Filed by Mykrolis Corporation

Pursuant to Rule 425 Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: Mykrolis Corporation

Commission File No. 001-16611

This filing relates to the proposed merger of equals transaction pursuant to the terms of that certain Agreement and Plan of Merger, dated as of March 21, 2005 (the “Merger Agreement”), by and among Entegris, Inc., a Minnesota corporation (“Entegris”), Mykrolis Corporation, a Delaware corporation (“Mykrolis”), and Eagle DE, Inc., a Delaware corporation and a wholly-owned subsidiary of Entegris (“Entegris Delaware”). The Merger Agreement is on file with the Securities and Exchange Commission (the “SEC”) as an exhibit to the Current Report on Form 8-K filed by each of Entegris and Mykrolis on March 21, 2005, and is incorporated by reference into this filing.

The following are slide presentations used for meetings of Mykrolis with investors.

Mykrolis Corporation Analyst Day 2005

Gideon Argov – CEO

Forward-Looking Statements/ Risk Factors

The matters discussed in this presentation include forward-looking statements, are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. When used herein or in such statements, the words “anticipate”, “believe”, “estimate”, “expect”, “hope”, “may”, “will”, “should” or the negative thereof and similar expressions as they relate to Mykrolis, its business or its management are intended to identify such forward-looking statements. Potential risks and uncertainties that could affect Mykrolis’s future operating results include, without limitation, the risk that a sustained industry recovery may be weaker than past recoveries, our inability to meet increasing demands for our products from our key customers; increased competition in our industry resulting in downward pressure on prices and reduced margins, as well as those risks described under the headings “Risks Relating to our Business and Industry”, “Risks Related to the Securities Markets and Ownership of Our Securities,” and “Risks Related to our Separation from Millipore” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2004.

The forward-looking statements made in this presentation relate only to events as of the date on which the statements are made. Except as required under the federal securities laws and the rules and regulations of the Securities and Exchange Commission, we do not have any intention or obligation to update publicly any forward-looking statements contained in this presentation, whether as a result of new information, future events or otherwise.

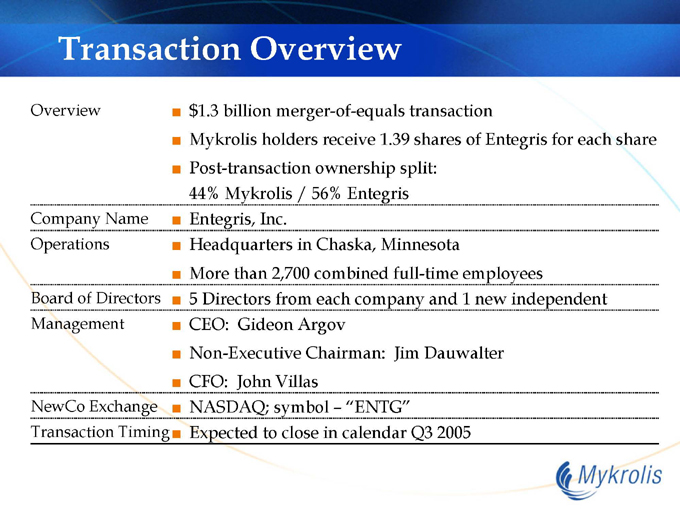

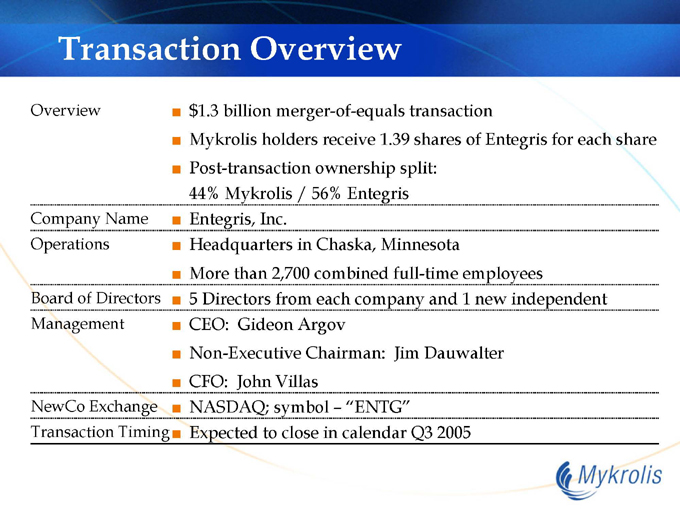

Transaction Overview

Overview $1.3 billion merger-of-equals transaction

Mykrolis holders receive 1.39 shares of Entegris for each share

Post-transaction ownership split:

44% Mykrolis / 56% Entegris

Company Name Entegris, Inc.

Operations Headquarters in Chaska, Minnesota

More than 2,700 combined full-time employees

Board of Directors 5 Directors from each company and 1 new independent

Management CEO: Gideon Argov

Non-Executive Chairman: Jim Dauwalter

CFO: John Villas

NewCo Exchange NASDAQ; symbol – “ENTG”

Transaction Timing Expected to close in calendar Q3 2005

NewCo Strategic Vision

The Leading Materials Integrity Management platform

Purify, protect, and transport critical materials used in semiconductor, microelectronics and other high technology manufacturing processes

Strong market position in core product lines

Above-market organic growth fueled by technology / customer synergies and geographic leverage Balanced portfolio + broad customer base = strength and stability

High exposure to unit-driven products cushions from semi cycle

Geographical diversity

Customer base not concentrated

Global footprint + scale = significant operating leverage

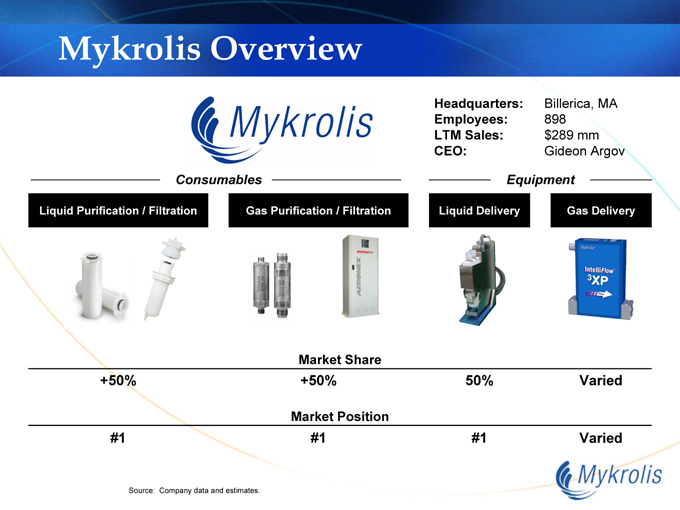

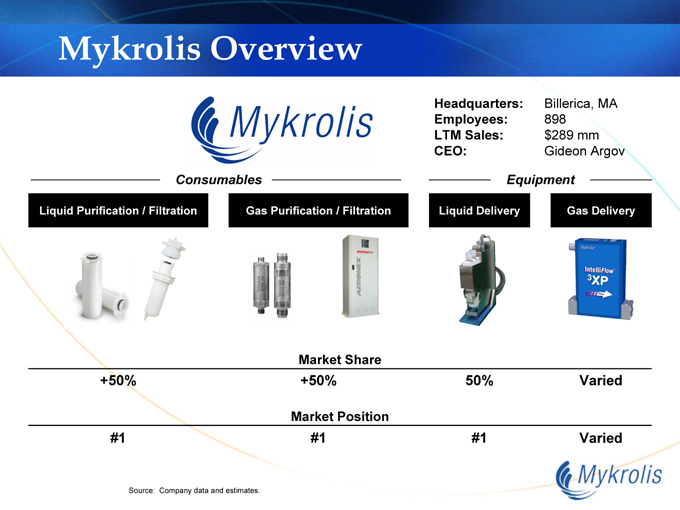

Mykrolis Overview

Headquarters: Billerica, MA

Employees: 898

LTM Sales: $289 mm

CEO: Gideon Argov

Consumables

Liquid Purification / Filtration

Gas Purification / Filtration

+50%

Market Share

+50%

#1

Market Position

#1

Equipment

Liquid Delivery

Gas Delivery

50%

Varied

#1

Varied

Source: Company data and estimates.

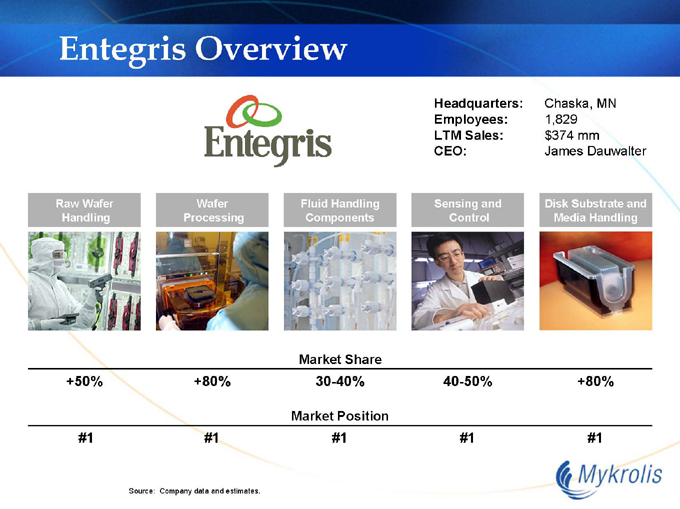

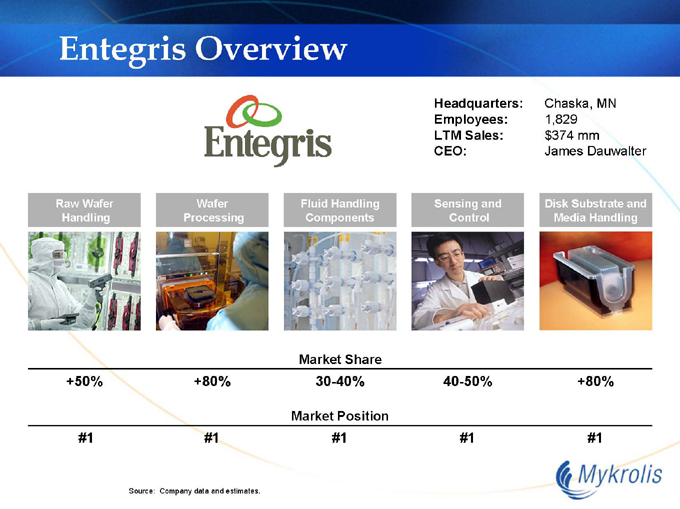

Entegris Overview

Headquarters: Chaska, MN

Employees: 1,829

LTM Sales: $374 mm

CEO: James Dauwalter

Raw Wafer Handling

Wafer Processing

Fluid Handling Components

Sensing and Control

Disk Substrate and Media Handling

+50%

+80%

Market Share

30-40%

40-50%

+80%

#1

#1

Market Position

#1

#1

#1

Source: Company data and estimates.

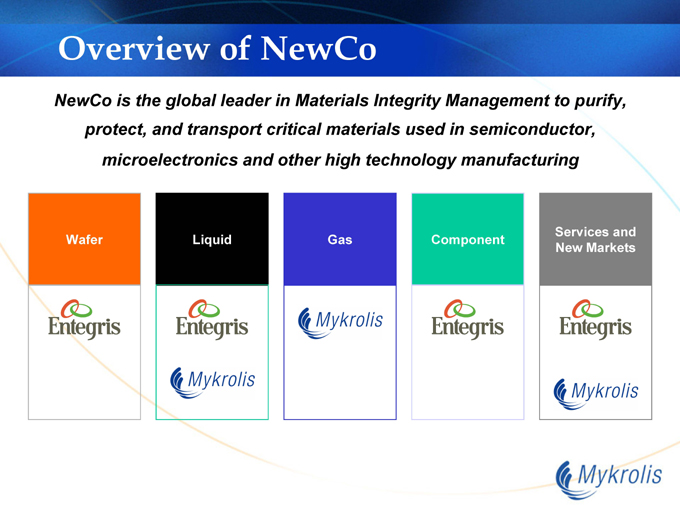

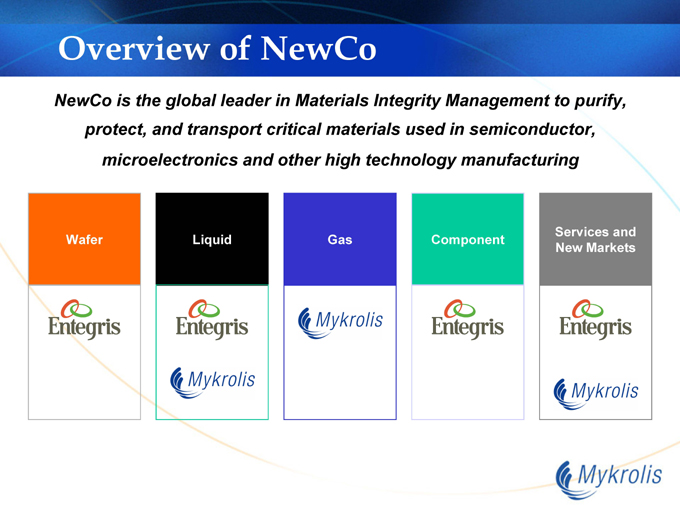

Overview of NewCo

NewCo is the global leader in Materials Integrity Management to purify, protect, and transport critical materials used in semiconductor, microelectronics and other high technology manufacturing

Wafer

Liquid

Gas

Component

Services and New Markets

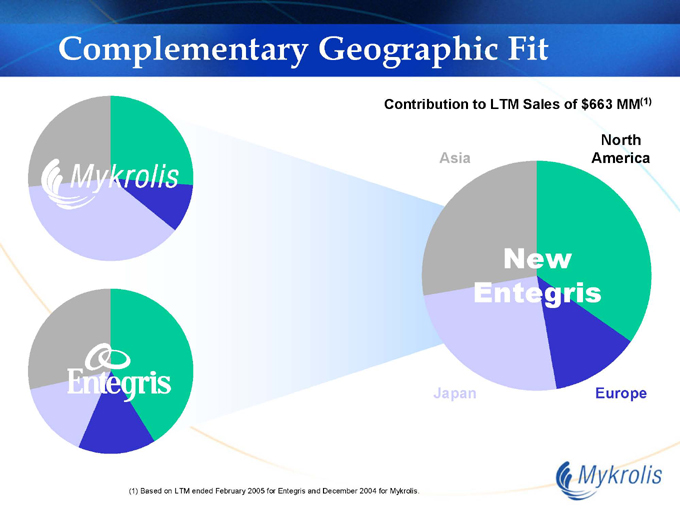

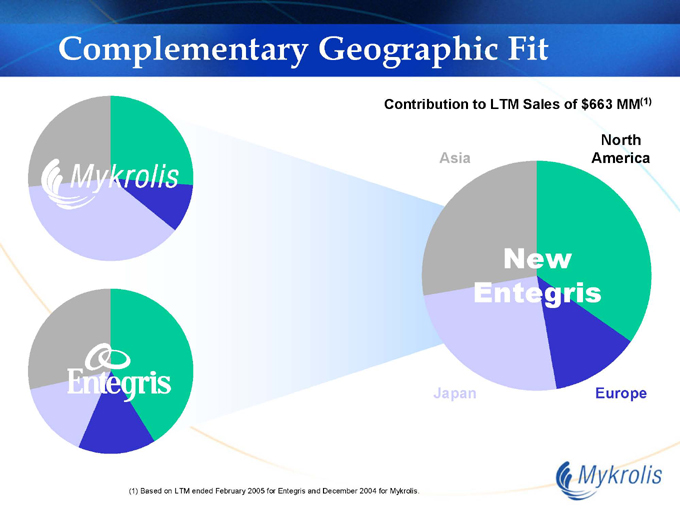

Complementary Geographic Fit

Contribution to LTM Sales of $663 MM(1)

New Entegris

North America

Europe

Japan

Asia

(1) Based on LTM ended February 2005 for Entegris and December 2004 for Mykrolis.

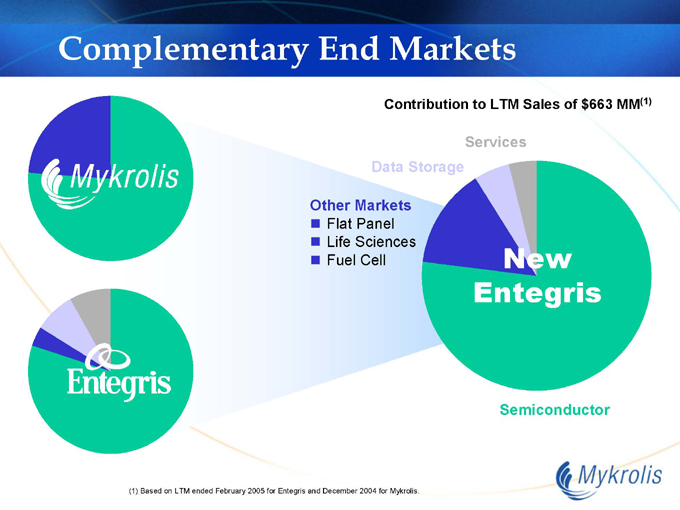

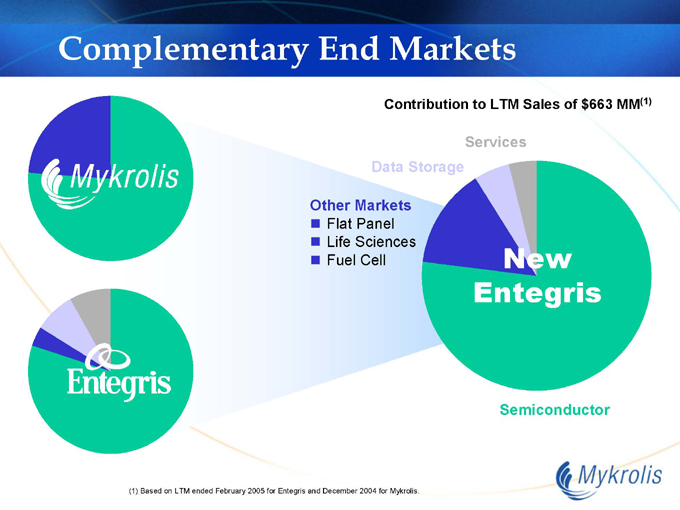

Complementary End Markets

Contribution to LTM Sales of $663 MM(1)

New Entegris

Services

Semiconductor

Other Markets

Flat Panel

Life Sciences

Fuel Cell

Data Storage

(1) Based on LTM ended February 2005 for Entegris and December 2004 for Mykrolis.

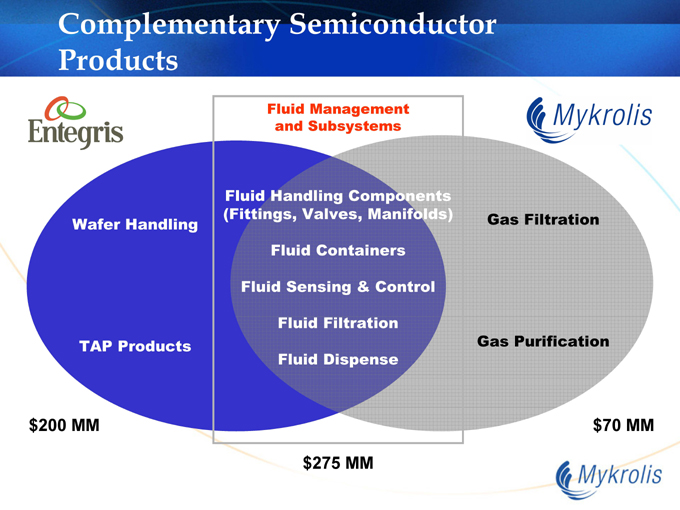

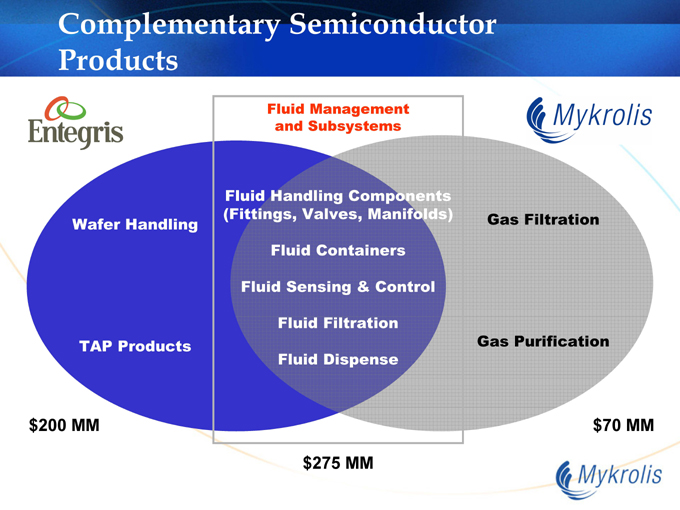

Complementary Semiconductor Products

Fluid Management and Subsystems

Wafer Handling

TAP Products

Fluid Handling Components (Fittings, Valves, Manifolds) Fluid Containers Fluid Sensing & Control Fluid Filtration Fluid Dispense

Gas Filtration

Gas Purification $200 MM $275 MM $70 MM

Strong Customers in All Targeted Markets

Wafer Growers

MEMC S.E.H. Siltronic SUMCO

OEMs

Applied Materials DNS

Tokyo Electron

IDMs, Foundries, and Back-end (Assembly & Test)

Chartered Inotera Intel Micron TI

Samsung ST Micro TSMC UMC

Microelectronics, Display, Storage

Komag MMC Seagate

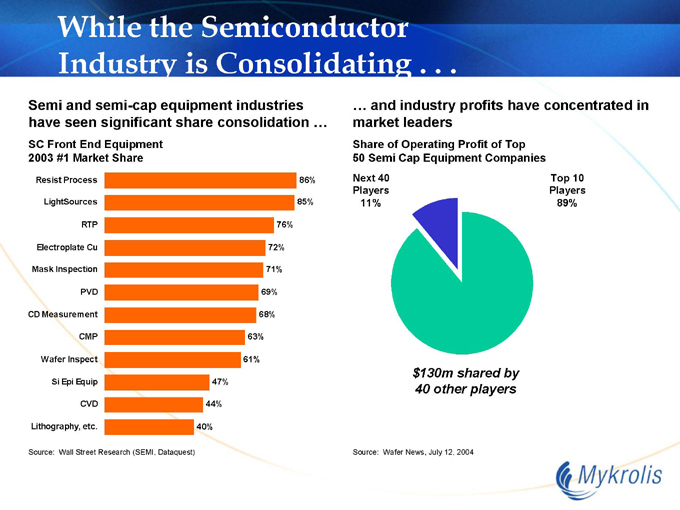

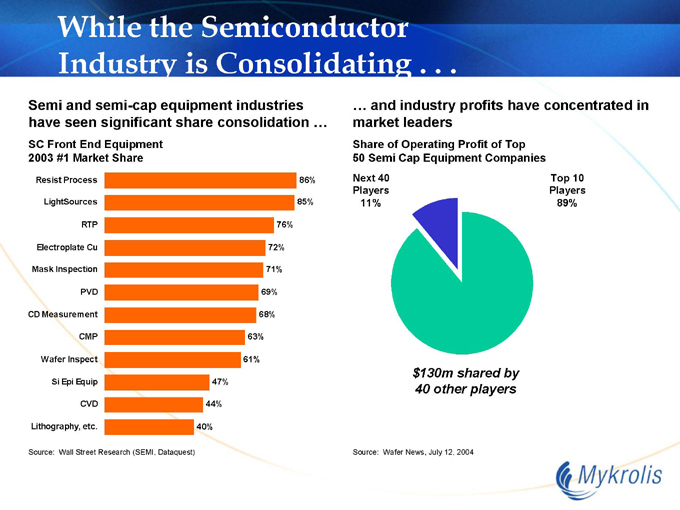

While the Semiconductor Industry is Consolidating . . .

Semi and semi-cap equipment industries have seen significant share consolidation …

SC Front End Equipment 2003 #1 Market Share

Resist Process LightSources RTP Electroplate Cu Mask Inspection PVD CD Measurement CMP

Wafer Inspect Si Epi Equip CVD

Lithography, etc.

86%

85%

76%

72%

71%

69%

68%

63%

61%

47%

44%

40%

Source: Wall Street Research (SEMI, Dataquest)

… and industry profits have concentrated in market leaders

Share of Operating Profit of Top 50 Semi Cap Equipment Companies

Next 40 Players 11%

Top 10 Players 89% $130m shared by 40 other players

Source: Wafer News, July 12, 2004

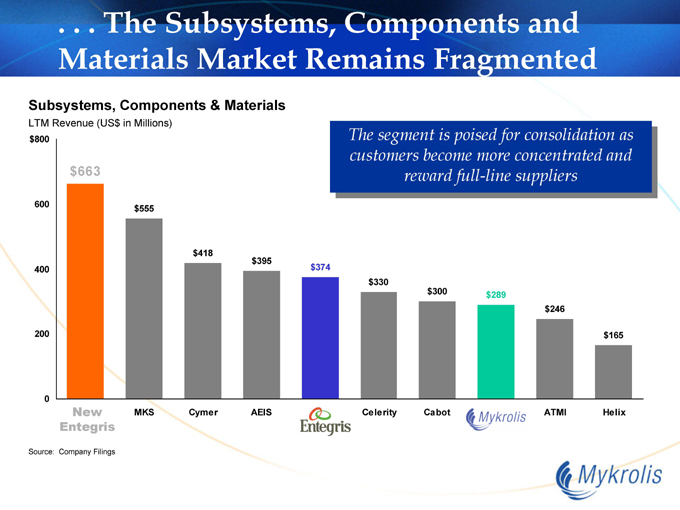

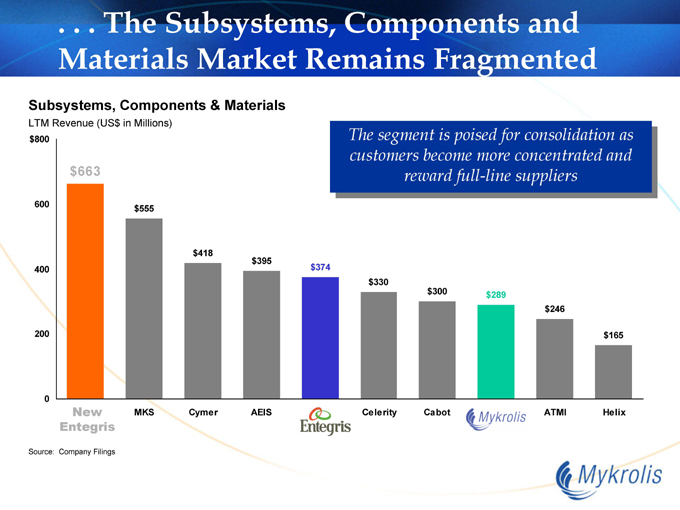

. . . The Subsystems, Components and Materials Market Remains Fragmented

Subsystems, Components & Materials

LTM Revenue (US$ in Millions)

The segment is poised for consolidation as customers become more concentrated and reward full-line suppliers $800

600

400

200

0 $663 $555 $418 $395 $374 $330 $300 $289 $246 $165

New MKS Cymer AEIS

Entegris

Celerity Cabot

ATMI Helix

Source: Company Filings

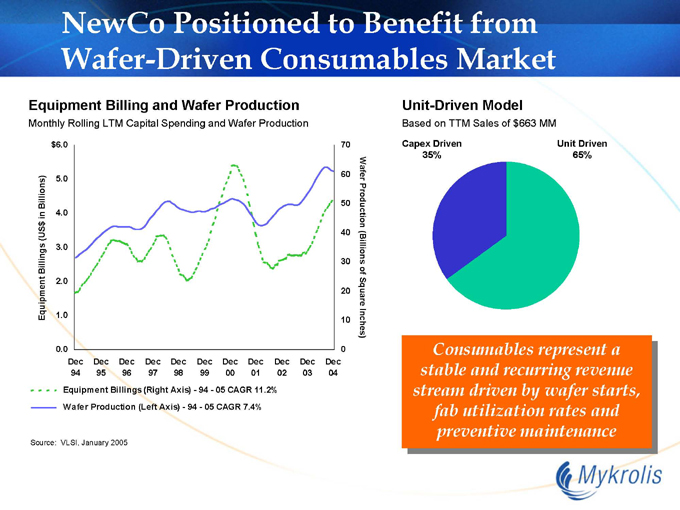

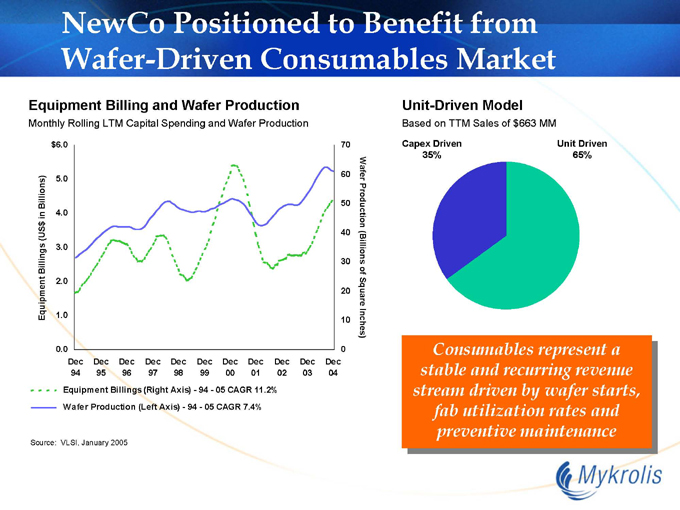

NewCo Positioned to Benefit from Wafer-Driven Consumables Market

Equipment Billing and Wafer Production

Monthly Rolling LTM Capital Spending and Wafer Production $6.0

5.0

4.0

3.0

2.0

1.0

0.0

Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec

94 95 96 97 98 99 00 01 02 03 04

70

60 50 40 30 20 10

Equipment Billings (Right Axis)—94—05 CAGR 11.2% Wafer Production (Left Axis)—94—05 CAGR 7.4%

Source: VLSI, January 2005

Unit-Driven Model

Based on TTM Sales of $663 MM

Capex Driven 35%

Unit Driven 65%

Consumables represent a stable and recurring revenue stream driven by wafer starts, fab utilization rates and preventive maintenance

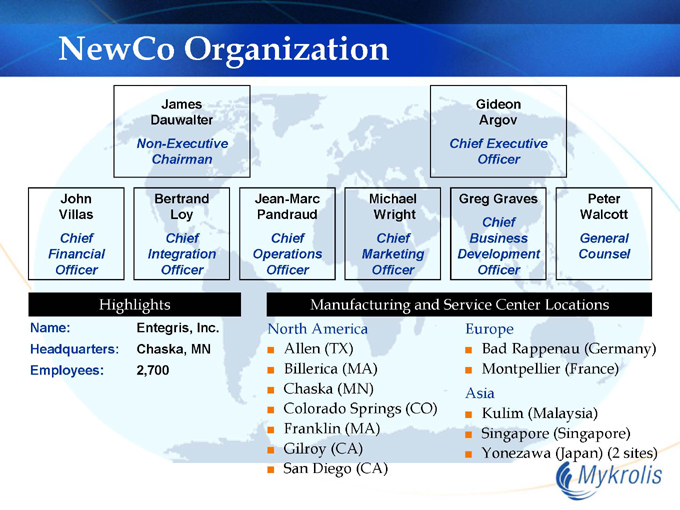

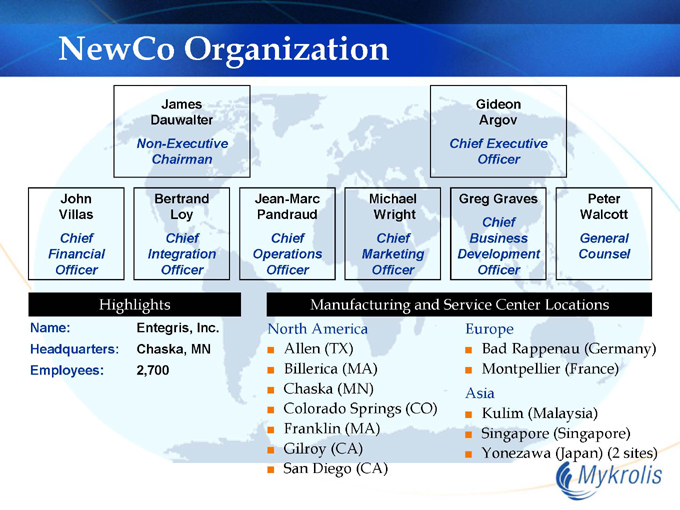

NewCo Organization

James Dauwalter

Non-Executive Chairman

Gideon Argov

Chief Executive Officer

John Villas

Chief Financial Officer

Bertrand Loy

Chief Integration Officer

Jean-Marc Pandraud

Chief Operations Officer

Michael Wright

Chief Marketing Officer

Greg Graves

Chief Business Development Officer

Peter Walcott

General Counsel

Highlights

Name: Entegris, Inc.

Headquarters: Chaska, MN

Employees: 2,700

Manufacturing and Service Center Locations

North America

Allen (TX) Billerica (MA) Chaska (MN)

Colorado Springs (CO) Franklin (MA) Gilroy (CA) San Diego (CA)

Europe

Bad Rappenau (Germany) Montpellier (France)

Asia

Kulim (Malaysia) Singapore (Singapore) Yonezawa (Japan) (2 sites)

NewCo Integration Plan

Integration Planning Process Already Well Under Way

Bertrand Loy named full-time Chief Integration Officer

Experienced senior integration team members already in place

Three Key Elements to Integration Plan

Avoid customer disruption

Achieve planned cost synergies

Grow revenue through complementary product, customer and geographic strengths

Significant incentives tied to delivery of specific results

Key Financial Highlights

Highly attractive pro forma financial profile

Enhanced financial scale and operating leverage

Attractive mix of products, customers and geographies

High percentage of unit-driven revenues

Significantly accretive to 2006 Cash EPS: $0.08

Pro forma EPS, excl. amortization of intangibles & restructuring

Tangible, near-term cost savings of $15 MM+

General and administrative savings and purchasing benefits

Efficiencies in sales and service operations

Elimination of redundant facilities and infrastructure

Longer-term revenue synergy opportunities

Strong balance sheet with $250 MM in combined cash + marketable securities

Merger Process Update – May 25, 2005

FTC granted request for early termination of HSR waiting period Filed S-4 with SEC on May 9, 2005 Subject to SEC timing, we expect shareholder meetings and closing to be in Q3-2005 In response to some questions about the S-4:

Previous discussions referenced in S-4 were for Mykrolis to acquire another firm

To date, Mykrolis has not been approached by another potential merger partner or acquirer

Mykrolis Corporation Analyst Day 2005

Jean-Marc Pandraud – President and COO

Presentation Agenda

History of Mykrolis

Where Mykrolis fits in the industry Contamination Control – technology trends Mykrolis Core Competencies:

Separations technology

Understanding of semiconductor and related processes

Global footprint and OEM/Device Maker relationships

Mykrolis’s portfolio of solutions to key process applications Mykrolis and Entegris Competencies Mesh Well

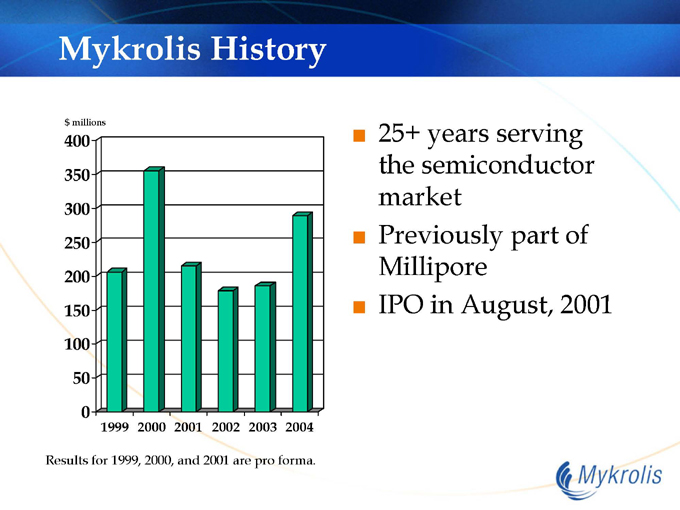

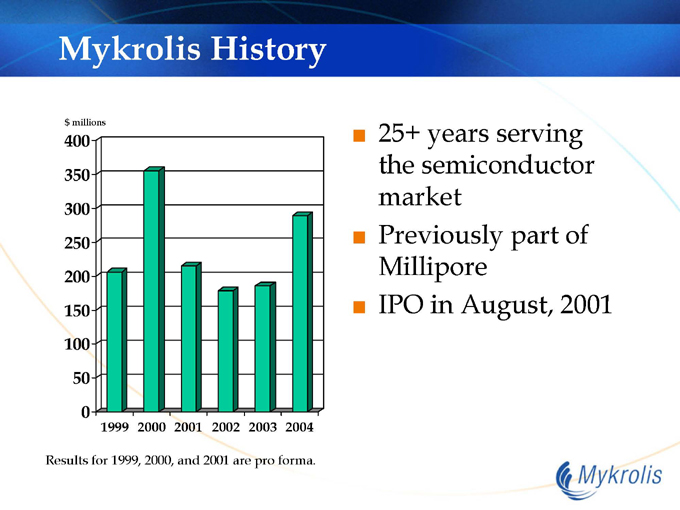

Mykrolis History

$ millions

400 350 300 250 200 150 100 50 0

1999 2000 2001 2002 2003 2004

25+ years serving the semiconductor market Previously part of Millipore IPO in August, 2001

Results for 1999, 2000, and 2001 are pro forma.

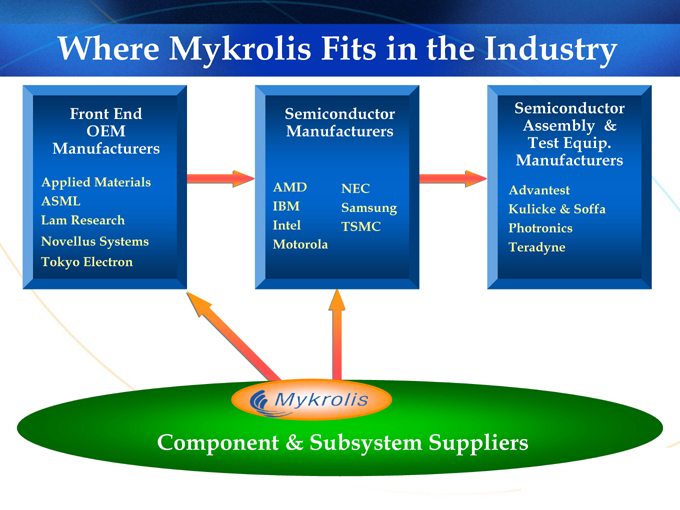

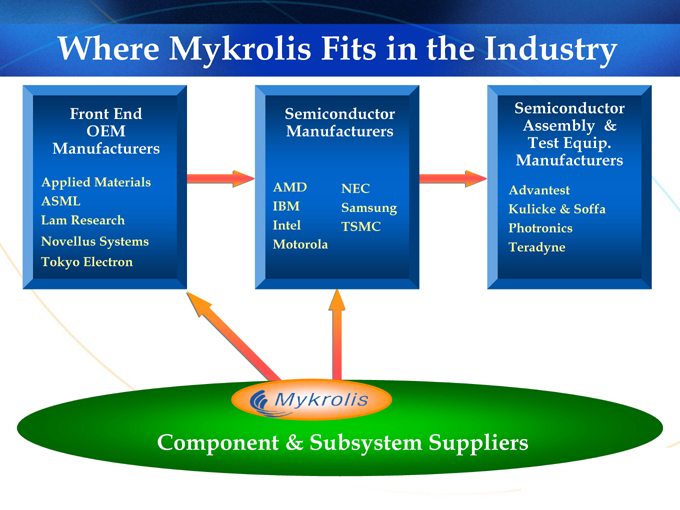

Where Mykrolis Fits in the Industry

Front End OEM Manufacturers

Applied Materials ASML

Lam Research Novellus Systems Tokyo Electron

Semiconductor Manufacturers

AMD IBM Intel Motorola

NEC Samsung TSMC

Semiconductor Assembly & Test Equip. Manufacturers

Advantest Kulicke & Soffa Photronics Teradyne

Component & Subsystem Suppliers

Mykrolis Overview

Headquarters: Billerica, MA

Employees: 898

LTM Sales: $289 mm

CEO: Gideon Argov

Consumables

Liquid Purification / Filtration

Gas Purification / Filtration

+50%

Market Share

+50%

#1

Market Position

#1

Equipment

Liquid Delivery

Gas Delivery

50%

Varied

#1

Varied

Source: Company data and estimates.

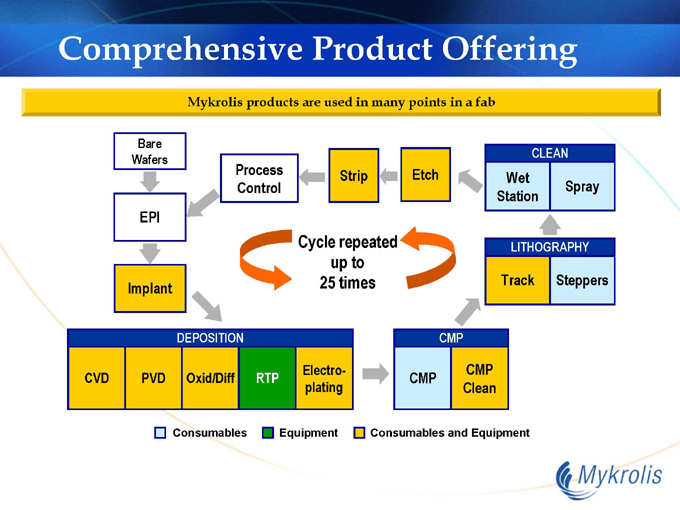

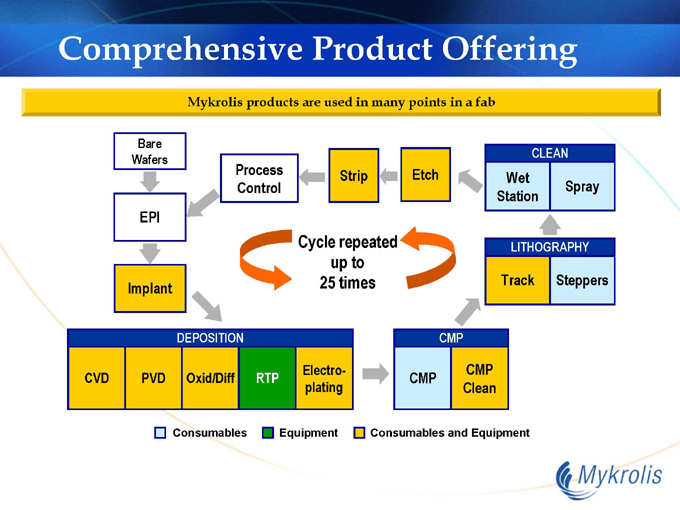

Comprehensive Product Offering

Mykrolis products are used in many points in a fab

Bare Wafers

EPI

Implant

DEPOSITION

CVD

PVD

Oxid/Diff

RTP

Electroplating

CMP

CMP

CMP Clean

LITHOGRAPHY

Track

Steppers

CLEAN

Wet Station

Spray

Etch

Strip

Process Control

Cycle repeated up to 25 times

Consumables

Equipment

Consumables and Equipment

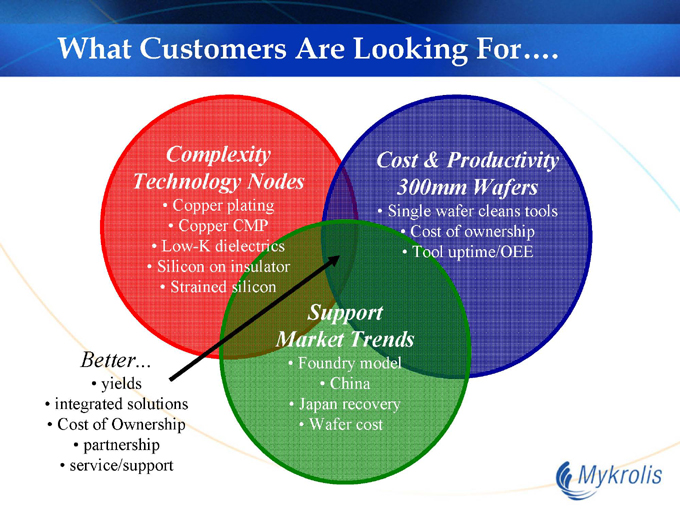

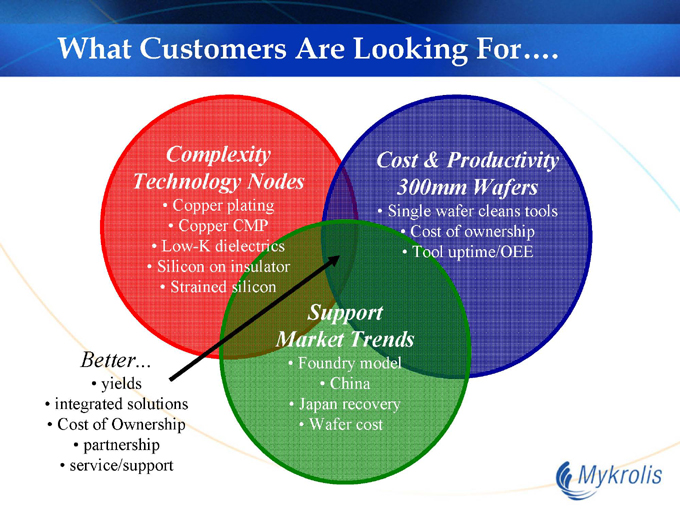

What Customers Are Looking For....

Complexity Technology Nodes

Copper plating

Copper CMP

Low-K dielectrics

Silicon on insulator

Strained silicon

Cost & Productivity 300mm Wafers

Single wafer cleans tools

Cost of ownership

Tool uptime/OEE

Support Market Trends

Foundry model

China

Japan recovery

Wafer cost

Better...

yields integrated solutions

Cost of Ownership partnership service/support

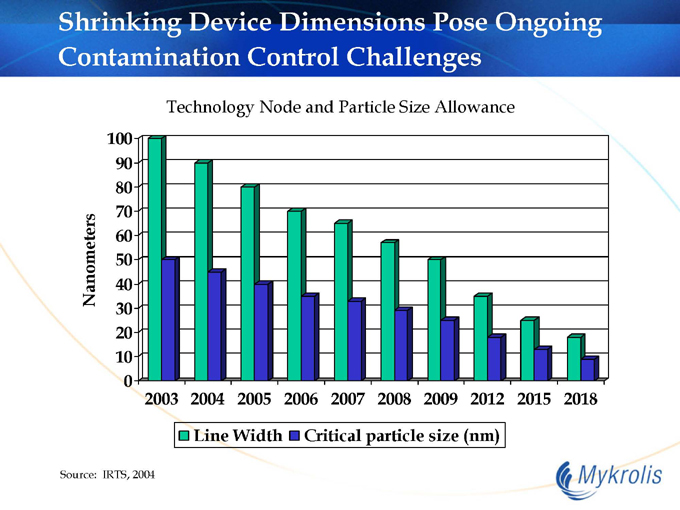

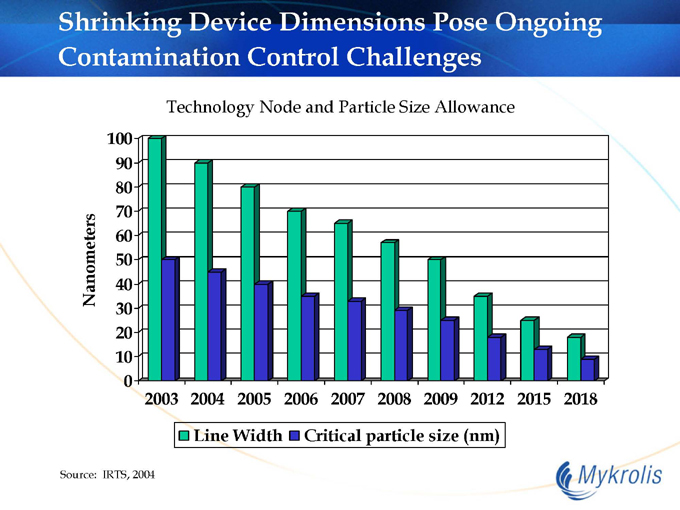

Shrinking Device Dimensions Pose Ongoing Contamination Control Challenges

Technology Node and Particle Size Allowance

Nanometers

100 90 80 70 60 50 40 30 20 10 0

2003 2004 2005 2006 2007 2008 2009 2012 2015 2018

Line Width

Critical particle size (nm)

Source: IRTS, 2004

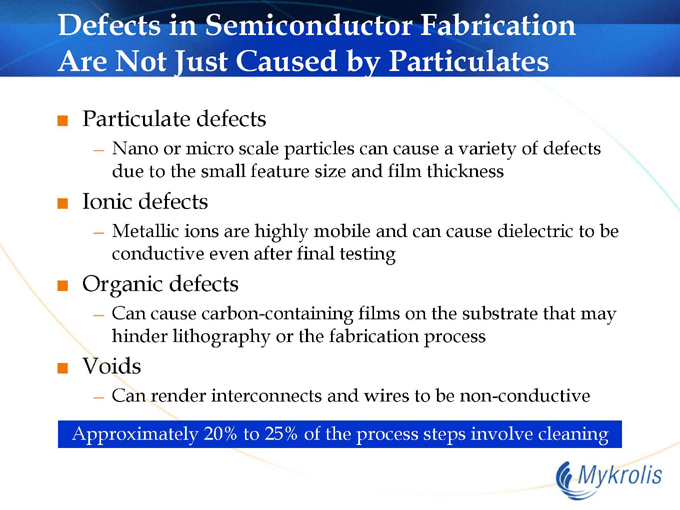

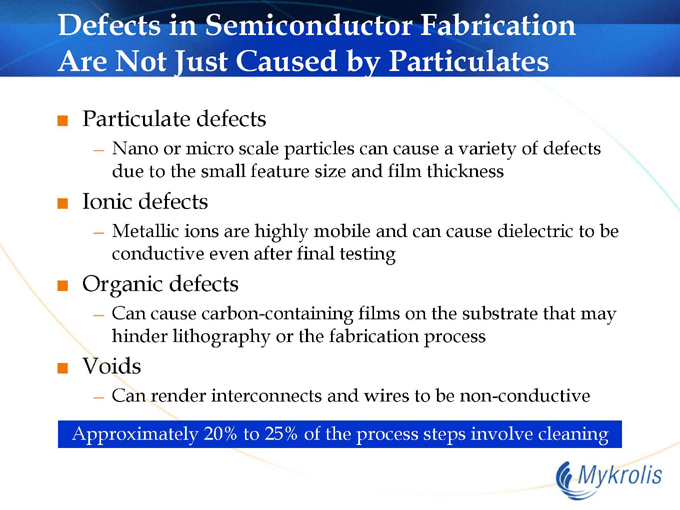

Defects in Semiconductor Fabrication Are Not Just Caused by Particulates

Particulate defects

Nano or micro scale particles can cause a variety of defects due to the small feature size and film thickness

Ionic defects

Metallic ions are highly mobile and can cause dielectric to be conductive even after final testing

Organic defects

Can cause carbon-containing films on the substrate that may hinder lithography or the fabrication process

Voids

Can render interconnects and wires to be non-conductive

Approximately 20% to 25% of the process steps involve cleaning

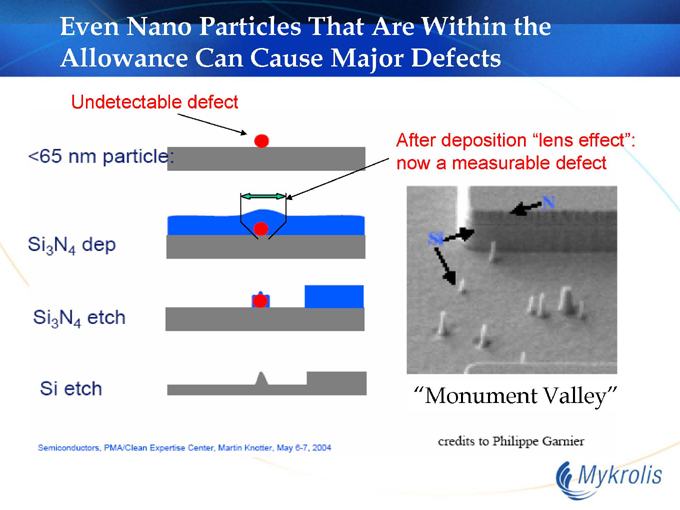

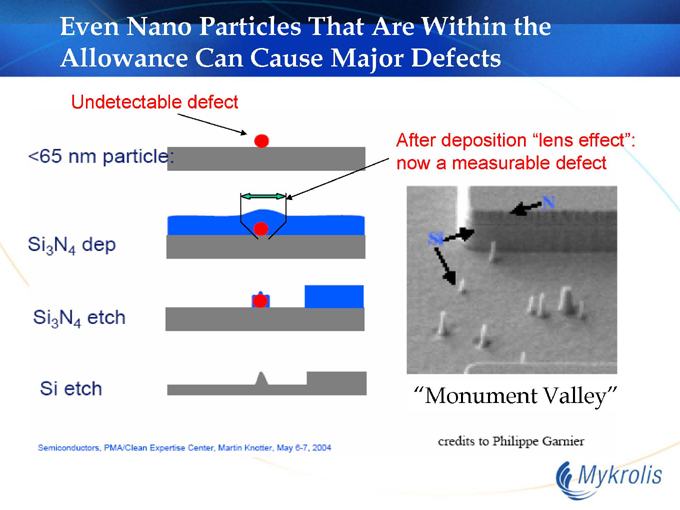

Even Nano Particles That Are Within the Allowance Can Cause Major Defects

Undetectable defect

After deposition “lens effect”: now a measurable defect

“Monument Valley”

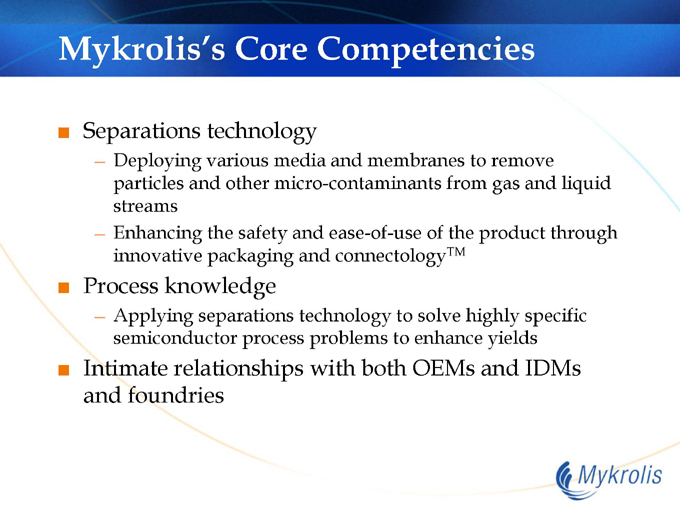

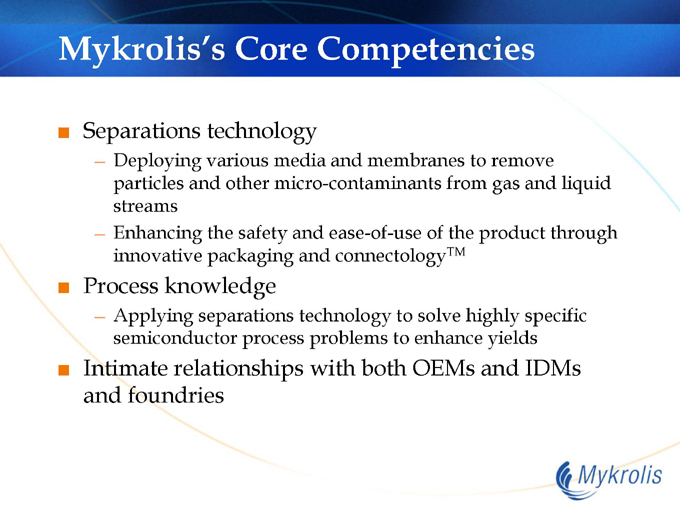

Mykrolis’s Core Competencies

Separations technology

Deploying various media and membranes to remove particles and other micro-contaminants from gas and liquid streams

Enhancing the safety and ease-of-use of the product through innovative packaging and connectologyTM

Process knowledge

Applying separations technology to solve highly specific semiconductor process problems to enhance yields

Intimate relationships with both OEMs and IDMs and foundries

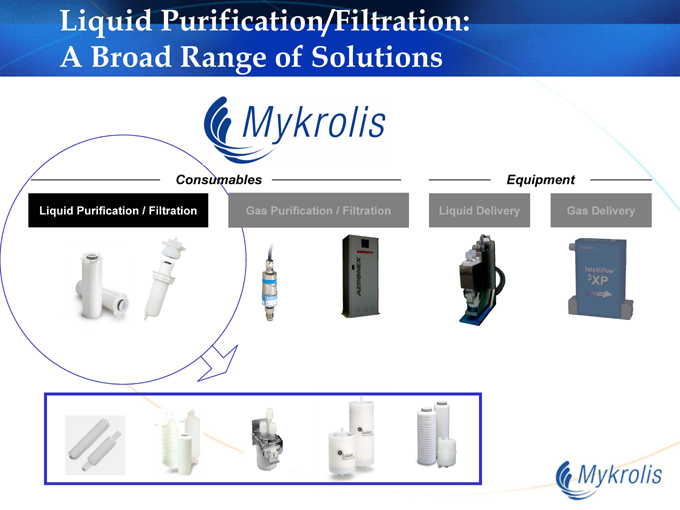

Liquid Purification/Filtration: A Broad Range of Solutions

Consumables

Liquid Purification / Filtration

Gas Purification / Filtration

Equipment

Liquid Delivery

Gas Delivery

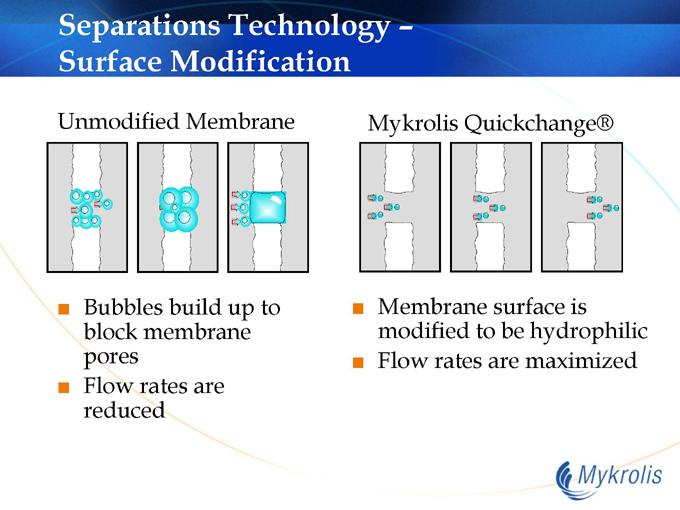

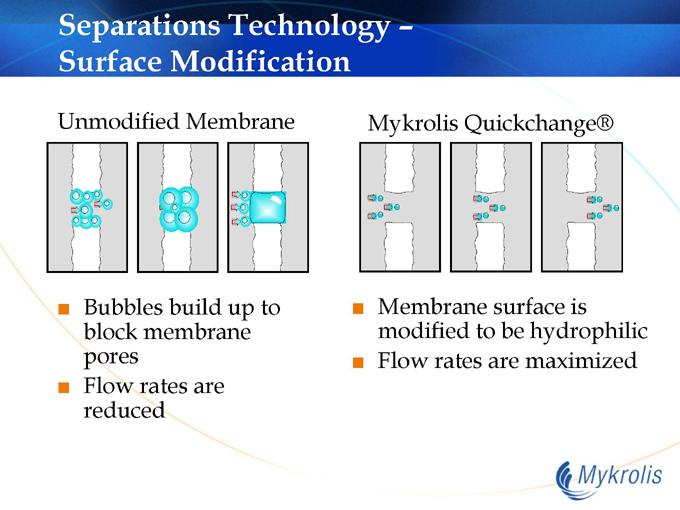

Separations Technology –Surface Modification

Unmodified Membrane

Bubbles build up to block membrane pores Flow rates are reduced

Mykrolis Quickchange®

Membrane surface is modified to be hydrophilic Flow rates are maximized

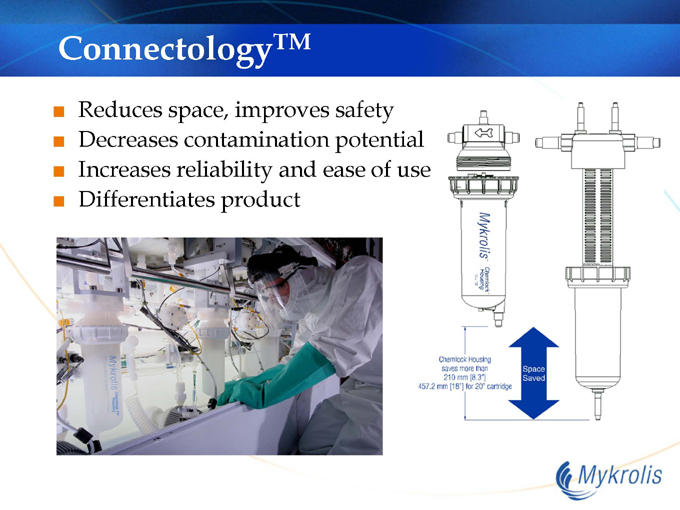

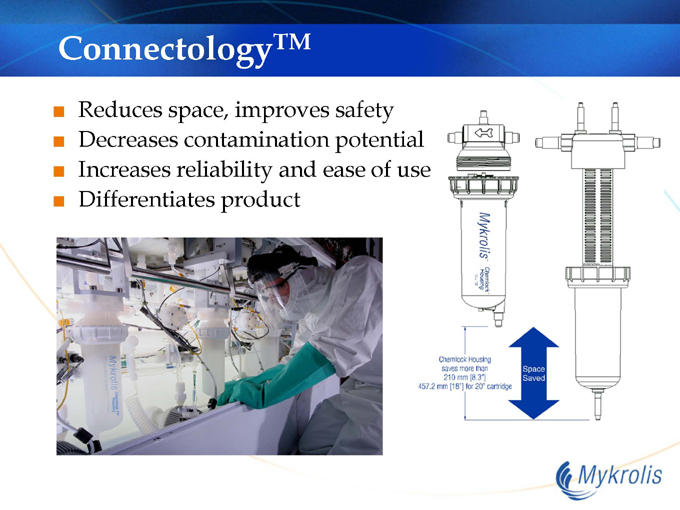

ConnectologyTM

Reduces space, improves safety Decreases contamination potential Increases reliability and ease of use Differentiates product

Process Knowledge Derived From Proximity to Customers

Global account managers for OEMs and IDMs Applications engineers and technical support close to the customer Recurring sales of consumables solidify relationships with IDMs and foundries 25+ years of industry experience

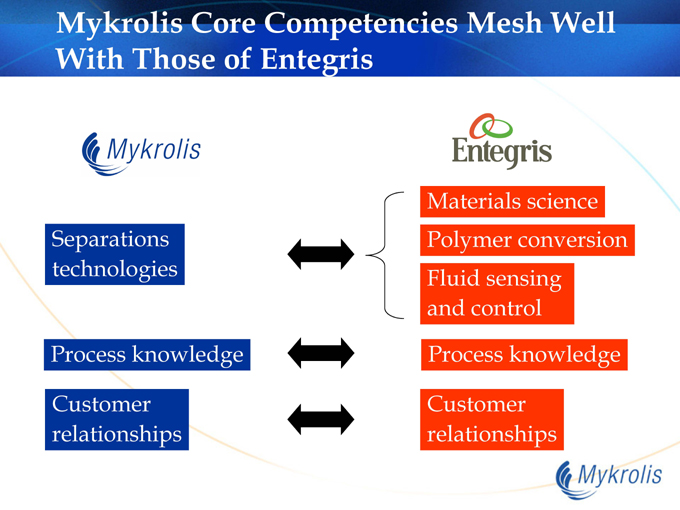

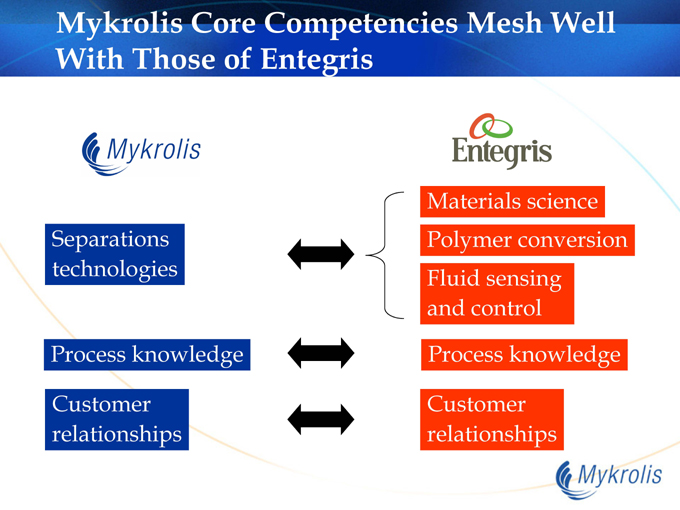

Mykrolis Core Competencies Mesh Well With Those of Entegris

Separations technologies

Process knowledge

Customer relationships

Materials science

Polymer conversion

Fluid sensing and control

Process knowledge

Customer relationships

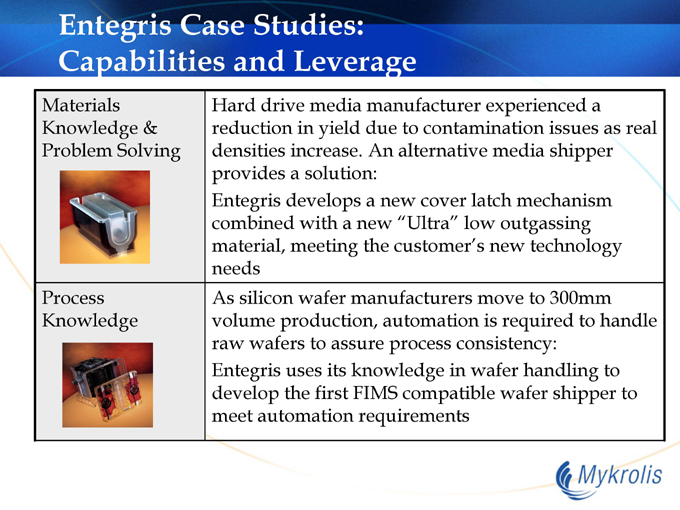

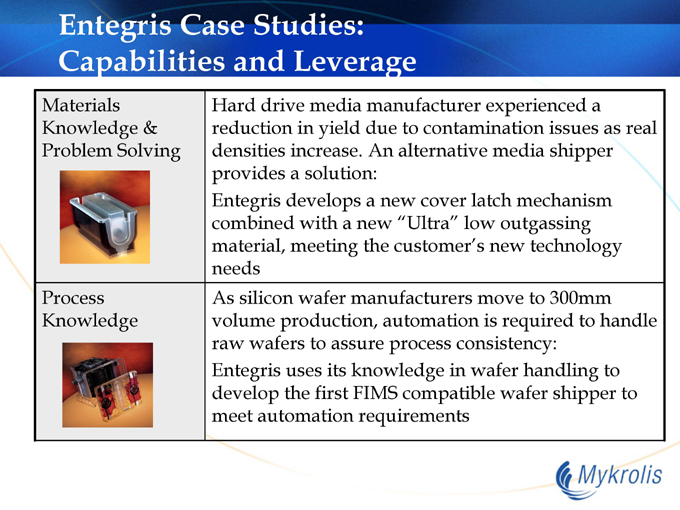

Entegris Case Studies: Capabilities and Leverage

Materials Knowledge & Problem Solving

Hard drive media manufacturer experienced a reduction in yield due to contamination issues as real densities increase. An alternative media shipper provides a solution: Entegris develops a new cover latch mechanism combined with a new “Ultra” low outgassing material, meeting the customer’s new technology needs

Process Knowledge

As silicon wafer manufacturers move to 300mm volume production, automation is required to handle raw wafers to assure process consistency: Entegris uses its knowledge in wafer handling to develop the first FIMS compatible wafer shipper to meet automation requirements

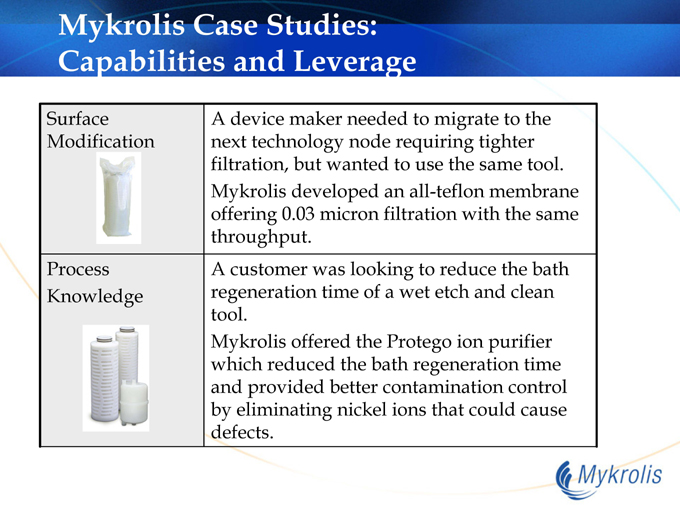

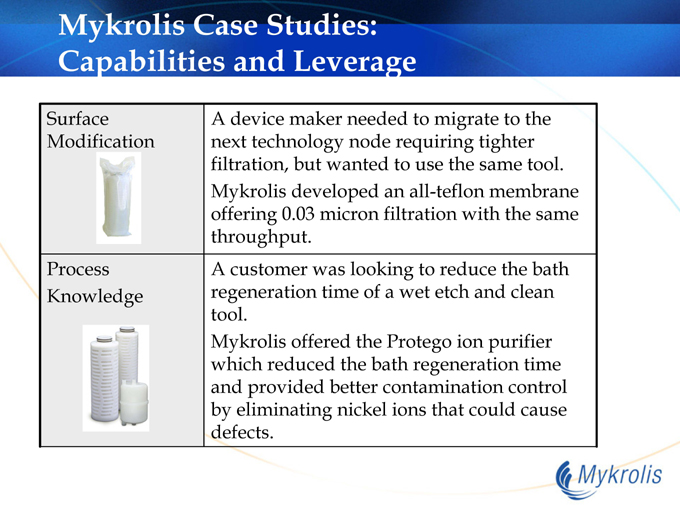

Mykrolis Case Studies: Capabilities and Leverage

Surface Modification

A device maker needed to migrate to the next technology node requiring tighter filtration, but wanted to use the same tool. Mykrolis developed an all-teflon membrane offering 0.03 micron filtration with the same throughput.

Process Knowledge

A customer was looking to reduce the bath regeneration time of a wet etch and clean tool.

Mykrolis offered the Protego ion purifier which reduced the bath regeneration time and provided better contamination control by eliminating nickel ions that could cause defects.

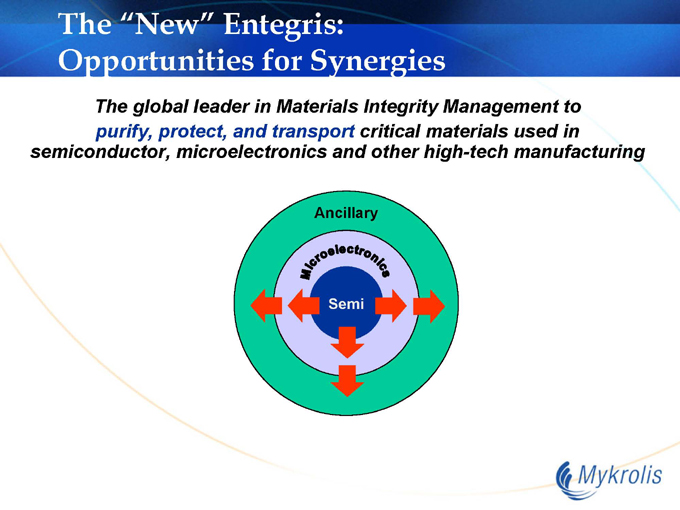

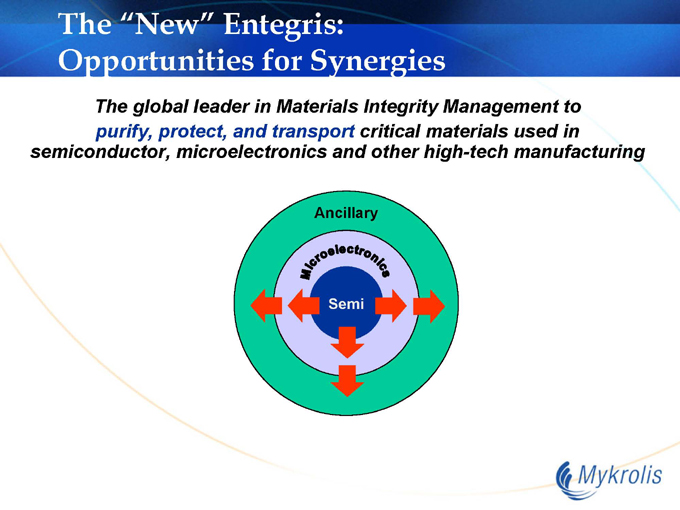

The “New” Entegris: Opportunities for Synergies

The global leader in Materials Integrity Management to purify, protect, and transport critical materials used in semiconductor, microelectronics and other high-tech manufacturing

Additional Information and Where to Find It

In connection with the proposed transaction, Entegris, Mykrolis and Eagle DE, Inc. (a newly formed corporation that will merge with Entegris to effect the reincorporation of Entegris in the State of Delaware in connection with the proposed transaction) have filed a joint proxy statement/prospectus with the SEC. A registration statement on Form S-4 has also been filed with the SEC. Securityholders of each company and other investors are urged to read the registration statement and the joint proxy statement/prospectus (including any amendments or supplements to the joint proxy statement/prospectus) regarding the proposed transaction when they become available because they will contain important information about Entegris, Mykrolis and the proposed transaction. Stockholders may obtain a free copy of the registration statement and the joint proxy statement/prospectus, as well as other filings containing information about Entegris and Mykrolis, without charge, at the SEC’s Internet site (http://www.sec.gov). Copies of the registration statement and the joint proxy statement/prospectus and the filings with the SEC that are incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Entegris, 3500 Lyman Blvd, Chaska, MN 55318, Attention: Investor Relations Dept., telephone: (952) 556-8080, or at irelations@entegris.com or to Mykrolis, 129 Concord Road, Billerica, MA 01821, Attention: Investor Relations Dept., telephone (978) 436-6500, or at investor_relations@mykrolis.com. In addition, investors and security holders may access copies of the documents filed with the SEC by Entegris on Entegris’ website at www.entegris.com, and investors and security holders may access copies of the documents filed with the SEC by Mykrolis on Mykrolis’ website at www.mykrolis.com.

Participants in Solicitation

Mykrolis, Entegris and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Mykrolis’ directors and executive officers is available in its proxy statement on Form DEF 14A filed with the SEC by Mykrolis on March 26, 2004 and in its Annual Report on Form 10-K filed with the SEC on March 11, 2005 and information regarding Entegris’ directors and executive officers is available in its proxy statement on Form DEF 14A filed with the SEC by Entegris on December 15, 2004 and in its Annual Report on Form 10-K filed with the SEC on November 12, 2004. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements

Certain statements in this filing regarding Mykrolis Corporation, Entegris, Inc., the proposed transaction and the combined company after completion of the proposed transaction constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expect,” “feel,” “believe,” “may,” “anticipate,” “plan,” “estimate,” “intend,” “should,” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Mykrolis, Entegris, and their respective subsidiaries or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors include, among others: the risks and factors described in the publicly filed documents of Mykrolis and Entegris, including their most recently filed Forms 10-K; general economic and business conditions and industry trends in the countries in which we operate; currency exchange risks; the continued strength of the industries in which we operate; uncertainties inherent in proposed business strategies and development plans; rapid technological changes; future financial performance, including availability, terms and deployment of capital; availability of qualified personnel; changes in, or the failure or the inability to comply with, government regulation in the countries in which we operate, and adverse outcomes from regulatory proceedings; changes in the nature of key strategic relationships with partners and joint venturers; competitor responses to the products and services of Mykrolis and Entegris, and the overall market acceptance of such products and services, including acceptance of the pricing of such products and services; the ability to achieve the cost savings and synergies contemplated by the proposed merger; the ability to promptly and effectively integrate the businesses of Mykrolis and Entegris; and the diversion of management time on merger-related issues. These forward-looking statements speak only as of the date of this filing. Mykrolis and Entegris expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in the respective expectations of Mykrolis and Entegris with regard thereto or any change in events, conditions or circumstances on which any such statement is based. The transaction is subject to customary closing conditions, including regulatory, stockholder and other third-party consents and approvals.