QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

| ý | | Filed by the Registrant |

| o | | Filed by a Party other than the Registrant |

|

|

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a—6(e)(2)) |

ý |

|

Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Under Rule 14a-12 |

TRANSMERIDIAN EXPLORATION, INC. |

(Name of Registrant as Specified in its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount previously paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

TRANSMERIDIAN EXPLORATION, INC.

397 N. SAM HOUSTON PKWY E., SUITE 300

HOUSTON, TEXAS 77060

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 17, 2005

Notice is hereby given that the Annual Meeting of Stockholders (the "Annual Meeting") of Transmeridian Exploration, Inc., a Delaware corporation ("Transmeridian" or the "Company"), will be held at the Wyndham Greenspoint Hotel, 12400 Greenspoint Drive, Houston, Texas on Tuesday, May 17, 2005 at 10:00 a.m. local time for the following purposes:

- (1)

- Election of six Directors to hold office in accordance with the Company's Certificate of Incorporation until the 2006 Annual Meeting of Stockholders or until their respective successors shall be duly elected and qualified;

- (2)

- To ratify the appointment of John A. Braden & Company, P. C. as independent auditors for the Company for the year ending December 31, 2005;

- (3)

- To approve an amendment to the Company's 2003 Stock Compensation Plan to increase the number of shares authorized for issuance under the Plan by 2,500,000 shares; and

- (4)

- Such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof.

The Board of Directors has fixed the close of business on March 25, 2005 as the date of record for determining the stockholders entitled to notice of and to vote, either in person or by proxy, at the Annual Meeting and any adjournment or postponement thereof.

Transmeridian's Annual Report for the year ended December 31, 2004, a Proxy Statement containing information relating to the matters to be acted upon at the Annual Meeting and a form of Proxy accompany this Notice.

You are cordially invited to attend the Annual Meeting.WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO DATE, SIGN AND PROMPTLY RETURN YOUR PROXY SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND IN ORDER THAT THE PRESENCE OF A QUORUM MAY BE ASSURED. Your vote is important. The giving of such proxy does not affect your right to revoke it later or vote your shares in person if you should attend the Annual Meeting.

IF YOU PLAN TO ATTEND THE MEETING, PLEASE NOTE THAT THIS IS A STOCKHOLDERS' MEETING AND ATTENDANCE WILL BE LIMITED TO STOCKHOLDERS OF TRANSMERIDIAN OR THEIR QUALIFIED REPRESENTATIVE. EACH STOCKHOLDER MAY BE ASKED TO PRESENT VALID PICTURE IDENTIFICATION, SUCH AS A DRIVER'S LICENSE OR PASSPORT. STOCKHOLDERS HOLDING STOCK IN BROKERAGE ACCOUNTS ("STREET NAME" HOLDERS) WILL NEED TO BRING A COPY OF A BROKERAGE STATEMENT REFLECTING STOCK OWNERSHIP AS OF THE RECORD DATE. QUALIFIED REPRESENTATIVES OF A STOCKHOLDER MUST HAVE IDENTIFICATION AS WELL AS A PROPERLY EXECUTED AND GUARANTEED PROXY FROM THE STOCKHOLDER THEY ARE REPRESENTING. CAMERAS, RECORDING DEVICES AND OTHER ELECTRONIC DEVICES WILL NOT BE PERMITTED AT THE MEETING.

|

|

By Order of the Board of Directors |

|

|

/s/ LORRIE T. OLIVIER

Lorrie T. Olivier

Chairman and Chief Executive Officer |

Houston Texas

April 7, 2005 | | |

TRANSMERIDIAN EXPLORATION, INC.

397 N. SAM HOUSTON PKWY E., SUITE 300

HOUSTON, TEXAS 77060

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 17, 2005

SOLICITATION OF PROXIES

The accompanying proxy is solicited on behalf of the Board of Directors of Transmeridian Exploration, Inc., a Delaware corporation ("Transmeridian" or the "Company"), in connection with the Annual Meeting of Stockholders (the "Annual Meeting"), which will be held at the Wyndham Greenspoint Hotel, 12400 Greenspoint Drive, Houston, Texas on Tuesday, May 17, 2005 at 10:00 a.m. local time, and at any adjournments or postponements thereof, for the purposes set forth in the accompanying notice. This Proxy Statement and the accompanying Proxy were first mailed to stockholders of record on or prior to April 27, 2005.

RECORD DATE AND VOTING SECURITIES

The Board of Directors has fixed the close of business on March 25, 2005 as the Record Date (herein so called) for determining the holders of common stock, $.0006 par value per share, of Transmeridian ("Common Stock"), and holders of the Company's Series A Cumulative Convertible Preferred Stock (the "Series A Preferred Stock") entitled to notice of and to vote, either in person or by proxy, at the Annual Meeting. The shares of Common Stock and the shares of the Series A Preferred Stock are the only shares of capital stock entitled to vote at the Annual Meeting. As of the Record Date, Transmeridian had 80,113,151 shares of Common Stock outstanding and 1,785.714 shares of Series A Preferred Stock outstanding. Each holder of the Series A Preferred Stock is entitled to the number of votes equal to the number of shares of Common Stock into which such shares of Series A Preferred Stock could be converted on the Record Date, subject to the limitation that each holder of the Series A Preferred Stock shall not convert the Series A Preferred Stock such that the number of shares of Common Stock issued after the conversion would exceed, when aggregated with all other shares of Common Stock owned by such holder at such time, in excess of 4.999% of the then issued and outstanding shares of Common Stock outstanding of the Company.

RECOMMENDATIONS OF THE BOARD

Unless a stockholder gives other instructions on the proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendation of the Board of Directors. The Board's recommendation is set forth together with a description of each item in this Proxy Statement. In summary the Board recommends a vote:

- •

- FOR the election of six Directors of Transmeridian to hold office in accordance with Transmeridian's Certificate of Incorporation until the 2006 Annual Meeting of Stockholders or until their respective successors shall be duly elected and qualified;

- •

- FOR the appointment of John A. Braden & Company, P. C. as independent auditors for the year ending December 31, 2005; and

- •

- FOR the amendment to the Company's 2003 Stock Compensation Plan to increase the number of shares authorized for issuance under such Plan by 2,500,000 shares.

QUORUM AND VOTING

The presence, in person or represented by proxy, of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining whether a quorum is present. If a quorum is not present or represented by proxy, the stockholders entitled to vote thereat, present in person or represented by proxy, have the power to adjourn the meeting from time to time, without notice other than an announcement at the meeting until a quorum is present or represented. At any such adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the meeting as originally called.

The affirmative vote of a plurality of the votes cast at the meeting is required for the election of directors. Stockholders do not have the right to cumulatively vote their shares for directors. A properly executed proxy marked "Withhold Authority" with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for the purpose of determining whether there is a quorum. Abstentions and broker non-votes will have no effect on the election of nominees to the Board of Directors.

The affirmative vote of a majority of the shares having voting power present, in person or represented by proxy, at the Annual Meeting is required to ratify the appointment of John A. Braden & Company, P. C. as independent auditors for Transmeridian and to amend the Company's 2003 Stock Compensation Plan to increase the number of shares authorized under such Plan by 2,500,000 shares. Abstentions and broker non-votes will have the same effect as a vote against these proposals.

Delaware law does not afford our stockholders the opportunity to dissent from the actions described in the proposals herein and receive value for their Common Stock.

PROXY SOLICITATION

The expense of the solicitation of proxies will be borne by Transmeridian. Solicitation of proxies may be made in person or by mail, telephone or telegraph by directors, executive officers and other employees of Transmeridian. Transmeridian will request banking institutions, brokerage firms, custodians, nominees and fiduciaries to forward solicitation material to the beneficial owners of Common Stock held of record by such persons, and Transmeridian will reimburse such entities for their reasonable out-of-pocket expenses.

REVOCATION OF PROXY

Any stockholder returning the accompanying proxy may revoke such proxy at any time prior to its exercise (a) by giving written notice to the Secretary of Transmeridian of such revocation; (b) by voting in person at the meeting; or (c) by executing and delivering to the Secretary of Transmeridian a later dated proxy.

OWNERSHIP OF COMMON STOCK

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 25, 2005, information about the beneficial ownership of our Common Stock by (i) any person (including any "group" as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934), known by us to be the beneficial owner of more than 5% of our voting securities, (ii) each director and nominee for director of the Company, (iii) each of the executive officers named in the Summary Compensation Table appearing in this Proxy Statement, and (iv) all executive officers and directors of the Company as a group. In compiling this table, we have relied on the records of our transfer agent, public filings and other information available to us. We believe this information is reliable. However, these holdings are subject to change. The percentage information is based on 80,113,151

2

shares of Common Stock outstanding as of the above date. We do not know of any arrangements, including any pledge by any person of securities of the Company, the operation of which may at a subsequent date result in a change of control of the Company.

Name of Beneficial Owner

| | Shares

Owned(a)

| | Percent

of Class

| |

|---|

| Executive Officers and Directors: | | | | | |

| Lorrie T. Olivier(b) | | 16,050,680 | | 20.0 | % |

| Bruce A. Falkenstein(c) | | 1,921,575 | | 2.4 | % |

| Philip J. McCauley(d) | | 708,333 | | 0.9 | % |

| Charles J. Campise | | 141,732 | | 0.2 | % |

| | |

| |

| |

| Earl W. McNiel | | 125,000 | | 0.2 | % |

| Joseph S. Thornton | | 100,000 | | 0.1 | % |

| George E. Reese | | 58,333 | | 0.1 | % |

| James H. Dorman | | 58,333 | | 0.1 | % |

| Marvin R. Carter | | 8,333 | | 0.0 | % |

| | |

| |

| |

| All directors and officers as a group | | 19,172,319 | | 23.8 | % |

| | |

| |

| |

| Other Beneficial Owners: | | | | | |

JMJC Investments, Inc.(b)

397 N. Sam Houston Pkwy. E., Suite 300

Houston, TX 77060 | | 6,300,000 | | 7.9 | % |

Jack Investments, Ltd.

4F-9, No. 51, Sec 2 Keelung Road,

Taipei 110, Taiwan | | 4,000,000 | | 5.0 | % |

Kornerstone Investment Group, Ltd.(e)

Trident Chambers

P.O. Box 146

Wickhams Cay, Road Town

Tortola, British Virgin Islands | | 5,133,000 | | 6.4 | % |

- (a)

- Each person has sole voting and investment power with respect to the common shares listed, except as noted below. Included in the total above are options exercisable within 60 days of the record date by Mr. Olivier (33,333 shares), Mr. Falkenstein (175,000 shares), Mr. Campise (116,667 shares), Mr. McCauley (158,333 shares), Mr. Reese (58,333 shares), Mr. Carter (8,333 shares) and Mr. Dorman (58,333 shares). The address for each of the Executive Officers and Directors is 397 N. Sam Houston Pkwy E., Suite 300, Houston, TX 77060.

- (b)

- Includes 8,917,347 shares owned by Olivier Family Living Trust, as well as 6,300,000 common shares owned by JMJC Investments, Inc. and 800,000 common shares owned by Colamer Ltd., both of which are entities controlled by Mr. Olivier. The shares held by JMJC Investments, Inc. are also reflected separately as this entity owns more than 5% of our common shares.

- (c)

- Includes 1,765,819 common shares owned by Falkenstein Family Living Trust, an entity controlled by Mr. Falkenstein.

- (d)

- Includes 500,000 common shares owned by Zen Trust, an entity controlled by Mr. McCauley.

- (e)

- The principal stockholder of Kornerstone is employed on a part-time basis as a consultant and manager of Caspi Neft, the Company's operating subsidiary in Kazakhstan.

3

ITEM ONE: ELECTION OF DIRECTORS

The number of directors constituting the full Board of Directors of Transmeridian has been established as not less than one, in accordance with Transmeridian's Bylaws. Six Directors will be elected at the Annual Meeting to hold office until the 2006 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified.

NOMINEES FOR ELECTION AS DIRECTORS:

NAME, AGE AND BUSINESS EXPERIENCE

| | DIRECTOR

SINCE

|

|---|

|

|

|

Lorrie T. Olivier, 54, has served as President and Chief Executive Officer of the Company since its inception. Mr. Olivier became Chairman of the Board in 2002. From 1991 to 2000, Mr. Olivier was employed by American International Petroleum Corporation (AIPC) as Vice President of Operations and President of AIPC Kazakhstan. He was the key executive in charge of developing AIPC's interests in the Caspian Sea region. Mr. Olivier has devoted his entire career to international oil and gas exploration and production, serving with Occidental Petroleum and Shell Oil. |

|

2000 |

Philip J. McCauley, 43, has been a Director of the Company since its formation in 2000. He is currently Industrial Fellow of the University of Nottingham, England. From 2000 to 2003 he was the Chairman and Chief Executive Officer of Audio Navigation Ltd. From November 1983 to December 1999, Mr. McCauley was the Chief Executive Officer of TTL Group Ltd. |

|

2000 |

James H. Dorman, 72, joined the Board of Directors in October 2002. Mr. Dorman has 48 years of experience as a professional geologist and oil and gas executive. In 1996, Mr. Dorman founded Doreal Energy Corporation, a publicly-held international exploration and production company, and served as President, Chief Executive Officer and a Director until retiring in 2001. He began his career with Chevron and then with Tenneco, Inc., serving for 25 years, where he last held the position of Exploration Vice President. |

|

2002 |

George E. Reese, 54, joined the Board of Directors in May 2003. He is Chairman of the Audit Committee. He served with Ernst & Young from 1972 to 1995, ultimately as a partner in the firm, including the last four years as Managing Partner of the Moscow office of the firm. He then became a financial executive with Crown Castle International from 1997 to 2001. He currently is a Director of M7 Aerospace, LP and the Chairman of Intercomp Technologies, L.L.C. |

|

2003 |

Marvin R. Carter, 75, joined the Board of Directors in April 2004. Mr. Carter has over 50 years of experience in oil and gas exploration, primarily in international operations. From 1971 until 1990 he served as President and General Manager for three Occidental Petroleum subsidiaries in South America. He also served as Vice President of Latin America Operations for Occidental and as Vice President, Executive Operations for Occidental until his retirement in 1994. He currently is the President of an oil and gas consulting firm. |

|

2004 |

| | | |

4

Dr. J. Fernando Zúñiga y Rivero, 77, Joined the Board of Directors in April 2005. Dr. Zúñiga y Rivero has worked for over fifty years in the international energy industry. Starting as an exploration geologist and biostratigrapher, he became exploration head of an Exxon affiliate and continued as exploration-production manager, integrated operations manager, general manager, and chairman/CEO of Petróleos del Perú, the national oil company of Perú. Subsequently as Energy Division project officer of The World Bank, he planned and implemented exploration-promotion projects in 58 countries, mainly in East and West Africa, Eastern Europe, Southeast Asia and Latin America. Holding a B.Sc. in Physics and Geological Sciences from San Agustín University in Arequipa, Perú, he carried on post-graduate studies in Paleontology and Stratigraphy at the University of California (Los Angeles) and was awarded a Ph.D. in Geological Sciences by the University of San Agustín in Arequipa, Perú. |

|

2005 |

Each of the nominees for election as directors has agreed to serve if elected. Transmeridian knows of no reason why any of the nominees for election as directors would be unable to serve. Should any of the nominees be unable to serve, all proxies returned to Transmeridian will be voted in accordance with the best judgment of the persons named as proxies except where a contrary instruction is given.

The Board of Directors recommends a voteFOR the re-election of Messrs. Olivier, McCauley, Dorman, Reese, Carter and Zúñiga y Rivero to the Board of Directors.

VOTE REQUIRED TO BE ELECTED AS A DIRECTOR

To be elected a Director, each nominee must receive the affirmative vote of a plurality of the votes duly cast at the Annual Meeting. Abstentions and broker non-votes will have no effect on the election of nominees to the Board of Directors.

DIRECTORS' MEETINGS AND COMMITTEES

The Board of Directors has standing audit, compensation, and nominating and governance committees. The Board of Directors has adopted written charters for the audit, executive compensation, and nominating and governance committees. These charters are available on the Company's website atwww.tmei.com. The Board of Directors of the Company held three meetings during 2004. All of the directors attended at least 75% of the total number of meetings of the Board and the committees on which they served. The Board took action by written consent three times during 2004.

BOARD INDEPENDENCE

The Board has determined that each of the director-nominees are "independent", as defined under the rules and regulations of the Securities and Exchange Commission governing audit committees, except for Mr. Olivier, the Chief Executive Officer of the Company. All of the members of the Nominating and Governance Committee, the Compensation Committee, and the Audit Committee are "independent directors," as defined in the applicable rules and regulations of the Securities and Exchange Commission. For purposes of defining independence, the Company also utilizes the definitions and requirements of the American Stock Exchange.

5

COMMITTEES OF THE BOARD

Audit Committee

The Audit Committee consists of Messrs. McCauley, Reese and Zúñiga y Rivero. Prior to his resignation from the Board of Directors in March 2005, Angus Simpson was also on the Audit Committee. Mr. Reese is the Chairman of the committee. The Board of Directors has determined that Mr. Reese is an "audit committee financial expert" and "independent" as defined under the applicable rules of the Securities and Exchange Commission and the listing requirements of the American Stock Exchange. The Audit Committee's Charter is available on the Company's web site atwww.tmei.com.

The functions of the audit committee include: (i) appointing the independent auditors for the annual audit and approving the fee arrangements with the independent auditors; (ii) monitoring the independence, qualifications, and performance of the independent auditors; (iii) reviewing the planned scope of the annual audit; (iv) reviewing the financial statements to be included in our Quarterly Reports on Form 10-Q and our Annual Report on Form 10-K, any significant adjustments proposed by the independent auditors and our disclosures under "Management's Discussion and Analysis of Financial Condition and Results of Operations"; (v) making a recommendation to the Board of Directors regarding inclusion of the audited financial statements in our Annual Report on Form 10-K; (vi) reviewing recommendations, if any, by the independent auditors resulting from the audit to ensure that appropriate actions are taken by management; (vii) reviewing matters of disagreement, if any, between management and the independent auditors; (viii) meeting privately on a periodic basis with the independent auditors and management to review the adequacy of our internal controls; (ix) monitoring our accounting management and controls; (x) monitoring our policies and procedures regarding compliance with the Foreign Corrupt Practices Act and compliance by our employees with our Code of Business Conduct and Ethics; and (xi) monitoring any litigation involving Transmeridian which may have a material financial impact on Transmeridian or relate to matters entrusted to the audit committee. The audit committee held five meetings during 2004. The audit committee did not take action by written consent during 2004.

Nominating and Governance Committee

The Nominating and Governance Committee consists of Messrs. Dorman, Carter and Zúñiga y Rivero. Prior to his resignation from the Board of Directors in March 2005, Angus Simpson was also on the Nominating and Governance Committee. Mr. Dorman is the Chairman of the Committee. The purpose of the Nominating and Governance Committee is to seek to ensure continuation of the effectiveness and independence of the Board of Directors. The Committee is responsible for reviewing the credentials of persons suggested as prospective directors, nominating persons to serve as directors and as officers of the Board of Directors, including the slate of directors to be elected each year at the annual meeting of stockholders, making recommendations concerning the size and composition of the Board of Directors, as well as criteria for Board membership, making recommendations concerning the Board's committee structure and makeup, providing for continuing education of the directors and self-assessment of the Board's effectiveness, and overseeing the Corporate-wide Code of Conduct and the Code of Ethics for senior financial officers of the Company. The Nominating and Governance Committee's Charter is available on the Company's web site atwww.tmei.com. The Nominating and Governance Committee held one meeting during 2004. The Nominating and Governance committee did not take action by written consent during 2004.

The Nominating and Governance Committee is presently developing written criteria for membership on the Board of Directors but has not yet finalized these criteria. The Committee's process for identifying and evaluating nominees is as follows: (a) for incumbent directors whose terms are expiring, it reviews the quality of their prior service to the Company, including the nature and extent of their participation in the Company's governance and their contributions of management and financial expertise and experience to the Board and the Company; and (b) for new director candidates, in addition to their expertise,

6

experience, reputation and stature, it considers whether their skills are complementary to those of existing Board members, whether they will fulfill the Board's needs for management, financial, technological or other expertise, and whether they are likely to have sufficient time to responsibly perform all of their duties as directors. The Nominating and Governance Committee considers candidates coming to its attention through current Board members, search firms, stockholders and other persons.

Director Nominees Recommended by Stockholders

Suggestions for nominees from stockholders are evaluated in the same manner as other nominees. Any stockholder nominations must be submitted in writing and should include the nominee's name and qualifications and be addressed to Chairman of the Nominating Committee, 397 N. Sam Houston Pkwy E, Suite 300, Houston, Texas 77060. The information must include the candidate's name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and the Company within the last three years, evidence of the nominating person's ownership of Company Common Stock, a written indication by the candidate of her or his willingness to serve if elected, and a written statement in support of the candidate including comments as to the candidate's character, judgment, age, business experience, and other commitments. For a stockholder recommendation to be considered by the Nominating and Governance Committee as a potential candidate at an annual meeting, nominations must be received on or before the deadline for receipt of stockholder proposals. In the event a stockholder decides to nominate a candidate for director and solicits proxies for such candidate, the stockholder will need to follow the rules set forth by the SEC. See "Stockholder Proposals for 2006 Annual Meeting."

There are no nominees for election to the Company's Board of Directors at the 2005 Annual Stockholders' meeting other than directors standing for re-election.

Stockholder Communications with the Board of Directors

Any stockholder may contact any of our directors by writing to them by mail c/o Director's Name at our principal executive offices, the address of which appears on the cover of this Proxy Statement.

Any stockholder may report to the Board of Directors any complaints regarding accounting, internal accounting controls, or auditing matters. Any stockholder who wishes to so contact the Board should send such complaints to the Audit Committee c/o Mr. George Reese, Chairman of the Audit Committee, at our principal executive offices, the address of which appears on the cover of this Proxy Statement.

Our Chief Financial Officer and outside counsel will review, summarize and, if appropriate, investigate the complaint and draft a response to the communication in a timely manner. A member of the Audit Committee, or the Audit Committee as a whole, will then review the summary of the communication, the results of the investigation, if any, and the draft response. The summary and response will be in the form of a memo, which will become part of the stockholders communications log that the Company will maintain with respect to all stockholder communications.

The Company encourages each of its directors to attend the annual meeting of stockholders. All directors attended last year's annual meeting of stockholders.

Compensation Committee

The Compensation Committee consists of Messrs. Dorman and Carter. Mr. Carter is the Chairman. The functions of this committee are to: (i) establish the compensation of the senior executive officers; (ii) periodically review the succession plans for our executive officers; and (iii) serve as the administrative committee for Transmeridian's Stock Option Plan and Stock Compensation Plan. The Compensation Committee held one meeting during 2004. The Compensation Committee did not take action by written consent during 2004.

7

COMPENSATION OF DIRECTORS

Prior to 2003, no compensation was paid to the directors. In May 2003, the Company granted options to purchase 150,000 shares of common stock to each of the two directors who have served on the Board since inception, Mr. McCauley and Mr. Simpson. The remaining two directors, Mr. Dorman and Mr. Reese, were each granted options to purchase 50,000 shares of common stock. The options granted have an exercise price of $0.24 per share and vest one year from the date of grant. In March 2004, a formal compensation plan was implemented for the Board of Directors. Each outside director will receive $10,000 per year, which represents $2,500 for each quarterly meeting attended. Additionally, each audit committee member will receive $1,000 quarterly and the committee chair will receive $2,000 quarterly. The compensation committee members will receive $500 quarterly and the committee chair will receive $1,000 quarterly. All director compensation coincides with regularly scheduled committee and board meetings. If additional meetings are required, then directors are compensated $750 for each half day and $1,500 for each full day of meetings. Additionally, each outside director receives an annual restricted stock award of 10,000 shares on the date of the Annual Meeting and an annual target grant of options to purchase 40,000 shares of common stock. In November 2004, the outside directors each received options to purchase 25,000 shares of common stock. The options granted have an exercise price of $1.50 per share and vest one-third after six months, on-third after 18 months and one-third after 30 months, each as measured from the date of grant.

8

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Kornerstone Investment Group, Ltd. (Kornerstone) is the beneficial owner of more than 5% of the Company's common stock. None of our executive officers or directors has a financial interest in Kornerstone. In connection with the acquisition of the Company's South Alibek Field in Kazakhstan, we granted Kornerstone a 10% carried working interest in the Field, effective after we recover all costs attributable to the carried interest. During 2000, the Company issued 1,000,000 shares of Common Stock, valued at $100,000, to Kornerstone in connection with the renegotiation of a financing arrangement related to the acquisition of the South Alibek Field. Additionally, during 2002, we paid Kornerstone $400,000 in connection with arrangement of $50 million of development financing related to the South Alibek Field. We paid $200,000 of the amount in cash and the balance was retired by the issuance of 4,000,000 shares of Common Stock pursuant to an agreement between the parties. During 2002, we also paid the principal stockholder of Kornerstone a stock bonus of 100,000 shares in connection with services performed in expanding the area covered by our the license on the South Alibek Field from 3,396 acres to 14,111 acres. The principal stockholder of Kornerstone is a citizen of Kazakhstan and is employed on a part-time basis as a consultant and manager of Caspi Neft, the Company's operating subsidiary in Kazakhstan.

During 2002, Mr. Olivier and entities under his control advanced cash totaling $180,000 to the Company. Additionally, two of our stockholders, none of whom owns more than 5% of our common shares outstanding, made advances totaling $68,025. During 2004, $198,025 of these loans, together with accrued interest of $68,676 was repaid. As of December 31, 2004 one loan remains outstanding with a principal balance of $50,000 and accrued interest of $19,608.

In connection with a contract for investor relations services for the Company, Mr. Olivier transferred 150,000 shares of our common stock from his personal holdings to the firm which was contracted to provide these services. This payment in common stock covered the period from December 15, 2002 through March 15, 2003. The value of these shares was $0.17 per share, or $25,500 in total.

Mr. Olivier is considered a promoter or founder of the Company within the meaning of Rule 405 of Securities Act of 1933. Mr. Olivier received 18,900,000 common shares in connection with the initial formation of the Company. Additionally, six other individuals received a total of 22,400,000 common shares. Of the shares issued to the founder, Mr. Olivier subsequently returned 5,600,000 shares to the Company to mitigate the dilutive effects of other common share issuances by the Company.

EXECUTIVE OFFICERS OF TRANSMERIDIAN

The officers of Transmeridian are elected annually by the Board of Directors following each Annual Meeting of Stockholders, or as soon thereafter as necessary and convenient. Each officer holds office until the earlier of such time as his or her successor is duly elected and qualified, his or her death or he or she resigns or is removed from office. Any officer elected or appointed by the Board of Directors may be removed by the Board of Directors whenever, in its judgment, the best interests of Transmeridian will be served thereby, but such removal will be without prejudice to the contract rights, if any, of the person so removed.

In July 2004, Mr. Earl McNiel was hired as Chief Financial Officer ("CFO") to replace Mr. Randall Keys, who resigned as CFO on the same date. Mr. Keys resigned from the Company to pursue other interests. The Company did not make a severance payment to Mr. Keys.

In January 2005, Mr. Joseph S. Thornton was hired as Vice President of Operations of the Company.

9

The executive officers of Transmeridian, their ages and positions held with Transmeridian and their business experience for the past five years are listed below.

Executive Officer

| | Age

| | Title

|

|---|

| Lorrie T. Olivier | | 54 | | President & CEO, Chairman of the Board |

| Earl W. McNiel | | 46 | | Vice President and Chief Financial Officer |

| Joseph S. Thornton | | 54 | | Vice President of Operations |

| Bruce A. Falkenstein | | 46 | | Vice President Exploration and Geology |

| Charles J. Campise | | 54 | | Corporate Controller |

Lorrie T. Olivier has served as President and Chief Executive Officer of the Company since its inception. Mr. Olivier became Chairman of the Board in 2002. From 1991 to 2000, Mr. Olivier was employed by American International Petroleum Corporation (AIPC) as Vice President of Operations and President of AIPC Kazakhstan. He was the key executive in charge of developing AIPC's interests in the Caspian Sea region. Mr. Olivier has devoted his entire career to international oil and gas exploration and production, serving with Occidental Petroleum and Shell Oil.

Earl W. McNiel joined the Company in July 2004 as Vice President and Chief Financial Officer. Mr. McNiel brings extensive financial experience to the Company, having served as Vice President and Chief Financial Officer of Pride International, Inc., a NYSE-listed oilfield service company from 1997 through 2003 and most recently as its Vice President of Planning and Corporate Development. He joined Pride in 1994 as its Chief Accounting Officer, and was promoted to CFO in 1997. Mr. McNiel has 24 years of experience with public companies, primarily in the energy industry, and has broad experience with financing and SEC matters. Before joining Pride, Mr. McNiel served as Chief Financial Officer of several publicly owned waste management companies and as Manager, Finance with ENSCO International, Inc. He began his career in public accounting and graduated with a BBA degree from Baylor University.

Joseph S. Thornton joined the Company in January 2005 as Vice President of Operations. Mr. Thornton has in excess of 30 years experience in oil and gas exploration, development and production operations. Most recently he served as Manager of Affiliates for Vanco Energy Company where he coordinated the activities for all the local branch offices and ensured contract compliance with the host Governments. Prior to that, he was Project Manager for Schlumberger in Moscow and Algeria where he was the project leader for production optimization opportunities and complex horizontal drilling operations. He held various senior positions with Ashland Exploration Benin and United Meridian International Corporation including Vice-President and General Manager for UMIC Côte d'Ivoire based in Abidjan. Mr. Thornton holds a Petroleum Engineering degree from the University of Oklahoma and is a registered Professional Engineer. He has also been knighted as an Officer in the National and Ivorian Orders of Merit.

Bruce A. Falkenstein joined the Company at its founding in 2000 and has served as Vice President of Exploration and Geology since its inception. Prior to joining Transmeridian, he served for 20 years with Amoco and BP, its successor, where he last held the position of Manager and Chief Geophysicist of the Kazakhstan Exploration team for BP Amoco. Since 1992, he has worked exclusively on the technical evaluation and acquisition of oil fields and operating licenses in Kazakhstan and the Caspian Sea region. Mr. Falkenstein has some fluency in Russian and is a State of Texas licensed Professional Geoscientist.

Charles J. Campise joined the Company as Corporate Controller in December 2003. Mr. Campise has more than 30 years of experience in accounting for oil and gas operations, including 12 years with Ocean Energy from 1988 to 2000, where his duties included responsibility for SEC Reporting and all international accounting. In 1998 he was transferred to West Africa as Vice President of Finance and Administration for Ocean Energy Cote d' Ivoire until 2001. In 2001 he was Finance Director and Board of Director member for an Apache Corporation Joint Venture Company in Cairo, Egypt. After leaving Apache in mid 2002 he

10

performed independent accounting and financial consulting, until accepting the position with the Company. Mr. Campise is a Certified Public Accountant in Texas.

COMPENSATION OF EXECUTIVE OFFICERS

The following table provides information about the compensation we paid our Chief Executive Officer and the other most highly compensated executive officers during the last three fiscal years.

Summary Compensation Table

| |

| |

| |

| |

| | Long Term Compensation(a)

|

|---|

| |

| | Annual Compensation

|

|---|

| |

| |

| | Securities

Underlying

Options/SARs

(#)

|

|---|

Name/Principal Position

| | Fiscal

Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | Restricted

Stock Awards

($)

|

|---|

Lorrie T. Olivier

President and Chief Executive Officer | | 2004

2003

2002 | | $

$

$ | 200,000

200,000

200,000 | | —

—

— | | —

—

— | | —

—

— | | 100,000

—

— |

Earl W. McNiel

Vice President and Chief Financial Officer(b) | | 2004

2003

2002 | | $

$

$ | 60,938

—

— | | —

—

— | | —

—

— | | —

—

— | | —

—

— |

Randall D. Keys

Former Chief Financial Officer(c) | | 2004

2003

2002 | | $

$

$ | 62,500

40,000

— | | —

—

— | | —

—

— | | —

26,875

— | | —

500,000

— |

Joseph S. Thornton

Vice President of Operations(d) | | 2004

2003

2002 | | $

$

$ | —

—

— | | —

—

— | | —

—

— | | —

—

— | | —

—

— |

Bruce A. Falkenstein

Vice President of Exploration & Geology | | 2004

2003

2002 | | $

$

$ | 120,000

120,000

120,000 | | —

—

— | | —

—

— | | —

—

— | | 75,000

250,000

— |

Charles J. Campise

Corporate Controller | | 2004

2003

2002 | | $

$

$ | 88,689

—

— | | —

—

— | | —

—

— | | —

—

— | | 50,000

100,000

— |

- (a)

- The Company did not make bonus or any other compensation payments during the year ended December 31, 2004.

- (b)

- Mr. McNiel was hired as Vice President and Chief Financial Officer in July 2004. On the date of hire he was granted a restricted stock award of 500,000 shares with 125,000 vesting on the date of hire and 125,000 vesting each anniversary thereafter over a three year period. The value of the award was $505,000, based on the closing price of the stock on the date of the grant.

- (c)

- In July 2004, Mr. Keys resigned as CFO of the Company to pursue other interests. The Company did not make any severance payments to Mr. Keys. Upon his resignation, 250,000 shares of unvested options were forfeited by Mr. Keys.

- (d)

- Mr. Thornton was hired as Vice President of Operations in January 2005.

11

OPTION/SAR GRANTS IN LAST FISCAL YEAR

The following table provides information about stock options granted during the year ended December 31, 2004.

| | Individual Grants

| |

| |

|

|---|

Name and Principal Position

| | Number of

Securities

Underlying

Options/SARs

Granted

(#)(a)

| | % of total

Options/SARs granted

to employees in

fiscal year

| | Exercise or

base price

($/Share)(b)

| | Expiration

Date

| | Grant

Date

Present

Value(d)

|

|---|

Lorrie T. Olivier

President and Chief Executive Officer | | 100,000 | | 35.71 | % | $ | 1.50 | | November 17, 2009 | | $ | 64,000 |

Earl W. McNiel

Vice President and Chief Financial Officer | | — | | — | | | — | | — | | | — |

Joseph S. Thornton

Vice President of Operations | | — | | — | | | — | | — | | | — |

Bruce A. Falkenstein

Vice President of Exploration and Geology | | 75,000 | | 26.79 | % | $ | 1.50 | | November 17, 2009 | | $ | 48,000 |

Charles J. Campise

Corporate Controller | | 50,000 | | 17.86 | % | $ | 1.50 | | November 17, 2009 | | $ | 32,000 |

- (a)

- No Stock Appreciation Rights ("SARs") were granted in 2004.

- (b)

- The exercise price equaled the fair market value of the common stock on the date of grant.

- (c)

- The Company uses the Black-Scholes option pricing model to estimate the fair value of stock options granted. The fair value of each option grant was estimated on the date of grant using the following assumptions: risk-free interest rates of 4.5 to 5.0%; expected lives between two and three years; and volatility of the price of the underlying common stock of 41-100%.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END OPTION/SAR VALUES

| |

| |

| | Number of securities underlying unexercised options/SAR's at fiscal

year end

| | Value of in-the-money options/SAR's at

fiscal year end(1)

|

|---|

| | Number of

Shares/SAR's

Acquired on

Exercise

| |

|

|---|

Name

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Lorrie T. Olivier | | — | | $ | — | | — | | 100,000 | | $ | — | | $ | 38,000 |

| Earl W. McNiel | | — | | $ | — | | — | | — | | $ | — | | $ | — |

| Joseph S. Thornton | | — | | $ | — | | — | | — | | $ | — | | $ | — |

| Bruce A. Falkenstein | | 84,211 | (2) | $ | 128,000 | | 150,000 | | 75,000 | | $ | 246,000 | | $ | 28,500 |

| Charles J. Campise | | — | | $ | — | | 50,000 | | 100,000 | | $ | 64,000 | | $ | 83,000 |

- (1)

- The closing price for the Common Stock as reported on the OTC Bulletin Board as of December 31, 2004 was $1.88. Value was calculated on the basis of the difference between the option exercise price and such closing price multiplied by the number of shares of Common Stock underlying the option.

- (2)

- Mr. Falkenstein exercised 100,000 of options on December 7, 2004 utilizing the cashless exercise method. The closing price on the exercise date was $1.52. Value was calculated on the basis of the difference between the option exercise price and such closing price multiplied by the number of shares of Common Stock underlying the option less the forfeited shares for the cashless exercise.

12

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No executive officer of Transmeridian served as a member of the Board of Directors or Compensation Committee of any entity that has one or more executive officers serving on Transmeridian's Board of Directors or Compensation Committee. During 2004, no executive officer or former Executive Officer of Transmeridian voted on any decision relating to compensation matters of the Company.

REPORT ON CHIEF EXECUTIVE COMPENSATION

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate future filings, including this Proxy Statement, in whole or in part, the following reports and the Performance Graph included herein shall not be incorporated by reference into any such filings.

Introduction

The Compensation Committee of the Board of Directors has overall responsibility for approving and evaluating our general compensation policies, as well as the compensation plans and specific compensation levels for executive officers. The Committee strives to ensure that our executive compensation programs will enable us to attract and retain key people and motivate them to achieve or exceed certain of our key objectives by making individual compensation directly dependent on our achievement of certain short and long-term business goals, such as profitability and asset management and by providing rewards for exceeding those goals

Compensation Programs

Base Salary. The Committee establishes base salaries for executive officers at levels which it believes to be competitive with salaries paid for comparable positions at other similarly sized companies as set forth in national and local compensation surveys. Base pay increases vary according to individual contributions to our success and comparisons to similar positions within the company and at other comparable companies.

Stock Options. The Committee believes that stock options provide a key incentive to officers to work towards maximizing stockholder value. These options may be provided through initial grants at or near the date of hire and through subsequent periodic grants. Options granted by us to our executive officers and other employees have exercise prices equal to the fair market value at the time of grant. Options vest and become exercisable at such date or dates as determined by the Board. The initial option grant is designed to be competitive with those of comparable companies for the level of the job that the executive holds and is designed to motivate the officer to make the kind of decisions and implement strategies and programs that will contribute to an increase in our stock price over time. Periodic additional stock options within the comparable range for the job are granted to reflect the executives' ongoing contributions to us, to create an incentive to remain with us and to provide a long-term incentive to achieve or exceed our financial goals. In fiscal 2004, the Compensation Committee awarded options to purchase 555,000 shares of common stock to the directors, executive officers and key employees of the Company at an exercise price of $1.50 per share. These options vest one-third after six months, one-third after 18 months and one-third after 30 months, each as measured from the date of grant.

Stock Compensation Plan. The purpose of the Company's Stock Compensation Plan is to (a) to promote the identity of interests between stockholders, employees, and directors of the Company by encouraging and creating significant ownership of Common Stock of the Company by such officers, employees, and directors of the Company and its subsidiaries; (b) to enable the Company to attract and retain qualified officers, employees and directors who contribute to the Company's success by their ability, ingenuity and industry; (c) to provide meaningful motivation and incentive for officers, employees, and directors who are responsible for the success of the Company and who are in a position to make significant

13

contributions toward its objectives; and (d) to provide a means to compensate officers, employees and directors of the Company as well as to compensate consultants, advisors, and other third parties who provide valuable services for the Company.

Pursuant to the terms and conditions of the Stock Compensation Plan, the Company is authorized to issue shares of Common Stock of the Company under the Plan, including the issuance of the following types of Awards: restricted stock awards, payments of bonuses in stock, payment for services to consultants in stock, warrants, and stock appreciation rights.

Other. In addition to the foregoing, officers participate in compensation plans available to all employees.

Compensation of Chief Executive Officer

The factors considered by the Compensation Committee in determining the compensation of the Chief Executive Officer include our operating and financial performance, as well as his leadership and establishment and implementation of strategic direction for us.

The Compensation Committee considers stock options and compensation under the Company's Stock Compensation Plan to be an important component of the Chief Executive Officer's compensation as a way to reward performance and motivate leadership for long-term growth and profitability. In fiscal 2003, at the request of Mr. Olivier, the Compensation Committee removed his name from consideration for a stock option grant. In fiscal 2004, the Compensation Committee awarded Mr. Olivier options to purchase 100,000 common shares at an exercise price of $1.50 per share. These options vest one-third after six months, one-third after 18 months and one-third after 30 months, each as measured from the date of grant.

Compensation Limitations

Under Section 162(m) of the Internal Revenue Code, adopted in August 1993, and regulations adopted thereunder by the Internal Revenue Service, publicly held companies may be precluded from deducting certain compensation paid to an executive officer in excess of $1.0 million in a year. The regulations exclude from this limit performance-based compensation and stock options provided certain requirements, such as stockholder approval, are satisfied. We plan to take actions, as necessary, to ensure that its stock option plans and executive annual cash bonus plans qualify for exclusion.

Respectively submitted by the

COMPENSATION COMMITTEE |

|

|

/s/ Marvin Carter

Marvin Carter, Chairman |

|

|

/s/ James H. Dorman

James H. Dorman |

|

|

Houston, Texas

April 7, 2005 |

|

|

14

ITEM TWO: RATIFICATION OF APPOINTMENT OF AUDITORS

The Board of Directors has selected John A. Braden & Company, P. C., independent public accountants, to audit the consolidated financial statements of the Company for the year ending December 31, 2005, and recommends that the stockholders ratify such selection. This appointment will be submitted to the stockholders for ratification at the Annual Meeting. Representatives of John A. Braden & Company, P. C. are expected to be present at the meeting and will be afforded the opportunity to make a statement if they desire to do so. The representatives of John A. Braden & Company, P. C. are also expected to be available to respond to appropriate questions.

John A. Braden & Co., P.C. has served as the Company's principal independent accountant since May 15, 2002. Prior to May 15, 2002, Grant Thornton LLP served as the Company's principal independent accountant. On May 15, 2002, the Company notified Grant Thornton LLP that they would no longer be engaged as the Company's principal independent accountants. This decision was recommended by the Company's management and approved by the Company's Audit Committee and Board of Directors. In connection with its audits for the fiscal years ended December 31, 2001 and 2000, there were no disagreements with Grant Thornton LLP on any matters of accounting principles or practices, financial statement disclosures, or auditing scope or procedures. Grant Thornton LLP's reports on the financial statements for each of those fiscal years contained an emphasis paragraph as to uncertainty about the Company's ability to continue as a going concern. In connection with Grant Thornton LLP's audits for the fiscal years ended December 31, 2001 and 2000, there were no "reportable events" (hereinafter defined) requiring disclosure pursuant to Item 304(a)(1)(v) of Regulation S-K. As used herein, the term "reportable events" means any of the items listed in paragraphs (a)(1)(v)(A)-(D) of Item 304 of Regulation S-K.

The Company engaged John A. Braden & Co., P.C. as its new independent accountants effective May 15, 2002. The Braden firm conducted a re-audit of the financial statements for the fiscal years ended December 31, 2001 and 2000 and issued an opinion on those financial statements. This opinion also contained an emphasis paragraph as to uncertainty about the Company's ability to continue as a going concern. During the two years ended December 31, 2001 and the subsequent interim period preceding the decision to change independent accountants, neither Transmeridian nor anyone on its behalf consulted the Braden firm regarding either the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on Transmeridian's consolidated financial statements, nor has the Braden firm provided to Transmeridian a written report or oral advice regarding such principles or audit opinion.

Audit and Non-Audit Fees

In addition to performing the audit of the company's consolidated financial statements, John A. Braden & Co., P.C., provided various other services for the years ended December 31, 2004, 2003 and 2002. The aggregate fees billed for each of the following categories of services are set forth below:

| | 2004

| | 2003

| | 2002

|

|---|

| Audit fees(1) | | $ | 78,795 | | $ | 76,857 | | $ | 76,809 |

| Tax fees(2) | | $ | — | | $ | 4,271 | | $ | 12,674 |

| All other services(3) | | $ | 41,976 | | $ | — | | $ | — |

- (1)

- "Audit fees" represents professional services in connection with the audit of our annual financial statements and review of our quarterly financial statements, advice on accounting matters that arose during the audit and audit services provided in connection with other statutory and regulatory filings.

- (2)

- Represents tax planning.

- (3)

- "All other services" includes evaluating the effects of various accounting issues, registration statement and the Sarbanes-Oxly Act.

15

The Audit Committee has reviewed the non-audit services provided to Transmeridian by John A. Braden & Co., P.C. and has concluded that such services are compatible with the maintenance of that firm's independence in the conduct of its auditing functions for Transmeridian. In accordance with its Charter, the Audit Committee approves in advance all audit and non-audit services to be provided by the Braden firm. During the fiscal year 2004, 100% of the services were pre-approved by the Audit Committee in accordance with this policy.

The submission for ratification of the appointment of John A. Braden & Co., P.C. is not required by law or by the By-Laws of the Company. The Board of Directors is nevertheless submitting it to the stockholders to ascertain their views. If the stockholders do not ratify the appointment, the selection of other independent public accountants will be considered by the Board of Directors. If John A. Braden & Co., P.C. shall decline to accept or become incapable of accepting its appointment, or if its appointment is otherwise discontinued, the Board of Directors will appoint other independent public accountants.

The Board of Directors recommends a voteFOR the ratification of the appointment of John A. Braden & Co., P.C. as independent auditors for the year ending December 31, 2005.

VOTE REQUIRED TO RATIFY THE APPOINTMENT OF JOHN A. BRADEN & COMPANY, P.C. AS INDEPENDENT AUDITORS

The proposal to ratify the appointment of John A. Braden & Co., P.C., as independent auditors for the year ending December 31, 2005, requires the affirmative vote of a majority of the shares having voting power present, in person or represented by proxy at the Annual Meeting. Abstentions and broker non-votes will have the same effect as a vote against the proposal.

ITEM THREE:

PROPOSAL TO AMEND THE COMPANY'S 2003 STOCK COMPENSATION PLAN

The Company's 2003 Stock Compensation Plan (the "Plan") was adopted by the Board of Directors in May 2003. The Plan provides for the issuance of restricted stock awards; payments of bonuses in stock; payment for services to consultants in the form of stock; employer contributions to a 401(k) plan; stock appreciation rights; and warrants up to an aggregate of 2,500,000 shares. As of April 1, 2004, stock awards and restricted stock grants covering an aggregate of 2,359,160 shares have been issued from the Plan. On April 6, 2004 the Board of Directors authorized an amendment to the Plan, subject to stockholder approval, to increase the number of shares authorized for issuance under the Plan by an additional 2,500,000 shares, for a total of 5,000,000 shares authorized under the Plan. A copy of the Amended and Restated 2003 Stock Compensation Plan which increases the number of shares authorized to a total of 5,000,000 shares is attached hereto as Appendix A.

Section 711 of the Company Guide of the American Stock Exchange, the stock exchange on which the Company's Common Stock is listed, requires shareholder approval of any material amendment to any stock option or purchase plan to which options or stock may be acquired by officers, directors, employees, or consultants. The stockholders are being requested to approve this amendment at the Annual Meeting of Stockholders. The last sale price of our Common Stock on April 1, 2004 as reported by American Stock Exchange was $2.47.

The Board of Directors believes that the amendment of the Plan is necessary in order to provide an effective method of recognizing employee contributions to the future advancement of the Company. The Company also believes that its ability to grant stock purchase rights under the Plan is critical to its success in attracting and retaining experienced and qualified employees and remaining competitive in compensation packages compared to surrounding companies. Additionally, given the Company's critical and on-going need to conserve cash for its exploration and production activities and operations, the use of long-term and short-term compensation from stock purchase rights and stock awards are an important form of compensation to conserve cash.

16

The following is a summary description of the 2003 Stock Compensation Plan.

Description of 2003 Stock Compensation Plan

General. The purpose of 2003 Stock Compensation Plan (the "Plan") is (a) to promote the identity of interests between shareholders, employees, and directors of the Company by encouraging and creating significant ownership of Common Stock of the Company by such officers, employees, and directors of the Company and its subsidiaries; (b) to enable the Company to attract and retain qualified officers, employees and directors who contribute to the Company's success by their ability, ingenuity and industry; (c) to provide meaningful motivation and incentive for officers, employees, and directors who are responsible for the success of the Company and who are in a position to make significant contributions toward its objectives; and (d) to provide a means to compensate officers, employees and directors of the Company as well as to compensate consultants, advisors, and other third parties who provide valuable services for the Company.

Administration. The Plan may generally be administered by the Compensation Committee of the Board, or such other Board committee as may be designated by the Board to administer the Plan, or any subcommittee of either; provided, however, that the Committee, and any subcommittee thereof, shall consist of two or more directors (or such lesser number as may be permitted by applicable law or rule), each of whom is a "disinterested person" within the meaning of the applicable provisions of Rule 16b-3 under the Exchange Act.

Eligibility. Awards may be granted only to individuals who are officers, employees (including employees who are also directors), directors and consultants of the Company or a subsidiary; provided, however, that no Award shall be granted to any member of the Committee.

Specific Terms of Awards. Awards may be granted on the terms and conditions set forth in the Plan. In addition, the Committee may impose on any Award or the exercise thereof, at the date of grant or thereafter (subject to Section 10.02 of the Plan), such additional terms and conditions, not inconsistent with the provisions of the Plan, as the Committee shall determine, including without limitation the acceleration of vesting of any Awards or terms requiring forfeiture of Awards in the event of termination of employment by the Participant.

Changes to the Plan. The Board may amend, alter, suspend, discontinue or terminate the Plan without the consent of shareholders or Participants, except that any such amendment, alteration, suspension, discontinuation, or termination shall be subject to the approval of the Company's shareholders within one year after such Board action if such amendment or alteration increases the number of shares reserved for Awards under the Plan, changes the class of Participants eligible to receive Awards under the Plan, or materially increases the benefits to Participants under the Plan, or if such shareholder approval is required by any federal or state law or regulation or the rules of any stock exchange on which the Shares may be listed in order to maintain compliance therewith, or if the Board in its discretion determines that obtaining such shareholder approval is for any reason advisable; provided, however, that, without the consent of an affected Participant, no amendment, alteration, suspension, discontinuation, or termination of the Plan after initial shareholder approval of the Plan may materially impair the rights of such Participant under any Award theretofore granted to him.

The foregoing is only a summary of the Plan. It does not purport to be complete, and does not discuss the tax consequences to any recipient under the United States federal income tax laws or the provisions of the income tax laws of any municipality, state or foreign country in which the recipient may reside.

The approval of the amendment to the Plan requires the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting.

17

THE COMPANY'S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING "FOR" THE AMENDMENT OF THE 2003 STOCK COMPENSATION PLAN AND THE INCREASE OF THE NUMBER OF SHARES RESERVED FOR ISSUANCE THEREUNDER AND APPROVAL OF THE AMENDED AND RESTATED 2003 STOCK COMPENSATION PLAN AS ATTACHED HERETO AS APPENDIX A.

AUDIT COMMITTEE REPORT

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this Report by reference therein.

The Audit Committee is responsible for overseeing our accounting and financial reporting processes and audits of our financial statements. As set forth in its Charter, the Audit Committee acts only in an oversight capacity and relies on the work and assurances of both management, which has primary responsibilities for our financial statements and reports, as well as the independent auditors who are responsible for expressing an opinion on the conformity of our audited financial statements to generally accepted accounting principles.

The Audit Committee met five times either in person or by telephone during fiscal year 2004. In the course of these meetings, the Audit Committee met with management and our independent auditors and reviewed the results of the external audit examinations, evaluations of our internal controls and the overall quality of our financial reporting.

The Audit Committee believes that a candid, substantive and focused dialogue with the independent auditors is fundamental to the Audit Committee's oversight responsibilities. To support this belief, the Audit Committee periodically meets separately with the independent auditors without management present. In the course of its discussions in these meetings, the Audit Committee asked a number of questions intended to bring to light any areas of potential concern related to our financial reporting and internal controls. These questions include:

- •

- Are there any significant accounting judgments, estimates or adjustments made by management in preparing the financial statements that would have been made differently had the auditors themselves prepared and been responsible for the financial statements?

- •

- Based on the auditors' experience, and their knowledge of our business, do our financial statements fairly present to investors, with clarity and completeness, our financial position and performance for the reporting period in accordance with generally accepted accounting principles and SEC disclosure requirements?

- •

- Based on the auditors' experience, and their knowledge of our business, have we implemented internal controls that are appropriate for our business?

The Audit Committee approved the engagement of John A. Braden & Co., P.C. (the "Braden firm") as our independent auditors for fiscal year 2004 and reviewed with the independent auditors their respective overall audit scope and plans. In approving the Braden firm, the Audit Committee considered the qualifications of the Braden firm and discussed with the Braden firm their independence, including a review of the audit and non-audit services provided by them to us. The Audit Committee also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as amended, and by the Sarbanes-Oxley Act of 2002, and it received and discussed with the independent auditors their written report required by Independence Standards Board Standard No. 1.

Management has reviewed the audited financial statements for fiscal year 2004 with the Audit Committee, including a discussion of the quality and acceptability of the financial reporting, the

18

reasonableness of significant accounting judgments and estimates and the clarity of disclosures in the financial statements. In connection with this review and discussion, the Audit Committee asked a number of follow-up questions of management and the independent auditors to help give the Audit Committee comfort in connection with its review.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2004, for filing with the SEC.

Respectively submitted by

THE AUDIT COMMITTEE |

|

|

/s/ George E. Reese

George E. Reese, Chairman |

|

|

/s/ Philip J. McCauley

Philip J. McCauley |

|

|

/s/ J. Fernando Zúñiga y Rivero

J. Fernando Zúñiga y Rivero |

|

|

Houston, Texas

April 7, 2005 |

|

|

19

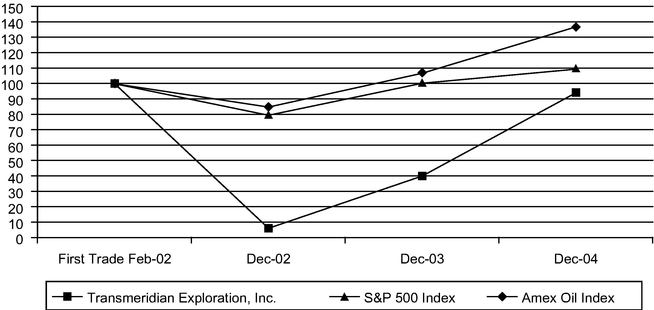

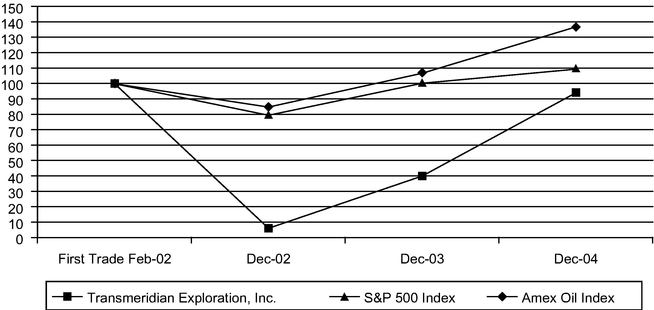

PERFORMANCE OF THE COMMON STOCK

The following performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference the proxy statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that Transmeridian specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

The graph below compares the cumulative total stockholder return on the Common Stock since February 2, 2002 (the date Transmeridian began trading on the OTC Bulletin Board) with the cumulative total return on the S&P 500 Index and the American Stock Exchange Oil Index over the same period (assuming the investment of $100 in the Common Stock, the S&P 500 Index and the American Stock Exchange Oil Index on February 2, 2002, and reinvestment of all dividends).

TransMeridian Exploration, Inc.

Common Stock Trend

February 2002 - December 2004

| | Feb

2002

| | Dec

2002

| | Dec

2003

| | Dec

2004

|

|---|

| Transmeridian Exploration, Inc | | 100.00 | | 6.00 | | 40.00 | | 94.25 |

| S&P 500 Index | | 100.00 | | 79.50 | | 100.47 | | 109.50 |

| Amex Oil Index | | 100.00 | | 84.94 | | 106.94 | | 137.07 |

COMPLIANCE WITH SECTION 16(A) OF THE SECURITIES EXCHANGE ACT OF 1934

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended, the rules promulgated thereunder and the requirements of the NASD, executive officers and directors of the Company and persons who beneficially own more than 10% of the common stock of the Company are required to file with the Securities and Exchange Commission and the NASD and furnish to the Company reports of ownership and change in ownership with respect to all equity securities of the Company.

Based solely on its review of the copies of such reports received by the Company during or with respect to the fiscal year ended December 31, 2004 and/or written representations from such reporting persons, the Company believes that its officers, directors and 10% stockholders complied with all Section 16(a) filing requirements applicable to such individuals, except that Mr. McCauley never filed his

20

original report on Form 3 and Mr. Olivier was late in reporting on a Form 4 one common stock purchase on August 10, 2004. Mr. McCauley's has now filed his From 3 and he did not require filing any Form 4s as his holdings did not change during Fiscal 2004. Mr. Olivier has now reported the one purchase transaction. The Company believes that the late filings were inadvertent.

STOCKHOLDER PROPOSALS FOR 2006 ANNUAL MEETING

Under the SEC's proxy rules, stockholder proposals that meet certain conditions may be included in Transmeridian's proxy statement and form of proxy for a particular annual meeting. Stockholders that intend to present a proposal at Transmeridian's 2006 Annual Meeting of Stockholders must send the proposal to Transmeridian so that it is received at Transmeridian's principal executive offices no later than December 31, 2005, to be considered for inclusion in the proxy statement and form of proxy related to the 2006 Annual Meeting of Stockholders. Stockholders that have an intention to present a proposal that will not be included in the proxy statement and the form of proxy, must give notice to Transmeridian no later than March 15, 2006, of the specific intention to do so. Any and all such proposals and notices should be sent to the attention of the Secretary of Transmeridian. Any and all such proposals must comply with applicable Securities and Exchange Commission regulations in order to be included in Transmeridian's proxy materials or to be presented at the Annual Meeting.

FINANCIAL AND OTHER INFORMATION

The financial statements of Transmeridian have been included as part of the Annual Report of Transmeridian enclosed with this Proxy Statement. The following financial statements and notes thereto, Management's Discussion and Analysis of Financial Condition and Results of Operations and Quantitative and Qualitative Disclosures About Market Risk are incorporated by reference: Form 10-K for the year ended December 31, 2004.

In addition, a representative of John A. Braden & Co., P.C. is expected to be present at the Annual Meeting with the opportunity to make a statement if he desires to do so and to be available to respond to appropriate questions from stockholders.

TRANSMERIDIAN WILL PROVIDE TO EACH PERSON SOLICITED, WITHOUT CHARGE EXCEPT FOR EXHIBITS, UPON REQUEST IN WRITING, A COPY OF ITS ANNUAL REPORT ON FORM 10-K, INCLUDING THE FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULES, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION FOR THE YEAR ENDED DECEMBER 31, 2004. REQUESTS SHOULD BE DIRECTED TO THE SECRETARY, TRANSMERIDIAN EXPLORATION, INC., 397 N. SAM HOUSTON PKWY E., SUITE 300, HOUSTON, TEXAS 77060.

|

|

By Order of the Board of Directors |

|

|

|

|

|

/s/ Earl W. McNiel

Earl W. McNiel

Vice President and Chief Financial Officer |

Houston, Texas

April 7, 2005 |

|

|

21

APPENDIX A

TRANSMERIDIAN EXPLORATION, INC.

AMENDED AND RESTATED 2003 STOCK COMPENSATION PLAN

This Amended and Restated 2003 Stock Compensation Plan amends the 2003 Stock Compensation Plan of Transmeridian Exploration, Inc. to increase the number of shares authorized for issuance under such Plan from 2,500,000 shares to 5,000,000 shares, and otherwise restates the remaining provisions of such Plan, without further amendment, in its entirety.

SECTION 1. PURPOSE.

The purpose of this 2003 Stock Compensation Plan (the "Plan") of Transmeridian Exploration, Inc. (together with any subsidiaries, affiliates or successor thereto, the "Company") is (a) to promote the identity of interests between shareholders, employees, and directors of the Company by encouraging and creating significant ownership of Common Stock of the Company by such officers, employees, and directors of the Company and its subsidiaries; (b) to enable the Company to attract and retain qualified officers, employees and directors who contribute to the Company's success by their ability, ingenuity and industry; (c) to provide meaningful motivation and incentive for officers, employees, and directors who are responsible for the success of the Company and who are in a position to make significant contributions toward its objectives; and (d) to provide a means to compensate officers, employees and directors of the Company as well as to compensate consultants, advisors, and other third parties who provide valuable services for the Company. Certain capitalized terms used in this Agreement are defined either in the body of the Agreement or in Section 12, "Definitions".

Pursuant to the terms and conditions of this Plan, the Company is authorized to issue shares of common stock of the Company, $.0006 par value, under the Plan, including the issuance of the following types of Awards:

- •

- Restricted Stock Awards

- •

- Payments of Bonus Awards in Shares

- •

- Payment for Services to Consultants in Shares

- •

- Employer Contributions to 401-K Plan

- •

- Stock Appreciation Rights

- •

- Warrants to purchase Shares

SECTION 2. SHARES SUBJECT TO THE PLAN.

Subject to adjustment as provided in Section 9, the total number of Shares reserved and available for Awards under the Plan during the term hereof shall be 5,000,000 million shares. For purposes of this Section 2, the number of and time at which Shares shall be deemed to be subject to Awards and therefore counted against the number of Shares reserved and available under the Plan shall be the earliest date at which the Committee can reasonably estimate the number of Shares to be distributed in settlement of an Award or with respect to which payments will be made; provided, however, that, subject to the requirements of Rule 16b-3, the Committee may adopt procedures for the counting of Shares relating to any Award for which the number of Shares to be distributed or with respect to which payment will be made cannot be fixed at the date of grant to ensure appropriate counting, avoid double counting (in the case of tandem or substitute awards), and provide for adjustments in any case in which the number of Shares actually distributed or with respect to which payments are actually made differs from the number of Shares previously counted in connection with such Award.