Exhibit 99.1

Corporate Update

Forward Looking Statements

Certain statements in this presentation contain forward-looking statements. The forward-looking statements involve a number of risks and uncertainties. A number of factors could cause our actual results, performance, achievements or industry results to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Additional information concerning factors that could cause actual results to materially differ from those in the forward-looking statements is contained in the Securities and Exchange Commission filings of the Company.

This information constitutes the proprietary and confidential information of InPhonic, Inc. and is not be disclosed, used, copied or otherwise disseminated without the prior written consent of InPhonic.

Proprietary and Confidential Copyright InPhonic, Inc. 2005

1

David Steinberg

Chief Executive Officer

Investment Attributes

Leading online marketer and seller of wireless services in the United States

Proprietary e-commerce platform integrated with every major US wireless carriers

Increased penetration of large and growing online wireless activation market

Rapid revenue growth and increased operating leverage

Multi-faceted growth opportunities

Proprietary and Confidential Copyright InPhonic, Inc. 2005

3

US Leader in E-Commerce for Wireless Services

750,000 wireless devices activated in 2004

27% of US wireless activation market1

Increasing activation volumes leading to higher commissions rates from carriers

Continued strong revenue growth $118.82 million in 2003 to $204.2 million in 2004 $315—325 million guidance for 2005

Decreasing customer acquisition costs driven by higher conversion rates and InPhonic-direct sales

Operating leverage driven by substantial technology investments

1. Source: Compete, Inc. market estimates

2. Normalized for SAB 101 deferral revenue recognition of $17.3 million in Q4, 2003.

Proprietary and Confidential Copyright InPhonic, Inc. 2005

4

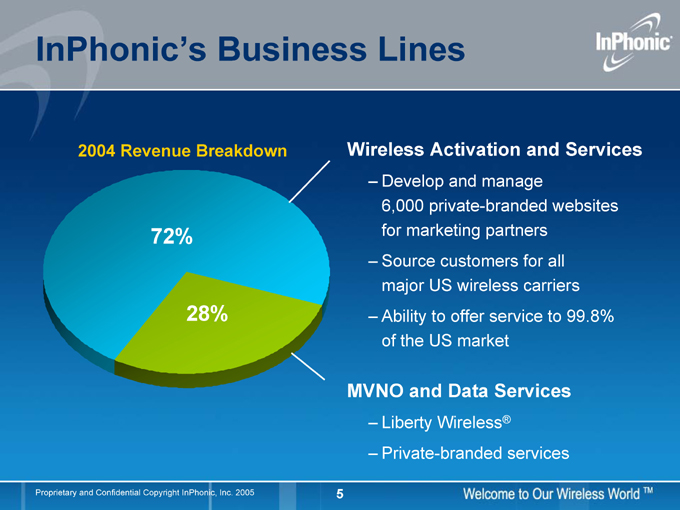

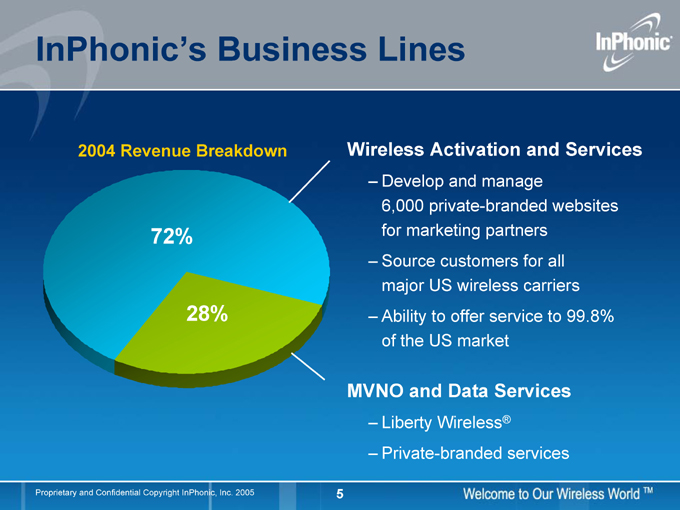

InPhonic’s Business Lines

2004 Revenue Breakdown

72%

28%

Wireless Activation and Services

Develop and manage

6,000 private-branded websites for marketing partners Source customers for all major US wireless carriers Ability to offer service to 99.8% of the US market

MVNO and Data Services

Liberty Wireless® Private-branded services

Proprietary and Confidential Copyright InPhonic, Inc. 2005

5

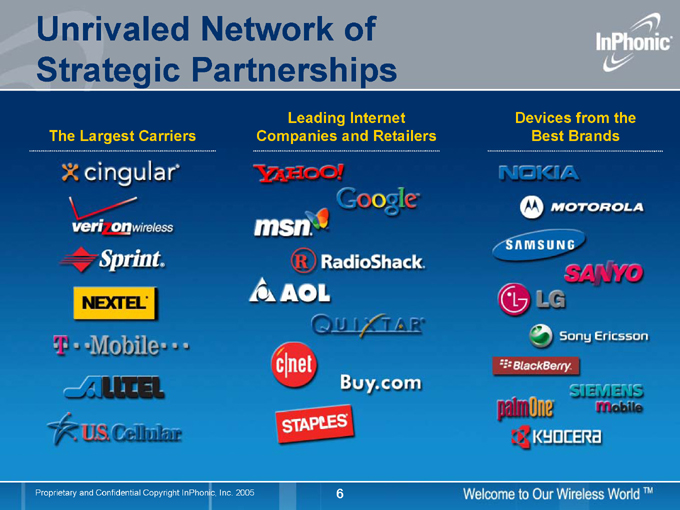

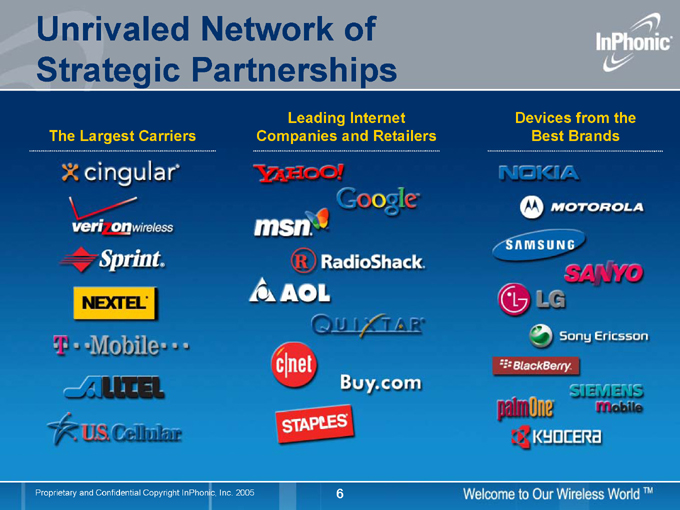

Unrivaled Network of Strategic Partnerships

The Largest Carriers

Leading Internet Companies and Retailers

Devices from the Best Brands

Proprietary and Confidential Copyright InPhonic, Inc. 2005

6

Online Sales Continue to Provide Significant Growth Opportunities

INPC Customer Activations

(thousands of units)

5

94

351

515

750

2000 2001 2002 2003 2004

2004 Total US Gross Subscriber Additions1 $24 billion market opportunity

InPhonic Share: 1.2%

67.5 million gross adds

Online Consumer Electronics Sales

Online Penetration %2

Wireless Penetration

5% 1

11.7%

23.1%

2004

2010

1. Source: Compete, Inc.

2. Source: Forrester Research

Proprietary and Confidential Copyright InPhonic, Inc. 2005

7

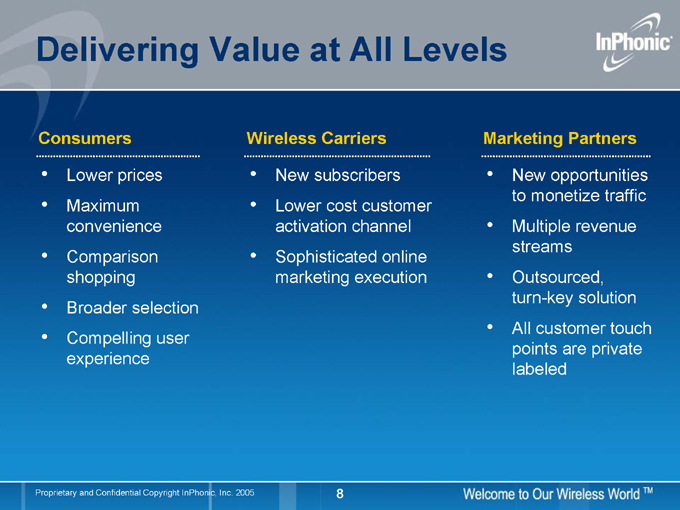

Delivering Value at All Levels

Consumers

Lower prices Maximum convenience Comparison shopping Broader selection Compelling user experience

Wireless Carriers

New subscribers Lower cost customer activation channel Sophisticated online marketing execution

Marketing Partners

New opportunities to monetize traffic Multiple revenue streams Outsourced, turn-key solution All customer touch points are private labeled

Proprietary and Confidential Copyright InPhonic, Inc. 2005

8

Powerful Online Sales and Marketing Channel

…thru 6,000 private label websites

68% of wireless customers research online before purchasing…

Carrier recommendation

Customer has the opportunity to be activated every time

InPhonic activates, ships, and services

Initial Service Order Request

Service Recommendation

Yield Maximization

Proprietary and Confidential Copyright InPhonic, Inc. 2005

9

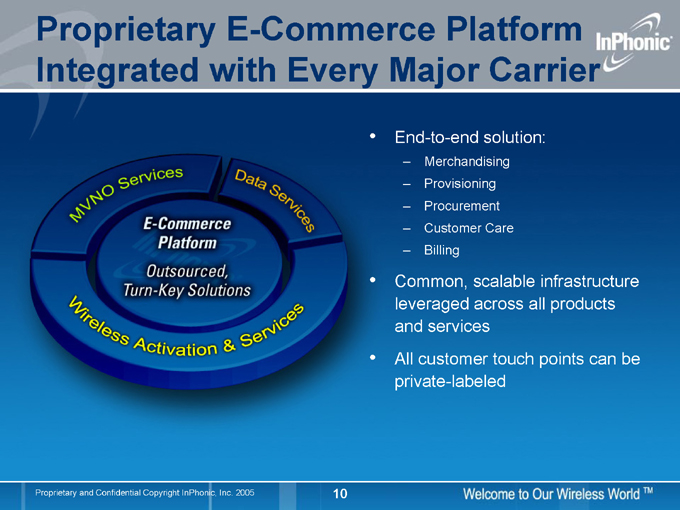

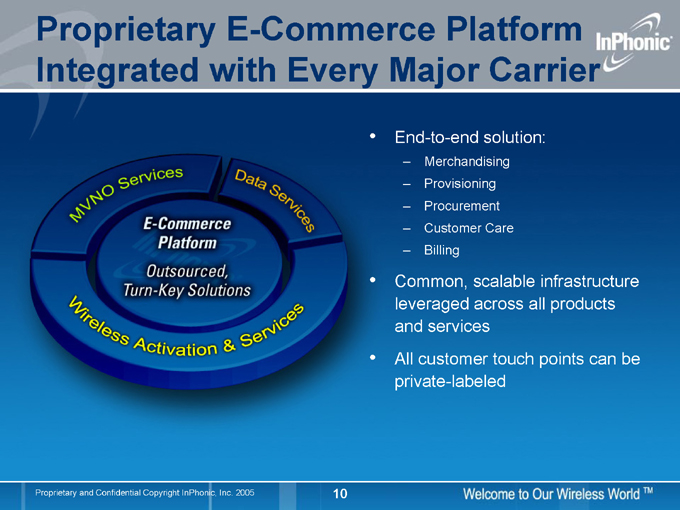

Proprietary E-Commerce Platform Integrated with Every Major Carrier

End-to-end solution:

Merchandising Provisioning Procurement Customer Care Billing

Common, scalable infrastructure leveraged across all products and services All customer touch points can be private-labeled

Proprietary and Confidential Copyright InPhonic, Inc. 2005

10

Growth Opportunities

Initiatives in Existing Business

Broaden base of private-label partners Expand and deepen carrier/OEM relationships Continue to enhance customer experience

New Strategic Initiatives

Cross-sell existing customers new products and services Enhance data services capability Explore international opportunities

Proprietary and Confidential Copyright InPhonic, Inc. 2005

11

Acquisition Strategy

Complementary and accretive opportunities

Increase margins/ expand subscriber base Broaden product portfolio Expand geographic reach

Proven track record of integrating operations A1 Wireless example

Acquired December 2004

2nd largest online seller of wireless services and devices in US Integrated operations into “best of breed” approach for servicing customers and carriers Deepened carrier relationships

Proprietary and Confidential Copyright InPhonic, Inc. 2005

12

Larry Winkler

Chief Financial Officer

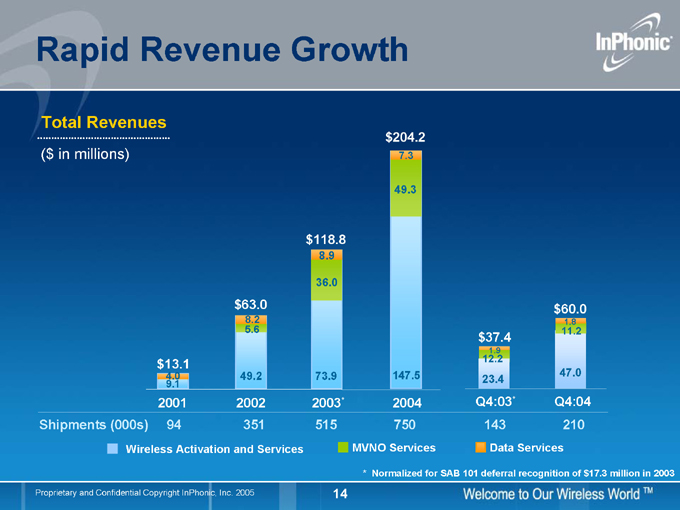

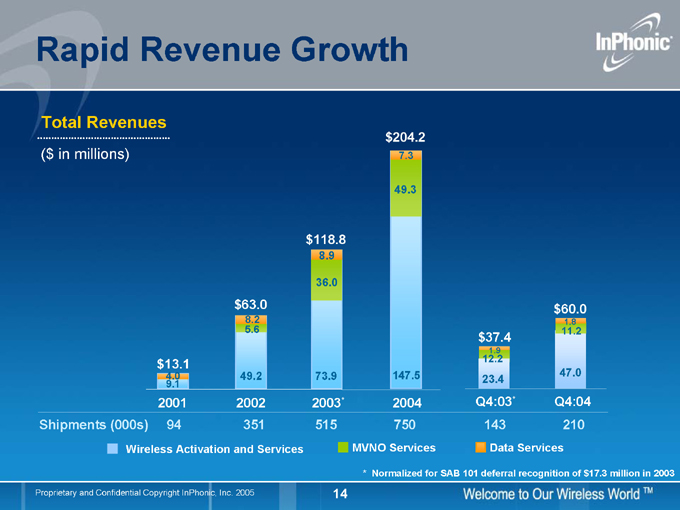

Rapid Revenue Growth

Total Revenues

($ in millions) $13.1

4.0 9.1 $63.0

8.2 5.6

49.2 $118.8

8.9

36.0

73.9 $204.2

7.3

49.3

147.5 $37.4

12.2 1.9

23.4 $60.0

1.8

11.2

47.0

2001 2002 2003* 2004 Q4:03* Q4:04

Shipments (000s) 94 351 515 750 143 210

Wireless Activation and Services

MVNO Services

Data Services

* Normalized for SAB 101 deferral recognition of $17.3 million in 2003

Proprietary and Confidential Copyright InPhonic, Inc. 2005

14

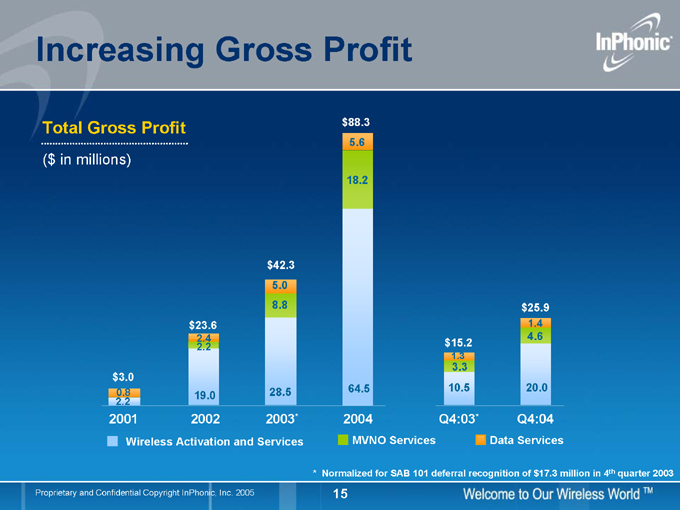

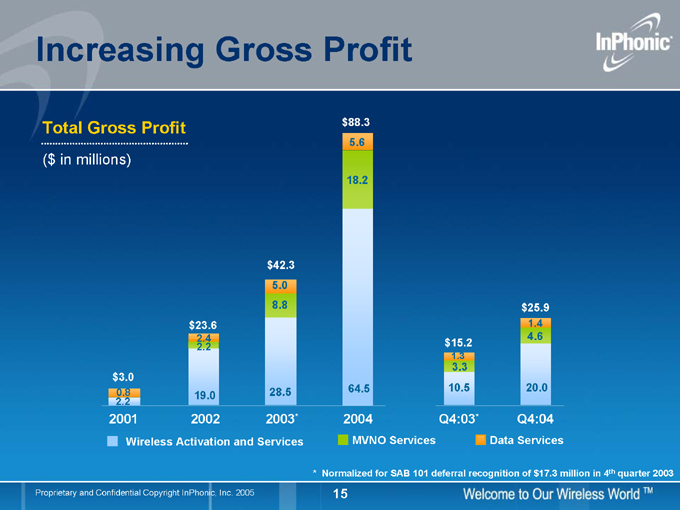

Increasing Gross Profit

Total Gross Profit

($ in millions) $3.0

2.2 0.8 $23.6

2.4 2.2

19.0 $42.3 5.0 8.8

28.5 $88.3 5.6

18.2

64.5

2001 2002 2003* 2004 $15.2

1.3

3.3 10.5 $25.9

1.4

4.6

20.0

Q4:03* Q4:04

Wireless Activation and Services

MVNO Services

Data Services

* Normalized for SAB 101 deferral recognition of $17.3 million in 4th quarter 2003

Proprietary and Confidential Copyright InPhonic, Inc. 2005

15

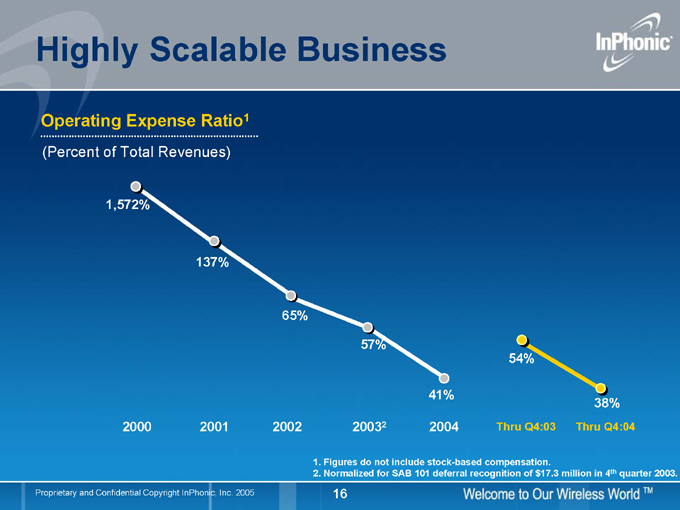

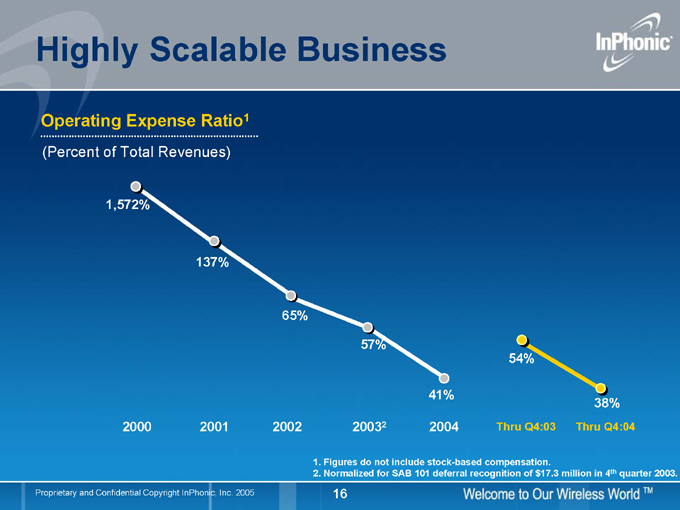

Highly Scalable Business

Operating Expense Ratio1

(Percent of Total Revenues)

1,572%

137%

65%

57%

41%

2000 2001 2002 20032 2004

54%

38%

Thru Q4:03 Thru Q4:04

1. Figures do not include stock-based compensation.

2. Normalized for SAB 101 deferral recognition of $17.3 million in 4th quarter 2003.

Proprietary and Confidential Copyright InPhonic, Inc. 2005

16

Strong Earnings Momentum

Quarterly EBITDA1

($ in millions)

Q1:03 Q2:03 Q3:03 Q4:032 Q1:04 Q2:04 Q3:04 Q4:04 $(2.5) $(8.4) $(9.0) $(5.0) $(2.8) $1.5 $2.3 $3.4

1. Figures do not include stock-based compensation.

2. Normalized for SAB 101 deferral recognition of $17.3 million in 2003

Proprietary and Confidential Copyright InPhonic, Inc. 2005

17

Improving Free Cash Flow

Quarterly FCF1

($ in millions)

Q1:03 Q2:03 Q3:03 Q4:032 Q1:04 Q2:04 Q3:04 Q4:04 $1.0 $(8.6) $(10.0) $(7.1) $(3.0) $1.2 $2.1 $3.2

1. Free Cash Flow= Net Income/(Loss) – Non Recurring Revenue Adjustments-Depreciation & Amortization – Stock-Based Compensation 2. Normalized for SAB 101 deferral recognition of $17.3 million in 2003

Proprietary and Confidential Copyright InPhonic, Inc. 2005

18

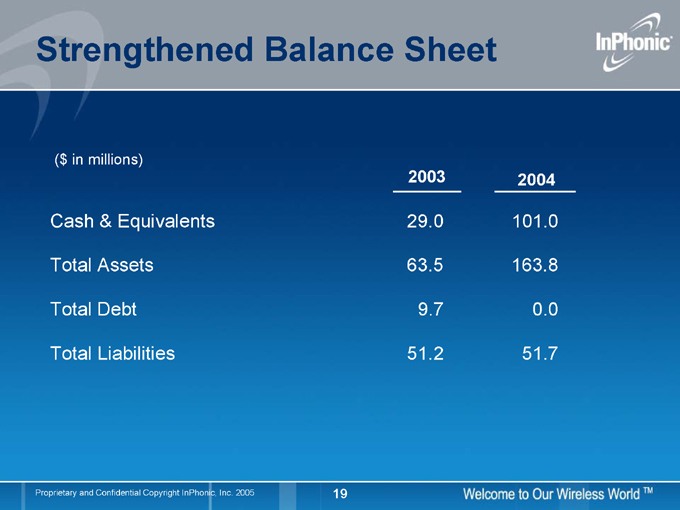

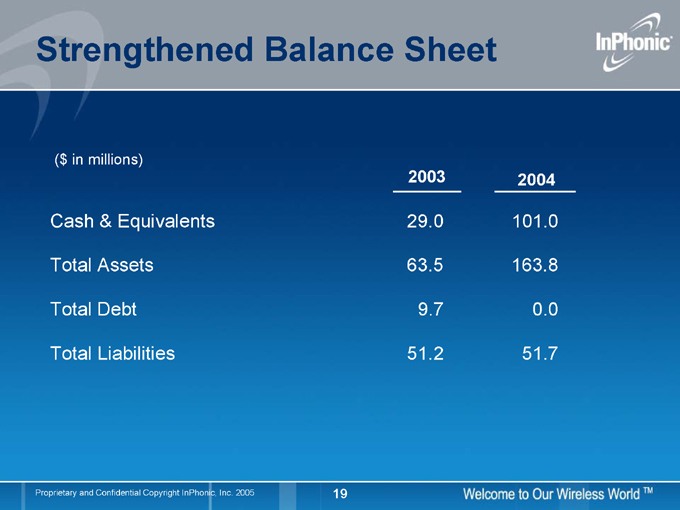

Strengthened Balance Sheet

($ in millions)

2003 2004

Cash & Equivalents 29.0 101.0

Total Assets 63.5 163.8

Total Debt 9.7 0.0

Total Liabilities 51.2 51.7

Proprietary and Confidential Copyright InPhonic, Inc. 2005

19

Questions & Answers