QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on August 26, 2003

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

TolerRx, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 2834 | | 04-3522987 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

300 Technology Square

Cambridge, Massachusetts 02139

(617) 452-1300

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices) |

Douglas J. Ringler, V.M.D.

President and Chief Executive Officer

TolerRx, Inc.

300 Technology Square

Cambridge, Massachusetts 02139

(617) 452-1300

(Name, address, including zip code, and telephone number, including

area code, of agent for service) |

copies to: |

Julio E. Vega, Esq.

Bingham McCutchen LLP

150 Federal Street

Boston, Massachusetts 02110

Telephone: (617) 951-8000

Facsimile: (617) 951-8736 | | David W. Pollak, Esq.

Morgan, Lewis & Bockius LLP

101 Park Avenue

New York, New York 10178

Telephone: (212) 309-6000

Facsimile: (212) 309-6001 |

Approximate date of commencement of proposed sale to public:As soon as practicable after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If delivery of the Prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

| | Amount to

be registered

| | Proposed maximum

offering price

per share

| | Proposed maximum

aggregate

offering price(1)

| | Amount of

registration fee(2)

|

|---|

|

| Common Stock, $0.001 par value per share | | | | | | $75,000,000 | | $6,068 |

|

(1) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

(2) Calculated pursuant to Rule 457(a) based on an estimate of the proposed maximum aggregate offering price.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

Subject to completion August 26, 2003

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Preliminary prospectus

shares

Common stock

This is an initial public offering of shares of common stock by TolerRx, Inc. The estimated initial public offering price is between $ and $ per share.

We have applied for listing of our common stock on the Nasdaq National Market under the symbol TLRX.

|

|---|

| | Per share

| | Total

|

|---|

|

|---|

Initial public offering price |

|

$ |

|

|

$ |

|

Underwriting discounts and commissions |

|

$ |

|

|

$ |

|

Proceeds to TolerRx, before expenses |

|

$ |

|

|

$ |

|

|

The underwriters may also purchase up to shares of common stock from us at the public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus. The underwriters may exercise this option only to cover over-allotments, if any. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ , and our total proceeds, before expenses, will be $ .

The underwriters are offering our common stock as set forth under "Underwriting." Delivery of the shares will be made on or about , 2003.

Investing in our common stock involves a high degree of risk. See "Risk factors" beginning on page 5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

| JP Morgan | | SG Cowen |

Leerink Swann & Company

|

, 2003

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information provided by this prospectus is accurate as of any date other than the date on the front of this prospectus.

Through and including (the 25th day after the date of this prospectus), all dealers that buy, sell, or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Table of contents

| | Page

|

|---|

| Prospectus summary | | 1 |

| Risk factors | | 5 |

| Special note regarding forward-looking statements | | 18 |

| Use of proceeds | | 19 |

| Dividend policy | | 19 |

| Capitalization | | 20 |

| Dilution | | 21 |

| Selected consolidated financial data | | 22 |

Management's discussion and analysis of

financial condition and results of operations | | 23 |

| Business | | 34 |

| Management | | 51 |

| Related party transactions | | 59 |

| Principal stockholders | | 61 |

| Description of capital stock | | 63 |

| Shares eligible for future sale | | 67 |

Certain U.S. federal income tax considerations

for Non-U.S. Holders of our common stock | | 70 |

| Underwriting | | 73 |

| Legal matters | | 76 |

| Experts | | 76 |

| Where you can find additional information | | 76 |

| Index to consolidated financial statements | | F-1 |

The names "TolerMab", "TolerRx", and the TolerRx logo are our trademarks. All other trademarks or tradenames referred to in this prospectus are the property of their respective owners.

i

Prospectus summary

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in shares of our common stock. You should read this entire prospectus carefully, including "Risk factors" beginning on page 5 and our consolidated financial statements and the notes to those financial statements beginning on page F-1, before making an investment decision.

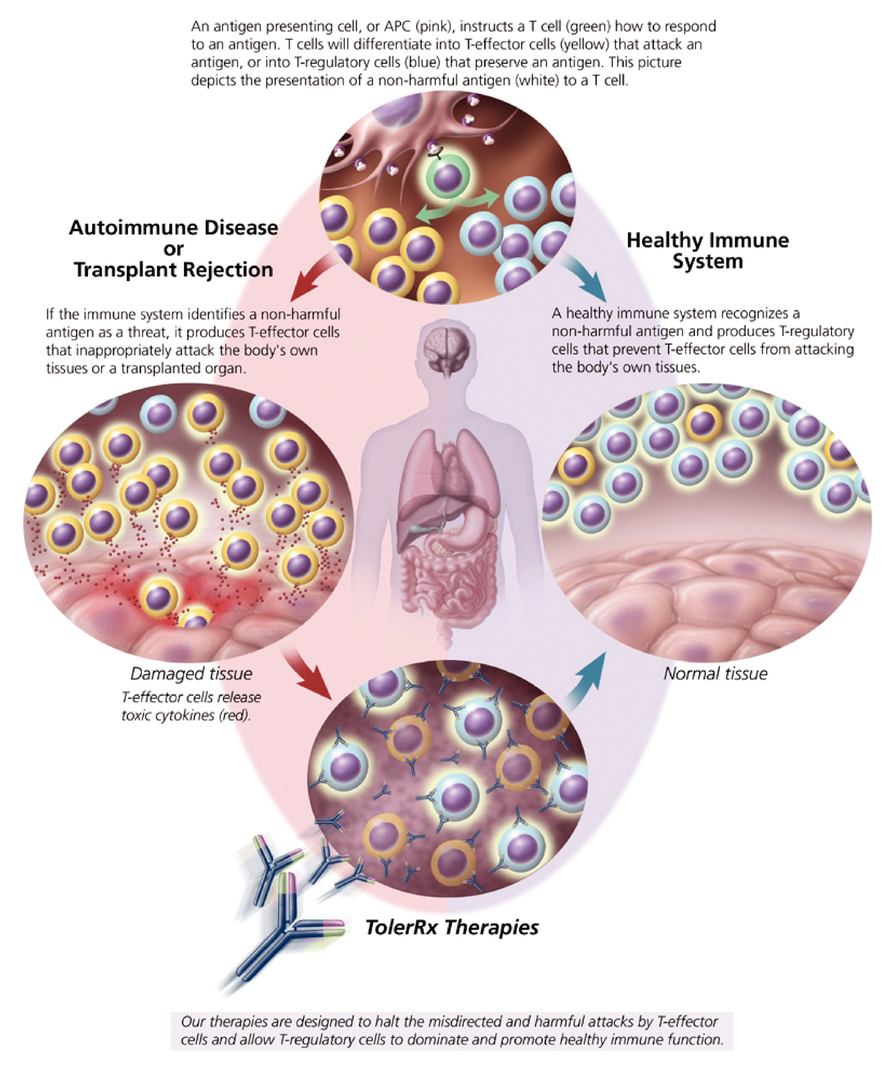

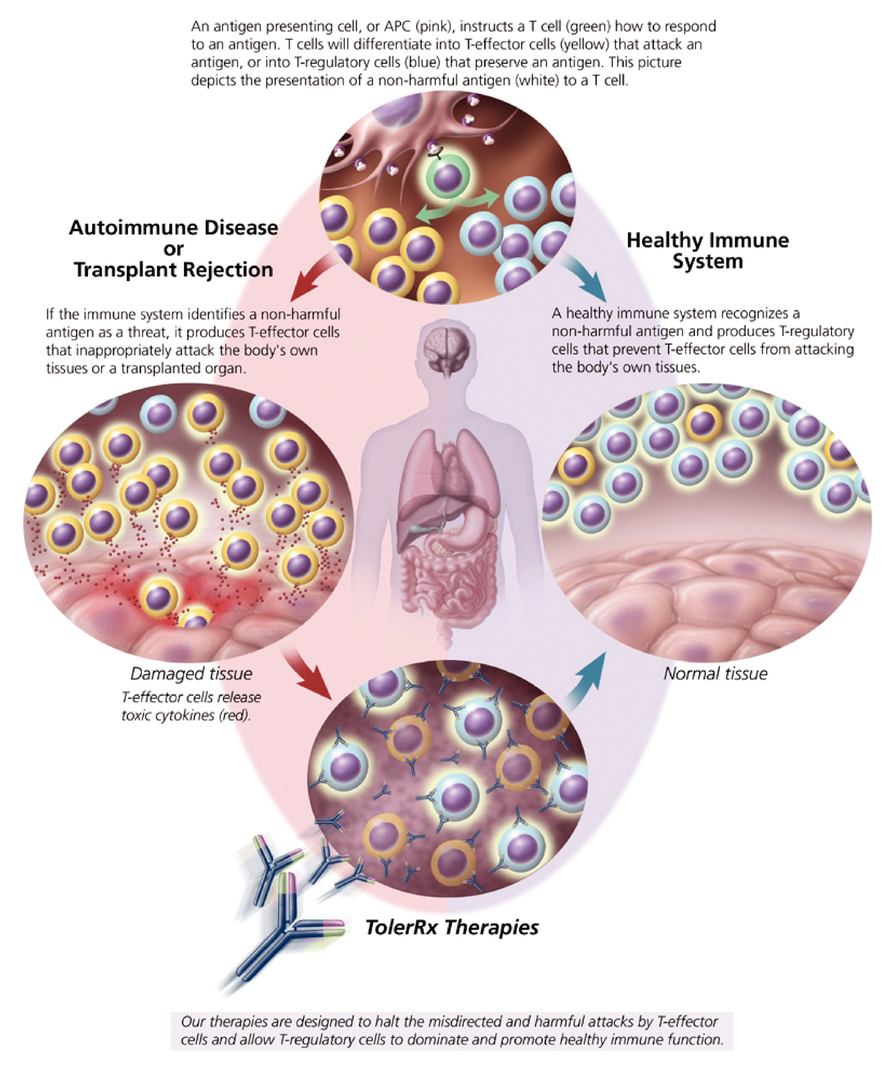

Our business

We are a biopharmaceutical company focused on the discovery, development, and commercialization of novel therapies to treat patients with diseases of the immune system. Our therapies are based upon a unique understanding of the way the immune system recognizes and avoids attacking the body's own tissues and proteins, as well as other antigens that are not harmful to the body. This state of non-aggressive responsiveness to an antigen is called immunological tolerance and is a natural part of a properly functioning immune system. Therapies that induce immunological tolerance represent a fundamentally new approach to treating and potentially curing autoimmune diseases, organ transplant rejection, and other conditions associated with adverse or undesirable immune responses.

We have established a pipeline of five products, two in human clinical trials and three in preclinical development. Our most advanced products are:

• TRX4

Our TRX4 monoclonal antibody is in an investigator-sponsored Phase II clinical trial of 80 patients in Europe with new-onset Type I diabetes. All of the patients have completed treatment and are currently in an 18-month follow-up phase. We plan to file an Investigational New Drug application for TRX4 with the U.S. Food and Drug Administration first for psoriasis and psoriatic arthritis by early 2004, and later for additional studies in new-onset Type I diabetes based on the results of the ongoing European trial; and

• TRX1

Our TRX1 monoclonal antibody is being developed in collaboration with Genentech to induce tolerance in transplantation, autoimmune diseases, and clinical situations where the immune system attacks therapeutic proteins or biologic drugs. In July 2003, we completed a Phase I clinical trial in the United Kingdom, which demonstrated that TRX1 was generally well tolerated.

We also have ongoing research and development programs focused on generating new monoclonal antibody and small molecule products for the treatment of immunological diseases.

In addition, we have developed our TolerMab antibody technology, which is intended to enable us to modify antibodies to induce immunological tolerance to themselves. One of the limitations with current monoclonal antibody therapies is that they can trigger an immune system response which renders such therapies ineffective. We believe that our TolerMab technology will improve the side effect profile and enhance the long-term effectiveness of antibody therapy to treat patients with chronic disease. We are evaluating two TolerMab antibodies in preclinical development.

1

Our strategy

Our goal is to become the recognized leader in the discovery, development, and commercialization of products that treat patients with diseases of the immune system, such as Type I diabetes, psoriasis, psoriatic arthritis, multiple sclerosis, rheumatoid arthritis, transplant rejection, and immune system neutralization of therapeutic proteins. Our strategy to achieve this goal is to:

• develop and commercialize our lead products to provide breakthrough therapies that induce immunological tolerance;

• generate new products for our pipeline based on our understanding of T-regulatory cells;

• leverage collaborative partnerships;

• retain commercialization rights to certain products;

• exploit knowledge of immunological tolerance to optimize clinical development; and

• commercialize the TolerMab antibody technology internally and through partners.

Collaboration with Genentech

In December 2002, we entered into a collaboration agreement with Genentech for the development and commercialization of our TRX1 monoclonal antibody. To date, we have received an aggregate of $8.0 million from Genentech in the form of a license fee, an equity investment, and a milestone payment. We may receive up to approximately $80 million in additional payments if all development and regulatory approval milestones for TRX1 in multiple disease indications are achieved. If TRX1 receives marketing approval, we will be entitled to receive royalties on worldwide net sales. In addition, in lieu of receiving royalties on sales of TRX1 in the United States, we have the option to participate in a cost and profit sharing relationship with Genentech and to support the commercialization of TRX1 through our own medical science liaisons who would educate the medical profession about our product. For further information regarding our collaboration with Genentech, including any payments thereunder, see "Risk factors" on page 7 and "Business" on page 34.

Corporate information

We were formed on July 6, 2000, as a Delaware corporation. Our principal executive offices are located at 300 Technology Square, Cambridge, Massachusetts 02139, and our telephone number is (617) 452-1300. Our web site address is www.tolerrx.com. Information contained on our web site is not a part of this prospectus.

2

The offering

| Common stock offered by TolerRx: shares | | |

Common stock to be outstanding after this offering: shares |

|

|

Use of proceeds |

|

|

We intend to use the proceeds from this offering for research and development activities relating to drug discovery and development programs, our collaboration with Genentech, and other general corporate and working capital purposes. See "Use of proceeds." |

Proposed Nasdaq National Market symbol: TLRX |

|

|

The number of shares of our common stock that will be outstanding after this offering is based on the number of shares outstanding as of June 30, 2003, unless otherwise indicated herein, without taking into consideration a reverse stock split which we intend to effect prior to this offering, assumes the conversion of all outstanding shares of our redeemable convertible preferred stock into common stock on a one-for-one basis, and excludes:

• 956,750 shares of our common stock issuable upon the exercise of stock options outstanding as of June 30, 2003 at a weighted average exercise price of $0.15 per share, of which options to purchase 42,750 shares of our common stock were then exercisable;

• 311,250 shares of our common stock issuable upon the exercise of warrants to purchase common stock at a weighted average exercise price of $0.81 per share; and

• 2,706,000 shares of our common stock reserved for future grant under our 2000 Equity Incentive Plan, as amended.

Unless specifically stated otherwise, the information in this prospectus:

• assumes no exercise of the underwriters' over-allotment option;

• assumes an initial public offering price of $ per share, the midpoint of the initial public offering price range indicated on the cover of this prospectus;

• reflects the automatic conversion of all shares of our redeemable convertible preferred stock into 61,035,000 shares of our common stock upon the completion of this offering;

• does not reflect a reverse stock split which we intend to effect prior to this offering; and

• reflects the filing, prior to the completion of this offering, of our restated certificate of incorporation, referred to in this prospectus as our certificate of incorporation, and the adoption of our amended and restated by-laws, referred to in this prospectus as our by-laws, implementing the provisions described under "Description of capital stock."

3

Summary consolidated financial information

The following table contains our summary consolidated financial information. You should read this information together with our consolidated financial statements and related notes to those statements, "Selected consolidated financial data," and "Management's discussion and analysis of financial condition and results of operations" included elsewhere in this prospectus.

Pro forma per share amounts in the table below reflect the conversion of all issued and outstanding shares of our redeemable convertible preferred stock into common stock as if the shares had been converted immediately upon their issuance.

| |

|---|

| |

| | Year ended

December 31,

| | Six months ended

June 30,

| |

|---|

| | Inception

through

December 31,

2000

| |

|---|

(in thousands, except share

and per share data)

| |

|---|

| | 2001

| | 2002

| | 2002

| | 2003

| |

|---|

| |

|---|

| Statement of operations data: | | | | | | | | | | | | | | | | |

| Revenues | | $ | — | | $ | — | | $ | 27 | | $ | — | | $ | 750 | |

| Operating expenses | | | | | | | | | | | | | | | | |

| | Research and development | | | 232 | | | 3,797 | | | 10,908 | | | 4,883 | | | 5,236 | |

| | General and administrative | | | 125 | | | 1,370 | | | 2,774 | | | 1,330 | | | 1,556 | |

| | Stock-based compensation | | | 9 | | | 627 | | | 613 | | | 432 | | | 607 | |

| | |

| |

| | | Total operating expenses | | | 366 | | | 5,794 | | | 14,295 | | | 6,645 | | | 7,399 | |

| | |

| |

| | | Loss from operations | | | (366 | ) | | (5,794 | ) | | (14,268 | ) | | (6,645 | ) | | (6,649 | ) |

| Interest income | | | — | | | 165 | | | 250 | | | 139 | | | 215 | |

| Interest expense | | | (1 | ) | | (40 | ) | | (295 | ) | | (117 | ) | | (156 | ) |

| | |

| |

| Net loss | | | (367 | ) | | (5,669 | ) | | (14,313 | ) | | (6,623 | ) | | (6,590 | ) |

| Accretion of redeemable convertible preferred stock | | | (10 | ) | | (737 | ) | | (2,224 | ) | | (934 | ) | | (2,411 | ) |

| |

| |

|---|

| Net loss attributable to common stockholders | | $ | (377 | ) | $ | (6,406 | ) | $ | (16,537 | ) | $ | (7,557 | ) | $ | (9,001 | ) |

| |

| |

|---|

| Net loss attributable to common stockholders per share, basic and diluted | | $ | (1.52 | ) | $ | (8.91 | ) | $ | (9.33 | ) | $ | (5.19 | ) | $ | (3.92 | ) |

| |

| |

|---|

| Pro forma net loss per share, basic and diluted | | | | | | | | $ | (0.51 | ) | | | | $ | (0.10 | ) |

| |

| |

|---|

| Shares used in computing net loss per share, basic and diluted | | | 248,119 | | | 719,094 | | | 1,773,180 | | | 1,455,871 | | | 2,295,342 | |

| |

| |

|---|

| Shares used in computing pro forma net loss per share, basic and diluted | | | | | | | | | 27,903,802 | | | | | | 63,330,342 | |

| |

The following table is a summary of our balance sheet as of June 30, 2003:

• on an actual basis;

• on a pro forma basis to give effect to the automatic conversion of all outstanding shares of our redeemable convertible preferred stock into common stock upon the closing of this offering; and

• on a pro forma as adjusted basis to give effect to the sale of the shares of common stock offered by this prospectus at an assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses.

|

|---|

June 30, 2003

(in thousands)

| | Actual

| | Pro forma

| | Pro forma

as adjusted

|

|---|

|

| Balance sheet data: | | | | | | | | | |

| Cash and cash equivalents | | $ | 35,628 | | $ | 35,628 | | $ | |

| Working capital | | | 31,178 | | | 31,178 | | | |

| Total assets | | | 42,593 | | | 42,593 | | | |

| Long-term debt, net of current portion | | | 486 | | | 486 | | | |

| Redeemable convertible preferred stock | | | 63,110 | | | — | | | |

| Accumulated deficit | | | (29,583 | ) | | (29,583 | ) | | |

| Stockholders' equity (deficit) | | | (30,328 | ) | | 32,782 | | | |

|

4

Risk factors

An investment in our common stock involves significant risks. Before making an investment decision, you should carefully consider the following risk factors in addition to the other information in this prospectus. The risks and uncertainties described are not the only ones facing us. Our business, results of operations, and financial condition may be materially and adversely affected by any of the following risks.

Risks related to our business

We have a history of substantial net losses and cannot predict when we will become profitable, if at all.

We were incorporated in July 2000 and have a limited operating history upon which an investor may evaluate our operations and future prospects. We have incurred net losses since our inception, including net losses of $14.3 million for the year ended December 31, 2002, and $6.6 million for the six months ended June 30, 2003. As of June 30, 2003, we had an accumulated deficit of $29.6 million. We expect to continue to incur significant operating losses in future periods and cannot predict when we will become profitable, if at all. We expect to make substantial expenditures to further our drug discovery and development programs. We expect that our rate of spending will accelerate as a result of the increased costs and expenses associated with our collaboration with Genentech and with our internal drug discovery and development programs. In the event that we exercise our cost and profit sharing option with Genentech, we will be required to pay a percentage of the costs of development and commercialization of TRX1, which amounts are uncertain and are expected to be substantial. Our revenue and profit potential is unproven, and our limited operating history makes our future operating results difficult to predict. Additionally, our quarterly revenues and operating results are difficult to predict and may fluctuate significantly from quarter to quarter for numerous reasons, including the timing of the receipt of milestone payments and royalties, neither of which are within our control. Consequently, an investor in our common stock may be unable to evaluate our future operations.

None of our products has received marketing approval, and we may not successfully develop any approved products in the future.

We plan to develop and commercialize products that we discover independently or acquire from third parties. To date, however, our most advanced products are in early clinical development, and we have not developed any products that have received marketing approval. Our ability to develop and commercialize products in the future will depend on our:

• successfully completing preclinical and clinical testing;

• obtaining necessary regulatory approvals;

• producing and manufacturing products;

• effectively deploying sales and marketing resources;

• entering into third-party collaborations for our products; and

5

• obtaining intellectual property protection for our products.

Some of the material risks that we may encounter in conducting internal drug development programs include the following:

• preclinical development and clinical trials for our potential products are expensive and time consuming and their outcome is uncertain;

• we have little experience in conducting clinical development activities and often rely on external clinical investigators;

• since we may be subject to extensive and changing government regulatory requirements, we may be unable to obtain government approval of any products in a timely manner;

• we will rely on third-party manufacturers to produce our products; and

• we currently have no distribution, sales, or marketing capabilities.

Our products are based on an understanding of the immune system that could ultimately prove to be incorrect.

Our success as a company depends on our ability to develop novel therapeutics that induce, maintain, or remove immunological tolerance and have clinically beneficial effects in a number of disease settings. In order to accomplish this, we must identify cells, cellular pathways, and molecular targets that are involved in the development and maintenance of immunological tolerance. The science of discovering therapeutics based on the identification of genes, cells, and cellular pathways that may be involved in the induction of immunological tolerance is relatively new and evolving rapidly. Our approach may fail to produce therapeutically relevant results, hindering our ability to pursue our clinical and regulatory strategy and sustain our growth. Immunological tolerance may be linked to one or a combination of several genes, cells, and cellular pathways. Therefore, a product that modifies the effect of any one gene, cell, or target may not have a clinical effect in patients.

Therapies that modulate the immune system may have harmful and unintended effects.

While we believe that our products will be safe, durable, and effective treatments for diseases of the immune system, our most advanced products to date are in early clinical development. There are potential risks involved with promoting immunological tolerance and interfering with normal immunological function, including unintended tolerization to viruses and cancers and increased susceptibility to the reactivation of chronic latent viral infections such as Epstein-Barr virus, other herpes viruses, and human papilloma virus.

Because many of the products that we develop will be based on new technologies and novel therapeutic approaches, the market may not be receptive.

The commercial success of any products we develop, if approved for marketing, will depend upon their acceptance by the medical community and private and government third-party payors as clinically useful, cost-effective, and safe. Many of the products that we are developing are based upon new technologies, such as our TolerMab antibody technology, and new therapeutic approaches based on short courses of therapy with long-term and durable

6

clinical benefits, such as the induction and maintenance of immunological tolerance. As a result, it may be more difficult for us to achieve market and third-party payor acceptance of our products, particularly the first products that we introduce to the market. Our efforts to educate the medical and third-party payor communities on these potentially unique approaches may require greater resources than would be typically required for products based on conventional technologies or therapeutic approaches. The safety, efficacy, convenience, and cost-effectiveness of our products as compared to competitive products will also affect market acceptance.

We rely significantly on Genentech for the development and commercialization of one of our lead products, TRX1. If our collaboration is terminated or does not yield favorable results, our business would be harmed significantly.

We have entered into a collaboration agreement with Genentech pursuant to which Genentech and we will conduct preclinical and clinical trials, and Genentech will seek regulatory approval and undertake the commercialization of our TRX1 monoclonal antibody and other CD4-targeting products. The collaboration agreement allows Genentech full discretion in electing how to pursue the development of TRX1. As a result, we cannot control the amount or timing of resources Genentech dedicates to the collaboration. Our receipt of revenues from achievement of drug development and regulatory approval milestones or royalties on sales under the collaboration agreement is dependent upon Genentech's activities and its development, manufacturing, and marketing resources. If we are unable to achieve any of the development or regulatory approval milestones, or the commercialization of TRX1 is not successful, we may not derive any additional revenue from the collaboration. Moreover, certain products that Genentech discovers may be competitive with TRX1. Accordingly, we cannot be certain that Genentech will proceed with the development of TRX1 or will pursue their existing or alternative products in preference to or in lieu of TRX1.

We are relying on Genentech to fund a substantial portion of the research and development expenses of TRX1 over the next several years. Genentech may terminate our collaboration agreement at any time, with or without cause, with 90 days notice, and in such event we would lose all right to any further payments under the agreement. If Genentech terminates or breaches the collaboration agreement, or otherwise does not conduct its collaborative activities in a timely manner, the development or commercialization of TRX1 could be delayed or terminated, or we could be required to undertake unforeseen additional responsibilities or devote unbudgeted additional resources to such development or commercialization.

We will require substantial funds in addition to the proceeds of this offering that we may not be able to raise.

Based on our current plans, we believe that our cash and cash equivalents, together with the estimated net proceeds from this offering, will be sufficient to meet our capital requirements for the next three years. However, after that, or in the event of unforeseen developments relating to our business, we will require substantial additional funds to develop and commercialize our products. Additional financing may not be available when we need it or, if available, it may not be on terms that are favorable to us. If we are unable to obtain adequate funding on a timely basis, we may be required to cease one or more of our drug discovery or development programs. We could be required to seek funds through arrangements with

7

collaborators or others that may require us to relinquish certain rights to our technologies or products, which we would have otherwise retained.

We may not be able to expand our current collaboration, enter into additional collaborations, or achieve the milestones needed to fund our growth.

We currently have no collaboration agreements other than with Genentech. We expect to receive revenue from Genentech and from future collaboration agreements for the research and development of products depending on the achievement of specific milestones and the development and commercialization of successful products. If we are unable to achieve the development and regulatory milestones specified in the Genentech agreement or expand the Genentech collaboration to include additional products or targets, or if we are unable to enter into new collaboration agreements, we may not generate sufficient revenues to successfully fund our research and development programs. Whether we generate sufficient revenues will depend, in part, on our efforts as well as the efforts of our collaborators. If we or any of our collaborators fail to meet specific milestones or to advance the products in accordance with the terms of a collaboration agreement, then that collaboration agreement may be terminated, which could result in a decrease in our future revenues.

Clinical trials for our products are expensive and time consuming and their outcome is uncertain. If our clinical trials are unsuccessful, or if they experience significant delays, our ability to commercialize products will be impaired.

Before we can obtain marketing approval for the commercial sale of any product, we must complete preclinical development and extensive clinical trials in humans to demonstrate a product's safety and efficacy. Each of these trials requires the investment of substantial time and expense.

The preclinical laboratory testing, formulation, development, manufacturing, and clinical trials of any product we develop independently or in collaboration with third parties, as well as the distribution and marketing of these products, are regulated by numerous federal, state, and local governmental authorities in the United States, principally the U.S. Food and Drug Administration, or FDA, and by similar agencies in other countries. It may take us several years to complete our testing, and failure can occur at any stage of testing. Interim results of preclinical or clinical studies do not necessarily predict their final results, and acceptable results in early studies might not be seen in later studies. Any preclinical or clinical test may fail to produce results that meet FDA requirements. Preclinical and clinical data can be interpreted in different ways, which could delay, limit, or prevent marketing approval. Negative or inconclusive results from a preclinical study or clinical trial, adverse medical events during a clinical trial, or safety issues resulting from products of the same class of drug could cause a preclinical study or clinical trial to be repeated, halted, or terminated, even if other studies or trials relating to the same drug are successful.

We may not complete our planned preclinical or clinical trials on schedule or at all. We may not be able to demonstrate the safety and efficacy of our products in long-term clinical trials which may result in a delay or failure to commercialize our products. As a result, we may have to expend substantial additional funds to obtain access to resources, or delay or modify our plans significantly. Our product development costs will increase if we experience delays in clinical testing or subsequent approvals. Significant clinical trial delays could allow our

8

competitors to bring products to market before we do, and impair our ability to commercialize our products or potential products.

If we are unable to obtain and maintain patent protection for our discoveries, the value of our technology and products will be adversely affected.

We will be able to protect our proprietary rights from unauthorized use by third parties only to the extent they are covered by valid and enforceable patents or are effectively maintained as trade secrets. To date, we have licenses to approximately 95 issued U.S. and foreign patents. In addition, we own or have licenses to approximately 45 pending U.S. and foreign patent applications. Because the patent position of pharmaceutical and biotechnology companies involves complex legal, scientific, and factual questions, the issuance, scope, and enforceability of patents cannot be predicted with certainty. In addition, there is some uncertainty as to whether human clinical data will be required for issuance of patents for human therapeutics. Patents, if issued, may be challenged, invalidated, or circumvented. Thus, any patents that we own or license from others may not provide adequate protection against competitors. Our pending patent applications, those we file in the future, or those we may license from third parties, may not result in patents being issued. If issued, they may not provide us with proprietary protection or competitive advantages against others with similar products and technology. Furthermore, others may independently develop similar products or technology or duplicate any technology that we have developed. Moreover, the laws of many foreign countries do not protect our intellectual property rights to the same extent as do the laws of the United States.

We may incur substantial costs or lose important rights as a result of litigation or other proceedings relating to patent and other intellectual property rights.

The defense and prosecution of intellectual property rights, U.S. Patent and Trademark Office interference proceedings, and related legal and administrative proceedings in the United States and elsewhere are costly and time consuming and their outcome is uncertain. Litigation may be necessary to:

• assert claims of infringement;

• enforce our issued and licensed patents;

• protect trade secrets or know-how; or

• determine the enforceability, scope, and validity of the proprietary rights of others.

If we become involved in any litigation, interference, or other administrative proceedings, we will incur substantial expense and it will divert the efforts of our scientific and management personnel. Uncertainties resulting from the initiation and continuation of litigation, interference, or other administrative proceedings could have a material adverse effect on our ability to compete in the marketplace pending resolution of the disputed matters. An adverse determination may subject us to significant liabilities or require us to seek licenses that may not be available from third parties on commercially reasonable terms, if at all. We or our collaborators may be restricted or prevented from developing and commercializing our products, if any, in the event of an adverse determination in a judicial or administrative

9

proceeding, or if we fail to obtain necessary licenses. Any of these outcomes would significantly harm our business.

As is commonplace in the biotechnology and pharmaceutical industries, we employ individuals who were previously employed at other biotechnology or pharmaceutical companies, including our competitors or potential competitors. To the extent our employees are involved in research areas which are similar to those areas in which they were involved at their former employers, we may be subject to claims that such employees or we have inadvertently or otherwise used or disclosed the alleged trade secrets or other proprietary information of the former employers. Litigation may be necessary to defend against such claims.

We rely on third-party licenses for the development and commercialization of our products. If any of these licenses are terminated, we may not be able to develop and commercialize the products covered by them.

We license from third parties intellectual property and technologies that are critical to the development of our products, including our lead products TRX4 and TRX1. We hold many of these licenses pursuant to license agreements that may be terminated by the licensors if we commit a material breach or if we become insolvent or file for bankruptcy. If any of these license agreements are terminated, we may not be able to develop and commercialize our products.

Third parties may own or control patents or patent applications and require us to seek licenses, which could increase our development and commercialization costs or prevent us from developing, partnering, or marketing our products.

We may not have rights under some patents or patent applications related to our products. Third parties may own or control such patents and patent applications in the United States and abroad. For example, we are currently developing recombinant antibody products that include both humanized and chimeric antibodies. We are aware of third-party patents issued in the United States and abroad that are directed at recombinant antibodies, including humanized and chimeric antibodies and their production. In such cases, in order to develop, manufacture, sell, or import some of our proposed products, we or our collaborators may choose to seek, or be required to seek, licenses under third-party patents issued in the United States and abroad or those that might issue from United States and foreign patent applications. In such event, we may be required to pay license fees or royalties or both to the licensor. If licenses are not available to us on acceptable terms, we or our collaborators may not be able to develop, manufacture, sell, import, or export these products.

We may have conflicts with our partners over rights to intellectual property or development strategies, which could harm the development of our products.

We may disagree with our existing or future collaborators, such as research and development partners, manufacturing partners, or sales and marketing partners, over rights to our intellectual property. We may also have disagreements with our partners over our drug development strategy and programs. In addition to diverting the efforts of our management and scientific personnel, such conflicts could reduce our ability to enter into future collaboration arrangements and negatively impact our relationship with existing collaborators,

10

which could reduce our revenues, delay or terminate our drug discovery programs, and result in time consuming and expensive litigation or arbitration.

We have only limited experience in regulatory affairs, and some of our products may be based on new technologies and discoveries. These factors may affect our ability or the time we require to obtain necessary marketing approvals.

We have only limited experience in drafting and filing the submissions necessary to gain marketing approval for our products. Moreover, certain of the products that are likely to result from our research and development programs may be based on new technologies and new therapeutic approaches that have not been extensively tested in humans. The regulatory requirements governing these types of products may be more rigorous than for conventional products. As a result, we may experience a longer regulatory process in connection with any products that we develop based on these new technologies or new therapeutic approaches.

Failure to attract, motivate, and retain skilled personnel and academic collaborators and to effectively manage our growth may have an adverse effect on our business.

Our success depends on our continued ability to attract, motivate, and retain highly qualified management and scientific personnel and our ability to develop and maintain important relationships with leading academic and other research institutions and scientists. Competition for personnel and relationships in our industry is intense. If we lose the services of our management or scientific personnel or if our relationships with academic and other research institutions and scientists are compromised, our drug discovery and development programs may be significantly delayed, and our research and development objectives may be impeded. We are particularly dependent on Dr. Douglas J. Ringler, our President and Chief Executive Officer. Dr. Ringler's employment is at-will, and the loss of his services could delay or prevent the achievement of our research, development, and business objectives.

In addition, we have experienced, and expect to continue to experience, growth in the number of our employees and the scope of our operations. To compete effectively, we will have to expand, improve, and effectively use our operating, management, and financial systems to accommodate our growth. Failure to effectively anticipate, implement, or manage the changes required to sustain our growth may have an adverse effect on our business.

Because we have limited manufacturing capabilities, we will be dependent on third parties to manufacture products for us.

We have no clinical grade or commercial scale manufacturing capabilities. We currently rely upon third parties to produce material for preclinical and clinical testing purposes. We expect to continue to rely on third parties, including Genentech, to produce materials required for clinical trials and for the commercial production of certain of our products.

There are a limited number of third-party manufacturers that operate under the FDA's current Good Manufacturing Practices regulations and that have the necessary expertise and capacity to manufacture our products. As a result, we may experience some difficulty finding manufacturers for our anticipated future needs. If we are unable to arrange for third-party manufacturing of our products, or to do so on commercially reasonable terms, we may not be able to complete development of our products.

11

Reliance on third-party manufacturers entails risks to which we would not be subject if we manufactured products ourselves, including reliance on the third party for regulatory compliance and quality assurance, the possibility of breach of the manufacturing agreement by the third party because of factors beyond our control, and the possibility of termination or nonrenewal of the agreement by the third party, based on its own business priorities, at a time that is costly or inconvenient for us.

We may in the future elect to manufacture certain of our products without the assistance of third parties. We would need to invest substantial additional funds and recruit qualified personnel in order to build or lease and operate any manufacturing facilities.

We may seek to expand our business through possible acquisitions of complementary products, technologies, or organizations, and we may have difficulty integrating those assets into our business and operations.

In the future, we may from time to time seek to expand our business through acquisitions. Our acquisition of products, technologies, companies, and businesses and our expansion of operations would involve risks such as the following:

• the potential inability to successfully integrate acquired operations and businesses and to realize anticipated synergies, economies of scale, or other expected values;

• unanticipated costs associated with the acquisition;

• adverse market reaction;

• the incurrence of expenses related to transactions that may or may not be consummated; and

• the inability to effectively manage and coordinate operations at multiple venues, which, among other things, could divert our management's attention from other important business matters.

In addition, our financial condition and the reported results of our operations could be negatively affected by any acquisition or expansion of operations, which could result in dilutive issuances of equity securities, the incurrence of additional debt, write-offs relating to in-process research and development, and the creation of intangible assets and goodwill.

We face a risk of product liability claims and may not be able to obtain adequate insurance.

Our business exposes us to the risk of product liability claims that is inherent in the manufacturing, testing, and marketing of human therapeutic products. Although we have product liability insurance that we believe is appropriate for our business at this time, this insurance is subject to deductibles and coverage limitations, and the market for such insurance is becoming more restrictive. We may not be able to obtain or maintain adequate protection against potential liabilities. If we are unable to sufficiently insure against potential product liability claims, we will be exposed to significant liabilities, which may materially and adversely affect our business and financial position. These liabilities could prevent or interfere with our product development and commercialization efforts.

12

Risks related to our industry

We face growing and new competition, which may result in others discovering, developing, or commercializing products before or more successfully than us.

The fields of biotechnology and pharmaceutical development are highly competitive, and there are often several companies developing products to the same targets. Many of our competitors are substantially larger than we are, and these competitors have substantially greater capital resources, research and development staffs, and facilities than we have. Furthermore, many of our competitors are more experienced in research, drug discovery, development, and commercialization, obtaining marketing approvals, product manufacturing, and marketing.

Many other companies have previously developed an antibody or small molecule directed to the same target on white blood cells as our TRX1 antibody, and both Genmab and IDEC Pharmaceuticals are conducting clinical trials with antibodies that are directed to the same target as TRX1. Our TRX4 monoclonal antibody is directed to the same target as products being developed or sold by Protein Design Labs and Johnson & Johnson. MedImmune is developing an antibody directed to the the same target as our TolerMab TRX3 antibody. These products could represent competition for us in terms of enrolling patients in clinical trials or eventual commercialization of our products, if approved. These competitors may also own or control intellectual property which may be necessary for the commercialization of our products, and we may not be able to obtain a license to such intellectual property on favorable terms, or at all.

The pharmaceutical and biotechnology industries are highly concentrated, and any further consolidation could reduce the number of our potential collaborators and may affect our ability to execute our business strategies.

There are a limited number of large pharmaceutical and biotechnology companies, and these companies represent the market of potential collaborators for our drug discovery and development programs. The number of our potential collaborators could decline even further through consolidation among these companies. If the number of our potential collaborators declines, their relative negotiating power with us may increase. If we are unable to enter into additional collaborations on commercially acceptable terms, we may not be able to execute our business strategies.

If we fail to obtain an adequate level of reimbursement for our products by third-party payors, there may be no commercially viable markets for our products.

Our ability or the ability of our collaborators to commercialize our products, if any, may depend in part on the extent to which government health administration authorities, private health insurers, and other organizations will reimburse consumers for the cost of treatment. These third-party payors continually attempt to contain or reduce the costs of healthcare by challenging both the need, and the prices charged, for medical products and services. In certain foreign countries, particularly the countries of the European Union, the pricing of prescription pharmaceuticals is subject to governmental control. Significant uncertainty exists as to the reimbursement status of newly approved therapeutics. We may not be able to sell our products profitably if reimbursement is unavailable or limited in scope or amount.

13

In both the United States and certain foreign jurisdictions, there have been a number of legislative and regulatory proposals to change the healthcare system. Further proposals are likely. The potential for adoption of these proposals affects or will affect our ability to market our products.

The manufacture and storage of pharmaceutical and biological products is subject to environmental regulation and risk.

Because of the biological nature of antibodies and their manufacturing process, the biotechnology industry is subject to extensive environmental regulation and the risk of incurring liability for damages or the cost of remedying environmental problems. If we fail to comply with environmental regulations to use, discharge, or dispose of hazardous materials appropriately or otherwise to comply with the conditions attached to our operating licenses, the licenses could be revoked, and we could be subject to criminal sanctions and substantial liability or could be required to suspend or modify our operations.

Environmental laws and regulations can require us to undertake or pay for investigation, clean-up, and monitoring of environmental contamination identified at properties that we may own or operate or that we formerly owned or operated. Further, they can require us to undertake or pay for such actions at offsite locations where we may have sent hazardous substances for disposal. These obligations are often imposed without regard to fault. In the event we are found to have violated environmental laws or regulations, our reputation will be harmed, and we may incur substantial monetary liabilities.

Guidelines and recommendations concerning the healthcare industry can negatively affect the use of our products.

Government agencies promulgate regulations and guidelines directly applicable to us and to our products. In addition, professional societies, practice management groups, and private health and science organizations involved in various diseases from time to time may also publish guidelines or recommendations to the healthcare and patient communities. Recommendations of government agencies or these other groups or organizations may relate to such matters as usage, dosage, route of administration, and use of concomitant therapies. Recommendations or guidelines that are followed by patients and healthcare providers could result in decreased use of our products.

Risks related to this offering

There may not be an active, liquid trading market for our common stock.

Prior to this offering, there has been no public market for our common stock. An active, liquid trading market for our common stock may not develop or be maintained following this offering. As a result, you may not be able to sell your shares of our common stock quickly or at the market price. The initial public offering price of our common stock was determined by negotiation between us and representatives of the underwriters based upon a number of factors and may not be indicative of prices that will prevail following the completion of this offering. The market price of our common stock may decline below the initial public offering price, and you may not be able to resell your shares of our common stock at or above the initial offering price.

14

Our stock price will likely be volatile, your investment could decline in value, and we may incur significant costs from class action litigation.

The trading price of our common stock is likely to be volatile and subject to wide price fluctuations in response to various factors, including:

• actual or anticipated variations in our quarterly operating results;

• introductions or announcements of technological innovations or new products by us, our collaborators, or our competitors;

• the loss of a significant collaborator;

• disputes or other developments relating to proprietary rights, including patents, litigation matters, and our ability to patent our products and technologies;

• changes in our financial estimates by securities analysts;

• conditions or trends in the pharmaceutical and biotechnology industries;

• additions or departures of key personnel;

• announcements by us or our competitors of significant acquisitions, strategic partnerships, clinical trial results, joint ventures, or capital commitments;

• regulatory developments in the United States and abroad;

• public concern or opinion as to new drug discovery techniques; and

• economic and political factors.

In addition, the stock market in general, and the market for biotechnology and pharmaceutical companies in particular, have experienced significant price and volume fluctuations that have often been unrelated or disproportionate to operating performance. These broad market and industry factors may seriously harm the market price of our common stock, regardless of our operating performance. In the past, following periods of volatility in the market price of a company's securities, securities class action litigation has often been instituted. A securities class action suit against us could result in potential liabilities, substantial costs, and the diversion of our management's attention and resources, regardless of the outcome.

Future sales of our common stock may depress our stock price.

The market price of our common stock could decline as a result of sales of substantial amounts of our common stock in the public market after the closing of this offering, or the perception that these sales could occur. In addition, these factors could make it more difficult for us to raise funds through future offerings of common stock. There will be shares of our common stock outstanding immediately after this offering, based on the number of shares of our common stock outstanding as of August 22, 2003. All of the shares of our common stock sold in this offering will be freely transferable without restriction or further registration under the Securities Act of 1933, except for any shares of our common stock purchased by our executive officers, directors, principal stockholders, and some related parties. For more information, see "Shares eligible for future sale."

15

Although all of our stockholders have agreed with our underwriters to be bound by a 180-day lock-up agreement that prohibits these holders from selling or transferring their stock except in limited circumstances, J.P. Morgan Securities Inc. and SG Cowen Securities Corporation, on behalf of the underwriters, at their discretion, can waive the restrictions of the lock-up agreement at an earlier time without prior notice or announcement and allow our stockholders to sell their shares of our common stock. If the restrictions of the lock-up agreement are waived, shares of our common stock will be available for sale into the market, subject only to applicable securities rules and regulations, which would likely reduce the market price for shares of our common stock.

After this offering, we intend to register shares of our common stock that are reserved for issuance upon the exercise of options granted or reserved for grant under our equity incentive plan and our employee stock purchase plan. Once we register these shares of our common stock, stockholders can sell them in the public market upon issuance, subject to restrictions under the securities laws and any applicable lock-up agreements. In addition, some of our existing stockholders will be entitled to register their shares of our common stock after this offering.

You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

If you purchase common stock in this offering, you will pay more for your shares than the amounts paid by existing stockholders for their shares. As a result, you will incur immediate and substantial dilution of $ per share, representing the difference between our pro forma net tangible book value per share after giving effect to this offering and the initial public offering price. In addition, purchasers of shares of our common stock in this offering will have contributed approximately % of the aggregate price paid by all purchasers of our stock, but will own only approximately % of the shares of our common stock outstanding after the offering based on the number of shares of our common stock and redeemable convertible preferred stock outstanding as of June 30, 2003. If the holders of outstanding options exercise those options at prices below the initial public offering price, you will incur further dilution. We may also acquire other companies or technologies or finance strategic alliances by issuing equity, which may result in additional dilution to our stockholders.

Our executive officers, directors, and current principal stockholders own a large percentage of our voting common stock and could limit new stockholders from influencing corporate decisions.

Immediately after this offering, our executive officers, directors, current principal stockholders, and their respective affiliates will beneficially own, in the aggregate, approximately % of our outstanding common stock. These stockholders, as a group, would be able to control substantially all matters requiring approval by our stockholders, including mergers, sales of assets, the election of all directors, and approval of other significant corporate transactions, in a manner with which you may not agree or that may not be in the best interest of other stockholders.

16

Provisions of Delaware law and our charter documents could delay or prevent an acquisition of us, even if the acquisition would be beneficial to our stockholders.

Provisions of Delaware law and our certificate of incorporation and by-laws could hamper a third party's acquisition of us, or discourage a third party from attempting to acquire control of us. Stockholders who wish to participate in these transactions may not have the opportunity to do so. These provisions could also limit the price that investors might be willing to pay in the future for shares of our common stock.

These provisions include:

• the application of a Delaware law prohibiting us from entering into a business combination with the beneficial owner of 15% or more of our outstanding voting stock for a period of three years after such 15% or greater owner first reached that level of stock ownership, unless we meet specified criteria;

• our ability to issue preferred stock with rights senior to those of the common stock without any further vote or action by the holders of our common stock;

• the requirement that our stockholders provide advance notice when nominating our directors; and

• the inability of our stockholders to convene a stockholders' meeting without the chairperson of the board, the president, or a majority of the board of directors first calling the meeting.

Our management will have broad discretion in the use of net proceeds from this offering.

As of the date of this prospectus, we cannot specify with certainty the amounts we will spend on particular uses from the net proceeds we will receive from this offering. Our management will have broad discretion in the application of the net proceeds but currently intends to use the net proceeds as described in "Use of proceeds." The failure by our management to apply these funds effectively could affect our ability to continue to develop our business.

We have never paid dividends on our capital stock, and we do not anticipate paying dividends in the foreseeable future.

We have paid no dividends on any of our classes of capital stock to date, and we currently intend to retain our future earnings, if any, to fund the development and growth of our business. In addition, the terms of any future debt or credit facility may preclude us from paying any dividends. As a result, capital appreciation, if any, of our common stock will be your sole source of gain for the foreseeable future.

17

Special note regarding forward-looking statements

This prospectus contains forward-looking statements. The forward-looking statements are principally contained in the sections entitled "Prospectus summary," "Business," and "Management's discussion and analysis of financial condition and results of operations." These statements involve known and unknown risks, uncertainties, and other factors which may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. For this purpose, any statement that is not a statement of historical fact should be considered a forward-looking statement. These forward-looking statements include statements about the following:

• our product research and development efforts, the clinical indications that we are pursuing or may pursue, and the implications of preclinical and clinical results, in particular with respect to TRX4 and TRX1;

• the commercialization of our products;

• our collaboration agreement with Genentech, including potential payments thereunder;

• our intentions regarding the establishment of collaborations;

• anticipated operating losses, future revenues, capital expenditures, debt and lease obligations, and need for additional financing;

• anticipated regulatory filing dates and clinical trial initiation dates for our products;

• the ability to obtain marketing approval for our products; and

• the benefits to be derived from collaborations with partners, license agreements, and other collaborative efforts, including those relating to the development and commercialization of our products.

In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "could," "would," "believe," "anticipate," "plan," "expect," "intend," "estimate," "potential," and similar expressions to help identify forward-looking statements.

Forward-looking statements reflect our current views with respect to future events and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of the risks associated with our business in greater detail under the heading "Risk factors." All forward-looking statements represent our estimates and assumptions only as of the date of this prospectus.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations, and prospects may change. We may not update these forward-looking statements, even though our situation may change in the future, unless we have obligations under federal securities laws to update and disclose material developments related to previously disclosed information. We qualify all of our forward-looking statements by these cautionary statements.

18

Use of proceeds

We estimate that the net proceeds from this offering will be $ million, or $ million if the underwriters exercise their over-allotment option in full, based on an assumed initial public offering price of $ per share and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds of this offering primarily for research and development activities relating to our internal drug discovery and development programs, our collaboration with Genentech, and other general corporate and working capital purposes, which may include investing in complementary products, licensing additional technologies, or making potential acquisitions.

The foregoing use of the net proceeds from this offering represents our current intentions based upon our present plans and business condition. We retain broad discretion in the allocation and use of the net proceeds of this offering, and a change in our plans or business condition could result in the application of the net proceeds from this offering in a manner other than as described in this prospectus. Pending the uses described above, we intend to invest the net proceeds from this offering in short-term, investment grade, interest-bearing securities.

Dividend policy

We have never declared or paid dividends on our capital stock. We currently intend to retain our future earnings, if any, to support the growth and development of our business, and we do not anticipate paying any dividends in the foreseeable future. Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, and other factors that our board of directors may deem relevant.

19

Capitalization

The following table describes our capitalization as of June 30, 2003:

• on an actual basis;

• on a pro forma basis giving effect to the automatic conversion upon the closing of this offering of all outstanding shares of our redeemable convertible preferred stock into an aggregate of 61,035,000 shares of common stock;

• on a pro forma as adjusted basis to give effect to the sale of shares of our common stock offered at an assumed initial public offering price of $ per share, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

You should read this table in conjunction with "Management's discussion and analysis of financial condition and results of operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus.

|

|---|

June 30, 2003

(in thousands, except share data)

| | Actual

| | Pro forma

| | Pro forma

as adjusted

|

|---|

|

|---|

| Long-term debt, net of current portion | | $ | 486 | | $ | 486 | | $ | |

| | |

| | | | | | |

| Redeemable convertible preferred stock: | | | | | | | | | |

| Series A convertible preferred stock, $0.001 par value; 9,035,000 shares authorized; 9,035,000 issued and outstanding actual; no shares authorized, issued or outstanding, pro forma and pro forma as adjusted | | | 7, 108 | | | — | | | |

| Series B convertible preferred stock, $0.001 par value; 17,146,250 shares authorized; 17,000,000 issued and outstanding actual; no shares authorized, issued or outstanding, pro forma and pro forma as adjusted | | | 19,439 | | | — | | | |

| Series C convertible preferred stock, $0.001 par value; 40,000,000 shares authorized; 35,000,000 issued and outstanding actual; no shares authorized, issued or outstanding, pro forma and pro forma as adjusted | | | 36,563 | | | — | | | |

| | |

|

| | | | 63,110 | | | — | | | |

| | |

|

| Stockholders' equity (deficit): | | | | | | | | | |

| Common stock, $0.001 par value; 75,000,000 shares authorized actual; 4,202,250 issued, 3,962,250 outstanding actual; shares authorized, 65,237,250 issued and 64,997,250 outstanding, pro forma; issued and outstanding, pro forma as adjusted | | | 4 | | | 65 | | | |

| Additional paid-in capital | | | — | | | 63,049 | | | |

| Deferred compensation | | | (749 | ) | | (749 | ) | | |

| Accumulated deficit | | | (29,583 | ) | | (29,583 | ) | | |

| | |

| | | | | | |

| | Total stockholders' equity (deficit) | | | (30,328 | ) | | 32,782 | | | |

| | |

|

| | | Total capitalization | | $ | 33,268 | | $ | 33,268 | | $ | |

|

Excludes (i) an aggregate of 956,750 shares of common stock issuable pursuant to stock options outstanding as of June 30, 2003 at a weighted average exercise price per share of $0.15, and (ii) 311,250 shares of common stock issuable pursuant to warrants outstanding as of June 30, 2003, at a weighted average exercise price per share of $0.81.

20

Dilution

The historical net tangible book value of our common stock as of June 30, 2003 was $ million, or $ per share. The historical net tangible book value per share of our common stock is the difference between our tangible assets and our liabilities, divided by the number of common shares outstanding. The pro forma net tangible book value of our common stock as of June 30, 2003 was $ million, or $ per share. The pro forma net tangible book value per share of our common stock is the difference between our tangible assets and our liabilities, divided by the number of shares of our common stock outstanding as of June 30, 2003, after giving effect to the automatic conversion of all outstanding shares of our redeemable convertible preferred stock into 61,035,000 shares of our common stock upon the completion of this offering. For new investors in our common stock, dilution is the per share difference between the initial public offering price of our common stock and the pro forma net tangible book value of our common stock immediately after completing this offering. Dilution in this case results from the fact that the per share offering price of our common stock is substantially in excess of the per share price paid by our current stockholders.

As of June 30, 2003, after giving effect to the sale of the shares of our common stock offered by this prospectus at an assumed initial public offering price of $ per share and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, the pro forma net tangible book value per share of our common stock would have been $ per share. Therefore, new investors in our common stock would have paid $ for a share of common stock having a pro forma net tangible book value of approximately $ per share after this offering. That is, their investment would have been diluted by approximately $ per share. At the same time, our current stockholders would have realized an increase in pro forma net tangible book value of $ per share after this offering without further cost or risk to themselves. The following table illustrates this per share dilution:

|

|---|

| Assumed initial public offering price per share | | $ | |

| | Pro forma net tangible book value per share before this offering | | $ | |

| | Increase in pro forma net tangible book value per share attributable to investors in this offering | | $ | |

| Pro forma net tangible book value per share after this offering | | $ | |

| Dilution per share to new investors | | $ | |

|

The following table sets forth, as of June 30, 2003, on a pro forma basis to give effect to the conversion of all shares of our redeemable convertible preferred stock into 61,035,000 shares of common stock, the number of shares of common stock purchased in this offering, the total consideration paid, and the average price per share paid by existing and new stockholders, before deducting underwriting discounts and commissions and our estimated offering expenses:

|

|---|

| | Shares purchased

| | Total consideration

| |

|

|---|

| | Average price

per share

|

|---|

| | Number

| | Percent

| | Amount

| | Percent

|

|---|

|

|---|

| Existing stockholders | | | | | % | $ | | | | % | $ | |

| New investors | | | | | | | | | | | | |

| | |

|

| | Total | | | | 100 | % | $ | | | 100 | % | | |

|

Excludes (i) an aggregate of 956,750 shares of common stock issuable pursuant to stock options outstanding as of June 30, 2003 at a weighted average exercise price per share of $0.15, and (ii) 311,250 shares of common stock issuable pursuant to warrants outstanding as of June 30, 2003, at a weighted average exercise price per share of $0.81.

21

Selected consolidated financial data

The following selected consolidated financial data as of December 31, 2001 and 2002, and for the period from inception (July 6, 2000) through December 31, 2000, and for the years ended December 31, 2001 and December 31, 2002, are derived from our audited consolidated financial statements appearing elsewhere in this prospectus. The selected consolidated financial data as of December 31, 2000, is derived from our audited financial statements, which are not included in this prospectus. The selected consolidated financial data for the six months ended June 30, 2002 and 2003 are derived from our unaudited financial statements appearing elsewhere in this prospectus. The unaudited financial statements include all adjustments, consisting of normal recurring accruals, which we consider necessary for a fair presentation of our financial position and results of operations for these periods.

Operating results for the six months ended June 30, 2003 are not necessarily indicative of the results that may be expected for the year ending December 31, 2003 or for any other periods in the future. The data below should be read in conjunction with, and are qualified by reference to, "Management's discussion and analysis of financial condition and results of operations" and our consolidated financial statements and related notes included elsewhere in this prospectus.

| |

| |

| | Year ended December 31,

| | Six months ended

June 30,

| |

|---|

| | Inception

through

December 31,

2000

| |

|---|

(in thousands, except share and per share data)

| |

|---|

| | 2001

| | 2002

| | 2002

| | 2003

| |

|---|

| |

| Statement of operations data: | | | | | | | | | | | | | | | | |

| Revenues | | $ | — | | $ | — | | $ | 27 | | $ | — | | $ | 750 | |

| Operating expenses | | | | | | | | | | | | | | | | |

| | Research and development | | | 232 | | | 3,797 | | | 10,908 | | | 4,883 | | | 5,236 | |

| | General and administrative | | | 125 | | | 1,370 | | | 2,774 | | | 1,330 | | | 1,556 | |

| | Stock-based compensation | | | 9 | | | 627 | | | 613 | | | 432 | | | 607 | |

| |

| |

|---|

| | | Total operating expenses | | | 366 | | | 5,794 | | | 14,295 | | | 6,645 | | | 7,399 | |

| |

| |

|---|

| | | Loss from operations | | | (366 | ) | | (5,794 | ) | | (14,268 | ) | | (6,645 | ) | | (6,649 | ) |

| Interest income | | | — | | | 165 | | | 250 | | | 139 | | | 215 | |

| Interest expense | | | (1 | ) | | (40 | ) | | (295 | ) | | (117 | ) | | (156 | ) |

| |

| |

|---|

| Net loss | | | (367 | ) | | (5,669 | ) | | (14,313 | ) | | (6,623 | ) | | (6,590 | ) |

| Accretion of redeemable convertible preferred stock | | | (10 | ) | | (737 | ) | | (2,224 | ) | | (934 | ) | | (2,411 | ) |

| |

| |

|---|

| Net loss attributable to common stockholders | | $ | (377 | ) | $ | (6,406 | ) | $ | (16,537 | ) | $ | (7,557 | ) | $ | (9,001 | ) |

| Net loss attributable to common stockholders per share, basic and diluted | | $ | (1.52 | ) | $ | (8.91 | ) | $ | (9.33 | ) | $ | (5.19 | ) | $ | (3.92 | ) |

| |

| |

|---|

| Shares used in computing net loss per share, basic and diluted | | | 248,119 | | | 719,094 | | | 1,773,180 | | | 1,455,871 | | | 2,295,342 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | December 31,

| |

| |

|---|

| | June 30,

2003

| |

|---|

(in thousands)

| | 2000

| | 2001

| | 2002

| |

|---|

| |

| Balance sheet data: | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 1,582 | | $ | 16,529 | | $ | 37,891 | | $ | 35,628 | |

| Working capital | | | 1,434 | | | 14,573 | | | 36,432 | | | 31,178 | |

| Total assets | | | 1,790 | | | 20,155 | | | 47,837 | | | 42,593 | |

| Long-term debt, net of current portion | | | — | | | 523 | | | 1,021 | | | 486 | |

| Redeemable convertible preferred stock | | | 1,958 | | | 23,625 | | | 60,639 | | | 63,110 | |

| Accumulated deficit | | | (367 | ) | | (6,036 | ) | | (21,609 | ) | | (29,583 | ) |