Pharmaceuticals sales were up 7% AER, 3% CER, reflecting the continued strong growth ofNucala and ourEllipta portfolio in Respiratory, andTivicay andTriumeq in HIV. | | | | In 2017 we had two significant Pharmaceutical approvals:Trelegy Ellipta, which provides three medicines in a once a day, single inhaler to treat COPD; andJuluca, the first2-drug regimen, once-daily, single pill for HIV, which helps to reduce the amount of medicines patients need. Pharmaceuticals turnover | | | £m | |

| | | | Respiratory | | | 6,991 | |

| | | | HIV | | | 4,350 | |

| | | | Immuno-inflammation | | | 377 | |

| | | | Established Pharmaceuticals | | | 5,558 | |

| | | | Total | | | 17,276 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Footnote

We use a number of adjusted,non-IFRS,

measures to report performance, as

described on page 58.

Dave, oncology scientist, UK

We have joined forces with our partners to rapidly evolve the science of immuno-oncology, in one area we are working on increasing the ability of the body’s immune system to help detect and attack cancer cells.

Fran, cancer survivor and GSK employee

What’s next

| | | | |

Innovation in Pharmaceuticals > See pages 24–27 | | |

| |

| | | | |

Performance in Pharmaceuticals > See pages 28–29 | | |

| |

| | | | |

We report on our Trust priority across all three businesses > See pages 42–51 | | |

| |

| | |

| 24 | | |

GSK Annual Report 2017 | | |

| | |

| | |

Pharmaceuticals

| | | | |

| Innovation | | Our priority is to strengthen our Pharmaceuticals business by focusing on fewer assets, improving the R&D and commercial interface, and with brilliant execution of launches. |

| | | | |

| | Our Pharmaceuticals business continues to grow and we are global leaders in Respiratory and HIV. In 2017, we had twobest-in-class medicines approved:Trelegy Ellipta, our once-daily triple therapy for chronic obstructive pulmonary disease (COPD) in a single inhaler; andJuluca, the firsttwo-drug regimen, once-daily, single pill for HIV. We also made important progress across our pipeline assets. Delivering best-in-class innovation We need to focus on medicines with the greatest potential, back them and stop other projects. Following a review of our drug development process, we are focusing on priority assets in two areas where we are world leaders – Respiratory and HIV – and two potential areas – Oncology andImmuno-inflammation. To ensure we have sufficient funding and resource for our priority areas and medicines – those where GSK can support more patients and strengthen our existing business over the long term – we terminated more than 60pre-clinical and clinical programmes. These included ending our collaboration with Janssen Biologics on sirukumab and starting the process of identifying a new owner for our rare disease gene therapy medicines. | | We have created a more integrated, competitive Pharmaceuticals business by significantly strengthening the existing partnership between R&D and commercial. We have made several significant leadership appointments including Hal Barron, Chief Scientific Officer and President of R&D, and Luke Miels, President, Global Pharmaceuticals. Both are highly respected leaders with a track record of bringing new medicines to market. Respiratory We have been a leader in respiratory medicine for nearly 50 years and remain at the forefront of scientific research in this area, offering innovative medicines aimed at treating patients’ symptoms and reducing the risk of their disease worsening. Trelegy Ellipta During the year, we gained US and European regulatory approval forTrelegy Ellipta, our new once-daily triple therapy for COPD in a single inhaler. This launch adds to our portfolio of once-daily, inhaled respiratory medicines – the broadest in our industry. We also achieved positive headline results from theTrelegy Ellipta phase III IMPACT study. The 10,000+ patient study found the once-daily triple therapy achieved significant reductions in moderate/severe exacerbations for COPD patients when compared with two other once-daily dual medicines from ourEllipta portfolio. We have submitted additional regulatory filings supported by the IMPACT data, with the aim of expanding the patient population forTrelegy Ellipta in COPD. We are also investigating the efficacy and safety ofTrelegy Ellipta in a phase III study (CAPTAIN) as a treatment for patients with asthma. |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | |

| | | Strategy in action | | |

| | “Scientific innovation is at the heart of GSK and is our highest priority as we build the next wave of growth for the company.”

| | |

| | Dr Hal Barron Chief Scientific Officer and President, R&D | | |

Other respiratory assets

We continue to lead in respiratory biologics and believeNucala (mepolizumab) offers a highly competitive profile. We received FDA approval for an additional indication for mepolizumab, as the first targeted treatment for uncontrolled eosinophilic granulomatosis with polyangiitis (EGPA). We have also submitted a regulatory file for mepolizumab for the treatment of COPD.

Our other priority respiratory assets also target COPD and are in phase II trials: danirixin, afirst-in-class oral CXCR2 antagonist, and nemiralisib, a highly selectivefirst-in-class phosphatidylinositol3-kinase delta (PI3Kd) inhibitor.

HIV

We have a long-standing commitment to HIV and are investigating new paradigms for treatment, prevention and cure.

Dolutegravir is the number one core agent globally, and through the success ofTivicay andTriumeq, it offers important benefits for a wide range of patients. It can be used without the need for a booster, and showed superior efficacy in five different clinical studies. It is generally well tolerated and has a high barrier to resistance and few interactions with commonly used medications.

Today, due to advances in antiretroviral therapy (ART), people living with HIV have near normal life expectancies compared to the general population, but may spend decades on HIV treatment. Our innovative research into2-drug regimens (2DR) was initiated in response to physician and patient demand to reduce long-term ART exposure.

Juluca

In November, we received US FDA approval forJuluca, a once-daily, single pill 2DR regimen for HIV.Juluca combines dolutegravir with rilpivirine (Edurant, a Janssen medicine) and is a complete regimen for treating HIV in adults who are virologically suppressed and have no resistance. The SWORD studies of over 1,000 patients in phase III trials showedJuluca achievednon-inferior viral suppression compared with traditional3-drug regimens. Through the purchase and use of a Priority Review Voucher, we accelerated this approval in the US. Following our June 2017 submission to the European Medicines Agency (EMA) for regulatory approval, we expect a response in 2018.

Other HIV assets

Our 2DR clinical trial programme now consists of eight phase III clinical trials, two of which have completed (SWORD studies) and support approval ofJuluca, with four other studies due to report in 2018.

Dolutegravir and lamivudine is being investigated versus a traditional3-drug regimen for treatment-naive HIV patients in the GEMINI 1 & 2 studies, and in the TANGO trial for patients who have achieved viral suppression on a tenofovir alafenamide fumarate (TAF)-based regimen.

The long-acting 2DR of cabotegravir and rilpivirine, is being investigated for administration every four weeks in virally suppressed adults withHIV-1 infection (ATLAS and FLAIR). In addition, the ATLAS 2M study has started to investigate administration every two months.

We also have two phase III studies that began in 2017 to evaluate cabotegravir as a long-acting monotherapy in the prevention of HIV. These trials are being conducted through a public-private funding collaboration.

| | |

| 26 | | |

GSK Annual Report 2017 | | |

| | |

| | |

Pharmaceuticalscontinued

|

> Read more about our Pharmaceuticals pipeline on pages 251 to 252 |

Oncology

In Oncology, we are focused on delivering transformational therapies that can lengthen the lives of patients with cancer. In 2017, we made significant progress in our emerging portfolio of next generation therapies in the areas of immuno-oncology, cell therapy and epigenetics.

Our 2857916 monoclonal antibody against BCMA has the potential to target a number of tumour types, including relapsed and refractory multiple myeloma. Promising early results suggest a highly competitive profile compared with existing approved treatments for multiple myeloma. It has been granted European PRIME and FDA breakthrough status, potentially resulting in faster review by the regulatory authorities when it is filed.

We exercised our option to gain an exclusive global licence from Adaptimmune for 3377794, an investigational SPEART-cell receptor targetingNY-ESO-1, and were granted European PRIME and FDA breakthrough status. Another oncology therapy, 3359609, is the first investigational inducibleT-cell costimulator (ICOS) agonist antibody to enter human clinical trials. Both of these assets are in phase I/II trials.

Immuno-inflammation

Immuno-inflammatory diseases are relatively common, chronic and debilitating conditions, for which there remains significant unmet medical need. To discover the next breakthrough for immune-mediated diseases, we are focusing on transformational medicines that could potentially alter the course of inflammatory disease and induce sustainable remission.

We received approval in the US and EU for a new subcutaneous (SC) formulation ofBenlysta, our treatment for systemic lupus erythematosus, which enables either home or hospital administration of the medicine. We also received approval in Japan for the use ofBenlysta for the first time.

We have two phase IIimmuno-inflammation priority assets: 3196165, a monoclonal antibody which blocks the effect of anti-granulocyte-macrophage colony stimulating factor(GM-CSF), for rheumatoid arthritis and osteoarthritis, and 2982772, a receptor interactingprotein-1 (RIP1) kinase inhibitor for psoriasis, ulcerative colitis and rheumatoid arthritis.

Future pipeline optionality

Outside our core therapy areas, we have a number of other promising programmes, including two late-stage priority assets: oral daprodustat, in phase III trials for anaemia associated with chronic renal disease, and ananti-SAP therapy for amyloidosis, currently in phase II.

| | | | | | |

| | Strengthening the R&D commercial interface

| | | | Ensuring there is a strong partnership between our R&D and commercial functions is a priority for us. This will help ensure we deliver differentiated medicines with the most competitive profiles and robust evidence plans to compete effectively in today’s dynamic market. A single strategy across R&D and commercial will ensure alignment and focus across the business. We are simplifying our processes to eliminate complexity, and in parallel, strengthening our commercial and medical resource to drive performance. |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | |

|

| | Strategy in action “Digital technology will transform many aspects of how we develop new medicines and interact with our customers.”

Karenann Terrell Chief Digital & Technology Officer | | |

Accelerating priority assets

We are improving the pace of our medicines development by enhancing ourspeed-to-clinical decision making through changes to our governance and by adapting the way we design and conduct our clinical trials.

To support this acceleration we established a new Board committee of global scientific experts, the Science Committee, to ensure that emerging scientific and medical knowledge is integrated into our strategic planning. In addition, a new Development Advisory Committee will provide the Board with strategic guidance on all aspects of our current and future development activity, with full consideration of emerging trends and alternative approaches. See page 109 for more information.

Our early research infrastructure – around 25 discovery performance units (DPUs) with their own project accountabilityand budgets – encourages a competitive dimension to proposed areas of discovery research and capital allocation.

New technology frontiers

Digital technology is having an impact on every part of our business and our goal is to harness these developments in data-rich, information-based medicine to accelerate our drug discovery and development, and drive our business forward.

Collaborations remain key to our innovation. During the year, we joined forces with two external companies to harness artificial intelligence (AI): Exscientia, a UK specialist in machine-learning; and Insilico Medicine, a US leader inAI-led drug discovery.

We alsoco-founded the private-public Accelerating Therapies for Opportunities in Medicine (ATOM) consortium, based in the US. This aims to cutpre-clinical cancer drug discovery from six years to just one, using supercomputers to analyse data from failed R&D programmes with the aimof finding patterns and vital clues to aid successful future development. We are also supporting the UK Biobank, a ground-breaking initiative to generate anonymised genetic sequence data from 50,000 volunteer participants to deliver insights into why some people are at greater risk of disease. In addition, we continue to work on the Open Targets programme, which supports an open access search engine that searches, evaluates and integrates biologic and genetic disease data.

| | |

| 28 | | |

GSK Annual Report 2017 | | |

| | |

| | |

Pharmaceuticalscontinued

| | |

| Performance | | Pharmaceuticals sales were up 7% AER, 3% CER, reflecting the continued strong growth of our new Respiratory and HIV products. |

2017 performance summary

Pharmaceuticals turnover in 2017 was £17,276 million, up 7% AER, 3% CER. In the US, total sales were £7,568 million, up 11% AER, 6% CER primarily driven by new Respiratory and HIV products. In Europe sales were £3,983 million, up 3% AER but down 3% CER, reflecting the continued transition of the Respiratory portfolio, generic competition toKivexaand the disposal of the Romanian distribution business. International sales were £5,725 million, up 6% AER and 4% CER.

Respiratory sales were up 7% AER, 3% CER to £6,991 million. New Respiratory products recorded combined sales of £1,930 million in 2017, more than offsetting the decline inSeretide/Advair.

HIV sales increased 22% AER, 16% CER to £4,350 million in the year. The growth was driven by continued increases in market share forTriumeq andTivicay, partly offset by the impact of generic competition toEpzicom/Kivexa, particularly affecting the European market.

Immuno-inflammation sales were £377 million, up 11% AER, 6% CER in the year.

Sales of Established Pharmaceuticals were £5,558 million, declining 2% AER,

5% CER, reflecting a three percentage point impact from recent divestments ofnon-core assets.

The Pharmaceuticals operating margin was 34.3%, up 0.2 percentage points AER but down 0.6 percentage points CER primarily reflecting increased R&D investment, including using a Priority Review Voucher in Q2 2017. The lower operating margin also reflected increased investment in new product support, as well as the continued impact of lower prices, particularly in Respiratory, partly offset by a more favourable product mix, primarily driven by the growth in HIV sales, and the continued cost reduction benefit of the Group’s Pharmaceuticals restructuring programme.

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | Delivering world class capability

| | Our ambitious commercial efforts are focused on driving the continuous growth of our priority brands in our largest markets, most notably the US. Our R&D teams continue to generate evidence from clinical trials to support the right patients for each medicine, as well as the differentiation of our brands. In 2017, strategic use of data and analytics has enabled us to optimise the role, engagement and training of our salesforce. This has helped make sure their knowledge of the disease, our strategy and the competitive environment have led to truly competitive customer engagement from day one of launch. | | For our asthma medicine,Relvar/Breo Ellipta, this focus on target customer groups helped this medicine become the first of our new Respiratory portfolio to be a £1 billion brand, helping over four million patients this year. | | | | |

| | | | | | | | | | | | | | |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | |

| | | Strategy in action “Strong sales of our new products show we can achieve great things when we are focused.”

Luke Miels President, Global Pharmaceuticals | | |

2020 outlook

Over the five years to 2020 we expect a low single-digit CAGR for sales (at 2015 exchange rates) despite a higher level of divestments over the period than we originally expected. Strong performances from our new medicines together with disciplined cost management are expected to enable the business to achieve an operating margin in the low 30s percentage range in 2020 (at 2015 exchange rates) even if an automatically substitutable generic version ofAdvair is launched in the US.

Driving performance for profitable, sustainable growth

In 2017, we refocused our Pharmaceuticals business to make it stronger and more competitive in order to deliver improved, sustainable returns. Under the leadership of Luke Miels, we have simplified our commercial management structure and reshaped our operations. We are aggressively reallocating resources to those areas best able to deliver profitable sustainable growth and returns, with much more focus on new medicines and major markets.

The changes we are making will drive sharper prioritisation, a simpler portfolio, faster decision making, more effective capital allocation and a strong focus on execution.

In 2017, we began streamlining our Pharmaceuticals products portfolio by exiting from or divesting 90non-core brands and we are on track to reach our goal of about 20% fewer brands. This included announcing an end to the manufacture and sale of the type 2 diabetes therapyEperzan/Tanzeum which we now expect to end during 2018. In addition, we announced a strategic review of our cephalosporins antibiotics business with an option to sell.

We are restructuring our emerging markets business to improve growth, profitability and sustainability while continuing to ensure access for the patients that need our medicines. Simplifying the geographies, reducing organisational layers and simplifying our cost structures, including moving to an export model in some markets, will support faster, more aligned execution.

Creating a simpler, competitive supply chain

We are simplifying our manufacturing and supply chain to achieve competitive and sustainable performance – delivering strong results in the fundamentals of safety, quality and service, as well as improved financial performance. We are focused on fewer priorities, removing waste and making things simpler. Our current plans address productivity improvement, procurement savings and working with our supplier base to prioritise fewer, more strategic supplier relationships. We are on track to reduce our suppliers by approximately 30% – leveraging our scale and standardising specifications to use fewer bespoke materials and improving our cost of goods.

We continue to invest in our manufacturing network and advanced manufacturing technologies which have the potential to improve product quality while reducing material waste and lead times for new capacity. Our work with continuous processing is well advanced and, where deployed, could reduce cost of goods by up to 20% in the long term.

Digital transformation

Our goal is to apply digital technology that delivers truly competitive customer engagement to drive better performance.

Our investment in this area is underpinned by our appointment of Karenann Terrell as Chief Digital and Technology Officer, who joined in September 2017 to help drive a digital transformation programme across our three businesses.

Across the Pharmaceuticals business we are using new technologies to improve performance with an increased focus on improving the customer experience. This includes customer-centric integrated campaigns and personalised content to help healthcare professionals deliver better patient outcomes and to drive preference for our brands.

|

Footnote |

We use a number of adjusted,non-IFRS, measures to report performance, as described on page 58. |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | |

| | | | |

| |  | | |

| | Virginie, Laboratory Technician, | | |

| | Vaccines R&D | | |

| | Our new vaccineShingrix represents a significant advance in vaccine technology and has clinically demonstrated a strong and sustained immune response and effficacy against shingles and its painful complications. | | |

| |

| | |

| | Alain, shingles sufferer and GSK employee | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Vaccines

Our Vaccines business has a broad portfolio and innovative pipeline of vaccines to help protect people throughout life. We deliver over two million vaccine doses per day to people living in over 160 countries.

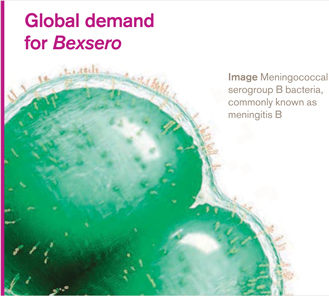

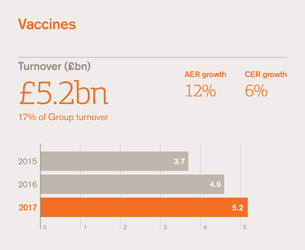

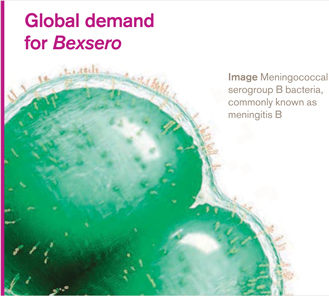

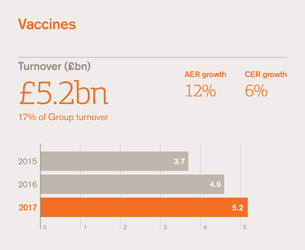

Vaccines sales were up 12% AER, 6% CER, primarily driven by meningitis vaccines, withBexsero growing across all regions andMenveo in the US and Europe, and higher sales of influenza products, primarily in the US and Europe.

Footnote

We use a number of adjusted,non-IFRS,

measures to report performance, as

described on page 58.

During the year, we received US FDA approval forShingrix, our new vaccine which represents a new standard for the prevention of shingles.

| | | | |

| Vaccines turnover | | £m | |

Meningitis | | | 890 | |

Influenza | | | 488 | |

Shingles | | | 22 | |

Established Vaccines | | | 3,760 | |

Total | | | 5,160 | |

What’s next

| | | | |

Innovation in Vaccines > See pages 32–33 | |

| | |

| | | | |

Performance in Vaccines > See pages 34–35 | |

| | |

| | | | |

We report on our Trust priority across all three businesses > See pages 42–51 | |

| | |

| | |

| 32 | | |

GSK Annual Report 2017 | | |

| | |

| | |

Vaccines

| | | | |

| Innovation | | Our advanced science and technology platform capability enables us to discover and develop vaccines that help protect people in over 160 countries from serious diseases. |

| | | | |

| | Our vaccines strategy is to bring differentiated, high-quality and needed vaccines to as many people as possible. We have global scale and are well positioned to take advantage of changing demographics. Vaccines are long-term assets without the volatility of patent cliffs, which provides opportunities to invest in life-cycle management and improve the competitive profile of our existing vaccines to better meet patient needs. We focus on finding new candidate vaccines to help protect people of all ages from disease and have a pipeline of 14 candidate vaccines currently in development. We believe that a core competitive advantage is our expertise in technology platforms which facilitates the development of more effective vaccines. Innovation in action In 2017, we received regulatory approval in the US and Canada forShingrix, with an efficacy of over 90%, which we believe provides a step change in the prevention of shingles. We anticipate it could driveone-third of Vaccines growth between 2015 and 2020. More than 90% of people over 50 are infected with the varicella zoster virus that causes shingles and one in three will develop shingles in their lifetime. | | Following approval by the US Food and Drug Administration (FDA) in October 2017, the competitive position ofShingrix has been further strengthened by recommendations from the US Centers for Disease Control and Prevention’s (CDC’s) Advisory Committee on Immunization Practices (ACIP) naming it as the preferred shingles vaccine for adults aged 50 and over. The recommendation includes revaccinating those who had previously received the competitor vaccine, meaning over 100 million people in the US will be eligible for theShingrixvaccine. In January 2018, we received a positive opinion from the European Medicines Agency’s (EMA’s) Committee for Medicinal Products for Human Use forShingrix. The results of regulatory filings forShingrix in Australia and Japan are also due in 2018. In addition, in December 2017 we announced new data confirming the safety and efficacy ofShingrix in immuno-compromised autologous haematopoietic stem cell transplant patients. Our commercial, manufacturing and R&D teams have worked closely together to ensure theShingrix launch is executed flawlessly. We are taking a staged approach to the global launch in order to manage the strong anticipated demand with reliable supply. |

| | | | | | |

| | Breakthrough vaccine science

| | | | Shingles is a painful and potentially serious condition.Shingrix was developed specifically to overcome theage-related decline in immunity and is the first shingles vaccine to combine anon-live antigen, to trigger a targeted immune response, with a specifically designed adjuvant system, AS01B, to make that response strong and sustained. This adjuvant is also used in our RTS,S vaccine for the prevention of malaria in children. |

| | | | |

| GSK Annual Report 2017 | | Strategic report | |  |

| | Governance and remuneration | | |

| | Financial statements | | |

| | Investor information | | |

| | | | |

| | | |

| | | Strategy in action | | |

| | “With our global Vaccines R&D organisation, supported by unique technology platforms and talented people, we are developing vaccines to meet existing and emerging needs.”

| | |

| | Emmanuel Hanon Senior Vice President, Head of R&D, Vaccines | | |

Delivering best-in-class innovation

We are aiming to develop assets which are best in class. Our investment in unique technology platforms, including adjuvants, is delivering a competitive advantage in targeting new, emerging and remaining medical needs.

Meningitis

Our focus is to maintain GSK’s meningococcal meningitis market leadership with both licensed and candidate vaccines. We aim to broaden the age range of our meningococcal vaccines in the US and demonstrate their impact in infants as well as meningococcal carriage in adolescents. In February 2018, we were granted Breakthrough Designation forBexsero in children aged 2 to 10 years. We are also working on new formulations, including a fully liquid presentation of our tetravalent vaccine for MenACWY,Menveo, which is expected to enter phase II clinical trials in 2018. The results from our phase III study of our booster forMenveo are expected in 2018. We are also committed to developing a single vaccine that tackles all five of the most common serogroups, A, B, C, W and Y.

Reflecting our active life-cycle management of our vaccines – where we strategically plan an asset’s commercial journey from its final clinical trials onwards – we continue to expand target populations and protection. In this way, we aim to extend patient benefits, increase use of our vaccines and be the leader in helping to prevent meningococcal disease.

In line with this approach, we are supporting an extensive study to examine if the meningococcal B vaccine reduces the spread of meningococcal bacteria in teenagers through ‘herd immunity’. This involves vaccinating 35,000 teenagers in South Australia, which has a high incidence of meningococcal B disease.

Other priority assets

Building on GSK’s existing respiratory leadership position through our Pharmaceuticals business, we have a number of candidate vaccines targeting respiratory diseases. These include our candidate vaccine for chronic obstructive pulmonary disease (COPD), which began a phase II proof of concept study in Europe in 2017. Other growth drivers in the respiratory portfolio are our respiratory syncytial virus (RSV) candidates, with different approaches tailored to each age group. We also have a research collaboration focused on tuberculosis, with our candidate vaccine currently in phase II trials.

We have developed the only malaria vaccine candidate to have received positive opinion from the European Medicines Agency (EMA) (see page 44).

New technology frontiers

We have new technologies, including adjuvant systems, structural vaccinology and synthetic vaccine platforms that are helping us move beyond observation and experimentation methods of vaccine development to create ‘vaccines by design’. These are made up of antigens, delivery systems and adjuvants that can help increase the immune system’s response to a vaccine.

GSK has been innovating in adjuvant systems for more than 25 years. Our unique approach has led to the development of several ‘adjuvant systems (AS) families’, which use a combination of adjuvants to achieve a better immune response and are fundamental to the next generation of our vaccines portfolio.

Our self-amplifying mRNA (SAM) technology uses the human body as a ‘factory’ to produce its own vaccines. SAM will not require traditional vaccine production methods, so could potentially enable us to produce vaccines more quickly and simply. We are in the early stages but data from a variety of animal models show SAM performs well.

External partnerships

Collaboration is central to our innovation. We have around 180 external scientific collaborations, with most of our 14 candidate vaccines being developed in partnership. Such collaborations enable our 2,000 Vaccines scientists at our global R&D centres, in the US, Belgium and Italy, to learn from other experts and stay close to emerging technologies. For example, we are involved in the phase II trial of an HIV vaccine with a group of NGOs and other pharmaceutical companies, led by the US National Institutes of Health.

|

> Read more about our Vaccines pipeline on page 253 |

| | |

| 34 | | |

GSK Annual Report 2017 | | |

| | |

| | |

Vaccinescontinued

| | | | |

Performance | �� | Demand for our world-leading meningitis portfolio contributed to a 12% AER, 6% CER increase in Vaccines sales. | | |

2017 performance summary

Vaccines sales grew 12% AER, 6% CER to £5,160 million, primarily driven by meningitis vaccines, withBexsero growing across all regions andMenveo in the US and Europe and higher sales of influenza products, primarily in the US and Europe.

Vaccines operating margin was 31.9%, up 0.8 percentage points AER and 1.3 percentage points higher on a CER basis. This was primarily driven by improved product mix, the benefit of a settlement for lost third-party supply volume, together with continued restructuring and integration benefits. This was partly offset by increased SG&A (selling, general and administration) resources to support business growth and new launches, increased supply chain costs and lower royalty income.

Meningitis

Meningitis sales grew 34% AER, 27% CER to £890 million.Bexsero sales growth of 43% AER, 34% CER was driven by new national immunisation programmes, private market sales and regional tenders in Europe, as well as growing demand in the US, together with strong private market sales in International.

Following 2017 launches in Argentina and Belgium,Bexsero is now available in 24 countries. The vaccine’s broad age indication provides competitive advantage in Europe, and in the US it offers the fastest series completion, with two doses administered in about one month.

Menveo sales grew 36% AER, 29% CER, primarily driven by the impact of favourableyear-on-year CDC stockpile movements, partly offset by supply constraints in International.

Influenza

Fluarix/FluLaval sales were up 18% AER, 12% CER to £488 million, reflecting strong sales execution, primarily in the US, and higher demand in Europe.

Shingles

Shingrix recorded initial sales to distributors of £22 million in the US after its FDA approval and favourable ACIP recommendations.

| | | | | | | | |

| | | | | | | | |

| |