1 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary. October 31, 2023

2 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary. Legal Disclaimers This presentation has been prepared by Synchronoss Technologies, Inc. (the “Company”) solely for informational purposes based on its own information, as well as information from public sources. This presentation has been prepared to assist interested parties in making their own evaluation of the Company and does not propose to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of the Company and the data set forth in the presentation and any other information provided by or on behalf of the Company. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and that the sources from which it has been obtained are reliable. The Company cannot guarantee the accuracy of such information and has not independently verified such information. This presentation contains forward looking statements within the meaning of the federal securities laws. These forward looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “might,” “should,” “could,” “predict,” “potential,” “believe,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “strive,” “projection, on,” “goal,” “target,” “outlook,” “aim,” “would,” and “annualized” or the negative version of those words or other comparable words or phrases of a future or forward looking nature. These forward looking statements are not historical facts, and are based on current expectation, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, m any of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward looking statements are not guarantees of future performance and are subject to risks, assumptions, estimates and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward looking statements. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. “A number of important factors could cause our actual results to differ materially from those indicated in these forward looking statements, including the following: risk factors described under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. In addition to US GAAP financials, this presentation includes certain non-GAAP financial measures. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with US GAAP. A reconciliation of historical non-GAAP measures to historical GAAP measures is contained in the Appendix. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance We have filed a registration statement (including a prospectus) with the SEC relating to the shares of common stock of the Company. Any offering will be made only by means of a prospectus and prospectus supplement that form part of the registration statement. A prospectus supplement is expected to be filed with the SEC in connection with the offering. Before you invest, you should read the prospectus and prospectus supplement in that registration statement, the documents that the Company has filed with the SEC that are incorporated by reference into the registration statement and the other documents that the Company has filed with the SEC for more complete information about the Company and this offering. You may access these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

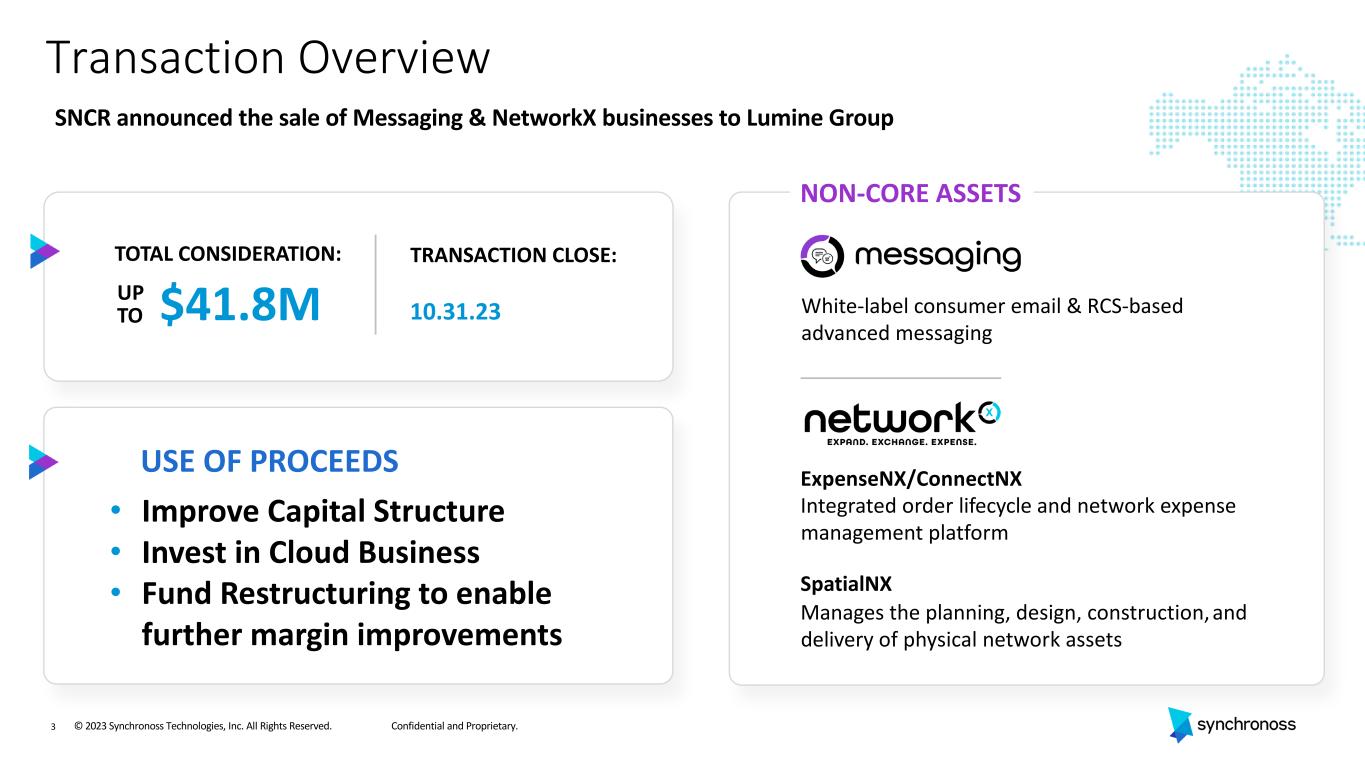

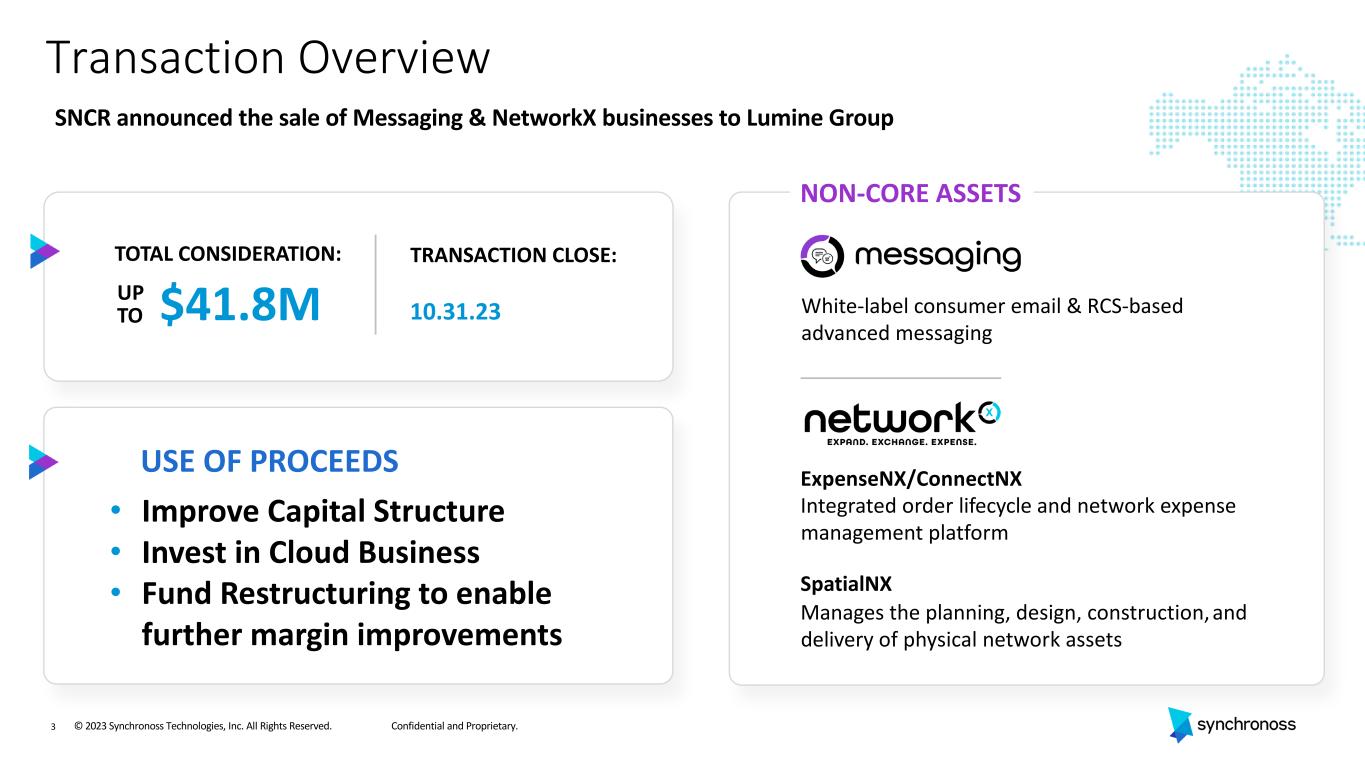

3 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary. ExpenseNX/ConnectNX Integrated order lifecycle and network expense management platform SpatialNX Manages the planning, design, construction, and delivery of physical network assets White-label consumer email & RCS-based advanced messaging SNCR announced the sale of Messaging & NetworkX businesses to Lumine Group Transaction Overview TOTAL CONSIDERATION: $41.8MUP TO TRANSACTION CLOSE: 10.31.23 NON-CORE ASSETS USE OF PROCEEDS • Improve Capital Structure • Invest in Cloud Business • Fund Restructuring to enable further margin improvements

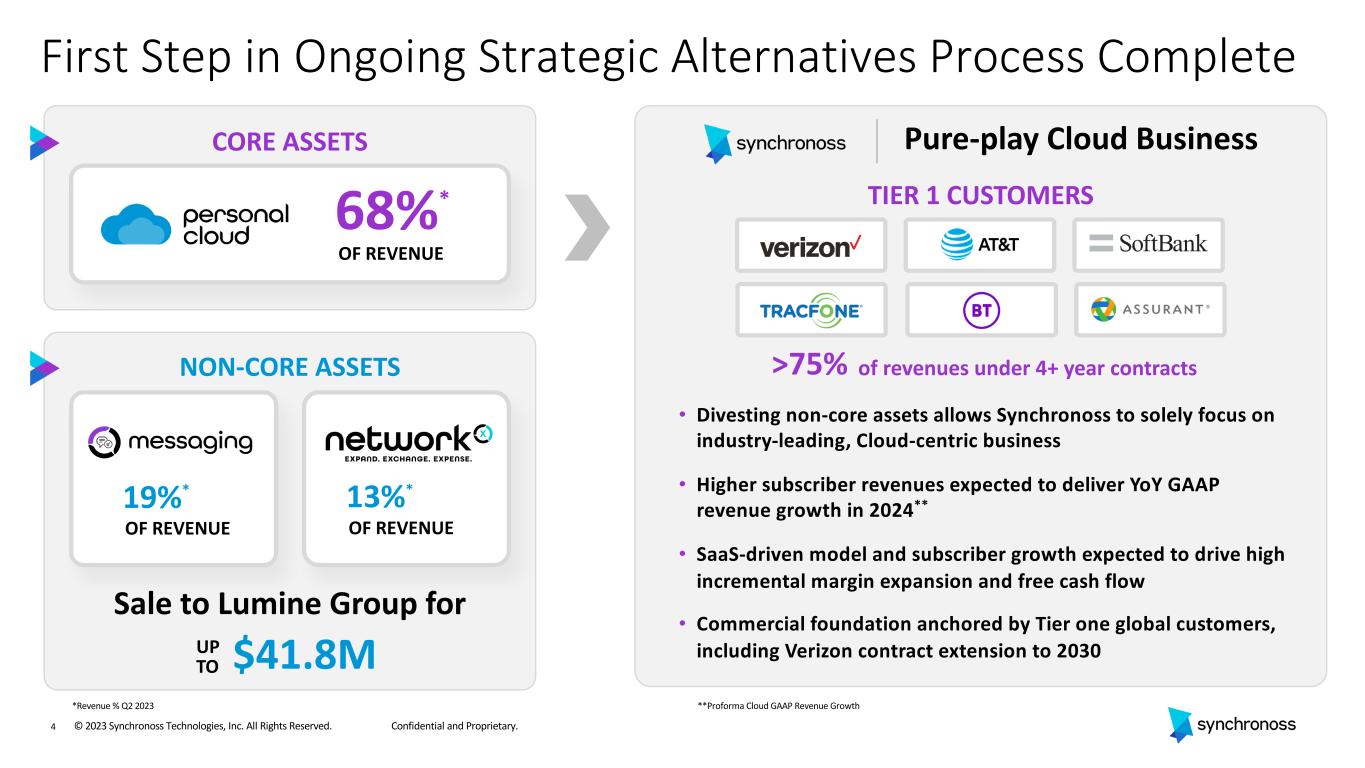

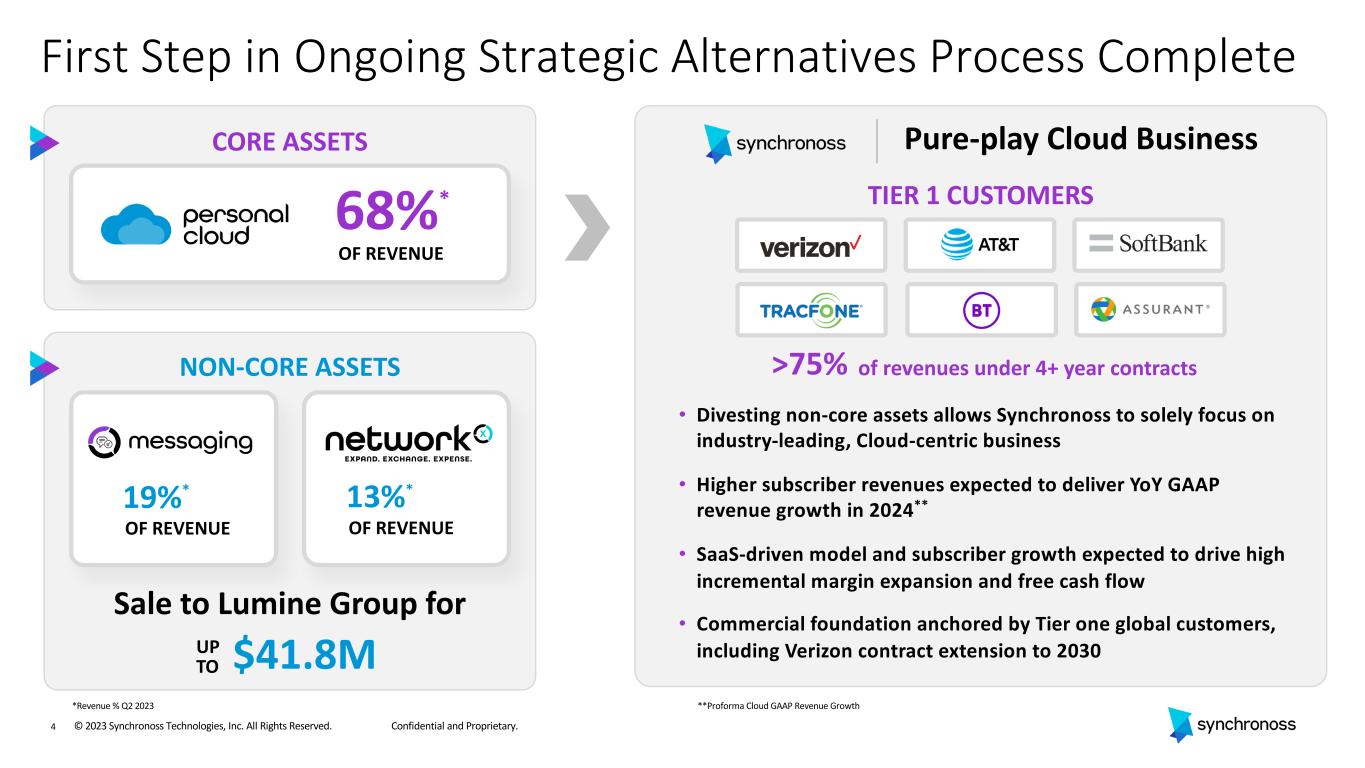

4 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary. First Step in Ongoing Strategic Alternatives Process Complete CORE ASSETS NON-CORE ASSETS 19%* OF REVENUE 13%* OF REVENUE • Divesting non-core assets allows Synchronoss to solely focus on industry-leading, Cloud-centric business • Higher subscriber revenues expected to deliver YoY GAAP revenue growth in 2024** • SaaS-driven model and subscriber growth expected to drive high incremental margin expansion and free cash flow • Commercial foundation anchored by Tier one global customers, including Verizon contract extension to 2030 Sale to Lumine Group for $41.8MUP TO 68%* OF REVENUE TIER 1 CUSTOMERS of revenues under 4+ year contracts >75% *Revenue % Q2 2023 Pure-play Cloud Business **Proforma Cloud GAAP Revenue Growth

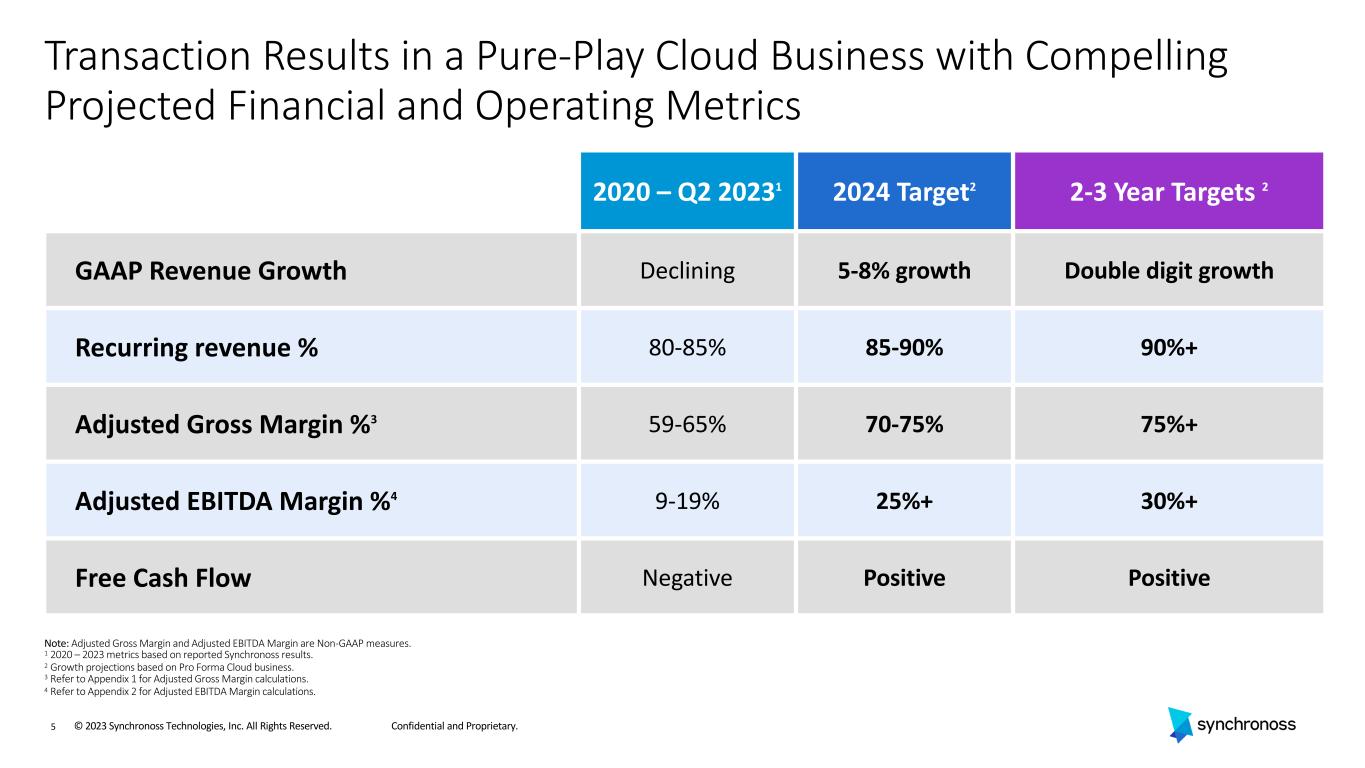

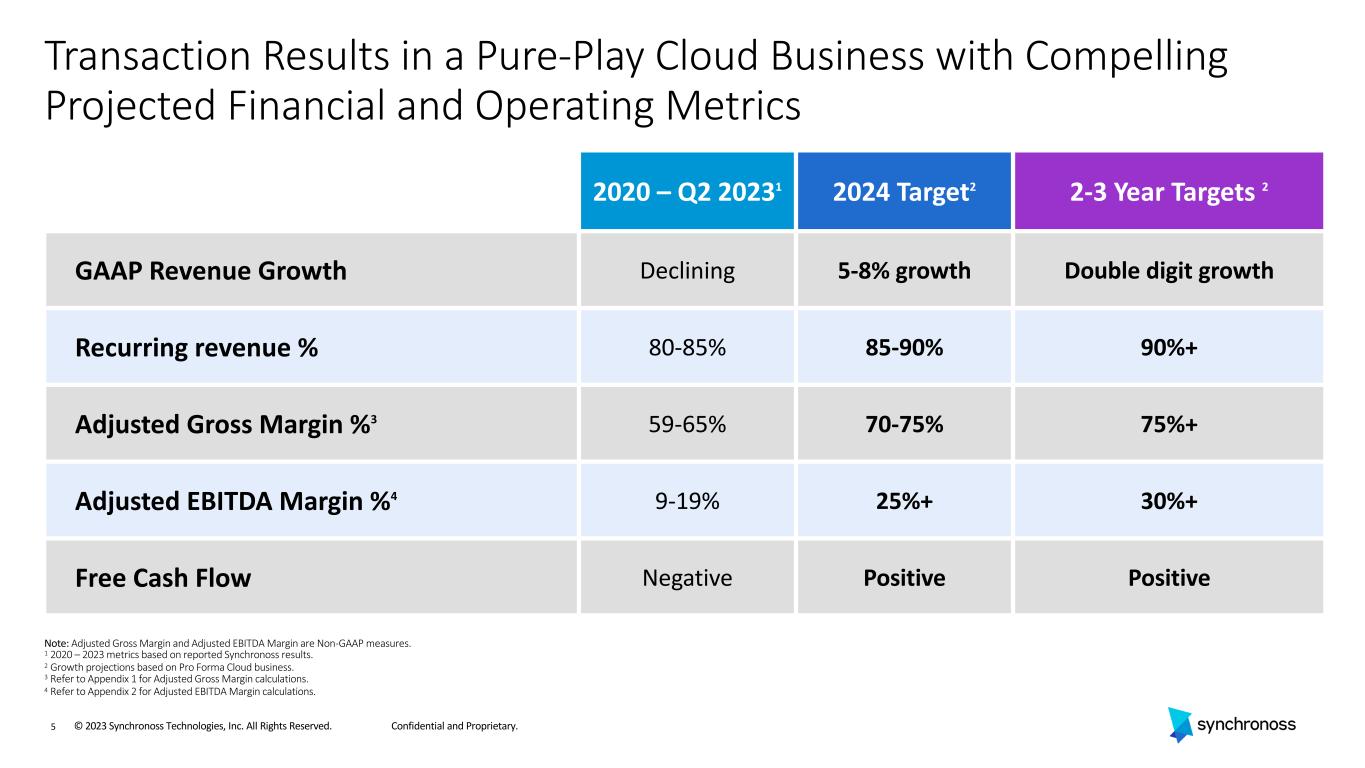

5 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary. 2020 – Q2 20231 2024 Target2 2-3 Year Targets 2 GAAP Revenue Growth Declining 5-8% growth Double digit growth Recurring revenue % 80-85% 85-90% 90%+ Adjusted Gross Margin %3 59-65% 70-75% 75%+ Adjusted EBITDA Margin %4 9-19% 25%+ 30%+ Free Cash Flow Negative Positive Positive Transaction Results in a Pure-Play Cloud Business with Compelling Projected Financial and Operating Metrics Note: Adjusted Gross Margin and Adjusted EBITDA Margin are Non-GAAP measures. 1 2020 – 2023 metrics based on reported Synchronoss results. 2 Growth projections based on Pro Forma Cloud business. 3 Refer to Appendix 1 for Adjusted Gross Margin calculations. 4 Refer to Appendix 2 for Adjusted EBITDA Margin calculations.

6 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary. Additional Growth Attainable by Further Penetration of $13.5B Market Opportunity $16B $12B ~$10B $8B $4B $0B Estimated Expanded Market Opportunity for Synchronoss’ Cloud Solution (in U.S.D.| 2021) Global Viable TAM for Synchronoss' Cloud Solution in Core Markets (MNOs/MVNOs) ~$2.0B Cloud for Home Market Opportunity - MSOs & Telcos Mobile Phone Insurance Market Opportunity Retailer Market Opportunity Security Providers Market Opportunity Financial Services Market Opportunity Total Viable Opportunity for Synchronoss ~$465M ~$250M~$160M~$335M ~$13.5B Source: Stax interviews, web survey, and analysis, May-June 2022; Synchronoss Internal Data; Wireless Provider 10Ks and Investor Publications; FED; Pew Research Center. Note: Total market opportunity assumes maximum adoption, which was determined from Stax’s web survey. Maximum adoption represents current adoption and subscribers that are interested in purchasing/using a cloud solution from each segment. Viable Expanded TAM Opportunity in U.S.

7 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary. Key Areas of Focus to Achieve Operating Model SHORT TERM: • Improve capital structure through reduction of outstanding preferred stock • Restructure organization to improve go-forward margin profile and Free Cash Flow • Enhance growth with SoftBank Cloud launch LONG TERM: • Continue subscriber growth and penetration of existing accounts • Selectively expand global customer base • Additional reductions in preferred stock leveraging expected IRS refund and Free Cash Flow

8 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary.

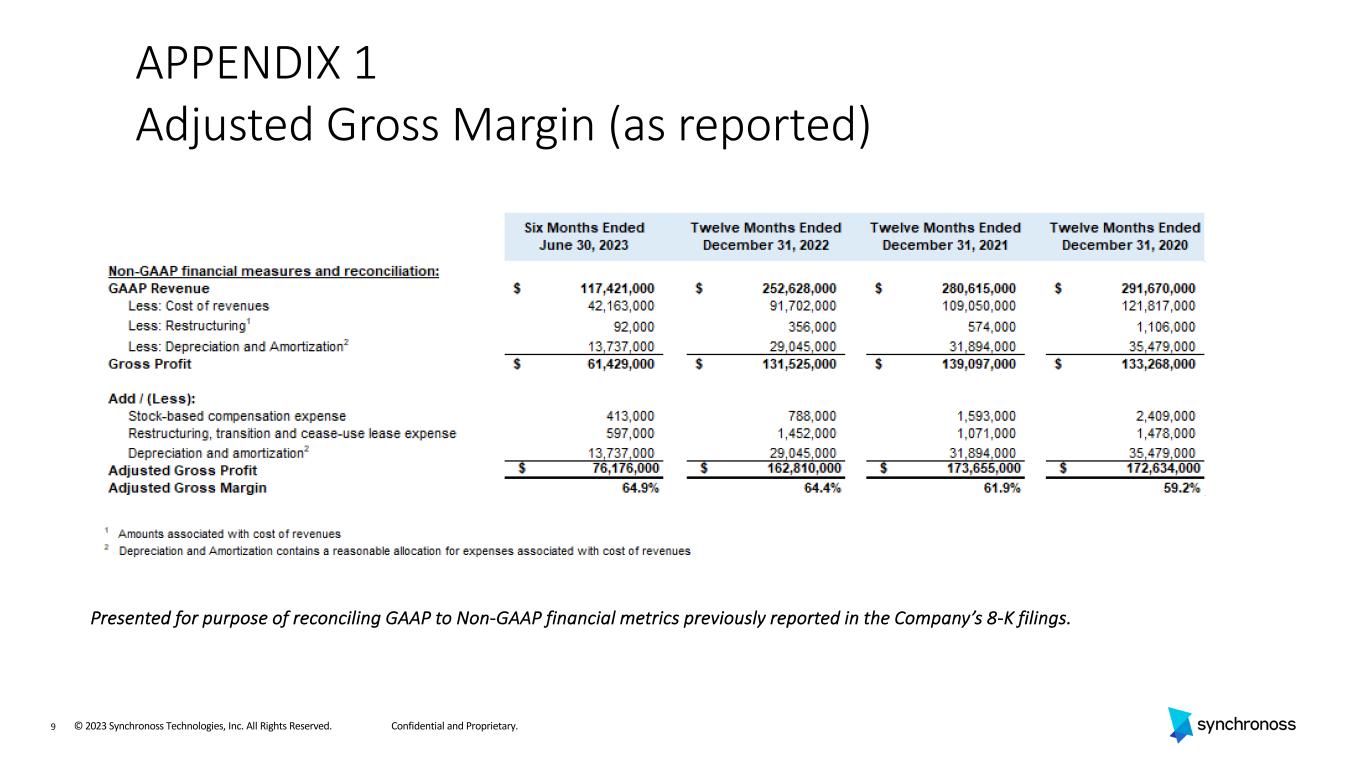

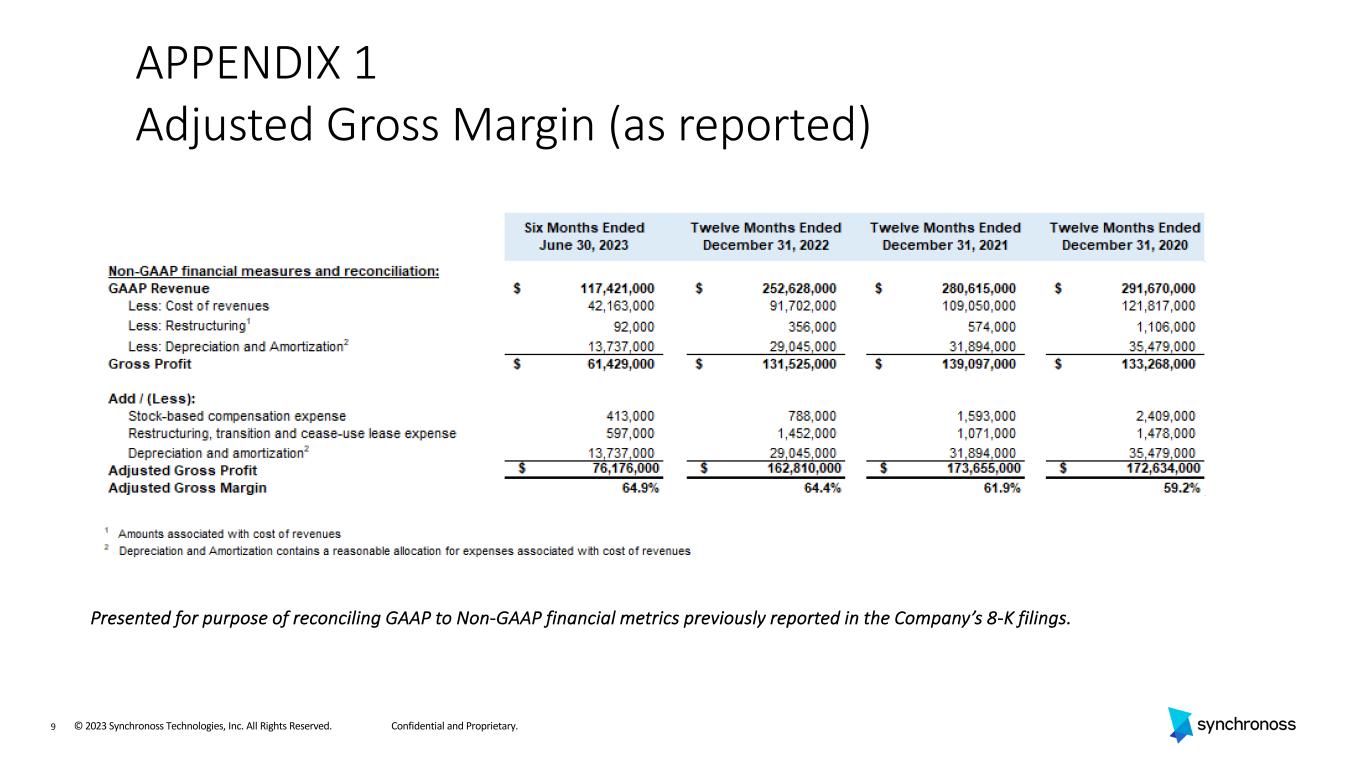

9 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary. APPENDIX 1 Adjusted Gross Margin (as reported) Presented for purpose of reconciling GAAP to Non-GAAP financial metrics previously reported in the Company’s 8-K filings.

10 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary. APPENDIX 2 Adjusted EBITDA Margin (as reported) Presented for purpose of reconciling GAAP to Non-GAAP financial metrics previously reported in the Company’s 8-K filings.

11 © 2023 Synchronoss Technologies, Inc. All Rights Reserved. Confidential and Proprietary.