Regulatory expenses were $137,947 for the year ended December 31, 2022 compared to $178,264 for the year ended December 31, 2021. The decrease of $40,317 is primarily due to reduced SEDAR filings fees of $20,789, reduced TSX listing fees of $20,054, and reduced NYSE listing fees of $3,407, partially offset by increased EDGAR filings fees of $2,050 and increased transfer agent fees of $1,883.

Excluding share-based payment charges of $117,994 and $143,957, respectively, wages and benefits increased to $796,084 for the year ended December 31, 2022 from $791,116 for the year ended December 31, 2021. The increase of $4,968 is primarily due to payroll-related benefit accruals as at December 31, 2022.

Professional fees were $226,439 for the year ended December 31, 2022 compared to $210,594 for the year ended December 31, 2021. The increase of $15,845 is primarily due to the timing of audit services of $36,350 and increased XBRL costs of $1,211 partially offset by reduced legal fees of $17,777 and reduced tax services of $3,939.

Insurance costs were $202,893 for the year ended December 31, 2022 compared to $179,659 for the year ended December 31, 2021. The increase of $23,234 is primarily due to premium increases to maintain coverage.

Travel costs were $29,935 for the year ended December 31, 2022 compared to $18,464 for the year ended December 31, 2021. The increase of $11,471 is primarily due to travel related to investor relations conferences.

Excluding share-based payments, all other operating expense categories reflected only moderate changes period over period.

Other items amounted to other income of $404,346 during the year ended December 31, 2022 compared to an expense of $64,839 during the year ended December 31, 2021. The Company had a foreign exchange gain of $348,207 during the year ended December 31, 2022 compared to a foreign exchange loss of $101,818 during the year ended December 31, 2021 as a result of the impact of exchange rates on certain of the Company’s U.S. dollar cash balances. The average exchange rate during the year ended December 31, 2022 was C$1 to $0.7692 compared to C$1 to $0.7994 for the year ended December 31, 2021.

Liquidity and Capital Resources

The Company has no revenue generating operations from which it can internally generate funds. To date, the Company’s ongoing operations have been predominantly financed through sale of its equity securities by way of public offerings, private placements and the subsequent exercise of share purchase and broker warrants issued in connection with such private placements. There are currently no warrants outstanding.

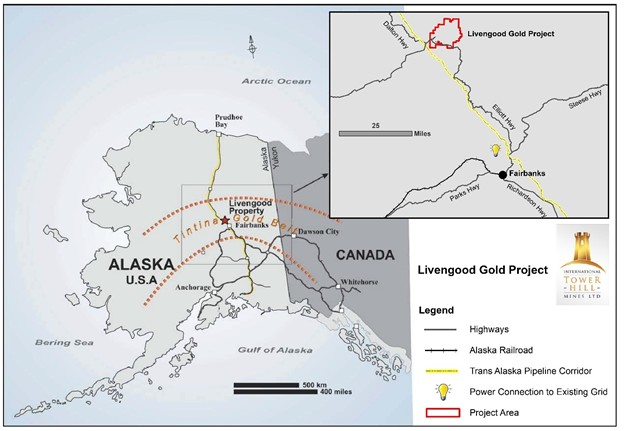

As at December 31, 2022, the Company reported cash and cash equivalents of $4,847,429 compared to $7,780,671 at December 31, 2021. The decrease of approximately $2.9 million resulted mainly from operating expenditures on the Livengood Gold Project of approximately $2.9 million and a negative foreign currency transaction impact of $0.3 million, partially offset by financing activities of $0.3 million.

Our anticipated expenditures for year 2023 are approximately $3.3 million, including $535,578 for mineral property leases and $206,215 for mining claim government fees. Total commitments for years 2023 through 2028 for mineral property leases and mining claim government fees are $3,300,328 and $1,237,290, respectively.

As at March 7, 2023, management believes that the Company has sufficient financial resources to maintain its operations for the next twelve months.

Financing activities during the year ended December 31, 2022 included the exercise of stock options. Proceeds of $290,290 were received on the issuance of 405,000 common shares.

The Company had no cash flows from financing activities during the year ended December 31, 2021.

The Company had no cash flows from investing activities during the years ended December 31, 2022 and December 31, 2021.

As at December 31, 2022, the Company had working capital of $4,711,616 compared to working capital of $7,342,470 at December 31, 2021. The Company expects that it will operate at a loss for the foreseeable future, but believes its current cash and cash equivalents