- AAWW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Atlas Air Worldwide (AAWW) DEF 14ADefinitive proxy

Filed: 8 May 20, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantþ | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

þ | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| ATLAS AIR WORLDWIDE HOLDINGS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

N/A | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

þ | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

LETTER TO OUR SHAREHOLDERS FROM THE BOARD OF DIRECTORS

Dear Shareholders,

We are pleased to invite you to attend the Annual Meeting of Shareholders on Tuesday, June 9, 2020 beginning at 10:00 a.m. Eastern Daylight Time. In light of the ongoing developments related to the novel coronavirus (COVID-19) and our concern for our shareholders and employees, we have decided to hold our 2020 Annual Meeting online. We expect this modification in meeting format to be effective for this year only and hope to revert to an in-person Annual Meeting in future years once public health conditions have improved. Instructions on how to attend, and vote at, the Annual Meeting are described in this Proxy Statement. We look forward to your participation online or by proxy.

As your Board, we welcome this opportunity to communicate with you. In stewarding your Company, we seek to achieve long-term, sustainable performance and to create value through the right business strategies, prudent risk management, effective corporate governance practices, environmental and social initiatives, effective executive compensation programs, and well-functioning talent and succession planning. We would like to highlight a few areas of significance for the Board this past year:

2019 Executive Leadership Changes

William J. Flynn, our longstanding Chief Executive Officer, retired at the end of 2019 and was succeeded in that role by John W. Dietrich, our then-current Executive Vice President and Chief Operating Officer. After considering several highly qualified candidates, we promoted James Forbes to be our Executive Vice President and Chief Operating Officer to succeed Mr. Dietrich. Both promotions were carefully deliberated by the Board pursuant to a succession planning process that commenced in early 2019. Our executive leadership changes were well executed as part of our strategic transition plan.

Our View and Our Outlook

Inventive, adaptive and forward-thinking, Atlas Air Worldwide is a leading global provider of outsourced aircraft and aviation operating services. With service to 400 destinations in 90 countries, we believe the scale and scope of our operations are unrivaled. As such, Atlas is well-positioned to navigate through the current economic uncertainty and coronavirus outbreak, and to play an important role in the movement of essential goods around the world, particularly during these times of need. There are so many people who depend on the goods we carry, including supplies and daily necessities, now more than ever.

Leading the way forward, we continue to leverage our core competencies and market leadership to execute on strategic opportunities and initiatives, and further shape our future.

Though the spread of the novel coronavirus has created ongoing uncertainty, our business view and outlook remains positive and is focused on several important themes.

Our thoughts about the strength of our business and the future begin with the company's strategic principles.

First, and always, maintaining safety, security and compliance is our top corporate priority. We will continue to promote a safe, compliant operation in everything we do.

We also have a tremendous team of highly experienced, customer-focused employees who bring diverse skill sets to help us drive our business forward.

We have a strong core of long-term customers, and we play a key role in their operating networks.

These are customers that we value, including DHL, Amazon, Asiana Cargo, Boeing, FedEx, Nippon Cargo Airlines, Qantas, UPS, the U.S. military and the National Football League, as well as many other airlines, freight forwarders, charter brokers, sports teams and direct shippers.

We have a modern, diversified fleet that provides customers the biggest and broadest array of aircraft for international, regional and domestic cargo and passenger operations.

We are a major player in express, e-commerce, the U.S. military and fast-growing markets. We are also a significant player in the transpacific, the growing market between South America and the rest of the world, and in the U.S.

We are constantly focused on operating efficiencies, cost management, and the on-time performance that our customers expect. Similarly, we are focused on ensuring that our resources are put to the most profitable use.

And we have a disciplined capital allocation strategy, with a focus on maintaining a strong balance sheet.

2019 Performance Highlights and Key Accomplishments

We continued to strengthen our leadership position in global aviation outsourcing during 2019 despite challenging global airfreight and economic conditions.

We flew our highest block hours ever, and we delivered record operating revenue.

While our full-year reported results reflected a loss from continuing operations, net of taxes, which included a noncash special charge partially offset by an unrealized gain on financial instruments, on an adjusted basis, we generated earnings that were among the best in company history.

We have driven substantial growth in the scale, diversity and profitability of our business over the past several years, establishing a solid platform from which to capitalize on our achievements and our future opportunities.

Key initiatives in 2019 that we expect our business to benefit from in 2020 and going forward included:

Over the next several years, the joint venture intends to develop a diversified freighter-aircraft leasing portfolio with an anticipated value of approximately $1 billion. Importantly, the joint venture is consistent with our corporate strategy, aiming to capitalize on the growing demand for cargo aircraft in the express and e-commerce markets.

First-Quarter 2020 Performance Highlights

Our first-quarter 2020 results reflected an increase in demand and higher airfreight yields in March. They also reflect the vital role that we play in supporting the global economy and our customers by keeping goods moving.

We are pleased to report that our first-quarter 2020 net income increased to $23.4 million, as compared to a reported loss of $29.7 million in the first quarter of 2019. On an adjusted basis, EBITDA* totaled $121.2 million in the first quarter this year compared with $120.4 million in the first quarter of 2019. In addition, our adjusted net income* in the first quarter of 2020 totaled $29.9 million compared with $27.3 million in the prior-year period.

We are grateful to be able to provide relief to businesses and communities in the fight against COVID-19. In addition to our commercial operations, we have donated services to transport critical personal protective equipment and other necessary supplies to affected areas, and have also made charitable contributions to organizations that help those in need.

The strong demand for airfreight has carried into the second quarter. To capitalize and serve that demand, we have reactivated three of our 747 converted freighters that had been parked, and began operating a 777F that was previously in our dry-leasing business.

Positioned for 2020 and Beyond

Though these are extraordinary times, with the future uncertainty caused by the novel coronavirus, we believe Atlas Air Worldwide is well-positioned for continued success in 2020 and beyond.

We have driven substantial growth in our business over the past several years, establishing a solid platform from which to capitalize on our achievements and our future opportunities.

Airfreight serves the global community by keeping necessary goods flowing at very important times of need.

Airfreight is also a vital element in a modern, global economy, fostering international trade, providing efficient access to markets, and contributing to global economic development.

As history has taught us through other crises, airfreight plays a key role in not only delivering relief supplies in times of need, but also in facilitating the movement of goods as the global supply chain rebalances. In fact, airfreight typically rebounds more quickly during periods of economic recovery.

In the near-term, we are currently accommodating special charter demand, and we are well-prepared for the anticipated surge of volumes once business and economic conditions recover.

Looking ahead, we have a strong core of long-term customers, and will continue to play an important role in their operating networks, especially as they navigate challenging times.

We have a strategic focus on faster-growing global airfreight markets, and will continue to leverage our significant commercial charter business to capitalize on demand.

Together with the exceptional teamwork of our employees and the guidance of our board of directors, Atlas Air Worldwide remains innovative, adaptive and forward-looking — leading the outsourced aviation sector, driving ahead

with our strategic initiatives, serving the needs of the global community and delivering value to our customers and shareholders.

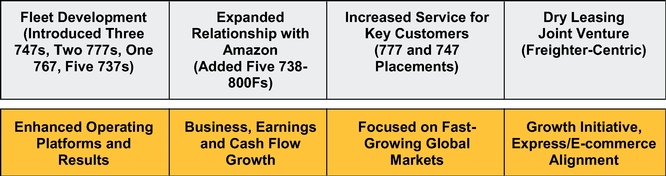

Continued Alignment of Strategy, Performance and Executive Compensation

Our operating results are a reflection of our leadership in international aviation outsourcing, despite the impact that recent macroeconomic conditions have had on airfreight demand. Key accomplishments in a challenging 2019 included the introduction of 11 aircraft to our operating fleet in response to customer demand for our services; continued progress on our initiative to provide air transport services for Amazon; expanded relationships with existing customers, including Asiana Cargo, DHL Express, Qantas, Nippon Cargo Airlines, the U.S. military and the National Football League; and the establishment of a joint venture with Bain Capital Credit to develop a diversified freighter-aircraft dry-leasing portfolio with a value of approximately $1 billion. In January 2020, we established a new relationship with EL AL Israel Airline Ltd. Our long-term strategy is to continue to move more deeply into the faster-growing areas of global airfreight. Driving our execution of this strategy are an experienced, dedicated team of employees focused on our customers' expectations; a modern, superior fleet tailored to meet our customers' unique needs; a broad array of value-added, global operating services; and a disciplined financial structure.

Our 2019 executive compensation programs were thoughtfully structured to align with our long-term strategy and drive our operational performance and deliver financial results. Shareholder feedback has been and will continue to be influential in shaping our governance and executive compensation programs and practices.

Recent Governance Enhancements

We regularly conduct ongoing reviews of our governance practices to incorporate specific feedback from shareholders and to ensure that we maintain best practices and enhanced disclosure in our proxy statement and other SEC filings. As a result, we implemented several noteworthy changes since our last shareholder meeting. Among other changes, we (1) oversaw successfully executed CEO and COO transitions; (2) amended our Corporate Governance Principles to provide for a Lead Independent Director position; (3) amended our Nominating and Governance Committee Charter to add technological competence to the list of core competencies to be possessed by the Board as a whole; (4) amended our Corporate Governance Principles to provide that our Directors may now serve on no more than three public company audit committees (including the Company's Audit Committee); (5) published our initial ESG report, Caring for the World We Carry, which may be viewed on our corporate website at https://www.atlasairworldwide.com/esg-pages/esg-report/; and (6) simplified the presentation of information in our 2019 Annual Report on Form 10-K to enhance the ability of investors to efficiently review our disclosures.

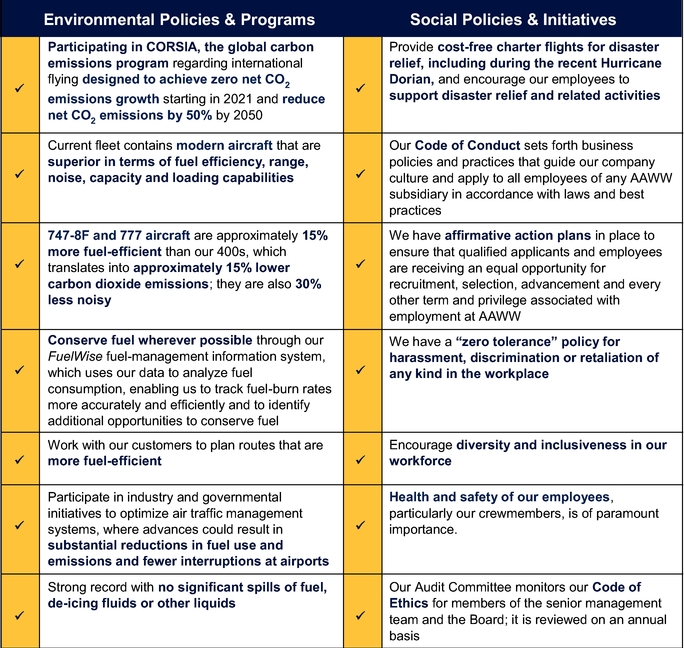

Continued Focus on our Environmental, Social and Governance Commitment

We believe that our long-term growth and success as an aviation leader will be achieved by partnering with our stakeholders to sustain and protect our natural resources, empower our employees and business partners, and demonstrate transparency and accountability through responsible corporate governance. Examples of how we strive to maintain sound business practices and long-term, sustainable strategies that are designed to promote our commitment to environmental, governance and social matters include the following, among others:

Please see the section titled "Environmental, Social and Governance" for a discussion of the various ways we address these matters, which we view as an important part of our business.

We look forward to our continued dialogue with you and welcome your feedback as we execute our strategy and focus on sustainable, long-term value creation. Please feel free to share your thoughts or concerns with us. Communications may be addressed to the Board in care of the Office of the Secretary, Atlas Air Worldwide Holdings, Inc., 2000 Westchester Avenue, Purchase, NY 10577, or e-mailed to corporate.secretary@atlasair.com.

We value your input and thank you for your investment and ongoing support.

William J. Flynn, Chairman

Duncan J. McNabb, Lead Independent Director

Timothy J. Bernlohr

Charles F. Bolden, Jr.

John W. Dietrich

Bobby J. Griffin

Carol B. Hallett

Jane H. Lute

Sheila A. Stamps

John K. Wulff

In Memoriam

Our Company was deeply saddened by the loss of Flight 3591 in February 2019, which claimed the lives of two of our pilots and a third pilot from another airline traveling with them. Our thoughts and prayers remain with their families, and we will continue to provide them care and support. The safety of our pilots and ground staff is our top priority, and we mourn the passing of our valued colleagues.

We also mourn the passing of the Chairman of our Board, Robert (Bob) Agnew, in August 2019. Bob was a member of the Atlas Air Worldwide board since July 2004, and was named Chairman in 2017. His leadership, extensive knowledge of the aviation industry, and depth of corporate expertise made him a tremendous asset to the board and to our Company.

Notice of 2020 |

To be held on June 9, 2020

We will hold the 2020 Annual Meeting of Shareholders of Atlas Air Worldwide Holdings, Inc., a Delaware corporation, on Tuesday, June 9, 2020, at 10:00 a.m., Eastern Daylight Time. The Annual Meeting will be held online, accessed through the sitewww.meetingcenter.io/271627362, to consider and act upon the following proposals:

The foregoing matters are described in more detail in the Proxy Statement that is attached to this notice.

Only shareholders of record at the close of business on April 20, 2020, which date has been fixed as the record date for notice of the Annual Meeting of Shareholders, are entitled to receive this notice and to vote at the meeting and any adjournments thereof.

Because the Annual Meeting is virtual and being conducted online only, shareholders will not be able to physically attend the Annual Meeting. To ensure your representation at the Annual Meeting, we urge you to complete, sign and date your proxy card and return it in the postage prepaid envelope provided for that purpose. The Proxy Statement accompanying this notice describes each of the items of business listed above in more detail.

The accompanying Proxy Statement includes further information about how to attend the Annual Meeting online, vote your shares online at the Annual Meeting, and submit questions online during the Annual Meeting. Please read this information carefully.

| By Order of the Board of Directors | ||||

ADAM R. KOKAS Executive Vice President, General Counsel and Secretary |

May 8, 2020

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 9, 2020

This Proxy Statement and the AAWW 2019 Annual Report are available for

downloading, viewing and printing at https://www.ezodproxy.com/atlasair/2020.

PROXY SUMMARY |

2019 Performance Highlights |

Overview of Business

We are a leading global provider of outsourced aircraft and aviation operating services. We operate the world's largest fleet of 747 freighters and provide customers a broad array of 747, 777, 767, and 737 aircraft for domestic, regional and international cargo and passenger operations. Our fleet total at 2019 year end was 123 aircraft, including the 11 we introduced in 2019 in response to customer demand for our services.

We provide unique value to our customers by giving them access to a wide range of modern, efficient aircraft, combined with outsourced aircraft operating services that we believe lead the industry in terms of quality and global scale. We operated 65,000 flights serving 400 destinations in 90 countries in 2019, reflecting our far-reaching global scale and scope.

Our customers include express delivery providers, e-commerce retailers, airlines, freight forwarders, the U.S. military, and charter brokers. We provide global services with operations in Africa, Asia, Australia, Europe, the Middle East, North America, and South America.

We are proud to play such an important role in facilitating the movement of essential goods around the world, particularly during times of important need. With the emergence of the novel coronavirus (COVID-19), more people than ever before are depending on the goods we carry, including food, pharmaceuticals, supplies and other daily necessities to support their well-being.

2019 Performance Highlights and Key Accomplishments

We continued to strengthen our leadership position in global aviation outsourcing during 2019 despite challenging global airfreight and economic conditions.

We flew our highest block hours ever, and we delivered record operating revenue.

While our full-year reported results reflected a loss from continuing operations, net of taxes, which included a noncash special charge partially offset by an unrealized gain on financial instruments, on an adjusted basis, we generated earnings that were among the best in company history.

i

| PROXY SUMMARY |

We have driven substantial growth in the scale, diversity and profitability of our business over the past several years, establishing a solid platform from which to capitalize on our achievements and our future opportunities.

Key initiatives in 2019 that we expect our business to benefit from in 2020 and going forward included:

Continued Growth Opportunities

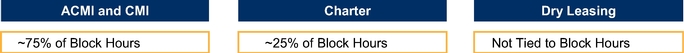

Our financial and operating performance in 2019 reflected the leadership of our ACMI and Charter businesses, the annuity-like contribution of our Dry Leasing operations, ongoing efficiency and productivity initiatives, and a disciplined balance sheet focus.

Despite current market challenges, we see continuing opportunity for long-term growth in our key markets, fueled by an expanding global middle class and higher levels of disposable income. Further globalization will require expansive and time-definite air networks to facilitate the domestic, regional, and international flow of goods.

While directing our operating platforms and our fleet during 2019, we continued to maintain a lean management structure.

In addition, we continued to execute on strategic initiatives to enrich our business mix, generate cost savings through operating efficiencies and other continuous improvement initiatives, and enhance our portfolio of assets and services. Our actions continue to position us to capitalize on both near- and long-term market opportunities.

ii

PROXY SUMMARY |

Disciplined and Balanced Capital Allocation Strategy

We are committed to creating, enhancing and delivering value to our shareholders. Our commitment reflects a disciplined and balanced capital allocation strategy that has focused on maintaining a strong balance sheet and investing in modern, efficient assets.

2019 Capital Allocation Actions:

First-Quarter 2020 Performance Highlights

Our first-quarter 2020 results reflected an increase in demand and higher airfreight yields in March. They also reflect the vital role that we play in supporting the global economy and our customers by keeping goods moving.

We are pleased to report that our first-quarter 2020 net income increased to $23.4 million, as compared to a reported loss of $29.7 million in the first quarter of 2019. On an adjusted basis, EBITDA* totaled $121.2 million in the first quarter this year compared with $120.4 million in the first quarter of 2019. In addition, our adjusted net income* in the first quarter of 2020 totaled $29.9 million compared with $27.3 million in the prior-year period.

We are grateful to be able to provide relief to businesses and communities in the fight against COVID-19. In addition to our commercial operations, we have donated services to transport critical personal protective equipment and other necessary supplies to affected areas, and have also made charitable contributions to organizations that help those in need.

The strong demand for airfreight has carried into the second quarter. To capitalize and serve that demand, we have reactivated three of our 747 converted freighters that had been parked, and began operating a 777F that was previously in our dry-leasing business.

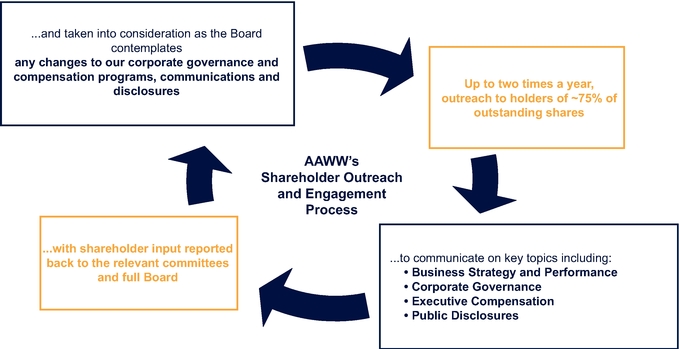

Shareholder Outreach, Engagement and Responsiveness |

We have engaged in extensive ongoing shareholder outreach for almost a decade to better understand our shareholders' perspectives and consider ideas for improvements to, among other things, our corporate governance, sustainability, and executive compensation practices, as well as our business strategy and performance, capital allocation strategy, and public disclosures. This year, we again engaged in a robust shareholder outreach program, reaching out to shareholders representing approximately two-thirds of our outstanding shares, establishing a dialogue with our newer shareholders, and maintaining a dialogue with those with which we have built a

iii

| PROXY SUMMARY |

long-standing relationship. Based on the relationships we have solidified over the years, certain of our institutional shareholders provided positive feedback without the desire for a formal meeting. We have made changes over the past several years to our governance and executive compensation practices in response to insights gained during these discussions.

During all shareholder outreach meetings, we sought input on our overall pay program, as well as emerging topics of expressed shareholder interest, such as environmental, social and governance ("ESG") matters. We received many supportive and positive comments on the Company's direction (both from a business growth and governance perspective), and on changes made to our pay and governance programs, including our pay program changes and our board rotation/refreshment and outlook, among others.

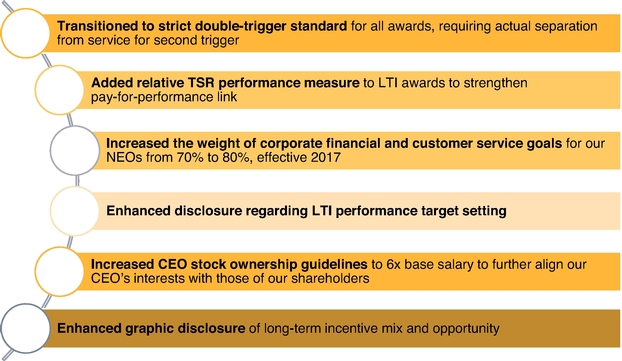

As a result of specific feedback from shareholders and to ensure that our programs reflect best practices, we have made a number of changes to our compensation program, practices, and disclosures over recent years, and made changes to our governance practices in response to topics of importance raised by shareholders. Examples of feedback that we have received are also included below.

Summary of Recent Key Messages and Actions Related to Shareholder Outreach

| | | | | | | | | | | | | |

| Topic | | | What We Heard From Our Shareholders | | |||||||

| | | | | | | | | | | | | |

| Board Composition and Refreshment | • Supportive of extensive board refreshment in recent years, including emphasis on strengthening needed board skills/experience, in addition to expansion of gender and other diversity | ||||||||||

| | | | | | | | | | | | | |

| ESG/Sustainability | • Investors continued to encourage our focus on ESG factors and commitment to strong ESG practices | ||||||||||

|

| • Investor interest in sustainability continues to gain momentum as investors seek to gain a deeper understanding of the Company's focus on, and commitment to, ESG matters | ||||||||||

| | | | | | | | | | | | | |

| Liquidity Goal | • For awards granted in 2020, we added a new Liquidity performance goal to our Annual Incentive Plan to further align our compensation program with our shareholders' interests | ||||||||||

| | | | | | | | | | | | | |

| Favorability of Relative LTI Metrics | • Support for the use of a Total Shareholder Return ("TSR") metric with a thoughtful broad comparator group and no upward modification in the event the absolute total shareholder return is negative (even if the Comparative TSR performance achieved would have provided for an upward adjustment) | ||||||||||

| | | | | | | | | | | | | |

| Meaningful Share Ownership Guidelines | • Support for increased share ownership levels for the CEO and other executives to further align the interests of management with those of shareholders | ||||||||||

| | | | | | | | | | | | | |

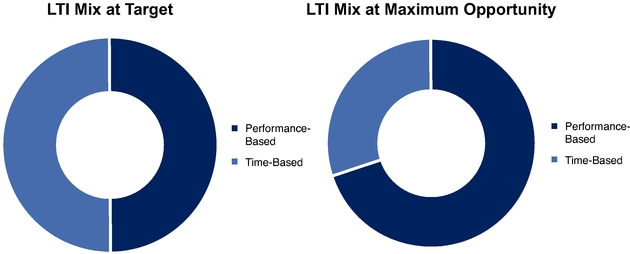

| Percentage Weighting of Performance-based LTI Awards | • Support for our performance-based versus time-based LTI weighting of 50%/50% | ||||||||||

| | | | | | | | | | | | | |

| Compensation Structure to Limit Inappropriate Risk Taking | • Investors continued to encourage our ongoing monitoring and review of our executive compensation program to identify potential sources of material risk within the program design and administration | ||||||||||

|

| • Support for comprehensive risk assessment performed annually by independent compensation consultant | ||||||||||

| | | | | | | | | | | | | |

| Peer Group Selection | • Supportive of revised, revamped peer group that more closely reflects the global nature and structure of our business and operations | ||||||||||

| | | | | | | | | | | | | |

iv

PROXY SUMMARY |

We regularly conduct ongoing reviews of both our governance and executive compensation practices to ensure that we maintain best practices and enhanced disclosure in our proxy statement and other SEC filings. We have also worked to expand and enhance our public disclosure around the topics of interest to our shareholders during these discussions.

In general, our outreach program has targeted shareholders representing up to 75% of our outstanding shares, with investor discussions occurring throughout the year on relevant topics and on the evolving governance and sustainability landscapes in the off-season and during the proxy season, as appropriate.

The diagram below represents our ongoing shareholder outreach process.

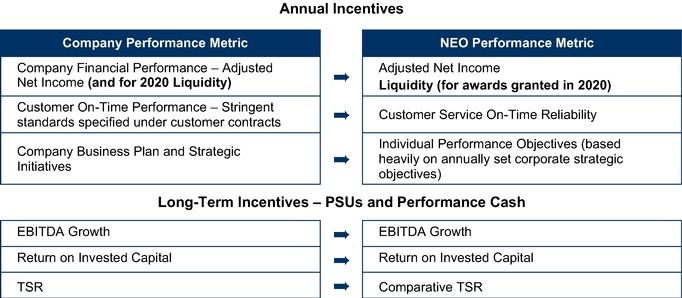

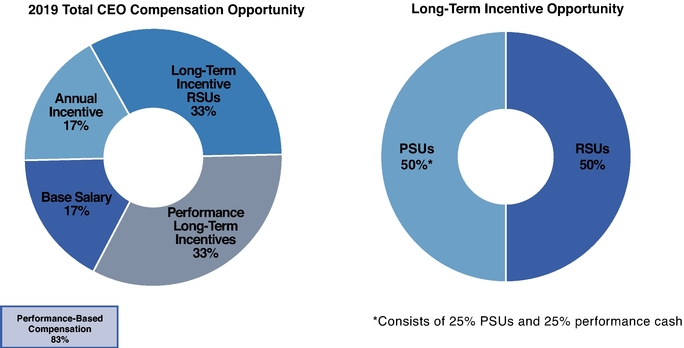

Compensation Program that Aligns Pay and Performance |

Our compensation programs are designed to drive achievement of our business strategies and to provide competitive opportunities. Accordingly, achievement of most of those opportunities depends on the attainment of certain performance goals tied to Company performance. Our compensation programs are designed to provide compensation that:

In making compensation decisions for 2019, the Compensation Committee considered our operating strategy and goals, as well as comments received through our shareholder outreach program. In response to shareholder feedback, we adopted some very significant and impactful changes, as described in this summary and the Compensation Discussion and Analysis.

v

| PROXY SUMMARY |

The Company's 2019 performance metrics that we believe are important to our shareholders are the same metrics that we used in our incentive plans in 2018:

Strong, Well-Balanced Corporate Governance Practices |

Corporate Governance Highlights

We have an abiding commitment to good governance as illustrated by the following practices:

vi

PROXY SUMMARY |

Shareholders should note that while the Board does not follow formal age and tenure policies, it is the Board's current expectation that Chairs (Board and Committees) will generally serve from three to five years and that members of the Board will generally serve 12 to 15 years. Both the Board and the Nominating and Governance Committee review Board and Committee composition, tenure, refreshment, and rotation matters on a regular basis.

Director Leadership Highlights |

We have made significant and meaningful efforts over the last several years to refresh the leadership and composition of our Board. Our Directors possess the right skills and experience to oversee our business and strategy. Our Board is committed to diversity and inclusion. Individuals are selected to join the Board based on their business and professional experience, the diversity of their background and their array of talents and perspectives. The Nominating and Governance Committee memorialized this commitment to diversity in its Charter and firmly believes that diversity should be a factor in assessing the Board's core competencies as a whole.

2019 Executive Leadership Transitions

As described in greater detail in "The Company" section of this Proxy Statement, we successfully named a new Chief Executive Officer and Chief Operating Officer during 2019, with John W. Dietrich succeeding William J. Flynn as President and Chief Executive Officer, effective as of January 1, 2020, and James A. Forbes replacing Mr. Dietrich as Executive Vice President and Chief Operating Officer, effective as of January 1, 2020. Mr. Dietrich and Mr. Forbes are both long-standing and high-performing employees of the Company and both possess a substantial background and extensive experience in the air freight industry. In tandem with these executive changes, we revised our Board leadership structure with Mr. Flynn replacing the late Robert F. Agnew as Chairman of the Board and the creation of a Lead Independent Director role, with Duncan J. McNabb, former Chairman of our Nominating and Governance Committee, assuming this new position. In addition, we appointed Bobby J. Griffin as Chairman of our Nominating and Governance Committee to succeed Mr. McNabb.

vii

| TABLE OF CONTENTS |

TABLE OF CONTENTS

| Page | ||||

General Information | 1 | |||

| | | | | |

About the Annual Meeting | 4 | |||

| | | | | |

Record Date and Voting Securities | 4 | |||

| | | | | |

Quorum, Vote Required | 4 | |||

| | | | | |

Attending the Annual Meeting | 5 | |||

| | | | | |

Submitting a Question at the Annual Meeting | 6 | |||

| | | | | |

Voting at the Annual Meeting | 6 | |||

| | | | | |

Proposal No. 1 – Election of Directors | 7 | |||

| | | | | |

Director Core Competencies | 7 | |||

| | | | | |

Nominees for Director | 10 | |||

| | | | | |

Corporate Governance, Board and Committee Matters | 20 | |||

| | | | | |

Board Leadership Structure | 20 | |||

| | | | | |

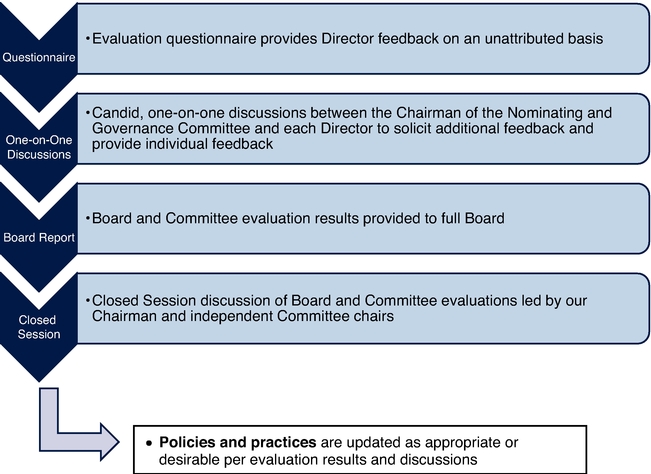

Board Effectiveness and Annual Assessment | 22 | |||

| | | | | |

Board Refreshment | 23 | |||

| | | | | |

Board Oversight of Strategy | 24 | |||

| | | | | |

Board Oversight of Risk-Mitigation Process | 24 | |||

| | | | | |

Director Independence | 26 | |||

| | | | | |

Active and Engaged Board | 27 | |||

| | | | | |

Executive Sessions | 28 | |||

| | | | | |

Communications with the Board | 28 | |||

| | | | | |

Environmental, Social and Governance | 29 | |||

| | | | | |

Code of Ethics and Employee Handbook | 30 | |||

| | | | | |

Anti-Hedging, Anti-Pledging Policies | 31 | |||

| | | | | |

Compensation of Nonemployee Directors | 31 | |||

| | | | | |

Board and Committee Information | 33 | |||

| | | | | |

Nominating and Governance Committee | 33 | |||

| | | | | |

Audit Committee | 35 | |||

| | | | | |

Compensation Committee | 36 | |||

| | | | | |

Compensation Discussion and Analysis | 39 | |||

| | | | | |

Overview | 40 | |||

| | | | | |

Discussion of Our Compensation Program | 46 | |||

| | | | | |

Compensation Committee Report | 59 | |||

| | | | | |

Compensation Tables and Explanatory Notes | 60 | |||

| | | | | |

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement |

TABLE OF CONTENTS |

| Page | ||||

Pay Ratio | 74 | |||

| | | | | |

Proposal No. 2 – Ratification of PricewaterhouseCoopers LLP as the Company's Independent Registered Public Accounting Firm for 2020 | 76 | |||

| | | | | |

Proposal No. 3 – Advisory Vote to Approve the Compensation of Our Named Executive Officers | 78 | |||

| | | | | |

Proposal No. 4 – Approval of an Amendment to our 2018 Incentive Plan | 80 | |||

| | | | | |

Stock Ownership | 89 | |||

| | | | | |

Beneficial Ownership Table | 89 | |||

| | | | | |

Delinquent Section 16(a) Reports | 91 | |||

| | | | | |

Certain Relationships and Related Person Transactions | 91 | |||

| | | | | |

Deadline for Receipt of Shareholder Proposals to be Presented at the 2021 Annual Meeting | 92 | |||

| | | | | |

Shareholder Proposals to Be Included in Our 2021 Proxy Statement | 92 | |||

| | | | | |

Proxy Access Notice Procedures | 92 | |||

| | | | | |

Advance-Notice Procedures | 92 | |||

| | | | | |

Additional Information | 92 | |||

| | | | | |

Shares Registered in the Name of a Bank, Broker or Nominee | 92 | |||

| | | | | |

Broker Non-Votes | 93 | |||

| | | | | |

Revocability of Proxies | 93 | |||

| | | | | |

Proxy Solicitation | 93 | |||

| | | | | |

Proxy Tabulation | 93 | |||

| | | | | |

Separate Voting Materials | 93 | |||

| | | | | |

List of Shareholders | 94 | |||

| | | | | |

Additional Copies of Annual Report | 94 | |||

| | | | | |

Limited Voting by Foreign Owners | 94 | |||

| | | | | |

Extent of Incorporation by Reference of Certain Materials | 95 | |||

| | | | | |

Other Matters | 96 | |||

| | | | | |

Exhibits | ||||

| | | | | |

| Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| GENERAL INFORMATION |

ATLAS AIR WORLDWIDE HOLDINGS, INC.

2000 Westchester Avenue

Purchase, New York 10577

PROXY STATEMENT |

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the "Board of Directors" or "Board") of Atlas Air Worldwide Holdings, Inc., a Delaware corporation ("AAWW" or the "Company"), for use at the Annual Meeting of Shareholders (the "Annual Meeting") to be held on Tuesday, June 9, 2020, at 10:00 a.m., Eastern Daylight Time, and at any adjournments or postponements of the Annual Meeting. The Annual Meeting will be held online, accessed through the sitewww.meetingcenter.io/271627362. It is expected that this Proxy Statement and the accompanying proxy will first be mailed or delivered to shareholders beginning on or about May 11, 2020. Proxies may be solicited in person, by telephone or by mail, and the costs of such solicitation will be borne by AAWW.

AAWW is a leading global provider of outsourced aircraft and aviation operating services. We operate the world's largest fleet of 747 freighters and provide customers with a broad array of 747, 777, 767 and 737 aircraft for domestic, regional and international cargo and passenger operations.

AAWW is a holding company with two wholly owned operating subsidiaries, Atlas Air, Inc. ("Atlas") and Southern Air, Inc. ("Southern"). We also have a 51% economic interest and a 75% voting interest in Polar Air Cargo Worldwide, Inc. ("Polar"). In addition, we are the parent company of several wholly owned subsidiaries related to our dry leasing services (collectively referred to as "Titan"). Except as otherwise noted, AAWW, Atlas, Southern and Titan (along with all other entities included in AAWW's consolidated financial statements) are collectively referred to herein as the "Company," "AAWW," "we," "us," or "our."

Combined with Polar, AAWW provides ACMI, CMI, Charter and Dry Leasing services to DHL Express ("DHL") in support of DHL's transpacific express, North American, intra-Asian and global networks. Additionally, we fly between the Asia Pacific region, the Middle East and Europe on behalf of DHL and other customers. Atlas also provides incremental charter capacity to Polar and DHL Express from time to time.

Our primary service offerings include the following:

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement | 1

THE COMPANY |

We currently operate our service offerings through the following reportable segments: ACMI, Charter, and Dry Leasing.

2019 Executive Leadership Transitions

Fiscal 2019 was a period of transition for us as we announced that William J. Flynn would transition from his role as our President and Chief Executive Officer, positions he held since joining the Company in 2006. Effective as of July 1, 2019, Mr. Flynn stepped down as President of the Company and, effective as of January 1, 2020 (the "Transition Date"), he retired from his position as Chief Executive Officer. At that time, Mr. Flynn also ceased to serve as an executive, officer or employee of the Company. In connection with Mr. Flynn's transition and effective as of July 1, 2019, the Board appointed John W. Dietrich, our then-current Executive Vice President and Chief Operating Officer, to serve as our President and Chief Operating Officer and, effective as of the Transition Date, Mr. Dietrich began serving as our President and Chief Executive Officer. Mr. Dietrich also joined our Board of Directors at that time.

After stepping down as President of the Company, Mr. Flynn continued to serve as a Director and was appointed the Chairman of the Board on August 22, 2019, following the passing of our prior Board Chairman, Robert F. Agnew. Mr. Flynn continues to serves as our non-executive Chairman, though he is not considered an independent Director under certain rules promulgated by the SEC and Nasdaq.

In addition, in October 2019, after considering several highly qualified candidates, we announced that effective January 1, 2020, James A. Forbes would succeed Mr. Dietrich and be promoted to Executive Vice President and Chief Operating Officer of the Company. Mr. Forbes brings exceptional qualifications and extensive experience to his new role. He has over 40 years of aviation operating experience, including more than 20 years with the Company.

The Board believes that CEO succession planning is one of its most important oversight responsibilities. In early 2019, the Board appointed a special committee consisting of Messrs. Flynn, Griffin and McNabb and Ms. Hallett to assist the Board in its final selection of a new President and Chief Executive Officer. The Board, with the assistance of the special committee, developed a candidate profile for the successor President and Chief Executive Officer based on Company culture and strategy, among other things. Leadership qualities considered important by the special committee and the Board included cultural fit (ability to engage, collaborate and inspire), breadth of perspective (being a multi-level thinker, as well as a strategic thinker), and effectiveness at execution and follow-through (decisiveness, persuasiveness, accountability and discipline), among others. The ability to help devise and to drive strategy and execute the Company's business plan was also considered an important trait by the special committee and the Board.

Based on the profile described above, the special committee and the Board determined that our four then-current Executive Vice Presidents, namely Messrs. Dietrich, Kokas, Schwartz, and Steen, were highly able, experienced, and qualified candidates to succeed Mr. Flynn as Chief Executive Officer and that retention of an executive search

2 | Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| THE COMPANY |

firm to identify external candidates was unnecessary. Each of these Executive Vice Presidents was a long-standing senior executive of AAWW, and each had access to, and interaction with, the members of the Board for many years. Each candidate was vetted fully by the members of the special committee. After extensive deliberation, the special committee determined that Mr. Dietrich best met the candidate profile devised by the Board and recommended that Mr. Dietrich succeed Mr. Flynn initially as President and Chief Operating Officer and ultimately as President and Chief Executive Officer after the Transition Date. The full Board concurred unanimously with this assessment and recommendation. The Board acknowledged Mr. Dietrich's over 30 years of experience in the aviation and air cargo industries, including more than 20 years with the Company. During his tenure with the Company, Mr. Dietrich has served as our Chief Operating Officer, General Counsel, Corporate Secretary, Chief Communications Officer, and Chief Human Resources Officer.

As described elsewhere in this proxy statement, in conjunction with our CEO succession planning, we actively considered our Board leadership structure and determined that our Board and our Company would be best served by having Mr. Flynn replace Mr. Agnew initially as Chairman of the Board and Chief Executive Officer and to continue as non-executive Chairman of the Board after the Transition Date. As our shareholders know, we are committed to maintaining strong independent leadership, which we have established through a robust, independent Lead Director role (currently filled by Duncan J. McNabb, former Chairman of the Nominating and Governance Committee) that is ably supported by the independence and diversity of our Board as a whole. In connection with the aforementioned changes, Bobby J. Griffin, who has extensive corporate governance experience, was elected as the new Chairman of the Nominating and Governance Committee to succeed Mr. McNabb. We will continue to re-evaluate our Board leadership structure from time to time to ensure that it aligns with the evolving circumstances and needs of our Company.

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement | 3

ABOUT THE ANNUAL MEETING |

At our Annual Meeting, the holders of shares of our Common Stock, par value $0.01 per share (the "Common Stock"), will act upon the matters outlined in the notice of meeting at the beginning of this Proxy Statement, in addition to transacting such other business, if any, as may properly come before the meeting or any adjournments or postponements thereof. The shares represented by your proxy will be voted as indicated on your proxy, if properly executed. If your proxy is properly signed and returned, but no directions are given on the proxy, the shares represented by your proxy will be voted:

In addition, if any other matters are properly submitted to a vote of shareholders at the Annual Meeting, the accompanying form of proxy gives the proxy holders the discretionary authority to vote your shares in accordance with their best judgment on that matter. Unless you specify otherwise, it is expected that your shares will be voted on those matters as recommended by our Board of Directors, or if no recommendation is given, in the proxy holders' discretion.

For additional information regarding our Annual Meeting, see "Additional Information" at the end of this Proxy Statement.

Record Date and Voting Securities |

All of our shareholders of record at the close of business on April 20, 2020 (the "Record Date") are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. As of the Record Date, there were 26,126,559 shares of Common Stock issued and outstanding. Each outstanding share of Common Stock will be entitled to one vote on each matter considered at the Annual Meeting. A description of certain restrictions on voting by shareholders who are not "U.S. citizens," as defined by applicable laws and regulations, can be found in "Additional Information — Limited Voting by Foreign Owners" at the end of this Proxy Statement.

Quorum, Vote Required |

A majority of the outstanding shares of Common Stock as of the Record Date must be present, in person or by proxy, at the Annual Meeting to have the required quorum for the transaction of business. If the number of shares of Common Stock present in person and by proxy at the Annual Meeting does not constitute the required quorum, the Annual Meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

Proposal No. 1: Election of Directors. In an uncontested election, a Director is elected by a majority of the votes cast (the number of shares voted "For" a Director-Nominee must exceed the number of votes cast "Against" that Director-Nominee). Shares voting "Abstain" or broker non-votes will have no effect on the election of Directors. Brokers, banks, and other nominees have no discretionary voting power in respect of this item.

Proposal No. 2: Ratification of the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2020. The affirmative vote of a majority of the shares represented at the Annual Meeting, either in person or by proxy and entitled to vote on this proposal is required to ratify the selection of PricewaterhouseCoopers LLP. Shares voting "Abstain" will have

4 | Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| ABOUT THE ANNUAL MEETING |

the same effect as a vote "Against" this Proposal 2. Brokers, banks, and other nominees have discretionary voting power in respect of this item.

Proposal No. 3: Advisory Vote to Approve the Compensation of the Company's NEOs. Because Proposal 3 asks for a nonbinding, advisory vote, there is no "required vote" that would constitute approval. We value highly the opinions expressed by our shareholders in this advisory vote, and our Compensation Committee, which is responsible for overseeing and administering our executive compensation programs, will consider the outcome of the vote when designing our compensation programs and making future compensation decisions for our NEOs. Shares voting "Abstain" will have the same effect as a vote "Against" this Proposal 3. Broker non-votes will have no effect on this nonbinding advisory vote. Brokers, banks, and other nominees have no discretionary voting power in respect of this item.

Proposal No. 4: Approval of an Amendment to our 2018 Incentive Plan. The affirmative vote of a majority of the shares represented at the Annual Meeting, either in person or by proxy and entitled to vote on this proposal, is required to approve the amendment to our 2018 Incentive Plan to increase the number of shares that are available for issuance of awards under such plan. Shares voting "Abstain" or broker non-votes will have no effect on approval of the amendment to our 2018 Incentive Plan. Brokers, banks, and other nominees have no discretionary voting power in respect of this item.

Attending the Annual Meeting |

General

We will host the Annual Meeting live online via the Internet. You may attend the Annual Meeting live online by visitingwww.meetingcenter.io/271627362. The Meeting will start at 10:00 a.m. Eastern Daylight Time on Tuesday, June 9, 2020. All shareholders are entitled to attend the Annual Meeting; however, you are entitled to participate, meaning vote and submit questions, at the Annual Meeting only if you were a shareholder of record as of the close of business on the record date of April 20, 2020, or if you were a beneficial owner of AAWW shares as of the record date and you register in advance in accordance with the instructions below.

The virtual Annual Meeting will begin promptly at 10:00 am, Eastern Daylight Time, on Tuesday, June 9, 2020. Online access to the audio webcast will open 15 minutes prior to the start of the Annual Meeting. Shareholders are encouraged to access the Annual Meeting prior to the start time and allow ample time to log into the audio webcast and test their computer systems.

Shareholders of Record

If you are a shareholder of record, then you do not need to register to virtually attend and participate in the Annual Meeting. You may attend and participate by accessing www.meetingcenter.io/271627362 and selecting "I have a Control Number." Enter the control number shown on your proxy card and the password for the Meeting, which is AAWW2020. If you cannot locate your proxy card but would still like to attend the Annual Meeting, you can join as a guest by selecting "I am a guest." You should note that guest attendees will not be allowed to vote or submit questions at the Annual Meeting.

Beneficial Owners

If you hold your AAWW shares in "street name," meaning a bank, broker or other nominee is the shareholder of record of your shares, you must register in advance to attend and participate in the virtual Annual Meeting. To register online in advance, you must first obtain a legal proxy from your bank, broker or other nominee. Once you have received a legal proxy from your bank, broker or other nominee, please email a scan or image of it to our transfer agent and registrar, Computershare Trust Company, N.A. ("Computershare") at legalproxy@computershare.com with "Legal Proxy" noted in the subject line. If you request a legal proxy from your bank, broker or other nominee, you should note that the issuance of the legal proxy will invalidate any prior voting instructions you have given and will

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement | 5

ABOUT THE ANNUAL MEETING |

prevent you from giving any further voting instructions to your bank, broker or other nominee to vote on your behalf and, in that case, you would only be able to vote at the virtual Annual Meeting.

Requests for registration must be received by Computershare no later than 5:00 p.m., Eastern Daylight Time, on June 4, 2020. Upon receipt of your valid proxy, Computershare will provide you with a control number by email. Once provided, you can attend and participate in the virtual Annual Meeting by accessingwww.meetingcenter.io/271627362 and selecting "I have a Control Number." Enter the control number provided by Computershare and the password, which is AAWW2020. If you do not have a legal proxy but would still like to attend the Annual Meeting, you can join as a guest by selecting "I am a guest." Please note that guest attendees will not be allowed to vote or to submit questions at the Annual Meeting.

Submitting a Question at the Annual Meeting |

You can submit questions pertinent to Meeting matters at the virtual Annual Meeting only if you were a shareholder of record of the Company at the close of business on the record date or if you were a beneficial owner as of the record date and you registered in advance in accordance with the instructions appearing above,

If you wish to submit a question, you may log into the virtual Annual Meeting website at www.meetingcenter.io/271627362 beginning 15 minutes before the start of the virtual Annual Meeting and submit your questions online. You will also be able to submit your questions during the Annual Meeting. To submit a question, you will need your control number and the meeting password, which is AAWW 2020. Once past the login screen, click on the "Messages" icon at the top of the screen and submit your question. In accordance with the rules of procedure, a copy of which will be available on the virtual Annual Meeting website, only questions pertinent to the Meeting or of concern to shareholders generally will be answered, subject to any time constraints that may be specified in the rules of procedure. Any questions that cannot be answered due to time constraints can be submitted to InvestorRelations@atlasair.com.

Voting at the Annual Meeting |

If you are a shareholder of record (i.e., you hold your shares registered in your name through Computershare), you can vote your shares in one of two ways: either by proxy or if you attend the Annual Meeting online, during the Annual Meeting.

If you choose to vote by proxy, you should complete, date and sign your proxy card and return it in the pre-paid envelope provided.

You may also vote your shares online while attending the virtual Annual Meeting by visitingwww.meetingcenter.io271627362. You will need your control number included on your proxy card in order to be able to vote during the Annual Meeting. Even if you plan to attend the Annual Meeting online, we urge you to vote your shares by proxy in advance of the Annual Meeting so that if you should become unable to attend the Annual Meeting online, your shares will be voted as directed by you.

If your AAWW common shares are held in a stock brokerage account by a bank, broker or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your bank, broker or other nominee that is considered the shareholder of record of those shares. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your shares via the internet or by phone if the bank, broker or other nominee offers these options to you or by completing, dating, signing and returning a voting instruction form. Your bank, broker or other nominee will send you instructions on how to submit your voting instructions for your shares of our common stock. Shareholders are encouraged to vote and submit proxies in advance of the meeting.

If you are the beneficial owner of AAWW common shares and you plan to attend and participate (i.e., vote and/or submit questions) in the Annual Meeting, please see "Attending the Annual Meeting" above for information on how to register in advance.

6 | Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

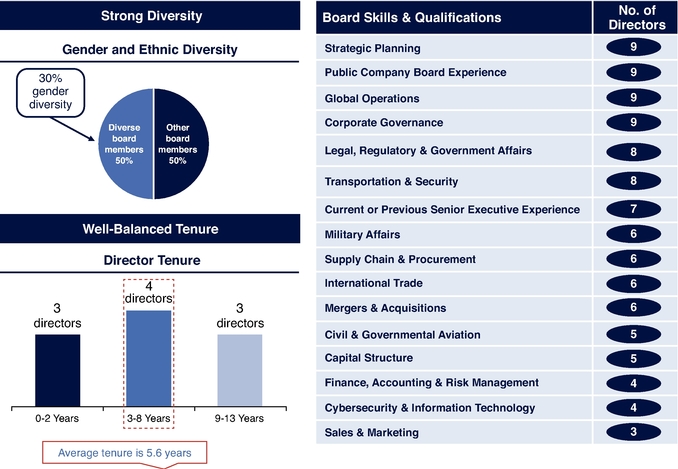

Our Board has nominated 10 persons to stand for election at the 2020 Annual Meeting and to hold office until the next Annual Meeting. All Nominees are currently Directors elected at the 2019 Annual Meeting, except for John W. Dietrich, our President and Chief Executive Officer who joined the Board on January 1, 2020. The Nominating and Governance Committee has recommended the 10 Nominees for nomination by the Board after an evaluation of the size and composition of the Board and a review of each member's skills, characteristics, and independence. The Board believes that each of the Nominees brings strong skills, background, experience, and industry expertise to the boardroom, giving the Board as a group the appropriate balance of skills needed to exercise its oversight responsibilities and composition that aligns with our long-term strategy. The Board further believes that diversity with respect to gender, ethnicity, background, professional experiences and perspectives are important elements in the Board selection process. To underscore its commitment to Board diversity, the Nominating and Governance Committee charter provides that such diversity (including gender and ethnicity) should be a factor in assessing the Board's core competencies as a whole. Both the Nominating and Governance Committee and the full Board will therefore consider attributes such as race, gender, cultural background and professional experience when reviewing candidates for the Board and in assessing the Board's overall composition.

Each Nominee has consented to be named as a Nominee for election as a Director and has agreed to serve if elected. Except as otherwise described below, if any of the Nominees is not available for election at the time of the Annual Meeting, discretionary authority will be exercised to vote for substitutes designated by our Board of Directors, unless the Board chooses to reduce the number of Directors. Management is not aware of any circumstances that would render any Nominee unavailable. At the Annual Meeting, Directors are expected to be elected to hold office until the 2021 Annual Meeting or until their successors are elected and qualified, as provided in our By-Laws.

Because this election is not a contested election, each Director will be elected by the vote of the majority of the votes cast when a quorum is present. A "majority of the votes cast" means that the number of votes cast "for" a Director exceeds the number of votes cast "against" that Director. "Votes cast" excludes abstentions and any votes withheld by brokers in the absence of instructions from street name holders ("broker non-votes").

It is the policy of the Board that, as a condition of nomination, each incumbent Director nominated has submitted to the Secretary of the Company an irrevocable contingent resignation. This resignation will be effective only if (i) the Nominee fails to receive a majority of the votes cast in an uncontested election and (ii) the Board accepts such resignation within 60 days following the certification of the election results.

Director Core Competencies |

Board Composition and Nomination Considerations

Our Board strives to maintain an appropriate balance of experience, tenure, diversity, leadership, skills and qualifications that are of importance to our Company and the execution of our strategy. Given the diversity of our business operations, it is important to bring together Directors with differing experiences, perspectives and backgrounds to ensure proper oversight of the interests of our Company and our shareholders.

The Nominating and Governance Committee works with the full Board to determine the qualifications and experiences it believes are most relevant and responsive to the needs of our business. In doing so, the Nominating and Governance Committee takes into account a number of factors, including:

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement | 7

PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

Board Refreshment, Evaluation and Recent Board Expansion

The Board of Directors and the Nominating and Governance Committee have a process in place for seeking out, evaluating and recommending potential candidates for election to the Board. Pursuant to that process, the full Board, under the guidance of the Nominating and Governance Committee, undertakes a thorough review of the skills, qualifications and tenure of our incumbent Directors, as well as the size of the Board, in the context of our long-range strategic plan, consistent with our governance principles, and taking into account feedback from shareholder outreach. The Board then reviews in detail the makeup, experience, skills, and qualifications of our then-incumbent Directors and identifies only new areas of subject-matter expertise that would enhance the overall strength of our current Board and the ability of the Company to execute its long-term strategic plan. The results of these evaluations and the meaningful and tangible feedback generated are also considered by the Board and the Committee in searching for and evaluating nominees who could (1) add new and different areas of subject-matter expertise to the Board consistent with our growing Company and long-term strategy, and (2) strengthen the overall effectiveness of the Board. Through this process, the Board has added three new independent Directors to its ranks (Ms. Lute, Ms. Stamps, and Mr. Bolden) since 2017, bringing fresh perspectives, greater diversity, and critical skill sets and qualifications to our Board. Such skills and qualifications include, but are not limited to, geopolitical, information technology, cybersecurity, finance and banking experience, as well as executive leadership skills and presence, and public company board experience.

We believe that we have established and maintained highly desirable processes, as described above, to ensure that we provide for thoughtful and timely Board refreshment.

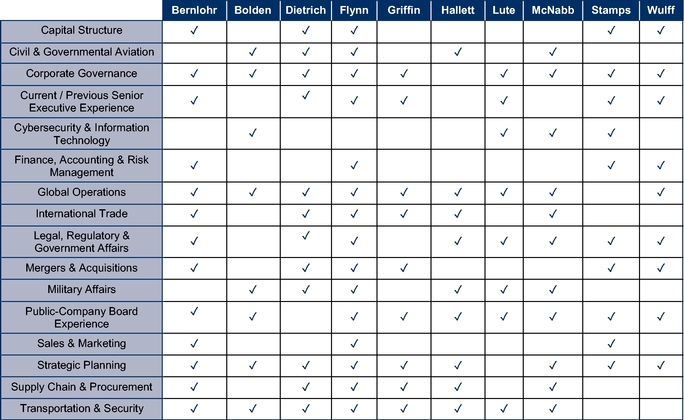

Director Skills and Experience

Our Board selected Director Nominees based on their diverse skills, qualifications, backgrounds and expertise, which the Board believes will contribute to the effective oversight of the Company. The chart below depicts the current skills, qualifications, and expertise represented on our Board.

8 | Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

We view each of the skillsets discussed in the above chart to be essential to the effective oversight of the Company, as discussed further below.

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS THAT YOU VOTE"FOR"THE ELECTION OF EACH OF THE NOMINEES NAMED ON THE IMMEDIATELY FOLLOWING PAGES.

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement | 9

PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | William J. Flynn

Chairman of the Board Other Public Company Directorships: Previous Public Company Directorships (last 5 years): Other Activities: | | | Background: Mr. Flynn has been the Chairman of our Board of Directors since August 2019. He served as our Chief Executive Officer from June 2006 to December 2019 and as our President from June 2006 to July 2019. Mr. Flynn has 43-years of experience in international supply chain management and freight transportation. Prior to joining us, Mr. Flynn served as President and Chief Executive Officer of GeoLogistics Corporation from 2002 where he led a successful turnaround of the company's profitability and the sale of the company in September 2005. Prior to his tenure at GeoLogistics, Mr. Flynn served as Senior Vice President at CSX Transportation from 2000 to 2002. Mr. Flynn spent over 20 years with Sea-Land Service, Inc., a global provider of container shipping services, serving in roles of increasing responsibility in the U.S., Latin America, and Asia. He ultimately served as head of the company's operations in Asia.

Board Skills and Qualifications: Capital Structure; Civil and Governmental Aviation; Corporate Governance; Finance, Accounting and Risk Management; Global Operations; International Trade; Legal, Regulatory and Government Affairs; Mergers and Acquisitions; Military Affairs; Current/Previous Senior Executive Experience; Supply Chain and Procurement; Public-Company Board Experience; Sales and Marketing; Strategic Planning; Transportation and Security

| ||

| | | | | | | |

10 | Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | Duncan J. McNabb

Lead Independent Director Committees: Other Public Company Directorships: Previous Public Company Directorships (last 5 years): Other Activities: | | | Background: General Duncan J. McNabb, Retired, U.S. Air Force, served as Commander of the United States Air Mobility Command from 2005 to 2007 and Commander of the United States Transportation Command (USTRANSCOM) from 2008 until his retirement from the Air Force in December 2011. USTRANSCOM is the single manager for air, land, and sea transportation for the Department of Defense (DOD). He also served as DOD's Distribution Process Owner, overseeing DOD's end-to-end supply chain, transportation, and distribution to our armed forces worldwide. Mr. McNabb commanded more than $56 billion in strategic transportation assets, over 150,000 service personnel and a worldwide command-and-control network. A graduate of the United States Air Force Academy and Air Force pilot, he flew more than 5,600 hours in transport and rotary aircraft, including the C-17. Mr. McNabb has held command and staff positions at squadron, group, wing, major command and DOD levels. During his over 37-year military career, Mr. McNabb also served as the Air Force Deputy Chief of Staff for Plans and Programs with responsibility for all Air Force programs and over $500 billion in funding over the Air Force's Five-Year Defense Plan (FYDP). He later served as Director of Logistics on the Joint Staff and was responsible for operational logistics and strategic mobility support to the Chairman of the Joint Chiefs and the Secretary of Defense. Before his final command at USTRANSCOM, Mr. McNabb served as the 33rd Vice Chief of Staff of the Air Force.

Board Skills and Qualifications: Civil and Governmental Aviation; Corporate Governance; Cybersecurity and Information Technology; Global Operations; International Trade; Legal, Regulatory and Government Affairs; Military Affairs; Supply Chain and Procurement; Public-Company Board Experience; Strategic Planning; Transportation and Security

| ||

| | | | | | | |

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement | 11

PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | Timothy J. Bernlohr

Independent Director Committees: Other Public Company Directorships: Previous Directorships (last 5 years): | | | Background: Mr. Bernlohr is the founder and managing member of TJB Management Consulting, LLC, which specializes in providing project-specific consulting services to businesses in transformation, including restructurings, interim executive management and strategic planning services (TJB Management Consulting is a privately held business). Mr. Bernlohr founded the consultancy in 2005. Mr. Bernlohr was President and Chief Executive Officer of RBX Industries, Inc., which was a nationally recognized leader in the design, manufacture, and marketing of rubber and plastic materials to the automotive, construction, and industrial markets, until it was sold in 2005. Prior to joining RBX in 1997, Mr. Bernlohr spent 16 years in the International and Industry Products divisions of Armstrong World Industries, where he served in a variety of management positions.

Board Skills and Qualifications: Capital Structure; Corporate Governance; Finance, Accounting and Risk Management; Global Operations; International Trade; Legal, Regulatory and Government Affairs; Mergers and Acquisitions; Current/Previous Senior Executive Experience; Public-Company Board Experience; Supply Chain and Procurement; Sales and Marketing; Strategic Planning; Transportation and Security

| ||

| | | | | | | |

12 | Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | Charles F. Bolden, Jr.

Independent Director Committees: Other Public Company Directorships: Previous Public Company Directorships (last 5 years): Other Activities: | | | Major General Charles F. Bolden, Jr., Retired, U.S. Marine Corps, served as the 12th Administrator of the National Aeronautics and Space Administration (NASA) from July 2009 to January 2017. As Administrator, he led a nationwide NASA team to advance the missions and goals of the U.S. space program. Mr. Bolden's 34-year career with the U.S. Marine Corps also included 14 years as a member of NASA's Astronaut Office. After joining the Office in 1980, Mr. Bolden traveled to orbit four times aboard the space shuttle between 1986 and 1994, commanding two of the missions and piloting two others. His flights included deployment of the Hubble Space Telescope and the first joint U.S.-Russian shuttle mission, which featured a cosmonaut as a member of his crew. Mr. Bolden left NASA in 1994 and returned to the operating forces of the Marine Corps. His final duty was as Commanding General of the 3rd Marine Aircraft Wing, Miramar, Calif.

Board Skills and Qualifications: Civil and Governmental Aviation; Corporate Governance; Cybersecurity and Information Technology; Global Operations; Military Affairs; Public-Company Board Experience; Strategic Planning; Transportation and Security

| ||

| | | | | | | |

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement | 13

PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | John W. Dietrich

President and CEO Other Public Company Directorships: Previous Public Company Directorships (last 5 years): Other Activities: | | | Background: Mr. Dietrich became our President and Chief Executive Officer in January 2020. He was also elected to our Board of Directors at such time. Prior to January 2020, he served as our President and Chief Operating Officer from July 2019 and our Executive Vice President and Chief Operating Officer from September 2006. During the period of March 2003 to September 2006, Mr. Dietrich held a number of senior executive positions in the Company, including Senior Vice President, General Counsel, Chief Human Resources Officer, Corporate Secretary, head of the Corporate Communications function, and President of Atlas Air, Inc. Mr. Dietrich joined Atlas in 1999 as Associate General Counsel. Prior to joining us, he was a litigation attorney at United Airlines from 1992 to 1999, where he focused on employment and commercial litigation issues. He also serves as Chairman of the National Defense Transportation Association, a director of Airlines for America, and a director of the National Air Carrier Association. Mr. Dietrich earned a Bachelor's of Science degree from Southern Illinois University and received his Juris Doctorate, cum laude, from the University of Illinois at Chicago John Marshall Law School. He is a member of the New York, Illinois and Colorado Bars.

Board Skills and Qualifications: Capital Structure; Civil and Governmental Aviation; Corporate Governance; Current/Previous Senior Executive Experience; Global Operations; International Trade; Legal Regulatory and Government Affairs; Mergers and Acquisitions; Military Affairs; Strategic Planning; Supply Chain and Procurement; Transportation and Security

| ||

| | | | | | | |

14 | Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | Bobby J. Griffin

Independent Director Committees: Other Public Company Directorships: Previous Public Company Directorships (last 5 years): | | | Background and Experience: Mr. Griffin served as President — International Operations for Ryder System, Inc., a global provider of transportation, logistics and supply chain management solutions from 2005 to 2007. Beginning in 1986, Mr. Griffin served in various other management positions with Ryder, including as Executive Vice President — International Operations from 2003 to 2005 and Executive Vice President — Global Supply Chain Operations from 2001 to 2003. Prior to Ryder, Mr. Griffin was an executive at ATE Management and Service Company, Inc., which was acquired by Ryder in 1986.

Board Skills and Qualifications: Corporate Governance; Current/Previous Senior Executive Experience; Global Operations; International Trade; Mergers and Acquisitions; Public-Company Board Experience; Supply Chain and Procurement; Strategic Planning; Transportation and Security

| ||

| | | | | | | |

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement | 15

PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | Carol B. Hallett

Independent Director Committees: Other Public Company Directorships: Previous Public Company Directorships (last 5 years): Other Activities: | | | Background: Ms. Hallett has been of counsel at the U.S. Chamber of Commerce since 2003 and served as a member of the U.S. Chamber Foundation Board of Directors from 2003 to 2015. From 1995 to 2003, Ms. Hallett was President and Chief Executive Officer of the Air Transport Association of America (ATA), the nation's oldest and largest airline trade association, now known as the Airlines for America (A4A). Prior to joining the ATA, Ms. Hallett served as senior government relations advisor with Collier, Shannon, Rill & Scott from 1993 to 1995. From 2003 to 2004, she was chair of Homeland Security at Carmen Group, Inc., where she helped develop the homeland security practice for the firm. From 1986 through 1989, Ms. Hallett served as United States Ambassador to the Commonwealth of the Bahamas. From 1989 to 1993, she was Commissioner of the United States Customs Service.

Board Skills and Qualifications: Civil and Governmental Aviation; Global Operations; International Trade; Legal, Regulatory and Government Affairs; Military Affairs; Supply Chain and Procurement; Public-Company Board Experience; Strategic Planning; Transportation and Security

| ||

| | | | | | | |

16 | Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | Jane H. Lute

Independent Director Committees: Other Public Company Directorships: Previous Public Company Directorships (last 5 years): Other Activities: | | | Background and Experience: Ms. Lute is the President and CEO of SICPA North America, a private company that specializes in providing solutions to protect the integrity and value of products, processes, and documents. Ms. Lute also serves as Special Advisor to the Secretary-General of the United Nations, where she has held several positions in peacekeeping and peace building. Previously, Ms. Lute served as Deputy Secretary for the U.S. Department of Homeland Secretary from 2009-2013. She also served as Chief Executive Officer of the Center for Internet Security (CIS), an operating not-for-profit organization and home of the Multi-State Information Sharing and Analysis Center (MS-ISAC), providing cybersecurity services for state, local, tribal and territorial governments. Ms. Lute has served on several international commissions focused on cybersecurity and the future of the Internet. She began her distinguished career in the United States Army and served on the National Security Council staff under both Presidents George H.W. Bush and William Jefferson Clinton. Ms. Lute holds a Ph.D. in political science from Stanford University and a J.D. from Georgetown University. She is a member of the Virginia bar.

Board Skills and Qualifications: Cybersecurity and Information Technology; Corporate Governance; Global Operations; Legal, Regulatory and Government Affairs; Military Affairs; Current/Previous Senior Executive Experience; Public-Company Board Experience; Transportation and Security

| ||

| | | | | | | |

Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement | 17

PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | Sheila A. Stamps

Independent Director Committees: Other Public Company Directorships: Previous Public Company Directorships (last 5 years): Other Activities: | | | Background and Experience: Ms. Stamps, has a diversity of strategic and financial experience including governance oversight of aviation businesses. She previously served as Executive Vice President at DBI, LLC, a private mortgage investment company, from 2011 to 2012. She served from 2008 to 2011 as Director of Pension Investments and Cash Management at New York State Common Retirement Fund, and from 2004 to 2005 as a Fellow at the Weatherhead Center for International Affairs at Harvard University. Prior to this, Ms. Stamps served as a Managing Director and Head of Relationship Management, Financial Institutions at Bank of America. From 1982 to 2003, she held a number of executive positions both domestic and international with Bank One Corporation (now JPMorgan), including Managing Director and Head of European Asset-Backed Securitization and a member of the EMEA Strategic Operating Committee. Ms. Stamps holds an MBA from the University of Chicago and a CERT Certificate in Cybersecurity from Carnegie Mellon.

Board Skills and Qualifications: Capital Structure; Corporate Governance; Cybersecurity and Information Technology; Finance, Accounting and Risk Management; Mergers and Acquisitions; Regulatory and Government Affairs; Sales and Marketing; Strategic Planning; Current/Previous Senior Executive Experience; Public-Company Board Experience

| ||

| | | | | | | |

18 | Atlas Air Worldwide Holdings, Inc. 2020 Notice & Proxy Statement

| PROPOSAL NO. 1 – ELECTION OF DIRECTORS |

| | | | | | | |

| | John K. Wulff