As filed with the Securities and Exchange Commission on September 20, 2006

Registration No. 333-135537

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Ascent Energy Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 1311 | | 72-1493233 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

4965 Preston Park Blvd., Suite 800

Plano, Texas 75093

(972) 543-3900

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Terry W. Carter

Chief Executive Officer and President

Ascent Energy Inc.

4965 Preston Park Blvd., Suite 800

Plano, Texas 75093

(972) 543-3900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

| T. Mark Kelly | | J. Michael Chambers |

| Caroline B. Blitzer | | Akin Gump Strauss Hauer & Feld LLP |

| Vinson & Elkins L.L.P. | | 1111 Louisiana Street, 44th Floor |

| 2300 First City Tower | | Houston, Texas 77002 |

| 1001 Fannin | | (713) 220-5800 |

| Houston, Texas 77002-6760 | | |

| (713) 758-2222 | | |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 20, 2006

PROSPECTUS

Shares

Common Stock

This is the initial public offering by Ascent Energy Inc. We are offering shares of our common stock for which no public market currently exists. We currently expect the initial public offering price to be between $ and $ per share. We have applied to list our common stock on The Nasdaq Global Market under the symbol “ASNT.”

Investing in our common stock involves risks. Please read “Risk Factors” beginning on page 14.

| | | | |

| | | Per Share | | Total |

| | |

Public offering price | | $ | | $ |

| | |

Underwriting discount | | $ | | $ |

| | |

Proceeds (before expenses) to Ascent Energy Inc. | | $ | | $ |

We have granted the underwriters a 30-day option to purchase up to an additional shares of our common stock from us on the same terms and conditions as set forth above if the underwriters sell more than shares of our common stock in this offering.

We intend to use a portion of the net proceeds of this offering to repay certain indebtedness outstanding under our credit facility, our senior notes and our senior subordinated notes. Certain of the underwriters and their affiliates are lenders under our credit facility or holders of our senior notes and/or our senior subordinated notes and therefore will receive a portion of those proceeds. In addition, our executive officers will receive a portion of those proceeds in the form of cash bonuses representing a part of the consideration in connection with the termination of an existing incentive plan.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lehman Brothers, on behalf of the underwriters, expects to deliver the shares of common stock on or about , 2006.

Joint Book-Running Managers

LEHMAN BROTHERS | JEFFERIES & COMPANY |

Senior Co-Managers

| | | | |

| MORGAN KEEGAN & COMPANY, INC. | | PETRIE PARKMAN & CO. |

Co-Managers

| | | | |

| CAPITAL ONE SOUTHCOAST | | FORTIS SECURITIES LLC | | KEYBANC CAPITAL MARKETS |

, 2006

[Art to come]

TABLE OF CONTENTS

| | |

U.S. Federal Tax Considerations for Non-U.S. Holders | | 118 |

Shares Eligible for Future Sale | | 121 |

Underwriting | | 123 |

Legal Matters | | 128 |

Experts | | 128 |

Where You Can Find More Information | | 129 |

Index to Consolidated Financial Statements | | F-1 |

Glossary of Natural Gas and Oil Terms | | A-1 |

Report of Netherland, Sewell & Associates, Inc., Reserve Engineering Firm as of December 31, 2005 | | B-1 |

Report of LaRoche Petroleum Consultants, Ltd., Reserve Engineering Firm as of December 31, 2005 | | C-1 |

Report of Netherland, Sewell & Associates, Inc., Reserve Engineering Firm as of June 30, 2006 | | D-1 |

Report of LaRoche Petroleum Consultants, Ltd., Reserve Engineering Firm as of June 30, 2006 | | E-1 |

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

Non-GAAP Financial Measures

The body of accounting principles generally accepted in the United States is commonly referred to as “GAAP.” A non-GAAP financial measure is generally defined by the Securities and Exchange Commission, or SEC, as one that purports to measure historical or future financial performance, financial position or cash flows, but excludes or includes amounts that would not be so excluded or included in the most comparable GAAP measure. In this prospectus, we disclose EBITDAX, which is, and PV-10, which may be, a non-GAAP financial measure. See note 3 to “Summary—Summary Consolidated Historical and Pro Forma Financial Information,” note 3 to “Summary—Summary Historical Reserve and Operating Data” and note 2 to the table in “Business and Properties—Our Areas of Operations.”

Natural Gas and Oil Information

We have provided definitions for the natural gas and oil terms used in this prospectus in the “Glossary of Natural Gas and Oil Terms” included as Appendix A. Unless otherwise indicated, all natural gas and oil statistics with respect to our proved reserves as of December 31, 2005 and as of June 30, 2006 set forth in this prospectus are based on reserve reports prepared by Netherland, Sewell & Associates, Inc. and LaRoche Petroleum Consultants, Ltd., independent reserve engineering firms. A summary of Netherland, Sewell & Associates, Inc.’s report on our proved reserves as of December 31, 2005 is attached to this prospectus as Appendix B and a

i

summary of Netherland, Sewell & Associates, Inc.’s report on our proved reserves as of June 30, 2006 is attached to this prospectus as Appendix D. A summary of LaRoche Petroleum Consultants, Ltd.’s report on our proved reserves as of December 31, 2005 is attached to this prospectus as Appendix C and a summary of LaRoche Petroleum Consultants, Ltd.’s report on our proved reserves as of June 30, 2006 is attached to this prospectus as Appendix E.

Our Investors

Unless the context requires otherwise, references in this prospectus to “The Jefferies Investors” means Jefferies & Company, Inc. and certain of its affiliated funds and employees, all of which are our securityholders, and “The TCW Funds” refers to certain affiliated funds that are our securityholders.

Our Financial Statements

The consolidated financial statements of Ascent Energy Inc. as of December 31, 2004 and December 31, 2005, and for each of the three years in the period ended December 31, 2005, appearing elsewhere in this prospectus and registration statement, have been audited by Ernst & Young LLP. In May 2006, Ernst & Young LLP informed us that the India member firm of E&Y Global had a business arrangement with an affiliate of Jefferies Group, Inc. in the United Kingdom that was not in accordance with the SEC’s auditor independence rules regarding Ernst & Young’s independence in its performance of audit services for us because Jefferies & Company, Inc., which is another affiliate of Jefferies Group, Inc., is a substantial shareholder of us. We have been advised by Ernst & Young LLP and Jefferies Group, Inc. that this business arrangement was terminated in June 2006. Please read “Experts” for additional information.

ii

SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including “Risk Factors” and our consolidated financial statements and the notes to those financial statements included elsewhere in this prospectus, as well as the exhibits to the registration statement of which this prospectus forms a part. See “Where You Can Find More Information.” Some of the statements in this prospectus are forward-looking statements. See “Cautionary Statement Concerning Forward-Looking Statements.”

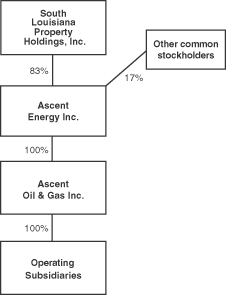

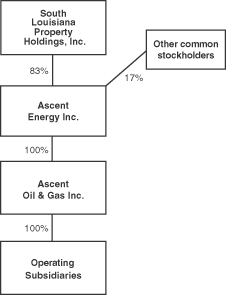

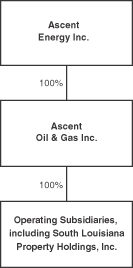

Unless otherwise indicated, the information contained in this prospectus (i) assumes that the underwriters do not exercise their option to purchase additional shares of our common stock and (ii) gives effect to the -for-1 reverse stock split of our common stock expected to be effected in connection with this offering. Unless the context requires otherwise, references in this prospectus to (i) ”Ascent,” “we,” “us” and “our” refer to Ascent Energy Inc., its Parent and its subsidiaries, (ii) “Parent” or “SLPH” refers to South Louisiana Property Holdings, Inc., formerly known as Forman Petroleum Corporation, which holds approximately 83% of the outstanding common stock (on a non-diluted basis) of Ascent Energy Inc. prior to the consummation of this offering and the Recapitalization and (iii) “Recapitalization” refers to a corporate recapitalization that we intend to consummate prior to this offering, as further described below.

Overview

We are a growth-oriented, independent natural gas and oil company engaged in the acquisition, exploration and development of both conventional and unconventional natural gas and oil properties in Texas, Oklahoma, Louisiana and the Appalachian region. Our growth efforts are directed primarily at finding and developing natural gas reserves in unconventional shale gas areas and in known tight gas areas. We operate substantially all of our properties.

Since joining us in mid-2003, our senior management team has embarked on a strategy to acquire and develop a risk-balanced inventory of high growth opportunities, predominately in shale gas. In order to implement this strategy, our new management initially devoted a substantial portion of its efforts to improving our operational efficiency and increasing our liquidity. Since 2004, our management has successfully added unconventional shale gas acreage in four large shale gas exploration areas and entered the prospective tight gas areas of the Cotton Valley trend in east Texas.

Our unconventional shale gas acreage acquired through June 30, 2006 consists of approximately 144,235 gross acres (89,654 net acres) located in the Woodford/Barnett shale in west Texas, the Barnett shale in north Texas, the Woodford shale and the Caney shale in Oklahoma and the Devonian shale in the Appalachian region. We have employed a strategy to acquire a meaningful position in several prospective shale gas areas to diversify risk while providing exposure to significant potential reserves.

As of June 30, 2006, most of our current production was from our approximate 64,510 gross acres (37,385 net acres) of conventional natural gas and oil properties in Texas, Oklahoma and Louisiana, which includes our acreage in the tight gas sands of the Cotton Valley trend in east Texas and the Vicksburg and Wilcox trends in south Texas. Each of these fields is characterized by established production profiles and numerous producing wells. We plan to expand our production and reserves from such conventional areas by further developing our current properties as well as acquiring additional properties that we believe can generate near-term production and cash flow.

1

Based on reserve reports prepared by our independent reserve engineering firms, our total proved reserves as of December 31, 2005 were approximately 106.1 Bcfe, of which 51.7% were proved developed producing and 10.5% were proved developed non-producing and 60.3% were oil and NGLs. As of June 30, 2006, we had interests in approximately 127,039 net acres, including approximately 103,843 net undeveloped acres. As of December 31, 2005, the PV-10 of our proved reserves was $371.3 million. Our 2005 reserve reports do not reflect any reserves attributable to our unconventional shale gas acreage.

The following table provides certain information regarding our proved reserves as of December 31, 2005 and our June 2006 average net daily production:

| | | | | | | | | | | | |

Area | | Bcfe (1) | | % Gas | | | PV-10 (2)

(in millions) | | June 2006

Average Net

Daily

Production

(MMcfe/d) | | Reserve Life

(in years) (3) |

Oklahoma | | 62.8 | | 17.1 | % | | $ | 204.3 | | 10.1 | | 17.0 |

Texas | | 31.0 | | 76.3 | % | | | 105.2 | | 10.4 | | 8.2 |

Louisiana | | 12.2 | | 62.4 | % | | | 61.8 | | 2.9 | | 11.5 |

| | | | | | | | | | | | |

Total | | 106.1 | | 39.7 | % | | $ | 371.3 | | 23.4 | | 12.4 |

| | | | | | | | | | | | |

| (1) | As of June 30, 2006, our estimated net proved reserves were 100.8 Bcfe, which was determined using June 30, 2006 posted prices, in accordance with SEC guidelines, of $6.04 per MMBtu of natural gas and $70.50 per Bbl of oil and includes 61.5 Bcfe attributable to our Oklahoma properties, 27.7 Bcfe attributable to our Texas properties and 11.6 Bcfe attributable to our Louisiana properties. Our June 30, 2006 reserve estimates are based on reserve reports prepared by our independent reserve engineers. See “Business and Properties—Proved Reserves.” |

| (2) | PV-10 represents the present value of estimated future cash inflows from proved natural gas and oil reserves, less future development and production expenses, discounted at 10% per annum to reflect timing of future cash flows and using December 31, 2005 posted prices for natural gas and oil. See note 3 to “—Summary Historical Reserve and Operating Data” for additional information about our computation of PV-10 and its reconciliation to the standardized measure of discounted future net cash flows, which is its most comparable GAAP financial measure as well as price sensitivity analysis related to PV-10. |

| (3) | Reserve life is calculated by dividing our proved reserves as of December 31, 2005 by our annualized June 2006 average net daily production. |

We have a 2006 capital expenditure budget of approximately $80.3 million, of which $59.7 million is targeted for drilling and workovers and $17.8 million is targeted for leasehold acquisitions. Approximately 41% of our 2006 capital expenditure budget is allocated to the acquisition, exploration and development of unconventional shale gas properties, and approximately 59% is allocated to exploration and development of our conventional resource properties, including our tight gas sands. From January 1, 2006 through June 30, 2006, we spent approximately $24.9 million on the drilling of 28 gross wells andthe completion of 16 producing wells. Eight of the wells were pending completion and evaluation and three wells were pending pipeline connections as of June 30, 2006. During the year ending December 31, 2006, we anticipate drilling 50 to 60 wells.

2

Unconventional Shale Gas

Our growth strategy is primarily directed at acquiring opportunities for reserve growth in long-lived reservoirs in unconventional shale gas areas. Unlike with most conventional reservoirs, the determination whether the development of our unconventional shale gas acreage is economically viable could take one to two years from the time we assemble a significant leasehold position. Our unconventional shale gas properties are located in regions that have experienced significant increases in industry leasing and drilling activity in the past several years. The following is a brief description of our unconventional shale gas acreage:

West Texas Woodford/Barnett Shale. As of June 30, 2006, we had acquired leasehold interests in approximately 80,078 gross (55,498 net) acres in this region, primarily located in Brewster County. We are currently drilling our initial test wells in this region. We are the operator of this acreage with an average working interest of approximately 65%.

North Texas Barnett Shale. As of June 30, 2006, we had acquired leasehold interests in approximately 13,764 gross (13,282 net) acres in this region. We expect to drill our initial test wells on a portion of this acreage in the first half of 2007. We are the operator of this acreage with a 100% working interest.

Oklahoma Woodford Shale and Caney Shale. As of June 30, 2006, we had acquired leasehold interests in approximately 7,629 gross (2,469 net) acres in the Woodford shale and approximately 3,848 gross (2,850 net) acres in the Caney shale. We have drilled and completed our first vertical test well in the Woodford shale. Based on the initial production results of approximately 411 Mcf/d from this well, we plan to drill six additional wells in the Woodford shale during the remainder of 2006. We have also drilled our initial horizontal well in the Caney shale. We are the operator of our Woodford shale acreage and our Caney shale acreage with working interests in each ranging from 50% to 80%.

Appalachian Devonian Shale. As of June 30, 2006, we had acquired leasehold interests in approximately 38,916 gross (15,555 net) acres in this region. We have initiated a five-well drilling program to test for natural gas and gather data that will help us determine the most appropriate drilling and completion strategy. We are the operator of this acreage with a 42% working interest. During September 2006, we entered into a non-binding agreement to acquire the outside 58% working interest in this region, which would bring our working interest to 100%. This agreement is subject to the negotiation of definitive documentation satisfactory to all parties, and consummation will be subject to customary closing conditions.

East Texas Tight Gas

Our growth strategy also includes acquiring property in tight gas sand areas in east Texas that has existing infrastructure to transport natural gas to market. This area is characterized by lower exploration and development risk than many of our other projects. We believe there are several offset opportunities that can be enhanced with the use of modern completion and stimulation techniques. We began acquiring leasehold interests and drilling in this area in the fourth quarter of 2005. As of June 30, 2006, we had drillednine wells in this area with a 100% success rate. As of June 30, 2006, we had acquired leasehold interests in approximately 5,280 gross (3,159 net) acres in the tight gas sands of the Cotton Valley trend in east Texas. We are the operator of this acreage with working interests ranging from 38% to 100%. Our year-end December 31, 2005 proved reserves from this acreage are associated with 12 proved undeveloped and proved developed producing locations.

3

South Texas Natural Gas

We are continuously seeking to expand our acreage in south Texas, including the Vicksburg and Wilcox trends, by acquiring property located in mature producing areas that we believe can generate near-term production and cash flow. As of June 30, 2006, we owned leasehold interests in approximately 4,228 gross (3,337 net) acres in the Vicksburg trend and approximately 4,736 gross (4,018 net) acres in the Wilcox trend, including producing acreage in the region. From January 1, 2006 to June 30, 2006, we drilledthree wells in this area with a 100% success rate. We are the operator of this acreage with working interests ranging from 75% to 100%. As of June 30, 2006, we had 34 producing wells in this region. Our year-end December 31, 2005 proved reserves from this acreage are associated with 49 proved undeveloped and proved developed producing locations.

Our Strengths

High Quality Asset Base in Mature Producing Basins.Our producing properties, consisting of approximately 36,330 gross acres (23,196 net acres) as of June 30, 2006, are located in prolific producing areas of south and east Texas, Oklahoma and Louisiana, with long histories of natural gas and oil production. We support our unconventional shale gas exploration with the cash flow generated from these mature properties.

Significant Growth Opportunities.We believe our approximate two-year inventory of conventional and tight gas drilling projects will generate near-term production growth and cash flow. In addition, we have acquired acreage positions in several unconventional shale gas areas where industry drilling and production activity has increased in the past several years. If our initial unconventional shale gas drilling projects are successful, we expect to increase significantly our long-term reserves, production and drilling inventory.

Effective Risk Management. Our areas of operation provide us with geographic, geological and operational diversity. Our diversified inventory of conventional and unconventional resource drilling locations ranges from lower risk development locations to higher risk exploration locations, including most of our unconventional shale gas acreage, that expose us to opportunities for greater reserve and production growth.

Experienced, Incentivized Management Team with Strong Technical Capability. Our senior management team has on average more than 28 years of industry experience and has considerable technical expertise in engineering, geoscience and field operations. Our in-house technical personnel have extensive experience in geology, geophysics, engineering and drilling and completion technology, including horizontal drilling and fracturing technology. Our officers will beneficially own approximately % of our common stock after the consummation of this offering and the Recapitalization.

Our Business Strategy

Drive Growth Through the Drillbit.We intend to create near-term reserve and production growth from our approximate two-year inventory of drilling opportunities. We anticipate most of our cash flow in the next several years will be generated from our existing producing properties and proved reserves as well as our lower-risk drilling opportunities, exploration and development. We intend to allocate a significant portion of our exploration budget to our higher-risk unconventional shale gas exploration and our tight gas sands exploration.

Focus on Growing Our Inventory of Shale Gas Opportunities. We intend to continue expanding our acreage positions in multiple shale gas areas. As of June 30, 2006, we had leasehold interests in approximately 144,235 gross (89,654 net) acres of prospective shale gas property over four areas. We have budgeted approximately $14.0 million to acquire shale gas acreage in 2006.

4

Pursue Tight Gas Sand Opportunities. We are pursuing multiple tight gas sand opportunities. We believe that our tight gas sand areas have significant potential reserves that have not been depleted by the use of past drilling and completion techniques. We typically pursue opportunities in known tight gas sand areas that have existing infrastructure to transport natural gas to the market. We have budgeted approximately $36.3 million to drill 16 wells in our tight gas sand operations in south and east Texas by the end of 2006.

Operate Substantially All of Our Assets.We serve as the operator of substantially all of our producing properties and intend to continue to do so in the future. Operating control enables us to better control timing and risk as well as the cost of exploration and development drilling and ongoing operations. We believe that in the competitive market for drilling rigs it is advantageous to be in a position to make longer term commitments to drilling rig operators in order to secure service.

Maintain Financial Flexibility. Following the completion of this offering and our anticipated Recapitalization, we will have increased our equity capital base by over $ million and will have approximately $ million of undrawn availability under our credit facility. We believe that future cash flow and access to the capital markets following this offering will provide us with financial flexibility that both enhances our ability to execute our business plan and allows us to selectively seek and complete acquisitions.

Seek Acquisitions that Complement Our Exploration and Development Plans. We pursue acquisitions that add efficiency to our existing operations or represent attractive additions to our exploration and development prospect inventory in large, mature producing regions. We maintain a disciplined acquisition process to help ensure that acquisitions fit our strategic and financial objectives.

Recapitalization

Immediately prior to the sale of our shares in this offering, we intend to consummate a corporate recapitalization involving the following transactions:

| | • | | we will effect a -for 1 reverse stock split of our Parent’s common stock and corresponding payment of cash in lieu of fractional shares; |

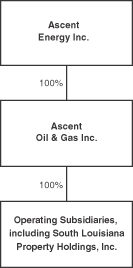

| | • | | our Parent will become a wholly owned subsidiary of Ascent Energy Inc. in a tax-free transaction that we refer to as the “Parent Merger;” |

| | • | | we will issue shares of our common stock in repayment of our senior subordinated notes that are not repaid with the net proceeds of this offering in a transaction that we refer to as the “Debt Exchange;” and |

| | • | | we will issue shares of our common stock in exchange for our outstanding Series A preferred stock (including accrued but unpaid dividends thereon) and warrants in a transaction we refer to as the “Preferred Exchange.” |

In addition, we intend to terminate our Amended and Restated Equity Incentive Plan, or 2005 Incentive Plan, and the awards granted thereunder. Participants in the 2005 Incentive Plan will receive cash bonuses and awards of restricted stock, which vest over a three year period, in exchange for terminating their rights under the 2005 Incentive Plan. We refer to this exchange as the “Incentive Issuance.” The Incentive Issuance is contingent on the consummation of this offering and the Recapitalization and the consent of each of the holders of awards under our 2005 Incentive Plan.

We refer to the transactions to be consummated in connection with this offering, including our Parent’s reverse stock split, the Parent Merger, the Debt Exchange, the Preferred Exchange and the Incentive Issuance, collectively as the “Recapitalization.” For additional information about the Recapitalization, please see “Recapitalization” and “Use of Proceeds.”

5

The Jefferies Investors, including Jefferies & Company, Inc., one of the underwriters in this offering, and certain of its affiliates, and The TCW Funds are the principal holders of our securities, and will receive cash and shares of our common stock in this offering and the Recapitalization. In addition, our executive officers are expected to participate in the Incentive Issuance and to receive cash and shares of our common stock in this offering and the Recapitalization. Please see “Related Party Transactions,” “Principal Stockholders” and “Management.”

Upon the consummation of this offering, the application of the net proceeds of this offering as described in “Use of Proceeds” and the consummation of the Recapitalization, all of our senior notes and senior subordinated notes will be extinguished and our outstanding long-term indebtedness will consist solely of approximately$ million of borrowings under our credit facility which mature November 1, 2009.

Our Company

Ascent Energy Inc. is a Delaware corporation formed in 2001. Our principal executive offices are located at 4965 Preston Park Blvd., Suite 800, Plano, Texas 75093. Our telephone number at that address is (972) 543-3900. We maintain a web site atwww.ascentenergy.info, which contains information about us. Our web site and the information contained on it and connected to it are not a part of, and will not be deemed incorporated by reference into, this prospectus.

6

THE OFFERING

Common stock offered | shares |

Underwriters’ option to purchase additional shares | shares |

Common stock outstanding immediately after the completion this offering and the Recapitalization (1) | shares |

Use of proceeds | We estimate that the net proceeds from this offering, after deducting underwriting discounts and estimated offering expenses payable by us, will be approximately $ million, based on an initial public offering price of $ per share. We intend to use the net proceeds of this offering to repay a portion of the indebtedness outstanding under our credit facility, all of our senior notes and a portion of our senior subordinated notes, to pay $ million of cash bonuses to employees participating in the Incentive Issuance, to pay cash in lieu of fractional shares pursuant to a reverse stock split of the Parent’s common stock to be effected in connection with the Parent Merger and for general corporate purposes, which could include refinancing some of our derivative arrangements. See “Use of Proceeds.” |

| | The Jefferies Investors, including Jefferies & Company, Inc., one of the underwriters in this offering, are holders of our senior notes and our senior subordinated notes and therefore are expected to receive a portion of the net proceeds of this offering and shares of common stock in connection with this offering and the Recapitalization. In addition, affiliates of certain of the underwriters in this offering are lenders under our credit facility and accordingly are expected to receive a portion of the net proceeds of this offering. See “Use of Proceeds,” “Related Party Transactions—Recapitalization,” “Principal Stockholders,” and “Underwriting.” |

| | Our executive officers are expected to participate in the Incentive Issuance and to receive a portion of the net proceeds of this offering and shares of our common stock in connection with this offering and the Recapitalization. See “Use of Proceeds,” “Management—Termination of 2005 Incentive Plan,” “Related Party Transactions—Termination of 2005 Incentive Plan” and “Principal Stockholders.” |

Nasdaq Global Market symbol | “ASNT” |

Risk factors | See “Risk Factors” beginning on page 14 and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| (1) | The number of shares of our common stock to be outstanding after this offering and the Recapitalization excludes shares reserved for issuance under our 2006 Long-Term Incentive Plan, of which shares are subject to options outstanding at the time of this offering with a weighted average exercise price of $ per share. |

7

SUMMARY CONSOLIDATED HISTORICAL AND PRO FORMA FINANCIAL INFORMATION

The following tables present our summary consolidated historical and pro forma condensed consolidated financial information for the periods presented. The summary consolidated historical financial information as of and for each of the three years ended December 31, 2005 has been derived from our audited consolidated financial statements and related notes. The audited consolidated financial statements and related notes as of December 31, 2004 and December 31, 2005 and for each of the three years ended December 31, 2005 are included elsewhere in this prospectus. The summary consolidated historical financial information as of June 30, 2006 and for the six months ended June 30, 2005 and June 30, 2006 has been derived from our unaudited consolidated financial statements and related notes included elsewhere in this prospectus which, in the opinion of management, have been prepared on the same basis as our audited consolidated financial statements and include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of this information.

The summary pro forma condensed consolidated statement of operations data for the year ended December 31, 2005 and for the six months ended June 30, 2005 and June 30, 2006 assumes that the Recapitalization, this offering and the application of the net proceeds from this offering occurred on January 1, 2005. The summary pro forma condensed consolidated balance sheet data as of June 30, 2006 assumes that the Recapitalization, this offering and the application of the net proceeds from this offering occurred on June 30, 2006. Unless otherwise indicated, the summary pro forma condensed consolidated financial information has been derived from our unaudited pro forma condensed consolidated financial statements and related notes included elsewhere in this prospectus and gives pro forma effect to the Recapitalization, this offering and the application of the net proceeds of this offering as described in “Use of Proceeds.” See “Unaudited Pro Forma Condensed Consolidated Financial Statements” for further discussion.

This information is only a summary and you should read it in conjunction with the material contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which includes a discussion of factors materially affecting the comparability of the information presented, and in conjunction with the historical and pro forma condensed consolidated financial statements and related notes included elsewhere in this prospectus.

Our historical consolidated financial statements for the years ending prior to December 31, 2005 have been restated to reflect our conversion to the successful efforts method of accounting for our investment in natural gas and oil properties and to correct our previously recorded income tax provision. Our audited historical consolidated financial statements for the years ended December 31, 2003 and December 31, 2004 have been restated to reflect our previously understated asset retirement obligation.

Prior to the Spring of 2003, we focused on the exploration and development of the reserves we acquired in connection with our formation in 2001. Since joining us in 2003, our senior management team has embarked on a strategy to acquire and develop a risk-balanced inventory of high growth opportunities. In order to implement this strategy, our management initially devoted a substantial portion of its efforts to increasing our liquidity and improving our operational efficiency. In July 2004, we completed a financial restructuring that allowed the operating subsidiaries of Ascent Energy Inc., as borrowers, to enter into a new credit facility and reduced our debt service obligations by permitting us to pay in kind certain interest obligations.

8

For the foregoing reasons, our summary consolidated historical and pro forma condensed consolidated financial information may not be meaningful or indicative of our future results.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Historical | | | Pro Forma |

| | | Year Ended December 31, | | | Six Months Ended June 30, | | | Year Ended

December 31, | | Six

Months Ended

June 30, | | Six

Months Ended

June 30, |

| | | 2003 | | | 2004 | | | 2005 | | | 2005 | | | 2006 | | | 2005 | | 2005 | | 2006 |

| | | (Restated) | | | (Restated) | | | | | | (Unaudited) | | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| | | (in thousands, except per share amounts) |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Oil | | $ | 20,377 | | | $ | 25,431 | | | $ | 33,228 | | | $ | 15,694 | | | $ | 19,631 | | | | | | | |

Natural gas | | | 24,553 | | | | 22,021 | | | | 36,634 | | | | 14,848 | | | | 16,271 | | | | | | | |

NGLs | | | 2,027 | | | | 3,257 | | | | 3,714 | | | | 1,776 | | | | 1,713 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 46,957 | | | | 50,709 | | | | 73,576 | | | | 32,318 | | | | 37,615 | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Production and ad valorem taxes | | | 4,307 | | | | 3,091 | | | | 3,332 | | | | 1,731 | | | | 2,231 | | | | | | | |

Lease operating expenses | | | 11,915 | | | | 12,018 | | | | 11,594 | | | | 5,487 | | | | 6,398 | | | | | | | |

General and administrative expenses | | | 10,388 | | | | 8,272 | | | | 8,436 | | | | 3,851 | | | | 5,548 | | | | | | | |

Exploration expenses | | | 5,630 | | | | 854 | | | | 3,460 | | | | 444 | | | | 818 | | | | | | | |

Depreciation, depletion and amortization | | | 21,539 | | | | 31,207 | | | | 20,771 | | | | 10,623 | | | | 10,393 | | | | | | | |

Property impairments | | | 3,802 | | | | 20,711 | | | | 1,254 | | | | — | | | | — | | | | | | | |

Derivative loss | | | — | | | | 6,604 | | | | 33,851 | | | | 17,983 | | | | 6,725 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 57,581 | | | | 82,757 | | | | 82,698 | | | | 40,119 | | | | 32,113 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from operations | | | (10,624 | ) | | | (32,048 | ) | | | (9,122 | ) | | | (7,801 | ) | | | 5,502 | | | | | | | |

Interest and other income | | | 7 | | | | 203 | | | | 561 | | | | 78 | | | | 110 | | | | | | | |

Interest expense | | | (13,661 | ) | | | (16,958 | ) | | | (19,496 | ) | | | (9,286 | ) | | | (11,266 | ) | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss before income taxes | | | (24,278 | ) | | | (48,803 | ) | | | (28,057 | ) | | | (17,009 | ) | | | (5,654 | ) | | | | | | |

Income tax benefit (expense) | | | 8,624 | | | | 12,472 | | | | 209 | | | | 127 | | | | (317 | ) | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss before cumulative effect of change in accounting principle | | | (15,654 | ) | | | (36,331 | ) | | | (27,848 | ) | | | (16,882 | ) | | | (5,971 | ) | | | | | | |

Cumulative effect of change in accounting principle, net of income tax of $273 in 2003 (1) | | | 262 | | | | — | | | | — | | | | — | | | | — | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss | | | (15,392 | ) | | | (36,331 | ) | | | (27,848 | ) | | | (16,882 | ) | | | (5,971 | ) | | | | | | |

Preferred stock dividends (2) | | | (3,976 | ) | | | (3,367 | ) | | | (3,358 | ) | | | (1,665 | ) | | | (1,665 | ) | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss attributable to common shares | | $ | (19,368 | ) | | $ | (39,698 | ) | | $ | (31,206 | ) | | $ | (18,547 | ) | | $ | (7,636 | ) | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss per common share: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic and diluted net loss per common share | | $ | (3.63 | ) | | $ | (6.67 | ) | | $ | (5.25 | ) | | $ | (3.12 | ) | | $ | (1.28 | ) | | | | | | |

Basic and diluted net loss per common share (pro forma for reverse stock split) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Selected Cash Flow and Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 16,935 | | | $ | 17,369 | | | $ | 31,475 | | | $ | 14,671 | | | $ | 18,281 | | | | | | | |

Net cash used in investing activities | | | (39,121 | ) | | | (22,584 | ) | | | (35,019 | ) | | | (17,316 | ) | | | (36,490 | ) | | | | | | |

Net cash provided by financing activities | | | 26,236 | | | | 1,650 | | | | 4,108 | | | | 4,550 | | | | 18,425 | | | | | | | |

Capital expenditures | | | 39,121 | | | | 22,985 | | | | 34,588 | | | | 16,296 | | | | 36,554 | | | | | | | |

EBITDAX (3) | | | 20,354 | | | | 28,658 | | | | 37,342 | | | | 17,351 | | | | 18,766 | | | | | | | |

9

| | | | | | | | | | | | | | | | | | | | | | |

| | | Historical | | | Pro Forma |

| | | As of December 31, | | | As of June 30, | | | As of June 30, |

| | | 2003 | | | 2004 | | | 2005 | | | 2005 | | | 2006 | | | 2006 |

| | | (Restated) | | | (Restated) | | | | | | (Unaudited) | | | (Unaudited) |

| | | (in thousands) |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 4,081 | | | $ | 516 | | | $ | 1,080 | | | $ | 2,421 | | | $ | 1,296 | | | |

Total assets | | | 200,374 | | | | 169,267 | | | | 187,221 | | | | 179,360 | | | | 215,059 | | | |

Long-term debt (4) | | | 141,493 | | | | 164,954 | | | | 185,223 | | | | 174,498 | | | | 212,429 | | | |

Preferred stock (including accrued but unpaid dividends) (5) | | | 46,265 | | | | 9,577 | | | | 12,865 | | | | 11,208 | | | | 14,496 | | | |

Stockholders’ deficit | | | (40,587 | ) | | | (36,060 | ) | | | (67,196 | ) | | | (54,572 | ) | | | (74,796 | ) | | |

Total liabilities and stockholders’ equity | | | 200,374 | | | | 169,267 | | | | 187,221 | | | | 179,360 | | | | 215,059 | | | |

| (1) | Reflects adoption of Statement of Financial Accounting Standards No. 143,“Accounting for Asset Retirement Obligations”(“SFAS 143”), effective January 1, 2003. |

| (2) | Represents accrued but unpaid dividends on our Series A preferred stock and Series B preferred stock. In August 2003, all outstanding shares of the Series B preferred stock were converted into an aggregate of one million shares of our common stock ( shares of our common stock pro forma for the reverse stock split), and all accrued but unpaid dividends thereon were declared and paid in cash. |

| (3) | EBITDAX is a non-GAAP financial measure. EBITDAX represents earnings before interest expense, income tax (expense) benefit, depreciation, depletion and amortization, property impairments, exploration expenses, non-cash hedging and derivative losses and cumulative effect of change in accounting principle. The following table shows our calculation of EBITDAX and reconciles it to net cash provided by operating activities, which we believe is the most comparable GAAP financial measure. EBITDAX should not be considered as an alternative to, or more meaningful than, net income (loss) or cash flow as determined in accordance with GAAP or as an indicator of a company’s operating performance or liquidity. Certain items excluded from EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure and the historical costs of depreciable assets, none of which are components of EBITDAX. Our computations of EBITDAX may not be comparable to other similarly titled measures of other companies. We believe that EBITDAX is a widely followed measure of operating performance and may also be used by investors to measure our ability to meet future debt service requirements, if any. We also believe EBITDAX assists investors in comparing a company’s liquidity on a consistent basis without regard to depreciation, depletion and amortization, property impairment and exploration expenses, which can vary significantly depending upon accounting methods. Our credit facility requires that, as of the last day of each fiscal quarter, our ratio of total debt to EBITDAX for the preceding four fiscal quarters be not greater than 2.5 to 1.0 and that our ratio of EBITDAX to cash interest expense (plus certain subsidiary dividends) for the preceding four fiscal quarters be not less than 2.5 to 1.0. As of June 26, 2006, our credit facility defines EBITDAX consistently with the definition of EBITDAX used and presented by us in this prospectus. As of June 30, 2006, our total debt to EBITDAX ratio was approximately1.8 to 1.0 and our EBITDAX to cash interest expense ratio was approximately9.0 to 1.0. |

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Six Months Ended June 30, | |

| | | 2003 | | | 2004 | | | 2005 | | | 2005 | | | 2006 | |

| | | (Restated) | | | (Restated) | | | | | | (Unaudited) | |

| | | (in thousands) | |

Net loss | | $ | (15,392 | ) | | $ | (36,331 | ) | | $ | (27,848 | ) | | $ | (16,882 | ) | | $ | (5,971 | ) |

Interest expense | | | 13,661 | | | | 16,958 | | | | 19,496 | | | | 9,286 | | | | 11,266 | |

Income tax (benefit) expense | | | (8,624 | ) | | | (12,472 | ) | | | (209 | ) | | | (127 | ) | | | 317 | |

Depreciation, depletion and amortization | | | 21,539 | | | | 31,207 | | | | 20,771 | | | | 10,623 | | | | 10,393 | |

Property impairments | | | 3,802 | | | | 20,711 | | | | 1,254 | | | | — | | | | — | |

Exploration expenses | | | 5,630 | | | | 854 | | | | 3,460 | | | | 444 | | | | 818 | |

Non-cash hedging and derivative losses | | | — | | | | 7,731 | | | | 20,418 | | | | 14,007 | | | | 1,943 | |

Cumulative effect of change in accounting principle | | | (262 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

EBITDAX | | | 20,354 | | | | 28,658 | | | | 37,342 | | | | 17,351 | | | | 18,766 | |

Exploration expenses | | | (4,604 | ) | | | (854 | ) | | | (3,460 | ) | | | (444 | ) | | | (514 | ) |

Interest expense | | | (13,003 | ) | | | (2,303 | ) | | | (3,392 | ) | | | (1,488 | ) | | | (2,447 | ) |

Gain on sale of assets | | | — | | | | (200 | ) | | | (658 | ) | | | (51 | ) | | | (71 | ) |

Other non-cash gains | | | (52 | ) | | | 21 | | | | 6 | | | | — | | | | 17 | |

Income tax expense | | | — | | | | — | | | | (98 | ) | | | (33 | ) | | | (156 | ) |

Changes in assets and liabilities | | | 14,240 | | | | (7,953 | ) | | | 1,735 | | | | (664 | ) | | | 2,686 | |

| | | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 16,935 | | | $ | 17,369 | | | $ | 31,475 | | | $ | 14,671 | | | $ | 18,281 | |

| | | | | | | | | | | | | | | | | | | | |

| (4) | All periods include borrowings under our credit facility and the aggregate principal amount of outstanding senior notes and senior subordinated notes, and all periods, except the year ended December 31, 2003, include long-term accrued interest on our senior notes and senior subordinated notes. |

| (5) | The amounts for the year ended December 31, 2003 represent the book value of our Series A preferred stock plus all accrued but unpaid dividends thereon. The amounts for all other periods represent only accrued but unpaid dividends on the Series A preferred stock. In December 2004, the terms of the Series A preferred stock were amended to eliminate our requirement to redeem the outstanding shares of Series A preferred stock on a specified date. The amendment resulted in a balance sheet reclassification of the book value of the Series A preferred stock to stockholders’ deficit. |

10

SUMMARY HISTORICAL RESERVE AND OPERATING DATA

The following tables present summary historical operating information for the years ended December 31, 2003, December 31, 2004 and December 31, 2005 and for the six months ended June 30, 2005 and June 30, 2006. The following tables also present summary historical information regarding our estimated net proved natural gas and oil reserves as of December 31, 2003, 2004 and 2005. All calculations of estimated net proved reserves have been made in accordance with the rules and regulations of the SEC and, except as otherwise indicated, give no effect to federal or state income taxes. For additional information about our reserves, please read “Business and Properties—Proved Reserves” and the information regarding our oil and gas activities beginning on page F-32.

Upon joining us in mid-2003, our senior management team undertook a detailed review and analysis of our proved natural gas and oil reserves, which resulted in a downward revision of our estimates of proved natural gas and oil reserves by a total of 37.7 Bcfe for the year ended December 31, 2003 and by an additional 62.9 Bcfe during the year ended December 31, 2004. The 2003 revision included approximately 22.3 Bcfe of proved non-producing and proved undeveloped reserves plus a subsequent 15.4 Bcfe reduction in underperforming producing properties. The 2004 revision included approximately 28.5 Bcfe of proved non-producing reserves and 34.4 Bcfe of proved undeveloped reserves. As a result of the events leading up to our July 2004 financial restructuring, we were forced to delay our 2004 capital expenditure program which resulted in a decline in our natural gas and oil production for the year ended December 31, 2004, because we were unable to offset natural production declines with new production. We had further production declines for the year ended December 31, 2005 resulting from a reduction in our capital expenditure program due to rig delays and the impact of Hurricanes Katrina and Rita. Our June 2006 production from our South Louisiana properties was2.9 MMcfe/d, which isapproximately 75% of our average daily pre-hurricane production from these properties during February 2005 through July 2005. We continue to see some post-hurricane improvement in production from our South Louisiana properties; however, it is common for production from mature water-drive wells not to return to pre-shut-in production rates after being shut-in. We do not expect that all of these wells will return completely to pre-hurricane production rates. Please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” including “—Overview—Reserve Write Down.”

For the foregoing reasons, our summary historical reserve and operating data may not be meaningful or indicative of our future reserve and operating data.

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | Six Months Ended

June 30, |

| | | 2003 | | 2004 | | 2005 | | 2005 | | 2006 |

| | | (Restated) | | (Restated) | | | | | | |

Production data: | | | | | | | | | | | | | | | |

Oil (MBbls) | | | 688 | | | 625 | | | 598 | | | 309 | | | 298 |

Natural gas (MMcf) | | | 6,545 | | | 5,158 | | | 4,592 | | | 2,348 | | | 2,324 |

NGLs (MBbls) | | | 107 | | | 120 | | | 107 | | | 60 | | | 43 |

Combined volumes (MMcfe) | | | 11,318 | | | 9,630 | | | 8,826 | | | 4,560 | | | 4,370 |

Average prices (net of hedging): | | | | | | | | | | | | | | | |

Oil (per Bbl) | | $ | 29.60 | | $ | 40.66 | | $ | 55.55 | | $ | 50.79 | | $ | 65.95 |

Natural gas (per Mcf) | | | 3.75 | | | 4.27 | | | 7.98 | | | 6.32 | | | 7.00 |

NGLs (per Bbl) | | | 21.37 | | | 27.15 | | | 34.56 | | | 29.76 | | | 39.41 |

Combined (per Mcfe) | | | 4.17 | | | 5.27 | | | 8.34 | | | 7.09 | | | 8.61 |

Average expenses (per Mcfe): | | | | | | | | | | | | | | | |

Production and ad valorem taxes | | $ | 0.38 | | $ | 0.32 | | $ | 0.38 | | $ | 0.38 | | $ | 0.51 |

Lease operating expenses | | | 1.05 | | | 1.25 | | | 1.31 | | | 1.20 | | | 1.46 |

General and administrative expenses | | | 0.92 | | | 0.86 | | | 0.96 | | | 0.84 | | | 1.27 |

Exploration expenses | | | 0.50 | | | 0.09 | | | 0.39 | | | 0.10 | | | 0.19 |

Depreciation, depletion and amortization | | | 1.90 | | | 3.24 | | | 2.35 | | | 2.33 | | | 2.38 |

Property impairments | | | 0.34 | | | 2.15 | | | 0.14 | | | — | | | — |

Derivative loss | | | — | | | 0.69 | | | 3.84 | | | 3.94 | | | 1.54 |

11

| | | | | | | | | |

| | | As of December 31, |

| | | 2003 | | 2004 | | 2005 |

| | | (dollars in thousands) |

Estimated net proved reserves (1): | | | | | | | | | |

Oil (MBbls) | | | 13,620 | | | 9,578 | | | 9,572 |

Natural gas (MMcf) | | | 80,423 | | | 37,311 | | | 42,066 |

NGLs (MBbls) (2) | | | — | | | 1,119 | | | 1,098 |

Total (MMcfe) | | | 162,141 | | | 101,491 | | | 106,089 |

PV-10 (3) | | $ | 379,494 | | $ | 239,632 | | $ | 371,303 |

Standardized measure of discounted future net cash flows (3) | | $ | 271,715 | | $ | 190,322 | | $ | 280,928 |

| (1) | In accordance with SEC requirements, our estimated net proved reserves, PV-10 and the standardized measure of discounted future net cash flows were determined using the following year-end posted prices for natural gas and oil: |

| | | | | | | | | |

| | | Year Ended December 31, |

| | | 2003 | | 2004 | | 2005 |

Natural gas (per MMBtu) | | $ | 5.97 | | $ | 5.74 | | $ | 8.17 |

Oil (per Bbl) | | | 29.25 | | | 40.00 | | | 57.75 |

| (2) | Oil reserve data as of December 31, 2003 includes NGLs. |

| (3) | PV-10 may be considered a non-GAAP financial measure; therefore, the following table reconciles our calculation of PV-10 to the standardized measure of discounted future net cash flows, which is the most comparable GAAP financial measure. PV-10 is the computation of the standardized measure of discounted future net cash flows on a pre-tax basis. Our reserve estimates have been calculated using the prices for natural gas and oil in note 1 above. The prices in note 1 above do not reflect adjustments for quality, transportation fees, energy content and regional price differentials as included in the calculation of our reserve estimates. We estimate that if natural gas prices declined by $0.25 per Mcf from the price used in determining our proved reserves as of December 31, 2005, the PV-10 of our proved reserves as of December 31, 2005 would decrease from $371.3 million to $364.9 million and the quantity of our reserves would decline by 825 MMcf of natural gas and 40,000 Bbls of oil and NGLs. We estimate that if oil prices declined by $1.00 per Bbl from the price used in determining our proved reserves as of December 31, 2005, then the PV-10 of our proved reserves as of December 31, 2005 would decrease from $371.3 million to $366.5 million and the quantity of our reserves would decline by 43 MMcf of natural gas and 44,300 Bbls of oil and NGLs. Estimates of PV-10 of reserves and the quantity of reserves would likely decline at a rate proportionately greater than specified above if natural gas and oil prices decline significantly from those used in calculating such estimates. Management believes that the presentation of the non-GAAP financial measure of PV-10 provides useful information to investors because it is widely used by professional analysts and sophisticated investors in evaluating natural gas and oil companies. Management also believes that PV-10 is relevant and useful for evaluating the relative monetary significance of our natural gas and oil properties. Further, professional analysts and sophisticated investors may use the measure as a basis for comparison of the relative size and value of our reserves to other companies’ reserves. Management also uses this pre-tax measure when assessing the potential return on investment related to our natural gas and oil properties and in evaluating acquisition candidates. Because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid, we believe the use of a pre-tax measure is valuable for evaluating us. PV-10 is not a measure of financial or operating performance under GAAP, nor is it intended to represent the current market value of our estimated natural gas and oil reserves. PV-10 should not be considered in isolation or as a substitute for the standardized measure of discounted future net cash flows as defined under GAAP. |

12

| | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2003 | | | 2004 | | | 2005 | |

| | | (in thousands) | |

Future cash inflows | | $ | 911,612 | | | $ | 664,223 | | | $ | 986,683 | |

Less: Future production costs | | | (235,308 | ) | | | (199,622 | ) | | | (276,962 | ) |

Less: Future development costs | | | (56,733 | ) | | | (48,002 | ) | | | (56,042 | ) |

| | | | | | | | | | | | |

Future net cash flows | | | 619,571 | | | | 416,599 | | | | 653,679 | |

Less: 10% discount factor | | | (240,077 | ) | | | (176,967 | ) | | | (282,376 | ) |

| | | | | | | | | | | | |

PV-10 | | | 379,494 | | | | 239,632 | | | | 371,303 | |

Less: Undiscounted income taxes | | | (187,825 | ) | | | (102,131 | ) | | | (179,732 | ) |

Plus: 10% discount factor | | | 80,046 | | | | 52,821 | | | | 89,357 | |

| | | | | | | | | | | | |

Discounted income taxes | | | (107,779 | ) | | | (49,310 | ) | | | (90,375 | ) |

| | | | | | | | | | | | |

Standardized measure of discounted future net cash flows | | $ | 271,715 | | | $ | 190,322 | | | $ | 280,928 | |

| | | | | | | | | | | | |

Our independent reserve engineers also prepared reports of our estimated net proved natural gas and oil reserves as of June 30, 2006. As of June 30, 2006, our estimated net proved reserves were 100.8 Bcfe, which included 37,401 MMcf of natural gas and 10,569 MBbls of oil and NGLs. These estimates were determined using a price of $6.04 per MMBtu of natural gas and $70.50 per Bbl of oil as compared to our December 31, 2005 year-end pricing of $8.17 per MMBtu of natural gas and $57.75 per Bbl of oil.

13

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following risks and all of the other information contained in this prospectus before deciding to invest in our common stock.

Risks Related to Our Business and Our Industry

Natural gas and oil prices are volatile and a decline in natural gas and oil prices could materially and adversely affect our financial results and impede our growth.

Our revenue, profitability and cash flow depend upon the prices and demand for natural gas and oil. Moreover, changes in natural gas and oil prices have a significant impact on the value of our reserves. The markets for these commodities are very volatile and even relatively modest drops in prices can significantly affect our financial results and impede our growth. Prices for natural gas and oil may fluctuate widely in response to a variety of additional factors that are beyond our control, such as:

| | • | | changes in global supply and demand for natural gas and oil; |

| | • | | commodity processing, gathering and transportation availability; |

| | • | | domestic and global political and economic conditions; |

| | • | | the ability of members of the Organization of Petroleum Exporting Countries to agree to and maintain oil price and production controls; |

| | • | | weather conditions, including hurricanes; |

| | • | | technological advances affecting energy consumption; |

| | • | | domestic and foreign governmental regulations; and |

| | • | | the price and availability of alternative fuels. |

Lower natural gas and oil prices may not only decrease our revenue on a per share basis, but also may reduce the amount of natural gas and oil that we can produce economically. This reduction may result in our having to make substantial downward adjustments to our estimated proved reserves.

Our natural gas and oil reserves and future production and, therefore, our future cash flow and revenue, are highly dependent on our successfully developing our undeveloped leasehold acreage, including our unconventional shale gas acreage.

Approximately 82% of our net leasehold acreage as of June 30, 2006, which includes our unconventional shale gas acreage, was undeveloped. Our business strategy involves using a significant amount of our operational and financial resources and cash flow for acquiring, exploring and developing our unconventional shale gas acreage. Unconventional shale gas acreage requires greater amounts of time and capital to develop, and to determine whether commercially productive reserves exist, than conventional acreage. As a result, we may not successfully develop our undeveloped acreage on the schedule we have established, at the costs we have budgeted, or at all. Our future natural gas and oil reserves and production and, therefore, our future cash flow and revenue are highly dependent on our successfully developing our undeveloped leasehold acreage. If we are unsuccessful in developing our undeveloped acreage as we have anticipated, our future cash flow and revenues could be materially and adversely affected.

Unless we replace our natural gas and oil reserves, our reserves and production will decline, which would materially and adversely affect our business, financial condition and results of operations.

Producing natural gas and oil reservoirs generally are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Thus, our future natural gas and oil reserves and

14

production and, therefore, our cash flow and revenue are highly dependent on our success in efficiently developing our current reserves and acquiring additional recoverable reserves, including additional recoverable reserves within our unconventional shale gas acreage. We may not be able to develop, find or acquire reserves to replace our current and future production at costs or other terms acceptable to us, or at all, in which case our business, financial condition and results of operations would be materially and adversely affected. Our combined natural gas, oil and NGL production has declined in each of the last two years from 11,318 MMcfe in 2003 to 9,630 MMcfe in 2004 to 8,826 MMcfe in 2005. In addition, our combined production for the six months ended June 30, 2006 declined to 4,370 MMcfe as compared to combined production for the six months ended June 30, 2005 of 4,560 MMcfe. Our independent reserve engineers have estimated that our natural gas and oil production in 2006 from our proved developed producing reserves as of December 31, 2005 will decline by approximately 18.6% from our production from those reserves for the year ended December 31, 2005.

If natural gas or oil prices decrease, we may be required to write down the capitalized cost of individual natural gas and oil properties.

Effective January 1, 2005, we changed our accounting method for our natural gas and oil properties from the full cost method to the successful efforts method. Under the successful efforts method of accounting, we capitalize all costs related to property acquisitions and successful exploratory wells, all development costs and the costs of support equipment and facilities. All costs related to unsuccessful exploratory wells are expensed once the well is determined to be unsuccessful. Other exploratory costs, including geological and geophysical costs, are expensed as incurred.

The capitalized costs of our natural gas and oil properties, on a field-by-field basis, may exceed the estimated undiscounted future net cash flows of that field. This may occur when natural gas or oil prices are low or if we have substantial downward adjustments to our estimated proved reserves or increases in our estimates of development costs. In such event, we would be required to record impairment charges to reduce the capitalized costs of each such field to our estimate of the field’s fair market value. Any impairment reduces our earnings and stockholders’ equity. Once incurred, an impairment charge cannot be reversed at a later date even if we experience increases in the price of natural gas or oil, or both, or increases in the amount of our estimated proved reserves. For the years ended December 31, 2005, 2004 and 2003, we recorded impairment charges of approximately $1.3 million, $20.7 million and $3.8 million, respectively, to reduce the capitalized costs of our fields to estimated fair market value.

The marketability of our production depends on gathering systems, transportation facilities and processing facilities that we do not control or that may not currently exist. If these systems and facilities become unavailable or are otherwise unable to provide services, or are not developed in areas without current infrastructure, our business, financial condition and results of operations could be materially and adversely affected.

The marketability of our natural gas and oil production depends in part upon the availability, proximity and capacity of pipelines, natural gas gathering systems, transportation barges and processing facilities owned by third parties. We do not control most of these facilities and they may not be available to us in the future. Alternative delivery methods could either be prohibitively expensive or available only after a period of delay, if at all, at certain well sites. We may be required to shut in wells for lack of a market or because access to natural gas pipelines, gathering system capacity or processing facilities may be limited or unavailable. If that were to occur, we would be unable to realize revenue from those wells until arrangements were made to deliver the production to market. As a result, if one or more transportation, gathering or processing facilities that we depend on became unavailable or otherwise unable to provide services, our revenues and, in turn, our business, financial condition and results of operations could be materially and adversely affected. In addition, most of the unconventional shale gas and tight gas areas in which we own acreage do not currently contain gathering systems, transportation facilities or processing facilities. If our drilling efforts are successful within these areas, we will need access to transportation and gathering facilities to deliver our production to market. Until such facilities are available, we would be unable to realize revenue from such production and, as a result, our business, financial condition and results of operations could be materially and adversely affected.

15

Any significant inaccuracies in our reserve estimates, or the underlying assumptions on which such estimates were based, could materially affect the quantities and present value of our reserves.

On several occasions, inaccurate estimates of our proved reserves have required downward revisions in our estimates of our proved reserves. Any further significant inaccuracies in the interpretations, assumptions or projections used to develop our natural gas and oil reserves could materially affect the estimated quantities and present value of our reserves as shown in this prospectus. In addition, actual future production, natural gas and oil prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable natural gas and oil reserves most likely will vary from our estimates. Any significant variance could materially affect the estimated quantities and present value of our reserves as shown in this prospectus.

The present values referred to in this prospectus may not represent the current market value of our estimated natural gas and oil reserves. The timing of our production and the expenses related to the development of our natural gas and oil properties will affect both the timing of actual future net cash flows from our proved reserves and their present value. In addition, our PV-10 estimates are based on prices and costs as of the date of the estimates. Actual future prices and costs may be materially higher or lower than the prices and costs as of the date of the estimates. Further, the effect of derivative instruments is not reflected in these assumed prices. Also, the 10% discount factor we use when calculating our PV-10 estimates may not be the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the natural gas and oil industry in general. For example, if natural gas prices decline by $0.25 per Mcf, the PV-10 of our total proved reserves as of December 31, 2005 would decrease from approximately $371.3 million to $364.9 million, and if oil prices decline by $1.00 per Bbl, the PV-10 of our total proved reserves as of December 31, 2005 would decrease from approximately $371.3 million to $366.5 million.

The unavailability or high cost of drilling rigs, equipment, supplies or personnel could adversely affect our ability to execute our exploration and development plans.

The natural gas and oil industry is cyclical and, from time to time, there are shortages of drilling rigs, equipment, supplies or qualified personnel. During these periods, the costs of rigs, equipment and supplies may be substantially increased and their availability may be limited. In addition, the demand for, and wage rates of, qualified personnel, including drilling rig crews, may rise as the number of rigs in service increases. If drilling rigs, equipment, supplies or qualified personnel are unavailable to us due to excessive costs or demand or otherwise, our ability to execute our exploration and development plans could be materially and adversely affected and, as a result, our business, financial condition and results of operations could be materially and adversely affected.

We depend on a limited number of key personnel who would be difficult to replace.

We depend on the performance of our executive officers and other key employees. The loss of any member of our senior management or other key employee, including Terry W. Carter, our President and Chief Executive Officer, Eddie M. LeBlanc, III, our Chief Financial Officer, or David L. McCabe, our Chief Operating Officer and Executive Vice President of Exploration and Development, could negatively impact our ability to execute our strategy. We do not maintain key person life insurance policies on any of our executive officers or key employees.

We may have difficulty managing growth in our business, which could adversely affect our financial condition and results of operations.

Significant growth in the size and scope of our operations could place a strain on our financial, technical, operational and management resources. The failure to continue to upgrade our technical, administrative, operating and financial control systems or the occurrences of unexpected expansion difficulties, including the failure to recruit and retain experienced managers, geologists, engineers and other professionals in the natural gas

16

and oil industry could have a material adverse effect on our business, financial condition and results of operations and our ability to timely execute our business plans.

Our identified drilling locations are scheduled over several years, which makes them susceptible to uncertainties that could materially alter the occurrence or timing of their drilling.

As part of our growth strategy, our management has identified drilling locations as an estimation of our future multi-year drilling activities on our existing acreage. As of June 30, 2006, we had identified over 865 gross drilling locations, only 83 of which were attributable to proved undeveloped reserves. Our ability to drill and develop these locations depends on a number of uncertainties, including the availability of capital, regulatory approvals, natural gas and oil prices, costs and drilling results. Because of these uncertainties, we do not know if the drilling locations we have identified will be drilled on our anticipated schedule, or at all, or if we will be able to produce natural gas or oil from these locations in commercially viable quantities. As such, our actual drilling activities may differ materially from those presently identified, which could materially and adversely affect our business, financial condition and results of operations.

Prospects that we decide to drill may not yield natural gas or oil in commercially viable quantities, or at all.

A prospect is a property on which we have identified what our geoscientists and engineers believe, based on available seismic, geological and engineering information, to be indications of commercial quantities of natural gas or oil. However, the use of seismic data and other technologies and the study of producing fields in the same area will not enable us to know conclusively prior to drilling and testing whether natural gas or oil will be present or, if present, whether natural gas or oil will be present in sufficient quantities to recover drilling or completion costs or to be economically viable. Even if sufficient amounts of natural gas or oil exist, we may damage the reservoir or experience mechanical difficulties while drilling or completing the well, resulting in a reduction in production from the well or abandonment of the well. From January 1, 2003 through June 30, 2006, 14% of the development wells we drilled were dry holes and 33% of the exploration wells we drilled were dry holes. If we drill wells that we identify as dry holes in our current and future prospects, our drilling success rate may decline and it may materially and adversely affect our business, financial condition and results of operations.

Drilling for and producing natural gas and oil are high risk activities with many uncertainties that could materially and adversely affect our business, financial condition and results of operations.

Our operations are subject to many risks and hazards incident to exploring and drilling for, producing, transporting, marketing and selling natural gas and oil. Many of these risks and hazards are beyond our control and unavoidable under certain circumstances. Any of these risks can cause substantial losses, including personal injury or loss of life, damage to or destruction of property, natural resources and equipment, pollution, environmental contamination or loss of wells and other regulatory penalties. These risks and hazards include:

| | • | | unusual or unexpected geological formations; |

| | • | | pressures, blowouts or fires; |

| | • | | cratering and explosions; |

| | • | | loss of drilling fluid circulation; |

| | • | | facility or equipment malfunctions; |

| | • | | unexpected operational events; |

| | • | | pipeline accidents and failures or casing collapses; |

| | • | | uncontrollable flows of natural gas, oil, brine or well fluids; |

17

| | • | | compliance with environmental and other governmental requirements; and |

| | • | | adverse weather conditions. |

If any of these risks is realized, our business, financial condition and results of operations could be materially and adversely affected.

Losses and liabilities from uninsured or underinsured drilling and operating activities could materially and adversely affect our business, financial condition and operations.

Insurance against every operational risk is not available at economic rates. Additionally, we may elect not to obtain insurance if we believe that the cost of available insurance is excessive relative to the perceived risks presented. Insurance expenses have increased due to recent hurricane activity in the Gulf of Mexico. Thus, losses could occur for uninsurable or uninsured risks or in amounts in excess of existing insurance coverage. The occurrence of an event that is not fully covered by insurance could materially and adversely affect our business, financial condition and results of operations.

We may be unable to successfully acquire additional leasehold interests or other natural gas and oil properties, and acquisitions that we do acquire may prove to be worth less than we paid because of uncertainties in evaluating recoverable reserves and potential liabilities, which may inhibit our ability to grow our production and replace our reserves.