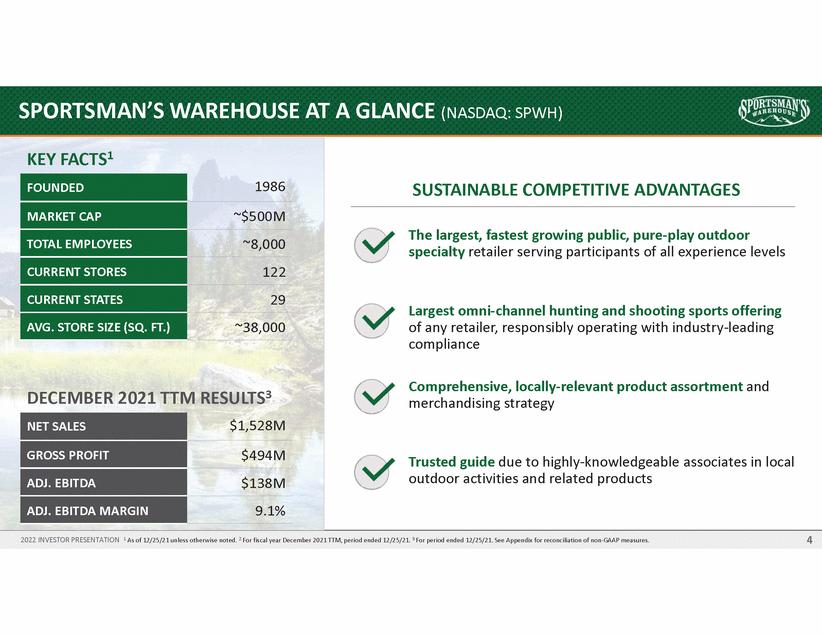

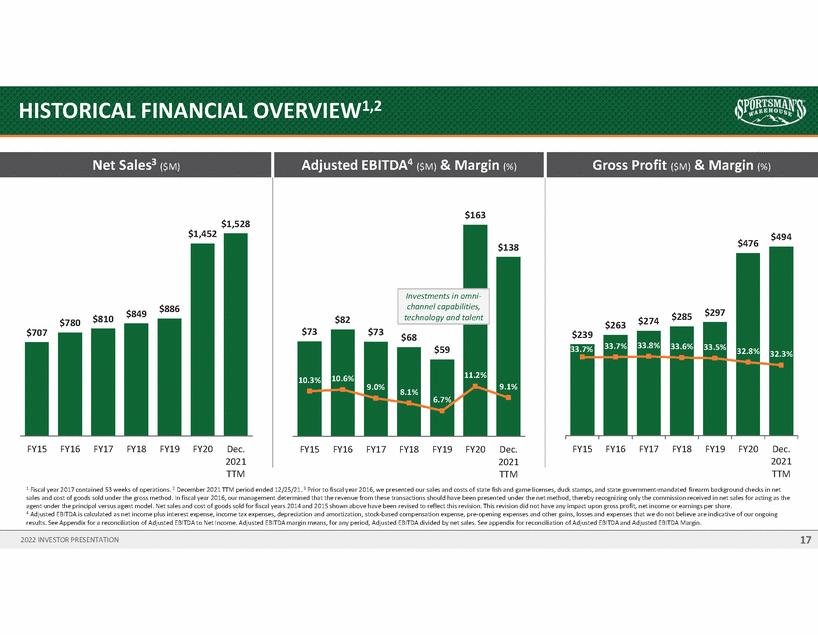

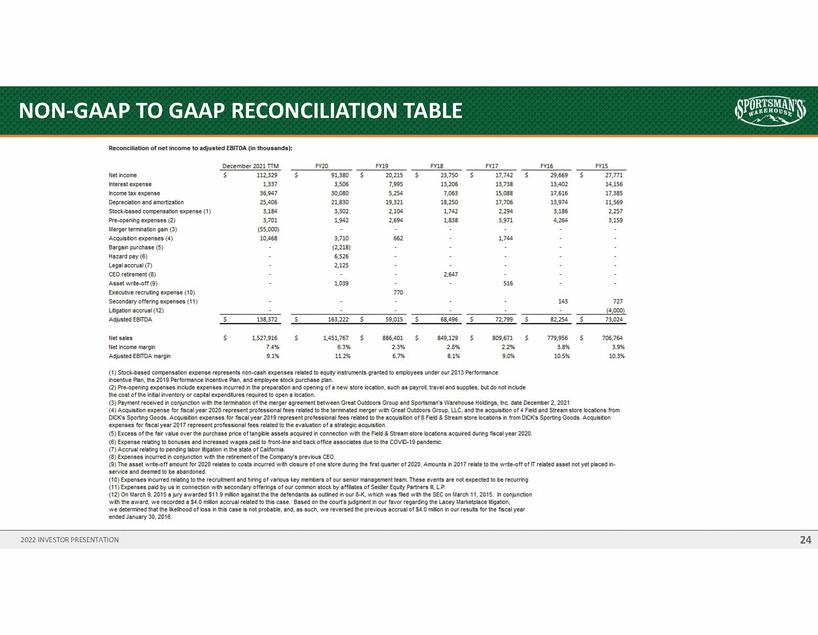

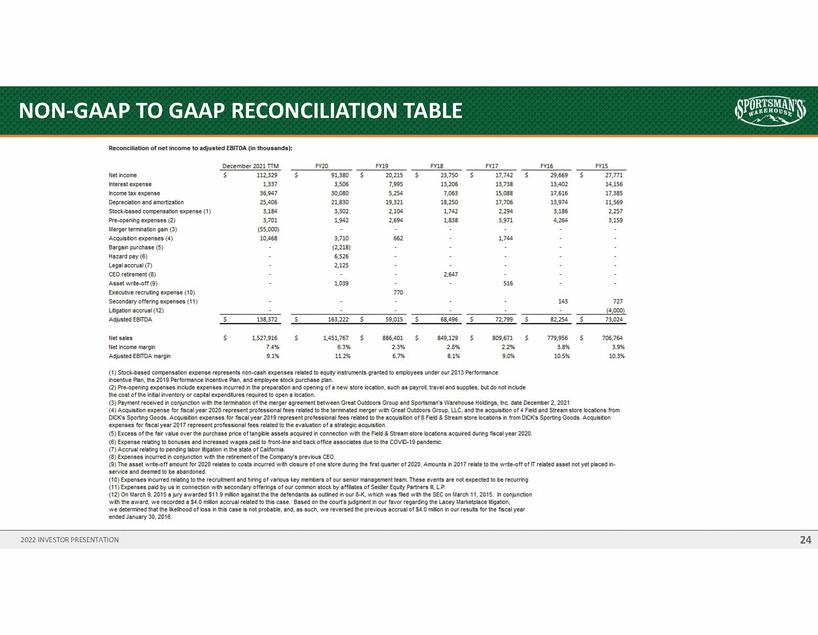

| TABLE Reconciliation of net income to adjusted EBITOA (in thousands}: Oe<ember 2021TIM FY20 FY19 FY18 FY17 FY16 FY15 s s s s Net income Interest expense Income tax expense Oepreciatton and amortization Stock-based compensation expense (1) Pre-opening expenses (2) Merger termination gain (3) Acquis ion expenses (4) Bargain purchase (5) Hazard pay (6) Legalaccrual(7) CEO retirement (8) Asset write-off (9) Executive recru ing expense (1D) Secondary offering expenses (11) L igation accrual(12) Adjusted EBITOA 112,329 1,337 36,947 25,406 3,184 3,701 (55,000) 10,468 91,380 3,506 30,080 21,830 3,302 1,942 20,215 7,995 5,254 19,321 2,104 2,694 23,750 13,206 7,063 18,250 1,742 1,838 17,742 13,738 15,088 17,706 2,294 3,971 29,669 13,402 17,616 13,974 3,186 4,264 27,771 14,156 17,385 11,569 2,257 3,159 3,710 (2,218) 6,526 2,125 662 1,744 2,647 1,039 516 770 143 727 (4,000) s 73,024 82,254 s 138,372 s 163,222 s 59,015 68,496 72,799 s s s s s s Net sales Net income margin Adjusted EBITOA margin 1,527,916 7.4% 9.1% 1,451,767 6.3% 11.2% 886,401 2.3% 6.7% 849,129 2.8',{, 8.1% 809,671 2.2% 9.0% 779,956 3.8% 10.5% 706,764 3.9% 10.3% (1) Stock-ba.sed compensation expense represents non-cash expenses related to equity instruments granted to employees under our 2013 Performance Incentive Plan, the 2D19 Performance Incentive Plan, and employee stock purchase plan. (2) Pre-opening expenses include expenses incurred in the preparation and opening of a new store location,such as payrol,traveland supplies, but do not include the cost of the in ialinventory or capalexpend ures required to open a location. (3) Payment received in conjunction with the tenmation of the merger agreement between Great Outdoors Group and Sportsman's Warehouse Holdings,Inc.date December 2, 2D21 (4) Acquis ion expense for fiScalyear 2D2D represent professional fees related to the terminated merger wh Great OutdoorsGroup,LLC, and the acquisition of 4 Field and Stream store locations from DICK's Sporting Goods. Acquisition expenses for fiScalyear 2019 represent professionalfees related to the acquis ion of 8 Field & Stream store locations in from DICK's Sporting Goods. Acquisition expenses for fiScal year 2017 represent profes.sKJnal fees related to the evaluation of a strategic acquisit1on. (S) Excess of the fair value over the purchase prtce of tangible assets acquired in connection with the Field & Stream store locations aoqui'ed during fiScal year 2020. (6) Expense relating to bonuses and increased wages paid to front-tine and back offiCe associates due to the COV0-19 pandemic. (7) Accrualrelating to pending labor litigation in the state of Cafornia. (8)Expenses incurred in conjunction wh the retirement of the Company's previous CEO. (9) The asset write-off amount for 2D2D relates to costs incurred w•h closure of one store during the frst quarter of 2D2D. Amounts in 2D17 relate to the wrtte-off of rr related asset not yet placed in service and deemed to be abandoned. (1D) Expenses incurred relating to the recru ment and hiring of various key members of our senior management team.These events are not expected to be recurring (11) Expenses paid by us in connection with secondary offerings of our common stock by aff iates of Seidler Equty Partners Ill, L.P. (12) On March 9, 2D15 a jury awarded S11.9 m ion against the the defendants as outlined in our S-K, which was flied wh the SEC on March 11, 2D15. In conjunction wh the award, we recorded a S4.0 million accrualrelated to this case. Based on the court's judgment in our favor regarding the Lacey Marketplacel igation, we determined that the likelihood of loss in this case is not probable, and, as such, we reversed the previous accrualof 54.0 miltion in our resuKs for the foscal year ended January 3D, 2D16. 24 2022 INVESTOR PRESENTATION cSP91t'8) NON-GAAP TO GAAP RECONCILIATION |