- CHT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Chunghwa Telecom (CHT) 6-KIndependent Auditors’ Report

Filed: 24 Feb 22, 6:19am

Exhibit 99.2

REPRESENTATION LETTER

The entities that are required to be included in the consolidated financial statements of affiliates in accordance with the “Criteria Governing Preparation of Affiliation Reports, Consolidated Business Reports and Consolidated Financial Statements of Affiliated Enterprises” for the year ended December 31, 2021 are all the same as those included in the consolidated financial statements of Chunghwa Telecom Co., Ltd. and its subsidiaries prepared in conformity with the International Financial Reporting Standard 10 “Consolidated Financial Statements”. Relevant information that should be disclosed in the consolidated financial statements of affiliates is included in the consolidated financial statements of Chunghwa Telecom Co., Ltd. and its subsidiaries. Hence, we do not prepare a separate set of consolidated financial statements of affiliates.

Very truly yours,

CHUNGHWA TELECOM CO., LTD.

| By | /s/ Chi-Mau Sheih | |

| Chi-Mau Sheih | ||

| Chairman |

February 23, 2022

- 1 -

INDEPENDENT AUDITORS’ REPORT

The Board of Directors and Stockholders

Chunghwa Telecom Co., Ltd.

Opinion

We have audited the accompanying consolidated financial statements of Chunghwa Telecom Co., Ltd. and its subsidiaries (The “Company”), which comprise the consolidated balance sheets as of December 31, 2021 and 2020, and the consolidated statements of comprehensive income, changes in equity and cash flows for the years then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as of December 31, 2021 and 2020, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with the Regulations Governing the Preparation of Financial Reports by Securities Issuers, and International Financial Reporting Standards (IFRS), International Accounting Standards (IAS), IFRIC Interpretations (IFRIC), and SIC Interpretations (SIC) endorsed and issued into effect by the Financial Supervisory Commission of the Republic of China.

Basis for Opinion

We conducted our audits in accordance with the Regulations Governing Auditing and Attestation of Financial Statements by Certified Public Accountants and auditing standards generally accepted in the Republic of China. Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Company in accordance with The Norm of Professional Ethics for Certified Public Accountant of the Republic of China, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Key Audit Matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the consolidated financial statements for the year ended December 31, 2021. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

- 2 -

The key audit matter of the consolidated financial statements for the year ended December 31, 2021 is as follows:

Revenue Recognition on Mobile Service

Refer to Notes 3 and 30 to the consolidated financial statements.

The Company’s mobile service revenue consists of subscriber-based charges made up of a significant volume of low-dollar transactions. Because of the complexity and a variety of subscriber-based charges as well as a large number of transactions, the Company uses highly automated systems to process and record its revenue transactions.

Given the Company’s systems to process and record revenue are highly automated, auditing revenue was complex and challenging due to the extent of audit effort required and involvement of professionals with expertise in information technology (IT) necessary for us to identify, test, and evaluate the Company’s IT systems.

Our audit procedures related to the Company’s systems to process revenue transactions included the following, among others:

| • | With the assistance of our IT specialists, we: |

| • | Identified the significant systems used to process revenue transactions and tested the general IT controls over each of these systems, including testing of user access controls and change management controls. |

| • | Performed testing of system interface controls and automated controls within the relevant revenue streams, as well as the controls designed to ensure the accuracy and completeness of revenue. |

| • | We tested internal controls within the relevant revenue business processes, including those in place to reconcile the various systems to the Company’s accounting system. |

| • | We selected samples from mobile service revenue and agreed to customer contracts and records of cash receipts. |

Other Matter

We have also audited the parent company only financial statements of Chunghwa Telecom Co., Ltd. as of and for the years ended December 31, 2021 and 2020 on which we have issued an unmodified opinion.

Responsibilities of Management and Those Charged with Governance for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with the Regulations Governing the Preparation of Financial Reports by Securities Issuers and IFRS, IAS, IFRIC, and SIC endorsed and issued into effect by the Financial Supervisory Commission of the Republic of China, and for such internal control as management determines is necessary to enable the preparation of the consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance, including the audit committee, are responsible for overseeing the Company’s financial reporting process.

- 3 -

Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with the auditing standards generally accepted in the Republic of China will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with the auditing standards generally accepted in the Republic of China, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

| 1. | Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| 2. | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. |

| 3. | Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. |

| 4. | Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’ report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Company to cease to continue as a going concern. |

| 5. | Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

| 6. | Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Company to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision, and performance of the group audit. We remain solely responsible for our audit opinion. |

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

- 4 -

From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial statements for the year ended December 31, 2021, and are therefore the key audit matters. We describe these matters in our auditors’ report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

The engagement partners on the audit resulting in this independent auditors’ report are Dien Sheng Chang and Cheng Hung Kuo.

/s/ Dien Sheng Chang | /s/ Cheng Hung Kuo | |||||

| Deloitte & Touche | ||||||

| Taipei, Taiwan | ||||||

| Republic of China | ||||||

February 23, 2022

Notice to Readers

The accompanying consolidated financial statements are intended only to present the consolidated financial position, financial performance and cash flows in accordance with accounting principles and practices generally accepted in the Republic of China and not those of any other jurisdictions. The standards, procedures and practices to audit such consolidated financial statements are those generally applied in the Republic of China.

For the convenience of readers, the independent auditors’ report and the accompanying consolidated financial statements have been translated into English from the original Chinese version prepared and used in the Republic of China. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese-language independent auditors’ report and consolidated financial statements shall prevail.

- 5 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2021 AND 2020

(In Thousands of New Taiwan Dollars)

| 2021 | 2020 | |||||||||||||||

| Amount | % | Amount | % | |||||||||||||

ASSETS | ||||||||||||||||

CURRENT ASSETS | ||||||||||||||||

Cash and cash equivalents (Notes 3 and 6) | $ | 39,778,624 | 8 | $ | 30,419,655 | 6 | ||||||||||

Financial assets at fair value through profit or loss (Notes 3, 4 and 7) | 2,566 | — | 9,897 | — | ||||||||||||

Hedging financial assets (Notes 3 and 20) | — | — | 1,752 | — | ||||||||||||

Contract assets (Notes 3 and 30) | 5,554,070 | 1 | 5,331,246 | 1 | ||||||||||||

Trade notes and accounts receivable, net (Notes 3, 4, 9, 13 and 30) | 23,947,107 | 5 | 22,621,902 | 5 | ||||||||||||

Receivables from related parties (Note 38) | 41,528 | — | 230,696 | — | ||||||||||||

Inventories (Notes 3, 4, 10 and 39) | 11,327,409 | 2 | 12,408,903 | 3 | ||||||||||||

Prepayments (Note 11) | 2,330,097 | — | 2,306,246 | — | ||||||||||||

Other current monetary assets (Notes 12, 28 and 35) | 5,060,878 | 1 | 6,123,665 | 1 | ||||||||||||

Other current assets (Notes 19, 32 and 39) | 2,978,780 | 1 | 2,349,097 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total current assets | 91,021,059 | 18 | 81,803,059 | 16 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

NONCURRENT ASSETS | ||||||||||||||||

Financial assets at fair value through profit or loss (Notes 3, 4 and 7) | 908,775 | — | 677,202 | — | ||||||||||||

Financial assets at fair value through other comprehensive income (Notes 3, 4, 8 and 35) | 3,615,888 | 1 | 7,193,174 | 2 | ||||||||||||

Investments accounted for using equity method (Notes 3, 14 and 35) | 7,332,774 | 2 | 6,893,001 | 1 | ||||||||||||

Contract assets (Notes 3 and 30) | 2,607,744 | — | 2,495,302 | — | ||||||||||||

Property, plant and equipment (Notes 3, 4, 13, 15, 35, 38 and 39) | 289,100,461 | 56 | 281,415,943 | 56 | ||||||||||||

Right-of-use assets (Notes 3, 4, 16 and 38) | 11,050,936 | 2 | 11,009,206 | 2 | ||||||||||||

Investment properties (Notes 3, 4, 17, 35 and 38) | 9,662,638 | 2 | 9,621,322 | 2 | ||||||||||||

Intangible assets (Notes 3, 4, 13, 18 and 35) | 83,945,083 | 16 | 90,284,560 | 18 | ||||||||||||

Deferred income tax assets (Notes 3, 13 and 32) | 2,785,006 | 1 | 3,132,713 | 1 | ||||||||||||

Incremental costs of obtaining contracts (Notes 3 and 30) | 987,656 | — | 999,593 | — | ||||||||||||

Net defined benefit assets (Notes 3, 4, 13 and 28) | 3,391,077 | 1 | 3,372,555 | 1 | ||||||||||||

Prepayments (Note 11) | 1,798,463 | — | 2,213,521 | — | ||||||||||||

Other noncurrent assets (Notes 19, 35, 39 and 40) | 4,862,800 | 1 | 5,266,841 | 1 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total noncurrent assets | 422,049,301 | 82 | 424,574,933 | 84 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

TOTAL | $ | 513,070,360 | 100 | $ | 506,377,992 | 100 | ||||||||||

|

|

|

|

|

|

|

| |||||||||

LIABILITIES AND EQUITY | ||||||||||||||||

CURRENT LIABILITIES | ||||||||||||||||

Short-term loans (Note 21) | $ | 65,000 | — | $ | 67,000 | — | ||||||||||

Short-term bills payable (Note 22) | — | — | 6,999,198 | 1 | ||||||||||||

Financial liabilities at fair value through profit or loss (Notes 3, 4 and 7) | 6,180 | — | 143 | — | ||||||||||||

Hedging financial liabilities (Notes 3 and 20) | 8,286 | — | — | — | ||||||||||||

Contract liabilities (Notes 3, 30 and 38) | 12,234,276 | 2 | 13,436,706 | 3 | ||||||||||||

Trade notes and accounts payable (Note 25) | 18,063,288 | 4 | 15,590,814 | 3 | ||||||||||||

Payables to related parties (Note 38) | 391,358 | — | 645,944 | — | ||||||||||||

Current tax liabilities (Notes 3 and 32) | 4,593,458 | 1 | 4,369,241 | 1 | ||||||||||||

Lease liabilities (Notes 3, 4, 16, 35 and 38) | 3,210,564 | 1 | 3,381,571 | 1 | ||||||||||||

Other payables (Notes 26 and 35) | 24,436,708 | 5 | 23,987,962 | 5 | ||||||||||||

Provisions (Notes 3, 13 and 27) | 284,813 | — | 313,555 | — | ||||||||||||

Current portion of long-term loans (Notes 23 and 39) | — | — | 1,600,000 | — | ||||||||||||

Other current liabilities | 998,367 | — | 1,042,977 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total current liabilities | 64,292,298 | 13 | 71,435,111 | 14 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

NONCURRENT LIABILITIES | ||||||||||||||||

Long-term loans (Notes 23 and 39) | 1,600,000 | — | — | — | ||||||||||||

Bonds payable (Note 24) | 26,976,675 | 6 | 19,980,272 | 4 | ||||||||||||

Contract liabilities (Notes 3 and 30) | 6,840,056 | 1 | 7,289,087 | 2 | ||||||||||||

Deferred income tax liabilities (Notes 3, 13 and 32) | 2,189,411 | — | 1,966,538 | — | ||||||||||||

Provisions (Notes 3, 13 and 27) | 141,865 | — | 100,616 | — | ||||||||||||

Lease liabilities (Notes 3, 4, 16, 35 and 38) | 7,061,689 | 2 | 6,215,096 | 1 | ||||||||||||

Customers’ deposits (Note 38) | 5,336,343 | 1 | 4,826,679 | 1 | ||||||||||||

Net defined benefit liabilities (Notes 3, 4, 13 and 28) | 2,287,663 | — | 3,415,331 | 1 | ||||||||||||

Other noncurrent liabilities | 5,081,910 | 1 | 1,890,805 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total noncurrent liabilities | 57,515,612 | 11 | 45,684,424 | 9 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total liabilities | 121,807,910 | 24 | 117,119,535 | 23 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

EQUITY ATTRIBUTABLE TO STOCKHOLDERS OF THE PARENT (Notes 13 and 29) | ||||||||||||||||

Common stocks | 77,574,465 | 15 | 77,574,465 | 15 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Additional paid-in capital | 171,279,625 | 33 | 171,261,379 | 34 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Retained earnings | ||||||||||||||||

Legal reserve | 77,574,465 | 15 | 77,574,465 | 15 | ||||||||||||

Special reserve | 2,675,419 | 1 | 2,675,419 | 1 | ||||||||||||

Unappropriated earnings | 50,639,022 | 10 | 47,918,166 | 10 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total retained earnings | 130,888,906 | 26 | 128,168,050 | 26 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Others | (408,150 | ) | — | 927,122 | — | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Total equity attributable to stockholders of the parent | 379,334,846 | 74 | 377,931,016 | 75 | ||||||||||||

NONCONTROLLING INTERESTS (Notes 13 and 29) | 11,927,604 | 2 | 11,327,441 | 2 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total equity | 391,262,450 | 76 | 389,258,457 | 77 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

TOTAL | $ | 513,070,360 | 100 | $ | 506,377,992 | 100 | ||||||||||

|

|

|

|

|

|

|

| |||||||||

The accompanying notes are an integral part of the consolidated financial statements.

- 6 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

YEARS ENDED DECEMBER 31, 2021 AND 2020

(In Thousands of New Taiwan Dollars, Except Earnings Per Share)

| 2021 | 2020 | |||||||||||||||

| Amount | % | Amount | % | |||||||||||||

REVENUES (Notes 3, 30, 38 and 45) | $ | 210,477,948 | 100 | $ | 207,608,998 | 100 | ||||||||||

OPERATING COSTS (Notes 3, 10, 28, 30, 31, 38 and 45) | 135,110,751 | 64 | 137,028,852 | 66 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

GROSS PROFIT | 75,367,197 | 36 | 70,580,146 | 34 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

OPERATING EXPENSES (Notes 3, 9, 28, 31, 38 and 45) | ||||||||||||||||

Marketing | 20,944,091 | 10 | 20,912,848 | 10 | ||||||||||||

General and administrative | 5,293,136 | 2 | 5,005,934 | 2 | ||||||||||||

Research and development | 3,687,747 | 2 | 3,849,999 | 2 | ||||||||||||

Expected credit loss | 142,991 | — | 44,885 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total operating expenses | 30,067,965 | 14 | 29,813,666 | 14 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

OTHER INCOME AND EXPENSES (Notes 15, 16, 17, 18, 31 and 45) | (369,411 | ) | — | 1,595,246 | 1 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

INCOME FROM OPERATIONS | 44,929,821 | 22 | 42,361,726 | 21 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

NON-OPERATING INCOME AND EXPENSES | ||||||||||||||||

Interest income (Note 45) | 94,684 | — | 115,922 | — | ||||||||||||

Other income (Notes 8, 31 and 38) | 377,820 | — | 469,608 | — | ||||||||||||

Other gains and losses (Notes 14, 31, 37 and 38) | 460,830 | — | (152,967 | ) | — | |||||||||||

Interest expense (Notes 16, 31, 38 and 45) | (218,171 | ) | — | (206,063 | ) | — | ||||||||||

Share of profits of associates and joint ventures accounted for using equity method | 421,640 | — | 242,745 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total non-operating income and expenses | 1,136,803 | — | 469,245 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

INCOME BEFORE INCOME TAX | 46,066,624 | 22 | 42,830,971 | 21 | ||||||||||||

INCOME TAX EXPENSE (Notes 3 and 32) | 8,871,745 | 4 | 8,125,428 | 4 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

NET INCOME | 37,194,879 | 18 | 34,705,543 | 17 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

(Continued)

- 7 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

YEARS ENDED DECEMBER 31, 2021 AND 2020

(In Thousands of New Taiwan Dollars, Except Earnings Per Share)

| 2021 | 2020 | |||||||||||||||

| Amount | % | Amount | % | |||||||||||||

TOTAL OTHER COMPREHENSIVE INCOME (LOSS) | ||||||||||||||||

Items that will not be reclassified to profit or loss: | ||||||||||||||||

Remeasurements of defined benefit pension plans (Note 28) | $ | 390,441 | — | $ | 1,193,149 | 1 | ||||||||||

Unrealized gain or loss on investments in equity instruments at fair value through other comprehensive income (Notes 3, 29 and 37) | (1,185,849 | ) | — | 404,955 | — | |||||||||||

Gain or loss on hedging instruments subject to basis adjustment (Notes 3 and 20) | (10,038 | ) | — | 1,425 | — | |||||||||||

Share of remeasurements of defined benefit pension plans of associates and joint ventures | (4,154 | ) | — | (4,282 | ) | — | ||||||||||

Income tax relating to items that will not be reclassified to profit or loss (Note 32) | (78,088 | ) | — | (238,630 | ) | — | ||||||||||

|

|

|

|

|

|

|

| |||||||||

| (887,688 | ) | — | 1,356,617 | 1 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Items that may be reclassified subsequently to profit or loss: | ||||||||||||||||

Exchange differences arising from the translation of the foreign operations | (76,620 | ) | — | (177,149 | ) | — | ||||||||||

Share of exchange differences arising from the translation of the foreign operations of associates and joint ventures (Note 14) | (1,523 | ) | — | (4,289 | ) | — | ||||||||||

Income tax relating to items that may be reclassified subsequently to profit or loss (Note 32) | — | — | (263 | ) | — | |||||||||||

|

|

|

|

|

|

|

| |||||||||

| (78,143 | ) | — | (181,701 | ) | — | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Total other comprehensive income (loss), net of income tax | (965,831 | ) | — | 1,174,916 | 1 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

TOTAL COMPREHENSIVE INCOME | $ | 36,229,048 | 18 | $ | 35,880,459 | 18 | ||||||||||

|

|

|

|

|

|

|

| |||||||||

NET INCOME ATTRIBUTABLE TO | ||||||||||||||||

Stockholders of the parent | $ | 35,753,579 | 17 | $ | 33,406,130 | 16 | ||||||||||

Noncontrolling interests | 1,441,300 | 1 | 1,299,413 | 1 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 37,194,879 | 18 | $ | 34,705,543 | 17 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

(Continued)

- 8 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

YEARS ENDED DECEMBER 31, 2021 AND 2020

(In Thousands of New Taiwan Dollars, Except Earnings Per Share)

| 2021 | 2020 | |||||||||||||||

| Amount | % | Amount | % | |||||||||||||

COMPREHENSIVE INCOME ATTRIBUTABLE TO | ||||||||||||||||

Stockholders of the parent | $ | 34,789,149 | 17 | $ | 34,598,348 | 17 | ||||||||||

Noncontrolling interests | 1,439,899 | 1 | 1,282,111 | 1 | ||||||||||||

|

|

|

|

|

| �� |

|

| ||||||||

| $ | 36,229,048 | 18 | $ | 35,880,459 | 18 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

EARNINGS PER SHARE (Note 33) | ||||||||||||||||

Basic | $ | 4.61 | $ | 4.31 | ||||||||||||

|

|

|

| |||||||||||||

Diluted | $ | 4.60 | $ | 4.30 | ||||||||||||

|

|

|

| |||||||||||||

| The accompanying notes are an integral part of the consolidated financial statements. | (Concluded) |

- 9 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

YEARS ENDED DECEMBER 31, 2021 AND 2020

(In Thousands of New Taiwan Dollars)

| Equity Attributable to Stockholders of the Parent (Notes 13, 20 and 29) | ||||||||||||||||||||||||||||||||||||||||||||

| Others | ||||||||||||||||||||||||||||||||||||||||||||

| Exchange Differences Arising from the Translation of the Foreign Operations | Unrealized Gain or Loss on Financial Assets at Fair Value Through Other Comprehensive Income | Gain or Loss on Hedging Instruments | Noncontrolling | |||||||||||||||||||||||||||||||||||||||||

| Additional Paid-in Capital | Retained Earnings | |||||||||||||||||||||||||||||||||||||||||||

| Common Stocks | Legal Reserve | Special Reserve | Unappropriated Earnings | Total | Total Equity | |||||||||||||||||||||||||||||||||||||||

BALANCE, JANUARY 1, 2020 | $ | 77,574,465 | $ | 171,255,985 | $ | 77,574,465 | $ | 2,675,419 | $ | 46,341,361 | $ | (148,377 | ) | $ | 836,598 | $ | 327 | $ | 376,110,243 | $ | 10,283,522 | $ | 386,393,765 | |||||||||||||||||||||

Appropriation of 2019 earnings | ||||||||||||||||||||||||||||||||||||||||||||

Cash dividends distributed by Chunghwa | — | — | — | — | (32,782,969 | ) | — | — | — | (32,782,969 | ) | — | (32,782,969 | ) | ||||||||||||||||||||||||||||||

Cash dividends distributed by subsidiaries | — | — | — | — | — | — | — | — | — | (775,420 | ) | (775,420 | ) | |||||||||||||||||||||||||||||||

Unclaimed dividend | — | 1,605 | — | — | — | — | — | — | 1,605 | — | 1,605 | |||||||||||||||||||||||||||||||||

Change in additional paid-in capital from investments in associates and joint ventures accounted for using equity method | — | (21,918 | ) | — | — | — | — | — | — | (21,918 | ) | (1,817 | ) | (23,735 | ) | |||||||||||||||||||||||||||||

Change in additional paid-in capital for not proportionately participating in the capital increase of subsidiaries | — | (103 | ) | — | — | — | — | — | — | (103 | ) | 103 | — | |||||||||||||||||||||||||||||||

Net income for the year ended December 31, 2020 | — | — | — | — | 33,406,130 | — | — | — | 33,406,130 | 1,299,413 | 34,705,543 | |||||||||||||||||||||||||||||||||

Other comprehensive income (loss) for the year ended December 31, 2020 | — | — | — | — | 936,958 | (166,154 | ) | 419,989 | 1,425 | 1,192,218 | (17,302 | ) | 1,174,916 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Total comprehensive income (loss) for the year ended December 31, 2020 | — | — | — | — | 34,343,088 | (166,154 | ) | 419,989 | 1,425 | 34,598,348 | 1,282,111 | 35,880,459 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Disposal of investments in equity instruments at fair value through other comprehensive income | — | — | — | — | 16,686 | — | (16,686 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||

Share-based payment transactions of subsidiaries | — | 25,810 | — | — | — | — | — | — | 25,810 | 63,063 | 88,873 | |||||||||||||||||||||||||||||||||

Net increase in noncontrolling interests | — | — | — | — | — | — | — | — | — | 475,879 | 475,879 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

BALANCE, DECEMBER 31, 2020 | 77,574,465 | 171,261,379 | 77,574,465 | 2,675,419 | 47,918,166 | (314,531 | ) | 1,239,901 | 1,752 | 377,931,016 | 11,327,441 | 389,258,457 | ||||||||||||||||||||||||||||||||

Appropriation of 2020 earnings | ||||||||||||||||||||||||||||||||||||||||||||

Cash dividends distributed by Chunghwa | — | — | — | — | (33,403,565 | ) | — | — | — | (33,403,565 | ) | — | (33,403,565 | ) | ||||||||||||||||||||||||||||||

Cash dividends distributed by subsidiaries | — | — | — | — | — | — | — | — | — | (896,335 | ) | (896,335 | ) | |||||||||||||||||||||||||||||||

Unclaimed dividend | — | 1,968 | — | — | — | — | — | — | 1,968 | — | 1,968 | |||||||||||||||||||||||||||||||||

Change in additional paid-in capital from investments in associates and joint ventures accounted for using equity method | — | (437 | ) | — | — | — | — | — | — | (437 | ) | (136 | ) | (573 | ) | |||||||||||||||||||||||||||||

Net income for the year ended December 31, 2021 | — | — | — | — | 35,753,579 | — | — | — | 35,753,579 | 1,441,300 | 37,194,879 | |||||||||||||||||||||||||||||||||

Other comprehensive income (loss) for the year ended December 31, 2021 | — | — | — | — | 311,189 | (77,745 | ) | (1,187,836 | ) | (10,038 | ) | (964,430 | ) | (1,401 | ) | (965,831 | ) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Total comprehensive income (loss) for the year ended December 31, 2021 | — | — | — | — | 36,064,768 | (77,745 | ) | (1,187,836 | ) | (10,038 | ) | 34,789,149 | 1,439,899 | 36,229,048 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Disposal of investments in equity instruments at fair value through other comprehensive income | — | — | — | — | 59,653 | — | (59,653 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||

Share-based payment transactions of subsidiaries | — | 16,715 | — | — | — | — | — | — | 16,715 | 56,735 | 73,450 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

BALANCE, DECEMBER 31, 2021 | $ | 77,574,465 | $ | 171,279,625 | $ | 77,574,465 | $ | 2,675,419 | $ | 50,639,022 | $ | (392,276 | ) | $ | (7,588 | ) | $ | (8,286 | ) | $ | 379,334,846 | $ | 11,927,604 | $ | 391,262,450 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

The accompanying notes are an integral part of the consolidated financial statements.

- 10 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2021 AND 2020

(In Thousands of New Taiwan Dollars)

| 2021 | 2020 | |||||||

CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

Income before income tax | $ | 46,066,624 | $ | 42,830,971 | ||||

Adjustments for: | ||||||||

Depreciation | 31,832,326 | 30,942,330 | ||||||

Amortization | 6,568,547 | 5,424,367 | ||||||

Amortization of incremental costs of obtaining contracts | 815,241 | 771,875 | ||||||

Expected credit loss | 142,991 | 44,885 | ||||||

Interest expense | 218,171 | 206,063 | ||||||

Interest income | (94,684 | ) | (115,922 | ) | ||||

Dividend income | (154,008 | ) | (246,084 | ) | ||||

Compensation cost of share-based payment transactions | 19,371 | 7,578 | ||||||

Share of profits of associates and joint ventures accounted for using equity method | (421,640 | ) | (242,745 | ) | ||||

Loss (gain) on disposal of property, plant and equipment | 3,349 | (1,427,984 | ) | |||||

Gain on disposal of investment properties | — | (151,357 | ) | |||||

Loss on disposal of intangible assets | — | 1,858 | ||||||

Loss (gain) on disposal of financial instruments | (353 | ) | 1,788 | |||||

Gain on disposal of investments accounted for using equity method | (3,239 | ) | (15,946 | ) | ||||

Provision for impairment loss and obsolescence of inventory | 206,824 | 1,161,281 | ||||||

Impairment loss on right-of-use assets | 420,590 | — | ||||||

Reversal of impairment loss on investment properties | (83,429 | ) | (27,066 | ) | ||||

Impairment loss on intangible assets | 28,901 | 9,303 | ||||||

Valuation loss (gain) on financial assets and liabilities at fair value through profit or loss, net | (243,381 | ) | 99,150 | |||||

Others | (132,924 | ) | 3,139 | |||||

Changes in operating assets and liabilities: | ||||||||

Decrease (increase) in: | ||||||||

Contract assets | (335,554 | ) | (202,628 | ) | ||||

Trade notes and accounts receivable | (1,339,250 | ) | 4,071,260 | |||||

Receivables from related parties | 189,168 | (213,862 | ) | |||||

Inventories | 874,670 | 3,915,328 | ||||||

Prepayments | 391,207 | 173,243 | ||||||

Other current monetary assets | (385,757 | ) | 354,739 | |||||

Other current assets | (629,683 | ) | 155,324 | |||||

Incremental cost of obtaining contracts | (803,304 | ) | (828,816 | ) | ||||

Increase (decrease) in: | ||||||||

Contract liabilities | (1,651,461 | ) | (3,289,055 | ) | ||||

Trade notes and accounts payable | 2,468,093 | 21,015 | ||||||

Payables to related parties | (254,586 | ) | (8,039 | ) | ||||

Other payables | 248,112 | (924,186 | ) | |||||

(Continued)

- 11 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2021 AND 2020

(In Thousands of New Taiwan Dollars)

| 2021 | 2020 | |||||||

Provisions | $ | 12,507 | $ | 94,589 | ||||

Other current liabilities | (12,390 | ) | 46,303 | |||||

Net defined benefit plans | (755,749 | ) | (173,970 | ) | ||||

|

|

|

| |||||

Cash generated from operations | 83,205,300 | 82,468,729 | ||||||

Interests paid | (192,064 | ) | (161,251 | ) | ||||

Income taxes paid | (8,155,036 | ) | (7,851,522 | ) | ||||

|

|

|

| |||||

Net cash provided by operating activities | 74,858,200 | 74,455,956 | ||||||

|

|

|

| |||||

CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

Acquisition of financial assets at fair value through other comprehensive income | (313,171 | ) | (85,246 | ) | ||||

Proceeds from disposal of financial assets at fair value through other comprehensive income | 2,911,570 | 297,476 | ||||||

Acquisition of financial assets at fair value through profit or loss | (44,072 | ) | (39,253 | ) | ||||

Proceeds from disposal of financial assets at fair value through profit or loss | 25,201 | 29,741 | ||||||

Acquisition of time deposits and negotiable certificates of deposit with maturities of more than three months | (17,369,138 | ) | (5,215,859 | ) | ||||

Proceeds from disposal of time deposits and negotiable certificates of deposit with maturities of more than three months | 18,446,270 | 6,630,359 | ||||||

Proceeds from disposal of repurchase agreements collateralized by bonds with maturities of more than three months | — | 15,335 | ||||||

Acquisition of investments accounted for using equity method | (329,520 | ) | (10,200 | ) | ||||

Proceeds from disposal of investments accounted for using equity method | 8,519 | — | ||||||

Acquisition of property, plant and equipment | (35,333,028 | ) | (23,510,820 | ) | ||||

Proceeds from disposal of property, plant and equipment | 27,038 | 319,089 | ||||||

Acquisition of intangible assets | (255,852 | ) | (47,605,187 | ) | ||||

Acquisition of investment properties | (146 | ) | (54,435 | ) | ||||

Proceeds from disposal of investment properties | — | 188,300 | ||||||

Decrease (increase) in other noncurrent assets | 336,878 | (207,616 | ) | |||||

Interests received | 95,118 | 124,653 | ||||||

Dividends received | 621,972 | 515,918 | ||||||

Net cash inflow on acquisition of subsidiaries | — | 354,056 | ||||||

|

|

|

| |||||

Net cash used in investing activities | (31,172,361 | ) | (68,253,689 | ) | ||||

|

|

|

| |||||

(Continued)

- 12 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2021 AND 2020

(In Thousands of New Taiwan Dollars)

| 2021 | 2020 | |||||||

CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

Proceeds from short-term loans | $ | 154,000 | $ | 115,000 | ||||

Repayments of short-term loans | (156,000 | ) | (142,000 | ) | ||||

Proceeds from short-term bills payable | 5,000,000 | 41,000,000 | ||||||

Repayments of short-term bills payable | (12,000,000 | ) | (34,000,000 | ) | ||||

Proceeds from issuance of bonds | 7,000,000 | 20,000,000 | ||||||

Payments for transaction costs attributable to the issuance of bonds | (7,675 | ) | (21,038 | ) | ||||

Increase in customers’ deposits | 477,444 | 61,757 | ||||||

Payments for the principal of lease liabilities | (3,728,949 | ) | (3,683,204 | ) | ||||

Increase in other noncurrent liabilities | 3,191,105 | 343,275 | ||||||

Cash dividends paid | (33,403,565 | ) | (32,782,969 | ) | ||||

Cash dividends distributed to noncontrolling interests | (896,335 | ) | (775,420 | ) | ||||

Change in other noncontrolling interests | 54,079 | 81,295 | ||||||

Unclaimed dividend | 1,968 | 1,605 | ||||||

|

|

|

| |||||

Net cash used in financing activities | (34,313,928 | ) | (9,801,699 | ) | ||||

|

|

|

| |||||

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | (12,942 | ) | (30,556 | ) | ||||

|

|

|

| |||||

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 9,358,969 | (3,629,988 | ) | |||||

CASH AND CASH EQUIVALENTS, BEGINNING OF THE YEAR | 30,419,655 | 34,049,643 | ||||||

|

|

|

| |||||

CASH AND CASH EQUIVALENTS, END OF THE YEAR | $ | 39,778,624 | $ | 30,419,655 | ||||

|

|

|

| |||||

| The accompanying notes are an integral part of the consolidated financial statements. | (Concluded) |

- 13 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2021 AND 2020

(In Thousands of New Taiwan Dollars, Unless Stated Otherwise)

| 1. | GENERAL |

Chunghwa Telecom Co., Ltd. (“Chunghwa”) was incorporated on July 1, 1996 in the Republic of China (“ROC”). Chunghwa is a company limited by shares and, prior to August 2000, was wholly owned by the Ministry of Transportation and Communications (“MOTC”). Prior to July 1, 1996, the current operations of Chunghwa were carried out under the Directorate General of Telecommunications (“DGT”). The DGT was established by the MOTC in June 1943 to take primary responsibility in the development of telecommunications infrastructure and to formulate policies related to telecommunications. On July 1, 1996, the telecom operations of the DGT were spun-off as Chunghwa which continues to carry out the business and the DGT continues to be the industry regulator.

Effective August 12, 2005, the MOTC completed the process of privatizing Chunghwa by reducing the government ownership to below 50% in various stages. In July 2000, Chunghwa received approval from the Securities and Futures Commission (the “SFC”) for a domestic initial public offering and its common stocks were listed and traded on the Taiwan Stock Exchange (the “TWSE”) on October 27, 2000. Certain of Chunghwa’s common stocks were sold, in connection with the foregoing privatization plan, in domestic public offerings at various dates from August 2000 to July 2003. Certain of Chunghwa’s common stocks were also sold in an international offering of securities in the form of American Depository Shares (“ADS”) on July 17, 2003 and were listed and traded on the New York Stock Exchange (the “NYSE”). The MOTC sold common stocks of Chunghwa by auction in the ROC on August 9, 2005 and completed the second international offering on August 10, 2005. Upon completion of the share transfers associated with these offerings on August 12, 2005, the MOTC owned less than 50% of the outstanding shares of Chunghwa and completed the privatization plan.

Chunghwa together with its subsidiaries are hereinafter referred to collectively as the “Company”.

The consolidated financial statements are presented in Chunghwa’s functional currency, New Taiwan dollars.

| 2. | APPROVAL OF FINANCIAL STATEMENTS |

The consolidated financial statements were approved by the Board of Directors on February 23, 2022.

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Statement of Compliance

The accompanying consolidated financial statements have been prepared in conformity with the Regulations Governing the Preparation of Financial Reports by Securities Issuers and the International Financial Reporting Standards (IFRS), International Accounting Standards (IAS), International Financial Reporting Interpretations Committee (IFRIC) and SIC Interpretations (SIC) (collectively, the “IFRSs”) endorsed and issued into effect by the Financial Supervisory Commission (the “FSC”) (collectively, the “Taiwan-IFRS”).

- 14 -

Basis of Preparation

The consolidated financial statements have been prepared on the historical cost basis except for certain financial instruments that are measured at fair values and net defined benefit liabilities (assets) which are measured at the present value of the defined benefit obligations less the fair value of plan assets.

Current and Noncurrent Assets and Liabilities

Current assets include:

| a. | Assets held primarily for the purpose of trading; |

| b. | Assets expected to be realized within twelve months after the reporting period; and |

| c. | Cash and cash equivalents unless the asset is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting period. |

Current liabilities include:

| a. | Liabilities held primarily for the purpose of trading; |

| b. | Liabilities due to be settled within twelve months after the reporting period; and |

| c. | Liabilities for which the Company does not have an unconditional right to defer settlement for at least twelve months after the reporting period. |

Assets and liabilities that are not classified as current are classified as noncurrent.

Light Era Development Co., Ltd. (“LED”) engages mainly in development of property for rent and sale. The assets and liabilities of LED related to property development within its operating cycle, which is over one year, are classified as current items.

Basis of Consolidation

| a. | Principles for preparing consolidated financial statements |

The consolidated financial statements incorporate the financial statements of Chunghwa and entities controlled by Chunghwa (its subsidiaries).

Income and expenses of subsidiaries acquired are included in the consolidated statement of comprehensive income from the acquisition date.

When necessary, adjustments are made to the financial statements of subsidiaries to bring their accounting policies in line with those used by the Company.

All inter-company transactions, balances, income and expenses are eliminated in full upon consolidation.

Attribution of total comprehensive income to noncontrolling interests

Total comprehensive income of subsidiaries is attributed to the stockholders of the parent and to the noncontrolling interests even if it results in the noncontrolling interests having a deficit balance.

- 15 -

Changes in the Company’s ownership interests in subsidiaries

Changes in the Company’s ownership interests in subsidiaries that do not result in the Company losing control over the subsidiaries are accounted for as equity transactions. The carrying amounts of the Company’s interests and the noncontrolling interests are adjusted to reflect the changes in their relative interests in the subsidiaries. Any difference between the amount by which the noncontrolling interests are adjusted and the fair value of the consideration paid or received is recognized directly in equity and attributed to stockholders of the parent.

| b. | The subsidiaries in the consolidated financial statements |

The detail information of the subsidiaries at the end of reporting period was as follows:

Percentage of Ownership Interests | ||||||||||||

December 31 | ||||||||||||

| Name of Investor | Name of Investee | Main Businesses and Products | 2021 | 2020 | Note | |||||||

Chunghwa Telecom Co., Ltd. | Senao International Co., Ltd. (“SENAO”) | Handset and peripherals retailer, sales of CHT mobile phone plans as an agent | 28 | 28 | a | ) | ||||||

Light Era Development Co., Ltd. (“LED”) | Planning and development of real estate and intelligent buildings, and property management | 100 | 100 | |||||||||

Donghwa Telecom Co., Ltd. (“DHT”) | International private leased circuit, IP VPN service, and IP transit services | 100 | 100 | b | ) | |||||||

Chunghwa Telecom Singapore Pte., Ltd. (“CHTS”) | International private leased circuit, IP VPN service, and IP transit services | 100 | 100 | |||||||||

Chunghwa System Integration Co., Ltd. (“CHSI”) | Providing system integration services and telecommunications equipment | 100 | 100 | |||||||||

Chunghwa Investment Co., Ltd. (“CHI”) | Investment | 89 | 89 | |||||||||

CHIEF Telecom Inc. (“CHIEF”) | Network integration, internet data center (“IDC”), communications integration and cloud application services | 56 | 56 | c | ) | |||||||

CHYP Multimedia Marketing & Communications Co., Ltd. (“CHYP”) | Digital information supply services and advertisement services | 100 | 100 | |||||||||

Prime Asia Investments Group Ltd. (B.V.I.) (“Prime Asia”) | Investment | 100 | 100 | |||||||||

Spring House Entertainment Tech. Inc. (“SHE”) | Software design services, internet contents production and play, and motion picture production and distribution | 56 | 56 | |||||||||

Chunghwa Telecom Global, Inc. (“CHTG”) | International private leased circuit, internet services, and transit services | 100 | 100 | |||||||||

Chunghwa Telecom Vietnam Co., Ltd. (“CHTV”) | Intelligent energy saving solutions, international circuit, and information and communication technology (“ICT”) services. | 100 | 100 | |||||||||

Smartfun Digital Co., Ltd. (“SFD”) | Providing diversified family education digital services | 65 | 65 | |||||||||

Chunghwa Telecom Japan Co., Ltd. (“CHTJ”) | International private leased circuit, IP VPN service, and IP transit services | 100 | 100 | |||||||||

Chunghwa Sochamp Technology Inc. (“CHST”) | Design, development and production of Automatic License Plate Recognition software and hardware | 51 | 51 | |||||||||

Honghwa International Co., Ltd. (“HHI”) | Telecommunications engineering, sales agent of mobile phone plan application and other business services, etc. | 100 | 100 | |||||||||

Chunghwa Leading Photonics Tech Co., Ltd. (“CLPT”) | Production and sale of electronic components and finished products | 75 | 75 | |||||||||

Chunghwa Telecom (Thailand) Co., Ltd. (“CHTT”) | International private leased circuit, IP VPN service, ICT and cloud VAS services | 100 | 100 | |||||||||

(Continued)

- 16 -

Percentage of Ownership Interests | ||||||||||||

December 31 | ||||||||||||

| Name of Investor | Name of Investee | Main Businesses and Products | 2021 | 2020 | Note | |||||||

CHT Security Co., Ltd. (“CHTSC”) | Computing equipment installation, wholesale of computing and business machinery equipment and software, management consulting services, data processing services, digital information supply services and internet identify services | 77 | 80 | d | ) | |||||||

International Integrated Systems, Inc. (“IISI”) | IT solution provider, IT application consultation, system integration and package solution | 51 | 51 | e | ) | |||||||

Senao International Co., Ltd. | Senao International (Samoa) Holding Ltd. (“SIS”) | International investment | 100 | 100 | f | ) | ||||||

Youth Co., Ltd. (“Youth”) | Sale of information and communication technologies products | 96 | 96 | g | ) | |||||||

Aval Technologies Co., Ltd. (“Aval”) | Sale of information and communication technologies products | 100 | 100 | |||||||||

Senyoung Insurance Agent Co., Ltd. (“SENYOUNG”) | Property and liability insurance agency | 100 | 100 | |||||||||

Youth Co., Ltd. | ISPOT Co., Ltd. (“ISPOT”) | Sale of information and communication technologies products | 100 | 100 | ||||||||

Youyi Co., Ltd. (“Youyi”) | Maintenance of information and communication technologies products | 100 | 100 | |||||||||

Aval Technologies Co., Ltd. | Wiin Technology Co., Ltd. (“Wiin”) | Sale of information and communication technologies products | 100 | 100 | ||||||||

Senyoung Insurance Agent Co., Ltd. | Senaolife Insurance Agent Co., Ltd. (“Senaolife”) | Life insurance services | 100 | 100 | ||||||||

CHIEF Telecom Inc. | Unigate Telecom Inc. (“Unigate”) | Telecommunications and internet service | 100 | 100 | ||||||||

Chief International Corp. (“CIC”) | Telecommunications and internet service | 100 | 100 | |||||||||

Shanghai Chief Telecom Co., Ltd. (“SCT”) | Telecommunications and internet service | 49 | 49 | h | ) | |||||||

Chunghwa Investment Co., Ltd. | Chunghwa Precision Test Tech. Co., Ltd. (“CHPT”) | Production and sale of semiconductor testing components and printed circuit board | 34 | 34 | i | ) | ||||||

Chunghwa Precision Test Tech. Co., Ltd. | Chunghwa Precision Test Tech. USA Corporation (“CHPT (US)”) | Design and after-sale services of semiconductor testing components and printed circuit board | 100 | 100 | j | ) | ||||||

CHPT Japan Co., Ltd. (“CHPT (JP)”) | Related services of electronic parts, machinery processed products and printed circuit board | 100 | 100 | |||||||||

Chunghwa Precision Test Tech. International, Ltd. (“CHPT (International)”) | Wholesale and retail of electronic materials, and investment | 100 | 100 | k | ) | |||||||

Senao International (Samoa) Holding Ltd. | Senao International HK Limited (“SIHK”) | International investment | 100 | 100 | l | ) | ||||||

Senao International HK Limited | Senao International Trading (Shanghai) Co., Ltd. (“SITS”) | Sale of information and communication technologies products | — | 100 | m | ) | ||||||

Prime Asia Investments Group Ltd. (B.V.I.) | Chunghwa Hsingta Co., Ltd. (“CHC”) | Investment | 100 | 100 | ||||||||

(Continued)

- 17 -

Percentage of Ownership Interests | ||||||||||||

December 31 | ||||||||||||

| Name of Investor | Name of Investee | Main Businesses and Products | 2021 | 2020 | Note | |||||||

Chunghwa Hsingta Co., Ltd. | Chunghwa Telecom (China) Co., Ltd. (“CTC”) | Integrated information and communication solution services for enterprise clients, and intelligent energy network service | 100 | 100 | n | ) | ||||||

Chunghwa Precision Test Tech. International, Ltd. | Shanghai Taihua Electronic Technology Limited (“STET”) | Design of printed circuit board and related consultation service | 100 | 100 | ||||||||

Su Zhou Precision Test Tech. Ltd. (“SZPT”) | Assembly processed of circuit board, design of printed circuit board and related consultation service | 100 | 100 | o | ) | |||||||

International Integrated Systems, Inc. | Infoexplorer International Co., Ltd.(“IESA”) | Investment | 100 | 100 | p | ) | ||||||

IISI Investment Co., Ltd. (“IICL”) | Investment | 100 | 100 | p | ) | |||||||

Unitronics Technology Corp. (“UTC”) | Development and maintenance of information system | 99.96 | 99.96 | p | ) | |||||||

Infoexplorer International Co., Ltd. | International Integrated Systems (Hong Kong) Limited (“IEHK”) | Investment and technical consulting service | 100 | 100 | p | ) | ||||||

IISI Investment Co., Ltd. | Leading Tech Co., Ltd. (“LTCL”) | Investment | 100 | 100 | p | ) | ||||||

Leading Tech Co., Ltd. | Leading Systems Co., Ltd. (“LSCL”) | Investment | 100 | 100 | p | ) | ||||||

Leading Systems Co., Ltd. | International Integrated Systems Inc. (Shanghai) (“IISS”) | Development and maintenance of information system | — | 100 | | p q | ) ) | |||||

International Integrated Systems Inc. (Shanghai) | Huiyu Shanghai Management Consultancy Co., Ltd. (“HSMC”) | Development and maintenance of information system | — | — | | p r | ) ) | |||||

(Concluded)

| a) | Chunghwa continues to control six out of eleven seats of the Board of Directors of SENAO through the support of large beneficial stockholders. As a result, the Company treated SENAO as a subsidiary. |

| b) | DHT reduced and returned its capital to its stakeholders in March 2021. The Company’s ownership interest in DHT remained the same. |

| c) | CHIEF issued new shares in March 2020, December 2020, March 2021 and December 2021 as its employees exercised options. Therefore, the Company’s ownership interest in CHIEF decreased to 59.08% and 58.89% as of December 31, 2020 and 2021, respectively. |

| d) | CHTSC issued new shares in February 2021 as its employees exercised options. Therefore, the Company’s ownership interest in CHTSC decreased to 77.46% as of December 31, 2021. |

| e) | Chunghwa obtained 20.38% ownership interest in IISI in July 2020 and Chunghwa’s ownership interest in IISI increased to 51.54% by considering the previously held ownership interest in IISI. Chunghwa obtained over half of the seats of the Board of Directors of IISI; therefore, Chunghwa gained control over IISI and treated it as a subsidiary. IISI issued new shares in September 2020 and January 2021 as its employees exercised options; therefore, the Company’s ownership interest in IISI decreased to 51.20% and 51.02% as of December 31, 2020 and 2021, respectively. |

- 18 -

| f) | SIS reduced and returned its capital to its stakeholders in November 2020 and July 2021. SIS reduced 8.14% and 48.15% of its capital to offset accumulated deficits in February and October 2021, respectively. The Company’s ownership interest in SIS remained the same. |

| g) | SENAO subscribed for all the shares in the capital increase of Youth in April 2020. Therefore, the Company’s ownership interest in Youth increased from 92.89% to 95.79%. |

| h) | CHIEF has two out of three seats of the Board of Directors of SCT according to the mutual agreements among stockholders and gained control over SCT; hence, SCT is deemed as a subsidiary of the Company. |

| i) | Though the Company’s ownership interest in CHPT is less than 50%, the management considered the absolute and relative size of ownership interest, and the dispersion of shares owned by the other stockholders and concluded that the Company has a sufficiently dominant voting interest to direct the relevant activities; hence, CHPT is deemed as a subsidiary of the Company. |

| j) | CHPT increased its investment in CHPT (US) proportionally in August 2021 and the Company’s ownership interest in CHPT (US) remained the same. |

| k) | CHPT increased its investment in CHPT (International) proportionally in April 2021 and the Company’s ownership interest in CHPT (International) remained the same. |

| l) | SIHK reduced and returned its capital to its stakeholders in November 2020 and May 2021. SIHK reduced 8.15% and 47.79% of its capital to offset accumulated deficits in January and August 2021, respectively. The Company’s ownership interest in SIHK remained the same. |

| m) | SITS completed its liquidation in April 2021. |

| n) | CTC was approved to end and dissolve its business in August 2020. The liquidation of CTC is still in process. |

| o) | CHPT (International) increased its investment in SZPT proportionally in July 2021. The Company’s ownership interest in SZPT remained the same. |

| p) | It is a subsidiary of IISI. |

| q) | IISS completed its liquidation in August 2021. |

| r) | HSMC completed its liquidation in December 2020. |

- 19 -

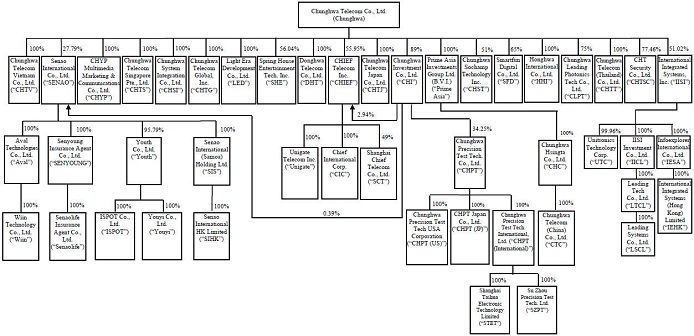

The following diagram presented information regarding the relationship and percentages of ownership interests between Chunghwa and its subsidiaries as of December 31, 2021.

Business Combinations

Acquisitions of businesses are accounted for using the acquisition method. Acquisition-related costs are generally recognized in profit or loss as they are incurred.

Goodwill is measured as the excess of the sum of the consideration transferred and the fair value of the acquirer’s previously held equity interests in the acquiree over the net of the acquisition-date amounts of the identifiable assets acquired and the liabilities assumed.

Noncontrolling interests that are present ownership interests and entitle their holders to a proportionate share of the entity’s net assets in the event of liquidation are measured at the noncontrolling interests’ proportionate share of the recognized amounts of the acquiree’s identifiable net assets.

When a business combination is achieved in stages, the Company’s previously held equity interest in an acquiree is remeasured to fair value at the acquisition date and the resulting gain or loss is recognized in profit or loss. Amounts arising from interests in the acquiree prior to the acquisition date that have previously been recognized in other comprehensive income are recognized on the same basis as would be required had those interests been directly disposed of by the Company.

Foreign Currencies

In preparing the financial statements of each individual entity, transactions in currencies other than the entity’s functional currency (foreign currencies) are recognized at the rates of exchange prevailing at the dates of the transactions.

At the end of each reporting period, monetary items denominated in foreign currencies are retranslated at the rates prevailing at that date. Exchange differences on monetary items arising from settlement or translation are recognized in profit or loss in the period in which they arise.

- 20 -

Non-monetary items carried at fair value that are denominated in foreign currencies are retranslated at the rates prevailing at the date when the fair value was determined and related exchange differences are recognized in profit or loss. Conversely, when the fair value changes were recognized in other comprehensive income, related exchange difference shall be recognized in other comprehensive income.

Non-monetary items that are measured at historical cost in a foreign currency are not retranslated.

For the purpose of presenting consolidated financial statements, the assets and liabilities of the Company’s foreign operations (including those subsidiaries, associates and joint ventures in other countries or currencies used different with Chunghwa) are translated into New Taiwan dollars using exchange rates prevailing at the end of each reporting period. Income and expense items are translated at the average exchange rates for the period. Exchange differences arising, if any, are recognized in other comprehensive income and attributed to stockholders of the parent and noncontrolling interests as appropriate.

Cash Equivalents

Cash equivalents include those maturities within three months from the date of acquisition, highly liquid, readily convertible to a known amount of cash and are subject to an insignificant risk of changes in value such as commercial papers, negotiable certificates of deposit, time deposits, repurchase agreements collateralized by bonds and stimulus vouchers. These cash equivalents are held for the purpose of meeting short-term cash commitments.

Inventories

Inventories are stated at the lower of cost or net realizable value item by item, except for those that may be appropriate to group items of similar or related inventories. Net realizable value is the estimated selling price of inventories less all estimated costs of completion and costs necessary to make the sale. The calculation of the cost of inventory is derived using the weighted-average method.

Buildings and Land Consigned to Construction Contractors

Inventories of LED are stated at the lower of cost or net realizable value item by item, except for those that may be appropriate to group as similar items or related inventories. Land acquired before construction is classified as land held for development and then reclassified as land held under development after LED begins its construction project.

Upon the completion of the construction project, LED recognizes revenues in the amount of proceeds from customers for land and buildings and related costs when ownership is transferred to the customers. The unsold portion of the completed construction project is transferred to land and building held for sale.

Investments in Associates and Joint Ventures

An associate is an entity over which the Company has significant influence and that is neither a subsidiary nor an interest in a joint venture. A joint venture is a joint arrangement whereby the Company and other parties that have joint control of the arrangement have rights to the net assets of the arrangement.

Investments accounted for using the equity method include investments in associates and interests in joint ventures. Under the equity method, an investment in an associate and a joint venture is initially recognized at cost and adjusted thereafter to recognize the Company’s share of profit or loss and other comprehensive income of the associate and joint venture as well as the distribution received. The Company also recognizes its share in changes in the associates and joint ventures.

- 21 -

When the Company subscribes for new shares of an associate and a joint venture at a percentage different from its existing ownership percentage, the resulting carrying amount of the investment differs from the amount of the Company’s proportionate interest in the associate and joint venture. The Company records such a difference as an adjustment to investments with the corresponding amount charged or credited to additional paid-in capital. When the adjustment should be debited to additional paid-in capital but the additional paid-in capital recognized from investments accounted for using equity method is insufficient, the shortage is debited to retained earnings.

Any excess of the cost of acquisition over the Company’s share of the fair value of the identifiable net assets and liabilities of an associate and a joint venture at the date of acquisition is recognized as goodwill, which is included within the carrying amount of the investment and shall not be amortized. Any excess of the Company’s share of the net fair value of the identifiable assets and liabilities over the cost of acquisition is recognized immediately in profit or loss.

The entire carrying amount of an investment (including goodwill) is tested for impairment as a single asset by comparing its recoverable amount with its carrying amount. Any impairment loss recognized is not allocated to any asset, including goodwill, that forms part of the carrying amount of the investment. Any reversal of that impairment loss is recognized to the extent that the recoverable amount of the investment subsequently increases.

The Company discontinues the use of the equity method from the date on which its investment ceases to be an associate and a joint venture. Any retained investment is measured at fair value at that date, and the fair value is regarded as the investment’s fair value on initial recognition as a financial asset. The difference between the previous carrying amount of the associate and joint venture attributable to the retained interest and its fair value is included in the determination of the gain or loss on disposal of the associate and joint venture. The Company accounts for all amounts previously recognized in other comprehensive income in relation to that associate and joint venture on the same basis as would be required had that associate and joint venture directly disposed of the related assets or liabilities.

When the Company transacts with its associate and joint venture, profits and losses resulting from the transactions with the associate and joint venture are recognized in the Company’s consolidated financial statements only to the extent of interests in the associate and joint venture that are not related to the Company.

Property, Plant and Equipment

Property, plant and equipment are initially measured at cost and subsequently measured at cost less accumulated depreciation and accumulated impairment loss.

Property, plant and equipment in the course of construction are depreciated and classified to the appropriate categories of property, plant and equipment when completed and ready for their intended use.

Depreciation on property, plant and equipment is recognized using the straight-line method. Each significant part is depreciated separately. Freehold land is not depreciated. The estimated useful lives, residual values and depreciation method are reviewed at the end of each year, with the effect of any changes in estimate accounted for on a prospective basis.

On derecognition of an item of property, plant and equipment, the difference between the net disposal proceeds and the carrying amount of the asset is recognized in profit or loss in the period in which the property is derecognized.

- 22 -

Investment Properties

Investment properties are properties held to earn rentals and/or for capital appreciation. Investment properties also include land held for a currently undetermined future use.

Investment properties are measured initially at cost, including transaction costs. Subsequent to initial recognition, investment properties are measured at cost less accumulated depreciation and accumulated impairment loss. Depreciation is recognized using the straight-line method.

For a transfer from the investment properties to property, plant and equipment, the deemed cost of the property, plant and equipment for subsequent accounting is its carrying amount at the commencement of owner-occupation.

For a transfer from the property, plant and equipment to investment properties, the deemed cost of the investment properties for subsequent accounting is its carrying amount at the end of owner-occupation.

For a contract where a land owner provides land for the construction of buildings by a property developer in exchange for a certain percentage of the buildings, any exchange gain or loss is recognized when the exchange transaction occurs if the exchange transaction has commercial substance.

On derecognition of the investment properties, the difference between the net disposal proceeds and the carrying amount of the asset is recognized in profit or loss in the period in which the property is derecognized.

Goodwill

Goodwill arising from the acquisition of a business is carried at cost as established at the date of acquisition of the business less accumulated impairment loss.

For the purpose of impairment testing, goodwill is allocated to each of the Company’s cash-generating units or groups of cash-generating units (referred to as “cash-generating unit”) that are expected to benefit from the synergies of the business combination.

A cash-generating unit to which goodwill has been allocated is tested for impairment annually, or more frequently when there is an indication that the unit may be impaired, by comparing its carrying amount, including the attributable goodwill, with its recoverable amount. However, if the goodwill allocated to a cash-generating unit was acquired in a business combination during the current annual period, that unit shall be tested for impairment before the end of the current annual period. If the recoverable amount of the cash-generating unit is less than its carrying amount, the impairment loss is allocated first to reduce the carrying amount of any goodwill allocated to the unit and then to the other assets of the unit pro rata based on the carrying amount of each asset in the unit. Any impairment loss is recognized directly in profit or loss. An impairment loss recognized for goodwill is not reversed in subsequent periods.

Intangible Assets Other Than Goodwill

Intangible assets with finite useful lives that are acquired separately are initially measured at cost and subsequently measured at cost less accumulated amortization and accumulated impairment loss. Amortization is recognized on a straight-line basis. The estimated useful life, residual value, and amortization method are reviewed at the end of each reporting period, with the effect of any changes in estimate being accounted for on a prospective basis. The residual value of an intangible asset with a finite useful life shall be assumed to be zero unless the Company expects to dispose of the intangible asset before the end of its economic life.

- 23 -

Intangible assets acquired in a business combination and recognized separately from goodwill are initially recognized at their fair value at the acquisition date (which is regarded as their cost). Subsequent to initial recognition, they are measured on the same basis as intangible assets that are acquired separately.

Gains or losses arising from derecognition of an intangible asset, measured as the difference between the net disposal proceeds and the carrying amount of the asset, are recognized in profit or loss in the period in which the asset is derecognized.

Impairment of Property, Plant and Equipment, Right-of-use Assets, Investment Properties, Intangible Assets Other Than Goodwill and Incremental Costs of Obtaining Contracts

At the end of each reporting period, the Company reviews the carrying amounts of its property, plant and equipment, right-of-use assets, investment properties and intangible assets, excluding goodwill, to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss. When it is not possible to estimate the recoverable amount of an individual asset, the Company estimates the recoverable amount of the cash-generating unit to which the asset belongs.

Intangible assets not yet available for use are tested for impairment at least annually, and whenever there is an indication that the asset may be impaired.

Recoverable amount is the higher of fair value less costs to sell and value in use. If the recoverable amount of an asset or cash-generating unit is estimated to be less than its carrying amount, the carrying amount of the asset or cash-generating unit is reduced to its recoverable amount, with the resulting impairment loss recognized in profit or loss.

Impairment loss from the assets related to incremental cost of obtaining contracts is recognized to the extent that the carrying amount of the assets exceeds the remaining amount of consideration that the Company expects to receive in exchange for related goods or services less the costs which relate directly to providing those goods or services.

When an impairment loss is subsequently reversed, the carrying amount of the asset or cash-generating unit is increased to the revised estimate of its recoverable amount, but only to the extent of the carrying amount that would have been determined had no impairment loss been recognized for the asset or cash-generating unit in prior years. A reversal of an impairment loss is recognized in profit or loss.

Financial Instruments

Financial assets and financial liabilities are recognized when the Company becomes a party to the contractual provisions of the instruments.

Financial assets and financial liabilities are initially measured at fair value. Transaction costs that are directly attributable to the acquisition of financial assets and financial liabilities (other than financial assets and financial liabilities at fair value through profit or loss) are added to the fair value of the financial assets or financial liabilities, as appropriate, on initial recognition. Transaction costs directly attributable to the acquisition of financial assets or financial liabilities at fair value through profit or loss are recognized immediately in profit or loss.

- 24 -

| a. | Financial assets |

All regular way purchases or sales of financial assets are recognized and derecognized on a trade date basis.

| 1) | Measurement category |

| a) | Financial assets at fair value through profit or loss (FVTPL) |

Financial asset is classified as at FVTPL when the financial asset is mandatorily classified as at FVTPL. Financial assets mandatorily classified as at FVTPL include investments in equity instruments which are not designated as at fair value through other comprehensive income (FVOCI).

Financial assets at FVTPL are stated at fair value, with any gains or losses arising on remeasurement recognized in profit or loss. The net gain or loss recognized in profit or loss does not incorporate any dividend earned on the financial asset. Fair value is determined in the manner described in Note 37.

| b) | Financial assets at amortized cost |

Financial assets that meet the following conditions are subsequently measured at amortized cost:

| i. | The financial asset is held within a business model whose objective is to hold financial assets in order to collect contractual cash flows; and |

| ii. | The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. |

Subsequent to initial recognition, financial assets at amortized cost are measured at amortized cost, which equals to gross carrying amount determined by the effective interest method less any impairment loss, except for short-term receivables as the effect of discounting is immaterial. Exchange differences are recognized in profit or loss.

Interest income is calculated by applying the effective interest rate to the gross carrying amount of such financial assets.

| c) | Investments in equity instruments at FVOCI |

On initial recognition, the Company may make an irrevocable election to designate investments in equity instruments as at FVOCI. Designation at FVOCI is not permitted if the equity investment is held for trading or if it is contingent consideration recognized by an acquirer in a business combination.

Investments in equity instruments at FVOCI are subsequently measured at fair value with gains and losses arising from changes in fair value recognized in other comprehensive income and accumulated in other equity. The cumulative gain or loss will not be reclassified to profit or loss on disposal of the equity investments. Instead, it will be transferred to retained earnings.