UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2011

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number0-32255

BALATON POWER INC.

(Exact name of Registrant specified in its charter)

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

Suite 206, 20257 54th Avenue

Langley, British Columbia

Canada V3A 3W2

(Address of principal executive offices)

Contact Person: Paul Preston

Address: Suite 206, 20257 54th Avenue, Langley, British Columbia V3A 3W2

Email: ppreston@shaw.ca

Telephone: (604) 533-5075, Toll Free: 1 (877) 559-5988, Facsimile: (604) 533-5065

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of each exchange on which registered |

| | |

| None | Not applicable |

i

Securities registered or to be registered pursuant to Section 12(g) of the Act:

COMMON SHARES WITHOUT PAR VALUE

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Number of outstanding shares of the Company’s only class of capital or common stock as at December 31, 2011 was 137,846,070 common shares without par value.

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES [ ] NO [X]

If this is an annual report or a transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES [ ] NO [X]

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES [ ] NO [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [X] |

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [X] | International Financial Reporting Standards as issued | Other [ ] |

| | by the International Accounting Standards Board [ ] | |

If “other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow:

Item 17 [ ] Item 18 [ ]

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES [ ] NO [X]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by checkmark whether the Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

YES [ ] NO [ ]N/A

TABLE OF CONTENTS

iv

Glossary

| Term | | Definition |

| | | |

| Annual Report | | This Form 20-F annual report of the Company for the year ended December 31, 2011 |

| | | |

| Amended Option Agreement | | The Company’s amended and restated option agreement with JAL for the Voisey’s Bay West Project dated for reference December 21, 2011 |

| | | |

| Balaton or the Company | | Balaton Power Inc. |

| | | |

| Balco | | Bharat Aluminium Co. |

| | | |

| Bayer Process | | A method of producing alumina from bauxite by heating it in a sodium hydroxide solution |

| | | |

| BRIMAC | | Balaton Remote Integrated Monitoring and Control System |

| | | |

| BSA | | Balaton Power Corporation S.A. |

| | | |

| CDN GAAP | | Generally accepted accounting principles in Canada |

| | | |

| CFC | | Controlled foreign corporation |

| | | |

| CIMM | | Canadian Institute of Mining and Metallurgy |

| | | |

| Code | | Internal Revenue Code |

| | | |

| Committee | | Board of directors of the Company who will be Plan administrators |

| | | |

| COMPL | | Continental Orissa Mining Private Limited |

| | | |

| Continental | | Continental Resources Ltd., a company incorporated under the laws of Québec |

| | | |

| CRA | | Canada Revenue Agency |

| | | |

| CRL | | Continental Resources (USA) Ltd., a wholly-owned subsidiary of the Company |

| | | |

| EDTA | | Ethylene-diamene-tetra-acetic acid technique, industry standard for analyses for radicals |

| | | |

| Essar | | Essar Aluminium Orissa Limited, an Indian resource development corporation |

| | | |

| Essar Agreement | | Agreement between CRL and Essar dated May 8, 2007 |

| | | |

| Exchange Act | | Securities Exchange Act of 1934, as amended (United States) |

| | | |

| FERC | | United States Federal Energy Regulatory Commission |

1

| Term | | Definition |

| | | |

| Gandhamardan Project | | The Company’s mineral project, situated in the Gandhamardan Hills, Duragali, State of Orissa, India |

| | | |

| GSI | | Geological Survey of India |

| | | |

| ICA | | Investment Canada Act |

| | | |

| Investor | | A person who acquires one or more Common Shares of the Company |

| | | |

| IRS | | United States Internal Revenue Service |

| | | |

| ISO Options | | Incentive stock options |

| | | |

| JAL | | JAL Exploration Inc., a British Columbia company |

| | | |

| Joint Venture Agreement | | The joint venture agreement between Continental and OMC dated April 18, 1997 |

| | | |

| MECL | | Mineral Exploration Corp. Ltd., an Indian company |

| | | |

| NQSO Options | | Non-qualified stock options |

| | | |

| ODM | | Orissa Directorate of Mines |

| | | |

| OMC | | Orissa Mining Corporation Limited, an Orissa State owned government corporation |

| | | |

| Option Plan | | The Company’s 2010 incentive stock option plan |

| | | |

| Option Agreement | | The Company’s option agreement with JAL for the Voisey’s Bay West Property dated March 4, 2011 |

| | | |

| Options Right Agreement | | The Company’s purchase of options right agreement with JAL for the Voisey’s Bay West Property dated July 27, 2010, as amended March 3, 2011 |

| | | |

| Permit | | The mining permit issued in the name of OMC for over 285 hectares named Block 7 of the Gandhamardan Project |

| | | |

| Perial | | Perial Ltd., a company incorporated under the laws of the Province of Ontario, and a major shareholder of the Company |

| | | |

| PFIC | | Passive foreign investment companies |

| | | |

| Pisces Process | | Fish protective water inlet device |

| | | |

| Proposed Revised Joint Venture Agreement | | The Proposed Revised Joint Venture Agreement is between CRL and OMC |

| | | |

| QEF | | Qualified electing fund |

2

| Term | | Definition |

| | | |

| SEC | | United States Securities and Exchange Commission |

| | | |

| System | | Low-impact run-of-the-river hydroelectric power production system |

| | | |

| Tax Act | | Income Tax Act(Canada) |

| | | |

| Technical Report | | A report prepared by E.A. Gallo, P. Geo, titled “Summary Report Gandhamardan Bauxite Deposit Sambalpur and Bolangir Districts, State of Orissa, India”, dated April 8, 2003 and amended January 19, 2007, and February 9, 2007 |

| | | |

| Treaty | | Canada-United States Income Tax Convention, 1980 |

| | | |

| US GAAP | | Generally accepted accounting principles in the United States of America |

| | | |

| U.S. Securities Act | | Securities Act of 1933, as amended (United States) |

| | | |

| VISA | | VISA International Ltd., an Indian Company |

| | | |

| Voisey’s Bay West Project (or “Project”) | | The Company’s mineral exploration project, situated on the east coast of north Labrador, Canada |

Resource Category (Classification) Definitions

| Mineral Reserve | The SEC’s Industry Guide 7 – “Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations” defines “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of: |

| | |

| (1)Proven (Measured) Reserves. Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| | |

| (2)Probable (Indicated) Reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| | |

| Mineral Resource | Canadian National Instrument 43-101, “Standards of Disclosure for Mineral Projects” (“NI 43-101”) defines a “Mineral Resource” as a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

3

Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Resource has a lower level of confidence than that applied to an Indicated Resource. An Indicated Resource has a higher level of confidence than an Inferred Resource but has a lower level of confidence than a Measured Resource.

(1)Inferred Resource. That part of the Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

(2)Indicated Resource. That part of the Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

(3)Measured Resource. That part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

The SEC’s Industry Guide 7 – “Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations” does not define or recognize resources. As used in this Annual Report, “resources” are as defined in Canadian NI 43-101.

CAUTIONARY NOTE TO U.S. INVESTORS

CONCERNING ESTIMATES OF MEASURED AND INDICATED RESOURCES

This Annual Report uses the terms “Measured Resources” and “Indicated Resources”. We advise U.S. investors that while these terms are recognized and required by Canadian regulations, the SEC does not recognize them.U.S. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves.

CAUTIONARY NOTE TO U.S. INVESTORS

CONCERNING ESTIMATES OF INFERRED RESOURCES

This Annual Report uses the term “inferred resources”. We advise U.S. investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. Inferred resources have a great amount of uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

4

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are not guarantees of the Company’s future operational or financial performance and are subject to risks and uncertainties. When used in this Annual Report, the words “estimate”, “intend”, “expect”, “anticipate” and similar expressions are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these statements, which speak only as of the date of this Annual Report. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated in such forward-looking statements.

Actual operational and financial results may differ materially from the Company’s expectations contained in the forward-looking statements due to various factors, many of which are beyond the control of the Company. These factors include, but are not limited to, the need for additional financing to pursue the Company’s business plan, risks involved in conducting business outside of the United States, changes in Canadian or U.S. tax or other laws or regulations, material changes in capital expenditures, as well as the risks and uncertainties described in the section entitled “Risk Factors” set forth in Item 3 of this Annual Report.

5

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following selected financial data is derived from and should be read in conjunction with the audited financial statements of the Company for the last five fiscal years ended December 31, 2011, as well as the sections of this Annual Report entitled “Information on the Company” and “Operating and Financial Review and Prospectus”. The financial statements are presented in United States dollars and have been prepared in accordance with US GAAP. Note 2 to the financial statements provides a summary of the material differences between CDN GAAP and US GAAP as they relate to the Company’s financial statements included herein.

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| (US$) | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Balance Sheet Data | | | | | | | | | | | | | | | |

| Total assets (CDN GAAP) | $ | 901,065 | | $ | 436,198 | | $ | 44,904 | | $ | 31,906 | | $ | 144,076 | |

| Total assets (US GAAP) | | 901,065 | | | 436,198 | | | 44,904 | | | 31,906 | | | 144,076 | |

| Total liabilities | | 718,835 | | | 666,584 | | | 679,580 | | | 843,795 | | | 699,017 | |

| Share capital | | 6,630,848 | | | 6,024,026 | | | 5,679,967 | | | 5,537,404 | | | 5,537,404 | |

| Retained earnings (deficit) (CDN GAAP) | | (9,497,858 | ) | | (9,268,874 | ) | | (8,826,957 | ) | | (8,601,003 | ) | | (8,344,055 | ) |

| Retained earnings (deficit) (US GAAP) | | (9,497,858 | ) | | (9,268,874 | ) | | (8,826,957 | ) | | (8,601,003 | ) | | (8,344,055 | ) |

| Period End Balances (as at) | | | | | | | | | | | | | | | |

| Working capital (deficit) | | (640,842 | ) | | (599,690 | ) | | (663,582 | ) | | (840,795 | ) | | (552,335 | ) |

| Resource properties | | 823,072 | | | 369,304 | | | -0- | | | -0- | | | -0- | |

| Shareholders’ equity (deficit) | | 182,230 | | | (230,386 | ) | | (634,676 | ) | | (811,889 | ) | | (554,941 | ) |

| Statement of Operations Data | | | | | | | | | | | | | | | |

| Revenue | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| Production costs | | - | | | - | | | - | | | - | | | - | |

| Write-down of resource properties | | - | | | - | | | - | | | 75,000 | | | 126,176 | |

| General and administrative expenses | | 99,916 | | | 148,400 | | | 86,958 | | | 98,680 | | | 449,488 | |

| Consulting fees and commissions | | 4,000 | | | 11,487 | | | 50,500 | | | - | | | 435,000 | |

| Professional fees | | 101,068 | | | 196,497 | | | 124,512 | | | 83,268 | | | 137,218 | |

6

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| (US$) | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Interest expense | | (24,000 | ) | | (7,276 | ) | | - | | | - | | | - | |

| Stock Base Compensation | | - | | | 78,257 | | | 34,997 | | | - | | | 48,700 | |

| Income (loss) (US GAAP) | | (228,984 | ) | | (441,917 | ) | | (255,954 | ) | | (256,948 | ) | | (1,147,882 | ) |

| Loss per common share (CDN GAAP)1 | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.01 | |

| Loss per common share (US GAAP)1 | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.01 | |

| Number of outstanding shares | | 137,846,070 | | | 123,941,070 | | | 95,726,070 | | | 83,453,737 | | | 83,453,737 | |

Notes:

| (1) | Stock options and warrants outstanding were not included in the computation of diluted loss per share as their inclusion would be anti-dilutive. |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The following provides a discussion of certain risks facing the Company. Additional risks that are currently unknown or that are currently deemed immaterial may also materially adversely affect the Company’s business, results of operations, financial condition and cash flows. You could lose all or part of your investment due to any of these risks.

The Company has no history of earnings and is subject to the risks inherent in a start-up company. The Company has no operating history, no revenues and is subject to all the risks inherent in a start-up business enterprise including lack of cash flow and no source of revenue. The Company has incurred losses since its inception, does not currently generate any revenue from the sale of its products and will require significant additional capital to place any of its projects into production.

The Company will require additional funding to continue operations.Historically, the Company has funded its operations through the sale of equity capital and will require additional funding to continue operations.The Company has had and will continue to have capital requirements in excess of its currently available resources and may not be able to meet its financial commitments as they become due. The Company is dependent on the proceeds of future financing to finance both its operations and those of its wholly-owned subsidiary, CRL. Specifically, the Company is dependent on the proceeds of future financing to finance exploration and future development of the Gandhamardan Project and the Voisey’s Bay West Project. To the extent that any such financing involves the sale of equity capital, the interests of the Company’s then existing shareholders could be substantially diluted. There is no assurance the Company will be successful in raising additional financing.

Very few mineral properties are ultimately developed into producing mines.The business of exploration for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing mines. Most exploration projects do not result in the discovery of commercially mineable deposits of ore. Substantial expenditures will be required for the Company to establish ore reserves through drilling, to develop metallurgical processes, to extract the metal from the ore and to develop the mining and processing facilities and infrastructure at any site chosen for mining.

7

Although substantial benefits may be derived from the discovery of a major mineral deposit, no assurance can be given that the Company will discover minerals in sufficient quantities to justify commercial operations or that the Company can obtain the funds required for development on a timely basis. The economics of developing precious and base metal mineral properties is affected by many factors including the cost of operations, variations in the grade of ore mined, fluctuations in metal markets, costs of processing equipment and other factors such as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection

The loss of any directors or officers would adversely affect the Company. Although none of our directors or officers has any significant technical training or experience in resource exploration or mining, the loss of any directors or officers would adversely affect the results of the Company. The Company is wholly dependent at present upon the personal efforts and abilities of its officers and directors, who exercise control over the day-to-day affairs of the Company. The loss of any director or officer could have an adverse effect on the Company.

The directors and officers of the Company rely on the opinions of consulting geologists that it retains from time to time for specific projects. As a result of management’s lack of formal training in resource exploration, there maybe a higher risk of our being unable to complete our business plan.

The issuance of additional shares would dilute the interests of existing shareholders. The Company is authorized to issue an unlimited number of common shares. On December 31, 2011, the Company had 137,846,070 common shares issued and outstanding. The Board of Directors has the power to issue additional shares and may in the future issue shares to acquire products, equipment or properties, or for other corporate purposes. Any additional issuance by the Company from its authorized but unissued share capital would have the effect of diluting the interest of existing shareholders.

The Company’s officers and directors may be indemnified against certain securities liabilities.The laws of the Province of British Columbia provide that the Company can indemnify any director, officer, agent and/or employee as to those liabilities and on those terms and conditions as are specified in theBritish Columbia Business Corporations Act. Further, the Company may purchase and maintain insurance on behalf of any such persons whether or not the Company has the power to indemnify such person against the liability insured. The foregoing could result in substantial expenditures by the Company and prevent any recovery from such officers, directors, agents and employees for losses incurred by the Company as a result of their actions. The Company has been advised that in the opinion of the SEC, indemnification is against public policy as expressed in theU.S. Securities Act, and is, therefore, unenforceable.

The Company’s management may not be subject to U.S. legal process.As Canadian citizens and residents, certain of the Company’s directors and officers may not be subject to U.S. legal proceedings, a result of which is that recovery on judgments issued by U.S. courts may be difficult or impossible. While reciprocal enforcement of judgment legislation exists between Canada and the U.S., the Company’s insiders may have defences available to avoid, in Canada, the effect of U.S. judgments under Canadian law, making enforcement difficult or impossible. The Company’s management may not have any personal assets available in the U.S. to satisfy judgments of U.S. courts. Therefore, the Company’s shareholders in the United States may have to avail themselves of remedies under Canadian corporate and securities laws for perceived oppression, breach of fiduciary duty and like legal complaints. Canadian law may not provide for remedies equivalent to those available under U.S. law.

8

Exploration and development of natural resources involves a high degree of risk.The Company is required to obtain the approval from the State of Orissa for the agreement with OMC (which has been superseded and replaced with a further Proposed Revised Joint Venture Agreement between CRL and OMC) before it will have the opportunity for exploration and future development of the Gandhamardan Project. Also, the Company will, among other things, be required to obtain various approvals from the government of Newfoundland and Labrador and the Nunatsiavut Government for exploration and future development of the Voisey’s Bay West Project. There can be no assurance that the Company will be able to obtain all necessary licenses and permits that may be required to conduct exploration, development and mining operations at any of the Company’s projects. In addition, as mineral projects near completion, proper permitting and environmental review may be required.

The terms of the Proposed Revised Joint Venture Agreement have been accepted by both CRL and OMC, however such revised agreement remains subject to the approval from the State of Orissa. As of the date of this filing, the Orissa State Government has not authorized OMC to execute the final Proposed Revised Joint Venture Agreement. There can be no assurance the Orissa State Government will authorize OMC to sign the Proposed Revised Joint Venture Agreement on the terms currently prescribed. In the event that OMC does not sign the Proposed Revised Joint Venture Agreement, the Company’s interest in the Gandhamardan Project would be significantly adversely affected. Substantial expenditures are required to conduct pre-feasibility and feasibility work which would include an environmental impact study, obtain Forestry clearances, approval of Mining Plan, secure sites for refinery, power plant, water station, rail and other studies in order to develop the extraction and processing facilities and infrastructure. No assurance can be given that Mineral Resources will be converted to Mineral Reserves, that funds required for the development can be obtained on a timely basis, that funds will be adequate to complete a feasibility study and/or that bauxite can be economically extracted from the Gandhamardan Project.

Even with a combination of experience, knowledge and careful examination, operating hazards and risks may not be mitigated. Operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, development and production of resources, any of which could result in work stoppages, damage to persons or property and possible environmental damage. Although the Company has or will obtain liability insurance in an amount which it considers adequate, the nature of these risks is such that the liabilities might exceed policy limits, the liabilities and hazards might not be insurable against, or the Company might not elect to insure itself against such liabilities due to high premium costs or other reasons, in which event the Company could incur significant costs that could have a material adverse effect upon its financial condition.

Commodity prices fluctuate and are affected by factors beyond the Company’s control. The Company’s revenues, if any, are expected to be in large part derived from future resource efforts including those of CRL’s projects and the Voisey’s Bay West Project. Commodity prices fluctuate and are affected by numerous factors beyond the Company’s control including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to extractive developments and improved extractive production methods. The effect of these factors on the price of bauxite, and therefore the economic viability of the Company’s exploration projects, cannot be accurately predicted.

The Company operates in a highly competitive industry. The resource industry is intensely competitive in all of its phases with numerous companies seeking to explore and develop resource properties. The Company competes with many companies larger than it and possessing greater financial resources and technical facilities. Competition could adversely affect CRL’s ability to explore and develop the Gandhamardan Project and the Company’s ability to explore and develop the Voisey’s Bay West Project.

9

The Company has and may enter into option and joint venture agreements, which will reduce its interests in its projects. The Company has entered into the Amended Option Agreement with JAL relating to the Voisey’s Bay West Project and the Company is subject to various terms and conditions in order to earn any interest in this project. There is no assurance that the Company will be able to meet the terms and conditions of the Amended Option Agreement in order to earn any interest in the Voisey’s Bay West Project.

With regard to the Gandhamardan Project, in order to conserve financial resources, the Company’s efforts are focused on its subsidiary CRL, which intends to enter into option, joint venture, or development agreements to form a consortium to finance the exploration and possible development of this project following obtaining approval from the State Government of Orissa for the Proposed Revised Joint Venture Agreement between OMC and CRL. There is no assurance that OMC or the Government of Orissa will approve CRL’s agreement with any such third party. When such agreements are entered into, CRL’s current interest in the Gandhamardan Project will be reduced and CRL will share with others in the development of the Project. Though CRL currently has entered into such an agreement with VISA, there is no assurance that such a consortium will continue or that it, or any additional consortiums, will be formed on terms favourable to CRL or that the development of the Gandhamardan Project will proceed.

The Company cannot guarantee title to its assets. While the Company has or will receive title opinions for any properties in which it has or will acquire a material interest, such opinions cannot be viewed as a guarantee of title. Title may be affected by unregistered interests and claims to title, which could adversely affect the Company’s ability to develop its properties.

The Company has inadequate working capital. It will be necessary for the Company and/or CRL to raise additional funds this year to move forward on the Gandhamardan Project and the Voisey’s Bay West Project. The Company and/or CRL may be required to raise funds through private placements or public offerings of treasury shares, through debt financing, if available, or sale of a portion of its interest in its projects. If the Company is not successful in raising further funds, it may not be able to further the development of its projects.

The Company is subject to Indian government regulations.CRL is subject to all governmental regulations in India regarding the development of the Gandhamardan Project. The level of regulation by the government in India relating to the project could affect the Company’s ability to obtain partners or consortium members for the development of the Gandhamardan Project.

The Company relies on Indian government agencies and OMC for the development of the Gandhamardan Project.The Company relies heavily on the cooperation of the State Government of Orissa, OMC and other governmental agencies in the finalization of joint venture relationships and the issuance of permits and licenses for the development of the Gandhamardan Project. The Company is dependent upon the Government of Orissa to approve the Proposed Revised Joint Venture Agreement between the Company and OMC and there is no assurance that the Government of Orissa will give such approval. The Company is also dependent upon OMC to approve any agreements between the Company and third parties that relate to the Gandhamardan Project and there is no assurance that OMC will give such approval.

The Company is subject to government policies in India. Activities conducted by residents and nonresidents in India and the flow of investment into the country and the return of capital out of the country are subject to regulation. All such controls and regulations are subject to change from time to time. Any change in government regulation or the economic and political stability of the host country India, could have a material adverse effect on the business of the Company and could impact investments in the Company’s common shares.

10

The Company is subject to government policies in Canada. Activities conducted by the Company in Newfoundland and Labrador are subject to regulation by federal, provincial and aboriginal governments. All such controls and regulations are subject to change from time to time. Any change in government regulation or the economic and political stability could have a material adverse effect on the business of the Company and could impact investments in the Company’s common shares.

Currency exchange rate fluctuations and higher inflation may adversely impact the Company’s future operating results and financial condition.The exchange rate between the Indian Rupee and the U.S. dollar has changed substantially in the last two decades and could fluctuate substantially in the future. On an annual average basis, the Indian Rupee declined against the U.S. dollar from 1980 to 2002. Beginning in May 2002, the Indian Rupee began appreciating relative to the U.S. dollar. On December 31, 2011 the U.S. dollar equalled 53.0222 Indian Rupees. Because some the Company’s assets may be held in Indian Rupees, devaluation or depreciation of the value of the Indian Rupee will adversely affect the value of these assets in foreign currency terms. In addition, the Company’s market valuation could be materially adversely affected by the devaluation of the Indian Rupee if U.S. investors analyze the Company’s value and performance based on the U.S. dollar equivalent of the Company’s financial condition and operating results. The Company expects that a substantial portion of its expenses, including personnel costs, may be denominated in Indian Rupees. As such, any appreciation of the Indian Rupee against the U.S. dollar would reduce the cost advantage derived from the Company’s Indian Rupee-denominated expenses and would likely adversely affect the Company’s financial condition and results of operations. In addition, an increase in inflation would adversely affect world economies generally, which would adversely affect the Company’s business.

The Company is subject to risks of operating in India.A large part of the Company’s assets and business operations could be located in India when the Joint Venture Agreement with OMC becomes effective. The Company has entered into a consortium agreement with an Indian company, VISA, to develop the Gandhamardan Project subject to the Joint Venture Agreement with OMC becoming effective as well as obtaining all other governmental approvals necessary to develop the Gandhamardan Project. Consequently, the Company’s financial performance and the market price of its shares may be affected by social and economic developments in India and the policies of the Government of India, including taxation and foreign investment policies, as well as changes in exchange rates, interest rates and controls.

Political instability related to the current multi-party coalition government could halt or delay the liberalization of the Indian economy and adversely affect economic conditions in India generally. The Government has traditionally exercised and continues to exercise significant influence over many aspects of the economy. The Company’s business, and the market price and liquidity of its shares, may be affected by interest rates, changes in Government policy, taxation, social and civil unrest and other political, economic or other developments in or affecting India. Since 1991, successive Indian governments have pursued policies of economic liberalization, including significantly relaxing restrictions on the private sector. The Company cannot assure you that these liberalization policies will continue in the future. The rate of economic liberalization could change, and specific laws and policies affecting the Company’s business, foreign investment, currency exchange rates and other matters affecting investment in the Company’s securities could change as well. A significant change in India’s economic liberalization and deregulation policies could adversely affect business and economic conditions in India generally, including the Company’s business.

Litigation and disputes may adversely affect the Company’s profitability and financial condition.The Company is, and may be in the future, subject to legal actions and disputes in the ordinary course of its business operations. Legal actions and disputes may arise under contracts, regulations or from a course of conduct taken by the Company. Differences in the legal and judicial system according to region make it difficult to predict the result of litigation or other legal proceedings currently involving the Company or of these which may arise in the future. Although the Company believes that it has adequately reserved in all material aspects for the costs of litigation and regulatory matters, no assurance can be provided that such reserves are sufficient. Given the large or indeterminate amounts of damages sometimes sought, and the inherent unpredictability of litigation and disputes, it is possible that an adverse outcome could have an adverse effect on the Company’s results of operation or cash flows.

11

Recent market events and conditions, including disruptions in the international credit markets and other financial systems and the deterioration of global economic conditions, could impede the Company’s access to capital or increase its cost of capital. Since 2007, the U.S. credit markets experienced serious disruption due to a deterioration in residential property values, defaults and delinquencies in the residential mortgage market and a decline in the value and credit quality of mortgage-backed securities. Other adverse events include delinquencies in non-mortgage consumer credit and a general decline in consumer confidence. These conditions worsened in 2008 and have continued into 2012, contributing to reduced confidence in credit and financial markets around the world and the collapse of, and governmental intervention in, major financial institutions. Asset price volatility and solvency concerns have increased, and there has been less liquidity, a widening of credit spreads, a lack of price transparency, increased credit losses and tighter credit conditions. Notwithstanding various government actions, concerns about the general condition of the capital markets, financial instruments and financial institutions persist, and stock markets have declined substantially.

These market disruptions have had a significant material adverse impact on companies in many sectors of the economy and have limited access to capital and credit. These disruptions could, among other things, make it more difficult for the Company to obtain, or increase the Company’s cost of obtaining, financing for its operations. Failure to raise capital when needed or on reasonable terms may have a material adverse effect on the Company’s business, financial condition and results of operations.

Additionally, these factors, as well as other related factors, may cause decreases in asset values that are deemed to be other than temporary, which may result in impairment losses. If these factors continue, the Company’s operations could be adversely impacted and the trading price of the Common Shares may be adversely affected.

The Company is also exposed to liquidity risks in meeting its operating and capital expenditure requirements in instances where cash positions are unable to be maintained or appropriate financing is unavailable. These factors may impact the ability of the Company to obtain loans and other credit facilities in the future and on favourable terms. If these increased levels of volatility and market turmoil continue, the Company’s operations could be adversely impacted and the trading price of the Common Shares could be adversely affected.

The trading market for our shares is not always liquid.Although the Company’s shares trade on the Over-The-Counter Bulletin Board (“OTC”) of the Financial Industry Regulatory Authority, Inc. (FINRA), the volume of shares traded at any one time can be limited, and, as a result, there may not be a liquid trading market for our shares. The Company also cannot assure you that any other market will be established in the future. The price of the Company’s common stock may be highly volatile and your liquidity may be adversely affected in the future.

Our common stock is thinly traded, so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.There is limited market activity in the Company’s stock and the Company is too small to attract the interest of many brokerage firms and analysts. The Company cannot give any assurance that a broader or more active public trading market for its common stock will develop or be sustained. While the Company is trading on the OTC, our trading volume may be limited by the fact that many major institutional investment funds, including mutual funds, as well as individual investors follow a policy of not investing in OTC stocks and certain major brokerage firms restrict their brokers from recommending OTC stocks because they are considered speculative, volatile, thinly traded and the market price of the common stock may not accurately reflect the Company’s underlying value. The market price of the Company’s common stock could be subject to wide fluctuations in response to quarterly variations in our revenues and operating expenses, announcements of new products or services by us, significant sales of the Company’s common stock, the operating and stock price performance of other companies that investors may deem comparable to us, and news reports relating to trends in our markets or general economic conditions.

12

Our securities may be subject to penny stock and other regulation.The Company’s stock is subject to “penny stock” rules as defined in 1934 Securities and Exchange Act rule 3151-1. The Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. The Company’s common shares are subject to these penny stock rules. Transaction costs associated with purchases and sales of penny stocks are likely to be higher than those for other securities. Penny stocks generally are equity securities with a price of less than U.S. $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

The penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the Company’s common shares in the United States and shareholders may find it more difficult to sell their shares.

In addition, the Company’s stock is subject to British Columbia Instrument 51-509 (Issuers quote in the US Over-The-Counter Markets) (“BCI 51-509”). Among other things, BCI 51-509 places additional disclosure requirements on the Company and also provides for legend requirements on certain share certificates of the Company’s stock. The requirements of BCI 51-509 may impose additional restrictions on the liquidity of the Company’s stock and shareholders may find it more difficult to sell their shares.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development

The Company’s legal and commercial name is Balaton Power Inc. The Company was incorporated under theCompany Act (British Columbia) (now the British ColumbiaBusiness Corporations Act) under the laws of the Province of British Columbia, Canada, on June 25, 1986.

13

The Company’s head office is located at Suite 206, 20257 54th Avenue, Langley, British Columbia, Canada V3A 3W2, Telephone: (604) 533-5075, Toll Free: 1 (877) 559-5988, Facsimile: (604) 533-5065, Email: boxbal@shaw.ca. The Company’s registered office is located at 1500 Royal Centre, 1055 West Georgia Street, P.O. Box 11117, Vancouver, BC V6E 4N7.

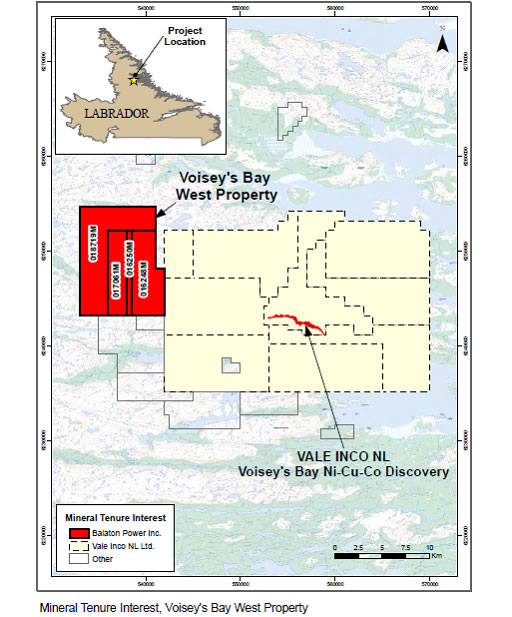

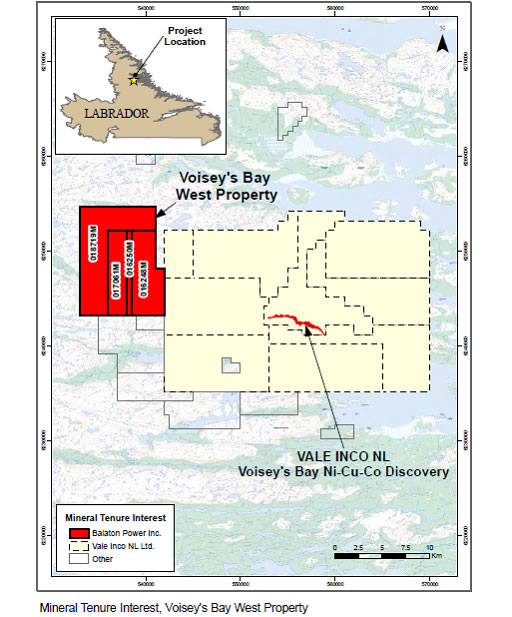

The Company is a mining exploration and development company currently pursuing mineral projects in both India and Canada. The Company’s Indian mineral project is a bauxite deposit in Gandhamardan Hill, Duragali, State of Orissa, India (the “Gandhamardan Project”). The Gandhamardan Project is being developed by the Company’s wholly owned subsidiary, Continental Resources (USA) Ltd. (“CRL”). The Company’s Canadian mineral project is a nickel and copper exploration property in the Voisey’s Bay West area of Labrador (the “Voisey’s Bay West Project”). The Voisey’s Bay West Project is being developed pursuant to the Amended Option Agreement with JAL Exploration Inc. (“JAL”).

The Company is a public company listed on the OTC Bulletin Board, with the stock symbol “BPWRF”.

On September 30, 2002, the Company entered into a Stock Exchange Agreement with Perial Ltd. (“Perial”) for the purchase of CRL. The Company issued a total of 33,000,000 common shares in its own capital to acquire CRL, of which 25,000,000 shares were allocated to Perial and 8,000,000 shares were issued as finder’s fees to non-related parties of the Company. At that time CRL was a joint venture partner with Orissa Mining Corporation (“OMC”), an Indian state-owned corporation, which held an interest in the Gandhamardan Project. The transaction was treated as a capital transaction by the Company and not a business combination. Prior to the transaction, CRL sold all of its oil and gas assets to its then parent company, Perial, for a promissory note in the amount of $481,724 and the assumption of CRL’s outstanding debts. The note is non-interest bearing and is repayable through the payment of a 25% interest in production from the oil and gas assets. Subsequently the 25% interest was converted to a 6.25% override and the value was lowered to $126,176. No revenues were received during 2007 and this interest was written down to zero on December 31, 2007.

At the time of the Company’s acquisition of CRL in 2002, CRL’s sole asset was a 50% interest and effective control of Continental Orissa Mining Private Limited (“COMPL”), a private Indian company which held rights to explore and develop the Gandhamardan Project. OMC held the other 50% interest in COMPL and is a Orissa State owned corporation. During 2004, COMPL was voluntarily dissolved to make way for a new entity that would facilitate future joint venture agreements between CRL and OMC. Since the dissolution of COMPL, CRL and OMC have planned to incorporate a new entity that will direct the development of the Gandhamardan Project. CRL and OMC have submitted a Proposed Revised Joint Venture Agreement to the Orissa Government for approval and upon the effectiveness of such revised agreement will form such an entity. As of the date of this filing, the approval of the Orissa Government for the Proposed Revised Joint Venture Agreement remains outstanding.

Over the past eight years, the Company has focussed on establishing a strong working relationship with OMC. The Company and OMC have discussed exploration and possible development of the Gandhamardan Project, although no written agreement has yet been signed as Indian government approval is still pending and no development or exploration has been done on the Project in recent years. Management has held discussions with potential partners to provide financial and technical resources to assist in the exploration and potential development of the Gandhamardan Project and to aid in the formation of the new entity with OMC, as described further below.

In February of 2005, CRL entered into a consortium agreement (the “ConsortiumAgreement”) with VISA International Ltd. (“VISA”) to assist in the development of the Gandhamardan Project, but in September of 2006 CRL sent a letter to VISA to terminate the Consortium Agreement. VISA subsequently commenced an arbitration in India in relation to CRL’s termination letter.

14

On May 8, 2007, Balaton announced that CRL had entered into an agreement in principle (the “Essar Agreement”) with Essar Aluminum Orissa Limited (“Essar”), an Indian resource development corporation, to develop the Gandhamardan Project and set up an alumina/aluminum complex subject to a feasibility study and applicable approvals. The Essar Agreement was subject to negotiation and execution of a definitive agreement, approval of OMC, and approval by the State of Orissa, India. In the fourth quarter of 2008, Essar served notice to CRL that Essar’s board had not approved Essar entering into a definitive and shareholder agreement with CRL at that time because of the global crisis in commodity and financial markets and CRL’s then unresolved litigation with VISA.

In the fourth quarter of 2008, CRL entered into discussion with VISA in an attempt to resolve the pending litigation between the parties and on September 23, 2009 the parties settled the litigation and revived the 2005 Consortium Agreement mentioned above (see “Legal Proceedings”).

In addition, in April 2009, CRL and Essar entered into a general release whereby Essar released CRL, and CRL released Essar from any previous agreements between the parties. Despite this release, CRL may approach Essar in the future now that it has resolved the litigation with VISA, but at as of the date of this filing, and considering the instability of the global commodity markets, CRL is free to pursue other potential partners for exploration and development for the Gandhamardan Project.

As of the date of this filing, no other agreements other than those referred to above have been entered into with any party by CRL for the exploration and potential development of the Gandhamardan Project.

Prior to the Company becoming involved with the Voisey’s Bay West Project, the above referenced efforts of the Company took substantially all of the time of the Company’s management over the past three years. When the time comes, the Gandhamardan Project will require financing activities to raise funds to further the Project. During the Company’s last three financial years to the date of this filing, the Company has made no principal capital expenditures or divestitures in this project.

On July 27, 2010, Balaton announced that it had entered into an agreement with JAL whereby Balaton purchased the right to enter into a subsequent option agreement to obtain two property options relating to the Voisey’s Bay West Project. During the fall of 2010 the Company commenced exploration operations on the Voisey’s Bay West Project and completed such operations in December 2010, as required by the agreement with JAL.

On March 7, 2011 the Company announced that it had entered into an Option Agreement with JAL to acquire up to an 80% interest in the Voisey’s Bay West Property, subject to a 2% NSR. Further, on June 1, 2011 the Company announced that it had increased its property position at the Voisey’s Bay West Project by purchasing an addition mineral licence from JAL. Finally, on December 21, 2011 the Company reached agreement with JAL to amend the Option Agreement (the“Amended Option Agreement”). As of the date of this filing, Balaton is working towards the further exploration and development of this project.

On October 18, 2011 the Company announced that it entered into an agreement with The Eversull Group, Inc. (the “Eversull Group”) for financial public relations, investor relations and shareholder consulting services. The Eversull Group was established in 1997 and is based in Frisco, Texas. The Eversull Group has been successful in achieving national and international media coverage for its clients. The Eversull Group has also been successful in assisting OTCBB companies to achieve listings on primary stock exchanges. The Eversull Group will assist the Company in developing a strategy to communicate to its shareholders and to the financial investment community.

15

B. Business Overview

The Company’s principal business is focussed on the exploration of the Gandhamardan Project located in the State of Orissa in India through CRL and the exploration of the Voisey’s Bay West Project.

The Company is currently seeking approval from the Government in the State of Orissa to a Proposed Revised Joint Venture Agreement with OMC relating to the Gandhamardan Project. In September of 2009 the Company reinstated the Consortium Agreement from 2005 that it had entered into with VISA and that relates to the Project.

The Company is currently planning operations for further exploration of the Voisey’s Bay West Project.

Gandhamardan Project

On April 18, 1997, Continental entered into an agreement with OMC (the “Joint Venture Agreement”) to form COMPL, a 50-50 joint venture company in the State of Orissa, India, with its primary purpose to explore and develop the Gandhamardan Project. Continental managed the daily operations of COMPL. Under the Joint Venture Agreement, OMC had an option to participate in Continental’s proposed aluminium complex (including refinery, power plant and smelter). OMC had to exercise this option within one year from the date of transfer of leases concerning the Gandhamardan Project, of which such option could be extended by mutual consent. Pursuant to the Joint Venture Agreement, Continental bore all costs associated with the preparation of a feasibility report and exploration of the deposit. In 2002, Continental transferred its interest in the deposit to CRL, an unrelated company, with the result that CRL and OMC became joint venture partners. On September 30, 2002, the Company entered into a Stock Exchange Agreement with Perial for the purchase of CRL in consideration for 33,000,000 common shares (See “Material Contracts”). During 2004, COMPL was voluntarily dissolved at the request of OMC. Currently, CRL and OMC plan to incorporate a new entity that will direct the development of the Gandhamardan Project according to the terms and conditions of a new agreement submitted to the Orissa Government for approval, and as of the date of this filing the approval is still pending.

During 2004, CRL met with OMC to discuss the terms and conditions for a new joint venture agreement to explore and develop the Gandhamardan Project. The Proposed Revised Joint Venture Agreement has been approved by CRL and OMC but is currently awaiting final approval from the Government of Orissa. No assurance can be made that the Government of Orissa will give its approval to such agreement.

During 2005, CRL set up and staffed an office in Bhubaneswar, Orissa and proceeded with the initial start up of the Gandhamardan Project. Included in the staff in the Bhubaneswar office was a geological team that obtained more than 1400 maps and reports covering the Gandhamardan area and had catalogued them with reference numbers for evaluating the top sites for alumina refinery, power plants, railroad spurs, water pipeline and aluminium smelter. Due to the delay in obtaining approvals and the current financial environment, as of date of this filing, the Bhubaneswar office has been closed and no staff are currently retained at that office.

The Company believes that the most efficient way to potentially develop the Gandhamardan Project is through the establishment of a consortium, as it will allow the members to spread the financial burden for building the aluminium complex (see discussion of history of the Company’s and CRL’s efforts in this regard in Item 4A “History and Development”). Currently, the Company has confirmed VISA as a consortium partner and may continue to approach other potential parties in the future. Though CRL has entered into the Consortium Agreement with VISA, there is no assurance that any consortium that the Company is involved with will be successful and there is no security as to what the terms of any future consortium formed will be. If the Company is unable to locate suitable partners, the Company will have to seek additional financing to carry out the Gandhamardan Project.

16

As the Gandhamardan Project is currently preliminary in nature and awaiting numerous approvals from the Government of the State of Orissa:

| | a. | the extent of the permits that must be acquired to conduct the work proposed for the project remains unknown at this time (as the date of this filing, OMC has obtained a mining permit for one of the seven blocks that relate to the project and approval for the remaining six has been submitted to the central government of India), |

| | | |

| | b. | the extent of the environmental liabilities to which the project is subject remains unknown at this time, and |

| | | |

| | c. | subject to any agreements with third parties relating to the project and finalization of the Proposed Revised Joint Venture Agreement, the extent of any royalties, overrides, back-in rights, payments or other agreements and encumbrances to which the project is subject remains unknown at this time. |

Summary Report on Gandhamardan Project

The Gandhamardan Project is summarized in the following information from a report prepared by E.A. Gallo, P. Geo. titled “Summary Report Gandhamardan Bauxite Deposit Sambalpur and Bolangir Districts, State of Orissa, India”, dated April 8, 2003 as amended January 19, 2007, and February 9, 2007 (the “TechnicalReport”). The Technical Report summarizes exploration on the property by past operations, and was prepared and is disclosed by the Company under Canadian securities regulations. The Technical Report has been filed on SEDAR and can be reviewed in its entirety at www.SEDAR.com. E.A. Gallo, a geologist, had worked extensively on the project and had visited the Gandhamardan area and made several trips to India to become knowledgeable on the Gandhamardan area.

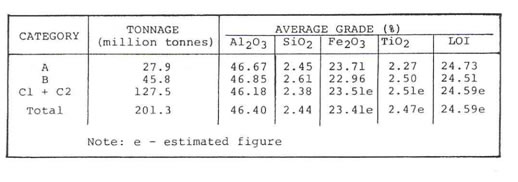

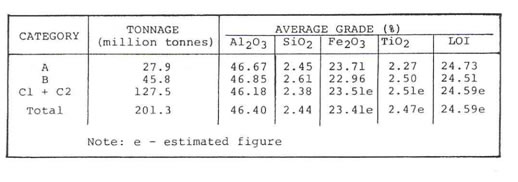

Historical Resource Estimates

The Technical Report sets out resource estimates calculated prior to the Canadian Institute of Mining and Metallurgy (“CIM”) Best Practices Guidelines for Estimation of Mineral Resources and Mineral Reserves and National Instrument 43-101 (“NI 43-101”) and were not performed to CIM standards. The Company has obtained the original data but a qualified person has not done the work necessary to verify the classification of the resource and the Company is not treating it as a NI 43-101 defined resource. It is a historic estimate that should not be relied upon. Moreover, there is no guarantee that further work will result in the delineation of the current mineral resources.

Significant risks are associated with the development of the Gandhamardan Project and the Company’s effort to date can only be considered preliminary in nature. Many factors affect the development of the project including the proximity of the project to rail, roads, water, cost of energy and environmental concerns associated with the development of the project. Based on the preliminary nature of the Company’s efforts, there can be no assurance that the project will be feasible or economically viable. The information provided below relating to the Technical Report has not been updated since last amendment of the Technical Report referenced above.

Introduction And Terms Of Reference

The Technical Report was written at the request of CRL, a subsidiary of the Company. It was written on April 8, 2003, revised on January 15, 2007 and further revised on February 9, 2007.

17

The Gandhamardan bauxite deposit was the focus of an extensive exploration-evaluation program conducted in stages over a number of years by ODM and MECL. A need was recognized to examine and assimilate the technical results of all this work, to draw whatever conclusions might emerge, and to make recommendations regarding any further work that might be warranted. The Technical Report addresses that need.

The prime sources of data utilized in preparing the Technical Report are technical reports written by geologists and engineers employed on the project by ODM and MECL. Information was also obtained from other technical reports, and from discussions held with officials of OMC, MECL, GSI, National Aluminium Company of India, and SNC-Lavalin Inc. As well, the author drew upon observations made during five visits to the area, including three to the property. These three visits lasted a total of 59 days.

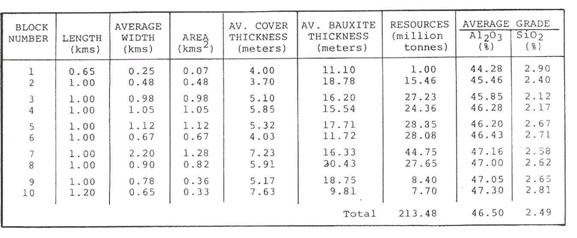

The author has relied heavily on technical reports written by ODM and MECL personnel. These persons are competent, qualified professionals. Nevertheless, occasional minor discrepancies were found in their reports, such as conflicting numbers, typographical errors, and illegible words. Most of the discrepancies involve drill hole sites and pit sites, and they could not be resolved. One of the more bothersome was in the ODM resource calculations. One calculation appears to include Block 10, the other does not, although it is not clear that this is the case. At any rate, Block 10 is one of the smallest blocks, and accounts for only about 3% of the total calculated tonnage. Its inclusion or omission does not change the weighted average grade calculations. The other discrepancies appear to have similar minimal effects on the size, shape, and grade of the bauxite zone, due to the thorough extent of work performed, and to the straight-forward nature of the deposit.

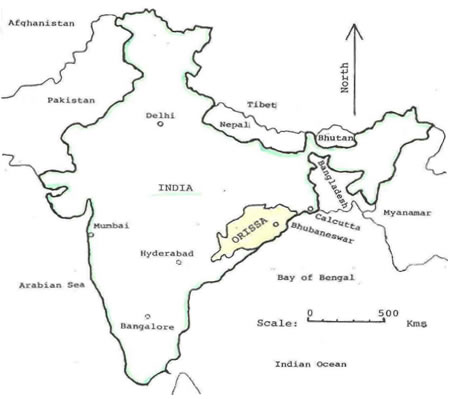

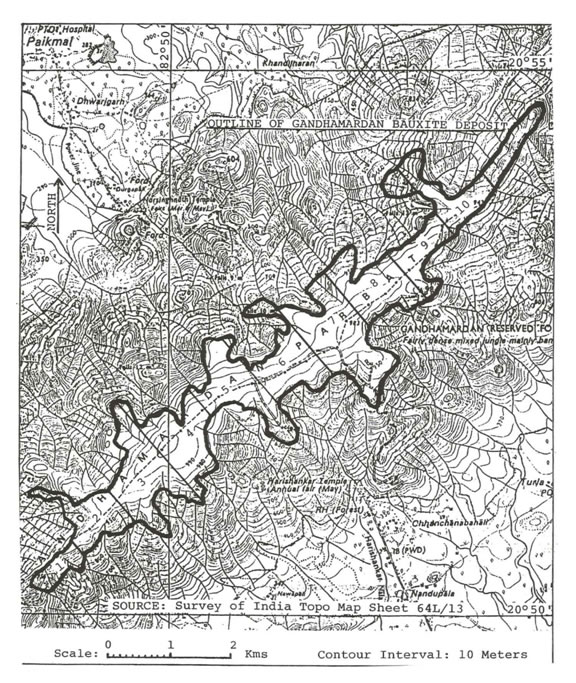

Property Description And Location

The Gandhamardan bauxite deposit occurs at the top of Gandhamardan hill. This hill, which has a plateau top, is linear, aligned in a NE-SW direction. The hill straddles the boundary between Balangir District to the SE, and Sambalpur District to the NW, in the west central part of the State of Orissa, in eastern India.

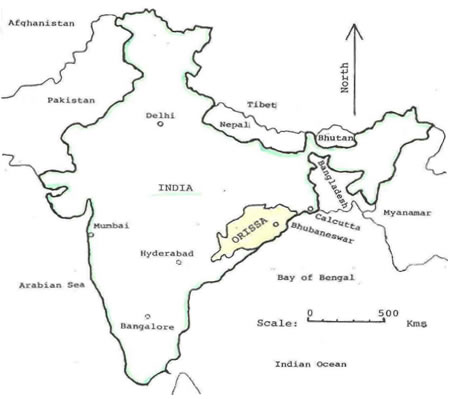

Figure I shows the general location of the State of Orissa in India.

18

Figure I - General Location Sketch

19

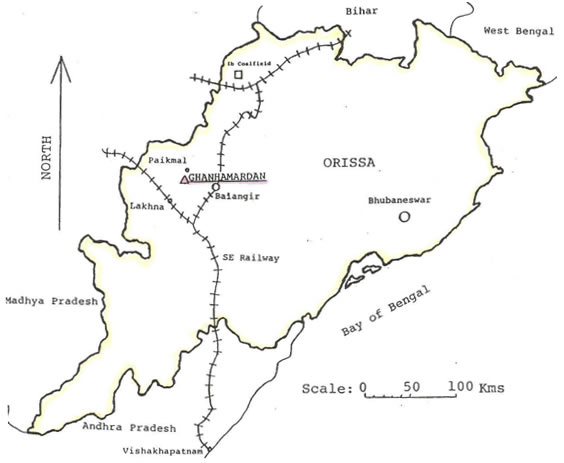

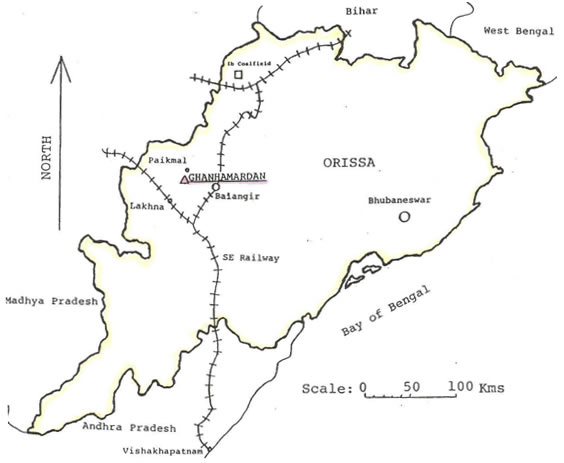

Figure II shows the location of Gandhamardan in the State of Orissa.

Figure II – Location of Gandhamardan in Orissa

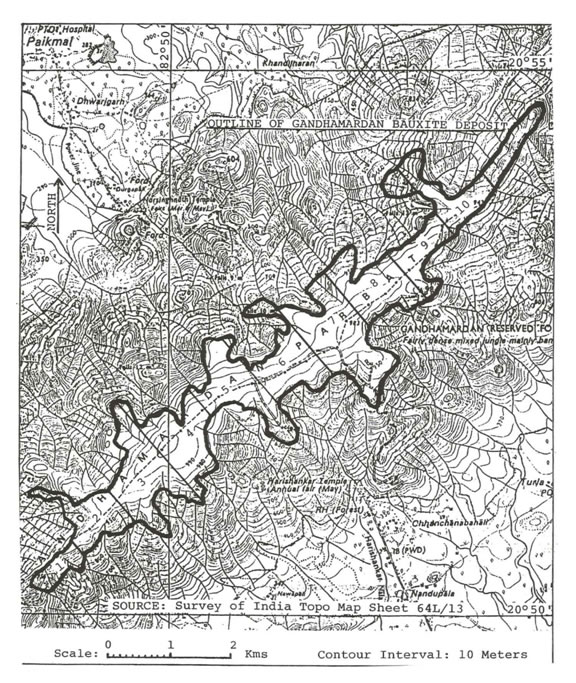

Gandhamardan is bounded by Latitudes 20 50’ and 20 55’ North, and Longitudes 82 45’ and 82 54’ East. It plots on Survey of India topographic sheet NTS 65L/13.

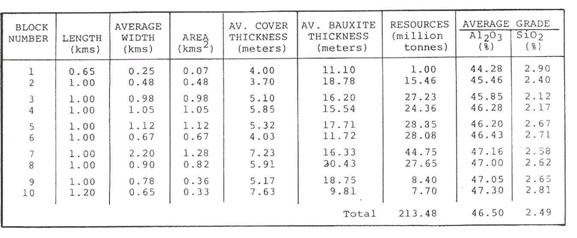

Gandhamardan hill extends in the NE-SW direction for a length of 9.8 kms. Its width ranges from 0.4 to 2.6 kms., and averages 0.75 km. The top of the hill is a plateau, with an areal extent of 7.4 kms2. The bauxite zone covers an area of 735 hectares. Because of its large size and lineal alignment, the deposit has been divided into 10 1-km wide blocks, numbered 1 to 10.

20

Figure III shows the extent of the deposit and the 10 blocks.

Figure III – Gandhamardan Bauxite Deposit Showing Block Divisions

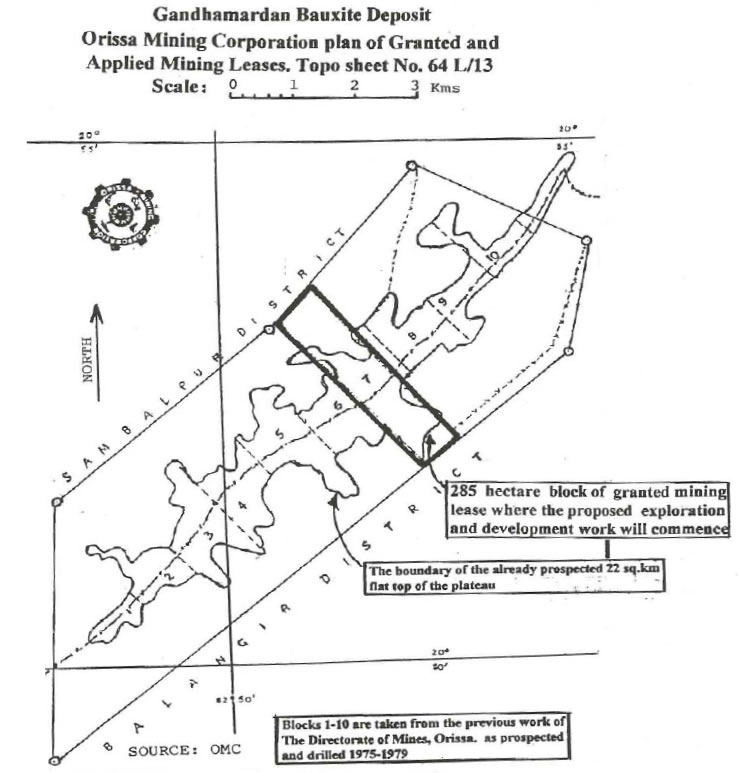

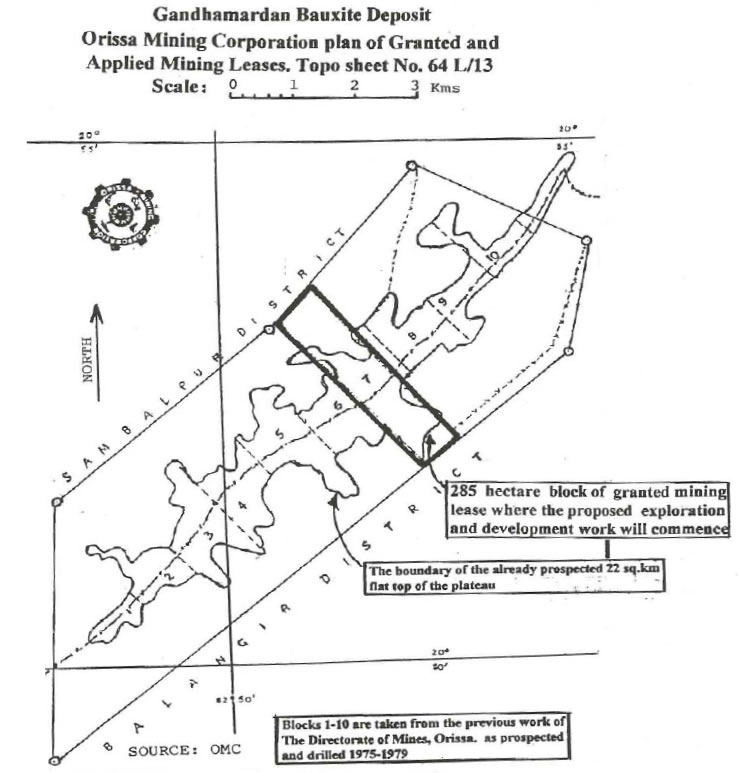

OMC currently holds a mining permit (the “Permit”) on Block 7. The Permit covers an area of 285 hectares, as shown in Figure IV.

21

Figure IV – Granted and Applied Mining Leases

As mentioned above, OMC has applied for mining permits covering the other blocks. A perimeter land survey and other environmental studies must be performed before additional permits are granted.

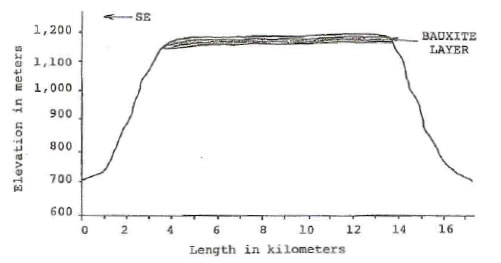

Gandhamardan hill stands approximately 1,200 meters above sea level, and 700 meters above a plain at the base of the hill. The plateau top has a gentle relief of about 50 meters.

Vegetation on the plateau consists primarily of tiger-grass, dwarf palm, chachar, chhena, bantulsi, etc., with small, isolated clumps of stunted hardwood trees such as char and kendu. The stunted trees rarely exceed 4 meters in height.

22

Vegetation on the hill flanks contrast greatly with that on the plateau. The flanks are densely forested by mature hardwood trees such as char, kendu, tenk, and sal. Underbrush consists mainly of bamboo clumps, leafy vines, shrubs, and medicinal herbs.

Gandhamardan hill is a designated Forest Reserve. Indian government regulations permit mining in a designated Forest Reserve provided that another area of equal or greater areal extent is secured and substituted in its stead, and the designation transferred to it. A permit must be granted by the Dept. of Forests to effect such a transfer. The Directorate of Mines has identified 3 potential substitute sites, and has made application to the Dept. of Forests for the necessary permit. Granting of the permit is pending as of the date of this filing.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Gandhamardan Project is easily accessed by 4-wheel drive vehicle along a poorly-maintained road up the NW flank of the hill. This road departs from the village of Duragali, at the base of the hill, and winds 4 kms. to the top. Duragali is connected by the paved road to Paikmal, a town with all modern facilities, including power, water, transportation, communication, food, shelter, supplies, services, and labour. Paikmal is connected by a paved road to the State Capital, Bhubaneswar, about 300 kms. to the E, and to port cities along the Bay of Bengal, equidistant to the SE.

At the time that the exploration work was performed, the hill top could also be accessed up the SE side. This road currently has three wash-outs. After repairs, this road would be navigable by 4-wheel drive vehicles. The SE road is preferable, as it provides a slightly shorter route to the hill top, and access by paved roads southerly to the towns of Lakhna and Nawaspara, 32 and 39 kms. distant, respectively. Both these towns lie along the South Eastern Railway line. This rail line was recently constructed by the Indian Government to facilitate the development of Orissa bauxite deposits by linking them to the port of Vishakhapnam on the Bay of Bengal.

The climate in the Gandhamardan area is sub-tropical, with summer temperatures averaging 33°C, and winter temperatures averaging 18°C. Annual rainfall averages 150 cms., most of it during the monsoon season, between July and August. The months of January and February experience little or no rain. Previously, the monsoon rains came in 3-year cycles, however, they have failed to come for the past several years, resulting in impoverished drought conditions. It is anticipated that the length of operating season for the project will be year round.

Should a mining operation be established, no tailings or wastes would be created, since the bauxite is direct-shipping. The cover of soil and laterite would be moved and stockpiled, then replaced after removal of the bauxite.

As the Gandhamardan Project is currently preliminary in nature and awaiting numerous approvals from the Government of the State of Orissa, the extent of the surface rights necessary for the project to proceed remains uncertain at this time.

History

The potential for bauxite at Gandhamardan was first recognized by the Geological Survey of India (the “GSI”) in the 1940’s, and they recommended that the area be thoroughly prospected.

In 1948, the Orissa Directorate of Mines (the “ODM”) sank several pits, which intersected only laterite.

23

In 1959, ODM identified bauxite at Gandhamardan, and they immediately undertook a programme of exploration and evaluation. GSI and Mineral Exploration Corp. Ltd. (“MECL”), an Indian federal government agency, participated, as did Aluminium Corp. of India, an aluminium producer.

ODM drilled 75 holes in 1959, and reported a resource of 6 million tonnes grading +50% Al2O3 to a depth of 17 meters.This figure does not conform to current NI 43-101 standards, and is classified as a historical estimate.

Subsequent phases of drilling were conducted between 1961 and 1965. In the late 1960’s, Aluminium Corp. of India undertook detailed exploration with MECL, after which MECL reported a resource of 26 million tones of metallurgical grade bauxite, using a cut-off of +46% Al2O3.This figure does not conform to current NI 43-101 standards, and is classified as a historical estimate.

The deposit attracted no further attention until 1975, when the economic potential of the large, low-silica bauxite deposits in the State Orissa became recognized. Bharat Aluminum Co. (“Balco”), an Indian corporation, expressed interest in Gandhamardan as a source of feed for their aluminium plant at Korba, situated 350 kms. by rail to the N, in the adjoining State of Madhya Pradesh. At Balco’s request, an integrated exploration programme was undertaken jointly by MECL, GSI, and ODM. The programme included linecutting, topographic surveying, geological mapping, pitting, drilling, sampling, mineralogical studies, and metallurgical tests.

Balco commissioned a feasibility study on a portion of the deposit in 1980, and upon its conclusion, prepared to bring the deposit into production. Local villagers opposed the project, and Balco finally gave it up.

The property remained idle until 1997, when Continental and OMC agreed to jointly develop it. Continental commissioned SNC-Lavalin to undertake a feasibility study on the deposit, however numerous delays ensued, and the study was never completed. The author of the Technical Report visited the property at this time, and during one of the visits, collected six samples, two from Pit GP-2, and two from each of two scarp sites. The samples were collected in the author of the Technical Report’s presence, and he personally transported them to a Canadian commercial laboratory. Analyses were performed for 12 radicals, including Al2O3, SiO2, Fe2O3, TiO2, and LOI, by x-ray fluorescence, fused-disc method. In 2002, OMC transferred the Agreement from Continental to CRL. There is no connection between the two companies.

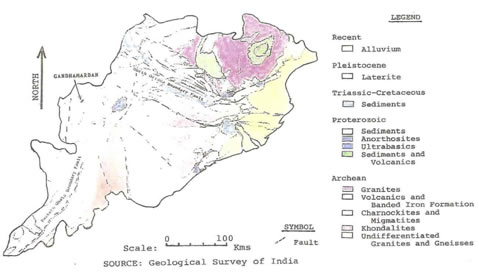

Geological Setting

The general geology of the Orissa region consists primarily of Precambrian rocks of the Indian Shield. These rocks have been divided into four distinct sectors, based on their lithologies and structure. The sectors are named after the geographic region in which they occur – West, South, Coastal, and North Sectors.

The West Sector is where Gandhamardan is located. This sector is underlain primarily by Archean granitic gneisses, khondalites, charnockites, and migmatites. These rocks trend in a general NE-SW direction, gently curving eastward at their northern end. Khondalites are rocks formed by high-grade metamorphism of argillaceous, arenaceous, and calcareous sediments. They are unique to this part of the world, and they host major deposits of bauxite. The West Sector is separated from the South and North Sectors by the Eastern Ghat Boundary Fault and the North Orissa Boundary Fault, respectively.

The South Sector is also underlain predominantly by Archean rocks. They are comprised of marbles, calc-granulites, carbonatites, gneisses, khondalites, and charnockites. This sector is composed of four fault blocks, each with distinct trends. The rocks in two of the blocks trend E-W. Trends in the other two blocks are NE-SW, and NW-SE, respectively. The North Orissa Boundary Fault separates the South Sector from the North Sector.

24

The Coastal Sector is underlain primarily by Quaternary laterite and alluvium. They appear to overlie the eastward extension of the South Sector rocks.

The North Sector is composed mainly of Archean granites and greenstones. The granites occur as large batholiths, and the greenstones as broad, intervening belts. The greenstones are comprised of mafic volcanics and banded iron formation. This assemblage of granites and greenstones is very similar to that which occurs in the Superior Province in NW Ontario. Ultramafic bodies intrude the granites and the volcanics. The western third of the North Sector is underlain by Grenville-type metasediments consisting of marble, quartzite, phyllite, and slate.

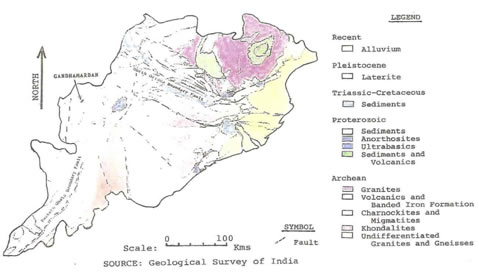

Figure V shows the general geology of the State of Orissa.

The local geology at Gandhamardan and the geology of the property are the same. Both consist exclusively of khondalites, represented by garnetiferous quartz-feldspar-sillimanite gneisses and schists with or without ilmenite and graphite. Subordinate garnetiferous quartzites are also present. The rocks have a pronounced NE-SW strike, conformable to the regional trend, and curve slightly to the east at their northern extremity. The rocks have been tightly folded, and now dip steeply to the SE at 45 to 70°.

Figure V – General Geology of Orissa

Prolonged exposure to the elements has altered the khondalite at the top of Gandhamardan hill, resulting in the formation of bauxite as an extensive layer blanketing the parent rock throughout the plateau.

Deposit Type

The bauxite occurs as a large residual deposit, formed by in situ, subaerial weathering of aluminium-rich rocks (khondalites) under tropical conditions. The deposit blankets the plateau top of a high ridge known as Gandhamardan hill. The bauxite mineralization is continuous and homogeneous, and is analogous to a horizontally-bedded stratigraphic unit.

25

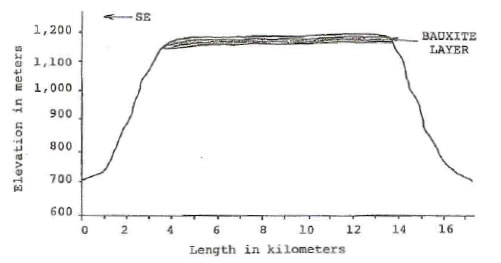

Figure VI is a schematic longitudinal section through Gandhamardan hill depicting the bauxite layer.

Figure VI – Schematic Longitudinal Section Through Gandhamardan

The bauxite is overlain by laterite, and the laterite by a thin, discontinuous layer of lateritic soil. This soil is rusty-red in colour, granular, and high in silca and iron content. It reaches a thickness of up to several centimeters.

The laterite is also rusty-red in colour, and high in silica and iron. The weathered surface is irregular, porous, and craggy. The upper portion of the laterited is hard, reflecting a relatively higher silica content than the lower portion. Iron content also decreases with depth, while aluminous content increases. The laterite varies in thickness from 0.3 to 12.0 meters, and averages 5.0 meters. The laterite grades downwards into bauxite.

The bauxite layer ranges from 4.3 to 35.0 meters in thickness, and averages 16.6 meters. It varies in colour from pinkish-red to yellowish-brown, buff, or brown. It is medium to fine grained, massive and compact. Vesicular and pisolitic textures may be displayed. Hardness varies from 2.5 to 3.5. Banding and foliation are sometimes evident.

Mineralization

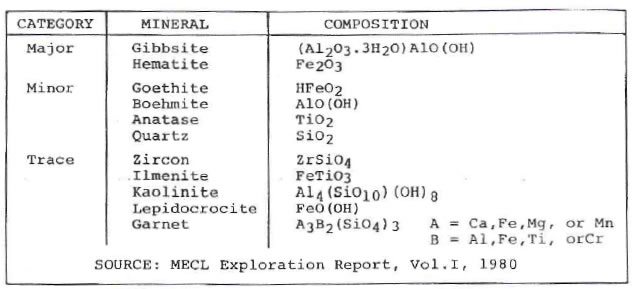

The bauxite is composed mainly of the minerals gibbsite and hematite, which together comprise about 95%. The remaining 5% is a mixture of several oxide minerals in minor and trace amounts.

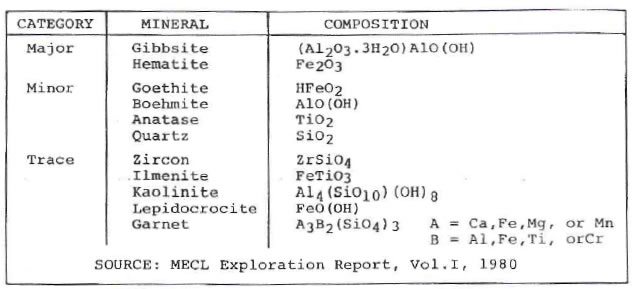

Table I shows the mineralogical composition of bauxite.

26

Table I – Mineralogical Composition of the Bauxite