UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

¨ Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6 (e) (2)) |

x Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

¨ Soliciting Material under Rule 14a-12 | | |

TALEO CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6 (i) (4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

$

| | ¨ | Fee paid previously with preliminary materials. |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 15, 2011

Dear Stockholder:

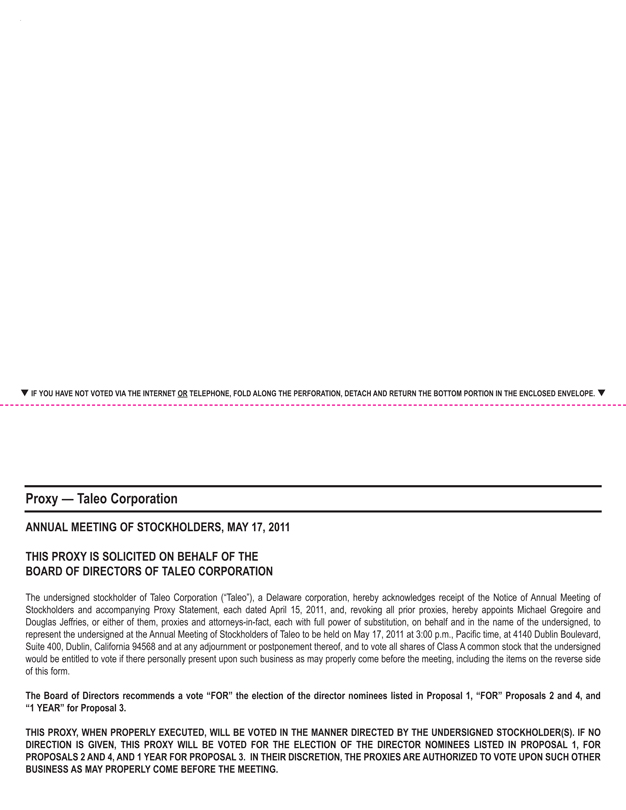

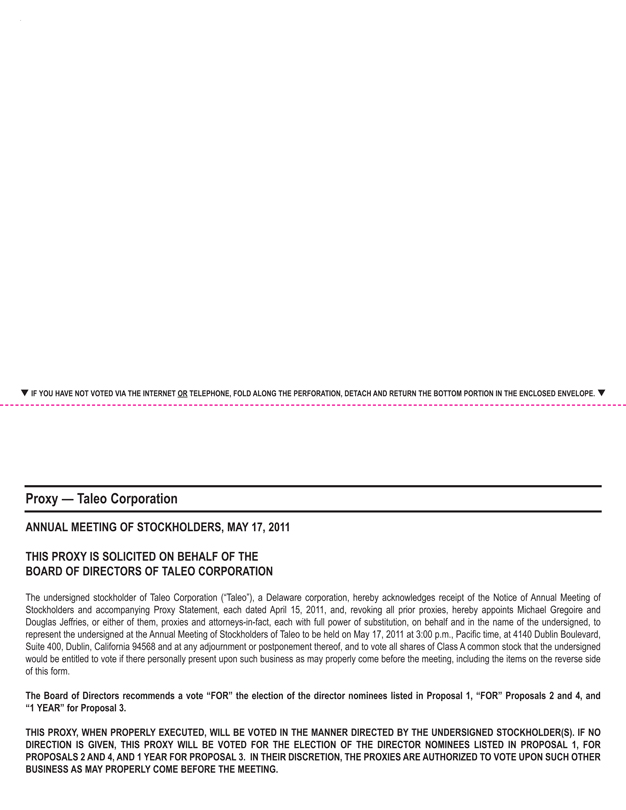

You are cordially invited to attend the 2011 Annual Meeting of Stockholders of Taleo Corporation that will be held on Tuesday, May 17, 2011 at 3:00 p.m., Pacific time, at Taleo Corporation’s principal executive offices located at 4140 Dublin Boulevard, Suite 400, Dublin, California 94568.

Details regarding admission to the Annual Meeting and the business to be conducted are described in the accompanying proxy materials. Also included is a copy of our 2010 Annual Report. We encourage you to read this information carefully.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, by telephone or by mailing a proxy card. Voting over the Internet, by telephone or by written proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend in person. Please review the instructions on the proxy card regarding each of these voting options.

Thank you for your ongoing support of Taleo.

|

Very truly yours, |

|

/s/ Michael Gregoire |

|

Michael Gregoire |

Chairman of the Board of Directors and Chief Executive Officer |

TALEO CORPORATION

4140 Dublin Boulevard, Suite 400

Dublin, California 94568

NOTICE OF ANNUAL MEETING

FOR 2011 ANNUAL MEETING OF STOCKHOLDERS

| | |

Time and Date: | | Tuesday, May 17, 2011 at 3:00 p.m., Pacific time. |

| |

Place: | | Taleo Corporation’s offices, located at: 4140 Dublin Boulevard, Suite 400, Dublin, California 94568 |

| |

Items of Business: | | (1) To elect three Class III directors for a term of three years or until their respective successors have been duly elected and qualified. |

| |

| | (2) To conduct a non-binding advisory vote on executive compensation. |

| |

| | (3) To conduct a non-binding advisory vote on the frequency of holding future advisory votes on executive compensation. |

| |

| | (4) To ratify the appointment of PricewaterhouseCoopers LLP as Taleo’s independent registered public accounting firm for the fiscal year ending December 31, 2011. |

| |

| | (5) To transact such other business as may properly come before the Annual Meeting. |

| |

| | These items of business are more fully described in the proxy statement accompanying this notice. |

| |

Adjournments and Postponements: | | Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. |

| |

Record Date: | | You are entitled to vote if you were a stockholder of record as of the close of business on March 31, 2011. |

| |

Voting: | | Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the proxy statement and submit your proxy card or vote on the Internet or by telephone as soon as possible. For specific instructions on how to vote your shares, please refer to the section entitled “Questions and Answers About Procedural Matters” and the instructions on the enclosed proxy card. |

All stockholders are cordially invited to attend the Annual Meeting in person.

|

By Order of the Board of Directors, |

|

/s/ Michael Gregoire |

|

Michael Gregoire |

Chairman of the Board of Directors and Chief Executive Officer |

This notice of Annual Meeting, proxy statement and accompanying form of proxy card are being distributed on or about April 15, 2011.

TABLE OF CONTENTS

i

TALEO CORPORATION

4140 Dublin Boulevard, Suite 400

Dublin, California 94568

PROXY STATEMENT FOR 2011 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT PROCEDURAL MATTERS

Annual Meeting

| Q: | Why am I receiving these proxy materials? |

| A: | The Board of Directors of Taleo Corporation is providing these proxy materials to you in connection with the solicitation of proxies for use at the 2011 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, May 17, 2011 at 3:00 p.m., Pacific time, and at any adjournment or postponement thereof, for the purpose of considering and acting upon the matters set forth herein. The notice of Annual Meeting, this proxy statement and accompanying form of proxy card are being distributed to you on or about April 15, 2011. |

| Q: | Where is the Annual Meeting? |

| A: | The Annual Meeting will be held at Taleo’s offices, located at 4140 Dublin Boulevard, Suite 400, Dublin, California 94568. The telephone number at that location is (925) 452-3000. |

| Q: | Can I attend the Annual Meeting? |

| A: | You are invited to attend the Annual Meeting if you were a stockholder of record or a beneficial owner as of March 31, 2011. You should bring photo identification for entrance to the Annual Meeting. The meeting will begin promptly at 3:00 p.m., Pacific time. Stockholders may request directions to Taleo’s offices in order to attend the Annual Meeting by calling (925) 452-3000. |

Stock Ownership

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| A: | Stockholders of record — If your shares are registered directly in your name with Taleo’s transfer agent, Computershare Trust Company, N.A., you are considered, with respect to those shares, the “stockholder of record.” These proxy materials have been sent directly to you by Taleo. |

| | Beneficial owners — Many Taleo stockholders hold their shares through a broker, trustee or other nominee, rather than directly in their own name. If your shares are held in a brokerage account or by a bank or another nominee, you are considered the “beneficial owner” of shares held in “street name.” The proxy materials have been forwarded to you by your broker, trustee or nominee who is considered, with respect to those shares, the stockholder of record. |

| | As the beneficial owner, you have the right to direct your broker, trustee or nominee on how to vote your shares. For directions on how to vote shares beneficially held in street name, please refer to the voting instruction card provided by your broker, trustee or nominee. Since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. |

Quorum and Voting

| Q: | How many shares must be present or represented to conduct business at the Annual Meeting? |

| A: | The presence of the holders of a majority of the shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Such stockholders are counted as present at the meeting if they (1) are present in person at the Annual Meeting or (2) have properly submitted a proxy. |

1

| | Under the General Corporation Law of the State of Delaware, abstentions and broker “non-votes” are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting. |

| | A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. |

| Q: | Who is entitled to vote at the Annual Meeting? |

| A: | Holders of record of Taleo’s Class A common stock, par value $0.00001 per share (the “Common Stock”), at the close of business on March 31, 2011 (the “Record Date”) are entitled to receive notice of and to vote their shares at the Annual Meeting. Such stockholders are entitled to cast one vote for each share of Common Stock held as of the Record Date. |

| | As of the Record Date, there were 40,926,909 shares of Class A common stock outstanding and entitled to vote at the Annual Meeting. No shares of Taleo’s preferred stock were outstanding. |

| Q: | How can I vote my shares in person at the Annual Meeting? |

| A: | Shares held in your name as the stockholder of record may be voted in person at the Annual Meeting. Shares held beneficially in street name may be voted in person at the Annual Meeting only if you obtain a legal proxy from the broker, trustee or other nominee that holds your shares giving you the right to vote the shares.Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy card or voting instructions as described below, so that your vote will be counted if you later decide not to attend the meeting. |

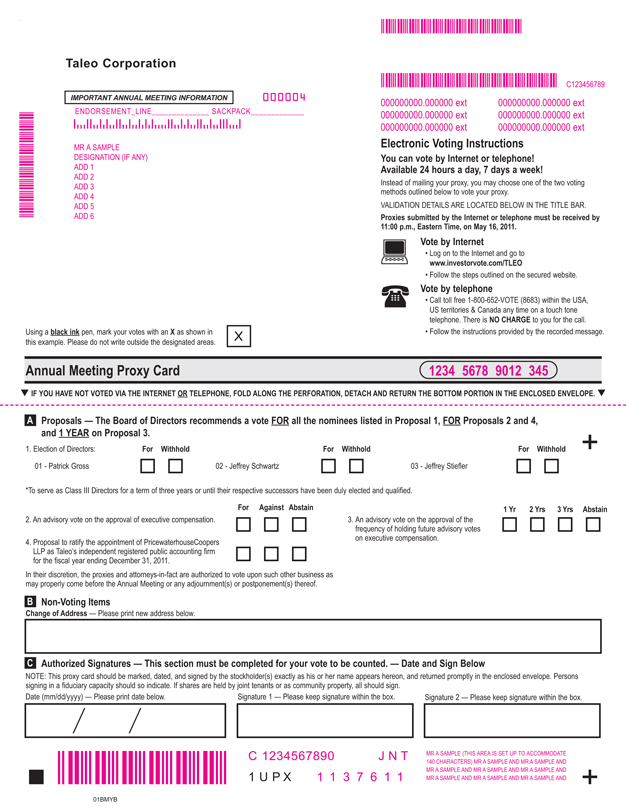

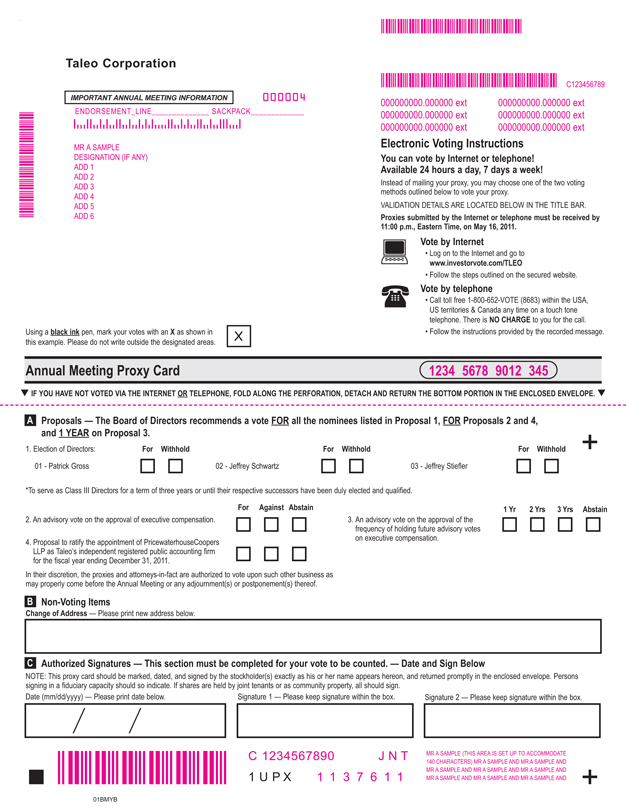

| Q: | How can I vote my shares without attending the Annual Meeting? |

| A: | Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by submitting a proxy. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee. For instructions on how to vote, please refer to the instructions below and those included on your proxy card or, for shares held beneficially in street name, the voting instructions provided to you by your broker, trustee or nominee. |

| | By mail — Stockholders of record may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelopes. Proxy cards submitted by mail must be received by the time of the meeting in order for your shares to be voted. Taleo stockholders who hold shares beneficially in street name may vote by mail by completing, signing and dating the voting instructions provided by their brokers, trustees or nominees and mailing them in the accompanying pre-addressed envelopes. |

| | By Internet — Stockholders of record with Internet access may submit proxies by following the “Vote by Internet” instructions on their proxy cards until 11:00 p.m., Eastern time, on May 16, 2011. Most Taleo stockholders who hold shares beneficially in street name may vote by accessing the web site specified in the voting instructions provided by their brokers, trustees or nominees. If you are a beneficial owner of shares held in street name, please check the voting instructions provided by your broker, trustee or nominee for Internet voting availability. |

| | By telephone — Stockholders of record who live in the United States, Puerto Rico or Canada may submit proxies by following the “Vote by Phone” instructions on their proxy cards until 11:00 p.m., Eastern time, on May 16, 2011. Most Taleo stockholders who hold shares beneficially in street name may vote by phone by calling the number specified in the voting instructions provided by their brokers, trustees or nominees. If you are a beneficial owner of shares held in street name, please check the voting instructions for telephone voting availability. |

2

| Q: | What proposals will be voted on at the Annual Meeting? |

| A: | At the Annual Meeting, stockholders will be asked to vote on: |

| | (1) | The election of three Class III directors for a term of three years or until their respective successors have been duly elected and qualified; |

| | (2) | The non-binding advisory vote on executive compensation; |

| | (3) | The non-binding advisory vote on the frequency of holding future advisory votes on executive compensation; and |

| | (4) | The ratification of the appointment of PricewaterhouseCoopers LLP as Taleo’s independent registered public accounting firm for the fiscal year ending December 31, 2011. |

Q: What is the voting requirement to approve each of the proposals?

| A: | Proposal One — A plurality of the votes cast is required for the election of directors. You may vote “FOR” or “WITHHOLD” on each of the three nominees for election as director. The three nominees for director receiving the highest number of affirmative votes will be elected as Class III directors of Taleo to serve for a term of three years or until their respective successors have been duly elected and qualified. Abstentions and broker non-votes will not affect the outcome of the election. |

| | Proposal Two — The affirmative vote of a majority of votes cast is required to approve the advisory vote on executive compensation. You may vote “FOR,” “AGAINST” or “ABSTAIN” on this proposal.Abstentions are deemed to be votes cast and have the same effect as a vote against this proposal. However, broker non-votes are not deemed to be votes cast and, therefore, are not included in the tabulation of the voting results on this proposal. |

| | Proposal Three — A plurality of the votes cast is required to approve the advisory vote on the frequency of holding future advisory votes on executive compensation. You may vote “ONE YEAR,” “TWO YEARS,” “THREE YEARS” or “ABSTAIN” on this proposal. The frequency — one year, two years or three years — receiving the highest number of votes will be the frequency of holding future advisory votes on executive compensation recommended by the stockholders. Abstentions and broker non-votes will not affect the outcome of this proposal. |

| | Proposal Four — The affirmative vote of a majority of votes cast is required to ratify the appointment of PricewaterhouseCoopers LLP as Taleo’s independent registered public accounting firm. You may vote “FOR,” “AGAINST” or “ABSTAIN” on this proposal.Abstentions are deemed to be votes cast and have the same effect as a vote against this proposal. However, broker non-votes are not deemed to be votes cast and, therefore, are not included in the tabulation of the voting results on this proposal. |

| Q: | How does the Board of Directors recommend that I vote? |

| A: | The Board of Directors recommends that you vote your shares: |

| | • | | “FOR” the three nominees for election as director listed in Proposal One; |

| | • | | “FOR” the approval of Taleo’s executive compensation; |

| | • | | For the option of every “ONE YEAR” as the frequency of holding future advisory votes on executive compensation; and |

| | • | | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as Taleo’s independent registered public accounting firm for the fiscal year ending December 31, 2011. |

| Q: | If I sign a proxy, how will it be voted? |

| A: | All shares entitled to vote and represented by properly executed proxy cards received prior to the Annual Meeting (and not revoked) will be voted at the Annual Meeting in accordance with the instructions indicated on those proxy cards. If no instructions are indicated on a properly executed proxy card, the shares represented by that proxy card will be voted as recommended by the Board of Directors. |

3

| Q: | What happens if additional matters are presented at the Annual Meeting? |

| | If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the enclosed proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. Taleo does not currently anticipate that any other matters will be raised at the Annual Meeting. |

| Q: | Can I change or revoke my vote? |

| A: | Subject to any rules your broker, trustee or nominee may have, you may change your proxy instructions at any time before your proxy is voted at the Annual Meeting. |

| | If you are a stockholder of record, you may change your vote by (1) filing with Taleo’s Secretary, prior to your shares being voted at the Annual Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy card relating to the same shares, or (2) by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not, by itself, revoke a proxy). A stockholder of record that has voted on the Internet or by telephone may also change his or her vote by later making a timely and valid Internet or telephone vote. |

| | If you are a beneficial owner of shares held in street name, you may change your vote (1) by submitting new voting instructions to your broker, trustee or other nominee or (2) if you have obtained a legal proxy from the broker, trustee or other nominee that holds your shares giving you the right to vote the shares, by attending the Annual Meeting and voting in person. |

| | Any written notice of revocation or subsequent proxy card must be received by Taleo’s Secretary prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to Taleo’s Secretary or should be sent so as to be delivered to Taleo’s principal executive offices, Attention: Corporate Secretary. |

| Q: | Who will bear the cost of soliciting votes for the Annual Meeting? |

| A: | Taleo will bear all expenses of this solicitation, including the cost of preparing and mailing these proxy materials. Taleo may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners. Directors, officers and employees of Taleo may also solicit proxies in person or by other means of communication. Such directors, officers and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. Taleo may engage the services of a professional proxy solicitation firm to aid in the solicitation of proxies from certain brokers, bank nominees and other institutional owners. Taleo’s costs for such services, if retained, will not be significant. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | We intend to announce preliminary voting results at the Annual Meeting and will publish final results in a current report on Form 8-K within four business days after the Annual Meeting. |

Stockholder Proposals and Director Nominations

| Q: | What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors? |

| A: | You may submit proposals, including director nominations, for consideration at future stockholder meetings. |

| | Requirements for stockholder proposals to be considered for inclusion in Taleo’s proxy materials — Stockholders may present proper proposals for inclusion in Taleo’s proxy statement and for consideration at the next annual meeting of its stockholders by submitting their proposals in writing to Taleo’s Secretary in a |

4

| | timely manner. In order to be included in the proxy statement for the 2012 annual meeting of stockholders, stockholder proposals must be received by Taleo’s Secretary no later than December 16, 2011, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

| | Requirements for stockholder proposals to be brought before an annual meeting — In addition, Taleo’s bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders. In general, nominations for the election of directors may be made by (1) the Board of Directors, (2) the Corporate Governance and Nominating Committee or (3) any stockholder entitled to vote who has delivered written notice to Taleo’s Secretary no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations. |

| | Taleo’s bylaws also provide that the only business that may be conducted at an annual meeting is business that is (1) specified in the notice of meeting given by or at the direction of the Board of Directors, (2) properly brought before the meeting by or at the direction of the Board of Directors or (3) properly brought before the meeting by a stockholder who has delivered written notice to the Secretary of Taleo no later than the Notice Deadline (as defined below). |

| | The “Notice Deadline” is defined as that date which is 120 days prior to the one year anniversary of the date on which Taleo first mailed its proxy materials to stockholders for the previous year’s annual meeting of stockholders. As a result, the Notice Deadline for the 2012 annual meeting of stockholders is December 16, 2011. |

| | If a stockholder who has notified Taleo of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, Taleo need not present the proposal for vote at such meeting. |

| Q: | How may I obtain a copy of the bylaw provisions regarding stockholder proposals and director nominations? |

| A: | A copy of the full text of the bylaw provisions discussed above may be obtained by writing to the Secretary of Taleo. All notices of proposals by stockholders, whether or not included in Taleo’s proxy materials, should be sent to Taleo’s principal executive offices, Attention: Corporate Secretary. |

Additional Information about the Proxy Materials

| Q: | What should I do if I receive more than one set of proxy materials? |

| A: | You may receive more than one set of proxy materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each Taleo proxy card or voting instruction card that you receive to ensure that all your shares are voted. |

| Q: | How may I obtain a separate set of proxy materials or the 2010 Annual Report? |

| A: | If you share an address with another stockholder, each stockholder may not receive a separate copy of the proxy materials and 2010 Annual Report. |

| | Stockholders who do not receive a separate copy of the proxy materials and 2010 Annual Report may request to receive a separate copy of the proxy materials and 2010 Annual Report by calling (925) 452-3000 or by writing to Investor Relations at Taleo’s principal executive offices. Alternatively, stockholders who share an address and receive multiple copies of the proxy materials and 2010 Annual Report can request to receive a single copy by following the instructions above. |

5

| Q: | What is the mailing address for Taleo’s principal executive offices? |

| A: | Taleo’s principal executive offices are located at 4140 Dublin Boulevard, Suite 400, Dublin, California 94568. The telephone number at that location is (925) 452-3000. |

| | Any written requests for additional information, additional copies of the proxy materials and 2010 Annual Report, notices of stockholder proposals, recommendations for candidates to the Board of Directors, communications to the Board of Directors or any other communications should be sent to this address. |

IMPORTANT NOTICE REGARDINGTHE AVAILABILITYOF PROXY MATERIALSFORTHE STOCKHOLDER MEETINGTO BE HELDON MAY 17, 2011.

The proxy statement and annual report to stockholders is available at http://ir.taleo.com/financials.cfm.

6

PROPOSAL ONE

ELECTION OF DIRECTORS

General

Taleo’s Board of Directors is currently comprised of nine members who are divided into three classes with staggered three-year terms. A director serves in office until his respective successor is duly elected and qualified or until his earlier death or resignation. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of an equal number of directors. Your proxy cannot be voted for a greater number of persons than the number of nominees named in this proxy statement.

Nominees

Three Class III directors have been nominated for election at the Annual Meeting for a three-year term expiring in 2014. Upon the recommendation of the Corporate Governance and Nominating Committee, the Board of Directors has nominatedPatrick Gross,Jeffrey Schwartz andJeffrey Stiefler for election as Class III directors. The term of office of each person elected as director will continue until such director’s term expires in 2014, or until such director’s successor has been duly elected and qualified.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the re-election of Messrs. Gross, Schwartz and Stiefler. Taleo expects that Messrs. Gross, Schwartz and Stiefler will accept such nominations; however, in the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the Board of Directors to fill such vacancy.

Director Qualifications

We have adopted a policy for evaluating director candidates which is described in more detail in the Corporate Governance section at page 17 below. Under this policy, the Corporate Governance and Nominating Committee considers issues such as character, judgment, diversity, age, expertise, business experience, length of service, independence, other commitments and the like in evaluating members of the Board of Directors in seeking to maximize board effectiveness. Taleo does not maintain a diversity policy with respect to its Board of Directors. As noted above, however, Taleo does consider diversity to be a relevant consideration, among others, in the process of evaluating and identifying director candidates. Taleo believes each director brings a strong and unique background and set of skills to the Board, giving the Board as a whole competence and experience in a wide variety of areas, including operations, industry experience, corporate governance, compliance, board service, executive management, finance, mergers and acquisitions, international business and various customer segments (including technology, the financial sector, and government). As the biographical information of our directors illustrates, all of our directors satisfy our general criteria for Board membership. When identifying director candidates, we take into account the present and future needs of the Board of Directors and the committees of the Board of Directors. For instance, depending on the composition of the Board of Directors at a given time, a candidate capable of meeting the requirements of an audit committee financial expert might be a more attractive candidate than a candidate with significantly more software industry expertise, or vice versa. We also consider the character, judgment and integrity of director candidates, which we evaluate through reference checks, background verification and reputation in the business community. We believe all of our directors to be of high character, good judgment and integrity. Our principal goal with respect to director qualifications is to seat directors who are able to increase the overall effectiveness of the Board of Directors and increase stockholder value. Beneath the biographical details of each nominee or director listed below, we have detailed the specific experience, qualifications, attributes or skills of each nominee or director that led the Board of Directors to conclude that each nominee or director should serve on the Board of Directors.

The Board of Directors Recommends a Vote “For” the Nominees Listed Above.

7

Information Regarding the Nominees and Other Directors

Nominees for Class III Directors for a Term Expiring in 2014

| | | | | | |

Name | | Age | | | Principal Occupation and Business Experience |

Patrick Gross | | | 66 | | | Chairman, The Lovell Group.Mr. Gross has served as a director since August 2006. Mr. Gross is chairman of The Lovell Group, a private business and technology advisory and investment firm, which he founded in October 2002. Mr. Gross is a founder of, and served in a variety of positions from 1970 to 2002 at American Management Systems, Inc., an information technology consulting, software development, and systems integration firm. Mr. Gross serves on the boards of directors of Capital One Financial Corporation, Career Education Corporation, Liquidity Services, Inc., Rosetta Stone Ltd., and Waste Management, Inc. Mr. Gross also serves on the boards of directors of various private companies. Mr. Gross previously served on the boards of directors of Mobius Management Systems, Inc. from 2002 to 2007 and Computer Network Technology Corporation from 1997 to 2006. Mr. Gross holds a bachelor’s degree in engineering science from Rensselaer Polytechnic Institute, a master’s degree in engineering from the University of Michigan and a master’s degree in business administration from Stanford University. Qualifications to serve as director:Mr. Gross is independent and has deep expertise in many areas, including corporate governance. Mr. Gross’s expertise includes selling into and servicing U.S. government entities, an area of planned expansion for Taleo. He also has management experience in the business of technology consulting, software development and systems integration, which is useful to the Board. Additionally, Mr. Gross has served as a director on the boards of public companies much larger than Taleo and, as a result, Mr. Gross is exposed to thinking and best practices with respect to governance and other board matters that has been of value to Taleo. Mr. Gross currently chairs Taleo’s corporate governance and nominating committee. |

| | |

Jeffrey Schwartz | | | 46 | | | Managing Director, Bain Capital Venture Partners, LLC. Mr. Schwartz has served as a director since January 2001. Mr. Schwartz is a managing director of Bain Capital Venture Partners, LLC, a private investment firm. Prior to joining Bain Capital Venture Partners in March 2000, Mr. Schwartz was a vice president of Wellington Management Company, LLP, an investment management firm, from January 1999 to February 2000, and a vice president with Merrill Lynch, Pierce, Fenner & Smith Incorporated, an investment banking firm, from August 1994 to January 1999. Mr. Schwartz also serves on the boards of directors of EDGAR Online, Inc. and various private companies. Mr. Schwartz holds a bachelor’s degree in economics from Dartmouth College and a master’s degree in business administration from Harvard Business School. Qualifications to serve as director:Mr. Schwartz is independent and has deep domain expertise in Taleo’s principal markets. Mr. Schwartz has experience in the areas of mergers and acquisitions, financing arrangements and venture investment. His expertise and experience has informed Taleo’s decisions over time with respect to transaction structure, transaction valuation, financing options and evaluation of investment opportunities. In his role as a managing director of Bain Capital Venture Partners, Mr. Schwartz is also exposed to a wide variety of business models and best practices for growth companies, and Mr. Schwartz has shared insights with Taleo in these areas over time. |

8

| | | | | | |

Jeffrey Stiefler | | | 64 | | | Former President of American Express Company and Former Chairman, President and Chief Executive Officer of Digital Insight.Mr. Stiefler has served as a director since August 2008 and Lead Independent Director since May 2010. Mr. Stiefler serves on the boards of directors of VeriFone Holdings, Inc., LPL, Inc. and various private companies, and is a venture partner for Emergence Capital Partners, a venture capital firm serving early and growth stage companies. Prior to that, Mr. Stiefler was the chairman, chief executive officer, and president of Digital Insight Corporation from August 2003 until the company’s sale to Intuit in February 2007. From February 1996 until September 2003, Mr. Stiefler served as an advisor to private equity firms McCown DeLeeuw and Company and North Castle Partners. From February 1983 until September 1995, Mr. Stiefler was with American Express Company, serving as president and a director of American Express from 1993 to 1995 and president and CEO of IDS Financial Services Corporation, a subsidiary of American Express from 1991 to 1993. Prior to American Express, he held a variety of leadership positions with Citicorp and Boise Cascade Corporation. Mr. Stiefler previously served on the Board of directors of Digital Insight from 2003 to 2007. Mr. Stiefler holds a bachelor’s degree in arts from Williams College and a master’s degree in business administration from Harvard Business School. |

| | |

| | | | | | Qualifications to serve as director:Mr. Stiefler is independent and has significant senior management expertise at a Fortune 100 company. As a former chief executive officer of a software company, Mr. Stiefler’s operational and strategic experiences are relevant to issues faced by Taleo on a regular basis. We believe he brings a unique perspective to the Board as a result of having served in the highest levels of management of both a large public company and a high growth, smaller public company. Mr. Stiefler’s current and past board experience, including the role of chairman of the board of directors of a public company, also exposed him to best practices and approaches that are beneficial to Taleo. |

Incumbent Class I Directors Whose Term Expires in 2012

| | | | | | |

Name | | Age | | | Principal Occupation and Business Experience |

Gary Bloom | | | 50 | | | Chief Executive Officer of eMeter, Inc., Former Vice Chairman and President of Symantec, and Former Chairman and Chief Executive Officer of Veritas.Mr. Bloom has served as a director since February 2007. Mr. Bloom is chief executive officer of eMeter, Inc. Mr. Bloom was previously the vice chairman and president of Symantec Corporation from July 2005 to March 2006. Mr. Bloom joined Symantec through Symantec’s merger with VERITAS Software Corporation, where he served as president and chief executive officer from November 2000 to January 2002, and chairman, president and chief executive officer from January 2002 to July 2005. Mr. Bloom joined VERITAS after a 14-year career with Oracle Corporation, an enterprise software company, rising to the rank of Executive Vice President. Mr. Bloom also serves on the board of directors of BMC Software, Inc., a public company. Mr. Bloom holds a bachelor’s degree in computer science from California Polytechnic State University San Luis Obispo. |

9

| | | | | | |

| | | | | | Qualifications to serve as director:Mr. Bloom is independent and his operational and strategic experiences as a chief executive officer in the software industry are relevant to the issues and opportunities that Taleo manages on a regular basis. His experience as a senior executive with over 20 years of software company experience gives him insights into the operational and strategic issues facing Taleo. Mr. Bloom’s past board experience, including the role of chairman of the board of directors of a public company, have also provided Mr. Bloom with experience into issues relevant to Taleo. |

| | |

Greg Santora | | | 59 | | | Former Chief Financial Officer of Intuit, Inc. and Shopping.com. Mr. Santora has served as a director since December 2006. Mr. Santora is an independent management consultant, advising clients in the technology industry. Prior to being an independent management consultant, Mr. Santora served as chief financial officer of Shopping.com, a provider of internet-based comparison shopping resources, from December 2003 to September 2005. From 1997 through 2002, he served as senior vice president and chief financial officer of Intuit, Inc., a provider of small business and personal finance software. Prior to Intuit, Mr. Santora spent nearly 13 years at Apple Computer in various senior financial positions including Senior Finance Director of Apple Americas and Senior Director of Internal Consulting and Audit. Mr. Santora, who began his accounting career with Arthur Andersen LLP, has been a CPA since 1974. He also serves on the board of directors of Align Technology, Inc. Mr. Santora holds a bachelor’s degree in accounting from the University of Illinois and a master’s degree in business administration from San Jose State University. Qualifications to serve as director:Mr. Santora is independent and has significant software industry experience and senior management experience as chief financial officer of Intuit. The compliance, financial reporting and audit expertise Mr. Santora gained in his senior finance and operations roles, including as a chief financial officer, is valuable in addressing issues that may arise at Taleo. Mr. Santora is currently the audit committee chairman and is the designated audit committee financial expert. Mr. Santora also serves on the board of directors and audit committee of another publicly traded company, which gives Mr. Santora insight and perspective into current best practices with respect to finance organizations and the audit committee function. |

| | |

James Tolonen | | | 61 | | | Former Senior Group Vice President of Finance and Administration and Chief Financial Officer at Business Objects, S.A. Mr. Tolonen has served as a director since August 2010. Mr. Tolonen serves on the boards of directors of Blue Coat Systems, Inc., a public company, and The Coral Reef Alliance, a not for profit entity. Mr. Tolonen was senior vice president of finance and administration and chief financial officer at Business Objects, S.A. from 2003 until 2008. In this capacity, Mr. Tolonen managed the global finance, tax, information technology and administrative organizations of Business Objects. Prior to his employment by Business Objects Mr. Tolonen held senior executive positions at IGN Entertainment, Inc. (a subsidiary of News Corporation), CyberMedia, Inc. and Novell, Inc. and served on the boards of directors of IGN Entertainment, Inc. and CyberMedia, Inc. Mr. Tolonen holds a bachelor’s degree in mechanical engineering and a master’s degree in business administration from the University of Michigan. |

10

| | | | | | |

| | | | | | Qualifications to serve as director:Mr. Tolonen is independent and has significant software industry experience and senior management experience as the former chief financial officer of Business Objects. The compliance, financial reporting and audit expertise Mr. Tolonen gained in his senior finance and operations roles, including as a chief financial officer, is valuable in addressing issues that may arise at Taleo. Mr. Tolonen is currently an audit committee member and is a designated audit committee financial expert. Mr. Tolonen also serves on the board of directors and audit committee of another publicly traded company, which gives Mr. Tolonen insight and perspective into current best practices with respect to finance organizations and the audit committee function. |

Incumbent Class II Directors Whose Term Expires in 2013

| | | | | | |

Name | | Age | | | Principal Occupation and Business Experience |

Michael Gregoire | | | 45 | | | Chairman of the Board of Directors, President and Chief Executive Officer, Taleo Corporation. Mr. Gregoire has served as Taleo’s president and chief executive officer since March 2005, as a director since April 2005, and as chairman of the board since May 2008. Prior to joining Taleo, Mr. Gregoire worked at PeopleSoft, an enterprise software company, from May 2000 to January 2005, most recently as executive vice president, global services. Prior to PeopleSoft, Inc., Mr. Gregoire served as managing director for Global Financial Markets at Electronic Data Systems, Inc., a technology services provider, from 1996 to April 2000, and in various other roles from 1988 to 1996. Mr. Gregoire also serves on the board of directors of ShoreTel Inc. Mr. Gregoire holds a master’s degree from California Coast University and a bachelor’s degree in physics and computing from Wilfred Laurier University in Ontario, Canada. Qualifications to serve as director: As the chief executive officer of Taleo, Mr. Gregoire has the ultimate operational management responsibilities for the business of Taleo. He has deep domain knowledge of Taleo’s markets and as chief executive officer is most knowledgeable about the state of Taleo’s business, the business risks faced by Taleo and management’s strategy and plans for accomplishing Taleo’s goals. Prior to joining Taleo, Mr. Gregoire had significant software industry expertise and experience at senior management levels, much of which was focused on providing human resource related software and services to large organizations. |

| | |

Jonathan Schwartz | | | 45 | | | Former President, Chief Executive Officer and Director of Sun Microsystems, Inc.Mr. Schwartz has served as a director since August 2010. An executive at Sun Microsystems from 1996 until 2010, Mr. Schwartz was most recently president, chief executive officer and a director of Sun Microsystems from 2006-2010. From 2004 to 2006, Mr. Schwartz was Sun’s president and chief operating officer, responsible for the operations and execution of Sun’s global businesses. In other executive positions at Sun, he oversaw the company’s software business, was its chief strategy officer, and led mergers, acquisitions and Sun’s venture capital portfolio. Prior to Sun, Mr. Schwartz was the founder, president and chief Executive officer of Lighthouse Design, Ltd., which was ultimately acquired by Sun Microsystems, and began his career with McKinsey & Company, Inc. Mr. Schwartz holds a bachelor’s degree in mathematics and economics from Wesleyan University. |

11

| | | | | | |

| | | | | | Qualifications to serve as director:Mr. Schwartz is independent and his operational and strategic experiences as a chief executive officer in the software industry are relevant to the issues and opportunities that Taleo manages on a regular basis. His experience as a senior executive gives him insights into the operational and strategic issues facing Taleo. Mr. Schwartz’s past board experience with a public company, has also provided Mr. Schwartz with expertise on issues relevant to Taleo. |

| | |

Michael Tierney | | | 58 | | | Former Chief Executive Officer of Seneca Investments, LLC. Mr. Tierney has served as a director since February 2001. Mr. Tierney is a co-founder and officer of Dramatic Health, Inc., a New York based company engaged since 2005 in the production and distribution of medical education videos. From 2001 through 2007, Mr. Tierney was the chief executive officer of Seneca Investments, LLC, which owned various investments in digital marketing and communications companies. Prior to joining Seneca, Mr. Tierney was a senior executive with Omnicom Group, Inc., a holding company of advertising, marketing and communications firms. From 1983 to 1992, and from 1995 to 2000, when he joined Omnicom, Mr. Tierney was an investment banker with Lehman Brothers, Stamford Company and Ecoban Finance Ltd., focusing on international transactions. From 1992 to 1995, he was President of Alusit Ltd., an international specialty packaging company subsequently acquired by Japan Tobacco, part of the Japanese Ministry of Finance. From 1979 to 1983, Mr. Tierney practiced law in New York and Hong Kong with Coudert Brothers, and as General Counsel, Asia, for American Express Bank. Mr. Tierney holds a bachelor’s degree in English from the University of Maryland and a law degree from the University of Chicago. Mr. Tierney is a member of the Visiting Committee of the Law School of the University of Chicago. Qualifications to serve as director: Mr. Tierney is independent and has significant experience in financial analysis and planning and international operations. Mr. Tierney’s service as chief executive officer and in other senior positions at large organizations has given him expertise in executive management and operations. His investment banking and legal experience has provided expertise in analysis, planning and execution with respect to corporate strategic initiatives, including mergers and acquisitions. Mr. Tierney was an early venture capital investor in Taleo, is a significant Taleo shareholder and is one of Taleo’s longest standing directors. Mr. Tierney’s experience as an investor in various global businesses has informed Taleo’s investment and acquisition decisions over time. Mr. Tierney also has significant business experience outside of North America — including experience in Eastern Europe, Russia and Asia — which has informed Taleo’s discussions regarding entry into new markets. |

There are no family relationships among any of our directors or executive officers. See “Corporate Governance” and “Executive Compensation — Compensation of Directors” below for additional information regarding the Board of Directors.

12

PROPOSAL TWO

ADVISORY VOTE ON EXECUTIVE COMPENSATION

General

The recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) enables stockholders to vote to approve, on an advisory or non-binding basis, the compensation of Taleo’s named executive officers as disclosed in this proxy statement in accordance with rules of the Securities and Exchange Commission (“SEC”).

As described in detail under the heading “Executive Compensation — Compensation Discussion and Analysis,” Taleo’s compensation philosophy is to provide competitive compensation to attract, motivate and retain the talented individuals that are critical for our success. Taleo has designed its compensation programs to encourage the achievement of overall financial results, including consistent revenue growth and profitability, and to encourage role specific individual contributions by our named executive officers. This compensation philosophy is designed to align the interests of our named executive officers with the interests of our stockholders and has resulted in Taleo’s ability to attract and retain the executive talent necessary to guide Taleo during a period of tremendous growth.

We are asking for stockholder approval of the compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules, which disclosures include the disclosures under “Executive Compensation — Compensation Discussion and Analysis,” the compensation tables and the narrative discussion following the compensation tables. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the policies and practices described in this proxy statement.

This vote is advisory and therefore not binding on our Board of Directors or the Compensation Committee of the Board of Directors. The Board of Directors and Compensation Committee value the opinions of stockholders and to the extent there is any significant vote against the named executive officer compensation as disclosed in this proxy statement, we will consider those stockholders’ concerns and evaluate whether any actions are necessary to address those concerns.

The Board of Directors Recommends a Vote “For” the Approval of Taleo’s Executive Compensation.

13

PROPOSAL THREE

ADVISORY VOTE ON THE FREQUENCY OF HOLDING FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

General

The Dodd-Frank Act also enables stockholders to vote, on an advisory or non-binding basis, on how frequently they would like to cast an advisory vote on the compensation of Taleo’s named executive officers. By voting on this proposal, stockholders may indicate whether they would prefer an advisory vote on named executive officer compensation once every year, every two years or every three years.

After careful consideration of the frequency alternatives, the Board of Directors believes that conducting an advisory vote on executive compensation every year is appropriate for Taleo and its stockholders at this time. The Board of Directors has determined that an annual advisory vote on executive compensation will allow stockholders to provide timely input on Taleo’s executive compensation philosophy, policies and practices as disclosed in the proxy statement each year. We recognize that our stockholders may have different views as to what is the best approach for Taleo, and we look forward to hearing from our stockholders on this proposal.

The Board of Directors Recommends a Vote For the Option of “One Year”

as the Frequency of Holding Future Advisory Votes on Executive Compensation.

14

PROPOSAL FOUR

RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

General

On May 28, 2009, the Audit Committee engaged PricewaterhouseCoopers LLP (“PwC”) as Taleo’s registered independent public accounting firm for the year ended December 31, 2009. The Audit Committee participated in and approved the decision to engage PwC.

During the year ended December 31, 2008 and through May 27, 2009, neither Taleo nor anyone acting on its behalf consulted with PwC regarding either: (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on Taleo’s financial statements, and neither a written report was provided to Taleo nor oral advice was provided that PwC concluded was an important factor considered by Taleo in reaching a decision as to the accounting, auditing or financial reporting issue, or (ii) any matter that was either the subject of a disagreement (as that term is defined in Item 304(a)(1)(v) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) or a reportable event (as that term is described in Item 304(a)(1)(v) of Regulation S-K).

In connection with the selection of PwC, on May 27, 2009, the Audit Committee decided to dismiss Deloitte & Touche LLP (“D&T”), the independent registered public accounting firm previously engaged to audit Taleo’s consolidated financial statements. The Audit Committee participated in and approved the decision to dismiss D&T.

In connection with the audit of Taleo’s consolidated financial statements during the interim period through May 27, 2009, there were no disagreements between Taleo and D&T on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to the satisfaction of D&T, would have caused D&T to make reference thereto in its report.

There were no reportable events (as that term is described in Item 304(a)(1)(v) of Regulation S-K) during the interim period through May 27, 2009.

Taleo provided D&T a copy of the above disclosures and requested D&T to furnish a letter addressed to the Securities and Exchange Commission stating whether it agrees with the statements made above. A copy of D&T’s affirmative letter is attached as Exhibit 16.1 to Taleo’s Current Report on Form 8-K filed with the Securities and Exchange Commission on June 2, 2009.

Subsequent to the dismissal of D&T on May 27, 2009, Taleo engaged the standalone services of D&T in certain matters related to their prior services to Taleo, none of which services modify the disclosures contained above. D&T provided approximately $659,115 of services to Taleo subsequent to May 27, 2009.

Representatives of PwC are expected to attend the Annual Meeting, where they will be available to respond to appropriate questions and, if they desire, to make a statement.

The Board of Directors Recommends a Vote “For” Ratification of the Appointment of

PricewaterhouseCoopers LLP as Taleo’s Independent Registered Public Accounting Firm

for the Fiscal Year Ending December 31, 2011.

15

Principal Accounting Fees and Services

The following table presents fees billed for professional audit services and other services rendered to Taleo by PwC for the years ended December 31, 2010 and December 31, 2009. D&T also provided services during 2009 but did not serve as Taleo’s independent registered public accounting firm the year ended December 31, 2009.

| | | | | | | | | | | | |

| | | PwC | | | D&T | |

| | | 2010 | | | 2009 | | | 2009 (1) | |

Audit Fees (2) | | $ | 1,234,500 | | | $ | 1,137,600 | | | $ | 719,233 | |

Audit-Related Fees | | | — | | | | — | | | | — | |

Tax Fees (3) | | | — | | | | — | | | $ | 52,882 | |

All Other Fees (4) | | | — | | | | — | | | $ | 15,000 | |

| | | | | | | | | | | | |

Total | | $ | 1,234,500 | | | $ | 1,137,600 | | | $ | 787,115 | |

| | | | | | | | | | | | |

| (1) | Amounts paid in Canadian dollars were converted to U.S. dollars using the average conversion rate of 0.9532 Canadian dollars per U.S. dollar on December 31, 2009. |

| (2) | Audit fees consisted of fees billed for professional services rendered for the audit of Taleo’s annual financial statements included in Taleo’s Annual Reports on Form 10-K and for the review of the financial statements included in Taleo’s Quarterly Reports on Form 10-Q, as well as services that generally only Taleo’s independent registered public accounting firm can reasonably provide. Audit fees also include fees related to a stock offering we completed in 2009 and the audit of Taleo’s internal control over financial reporting and management’s assessment of the effectiveness of Taleo’s internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002. |

| (3) | Tax fees consisted principally of services related to Taleo’s Canadian tax audit, tax compliance, and reporting and tax consulting. |

| (4) | Other fees consisted of fees related to the transition from D&T to PwC as our independent registered public accounting firm for the year ended December 31, 2009. |

Pre-Approval of Audit and Non-Audit Services

Taleo’s Audit Committee has adopted a policy for pre-approving the services and associated fees of Taleo’s independent registered public accounting firm. Under this policy, the Audit Committee must pre-approve all services and associated fees provided to Taleo by its independent registered public accounting firm, with certain exceptions described in the policy.

All PwC and D&T services and fees in 2009 and 2010 were pre-approved by the Audit Committee.

16

CORPORATE GOVERNANCE

Code of Business Conduct and Ethics

Taleo has adopted a Code of Business Conduct and Ethics, which is applicable to our directors and employees, including our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. The Code of Business Conduct and Ethics is available on Taleo’s website at www.taleo.com under “Company” — “Corporate Governance” or at http://ir.taleo.com/governance.cfm. Taleo will also post on this section of its website any amendment to the Code of Business Conduct and Ethics, as well as any waivers of the Code of Business Conduct and Ethics, which are required to be disclosed by the rules of the Securities and Exchange Commission (“SEC”) or The NASDAQ Stock Market LLC (“Nasdaq”).

Independence of the Board of Directors

The Board of Directors has determined that, with the exception of Michael Gregoire, all of its members are “independent directors” as that term is defined in the Nasdaq listing standards.

Board Leadership Structure

Taleo is led by Mr. Gregoire, who has served as Chief Executive Officer since March 2005 and as Chairman of the Board of Directors since May 2008. Our Board of Directors is currently comprised of Mr. Gregoire and eight independent directors. Pursuant to our Corporate Governance Principles we do not require separation of the roles of Chairman of the Board of Directors and Chief Executive Officer. We do, however, require the election of a Lead Independent Director if the Chairman of the Board of Directors is a current or former executive of Taleo or otherwise not an “independent director” as defined in Rule 5605 of the Nasdaq Stock Market, Inc. Marketplace Rules. The role of Lead Independent Director at Taleo is described below, and the position is currently held by Jeffrey Stiefler, who has been a director of Taleo since August 2008.

In addition, the Board of Directors has three standing committees — Audit, Compensation, and Corporate Governance and Nominating (“Standing Committees”) — which are further described below. Each of the Standing Committees is comprised solely of independent directors, with each of the three committees having a separate chair. Our Corporate Governance Principles also provide that our non-management directors will meet in executive session at each board meeting and our Lead Independent Director presides at those sessions. We also have a mechanism for stockholders to communicate directly with non-management directors through the chair of our Corporate Governance and Nominating Committee.

In May 2008, the Board of Directors elected to consolidate the role of Chief Executive Officer and Chairman of the Board of Directors, and to appoint a Lead Independent Director. The Board of Directors believes that at this stage of Taleo’s size and growth it is appropriate to have Mr. Gregoire serve as both Chairman and Chief Executive Officer.

Our directors bring a broad range of leadership experience to the boardroom and regularly contribute to the thoughtful discussion involved in effectively overseeing the business and affairs of Taleo. We believe the atmosphere of our Board is collegial and that all board members are well engaged in their responsibilities, express their views and consider the opinions expressed by other directors. We do not believe that appointing an independent board chairman would improve the performance of the current Board of Directors. However, on an annual basis, as part of our governance review and succession planning, the Board of Directors (led by the Corporate Governance and Nominating committee) evaluates our leadership structure to ensure that it remains the optimal structure for Taleo and our stockholders, and we may determine in the future to adopt a different approach.

Our board leadership structure is commonly utilized by other public companies in the United States, and we believe that this leadership structure has been effective for Taleo. We believe that having a combined Chief Executive Officer and Chairman of the Board, independent chairs for each of our board committees and an independent lead director provides the right form of leadership for Taleo.

17

Lead Independent Director

Mr. Stiefler was appointed Lead Independent Director in May 2010. As Lead Independent Director, among other things, Mr. Stiefler:

| | • | | presides at all meetings of the Board of Directors at which the Chairman is not present; |

| | • | | calls and presides at all closed session meetings of the independent directors; |

| | • | | prepares the agenda and approves materials for meetings of the independent directors; |

| | • | | communicates with the Chairman and Chief Executive Officer, raises issues with management on behalf of the independent directors and acts as a liaison between the Chairman and Chief Executive Officer and the independent directors when appropriate; |

| | • | | consults with the Chairman regarding Board agendas, schedules and materials; and |

| | • | | serves as the Board’s liaison for consultation and communication with shareholders as appropriate, including on request of major shareholders. |

Board Meetings and Committees

During 2010, the Board of Directors held a total of twelve meetings (including regularly scheduled and special meetings) and also took certain actions by written consent. Except for Mr. Jeffrey Schwartz, each of the directors attended or participated in 75% or more of the aggregate of the total number of meetings held by the Board of Directors and the Standing Committees of the Board of Directors on which he served during the past fiscal year.

Audit Committee

The Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act, currently consists of Greg Santora, Michael Tierney and James Tolonen, each of whom is “independent” as such term is defined for audit committee members by the Nasdaq listing standards. Mr. Santora is the chairman of the Audit Committee. The Board of Directors has determined that each of Mr. Santora and Mr. Tolonen is an “audit committee financial expert” as defined under the rules of the SEC. The Audit Committee met eleven times during 2010.

The Audit Committee is responsible for:

| | • | | Overseeing the accounting and financial reporting processes and audits of our financial statements; |

| | • | | Overseeing and monitoring (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters, (iii) our independent auditor’s qualifications, independence and performance, and (iv) our internal accounting and financial controls; and |

| | • | | Providing to the Board additional information and materials as it deems necessary to make the board aware of significant financial matters that require the attention of the Board. |

The Audit Committee has adopted a written charter approved by the Board of Directors, which is available on Taleo’s website at www.taleo.com under “Company” — “Corporate Governance” or at http://ir.taleo.com/governance.cfm.

The Audit Committee Report is included in this proxy statement on page 49.

18

Compensation Committee

The Compensation Committee currently consists of Gary Bloom, Patrick Gross, Jeffrey Schwartz and Jonathan Schwartz, each of whom is “independent” as such term is defined by the Nasdaq listing standards. Mr. Bloom is the chairman of the Compensation Committee. The Compensation Committee met eight times during 2010.

The Compensation Committee is responsible for:

| | • | | Overseeing our compensation policies, plans and benefit programs and making recommendations to the Board with respect to improvements or changes to the plans and other plans proposed for adoption; |

| | • | | Reviewing and approving for our chief executive officer and other executive officers: (i) annual base salary, (ii) annual incentive bonus, including the specific goals and amount, (iii) equity compensation, (iv) employment agreements, severance arrangements and change of control agreements/provisions, (v) signing bonuses or payment of relocation costs, and (vi) any other benefits, compensation or arrangements; |

| | • | | Approving and evaluating the compensation plans, policies and programs for executive officers; and |

| | • | | Acting as administrator of our equity compensation plans. |

The Compensation Committee has delegated to the Non-executive Equity Committee, consisting of Taleo’s chief executive officer, the authority to grant stock options within certain guidelines to employees other than Taleo’s executive officers. See “Executive Compensation — Compensation Discussion and Analysis” and “Executive Compensation — Compensation of Directors” below for a description of Taleo’s processes and procedures for the consideration and determination of executive and director compensation.

The Compensation Committee has adopted a written charter approved by the Board of Directors, a copy of which is available on Taleo’s website at www.taleo.com under “Company” — “Corporate Governance” or at http://ir.taleo.com/governance.cfm.

The Compensation Committee Report is included in this proxy statement on page 31.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee currently consists of Gary Bloom, Patrick Gross, Jeffrey Stiefler and Michael Tierney, each of whom is “independent” as such term is defined by the Nasdaq listing standards. Mr. Gross is the chairman of the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee met seven times during 2010.

The Corporate Governance and Nominating Committee is responsible for:

| | • | | Reviewing and making recommendations to the Board regarding matters concerning corporate governance; |

| | • | | Reviewing the composition and performance of the Board and making recommendations to the board regarding director nominees and director compensation; |

| | • | | Reviewing and making recommendations to the Board regarding committees and their composition; and |

| | • | | Reviewing conflicts of interest of members of the Board of Directors and officers. |

The Corporate Governance and Nominating Committee will consider recommendations of candidates for the Board of Directors submitted by the stockholders of Taleo; for more information, see “Process for Recommending Candidates for Election to the Board of Directors” below.

19

The Corporate Governance and Nominating Committee has adopted a written charter approved by the Board of Directors, a copy of which is available on Taleo’s website at www.taleo.com under “Company” — “Corporate Governance” or at http://ir.taleo.com/governance.cfm.

Compensation Committee Interlocks and Insider Participation

Mr. Bloom, Mr. Gross and Mr. Jeffrey Schwartz and Mr. Jonathan Schwartz served as members of the Compensation Committee during 2010. No interlocking relationship exists between any member of Taleo’s Board of Directors or Compensation Committee and any member of the board of directors or compensation committee of any other company, nor has any such interlocking relationship existed in the past. No member of the Compensation Committee is or was formerly an officer or an employee of Taleo.

Attendance at Annual Stockholder Meetings by the Board of Directors

Taleo encourages members of the Board of Directors to attend the annual meeting of stockholders, but does not have a policy requiring attendance. At the time of our 2010 annual meeting of stockholders, we had eight directors. Eight directors attended Taleo’s 2010 annual meeting of stockholders.

Process for Recommending Candidates for Election to the Board of Directors

The Corporate Governance and Nominating Committee is responsible for, among other things, reviewing and recommending to the full Board the criteria for membership on the Board of Directors and recommending candidates for election to the Board of Directors. In addition, the Corporate Governance and Nominating Committee considers recommendations for candidates to the Board of Directors from stockholders. Stockholder recommendations for candidates to the Board of Directors must be directed in writing to Taleo’s Corporate Secretary at Taleo’s principal executive offices and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and Taleo within the last three years and evidence of the recommending person’s ownership of Taleo stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for membership on the Board of Directors, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, other commitments and the like, personal references, and an indication of the candidate’s willingness to serve.

The Corporate Governance and Nominating Committee’s general criteria and process for evaluating and identifying the candidates that it recommends to the full Board of Directors for selection as director nominees are as follows:

| | • | | The Corporate Governance and Nominating Committee regularly reviews the current composition and size of the Board of Directors. |

| | • | | The Corporate Governance and Nominating Committee oversees an annual evaluation of the performance of the Board of Directors as a whole and evaluates the performance of individual members of the Board of Directors eligible for reelection at the annual meeting of stockholders. |

| | • | | In its evaluation of director candidates, including the members of the Board of Directors eligible for reelection, the Corporate Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on the Board of Directors and considers (i) the current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board of Directors, (ii) such issues as character, judgment, diversity, age, expertise, business experience, length of service, independence, other commitments and the like, and (iii) such other factors as the Corporate Governance and Nominating Committee may consider appropriate. |

| | • | | While the Corporate Governance and Nominating Committee has not established specific minimum qualifications for director candidates, the Corporate Governance and Nominating Committee believes that candidates and nominees must reflect a Board of Directors that is comprised of directors who |

20

| | (i) are predominantly independent, (ii) are of high integrity, (iii) have broad, business-related knowledge and experience at the policy-making level in business, government or technology, including their understanding of the software industry and Taleo’s business in particular, (iv) have qualifications that will increase the overall effectiveness of the Board of Directors, and (v) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to audit committee members. |

| | • | | With regard to candidates who are properly recommended by stockholders or by other means, the Corporate Governance and Nominating Committee will review the qualifications of any such candidate, which review may, in the Corporate Governance and Nominating Committee’s discretion, include interviewing references for the candidate, direct interviews with the candidate, or other actions that the Corporate Governance and Nominating Committee deems necessary or proper. |

| | • | | In evaluating and identifying candidates, the Corporate Governance and Nominating Committee has the authority to retain and terminate any third-party search firm that is used to identify director candidates, and has the authority to approve the fees and retention terms of any search firm. |

| | • | | The Corporate Governance and Nominating Committee will apply these same principles when evaluating candidates to the Board of Directors who may be elected initially by the full Board of Directors to fill vacancies or add additional directors prior to the annual meeting of stockholders at which directors are elected. |

| | • | | After completing its review and evaluation of director candidates, the Corporate Governance and Nominating Committee selects, or recommends to the full Board of Directors for selection, the director nominees. |

Board Role in Risk Oversight

Taleo has traditionally considered risks in two broad categories: financial/compliance risks which fall within the purview of the Audit Committee in its oversight of the audit process and the Sarbanes Oxley 404 certification process, and operational/strategic risks that are considered by the Board of Directors in the context of an annual strategy and planning meeting at which all of Taleo’s functional areas and business lines are reviewed. In addition, compensation related risks fall under the responsibility of the Compensation Committee. Taleo has also adopted an enterprise risk management framework through which the Audit Committee will oversee the company’s enterprise risk management process in all areas other than compensation-related risks, which is overseen by the Compensation Committee. The Board of Directors will receive periodic reports from the Audit Committee and management of the results of this process. In addition, the full Board of Directors will continue to have an annual board meeting devoted solely to discussions of Taleo’s strategy, which discussion will encompass the risks inherent in Taleo’s strategic direction.

Employee Compensation Risks

The Compensation Committee of the Board of Directors has assessed the risks associated with Taleo’s compensation policies and practices for all employees, including non-executive officers. This assessment was based on a review of the structure, controls and application of Taleo’s compensation programs. Based on the results of its assessment, Taleo does not believe that its compensation policies and practices for all employees, including non-executive officers, create risks that are reasonably likely to have a material adverse effect on Taleo.

Contacting the Board of Directors

Any stockholder who desires to contact our Chairman of the Board or the other members of our Board of Directors may do so by writing to the Board of Directors, c/o Chairman of Corporate Governance and Nominating Committee at Taleo’s principal executive offices. Communications received will be distributed to the Chairman of the Board or the other members of the Board of Directors as appropriate depending on the facts and circumstances outlined in the communication received.

21

EXECUTIVE OFFICERS

The following table provides information concerning our executive officers as of March 31, 2011:

| | | | | | |

Name | | Age | | | Position |

Michael Gregoire | | | 45 | | | Chairman, President and Chief Executive Officer |

Douglas Jeffries | | | 54 | | | Executive Vice President and Chief Financial Officer |

Jason Blessing | | | 39 | | | Senior Vice President, Products and Technology |

Guy Gauvin | | | 43 | | | Executive Vice President, Global Services |

Neil Hudspith | | | 53 | | | Executive Vice President, Worldwide Field Operations and Chief Customer Officer |

Michael Gregoire.See biographical information set forth above under “Proposal One — Election of Directors — Information Regarding the Nominees and Other Directors.”

Doug Jeffrieshas served as our executive vice president and chief financial officer since November 2010. Prior to joining Taleo, Mr. Jeffries served as senior vice president and chief financial officer of Palm, Inc. from December 2008 to July 2010, chief financial officer of Pacific Ethanol, Inc. from June 2007 to July 2007, and vice president of finance and chief accounting officer of eBay, Inc. from December 2003 to May 2007. Mr. Jeffries holds a bachelor’s degree in accounting from California State University, Chico and a master’s degree in business administration from the University of Southern California.

Jason Blessinghas served as our senior vice president, products and technology since July 2010. Prior to serving as our senior vice president, products and technology, Mr. Blessing served as group vice president and general manager, small and medium business from April 2007 to July 2010. Prior to joining Taleo, Mr. Blessing served as regional vice president, consulting of Oracle / PeopleSoft from January 2004 to November 2006, and vice president, information technology of PeopleSoft from March 1999 to December 2004. Mr. Blessing holds a bachelor’s degree from the University of Michigan, Ann Arbor.

Guy Gauvin has served as our executive vice president, global services since April 2005. Prior to serving as our executive vice president, global services, Mr. Gauvin served as our executive vice president, worldwide operations, from March 2002 to April 2005. Prior to serving as executive vice president, worldwide operations, Mr. Gauvin served as our vice president, customer services, from August 1999 to March 2002. Prior to joining us, from May 1995 to August 1999, Mr. Gauvin served as vice president of global services at Baan Supply Chain Solutions. Mr. Gauvin holds a bachelor’s degree in mechanical engineering from Laval University in Canada.