Exhibit 99.1

Announcement to the Market

Disclosure of results for the fourth quarter and from January to December of 2020, according to International Financial Reporting Standards – IFRS

We present below the differences between our financial statements in BRGAAP and in International Financial Reporting Standards – IFRS.

As from January 1st, 2018, IFRS 9 came into effect, the accounting standard that replaces IAS 39 in the treatment of Financial Instruments. The new standard is structured to encompass the pillars of classification, measurement of financial assets and impairment and was applied retrospectively by Itaú Unibanco Holding.

The complete consolidated financial statements under IFRS from January to December 2020 are available at our website: www.itau.com.br/investor-relations.

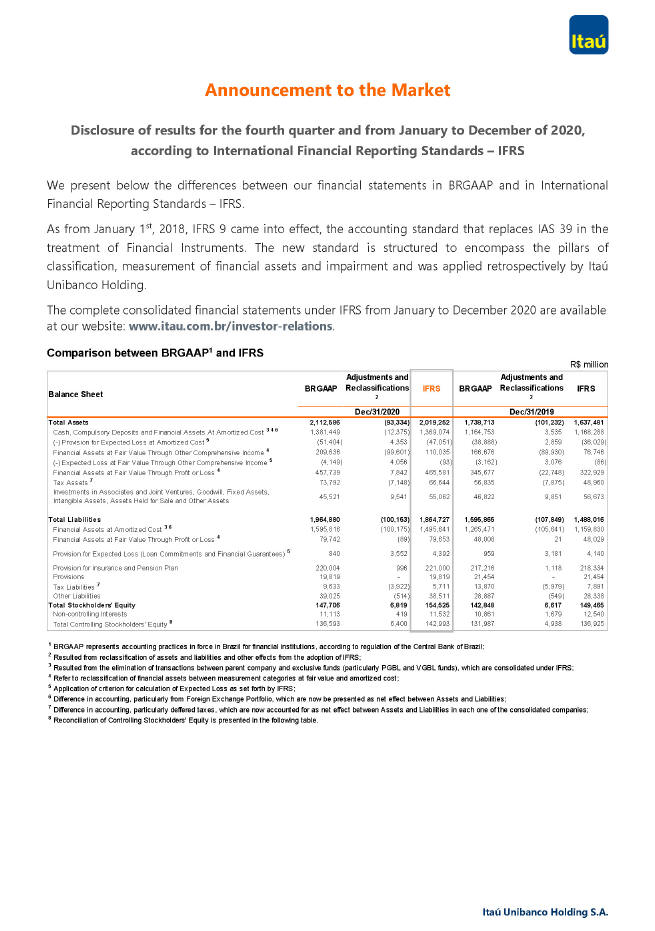

Comparison between BRGAAP1 and IFRS

R$ million

Balance Sheet BRGAAP Adjustments and Reclassifications 2 IFRS BRGAAP Adjustments and Reclassifications 2 IFRS

Dec/31/2020 Dec/31/2019

Total Assets 2,112,586 (93,334) 2,019,252 1,738,713 (101,232) 1,637,481

Cash, Compulsory Deposits and Financial Assets At Amortized Cost 3 4 6 1,381,449 (12,375) 1,369,074 1,164,753 3,535 1,168,288

(-) Provision for Expected Loss at Amortized Cost 5 (51,404) 4,353 (47,051) (38,888) 2,859 (36,029)

Financial Assets at Fair Value Through Other Comprehensive Income 4 209,636 (99,601) 110,035 166,676 (89,930) 76,746

(-) Expected Loss at Fair Value Through Other Comprehensive Income 5 (4,149) 4,056 (93) (3,162) 3,076 (86)

Financial Assets at Fair Value Through Profit or Loss 4 457,739 7,842 465,581 345,677 (22,748) 322,929

Tax Assets 7 73,792 (7,148) 66,644 56,835 (7,875) 48,960

Investments in Associates and Joint Ventures, Goodwill, Fixed Assets,

Intangible Assets, Assets Held for Sale and Other Assets 45,521 9,541 55,062 46,822 9,851 56,673

Total Liabilities 1,964,880 (100,153) 1,864,727 1,595,865 (107,849) 1,488,016

Financial Assets at Amortized Cost 3 6 1,595,816 (100,175) 1,495,641 1,265,471 (105,641) 1,159,830

Financial Assets at Fair Value Through Profit or Loss 4 79,742 (89) 79,653 48,008 21 48,029

Provision for Expected Loss (Loan Commitments and Financial Guarantees) 5 840 3,552 4,392 959 3,181 4,140

Provision for Insurance and Pension Plan 220,004 996 221,000 217,216 1,118 218,334

Provisions 19,819 - 19,819 21,454 - 21,454

Tax Liabilities 7 9,633 (3,922) 5,711 13,870 (5,979) 7,891

Other Liabilities 39,025 (514) 38,511 28,887 (549) 28,338

Total Stockholders’ Equity 147,706 6,819 154,525 142,848 6,617 149,465

Non-controlling Interests 11,113 419 11,532 10,861 1,679 12,540

Total Controlling Stockholders’ Equity 8 136,593 6,400 142,993 131,987 4,938 136,925

1 BRGAAP represents accounting practices in force in Brazil for financial institutions, according to regulation of the Central Bank of Brazil;

2 Resulted from reclassification of assets and liabilities and other effects from the adoption of IFRS;

3 Resulted from the elimination of transactions between parent company and exclusive funds (particularly PGBL and VGBL funds), which are consolidated under IFRS;

4 Refer to reclassification of financial assets between measurement categories at fair value and amortized cost;

5 Application of criterion for calculation of Expected Loss as set forth by IFRS;

6 Difference in accounting, particularly from Foreign Exchange Portfolio, which are now be presented as net effect between Assets and Liabilities;

7 Difference in accounting, particularly deffered taxes, which are now accounted for as net effect between Assets and Liabilities in each one of the consolidated companies;

8 Reconciliation of Controlling Stockholders’ Equity is presented in the following table.

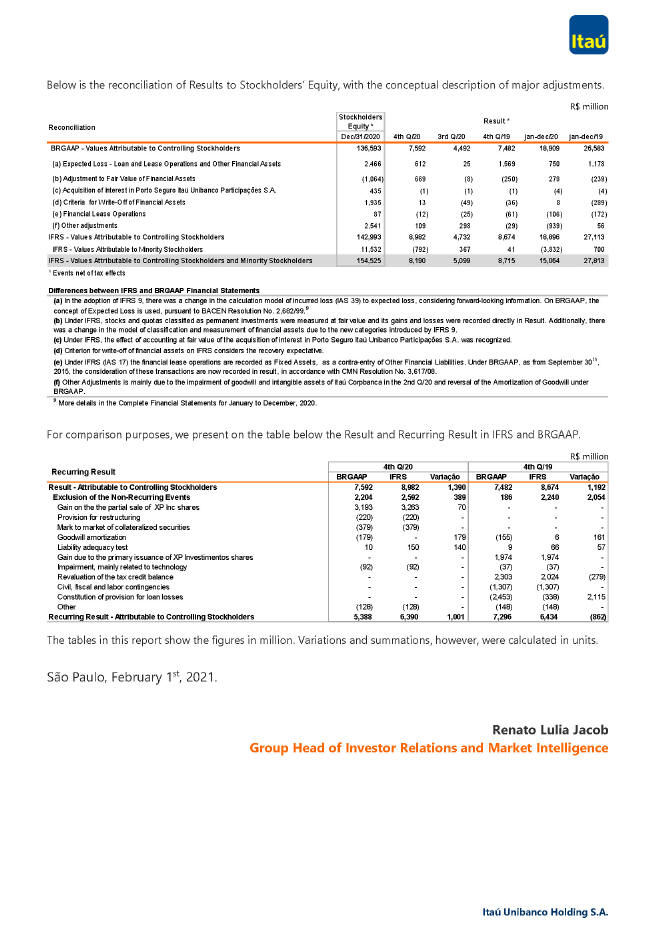

Below is the reconciliation of Results to Stockholders’ Equity, with the conceptual description of major adjustments.

R$ million

Reconciliation Stockholders Equity *

Dec/31/2020 4th Q/20 3rd Q/20 Result * 4th Q/19 jan-dec/20 jan-dec/19

BRGAAP - Values Attributable to Controlling Stockholders 136,593 7,592 4,492 7,482 18,909 26,583

(a) Expected Loss - Loan and Lease Operations and Other Financial Assets 2,466 612 25 1,569 750 1,178

(b) Adjustment to Fair Value of Financial Assets (1,064) 669 (8) (250) 278 (239)

(c) Acquisition of Interest in Porto Seguro Itaú Unibanco Participações S.A. 435 (1) (1) (1) (4) (4)

(d) Criteria for Write-Off of Financial Assets 1,935 13 (49) (36) 8 (289)

(e) Financial Lease Operations 87 (12) (25) (61) (106) (172)

(f) Other adjustments 2,541 109 298 (29) (939) 56

IFRS - Values Attributable to Controlling Stockholders 142,993 8,982 4,732 8,674 18,896 27,113

IFRS - Values Attributable to Minority Stockholders 11,532 (792) 367 41 (3,832) 700

IFRS - Values Attributable to Controlling Stockholders and Minority Stockholders 154,525 8,190 5,099 8,715 15,064 27,813

* Events net of tax effects

Differences between IFRS and BRGAAP Financial Statements

(a) In the adoption of IFRS 9, there was a change in the calculation model of incurred loss (IAS 39) to expected loss, considering forward-looking information. On BRGAAP, the concept of Expected Loss is used, pursuant to BACEN Resolution No. 2,682/99.9

(b) Under IFRS, stocks and quotas classified as permanent investments were measured at fair value and its gains and losses were recorded directly in Result. Additionally, there was a change in the model of classification and measurement of financial assets due to the new categories introduced by IFRS 9.

(c) Under IFRS, the effect of accounting at fair value of the acquisition of interest in Porto Seguro Itaú Unibanco Participações S.A. was recognized.

(d) Criterion for write-off of financial assets on IFRS considers the recovery expectative.

(e) Under IFRS (IAS 17) the financial lease operations are recorded as Fixed Assets, as a contra-entry of Other Financial Liabilities. Under BRGAAP, as from September 30th, 2015, the consideration of these transactions are now recorded in result, in accordance with CMN Resolution No. 3,617/08.

(f) Other Adjustments is mainly due to the impairment of goodwill and intangible assets of Itaú Corpbanca in the 2nd Q/20 and reversal of the Amortization of Goodwill under BRGAAP.

9 More details in the Complete Financial Statements for January to December, 2020.

For comparison purposes, we present on the table below the Result and Recurring Result in IFRS and BRGAAP.

R$ million

Recurring Result 4th Q/20 BRGAAP IFRS Variação 4th Q/19BRGAAP IFRS Variação

Result - Attributable to Controlling Stockholders 7,592 8,982 1,390 7,482 8,674 1,192

Exclusion of the Non-Recurring Events 2,204 2,592 389 186 2,240 2,054

Gain on the the partial sale of XP Inc shares 3,193 3,263 70 - - -

Provision for restructuring (220) (220) - - - -

Mark to market of collateralized securities (379) (379) - - - -

Goodwill amortization (179) - 179 (155) 6 161

Liability adequacy test 10 150 140 9 66 57

Gain due to the primary issuance of XP Investimentos shares - - - 1,974 1,974 -

Impairment, mainly related to technology (92) (92) - (37) (37) -

Revaluation of the tax credit balance - - - 2,303 2,024 (279)

Civil, fiscal and labor contingencies - - - (1,307) (1,307) -

Constitution of provision for loan losses - - - (2,453) (338) 2,115

Other (128) (128) - (148) (148) -

Recurring Result - Attributable to Controlling Stockholders 5,388 6,390 1,001 7,296 6,434 (862)

The tables in this report show the figures in million. Variations and summations, however, were calculated in units.

São Paulo, February 1st, 2021.

Renato Lulia Jacob

Group Head of Investor Relations and Market Intelligence

Itaú Unibanco Holding S.A.