UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10273

Morgan Stanley International Value Equity Fund

(Exact name of registrant as specified in charter)

522 Fifth Avenue, New York, New York 10036

(Address of principal executive offices) (Zip code)

Ronald E. Robison

522 Fifth Avenue, New York, New York 10036

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-296-6990

Date of fiscal year end: August 31, 2007

Date of reporting period: August 31, 2007

Item 1 - Report to Shareholders

Welcome, Shareholder:

In this report, you’ll learn about how your investment in Morgan Stanley International Value Equity Fund performed during the annual period. We will provide an overview of the market conditions, and discuss some of the factors that affected performance during the reporting period. In addition, this report includes the Fund’s financial statements and a list of Fund investments.

| This material must be preceded or accompanied by a prospectus for the fund being offered. |

| Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund’s shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks. |

|  |

|  |

| Fund Report |

| For the year ended August 31, 2007 |

|  |

Total Return for the 12 Months Ended August 31, 2007

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Class A |  |  |  | Class B |  |  |  | Class C |  |  |  | Class D |  |  |  | MSCI

EAFE

Index1 |  |  |  | Lipper Int’l

Large-Cap

Core

Funds

Index2 |

| | 15.93 | % |  |  |  | | 15.32 | % |  |  |  | | 15.17 | % |  |  |  | | 16.20 | % |  |  |  | | 18.71 | % |  |  |  | | 19.04 | % |

|

| The performance of the Fund’s four share classes varies because each has different expenses. The Fund’s total returns assume the reinvestment of all distributions but do not reflect the deduction of any applicable sales charges. Such costs would lower performance. See Performance Summary for standardized performance and benchmark information. |

Market Conditions

The international markets, as represented by the MSCI EAFE Index, returned 18.71 percent for the 12 months ended August 31, 2007. These strong returns were again aided by continued weakness in the U.S. dollar which depreciated against all major currencies, with the exception of the yen, for the 12-month period. In the fourth quarter of 2006, the vigor with which investors regained their appetite for risk continued and cyclical stocks, which are stocks whose prices move in tandem with the economic cycle, outperformed into the first quarter of 2007. However, the strength of returns for the international markets began to falter by the end of the second quarter as market jitters returned amid growing concerns about credit quali ty in asset backed securities markets. After the indiscriminate selling in July of 2007, investors became a little more discerning about risk in August and the traditional defensive sectors (those that are less dependent on the economic cycle) outperformed during the month.

For the period overall, European markets continued their outperformance over other major regions. The more defensive U.K. market posted strong returns for the 12-month period as did the Pacific ex-Japan region. In contrast, Japan was the notable laggard as economic concerns continued to weigh heavily on the market.

On a sector basis, eight out of 10 sectors posted double-digit returns. Materials was the best performing sector as it benefited from continued demand of hard commodities and investors’ preference for cyclical stocks throughout most of the period. The telecommunications and industrials sectors also performed well during the period. In contrast, the consumer discretionary, energy and financials sectors lagged the MSCI EAFE Index return, while the health care sector was the worst performing sector for the period under review.

Performance Analysis

All share classes of Morgan Stanley International Value Equity Fund underperformed the Morgan Stanley Capital International (MSCI) EAFE Index and the Lipper International Large-Cap Core Funds Index for the 12 months ended August 31, 2007, assuming no deduction of applicable sales charges.

The Fund’s underweight to the financials sector was a positive contributor as the sector significantly underperformed the MSCI EAFE Index on concerns about the U.S. subprime market, the credit cycle and

2

problems unfolding in the commercial paper markets. However, poor performance from the Fund’s Japanese financial holdings, in particular, was a significant detractor in part because of the Bank of Japan’s decision to delay the ‘‘normalization’’ of interest rates (that is, boosting rates from their ultra-low level) due to the country’s weak economic data and the broader global credit crisis. Stock selection and underweight to the industrials sector were also negative influences on relative returns, as investors favored cyclical stocks such as those in the industrials sector over defensive stocks (in which the Fund was more heavily invested) for most of the 12-month period.

The Fund did, however, receive positive contributions from stock selection in and an overweight to the consumer staples sector as the sector enjoyed strong performance driven by corporate activity and takeover speculation. Stock selection in the consumer discretionary sector, primarily in autos, and an overweight to the materials sector, which was the best performing sector for the period, also added value.

We believe the equity markets seem to think the credit crisis is over and are confident in the expectation that the Federal Reserve (the ‘‘Fed’’) stands willing to bail them out once again. However, we believe such confidence is overly optimistic. Although many economists have increased their probabilities of a U.S. recession – and even with the Fed acknowledging that the risks to growth are on the downside – we believe the equity markets are ignoring the elephant in the room. In our view, the crisis is not over yet and we remain comfortable with the Fund’s defensive bias, particularly the large underweight exposure to financials.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future.

3

|  |  |  |  |  |  |

| TOP 10 HOLDINGS |  | |

| Imperial Tobacco Group PLC |  | | 3.6 | % |

| Nestle S.A. (Registered Shares) |  | | 3.5 | |

| British American Tobacco PLC |  | | 3.5 | |

| Cadbury Schweppes PLC |  | | 3.5 | |

| Holcim Ltd. (Registered Shares) |  | | 3.1 | |

| Bayer AG |  | | 2.2 | |

| Kao Corp. |  | | 2.2 | |

| Ericsson (B Shares) |  | | 2.2 | |

| Total S.A. |  | | 2.1 | |

| Unilever NV (Share Certificates) |  | | 2.1 | |

|

|  |  |  |  |  |  |

| TOP FIVE COUNTRIES |  | |

| United Kingdom |  | | 29.2 | % |

| Japan |  | | 23.8 | |

| Switzerland |  | | 9.0 | |

| Netherlands |  | | 7.5 | |

| Germany |  | | 7.5 | |

|

| Data as of August 31, 2007. Subject to change daily. All percentages for top 10 holdings and top five countries are as a percentage of net assets. These data are provided for informational purposes only and should not be deemed a recommendation to buy or sell the securities mentioned. Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services. |

Investment Strategy

The Fund will normally invest at least 80 percent of its assets in a diversified portfolio of common stocks and other equity securities, including depositary receipts and securities convertible into common stock, of companies located outside of the United States. These companies may be of any asset size and may be located in developed or emerging market countries. The Fund invests in at least three different countries located outside of the United States. A company will be considered located outside of the United States if it (a) is not organized under the laws of the United States, (b) does not have securities which are principally traded on a U.S. stock exchange, (c) does not derive at least 50 percent of its revenues from goods produced or sold, investments made, or services performed in the United States or (d) does not maintain at least 50 percent of its assets in the United States.

For More Information About Portfolio Holdings

Each Morgan Stanley fund provides a complete schedule of portfolio holdings in its semiannual and annual reports within 60 days of the end of the fund’s second and fourth fiscal quarters. The semiannual reports and the annual reports are filed electronically with the Securities and Exchange Commission (SEC) on Form N-CSRS and Form N-CSR, respectively. Morgan Stanley also delivers the semiannual and annual reports to fund shareholders and makes these reports available on its public web site, www.morganstanley.com. Each Morgan Stanley fund also files a complete schedule of portfolio holdings with the SEC for the fund’s first and third fiscal quarters on Form N-Q. Morgan Stanley does not deliver the reports for the f irst and third fiscal quarters to shareholders, nor are the reports posted to

4

the Morgan Stanley public web site. You may, however, obtain the Form N-Q filings (as well as the Form N-CSR and N-CSRS filings) by accessing the SEC’s web site, http://www.sec.gov. You may also review and copy them at the SEC’s public reference room in Washington, DC. Information on the operation of the SEC’s public reference room may be obtained by calling the SEC at (800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC’s e-mail address (publicinfo@sec.gov) or by writing the public reference section of the SEC, Washington, DC 20549-0102.

Proxy Voting Policy and Procedures and Proxy Voting Record

You may obtain a copy of the Fund’s Proxy Voting Policy and Procedures without charge, upon request, by calling toll free (800) 869-NEWS or by visiting the Mutual Fund Center on our Web site at www.morganstanley.com. It is also available on the Securities and Exchange Commission’s Web site at http://www.sec.gov.

You may obtain information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 without charge by visiting the Mutual Fund Center on our Web site at www.morganstanley.com. This information is also available on the Securities and Exchange Commission’s Web site at http://www.sec.gov.

Householding Notice

To reduce printing and mailing costs, the Fund attempts to eliminate duplicate mailings to the same address. The Fund delivers a single copy of certain shareholder documents, including shareholder reports, prospectuses and proxy materials, to investors with the same last name who reside at the same address. Your participation in this program will continue for an unlimited period of time unless you instruct us otherwise. You can request multiple copies of these documents by calling (800) 350-6414, 8:00 a.m. to 8:00 p.m., ET. Once our Customer Service Center has received your instructions, we will begin sending individual copies for each account within 30 days.

5

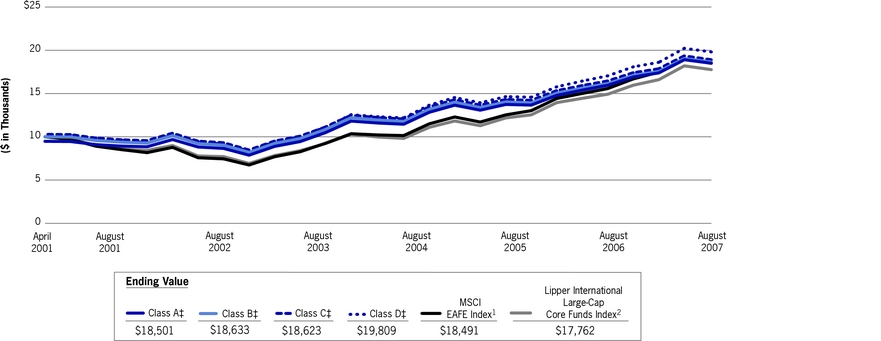

Performance of $10,000 Investment

6

Average Annual Total Returns — Period Ended August 31, 2007

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  |  | Class A Shares*

(since 04/26/01) |  |  |  | Class B Shares**

(since 04/26/01) |  |  |  | Class C Shares†

(since 04/26/01) |  |  |  | Class D Shares††

(since 04/26/01) |

| Symbol |  |  |  | IVQAX |  |  |  | IVQBX |  |  |  | IVQCX |  |  |  | IVQDX |

| 1 Year |  |  |  | | 15.93% | 3 |  |  |  | | 15.32% | 3 |  |  |  | | 15.17% | 3 |  |  |  | | 16.20% | 3 |

| |  |  |  | | 9.85 | 4 |  |  |  | | 10.32 | 4 |  |  |  | | 14.17 | 4 |  |  |  | | — | |

| 5 Years |  |  |  | | 15.97 | 3 |  |  |  | | 15.13 | 3 |  |  |  | | 15.11 | 3 |  |  |  | | 16.25 | 3 |

| |  |  |  | | 14.72 | 4 |  |  |  | | 14.90 | 4 |  |  |  | | 15.11 | 4 |  |  |  | | — | |

| Since Inception |  |  |  | | 11.12 | 3 |  |  |  | | 10.30 | 3 |  |  |  | | 10.29 | 3 |  |  |  | | 11.37 | 3 |

| |  |  |  | | 10.18 | 4 |  |  |  | | 10.30 | 4 |  |  |  | | 10.29 | 4 |  |  |  | | — | |

|

| Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please visit www.morganstanley.com/msim or speak with your Financial Advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class A, Class B, Class C, and Class D shares will vary due to differences in sales charges and expenses. |

| * | The maximum front-end sales charge for Class A is 5.25%. |

| ** | The maximum contingent deferred sales charge (CDSC) for Class B is 5.0%. The CDSC declines to 0% after six years. |

| † | The maximum contingent deferred sales charge for Class C is 1.0% for shares redeemed within one year of purchase. |

| †† | Class D has no sales charge. |

| (1) | The Morgan Stanley Capital International (MSCI) EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the US & Canada. The term ‘‘free float’’ represents the portion of shares outstanding that are deemed to be available for purchase in the public equity markets by investors. The MSCI EAFE Index consists of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possib le to invest directly in an index. |

| (2) | The Lipper International Large-Cap Core Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper International Large-Cap Core Funds Classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. The Fund is in the Lipper International Large-Cap Core Funds classification as of the date of this report. |

| (3) | Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges. |

| (4) | Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund’s current prospectus for complete details on fees and sales charges. |

| ‡ | Ending value assuming a complete redemption on August 31, 2007. |

7

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees; and (2) ongoing costs, including advisory fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 03/01/07 – 08/31/07.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|  |  |  |  |  |  |  |  |  |  |

| |  | Beginning

Account Value |  | Ending

Account Value |  | Expenses Paid

During Period* |

| |  | 03/01/07 |  | 08/31/07 |  | 03/01/07 –

08/31/07 |

| Class A |  | | | |  | | | |  | | | |

| Actual (6.42% return) |  | $ | 1,000.00 | |  | $ | 1,064.20 | |  | $ | 6.92 | |

| Hypothetical (5% annual return before expenses) |  | $ | 1,000.00 | |  | $ | 1,018.50 | |  | $ | 6.77 | |

| |  | | | |  | | | |  | | | |

| Class B |  | | | |  | | | |  | | | |

| Actual (6.16% return) |  | $ | 1,000.00 | |  | $ | 1,061.60 | |  | $ | 8.37 | |

| Hypothetical (5% annual return before expenses) |  | $ | 1,000.00 | |  | $ | 1,017.09 | |  | $ | 8.19 | |

| |  | | | |  | | | |  | | | |

| Class C |  | | | |  | | | |  | | | |

| Actual (5.97% return) |  | $ | 1,000.00 | |  | $ | 1,059.70 | |  | $ | 10.80 | |

| Hypothetical (5% annual return before expenses) |  | $ | 1,000.00 | |  | $ | 1,014.72 | |  | $ | 10.56 | |

| |  | | | |  | | | |  | | | |

| Class D |  | | | |  | | | |  | | | |

| Actual (6.47% return) |  | $ | 1,000.00 | |  | $ | 1,064.70 | |  | $ | 5.62 | |

| Hypothetical (5% annual return before expenses) |  | $ | 1,000.00 | |  | $ | 1,019.76 | |  | $ | 5.50 | |

|

| * | Expenses are equal to the Fund’s annualized expense ratios of 1.33%, 1.61%, 2.08% and 1.08% for Class A, Class B, Class C and Class D shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

Investment Advisory Agreement Approval

Nature, Extent and Quality of Services

The Board reviewed and considered the nature and extent of the investment advisory services provided by the Investment Adviser under the Advisory Agreement, including portfolio management, investment research and equity and fixed income securities trading. The Board reviewed similar information and factors regarding the Sub-Adviser, to the extent applicable. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Fund’s Administrator under the Administration Agreement, including accounting, clerical, bookkeeping, compliance, business management and planning, and the provision of supplies, office space and utilities at the Investment Adviser’s expens e. (The Investment Adviser, Sub-Adviser and Administrator together are referred to as the ‘‘Adviser’’ and the Advisory, Sub-Advisory and Administration Agreements together are referred to as the ‘‘Management Agreement.’’) The Board also compared the nature of the services provided by the Adviser with similar services provided by non-affiliated advisers as reported to the Board by Lipper Inc. (‘‘Lipper’’).

The Board reviewed and considered the qualifications of the portfolio managers, the senior administrative managers and other key personnel of the Adviser who provide the advisory and administrative services to the Fund. The Board determined that the Adviser’s portfolio managers and key personnel are well qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board concluded that the nature and extent of the advisory and administrative services provided were necessary and appropriate for the conduct of the business and investment activities of the Fund. The Board also concluded that the overall quality of the advisory and administrative services was sati sfactory.

Performance Relative to Comparable Funds Managed by Other Advisers

On a regular basis, the Board reviews the performance of all funds in the Morgan Stanley Fund Complex, including the Fund, compared to their peers, paying specific attention to the underperforming funds. In addition, the Board specifically reviewed the Fund’s performance for the one-, three- and five-year periods ended November 30, 2006, as shown in a report provided by Lipper (the ‘‘Lipper Report’’), compared to the performance of comparable funds selected by Lipper. The Board discussed with the Adviser the performance goals and the actual results achieved in managing the Fund. The Board concluded that the Fund’s performance was acceptable.

Fees Relative to Other Proprietary Funds Managed by the Adviser with Comparable

Investment Strategies

The Board reviewed the advisory and administrative fee (together, the ‘‘management fee’’) rate paid by the Fund under the Management Agreement. The Board noted that the management fee rate was comparable to the management fee rates charged by the Adviser to other proprietary funds it manages with investment strategies comparable to those of the Fund.

9

Fees and Expenses Relative to Comparable Funds Managed by Other Advisers

The Board reviewed the management fee rate and total expense ratio of the Fund as compared to the average management fee rate and average total expense ratio for funds, selected by Lipper (the ‘‘expense peer group’’), managed by other advisers with investment strategies comparable to those of the Fund, as shown in the Lipper Report. The Board concluded that the Fund’s management fee rate and total expense ratio were competitive with those of its expense peer group.

Breakpoints and Economies of Scale

The Board reviewed the structure of the Fund’s management fee schedule under the Management Agreement and noted that it did not include any breakpoints. The Board noted that the Fund will be closed to new investors when the Fund’s assets reach $1 billion, subject to certain limited exceptions. The Board considered that the total expense ratio was competitive with the Fund’s expense peer group. The Board concluded that the management fee effectively reflects economies of scale at the present time.

Profitability of the Adviser and Affiliates

The Board considered information concerning the costs incurred and profits realized by the Adviser and affiliates during the last year from their relationship with the Fund and during the last two years from their relationship with the Morgan Stanley Fund Complex and reviewed with the Adviser the cost allocation methodology used to determine the profitability of the Adviser and affiliates. Based on its review of the information it received, the Board concluded that the profits earned by the Adviser and affiliates were not excessive in light of the advisory, administrative and other services provided to the Fund.

Fall-Out Benefits

The Board considered so-called ‘‘fall-out benefits’’ derived by the Adviser and affiliates from their relationship with the Fund and the Morgan Stanley Fund Complex, such as sales charges on sales of Class A shares and ‘‘float’’ benefits derived from handling of checks for purchases and sales of Fund shares, through a broker-dealer affiliate of the Adviser and ‘‘soft dollar’’ benefits (discussed in the next section). The Board also considered that a broker-dealer affiliate of the Adviser receives from the Fund 12b-1 fees for distribution and shareholder services. The Board concluded that the float benefits were relatively small and the sales charges and 1 2b-1 fees were competitive with those of other broker-dealers.

Soft Dollar Benefits

The Board considered whether the Adviser realizes any benefits as a result of brokerage transactions executed through ‘‘soft dollar’’ arrangements. Under such arrangements, brokerage commissions paid by the Fund and/or other funds managed by the Adviser would be used to pay for research that a securities broker obtains from third parties, or to pay for both research and execution services from securities brokers who effect transactions for the Fund. The Board recognized that the receipt of such research from brokers may reduce the Adviser’s costs but concluded that the receipt of such research strengthens the investment management resources of the Adviser, which may ultimately benefit the Fund an d other funds in the Morgan Stanley Fund Complex.

10

Adviser Financially Sound and Financially Capable of Meeting the Fund’s Needs

The Board considered whether the Adviser is financially sound and has the resources necessary to perform its obligations under the Management Agreement. The Board concluded that the Adviser has the financial resources necessary to fulfill its obligations under the Management Agreement.

Historical Relationship Between the Fund and the Adviser

The Board also reviewed and considered the historical relationship between the Fund and the Adviser, including the organizational structure of the Adviser, the policies and procedures formulated and adopted by the Adviser for managing the Fund’s operations and the Board’s confidence in the competence and integrity of the senior managers and key personnel of the Adviser. The Board concluded that it is beneficial for the Fund to continue its relationship with the Adviser.

Other Factors and Current Trends

The Board considered the controls and procedures adopted and implemented by the Adviser and monitored by the Fund’s Chief Compliance Officer and concluded that the conduct of business by the Adviser indicates a good faith effort on its part to adhere to high ethical standards in the conduct of the Fund’s business.

General Conclusion

On April 25, 2007, after considering and weighing all of the above factors, the Board concluded that it would be in the best interest of the Fund and its shareholders to approve renewal of the Management Agreement for another year until April 30, 2008. On June 20, 2007, the Board again considered and weighed all of the above factors and concluded that it would be in the best interest of the Fund and its shareholders to approve renewal of the Management Agreement to continue until June 30, 2008.

11

Morgan Stanley International Value Equity Fund

Portfolio of Investments  August 31, 2007

August 31, 2007

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Common Stocks (96.3%) |  | | | |

| | | |  | Australia (a) (1.4%) |

| | | |  | Beverages: Alcoholic |  | | | |

| | 1,004,074 | |  | Foster’s Group Ltd. (d) |  | $ | 5,225,538 | |

| | | |  | Chemicals: Major Diversified |  | | | |

| | 81,918 | |  | Orica Ltd. |  | | 1,928,003 | |

| | | |  | Oil & Gas Production |  | | | |

| | 389,406 | |  | Santos Ltd. |  | | 4,249,885 | |

| | | |  | Total Australia |  | | 11,403,426 | |

| | | |  | Austria (a) (1.0%) |  | | | |

| | | |  | Major Telecommunications |  | | | |

| | 320,987 | |  | Telekom Austria AG |  | | 8,287,885 | |

| | | |  | Belgium (a) (2.1%) |  | | | |

| | | |  | Financial Conglomerates |  | | | |

| | 248,693 | |  | Fortis Group |  | | 9,132,538 | |

| | | |  | Major Banks |  | | | |

| | 65,789 | |  | KBC Groep NV |  | | 8,266,286 | |

| | | |  | Total Belgium |  | | 17,398,824 | |

| | | |  | Canada (a) (0.6%) |  | | | |

| | | |  | Oil & Gas Production |  | | | |

| | 81,513 | |  | EnCana Corp. |  | | 4,779,120 | |

| | | |  | France (a) (6.3%) |  | | | |

| | | |  | Construction Materials |  | | | |

| | 41,998 | |  | Lafarge S.A. (d) |  | | 6,544,661 | |

| | | |  | Electrical Products |  | | | |

| | 290,049 | |  | Legrand S.A. (d) |  | | 10,324,663 | |

| | | |  | Integrated Oil |  | | | |

| | 230,697 | |  | Total S.A. (d) |  | | 17,334,743 | |

| | | |  | Major Banks |  | | | |

| | 55,483 | |  | BNP Paribas S.A. |  | | 5,871,628 | |

| | | |  | Major Telecommunications |  | | | |

| | 186,190 | |  | France Telecom S.A. (d) |  | | 5,637,980 | |

| | | |  | Motor Vehicles |  | | | |

| | 41,485 | |  | Renault S.A. (d) |  | | 5,613,871 | |

| | | |  | Total France |  | | 51,327,546 | |

| | | |  | Germany (a) (6.5%) |  | | | |

| | | |  | Apparel/Footwear |  | | | |

| | 11,819 | |  | Adidas AG |  | | 696,026 | |

| | | |  | Chemicals: Major Diversified |  | | | |

| | 230,894 | |  | Bayer AG |  | $ | 18,236,915 | |

| | | |  | Electric Utilities |  | | | |

| | 147,094 | |  | RWE AG |  | | 16,554,919 | |

| | | |  | Motor Vehicles |  | | | |

| | 177,957 | |  | Bayerische Motoren Werke (BMW) AG |  | | 10,870,738 | |

| | 70,235 | |  | DaimlerChrysler AG (Registered Shares) |  | | 6,269,504 | |

| | | |  | |  | | 17,140,242 | |

| | | |  | Total Germany |  | | 52,628,102 | |

| | | |  | Greece (a) (1.1%) |  | | | |

| | | |  | Casino/Gaming |  | | | |

| | 238,390 | |  | Greek Organisation of Football Prognostics S.A. |  | | 8,734,750 | |

| | | |  | Ireland (a) (1.2%) |  | | | |

| | | |  | Construction Materials |  | | | |

| | 220,130 | |  | CRH PLC |  | | 9,551,912 | |

| | | |  | Italy (a) (2.2%) |  | | | |

| | | |  | Integrated Oil |  | | | |

| | 392,084 | |  | Eni SpA |  | | 13,528,993 | |

| | | |  | Major Banks |  | | | |

| | 513,021 | |  | UniCredito Italiano SpA |  | | 4,401,525 | |

| | | |  | Total Italy |  | | 17,930,518 | |

| | | |  | Japan (a) (23.8%) |  | | | |

| | | |  | Advertising/Marketing Services |

| | 83,900 | |  | Asatsu – DK Inc. |  | | 2,809,820 | |

| | | |  | Chemicals: Specialty |  | | | |

| | 297,300 | |  | JSR Corp. (d) |  | | 6,663,177 | |

| | 653,000 | |  | Taiyo Nippon Sanso Corp. (d) |  | | 5,777,450 | |

| | | |  | |  | | 12,440,627 | |

| | | |  | Commercial Printing/Forms |  | | | |

| | 282,000 | |  | Dai Nippon Printing Co., Ltd. |  | | 4,115,106 | |

| | | |  | Electric Utilities |  | | | |

| | 90,800 | |  | Kansai Electric Power Co., Inc. (The) |  | | 2,121,523 | |

| | | |  | Electronic Components |  | | | |

| | 168,200 | |  | Hoya Corp. (d) |  | | 5,841,342 | |

|

See Notes to Financial Statements

12

Morgan Stanley International Value Equity Fund

Portfolio of Investments  August 31, 2007 continued

August 31, 2007 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Electronic Equipment/Instruments |

| | 246,200 | |  | Canon Inc. |  | $ | 14,072,716 | |

| | 57,000 | |  | Keyence Corp. (d) |  | | 12,645,347 | |

| | 7,100 | |  | Kyocera Corp. |  | | 650,820 | |

| | 741,000 | |  | Mitsubishi Electric Corp. |  | | 8,790,763 | |

| | 180,300 | |  | Omron Corp. |  | | 4,787,309 | |

| | | |  | |  | | 40,946,955 | |

| | | |  | Finance/Rental/Leasing |  | | | |

| | 34,290 | |  | Takefuji Corp. |  | | 920,803 | |

| | | |  | Gas Distributors |  | | | |

| | 1,118,000 | |  | Osaka Gas Co., Ltd. |  | | 4,148,543 | |

| | | |  | Household/Personal Care |  | | | |

| | 635,000 | |  | Kao Corp. |  | | 18,042,476 | |

| | | |  | Industrial Specialties |  | | | |

| | 208,700 | |  | Nitto Denko Corp. (d) |  | | 9,725,471 | |

| | | |  | Life/Health Insurance |  | | | |

| | 215,650 | |  | T&D Holdings, Inc. |  | | 12,543,920 | |

| | | |  | Major Banks |  | | | |

| | 1,296,000 | |  | Shinsei Bank, Ltd. |  | | 4,328,754 | |

| | 2,039 | |  | Sumitomo Mitsui Financial Group, Inc. (d) |  | | 16,128,234 | |

| | | |  | |  | | 20,456,988 | |

| | | |  | Movies/Entertainment |  | | | |

| | 155,700 | |  | Oriental Land Co., Ltd. |  | | 8,811,070 | |

| | | |  | Pharmaceuticals: Other |  | | | |

| | 208,100 | |  | Astellas Pharma Inc. |  | | 9,657,646 | |

| | | |  | Property – Casualty Insurers |  | | | |

| | 1,279,000 | |  | Mitsui Sumitomo Insurance Co., Ltd. |  | | 14,432,570 | |

| | | |  | Railroads |  | | | |

| | 810 | |  | Central Japan Railway Co. |  | | 9,124,328 | |

| | | |  | Recreational Products |  | | | |

| | 188,500 | |  | Sega Sammy Holdings Inc. (d) |  | | 2,882,810 | |

| | | |  | Semiconductors |  | | | |

| | 4,700 | |  | Rohm Co., Ltd. |  | | 418,528 | |

| | | |  | Textiles |  | | | |

| | 1,193,000 | |  | Teijin Ltd. (d) |  | | 5,968,682 | |

| | | |  | Wireless Telecommunications |  | | | |

| | 5,292 | |  | NTT DoCoMo, Inc. |  | $ | 8,092,064 | |

| | | |  | Total Japan |  | | 193,501,272 | |

| | | |  | Netherlands (a) (7.5%) |  | | | |

| | | |  | Financial Conglomerates |  | | | |

| | 252,202 | |  | ING Groep NV (Share Certificates) (d) |  | | 10,170,406 | |

| | | |  | Food: Major Diversified |  | | | |

| | 549,925 | |  | Unilever NV (Share Certificates) |  | | 16,828,506 | |

| | | |  | Food: Specialty/Candy |  | | | |

| | 147,641 | |  | CSM |  | | 4,907,123 | |

| | | |  | Industrial Specialties |  | | | |

| | 112,833 | |  | Akzo Nobel NV |  | | 8,898,632 | |

| | | |  | Integrated Oil |  | | | |

| | 291,375 | |  | Royal Dutch Shell PLC (Class A) |  | | 11,302,107 | |

| | | |  | Steel |  | | | |

| | 133,164 | |  | Arcelor Mittal NV |  | | 8,797,332 | |

| | | |  | Total Netherlands |  | | 60,904,106 | |

| | | |  | Norway (a) (0.3%) |  | | | |

| | | |  | Integrated Oil |  | | | |

| | 86,307 | |  | Statoil ASA |  | | 2,489,546 | |

| | | |  | Spain (a) (1.9%) |  | | | |

| | | |  | Major Banks |  | | | |

| | 263,401 | |  | Banco Bilbao Vizcaya Argentaria, S.A. |  | | 6,076,407 | |

| | | |  | Major Telecommunications |  | | | |

| | 370,561 | |  | Telefonica S.A. |  | | 9,233,853 | |

| | | |  | Total Spain |  | | 15,310,260 | |

| | | |  | Sweden (a) (2.2%) |  | | | |

| | | |  | Telecommunication Equipment |

| | 4,762,141 | |  | Telefonaktiebolaget LM Ericsson (B Shares) |  | | 17,741,555 | |

| | | |  | Switzerland (a) (9.0%) |  | | | |

| | | |  | Construction Materials |  | | | |

| | 230,786 | |  | Holcim Ltd. (Registered Shares) |  | | 25,012,300 | |

|

See Notes to Financial Statements

13

Morgan Stanley International Value Equity Fund

Portfolio of Investments  August 31, 2007 continued

August 31, 2007 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Food: Major Diversified |  | | | |

| | 65,164 | |  | Nestle S.A. (Registered Shares) |  | $ | 28,480,302 | |

| | | |  | Pharmaceuticals: Major |  | | | |

| | 253,037 | |  | Novartis AG (Registered Shares) |  | | 13,339,661 | |

| | 34,522 | |  | Roche Holding AG |  | | 6,011,046 | |

| | | |  | |  | | 19,350,707 | |

| | | |  | Total Switzerland |  | | 72,843,309 | |

| | | |  | United Kingdom (a) (29.2%) |  | | | |

| | | |  | Casino/Gaming |  | | | |

| | 1,430,579 | |  | Ladbrokes PLC |  | | 12,608,657 | |

| | | |  | Electric Utilities |  | | | |

| | 653,560 | |  | Drax Group PLC |  | | 8,780,434 | |

| | 594,590 | |  | National Grid PLC |  | | 8,917,456 | |

| | 213,088 | |  | Scottish & Southern Energy PLC |  | | 6,104,221 | |

| | | |  | |  | | 23,802,111 | |

| | | |  | Food: Specialty/Candy |  | | | |

| | 2,386,381 | |  | Cadbury Schweppes PLC |  | | 28,385,103 | |

| | | |  | Hotels/Resorts/Cruiselines |  | | | |

| | 411,890 | |  | InterContinental Hotels Group PLC |  | | 8,631,735 | |

| | | |  | Household/Personal Care |  | | | |

| | 302,296 | |  | Reckitt Benckiser PLC |  | | 16,476,716 | |

| | | |  | Industrial Conglomerates |  | | | |

| | 322,740 | |  | Smiths Group PLC |  | | 6,434,922 | |

| | | |  | Integrated Oil |  | | | |

| | 1,057,273 | |  | BP PLC |  | | 11,866,951 | |

| | | |  | Major Banks |  | | | |

| | 223,068 | |  | HSBC Holdings PLC |  | | 4,040,779 | |

| | 849,007 | |  | Royal Bank of Scotland Group PLC |  | | 9,861,473 | |

| | | |  | |  | | 13,902,252 | |

| | | |  | Other Metals/Minerals |  | | | |

| | 322,441 | |  | BHP Billiton PLC |  | $ | 9,527,008 | |

| | | |  | Personnel Services |  | | | |

| | 4,679,009 | |  | Hays PLC |  | | 15,073,014 | |

| | | |  | Pharmaceuticals: Major |  | | | |

| | 120,558 | |  | AstraZeneca PLC |  | | 5,953,261 | |

| | 228,577 | |  | GlaxoSmithKline PLC |  | | 5,968,583 | |

| | | |  | |  | | 11,921,844 | |

| | | |  | Precious Metals |  | | | |

| | 9,290 | |  | Lonmin PLC |  | | 584,839 | |

| | | |  | Publishing: Books/Magazines |  | | | |

| | 769,864 | |  | Reed Elsevier PLC |  | | 9,289,649 | |

| | | |  | Publishing: Newspapers |  | | | |

| | 246,110 | |  | Johnston Press PLC |  | | 1,916,982 | |

| | | |  | Tobacco |  | | | |

| | 855,379 | |  | British American Tobacco PLC |  | | 28,412,221 | |

| | 638,137 | |  | Imperial Tobacco Group PLC |  | | 28,878,993 | |

| | | |  | |  | | 57,291,214 | |

| | | |  | Wireless Telecommunications |  | | | |

| | 3,042,630 | |  | Vodafone Group PLC |  | | 9,846,917 | |

| | | |  | Total United Kingdom |  | | 237,559,914 | |

| | | |  | Total Common Stocks

(Cost $646,212,035) |  | | 782,392,045 | |

| | | |  | Preferred Stock (1.0%) |  | | | |

| | | |  | Germany (a) |  | | | |

| | | |  | Motor Vehicles |  | | | |

| | 4,632 | |  | Porsche AG

(Cost $3,723,577) |  | | 8,284,776 | |

|

See Notes to Financial Statements

14

Morgan Stanley International Value Equity Fund

Portfolio of Investments  August 31, 2007 continued

August 31, 2007 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Short-Term Investments (10.0%) |

| | | |  | Short-Term Debt Securities

held as Collateral on

Loaned Securities (7.6%) |

| $ | 2,474 | |  | AIG Match Funding Corp., 5.55%, 12/17/07 (b) |  | $ | 2,474,030 | |

| | 1,767 | |  | Alliance & Leister Plc., 5.34%, 08/08/08 (b) |  | | 1,767,107 | |

| | 884 | |  | Bancaja,

5.36%, 08/12/08 (b) |  | | 883,554 | |

| | 884 | |  | Bank of New York Co., Inc., 5.35%, 08/08/08 (b) |  | | 883,554 | |

| | 1,532 | |  | Barton Capital Corp., 5.75%, 09/04/07 |  | | 1,531,956 | |

| | 883 | |  | BASF AG,

5.36%, 08/19/08 (b) |  | | 883,465 | |

| | 1,767 | |  | BNP Paribas Mtn.,

5.50%, 05/19/08 (b) |  | | 1,767,107 | |

| | 3,534 | |  | CAM US Finance SA Unipersonal,

5.37%, 08/01/08 (b) |  | | 3,534,214 | |

| | 1,767 | |  | Canadian Imperial Bank, NY,

5.42%, 07/28/08 (b) |  | | 1,767,107 | |

| | 883 | |  | CC USA Inc.,

5.26%, 01/28/08 (b) |  | | 882,791 | |

| | 3,181 | |  | CIT Group Holdings,

5.38%, 06/18/08 (b) |  | | 3,180,793 | |

| | 1,767 | |  | Credit Suisse First Boston, NY,

5.32%, 03/14/08 (b) |  | | 1,767,107 | |

| | | |  | First Tennessee Bank, |  | | | |

| | 884 | |  | 5.58%, 08/15/08 (b) |  | | 883,554 | |

| | 3,534 | |  | 5.59%, 08/15/08 (b) |  | | 3,533,943 | |

| | | |  | Goldman Sachs Group, Inc. |

| | 884 | |  | 5.66%, 08/14/08 (b) |  | | 883,553 | |

| | 1,661 | |  | 5.50%, 11/14/08 (b) |  | | 1,661,081 | |

| | 884 | |  | HSBC Finance Corp., 5.34%, 08/05/08 (b) |  | | 883,553 | |

| | 3,535 | |  | IBM Corp.,

5.30%, 08/08/08 (b) |  | | 3,534,561 | |

| | 1,767 | |  | KBC, Brussels,

5.75%, 09/04/07 |  | | 1,767,107 | |

| $ | 1,767 | |  | Macquarie Bank Ltd., 5.53%, 08/20/08 (b) |  | $ | 1,767,107 | |

| | 1,772 | |  | Marshall & Ilsley Bank, 5.37%, 12/17/07 |  | | 1,772,064 | |

| | 2,651 | |  | Metropolitan Life Global Funding,

5.49%, 08/22/08 (b) |  | | 2,650,660 | |

| | 884 | |  | National City Bank Cleveland,

5.32%, 09/18/07 (b) |  | | 883,537 | |

| | 3,534 | |  | National Rural Utilites Coop., Fin.,

5.33%, 08/29/08 (b) |  | | 3,534,214 | |

| | 2,050 | |  | Nationwide Building Society,

5.44%, 07/25/08 (b) |  | | 2,049,844 | |

| | 3,534 | |  | National Bank Canada,

5.31%, 04/02/08 (b) |  | | 3,533,634 | |

| | 3,503 | |  | Rhein-Main Securitisaton Limited,

5.33%, 09/24/07 |  | | 3,503,113 | |

| | 4,241 | |  | Societe Generale, NY, 5.55%, 12/31/07 (b) |  | | 4,240,625 | |

| | 1,944 | |  | Unicredito Delware Inc. 5.62%, 08/14/08 (b) |  | | 1,943,893 | |

| | 1,237 | |  | Unicredito Italiano Bank (IRE) PLC,

5.35%, 08/08/08 (b) |  | | 1,236,975 | |

| | | |  | Total Short-Term Debt Securities held as Collateral on Loaned Securities

(Cost $61,585,803) |  | | 61,585,803 | |

|

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES (000) |

| | | |  | Investment Company (c) (2.4%) |

| | 19,547 | |  | Morgan Stanley Institutional Liquidity Money Market Portfolio – Institutional Class

(Cost $19,546,880) |  | | 19,546,880 | |

| | | |  | Total Short-Term Investments

(Cost $81,132,683) |  | | 81,132,683 | |

|

See Notes to Financial Statements

15

Morgan Stanley International Value Equity Fund

Portfolio of Investments  August 31, 2007 continued

August 31, 2007 continued

|  |  |  |  |  |  |  |  |  |  |

| |  | |  | VALUE |

Total Investments

(Cost $731,068,295) (e) |  | | 107.3 | % |  | $ | 871,809,504 | |

| Liabilities in Excess of Other Assets |  | | (7.3 | ) |  | | (58,934,994 | ) |

| Net Assets |  | | 100.0 | % |  | $ | 812,874,510 | |

|

| (a) | Securities with a total market value of $790,676,821 have been valued at their fair value as determined in good faith under procedures established by and under the general supervision of the Fund’s Trustees. |

| (b) | Variable/Floating Rate Security - interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on August 31, 2007. |

| (c) | See Note 4 to the financial statements regarding investments in Morgan Stanley Institutional Liquidity Money Market portfolio – Institutional Class. |

| (d) | All or a portion of this security was on loan as of August 31, 2007. |

| (e) | The aggregate cost for federal income tax purposes is $733,528,561. The aggregate gross unrealized appreciation is $163,871,818 and the aggregate gross unrealized depreciation is $25,590,875, resulting in net unrealized appreciation of $138,280,943. |

Forward Foreign Currency Contracts Open at August 31, 2007:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

CONTRACTS

TO DELIVER |  | IN

EXCHANGE

FOR |  | DELIVERY

DATE |  | UNREALIZED

APPRECIATION

(DEPRECIATION) |

| EUR |  | | 92,917 | |  | $126,637 |  | | 09/04/07 | |  | $ | (158 | ) |

| $ |  | | 190,004 | |  | JPY 22,019,579 |  | | 09/04/07 | |  | | 800 | |

| Net Unrealized Appreciation |  | |  | | $642 | |

|

Currency Abbreviations:

JPY Japanese Yen.

EUR Euro.

See Notes to Financial Statements

16

Morgan Stanley International Value Equity Fund

Summary of Investments  August 31, 2007

August 31, 2007

|  |  |  |  |  |  |  |  |  |  |

| INDUSTRY |  | VALUE |  | PERCENT OF

TOTAL

INVESTMENTS |

| Short-Term Investments |  | $ | 81,132,683 | |  | | 9.3 | % |

| Major Banks |  | | 58,975,086 | |  | | 6.8 | |

| Tobacco |  | | 57,291,214 | |  | | 6.6 | |

| Integrated Oil |  | | 56,522,340 | |  | | 6.5 | |

| Food: Major Diversified |  | | 45,308,808 | |  | | 5.2 | |

| Electric Utilities |  | | 42,478,553 | |  | | 4.9 | |

| Construction Materials |  | | 41,108,873 | |  | | 4.7 | |

| Electronic Equipment/ Instruments |  | | 40,946,955 | |  | | 4.7 | |

| Household/Personal Care |  | | 34,519,192 | |  | | 4.0 | |

| Food: Specialty/Candy |  | | 33,292,226 | |  | | 3.8 | |

| Pharmaceuticals: Major |  | | 31,272,551 | |  | | 3.6 | |

| Motor Vehicles |  | | 31,038,889 | |  | | 3.6 | |

| Major Telecommunications |  | | 23,159,718 | |  | | 2.7 | |

| Casino/Gaming |  | | 21,343,407 | |  | | 2.4 | |

| Chemicals: Major Diversified |  | | 20,164,918 | |  | | 2.3 | |

| Financial Conglomerates |  | | 19,302,944 | |  | | 2.2 | |

| Industrial Specialties |  | | 18,624,103 | |  | | 2.1 | |

| Wireless Telecommunications |  | | 17,938,981 | |  | | 2.1 | |

| Telecommunication Equipment |  | | 17,741,555 | |  | | 2.0 | |

| Personnel Services |  | | 15,073,014 | |  | | 1.7 | |

| Property – Casualty Insurers |  | | 14,432,570 | |  | | 1.7 | |

| Life/Health Insurance |  | | 12,543,920 | |  | | 1.4 | |

| Chemicals: Specialty |  | $ | 12,440,627 | |  | | 1.4 | % |

| Electrical Products |  | | 10,324,663 | |  | | 1.2 | |

| Pharmaceuticals: Other |  | | 9,657,646 | |  | | 1.1 | |

| Other Metals/Minerals |  | | 9,527,008 | |  | | 1.1 | |

| Publishing: Books/Magazines |  | | 9,289,649 | |  | | 1.1 | |

| Railroads |  | | 9,124,328 | |  | | 1.0 | |

| Oil & Gas Production |  | | 9,029,005 | |  | | 1.0 | |

| Movies/Entertainment |  | | 8,811,070 | |  | | 1.0 | |

| Steel |  | | 8,797,332 | |  | | 1.0 | |

| Hotels/Resorts/Cruiselines |  | | 8,631,735 | |  | | 1.0 | |

| Industrial Conglomerates |  | | 6,434,922 | |  | | 0.7 | |

| Textiles |  | | 5,968,682 | |  | | 0.7 | |

| Electronic Components |  | | 5,841,342 | |  | | 0.7 | |

| Beverages: Alcoholic |  | | 5,225,538 | |  | | 0.6 | |

| Gas Distributors |  | | 4,148,543 | |  | | 0.5 | |

| Commercial Printing/Forms |  | | 4,115,106 | |  | | 0.5 | |

| Recreational Products |  | | 2,882,810 | |  | | 0.3 | |

| Advertising/Marketing Services |  | | 2,809,820 | |  | | 0.3 | |

| Publishing: Newspapers |  | | 1,916,982 | |  | | 0.2 | |

| Finance/Rental/Leasing |  | | 920,803 | |  | | 0.1 | |

| Apparel/Footwear |  | | 696,026 | |  | | 0.1 | |

| Precious Metals |  | | 584,839 | |  | | 0.1 | |

| Semiconductors |  | | 418,528 | |  | | 0.0 | |

| |  | $ | 871,809,504 | * |  | | 100.0 | % |

|

|

| * | Does not include open forward foreign currency contracts with net unrealized appreciation of $642. |

See Notes to Financial Statements

17

Morgan Stanley International Value Equity Fund

Financial Statements

Statement of Assets and Liabilities

August 31, 2007

|  |  |  |  |  |  |

| Assets: |

Investments in securities, at value

(cost $711,521,415) (including $59,129,251 of securities loaned) |  | $852,262,624 |

| Investments in affiliate (cost $19,546,880) |  | 19,546,880 |

| Unrealized appreciation on open forward foreign currency contracts |  | 800 |

| Foreign cash, at value ($2,313,219) |  | 2,320,619 |

Receivable for:

|

| Dividends |  | 1,583,108 |

| Investments sold |  | 465,938 |

| Shares of beneficial interest sold |  | 256,746 |

| Foreign withholding taxes reclaimed |  | 149,425 |

| Dividend from affiliate |  | 89,464 |

| Prepaid expenses and other assets |  | 68,268 |

| Receivable from Distributor |  | 33,198 |

| Total Assets |  | 876,777,070 |

| Liabilities: |  | |

| Collateral on securities loaned at value |  | 61,585,803 |

| Unrealized depreciation on open forward foreign currency contracts |  | 158 |

| Payable for: |  | |

| Investments purchased |  | 911,674 |

| Shares of beneficial interest redeemed |  | 658,728 |

| Investment advisory fee |  | 540,613 |

| Administration fee |  | 54,229 |

| Transfer agent fee |  | 2,809 |

| Accrued expenses and other payables |  | 148,546 |

| Total Liabilities |  | 63,902,560 |

| Net Assets |  | $812,874,510 |

| Composition of Net Assets: |  | |

| Paid-in-capital |  | $566,641,015 |

| Net unrealized appreciation |  | 140,771,441 |

| Accumulated undistributed net investment income |  | 6,327,211 |

| Accumulated undistributed net realized gain |  | 99,134,843 |

| Net Assets |  | $812,874,510 |

| Class A Shares: |  | |

| Net Assets |  | $125,526,711 |

| Shares Outstanding (unlimited authorized, $.01 par value) |  | 8,911,307 |

| Net Asset Value Per Share |  | $14.09 |

| Maximum Offering Price Per Share, |  | |

| (net asset value plus 5.54% of net asset value) |  | $14.87 |

| Class B Shares: |  | |

| Net Assets |  | $184,035,240 |

| Shares Outstanding (unlimited authorized, $.01 par value) |  | 13,189,391 |

| Net Asset Value Per Share |  | $13.95 |

| Class C Shares: |  | |

| Net Assets |  | $66,485,992 |

| Shares Outstanding (unlimited authorized, $.01 par value) |  | 4,804,973 |

| Net Asset Value Per Share |  | $13.84 |

| Class D Shares: |  | |

| Net Assets |  | $436,826,567 |

| Shares Outstanding (unlimited authorized, $.01 par value) |  | 30,849,128 |

| Net Asset Value Per Share |  | $14.16 |

|

Statement of Operations

For the year ended August 31, 2007

|  |  |  |  |  |  |

| Net Investment Income: |

| Income |

| Dividends (net of $1,703,682 foreign withholding tax) |  | $ | 22,600,988 | |

| Dividends from affiliate |  | | 299,736 | |

| Income from securities loaned – net |  | | 565,947 | |

| Interest |  | | 719,277 | |

| Total Income |  | | 24,185,948 | |

| Expenses |  | | | |

| Investment advisory fee |  | | 6,739,145 | |

| Distribution fee (Class A shares) |  | | 295,639 | |

| Distribution fee (Class B shares) |  | | 1,580,969 | |

| Distribution fee (Class C shares) |  | | 639,843 | |

| Transfer agent fees and expenses |  | | 1,149,270 | |

| Administration fee |  | | 673,915 | |

| Shareholder reports and notices |  | | 377,337 | |

| Custodian fees |  | | 244,922 | |

| Professional fees |  | | 83,451 | |

| Registration fees |  | | 66,963 | |

| Trustees’ fees and expenses |  | | 14,199 | |

| Other |  | | 79,277 | |

| Total Expenses |  | | 11,944,930 | |

| Less: amounts waived/reimbursed |  | | (4,274 | ) |

| Less: expense offset |  | | (5,806 | ) |

| Net Expenses |  | | 11,934,850 | |

| Net Investment Income |  | | 12,251,098 | |

| Net Realized and Unrealized Gain: |  | | | |

| Net Realized Gain (Loss) on: |  | | | |

| Investments |  | | 112,401,523 | |

| Foreign exchange transactions |  | | (2,001,954 | ) |

| Net Realized Gain |  | | 110,399,569 | |

| Net Change in Unrealized Appreciation/Depreciation on: |  | | | |

| Investments |  | | 774,608 | |

Translation of forward foreign currency contracts, other assets and liabilities denominated

in foreign currencies |  | | 1,196,592 | |

| Net Change in Unrealized Appreciation/Depreciation |  | | 1,971,200 | |

| Net Gain |  | | 112,370,769 | |

| Net Increase |  | $ | 124,621,867 | |

|

See Notes to Financial Statements

18

Morgan Stanley International Value Equity Fund

Financial Statements continued

Statements of Changes in Net Assets

|  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE YEAR

ENDED

AUGUST 31, 2007 |  | FOR THE YEAR

ENDED

AUGUST 31, 2006 |

| Increase (Decrease) in Net Assets: |

| Operations: |

| Net investment income |  | $ | 12,251,098 | |  | $ | 14,965,270 | |

| Net realized gain |  | | 110,399,569 | |  | | 101,057,275 | |

| Net change in unrealized appreciation |  | | 1,971,200 | |  | | 9,350,056 | |

| Net Increase |  | | 124,621,867 | |  | | 125,372,601 | |

| Dividends and Distributions to Shareholders from: |  | | | |  | | | |

| Net investment income |  | | | |  | | | |

| Class A shares |  | | (1,761,480 | ) |  | | (1,330,082 | ) |

| Class B shares |  | | (1,339,266 | ) |  | | (899,519 | ) |

| Class C shares |  | | (527,995 | ) |  | | (379,727 | ) |

| Class D shares |  | | (7,472,390 | ) |  | | (6,565,623 | ) |

| Net realized gain |  | | | |  | | | |

| Class A shares |  | | (14,866,046 | ) |  | | (6,570,824 | ) |

| Class B shares |  | | (26,383,716 | ) |  | | (15,336,622 | ) |

| Class C shares |  | | (8,583,533 | ) |  | | (4,687,045 | ) |

| Class D shares |  | | (55,111,330 | ) |  | | (29,592,057 | ) |

| Total Dividends and Distributions |  | | (116,045,756 | ) |  | | (65,361,499 | ) |

| Net decrease from transactions in shares of beneficial interest |  | | (27,005,032 | ) |  | | (101,181,973 | ) |

| Net Decrease |  | | (18,428,921 | ) |  | | (41,170,871 | ) |

| Net Assets: |  | | | |  | | | |

| Beginning of period |  | | 831,303,431 | |  | | 872,474,302 | |

End of Period

(Including accumulated undistributed net investment income of $6,327,211 and $7,179,198, respectively) |  | $ | 812,874,510 | |  | $ | 831,303,431 | |

|

See Notes to Financial Statements

19

Morgan Stanley International Value Equity Fund

Notes to Financial Statements  August 31, 2007

August 31, 2007

1. Organization and Accounting Policies

Morgan Stanley International Value Equity Fund (the ‘‘Fund’’) is registered under the Investment Company Act of 1940, as amended (the ‘‘Act’’), as a diversified, open-end management investment company. The Fund’s investment objective is to seek long-term capital appreciation. The Fund was organized as a Massachusetts business trust on January 11, 2001 and commenced operations on April 26, 2001.

The Fund offers Class A shares, Class B shares, Class C shares and Class D shares. The four classes are substantially the same except that most Class A shares are subject to a sales charge imposed at the time of purchase and some Class A shares, and most Class B shares and Class C shares are subject to a contingent deferred sales charge imposed on shares redeemed within eighteen months, six years and one year, respectively. Class D shares are not subject to a sales charge. Additionally, Class A shares, Class B shares and Class C shares incur distribution expenses.

The Fund will assess a 2% redemption fee, on Class A shares, Class B shares, Class C shares, and Class D shares, which is paid directly to the Fund, for shares redeemed or exchanged within thirty days of purchase, subject to certain exceptions. The redemption fee is designed to protect the Fund and its remaining shareholders from the effects of short-term trading.

The following is a summary of significant accounting policies:

A. Valuation of Investments — (1) for equity securities traded on foreign exchanges, the last reported sale price or the latest bid price may be used if there were no sales on a particular day; (2) an equity portfolio security listed or traded on the New York Stock Exchange (‘‘NYSE’’) or American Stock Exchange or other exchange is valued at its latest sale price prior to the time when assets are valued; if there were no sales that day, the security is valued at the mean between the last reported bid and asked price; (3) an equity portfolio security listed or traded on the Nasdaq is valued at the Nasdaq Official Closing Price; if there were no sales that day, the security is valued at the mean between the last reported bid and asked price; (4) all other portfolio securities for which over-the-counter market quotations are readily available are valued at the mean b etween the last reported bid and asked price. In cases where a security is traded on more than one exchange, the security is valued on the exchange designated as the primary market; (5) when market quotations are not readily available including circumstances under which Morgan Stanley Investment Advisors Inc. (the ‘‘Investment Adviser’’) or Morgan Stanley Investment Management Limited (the ‘‘Sub-Adviser’’), an affiliate of the Investment Adviser, determines that the latest sale price, the bid price or the mean between the last reported bid and asked price do not reflect a security’s market value, portfolio securities are valued at their fair value as determined in good faith under procedures established by and under the general supervision of the Fund’s Trustees. Occasionally, developments affecting the closing prices of securities and other assets may occur between the times at which valuations of such securities are determined (that is, close of t he foreign market on which the securities trade) and the close of business on the NYSE. If developments occur

20

Morgan Stanley International Value Equity Fund

Notes to Financial Statements  August 31, 2007 continued

August 31, 2007 continued

during such periods that are expected to materially affect the value of such securities, such valuations may be adjusted to reflect the estimated fair value of such securities as of the close of the NYSE, as determined in good faith by the Fund’s Trustees or by the Investment Adviser using a pricing service and/or procedures approved by the Trustees of the Fund; (6) certain portfolio securities may be valued by an outside pricing service approved by the Fund’s Trustees; (7) investments in open-end mutual funds, including the Morgan Stanley Institutional Liquidity Funds, are valued at the net asset value as of the close of each business day; and (8) short-term debt securities having a maturity date of more than sixty days at time of purchase are valued on a mark-to-market basis until sixty days prior to maturity and thereafter at amortized cost based on their value on the 61st day. Short-term debt securities having a maturity date of sixty days or less at the time of purchase are valued at amorti zed cost.

B. Accounting for Investments — Security transactions are accounted for on the trade date (date the order to buy or sell is executed). Realized gains and losses on security transactions are determined by the identified cost method. Dividend income and other distributions are recorded on the ex-dividend date except for certain dividends on foreign securities which are recorded as soon as the Fund is informed after the ex-dividend date. Discounts are accreted and premiums are amortized over the life of the respective securities and are included in interest income. Interest income is accrued daily.

C. Multiple Class Allocations — Investment income, expenses (other than distribution fees), and realized and unrealized gains and losses are allocated to each class of shares based upon the relative net asset value on the date such items are recognized. Distribution fees are charged directly to the respective class.

D. Foreign Currency Translation and Forward Foreign Currency Contracts — The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investment securities, other assets and liabilities and forward foreign currency contracts (‘‘forward contracts’’) are translated at the exchange rates prevailing at the end of the period; and (2) purchases, sales, income and expenses are translated at the exchange rates prevailing on the respective dates of such transactions. The resultant exchange gains and losses are recorded as realized and unrealized gain/loss on foreign exchange transactions. Pursuant to U.S. federal income tax regulations, certain foreign exchange gains/losses included in realized and unrealized gain/loss are included in or are a reduction of ordinary income for federal income tax purposes. The Fund doe s not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in the market prices of the securities. Forward contracts are valued daily at the appropriate exchange rates. The resultant unrealized exchange gains and losses are recorded as unrealized foreign currency gain or loss. The Fund records realized gains or losses on delivery of the currency or at the time the forward contract is extinguished (compensated) by entering into a closing transaction prior to delivery.

E. Security Lending — The Fund may lend securities to qualified financial institutions, such as broker-dealers, to earn additional income. Any increase or decrease in the fair value of the securities loaned that might occur

21

Morgan Stanley International Value Equity Fund

Notes to Financial Statements  August 31, 2007 continued

August 31, 2007 continued

and any interest earned or dividends declared on those securities during the term of the loan would remain in the Fund. The Fund receives cash or securities as collateral in an amount equal to or exceeding 100% of the current fair value of the loaned securities. The collateral is marked-to-market daily, by the securities lending agent, to ensure that a minimum of 100% collateral coverage is maintained.

Based on pre-established guidelines, the securities lending agent invests any cash collateral that is received in high-quality short-term investments. Securities lending income is generated from the earnings on the invested collateral and borrowing fees, less any rebates owed to the borrowers and compensation to the lending agent.

The value of loaned securities and related collateral outstanding at August 31, 2007 were $59,129,251 and $61,585,803, respectively. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

F. Federal Income Tax Policy — It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Accordingly, no federal income tax provision is required.

G. Dividends and Distributions to Shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

H. Use of Estimates — The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates.

2. Investment Advisory/Administration and Sub Advisory Agreements

Pursuant to an Investment Advisory Agreement, the Fund pays the Investment Adviser an advisory fee, accrued daily and payable monthly, by applying the annual rate of 0.80% to the net assets of the Fund determined as of the close of each business day.

Pursuant to an Administration Agreement with Morgan Stanley Services Company Inc. (the ‘‘Administrator’’), an affiliate of the Investment Adviser and Sub-Adviser, the Fund pays an administration fee, accrued daily and payable monthly, by applying the annual rate of 0.08% to the Fund’s daily net assets.

Under the Sub-Advisory Agreement between the Sub-Adviser and the Investment Adviser, the Sub-Adviser invests the Fund’s assets including placing orders for the purchase and sales of portfolio securities. As compensation for its services provided pursuant to the Sub-Advisory Agreement, the Investment Adviser paid the Sub-Adviser compensation of $3,183,614 for the year ended August 31, 2007.

22

Morgan Stanley International Value Equity Fund

Notes to Financial Statements  August 31, 2007 continued

August 31, 2007 continued

3. Plan of Distribution

Shares of the Fund are distributed by Morgan Stanley Distributors Inc. (the ‘‘Distributor’’), an affiliate of the Investment Adviser and Administrator and Sub-Adviser. The Fund has adopted a Plan of Distribution (the ‘‘Plan’’) pursuant to Rule 12b-1 under the Act. The Plan provides that the Fund will pay the Distributor a fee which is accrued daily and paid monthly at the following annual rates: (i) Class A – up to 0.25% of the average daily net assets of Class A shares; (ii) Class B – up to 1.0% of the average daily net assets of Class B shares; and (iii) Class C – up to 1.0% of the average daily net assets of Class C shares.

In the case of Class B shares, provided that the Plan continues in effect, any cumulative expenses incurred by the Distributor but not yet recovered may be recovered through the payment of future distribution fees from the Fund pursuant to the Plan and contingent deferred sales charges paid by investors upon redemption of Class B shares. Although there is no legal obligation for the Fund to pay expenses incurred in excess of payments made to the Distributor under the Plan and the proceeds of contingent deferred sales charges paid by investors upon redemption of shares, if for any reason the Plan is terminated, the Trustees will consider at that time the manner in which to treat such expenses. The Distributor has advised the Fu nd that there were no such expenses as of August 31, 2007.

For the year ended August 31, 2007, the distribution fee was accrued for Class B shares at an annual rate of 0.77%. At August 31, 2007, included in the Statement of Assets and Liabilities, is a receivable from the Fund’s Distributor which represents payments due to be reimbursed to the Fund under the Plan. Because the Plan is what is referred to as a ‘‘reimbursement plan’’, the Distributor reimburses to the Fund any 12b-1 fees collected in excess of the actual distribution expenses incurred. This receivable represents this excess amount as of August 31, 2007.

In the case of Class A shares and Class C shares, expenses incurred pursuant to the Plan in any calendar year in excess of 0.25% or 1.0% of the average daily net assets of Class A or Class C, respectively, will not be reimbursed by the Fund through payments in any subsequent year, except that expenses representing a gross sales credit to Morgan Stanley Financial Advisors and other authorized financial representatives at the time of sale may be reimbursed in the subsequent calendar year. For the year ended August 31, 2007, the distribution fee was accrued for Class A shares and Class C shares at the annual rate of 0.24% and 0.94%, respectively.

The Distributor has informed the Fund that for the year ended August 31, 2007, it received contingent deferred sales charges from certain redemptions of the Fund’s Class B shares and Class C shares of $252,537 and $8,436, respectively and received $141,890 in front-end sales charges from sales of the Fund’s Class A shares. The respective shareholders pay such charges which are not an expense of the Fund.

23

Morgan Stanley International Value Equity Fund

Notes to Financial Statements  August 31, 2007 continued

August 31, 2007 continued

4. Security Transactions and Transactions with Affiliates

The Fund invests in Morgan Stanley Institutional Liquidity Money Market Portfolio – Institutional Class, an open-end management investment company managed by the Investment Adviser. Investment advisory fees paid by the Fund are reduced by an amount equal to the advisory and administrative services fees paid by Morgan Stanley Institutional Liquidity Money Market Portfolio – Institutional Class with respect to assets invested by the Fund in Morgan Stanley Institutional Liquidity Money Market Portfolio – Institutional Class. For the year ended August 31, 2007, advisory fees paid were reduced by $4,274 relating to the Fund’s investment in Morgan Stanley Institutional Liquidity Money Market Portfolio – Institutional Class. Income distributions earned by the Fund are recorded as dividends from affiliate in the Statement of Operations and totaled $299,736 for the year ended August 31, 2007. During the year ended August 31, 2007, cost of purchases and sales in investments in Morgan Stanley Institutional Liquidity Money Market Portfolio – Institutional Class aggregated $90,720,173 and $71,173,294, respectively.

The cost of purchases and proceeds from sales of portfolio securities, excluding short-term investments, for the year ended August 31, 2007 aggregated $239,987,574, and $367,004,205, respectively.

Morgan Stanley Trust, an affiliate of the Investment Adviser, Administrator, Sub-Adviser and Distributor, is the Fund’s transfer agent.

The Fund has an unfunded Deferred Compensation Plan (the ‘‘Compensation Plan’’) which allows each independent Trustee to defer payment of all, or a portion, of the fees he or she receives for serving on the Board of Trustees. Each eligible Trustee generally may elect to have the deferred amounts credited with a return equal to the total return on one or more of the Morgan Stanley funds that are offered as investment options under the Compensation Plan. Appreciation/depreciation and distributions received from these investments are recorded with an offsetting increase/decrease in the deferred compensation obligation and do not affect the net asset value of the Fund.

5. Expense Offset

The expense offset represents a reduction of the fees and expenses for interest earned on cash balances maintained by the Fund with the transfer agent.

6. Purposes of and Risks Relating to Certain Financial Instruments

The Fund may enter into forward contracts for many purposes, including to facilitate settlement of foreign currency denominated portfolio transactions or to manage foreign currency exposure associated with foreign currency denominated securities.

Forward contracts involve elements of market risk in excess of the amounts reflected in the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the foreign exchange rates

24

Morgan Stanley International Value Equity Fund

Notes to Financial Statements  August 31, 2007 continued

August 31, 2007 continued

underlying the forward contracts. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

The Fund may lend securities to qualified financial institutions, such as broker-dealers, to earn additional income. Risks in securities lending transactions are that a borrower may not provide additional collateral when required or return the securities when due, and that the value of the short-term investments will be less than the amount of cash collateral plus any rebate that is required to be returned to the borrower.

At August 31, 2007, investments in securities of issuers in the United Kingdom and Japan were 29.2% and 23.8%, respectively, of the Fund’s net assets. These investments, as well as other non-U.S. securities, may be affected by economic or political developments in these regions.

At August 31, 2007, the Fund’s cash balance consisted principally of interest bearing deposits with J.P. Morgan Chase, the Fund’s custodian.

25

Morgan Stanley International Value Equity Fund

Notes to Financial Statements  August 31, 2007 continued

August 31, 2007 continued

7. Shares of Beneficial Interest†

Transactions in shares of beneficial interest were as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE YEAR

ENDED

AUGUST 31, 2007 |  | FOR THE YEAR

ENDED

AUGUST 31, 2006 |

| |  | SHARES |  | AMOUNT |  | SHARES |  | AMOUNT |

| CLASS A SHARES |  | | | |  | | | |  | | | |  | | | |  | |

| Sold |  | | 1,018,491 | |  | $ | 14,231,870 | |  | | 1,584,508 | |  | $ | 20,998,545 | |

| Conversion from Class B |  | | 1,245,102 | |  | | 17,395,490 | |  | | 980,212 | |  | | 13,040,431 | |

| Reinvestment of dividends and distributions |  | | 1,127,651 | |  | | 14,817,340 | |  | | 567,518 | |  | | 7,099,654 | |

| Redeemed |  | | (2,528,487 | ) |  | | (35,210,025 | ) |  | | (2,468,462 | ) |  | | (32,744,644 | ) |

| Net increase – Class A |  | | 862,757 | |  | | 11,234,675 | |  | | 663,776 | |  | | 8,393,986 | |

| CLASS B SHARES |

| Sold |  | | 797,060 | |  | | 11,097,612 | |  | | 1,248,643 | |  | | 16,427,789 | |

| Conversion to Class A |  | | (1,256,980 | ) |  | | (17,395,490 | ) |  | | (989,709 | ) |  | | (13,040,431 | ) |

| Reinvestment of dividends and distributions |  | | 1,873,460 | |  | | 24,467,389 | |  | | 1,168,116 | |  | | 14,519,679 | |

| Redeemed |  | | (3,332,163 | ) |  | | (46,228,777 | ) |  | | (4,743,299 | ) |  | | (62,239,852 | ) |

| Net decrease – Class B |  | | (1,918,623 | ) |  | | (28,059,266 | ) |  | | (3,316,249 | ) |  | | (44,332,815 | ) |

| CLASS C SHARES |

| Sold |  | | 420,994 | |  | | 5,789,648 | |  | | 424,125 | |  | | 5,555,991 | |

| Reinvestment of dividends and distributions |  | | 630,055 | |  | | 8,171,809 | |  | | 380,689 | |  | | 4,705,315 | |

| Redeemed |  | | (1,005,113 | ) |  | | (13,804,764 | ) |  | | (1,743,803 | ) |  | | (22,826,134 | ) |

| Net increase (decrease) – Class C |  | | 45,936 | |  | | 156,693 | |  | | (938,989 | ) |  | | (12,564,828 | ) |

| CLASS D SHARES |

| Sold |  | | 3,286,240 | |  | | 46,037,950 | |  | | 5,481,946 | |  | | 72,879,848 | |

| Reinvestment of dividends and distributions |  | | 4,085,174 | |  | | 53,883,445 | |  | | 2,433,286 | |  | | 30,513,410 | |

| Redeemed |  | | (7,865,614 | ) |  | | (110,258,529 | ) |  | | (11,736,454 | ) |  | | (156,071,574 | ) |

| Net decrease – Class D |  | | (494,200 | ) |  | | (10,337,134 | ) |  | | (3,821,222 | ) |  | | (52,678,316 | ) |

| Net decrease in Fund |  | | (1,504,130 | ) |  | $ | (27,005,032 | ) |  | | (7,412,684 | ) |  | $ | (101,181,973 | ) |

|

|  |

| † | The Fund will suspend offering its shares to new investors when the Fund’s assets reach $1 billion. Following the general suspension of the offering of the Fund’s shares to new investors, the Fund will continue to offer its shares to existing shareholders and may recommence offering its shares to other new investors in the future. |

26

Morgan Stanley International Value Equity Fund

Notes to Financial Statements  August 31, 2007 continued

August 31, 2007 continued

8. Federal Income Tax Status

The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations which may differ from generally accepted accounting principles. These ‘‘book/tax’’ differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed net investment income and net realized capital gains for tax purposes are reported as distributions of paid-in-capital.

The tax character of distributions paid was as follows:

|  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE YEAR

ENDED

AUGUST 31, 2007 |  | FOR THE YEAR

ENDED

AUGUST 31, 2006 |

| Ordinary income |  | $ | 16,125,759 | |  | $ | 13,997,461 | |

| Long-term capital gains |  | | 99,919,997 | |  | | 51,364,038 | |

| Total distributions |  | $ | 116,045,756 | |  | $ | 65,361,499 | |

| |  | | | |  | | | |

|

As of August 31, 2007, the tax-basis components of accumulated earnings were as follows:

|  |  |  |  |  |  |

| Undistributed ordinary income |  | $ | 17,899,657 | |

| Undistributed long-term gains |  | | 90,743,373 | |

| Net accumulated earnings |  | | 108,643,030 | |

| Foreign tax credit pass-through |  | | 1,369,286 | |

| Post-October losses |  | | (693,795 | ) |

| Temporary differences |  | | (1,396,201 | ) |

| Net unrealized appreciation |  | | 138,311,175 | |

| Total accumulated earnings |  | $ | 246,233,495 | |

|

As of August 31, 2007, the Fund had temporary book/tax differences primarily attributable to post-October losses (foreign currency losses incurred after October 31 within the taxable year which are deemed to arise on the first business day of the Fund’s next taxable year), capital loss deferrals on wash sales and foreign tax credit pass-through.

27

Morgan Stanley International Value Equity Fund

Notes to Financial Statements  August 31, 2007 continued

August 31, 2007 continued

Permanent differences, due to foreign currency losses, resulted in the following reclassifications among the Fund’s components of net assets at August 31, 2007:

|  |  |  |  |  |  |  |  |  |  |

ACCUMULATED

UNDISTRIBUTED

NET INVESTMENT

INCOME |  | ACCUMULATED

UNDISTRIBUTED

NET REALIZED

GAIN |  | PAID-IN-CAPITAL |

| $(2,001,954) |  | $ | 2,001,954 | |  | | — | |

|

9. Accounting Pronouncements