UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

| Buffalo Funds |

| (Name of Registrant as Specified in its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

| | |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| x | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) Title of each class of securities to which transaction applies: ___________________________________ |

| | (2) Aggregate number of securities to which transaction applies: __________________________________ |

| | (3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): ___________________________________________________________________________________ |

| | (4) Proposed maximum aggregate value of transaction:__________________________________________ |

| | (5) Total fee paid: _______________________________________________________________________ |

| | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) Amount Previously Paid: _______________________________________________________________ |

| | (2) Form, Schedule or Registration Statement No.:_____________________________________________ |

| | (3) Filing Party: _________________________________________________________________________ |

| | (4) Date Filed: __________________________________________________________________________ |

Buffalo Funds

5420 West 61st Place

Shawnee Mission, Kansas 66205

August 18, 2015

Dear Shareholder:

We need your help with the upcoming special meeting of shareholders of Buffalo Funds (the “Trust”) with respect to all of its portfolios. At the meeting, shareholders are being asked to vote on an important proposal affecting the Trust. The Board of Trustees (the “Board”) believes the proposal will benefit you as a shareholder. Accordingly, the Board recommends that you vote “for” the proposal described below and in the proxy statement.

Although I am urging you to vote your proxy today, you also are welcome to attend the meeting in person. The meeting will be held at 11:00 a.m. Central Time on October 2, 2015, at 777 East Wisconsin Avenue, 10th Floor, Milwaukee, Wisconsin 53202.

At the meeting, the shareholders of the Trust are being asked to elect seven trustees to the Board, including four current trustees and three trustee nominees.

Detailed information about the proposal is contained in the enclosed materials.

Whether or not you plan to attend the meeting, please complete, sign and return your proxy card in the envelope provided so that your vote may be counted. Alternatively, you also can vote by telephone or by internet, by following instructions on the proxy card. If you attend the meeting, you may, if you wish, withdraw any proxy previously given and vote in person. Please read the entire proxy statement carefully before you vote your proxy.

Thank you for your prompt attention and participation.

Sincerely,

/s/ Clay E. Brethour

Clay E. Brethour

President, Buffalo Funds

BUFFALO FUNDS

PROXY STATEMENT Q&A

| Q. | Why am I receiving this proxy statement? |

| A. | You are receiving these proxy materials — that include the proxy statement and your proxy card — because you have the right to vote on an important proposal concerning Buffalo Funds (the “Trust”). |

| Q. | What is the proposal about? |

| A. | This proxy statement presents one proposal. All shareholders of the Trust, consisting of the Buffalo Discovery Fund, Buffalo Dividend Focus Fund, Buffalo Emerging Opportunities Fund, Buffalo Flexible Income Fund, Buffalo Growth Fund, Buffalo High Yield Fund, Buffalo International Fund, Buffalo Large Cap Fund, Buffalo Mid Cap Fund, and Buffalo Small Cap Fund (collectively, the “Funds”), are being asked to vote. |

This proposal relates to the election of trustees (each, a “Trustee”) to the Board of Trustees (the “Board”) of the Trust. Thomas S. Case, who has served as a Trustee since 1995, retired as a Trustee, effective May 22, 2015. In order for the Trust to remain in compliance with federal securities laws, you are being asked to elect three new Trustee nominees, Rachel F. Lupardus, Hans H. Miller, and Jeffrey D. Yowell, and to elect the incumbent Trustees, Clay E. Brethour, J. Gary Gradinger, Philip J. Kennedy, and Joseph C. Neuberger.

| Q. | How many of the nominees will be Independent Trustees if elected? |

| A. | Five of the seven nominees will be Independent Trustees (i.e., Trustees who are not “interested persons” of the Trust as that term is defined in the Investment Company Act of 1940, as amended), if elected. Mr. Brethour would be a Trustee who is an “interested person” of the Trust as a result of his position with Kornitzer Capital Management, Inc., the Funds’ investment adviser, and Mr. Neuberger would be an “interested person” of the Trust since he is an interested person of Quasar Distributors, LLC, which acts as principal underwriter to the Funds. Mr. Neuberger also serves as the Executive Vice President of the Funds’ administrator, fund accountant and transfer agent, U.S. Bancorp Fund Services, LLC. |

| Q. | How long will each Trustee serve? |

| A. | Each incumbent Trustee, and Ms. Lupardus, Mr. Miller, and Mr. Yowell if elected, may serve on the Board until he or she dies, resigns, is declared incompetent by a court of appropriate jurisdiction or is removed. In accordance with the Trust’s Nominating Committee Charter, Trustees are subject to mandatory retirement during the year in which they turn 75. |

| Q. | Who is entitled to vote at the special meeting? |

| A. | Shareholders of record of the Trust as of the close of business on August 7, 2015 (the “Record Date”) are entitled to be present and to vote at the special meeting or any adjournment thereof. Shareholders of record of the Trust at the close of business on the Record Date will be entitled to cast one vote for each full share and a fractional vote for each fractional share they hold. |

| A. | You may vote on the internet at the website provided on your proxy card or you may vote by telephone using the toll-free telephone number found on your proxy card. You may also use the enclosed postage prepaid envelope to mail your proxy card to the Trust. Please follow the enclosed instructions to use these methods of voting. You may also vote in person at the special meeting. |

| Q. | What if I cannot attend the special meeting in person? |

| A. | Whether or not you plan to attend the special meeting and regardless of the number of shares that you own, please authorize the proxies to vote your shares by marking, signing and returning the enclosed proxy card in the postage prepaid envelope provided. You also may vote by using the toll-free telephone number or by internet according to the instructions noted on the enclosed proxy card. If a quorum of shareholders is not attained for the special meeting, then the special meeting may be delayed to allow time to solicit additional proxies or the proxy materials may need to be re-issued. |

| Q. | I am a small investor. Why should I bother to vote? |

| A. | Your vote is needed to ensure that a quorum is present at the special meeting so that the proposal can be acted upon. Your immediate response on the enclosed proxy card will help prevent the need for any further proxy solicitations. We encourage all shareholders to participate, including small investors. If other shareholders like you do not vote, the Trust may not receive enough votes to go forward with the special meeting. If this happens, we may need to solicit votes again, which increases costs. |

Q. Where can I obtain additional information about the proposal?

| A. | The proposal is discussed in more detail in the enclosed proxy statement, which we encourage you to read. |

| Q. | How does the Board recommend that I vote? |

| A. | After careful consideration, the Board, including the Independent Trustees, unanimously recommends that you vote FOR the proposal. |

BUFFALO FUNDS

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

A special meeting of shareholders of the Buffalo Discovery Fund, Buffalo Dividend Focus Fund, Buffalo Emerging Opportunities Fund, Buffalo Flexible Income Fund, Buffalo Growth Fund, Buffalo High Yield Fund, Buffalo International Fund, Buffalo Large Cap Fund, Buffalo Mid Cap Fund, and Buffalo Small Cap Fund (collectively, the “Funds”), each a series of Buffalo Funds (the “Trust”) will be held on October 2, 2015 at 777 East Wisconsin Avenue, 10th Floor, Milwaukee, Wisconsin 53202 at 11:00 a.m. Central Time.

The meeting is being held so that shareholders can consider the following proposal and transact such other business as may be properly brought before the meeting (and any adjournments or postponements thereof):

| 1. | To elect seven trustees to the Trust’s Board of Trustees. |

The Board of Trustees of the Trust unanimously recommends that you vote in favor of the proposal.

Shareholders of record of the Funds at the close of business on the record date, August 7, 2015, are entitled to notice of and to vote at the meeting and any adjournment(s) or postponements thereof. Whether or not you plan to attend the meeting in person, please vote your shares. In order that your shares may be represented at the meeting, please vote your proxy as soon as possible either by mail, telephone or internet as indicated on the enclosed proxy card. If voting by mail, you are requested to:

| · | indicate your vote on the proxy card; |

| · | date and sign the proxy card; |

| · | mail the proxy card promptly in the enclosed envelope which requires no postage if mailed in the United States; and |

| · | allow sufficient time for the proxy card to be received by 11:59 p.m., Central Time, on October 1, 2015. (However, proxies received after this date may still be voted in the event of an adjournment or postponement to a later date.) |

You may also vote either by telephone or via the internet, as follows:

| To vote by telephone: | | To vote by internet: |

| (1) Read the proxy statement and have the enclosed proxy card at hand. | | (1) Read the proxy statement and have the enclosed proxy card at hand. |

| | | |

| (2) Call the toll-free number that appears on the enclosed proxy card. | | (2) Go to the website that appears on the enclosed proxy card. |

| | | |

| (3) Enter the control number set forth on the enclosed proxy card and follow the instructions. | | (3) Enter the control number set forth on the enclosed proxy card and follow the instructions. |

We encourage you to vote by telephone or via the internet using the control number that appears on the enclosed proxy card. Use of telephone or internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed proxy statement carefully before you vote.

PLEASE RESPOND – WE ASK THAT YOU VOTE PROMPTLY IN ORDER

TO AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATION.

YOUR VOTE IS IMPORTANT.

By Order of the Board of Trustees,

/s/ Edward L. Paz

Edward L. Paz

Secretary, Buffalo Funds

August 18, 2015

PROXY STATEMENT

BUFFALO FUNDS

5420 West 61st Place

Shawnee Mission, Kansas 66205

Relating to a

Special Meeting of Shareholders

to be held on October 2, 2015

This proxy statement is being provided to you in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Buffalo Funds (the “Trust”) with respect to its series Buffalo Discovery Fund, Buffalo Dividend Focus Fund, Buffalo Emerging Opportunities Fund, Buffalo Flexible Income Fund, Buffalo Growth Fund, Buffalo High Yield Fund, Buffalo International Fund, Buffalo Large Cap Fund, Buffalo Mid Cap Fund, and Buffalo Small Cap Fund (each a “Fund” and collectively, the “Funds”). The proxies are being solicited for use at a special meeting of shareholders of the Trust to be held on October 2, 2015 at 777 East Wisconsin Avenue, 10th Floor, Milwaukee, Wisconsin 53202 at 11:00 a.m. Central Time and any adjourned or postponed session thereof, for the purposes set forth in the enclosed notice of special meeting of shareholders (the “Notice”).

The following proposal will be considered and acted upon at the meeting:

| Proposal Summary | Funds Voting on the Proposal |

| | |

| 1.To elect seven trustees to the Board. | All Funds |

We anticipate that the Notice, this proxy statement and the proxy card (collectively, the “Proxy Materials”) will be mailed to shareholders beginning on or about August 24, 2015. Only shareholders who beneficially owned any shares in the Funds at the close of business on August 7, 2015 (the “Record Date”) are entitled to vote.

Other Business

The Board knows of no other business to be brought before the meeting. However, if any other matters come before the meeting, proxy cards that do not contain specific restrictions to the contrary will be voted in accordance with the judgment of the persons named as proxies.

General Information

The Trust is an open-end management investment company registered under the Investment Company Act of 1940 (the “1940 Act”). Kornitzer Capital Management, Inc. acts as the investment adviser to the Funds (the “Advisor”).

This solicitation is being made primarily by the mailing of this proxy statement and the accompanying proxy cards. Supplementary solicitations may be made by mail or telephone by representatives of the Trust or the Advisor. The Advisor and U.S. Bancorp Fund Services, LLC (“USBFS”) will bear the cost of preparing, printing and mailing the proxy statement and soliciting and tabulating proxies.

In the event that the necessary quorum to transact business or the vote required to approve or reject any proposal is not obtained by the date of the meeting, those present in person or by proxy may, by majority vote, approve one or more adjournments of the meeting to permit further solicitation of proxies. Please be sure to read the entire proxy statement before voting.

The most recent annual report of the Funds, including financial statements, for the fiscal year ended March 31, 2015 has been mailed to shareholders. Additional copies of this annual report and the Funds’ semi-annual report for the period ended September 30, 2014 are available without charge by calling Shareholder Services at 1-800-49-BUFFALO or (800) 492-8332, by visiting www.buffalofunds.com, or by sending a written request to U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON OCTOBER 2, 2015. This proxy statement is available on the internet at www.proxyonline.com.

PROPOSAL 1: ELECTION OF TRUSTEES

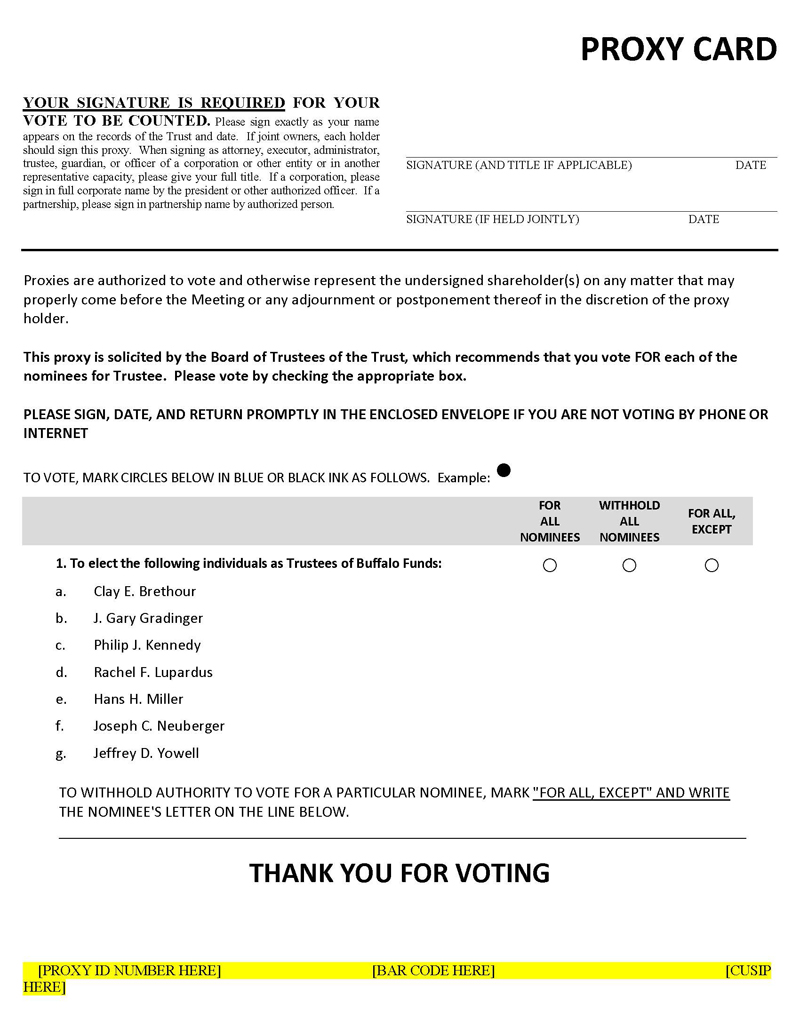

All shareholders of the Funds are being asked to elect seven nominees to constitute the Board. At a Board meeting held on May 22, 2015, Thomas S. Case announced his retirement from the Board effective as of the close of the meeting. In order for the Trust to remain in compliance with federal securities laws, on July 9, 2015, the Board, upon the recommendation of the Nominating Committee, which consists entirely of Trustees who are not “interested persons” of the Trust as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”) (“Independent Trustees”), approved the following nominees: Clay E. Brethour, J. Gary Gradinger, Philip J. Kennedy, Joseph C. Neuberger, Rachel F. Lupardus, Hans H. Miller, and Jeffrey D. Yowell (each a “Nominee” and collectively, the “Nominees”). Messrs. Brethour, Gradinger, Kennedy, and Neuberger are currently members of the Board, and the Board nominated Ms. Lupardus, Mr. Miller, and Mr. Yowell to serve as Independent Trustees, subject to their election by shareholders. Accordingly, the Board currently consists of four Trustees, and the Trustees have determined to increase the size of the Board to seven members. If elected, Ms. Lupardus, Mr. Miller, and Mr. Yowell will become new Trustees effective as of the adjournment of the special meeting.

Except for Clay E. Brethour and Joseph C. Neuberger, each of the Nominees would be an Independent Trustee. Mr. Brethour is deemed to be an “Interested Trustee” because of his employment with the Advisor, while Mr. Neuberger is an “Interested Trustee” of the Trust since he is an interested person of Quasar Distributors, LLC, which acts as principal underwriter to the Funds. Mr. Neuberger also serves as the Executive Vice President of the Funds’ administrator, fund accountant and transfer agent, USBFS.

If all of the Nominees are elected, the Board will consist of five Independent Trustees and two Interested Trustees.

If elected, each Trustee will hold office during the lifetime of the Trust until he or she (a) dies, (b) resigns, (c) is declared incompetent by a court of appropriate jurisdiction, or (d) is removed, or, if sooner, until the next meeting of shareholders called for the purpose of electing Trustees. In accordance with Trust policy, Trustees are subject to mandatory retirement at the end of the year in which they reach age 75.

All Nominees have consented to serve as Trustees. Certain biographical and other information relating to the Nominees, including each Nominee’s experience, qualifications, attributes and skills for Board membership, is set forth below.

Nominees for the Board

| Name, Age and Address | Position(s) Held with the Trust and Length of Time Served(2) | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During Past Five Years |

| INTERESTED TRUSTEES |

Joseph C. Neuberger (53) 615 East Michigan Street Milwaukee, WI 53202 | Trustee, Indefinite term and served since May 2003. Chairman, Indefinite term and served since May 2003. | Executive Vice President, U.S. Bancorp Fund Services, LLC 1994 – present. | 10 | Trustee, USA MUTUALS (an open-end investment company with three portfolios); Trustee, Trust for Professional Managers (an open-end investment company with 38 portfolios). |

| Name, Age and Address | Position(s) Held with the Trust and Length of Time Served(2) | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During Past Five Years |

| | | | | |

Clay E. Brethour (46) 5420 West 61st Place Shawnee Mission, KS 66205 | Trustee, Indefinite term and served since August 2013 President and Treasurer, One year term and served since September 2014. | Portfolio Manager, Kornitzer Capital Management, Inc. (management company) 2000 – present. | 10 | None |

| INDEPENDENT TRUSTEES |

J. Gary Gradinger (72) 5420 West 61st Place Shawnee Mission, KS 66205 | Trustee, Indefinite term and served since February 2001. | Chairman and Chief Executive Officer, Golden Star Inc. (manufacturer of textile cleaning products) 1969 – present. | 10 | Formerly, Director, MGP Ingredients, Inc. (a food ingredients company)(2005 – 2014). |

Philip J. Kennedy (70) 5420 West 61st Place Shawnee Mission, KS 66205 | Trustee, Indefinite term and served since May 1995. | Business Consultant and C.P.A. Finance and Accounting Professor, Penn State Shenango, 2001 – 2011. | 10 | None |

Rachel F. Lupardus (43) 5420 West 61st Place Shawnee Mission, KS 66205 | Trustee Nominee | Chief Operating Officer/Chief Financial Officer, Trozzolo Communications Group (marketing communications agency), 2015 – present; Chief Financial Officer, Customer Engagement, KBM Group LLC (marketing services company) 2014 – 2015; Chief Financial Officer, DataCore Marketing, LLC (marketing services company), 2004 – 2013. | 10 | None |

Hans H. Miller (62) 5420 West 61st Place Shawnee Mission, KS 66205 | Trustee Nominee | Strategic business advisor, 2008 – present; Senior Advisor and Managing Director, Banc of America Securities, 2005 – 2008; Senior Operating and Corporate Executive, The Hartford Financial Services Group, Inc. (insurance and investments), 1988 – 2004. | 10 | Hwa Hong Corporation Limited (real estate development holding company) 2005 – present; Protective Life Corporation (insurance holding company) (2009 – 2015); Tawa PLC (insurance holding company) 2011 – 2012. |

| Name, Age and Address | Position(s) Held with the Trust and Length of Time Served(2) | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During Past Five Years |

Jeffrey D. Yowell (48) 5420 West 61st Place Shawnee Mission, KS 66205 | Trustee Nominee | President and Owner, Getter Farms, LLC (agriculture and farm-related operations), 2007 – present; President, Strategic Services, KBM Group LLC (marketing services company), 2013; President and Chief Executive Officer, DataCore Marketing, LLC (marketing services company), 1992 – 2012. | 10 | None |

Experience and Qualifications of Nominees

Clay E. Brethour. Mr. Brethour has served as a Trustee of the Trust since August 2013. Mr. Brethour has served on the investment staff of the Advisor since 2000. In addition, Mr. Brethour has served as co-portfolio manager for the Buffalo Discovery Fund since 2004, and for the Buffalo Growth Fund since 2007. Mr. Brethour has served as an investment professional since 1992. Through his employment experience, Mr. Brethour is experienced with financial, accounting, regulatory and investment matters.

Joseph C. Neuberger. Mr. Neuberger has served as a Trustee of the Trust since May 2003. Mr. Neuberger has also served as a trustee of USA Mutuals since 2001 and as a trustee of Trust for Professional Managers since 2001. Mr. Neuberger has served as Executive Vice President of U.S. Bancorp Fund Services, LLC, a multi-service line service provider to mutual funds, since 1994. Through his experience as a trustee of mutual funds and his employment experience, Mr. Neuberger is experienced with financial, accounting, regulatory and investment matters.

J. Gary Gradinger. Mr. Gradinger has served as a Trustee of the Trust since inception. He also serves as a director of MGP Ingredients, Inc., and as Chairman, President and Chief Executive Officer of Golden Star Inc., a manufacturer of textile cleaning products. Through his board and employment experience, Mr. Gradinger is experienced with financial, accounting, regulatory and investment matters.

Philip J. Kennedy. Mr. Kennedy has served as a Trustee of the Trust since inception, and serves as the Chair of the Audit Committee. He is a C.P.A. and serves as a business consultant, since 1987. In addition, Mr. Kennedy also served as Internship Coordinator and Instructor in the Department of Business Administration, Penn State Shenango, from 2001 to 2011. Through his board and employment experience, Mr. Kennedy is experienced with financial, accounting, regulatory and investment matters.

Rachel F. Lupardus. Ms. Lupardus is a Nominee to serve on the Board. Ms. Lupardus has been the Chief Operating Officer/Chief Financial Officer of Trozzolo Communications Group, a marketing communications agency, since March 2015. Prior to that Ms. Lupardus served as the Chief Financial Officer of KBM Group LLC, Customer Engagement, from 2014 until March 2015 and as Chief Financial Officer of DataCore Marketing LLC, an entity that was acquired by KBM Group LLC in 2007, from 2004 to 2013. Through her employment experience, Ms. Lupardus is experienced with financial, accounting, regulatory and investment matters.

Hans H. Miller. Mr. Miller is a Nominee to serve on the Board. From 1988 to 2004, Mr. Miller served as a senior operating and corporate executive at The Hartford Financial Services Group, Inc., a Fortune 100 insurance and investment group. From 2005 to 2008 he served as a Senior Advisor and Managing Director of Bank of America Securities. Mr. Miller has served on several public company boards for U.S., European, and Asian companies including positions as non-executive chairman, chairman of audit/risk, compensation and investment committees. He is a Fellow of the National Association of Corporate Directors and the Institute of Directors. Through his employment experience and previous experience as a corporate director, Mr. Miller is experienced with financial, accounting, regulatory and investment matters.

Jeffrey D. Yowell. Mr. Yowell is a Nominee to serve on the Board. He has been the President and owner of Getter Farms, LLC, an agriculture and farm operation since 2007. Prior to that he was an executive at KBM Group LLC and DataCore Marketing, LLC, both of which are marketing services companies. Mr. Yowell was the owner, President and Chief Executive Officer of DataCore Marketing, LLC until selling it to KBM Group LLC in 2007. Through his employment experience, Mr. Yowell is experienced with financial, accounting, regulatory and investment matters.

Principal Officers of the Trust

Information about the officers of the Trust is listed below.

Name (Year of Birth) and Address | | Position(s) Held with the Trust and Length of Time Served(1) | Principal Occupation(s) During Past Five Years |

Clay E. Brethour (46) 5420 West 61st Place Shawnee Mission, KS 66205 | | President and Treasurer, One year term and served since September 2014. | Portfolio Manager, Kornitzer Capital Management, Inc. (management company) 2000 – present. |

Fred Coats (50) 5420 West 61st Place Shawnee Mission, KS 66205 | | Chief Compliance Officer, One year term and served since May 2015 | Chief Compliance Officer, Kornitzer Capital Management, Inc. (management company) May 2015 – present; Private Practice Attorney May 1993 – present. |

Edward L. Paz (44) 615 East Michigan Street Milwaukee, WI 53202 | | Secretary, One year term and served since May 2015 | Vice President, U.S. Bancorp Fund Services, LLC 2007 – present. |

(1) Each officer is elected annually and serves until his successor has been duly elected and qualified.

Ownership by Nominees in the Funds

As of June 15, 2015, the Funds’ officers, and the Nominees as a group, beneficially owned less than 1% of the outstanding shares of each Fund.

The following tables shows the dollar amount range of each Nominee’s beneficial ownership of the Funds as of June 15, 2015, using the following dollar ranges: None, $1-$10,000, $10,001-$50,000, $50,001-$100,000, and over $100,000.

| Name of Fund | Joseph C. Neuberger Interested Trustee Nominee | Clay E. Brethour Interested Trustee Nominee | J. Gary Gradinger Independent Trustee Nominee | Philip K. Kennedy Independent Trustee Nominee | Rachel F. Lupardus Independent Trustee Nominee | Hans H. Miller Independent Trustee Nominee | Jeffrey D. Yowell Independent Trustee Nominee |

| | | | | | | | |

| Buffalo Discovery Fund | $1 - $10,000 | Above $100,000 | $1 - $10,000 | $1 - $10,000 | $1 - $10,000 | None | $10,001 - $50,000 |

| | | | | | | | |

| Buffalo Dividend Focus Fund | None | None | Above $100,000 | Above $100,000 | None | None | None |

| | | | | | | | |

| Buffalo Emerging Opportunities Fund | None | $10,001 - $50,000 | $1 - $10,000 | $1 - $10,000 | None | None | $1 - $10,000 |

| | | | | | | | |

| Buffalo Flexible Income Fund | Above $100,000 | None | None | Above $100,000 | $10,001 - $50,000 | None | $10,001 - $50,000 |

| | | | | | | | |

| Buffalo Growth Fund | None | Above $100,000 | None | $1 - $10,000 | $10,001 - $50,000 | None | $1 - $10,000 |

| | | | | | | | |

| Buffalo High Yield Fund | None | None | None | $1 - $10,000 | None | None | None |

| | | | | | | | |

| Buffalo International Fund | None | None | $1 - $10,000 | $10,001 - $50,000 | None | None | Above $100,000 |

| | | | | | | | |

| Buffalo Large Cap Fund | None | $1 - $10,000 | None | $1 - $10,000 | None | None | $10,001 - $50,000 |

| | | | | | | | |

| Buffalo Mid Cap Fund | None | None | None | $10,001 - $50,000 | $10,001 - $50,000 | None | $10,001 - $50,000 |

| | | | | | | | |

| Buffalo Small Cap Fund | $50,001 - $100,000 | $10,001 - $50,000 | $1 - $10,000 | $50,001 - $100,000 | None | None | $10,001 - $50,000 |

| | | | | | | | |

Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Trustee(1) in Family of Investment Companies | Above $100,000 | Above $100,000 | Above $100,000 | Above $100,000 | $10,001 - $50,000 | None | Above $100,000 |

| | (1) | Beneficial ownership is determined in accordance with Rule 16a-1(a)(2) under the Securities Exchange Act of 1934, as amended. |

Certain Transactions

As of June 15, 2015, no Nominee, or any immediate family member of such a Nominee, had any direct or indirect interest in: (i) the Funds’ investment adviser or distributor or (ii) any person (other than a registered investment company or series thereof) directly or indirectly controlling, controlled by, or under common control with the investment adviser or distributor.

Board Leadership Structure

The Board of Trustees is currently comprised of two Independent Trustees – Mr. J. Gary Gradinger and Mr. Philip J. Kennedy – and two Interested Trustees – Mr. Joseph C. Neuberger and Mr. Clay E. Brethour. The Trust’s Chairman, Mr. Neuberger, is an interested person of the Trust by virtue of the fact that he is an interested person of Quasar Distributors, LLC, which acts as principal underwriter to the Funds. Mr. Neuberger also serves as the Executive Vice President of the Funds’ administrator, fund accountant and transfer agent. Mr. Brethour is an interested person of the Trust by the virtue of his employment by the Advisor. The Trust has not appointed a lead Independent Trustee.

The Board of Trustees has established three standing committees – the Audit Committee, the Nominating Committee and the Valuation Committee. All Independent Trustees are members of the Audit Committee and the Nominating Committee. Inclusion of all Independent Trustees as members of the Audit Committee and the Nominating Committee allows all such Trustees to participate in the full range of the Board of Trustees’ oversight duties, including oversight of risk management processes. In accordance with the fund governance standards prescribed by the SEC under the 1940 Act, the Independent Trustees on the Nominating Committee select and nominate all candidates for Independent Trustee positions.

Each Trustee was appointed to serve on the Board of Trustees because of his experience, qualifications, attributes and/or skills as set forth in the prior section entitled “Experience and Qualifications of Nominees.” The Board of Trustees reviews its leadership structure regularly. The Board of Trustees believes that its leadership structure is appropriate and effective in light of the size of the Trust, the nature of its business and industry practices.

The Trust is governed by the Board of Trustees which is responsible for protecting the interests of Fund shareholders under the laws of Delaware. The Trustees are experienced business persons, who meet throughout the year to oversee the Funds’ activities, review contractual arrangements with companies that provide services to the Funds, and review Fund performance. The officers of the Trust are responsible for supervising the Funds’ business operations, but the Funds are managed by the Advisor, subject to the supervision and control of the Board of Trustees.

Risk Management

The Board of Trustees’ role is one of oversight rather than day-to-day management of the Funds. The Trust’s Audit Committee assists with this oversight function. The Board of Trustees’ oversight extends to the Trust’s risk management processes. Those processes are overseen by Trust officers, including the President and Treasurer, Secretary and Chief Compliance Officer (“CCO”), who regularly report to the Board of Trustees on a variety of matters at Board meetings.

The Advisor reports to the Board of Trustees, on a regular and as-needed basis, on actual and possible risks affecting the Funds and the Trust as a whole. The Advisor reports to the Board of Trustees on various elements of risk, including investment, credit, liquidity, valuation, operational and compliance risks, as well as any overall business risks that could impact the Funds.

The Board of Trustees has appointed the CCO who reports directly to the Board of Trustees and who participates in the Board of Trustees’ regular meetings. In addition, the CCO presents an annual report to the Board of Trustees in accordance with the Trust’s compliance policies and procedures. The CCO regularly discusses risk issues affecting the Trust and the Funds during Board of Trustee meetings. The CCO also provides updates to the Board of Trustees on the operation of the Funds’ compliance policies and procedures and on how these procedures are designed to mitigate risk. Finally, the CCO and/or other officers of the Trust report to the Board of Trustees in the event any material risk issues arise in between Board meetings.

Board Compensation

The Funds do not directly compensate any Trustee or Trust officer for their normal duties and services. Mr. Neuberger, who is an Interested Trustee due to his employment with USBFS, and Mr. Brethour, who is an Interested Trustee due to his employment with the Advisor, are compensated by their respective employers and not by the Funds. With respect to other Trustees (i.e., the Independent Trustees) USBFS pays the trustee fees from its share of the management fee that it receives from the Advisor. USBFS is an affiliate of the Funds’ underwriter.

For the fiscal year ended March 31, 2015, each Independent Trustee received an annual retainer of $32,000 for the fiscal year (April 1 to March 31), plus $200 per Fund for each meeting of the Board of Trustees attended in-person and $100 per Fund for telephone attendance. The Chair of the Audit Committee receives additional annual compensation of $5,000. The Board of Trustees generally meets four times each year.

In addition, the Funds are directly responsible for payment of out-of-pocket expenses incurred by the Independent Trustees for travel, meals, lodging and similar items in connection with attendance at conferences or Board meetings. Reimbursements to Trustees for out-of-pocket expenses are accrued and paid for by the Funds. Payment of out-of-pocket expenses is allocated equally among the Funds.

The following table shows the total amount of compensation paid to each Independent Trustee, including fees paid on behalf of the Funds by USBFS and out-of-pocket expenses paid directly by the Funds, for the fiscal year ended March 31, 2015:

| Name of Person, Position | Pension or Retirement Benefits Accrued as Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Fees Paid on Behalf of Buffalo Funds Complex by USBFS | Out-of- Pocket Expenses Paid by the Buffalo Funds Complex | Total Amount of Compensation |

Thomas S. Case, Trustee(1) | None | None | $40,000 | $5,740 | $45,740 |

| J. Gary Gradinger, Trustee | None | None | $40,000 | $2,455 | $42,455 |

| Philip J. Kennedy, Trustee | None | None | $45,000 | $6,292 | $51,292 |

| (1) | Mr. Case retired from the Board of Trustees effective May 22, 2015. |

Board Committees

The Board has three standing committees. Information about those standing committees is discussed below.

Audit Committee

The Trust has an Audit Committee, which assists the Board of Trustees in fulfilling its duties relating to each Fund’s accounting and financial reporting practices, and also serves as a direct line of communication between the Board of Trustees and the independent registered public accounting firm. The Audit Committee is comprised of Messrs. Gradinger and Kennedy, the Trust’s Independent Trustees, and Mr. Kennedy serves as the Chair of the Audit Committee. The specific functions of the Audit Committee include recommending the engagement or retention of the independent registered public accounting firm, reviewing with the independent registered public accounting firm the plan and results of the auditing engagement, approving professional services provided by the independent registered public accounting firm prior to the performance of such services, considering the range of audit and non-audit fees, reviewing the independence of the independent registered public accounting firm, reviewing the scope and results of the Trust’s procedures for internal auditing, and reviewing the Trust’s system of internal accounting controls. The Audit Committee met twice during the Trust’s last fiscal year. The Board will appoint Ms. Lupardus, Mr. Miller, and Mr. Yowell to serve on the Audit Committee upon their election by shareholders.

Nominating Committee

The Trust also has a Nominating Committee, which has the responsibility, among other things, to: (i) make recommendations and to consider shareholder recommendations for nominations for Board members; (ii) periodically review and approve Trustee compensation; and (iii) make recommendations to the full Board of Trustees for nominations for membership on all committees, review all committee assignments and periodically review the responsibilities and need for all committees of the Board of Trustees. The Nominating Committee is comprised of Messrs. Gradinger and Kennedy, the Trust’s Independent Trustees. The Nominating Committee met once during the Trust’s last fiscal year. The Board will appoint Ms. Lupardus, Mr. Miller, and Mr. Yowell to serve on the Nominating Committee upon their election by shareholders.

Valuation Committee

The Board of Trustees has appointed a Valuation Committee that is responsible for: (1) monitoring the valuation of Fund securities and other investments; and (2) as required, when the full Board of Trustees is not in session, determining the fair value of illiquid and other holdings after consideration of all relevant factors, which determinations are reported to the full Board of Trustees. The Valuation Committee meets as necessary when a market quotation for a portfolio security of a Fund is not readily available. Currently, Mr. Brethour, Mr. Neuberger, Mr. William Kornitzer, CFA, co-portfolio manager of the Buffalo International Fund, Mr. Alexander Hancock, CFA, co-portfolio manager of the Buffalo High Yield Fund, and Mr. Eric McCormick, an assistant officer of the Funds, are members of the Valuation Committee. The Valuation Committee met four times during the Trust’s last fiscal year.

Shareholder Communications

Shareholders may communicate with the Board (or individual Trustees serving on the Board) by sending written communications, addressed to the Board as a group or any individual Trustee, to the Funds at 5420 West 61st Place, Shawnee Mission, Kansas 66205. The Funds will ensure that this communication (assuming it is properly marked care of the Board or care of a specific Trustee) is delivered to the Board or the specified Trustee, as the case may be.

Trustee Nomination Process

The Board as a whole is responsible for identifying, evaluating and recommending nominees to serve as Trustees of the Trust. The Board has established the Nominating Committee to develop and recommend guidelines and criteria for the selection of candidates for Trustees and to recommend candidates to serve as Trustees. The Nominating Committee operates pursuant to a written charter, which was most recently amended on May 23, 2013. The Nominating Committee Charter is attached as Exhibit A to the proxy statement. The Nominating Committee will consider candidates recommended by shareholders provided such recommendations are presented with appropriate background material concerning the candidate that demonstrates his or her ability to serve as a Board member.

According to the Nominating Committee Charter approved by the Board, the Nominating Committee will consider and review shareholder recommendations for nominations to fill vacancies on the Board of Trustees if such recommendations satisfy the criteria for selecting Board members set forth in the Nominating Committee Charter and are properly submitted to the Committee or the Trust. The Nominating Committee Charter requires that candidates for service on the Board satisfy the following minimum qualifications: (a) such candidates would be Independent Trustees if selected for service on the Board; (b) such candidates demonstrate an ability to make the time commitment necessary to serve effectively on the Board; and (c) such candidates should be individuals of the highest character and integrity and demonstrate the ability to work well with others.

In order to recommend a nominee, a “qualifying shareholder” (as defined below) should provide a written notice to the Nominating Committee containing the following information: (a) the name and address of the qualifying shareholder making the recommendation; (b) the number of shares of each class and series, if any, of shares of the Funds which are owned of record and beneficially by such qualifying shareholder and the length of time that such shares have been so owned by the qualifying shareholder; (c) a description of all arrangements and understandings between such qualifying shareholder and any other person or persons (naming such person or persons) pursuant to which the recommendation is being made; (d) the name, age, date of birth, business address and residence address of the person or persons being recommended; (e) such other information regarding each person recommended by such qualifying shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had the nominee been nominated by the Board of Trustees; (f) whether the shareholder making the recommendation believes the person recommended would or would not be an “interested person” of the Trust, as defined in Section 2(a)(19) of the 1940 Act; and (g) the written consent of each person recommended to serve as a Trustee of the Trust if so nominated and elected/appointed. The notice should be sent to the Secretary of the Trust, at 615 East Michigan Street, Milwaukee, WI 53202, and the envelope containing the notice should indicate “Nominating Committee.” The Secretary of the Funds shall forward the recommendation and supporting information to the Chair of the Nominating and Governance Committee for consideration by the Committee.

A “qualifying shareholder” who is eligible to recommend a nominee to the Nominating Committee is: (i) a shareholder that beneficially owns more than 3% of a fund’s outstanding shares for at least 3 years prior to submitting the recommendation to the Nominating Committee; or (ii) a group of shareholders that beneficially own, in the aggregate, more than 3% of a Fund’s shares for at least 3 years prior to submitting the recommendation to the Nominating Committee; and (iii) provides a written notice to the Nominating Committee containing the information above.

It is the intention of the Nominating Committee that the recommending shareholder demonstrate a significant and long-term commitment to the Funds and their other shareholders and that his or her objectives in submitting a recommendation is consistent with the best interests of the Funds and all of their shareholders.

In the event the Nominating Committee receives a recommendation from a qualifying shareholder: (i) during a time when no vacancy exists or is expected to exist in the near term; or (ii) within 60 days of the date of the meeting of the Board of Trustees at which the Board of Trustees acts to fill a vacancy or call a meeting of shareholders for the purpose of filling such vacancy, and in each case the recommendation otherwise contains all the information required, the Nominating Committee will retain such recommendation in its files until a vacancy exists or is expected to exist in the near term and the Nominating Committee commences its efforts to fill such vacancy.

In evaluating nominees, the Nominating Committee will consider whether the individual’s background, skills and experience will complement the background, skills and experience of other nominees and will contribute to the diversity of the Board. Ms. Lupardus, Mr. Miller, and Mr. Yowell were approved by the Nominating Committee as Nominees after being recommended for consideration by officers of the Trust who are also employees or officers of the Advisor.

Board Recommendation

The Board unanimously recommends that shareholders of the Trust vote FOR the election of each of the Nominees.

Required Vote

Trustees are elected by the affirmative vote of a plurality of the votes validly cast in person or by proxy at a meeting at which a quorum exists. This means that the seven Nominees who receive the largest number of votes will be elected as Trustees. Abstentions and broker non-votes will not be counted as votes cast, but will be counted for purposes of determining whether a quorum is present. All outstanding shares of the Trust shall be voted in aggregate.

OTHER INFORMATION

Management and Other Service Providers

Set forth below is a description of the current service providers of the Funds.

Advisor. Kornitzer Capital Management, Inc., or the Advisor, is the manager and investment advisor for the Funds and is responsible for overseeing and implementing each Fund’s investment program and managing the day-to-day investment activity and general operations of each Fund. The Advisor was founded in 1989. In addition to managing and advising the Funds, the Advisor provides investment advisory services to a broad variety of individual, corporate and other institutional clients. As manager, the Advisor, directly or through its service providers, provides or pays the cost of all management, supervisory and administrative services required in the normal operation of the Funds. This includes: investment management and supervision; transfer agent and accounting services; a portion of foreign custody fees (if applicable); fees for domestic custody services; independent auditors and legal counsel; fees and expenses of officers, trustees and other personnel; rent; shareholder services; and other items incidental to corporate administration. The Advisor is located at 5420 West 61st Place, Shawnee Mission, Kansas 66205.

Principal Underwriter and Distributor. Quasar Distributors, LLC (the “Distributor”), a Delaware limited liability company located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, is the principal underwriter for the shares of the Funds. The Distributor is a registered broker-dealer and member of the Financial Industry Regulatory Authority, Inc. The offering of the Funds’ shares is continuous, and the Distributor will distribute the shares on a best-efforts basis.

Administrator. U.S. Bancorp Fund Services, LLC, or USBFS, provides various administrative and accounting services necessary for the operations of the Funds. Services provided by USBFS, pursuant to the Board-approved Master Services Agreement between the Advisor and USBFS include: facilitating general Fund management; handling disbursement of Trustee annual compensation for the Funds: monitoring Fund compliance with federal and state regulations; supervising the maintenance of each Fund’s general ledger, the preparation of each Fund’s financial statements, the determination of the net asset value of each Fund’s assets and the declaration and payment of dividends and other distributions to shareholders; and preparing specified financial, tax and other reports. The Advisor has also retained USBFS to serve as the transfer agent for each Fund. As the Funds’ transfer agent, USBFS performs shareholder service functions such as maintaining the records of each shareholder’s account, answering shareholders’ inquiries concerning their accounts, processing purchases and redemptions of each Fund’s shares, acting as dividend and distribution disbursing agent and performing other accounting and shareholder service functions. USBFS is located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, and is an affiliate of the Distributor.

Independent Registered Public Accounting Firm.

The Audit Committee, composed of the Independent Trustees of the Trust, has selected Ernst & Young LLP (“Ernst & Young”), One Kansas City Place, 1200 Main Street, Suite 2500, Kansas City, Missouri 64105, as the independent public accounting firm to each Fund. Ernst & Young is subject to annual appointment by the Audit Committee. Ernst & Young conducts an annual audit of each Fund’s financial statements and performs tax and accounting advisory services.

Audit Fees — The aggregate fees billed for professional services rendered by Ernst & Young for the audit of the Funds’ annual financial statements or services normally provided in connection with statutory and regulatory filings or engagements for the last two fiscal years ended March 31, 2015 and March 31, 2014 were $206,000 and $198,190, respectively.

Audit Related Fees — The aggregate fees for services rendered by Ernst & Young for assurance and related services that are reasonably related to the performance of the audit or review of financial statements, including reviewing Funds’ semi-annual reports, that were not reported as Audit Fees above for the last two fiscal years ended March 31, 2015 and March 31, 2014 were $7,000 and $6,445, respectively.

Tax Fees — The aggregate fees billed for professional services rendered by Ernst & Young to the Funds for tax compliance, tax planning, and tax advice, including tax return review and excise tax distribution review services, for the last two fiscal years ended years ended March 31, 2015 and March 31, 2014 were $33,720 and $30,315, respectively. These services consisted of Ernst & Young reviewing the Funds’ excise tax returns, distribution requirements and registered investment company tax returns, as well as consultations regarding the tax consequences of specific investments.

All Other Fees — There were no fees billed for the fiscal years ended March 31, 2015 and March 31, 2014 for products and services provided by Ernst & Young to the Funds, other than the services reported in Audit Fees, Audit Related Fees and Tax Fees above.

For the last two fiscal years ended March 31, 2015 and March 31, 2014, no fees for services rendered to the Funds and the Advisor and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Funds for non-audit services that relate directly to the operations and financial reporting of the Funds were billed by Ernst & Young.

The Audit Committee of the Board meets with the Funds’ independent registered public accounting firm and the Funds’ management to review and pre-approve all audit services to be provided by the independent accountants. The Audit Committee also pre-approves all permitted non-audit services to be provided by the Funds’ independent registered public accounting firm to the Funds.

The Audit Committee, pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X, also pre-approves Ernst & Young’s engagements for non-audit services with the Advisor, and any entity controlling, controlled by, or under common control with the Advisor that provides ongoing services to the Funds. There were no fees billed for non-audit services rendered by Ernst & Young to the Advisor for the last two fiscal years ended March 31, 2015 and March 31, 2014.

Representatives of Ernst & Young are not expected to be present at the special meeting of shareholders. Should any representatives of Ernst & Young attend the meeting they will have an opportunity to make a statement if they so desire.

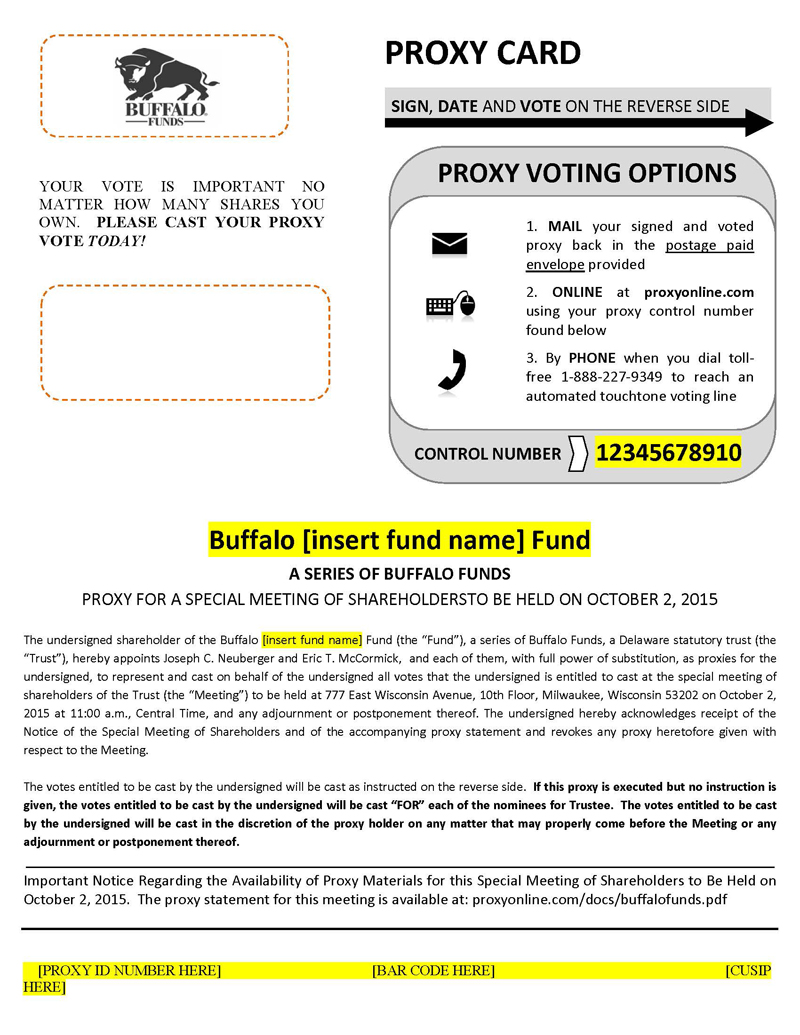

Proxies

Whether you expect to be personally present at the special meeting or not, we encourage you to vote by proxy. You can do this in one of three ways. You may complete, date, sign and return the accompanying proxy card using the enclosed postage prepaid envelope; you may vote by calling 1-888-227-9349; or you may vote by internet in accordance with the instructions noted on the enclosed proxy card. Your shares will be voted as you instruct. If no choice is indicated, your shares will be voted FOR the proposal and in the discretion of the persons named as proxies on such other matters that may properly come before the special meeting. Any shareholder giving a proxy may revoke it before it is exercised at the special meeting by submitting to the Secretary of the Funds a written notice of revocation or a subsequently signed proxy card, or by attending the special meeting and voting in person. A prior proxy can also be revoked through the website or toll free telephone number listed on the enclosed proxy card. If not so revoked, the shares represented by the proxy will be cast at the special meeting and any adjournments thereof. Attendance by a shareholder at the special meeting does not, in itself, revoke a proxy.

Quorum

A quorum must be present at the meeting for the transaction of business. Under the Trust’s Declaration of Trust, a quorum is defined as the presence, in person or by proxy, of one-third of the issued and outstanding shares of the Trust entitled to vote on the proposal.

Adjournment

In the event that a quorum is not present at the meeting, or in the event that a quorum is present but sufficient votes to approve the proposal are not received, the persons named as proxies may propose one or more adjournments of the meeting to a later date to permit further solicitation of votes. Any such adjournment will require the affirmative vote of a majority of shares of the Funds, present or represented by proxy at the meeting to be adjourned. When voting on a proposed adjournment, the persons named as proxies will vote all proxies that they are entitled to vote FOR approval of any proposal in favor of adjournment and will vote all proxies required to be voted AGAINST any such proposal against adjournment.

Solicitation of Proxies

Proxies are solicited primarily by mail. Additional solicitations may be made by telephone by officers or employees of the Funds and the Advisor or by proxy soliciting firms retained by the Funds. The Funds have retained AST Fund Solutions (the “Solicitor”) to provide proxy solicitation services in connection with the meeting at an estimated cost of approximately $8,000, as well as the reimbursement of reasonable out-of-pocket expenses. The Solicitor will also be responsible for printing and mailing the proxy statement as well as providing proxy tabulation services. In addition, the Advisor and USBFS may reimburse persons holding shares in their names or names of their nominees for expenses incurred in forwarding solicitation material to their beneficial owners. The Advisor and USBFS will bear the costs of preparing, printing and mailing the proxy statements and soliciting and tabulating proxies.

As the meeting date approaches, the shareholders of the Funds may receive a call from a representative of the Solicitor if the Funds have not yet received their proxies. Authorization to permit the Solicitor to execute proxies may be obtained by telephonic instructions from shareholders. Proxies that are obtained telephonically will be recorded in accordance with the procedures set forth below. Management of the Funds believes that these procedures are reasonably designed to ensure that the identity of the shareholder casting the vote is accurately determined and that the proxies of the shareholders are accurately determined. In all cases where a telephonic proxy is solicited, the Solicitor’s representative is required to ask the shareholder for the shareholder’s full name, address, title (if the person giving the proxy is authorized to act on behalf of an entity, such as a corporation), the number of shares owned and to confirm that the shareholder has received this proxy statement in the mail. If the shareholder solicited agrees with the information provided to the Solicitor by the Funds, the Solicitor’s representative has the responsibility to explain the process, read the proposal listed on the proxy card, and ask for the shareholder’s votes on each proposal. The Solicitor’s representative, although permitted to answer questions about the process, is not permitted to recommend to the shareholder how to vote, other than to read any recommendation set forth in this proxy statement. The Solicitor will record the shareholder’s proxy on the card. Within 72 hours, the Solicitor will send the shareholder a letter to confirm the shareholder’s vote and ask the shareholder to call the Solicitor immediately if the shareholder’s proxy is not correctly reflected in the confirmation.

Record Date and Outstanding Shares

Only shareholders of the Funds at the close of business on the Record Date (August 7, 2015) are entitled to notice of and to vote at the meeting and any postponement or adjournment thereof. Shareholders are entitled to one vote for each full share held and are entitled to fractional votes for fractional shares.

As of the Record Date, the aggregate number of outstanding shares of the Trust that were entitled to vote at the meeting is as follows:

| Name of Fund | Shares |

| Buffalo Discovery Fund | 38,463,555.966 |

| Buffalo Dividend Focus Fund | 2,659,429.608 |

| Buffalo Emerging Opportunities Fund | 11,421,602.796 |

| Buffalo Flexible Income Fund | 84,958,962.941 |

| Buffalo Growth Fund | 12,612,964.760 |

| Buffalo High Yield Fund | 21,995,101.860 |

| Buffalo International Fund | 22,081,623.325 |

| Buffalo Large Cap Fund | 1,870,534.993 |

| Buffalo Mid Cap Fund | 29,925,154.444 |

| Buffalo Small Cap Fund | 56,423,424.224 |

Control Persons and Principal Shareholders

A principal shareholder is any person who owns of record or beneficially 5% or more of the outstanding shares of a Fund. A control person is a shareholder that owns beneficially or through controlled companies more than 25% of the voting securities of a Fund or acknowledges the existence of control. Shareholders owning voting securities in excess of 25% may determine the outcome of any matter affecting and voted on by shareholders of a Fund.

As of the Record Date, the following shareholders were considered to be either a control person or principal shareholder of a Fund:

Buffalo Discovery Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

Charles Schwab & Co. Inc. Reinvest Account Attn: Mutual Fund Department 211 Main Street San Francisco, CA 94105-1905 | 16,885,537.906 | 43.90% | Record |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 7,374,662.831 | 19.17% | Record |

Buffalo Dividend Focus Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

Great Plains Trust Company* House Account – Reinvest 7700 Shawnee Mission Parkway, Suite 101 Overland Park, KS 66202-3057 | 1,332,167.693 | 50.09% | Record |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 487,595.494 | 18.33% | Record |

Charles Schwab & Co. Inc. Reinvest Account Attn: Mutual Fund Department 211 Main Street San Francisco, CA 94105-1905 | 286,310.189 | 10.77% | Record |

Buffalo Emerging Opportunities Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 3,590,843.931 | 31.44% | Record |

Charles Schwab & Co. Inc. Reinvest Account Attn: Mutual Fund Department 211 Main Street San Francisco, CA 94105-1905 | 1,948,924.864 | 17.06% | Record |

UBS WM USA Omni Account M/F Attn: Dept. Manager 1000 Harbor Boulevard, 5th Floor Weehawken, NJ 07086-6761 | 837,941.531 | 7.34% | Record |

Great Plains Trust Company* House Account – Reinvest 7700 Shawnee Mission Parkway, Suite 101 Overland Park, KS 66202-3057 | 776,085.282 | 6.79% | Record |

Great-West Trust Company LLC TTEE Employee Benefit Clients 401K 8515 East Orchard Road, 2T2 Greenwood Village, CO 80111-5002 | 724,682.586 | 6.34% | Record |

Pershing, LLC 1 Pershing Plaza Jersey City, NJ 07399-0002 | 574,103.222 | 5.03% | Record |

Buffalo Flexible Income Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

Charles Schwab & Co. Inc. Reinvest Account Attn: Mutual Fund Department 211 Main Street San Francisco, CA 94105-1905 | 35,706,997.353 | 42.03% | Record |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 24,891,847.378 | 29.30% | Record |

Great Plains Trust Company* House Account – Reinvest 7700 Shawnee Mission Parkway, Suite 101 Overland Park, KS 66202-3057 | 7,396,556.898 | 8.71% | Record |

Buffalo Growth Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

Charles Schwab & Co. Inc. Reinvest Account Attn: Mutual Fund Department 211 Main Street San Francisco, CA 94105-1905 | 3,789,218.566 | 30.04% | Record |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 3,743,574.379 | 29.68% | Record |

Great Plains Trust Company* House Account – Reinvest 7700 Shawnee Mission Parkway, Suite 101 Overland Park, KS 66202-3057 | 724,511.157 | 5.74% | Record |

Buffalo High Yield Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

Great Plains Trust Company* House Account – Reinvest 7700 Shawnee Mission Parkway, Suite 101 Overland Park, KS 66202-3057 | 6,855,593.364 | 31.17% | Record |

Pershing, LLC 1 Pershing Plaza Jersey City, NJ 07399-0002 | 5,995,552.659 | 27.26% | Record |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 3,252,320.421 | 14.79% | Record |

| | | | |

Charles Schwab & Co. Inc. Reinvest Account Attn: Mutual Fund Department 211 Main Street San Francisco, CA 94105-1905 | 2,493,381.500 | 11.34% | Record |

Buffalo International Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 9,863,161.617 | 44.67% | Record |

Great Plains Trust Company* House Account – Reinvest 7700 Shawnee Mission Parkway, Suite 101 Overland Park, KS 66202-3057 | 9,821,638.185 | 44.48% | Record |

Buffalo Large Cap Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

Great Plains Trust Company* House Account – Reinvest 7700 Shawnee Mission Parkway, Suite 101 Overland Park, KS 66202-3057 | 575,512.553 | 30.77% | Record |

Charles Schwab & Co. Inc. Reinvest Account Attn: Mutual Fund Department 211 Main Street San Francisco, CA 94105-1905 | 189,972.206 | 10.16% | Record |

LPL Financial Omnibus Customer Account Attn: Lindsay O’Toole 4707 Executive Drive San Diego, CA 92121-3091 | 143,285.312 | 7.66% | Record |

Nationwide Trust Company FSB C/O IPO Portfolio Accounting P.O. Box 182029 Columbus, OH 43218-2029 | 113,010.781 | 6.04% | Record |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 97,702.494 | 5.22% | Record |

Buffalo Mid Cap Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

TD Ameritrade, Inc. For Exclusive Benefit of Customers P.O. Box 2226 Omaha, NE 68103-2226 | 5,684,769.552 | 19.00% | Record |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 5,502,194.352 | 18.39% | Record |

Edward D. Jones & Co. For Benefit of Customers 12555 Manchester Road St. Louis, MO 63131-3729 | 5,226,022.372 | 17.46% | Record |

Charles Schwab & Co. Inc. Reinvest Account Attn: Mutual Fund Department 211 Main Street San Francisco, CA 94105-1905 | 4,167,363.611 | 13.93% | Record |

Buffalo Small Cap Fund

| Name and Address | Shares | Percentage Ownership | Type of Ownership |

National Financial Services Corp. For Exclusive Benefit of Customers 499 Washington Boulevard, Floor 5 Jersey City, NJ 07310-2010 | 12,210,541.850 | 21.64% | Record |

Charles Schwab & Co. Inc. Reinvest Account Attn: Mutual Fund Department 211 Main Street San Francisco, CA 94105-1905 | 10,739,538.286 | 19.03% | Record |

Edward D. Jones & Co. For the Benefit of Customers 12555 Manchester Road St. Louis, MO 63131-3729 | 5,845,065.198 | 10.36% | Record |

T. Rowe Price Retirement Planning Service 4515 Painters Mill Road Owings Mills, MD 21117-4903 | 2,832,987.842 | 5.02% | Record |

| | * The majority beneficial owner of Great Plains Trust Company is an irrevocable trust created by John C. Kornitzer, the President and Chairman of the Advisor, for the benefit of his family members; therefore, Mr. Kornitzer is considered a principal shareholder in several of the Funds. |

FUTURE MEETINGS; SHAREHOLDER PROPOSALS

The Funds do not hold annual or other regular meetings of the shareholders. Since the Funds do not hold regular meetings of shareholders, the anticipated date of the next shareholder meeting of the Funds cannot be provided. To be considered for inclusion in the proxy statement for any subsequent meeting of shareholders, a shareholder proposal must be submitted a reasonable time before the proxy statement for that meeting is mailed. Whether a proposal is included in the proxy statement will be determined in accordance with applicable federal and state laws. The timely submission of a proposal does not guarantee its inclusion.

| | By Order of the Board of Trustees, | |

| | | |

| | /s/ Edward L. Paz | |

| | | |

| | Edward L. Paz | |

| | Secretary, Buffalo Funds | |

August 18, 2015

EXHIBIT A

Buffalo Funds

Nominating Committee Charter

This Charter has been adopted by the Board of Trustees (the “Board”) of the Buffalo Funds (the “Funds”) to govern the Board’s Nominating Committee, which shall have the purposes, goals, responsibilities, authority and specific powers described herein.

I. The Committee.

The Nominating Committee (the “Committee”) is a committee of, and established by, the Board. The Committee consists of such number of members as set by the Board from time to time and its members shall be selected by the Board. The Committee shall be comprised entirely of “independent” members, which for purposes of this Charter shall mean members who are not “interested persons” of the Funds (“Independent Board members”) as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”). A member of the Committee shall be selected by the Board to serve as the Committee’s chairperson. The Committee may delegate any portion of its authority to a subcommittee comprised solely of its members.

| II. | Board Size, Compensation, Composition and Nominations. |

| | 1. | The Committee shall (a) evaluate from time to time the appropriate size of the Board and recommend any increase or decrease with respect thereto, (b) recommend any changes in the composition (including the relative relationship of interested to Independent Board members) of the Board so as to best reflect the objectives of the 1940 Act, the Funds and the Board, and (c) recommend to the incumbent Independent Board members (i) a slate of Independent Board members to be elected at shareholder meetings, or (ii) nominees to fill Independent Board member vacancies on the Board, where and when appropriate. |

| | 2. | The Committee shall periodically review the compensation of Independent Board members and is authorized to establish compensation of the Independent Board members as the Committee deems appropriate. |

| | 3. | The Committee shall identify, research, recruit and evaluate the qualifications of candidates for nomination for Independent Board members to serve on the Board, and make recommendations with respect thereto. Persons selected must be independent in terms of both the letter and the spirit of the 1940 Act. The Committee shall also consider the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, such as business, financial or family relationships with investment managers, employees or service providers of the Funds. |

| | 4. | The Committee shall also evaluate candidates’ qualifications, and make recommendations to the full Board, for positions as “interested” members on the Board. |

| | 5. | The Committee shall review shareholder recommendations for nominations to fill vacancies on the Board if such recommendations are properly submitted to the Committee or the Funds. The Committee shall adopt, by resolution, policies regarding its procedures for considering candidates for the Board, including any recommended by shareholders (such procedures are attached as Exhibit A). |

| | 6. | The Committee shall consider and recommend to the Independent Board members or the full Board, as appropriate, procedures for implementing changes required by statute, regulatory bodies and case law relating to the nomination, election or solicitation process with regard to election of Board members. |

During the year in which an Independent Board member reaches the age of 75, the Nominating Committee will accept the resignation of such Board member. Exceptions to this policy and extensions of the timeframe for accepting the Independent Board member’s resignation may be made on a case by case basis.

| IV. | Other Powers and Responsibilities. |

1. The Committee shall meet as often as deemed necessary in open or executive sessions. The Committee may invite members of management, counsel, advisers and others to attend its meetings, as it deems appropriate. The Committee shall have separate sessions with management and others, as and when it deems appropriate.

2. A majority of the members of the Committee shall constitute a quorum for the transaction of business at any meeting of the Committee. The action of a majority of the members of the Committee present at a meeting at which a quorum is present shall be the action of the Committee. The Committee may meet in person or by telephone, and the Committee may act by written consent, to the extent permitted by law and by the Fund’s by-laws. In the event of any inconsistency between this Charter and the Funds’ organizational documents, the provisions of the Funds’ organizational documents shall be given precedence.

3. The Committee shall have the resources and authority appropriate to discharge its responsibilities, including authority to retain special counsel and other advisers at the expense of the Funds.

4. The Committee shall report its activities to the Board and make such recommendations, as the Committee may deem necessary or appropriate.

5. The Committee shall review this Charter as deemed necessary and recommend any changes to the full Board. The Committee shall publish the Charter as required by rules and regulations of applicable law and as otherwise deemed advisable by the Committee.

6. The Committee shall annually conduct a performance evaluation of the Committee as part of the annual Board self-assessment process.

7. The Committee shall have the authority to develop with management, and monitor the process of, an approach to orienting new Board members and continuing education for existing Board members.

8. The Committee shall perform any other activities consistent with this Charter, the Funds’ By-Laws and governing law as the Committee or Board deems necessary or appropriate.

As revised by the Board of Trustees: May 16, 2012 and May 23, 2013

Exhibit A

NOMINATING COMMITTEE

STATEMENT OF POLICY AND PROCEDURES

FOR CONSIDERING CANDIDATES FOR THE BOARD OF TRUSTEES

The Nominating Committee of the Board of Trustees (the “Board”) of the Buffalo Funds (the “Funds”) has adopted this Statement of Policy and Procedures to memorialize its views as to (i) the criteria for selecting nominees for Trustees of the Funds (“Board members”) and (ii) the appropriate procedures for shareholders of the Funds to submit recommendations to the Nominating Committee for candidates for the Board.

In the event that a vacancy to be filled occurs or is expected to occur on the Funds’ Board, subject to the conditions and procedures described more fully below, the Nominating Committee shall consider and review recommendations for candidates to fill such vacancy made by current Board members (or in the case of candidates for Board members who are not “interested persons” of the Funds (“Independent Board members”) as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), by the current Independent Board members, and if and when requested by the Nominating Committee, by all Board members) and Fund management (when and as may be requested by the Nominating Committee), as well as recommendations by Qualifying Shareholders (as defined below) that are submitted in writing and are addressed to the Nominating Committee at the Funds’ offices.

Criteria for Selecting Board Nominees

In considering the qualifications of a potential candidate, the Nominating Committee will generally consider such candidate’s educational background, business or professional experience, and reputation. The Nominating Committee will endeavor to identify qualified candidates who reflect a diversity of experience, gender, race and age. In addition, the following minimum qualifications shall apply with respect to a candidate for Board membership as an Independent Board member:

1. Such candidate shall be independent from relationships with the Funds’ investment manager and other principal service providers both within the terms and the spirit of the statutory independence requirements specified under the 1940 Act and the rules and interpretations thereunder.

2. Such candidate shall demonstrate an ability and willingness to make the considerable time commitment, including personal attendance at Board meetings, believed necessary to his or her function as an effective Board member.

3. Such candidate shall be an individual of the highest character and integrity and have an inquiring mind, vision and the ability to work well with others.

Procedures for Submitting Recommendations to the Nominating Committee for Trustee Nominees

The Nominating Committee will consider recommendations for Trustee nominees submitted to it by current Board members, Fund management and Qualifying Shareholders (as defined below) so long as such recommendations are presented with appropriate background material concerning the candidate that demonstrates his or her ability to serve as a Board member, including as an Independent Board member of the Funds, in accordance with the criteria set forth above.

A Qualifying Shareholder is a (i) shareholder that beneficially owns more than 3% of a Fund’s outstanding shares for at least 3 years prior to submitting the recommendation to the Nominating Committee, or (ii) a group of shareholders that beneficially own, in the aggregate, more than 3% or a Fund’s shares for at least 3 years prior to submitting the recommendation to the Nominating Committee. Each Qualifying Shareholder must also provide a written notice to the Nominating Committee containing the following information:

| (a) | the name and address of the Qualifying Shareholder making the recommendation; |

| (b) | the number of shares of each class and series, if any, of shares of the Fund which are owned of record and beneficially by such Qualifying Shareholder and the length of time that such shares have been so owned by the Qualifying Shareholder; |

| (c) | a description of all arrangements and understandings between such Qualifying Shareholder and any other person or persons (naming such person or persons) pursuant to which the recommendation is being made; |

| (d) | the name, age, date of birth, business address and residence address of the person or persons being recommended; |

| (e) | such other information regarding (i) the Qualifying Shareholder and (ii) each person recommended by such Qualifying Shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission had the nominee been nominated by the Board; |

| (f) | whether the shareholder making the recommendation believes the person recommended would or would not be an “interested person” of the Funds, as defined in Section 2(a)(19) of the 1940 Act; and |

| (g) | the written consent of each person recommended to be named in the Funds’ proxy statement and to serve as a Trustee of the Funds if so nominated and elected/appointed. |

It is the intention of the Nominating Committee that the recommending shareholder demonstrate a significant and long-term commitment to the Funds and its other shareholders and that his or her objectives in submitting a recommendation is consistent with the best interests of the Funds and all of their shareholders.