Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on December 10, 2004

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PLAINS ALL AMERICAN PIPELINE, L.P.

PAA FINANCE CORP.*

(Exact Name of Registrant as Specified in its Charter)

| Delaware Delaware (State or Other Jurisdiction of Incorporation or Organization) | 4610 4610 (Primary Standard Industrial Classification Code Number) | 76-0582150 76-0669671 (I.R.S. Employer Identification Number) |

333 Clay Street, Suite 1600

Houston, Texas 77002

(713) 646-4100

(Address, Including Zip Code, and Telephone Number, including

Area Code, of Registrant's Principal Executive Offices)

Tim Moore

Vice President and General Counsel

333 Clay Street, Suite 1600

Houston, Texas 77002

(713) 646-4100

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Copy to:

David P. Oelman

Vinson & Elkins L.L.P.

1001 Fannin Street, Suite 2300

Houston, Texas 77002

(713) 758-2222

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price per Note | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||

|---|---|---|---|---|---|---|---|---|

| 4.750% Senior Notes due 2009 | $175,000,000 | 100% | $175,000,000 | $22,173 | ||||

| Guarantees(2) | — | — | — | — | ||||

| 5.875% Senior Notes due 2016 | $175,000,000 | 100% | $175,000,000 | $22,173 | ||||

| Guarantees(2) | — | — | — | — | ||||

| Total | $350,000,000 | 100% | $350,000,000 | $44,346 | ||||

- (1)

- Determined in accordance with Rule 457(f) under the Securities Act of 1933, as amended.

- (2)

- No separate consideration will be received for the guarantees, and no separate fee is payable pursuant to Rule 457(a) under the Securities Act of 1933.

- *

- Includes certain subsidiaries of Plains All American Pipeline, L.P. identified on the following pages.

| Plains Marketing, L.P. (Exact Name of Registrant As Specified In Its Charter) | ||

Delaware | 76-0684572 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

Plains Pipeline, L.P. (Exact Name of Registrant As Specified In Its Charter) | ||

Texas | 76-0587185 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

Plains Marketing GP Inc. (Exact Name of Registrant As Specified In Its Charter) | ||

Delaware | 76-0684572 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

Plains Marketing Canada LLC (Exact Name of Registrant As Specified In Its Charter) | ||

Delaware | 76-0653735 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

Plains Marketing Canada, L.P. (Exact Name of Registrant As Specified In Its Charter) | ||

Canada | 892946211 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (GST Number) | |

PMC (Nova Scotia) Company (Exact Name of Registrant As Specified In Its Charter) | ||

Nova Scotia | 894798610 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (GST Number) | |

Basin Holdings GP LLC (Exact Name of Registrant As Specified In Its Charter) | ||

Delaware | 13-4204744 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

Basin Pipeline Holdings, L.P. (Exact Name of Registrant As Specified In Its Charter) | ||

Delaware | 13-4204757 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

Rancho Holdings GP LLC (Exact Name of Registrant As Specified In Its Charter) | ||

Delaware | 13-4204734 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

Rancho Pipeline Holdings, L.P. (Exact Name of Registrant As Specified In Its Charter) | ||

Delaware | 13-4204750 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject To Completion, Dated December 10, 2004

Prospectus

Plains All American Pipeline, L.P.

PAA Finance Corp.

Offer to Exchange up to

$175,000,000 of 4.750% Senior Notes due 2009

for

$175,000,000 of 4.750% Senior Notes due 2009

that have been Registered under the Securities Act of 1933

and

Offer to Exchange up to

$175,000,000 of 5.875% Senior Notes due 2016

for

$175,000,000 of 5.875% Senior Notes due 2016

that have been Registered under the Securities Act of 1933

Terms of the Exchange Offers

| • We are offering to exchange up to $175,000,000 of our outstanding 4.750% Senior Notes due 2009 ("2009 Notes") and up to $175,000,000 of our outstanding 5.875% Senior Notes due 2016 ("2016 Notes," and together with the 2009 Notes, the "Outstanding Notes") for new Notes with substantially identical terms that have been registered under the Securities Act and are freely tradable. • We will exchange for an equal principal amount of new Notes all outstanding Notes of the same series that you validly tender and do not validly withdraw before the exchange offers expire. | • Each exchange offer will expire at 5:00 p.m., New York City time, on , 200 , unless extended. We do not currently intend to extend either exchange offer. • Tenders of outstanding Notes may be withdrawn at any time prior to the expiration of the applicable exchange offer. • Each exchange of outstanding Notes for new Notes will not be a taxable event for U.S. federal income tax purposes. |

Terms of the 2009 Notes Offered in the Exchange Offer

| Maturity • The 2009 Notes will mature on August 15, 2009. Interest • We will pay interest on the 2009 Notes semi-annually in arrears on February 15 and August 15 of each year, beginning February 15, 2005. • Interest will accrue from August 12, 2004. | Redemption • We may redeem the 2009 Notes, in whole or in part, at any time at a price equal to 100% of the principal amount of the 2009 Notes to be redeemed plus a make-whole premium described in this prospectus, plus accrued and unpaid interest, if any, to the redemption date. Ranking • The 2009 Notes are unsecured. The 2009 Notes are general senior unsecured obligations of the issuers and will rank equally with the Notes of the other series and with the existing and future senior unsecured indebtedness of the issuers. |

Terms of the 2016 Notes Offered in the Exchange Offer

| Maturity • The 2016 Notes will mature on August 15, 2016. Interest • We will pay interest on the 2016 Notes semi-annually in arrears on February 15 and August 15 of each year, beginning February 15, 2005. • Interest will accrue from August 12, 2004. | Redemption • We may redeem the 2016 Notes, in whole or in part, at any time at a price equal to 100% of the principal amount of the 2016 Notes to be redeemed plus a make-whole premium described in this prospectus, plus accrued and unpaid interest, if any, to the redemption date. Ranking • The 2016 Notes are unsecured. The 2016 Notes are general senior unsecured obligations of the issuers and will rank equally with the Notes of the other series and with the existing and future senior unsecured indebtedness of the issuers. |

Please read "Risk Factors" on page 7 for a discussion of factors you should consider before participating in the exchange offers.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2004.

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission, or SEC. In making your investment decision, you should rely only on the information contained in this prospectus and in the accompanying letters of transmittal. We have not authorized anyone to provide you with any other information. If you receive any unauthorized information, you must not rely on it. We are not making offers to sell these securities in any state where the offers are not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

Each broker-dealer that receives the Notes for its own account pursuant to these exchange offers must acknowledge in the applicable letter of transmittal that it will deliver a prospectus in connection with any resale of the Notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of the Notes received in exchange for outstanding Notes where such outstanding Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed to make this prospectus available for a period of one year from the expiration date of these exchange offers to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

i

ii

| TAX CONSIDERATIONS | 138 | ||

| PLAN OF DISTRIBUTION | 138 | ||

| VALIDITY OF THE NEW NOTES | 139 | ||

| EXPERTS | 139 | ||

| WHERE YOU CAN FIND MORE INFORMATION | 140 | ||

| FORWARD-LOOKING STATEMENTS | 141 | ||

| INDEX TO FINANCIAL STATEMENTS | F-1 | ||

iii

This summary may not contain all the information that may be important to you. You should read this entire prospectus before deciding to participate in the exchange offers. You should carefully consider the information set forth under "Risk Factors." In addition, certain statements include forward-looking information which involves risks and uncertainties. Please read "Forward-Looking Statements." References to the "Notes" in this prospectus include both the outstanding Notes and the new Notes.

In this prospectus, the terms "we," "our," "ours," and "us" refer to Plains All American Pipeline, L.P. and its subsidiaries, unless otherwise indicated or the context requires otherwise.

Plains All American Pipeline, L.P.

We are a publicly traded Delaware limited partnership engaged in interstate and intrastate crude oil transportation, and crude oil gathering, marketing, terminalling and storage, as well as the marketing and storage of liquefied petroleum gas and other petroleum products. We refer to liquefied petroleum gas and other petroleum products collectively as "LPG." We have an extensive network of pipeline transportation, storage and gathering assets in key oil producing basins and at major market hubs in the United States and Canada. Several members of our existing management team founded this midstream crude oil business in 1992, and we completed our initial public offering in 1998.

We have operations in the United States and Canada, which can be categorized into two primary business activities: crude oil pipeline transportation operations and gathering, marketing, terminalling and storage operations.

Our executive offices are located at 333 Clay Street, Suite 1600, Houston, Texas 77002 and our telephone number is (713) 646-4100.

Business Strategy

Our principal business strategy is to capitalize on the regional crude oil supply and demand imbalances that exist in the United States and Canada by combining the strategic location and distinctive capabilities of our transportation and terminalling assets with our extensive marketing and distribution expertise to generate sustainable earnings and cash flow.

We intend to execute our business strategy by:

- •

- increasing and optimizing throughput on our existing pipeline and gathering assets and realizing cost efficiencies through operational improvements;

- •

- utilizing and expanding our Cushing Terminal and our other assets to service the needs of refiners and to profit from merchant activities that take advantage of crude oil pricing and quality differentials;

- •

- selectively pursuing strategic and accretive acquisitions of crude oil transportation assets, including pipelines, gathering systems, terminalling and storage facilities and other assets that complement our existing asset base and distribution capabilities;

- •

- optimizing and expanding our Canadian operations and our presence in the Gulf Coast and Gulf of Mexico to take advantage of anticipated increases in the volume and qualities of crude oil produced in these areas; and

- •

- prudently and economically leveraging our asset base, knowledge base and skill sets to participate in energy businesses that are closely related to, or significantly intertwined with, the crude oil business.

To a lesser degree, we also engage in a similar business strategy with respect to the wholesale marketing and storage of LPG, which we began as a result of an acquisition in mid-2001.

1

On August 12, 2004, we completed private offerings of $175 million aggregate principal amount of our 4.750% senior notes due 2009 ("2009 Notes") and $175 million aggregate principal amount of our 5.875% senior notes due 2016 ("2016 Notes" and together with the 2009 Notes, the "outstanding Notes"). We entered into registration rights agreements with the initial purchasers in those offerings, in which we agreed to deliver to you this prospectus and to use our reasonable best efforts to complete the exchange offers within 240 days after the date we issued the outstanding Notes.

| Exchange Offers | We are offering to exchange new Notes (the "New Notes") for: | |||

• | up to $175 million principal amount of our 4.750% 2009 Notes that have been registered under the Securities Act of 1933 (the "Securities Act"), for an equal amount of our outstanding 2009 Notes; and | |||

• | up to $175 million principal amount of our 5.875% 2016 Notes that have been registered under the Securities Act for an equal amount of our outstanding 2016 Notes | |||

to satisfy our obligations under the registration rights agreements that we entered into when we issued the outstanding Notes in transactions exempt from registration under the Securities Act. | ||||

The terms of each series of the new Notes are substantially identical to those terms of each series of the outstanding Notes, except that the transfer restrictions, registration rights and provisions for additional interest relating to the outstanding Notes do not apply to the new Notes. | ||||

Expiration Date | Each exchange offer will expire at 5:00 p.m. New York City time, on , 200 , unless we decide to extend either exchange offer. We may extend one exchange offer without extending the other. | |||

Condition to the Exchange Offers | The registration rights agreements do not require us to accept outstanding Notes for exchange if the applicable exchange offer or the making of any exchange by a holder of the outstanding Notes would violate any applicable law or interpretation of the staff of the SEC. A minimum aggregate principal amount of outstanding Notes being tendered is not a condition to either exchange offer. | |||

Procedures for Tendering Outstanding Notes | To participate in an exchange offer, you must follow the procedures established by The Depository Trust Company, which we call "DTC," for tendering notes held in book-entry form. These automated tender offer program procedures, which we call "ATOP," require that (i) the exchange agent receive, prior to the expiration date of the applicable exchange offer, a computer generated message known as an "agent's message" that is transmitted through ATOP and (ii) DTC confirms that: | |||

• | DTC has received your instructions to exchange your Notes, and | |||

2

• | you agree to be bound by the terms of the applicable letter of transmittal. | |||

For more information on tendering your outstanding Notes, please refer to the sections in this prospectus entitled "Exchange Offers—Terms of the Exchange Offers" and "—Procedures for Tendering." | ||||

Guaranteed Delivery Procedures | None. | |||

Withdrawal of Tenders | You may withdraw your tender of outstanding Notes under either exchange offer at any time prior to the expiration date. To withdraw, you must submit a notice of withdrawal to the exchange agent using ATOP procedures before 5:00 p.m. New York City time on the expiration date of the exchange offer. Please read "Exchange Offers—Withdrawal of Tenders." | |||

Acceptance of Outstanding Notes and Delivery of New Notes | If you fulfill all conditions required for proper acceptance of outstanding Notes, we will accept any and all outstanding Notes that you properly tender in the applicable exchange offer on or before 5:00 p.m. New York City time on the expiration date. We will return to you, without expense as promptly as practicable after the expiration date, any outstanding Note that we do not accept for exchange. We will deliver the new Notes as promptly as practicable after the expiration date and acceptance of the outstanding Notes for exchange. Please refer to the section in this prospectus entitled "Exchange Offers—Terms of the Exchange Offers." | |||

Fees and Expenses | We will bear all expenses related to each exchange offer. Please refer to the section in this prospectus entitled "Exchange Offers—Fees and Expenses." | |||

Use of Proceeds | The issuance of the new Notes will not provide us with any new proceeds. We are making these exchange offers solely to satisfy our obligations under the registration rights agreements. | |||

Consequences of Failure to Exchange Outstanding Notes | If you do not exchange your outstanding Notes in the applicable exchange offer, you will no longer be able to require us to register the outstanding Notes under the Securities Act except in the limited circumstances provided under the applicable registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer the outstanding Notes unless we have registered the outstanding Notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act. | |||

Tax Considerations | The exchange of new Notes for 2009 Notes and the exchange of new Notes for 2016 Notes should not be a taxable event for U.S. federal income tax purposes. Please read "Tax Considerations." | |||

3

Exchange Agent | We have appointed Wachovia Bank, National Association, as exchange agent for each of the exchange offers. You should direct questions and requests for assistance and requests for additional copies of this prospectus or the letters of transmittal to the exchange agent addressed as follows: Wachovia Bank, National Association, Customer Information Center, Corporate Trust Operations—NC1153, 1525 West W. T. Harris Blvd. Charlotte, North Carolina 28288-1153. Eligible institutions may make requests by facsimile at (704) 590-7628. | |||

4

The new Notes will be identical to the outstanding Notes except that the new Notes are registered under the Securities Act and will not have transfer restrictions, registration rights or provisions for additional interest. The new Notes will evidence the same debt as the outstanding Notes, and the same indenture will govern the new Notes and the outstanding Notes.

The following summary contains basic information about the new Notes and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the notes, please refer to the section of this prospectus entitled "Description of Notes."

| Issuers | Plains All American Pipeline, L.P. and PAA Finance Corp. PAA Finance Corp., a Delaware corporation, is an indirect wholly owned subsidiary of Plains All American Pipeline, L.P. that has been organized for the purpose of co-issuing our existing notes, the Notes offered hereby, and the notes issued in any future offerings. PAA Finance Corp. does not have any operations of any kind and will not have any revenue other than as may be incidental to its activities as a co-issuer of the Notes. | |||

Notes Offered | $175 million aggregate principal amount of the 2009 Notes. | |||

$175 million aggregate principal amount of the 2016 Notes. | ||||

Maturity Dates | August 15, 2009 for the 2009 Notes. | |||

August 15, 2016 for the 2016 Notes. | ||||

Interest Payment Dates | We will pay interest on the Notes of each series semi-annually in arrears on February 15 and August 15 of each year, beginning on February 15, 2005. | |||

Optional Redemption | We may redeem the Notes of either series, in whole or in part, at any time and from time to time at a price equal to the greater of (i) 100% of the principal amount of Notes to be redeemed or (ii) the sum of the present values of the remaining scheduled payments of principal of and interest on the Notes to be redeemed discounted to the redemption date on a semi-annual basis at the Adjusted Treasury Rate (as defined herein) plus 20 basis points, in the case of the 2009 Notes, and 25 basis points, in the case of the 2016 Notes plus, in each case, accrued interest to the date of redemption. See "Description of Notes—Optional Redemption." | |||

Guarantees | Initially, all payments with respect to the Notes (including principal and interest) are fully and unconditionally guaranteed, jointly and severally, by substantially all of our existing subsidiaries. In the future, our subsidiaries that guarantee other indebtedness of ours or another subsidiary must also guarantee the Notes. The guarantees are also subject to release in certain circumstances. The guarantees of each series are general unsecured obligations of the subsidiary guarantors and rank equally with the guarantees of the other series and with any existing and future senior unsecured indebtedness of the subsidiary guarantors. | |||

5

Ranking | The Notes are general senior unsecured obligations of the issuers and rank equally with the Notes of the other series and with the existing and future senior unsecured indebtedness of the issuers. | |||

Certain Covenants | The indenture governing the Notes contains covenants for your benefit. These covenants restrict our ability and our restricted subsidiaries' ability, with certain exceptions, to: | |||

• | incur liens on principal properties to secure debt; | |||

• | engage in sale-leaseback transactions; or | |||

• | merge or consolidate with another entity or sell, lease or transfer substantially all of our properties or assets to another entity. | |||

Transfer Restrictions; Absence of a Public Market for the Notes | The new Notes generally will be freely transferable, but will also be new securities for which there will not initially be a market. There can be no assurance as to the development or liquidity of any market for the new Notes. | |||

Form of New Notes | The new Notes will be represented by one or more global notes. The global notes of each series will be deposited with the trustee, as custodian for DTC. The global notes of each series will be shown on, and transfers of the global notes of each series will be effected only through, records maintained in book-entry form by DTC and its direct and indirect participants. | |||

Same-Day Settlement | The new Notes will trade in DTC's Same Day Funds Settlement System until maturity or redemption. Therefore, secondary market trading activity in the new Notes will be settled in immediately available funds. | |||

Trading | We do not expect to list the new Notes for trading on any securities exchange. | |||

Trustee, Registrar and Exchange Agent | Wachovia Bank, National Association. | |||

Governing Law | The new Notes and the indenture relating to the new Notes will be governed by, and construed in accordance with, the laws of the State of New York. | |||

6

In addition to the other information set forth elsewhere in this prospectus, you should carefully consider the risks relating to our partnership, the exchange offers and the Notes described below before deciding whether to participate in the exchange offers.

The level of our profitability is dependent upon an adequate supply of crude oil from fields located offshore and onshore California. Production from these offshore fields has experienced substantial production declines since 1995.

A significant portion of our segment profit is derived from pipeline transportation margins associated with the Santa Ynez and Point Arguello fields located offshore California. We expect that there will continue to be natural production declines from each of these fields as the underlying reservoirs are depleted. We estimate that a 5,000 barrel per day decline in volumes shipped from these fields would result in a decrease in annual pipeline segment profit of approximately $3.1 million. In addition, any production disruption from these fields due to production problems, transportation problems or other reasons would have a material adverse effect on our business.

Our trading policies cannot eliminate all price risks. In addition, any non-compliance with our trading policies could result in significant financial losses.

Generally, it is our policy that as we purchase crude oil we establish a margin by selling crude oil for physical delivery to third party users, such as independent refiners or major oil companies, or by entering into a future delivery obligation under futures contracts on the NYMEX and over-the-counter. Through these transactions, we seek to maintain a position that is substantially balanced between purchases, on the one hand, and sales or future delivery obligations, on the other hand. Our policy is generally not to acquire and hold crude oil, futures contracts or derivative products for the purpose of speculating on price changes. This policy cannot, however, eliminate all price risks. For example, any event that disrupts our anticipated physical supply of crude oil could expose us to risk of loss resulting from price changes. Moreover, we are exposed to some risks that are not hedged, including certain basis risks and price risks on certain of our inventory, such as pipeline linefill, which must be maintained in order to transport crude oil on our pipelines. In addition, we engage in a controlled trading program for up to an aggregate of 500,000 barrels of crude oil. Although this activity is monitored independently by our risk management function, it exposes us to price risks within predefined limits and authorizations.

In addition, our trading operations involve the risk of non-compliance with our trading policies. For example, we discovered in November 1999 that our trading policy was violated by one of our former employees, which resulted in aggregate losses of approximately $181.0 million. We have taken steps within our organization to enhance our processes and procedures to detect future unauthorized trading. We cannot assure you, however, that these steps will detect and prevent all violations of our trading policies and procedures, particularly if deception or other intentional misconduct is involved.

If we do not make acquisitions on economically acceptable terms our future growth may be limited.

Our ability to grow is substantially dependent on our ability to make acquisitions that result in an increase in adjusted operating surplus per unit. If we are unable to make such accretive acquisitions either because (i) we are unable to identify attractive acquisition candidates or negotiate acceptable purchase contracts with them, (ii) we are unable to raise financing for such acquisitions on economically acceptable terms or (iii) we are outbid by competitors, our future growth will be limited. In particular, competition for midstream assets and businesses has intensified substantially and as a result such assets and businesses have become more costly. As a result, we may not be able to complete

7

the number or size of acquisitions that we have targeted internally or to continue to grow as quickly as we have historically.

Our acquisition strategy requires access to new capital. Tightened capital markets or other factors which increase our cost of capital could impair our ability to grow.

Our business strategy is substantially dependent on acquiring additional assets or operations. We continuously consider and enter into discussions regarding potential acquisitions. These transactions can be effected quickly, may occur at any time and may be significant in size relative to our existing assets and operations. Any material acquisition will require access to capital. Any limitations on our access to capital or increase in the cost of that capital could significantly impair our ability to execute our acquisition strategy. Our ability to maintain our targeted credit profile, including maintaining our credit ratings, could impact our cost of capital as well as our ability to execute our acquisition strategy.

Our acquisition strategy involves risks that may adversely affect our business.

Any acquisition involves potential risks, including:

- •

- performance from the acquired assets and businesses that is below the forecasts we used in evaluating the acquisition;

- •

- a significant increase in our indebtedness and working capital requirements;

- •

- the inability to timely and effectively integrate the operations of recently acquired businesses or assets;

- •

- the incurrence of substantial unforeseen environmental and other liabilities arising out of the acquired businesses or assets, including liabilities arising from the operation of the acquired businesses or assets prior to our acquisition;

- •

- customer or key employee loss from the acquired businesses; and

- •

- the diversion of management's attention from other business concerns.

Any of these factors could adversely affect our ability to achieve anticipated levels of cash flows from our acquisitions, realize other anticipated benefits and our ability to meet our debt service requirements.

The nature of our assets and business could expose us to significant compliance costs and liabilities.

Our operations involving the storage, treatment, processing, and transportation of liquid hydrocarbons including crude oil are subject to stringent federal, state, and local laws and regulations governing the discharge of materials into the environment, otherwise relating to protection of the environment, operational safety and related matters. Compliance with these laws and regulations increases our overall cost of business, including our capital costs to construct, maintain and upgrade equipment and facilities, or claims for damages to property or persons resulting from our operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil, and criminal penalties, the imposition of investigatory and remedial liabilities, and the issuance of injunctions that may restrict or prohibit our operations or even claims of damages to property or persons resulting from our operations. The laws and regulations applicable to our operations are subject to change, and we cannot provide any assurance that compliance with current and future laws and regulations will not have a material effect on our results of operations or earnings. A discharge of hazardous liquids into the environment could, to the extent such event is not insured, subject us to substantial expense, including both the cost to comply with applicable laws and regulations and liability to private parties for personal injury or property damage.

8

The profitability of our pipeline operations depends on the volume of crude oil shipped by third parties.

Third party shippers generally do not have long-term contractual commitments to ship crude oil on our pipelines. A decision by a shipper to substantially reduce or cease to ship volumes of crude oil on our pipelines could cause a significant decline in our revenues. For example, we estimate that an average 10,000 barrel per day variance in the Basin Pipeline System, equivalent to an approximate 4% volume variance on that system, would change annualized segment profit by approximately $1.0 million. In addition, we estimate that an average 10,000 barrel per day variance on the Capline Pipeline System, equivalent to an approximate 7% volume variance on that system, would change annualized segment profit by approximately $1.5 million.

The success of our business strategy to increase and optimize throughput on our pipeline and gathering assets is dependent upon our securing additional supplies of crude oil.

Our operating results are dependent upon securing additional supplies of crude oil from increased production by oil companies and aggressive lease gathering efforts. The ability of producers to increase production is dependent on the prevailing market price of oil, the exploration and production budgets of the major and independent oil companies, the depletion rate of existing reservoirs, the success of new wells drilled, environmental concerns, regulatory initiatives and other matters beyond our control. There can be no assurance that production of crude oil will rise to sufficient levels to cause an increase in the throughput on our pipeline and gathering assets.

Our operations are dependent upon demand for crude oil by refiners in the Midwest and on the Gulf Coast. Any decrease in this demand could adversely affect our business.

Demand for crude oil is dependent upon the impact of future economic conditions, fuel conservation measures, alternative fuel requirements, governmental regulation or technological advances in fuel economy and energy generation devices, all of which could reduce demand. Demand also depends on the ability and willingness of shippers having access to our transportation assets to satisfy their demand by deliveries through those assets, and any decrease in this demand could adversely affect our business.

We face intense competition in our gathering, marketing, terminalling and storage activities.

Our competitors include other crude oil pipelines, the major integrated oil companies, their marketing affiliates, and independent gatherers, brokers and marketers of widely varying sizes, financial resources and experience. Some of these competitors have capital resources many times greater than ours and control greater supplies of crude oil. We estimate that a $0.01 per barrel variance in the aggregate average segment profit would have an approximate $2.5 million annual effect on segment profit.

The profitability of our gathering and marketing activities is generally dependent on the volumes of crude oil we purchase and gather.

To maintain the volumes of crude oil we purchase, we must continue to contract for new supplies of crude oil to offset volumes lost because of natural declines in crude oil production from depleting wells or volumes lost to competitors. Replacement of lost volumes of crude oil is particularly difficult in an environment where production is low and competition to gather available production is intense. Generally, because producers experience inconveniences in switching crude oil purchasers, such as delays in receipt of proceeds while awaiting the preparation of new division orders, producers typically do not change purchasers on the basis of minor variations in price. Thus, we may experience difficulty acquiring crude oil at the wellhead in areas where there are existing relationships between producers and other gatherers and purchasers of crude oil. We estimate that a 5,000 barrel per day decrease in

9

barrels gathered by us would have an approximate $1.0 million per year negative impact on segment profit. This impact is based on a reasonable margin throughout various market conditions. Actual margins vary based on the location of the crude oil, the strength or weakness of the market and the grade or quality of crude oil.

We are exposed to the credit risk of our customers in the ordinary course of our gathering and marketing activities.

There can be no assurance that we have adequately assessed the credit worthiness of our existing or future counterparties or that there will not be an unanticipated deterioration in their credit worthiness, which could have an adverse impact on us.

In those cases in which we provide division order services for crude oil purchased at the wellhead, we may be responsible for distribution of proceeds to all parties. In other cases, we pay all of or a portion of the production proceeds to an operator who distributes these proceeds to the various interest owners. These arrangements expose us to operator credit risk, and there can be no assurance that we will not experience losses in dealings with other parties.

Our pipeline assets are subject to federal, state and provincial regulation.

Our domestic interstate common carrier pipelines are subject to regulation by the Federal Energy Regulatory Commission (FERC) under the Interstate Commerce Act. The Interstate Commerce Act requires that tariff rates for petroleum pipelines be just and reasonable and non-discriminatory. We are also subject to the Pipeline Safety Regulations of the U.S. Department of Transportation. Our intrastate pipeline transportation activities are subject to various state laws and regulations as well as orders of regulatory bodies.

Our Canadian pipeline assets are subject to regulation by the National Energy Board and by provincial agencies. With respect to a pipeline over which it has jurisdiction, each of these Canadian agencies has the power to determine the rates we are allowed to charge for transportation on such pipeline. The extent to which regulatory agencies can override existing transportation contracts has not been fully decided.

Our pipeline systems are dependent upon their interconnections with other crude oil pipelines to reach end markets.

Reduced throughput on these interconnecting pipelines as a result of testing, line repair, reduced operating pressures or other causes could result in reduced throughput on our pipeline systems that would adversely affect our profitability.

Fluctuations in demand can negatively affect our operating results.

Fluctuations in demand for crude oil, such as caused by refinery downtime or shutdown, can have a negative effect on our operating results. Specifically, reduced demand in an area serviced by our transmission systems will negatively affect the throughput on such systems. Although the negative impact may be mitigated or overcome by our ability to capture differentials created by demand fluctuations, this ability is dependent on location and grade of crude oil, and thus is unpredictable.

The terms of our indebtedness may limit our ability to borrow additional funds or capitalize on business opportunities.

As of September 30, 2004, our total outstanding long-term debt was approximately $837.6 million. Various limitations in our indebtedness may reduce our ability to incur additional debt, to engage in

10

some transactions and to capitalize on business opportunities. Any subsequent refinancing of our current indebtedness or any new indebtedness could have similar or greater restrictions.

Changes in currency exchange rates could adversely affect our operating results.

Because we conduct operations in Canada, we are exposed to currency fluctuations and exchange rate risks that may adversely affect our results of operations.

Our tax treatment depends on our status as a partnership for federal income tax purposes, as well as our not being subject to entity level taxation by states. If the IRS treats us as a corporation or we become subject to entity level taxation for state tax purposes, it would substantially reduce our ability to pay our debt service obligations.

If we were classified as a corporation for federal income tax purposes, we would pay federal income tax on our income at the corporate rate. Treatment of us as a corporation would cause a material reduction in our anticipated cash flow, which would materially and adversely affect our ability to pay our debt service obligations, including the New Notes.

In addition, because of widespread state budget deficits, several states are evaluating ways to subject partnerships to entity level taxation through the imposition of state income, franchise or other forms of taxation. Imposition of such forms of taxation would reduce our cash flow.

We will be required to comply with Section 404 of the Sarbanes Oxley Act for the first time.

The Sarbanes Oxley Act of 2002 has imposed many new requirements on public companies regarding corporate governance and financial reporting. Among these is the requirement under Section 404 of the Act, beginning with our 2004 Annual Report, for management to report on our internal control over financial reporting and for our independent public accountants to attest to management's report. During 2003, we commenced actions to enhance our ability to comply with these requirements, including but not limited to the addition of staffing in our internal audit department, documentation of existing controls and implementation of new controls or modification of existing controls as deemed appropriate. We have continued to devote substantial time and resources to the documentation and testing of our controls, and to planning for and implementation of remedial efforts in those instances where remediation is indicated. At this point, we have no indication that management will be unable to favorably report on our internal controls nor that our independent auditors will be unable to attest to management's findings. Both we and our auditors, however, must complete the process (which we have never completed before), so we cannot assure you of the results. It is unclear what impact failure to comply fully with Section 404 or the discovery of a material weakness in our internal control over financial reporting would have on us, but presumably it could result in the reduced ability to obtain financing, the loss of customers, and additional expenditures to meet the requirements.

Risks Related to the Exchange Offers and the Notes

If you do not properly tender your outstanding Notes, you will continue to hold unregistered outstanding Notes and your ability to transfer outstanding Notes will be adversely affected.

We will only issue new Notes in exchange for outstanding Notes that you timely and properly tender. Therefore, you should allow sufficient time to ensure timely delivery of the outstanding Notes and you should carefully follow the instructions on how to tender your outstanding Notes. Neither we nor the exchange agent is required to tell you of any defects or irregularities with respect to your tender of outstanding Notes.

11

If you do not exchange your outstanding Notes for new Notes pursuant to the applicable exchange offer, the outstanding Notes you hold will continue to be subject to the existing transfer restrictions. In general, you may not offer or sell the outstanding Notes except under an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We do not plan to register outstanding Notes under the Securities Act unless our registration rights agreements with the initial purchasers of the outstanding Notes require us to do so. Further, if you continue to hold any outstanding Notes after the applicable exchange offer is consummated, you may have trouble selling them because there will be fewer Notes outstanding.

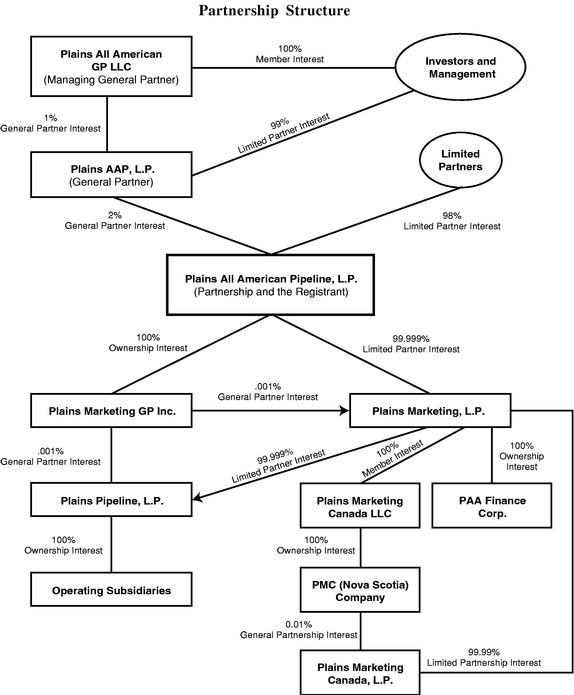

We have a holding company structure in which our subsidiaries conduct our operations and own our operating assets.

We are a holding company, and our subsidiaries conduct all of our operations and own all of our operating assets. We have no significant assets other than the partnership interests and the equity in our subsidiaries. As a result, our ability to make required payments on the Notes depends on the performance of our subsidiaries and their ability to distribute funds to us. The ability of our subsidiaries to make distributions to us may be restricted by, among other things, credit facilities and applicable state partnership laws and other laws and regulations. Pursuant to the credit facilities, we may be required to establish cash reserves for the future payment of principal and interest on the amounts outstanding under the credit facilities. If we are unable to obtain the funds necessary to pay the principal amount at maturity of either series of the Notes, we may be required to adopt one or more alternatives, such as a refinancing of the Notes. We cannot assure you that we would be able to refinance either series of the Notes.

Your right to receive payments on the Notes and the guarantees is unsecured and will be effectively subordinated to our existing and future secured indebtedness as well as to any existing and future indebtedness of our subsidiaries that do not guarantee the Notes.

The Notes are effectively subordinated to claims of our secured creditors, and the guarantees are effectively subordinated to the claims of our secured creditors as well as the secured creditors of our subsidiary guarantors. Although substantially all of our subsidiaries, other than PAA Finance Corp., the co-issuer of the Notes, will initially guarantee the Notes, in the future, under certain circumstances, the guarantees are subject to release and we may have subsidiaries that are not guarantors. In that case, the Notes would be effectively subordinated to the claims of all creditors, including trade creditors and tort claimants, of our subsidiaries that are not guarantors. In the event of the insolvency, bankruptcy, liquidation, reorganization, dissolution or winding up of the business of a subsidiary that is not a guarantor, creditors of that subsidiary would generally have the right to be paid in full before any distribution is made to us or the holders of the Notes.

Our leverage may limit our ability to borrow additional funds, comply with the terms of our indebtedness or capitalize on business opportunities.

Our leverage is significant in relation to our partners' capital. Various limitations in our credit agreements and other debt instruments may reduce our ability to incur additional debt, to engage in some transactions and to capitalize on business opportunities. Any subsequent refinancing of our current indebtedness or any new indebtedness could have similar or greater restrictions.

Our leverage could have important consequences to investors in the Notes. We will require substantial cash flow to meet our principal and interest obligations with respect to the Notes and our other consolidated indebtedness. Our ability to make scheduled payments, to refinance our obligations with respect to our indebtedness or our ability to obtain additional financing in the future will depend on our financial and operating performance, which, in turn, is subject to prevailing economic conditions and to financial, business and other factors. We believe that we will have sufficient cash flow from

12

operations and available borrowings under our bank credit facility to service our indebtedness, although the principal amount of the Notes of each series will likely need to be refinanced at maturity in whole or in part. However, a significant downturn in the hydrocarbon industry or other development adversely affecting our cash flow could materially impair our ability to service our indebtedness. If our cash flow and capital resources are insufficient to fund our debt service obligations, we may be forced to refinance all or a portion of our debt or sell assets. We cannot assure you that we would be able to refinance our existing indebtedness or sell assets on terms that are commercially reasonable. In addition, if one or more rating agencies were to lower our debt ratings, we could be required by some of our counterparties to post additional collateral, which would reduce our available liquidity and cash flow.

Our leverage may adversely affect our ability to fund future working capital, capital expenditures and other general partnership requirements, future acquisition, construction or development activities, or to otherwise fully realize the value of our assets and opportunities because of the need to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness or to comply with any restrictive terms of our indebtedness. Our leverage may also make our results of operations more susceptible to adverse economic and industry conditions by limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate and may place us at a competitive disadvantage as compared to our competitors that have less debt.

A court may use fraudulent conveyance considerations to void or subordinate the subsidiary guarantees.

Various applicable fraudulent conveyance laws have been enacted for the protection of creditors. A court may use fraudulent conveyance laws to subordinate or void the subsidiary guarantees of the Notes issued by any of our subsidiary guarantors. It is also possible that under certain circumstances a court could hold that the direct obligations of a subsidiary guaranteeing the Notes could be superior to the obligations under that guarantee.

A court could void or subordinate the guarantee of the Notes by any of our subsidiaries in favor of that subsidiary's other debts or liabilities to the extent that the court determined either of the following were true at the time the subsidiary issued the guarantee:

- •

- that subsidiary incurred the guarantee with the intent to hinder, delay or defraud any of its present or future creditors or that subsidiary contemplated insolvency with a design to favor one or more creditors to the total or partial exclusion of others; or

- •

- that subsidiary did not receive fair consideration or reasonable equivalent value for issuing the guarantee and, at the time it issued the guarantee, that subsidiary:

- •

- was insolvent or rendered insolvent by reason of the issuance of the guarantee;

- •

- was engaged or about to engage in a business or transaction for which the remaining assets of that subsidiary constituted unreasonably small capital; or

- •

- intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they matured.

The measure of insolvency for purposes of the foregoing will vary depending upon the law of the relevant jurisdiction. Generally, however, an entity would be considered insolvent for purposes of the foregoing if the sum of its debts, including contingent liabilities, were greater than the fair saleable value of all of its assets at a fair valuation, or if the present fair saleable value of its assets were less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and matured.

Among other things, a legal challenge of a subsidiary's guarantee of the Notes on fraudulent conveyance grounds may focus on the benefits, if any, realized by that subsidiary as a result of our

13

issuance of the Notes. To the extent a subsidiary's guarantee of the Notes is voided as a result of fraudulent conveyance or held unenforceable for any other reason, the Note holders would cease to have any claim in respect of that guarantee.

Your ability to transfer the Notes may be limited by the absence of a trading market.

The Notes will be new securities for which currently there is no trading market. We do not currently intend to apply for listing of the Notes on any securities exchange or stock market. The liquidity of any market for the Notes of either series will depend on the number of holders of those Notes, the interest of securities dealers in making a market in those Notes and other factors. Accordingly, we cannot assure you as to the development or liquidity of any market for the Notes of either series.

We do not have the same flexibility as other types of organizations to accumulate cash, which may limit cash available to service the Notes or to repay them at maturity.

Unlike a corporation, our partnership agreement requires us to distribute, on a quarterly basis, 100% of our available cash to our unitholders of record and to our general partner. Available cash is generally all of our cash receipts adjusted for cash distributions and net changes to reserves. Our general partner will determine the amount and timing of such distributions and has broad discretion to establish and make additions to our reserves or the reserves of our operating partnerships in amounts the general partner determines in its reasonable discretion to be necessary or appropriate:

- •

- to provide for the proper conduct of our business and the businesses of our operating partnerships (including reserves for future capital expenditures and for our anticipated future credit needs),

- •

- to provide funds for distributions to our unitholders and the general partner for any one or more of the next four calendar quarters, or

- •

- to comply with applicable law or any of our loan or other agreements.

Although our payment obligations to our unitholders are subordinate to our payment obligations to you, the value of our units will decrease in direct correlation with decreases in the amount we distribute per unit. Accordingly, if we experience a liquidity problem in the future, we may not be able to issue equity to recapitalize.

14

Each exchange offer is intended to satisfy our obligations under the related registration rights agreement. We will not receive any cash proceeds from the issuance of the new Notes in the exchange offers. In consideration for issuing the new Notes as contemplated by this prospectus, we will receive outstanding Notes in a like principal amount. The form and terms of the new Notes are identical in all respects to the form and terms of the outstanding Notes, except the new Notes do not include certain transfer restrictions, registration rights or provisions for additional interest. Outstanding Notes surrendered in exchange for the new Notes will be retired and cancelled and will not be reissued. Accordingly, the issuance of the new Notes will not result in any change in our outstanding indebtedness.

RATIO OF EARNINGS TO FIXED CHARGES

The ratio of earnings to fixed charges for each of the periods indicated are as follows:

| | | Year Ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Nine Months Ended September 30, 2004 | |||||||||||

| | 2003 | 2002 | 2001 | 2000(2) | 1999(2)(3) | |||||||

| RATIO OF EARNINGS TO FIXED CHARGES(1) | 3.77 | x | 2.39 | x | 2.77 | x | 2.26 | x | 3.33 | x | — | |

- (1)

- For purposes of computing the ratio of earnings to fixed charges, "earnings" consist of pretax income from continuing operations plus fixed charges (excluding capitalized interest). "Fixed charges" represent interest incurred (whether expensed or capitalized), amortization of debt expense, and that portion of rental expense on operating leases deemed to be the equivalent of interest.

- (2)

- The 1999 and 2000 periods include losses of $1.5 million and $15.1 million, respectively, related to early extinguishment of debt previously classified as extraordinary items. Effective with our adoption of SFAS 145, "Rescission of FASB Statements No. 4, 44, and 64, Amendment of FASB Statement No. 13, and Technical Corrections" in January 2003, such items are included in income from continuing operations.

- (3)

- In 1999, available earnings failed to cover fixed charges by $103.4 million.

15

We sold the outstanding Notes on August 12, 2004, pursuant to a purchase agreement dated as of August 5, 2004, by and among us, PAA Finance Corp., certain of our subsidiaries and the initial purchasers named therein. The outstanding Notes were subsequently offered by the initial purchasers to qualified institutional buyers pursuant to Rule 144A under the Securities Act and to non-U.S. persons pursuant to Regulation S under the Securities Act.

Purpose and Effect of the Exchange Offers

In connection with the issuance of the outstanding Notes, we entered into registration rights agreements with respect to each series of Notes. Under the registration rights agreements, we agreed to use our reasonable best efforts to:

- •

- within 120 days of the original issuance of the Notes on August 12, 2004, file a registration statement with the SEC with respect to a registered offer to exchange the outstanding Notes for new Notes substantially identical to such Notes of such series except that the new Notes will not contain terms with respect to transfer restrictions, registration rights or provisions for additional interest;

- •

- cause the registration statement to be declared effective within 210 days of the original issuance of the outstanding Notes;

- •

- to consummate the exchange of the outstanding Notes for new Notes within 240 days of the original issuance of the outstanding Notes;

- •

- promptly following the effectiveness of the registration statement, offer the new Notes in exchange for surrender of the outstanding Notes; and

- •

- keep the exchange offers open for not less than 20 business days (or longer if required by applicable law) after the date notice of the exchange offers is mailed to the holders of the outstanding Notes.

We have fulfilled the agreements described in the first preceding bullet point and are now offering eligible holders of the outstanding Notes the opportunity to exchange their outstanding Notes for new Notes registered under the Securities Act. Holders are eligible if they are not prohibited by any law or policy of the SEC from participating in each exchange offer. The new Notes will be substantially identical to the outstanding Notes except that the new Notes will not contain terms with respect to transfer restrictions, registration rights or additional interest.

Under limited circumstances, we agreed to use our reasonable best efforts to cause the SEC to declare effective a shelf registration statement for the resale of the outstanding Notes. We also agreed to use our reasonable best efforts to keep the shelf registration statement effective for up to two years after its effective date. The circumstances include if:

- •

- a change in law or applicable interpretations thereof by the staff of the SEC do not permit us to effect the exchange offers;

- •

- for any other reason the applicable exchange offer is not consummated within 240 days from the date of the original issuance of the applicable series of outstanding Notes;

- •

- any initial purchaser notifies us that outstanding Notes held by it are not eligible to be exchanged for new Notes in the applicable exchange offer and are held by it following consummation of the applicable exchange offer; or

- •

- any holder other than an initial purchaser is not eligible to participate in the applicable exchange offer.

16

Subject to certain exceptions, we will pay additional cash interest on the applicable outstanding Notes if:

- •

- the registration statement is not filed with the SEC on or before the 120th day after the original issuance of the outstanding Notes;

- •

- the registration statement is not declared effective by the SEC on or before the 210th day of the original issuance of the outstanding Notes;

- •

- the exchange offers are not consummated on or before the 240th day of the original issuance of the outstanding Notes;

- •

- obligated to file a shelf registration statement, we fail to file the shelf registration statement with the SEC on or prior to the 120th day after the date on which the obligation to file a shelf registration statement arises;

- •

- obligated to file a shelf registration statement, the shelf registration statement is not declared effective on or prior to the 210th day after the date on which the obligation to file a shelf registration statement arises; or

- •

- after this registration statement or the shelf registration statement, as the case may be, is declared effective, such registration statement thereafter ceases to be effective (subject to certain exceptions) (each such event referred to in the preceding clauses being a "registration default").

Such additional interest will be payable from and including the date on which any such registration default occurs to the date on which all registration defaults have been cured.

The rate of the additional interest will be 0.25% per annum for the first 90-day period immediately following the occurrence and during the continuation of the registration default, and such rate will increase by an additional 0.25% per annum for each subsequent 90-day period until all registration defaults have been cured, up to a maximum additional interest rate of 0.50% per annum. We will pay such additional interest on regular interest payment dates. Such additional interest will be in addition to any other interest payable from time to time with respect to the outstanding Notes and the new Notes.

Upon the filing or effectiveness of this registration statement, the consummation of the exchange offers, the filing or effectiveness of a shelf registration statement, or the effectiveness of a succeeding registration statement, as the case may be, the interest rate borne by the Notes from the date of such filing, effectiveness or consummation, as the case may be, will be reduced to the original interest rate. However, if after any such reduction in interest rate, a different event specified in the clauses above occurs, the interest rate may again be increased pursuant to the preceding provisions.

To exchange your outstanding Notes for transferable new Notes in the applicable exchange offer, you will be required to represent that at the time of the consummation of the applicable exchange offer:

- •

- any new Notes will be acquired in the ordinary course of your business;

- •

- you have no arrangement or understanding with any person or entity to participate in the distribution of the new Notes;

- •

- you are not engaged in and do not intend to engage in the distribution of the new Notes;

- •

- if you are a broker-dealer that will receive new Notes for your own account in exchange for outstanding Notes, you acquired those notes as a result of market-making activities or other trading activities and you will deliver a prospectus, as required by law, in connection with any resale of such new Notes; and

- •

- you are not our "affiliate," as defined in Rule 405 of the Securities Act.

17

In addition, we may require you to provide information to be used in connection with the shelf registration statement to have your outstanding Notes included in the shelf registration statement. A holder who sells outstanding Notes under the shelf registration statement generally will be required to be named as a selling securityholder in the related prospectus and to deliver a prospectus to purchasers. Such a holder will also be subject to the civil liability provisions under the Securities Act in connection with such sales and will be bound by the provisions of the registration rights agreement that are applicable to such a holder, including indemnification obligations.

The description of the registration rights agreements contained in this section is a summary only. For more information, you should review the provisions of the registration rights agreements that we filed with the SEC as an exhibit to the registration statement of which this prospectus is a part.

Based on no action letters of the SEC staff issued to third parties, we believe that new Notes may be offered for resale, resold and otherwise transferred by you without further compliance with the registration and prospectus delivery provisions of the Securities Act if:

- •

- you are not our "affiliate" within the meaning of Rule 405 under the Securities Act;

- •

- such new Notes are acquired in the ordinary course of your business; and

- •

- you do not intend to participate in a distribution of the new Notes.

The SEC, however, has not considered either exchange offer for the new Notes in the context of a no action letter, and the SEC may not make a similar determination as in the no action letters issued to these third parties.

If you tender in an exchange offer with the intention of participating in any manner in a distribution of the new Notes, you

- •

- cannot rely on such interpretations by the SEC staff; and

- •

- must comply with the registration and prospectus delivery requirements of the Securities Act in connection with a secondary resale transaction.

Unless an exemption from registration is otherwise available, any security holder intending to distribute new Notes should be covered by an effective registration statement under the Securities Act. The registration statement should contain the selling securityholder's information required by Item 507 of Regulation S-K under the Securities Act.

This prospectus may be used for an offer to resell, resale or other retransfer of new Notes only as specifically described in this prospectus. Failure to comply with the registration and prospectus delivery requirements by a holder subject to these requirements could result in that holder incurring liability for which it is not indemnified by us. If you are a broker-dealer, you may participate in an exchange offer only if you acquired the outstanding Notes as a result of market-making activities or other trading activities. Each broker-dealer that receives new Notes for its own account in exchange for outstanding Notes, where such outstanding Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge in the applicable letter of transmittal that it will deliver a prospectus in connection with any resale of the new Notes. Please read the section captioned "Plan of Distribution" for more details regarding the transfer of new Notes.

Subject to the terms and conditions described in this prospectus and in the applicable letter of transmittal, we will accept for exchange any outstanding Notes properly tendered and not withdrawn prior to 5:00 p.m. New York City time on the expiration date. We will issue new Notes in principal

18

amount equal to the principal amount of outstanding Notes of the same series surrendered under the applicable exchange offer. Outstanding Notes may be tendered only for new Notes and only in minimum principal amounts of $2,000 and integral multiples of $2,000.

Neither exchange offer is conditioned upon any minimum aggregate principal amount of outstanding Notes being tendered for exchange. Each exchange offer will be conducted independently from the other exchange offer, and consummation of one exchange offer will not be conditioned upon consummation of the other.

As of the date of this prospectus, $175 million in aggregate principal amount of the 2009 Notes are outstanding and $175 million in aggregate principal amount of the 2016 Notes are outstanding. This prospectus is being sent to DTC, the sole registered holder of the outstanding Notes, and to all persons that we can identify as beneficial owners of the outstanding Notes. There will be no fixed record date for determining registered holders of outstanding Notes entitled to participate in either exchange offer.

We intend to conduct each exchange offer in accordance with the provisions of the applicable registration rights agreement, the applicable requirements of the Securities Act and the Securities Exchange Act of 1934 and the rules and regulations of the SEC. Outstanding Notes that the holders thereof do not tender for exchange in the applicable exchange offer will remain outstanding and continue to accrue interest. These outstanding Notes will be entitled to the rights and benefits such holders have under the respective indenture relating to the Notes and the applicable registration rights agreement.

We will be deemed to have accepted for exchange properly tendered outstanding Notes when we have given oral or written notice of the acceptance to the exchange agent and complied with the applicable provisions of the registration rights agreement. The exchange agent will act as agent for the tendering holders for the purposes of receiving the new notes from us.

If you tender outstanding Notes in an exchange offer, you will not be required to pay brokerage commissions or fees or, subject to the letter of transmittal, transfer taxes with respect to the exchange of outstanding Notes. We will pay all charges and expenses, other than certain applicable taxes described below, in connection with each exchange offer. It is important that you read the section labeled "—Fees and Expenses" for more details regarding fees and expenses incurred in an exchange offer.

We will return any outstanding Notes that we do not accept for exchange for any reason without expense to their tendering holder as promptly as practicable after the expiration or termination of the applicable exchange offer.

Each exchange offer will expire at 5:00 p.m. New York City time on , 200 , unless, in our sole discretion, we extend it. We may extend one exchange offer without extending the other.

Extensions, Delays in Acceptance, Termination or Amendment

We expressly reserve the right, at any time or various times, to extend the period of time during which either exchange offer is open. During any such extensions, all outstanding Notes previously tendered will remain subject to the applicable exchange offer, and we may accept them for exchange.

In order to extend an exchange offer, we will notify the exchange agent orally or in writing of any extension. We will notify the registered holders of outstanding Notes of the extension no later than 9:00 a.m., New York City time, on the business day after the previously scheduled expiration date.

19

If any of the conditions described below under "—Conditions to the Exchange Offers" have not been satisfied, in relation to either exchange offer, we reserve the right, in our sole discretion

- •

- to delay accepting for exchange any outstanding Notes,

- •

- to extend the exchange offer, or

- •

- to terminate the exchange offer,

by giving oral or written notice of such delay, extension or termination to the exchange agent. Subject to the terms of the applicable registration rights agreement, we also reserve the right to amend the terms of either exchange offer in any manner.

Any such delay in acceptance, extension, termination or amendment will be followed as promptly as practicable by oral or written notice thereof to the registered holders of outstanding Notes. If we amend an exchange offer in a manner that we determine to constitute a material change, we will promptly disclose such amendment by means of a prospectus supplement. The supplement will be distributed to the registered holders of the outstanding Notes that are subject to the applicable exchange offer. Depending upon the significance of the amendment and the manner of disclosure to the registered holders, we will extend such exchange offer if such exchange offer would otherwise expire during such period. If an amendment constitutes a material change to an exchange offer, including the waiver of a material condition, we will extend the applicable exchange offer, if necessary, to remain open for at least five business days after the date of the amendment. In the event of any increase or decrease in the price of the outstanding Notes or in the percentage of outstanding Notes being sought by us, we will extend the applicable exchange offer to remain open for at least 10 business days after the date we provide notice of such increase or decrease to the registered holders of outstanding Notes.

Conditions to the Exchange Offers

We will not be required to accept for exchange, or exchange any new Notes for, any outstanding Notes if the applicable exchange offer, or the making of any exchange by a holder of outstanding Notes, would violate applicable law or any applicable interpretation of the staff of the SEC. Similarly, we may terminate either exchange offer as provided in this prospectus before accepting outstanding Notes for exchange in the event of such a potential violation.

In addition, we will not be obligated to accept for exchange the outstanding Notes of any holder that has not made to us the representations described under "—Purpose and Effect of the Exchange Offers," "—Procedures for Tendering" and "Plan of Distribution" and such other representations as may be reasonably necessary under applicable SEC rules, regulations or interpretations to allow us to use an appropriate form to register the new Notes under the Securities Act.

We will not accept for exchange any outstanding Notes tendered, and will not issue new Notes in exchange for any such outstanding Notes, if at such time any stop order has been threatened or is in effect with respect to (1) the registration statement of which this prospectus constitutes a part or (2) the qualification of the applicable indenture relating to the Notes under the Trust Indenture Act of 1939.

We expressly reserve the right to amend or terminate either exchange offer, and to reject for exchange any outstanding Notes not previously accepted for exchange, upon the occurrence of any of the conditions to the exchange offers specified above. We will give oral or written notice of any extension, amendment, non-acceptance or termination to the holders of the outstanding Notes as promptly as practicable.

These conditions are for our sole benefit, and we may assert them or waive them in whole or in part at any time or at various times in our sole discretion. If we fail at any time to exercise any of these

20

rights, this failure will not mean that we have waived our rights. Each such right will be deemed an ongoing right that we may assert at any time or at various times.

Each exchange offer is independent of the other, and the closing of one exchange offer is not conditioned upon the closing of the other.

�� In order to participate in an exchange offer, you must properly tender your outstanding Notes to the exchange agent as described below. It is your responsibility to properly tender your Notes. We have the right to waive any defects. However, we are not required to waive defects and are not required to notify you of defects in your tender.

If you have any questions or need help in exchanging your Notes, please call the exchange agent, whose address and phone number are set forth in "Prospectus Summary—The Exchange Offers—Exchange Agent."

All of the outstanding Notes were issued in book-entry form, and all of the outstanding Notes are currently represented by global certificates held for the account of DTC. We have confirmed with DTC that the outstanding Notes may be tendered using the Automated Tender Offer Program ("ATOP") instituted by DTC. The exchange agent will establish an account with DTC for purposes of the exchange offers promptly after the commencement of the exchange offers and DTC participants may electronically transmit their acceptance of the exchange offer by causing DTC to transfer their outstanding Notes to the exchange agent using the ATOP procedures. In connection with the transfer, DTC will send an "agent's message" to the exchange agent. The agent's message will state that DTC has received instructions from the participant to tender outstanding Notes and that the participant agrees to be bound by the terms of the applicable letter of transmittal.