- GALT Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Galectin Therapeutics (GALT) DEF 14ADefinitive proxy

Filed: 28 Apr 05, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

PRO-PHARMACEUTICALS, INC.

(Name of Registrant As Specified In Its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PRO-PHARMACEUTICALS, INC.

189 WELLS AVENUE

NEWTON, MASSACHUSETTS 02459

April 28, 2005

Dear Stockholder:

I invite you to the 2005 Annual Meeting of Stockholders of Pro-Pharmaceuticals, Inc. The meeting will be held at 10:00 a.m. on Wednesday, May 25, 2005, at the Sheraton Needham Hotel, 100 Cabot Street, Needham, Massachusetts.

On the pages following this letter, you will find the Notice of our 2005 Annual Meeting of Stockholders, and the Proxy Statement, which describes the matters to be considered at the Annual Meeting. We have also enclosed your proxy card and our Annual Report on Form 10-K for the year ended December 31, 2004. You will find voting instructions on the enclosed proxy card. If your shares are held in “street name” (that is, held for your account by a broker or other nominee), you will receive instructions from the holder of record that you must follow for your shares to be voted.

The Annual Meeting is an excellent opportunity to learn more about Pro-Pharmaceuticals’ business and operations, and we hope you will be able to attend.

Thank you for your ongoing support and continued interest in Pro-Pharmaceuticals.

Sincerely yours, |

| /s/ DAVID PLATT |

| David Platt, Ph.D. |

| President and Chief Executive Officer |

PRO-PHARMACEUTICALS, INC.

189 WELLS AVENUE

NEWTON, MASSACHUSETTS 02459

NOTICE OF 2005 ANNUAL MEETING OF STOCKHOLDERS

DATEAND TIME:

Wednesday, May 25, 2005 at 10:00 a.m., local time

PLACE:

Sheraton Needham Hotel

100 Cabot Street

Needham, Massachusetts 02494

ITEMSOF BUSINESS:

| · | To consider and act upon a proposal to elect seven members of the Board of Directors to one-year terms |

| · | To consider and act on a proposal to ratify the appointment of Deloitte & Touche LLP as our independent auditors to audit our financial statements for our 2005 fiscal year |

| · | To transact such other business as may properly come before the Annual Meeting |

RECORD DATE:

You are entitled to vote if you were a stockholder of record at the close of business on April 12, 2005.

By Order of the Board of Directors | ||||

| /s/ DAVID PLATT | ||||

| April 28, 2005 | David Platt, Ph.D. | |||

| Newton, Massachusetts | President and Chief Executive Officer | |||

PRO-PHARMACEUTICALS, INC.

189 WELLS AVENUE

NEWTON, MASSACHUSETTS 02459

April 28, 2005

PROXY STATEMENT

FOR 2005 ANNUAL MEETING OF STOCKHOLDERS

DATE, TIME, AND PLACE OF MEETING

This Proxy Statement is being provided to you by the Board of Directors of Pro-Pharmaceuticals, Inc. in connection with our 2005 Annual Meeting of Stockholders. The Annual Meeting will be held at 10:00 a.m. on Wednesday, May 25, 2005 at the Sheraton Needham Hotel, 100 Cabot Street, Needham, Massachusetts 02494, for the purposes set forth in the accompanying Notice of Annual Meeting. We intend to mail this Proxy Statement and the accompanying Notice of Annual Meeting on or about April 28, 2005, to all stockholders entitled to vote at the Annual Meeting.

PURPOSE OF MEETING

The proposals that will be considered and acted on at the Annual Meeting are (1) the election of seven directors to one-year terms; and (2) the ratification of the appointment of Deloitte & Touche LLP as our independent auditors to audit our financial statements for our 2005 fiscal year. The Board of Directors knows of no other business to be presented for consideration at the Annual Meeting. Each proposal is described in more detail in this Proxy Statement.

INFORMATION ABOUT PROXIES AND VOTING

Proxies

We urge holders of our common stock who are entitled to vote to sign the enclosed proxy card and return it promptly in the return envelope by following the instructions on the proxy card (both enclosed with these materials). Proxies will be voted as directed. Any proxy card returned without directions given will be voted “FOR” the election as directors of the nominees named herein, “FOR” ratification of the appointment of Deloitte & Touche LLP as our independent accountant to audit our financial statements for our 2005 fiscal year, and, as to any other business that may come before the Annual Meeting, in accordance with the judgment of the person or persons named in the proxy. A stockholder may revoke a proxy at any time prior to the voting thereof by providing written notice of revocation to Pro-Pharmaceuticals, Inc. at 189 Wells Avenue, Newton, Massachusetts 02459, Attention: Vice President, Investor Relations. The proxy may also be revoked by submitting to us before the Annual Meeting a more recently dated proxy or by attending the Annual Meeting and voting in person.

Solicitation of Proxies

The solicitation of proxies in the enclosed form is made on behalf of the Board of Directors. Pro-Pharmaceuticals is covering all costs of soliciting these proxies, including the costs of preparing, printing and mailing to stockholders this Proxy Statement and accompanying materials. In addition to use of the mails, proxies may be solicited personally or by telephone or otherwise by our officers, directors and employees, who will not be additionally compensated for such activities. We are also working with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of shares held of record by such institutions and persons. We will reimburse their reasonable expenses incurred to assist us.

Stockholders Entitled to Vote

Only holders of record of our common stock at the close of business on April 12, 2005 will be entitled to notice of and to vote at the Annual Meeting. At the close of business on April 12, 2005, Pro-Pharmaceuticals had

1

outstanding and entitled to vote 27,315,411 shares of common stock. Each holder of record of common stock on April 12, 2005 is entitled to one vote for each share held on all matters to be voted on at the Annual Meeting. There is no cumulative voting for the common stock.

Establishing a Quorum

Holders of more than 50% of our shares of common stock issued and outstanding must be present or represented at the Annual Meeting to have a quorum for conducting business. Shares as to which a broker indicates that it has no discretion to vote and which are not voted, known as “broker non-votes,” will be considered present at the Annual Meeting for purposes of determining the presence of a quorum, but such shares have no effect on the approval of the proposals described in this Proxy Statement. Proxies marked as abstaining on any matter to be acted on by the stockholders will be treated as present at the Annual Meeting for purposes of determining a quorum but will not be counted as votes cast on such matters.

Votes Required

Directors will be elected by a plurality of the votes of the stockholders cast at the Annual Meeting. A majority of the outstanding votes of stockholders entitled to vote are required for each of the other matters to be considered at the Annual Meeting. Neither abstentions nor broker non-votes will have any effect on the outcome of the votes on these matters.

OWNERSHIP OF PRO-PHARMACEUTICALS, INC. COMMON STOCK

The following table sets forth certain information regarding beneficial ownership of our common stock, as of April 12, 2005, by (1) each stockholder known to us to be the beneficial owner of more than 5% of our outstanding shares of common stock, (2) each of the executive officers whose names appear in the summary compensation table as well as (3) each current director and (4) our executive officers and directors as a group, as of April 12, 2005.

Name(1) | Shares of Common Stock Beneficially Owned (2) | Percentage of Class | |||

David Platt, Ph.D.(3) | 4,547,747 | 16.6 | % | ||

James C. Czirr(4) | 4,758,768 | 17.6 | |||

Burton C. Firtel(5) | 448,000 | 1.6 | |||

Dale H. Conaway, D.V.M.(6) | 40,096 | * | |||

David H. Smith(7) | 382,500 | 1.4 | |||

Edgar Ben-Josef, M.D.(8) | 16,000 | * | |||

Mildred S. Christian, Ph.D.(9) | 122,208 | * | |||

Steven Prelack(8) | 17,500 | * | |||

Jerald K. Rome(10) | 248,844 | * | |||

Maureen E. Foley(11) | 775,000 | 2.8 | |||

Charles F. Harney | 0 | * | |||

All executive officers and directors as a group (11 persons) | 6,597,895 | 22.8 | % |

| * | Less than 1%. |

| (1) | The address of each of the persons listed is c/o Pro-Pharmaceuticals, Inc., 189 Wells Avenue, Newton, MA 02459. |

| (2) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number of shares owned by a person and the percentage ownership of that person, shares of common stock subject to options and warrants held by that person that are currently exercisable or exercisable within 60 days of April 12, 2005, are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. This table has been prepared based on 27,315,411 shares of common stock outstanding as of April 12, 2005. |

2

| (3) | Includes 7,379 shares, as well as 3,500 shares issuable upon the exercise of an immediately exercisable share purchase warrant, all owned by Dr. Platt’s wife, and as to which Dr. Platt disclaims beneficial ownership. |

| (4) | Includes 29,400 shares owned by children of Mr. Czirr, as to which Mr. Czirr disclaims beneficial ownership. |

| (5) | Includes 269,000 shares issuable upon the exercise of stock options. Also includes 50,000 shares issuable upon the exercise of an immediately exercisable share purchase warrant. |

| (6) | Includes 21,000 shares issuable upon the exercise of stock options. Also includes 6,250 shares issuable upon the exercise of an immediately exercisable share purchase warrant. |

| (7) | Includes 119,000 shares issuable upon the exercise of stock options. Also includes 100,000 shares and 100,000 shares issuable upon the exercise of an immediately exercisable share purchase warrant, all owned by a limited liability company of which Mr. Smith is a member and the manager. Mr. Smith disclaims beneficial ownership of such securities except to the extent of his pecuniary interest therein. |

| (8) | Represents shares issuable upon the exercise of stock options. |

| (9) | Includes 69,354 shares issuable upon the exercise of stock options. |

| (10) | Includes 42,000 shares and 82,000 shares issuable upon the exercise of immediately exercisable share purchase warrants, all owned by Mr. Rome’s grandchildren, and as to which Mr. Rome disclaims beneficial ownership. |

| (11) | Includes 770,000 shares issuable upon the exercise of stock options. |

We are not aware of any arrangements which may result in “changes in control” as that term is used in Item 403(c) of Regulation S-K.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Seven members of our Board of Directors are nominated to be re-elected at the Annual Meeting to serve one-year terms until the 2006 annual meeting of stockholders and until their respective successors are elected and shall qualify. Each nominee has agreed to serve if elected. Votes that are withheld will be counted in determining the presence of a quorum, but will have no effect on the vote. Dr. Ben-Josef has declined to be re-elected a director because of professional demands, but will remain a member of our Scientific Advisory Board and Medical Advisory Board.

Set forth below is information regarding the nominees, as of April 15, 2004, including their ages, positions with Pro-Pharmaceuticals, recent employment and other directorships.

The Board recommends a vote FOR the election to the Board of each of the following nominees.

Name | Age as of 4/15/05 | Position | ||

David Platt, Ph.D. | 51 | President, Chief Executive Officer, and Director | ||

Burton C. Firtel | 65 | Director | ||

Dale H. Conaway, D.V.M. | 50 | Director | ||

David H. Smith | 65 | Director | ||

Mildred S. Christian, Ph.D. | 62 | Director | ||

Steven Prelack | 47 | Director | ||

Jerald K. Rome | 70 | Director |

Dr. Platt has served as Chairman, President, Chief Executive Officer and a director since May 2001. He served as Treasurer from May 2001 until June 2003 when our Chief Financial Officer succeeded to the office. From 1992 to 2000, he was Chairman and Chief Executive Officer of SafeScience, Inc. (now known as GlycoGenesys, Inc.; Nasdaq SmallCap: GLGS), a biotechnology company involved in research and development

3

of products for treating cancer and immune system diseases. From 1991 to 1992, Dr. Platt was a research scientist with the Department of Internal Medicine at the University of Michigan, Ann Arbor, and from 1988 to 1990 was a research fellow at Wayne State University and the Michigan Cancer Foundation in Detroit (re-named Barbara Ann Karmanos Cancer Institute). Previously, he was a research fellow in the Weizmann Institute of Science, Rehovot, Israel. Dr. Platt received a Ph.D. in chemistry from Hebrew University in Jerusalem and earned an M.S. and a B.S. degree from Hebrew University. He also earned a Bachelor of Engineering degree from Technion in Haifa, Israel. Dr. Platt has published peer review articles and holds many patents, primarily in the field of carbohydrate chemistry.

Mr. Firtel has served as a director since May 2001. He is President of Adco Medical Supplies Incorporated, a company he founded in 1970. Adco Medical Supplies distributes disposable medical supplies to U.S. customers, mostly for hospital use. Mr. Firtel also serves as President of Plastic Fabricators Incorporated, a manufacturer of plastic burial supplies sold through distributors to customers in the funeral industry, which was acquired by Adco Medical Supplies in 1992. Mr. Firtel received a B.S. degree in business administration from Boston University.

Dr. Conaway has served as a director since May 2001. He is the Deputy Regional Director (Southern Region) and Chief Veterinary Medical Officer for the Office of Research Oversight, an office within the Veterans Health Administration under the U.S. Department of Veterans Affairs. From 1998 to 2001, he served as Manager of the Equine Drug Testing and Animal Disease Surveillance Laboratories for the Michigan Department of Agriculture. From 1994 to 1998 he was Regulatory Affairs Manager for the Michigan Department of Public Health Vaccine Production Division. Dr. Conaway received B.S. and D.V.M. degrees from Tuskegee Institute and an M.S. degree in pathology from the College of Veterinary Medicine at Michigan State University.

Mr. Smith has served as a director since January 2002. Since 1996, he has been a Founder and Managing Director of venture capital funds, as follows: Interim Advantage Fund, LLC (founded in 1996), Contra V.C., LLC (founded in 1998), Tailwind V.C., LLC (founded in 2000), and Fivex, LLC (founded in 2004). He has had significant business experience in the clinical laboratory industry. He was a co-founder, Vice President and Director of Canberra Industries, a large publicly-traded manufacturer of analytical instruments, and also of Canberra Clinical Laboratories, which was sold in 1986 to MetPath, Inc., a subsidiary of Corning, Inc. Mr. Smith received a B.A. degree in political science from Hampden-Sydney College.

Dr. Christian has served as a director since October 2002. She is President of Argus International, Inc., a provider of consulting services in regulatory affairs, and Chairman and Chief Executive Officer of Argus Health Products, LLC, which develops and internationally distributes preventive and maintenance health care products for health care professionals and the over-the-counter market. Until 2002, she was Executive Director of Research of Argus and Redfield Laboratories, both divisions of Charles River Laboratories. Before founding Argus Research Laboratories in 1979 and Argus International in 1980, Dr. Christian spent 14 years in drug development at McNeil Laboratories, a division of Johnson & Johnson Corporation. She has participated at all levels in the performance, evaluation and submission in over 1,800 pre-clinical studies, from protocol to final report. Dr. Christian is a member of 20 professional organizations, including current service as Councilor of the European Teratology Society and Secretary/Treasurer of the Academy of Toxicological Sciences, and was past president of the Teratology Society, the American College of Toxicology, and the Academy of Toxicological Sciences. She is an honorary member of the Society of Quality Assurance and founding editor of theJournal of Toxicological Sciences. She has edited or contributed to several major textbooks and is the author of over 120 papers and abstracts published in U.S. and international journals. Dr. Christian earned her Ph.D. from Thomas Jefferson University in developmental anatomy and pharmacology, and her B.S. and M.S. degrees in zoology from Pennsylvania State University.

Mr. Prelack has served as a director since April 2003. Since 2001 he has served as Senior Vice President, Chief Financial Officer and Treasurer of VelQuest Corporation, a provider of automated compliance management solutions for the pharmaceutical industry. In this capacity, he oversees business development,

4

financial, administrative and other functions, and has been responsible for VelQuest’s transition from a development-stage company to an operating company. From 1996 to 2000, he was Senior Vice President, Chief Financial Officer and Treasurer of LifeMetrix, Inc., a leading provider of cancer disease management services, as well as disease management technology, data and clinical trial product lines and related technology-based services. As co-founder of LifeMetrix, Mr. Prelack was responsible for all stages of its development, including initial seed capital funding, execution of its strategic business plan, and sale of the company. Mr. Prelack is a Strategic Financial Adviser to Codeco Corporation, a designer and manufacturer of custom resisters and switches, and to OPCAT, Inc., which specializes in OPM, a systems design and architecture platform.Mr. Prelack, a certified public accountant, received a B.B.A. degree from the University of Massachusetts (Amherst) with dual majors in finance and accounting.

Mr. Rome has served as a director since March 2004. He has been a private investor from 1996 to the present. Previously, he founded Amberline Pharmaceutical Care Corp., a marketer of non-prescription pharmaceuticals, in 1993 and served as its President from 1993 to 1996. From 1980 to 1990, he served as Chairman, President and Chief Executive Officer of Moore Medical Corp. (AMEX: MMD), a national distributor of branded pharmaceuticals and manufacturer and distributor of generic pharmaceuticals, and was previously Executive Vice President of the H.L. Moore Drug Exchange, a division of Parkway Distributors and predecessor of Moore Medical Corp.Mr. Rome received a B.S. degree in pharmaceutical sciences from the University of Connecticut.

Executive Officers

David Platt has served as our President and Chief Executive Officer since May 2001. His biography is set forth above.

Carl Lueders has served as our Chief Financial Officer and Treasurer since February 9, 2005. From 2003 to 2005 he served as Chief Financial Officer of R.F. Morse & Son, Inc., an agri-based company. From 2002 to 2003 he was Chief Executive Officer of Brine, Inc., a developer, manufacturer and marketer of sporting goods equipment. From 1979 to 2001, Mr. Lueders held finance and planning positions at Polaroid Corporation, including Vice President and Controller, Treasurer and Acting Chief Financial Officer. Mr. Lueders, a certified public accountant, received an M.B.A. from Babson College and a B.A. in economics from the University of Massachusetts.

Maureen Foley has served as our Chief Operating Officer since October 2001 and, prior to October 2001, as our Manager of Operations. She also holds the office of Secretary. She has been involved in the start-up of several high tech companies, beginning with Organogenesis, an MIT spin-off developing living tissue for skin graft and organ repair applications. In 1996, Ms. Foley joined Thermo Electron’s Thermo Fibergen division, a paper waste processing developer. In 1999 she joined ArsDigita, a developer of business software and programs, and in 2000 she joined eHealthDirect, a developer of medical records processing software. In these positions she has been responsible for the establishment and administration of business operations including human resources and benefits, accounting, finance and payroll, marketing, product development, facilities management and operations, and project management. She is a Director and Chairman of Tax/Eze, Inc., a tax preparation and financial services company. Ms. Foley is a graduate of The Wyndham School, Boston, Massachusetts, with a major in mechanical engineering. She has completed advanced management courses in project management, budget and planning, tax preparation and human resources.

None of the directors nor executive officers specified above share any familial relationship.

To the best of our knowledge, there are no material proceedings to which any of our directors (all of whom are current nominees) or executive officers is a party adverse to, or has a material interest adverse to, Pro-Pharmaceuticals. To the best of our knowledge, there have been no events under any bankruptcy act, no criminal proceedings and no judgments or injunctions that are material to the evaluation of the ability or integrity of any director, executive officer, promoter or control person of Pro-Pharmaceuticals during the past five years.

5

Board of Directors Meetings and Committees of the Board

During the year ended December 31, 2004, our Board held fifteen meetings. During 2004, the Board had three standing committees: the Compensation Committee, the Audit Committee and the Nominating and Corporate Governance Committee. All of the directors on each committee are “independent” within the meaning of American Stock Exchange listing standards. During 2004 Edgar Ben-Josef attended fewer than 75% of the aggregate number of meetings of the Board of Directors and the committees of the Board on which he served. As required by the stock exchange rules, we held one meeting of the Board attended only by the independent (non-management) directors.

Compensation Committee

The Compensation Committee, whose members are Mildred Christian (chair) and Edgar Ben-Josef, met four times during 2004. David Smith will serve on this Committee during 2005, if re-elected as a director at the Annual Meeting, and would replace Dr. Ben-Josef. The Committee is responsible for reviewing and recommending compensation policies and programs, as well as salary and benefit levels for our executive officers. Its specific responsibilities include supervising and overseeing the administration of our incentive compensation and stock programs and, as such, the Committee is responsible for administration of grants and awards to directors, officers, employees, consultants and advisors under Pro-Pharmaceuticals’ 2001 Stock Incentive Plan, and the 2003 Non-employee Director Stock Incentive Plan. Additional information about the Compensation Committee is provided below under the caption “Report of the Compensation Committee.”

Audit Committee

The Audit Committee, whose members are Steven Prelack (chair), Dale Conaway and Jerald Rome, met seven times during 2004. Its chair met informally from time to time with our management and outside auditor. The charter of the Audit Committee was filed as an exhibit to our proxy statement for the 2004 Annual Meeting, and is posted on our website at www.pro-pharmaceuticals.com. The Audit Committee is responsible for oversight of the quality and integrity of the accounting, auditing and reporting practices of Pro-Pharmaceuticals. More specifically, it assists the Board of Directors in fulfilling its oversight responsibilities relating to (i) the quality and integrity of our financial statements, reports and related information provided to stockholders, regulators and others, (ii) our compliance with legal and regulatory requirements, (iii) the independent auditor’s qualifications, independence and performance, (iv) the internal control over financial reporting that management and the Board have established, and (v) the audit, accounting and financial reporting processes generally. The Committee is also responsible for review and approval of related-party transactions. Additional information about the Audit Committee is provided below under the caption “Report of the Audit Committee.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, whose members are Edgar Ben-Josef (chair) and Steven Prelack, met once during the last fiscal year. Jerald Rome, Dale Conaway and Mildred Christian, if re-elected as directors at the Annual Meeting, will serve on this Committee (replacing Dr. Ben-Josef and Mr. Prelack), and Mr. Rome has agreed to become the chair, The Committee’s charter is available on our website at www.pro-pharmaceuticals.com. The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become members of the Board, and to recommend to the Board candidates for election or re-election as directors, and for reviewing our governance policies in light of the corporate governance rules of the American Stock Exchange and the Securities and Exchange Commission. Under its charter, the Nominating and Corporate Governance Committee is required to establish and recommend criteria for service as a director, including matters relating to professional skills and experience, board composition, potential conflicts of interest and manner of consideration of individuals proposed by management or stockholders for nomination. The Committee believes candidates for the Board should have the ability to exercise objectivity and independence in making informed business decisions; extensive knowledge, experience and judgment; the highest integrity; loyalty to the interests of Pro-Pharmaceuticals and its stockholders; a willingness to devote the extensive time necessary to fulfill a director’s duties; the ability to contribute to the diversity of

6

perspectives present in board deliberations; and an appreciation of the role of the corporation in society. The Committee will consider candidates meeting these criteria who are suggested by directors, management, stockholders and other advisers hired to identify and evaluate qualified candidates.

The Committee has adopted a policy for stockholders to submit recommendations for director candidates. A stockholder desiring to make a recommendation may do so in writing by letter to the Nominating and Corporate Governance Committee stating the reasons for the recommendation and how the candidate may meet the Committee’s director selection criteria. The letter may be confidential and should be addressed to the Chairman of the Nominating and Governance Committee, c/o Vice President, Investor Relations, Pro-Pharmaceuticals, Inc., 189 Wells Avenue, Newton, Massachusetts 02459. The Committee will evaluate stockholder-recommended candidates in the same manner as candidates recommended by other persons. Further information about stockholder nominations will be provided on our website as it becomes available.

Stockholder Communications with the Board of Directors

Stockholders may send communications to the Board, the Chairman, or one or more non-management directors by using the contact information provided on our website. Stockholders also may send communications by letter addressed to the President, Pro-Pharmaceuticals, Inc., 189 Wells Avenue, Newton, Massachusetts 02459, or by contacting our President or Vice President, Investor Relations, at (617) 559-0033.All communications will be received and reviewed by our President and/or Vice President, Investor Relations. Stockholder concerns about our accounting, internal controls, auditing matters or business practices will be reported to the Audit Committee. All other concerns will be reported to the appropriate committee(s) of the Board.

Attendance of Board Members at the Annual Meeting

We encourage, but do not require, our Board members to attend the annual meeting of stockholders. Four members of the Board attended our 2003 annual meeting.

7

EXECUTIVE COMPENSATION

The following table sets forth certain information regarding our Chief Executive Officer and each of our four most highly compensated executive officers whose total annual salary and bonus for the fiscal year ended December 31, 2004 exceeded $100,000 (the “Named Executive Officers”). For the 2004 fiscal year, our Named Executive Officers were David Platt, Charles Harney and Maureen Foley.

Summary Compensation Table

| Annual Compensation | Long-Term Compensation | ||||||||||||||||

| Awards | Payouts | ||||||||||||||||

Name and Principal Position | Year | Salary ($) | Bonus ($) | Other Annual Compen- sation ($) | Restricted ($) | Securities Under- Lying Options/ SARs (#) | LTIP Payouts ($) | All Other ($) | |||||||||

David Platt, President and Chief Executive Officer | 2004 2003 2002 | 222,933 180,000 157,500 | | 100,000 — | — — — | — — — | — — — | — — — | — — — | ||||||||

Charles Harney, Chief Financial Officer | 2004 2003 | 179,300 5,102 | (1) | — | |||||||||||||

Maureen Foley, Chief Operating Officer | 2004 2003 2002 | 153,400 120,000 83,750 | | 35,000 — — | — — — | — — — | 75,000 650,000 100,000 | — — — | — — — | ||||||||

| (1) | For service as Chief Financial Officer until November 1, 2004. Mr. Harney was paid $32,113 for financial management advisory services rendered between November 2 and December 31, 2004. Carl Lueders, whose biography is set forth above, became our Chief Financial Officer on February 9, 2005. |

Option Grants in Last Fiscal Year

The following table shows all grants of options to acquire shares of Pro-Pharmaceuticals common stock granted to the Named Executive Officers listed in the Summary Compensation Table for the fiscal year ended December 31, 2004.

| Individual Grants | |||||||||||||||

Name | Number of Granted | % of Total Options Granted to Pro- in Fiscal Year | Exercise Price | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term ($) | ||||||||||

| 5%(3) | 10%(3) | ||||||||||||||

Maureen Foley | 75,000 | (1) | 35% | $1.90 | 12/21/14 | $ | 89,617 | $ | 227,108 | ||||||

| (1) | The options vest at the rate of 25,000 shares on December 21, 2005, 2006 and 2007. |

| (2) | The exercise price equals the closing price of our common stock on the grant date, December 21, 2004. |

| (3) | Potential realizable value assumes that the common stock appreciates at the rate shown (compounded annually) from the grant date until the option expiration date. The assumed rate of appreciation is derived from an SEC regulation and is provided for illustrative purposes. It does not represent our estimate of the rate of price appreciation for our stock, nor the present value of the stock options. |

8

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table shows aggregate exercises of options to purchase Pro-Pharmaceuticals’ common stock in the fiscal year ended December 31, 2004 by the Named Executive Officers.

Name | Shares Acquired on Exercise (#) | Value Realized | Number of Securities at Fiscal Year-End | Value of Unexercised In-The-Money Options at | |||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

Maureen Foley | — | — | 770,000 | 75,000 | — | $ | 45,000 | ||||||

| (1) | The value of unexercised options is based on the difference between the exercise price and the $2.50 closing price on the American Stock Exchange of a share of our common stock on December 31, 2004. |

Compensation of Directors

We compensate each of our non-employee directors with a grant of 500 non-qualified stock options for each meeting of our Board, and each meeting of a standing committee of the Board that such director attended during a year of service. Beginning with Board and committee service in 2003, we grant options under our 2003 Non-employee Directors Stock Incentive Plan, which was adopted by our Board in late 2003 and approved at our 2004 annual meeting of stockholders. For service in 2003, we granted options as of September 15, 2004, which were immediately exercisable at $3.86 per share, to our non-employee directors as follows: Edgar Ben-Josef—7,000 options, Mildred Christian—9,000 options, Dale Conaway—7,000 options, Burton Firtel—7,500 options, Steven Prelack—250 options, and David Smith—7,000 options. For service in 2004, we granted options as of February 24, 2005, which were immediately exercisable at $2.70 per share, to our non-employee directors as follows: Edgar Ben-Josef—5,000 options, Mildred Christian—9,000 options, Dale Conaway—9,500 options, Burton Firtel—7,500 options, Steven Prelack—11,000 options, and David Smith—7,500 options.

We paid Mr. Prelack, a director and member of our Audit Committee, $54,000 for service in 2004 as chair of this Committee. We paid Messrs. Firtel and Prelack and Dr. Conaway $6,000, $3,200 and $1900 respectively for special services as directors in 2004 to provide oversight of our litigation matters, particularly as related to our intellectual property.

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

Dr. Platt is the only Named Executive Officer with whom we have an employment contract, a copy of which was filed as an exhibit to our Annual Report for the year ended December 31, 2003 filed on Form 10-K on March 30, 2004. The agreement, which became effective on January 2, 2004, provides that Dr. Platt shall serve as President and Chief Executive Officer at an initial base salary of $220,000 per year (effective in 2004 and increased to $260,000 for 2005), subject to annual review, and shall receive our standard employee life, disability and health insurance benefits. Dr. Platt is also entitled to receive bonus compensation as follows:

| (i) | upon consummation of a transaction with a pharmaceutical company expected to result in at least $10,000,000 of equity investment or $50,000,000 of royalty revenue or other substantial benefit as our Board may determine, a cash bonus of $200,000 and fully vested 10-year stock options exercisable at not less than the market value to purchase at least 200,000 of our shares of common stock; |

| (ii) | upon approval by the Food and Drug Administration of each new investigational new drug application filed by us for commencement of human trials, a cash bonus of $100,000 and 100,000 of such stock options; |

| (iii) | upon approval by the FDA of each new drug application filed by us for any drug or drug delivery candidate, a cash bonus of $400,000 and 400,000 of such stock options; and |

| (iv) | a cash bonus upon achievement of goals specified by our Board as determined in the first quarter of each fiscal year, with 50% based on performance relative to his work as an executive manager and/or scientist and 50% based on reference to objective criteria such as the market price of our stock or meeting budgets approved by the Board. |

9

If Dr. Platt’s employment terminates other than “for cause” or within twelve months after a change of control of Pro-Pharmaceuticals, he is entitled to, among other things, severance payments for two years based on his salary as of termination, a cash payment ranging from $1,000,000 and $2,000,000 calculated by reference to prior bonus payments, continuation of or comparable health plan benefits for him and his family for two years, and immediate vesting of any unvested stock options.

The agreement requires Dr. Platt to assign inventions and other intellectual property to Pro-Pharmaceuticals which he conceives or reduces during employment and for such period as the company pays severance, contains protective provisions concerning confidential information, non-competition and non-solicitation of employees, and provides for indemnification of Dr. Platt.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during 2004 were Mildred Christian and Edgar Ben-Josef. If re-elected at the 2005 Annual Meeting, David Smith will replace Dr. Ben-Josef. None of these persons was an officer or employee of Pro-Pharmaceuticals during the fiscal year, formerly an officer of Pro-Pharmaceuticals, or had any relationship otherwise requiring disclosure hereunder.

Report of the Compensation Committee on Executive Compensation

The Compensation Committee determines the cash and other incentive compensation, if any, to be paid to our executive officers and key employees. Compensation may include both cash (base salary and bonus) and equity-based compensation. Base salary is determined with reference to market norms. Bonus compensation (cash and/or options) is based on a number of factors such as our financial and non-financial performance, including fund raising; operating within budget; enhancing our market value; developing drug candidates, including enhancing our product pipeline; and expanding our intellectual property portfolio.

Equity-based compensation is comprised of stock option grants. We believe that equity-based compensation is useful to align the economic interest of the executive officers of Pro-Pharmaceuticals with the economic interests of our stockholders. The Compensation Committee reviews the outstanding unvested options of the key executives from time to time and may grant additional options to encourage the retention of key executives.

The compensation of our Chief Executive Officer is generally based on the same policies and criteria as the other executive officers. Dr. Platt’s base salary was $180,000 in 2003, $220,000 in 2004, and was increased to $260,000 for 2005. In developing Dr. Platt’s employment agreement, including bonus compensation in cash and stock options for milestone achievements, the Compensation Committee considered the factors noted above. The Committee believes Dr. Platt’s compensation, including salary, bonus and stock options, fall within the Company’s compensation philosophy and are consistent with industry norms for a development-stage pharmaceutical company, and that severance contingencies are appropriate in light of the substantial contribution he has made to our science and intellectual property. We also awarded Dr. Platt a cash bonus of $100,000 for satisfactorily achieving in 2004 certain incentives set by the Committee comprised of factors such as filing patent applications, completing equity financings, and meeting certain milestones for our Phase I and Phase II human clinical trials.

The Committee approved an increase of the salary of Maureen Foley, our Chief Operating Officer, from $150,000 in 2004 to $185,000 in 2005 in recognition of her contributions to the company and to bring her within industry standards for such an office. We also awarded Ms. Foley 75,000 stock options in December 2004, which vest at the rate of 25,000 options per year beginning the first anniversary of the grant date, as a long-term retention vehicle which is consistent with industry standards for such an office.

The objective of a formal compensation policy is to enable the Company to attract and retain qualified executives, and reward executives for performance against a number of Company goals agreed upon for the long-term maximization of stockholder value. The Compensation Committee has implemented this policy against which to assess executive compensation.

COMPENSATION COMMITTEE

Mildred Christian, Ph.D.

Edgar Ben-Josef, M.D.

10

Performance Graph

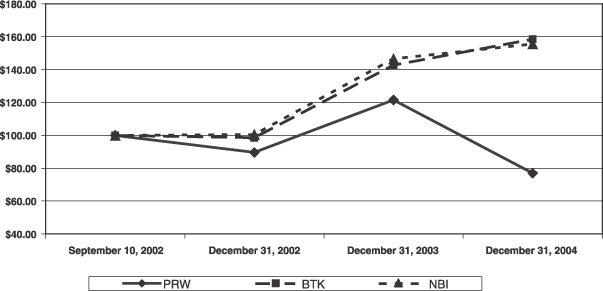

The graph below shows the cumulative total stockholder return assuming the investment of $100 beginning September 10, 2002 (the date our common stock began trading on the Over-the-Counter Bulletin Board) through December 31, 2004, in each of Pro-Pharmaceuticals’ common stock, the AMEX Biotechnology Index (BTK) and the Nasdaq Biotechnology Index (NBI). Our common stock has been traded on the American Stock Exchange since September 2003. The other indices may reflect the investment of dividends; however, we have not declared or paid any dividends to date. The price performance of Pro-Pharmaceuticals shown in the following graph is not indicative of future stock price performance.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors has, subject to the ratification of the stockholders, appointed Deloitte & Touche LLP, as Pro-Pharmaceuticals’ independent auditors for the fiscal year ending December 31, 2005. Deloitte & Touche has served as our independent auditors since February 2002. We do not expect a representative of Deloitte & Touche to be present at the Annual Meeting.

The Board recommends a vote “FOR” the ratification of the appointment of Deloitte & Touche LLP, as Pro-Pharmaceuticals’ independent auditors for the fiscal year ending December 31, 2005.

Following is information concerning the fees paid to Deloitte & Touche during our 2004 and 2003 fiscal years.

Fiscal Year 2004 | Fiscal Year 2003 | |||||

Audit Fees(1) | $ | 154,500 | $ | 252,800 | ||

Audit-Related Fees(2) | 57,450 | 14,300 | ||||

Tax Fees(3) | 7,425 | 0 | ||||

Subtotal | 219,375 | 267,100 | ||||

All Other Fees(4) | 66,800 | 18,250 | ||||

Total Fees | $ | 286,175 | $ | 285,350 | ||

11

| (1) | Audit Fees. These are fees for professional services performed by Deloitte & Touche for the audit of our annual financial statements included in our annual report on Form 10-K and review of financial statements included in our quarterly 10-Q filings, and services that are normally in connection with statutory and regulatory filings or engagements for such fiscal year. |

| (2) | Audit-Related Fees. These are fees for assurance and related services performed by Deloitte & Touche that are reasonably related to the performance of the audit or review of our financial statements, including financial disclosures made in our equity finance documentation and registration statements filed with the SEC that incorporate financial statements and the auditors report thereon, and consultation with our Audit Committee on financial accounting/reporting standards. |

| (3) | Tax Fees. These are fees paid to Deloitte & Touche for professional services with respect to tax compliance, in particular, preparation of our corporate tax returns. |

| (4) | All Other Fees. These are fees for all other products and services provided or performed by Deloitte & Touche, not falling in one or more of the above categories and in 2003 and 2004 included services related to response to legal proceedings disclosed in our Annual Report on Form 10-K. |

The Audit Committee has considered whether the provision of non-core audit services to Pro-Pharmaceuticals by Pro-Pharmaceuticals’ principal auditor is compatible with maintaining independence.

Pre-Approval Policy and Procedures

The Audit Committee has adopted a policy and procedures which set forth the manner in which the Committee will review and approve all services to be provided by the independent auditor before the auditor is retained to provide such services. The policy requires Audit Committee pre-approval of the terms and fees of the annual audit services engagement, as well as any changes in terms and fees resulting from changes in audit scope or other items. The Audit Committee also pre-approves, on an annual basis, other audit services, and audit-related and tax services set forth in the policy, subject to estimated fee levels, on a project basis and aggregate annual basis, which have been pre-approved by the Committee.

All other services performed by the auditor that are not prohibited non-audit services under SEC or other regulatory authority rules must be separately pre-approved by the Audit Committee. Amounts in excess of pre-approved limits for audit services, audit-related services and tax services require separate pre-approval of the Audit Committee.

The Chief Financial Officer reports quarterly to the Audit Committee on the status of pre-approved services, including projected fees. All of the services reflected in the above table were approved by the Audit Committee.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee is responsible for providing independent, objective oversight of Pro-Pharmaceuticals’ accounting functions and internal control over financial reporting. The Audit Committee acts under a written charter first adopted and approved by the Board of Directors in 2001, as amended in 2004, which is reviewed annually. The Audit Committee is comprised of Steven Prelack, Dale Conaway and Jerald Rome. The Board has determined that Mr. Prelack is an “Audit Committee Financial Expert” within the meaning of the rules of the Securities and Exchange Commission. Each of the members of the Audit Committee qualifies as an “independent” director under applicable American Stock Exchange rules.A copy of the Audit Committee charter was filed as Appendix C to the proxy statement for our 2004 annual meeting of stockholders.

The Audit Committee has reviewed and discussed audited financial statements for Pro-Pharmaceuticals with management. The Audit Committee has also discussed with Deloitte & Touche LLP the matters required to be discussed by the Statement on Auditing Standards No. 61,Communication With Audit Committees, which

12

includes, among other items, matters related to the conduct of the annual audit of our company’s financial statements. The Audit Committee has also received and reviewed the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1, concerning their independence, as required under applicable independence standards for auditors of public companies, and has discussed with Deloitte & Touche LLP its independence from Pro-Pharmaceuticals.

Based upon the review and discussions referred to above, the Audit Committee recommended to our Board of Directors that the audited financial statements of Pro-Pharmaceuticals for the 2004 fiscal year be included in Annual Report filed on Form 10-K for the year ended December 31, 2004.

AUDIT COMMITTEE

Steven Prelack, chair

Dale Conaway, D.V.M.

Jerald K. Rome

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In January 2003 we entered into a contract with David Smith, a director, pursuant to which he would provide consulting services in connection with our business development and related financial services in consideration of an option to purchase 100,000 shares of our common stock, exercisable at $3.50 per share. The original terms provided that options for 33,334 shares vested on the grant date, options for 33,333 shares vested in January 2004, and options for 33,333 shares vested in January 2005. We terminated the contract in January 2004 and accelerated the vesting of the remaining 33,333 options as of the termination date.

In June 2003 we entered into a contract with Burton Firtel, a director, effective as of March 2003, pursuant to which he would provide consulting services to us in consideration of an option to purchase 24,000 shares of common stock, exercisable at $3.50 per share, which vests at the rate of 2,000 options per month as services are performed. We terminated the contract as of March 1, 2004.

OTHER BUSINESS

Management knows of no other matters that may be presented at the Annual Meeting.

DISSENTERS’ RIGHTS OF APPRAISAL

No action is proposed herein for which the laws of the State of Nevada, the Articles of Incorporation or By-laws of Pro-Pharmaceuticals provide a right of a stockholder to dissent and obtain appraisal of or payment for such stockholder’s shares.

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors, and persons who own more than ten percent of our common stock, to file reports of ownership and changes of ownership of such securities with the Securities and Exchange Commission. Based on a review of our records, we believe that all filing requirements applicable to our officers, directors and holders of more than ten percent of our common stock were complied with during the 2004 fiscal year, except for Jerald Rome, a Form 3 for whom, required upon his becoming a director and reporting person, was filed late.

13

STOCKHOLDER PROPOSALS FOR 2006 ANNUAL MEETING

Under SEC rules, if a stockholder wants us to include a proposal in our Proxy Statement and form of proxy for presentation at our 2006 annual meeting of stockholders, the proposal must be received by us, attention: Vice President, Investor Relations, at our principal executive offices by December 29, 2005. Also in accordance with SEC guidelines, if a stockholder notifies us of that stockholder’s intent to present a proposal at our 2006 annual meeting of stockholders after March 13, 2006, we may, acting through the persons named as proxies in the proxy materials for that meeting, exercise discretionary voting authority with respect to the proposal without including information about the proposal in our proxy materials. However, in either case, if the date of the 2006 annual meeting is changed by more than 30 days from the date of the 2005 meeting, then the deadline would be a reasonable time before we begin to print and mail our proxy materials.

DELIVERY OF VOTING MATERIALS

To reduce the expenses of delivering duplicate voting materials to our stockholders who may have more than one Pro-Pharmaceuticals stock account, we are taking advantage of “householding” rules that permit us to deliver only one set of the Proxy Statement and our Annual Report on Form 10-K for the 2004 fiscal year to stockholders who share an address unless otherwise requested. If you hold your shares through a broker, you may have consented to reducing the number of copies of materials delivered to your address. If you wish to revoke a consent previously provided to your broker, you must contact the broker to do so. In any event, if you share an address with another stockholder and have received only one set of voting materials, you may write or call us to request a separate copy of these materials at no cost to you. For future annual meetings, you may request separate voting materials, or request that we send only one set of voting materials to you if you are receiving multiple copies, by either: (i) telephoning us at (617) 559-0033; (ii) sending a letter to us at 189 Wells Avenue, Newton, Massachusetts 02459, Attention: Vice President, Investor Relations; or (iii) sending an e-mail to us at squeglia@pro-pharmaceuticals.com. If you hold your shares through a broker, you can request a single copy of materials for future meetings by contacting the broker.

By Order of the Board of Directors | ||||

| /s/ DAVID PLATT | ||||

April 28, 2005 | David Platt, Ph.D. | |||

Newton, Massachusetts | President and Chief Executive Officer | |||

14

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

PRO-PHARMACEUTICALS, INC.

The undersigned appoints David Platt, Ph.D. and Maureen Foley, and each of them, as proxies, each with the power of substitution, and authorizes each of them to represent and to vote, as designated on the reverse hereof, all of the shares of common stock of Pro-Pharmaceuticals, Inc. held of record by the undersigned at the close of business on April 12, 2005 at the 2005 Annual Meeting of Stockholders of Pro-Pharmaceuticals, Inc. to be held on May 25, 2005 or at any adjournment thereof.

(Continued, and to be marked, dated and signed, on the other side)

PRO-PHARMACEUTICALS, INC.

To Vote Your Proxy

Mark, sign and date your proxy card below, detach it and return it in the postage-paid envelope provided.

FOLD AND DETACH HERE AND READ THE REVERSE SIDE

PROXY

THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO DIRECTION IS INDICATED, WILL BE VOTED “FOR” THE PROPOSALS. THIS PROXY IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. | Please mark your votes like this | x |

| VOTE FOR ALL NOMINEES | WITHHOLD AUTHORITY | FOR | AGAINST | ABSTAIN | ||||||||

1. ELECTION OF DIRECTORS To withhold authority to vote for any individual nominee, strike a line through that nominee’s name below: | ¨ | ¨ | 2. RATIFICATION OF APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE INDEPENDENT AUDITORS FOR 2005 | ¨ | ¨ | ¨ | ||||||

Mildred S. Christian, Ph.D. Dale H. Conaway, D.V.M. Burton C. Firtel David Platt, Ph.D. Steven Prelack Jerald K. Rome David H. Smith |

3. In their discretion, the proxies are authorized to vote on such other business as may properly come before the Meeting. | |||||||||||

| COMPANY ID: | ||||

| PROXY NUMBER: | ||||

| ACCOUNT NUMBER: | ||||

Signature: Signature (if joint): Date: , 2005

Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as attorney, executor, administrator, personal representative, trustee or guardian, please give title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.