| 1 |

| | |

| 10 |

| | |

| 15 |

| | |

| 18 |

| | |

| 18 |

| | |

| 19 |

| | |

| 19 |

| | |

| Appendix A-1 |

| | |

| Appendix B-1 |

| | |

| Appendix C-1 |

| | |

| Appendix D-1 |

| | |

| Part B-1 |

The following is a summary of more complete information appearing later in this information statement/prospectus or incorporated herein. You should read carefully the entire information statement/prospectus, including the Reorganization Agreement, the form of which is attached as Appendix A, because it contains details that are not in the summary.

As used in this information statement/prospectus, the term “Reorganization” refers collectively to: (1) the transfer of all of the assets and liabilities of the China Fund to the International Fund; (2) the issuance of shares of common stock by the International Fund to the China Fund in an amount that will equal, in aggregate net asset value, the aggregate net asset value of the shares of the China Fund on the last business day preceding the closing of the Reorganization; (3) the opening of accounts by the International Fund for the China Fund shareholders, the crediting of China Fund shareholders, in exchange for their shares of the China Fund, with that number of full and fractional shares of the International Fund that are equivalent in aggregate net asset value to the aggregate net asset value of the shareholders’ shares in the China Fund at the time of the Reorganization; and (4) the dissolution of the China Fund.

The Reorganization is expected to be a tax-free reorganization for federal income tax purposes under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). For information on the tax consequences of the Reorganization, see the sections entitled “Summary – Federal Income Tax Consequences of the Reorganization” and “Information About the Reorganization – Federal Income Tax Consequences” in this information statement/prospectus.

Comparison of the China Fund to the International Fund

The following table presents a side-by-side comparison of the China Fund to the International Fund. The Funds have substantially similar investment objectives, strategies and risks, with the exception of the China Fund’s non-fundamental policy of investing at least 80% of its net assets in the securities of the China Companies, described in greater detail below under “Primary Investments.” Accordingly, the risks associated with this investment policy, such as Geographic Concentration Risk, apply only to the China Fund and not the International Fund.

| | | China Fund | | International Fund |

| Form of Organization | | A diversified series of the Trust, an open-end investment management company organized as a Delaware statutory trust. | | Same. |

| Net Assets as of November 30, 2012 | | $[…] | | $[…] |

| Investment Advisor and Portfolio Managers | | Investment Advisor: Kornitzer Capital Management, Inc. Portfolio Managers: William Kornitzer, CFA, Nicole Kornitzer, CFA, and Yulin Li, CFA, CPA. | | Investment Advisor: Same. Portfolio Managers: William Kornitzer, CFA and Nicole Kornitzer, CFA. |

| Annual Operating Expenses as a Percentage of Average Net Assets for the Fiscal Year | | The total operating expense ratio for the fiscal year ended March 31, 2012 was 1.80%. | | The total operating expense ratio for the fiscal year ended March 31, 2012 was 1.15%, which includes Acquired Fund Fees and Expenses of 0.01%. |

| Investment Objective | | Long-term growth of capital. | | Same. |

| | | China Fund | | International Fund |

| Primary Investments | | The Fund may invest in China Companies of any size. The Fund considers China Companies to be those companies which meet at least one of the following criteria: · are organized under the laws of, or with a principal office in, the People’s Republic of China or its administrative and other districts, including Hong Kong (“China”) (including companies which may not have a substantial economic presence in China); or · issue securities for which the principal trading market is in China; or · derive at least 50% of their revenues or profits from goods produced or sold, investments made, or services performed in China, or which have at least 50% of their assets in China. | | The Fund may invest directly or indirectly in foreign securities or foreign currencies of both developed and developing countries. For purposes of the International Fund’s investments, “foreign securities” means those securities issued by companies: · that are organized under the laws of, or with a principal office in, a country other than the U.S. and issue securities for which the principal trading market is in a country other than the U.S.; or · that derive at least 50% of their revenues or profits from goods produced or sold, investments made, or services provided in a country other than the U.S., or have at least 50% of their assets in a country other than the U.S. |

| Investment Strategies and Process | | Investment Strategies. In addition to its primary investments in common stocks, the China Fund may make equity investments in preferred stock, warrants, rights and securities convertible into common stock of China Companies, as well as interests in trusts or depositary receipts including ADRs, European Depositary Receipts (“EDRs”) or Global Depositary Receipts (“GDRs”) that represent indirect ownership interests in China Companies. In addition to direct investments in securities of China Companies, the Fund may invest in other investment companies, including, but not limited to, exchange-traded funds (“ETFs”) that invest in China Companies. The China Fund’s China Company portfolio securities are typically listed and traded in the United States (on the NASDAQ and NYSE) and Hong Kong (on the Hong Kong Stock Exchange), but the Fund is authorized to invest in China Companies traded on any recognized securities exchange, including China’s Class A-Share and B-Share market, Taiwan, Singapore or London exchanges. The China Fund may also invest indirectly in China Companies through equity-linked notes or swap agreements, although these investments are limited to 30% of the Buffalo China Fund’s net assets. In addition to the China Fund’s main investments, the Fund may invest up to 20% of its net assets in domestic or foreign securities of companies that do not qualify as China Companies, but which the portfolio managers expect to benefit from developments in the Chinese economy. Companies in which the Fund may invest may be in any sector and of any size market capitalization; provided that the Advisor believes that the company’s securities will appreciate in value as a result of developments in the Chinese economy. Investment Process. The Fund’s investments are selected with a value orientation and a long-term investment horizon. The Fund’s portfolio managers primarily utilize a bottom-up approach, focusing initially on each company’s fundamental characteristics. The Fund seeks to invest in companies with: strong profits and/or cash flow generation; strong financial characteristics and growth potential; undervalued assets; and/or strong management teams. Once attractive candidates are identified, the Fund seeks to invest in companies that are trading below their intrinsic values, as estimated by the Fund’s portfolio managers. | | Investment Strategies. Under normal circumstances, the International Fund does not expect its investments in emerging markets to exceed 35% of its net assets. Equity securities in which the International Fund will invest include common stocks, preferred stocks, convertible securities, warrants, rights and depositary receipts. The Fund’s investments in depositary receipts may include sponsored or unsponsored ADRs, EDRs or GDRs. The International Fund may invest in securities of companies of any size. Investment Process. In selecting securities for the International Fund, the Advisor uses a bottom-up approach in choosing investments. In its selection process, the Advisor seeks to identify a broad mix of foreign companies that are expected to benefit from longer-term industry, technological, or global trends. The Advisor also selects securities based on: (1) fundamental analysis of industries and the economic cycle; (2) company-specific analysis such as product cycles and quality of management; and (3) rigorous valuation analysis. In making portfolio selections for the International Fund, the Advisor will also consider the economic, political and market conditions of the various countries in which the Fund may invest. The Advisor may sell the International Fund’s investments to secure gains, limit losses or reinvest in more promising investment opportunities. |

| | | China Fund | | International Fund |

| Temporary Strategies | | The Fund intends to hold some portion of its assets in cash or high quality, short-term debt obligations and money market instruments for reserves to cover redemptions and unanticipated expenses. There may be times, when the Fund may respond to market, economic, political or other considerations by investing up to 100% of its assets in high quality, short-term debt securities. During those times, the Fund may not achieve its investment objective and, instead, will focus on preserving your investment. To the extent the Fund uses a money market fund for its cash position, there will be some duplication of expenses because the Fund would bear its pro rata portion of such money market fund’s advisory fees and operational expenses. | | Same. |

| Fundamental and Non-Fundamental Investment Policies and Restrictions | | For a more complete description of the Fund’s fundamental and non-fundamental investment policies and restrictions, see Appendix B. In general, the Fund has adopted fundamental policies that, subject to certain exceptions, restrict the Fund with respect to the following activities: (1) with respect to 75% of its assets, purchasing more than a certain amount in any one issuer; (2) investing directly in real estate or interests in real estate; (3) acting as an underwriter of securities issued by others; (4) lending any security or making any other loan; (5) borrowing money or issuing senior securities; (6) concentrating its investments in any particular industry or group of industries; and (7) purchasing or selling physical commodities. The Fund has also adopted the non-fundamental policies that, subject to certain exceptions restrict the Fund with respect to the following activities: (1) investing in other investment companies up to certain limits; (2) holding more than 15% of its net assets in illiquid securities; (3) investing in another company for the purpose of exercising control; (4) purchasing additional securities when Fund borrowings exceed 5% of Fund assets; (5) provide shareholders with 60 days’ prior notice before changing its policy of investing at least 80% of its assets according to its principal investment strategy. The Fund may change it’s non-fundamental restrictions without obtaining the approval of its shareholders. | | With the exception of the China Fund’s non-fundamental restriction on changing its policy of investing at least 80% of its assets according to its principal investment strategy, the International Fund’s Fundamental and Non-Fundamental Investment Restrictions are identical to those of the China Fund. |

| | | China Fund | | International Fund |

| Management and Other Fees | | Management Fee. The Fund pays a management fee to KCM of 1.50% of the Fund’s average daily net assets. Other Fees. The Fund pays a separate fee for administration, fund accounting and transfer agency services to U.S. Bancorp Fund Services, LLC (“USBFS”). Additionally, the Fund pays separate fees for custodial services to U.S. Bank National Association (“US Bank”). | | Management Fee. The Fund pays a management fee to KCM of 1.00% of the Fund’s average daily net assets. Other Fees. Same. |

| Sales Charges | | The Fund does not impose sales commissions on investments in the Fund. | | Same. |

| Distribution and Rule 12b-1 Fees | | There are no Rule 12b-1 distribution fees charged on investments in the Fund. | | Same. |

| Buying Shares | | You may buy shares directly from the Fund through its transfer agent or through third-party financial intermediaries. | | Same. |

| Exchange Privilege | | You may exchange existing shares ($1,000 minimum exchange for new accounts) for shares in another Buffalo Fund. Shares must be exchanged into an identically-registered account(s). | | Same. |

| Selling Shares | | You may withdraw proceeds from your account at any time. Your NAV for a redemption will be the next computed NAV after your request is received by the Fund, its agents or an authorized financial intermediary in “good order”. If the account is registered in your name, you may sell your shares by contacting the Fund by mail or telephone as described in detail in the Fund’s Prospectus. Redemptions may also be made through third-party financial intermediaries, such as fund supermarkets or broker-dealers, who may charge a commission or other transaction fee. If you redeem shares within 60 days of purchase, you may be subject to a Redemption Fee equal to 2.00% of the amount redeemed. | | Same. |

Comparison of Principal Risks of Investing in the Funds

A discussion regarding certain principal risks of investing in the Funds is set forth below. Where applicable, differences between the China Fund and the International Fund have been highlighted. With the exception of the risks specific to the China Fund’s policy of investing at least 80% of its net assets in China Companies, as described below, both Funds are subject to substantially identical principal risks. This discussion is qualified in its entirety by the more extensive discussion of risk factors set forth in the Funds’ Prospectus and the Statement of Additional Information. As with all mutual funds, there is the risk that you could lose all or a portion of your investment in the Fund. The following are the principal risks that could affect the value of your investment:

China Companies Risk (Principal risk of the China Fund only) – In addition to risks associated with investing in foreign securities, there are special risks associated with investments in China and Hong Kong, including exposure to currency fluctuations, less liquidity, expropriation, confiscatory taxation, nationalization, exchange control regulations, differing legal standards and rapid fluctuations in inflation and interest rates. The Chinese government could, at any time, alter or discontinue any existing economic reform programs.

Market Risk (Both Funds) – The value of a Fund’s shares will fluctuate as a result of the movement of the overall stock market or of the value of the individual securities held by the Fund, and you could lose money.

Management Risk (Both Funds) – Management risk means that your investment in a Fund varies with the success and failure of the Advisor’s investment strategies and the Advisor’s research, analysis and determination of portfolio securities.

Equity Market Risk (Both Funds) – Equity securities held by a Fund may experience sudden, unpredictable drops in value or long periods of decline in value due to general stock market fluctuations, increases in production costs, decisions by management or related factors.

Common Stocks. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Common stocks are generally subject to greater risk than preferred stocks and debt obligations because holders of common stock generally have inferior rights to receive payments from issuers in comparison with the rights of the holders of other securities, bondholders and other creditors.

Preferred Stocks. Preferred stocks are subject to the risk that the dividend on the stock may be changed or omitted by the issuer, and that participation in the growth of an issuer may be limited.

Convertible Securities. A convertible security is a fixed-income security (a debt instrument or a preferred stock) which may be converted at a stated price within a specified period of time into a certain quantity of the common stock of the same or a different issuer. The market value of a convertible security performs like that of a regular debt security, that is, if market interest rates rise, the value of the convertible security falls.

Warrants. Investments in warrants involve certain risks, including the possible lack of a liquid market for resale of the warrants, potential price fluctuations as a result of speculation or other factors, and failure of the price of the underlying security to reach or have reasonable prospects of reaching a level at which the warrant can be prudently exercised (in which event the warrant may expire without being exercised, resulting in a loss of the Fund’s entire investment therein).

Rights. The purchase of rights involves the risk that the Fund could lose the purchase value of a right if the right is not exercised prior to its expiration. Also, the purchase of rights involves the risk that the effective price paid for the right added to the subscription price of the related security may exceed the value of the subscribed security’s market price.

Large-Cap Company Risk (Both Funds) – Larger, more established companies may be unable to respond quickly to new competitive challenges and are sometimes unable to attain the high growth rates of successful smaller companies during periods of economic expansion.

Mid-Cap Company Risk (Both Funds) – Investing in mid-cap companies may involve greater risk than investing in large-cap companies due to less management experience, financial resources, product diversification and competitive strengths. Therefore, such securities may be more volatile and less liquid than large-cap companies.

Small-Cap Company Risk (Both Funds) – Investing in small-cap companies may involve greater risk than investing in large- or mid-cap companies due to less management experience, financial resources, product diversification and competitive strengths. Therefore, such securities may be more volatile and less liquid than mid- and large-cap companies.

Convertible Securities Risk (Both Funds) – Convertible securities generally offer lower interest or dividend yields than non-convertible debt securities of similar quality. The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the company and other factors also may have an effect on a convertible security’s investment value.

Debt Securities Risk (Principal risk of the China Fund only; applies to the International Fund as a non-principal risk) – Interest rates may go up resulting in a decrease in the value of the debt securities held by the Fund. Investments in debt securities include credit risk, which is the risk that an issuer will not make timely payments of principal and interest. There is also the risk that a bond issuer may “call,” or repay, its high yielding bonds before their maturity dates. Debt securities subject to prepayment can offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. Limited trading opportunities for certain debt securities may make it more difficult to sell or buy a security at a favorable price or time. The International Fund does not invest in debt securities as a principal strategy.

Shares of Other Investment Companies Risk (Principal risk of the China Fund only; applies to the International Fund as a non-principal risk) – The Fund will indirectly bear fees and expenses charged by other investment companies in which the Fund invests, in addition to the Fund’s direct fees and expenses and, as a result, your cost of investing in the Fund will generally be higher than the cost of investing directly in the shares of the other investment companies. The International Fund does not invest in other investment companies as a principal strategy.

ETF Risk (Principal risk of the China Fund only; applies to the International Fund as a non-principal risk) – The Fund will bear the indirect fees and expenses charged by ETFs in which the Fund invests in addition to its own direct fees and expenses, as well as indirectly bearing the principal risks of those ETFs. ETFs are subject to the risk that the market price of an ETF’s shares may trade at a discount to their net asset value or that an active trading market for an ETF’s shares may not develop or be maintained. The International Fund does not invest in ETFs as a principal strategy.

Foreign Risk (Both Funds) – Investing in securities of foreign corporations involves additional risks relating to: political, social, religious and economic developments abroad; market instability; fluctuations in foreign exchange rates; different regulatory requirements, market practices, accounting standards and practices; and less publicly available information about foreign issuers. Additionally, these investments may be less liquid, carry higher brokerage commissions and other fees, and procedures and regulations governing transactions and custody in foreign markets also may involve delays in payment, delivery or recovery of money or investments. Investments in common stocks of U.S. companies with international operations, and the purchase of sponsored or unsponsored ADRs, EDRs or GDRs carry similar risks.

American Depositary Receipts – Unsponsored ADRs held by the Fund are frequently under no obligation to distribute shareholder communications received from the underlying issuer. For this and other reasons, there is less information available about unsponsored ADRs than sponsored ADRs. Unsponsored ADRs are also not obligated to pass through voting rights to the Fund. Investing in foreign companies, even indirectly through ADRs, may involve the same inherent risks as investing in securities of foreign issuers, as described above.

Emerging Markets Risk (Both Funds) – Emerging markets are markets of countries, such as China, in the initial stages of industrialization and that generally have low per capita income. In addition to the risks of foreign securities in general, emerging markets are generally more volatile, have relatively unstable governments, social and legal systems that do not protect shareholders, economies based on only a few industries and securities markets that are substantially smaller, less liquid and more volatile with less government oversight than more developed countries.

Currency Risk (Both Funds) – When a Fund buys or sells securities on a foreign stock exchange, the transaction is undertaken in the local currency rather than in U.S. dollars, which carries the risk that the value of the foreign currency will increase or decrease, which may impact the value of the Fund’s portfolio holdings and your investment. Other countries may adopt economic policies and/or currency exchange controls that affect its currency valuations in a disadvantageous manner for U.S. investors and companies and restrict or prohibit a Fund’s ability to repatriate both investment capital and income, which could place the Fund’s assets at risk of total loss.

Geographic Concentration Risk (Principal risk of the China Fund only) – Because the China Fund invests its assets primarily in China Companies, it is subject to greater risks of adverse events that occur in that region, including political, social, religious or economic disruptions occurring in countries in which the China Fund is not invested.

Swap Agreement and Synthetic Instruments Risk (Principal risk of the China Fund only) – The China Fund’s investments in swap agreements and synthetic instruments may not be assigned without the consent of the counter-party, and may result in losses in the event of a default or bankruptcy of the counter-party. As result, these securities may become illiquid. Fluctuations in the values of synthetic instruments may not correlate perfectly with the overall securities markets. The International Fund does not invest in swap agreements or synthetic instruments.

Other Consequences of the Reorganization

Management Fee: KCM serves as the investment advisor to both the China Fund and the International Fund. After the Reorganization, KCM will continue to serve as the investment advisor to the International Fund.

China Fund Management Fee – Paid to KCM | International Fund Management Fee – Paid to KCM |

| 1.50% | 1.00% |

Under the investment advisory agreement between KCM and Buffalo Funds, on behalf of the International Fund, the annual management fee payable by the International Fund is 0.50% lower than the rate payable to KCM by the China Fund. The investment advisory agreements are further described under “Additional Information About the Funds – Investment Advisory Agreement,” below.

Past Performance

The performance information below provides some indication of the risks of investing in the Funds by showing changes in the Funds’ performance from year to year and by showing how the Funds’ average annual returns for one and five years (in the case of the China Fund) and since inception compare with those of a broad measure of market performance and the returns of additional indexes of securities with characteristics similar to those that the Funds typically hold. The performance information, before and after taxes, is not necessarily an indication of how the Funds will perform in the future. Updated performance information is available on the Fund’s website at http://www.buffalofunds.com/performance.html, or by calling the Fund toll-free at 1-800-49-BUFFALO (1-800-492-8332).

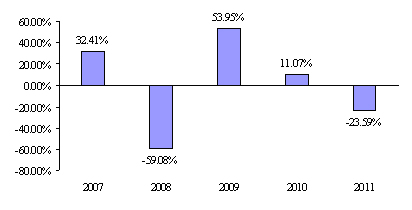

CHINA FUND

Annual Total Return as of December 31 of Each Year

Calendar Year-to-Date Return (through September 30, 2012) = 5.46%

Best Quarter through December 31, 2011: June 30, 2009 = 33.94%

Worst Quarter through December 31, 2011: September 30, 2008 = (30.07%)

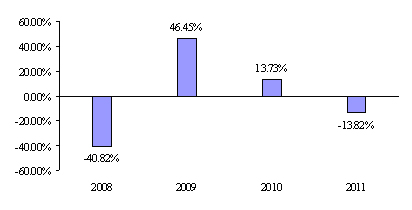

INTERNATIONAL FUND

Annual Total Return as of December 31 of Each Year

Calendar Year-to-Date Return (through September 30, 2012) = 12.50%

Best Quarter through December 31, 2011: June 30, 2009 = 31.64%

Worst Quarter through December 31, 2011: September 30, 2008 = (21.68%)

Average Annual Total Returns

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Actual after-tax returns depend on each investor’s individual tax situation and may differ from those shown in the table. The after-tax returns shown are not relevant to investors who own shares of a Fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan.

| For the periods ended December 31, 2011 | 1 Year | 5 Years | Since Inception (12/18/2006) |

| Buffalo China Fund | | | |

| Return Before Taxes | -23.59% | -6.67% | -6.06% |

| Return After Taxes on Distributions | -23.47% | -7.21% | -6.60% |

| Return After Taxes on Distributions and Sale of Fund Shares | -15.19% | -5.67% | -5.17% |

MSCI China Free Index (reflects no deduction for fees, expenses or taxes) | -18.41% | 2.52% | 4.23% |

Hang Seng Index (reflects no deduction for fees, expenses or taxes) | -19.97% | -1.58% | -0.80% |

| For the periods ended December 31, 2011 | 1 Year | 5 Years | Since Inception (9/28/2007) |

| Buffalo International Fund | | | |

| Return Before Taxes | -13.82% | N/A | -3.60% |

| Return After Taxes on Distributions | -13.75% | N/A | -3.55% |

| Return After Taxes on Distributions and Sale of Fund Shares | -8.74% | N/A | -2.89% |

MSCI AC World Index Ex USA® (reflects no deduction for fees, expenses or taxes) | -13.71% | N/A | -7.00% |

Lipper International Funds Index® (reflects no deduction for fees, expenses or taxes) | -14.48% | N/A | -7.52% |

The Funds’ Fees and Expenses

The following Summary of Fund Expenses shows the current fees and expenses for the China Fund compared to those of the International Fund (based on the fiscal year ended March 31, 2012) and the pro forma fees and expenses of the International Fund for the same period assuming the Reorganization had occurred on March 31, 2012.

Summary of Fund Fees and Expenses

Shareholder Fees (fees paid directly from your investment) | China Fund | International Fund | International Fund (Pro Forma) |

| Redemption Fee (as a percentage of amount redeemed within 60 days of purchase) | 2.00% | 2.00% | 2.00% |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | China Fund | International Fund | International Fund (Pro Forma) |

| Management Fees | 1.50% | 1.00% | 1.00% |

| Other Expenses | 0.30% | 0.14% | 0.13% |

| Acquired Fund Fees and Expenses | 0.00% | 0.01% | 0.01% |

Total Annual Fund Operating Expenses(1) | 1.80% | 1.15% | 1.14% |

| (1) | Acquired Fund Fees and Expenses represent the indirect costs of the Fund’s investments in other investment companies. The Total Annual Fund Operating Expenses for the Fund do not correlate to the ratio of expenses to average net assets listed in the Fund’s financial highlights, which reflects the operating expenses of the Fund and does not include the amount of the Fund’s proportionate share of the fees and expenses of other investment companies in which the Fund invests. |

Example of Effect on Fund Expenses

The Example is intended to help you compare the costs of investing in the China Fund with the cost of investing in the International Fund, assuming the Reorganization has been completed. The Example assumes that you invest $10,000 in the specified Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, and that each Fund’s total operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| China Fund | $183 | $566 | $975 | $2,116 |

| International Fund | $117 | $365 | $633 | $1,398 |

International Fund (pro forma) | $116 | $362 | $628 | $1,386 |

Portfolio Turnover

The China Fund and the International Fund each pay transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Funds’ performance. During the most recent fiscal period ended March 31, 2012, the portfolio turnover rate for the China Fund was 94% and the portfolio turnover rate for the International Fund was 29%.

Federal Income Tax Consequences of the Reorganization

As a non-waivable condition to the Reorganization, the Funds will have received an opinion of counsel to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes within the meaning of Section 368(a) of the Code. Accordingly, neither the Funds nor their shareholders will recognize any gain or loss for federal income tax purposes as a result of the Reorganization. In addition, the tax basis and the holding period of the International Fund shares received by each shareholder of the China Fund in the Reorganization will be the same as the tax basis and holding period of the China Fund shares given up by such shareholder in the Reorganization; provided that, with respect to the holding period for the International Fund shares received, the China Fund’s shares given up must have been held as capital assets by the shareholder. See “Information About the Reorganization – Federal Income Tax Consequences,” below.

* * * * * * * * * * * * *

The preceding is only a summary of certain information contained in this information statement/prospectus relating to the Reorganization. This summary is qualified by reference to the more complete information contained elsewhere in this information statement/prospectus, the Prospectus and Statement of Additional Information of the China Fund and the International Fund, and the Reorganization Agreement. Shareholders should read this entire information statement/prospectus carefully.

Reasons for the Reorganization. The Reorganization is part of the continuing effort by KCM to streamline and rationalize the Buffalo Funds mutual fund portfolio offerings. After careful consideration, KCM has determined that there was no meaningful distinction between investment objective, investment strategies, risk and portfolios of the China Fund and the International Fund. While the principal investment strategies differ in that the China Fund’s strategy focuses specifically on securities of China Companies, the China Fund portfolio securities fit within the investment policies of the International Fund, although it is expected that some portfolio securities of the China Fund may be sold as a result of the Reorganization. In addition, two of the China Fund’s portfolio managers are also portfolio managers of the International Fund, resulting in the duplication of portfolio management efforts, as the Funds investment portfolios are constructed using similar techniques, notably a bottom-up approach in selecting securities. This method of construction requires that the portfolio managers perform rigorous fundamental analysis of potential securities. As a result, KCM recommended, and the Board approved, the Reorganization of the smaller China Fund into the larger International Fund. In considering KCM’s recommendation, the Board considered a number of factors which are discussed in more detail below, including potential alternatives to the Reorganization. Pursuant to the Reorganization Agreement, KCM has agreed to bear all expenses incurred in connection with the Reorganization.

Following the Reorganization, the investment advisory fee paid by the International Fund (1.00% of the Fund’s average daily net assets) will be lower than the advisory fee paid by the China Fund (1.50% of the Fund’s average daily net assets).

Reorganization Agreement. The Reorganization Agreement sets forth the terms by which the China Fund will be reorganized into the International Fund. The form of the Reorganization Agreement is attached as Appendix A and the description of the Reorganization Agreement contained herein is qualified in its entirety by the attached Reorganization Agreement. The following sections summarize the material terms of the Reorganization Agreement and the federal income tax treatment of the reorganization.

The Reorganization. The Reorganization Agreement provides that upon the transfer of all of the assets and liabilities of the China Fund to the International Fund, the International Fund will issue to the China Fund that number of full and fractional International Fund shares having an aggregate net asset value equal in value to the aggregate net asset value of the China Fund, calculated as of the closing date of the Reorganization (the “Closing Date”). The China Fund will redeem its shares in exchange for the International Fund shares received by it and will distribute such shares to the shareholders of the China Fund in complete liquidation of the China Fund. China Fund shareholders will receive International Fund shares based on their respective holdings in the China Fund as of the last business day preceding the Closing Date (the “Valuation Time”). It is expected that some securities of the China Fund may be sold as a result of the Reorganization.

Upon completion of the Reorganization, each shareholder of the China Fund will own that number of full and fractional shares of the International Fund having an aggregate net asset value equal to the aggregate net asset value of such shareholder’s shares held in the China Fund as of the Valuation Time. Such shares will be held in an account with the International Fund identical in all material respects to the account currently maintained by the China Fund for such shareholder.

Until the Valuation Time, shareholders of the China Fund will continue to be able to redeem their shares at the net asset value next determined after receipt by the China Fund’s transfer agent of a redemption request in proper form. Redemption and purchase requests received by the transfer agent after the Valuation Time will be treated as requests received for the redemption or purchase of shares of the International Fund received by the shareholder in connection with the Reorganization. After the Reorganization, all of the issued and outstanding shares of the China Fund will be canceled on the books of the China Fund and the transfer agent’s books of the China Fund will be permanently closed.

The Reorganization is subject to a number of conditions, including, without limitation, the receipt of a legal opinion from counsel addressed to the China Fund and the International Fund with respect to certain tax issues, as more fully described in “Federal Income Tax Consequences” below, and the parties’ performance in all material respects of their respective agreements and undertakings in the Reorganization Agreement. Assuming satisfaction of the conditions in the Reorganization Agreement, the Closing Date of the Reorganization will be at the close of business on January 25, 2012, or such other date as is agreed to by the parties.

The Reorganization Agreement may not be changed except by an agreement signed by each party to the Agreement.

Federal Income Tax Consequences. Subject to the assumptions and limitations discussed below, the following discussion describes the material U.S. federal income tax consequences of the Reorganization to shareholders of the China Fund. This discussion is based on the Code, applicable Treasury regulations, and federal administrative interpretations and court decisions in effect as of the date of this information statement/prospectus, all of which may change, possibly with retroactive effect. Any such changes could alter the tax consequences described in this summary.

This discussion of material U.S. federal income tax consequences of the Reorganization does not address all aspects of U.S. federal income taxation that may be important to a holder of China Fund shares in light of that shareholder’s particular circumstances or to a shareholder subject to special rules.

In addition, this discussion does not address any other state, local or foreign income tax or non-income tax consequences of the Reorganization or of any transactions other than the Reorganization.

Note: China Fund shareholders are urged to consult their own tax advisers to determine the particular U.S. federal income tax or other tax consequences to them of the Reorganization and the other transactions contemplated herein.

The China Fund and the International Fund will receive an opinion from the law firm of Godfrey & Kahn, S.C. substantially to the effect that, based on certain facts, assumptions and representations made by the China Fund and the International Fund, on the basis of existing provisions of the Code, current administrative rules and court decisions, for federal income tax purposes:

(a) The Reorganization will constitute a tax-free reorganization within the meaning of Section 368(a) of the Code, and the China Fund and the International Fund will each be a party to a reorganization within the meaning of Section 368(b) of the Code.

(b) No gain or loss will be recognized by the China Fund upon the transfer of all of its assets to the International Fund in exchange solely for the International Fund Shares and the assumption by the International Fund of the China Fund’s liabilities or upon the distribution of the International Fund Shares to the China Fund’s shareholders in exchange for their shares of the China Fund, except for (1) any gain or loss recognized on (i) “Section 1256 contracts” as defined in Section 1256(b) of the Code or (ii) stock in a “passive foreign investment company” as defined in Section 1297(a) of the Code, and (2) any other gain or loss required to be recognized by reason of the reorganization (i) as a result of the closing of the tax year of the China Fund, (ii) upon termination of a position, or (iii) upon the transfer of an asset regardless of whether such transfer would otherwise be a nontaxable transaction under the Code.

(c) No gain or loss will be recognized by the International Fund upon the receipt by it of all of the assets of the China Fund in exchange solely for International Fund Shares and the assumption by the International Fund of the liabilities of the China Fund.

(d) The aggregate tax basis of the assets of the China Fund received by the International Fund will be the same as the aggregate tax basis of such assets to the China Fund immediately prior to the Reorganization.

(e) The holding period of the assets of the China Fund received by the International Fund, other than any asset with respect to which gain or loss is required to be recognized as described in (b), above, will include the holding period of those assets in the hands of the China Fund immediately prior to the Reorganization.

(f) No gain or loss will be recognized by the shareholders of the China Fund upon the exchange of their China Fund Shares for the International Fund Shares (including fractional shares to which they may be entitled).

(g) The aggregate adjusted tax basis of the International Fund Shares received by the shareholders of the China Fund (including fractional shares to which they may be entitled) pursuant to the Reorganization will be the same as the aggregate adjusted tax basis of the China Fund Shares held by the China Fund’s shareholders immediately prior to the Reorganization.

(h) The holding period of the International Fund Shares received by the shareholders of the China Fund (including fractional shares to which they may be entitled) will include the holding period of the China Fund Shares surrendered in exchange therefore, provided that the China Fund Shares were held as a capital asset on the Closing Date.

It is expected that a portion of the portfolio assets of the China Fund may be sold prior to and in connection with the Reorganization. The actual tax effect of such sales depends on the difference between the price at which such portfolio assets are sold and the tax basis in such assets of the China Fund. Any capital gains recognized in these sales on a net basis, after reduction by any available capital losses, will be distributed to shareholders as capital gain dividends (to the extent of net realized long-term capital gains over net realized short-term capital losses) and/or ordinary dividends (to the extent of net realized short-term capital gains over net realized long-term capital losses) during or with respect to the year of sale, and such distributions will be taxable to the China Fund shareholders. The Reorganization will end the tax year of the China Fund, and will therefore accelerate any distributions to shareholders from the China Fund for its short tax year ending on the date of the Reorganization. Those tax year-end distributions will be taxable and will include any undistributed capital gains resulting from portfolio turnover prior to the Reorganization.

For net capital losses arising in tax years beginning on or before December 22, 2010, the Funds are permitted to carry forward a net capital loss to offset capital gains, if any, realized during the eight years following the year of the loss, and each Fund’s capital loss carryforward is treated as a short-term capital loss in the year to which it is carried. For net capital losses arising in tax years beginning after December 22, 2010, the Funds may carry forward such losses, if any, indefinitely, and net capital losses generally retain their character as short-term or long-term. If future capital gains are offset by carried forward capital losses, such future capital gains are not subject to Fund-level federal income taxation, regardless of whether they are distributed to shareholders. Accordingly, the Funds do not expect to distribute any such offsetting capital gains. The Funds cannot carry back or carry forward any net operating losses.

As of March 31, 2012, the accumulated capital loss carryforwards for federal income tax purposes which are available to each Fund, subject to the limitations discussed below, to offset future taxable capital gains are as follows:

| | Expiration | Short-Term | Long-Term |

| Buffalo China Fund | March 31, 2017 | $1,307,508 | $-- |

| | March 31, 2018 | $7,794,631 | $-- |

| | March 31, 2019 | $843,515 | $-- |

| | Unlimited | $919,459 | $664,542 |

| | Totals | $10,865,113 | $664,542 |

| | | | |

| Buffalo International Fund | March 31, 2017 | $970,960 | $-- |

| | March 31, 2018 | $2,976,289 | $-- |

| | Unlimited | $735,535 | $809,320 |

| | Totals | $4,682,784 | $809,320 |

The Reorganization would impact the use of the China Fund’s “pre-acquisition losses” (including capital loss carryforwards, net current year capital losses, and unrealized losses that exceed certain thresholds) generally in the following manner: (1) the pre-acquisition losses, subject to the limitations described herein, would benefit the shareholders of the combined Fund, rather than only the shareholders of the China Fund; (2) the amount of the pre-acquisition losses that could be utilized in any taxable year would equal the long-term tax-exempt rate at such time, multiplied by the aggregate net asset value of the China Fund at the time of the Reorganization, and this yearly limitation would be increased by any capital gains realized after the Reorganization on securities held by the China Fund that had unrealized appreciation at the time of the Reorganization; (3) for five years following the date of the Reorganization and assuming certain thresholds are exceeded, subsequently recognized gains that are attributable to appreciation in the International Fund’s portfolio at the time of the Reorganization cannot be utilized against any pre-acquisition losses of the China Fund; and (4) the China Fund’s loss carryforwards, as limited under the previous two rules, are permitted to offset that portion of the gains of the International Fund for the taxable year of the Reorganization that is equal to the portion of the International Fund’s taxable year that follows the date of the Reorganization (prorated according to the number of days).

The combination of the above-referenced limitations on the use of the China Fund’s loss carryforwards may result in a significant portion of the China Fund’s loss carryforwards subject to the eight taxable year expiration referred to above expiring unused. It should be noted that there would be no assurances that either Fund would be able to use such losses in the absence of the Reorganization.

The Reorganization would impact the use of the International Fund’s pre-acquisition losses generally in the following manner: (1) the shareholders of the combined Fund, subject to the limitations described herein, would benefit from the pre-acquisition losses rather than only the shareholders of the International Fund; and (2) for five years following the date of the Reorganization and assuming certain thresholds are exceeded, any gains recognized after the Reorganization that are attributable to appreciation in the China Fund’s portfolio at the time of the Reorganization would not be able to be offset by any pre-acquisition losses of the International Fund.

The capital loss carryforwards and limitations described above may change significantly between now and the Reorganization Closing Date, expected to be approximately January 25, 2012. Further, the ability of each Fund to use these losses (even in the absence of the Reorganization) depends on factors other than loss limitations, such as the future realization of capital gains or losses. The combination of these factors on the use of loss carryforwards may result in some portion of the loss carryforwards of either or both of the Funds expiring unused.

As a result of the blending of tax attributes of the China Fund and the International Fund (as affected by the rules discussed above), shareholders of a Fund may pay taxes sooner, or pay more taxes, than they would have had the Reorganization not occurred.

A successful challenge to the tax-free status of the Reorganization by the Internal Revenue Service (the “IRS”) would result in a China Fund shareholder recognizing gain or loss with respect to each China Fund share equal to the difference between that shareholder’s basis in the share and the fair market value, as of the time of the Reorganization, of the International Fund shares received in exchange therefor. In such event, a shareholder’s aggregate basis in the shares of the International Fund received in the exchange would equal such fair market value, and the shareholder’s holding period for the shares would not include the period during which such shareholder held China Fund shares.

If any of the representations or covenants of the parties as described herein is inaccurate, the tax consequences of the transaction could differ materially from those summarized above. Furthermore, the description of the tax consequences set forth herein and the tax opinion to be issued as described hereunder will neither bind the IRS, nor preclude the IRS or the courts from adopting a contrary position. No assurance can be given that contrary positions will not successfully be asserted by the IRS or adopted by a court if the issues are litigated. No ruling has been or will be requested from the IRS in connection with this transaction. No assurance can be given that future legislative, judicial or administrative changes, on either a prospective or retroactive basis, or future factual developments, would not adversely affect the accuracy of the conclusions stated herein. Therefore, shareholders may find it advisable to consult their own tax adviser as to the specific tax consequences to them under the federal income tax laws, as well as any consequences under other applicable state or local or foreign tax laws given each shareholder’s own particular tax circumstances.

Board Considerations

In considering and approving the Reorganization at a meeting held on November 16, 2012, the Board discussed the future of the China Fund and the advantages of reorganizing the China Fund into the International Fund. Among other things, the Board also reviewed, with the assistance of outside legal counsel, the overall proposal for the Reorganization, the principal terms and conditions of the Reorganization Agreement, including that the Reorganization be consummated on a tax-free basis, and certain other materials provided prior to and during the meeting and at other meetings throughout the past year.

In considering the Reorganization, the Board took into account a number of additional factors. Some of the more prominent considerations are discussed further below. The Buffalo Funds Board considered the following matters, among others and in no order of priority:

| · | The China Fund and the International Fund have the same investment objective of long-term growth of capital and have substantially similar principle investment strategies; |

| · | The fundamental investment restrictions are identical for the two Funds; |

| · | The KCM personnel that manage the International Fund also manage the China Fund; |

| · | The Board will continue to oversee the International Fund; |

| · | The management fee for the International Fund is 0.50% lower than the management fee for the China Fund; |

| · | Following the Reorganization, the total operating expense ratio for the International Fund, including acquired fund fees and expenses, is expected to be substantially less than for the China Fund; |

| · | Neither the China Fund nor the International Fund charge a 12b-1 fee; |

| · | The Reorganization, as contemplated by the Reorganization Agreement, will be a tax free reorganization; |

| · | The costs of the Reorganization, as contemplated by the Reorganization Agreement, will be borne by KCM; and |

| · | The interests of the current shareholders of the China Fund and the International Fund will not be diluted as a result of the Reorganization. |

The Board also considered alternatives to the Reorganization, such as the liquidation of the China Fund. In considering the alternative of liquidation, the Board noted that: (1) shareholders not wishing to become part of the International Fund could redeem their shares of the China Fund at any time prior to closing without penalty; and (2) that the Reorganization would allow shareholders of the China Fund who wished to retain their investment after the Reorganization to do so in a registered mutual fund with a similar investment strategy managed by the very same investment advisor and portfolio team in a substantially similar manner while, at the same time, retaining the full benefit of the use of the China Fund’s capital loss carryforward amounts. The Board also discussed the alternative of maintaining the China Fund as a stand alone entity. In this regard the Board considered that KCM was no longer inclined to maintain the management of the China Fund as a separate entity, since it was so similar to the International Fund.

Furthermore, the Board considered that Rule 17a-8(a)(3) permits a merger of affiliated companies without obtaining shareholder approval if certain conditions are met as noted below:

| · | No fundamental policy of the merging company is materially different from the fundamental policies of the surviving company; |

| · | No advisory contract between the merging company is materially different from an advisory contract of the surviving company; |

| · | Trustees of the merging company who are not interested persons of the merging company and who were elected by its shareholders will comprise a majority of the trustees of the surviving company who are not interested persons of the surviving company; and |

| · | Any distribution fees authorized to be paid by the surviving company pursuant to Rule 12b-1 are no greater than the distribution fees of the merging company. |

The Board noted that all these conditions had been met. After consideration of the factors noted above, together with other factors and information considered to be relevant, the Board determined that the Reorganization is in the best interests of the China Fund and International Fund shareholders, and accordingly, unanimously approved the Reorganization with the International Fund and the Reorganization Agreement.

Costs and Expenses of the Reorganization. The Reorganization Agreement provides that all expenses of the Reorganization will be borne by KCM. Such expenses include, without limitation: (a) expenses associated with the preparation and filing of this information statement/prospectus; (b) postage; (c) printing; (d) accounting fees; and (e) legal fees incurred by the Trust.

Capitalization. The following table sets forth the capitalization of the China Fund, the International Fund and, on a pro forma basis, the successor International Fund, as of March 31, 2012, after giving effect to the Reorganization.

| Fund Capitalization as of March 31, 2012 | Net Assets | Shares Outstanding | Net Asset Value Per Share |

China Fund | $22,129,722 | 3,135,379 | 7.06 |

International Fund | $70,804,884 | 7,437,637 | 9.52 |

International Fund (Pro Forma) | $92,934,606 | 9,762,038 | 9.52 |

Investment Advisor. Each Fund’s investment advisor is Kornitzer Capital Management, Inc.

Purchase, Redemption and Exchange Policies. The purchase, redemption and exchange policies for the Funds are identical and are highlighted below. For a more complete discussion of the Funds’ purchase, redemption and exchange policies, please see Appendix C.

| Type of Account | To Open Your Account | To Add to Your Account |

| Regular Accounts | $2,500 | $100 |

| Exchange from another Buffalo Fund | $1,000 | $100 |

| Automatic Investment Plan (“AIP”) Accounts | $100 | $100 |

| Individual Retirement Accounts (“IRA”) and Uniform Transfer/Gifts to Minors Accounts | $250 | $100 |

| SEPs, Coverdell ESAs, and SAR-SEPs | $250 | $100 |

| Purchase, Redemption and Exchange Policies | | China Fund | | International Fund |

| Purchases | | By telephone, Internet, mail, wire, through an AIP, through exchanges from another Buffalo Fund, and through a broker-dealer or other third-party financial intermediary. | | Same. |

| Redemptions | | By mail, wire, telephone, systematic withdrawal plan, or electronic funds transfer. | | Same. |

| Exchange Privileges | | Permitted between identically registered accounts. | | Same. |

| Redemption Fees | | 2.00% of the amount redeemed within 60 days of purchase. | | Same. |

| Market Timing Policies | | The Fund does not allow market timers, and has adopted policies and procedures with respect to frequent purchases and redemptions of Fund shares. These policies are implemented, in part, through the Fund’s redemption fee. The Fund may also refuse to sell shares to market timers and will take actions necessary to stop market timing activity, including closing any account to new purchases believed to be held for a market timer. | | Same. |

Distributions. The China Fund and International Fund generally declare and distribute substantially all of their investment company taxable income and net capital gain, if any, at least annually, usually in December.

Tax Information. Both Funds’ distributions are taxable, and are taxed as ordinary income or long-term capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

Payments to Broker-Dealers and Other Financial Intermediaries. If you purchase the China Fund or the International Fund through a broker-dealer or other financial intermediary (such as a bank), the Funds and/or their related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the China Fund and/or the International Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Investment Advisory Agreement. Under the advisory agreement with Buffalo Funds, on behalf of both the China Fund and the International Fund, KCM supervises the management of the Funds’ investments and business affairs. At its expense, KCM provides office space and all necessary office facilities, equipment and personnel for servicing the investments of the Funds. As compensation for its services, the China Fund pays to KCM a monthly advisory fee at the annual rate of 1.50% of the Fund’s average daily net assets, and the International Fund pays a monthly advisory fee at the annual rate of 1.00% of the Fund’s average daily net assets.

Valuation. The China Fund and the International Fund have the same Valuation Policy, which is more fully discussed in Appendix C “Shareholder Information for the International Fund.” There are no material differences between the valuation policies of the Funds.

Description of the Securities to be Issued; Rights of Shareholders. Set forth below is a description of the International Fund shares to be issued to the shareholders of the China Fund in the Reorganization. Also set forth below is a discussion of the rights of shareholders of each Fund. Because both Funds are series of the Trust, the Funds’ shares have identical characteristics.

The following is a summary of the material rights of shareholders of the International Fund and China Fund, but does not purport to be a complete description of these rights. These rights may be determined in full by reference to the Delaware statute governing statutory trusts (the “Delaware Statute”), the Trust’s Agreement and Declaration of Trust, and the Trust’s Amended and Restated Bylaws (collectively, the “Governing Instruments”). The Governing Instruments are subject to amendment in accordance with their terms. Copies of the Governing Instruments are available upon request and without charge by following the instructions listed under “Available Information.”

Form of Organization. Both the China Fund and the International Fund are series of Buffalo Funds, an open-end management investment company organized as a Delaware statutory trust on February 14, 2001. Both the China Fund and the International Fund offer a single class of shares.

Capital Stock. The Trust is authorized to issue an unlimited number of interests (or shares). The China Fund and the International Fund are two series, or mutual funds, formed by the Trust. Interests in the China Fund and the International Fund are represented by shares of beneficial interest each with no par value. As of the date of this information statement/prospectus, shares of [nine] other series of the Trust are offered in [separate prospectuses and statements of additional information]. The Trust may start additional series and offer shares of new funds under the Trust at any time.

Voting Rights. Each share of the China Fund and the International Fund represents an interest in the respective Fund that is equal to and proportionate with each other share of the respective Fund. Buffalo Fund shareholders are entitled to one vote per share (and a fractional vote per fractional share) held on matters on which they are entitled to vote. The Trust is not required to (nor does it) hold annual shareholder meetings. However, special meetings may be called for purposes such as electing or removing trustees. On any matters submitted to a vote of shareholders of either Fund, all shares are voted together without regard to class or series except when separate voting is required by the 1940 Act or other applicable law.

Shareholder Liability. The Delaware Statute does not include an express provision relating to the limitation of liability of the beneficial owners of a Delaware statutory trust. The Governing Instruments provide that no shareholder shall be subject to any personal liability whatsoever to any person in connection with property of a Fund or the acts, obligations or affairs of the Trust. The Governing Instruments further provide that, if any shareholder is made a party to any suit or proceeding to enforce any such liability of a Fund, he or she shall not be held to any personal liability. The Trust shall indemnify and hold each shareholder harmless from and against all claims and liabilities to which such shareholder may become subject by reason of being or having been a shareholder, and shall reimburse the shareholder for all legal and other expenses reasonably incurred by him in connection with any such claim or liability.

Preemptive Rights. Shareholders of Buffalo Funds are not entitled to any preference, preemptive, appraisal, conversion or exchange rights.

Fund Trustees and Officers. The Trust is managed under the general oversight of the Board. The persons sitting on the Board will continue to be the same after the Reorganization.

Fund Management. KCM is a Kansas corporation and an SEC-registered investment advisor. KCM was organized in 1989 and its principal place of business is located at 5420 West 61st Place, Shawnee Mission, Kansas 66205. As of September 30, 2012, KCM had approximately $8.1 billion in assets under management. KCM will continue to be responsible for providing investment advisory and portfolio management services to the International Fund following the Reorganization.

William Kornitzer, CFA, Co-Portfolio Manager. Mr. Kornitzer has been an investment professional since 1992. Mr. Kornitzer worked for KCM as a research analyst from 1997-2000 and rejoined the firm in 2004 as a co-portfolio manager of the Large Cap and Growth (formerly the Buffalo USA Global Fund) Funds from 2004-2007. Mr. Kornitzer received his MBA from Drexel University and his B.S. in Finance from Virginia Tech. Mr. Kornitzer has served as co-portfolio manager of the China Fund since 2009 and the International Fund since its inception.

Nicole Kornitzer, CFA, Co-Portfolio Manager and Research Analyst. Ms. Kornitzer has been an investment professional since 2000 and she worked for KCM as a research analyst from 2000-2002 and rejoined the firm in 2004. Ms. Kornitzer holds a B.A. in Biology from the University of Pennsylvania and a Masters Degree in French Cultural Studies from Columbia University in Paris, France. Ms. Kornitzer has served as co-portfolio manager of the China Fund and the International Fund since 2009.

Yulin Li, CFA, CPA, Co-Portfolio Manager and Research Analyst. Mr. Li has been an investment professional since 2010. Prior to joining KCM in 2010 as a research analyst for the Buffalo International and China Funds, Mr. Li served as a general manager and senior actuary at AEGON, a global life insurance company, for over 10 years. Mr. Li received his MBA in International Finance from the University of Illinois at Urbana-Champaign and his B.S. in Civil Engineering from Southwest University in Nanjing China. Effective February 1, 2012, Mr. Li became a co-portfolio manager of the China Fund. Mr. Li will not serve as a co-portfolio manager of the International Fund.

The Statement of Additional Information relating to this information statement/prospectus provides additional information about the International Fund’s portfolio managers, including other accounts they manage, their ownership of Fund shares and their compensation.

Other Fund Service Providers. Both the International Fund and the China Fund use the services of U.S. Bancorp Fund Services, LLC (“USBFS”) as their transfer agent, administrator and fund accountant. Both Funds also use the services of U.S. Bank, an affiliate of USBFS, as their custodian. Upon completion of the Reorganization, USBFS and U.S. Bank will continue to provide services to the International Fund.

Independent Accountants. Ernst & Young LLP serves as the independent registered public accounting firm to both the International Fund and the China Fund.

Ownership of Securities of the Funds. As of the Record Date, the Funds had the following number of shares issued and outstanding. As of the same date, directors and officers of the China Fund as a group owned less than 1% of the outstanding voting securities of each of the Funds.

| Shares Issued & Outstanding as of November 30, 2012 | |

| China Fund | […] |

| International Fund | […] |

As of the same date, the following persons owned beneficially or of record more than 5% of the outstanding shares of the China Fund and the International Fund:

| Principal Shareholders and Control Persons as of November 30, 2012 | | Shareholder and Address | | Percentage of Fund Owned |

| China Fund | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| International Fund | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Any shareholder that owns 25% or more of the outstanding shares of a Fund or a class of a Fund may be presumed to “control” (as that term is defined in the 1940 Act) the Fund or that class. Shareholders with a controlling interest could affect the outcome of proxy voting or the direction of management of a Fund.

The Trust is subject to the requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and in accordance therewith, files reports, proxy material and other information about each of the Funds with the SEC. These documents can be inspected and copied at the SEC’s Public Reference Room in Washington, D.C. (100 F Street, Washington, D.C. 20549). Please call the SEC at 1-202-551-8090 for information relating to the operation of the Public Reference Room. Reports and other information about a Fund are also available on the EDGAR database on the SEC’s Internet site located at http://www.sec.gov. Alternatively, copies of this information may be obtained, upon payment of a duplicating fee, by electronic request to the following e-mail address: publicinfo@sec.gov, or by writing the Public Reference Section of the SEC, Washington, D.C. 20549-1520.

Certain legal matters concerning the federal income tax consequences of the Reorganization and the issuance of shares of the International Fund will be passed on by the law firm of Godfrey & Kahn, S.C., 780 North Water Street, Milwaukee, WI 53202.

The financial statements and financial highlights of the China Fund and the International Fund incorporated in this information statement/prospectus by reference from the Funds’ Annual Report on Form N-CSR for the fiscal year ended March 31, 2012 have been audited by Ernst & Young LLP, an independent registered public accounting firm, as stated in their report, which is incorporated herein by reference, and have been so incorporated in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

The China Fund is not required, and does not intend, to hold regular annual meetings of shareholders. Shareholders wishing to submit proposals for consideration for inclusion in a proxy statement for the next meeting of shareholders should send their written proposals to the Secretary of the China Fund at U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, Wisconsin 53201-0701, so that they are received within a reasonable time before any such meeting. The timely submission of a proposal does not guarantee its submission.

By order of the Board of Trustees,

/s/ Kent W. Gasaway

Kent W. Gasaway

President, Buffalo Funds

Appendix A

This Agreement and Plan of Reorganization (“Agreement”) is made as of [ ], 2012, by and between Buffalo Funds, a Delaware statutory trust (the “Trust”), on behalf of its series the Buffalo China Fund (the “China Fund”) and the Trust, on behalf of its series the Buffalo International Fund (the “International Fund” and, together with the China Fund, the “Funds”). Kornitzer Capital Management, Inc. is a party to this Agreement solely for purposes of paragraph 8.2. All agreements, representations, actions and obligations described herein made or to be taken or undertaken by the International Fund or the China Fund are made and shall be taken or undertaken by the Trust on behalf of the International Fund and China Fund.

This Agreement is intended to be and is adopted as a “plan of reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). The reorganization will consist of the transfer of all of the assets of the China Fund to the International Fund in exchange solely for shares of beneficial interest of the International Fund (the “International Fund Shares”), the assumption by the International Fund of all liabilities of the China Fund, and the distribution of the International Fund Shares to the shareholders of the China Fund in redemption of all outstanding China Fund Shares (as defined below) and in complete liquidation of the China Fund, all upon the terms and conditions hereinafter set forth in this Agreement (the “Reorganization”).

WHEREAS, the China Fund is a series of a registered open-end management investment company, and the International Fund is a series of a registered open-end management investment company, and the China Fund owns securities which are assets of the character in which the International Fund is permitted to invest;

WHEREAS, both the China Fund and the International Fund are authorized to issue their shares of beneficial interest;

WHEREAS, the Board of Trustees of the Trust has determined, with respect to the China Fund, that (1) participation in the Reorganization is in the best interests of the China Fund and its shareholders, and (2) the interests of the existing shareholders of the China Fund would not be diluted as a result of the Reorganization; and

WHEREAS, the Board of Trustees of the Trust has determined, with respect to the International Fund, that (1) participation in the Reorganization is in the best interests of the International Fund and its shareholders, and (2) the interests of the existing shareholders of the International Fund would not be diluted as a result of the Reorganization;

NOW, THEREFORE, in consideration of the premises and of the covenants and agreements hereinafter set forth, the parties hereto covenant and agree as follows:

ARTICLE I

1.1 The Reorganization. Subject to the terms and conditions herein set forth and on the basis of the representations and warranties contained herein, at the Effective Time (as defined in paragraph 3.1), the Trust shall assign, deliver and otherwise transfer the Assets (as defined in paragraph 1.2) of the China Fund to the International Fund, and the Trust shall assume the Liabilities (as defined in paragraph 1.3) of the China Fund on behalf of the International Fund. In consideration of the foregoing, at the Effective Time, the International Fund shall deliver to the China Fund full and fractional International Fund Shares (to the third decimal place). The number of International Fund Shares to be delivered shall be determined as set forth in paragraph 2.3.

1.2 Assets of the China Fund. The assets of the China Fund to be acquired by the International Fund shall consist of all assets and property, including, without limitation, all cash, cash equivalents, securities, receivables (including securities, interests and dividends receivable), commodities and futures interests, rights to register shares under applicable securities laws, any deferred or prepaid expenses shown as an asset on the books of the China Fund at the Valuation Time, books and records of the China Fund, and any other property owned by the China Fund at the Valuation Time (collectively, the “Assets”).

1.3 Liabilities of the China Fund. The China Fund will use commercially reasonable efforts to discharge all of its known liabilities and obligations prior to the Valuation Time consistent with its obligation to continue to pursue its investment objective and strategies in accordance with the terms of its prospectus. The International Fund will assume all of the China Fund’s liabilities and obligations of any kind whatsoever, whether known or unknown, absolute, accrued, contingent or otherwise, in existence on the Closing Date (collectively, the “Liabilities”).

1.4 Distribution of International Fund Shares. At the Effective Time (or as soon thereafter as is reasonably practicable), the China Fund will distribute the International Fund Shares received from the International Fund pursuant to paragraph 1.1, pro rata to the record holders of the shares of the China Fund determined as of the Effective Time (the “China Fund Shareholders”) in complete liquidation of the China Fund. Such distribution and liquidation will be accomplished by the transfer of the International Fund Shares then credited to the account of the China Fund on the books of the International Fund to open accounts on the share records of the International Fund in the names of the China Fund Shareholders. The aggregate net asset value of the International Fund Shares to be so credited to China Fund Shareholders shall be equal to the aggregate net asset value of the then outstanding shares of beneficial interest of the China Fund (the “China Fund Shares”) owned by China Fund Shareholders at the Effective Time. All issued and outstanding shares of the China Fund will simultaneously be redeemed and canceled on the books of the China Fund. The International Fund shall not issue certificates representing the International Fund Shares in connection with such exchange.

1.5 Recorded Ownership of International Fund Shares. Ownership of International Fund Shares will be shown on the books of the International Fund’s Transfer Agent (as defined in paragraph 3.3).

1.6 Filing Responsibilities of China Fund. Any reporting responsibility of the China Fund, including, but not limited to, the responsibility for filing regulatory reports, tax returns, or other documents with the Securities and Exchange Commission (“Commission”), any state securities commission, and any Federal, state or local tax authorities or any other relevant regulatory authority, is and shall remain the responsibility of the China Fund.

ARTICLE II

VALUATION

2.1 Net Asset Value of the China Fund. The net asset value of the China Fund Shares shall be the net asset value computed as of the Valuation Time, after the declaration and payment of any dividends and/or other distributions on that date, using the valuation procedures of the China Fund.

2.2 Net Asset Value of the International Fund. The net asset value of the International Fund Shares shall be the net asset value computed as of the Valuation Time, after the declaration and payment of any dividends and/or other distributions on that date, using the valuation procedures of the International Fund.

2.3 Calculation of Number of International Fund Shares. The number of International Fund Shares to be issued (including fractional shares (to the third decimal place), if any) in connection with the Reorganization shall be determined by dividing the value of the per share net asset value of the China Fund Shares participating therein, determined in accordance with the valuation procedures referred to in paragraph 2.1, by the net asset value per share of the International Fund, determined in accordance with the valuation procedures referred to in paragraph 2.2. The parties agree that the intent of this calculation is to ensure that the aggregate net asset value of the International Fund Shares to be so credited to China Fund Shareholders shall be equal to the aggregate net asset value of the then outstanding shares of beneficial interest of the China Fund Shares owned by China Fund Shareholders at the Effective Time.