Filed by Bruker Daltonics, Inc.

Pursuant to Rule 425 under the

Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Bruker AXS Inc.

Commission File No. 000-33357

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Link to searchable text of slide shown above.

Searchable text section of graphics shown above.

1

BDAL and BAXS Announce Merger Agreement

Planned Merger of

Bruker Daltonics Inc. (BDAL)

and

Bruker AXS Inc. (BAXS)

April 7, 2003

2

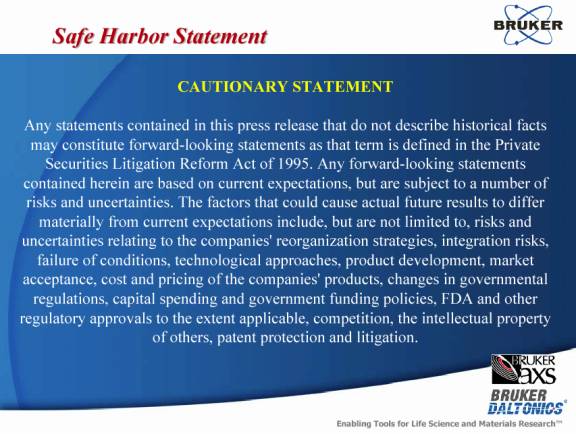

Safe Harbor Statement

CAUTIONARY STATEMENT

Any statements contained in this press release that do not describe historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are based on current expectations, but are subject to a number of risks and uncertainties. The factors that could cause actual future results to differ materially from current expectations include, but are not limited to, risks and uncertainties relating to the companies’ reorganization strategies, integration risks, failure of conditions, technological approaches, product development, market acceptance, cost and pricing of the companies’ products, changes in governmental regulations, capital spending and government funding policies, FDA and other regulatory approvals to the extent applicable, competition, the intellectual property of others, patent protection and litigation.

3

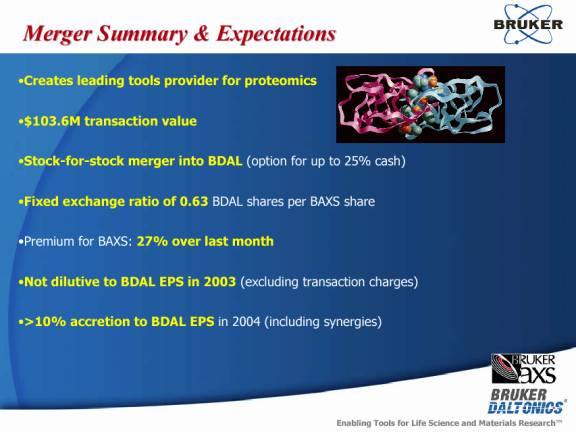

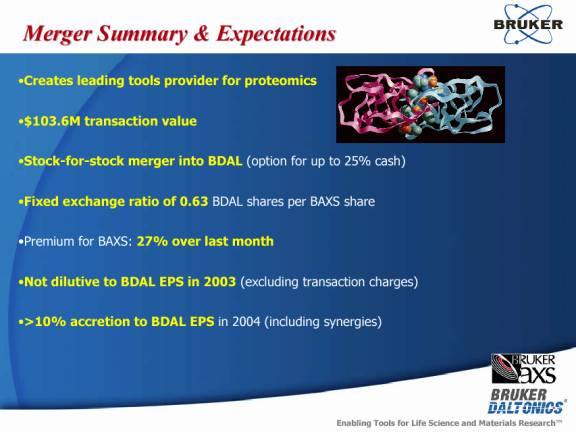

Merger Summary & Expectations

•Creates leading tools provider for proteomics

•$103.6M transaction value

•Stock-for-stock merger into BDAL (option for up to 25% cash)

•Fixed exchange ratio of 0.63 BDAL shares per BAXS share

•Premium for BAXS: 27% over last month

•Not dilutive to BDAL EPS in 2003 (excluding transaction charges)

•>10% accretion to BDAL EPS in 2004 (including synergies)

4

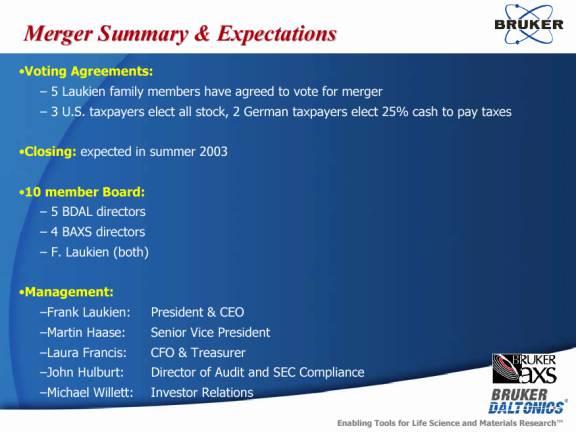

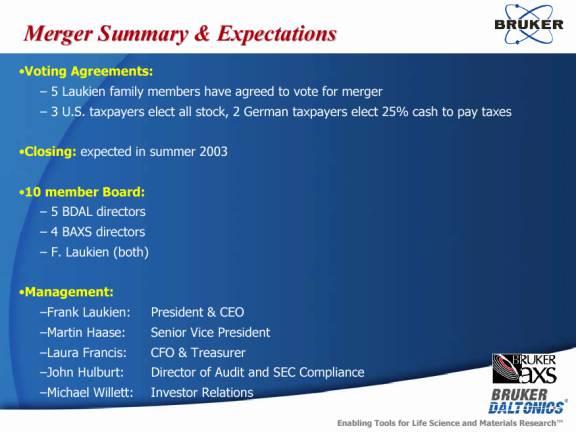

Merger Summary & Expectations |

•Voting Agreements: |

– 5 Laukien family members have agreed to vote for merger |

– 3 U.S. taxpayers elect all stock, 2 German taxpayers elect 25% cash to pay taxes |

|

•Closing: expected in summer 2003 |

|

•10 member Board: |

– 5 BDAL directors |

– 4 BAXS directors |

– F. Laukien(both) |

|

•Management: |

– Frank Laukien: | President & CEO |

– Martin Haase: | Senior Vice President |

– Laura Francis: | CFO & Treasurer |

– John Hulburt: | Director of Audit and SEC Compliance |

– Michael Willett: | Investor Relations |

5

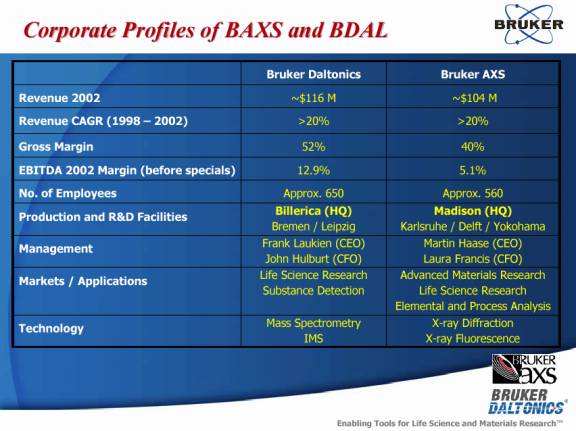

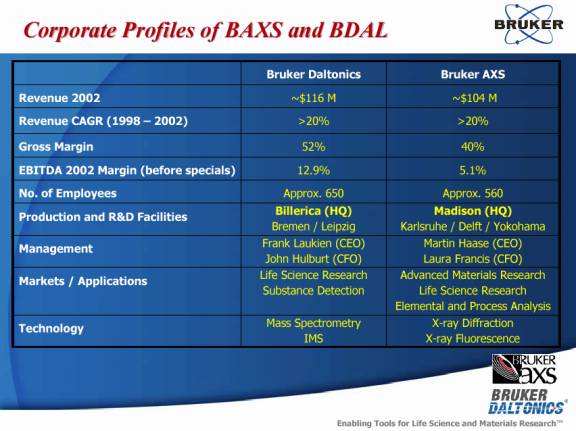

Corporate Profiles of BAXS and BDAL

Bruker Daltonics | | Bruker AXS | | |

Revenue 2002 | | ~$116 M | | ~$104 M |

Revenue CAGR (1998 – 2002) | | >20% | | >20% |

Gross Margin | | 52% | | 40% |

EBITDA 2002 Margin (before specials) | | 12.9% | | 5.1% |

No. of Employees | | Approx. 650 | | Approx. 560 |

Production and R&D Facilities | | Billerica (HQ)

Bremen / Leipzig | | Madison (HQ) |

| | Karlsruhe / Delft / Yokohama | | |

Management | | Frank Laukien (CEO)

John Hulburt (CFO) | | Martin Haase (CEO) |

| | Laura Francis (CFO) | | |

Markets / Applications | | Life Science Research

Substance Detection | | Advanced Materials Research

Life Science Research

Elemental and Process Analysis |

Technology | | Mass Spectrometry

IMS | | X-ray Diffraction

X-ray Fluorescence |

6

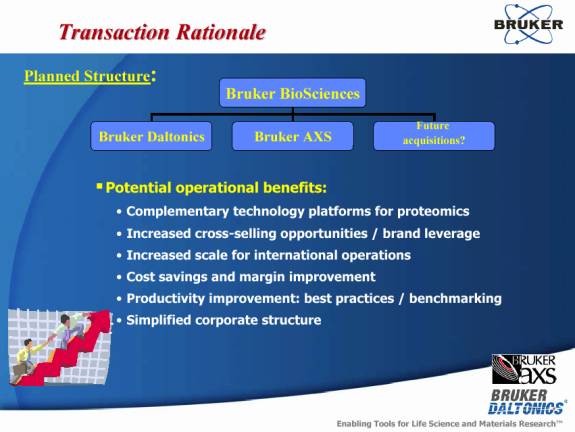

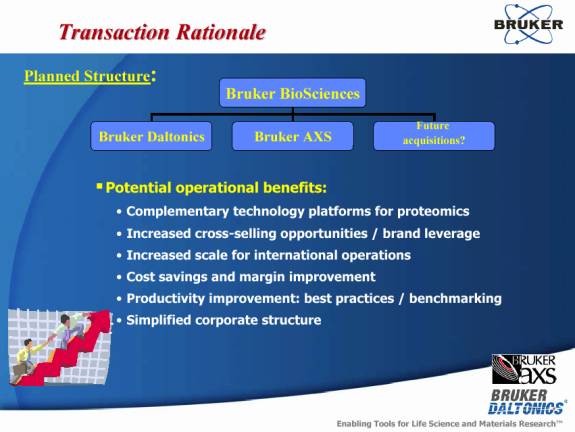

Transaction Rationale

Planned Structure:

Bruker BioSciences

Bruker Daltonics Bruker AXS Future acquisitions?

Potential operational benefits:

• Complementary technology platforms for proteomics

• Increased cross-selling opportunities / brand leverage

• Increased scale for international operations

• Cost savings and margin improvement

• Productivity improvement: best practices / benchmarking

• Simplified corporate structure

7

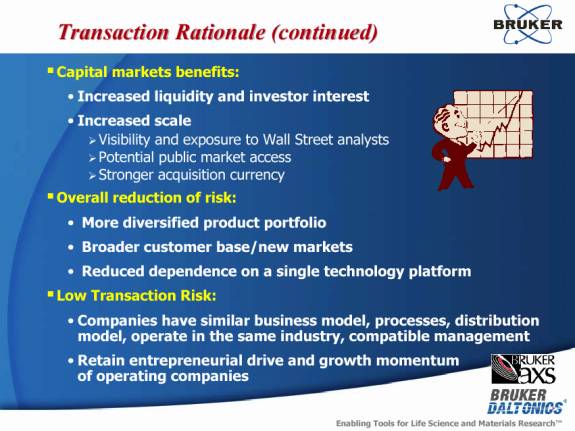

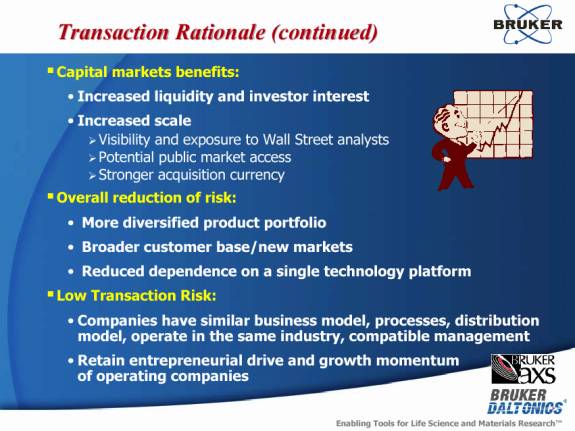

Transaction Rationale (continued)

[graph]

Capital markets benefits:

• Increased liquidity and investor interest

• Increased scale

Ø Visibility and exposure to Wall Street analysts

Ø Potential public market access

Ø Stronger acquisition currency

Overall reduction of risk:

• More diversified product portfolio

• Broader customer base/new markets

• Reduced dependence on a single technology platform

Low Transaction Risk:

• Companies have similar business model, processes, distribution

model, operate in the same industry, compatible management

• Retain entrepreneurial drive and growth momentum

of operating companies

8

Bruker Daltonics

Enabling Life Science Tools based on Mass Spectrometry

9

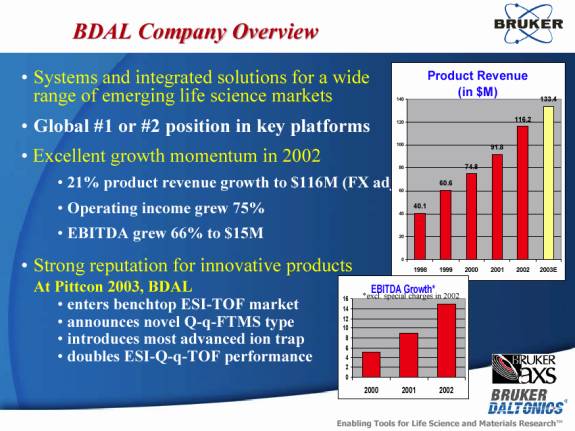

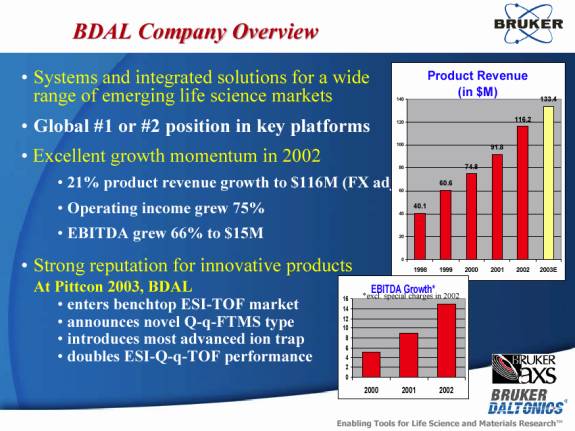

BDAL Company Overview

• Systems and integrated solutions for a wide range of emerging life science markets

• Global #1 or #2 position in key platforms

• Excellent growth momentum in 2002

• 21% product revenue growth to $116M (FX adj

• Operating income grew 75%

• EBITDA grew 66% to $15M

• Strong reputation for innovative products

At Pittcon 2003, BDAL

• enters benchtop ESI-TOF market

• announces novel Q-q-FTMS type

• introduces most advanced ion trap

• doubles ESI-Q-q-TOF performance

Product Revenue |

| | (in $ M) | | |

| | | | | 133.4 |

| | | | | |

| | | | 116.2 | |

| | | | | |

| | | 91.8 | | |

| | | | | |

| | 74.8 | | | |

| 60.6 | | | | |

| | | | | |

| | | | | |

40.1 | | | | | |

1998 | 1999 | 2000 | 2001 | 2002 | 2003E |

EBITDA Growth*

*excl. special charges in 2002

[graph]

10

Enabling Life Science Tools for the Post-Genomic Era

Our MS | | Our Related | | Solutions for |

Platforms | | Technologies | | Target Markets |

| | | | |

| | | | Life Sciences Industries |

MALDI-TOF(/TOF) MS | | Consumables & Kits | | |

| | AnchorChip™ | | •Pharma- |

| | Microarrays | | ceuticals |

| | | | •Biotechnology |

(Q-q-) FTMS | | | | |

Ion Trap MS | | | | •Agricultural |

| | HPLC, Liquid | | Biotech |

| | Handling | | |

| | | | •Molecular |

| | | | Diagnostics |

| | | | |

ESI-(Q-q)-TOF MS | | | | Other Life Science Markets |

| | Robotics, Automation | | |

Substance Detection | | | | •Universities |

| | Bioinformatics | | |

| | | | •Med Schools |

| | | | •Government (NIH, etc.) |

| | | | |

| | | | |

| | | | •Defense, Law Enforcement |

| | | | and Anti-Terrorism |

11

MALDI-TOF(/TOF) Platform

Our advantages:

ultraflex™ TOF/TOF $575k

• highest sample throughput

• excellent sensitivity

• AnchorChips™

• microtitre plate robotics

March 2003 Update:

• BDAL 25% $-growth

in MALDI-TOF orders

• >60 TOF/TOFs sold

Applications:

• Expression Proteomics

• Clinical Proteomics

• Genotyping

autoflex™ $200-$260k

• core of MassArray™ genotyping platform

• 24/7 operation

• 100k samples per day

omniflex™: $90k-$130k

• SPR/MS with Biacore

12

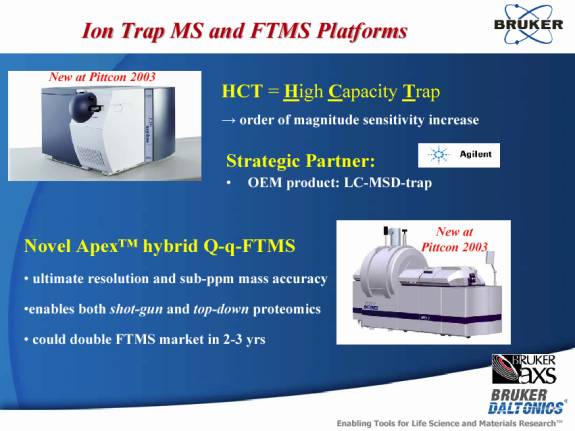

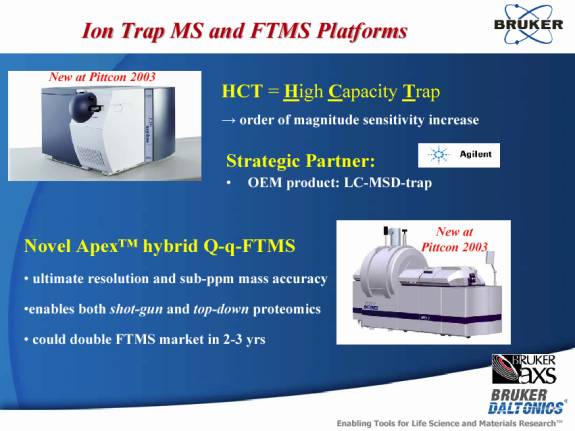

Ion Trap MS and FTMS Platforms

New at Pittcon 2003 [graphic]

HCT = High Capacity Trap

order of magnitude sensitivity increase

Strategic Partner:

• OEM product: LC-MSD-trap

New at Pittcon 2003 [graphic]

Novel Apex™ hybrid Q-q-FTMS

• ultimate resolution and sub-ppm mass accuracy

•enables both shot-gun and top-down proteomics

• could double FTMS market in 2-3 yrs

13

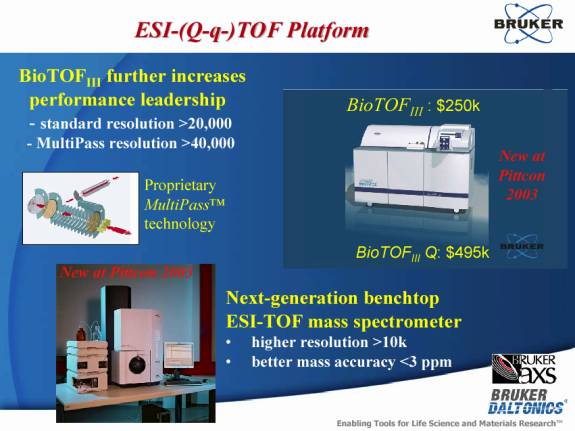

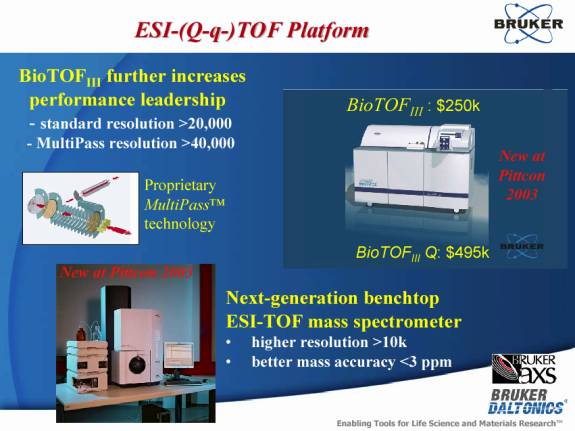

ESI-(Q-q-)TOF Platform

BioTOFIII further increases

performance leadership

- standard resolution >20,000

- MultiPass resolution >40,000

Proprietary

MultiPass™ technology

BioTOFIII : $250k [graphic] New at Pittcon 2003

BioTOFIII Q: $495k [graphic] New at Pittcon 2003

Next-generation benchtop

ESI-TOF mass spectrometer

• higher resolution >10k

• better mass accuracy <3 ppm

14

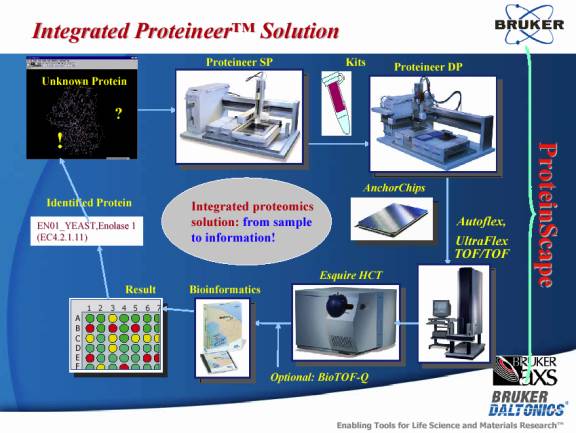

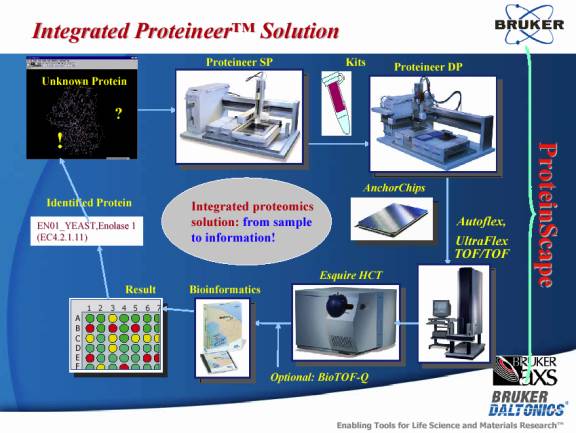

Integrated Proteineer™ Solution

Unknown Protein Proteineer SP Kits Proteineer DP

Identified Protein AnchorChips

EN01_YEAST,Enolase 1 from sample Autoflex,

(EC4.2.1.11) to information! UltraFlex TOF/TOF

Result Bioinformatics Esquire HCT

ProteinScape

Optional: BioTOF-Q

15

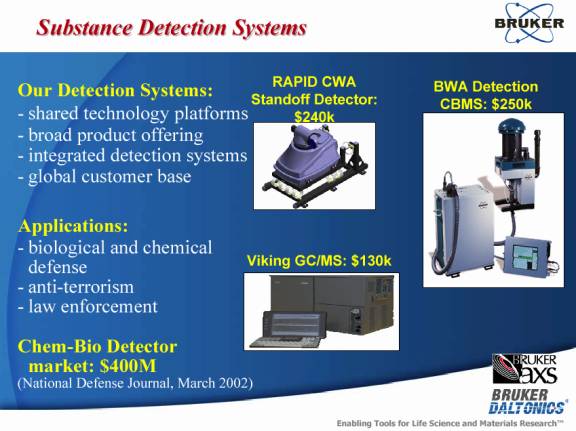

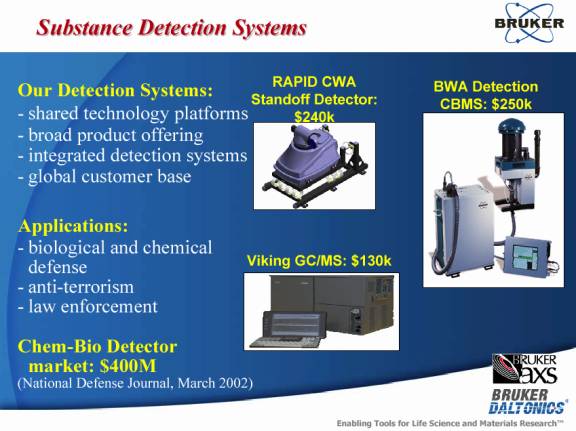

Substance Detection Systems

Our Detection Systems: | | RAPID CWA | | BWA Detection |

| | Standoff Detector: | | CBMS: $250k |

— shared technology platforms | | $240k | | |

— broad product offering | | [graphic] | | [graphic] |

— integrated detection systems | | | | |

— global customer base | | | | |

| | | | |

Applications: | | | | |

— biological and chemical defense | | | | |

| | Viking GC/MS: $130k | | |

— anti-terrorism | | [graphic] | | |

— law enforcement | | | | |

| | | | |

Chem-Bio Detector | | | | |

market: $400M | | | | |

(National Defense Journal, March 2002) | | | | |

16

Life Science Systems Bookings

March 2003 Update:

• 2002 life-science systems orders grew 22% vs. 2001

• Total life-science MS market 2003: >$1B Market growth: ~15%

[Chart]

17

Bruker AXS

Advanced X-ray Solutions

a leading provider of

high-throughput

discovery tools for

structural proteomics

and

advanced materials

research

[Graphic]

18

Bruker AXS Summary

• X-ray Crystallography essential for structural proteomics and materials research

• BAXS has technological leadership, good market share

• BAXS is fastest growing supplier of crystallography tools

• Further growth potential in large Japanese Market via acquisition of MAC Science

• >25% recurring revenue from profitable aftermarket

• Strong Operating Performance

• >15% organic revenue growth in 2001 and 2002

• Doubled EPS between 2001 and 2002

19

High Throughput

Drug and Materials Discovery

[Graphic]

Conventional Discovery Technology

• Sequential and slow

• Few leads and targets

• Low hit rate

Long time to market

High Throughput Technology

• Combinatorial concepts accelerate process

• Parallel processing increases number of leads and targets

More in less time

20

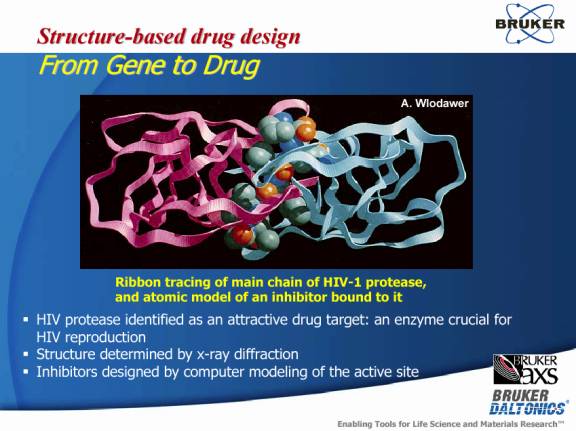

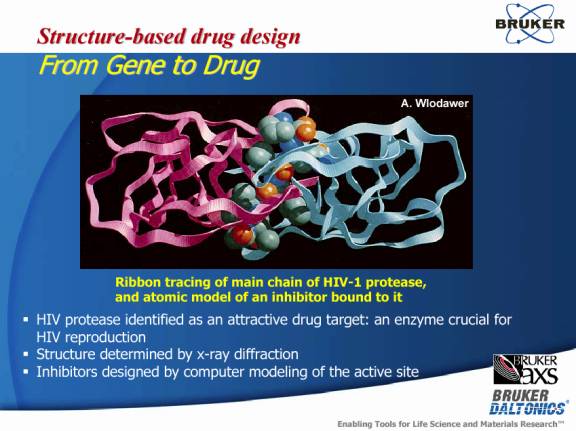

Structure-based drug design

From Gene to Drug

[Graphic]

Ribbon tracing of main chain of HIV-1 protease, and atomic model of an inhibitor bound to it

• HIV protease identified as an attractive drug target: an enzyme crucial for HIV reproduction

• Structure determined by x-ray diffraction

• Inhibitors designed by computer modeling of the active site

21

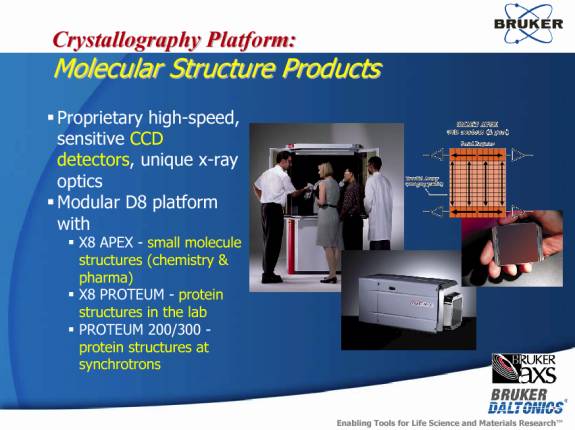

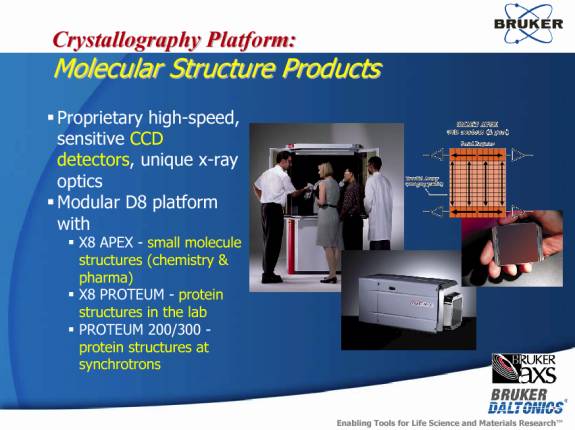

Crystallography Platform:

Molecular Structure Products

• Proprietary high-speed, sensitive CCD detectors, unique x-ray optics

• Modular D8 platform with

• X8 APEX - small molecule structures (chemistry & pharma)

• X8 PROTEUM - protein structures in the lab

• PROTEUM 200/300 -protein structures at synchrotrons

[Graphic]

22

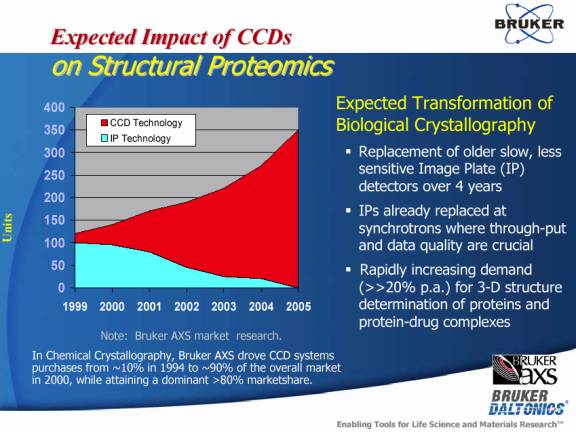

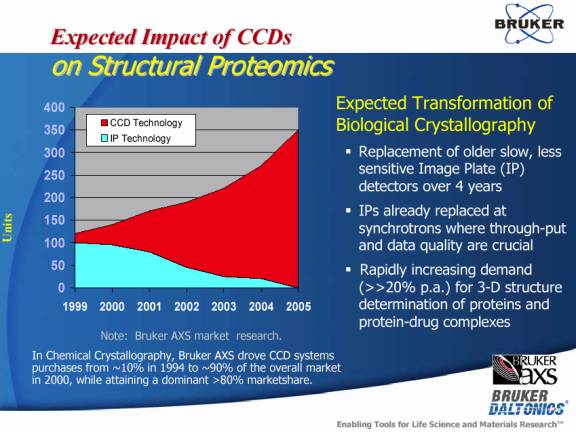

Expected Impact of CCDs

on Structural Proteomics

[Graphic]

Note: Bruker AXS market research.

In Chemical Crystallography, Bruker AXS drove CCD systems purchases from ~10% in 1994 to ~90% of the overall market in 2000, while attaining a dominant >80% marketshare.

Expected Transformation of Biological Crystallography

• Replacement of older slow, less sensitive Image Plate (IP) detectors over 4 years

• IPs already replaced at synchrotrons where through-put and data quality are crucial

• Rapidly increasing demand (>>20% p.a.) for 3-D structure determination of proteins and protein-drug complexes

23

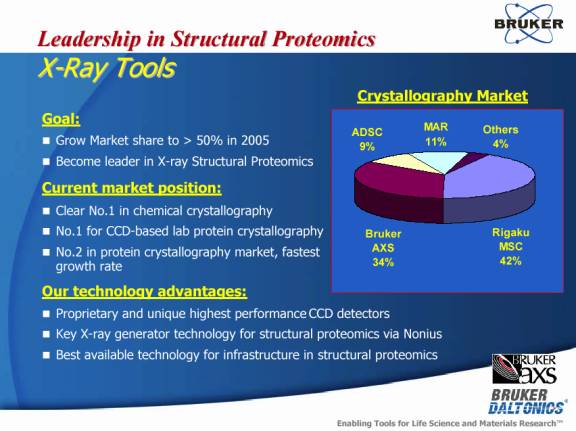

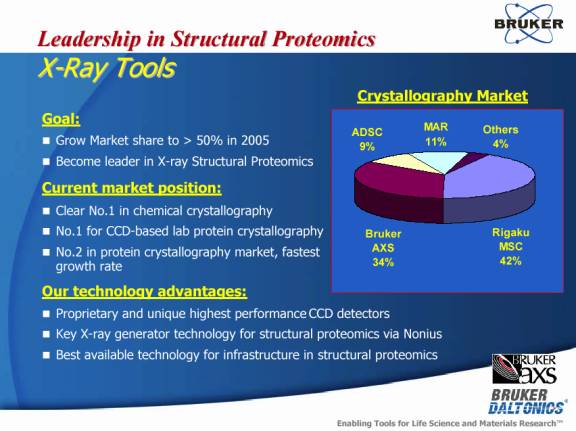

Leadership in Structural Proteomics

X-Ray Tools

Goal:

• Grow Market share to > 50% in 2005

• Become leader in X-ray Structural Proteomics

Current market position:

• Clear No.1 in chemical crystallography

• No.1 for CCD-based lab protein crystallography

• No.2 in protein crystallography market, fastest growth rate

Our technology advantages:

• Proprietary and unique highest performance CCD detectors

• Key X-ray generator technology for structural proteomics via Nonius

• Best available technology for infrastructure in structural proteomics

[Graphic]

24

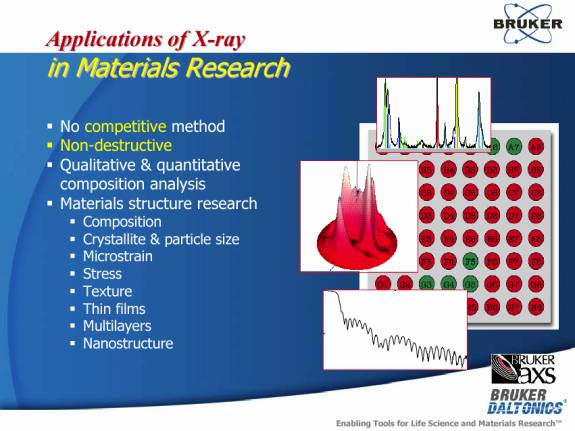

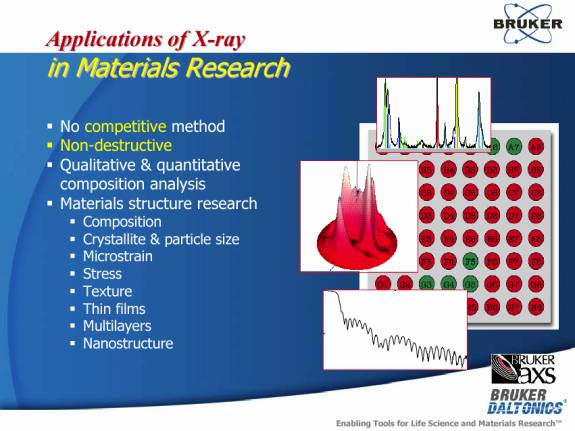

Applications of X-ray

in Materials Research

• No competitive method

• Non-destructive

• Qualitative & quantitative composition analysis

• Materials structure research

• Composition

• Crystallite & particle size

• Microstrain

• Stress

• Texture

• Thin films

• Multilayers

• Nanostructure

[Graphic]

25

Advanced Materials Research

Technology Platform

• D8 platform with unique

• ultrasensitive real-time HISTAR 2D detector

• high-intensity x-ray optics sample handling systems

• D8 Product family

• D8 DISCOVER CC

• combinatorial materials design

• D8 DISCOVER GADDS

• Texture, stress and nano-materials

• D8 DISCOVER MR

• High resolution semiconductor & thin film applications

• NANOSTAR

• Nanostructure Analyzer

• D8 ADVANCE

• Multi-Purpose Diffraction System

• D4 Endeavor

• High-throughput X-ray Diffraction

[Graphic]

26

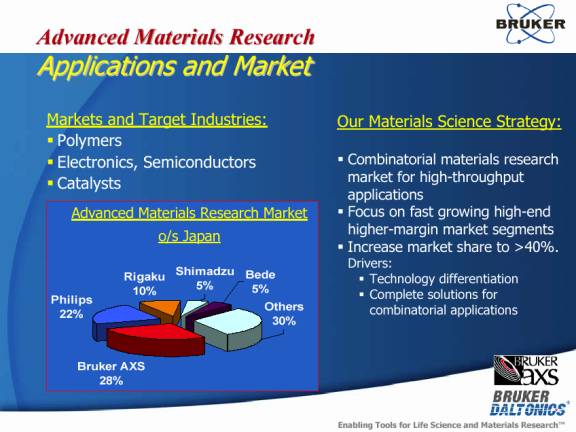

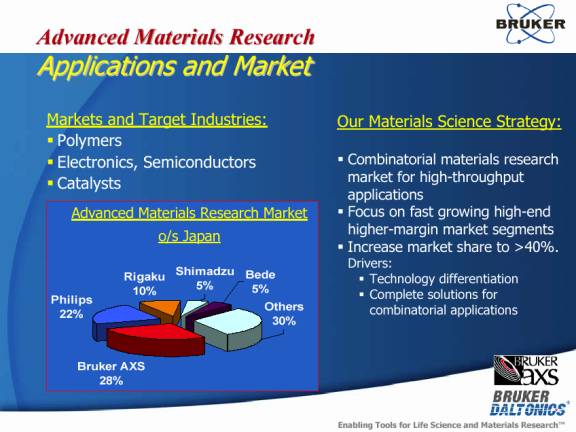

Advanced Materials Research

Applications and Market

Markets and Target Industries:

• Polymers

• Electronics, Semiconductors

• Catalysts

Advanced Materials Research Market o/s Japan

[Graphic]

Our Materials Science Strategy:

• Combinatorial materials research market for high-throughput applications

• Focus on fast growing high-end higher-margin market segments

• Increase market share to >40%. Drivers:

• Technology differentiation

• Complete solutions for combinatorial applications

27

Bruker BioSciences Corporation

Enabling tools for Life Science and Materials Research

[Graphic]

28

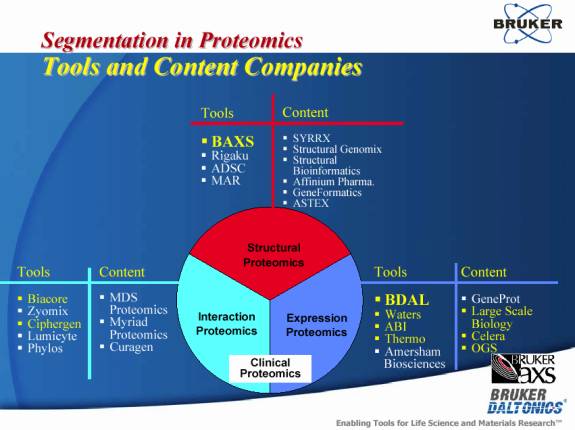

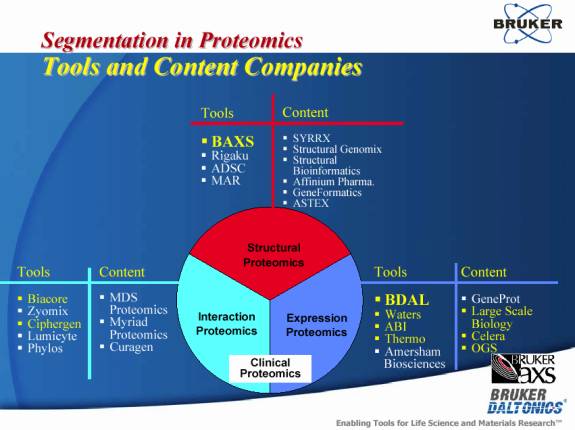

Segmentation in Proteomics

Tools and Content Companies

Tools | | Content | |

BAXS | | SYRRX | |

Structural Genomix | | | |

Rigaku | | Structural | |

ADSC | | Bioinformatics | |

MAR | | Affinium Pharma. | |

GeneFormatics | | | |

ASTEX | | | |

Tools | | Content | |

Biacore | | MDS | |

Zyomix | | Proteomics | |

Ciphergen | | Myriad | |

Lumicyte | | Proteomics | |

Phylos | | Curagen | |

Tools | | Content | |

BDAL | | GeneProt | |

Waters | | Large Scale | |

ABI | | Biology | |

Thermo | | Celera | |

Amersham | | OGS | |

Biosciences | | | |

[Graphic]

29

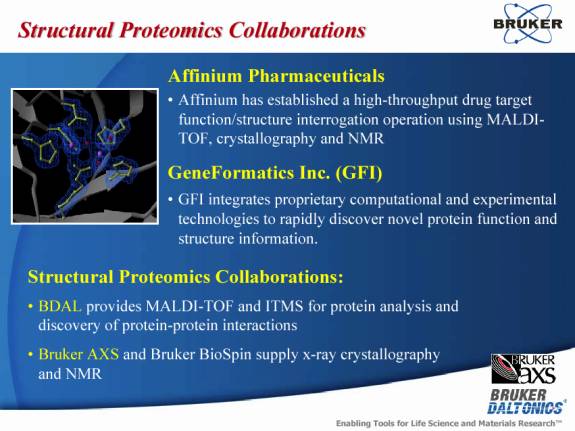

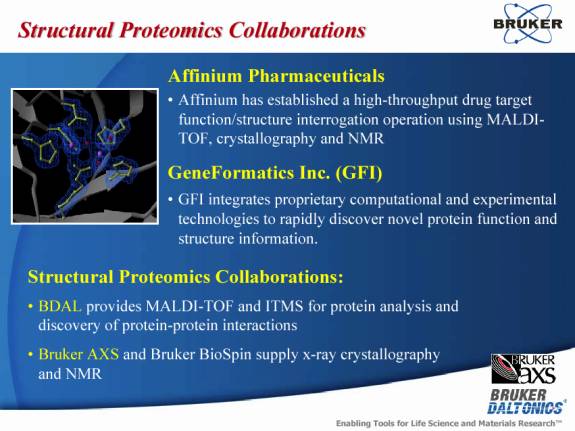

Structural Proteomics Collaborations

[Graphic]

Affinium Pharmaceuticals

• Affinium has established a high-throughput drug target function/structure interrogation operation using MALDI-TOF, crystallography and NMR

GeneFormatics Inc. (GFI)

• GFI integrates proprietary computational and experimental technologies to rapidly discover novel protein function and structure information.

Structural Proteomics Collaborations:

• BDAL provides MALDI-TOF and ITMS for protein analysis and discovery of protein-protein interactions

• Bruker AXS and Bruker BioSpin supply x-ray crystallography and NMR

30

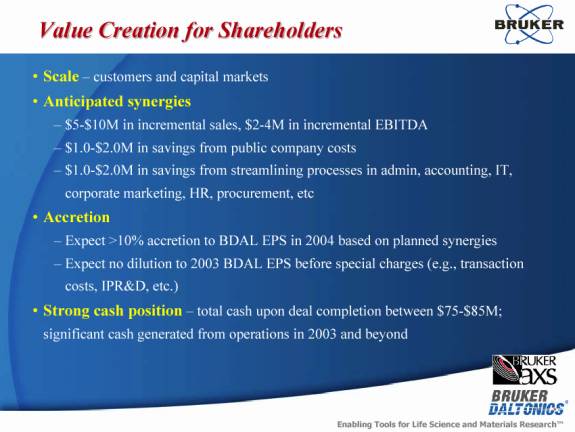

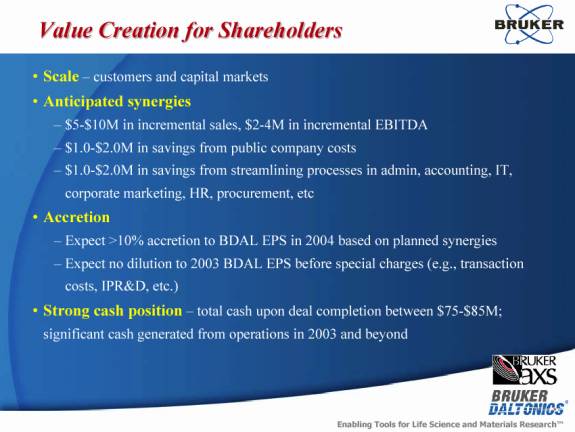

Value Creation for Shareholders

• Scale — customers and capital markets

• Anticipated synergies

— $5-$10M in incremental sales, $2-4M in incremental EBITDA — $1.0-$2.0M in savings from public company costs

— $1.0-$2.0M in savings from streamlining processes in admin, accounting, IT, corporate marketing, HR, procurement, etc

• Accretion

— Expect >10% accretion to BDAL EPS in 2004 based on planned synergies

— Expect no dilution to 2003 BDAL EPS before special charges (e.g., transaction costs, IPR&D, etc.)

• Strong cash position — total cash upon deal completion between $75-$85M; significant cash generated from operations in 2003 and beyond

31

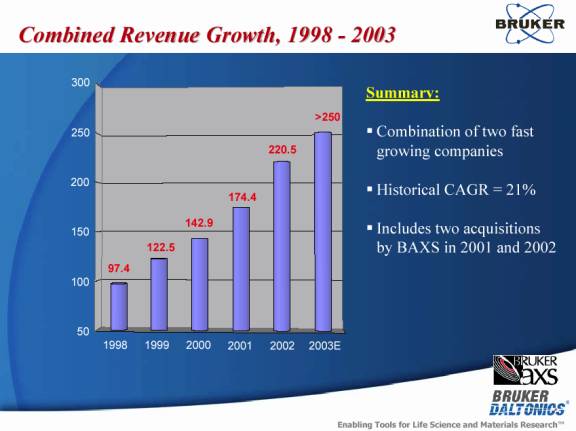

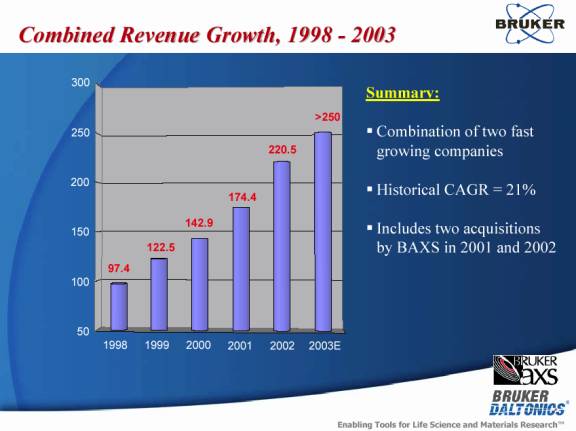

Combined Revenue Growth, 1998 - 2003

[Graphic]

Summary:

• Combination of two fast growing companies

• Historical CAGR = 21%

• Includes two acquisitions by BAXS in 2001 and 2002

32

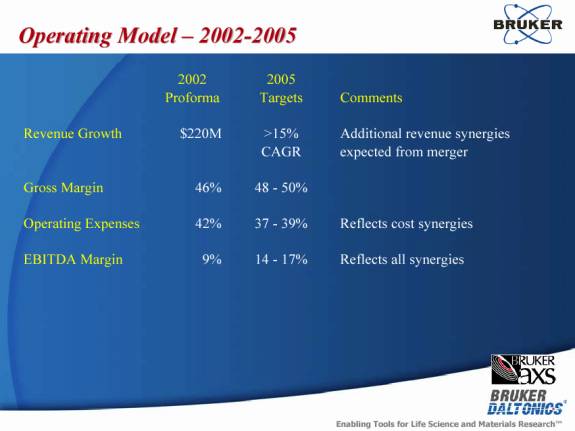

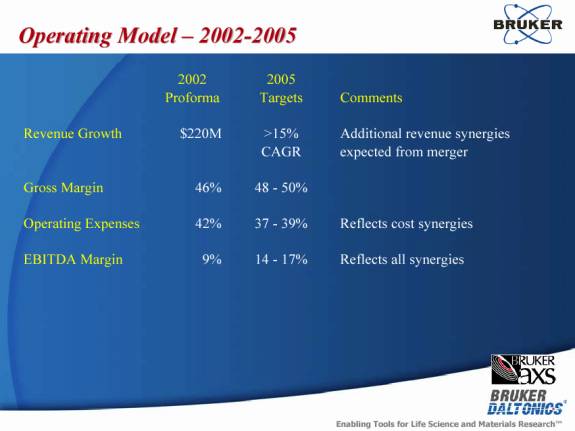

Operating Model — 2002-2005

| | 2002 | | 2005 | | | |

| | Proforma | | Targets | | Comments | |

| | | | | | | |

Revenue Growth | | $220M | | >15 | % | Additional revenue synergies | |

CAGR | | | | | | expected from merger | |

| | | | | | | |

Gross Margin | | 46 | % | 48 — 50 | % | | |

| | | | | | | |

Operating Expenses | | 42 | % | 37 — 39 | % | Reflects cost synergies | |

| | | | | | | |

EBITDA Margin | | 9 | % | 14 — 17 | % | Reflects all synergies | |

33

Merger Summary & Expectations

• Creates leading tools provider for proteomics

• $103.6M transaction value

• Stock-for-stock merger into BDAL (option for up to 25% cash)

• Fixed exchange ratio of 0.63 BDAL shares per BAXS share

• Premium for BAXS: 27% over last month

• Not dilutive to BDAL EPS in 2003 (excluding transaction charges)

• >10% accretion to BDAL EPS in 2004 (including synergies)

34