![[exhibit1001.jpg]](https://capedge.com/proxy/6-K/0001378296-10-000196/exhibit1001.jpg)

International Tower Hill Mines Ltd.

(An Exploration Stage Company)

Interim Consolidated Financial Statements

(Expressed in Canadian dollars)

(Unaudited - Prepared by Management)

August 31, 2010

INTERNATIONAL TOWER HILL MINES LTD.

(An Exploration Stage Company)

Interim Consolidated Financial Statements

(Expressed in Canadian dollars)

August 31, 2010

Page

Interim Unaudited Consolidated Financial Statements

Interim Unaudited Consolidated Balance Sheets

1

Interim Unaudited Consolidated Statements of Operations and Comprehensive Loss

2

Interim Unaudited Consolidated Statements of Cash Flows

3

Interim Unaudited Consolidated Statements of Equity

4

Notes to the Interim Unaudited Consolidated Financial Statements

5-35

INTERNATIONAL TOWER HILL MINES LTD.

(An Exploration Stage Company)

Interim Consolidated Balance Sheets

(Expressed in Canadian dollars)

(Unaudited - Prepared by Management)

| | | |

| | August 31, 2010 | May 31, 2010 |

| | | |

ASSETS | | |

Current | | |

Cash and cash equivalents (note 4a) | $ 35,485,177 | $ 43,460,324 |

Marketable securities (note 5) | 488,000 | 360,000 |

Accounts receivable | 107,818 | 110,214 |

Prepaid expenses | 215,742 | 274,246 |

Due from related parties (note 10) | 38,018 | - |

Current assets related to discontinued operations (note 2) | - | 13,663 |

| | 36,334,755 | 44,218,447 |

| | | |

Property and Equipment (note 6) | 85,907 | 80,040 |

Mineral properties (note 7) | 51,737,941 | 41,849,485 |

Long-term assets related to discontinued operations(note 2) | - | 12,245,690 |

| | $ 88,158,603 | $ 98,393,662 |

| | | |

LIABILITIES | | |

Current | | |

Accounts payable and accrued liabilities | $ 4,196,595 | $ 1,226,000 |

Current liabilities related to discontinued operations (note 2) | - | 46,959 |

| | 4,196,595 | 1,272,959 |

| | | |

SHARE CAPITAL AND DEFICIT | | |

Share capital (note 8) | 103,428,374 | 124,277,370 |

Contributed surplus | 15,873,242 | 14,240,223 |

Deficit | (35,339,608) | (41,396,890) |

| | 83,962,008 | 97,120,703 |

| | | |

| | $ 88,158,603 | $ 98,393,662 |

Nature and continuance of operations(note 1)

Commitments(note 13)

Subsequent events (note 15)

Approved on behalf of the Directors:

"Hendrik Van Alphen"

Director

"Anton Drescher"

Director

See accompanying notes to the interim unaudited consolidated financial statements

1

INTERNATIONAL TOWER HILL MINES LTD.

(An Exploration Stage Company)

Interim Consolidated Statements of Operations and Comprehensive Loss

(Expressed in Canadian dollars)

(Unaudited - Prepared by Management)

Three months ended August 31, | 2010 | 2009 |

| | | |

Administrative expenses | | |

Administration (note 10) | $ 7,841 | $ 7,018 |

Amortization | 6,406 | 9,807 |

Charitable donations | 21,934 | 5,685 |

Consulting (notes 8 and 10) | 1,082,147 | 136,249 |

Insurance | 46,210 | 26,584 |

Investor relations (notes 8 and 10) | 500,361 | 75,582 |

Office | 36,227 | 26,588 |

Professional fees (notes 8 and 10) | 163,239 | 122,258 |

Property investigation | 648 | 195 |

Regulatory | 16,809 | 8,911 |

Rent (note 10) | 24,108 | 23,767 |

Telephone | 11,172 | 3,902 |

Travel | 25,968 | 43,491 |

Wages and benefits (notes 8 and 10) | 2,002,634 | 158,231 |

| | (3,945,704) | (648,268) |

| | | |

Other items | | |

Interest income | 60,537 | 26,728 |

Loss on foreign exchange | (10,413) | (16,367) |

Spin-out (cost) recovery (note 2) | (400,594) | - |

Unrealized gain on marketable securities (note 5) | 128,000 | 16,250 |

| | (222,470) | 26,611 |

| | | |

Loss from continuing operations | (4,168,174) | (621,657) |

Loss from discontinued operations (note 2) | (934,157) | (238,702) |

Net loss and comprehensive loss for the period | $ (5,102,331) | $ (860,359) |

| | | |

| | | |

Basic and fully diluted loss per share from continuing operations |

$ (0.06) |

$ (0.01) |

Basic and fully diluted loss per share from discontinued operations |

$ (0.01) |

$ (0.00) |

| | | |

Weighted average number of shares outstanding | 66,986,979 | 56,603,637 |

See accompanying notes to the interim unaudited consolidated financial statements

2

INTERNATIONAL TOWER HILL MINES LTD.

(An Exploration Stage Company)

Interim Consolidated Statements of Cash Flows

(Expressed in Canadian dollars)

(Unaudited - Prepared by Management)

| | | |

Three months ended August 31, | 2010 | 2009 |

Operating Activities | | |

Loss for the period from continuing operations | $ (4,168,174) | $ (621,657) |

Add items not affecting cash | | |

Amortization | 6,406 | 9,807 |

Stock-based compensation | 3,063,947 | 9,821 |

Unrealized (gain) loss on marketable securities | (128,000) | (16,250) |

Loss on foreign exchange | 10,413 | 16,367 |

Changes in non-cash items: | | |

Accounts receivable | 2,396 | (25,587) |

Prepaid expenses | 38,262 | 44,442 |

Accounts payable and accrued liabilities | 17,566 | 75,066 |

Due from related party | (38,018) | - |

Cash used in operating activities of continuing operations | (1,195,202) | (507,991) |

| | | |

Loss for the period from discontinued operations | (934,157) | (238,702) |

Add items not affecting cash | | |

Stock-based compensation | 756,202 | 3,642 |

(Gain) loss on foreign exchange | (20,318) | 1,516 |

Changes in non-cash items: | | |

Accounts receivable | (102) | - |

Accounts payable and accrued liabilities | 562 | (13) |

Cash used in operating activities of discontinued operations | (197,813) | (233,557) |

| | | |

Financing Activities | | |

Issuance of share capital | 4,192,958 | 3,264,998 |

Share issuance costs | (8,657) | (35,109) |

Cash provided by financing activities of continuing operations | 4,184,301 | 3,229,890 |

| | | |

Additional funding to Corvus | (764,512) | - |

Cash transferred on Plan of Arrangement (note 2) | (3,300,000) | - |

Cash provided by (used in) financing activities of discontinued operations | (4,064,512) | - |

| | | |

Investing Activities | | |

Expenditures on mineral properties | (7,208,161) | (6,482,529) |

Expenditures on equipment | (12,273) | (7,766) |

Cash used in investing activities of continuing operations | (7,220,434) | (6,490,295) |

| | | |

Expenditures on mineral properties, net of costs recovered | 633,670 | (25,071) |

Cash provided by (used in) investing activities of discontinued operations | 633,670 | (25,071) |

| | | |

Effect of foreign exchange on cash of continuing operations | (96,916) | (11,919) |

| | | |

Effect of foreign exchange on cash of discontinued operations | (18,241) | (1,362) |

| | | |

Decrease in cash | (7,975,147) | (4,040,305) |

Cash and cash equivalents, beginning of period | 43,460,324 | 32,489,341 |

| | | |

Cash and cash equivalents, end of period | $ 35,485,177 | $ 28,449,036 |

| | |

Supplemental cash flow information | | |

Interest paid | $ - | $ - |

Income taxes paid | $ - | $ - |

Non-cash financing and investing transactions (note 17) | | |

See accompanying notes to the interim unaudited consolidated financial statements

3

INTERNATIONAL TOWER HILL MINES LTD.

(An Exploration Stage Company)

Interim Consolidated Statements of Equity

(Expressed in Canadian dollars)

(Unaudited - Prepared by Management)

| | Number of shares (Old) | Share Capital (Old) | Number of shares (New) | Share Capital (New) | Contributed Surplus |

Deficit |

Total |

Balance, May 31, 2009 | 56,457,973 | $ 79,256,633 | - | $ - | $ 10,218,728 | $ (23,528,564) | $ 65,946,797 |

Private placements | 6,286,248 | 33,630,650 | - | - | - | - | 33,630,650 |

Exercise of warrants | 245,901 | 725,408 | - | - | - | - | 725,408 |

Exercise of options | 2,907,800 | 5,277,950 | - | - | - | - | 5,277,950 |

Stock-based compensation | - | - | - | - | 9,901,192 | - | 9,901,192 |

Reallocation from contributed surplus |

- |

5,879,697 |

- |

- |

(5,879,697) |

- |

- |

Shares issued for property acquisition |

220,000 |

801,000 |

- |

- |

- |

- |

801,000 |

Share issuance costs | - | (1,293,968) | - | - | - | - | (1,293,968) |

Net loss | - | - | - | - | - | (17,868,326) | (17,868,326) |

Balance, May 31, 2010 | 66,117,922 | 124,277,370 | - | - | 14,240,223 | (41,396,890) | 97,120,703 |

Exercise of warrants | 48,099 | 141,892 | - | - | - | - | 141,892 |

Exercise of options | 1,062,200 | 1,867,950 | - | - | - | - | 1,867,950 |

Stock-based compensation | - | - | - | - | 3,885,118 | - | 3,885,118 |

Reallocation from contributed surplus |

- |

2,252,099 |

- |

- |

(2,252,099) |

- |

- |

Share issuance costs | - | (8,657) | - | - | - | - | (8,657) |

Net loss | - | - | - | - | - | (5,102,331) | (5,102,331) |

Transfer of Nevada and Other Alaska Business to Corvus |

- |

- |

- |

- |

(23,985,396) |

11,159,613 |

(12,825,783) |

Working capital contribution to Corvus |

- |

- |

- |

- |

(3,300,000) |

- |

(3,300,000) |

Distribution of the common shares of Corvus to ITH shareholders as a return of capital |

- |

(27,285,396) |

- |

- |

27,285,396 |

- |

- |

Exchange of old shares of ITH for new shares of ITH at a ratio of 1:1 |

(67,228,221) |

(101,245,258) |

67,228,221 |

101,245,258 |

- |

- |

- |

Private placement | - | - | 415,041 | 2,183,116 | - | - | 2,183,116 |

Adjustment due to rounding | - | - | (107) | - | - | - | - |

Balance, August 31, 2010 | - | $ - | 67,643,155 | $ 103,428,374 | $ 15,873,242 | $ (35,339,608) | $ 83,962,008 |

See accompanying notes to the interim unaudited consolidated financial statements

4

INTERNATIONAL TOWER HILL MINES LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Expressed in Canadian dollars)

For the year ended May 31, 2008, 2007 and 2006

1.

NATURE AND CONTINUANCE OF OPERATIONS

The Company is in the business of acquiring, exploring and evaluating mineral properties, and either joint venturing or developing these properties further or disposing of them when the evaluation is completed. At August 31, 2010, the Company was in the exploration stage and has a 100% interest in its Livengood project in Alaska U.S.A.

These consolidated financial statements have been prepared in accordance with Canadian generally accepted accounting principles ("GAAP") on a going-concern basis, which presume the realization of assets and discharge of liabilities in the normal course of business for the foreseeable future. The Company's ability to continue as a going-concern is dependent upon achieving profitable operations and/or obtaining additional financing. During the current period, the Company has raised $4,192,958 (May 31, 2010 - $39,634,008) through the issuance of share capital and has working capital at August 31, 2010 of $32,138,160 (May 31, 2010 - $42,978,784) which is considered sufficient to fund its operations and exploration program for the ensuing year. These consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities tha t might be necessary should the Company be unable to continue in business.

The business of mining and exploration involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The Company has no source of revenue, and has significant cash requirements to meet its administrative overhead and maintain its mineral property interests. The recoverability of amounts shown for mineral properties is dependent on several factors. These include the discovery of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete the development of these properties, and future profitable production or proceeds from disposition of mineral properties. The carrying values of the Company's mineral property interests do not reflect current or future values.

2.

DISCONTINUED OPERATIONS AND TRANSFER OF MINERAL PROPERTIES

On August 26, 2010, International Tower Hill Mines Ltd. ("ITH" or the "Company") completed a Plan of Arrangement (the "Arrangement") under the British Columbia Business Corporation Act pursuant to which it transferred its other existing Alaska (other than the Livengood project) and Nevada assets ("Nevada and Other Alaska Business") to a new public company, Corvus Gold Inc. ("Corvus"). Under the Arrangement, each shareholder of ITH received one Corvus common share for every two ITH common shares held as at the effective date of the Arrangement as a return of capital and exchanged each common share of ITH for a new common share of ITH. ITH has transfered its wholly-owned subsidiaries, Raven Gold Alaska Inc. ("Raven Gold"), incorporated in Alaska, United States, and Talon Gold Nevada Inc. ("Talon Nevada"), incorporated in Nevada, United States. Following this transfer and related transactions, there was an indirect spin-out of certain of its mineral properties, Chisna, West Pogo, Terra, LMS, and North Bullfrog (the "Spin-out Properties"), together (the "Nevada and Other Alaska Business").

The Company did not realize any gain or loss on the transfer of the Nevada and Other Alaska Business, which was comprised of a working capital contribution of $3,300,000 and the other Nevada and Other Alaska assets and liabilities as at the effective date of the Arrangement. Costs of the Arrangement, comprised principally of legal and regulatory expense, amounted to $400,594 during the period.

The Arrangement was approved by a favourable vote of ITH's shareholders at a special meeting held on August 12, 2010 to approve the Arrangement.

5

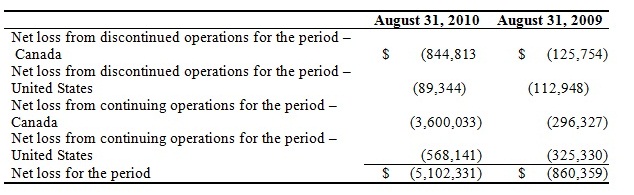

The Company has, in accordance with CICA 3475, "Disposal of Long-lived Assets and Discontinued Operations", accounted for the financial results associated with the Nevada and Other Alaska Business up to the date of the Arrangement as discontinued operations in these financial statements and has reclassified the related amounts for the current and prior period.

The amount recognized as loss from discontinued operations includes the direct operating results of the Other Alaska and Nevada business and an allocation of head office general and administrative expense. The allocation of head office general and administrative expense was calculated on the basis of the ratio of costs incurred on the Spin-out Properties in each period presented as compared to the costs incurred on all mineral properties of the Company in each of the periods. Management cautions readers of these financial statements, that the allocation of expenses does not necessarily reflect future general and administrative expenses.

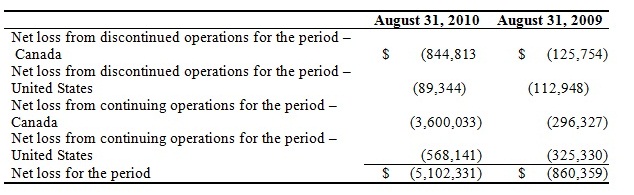

The following table shows the results related to discontinued operations for the three month periods ended August 31, 2010 and 2009. Included therein is $756,202 (2009 - $3,642) of stock-based compensation ("SBC") charges:

| | Three Months ended August 31 |

| | 2010 | 2009 |

| | | |

Administration Charitable donations Consulting Foreign exchange gain Insurance Investor relations Office Professional fees Property investigations Regulatory Rent Telephone Travel Wages and benefits | $ 1,780 5,413 265,721 (20,318) 10,099 130,737 7,214 40,741 291 3,816 5,302 2,418 5,625 475,318 | $ 2,603 2,108 50,526 1,516 9,858 28,028 9,860 45,776 55 3,305 8,814 1,447 16,128 58,678 |

| | $ 934,157 | $ 238,702 |

The transfer of the assets is summarized in the table below:

| August 25, 2010 | May 31, 2010 |

Cash and cash equivalents | $ 1,203,240 | $ - |

Accounts receivable

| 199 | 97 |

Prepaid expenses | 3,200 | 13,566 |

Mineral Properties | 12,392,408 | 12,245,690 |

Accounts payable | (773,264) | (46,959) |

Net assets transferred to Corvus | $ 12,825,783 | |

6

3.

SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies used by management in the preparation of these consolidated financial statements in accordance with Canadian GAAP.

a)

Basis of consolidation

These consolidated financial statements include the accounts of International Tower Hill Mines Ltd. and its wholly owned subsidiaries Talon Gold Alaska, Inc. ("TG Alaska") (an Alaska corporation) and Talon Gold (US) LLC (a Colorado limited liability company)(a British Columbia corporation), and 813034 Alberta Ltd. (an Alberta corporation). All intercompany transactions and balances have been eliminated.

b)

Cash equivalents

The Company considers cash equivalents to consist of highly liquid investments that are cashable on demand, and which are subject to insignificant credit and interest rate risk.

c)

Marketable securities

Marketable securities are classified as held-for-trading, and are carried at quoted market value, where applicable, or at an estimate of fair value. Resulting realized and unrealized gains or losses, net of applicable income taxes, are reflected in operations.

d)

Foreign currency translation

Monetary assets and liabilities are translated at period-end exchange rates; other assets and liabilities have been translated at the rates prevailing at the date of transaction. Revenue and expense items, except for amortization, are translated at the average rate of exchange for the period. Amortization is converted using rates prevailing at dates of acquisition. Gains and losses from foreign currency translation are included in the consolidated statements of operations.

e)

Property and equipment

Property and equipment are stated at cost, net of accumulated amortization. Amortization is recorded over the estimated useful life of the assets at the following annual rates:

Computer equipment

-

30% declining balance

Computer software

-

3 years straight line

Furniture and equipment

-

20% declining balance

Leasehold improvements

-

straight-line over the lease term

f)

Mineral properties

Mineral properties consist of mining claims, leases and options. Acquisition options, leasehold and exploration costs are capitalized and deferred until such time as the property is put into production or the properties are disposed of either through sale or abandonment. If the property is put into production, the costs of acquisition and exploration will be written-off over the life of the property, based on estimated economic reserves. Proceeds received from the sale of any interest in a property will first be credited against the

7

carrying value of the property, with any excess included in operations for the period. If a property is abandoned, the property and deferred exploration costs will be written-off to operations in the period of abandonment.

Recorded costs of mineral properties and deferred exploration and development expenditures are not intended to reflect present or future values of mineral properties.

Deferred costs related to mineral property interests are periodically reviewed for impairment. A review for potential impairment is subject to potentially material measurement uncertainty. If a review indicates that a mineral property interest has been impaired the related deferred costs are written-down or written-off.

Although the Company has taken steps to verify title to mineral properties in which it has an interest, based on industry norms for the current stage of exploration of such properties, these procedures do not guarantee the Company's title. Property title may be subject to unregistered prior agreements and inadvertent non-compliance with regulatory requirements.

g)

Asset retirement obligations

Asset retirement obligations are recognized for legal obligations related to the retirement of long-lived tangible assets that arise from the acquisition, construction, development or normal operation of such assets. A liability for an asset retirement obligation is recognized in the period in which it is incurred and when a reasonable estimate of the fair value of the liability can be made with the corresponding asset retirement cost recognized by increasing the carrying amount of the related long-lived asset. The asset retirement cost is subsequently allocated in a rational and systematic method over the underlying asset's useful life. The initial fair value of the liability is accreted, by charges to operations, to its estimated future value.

h)

Share capital

The Company has adopted the residual value method with respect to the measurement of shares and warrants issued as private placement units. The residual value method first allocates value to the more easily measurable component based on fair value and then the residual value, if any, to the less easily measurable component.

The fair value of the common shares issued in the private placements was determined to be the more easily measurable component and these were valued at their fair value, as determined by the closing quoted bid price on the announcement date. The balance, if any, was allocated to the attached warrants. Any fair value attributed to the warrants is recorded as warrants.

Share capital issued as non-monetary consideration is recorded at the fair market value of the shares issued, which is determined by the Board of Directors of the Company and is generally based on the trading price of the shares at the time an agreement to issue shares has been reached.

Share issuance costs incurred on the issuance of the Company's shares are charged directly to share capital.

8

i)

Loss per share

Basic loss per share is calculated using the weighted average number of shares outstanding during the period. Diluted loss per share has not been presented separately as the outstanding options and warrants are anti-dilutive for each of the periods presented.

The Company uses the treasury stock method of calculating fully diluted per share amounts whereby any proceeds from the exercise of stock options or other dilutive instruments are assumed to be used to purchase common shares at the average market price during the period.

j)

Income tax

Income taxes are accounted for using the future income tax method. Under this method income taxes are recognized for the estimated income taxes payable for the current period and future income taxes are recognized for temporary differences between the tax and accounting bases of assets and liabilities and for the benefit of losses available to be carried forward for tax purposes that are more likely than not to be realized. Future income tax assets and liabilities are measured using tax rates expected to apply in the years in which the temporary differences are expected to be recovered or settled. To the extent that future income tax assets are not considered more likely than not to be realized, a valuation allowance is recorded.

k)

Stock-based compensation

The Company accounts for SBC using a fair value based method with respect to all stock-based payments measured and recognized, to directors, employees and non-employees. For directors and employees, the fair value of the options is measured at the date of grant. For non-employees, the fair value of the options is measured on the earlier of the date at which the counterparty performance is completed or the date the performance commitment is reached or the date at which the equity instruments are granted if they are fully vested and non-forfeitable. The fair value of the options is accrued and charged either to operations or mineral properties, with the offset credit to contributed surplus. For directors and employees the options are recognized over the vesting period, and for non-employees the options are recognized over the related service period. If and when the stock options are ultimately exercised, the applicable amounts of contributed surplus are transferred to share capital. The Company has not incorporated an estimated forfeiture rate for stock options that will not vest; rather the Company accounts for actual forfeitures as they occur.

l)

Joint venture accounting

Where the Company's exploration and development activities are conducted with others, the accounts reflect only the Company's proportionate interest in such activities.

m)

Measurement uncertainty

The preparation of financial statements in conformity with Canadian GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of revenues and expenditures during the reporting period. Actual results could differ from those reported.

9

Significant areas requiring the use of management estimates include the rates of amortization for property and equipment, the recoverability of mineral properties, the assumptions used in the determination of the fair value of financial instruments and SBC, asset retirement obligation estimates, allocation of administrative expenses to discontinued operations, and the determination of the valuation allowance for future income tax assets and accruals. Management believes the estimates are reasonable; however, actual results could differ from those estimates and could impact future results of operations and cash flows.

n)

Financial Instruments - Recognition and Measurement; Disclosure and Presentation

All financial instruments are classified into one of the following five categories: held-for-trading, held-to-maturity, loans and receivables, available-for-sale financial assets, or other financial liabilities. Initial and subsequent measurement and recognition of changes in the value of financial instruments depends on their initial classification. All financial instruments, including derivatives, are included on the balance sheet and are measured at fair market value upon inception with the exception of certain related party transactions. Held-for-trading financial instruments are measured at fair value and all gains and losses are included in operations in the period in which they arise. Available-for-sale financial assets are measured at fair value with revaluation gains and losses included in other comprehensive income until the asset is removed from the balance she et. Loans and receivables, held to maturity investments and other financial liabilities are measured at amortized cost using the effective interest method. Gains and losses upon inception, de-recognition, impairment write-downs and foreign exchange translation adjustments are recognized immediately. Transaction costs related to financial instruments will be expensed in the period incurred.

The Company classified its financial instruments as follows:

- Cash and cash equivalents are classified as held-for-trading.

- Accounts receivable and due from related parties are classified as loans and receivables.

- Marketable securities are classified as held-for-trading.

- Accounts payable and accrued liabilities are classified as other liabilities.

o)

Comprehensive Income

Comprehensive income is the change in shareholders' equity during a period from transactions and other events from non-owner sources. This standard requires certain gains and losses that would otherwise be recorded as part of the net earnings to be presented in other "comprehensive income" until it is considered appropriate to recognize into net earnings. This standard requires the presentation of comprehensive income, and its components in a separate financial statement that is displayed with the same prominence as the other financial statements. There are no material differences between comprehensive income (loss) and net loss for the years reported.

10

p)

Future accounting changes

(i)

International Financial Reporting Standards ("IFRS")

In 2008, the Canadian Accounting Standards Board ("AcSB") confirmed that the transition to IFRS from Canadian GAAP will be effective for fiscal years beginning on or after January 1, 2011 for publicly accountable enterprises. The company will therefore be required to present IFRS financial statements for its August 31, 2011 interim consolidated financial statements. The effective date will require the restatement for comparative purposes of amounts reported by the Company for the interim periods for the year ended May 31, 2011. The Company is currently evaluating the impact of the conversion on the Company's consolidated financial statements and is considering accounting policy choices available under IFRS.

(ii)

Business combinations

In January 2009, the CICA issued Handbook Section 1582, "Business Combinations", which replaces the existing standards. This section establishes the standards for the accounting of business combinations, and states that all assets and liabilities of an acquired business will be recorded at fair value. Estimated obligations for contingent considerations and contingencies will also be recorded at fair value at the acquisition date. The standard also states that acquisition-related costs will be expensed as incurred and that restructuring charges will be expensed in the periods after the acquisition date. This standard is equivalent to IFRS on business combinations. This standard is applied prospectively to business combinations with acquisition dates on or after January 1, 2011. Earlier adoption is permitted. This standard is not expected to be adopted prior to the transition to IFRS.

(iii)

Consolidated financial statements

In January 2009, the CICA issued Handbook Section 1601, "Consolidated Financial Statements", which replaces the existing standards. This section establishes the standards for preparing consolidated financial statements and is effective for interim and annual consolidated financial statements beginning on or after January 1, 2011.This standard is not expected to be adopted prior to the transition to IFRS.

(iv)

Non-controlling interests

In January 2009, the CICA issued Handbook Section 1602, "Non-controlling Interests", which establishes standards for the accounting of non-controlling interests of a subsidiary in the preparation of consolidated financial statements subsequent to a business combination. This standard is equivalent to IFRS on consolidated and separate financial statements. This standard is effective for interim and annual consolidated financial statements beginning on or after January 1, 2011. This standard is not expected to be adopted prior to the transition to IFRS.

11

4. RISK MANAGEMENT AND FINANCIAL INSTRUMENTS

Fair Value of Financial Instruments

The carrying values of cash and cash equivalents, marketable securities, accounts receivable and accounts payable and accrued liabilities approximate their fair values due to the short-term maturity of these financial instruments.

The Company's risk exposure and the impact on the Company's financial instruments are summarized below:

Fair Value Hierarchy

Financial instruments recorded at fair value on the Consolidated Balance Sheets are classified using a fair value hierarchy that reflects the significance of the inputs used in making the measurements. The fair value hierarchy has the following levels:

Level 1

-

valuation based on quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2

-

valuation techniques based on inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3

-

valuation techniques using inputs for the asset or liability that are not based on observable market data (unobservable inputs).

The fair value hierarchy requires the use of observable market inputs whenever such inputs exist. A financial instrument is classified to the lowest level of the hierarchy for which a significant input has been considered in measuring fair value.

The following table presents the financial instruments recorded at fair value in the Consolidated Balance Sheets, classified using the fair value hierarchy described above:

| | Level 1 | Level 2 | Level 3 |

Cash and cash equivalents | $ 35,485,177 | $ - | $ - |

Marketable securities | $ 488,000 | $ - | $ - |

The Company's risk exposure and the impact on the Company's financial instruments are summarized below:

a)

Credit risk

Credit risk is the risk of financial loss to the Company if a counter-party to a financial instrument fails to meet its contractual obligations. The Company manages credit risk, in respect of cash and cash equivalents, by purchasing highly liquid, short-term investment-grade securities held at a major Canadian financial institution in accordance with the Company's investment policy. The Company has no asset backed securities.

The Company's concentration of credit risk and maximum exposure thereto is as follows relating to financial assets:

| | August 31, 2010 | | May 31, 2010 |

Cash and cash equivalents | $ 35,485,177 | | $ 43,460,324 |

Accounts receivable | $ 107,818 | | $ 110,214 |

12

At August 31, 2010, the Company held a total of $17,024,500 (May 31, 2010 - $26,537,499) cash equivalents which consist of interest saving accounts and Guaranteed Investment Certificates ("GICs"):

| | Quantity | Maturity Date | Annual Yield |

BNS Montreal Trust (GIC) | $ 5,000,000 | May 9, 2011 | 0.65% |

Advisors' Advantage Trust (GIC) | 5,000,000 | May 9, 2011 | 0.65% |

National Bank of Canada (GIC) | 2,500,000 | June 10, 2011 | 0.55% |

Advisors' Advantage Trust (GIC) | 4,524,500 | June 13, 2011 | 0.75% |

| | $ 17,024,500 | | |

The Company's cash and cash equivalents at August 31, 2010 consists of $35,406,576 in Canada and $78,601 in the United States. Concentration of credit risk exists with respect to the Company's Canadian cash and cash equivalents as all amounts are held at a single major Canadian financial institution. Credit risk with regard to cash held in the United States is mitigated as the amount held in the United States is only sufficient to cover short-term requirements. With respect to receivables at August 31, 2010, the Company is not exposed to significant credit risk as the majority are from governmental agencies and interest accruals.

b)

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company's approach to managing liquidity risk is to provide reasonable assurance that it will have sufficient funds to meet liabilities when due. The Company manages its liquidity risk by forecasting cash flows for operations and anticipated investing and financing activities. The Company normally maintains sufficient cash and cash equivalents to meet the Company's business requirements. At August 31, 2010, the Company had accounts payable and accrued liabilities of $4,196,595 (May 31, 2010 - $1,226,000), which are all payable within six months and are expected to be settled from available working capital as they come due.

c)

Market risk

Market risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market prices. Market risk comprises three types of risk: interest rate risk, foreign currency risk, and other price risk.

(i)

Interest rate risk

The Company's cash and cash equivalents consists of cash held in bank accounts and short term deposit certificates of GIC's with several major Canadian financial institutions that earn interest at variable interest rates. Due to the short-term nature of these financial instruments, fluctuations in market rates do not have a significant impact on estimated fair values as of August 31, 2010. Future cash flows from interest income on cash and cash equivalents will be affected by interest rate fluctuations. The Company manages interest rate risk by maintaining an investment policy that focuses primarily on preservation of capital and liquidity. The Company's sensitivity analysis suggests that a 0.5% change in interest rates would affect interest income by approximately $85,000.

13

(ii)

Foreign currency risk

The Company is exposed to foreign currency risk to the extent that certain monetary financial instruments and other assets are denominated in United States dollars. The Company has not entered into any foreign currency contracts to mitigate this risk, as it believes this risk is minimized by the minimal amount of cash held in United States funds, nor entered into any hedging arrangements with respect to mineral property expenditure commitments denominated in United States dollars. The Company's sensitivity analysis suggests that a consistent 5% change in the absolute rate of exchange for the United States dollars, the foreign currency for which the Company has net assets employed, would affect net assets and foreign exchange gain (loss) by approximately $63,000. As at August 31, 2010, the Company had the following financial instruments in US$:

| |

CAD$ equivalent |

US$ |

| | | |

Cash | $ 78,601 | $ 73,700 |

Accounts payables and accrued liabilities | $ 3,859,928 | $ 3,619,248 |

As at August 31, 2010, US$ amounts were converted at a rate of US$1 to CAD$1.0665.

(iii)

Other price risk

Other price risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market prices, other than those arising from interest rate risk or foreign exchange risk. The Company's investment in marketable securities is exposed to such risk.

5.

MARKETABLE SECURITIES

| | August 31, 2010 | May 31, 2010 |

| | | |

Millrock Resources Inc. | $ 390,000 | $ 273,000 |

Ocean Park Ventures Corp. | 98,000 | 87,000 |

| | $ 488,000 | $ 360,000 |

On April 4, 2008 the Company sold its South Estelle, Alaska property to Millrock Resources Inc. ("Millrock") for 650,000 Millrock shares or $247,000 based upon their market value on that date of $0.38 per share.

On March 15, 2010, the Company received the initial 200,000 common shares of Ocean Park Ventures Corp. ("OPV"), valued on that date of $0.72 per share or $144,000, in consideration for providing the resources for Raven Gold to enter into the joint ventures.

Fair value adjustment for three months ended August 31, 2010, amounted to an unrealized gain of $128,000 (2009 - $16,250).

14

6.

PROPERTY AND EQUIPMENT

| | August 31, 2010 |

| |

Cost | Accumulated Amortization | Net Book Value |

Furniture and equipment | $ 8,215 | $ 3,909 | $ 4,306 |

Computer equipment | 137,849 | 65,301 | 72,548 |

Computer software | 89,476 | 89,476 | - |

Leasehold improvements | 17,061 | 8,008 | 9,053 |

| | $ 252,601 | $ 166,694 | $ 85,907 |

| | May 31, 2010 |

| |

Cost | Accumulated Amortization | Net Book Value |

Furniture and equipment | $ 8,215 | $ 3,700 | $ 4,515 |

Computer equipment | 125,576 | 60,148 | 65,428 |

Computer software | 89,476 | 89,476 | - |

Leasehold improvements | 17,061 | 6,964 | 10,097 |

| | $ 240,328 | $ 160,288 | $ 80,040 |

15

7.

MINERAL PROPERTIES

Accumulated costs in respect of mineral tenures and mineral rights owned, leased or under option, consist of the following:

| Siwash Silver leases | BMP | Coffee Dome | Livengood | Total CAD$ |

| (note 6(a)) | (note 6(b)) | (note 6(c)(ii)) | (note 6(c)(i)) | |

Balance, May 31, 2009 | $ 1 | $ 573,139 | $ 1,074,197 | $ 20,715,816 | $ 22,363,153 |

Acquisition costs: | | | | | |

Cash payments | - | - | - | - | - |

Common shares issued | - | - | - | - | - |

| | - | - | - | - | - |

Deferred exploration costs: | | | | | |

Advance to contractors | - | - | - | (3,215) | (3,215) |

Contract services | - | 1,790 | 140,643 | 4,223,621 | 4,366,054 |

Assay | - | - | 140,241 | 2,977,431 | 3,117,672 |

Drilling | - | - | 268,280 | 9,457,688 | 9,725,968 |

Field costs | - | 19 | 33,124 | 2,559,742 | 2,592,885 |

Equipment rental | - | - | 29,085 | 511,413 | 540,498 |

Land maintenance & tenure | - | 1,193 | 97,952 | 1,158,079 | 1,257,224 |

Transportation | - | - | 12,695 | 128,779 | 141,474 |

Travel | - | - | - | 120,130 | 120,130 |

| | - | 3,002 | 722,020 | 21,133,668 | 21,858,690 |

Total expenditures for the year | - | 3,002 | 722,020 | 21,133,668 | 21,858,690 |

Property write-off | - | (576,141) | (1,796,217) | - | (2,372,358) |

Balance, May 31, 2010 | 1 | - | - | 41,849,484 | 41,849,485 |

Acquisition costs: | | | | | |

Cash payments | - | - | - | - | - |

Common shares issued | - | - | - | - | - |

| | - | - | - | - | - |

Deferred exploration costs: | | | | | |

Advance to contractors | - | - | - | (565,382) | (565,382) |

Contract services | - | - | - | 1,928,124 | 1,928,124 |

Assay | - | - | - | 1,136,128 | 1,136,128 |

Drilling | - | - | - | 5,000,587 | 5,000,587 |

Field costs | - | - | - | 1,090,832 | 1,090,832 |

Equipment rental | - | - | - | 172,501 | 172,501 |

Land maintenance & tenure | - | - | - | 1,008,123 | 1,008,123 |

Transportation | - | - | - | 84,962 | 84,962 |

Travel | - | - | - | 32,581 | 32,581 |

| | - | - | - | 9,888,456 | 9,888,456 |

Total expenditures for the period | - | - | - | 9,888,456 | 9,888,456 |

Balance, August 31, 2010 | $ 1 | $ - | $ - | $ 51,737,940 | $ 51,737,941 |

16

a)

Siwash Silver Claims, B.C.

On September 22, 2006, the Company entered into a letter agreement with Ravencrest Resources Inc. ("Ravencrest") whereby Ravencrest will acquire all of the Company's interest in 97 mineral claims and one lot in exchange for the Company retaining a 5% Net Smelter Returns ("NSR") Royalty and Ravencrest's assumption of all liabilities and risks concerning the property. The original mining venture agreement dated March 31, 2005 between the Company and Ravencrest was also terminated. Accordingly, the Company wrote-down the Siwash Silver Claims to a nominal value of $1, recognizing a charge to operations of $1,030,315 during the year ended May 31, 2007.

b)

BMP Project, Alaska

In September, 2006, the Company staked a total of 108 Alaska state mining claims at a new location in the Bethel Recording District. The claims cover a base metal target developed from the Company's exploration program conducted in 2006.

On March 26, 2008, the Company executed an agreement with respect to the exploration and option to lease of key exploration ground adjoining the Company's BMP claim block from Cook Inlet Region, Inc. ("CIRI"), an Alaska Native Regional Corporation.

The Company and CIRI have signed an Exploration Agreement with an Option to Lease, covering a 6,200 hectare area located immediately adjacent to the eastern side of the Company's existing BMP claim block. The general terms of the Agreement are as follows:

Exploration Agreement(2 years initial term with automatic 3 years renewal)

- Payments: Annual rental payment of USD 20,000 per year for the first 2 years (paid), increasing to USD 40,000 for years 3 through 5. At the end of year 2, the Company will be required to reduce the lands subject to the agreement by 50% unless otherwise justifiable geologically, in which case a bonus of USD 5.00 per acre is payable upon the renewal for all lands retained in excess of 3,100 hectares.

- Work Commitments: USD 275,000 in year 1 escalating to USD 500,000 in year 5.

- Lease Option: Upon having expended a minimum of USD 800,000, drilled 2,500 feet of core drilling and produced a positive pre-feasibility study over an area within the CIRI lands that contains mineralization and may be capable of development into a mine, the Company may elect to enter into a mining lease over the ground that is the subject to the positive pre-feasibility study.

Mining Lease(15 year initial term, and so long thereafter as commercial production continues)

- Advance Minimum Royalty: Payments of USD 150,000 in years 1 - 3, USD 200,000 in years 4 - 5 and USD 400,000 for year 6 and beyond (unless a feasibility study has been completed). AMR payments are 50% deductible from royalty payments.

- Sliding Scale Royalty: An NSR Royalty of between 1% and 2.5% before payback and between 3% and 5% (depending upon the gold price) after payback is payable in respect of precious metals, and an NSR Royalty of 1% before payback and 3% after payback is payable in respect of base metals. In both cases, CIRI will have the option to replace the NSR Royalty with a Net Profits Interest Royalty (10% before and 20% after payback).

17

- CIRI Participation Option: Upon a production decision being made, CIRI will have the right to acquire up to a 15% working interest in the leased area by contributing 2 times itspro ratashare of the cumulative project expenditures by the Company (other than AMR payments) to the date of the exercise of CIRI's participation option.

The Company will also make annual donations of USD 10,000 (paid USD 20,000) to the CIRI Foundation or other scholarship fund designated by CIRI during the continuance of the exploration.

On October 2, 2009, the Company terminated the option agreement with CIRI due to disappointing exploration results and a desire to focus on the Livengood project. The Company wrote-off the $576,141 in associated costs.

c)

Properties acquired from AngloGold, Alaska

Pursuant to an Asset Purchase and Sale and Indemnity Agreement dated June 30, 2006, as amended on July 26, 2007, (the "AngloGold Agreement") among the Company, AngloGold Ashanti (U.S.A.) Exploration Inc. ("AngloGold") and TG Alaska, the Company acquired all of AngloGold's interest in a portfolio of seven mineral exploration projects in Alaska (then aggregating 246 square kilometres) and referred to as the Livengood, Chisna, Gilles, Coffee Dome, West Pogo, Blackshell, and Caribou properties (the "Sale Properties") in consideration of cash payment USD 50,000 on August 4, 2006, and the issuance of 5,997,295 common shares, representing approximately 19.99% of the Company's issued shares following the closing of the acquisition and two private placement financings raising an aggregate of $11,479,348. AngloGold has the right to maintain its percentage equity interest in the Company, on an ongoing basis, provided that such right will terminate if AngloGold's interest falls below 10% at any time after January 1, 2009.

As further consideration for the transfer of the Sale Properties, the Company granted to AngloGold a 90 day right of first offer with respect to the Sale Properties and any additional mineral properties in Alaska in which the Company acquires an interest and which interest the Company proposes to farm out or otherwise dispose of. If AngloGold's equity interest in the Company is reduced to less than 10%, then this right of first offer will terminate. Details of the Sale Properties are as follows:

(i)

Livengood Property

The Livengood property is located in the Tintina gold belt approximately 110 kilometres north of Fairbanks, Alaska. Subsequent to the acquisition of the original property from AngloGold, the Company acquired additional property interests in the area, and the Livengood property now consists of approximately 4,034 hectares of mineral rights leased from the State of Alaska, 169 State of Alaska mining claims (2,675 hectares) leased from two individuals, 20 federal unpatented lode mining claims (177 hectares) leased from two individuals, three federal patented lode mining claims (20.25 hectares) leased from a group of individuals and two unpatented federal lode mining and four federal unpatented placer mining claims (47.7 hectares) leased from an individual and 115 State of Alaska mining claims staked by the Company in 2010 (approximately 1,860 hectares).

18

Details of the leases are as follows:

- the lease of the Alaska State mineral rights is for an initial term of three years, commencing July 1, 2004 (subject to extension for two extensions of three years each) and requires work expenditures of USD 10/acre/year in years 1 - 3, USD 20/acre/year in years 4 - 6 and USD 30/acre/year in years 7 - 9 and advance royalty payments of USD 5/acre/year in years 1 - 3, USD 15/acre/year in years 4 - 6 and USD 25/acre/year in years 7 - 9. An NSR production royalty of between 2.5% and 5.0% (depending upon the price of gold) is payable to the lessor with respect to the lands subject to this lease. In addition, an NSR production royalty of 1% is payable to the lessor with respect to the unpatented federal mining claims subject to the lease below.

- the lease of the 169 State of Alaska mining claims is for a term of ten years, commencing on September 11, 2006. The lease requires payments of USD 75,000 on execution (paid), USD 50,000 in each of years 2 - 5 (incurred) and USD 100,000 in each of years 6 - 10 and work expenditures of USD 100,000 in year one, USD 200,000 in each of years 2 - 5 and USD 300,000 in each of years 6 - 10. An NSR production royalty of between 2% and 5% is payable to the lessors (depending upon the price of gold). The Company may buy all interest in the property subject to the lease (including the retained royalty) for USD 10,000,000.

- the lease of the 20 Federal unpatented claims is for an initial term of ten years, commencing on April 21, 2003 and for so long thereafter as mining related activities are carried out. The lease requires a bonus payment of USD 5,000 on signing (paid), and advance royalties of USD 20,000 on execution (paid), USD 30,000 on or before April 21, 2004 (paid), USD 40,000 on or before April 21, 2005 (paid), USD 50,000 on or before April 21, 2006 (paid), USD 40,000 on or before April 21, 2007 (paid) and an additional USD 50,000 on or before each subsequent April 21 during the term (paid USD 150,000). An NSR production royalty of between 2% and 3% (depending on the price of gold) is payable to the lessors. The Company may purchase 1% of the royalty for USD 1,000,000.

- the lease of the patented federal claims is for an initial term of ten years, and for so long thereafter as the Company pays the lessors the minimum royalties required under the lease. The lease requires a bonus payment of USD 10,000 on signing (paid), and minimum royalties of USD 10,000 on or before January 18, 2008 (paid), USD 10,000 on or before January 18, 2009 (paid), USD 10,000 on or before January 18, 2010 (paid) and an additional USD 20,000 on or before each of January 18, 2011 through January 18, 2016 and an additional USD 25,000 on each subsequent January 18 thereafter during the term (all of which minimum royalties are recoverable from production royalties). An NSR production royalty of 3% is payable to the lessors. The Company may purchase all interest of the lessors in the leased property (including the production royalty) for USD 1,000,000 (less all minimum and production royalties paid to the date of purchase), of which USD 500,000 is payable in cash over four years following the closing of the purchase and the balance of USD 500,000 is payable by way of the 3% NSR production royalty.

19

- the mining lease of the two unpatented federal lode mining and four federal unpatented placer claims has an initial term of ten years, commencing on March 28, 2007, and for so long thereafter as mining related activities are carried out. The lease requires payment of advance royalties of USD 3,000 on execution (paid), USD 5,000 on or before March 28, 2009 (paid), USD 10,000 on or before March 28, 2010 (paid) and an additional USD 15,000 on or before each subsequent March 28 thereafter during the initial term (all of which minimum royalties are recoverable from production royalties). The Company is required to pay the lessor the sum of USD 250,000 upon making a positive production decision. An NSR production royalty of 2% is payable to the lessor. The Company may purchase all interest of the lessor in the leased property (including the production royalty) for USD 1,000,000.

(ii) Coffee Dome Property

The Coffee Dome property is located approximately 15 kilometres northeast of the Fort Knox mine. The property consists of 59 State of Alaska mining claims (2,600 hectares) owned 100% by the Company, six State of Alaska mining claims (388.8 hectares) leased from an individual and 1,166.2 hectares of fee lands leased from the University of Alaska (the "University").

The lease of the six State of Alaska mining claims is for an initial term of twenty years, commencing on August 11, 2005 and for so long thereafter as mining related activities are carried out. The lease requires a bonus payment of USD 10,000 on signing (paid), and advance royalties of USD 15,000 on or before December 31, 2005 (paid), USD 25,000 on or before August 11, 2006 (paid) and an additional USD 50,000 on or before each subsequent August 11 during the term (paid USD 150,000). A production payment of USD 500,000 is also payable upon the Company making a positive production decision. An NSR production royalty of between 0.5% and 5% (depending on the price of gold) is payable to the lessor. The Company may purchase 1% of the royalty for USD 2,000,000. The lessor also has the right to receive an NSR production royalty on production of gold of between 0.5% and 5% (depending on the price of gold) and a 3% NSR production royalty on production of minerals other than gold, from any lands acquired by the Company within a defined area of interest. In addition, the lessor is entitled to receive an NSR production royalty on all minerals equal to the greater of 1% and one-half of the difference between 4% and the actual NSR production royalty payable by the Company to a third party with respect to certain defined lands held by such third party upon the Company entering into a mining lease with such third party.

The agreement with the University is a two stage Exploration Agreement with Option to Lease. The Agreement has an effective date of January 1, 2007 and covers approximately 1,166 hectares of land. The key terms of the Agreement (and any resulting mining lease) are as follows:

20

Exploration Agreement: In order to maintain the option to lease in good standing, the Company is required to pay the University USD 117,500 over five years (paid USD 87,500) and incur exploration expenditures totalling USD 400,000 over five years (USD 25,000 commitment for the first year, USD 50,000 for the second year). If the Company does not terminate the option prior to January 1 in any option year, the specified minimum expenditures for that year become a commitment of the Company. The Company is also responsible for all taxes and assessments on the lands subject to the option to lease.

Mining Lease: At any time during the option period, the Company has the right to enter into a mining lease over some or all of the lands subject to the option. The mining lease will have an initial term of 15 years and for so long thereafter as commercial production continues and requires escalating advance royalty payments of USD 30,000 in year 1 to USD 150,000 in year 9 and beyond. Advance royalty payments are credited against 50% of production royalties. The Company is also required to incur escalating minimum mandatory exploration expenditures of USD 125,000 in year 1 to USD 350,000 in year 5 and beyond and to deliver a feasibility study within 10 years of the commencement of the lease. Upon the commencement of commercial production, the Company is required to pay a sliding scale NSR royalty of from 3% (USD 300 and below gold) up to 5% (USD 500 and up gold ). The Company will also pay a sliding scale NSR royalty of from 0.5% (USD 450 and below gold) to 1% (USD 450 and above gold) on any federal or Alaska State claims staked by the Company or its affiliates within a 2 mile area of interest surrounding the University land (not including the Company's existing leased claims).

During the year ended May 31, 2010, the Company decided to terminate the leases due to disappointing results and wrote-off $1,796,217 in associated costs. The balance of the Alaska State mining claims held by the Company will be dropped in September 2010.

8.

SHARE CAPITAL

Authorized

500,000,000 common shares without par value.

Shareholder rights plan

On August 26, 2009, the Company's Board of Directors (the "Board") approved and adopted a Shareholder Rights Plan which was approved by the shareholders on October 15, 2009.

The purpose of the Shareholder Rights Plan is to provide shareholders and the Board with adequate time to consider and evaluate any unsolicited bid made for the Company, to provide the Board with adequate time to identify, develop and negotiate value-enhancing alternatives, if considered appropriate, to any such unsolicited bid, to encourage the fair treatment of shareholders in connection with any take-over bid for the Company and to ensure that any proposed transaction is in the best interest of the Company's shareholders.

21

The rights issued under the Shareholder Rights Plan will become exercisable only if a person, together with its affiliates, associates and joint actors, acquires or announces its intention to acquire beneficial ownership of shares which, when aggregated with its current holdings, total 20% or more of the Company's outstanding common shares, other than by a Permitted Bid. Permitted Bids must be made by way of a take-over bid circular prepared in compliance with applicable securities laws and, among other conditions, must remain open for 60 days. If a take-over bid does not meet the Permitted Bid requirements of the Shareholder Rights Plan, the rights will entitle shareholders, other than any shareholder or shareholders making the take-over bid, to purchase additional common shares of the Company at a substantial discount to the market price of the common shares at that time.

Share issuances

On August 26, 2010, the Company issued 415,041 common shares at a price of $5.26 per share for gross proceeds of $2,183,116 to AngloGold.

During the current period, 1,062,200 stock options and 48,099 warrants were exercised for proceeds of $2,009,842.

Warrants

Warrant transactions are summarized as follows:

| | August 31, 2010 | Year ended May 31, 2010 |

| | Number of Warrants | Weighted Average Exercise Price | Number of Warrants | Weighted Average Exercise Price |

| | | | | |

Warrants exercisable, beginning of period | 48,099 | $2.95 | 294,000 | $2.95 |

Exercised | (48,099) | ($2.95) | (245,901) | ($2.95) |

Warrants exercisable, end of period | - | - | 48,099 | $2.95 |

There are no warrants outstanding at August 31, 2010.

Options and SBC

The Company has adopted an incentive stock option plan (the "2006 Plan"). The essential elements of the 2006 Plan provide that the aggregate number of common shares of the Company's capital stock that may be made issuable pursuant to options granted under the 2006 Plan may not exceed 10% of the number of issued shares of the Company at the time of the granting of the options. Options granted under the 2006 Plan will have a maximum term of ten years. The exercise price of options granted under the 2006 Plan will not be less than the discounted market price of the common shares (defined as the last closing market price of the Company's common shares immediately preceding the issuance of a news release announcing the granting of the options, less the maximum discount permitted under applicable stock exchange policies), or such other price as may be agreed to by the Company a nd accepted by the Toronto Stock Exchange. Options granted under the 2006 Plan vest immediately, unless otherwise determined by the directors at the date of grant.

22

Pursuant to the 2006 Plan, on August 19, 2010 the Company granted incentive stock options to directors, officers, employees and consultants of the Company to purchase 1,495,000 common shares in the capital stock of the Company. The options are exercisable on or before August 19, 2012 at a price of $6.57 per share.

A summary of the status of the stock option plan as of August 31, 2010, and changes during the period is presented below:

| | August 31, 2010 | Year ended May 31, 2010 (audited) |

| | Number of Shares | Weighted Average Exercise Price | Number of Shares | Weighted Average Exercise Price |

Options outstanding, beginning of period | 5,822,200 | $5.08 | 5,645,000 | $2.13 |

Granted | 1,495,000 | $6.57 | 3,085,000 | $7.39 |

Exercised | (1,062,200) | ($1.76) | (2,907,800) | ($1.82) |

Expired | (5,000) | ($1.75) | - | - |

Options outstanding, end of period | 6,250,000 | $6.00 | 5,822,200 | $5.08 |

Stock options outstanding are as follows:

| | August 31, 2010 | May 31, 2010 |

Expiry Date |

Exercise Price | Number of

Shares outstanding and exercisable |

Exercise Price | Number of

Shares outstanding and exercisable |

July 16, 2010 | - | - | $1.75 | 1,057,200 |

March 12, 2011 | $2.66 | 755,000 | $2.66 | 765,000 |

May 20, 2011 | $3.15 | 915,000 | $3.15 | 915,000 |

January 12, 2012 | $7.95 | 250,000 | $7.95 | 250,000 |

April 14, 2012 | $7.34 | 2,835,000 | $7.34 | 2,835,000 |

August 19, 2012 | $6.57 | 1,495,000 | - | - |

| |

| 6,250,000 | | 5,822,200 |

The Company uses the fair value method for determining SBC expense for all options granted during the fiscal periods. The fair value of options granted was $3,063,947 for continuing operations (2009 - $nil), and $821,171 (2009 - $nil) for discontinued operations, determined using the Black-Scholes option pricing model based on the following average assumptions:

| | August 31, 2010 |

Expected life (years) | 2 |

Interest rate | 1.37% |

Annualized Volatility | 70.91% |

Dividend yield | 0% |

Exercise price | $6.57 |

Stock price on the grant date | $6.60 |

Fair value | $2.60 |

23

SBC charges of $3,063,947 (2009 - $9,821) were allocated as follows for continuing operations:

Three months ended August 31, 2010 | Before allocation of SBC | SBC | After allocation of SBC |

Investor relations | $ 187,714 | $ 312,647 | $ 500,361 |

Consulting | 71,253 | 1,010,894 | 1,082,147 |

Wages and benefits | 335,179 | 1,667,455 | 2,002,634 |

Professional fees | 90,288 | 72,951 | 163,239 |

| | | $ 3,063,947 | |

Three months ended August 31, 2009 | Before allocation of SBC | SBC | After allocation of SBC |

Investor relations | $ 65,761 | $ 9,821 | $ 75,582 |

9.

INCOME TAXES

A reconciliation of income taxes at statutory rates with the reported taxes is as follows for three months ended August 31:

| | 2010 | 2009 |

| | | |

Loss from continuing operations before income taxes | $ (4,168,174) | $ (621,657) |

Statutory Canadian corporate tax rate | 27.67% | 29.38% |

| | | |

Income tax recovery at statutory rates | $ (1,153,334) | $ (182,643) |

Unrecognized items for tax purposes | 789,155 | (94,669) |

Effect of tax rate change | 20,097 | 115,877 |

Difference in tax rates in other jurisdictions | (87,400) | (45,611) |

Change in valuation allowance | 431,482 | 207,046 |

| | $ - | $ - |

The significant components of the Company's future income tax assets are as follows:

| | August 31, 2010 | May 31, 2010 |

Future income tax assets | | |

Mineral properties | $ 531,287 | $ 1,115,774 |

Equipment | 3,801 | 1,277 |

Share issue costs | 530,123 | 597,764 |

Non-capital losses available for future periods | 7,766,232 | 7,606,210 |

| | 8,831,443 | 9,321,025 |

Valuation allowance | (8,831,443) | (9,321,025) |

| | | |

| | $ - | $ - |

24

At August 31, 2010, the Company has available non-capital tax losses for Canadian income tax purposes of approximately $8,966,000 and net operating losses for US income tax purposes of approximately $12,730,000 available for carry-forward to reduce future years' taxable income, if not utilized, expiring as follows:

| | Canada

| United States |

2025 | $ 81,000 | $ - |

2026 | 91,000 | - |

2027 | 1,031,000 | 1,459,000 |

2028 | 1,301,000 | 1,466,000 |

2029 | 2,378,000 | 3,410,000 |

2030 | 3,052,000 | 5,760,000 |

2031 | 1,030,000 | 635,000 |

| | $ 8,966,000 | $ 12,730,000 |

In addition, the Company has available mineral resource related expenditure pools for Canadian income tax purposes totalling approximately $2,628,000 which may be deducted against future taxable income in Canada on a discretionary basis. The Company also has available mineral resource expenses that are related to the Company's exploration activities in the United States of approximately $51,448,000, which may be deductible for US tax purposes. Future tax benefits, which may arise as a result of applying these deductions to taxable income, have not been recognized in these accounts due to the uncertainty of future taxable income.

10.

RELATED PARTY TRANSACTIONS

During the three months ended August 31, 2010, the Company paid $239,849 (2009 - $146,405) in consulting, investor relations, wages and benefits to officers, directors and companies controlled by directors of the Company and $13,045 (2009 - $11,677) in rent and administration to a company with common officers and directors. Professional fees of $10,425 (2009 - $13,660) were paid to a company related to an officer of the Company. These figures do not include SBC (see Note 8).

At August 31, 2010, included in accounts payable and accrued liabilities was $Nil (May 31, 2010 - $19,760) in expenses owing to directors and officers of the Company and $Nil (May 31, 2010 - $8,790) to a company related by common directors and officers.

At August 31, 2010, $38,018 (May 31, 2010 - $Nil) was due from companies under common control.

These amounts were unsecured, non-interest bearing and had no fixed terms of repayment. Accordingly, fair value could not be readily determined.

The Company has entered into a retainer agreement dated August 1, 2008 with Lawrence W. Talbot Law Corporation ("LWTLC"), pursuant to which LWTLC agrees to provide legal services to the Company. Pursuant to the retainer agreement, the Company has agreed to pay LWTLC a minimum annual retainer of $50,000 (plus applicable taxes and disbursements). The retainer agreement may be terminated by LWTLC on reasonable notice, and by the Company on one year's notice (or payment of one year's retainer in lieu of notice). An officer of the Company is a director and shareholder of LWTLC.

These transactions with related parties have been valued in these financial statements at the exchange amount,

25

which is the amount of consideration established and agreed to by the related parties.

11.

GEOGRAPHIC SEGMENTED INFORMATION

| |

Canada | United States |

Total |

August 31, 2010 | | | |

Mineral properties | $ 1 | $ 51,753,940 | $ 51,737,941 |

Property and equipment | $ 16,165 | $ 69,742 | $ 85,907 |

Total assets | $ 36,173,446 | $ 51,985,157 | $ 88,158,603 |

May 31, 2010 | | | |

Mineral properties | $ 1 | $ 41,849,484 | $ 41,849,485 |

Property and equipment | $ 11,918 | $ 68,122 | $ 80,040 |

Total assets | $ 43,239,713 | $ 55,153,949 | $ 98,393,662 |

12.

DIFFERENCES BETWEEN CANADIAN AND UNITED STATES GAAP

These consolidated financial statements are prepared in accordance with GAAP in Canada, which differs in certain respects from GAAP in the United States. The material differences between Canadian and United States GAAP, in respect of these financial statements, are as follows:

a)

Mineral property exploration and development

Under United States GAAP, all mineral exploration and development property expenditures are expensed in the year incurred in an exploration stage company until there is substantial evidence that a commercial body of minerals has been located. Canadian GAAP allows mineral exploration and development property expenditures to be deferred during this process.

The effect on the Company's financial statements is summarized below:

26

Three months ended August 31, | 2010 | 2009 |

Consolidated statements of operations and deficit | | |

Loss from continuing operations for the period under | | |

Canadian GAAP | $ (4,168,174) | $ (621,657) |

Mineral property expenditures, net | (9,888,456) | (7,551,040) |

Loss from continuing operations for the period under United States GAAP |

$ (14,056,630) |

$ (8,172,697) |

Loss from continuing operations per share under United States GAAP |

$ (0.21) |

$ (0.14) |

Three months ended August 31 | 2010 | 2009 |

Consolidated statements of operations and deficit | | |

Loss from discontinued operations for the period under | | |

Canadian GAAP | $ (934,157) | $ (238,702) |

Mineral property expenditures, net | (146,718) | (38,876) |

Loss from discontinued operations for the period under United States GAAP |

$ (1,080,875) |

$ (277,578) |

Loss from discontinued operations per share under United States GAAP |

$ (0.03) |

$ (0.01) |

| | August 31, 2010 | May 31, 2010 |

Consolidated balance sheets | | |

Mineral Properties | | |

Canadian GAAP | $ 51,737,941 | $ 41,849,485 |

Mineral property expenditures (cumulative) | (46,599,389) | (36,710,933) |

| | | |

Mineral Properties United States GAAP | $ 5,138,552 | $ 5,138,552 |

| | | |

Long-term assets related to discontinued operations | | |

Canadian GAAP | $ - | $ 12,245,690 |

Mineral property expenditures (cumulative) | - | (9,364,796) |

| | | |

Long-term assets related to discontinued operations under United States GAAP |

$ - |

$ 2,880,894 |

| | | |

Deficit | | |

Canadian GAAP | $ (35,339,608) | $ (41,396,890) |

Mineral property expenditures (cumulative) | (46,599,389) | (46,075,429) |

| | | |

Deficit under United States GAAP | $ (81,938,997) | $ (87,472,619) |

27

Three months ended August 31 | 2010 | 2009 |

Consolidated statements of cash flows | | |

Operating activities from continuing operations | | |

Cash used per Canadian GAAP | $ (1,195,202) | $ (507,991) |

Effect of the write-off of exploration expenditures | (6,840,954) | (6,490,295) |

Cash from continuing operations used per United States GAAP | $ (8,036,156) | $ (6,998,286) |

Investing activities from continuing operations | | |

Cash used per Canadian GAAP | $ (6,840,954) | $ (6,490,295) |

Effect of the write-off of exploration expenditures | 6,840,954 | 6,490,295 |

Cash from continuing operations used per United States GAAP | $ - | $ - |

Three months ended August 31, | 2010 | 2009 |

Consolidated statements of cash flows | | |

Operating activities from discontinued operations | | |

Cash used per Canadian GAAP | $ (132,844) | $ (233,557) |

Effect of the write-off of exploration expenditures | 551,715 | (25,071) |

Cash from (used in) discontinued operations per United States GAAP |

$ 418,871 |

$ (258,628) |

Investing activities from discontinued operations | | |

Cash from (used) per Canadian GAAP | 551,715 | $ (25,071) |

Effect of the write-off of exploration expenditures | (551,715) | 25,071 |

Cash from discontinued operations used per United States GAAP | $ - | $ - |

a)

SBC

The Company has adopted Statement of Financial Accounting Standards No. 123R (codified under ASC 178 and ASC 505-50), and records compensation cost for stock-based employee compensation plans at fair value. Accordingly, compensation cost for stock options granted is measured as the fair value at the date of grant, and there is no difference in these consolidated financial statements.

b)

Loss per share

Under both Canadian and United States GAAP basic loss per share is calculated using the weighted average number of common shares outstanding during the year.

Under United States GAAP, the weighted average number of common shares outstanding excludes any shares that remain in escrow, but may be earned out based on the Company incurring a certain amount of exploration and development expenditures. The weighted average number of shares outstanding under United States GAAP for the period sended August 31, 2010 and 2009 was 66,986,979 and 56,603,637 respectively.

28

c)

Income taxes

Under United States GAAP, the Company would have initially recorded an income tax asset for the benefit of the resource deduction pools. This asset would have been reduced to $Nil by a valuation allowance. The result is no difference in net income reported between Canadian and United States GAAP.

d)

Recent United States Accounting Pronouncements

(i)

In May 2009, the FASB issued Accounting Standards Codification ("ASC") 855-10, Subsequent Events ("ASC 855-10") (amended in February 2010) (formerly SFAS Statement No 165), which establishes principles and requirements for subsequent events. In particular, ASC 855-10 sets forth: (a) the period after the balance sheet date during which management of a reporting entity shall evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements; (b) the circumstances under which an entity shall recognize events or transactions occurring after the balance sheet date in its financial statements; and (c) the disclosures that an entity shall make about events or transactions that occurred after the balance sheet date. The adoption of this new standard is not expected to have an impact on the Entity's consolidated financial statements.

(ii)

In June 2009, the FASB issued new guidance which is now a part of ASC 860-10 (formerly SFAS Statement No 166), to improve the relevance, representational faithfulness, and comparability of the information that a reporting entity provides in its financial statements about a transfer of financial assets; the effects of a transfer on its financial position, financial performance, and cash flows; and a transferor's continuing involvement, if any, in transferred financial assets. The FASB undertook this project to address (1) practices that have developed since the issuance of FASB Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities (which is now a part of ASC 860-10), that are not consistent with the original intent and key requirements of that Statement and (2) concerns of financial statement users that many of the financial as sets (and related obligations) that have been derecognized should continue to be reported in the financial statements of transferors. This new guidance is effective for fiscal years beginning after November 15, 2009 does not have a material impact on the Company's consolidated financial statements when adopted June 1, 2010.

(iii)

In June 2009, the FASB issued new guidance which is now part of ASC 810-10 (formerly SFAS Statement No. 167), to improve financial reporting by enterprises involved with variable interest entities. The FASB undertook this project to address (1) the effects on certain provisions of FASB Interpretation No. 46 (revised December 2003),Consolidation of Variable Interest Entities(which is now part of ASC 810-10), as a result of the elimination of the qualifying special-purpose entity,and (2) constituent concerns about the application of certain key provisions of ASC 810-10, including those in which the accounting and disclosures under ASC 810-10 do not always provide timely and useful information about an enterprise's involvement in a variable interest entity. This new guidance is effective as of the beginning of each reporting entity's first annual reporting period t hat begins after November 15, 2009, for interim periods within that first annual reporting period, and for interim and annual reporting periods thereafter. Earlier application is prohibited. This new guidance does not have a material impact on the Company's consolidated financial statements when adopted June 1, 2010.

29

(iv)

In June 2009, the FASB issued new guidance which is now part of ASC 105-10 (the "Codification") (formerly Statement of Financial Accounting Standards No. 168, TheFASB Accounting Standards CodificationTMand the Hierarchy of Generally Accepted Accounting Principles), which will become the source of authoritative U.S. GAAP recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. On the effective date of the Codification, the Codification will supersede all then-existing non-SEC accounting and reporting standards. All other non-grandfathered non-SEC accounting literature not included in the Codification will become non-authoritative. The Codification is effective for financial statements issu ed for interim and annual periods ending after September 15, 2009. The adoption of the Codification only had the effect of amending references to authoritative accounting guidance in the Company's consolidated financial statements.

(v)