THE TRANSFER AGREEMENTS, THE SERVICING AGREEMENT,

THE ADMINISTRATION AGREEMENT AND THE ASSET REPRESENTATIONS REVIEW AGREEMENT

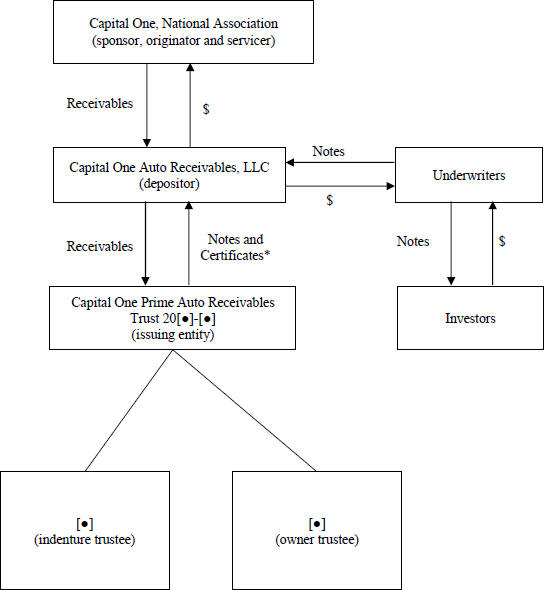

The following information in this section summarizes material provisions of the “purchase agreement” entered into between the originator and the depositor, and the “sale agreement” entered into between the depositor and the issuing entity. We sometimes refer to these agreements together as the “transfer agreements.” This section also summarizes the “administration agreement” entered into by the issuing entity, the servicer and the indenture trustee, the “servicing agreement” entered into by the issuing entity, CONA and the indenture trustee and the “asset representations review agreement” entered into by the issuing entity, CONA and the asset representations reviewer.

Forms of the transfer agreements, the servicing agreement, the asset representations review agreement and the administration agreement have been filed as exhibits to the registration statement of which this prospectus is a part. We will file a copy of the actual transfer agreements, the servicing agreement, the asset representations review agreement and the administration agreement with the SEC on Form 8-K concurrently with or prior to the time we file this prospectus with the SEC. This is not a complete description of the transfer agreements, the servicing agreement, the asset representations review agreement or the administration agreement, and the summaries thereof in this prospectus are subject to all of the provisions of the transfer agreements, the servicing agreement, the asset representations review agreement and the administration agreement.

Sale and Assignment of Receivables and Related Security Interests

Under the purchase agreement, CONA, as originator, will sell, transfer, assign and otherwise convey to the depositor all of its right, title and interest, in, to and under the receivables, collections after the cut-off date, the receivables files and the related security relating to those receivables. The purchase agreement will create a first priority ownership/security interest in the property transferred thereunder in favor of the depositor.

Under the sale agreement, the depositor will sell, transfer, assign and otherwise convey to the issuing entity all of its right, title and interest in, to and under the receivables, collections after the cut-off date, the receivable files, the related security relating to those receivables and related property. The sale agreement will create a first priority ownership/security interest in that property in favor of the issuing entity.

Under the indenture, the issuing entity will pledge all of its right, title and interest in, to and under the issuing entity property to the indenture trustee. The terms of the indenture create a first priority perfected security interest in the issuing entity property in favor of the indenture trustee for the benefit of the noteholders.

Representations and Warranties

The originator, pursuant to the purchase agreement will make certain representations and warranties regarding each receivable as of the cut-off date (the “Eligibility Representations”). The Eligibility Representations are set forth under “The Receivables Pool” in this prospectus and include, among other representations, representations regarding the economic terms of each receivable, the enforceability of the receivable against the related obligor, the security interest in the related financed vehicle, the origination and acquisition of the receivable, the characterization of the receivable under the Uniform Commercial Code and the compliance of the origination of that receivable with applicable law.

If any party to the purchase agreement discovers or receives notice of a breach of any of the Eligibility Representations with respect to any receivable which materially and adversely affects the interests of the issuing entity, the noteholders or the certificateholders, the party discovering or receiving written notice of such breach will give prompt written notice of that breach to the other parties to the purchase agreement; provided, that delivery of the monthly servicer’s report which identifies the receivables that are being or have been repurchased will be deemed to constitute prompt notice of that breach; provided, further, that the failure to give that notice will not affect any obligation of the originator under the purchase agreement. If the breach materially and adversely affects the interests of the issuing entity, the noteholders or the certificateholders, then the originator will either (a) correct

89