QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on November 15, 2002

Registration No. 333-100344

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO. 1

to

FORM S-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

AMEREN ENERGY GENERATING COMPANY

(Exact Name of Registrant as Specified in Its Charter)

| Illinois | 4911 | 37-1395586 |

(State or Other Jurisdiction of

Incorporation or Organization) | (Primary Standard Industrial

Classification Code Number) | (I.R.S. Employer

Identification Number) |

1901 Chouteau Avenue

St. Louis, Missouri 63103

(314) 621-3222

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant's Principal Executive Offices)

Jerre E. Birdsong

Vice President and Treasurer

AmerenEnergy Generating Company

1901 Chouteau Avenue

St. Louis, Missouri 63103

(314) 621-3222

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent For Service)

Copies to:

Steven R. Sullivan

Vice President, General Counsel and Secretary

AmerenEnergy Generating Company

1901 Chouteau Avenue

St. Louis, Missouri 63103

(314) 621-3222 | | William J. Harmon

Jones, Day, Reavis & Pogue

77 West Wacker Drive

Chicago, Illinois 60601

(312) 782-3939 |

Approximate date of commencement of proposed sale to the public:

The exchange will occur as soon as practicable after the effective date of this registration statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

| Title of Each Class of Securities to Be Registered | | Amount to be Registered | | Proposed Maximum Offering Price Per Unit | | Proposed Maximum Aggregate Offering Price | | Amount of Registration Fee(1) |

|

| 7.95% Senior Notes, Series F due 2032 | | $275,000,000 | | 100% | | $275,000,000 | | $25,300(2) |

|

- (1)

- In accordance with Rule 457(f)(2) under the Securities Act of 1933, the registration fee is based on the book value of the outstanding 7.95% Senior Notes, Series E due 2032, of AmerenEnergy Generating Company to be canceled in the exchange transaction hereunder.

- (2)

- This entire amount has been paid previously.

We hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until we file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Subject to completion dated November 15, 2002

The information in this prospectus is not complete and may be changed. We may not consummate the exchange offer until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these notes and is not soliciting an offer to buy these notes in any state where the offer or sale is not permitted.

Preliminary Prospectus

$275,000,000

AMEREN ENERGY GENERATING COMPANY

Exchange Offer for all Outstanding

7.95% Senior Notes, Series E Due 2032

The Exchange Offer will expire at 5:00 p.m., New York City

time, on January 15, 2003, unless we extend it.

Terms of the Exchange Offer

We are offering to exchange new registered 7.95% Senior Notes, Series F due 2032, for all of our old unregistered 7.95% Senior Notes, Series E due 2032.

The terms of the new notes will be identical in all material respects to the terms of the old notes, except that the registration rights and related liquidated damages provisions and the transfer restrictions applicable to the old notes will not be applicable to the new notes. The new notes will have the same financial terms and covenants as the old notes, and will be subject to the same business and financial risks. Any outstanding old notes not validly tendered will remain subject to existing transfer restrictions.

Subject to the satisfaction or waiver of conditions specified in this prospectus, we will exchange the new notes for all old notes that are validly tendered and not withdrawn by you at any time prior to the expiration of the exchange offer as described in this prospectus.

Ameren Services Company, which we refer to as Ameren Services, is serving as the exchange agent. If you wish to tender your old notes, you must complete, execute and deliver, among other things, a letter of transmittal to the exchange agent no later than 5:00 p.m., New York City time, on the expiration date of the exchange offer.

The exchange of old notes for new notes pursuant to the exchange offer will not be taxable for United States federal income tax purposes. See "Material United States Federal Income Tax Considerations."

The new notes will not be listed on any securities exchange or included in any automated quotation system.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of those new notes. The letter of transmittal that is included as an exhibit to the registration statement of which this prospectus is a part states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933, as amended, which we refer to as the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where the old notes were acquired by that broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 270 days after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with those resales. See "Plan of Distribution."

See "Risk Factors" on page 14 of this prospectus for a discussion of risks that you should consider before participating in the exchange offer.

We are not asking you for a proxy and you are requested not to send us a proxy.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2002.

TABLE OF CONTENTS

| | Page

|

|---|

| Important Notice About Information in this Prospectus | | i |

| Where You Can Find More Information | | i |

| Documents Incorporated by Reference | | ii |

| Prospectus Summary | | 1 |

| Risk Factors | | 14 |

| Forward-Looking Statements | | 22 |

| The Exchange Offer | | 24 |

| Use of Proceeds | | 34 |

| Capitalization | | 35 |

| Summary of Independent Technical Review | | 36 |

| Summary of Independent Market Consultant's Report | | 39 |

| Conversion of Projected Cash Available for Debt Service to Generally Accepted Accounting Principles (Unaudited) | | 41 |

| Description of the New Notes | | 43 |

| Material United States Federal Income Tax Considerations | | 58 |

| Plan of Distribution | | 59 |

| Legal Matters | | 60 |

| Experts | | 60 |

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different or to make any representations about us or the transactions we discuss in this prospectus. If you receive information about these matters that is not included in this prospectus, you must not rely on that information. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission, which we refer to as the SEC, under the Securities Exchange Act of 1934, which we refer to as the Exchange Act. These reports and other information may be inspected and copied at the offices of the SEC at Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549.

You may obtain information regarding the operation of the SEC's public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports and other information regarding registrants such as our company and Ameren Corporation that file electronically with the SEC. The address of that site is (http://www.sec.gov). The new notes offered for exchange under this prospectus will not be guaranteed by, or otherwise be obligations of, Ameren Corporation or any of its direct or indirect subsidiaries other than our company.

We have filed with the SEC a registration statement on Form S-4 under the Securities Act of 1933, which we refer to as the Securities Act, and the rules and regulations promulgated under the Securities Act, with respect to the new notes offered for exchange under this prospectus. This prospectus, which constitutes part of that registration statement, does not contain all of the information set forth in the registration statement and the attached exhibits and schedules. The statements contained in this prospectus as to the contents of any contract, agreement or other document that is filed as an exhibit to the registration statement are not necessarily complete. Accordingly, each of those statements is qualified in all respects by reference to the full text of the contract, agreement or document filed as an exhibit to the registration statement or otherwise filed with the SEC.

We are incorporated in the State of Illinois. Our principal executive offices are located at 1901 Chouteau Avenue, St. Louis, Missouri 63103. Our telephone number is (314) 621-3222. You can find

i

limited information regarding our company on Ameren's website at (http://www.ameren.com). That website is not incorporated by reference in this prospectus.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to "incorporate by reference" various documents, which means that we can disclose important information to you by referring you to those documents. The information in the documents incorporated by reference is considered to be part of this prospectus, and information in documents that we file later with the SEC will automatically update and supersede that information. We incorporate by reference the documents listed below and any future filings we will make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the expiration of the exchange offer:

- •

- our annual report on Form 10-K for the year ended December 31, 2001;

- •

- our reports on Form 10-Q for the quarterly periods ended March 31, 2002, June 30, 2002 and September 30, 2002; and

- •

- our current reports on Form 8-K dated May 30, 2002 and June 6, 2002.

This prospectus incorporates important business and financial information about our company that is not included in, or delivered with, this prospectus. We will provide a copy of the documents we incorporate by reference in this prospectus, at no cost, to any person who receives this prospectus upon written or oral request. To obtain timely delivery, requests for copies should be made no later than January 8, 2003. This date is five business days before the scheduled expiration of the offer. To request a copy of any or all of these documents, you should write or telephone us at AmerenEnergy Generating Company, P.O. Box 66149, St. Louis, Missouri 63166-6149, Attention: Secretary, telephone number (314) 554-2715.

ii

PROSPECTUS SUMMARY

This summary highlights the information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of this exchange offer, we encourage you to read this entire prospectus and the documents to which we refer you.

Summary of the Terms of the Exchange Offer

| Old Notes | | On June 6, 2002, we sold in a private transaction the old notes, which consist of $275 million aggregate principal amount of our 7.95% Senior Notes, Series E due 2032, to Lehman Brothers, Banc One Capital Markets, Inc., BNY Capital Markets, Inc., Credit Suisse First Boston and Westdeutsche Landesbank Girozentrale. These initial purchasers then sold the old notes to institutional investors. Simultaneously with the initial sale of the old notes, we entered into a registration rights agreement with the initial purchasers under which we agreed, among other things, to deliver this prospectus to you and to complete an exchange offer for the old notes. See "The Exchange Offer—Purpose of the Exchange Offer." |

The Exchange Offer; New Notes |

|

We are offering to exchange up to $275 million aggregate principal amount of our 7.95% Senior Notes, Series F due 2032, that have been registered under the Securities Act for a like aggregate principal amount of our 7.95% Senior Notes, Series E due 2032. The terms of the new notes are identical in all material respects to the terms of the old notes, except that the registration rights and related liquidated damages provisions and the transfer restrictions applicable to the old notes are not applicable to the new notes. |

|

|

Old notes may be tendered only in denominations of $100,000 and integral multiples of $1,000 in excess thereof. Subject to the satisfaction or waiver of conditions specified in this prospectus, we will exchange the new notes for all old notes that are validly tendered and not withdrawn prior to the expiration of the exchange offer. We will cause the exchange to be effected promptly after the expiration of the exchange offer. |

|

|

Upon completion of the exchange offer, there may be no market for the old notes, and if you failed to exchange the old notes, you may have difficulty selling them. |

Resales of the New Notes |

|

Based on interpretations by the staff of the SEC we believe that the new notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you, without compliance with the registration and prospectus delivery requirements of the Securities Act, if you: |

|

|

• acquire the new notes in the ordinary course of your business; |

|

|

|

1

|

|

• are not engaging in and do not intend to engage in a distribution of the new notes; |

|

|

• do not have an arrangement or understanding with any person to participate in a distribution of the new notes; |

|

|

• are not an affiliate of ours within the meaning of Rule 405 under the Securities Act; and |

|

|

• are not a broker-dealer that acquired the old notes directly from us. |

|

|

If any of these conditions is not satisfied and you transfer any new notes without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We do not assume or indemnify you against this liability. |

|

|

In addition, if you are a broker-dealer seeking to receive new notes for your own account in exchange for old notes that you acquired as a result of market-making or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any offer to resell, resale or other transfer of the new notes that you receive in the exchange offer. See "Plan of Distribution." |

Expiration Date |

|

The exchange offer will expire at 5:00 p.m., New York City time, on January 15, 2003, unless we extend it. |

Withdrawal |

|

You may withdraw the tender of your old notes at any time prior to the expiration of the exchange offer. We will return to you any of your old notes that are not accepted for exchange for any reason, without expense to you, promptly after the rejection of the tender or the expiration or termination of the exchange offer. |

Consequences of Failing to Exchange Your Old Notes |

|

The exchange offer satisfies our obligations and your rights under the registration rights agreement. After the exchange offer is completed, you will not be entitled to any registration rights with respect to your old notes. |

|

|

Therefore, if you do not exchange your old notes, you will not be able to reoffer, resell or otherwise dispose of your old notes unless: |

|

|

• you comply with the registration and prospectus delivery requirements of the Securities Act; or |

|

|

• you qualify for an exemption from those Securities Act requirements. |

|

|

These conditions may adversely affect the market price of your old notes. |

|

|

|

2

Interest on the New Notes and the Old Notes |

|

Our Series F Notes will bear interest at the annual rate of 7.95%. Interest will be payable semi-annually on the new notes each June 1 and December 1. Interest on the new notes will accrue from the last date through which interest was paid on the old notes (expected to be December 1, 2002) and will first be paid on the new notes on the first June 1 or December 1 following the date the exchange offer is completed (expected to be June 1, 2003). No interest will be paid in connection with the exchange. No interest will be paid on the old notes following their acceptance for exchange. See "Description of the New Notes." |

Conditions to the Exchange Offer |

|

The exchange offer is subject to various conditions. We reserve the right to terminate or amend the exchange offer at any time before the expiration date if various specified events occur. The exchange offer is not conditioned upon any minimum principal amount of outstanding old notes being tendered. See "The Exchange Offer—Conditions of the Exchange Offer." |

Exchange Agent |

|

Ameren Services is serving as exchange agent for the exchange offer. All executed letters of transmittal should be directed to the exchange agent as follows: |

|

|

By mail: |

|

|

Ameren Services Company

P.O. Box 66887, St. Louis, Missouri 63166-6887

Attention: Investor Services MC 1035, Personal and Confidential |

|

|

By hand or overnight courier: |

|

|

Ameren Services Company

1901 Chouteau Avenue, St. Louis, Missouri 63103

Attention: Investor Services MC 1035, Personal and Confidential |

|

|

Eligible institutions may deliver documents by facsimile at: (314) 554-2401. |

Information Agent |

|

Morrow & Co, Inc. is serving as information agent for the exchange offer. You should direct all communications regarding the exchange offer, including requests for assistance or for additional copies of the prospectus or the letter of transmittal, to the information agent as follows: |

|

|

By mail, hand or overnight courier: |

|

|

Morrow & Co., Inc.

445 Park Avenue, Fifth Floor, New York, New York 10022 |

|

|

Banks and brokerage firms should call the information agent toll-free at: (800) 654-2468. |

|

|

|

3

|

|

Noteholders should call the information agent toll-free at: (800) 607-0088. |

|

|

All others should call the information agent collect at: (212) 754-8000. |

|

|

You may contact the information agent via e-mail at ameren.info@morrowco.com. |

Procedures for Tendering Old Notes |

|

If you wish to tender your old notes, you must cause the following to be transmitted to and received by the exchange agent no later than 5:00 p.m., New York City time, on the expiration date of the exchange offer: |

|

|

• a confirmation of a book-entry transfer of the tendered old notes into the exchange agent's account at The Depository Trust Company, which we refer to as DTC; |

|

|

• a properly completed and duly executed letter of transmittal in the form accompanying this prospectus (with any required signature guarantees) or, at the option of the tendering holder in the case of a book-entry tender, an agent's message instead of the letter of transmittal; and |

|

|

• any other documents required by the letter of transmittal. |

|

|

The new notes are referred to as the "Exchange Notes" in the letter of transmittal. |

Guaranteed Delivery Procedures |

|

If you wish to tender your old notes and you cannot complete procedures for book-entry transfer or cause the old notes or any other required documents to be transmitted to and received by the exchange agent before 5:00 p.m., New York City time, on the expiration date, you may tender your old notes according to the guaranteed delivery procedures described in this prospectus under the heading "The Exchange Offer—Guaranteed Delivery Procedures." |

Special Procedures for Beneficial Owners |

|

If you are the beneficial owner of old notes that are registered in the name of your broker, dealer, commercial bank, trust company or other nominee, and you wish to participate in the exchange offer, you should promptly contact the person in whose name your outstanding old notes are registered and instruct that person to tender your old notes on your behalf. See "The Exchange Offer—Procedures for Tendering." |

Representations of Tendering

Holders |

|

By tendering old notes pursuant to the exchange offer, you will, in addition to other customary representations, represent to us that you: |

|

|

• are not an affiliate of ours; |

|

|

• are not a broker-dealer tendering old notes acquired directly from us; |

|

|

|

4

|

|

• are acquiring the new notes in the ordinary course of business; |

|

|

• are not engaging in and do not intend to engage in a distribution of the new notes; |

|

|

• have no arrangement or understanding with any person to participate in the distribution of the new notes; and |

|

|

• acknowledge that if you are deemed to have participated in the exchange offer for the purpose of distributing the new notes, you will comply with the registration and prospectus delivery requirements of the Securities Act. |

Acceptance of Old Notes and Delivery of New Notes |

|

Subject to the satisfaction or waiver of the conditions to the exchange offer, we will accept for exchange any and all old notes that are properly tendered and not withdrawn prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer. We will cause the exchange to be effected promptly after the expiration of the exchange offer. |

United States Federal Income Tax Considerations |

|

Your acceptance of the exchange offer and the exchange of your old notes for new notes will not be taxable for U.S. federal income tax purposes. See "Material United States Federal Income Tax Considerations." |

Regulatory Approvals |

|

All regulatory approvals necessary for the exchange of the old notes for the new notes have been obtained. |

Appraisal or Dissenters' Rights |

|

You will have no appraisal or dissenters' rights in connection with the exchange offer. |

Use of Proceeds |

|

We will not receive any proceeds from the issuance of new notes pursuant to the exchange offer. We will pay expenses incident to the exchange offer to the extent indicated in the registration rights agreement. |

Summary of the Terms of the New Notes

The terms of the new notes will be identical in all material respects to the terms of the old notes, except that the registration rights and related liquidated damages provisions and the transfer restrictions applicable to the old notes are not applicable to the new notes. The new notes will evidence the same debt as the old notes. The new notes and the old notes will be governed by the same indenture. For more complete information about the new notes, see the "Description of the New Notes" section of this prospectus.

Issuer |

|

AmerenEnergy Generating Company |

New Notes |

|

We will offer the new notes in one series: up to $275 million principal amount of 7.95% Senior Notes, Series F due 2032. |

Maturity |

|

Our Series F Notes will mature on June 1, 2032. |

Interest Rate |

|

Interest will accrue on the Series F Notes at a rate of 7.95% per year. |

|

|

|

5

Interest Accrual |

|

Interest on the new notes will accrue from the last date through which interest was paid on the old notes (expected to be December 1, 2002) and will first be paid on the new notes on the first June 1 or December 1 following the date the exchange offer is completed (expected to be June 1, 2003). No interest will be paid in connection with the exchange. |

Interest Payment Dates |

|

We will pay interest on the new notes semi-annually on June 1 and December 1, beginning on the first June 1 or December 1 following completion of the exchange offer (expected to be June 1, 2003). |

Optional Redemption |

|

We may redeem the new notes, in whole or in part, at any time at a redemption price equal to 100% of the principal amount of the notes to be redeemed plus accrued interest, if any, plus a make-whole premium, calculated using a discount rate equal to the interest rate on comparable U.S. treasury securities plus 37.5 basis points. |

Ranking |

|

The new notes will be our senior unsecured obligations and will rank equally in right of payment with all of our other present and future senior debt, including $425 million of senior unsecured debt and $50 million of short-term intercompany debt outstanding as of November 8, 2002 (which excludes the old notes). The new notes will rank senior in right of payment to all of our present and future subordinated debt. |

Covenants |

|

The indenture limits our ability to, among other things: |

|

|

• sell assets; |

|

|

• create liens; and |

|

|

• engage in mergers, consolidations or similar transactions. |

|

|

In addition, the indenture includes transitional covenants that limit our ability to incur indebtedness and pay dividends or make other specified restricted payments, which transitional covenants may be terminated by us on or after the date on which financial statements for five full years of operations of our company (commencing January 1, 2001) are available and upon written reaffirmation by each of Standard & Poor's Ratings Services, Moody's Investors Services, Inc. and Fitch, Inc. of at least the original ratings of the old notes (after giving effect to that termination). |

|

|

See "Description of the New Notes—Covenants" and "—Transitional Covenants." |

Events of Default |

|

The indenture describes the circumstances that constitute events of default with respect to the new notes. See "Description of the New Notes—Events of Default." |

|

|

|

6

Form of the New Notes |

|

The new notes will be represented by one or more permanent global securities in registered form deposited with The Bank of New York, as custodian, for the benefit of DTC. You will not receive notes in registered form unless one of the events set forth under the heading "Description of the New Notes—Book-Entry; Delivery and Form" occurs. Instead, beneficial interests in the new notes will be shown on, and transfers of these interests will be effected only through, records maintained in book-entry form by DTC with respect to its participants. |

Absence of a Public Market for the New Notes |

|

There has been no public market for the old notes, and no active public market for the new notes is currently anticipated. We do not intend to apply for a listing of the new notes on any securities exchange or inclusion in any automated quotation system. We cannot make any assurances regarding the liquidity of the market for the new notes, the ability of holders to sell their new notes or the price at which holders may sell their new notes. See "Plan of Distribution." |

Trustee |

|

The Bank of New York is serving as the trustee under the indenture. |

7

AmerenEnergy Generating Company

General

We are Ameren Corporation's non-regulated generating subsidiary. Through our affiliates, we supply power primarily under contractual arrangements to customers that include Ameren Corporation's regulated utility companies and third parties. Most of our assets were formerly owned and operated by one of those affiliated regulated utility companies, Central Illinois Public Service Company, which we refer to as AmerenCIPS. We were incorporated in the State of Illinois in March 2000 and we acquired certain of our generation assets from AmerenCIPS at net book value on May 1, 2000, consisting of the coal plants described below, all related fuel, supply, transportation, maintenance and labor agreements, approximately 45% of AmerenCIPS' employees, and certain other related rights, assets and liabilities. Since our acquisition of assets from AmerenCIPS, we have acquired 24 additional gas-fired units. Our generation business now includes the following:

Coal Plants. The following stations, which we refer to as our coal plants: four generating stations (11 units) we acquired from AmerenCIPS (Newton, Coffeen, Meredosia and Hutsonville in Illinois). These plants predominantly use coal for fuel and can generate 2,695 megawatts of electricity. We also acquired a coal-fired plant located in Grand Tower, Illinois from AmerenCIPS. We have repowered this plant with gas-fired combustion turbine units in a combined cycle configuration. The repowered Grand Tower units are included in the gas-fired units described below.

Gas-Fired Units. The following stations, which we refer to as our gas-fired units: seven generating stations (Columbia in Missouri, and Kinmundy, Gibson City, Pinckneyville, Grand Tower, Joppa and Elgin in Illinois), consisting of 24 gas-fired generating units acquired since our inception, including three units that we acquired in Elgin, Illinois in September and October 2002. These stations use natural gas as fuel (some have dual fuel capability and can also burn oil) and are used to supply intermediate and peaking power. These stations can generate 1,986 megawatts of electricity, which excludes an additional 117 megawatts associated with one generating unit we expect to acquire in Elgin by the end of 2002.

We currently sell all the output of our generating facilities through two of our affiliates, AmerenEnergy Marketing Company, which we refer to as Marketing Co., and AmerenEnergy, Inc., which we refer to as Ameren Energy.

Marketing Co.

Marketing Co. sells a significant portion of our power to our affiliate, AmerenCIPS, which is a transmission and distribution utility in Illinois serving about 325,000 electric customers. AmerenCIPS purchases all of its requirements to supply its native load customers from Marketing Co. at fixed prices for capacity and energy. Marketing Co. pays us the same prices it receives from AmerenCIPS. Marketing Co.'s contract with AmerenCIPS extends through the end of 2004.

Marketing Co. also sells our power to AmerenCIPS to satisfy a number of fixed-price retail contracts. Marketing Co. receives from AmerenCIPS the prices it receives under these agreements. Marketing Co., in turn, pays us the same prices that it receives for this power.

Marketing Co. is responsible for marketing efforts to obtain retail contracts and wholesale contracts for sales with a duration of longer than one year for all our power other than that sold to AmerenCIPS or released for sale through Ameren Energy. We will receive from Marketing Co. the same prices it receives under these contracts.

8

Ameren Energy

Ameren Energy concentrates on short-term wholesale transactions of less than one year and seeks to sell that portion of our output not subject to the long-term arrangements described above. In cooperation with Marketing Co., Ameren Energy seeks to optimize the value of our generation portfolio. Ameren Energy acts as an agent on our behalf.

Recent Developments

We expect to enter into agreements with our affiliate, Union Electric Company, which we refer to as AmerenUE, whereby we will transfer to AmerenUE certain of our generating assets aggregating approximately 400-500 megawatts of capacity. The transfer, which will be at net book value and is subject to receipt of necessary regulatory approvals, is expected to close in the second quarter of 2003. Cash proceeds from the sale will be applied in accordance with restrictions in the indenture for the notes (to the extent applicable).

Ameren Corporation

St. Louis-based Ameren Corporation (NYSE: AEE) is among the nation's 25 largest investor-owned electric utilities, with $10 billion in assets. Ameren provides energy services to 1.5 million electric and 300,000 natural gas customers throughout its 44,500 square mile territory in Missouri and Illinois.

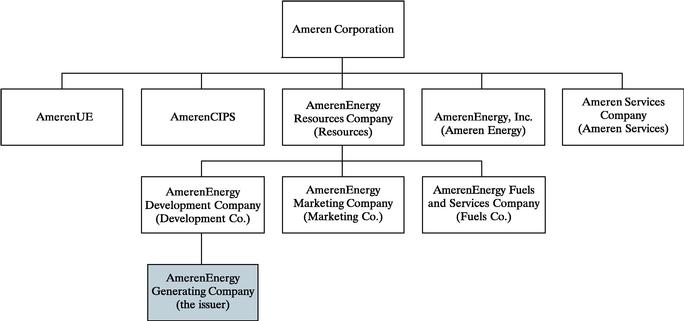

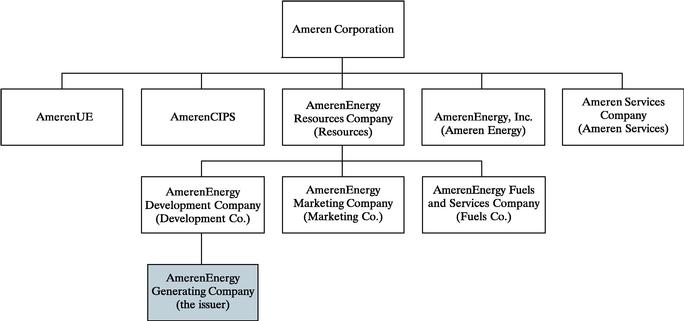

Ameren Corporation is a public utility holding company registered under the Public Utility Holding Company Act of 1935, which we refer to as PUHCA, and does not own or operate any significant assets other than the common stock of its subsidiaries. Ameren Corporation, directly or indirectly, owns all of the common stock of these principal subsidiary companies:

- •

- AmerenUE is the largest electric utility in the state of Missouri and supplies electric and natural gas service to about 1.2 million electric customers and 130,000 gas customers in Missouri and Illinois.

- •

- AmerenCIPS is an electric utility in the state of Illinois and supplies electric and natural gas service to about 325,000 electric customers and 170,000 gas customers in portions of central and southern Illinois.

- •

- AmerenEnergy Resources Company, which we refer to as Resources, is a holding company for Ameren's non-regulated generation business (including our company), related marketing business and fuel procurement business.

- •

- Ameren Energy is an energy trading company that acts as agent for AmerenUE and our company for the wholesale purchase and sale of electricity for terms of less than one year.

- •

- Ameren Services Company, which we refer to as Ameren Services, provides shared support services to all of the Ameren companies.

- •

- Ameren Energy Development Company, which we refer to as Development Co., is our non-regulated parent company which develops and constructs generating facilities. Development Co. is also an exempt wholesale generator under PUHCA and leases the Joppa gas-fired units from us.

- •

- Marketing Co. is a non-regulated wholesale and retail energy marketing company that concentrates on wholesale sales of electricity for terms greater than one year and retail sales.

- •

- AmerenEnergy Fuels and Services Company, which we refer to as Fuels Co., is a non-regulated subsidiary that manages coal, natural gas and fuel oil purchasing for Ameren on a centralized basis.

9

- •

- Our company is an exempt wholesale generator under PUHCA.

In addition, Ameren holds, indirectly through AmerenUE and Resources, a 60% ownership interest in Electric Energy, Inc., which we refer to as EEI. EEI owns and/or operates electric generation and transmission facilities in Illinois that currently supply electric power to a uranium enrichment plant located in Paducah, Kentucky and to EEI's owners or their affiliates.

The chart below depicts the simplified corporate structure of Ameren Corporation and its direct and indirect subsidiaries.

Independent Consultants' Reports

Stone & Webster Consultants, Inc., who we refer to as Stone & Webster or as independent technical consultant, has prepared the Independent Technical Review concerning certain technical, environmental and economic aspects of our electric generating facilities (excluding the three units that we recently acquired, and one additional unit that we expect to acquire, in Elgin, Illinois). We have filed the Independent Technical Review as an exhibit to our current report on Form 8-K that we filed with the SEC on May 30, 2002. The Independent Technical Review is incorporated by reference in this prospectus and should be read in its entirety. The Independent Technical Review is an update to the independent technical review dated October 25, 2000 prepared by Stone & Webster in conjunction with our initial issuance of notes in November 2000. The Independent Technical Review is available as part of our current report dated May 30, 2002 and the original independent technical review is available as part of our prospectus filed on April 18, 2001 pursuant to Rule 424 of the Securities Act, and each can be obtained at the SEC's public reference room, 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The SEC also maintains a Website that contains reports and other information regarding registrants such as us that file electronically with the SEC. The address of that site is (http://www.sec.gov). The independent technical consultant prepared the projected operating and financial results incorporated by reference in this prospectus with information that was available as of various dates primarily prior to December 31, 2001. The Independent Technical Review has not been updated.

Platts/RDI Consulting, a McGraw-Hill Company, who we refer to as independent market consultant, has prepared a report that analyzes the Midwest United States electricity market and the economic competitiveness of our electric generating facilities (excluding the three units that we recently

10

acquired, and one additional unit that we expect to acquire, in Elgin, Illinois) within that market. The report provides an assessment of the long-term market opportunities, including a forecast of capacity and energy prices, in the region. We have filed the report as an exhibit to our current report on Form 8-K that we filed with the SEC on May 30, 2002. The report is incorporated by reference in this prospectus and should be read in its entirety. The independent market consultant prepared the market analysis incorporated by reference in this prospectus, which served as a basis for some assumptions made in preparing the projected operating and financial information, with information that was available as of various dates primarily prior to December 31, 2001. The market report has not been updated.

How To Contact Us

AmerenEnergy Generating Company is incorporated in the State of Illinois. Our principal executive offices are located at 1901 Chouteau Avenue, St. Louis, Missouri 63103. Our telephone number is (314) 621-3222. You can find limited information regarding our company on Ameren's website at (http://www.ameren.com). The information in this website is not incorporated by reference in this prospectus.

11

Summary Financial and Operating Data

Following is a summary of selected historical financial data for our company. We have a limited operating history and, therefore, separate financial statements with regard to our business are available only since May 1, 2000. Prior to that date, all operations of our coal plants were fully integrated with, and therefore results of operations were consolidated into the financial statements of, AmerenCIPS, whose business was to generate, transmit and distribute electricity and to provide other customer support services. The selected historical information as of December 31, 2001 and for the year then ended has been derived from audited financial statements of our company incorporated by reference in this prospectus. You should read the information set forth below in conjunction with the section captioned "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our audited historical financial statements and the accompanying notes included in our annual report on Form 10-K for the year ended December 31, 2001 and our quarterly reports on Form 10-Q for the quarters ended March 31, 2002, June 30, 2002 and September 30, 2002 incorporated by reference in this prospectus. In the opinion of our management, the quarterly financial statements from which the data set forth below were derived contain only normal and recurring adjustments necessary for a fair presentation of the information shown. For a description of the Subordinated Intercompany Notes referred to in the Balance Sheet Data, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" included in our annual report on Form 10-K for the year ended December 31, 2001 and our quarterly reports on Form 10-Q for the quarters ended March 31, 2002, June 30, 2002 and September 30, 2002 incorporated by reference in this prospectus.

Historical Financial Data

(in thousands)

Income Statement Data

| | Nine months ended

September 30, 2002

| | Year ended

December 31, 2001

| | Eight months ended

December 31, 2000

|

|---|

| Revenues | | $ | 679,453 | | $ | 985,819 | | $ | 479,701 |

| Operating Expenses | | | 564,735 | | | 790,667 | | | 376,433 |

| Pre-Tax Income | | | 51,062 | | | 125,213 | | | 71,021 |

| Net Income | | | 30,759 | | | 75,924 | | | 43,808 |

Balance Sheet Data

| | As of

September 30, 2002

| | As of

December 31, 2001

|

|---|

| Current Assets | | $ | 184,025 | | $ | 193,396 |

| Total Assets | | | 1,802,301 | | | 1,756,928 |

| Total Liabilities | | | 1,509,463 | | | 1,482,548 |

| | Senior Debt | | | 698,021 | | | 423,880 |

| | Subordinated Intercompany Notes | | | 461,490 | | | 508,082 |

| Stockholder's Equity | | | 292,838 | | | 274,380 |

12

Ratio of Earnings to Fixed Charges (in thousands)

| | Nine months ended

September 30, 2002

| | Year ended

December 31, 2001

| | Eight months

ended

December 31, 2000

|

|---|

| Pre-tax income from continuing operations | | $ | 51,062 | | $ | 125,213 | | $ | 71,021 |

| Add - fixed charges: | | | | | | | | | |

| | Interest expense and amortization of debt discount on third-party indebtedness | | | 33,026 | | | 34,034 | | | 5,344 |

| | Interest expense on intercompany indebtedness | | | 30,391 | | | 41,036 | | | 29,537 |

| | Interest capitalized | | | 740 | | | 1,316 | | | 803 |

| | |

| |

| |

|

| Total fixed charges | | $ | 64,157 | | $ | 76,386 | | $ | 35,684 |

| Pre-tax income from continuing operations plus fixed charges | | $ | 115,219 | | $ | 201,599 | | $ | 106,705 |

| | |

| |

| |

|

| Ratio of earnings to fixed charges | | | 1.796 | | | 2.639 | | | 2.990 |

13

RISK FACTORS

The new notes, like the old notes, entail risk. In deciding whether to participate in the exchange offer, you should consider the risks associated with the nature of our business and the risk factors relating to the exchange offer in addition to the other information contained in this prospectus. You should carefully consider the following factors before making a decision to exchange your old notes for new notes. The risk factors described below are not necessarily exhaustive, and we encourage you to perform your own investigation with respect to the new notes and our company.

If you fail to exchange your old notes, they will remain subject to transfer limitations and you may be unable to sell them.

Because we did not register the old notes under the Securities Act or any state securities laws, and we do not intend to do so after the exchange offer, the old notes may only be transferred in limited circumstances under applicable securities laws. If the holders of the old notes do not exchange their old notes in the exchange offer, they lose their right to have their old notes registered under the Securities Act, subject to some limitations. As a holder of old notes after the exchange offer, you may be unable to sell your old notes.

There is no public market for the new notes, so you may be unable to sell them.

The new notes are new securities for which there is currently no market. Consequently, the new notes will be relatively illiquid, and you may be unable to sell them. We do not intend to apply for listing of the new notes on any securities exchange or for the inclusion of the new notes in any automated quotation system. Accordingly, we cannot assure you that a liquid market for the new notes will develop.

You must tender the old notes in accordance with proper procedures in order to ensure the exchange will occur.

The exchange of the old notes for the new notes can only occur if you follow the proper procedures as detailed in this prospectus. The new notes will be issued in exchange for the old notes only after timely receipt by the exchange agent of the old notes or a book-entry confirmation, a properly completed and executed letter of transmittal (or an agent's message instead of a letter of transmittal) and all other required documentation. If you want to tender your old notes in exchange for new notes, you should allow sufficient time to ensure timely delivery. The exchange agent is not and we are not under any duty to give you notification of defects or irregularities with respect to your tender of old notes for exchange. Old notes that are not tendered will continue to be subject to the existing transfer restrictions. In addition, if you are an affiliate of ours or you tender the old notes in the exchange offer in order to participate in a distribution of the new notes, you will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. For additional information, please refer to the sections entitled "The Exchange Offer" and "Plan of Distribution" later in this prospectus.

Our revenues and results of operations depend in part on market and other forces beyond our control.

A number of the markets for wholesale electric energy transactions in the Mid-American Interconnected Network, or MAIN, which includes most of Illinois, eastern portions of Missouri and Wisconsin, and much of Peninsular Michigan, have been, or are in the process of becoming, deregulated. We and other non-regulated owners of electricity generating facilities will not have any recovery of our costs or any specified rate of return set by a regulatory body. Therefore, with the exception of revenue generated by contracted loads under the power purchase agreement that we entered into with Marketing Co., which we refer to as the Genco—Marketing Co. agreement, our

14

revenues and results of operations will depend on the prices that we can obtain for energy and capacity in Illinois and adjacent markets. Among the factors that could influence those prices (all of which factors are beyond our control to a significant degree) are:

- •

- fuel supply and price: the current and future market prices for natural gas, fuel oil and coal;

- •

- future power prices: current and forward prices for the sale of electricity;

- •

- competition: the extent of additional supplies of electric energy from our current competitors or new market entrants;

- •

- pace of deregulation: the potential deceleration of deregulation in our market area and slowing of the expansion of deregulated markets;

- •

- pricing and market development: the regulatory and pricing structures developed for Midwest energy markets as they continue to evolve and the pace of development of regional markets for energy and capacity outside of bilateral contracts;

- •

- transmission: future pricing for, and availability of, transmission services on transmission systems, the effect of regional transmission organization, or RTO, development and export energy transmission constraints, which could limit our ability to sell energy in markets adjacent to Illinois;

- •

- demand: the rate of growth in electricity usage as a result of population changes, regional economic conditions and the implementation of conservation programs; and

- •

- weather: climate conditions prevailing in the Midwest market from time to time.

We expect to face significant competition due to the expiration of significant power supply agreements and new capacity in our market.

We do not expect competition in the electric industry to have a material effect on us until the power purchase agreement between Marketing Co. and AmerenCIPS, which we refer to as the Marketing Co.—CIPS agreement, which we service through our Genco—Marketing Co. agreement, expires (as scheduled by its current terms) on December 31, 2004. At that time, we will be subject to competition from major power suppliers who we expect will target our Midwest markets as well as other national markets. Some of our competitors may have greater financial, marketing, trading and generating resources than we do to bring to bear in our target markets.

MAIN and the East Central Area Reliability, or ECAR, region have experienced high levels of new capacity development in the last two years. The independent market consultant estimates that over 29,000 MW of new generating capacity (including our gas-fired units) will come on-line in MAIN and ECAR between 2000 and 2005. The independent market consultant projects that ECAR/MAIN reserve margins will approach 19% by 2003 before declining to 16% in 2005.

This new capacity is expected to contribute to increasing pricing pressures in our target markets. The independent market consultant's base case electricity price forecast (including both energy and capacity prices) for southern Illinois projects a decline in the "all hours" average to a low of $27.37 in 2004, compared to an actual "all hours" average price of $39.65 in 2001. We expect vigorous and continuing competition by other suppliers as a consequence of these factors.

Delays in development of deregulated markets in the Midwest may affect Ameren's marketing efforts, which may hinder growth in our potential customer base.

Marketing Co. may not be able to successfully effectuate its marketing strategy, which is to enter into new long-term contracts for the sale of capacity and energy to replace our existing long-term sales contracts as they expire. Legislation was recently adopted in Illinois that extended the current rate

15

freeze for retail electric customers from December 31, 2004 to December 31, 2006. The number of Illinois retail customers electing alternative energy suppliers since the advent of deregulation has been small, in part because the rate freeze has kept the bundled rates charged by the incumbent distribution utilities at an attractive level. The pace of deregulation elsewhere in the Midwest may also be slowed by the well-publicized problems resulting from California's deregulation experience, and the current forecast of stable or declining electricity supply prices in many parts of the country. These factors may further delay the development of deregulation in our markets, which could slow the growth of the potential customer base that Marketing Co. targets to secure long-term contracted load.

The operation of the electric generating facilities involves risks that could have an adverse impact on our energy output and efficiency levels.

Operation of electric generating facilities involves certain risks which can adversely affect energy output and efficiency levels. Included among these risks are: increased prices for fuel and fuel transportation as existing contracts expire, facility shutdowns due to a breakdown or failure of equipment or processes or interruptions in fuel supply, labor disputes, inability to comply with regulatory or permit requirements, disruptions in the delivery of electricity, operator error and catastrophic events such as fires, explosions, floods or other similar occurrences affecting our electric generating facilities, ourselves or third parties upon which our business may depend.

Our generating facilities will require ongoing capital expenditures.

Our coal plants, like generating facilities of similar age, will require additional capital expenditures. The units comprising the Newton facility and the Coffeen facility were installed between 1965 and 1982. The remaining coal plants were installed prior to 1965. Generating equipment of this age, even if well maintained, will require additional capital expenditures to maintain reliable levels of operations. We plan significant capital projects at our coal plants over the next five years, including the addition of environmental compliance equipment and refurbishment or replacement of major station components. The capital expenditures we project to make at our coal plants are expected to range from $225 million to $275 million in the aggregate for the five-year period from 2002 through 2006, excluding any capital expenditures required to comply with nitrogen oxide (NOx) emissions standards. We cannot assure you that additional capital expenditures will not be required; that our cost estimates are accurate; or that, if necessary, we will be able to obtain financing at reasonable rates to pay for those expenditures. The indenture for the notes may limit our ability to incur future indebtedness.

The price and availability of fuel will have a significant effect on our profitability.

Our coal plants depend principally upon mid- and low-sulfur coal as their fuel supply, and our environmental compliance strategy also relies on low-sulfur coal to a significant extent. A substantial portion of our operating expenses for these plants will consist of the costs of obtaining this fuel supply. While most of the required coal for our coal plants through 2004 is covered by existing supply contracts, we expect to continue to use the spot market to satisfy some portion of our annual coal requirements for the foreseeable future. Our revenues from our coal plants may not keep pace with our coal costs if market prices for coal escalate more rapidly than market prices for sales of energy. In addition, various constraints on the railroads that deliver low-sulfur western coal to our coal plants may cause delivery delays from time to time.

Our gas-fired units depend principally upon natural gas for their fuel supply, and a significant portion of our operating expenses for these units consists of costs of gas supply and delivery. Natural gas prices have exhibited a significant level of volatility in recent years. We utilize a combination of term supply contracts and short-term purchases, both utilizing mostly market-based pricing, as part of our natural gas procurement strategy. We may also employ embedded price hedges, storage and balancing agreements and futures contracts. We cannot assure you that these strategies will be

16

successful in reducing gas price volatility or that we will be able to procure gas at prices assumed in the financial projections included in the Independent Technical Review incorporated by reference in this prospectus.

We have in place various capacity agreements with pipelines to deliver natural gas requirements to our gas-fired units on demand. Although a portion of the pipeline capacity supporting our gas-fired units utilizes firm transportation and firm storage, a significant amount of pipeline capacity will be interruptible or released capacity and thus subject to risk of curtailment by the interstate pipeline or by the primary capacity holder. The significant amount of new gas-fired generating capacity added in MAIN and ECAR in recent years may contribute to tighter pipeline capacity availability, particularly during on-peak power supply periods.

Increases in transmission constraints could adversely affect market access, transmission pricing and our ability to provide energy to our markets.

We expect that access to some of our target markets will become transmission constrained in the future as wholesale markets more fully develop, retail competition opens and new generating capacity comes on-line. If electric transmission capacity is not enhanced through construction of new lines, improvements of existing lines or other methods of improving efficiency, we may experience difficulty, at times, delivering our product to some of our target markets. Delays in the development of regional transmission organizations could contribute to delays in making capacity and efficiency improvements in transmission systems. Constrained transmission systems could also result in our paying higher tariffs for transmission services than we project.

The coal plants have not been operated historically on a competitive basis and some of the coal plants have not operated at the capacity factors we project.

Substantially all of our business consists of owning and operating our electric generating facilities. Although the coal plants had a significant operating history at the time we acquired them, they had been operated as an integrated part of a regulated utility under the coal supply contracts then in place prior to their acquisition by us. Our business plan assumes, among other things, that some of our coal plants will be dispatched more of the time than they had been historically due to renegotiated coal supply contracts and the switch to low-sulfur western coal which have made operation of these plants more economically attractive. The energy generated by our coal plants before we acquired them was sold by AmerenCIPS based upon rates set by regulatory authorities. We cannot assure you that we will be able to operate the coal plants at the capacity factors we project or that these plants will compete successfully in an environment in which electricity prices will be set by market forces.

Increased federal and state environmental regulation could require us to incur large capital expenditures and increase our operating costs.

We believe that we have obtained all material environmental-related approvals required as of the date hereof to operate the coal plants and the gas-fired units or that those approvals have been applied for and will be issued in a timely manner. These approvals concern, among other things, the protection of the environment and the health and safety of employees and the public. Failure to comply with any applicable statutes, regulations and ordinances could have a material adverse effect on us, including potential civil or criminal liability, imposition of clean-up liens and fines and expenditures of funds to bring the coal plants and other plants that we own or acquire into compliance.

We plan to comply with NOx and sulfur dioxide (SO2) emissions limitations through a combination of the acquisition of emissions credits and the future addition of additional pollution control equipment at our coal plants. The laws and regulations governing emissions from coal-burning plants, particularly NOx, are in the process of being revised by federal and state authorities, and substantially more

17

stringent limitations than those currently applicable may be imposed. We currently estimate that our capital expenditures to comply with the current emissions limitations could range from $100 million to $150 million for the period 2002 through 2007. We cannot assure you that our compliance strategy, although reasonable based upon the information available to us today, will successfully address the relevant standards in the future, or that the strategy can be executed at the costs we project.

We plan to acquire SO2 emission allowance credits in order to comply with federal and state limits on SO2 emissions from our coal plants. We are currently utilizing surplus allowance credits obtained from AmerenUE to meet those limits, and expect to be able to continue to do so for the next several years. Thereafter, we will have to purchase allowance credits on the open market to meet future compliance requirements. We are subject to the risk of increases in the market prices for these allowance credits beyond the amounts assumed in the financial projections contained in the Independent Technical Review, as well as the risk of sufficient availability of these credits once AmerenUE's surplus is fully utilized.

Potential soil and groundwater contamination associated with coal piles and historical ash disposal operations exists at the sites of each of our coal plants. When we acquired the coal plants from AmerenCIPS, AmerenCIPS indemnified us from and against any and all environmental damages arising from the presence, use, generation, storage, treatment, discharge, release or disposal (including off-site disposal) of hazardous materials upon, about, from or beneath the property transferred to us or migrating to or from that property, or arising in any manner whatsoever out of the violation of any environmental requirements pertaining to that property and the activities thereon, in each case to the extent that the environmental damages or violation of any environmental requirements are attributable to, or the result of, any act or omission by AmerenCIPS prior to the date of transfer. This indemnity will be subject to interpretation as specific circumstances arise, and will not apply to remediation which may be required in respect of actions we take (or omit to take) after the transfer date. To the extent the AmerenCIPS indemnity does not protect us, future remediation costs could be substantial. While coal combustion waste is not considered hazardous waste under current applicable law, the United States Environmental Protection Agency, or the USEPA, may enact stringent regulations concerning the landfill disposal of those materials.

Our gas-fired units are subject to operational risks that could result in unscheduled plant outages, unanticipated operation and maintenance expenses and increased power purchase costs and similar problems.

The gas-fired units that we recently acquired are new or refurbished units with a limited operating history. Operation of these units could be affected by many factors, including start-up problems, the breakdown or failure of equipment or processes, the performance of these units below expected levels of output or efficiency, failure to operate at design specifications, labor disputes, changes in law and failure to meet environmental and other permit conditions. The occurrence of these events could significantly reduce or eliminate revenues or significantly increase the expenses related to those facilities. The proceeds of any available insurance and limited warranties may not be adequate to cover our lost revenues or increased costs.

Our affiliates and third parties conduct important parts of our business and loss of their services could result in a significant increase in our expenses.

Our non-management employees are principally engaged in operating our coal plants. Most of the balance of our business will be operated by affiliates and third parties with the participation of our management. In particular:

- •

- Marketing Co. and Ameren Energy market our energy and capacity;

- •

- Fuels Co. is responsible for our fuel supply;

18

- •

- Ameren Energy administers and coordinates the dispatch of our plants jointly with AmerenUE's plants on the bases set forth in the Amended Joint Dispatch Agreement described in this prospectus;

- •

- Development Co. develops and constructs generation assets for our company and leases the Joppa gas-fired units from us;

- •

- Siemens Westinghouse Operating Services Company operates and maintains the Gibson City, Kinmundy, Pinckneyville, Columbia and Elgin generating stations for us under a long-term contract; and

- •

- Ameren Services provides support services to us.

We would require substantial additional resources to perform any of these important functions ourselves if that were to become necessary or desirable due to changes in law or regulation, any substandard performance by one or more of these parties or other factors.

Failure or delay in complying with the substantial energy regulatory requirements to which our business is subject could hinder our operations and sales, or result in liabilities and additional costs to us.

Our business could be materially and adversely affected as a result of legislative or regulatory changes or judicial or administrative interpretations of existing energy regulatory laws, regulations or licenses that impose more comprehensive or stringent requirements on us.

We believe that we have obtained all material energy-related approvals required as of the date of this prospectus to operate our coal plants and our gas-fired units. We may be required to obtain additional regulatory approvals, including, without limitation, licenses, renewals, extensions, transfers, assignments, reissuances or similar actions. We cannot assure you that we will be able to:

- •

- obtain all required regulatory approvals that we do not yet have or that we may be required to obtain in the future,

- •

- obtain any necessary modifications to existing regulatory approvals, or

- •

- maintain all required regulatory approvals.

Delay in obtaining or failure to obtain and maintain in full force and effect necessary regulatory approvals, or delay or failure to satisfy any applicable regulatory requirements, could prevent operation of our plants, or the sale of electricity from those assets, or could result in potential civil or criminal liability or in additional costs to us.

Marketing Co. currently sells a substantial portion of our output to our affiliates (AmerenCIPS and AmerenUE), and we participate with AmerenUE in the Amended Joint Dispatch Agreement which provides us with the opportunity to share in the benefits of Ameren's overall power supply resources. Pending or future federal and state regulatory proceedings and policies may evolve in ways that could impact our ability to continue to participate in these affiliate transactions on current terms.

The price risk management activities conducted on our behalf by affiliates may not be effective in managing fuel and electricity pricing risks, which could result in unanticipated liabilities to us or increased volatility of our earnings.

Ameren Energy and Fuels Co. engage in price risk management activities related to our sales of electricity and purchases of fuels. These activities are for our account. Ameren Energy and Fuels Co. may use derivative financial instruments, such as futures contracts and options and forward contracts to manage market risks and exposure to fluctuating electricity, coal and natural gas prices. We cannot

19

assure you that these strategies will be successful in managing our pricing risks, or that they will not result in net liabilities to us as a result of future volatility in electricity and fuel markets.

Marketing Co.'s strategy is to continue to pursue long-term arrangements to sell our output on a contracted basis. If this strategy is unsuccessful, we may be required to rely on Ameren Energy to sell a larger portion of our output under short-term wholesale transactions or in spot market sales. Any increase in short-term sales would result in greater exposure to more volatile short-term market pricing and cause us to place increased reliance on price risk management activities.

Conflicts of interest may arise between us and our affiliates.

We and our affiliates that we rely on for important parts of our business and sales, such as Marketing Co., Ameren Energy and Development Co., are all directly or indirectly wholly-owned by Ameren Corporation. Conflicts of interest may arise if we need to enforce the terms of agreements between us and any of our affiliates. For example, we expect to rely on a contractual indemnity from AmerenCIPS in the event that we incur remediation costs at the sites of our coal plants on account of pre-existing environmental contamination. Because of these affiliate relationships, it is possible that decisions concerning the interpretation or operation of these agreements could be made from perspectives other than the interests solely of our company or our creditors.

It is possible that other Ameren entities could acquire or participate in the ownership of future generating additions and compete with us. We expect to sell some of our existing units to an affiliate. We will comply with the restrictions on asset dispositions contained in the indenture for the notes, to the extent applicable. See "Prospectus Summary—AmerenEnergy Generating Company—Recent Developments."

We are relying on projections of the future performance of our electric generating facilities that may not accurately depict our future performance.

The projected operating and financial results contained in the Independent Technical Review incorporated by reference in this prospectus are predicated upon various assumptions and forecasts of our electric generating facilities' revenue generating capacity and the costs associated with that revenue generating capacity. The assumptions made with respect to future market prices for energy are based upon a comprehensive market analysis prepared by the independent market consultant incorporated by reference in this prospectus. This market forecast served as a basis for the revenue assumptions incorporated in the projected operating results beyond the revenue assumptions based on our fixed-price contractual commitments. The independent technical consultant has reviewed the technical operating parameters of our electric generating facilities. The independent technical consultant has also evaluated the operations and maintenance budgets of our facilities and the related assumptions and forecasts contained therein based on a review of various technical, environmental, economic and permitting aspects of the facilities. The independent technical consultant prepared the projected operating and financial results incorporated by reference in this prospectus with information that was available as of various dates primarily prior to December 31, 2001.

The information and projections contained in the Independent Technical Review do not take account of the three units that we recently acquired, or one additional unit we expect to acquire, in Elgin, Illinois in 2002. We expect to pay an affiliate approximately $222 million for these units.

The independent market consultant prepared the market analysis incorporated by reference in this prospectus, which served as a basis for some assumptions made in preparing the projected operating and financial information, with information that was available as of various dates primarily prior to December 31, 2001. We have not requested, nor do we intend to request, that either the independent technical consultant or the independent market consultant update their reports with information that is currently available. The projected operating and financial results included in this prospectus are our

20

responsibility and have been prepared on the basis of assumptions that we and the persons who have provided them believe to be reasonable.

Our independent auditors, PricewaterhouseCoopers LLP, have not examined, reviewed or compiled the projected operating and financial results and, accordingly, do not express an opinion or any other form of assurance with respect to them. The report of PricewaterhouseCoopers LLP included in this prospectus relates to our historical financial statements for the period from May 1, 2000 through December 31, 2000 and for the year ended December 31, 2001. It does not extend to our projected financial data and should not be read to do so.

Accordingly, the projected operating and financial results are not necessarily indicative of our future performance and neither we, the independent market consultant, the independent technical consultant nor any other person assumes any responsibility for their accuracy. Therefore, no representation is made or intended, nor should any be inferred, with respect to the likely existence of any particular future set of facts or circumstances. If actual results are less favorable than those shown or if the assumptions used in formulating the base case and the sensitivities included in the projected operating results prove to be incorrect, our ability to pay our operating expenses and other obligations may be materially adversely affected.No updating of the projected operating and financial results has been made to account for developments in our business (including changes to fuel costs, operating and maintenance expense and other variables) or for developments in wholesale energy markets (including price changes) since such projected financial results were prepared. The projected operating and financial results were prepared with information that was available as of various dates primarily prior to December 31, 2001.

We have no obligation to provide the holders of the notes with any revised or updated projected operating results or analysis of the differences between the projected operating results and actual operating results.

21

FORWARD-LOOKING STATEMENTS

Statements made in this prospectus which are not based on historical facts, are "forward-looking" and, accordingly, involve risks and uncertainties that could cause actual results to differ materially from those discussed. These forward-looking statements can be identified by the use of forward-looking terminology such as "believes," "expects," "may," "intends," "will," "should," or "anticipates," or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. Although these "forward-looking" statements have been made in good faith and are based upon reasonable assumptions, there is no assurance that the expected results will be achieved. These statements include (without limitation) statements as to future expectations, beliefs, plans, strategies, objectives, events, conditions and financial performance. In connection with the "Safe Harbor" provisions of the Private Securities Litigation Reform Act of 1995, we are providing this cautionary statement to identify important factors that could cause actual results to differ materially from those anticipated.

The following factors, in addition to those discussed elsewhere in this prospectus or incorporated by reference in this prospectus, and in subsequent securities filings, could cause results to differ materially from management expectations as suggested by the forward-looking statements:

- •

- the effects of the stipulation and agreement relating to the AmerenUE excess earnings complaint case and other regulatory actions, including changes in regulatory policy;

- •

- changes in laws and other governmental actions, including monetary and fiscal policies;

- •

- the impact on us of current regulations related to the opportunity for customers to choose alternative energy suppliers in Illinois;

- •

- the effects of increased competition in the future;

- •

- the effects of Ameren's participation in a Federal Energy Regulatory Commission, or FERC, approved Regional Transmission Organization, or RTO, including activities associated with the Midwest Independent System Operator;

- •

- availability and future market prices for fuel and purchased power, electricity, and natural gas, including the use of financial and derivative instruments and volatility of changes in market prices;

- •

- wholesale and retail pricing for electricity in the Midwest;

- •

- business and economic conditions;

- •

- the impact of the adoption of new accounting standards;

- •

- interest rates and the availability of capital;

- •

- actions of rating agencies and the effects of those actions;

- •

- weather conditions;

- •

- generation plant construction, installation and performance;

- •

- the effects of strategic initiatives, including acquisitions and divestitures;

- •

- the impact of current environmental regulations on generating companies and the expectation that more stringent requirements will be introduced over time, which could potentially have a negative financial effect;

- •

- future wages and employee benefits costs;

22

- •

- disruptions of the capital markets or other events making Ameren's and our access to necessary capital more difficult or costly;

- •

- competition from other generating facilities including new facilities that may be developed in the future;

- •

- cost and availability of transmission capacity for the energy generated by our generating facilities or required to satisfy energy sales made on our behalf; and

- •

- legal and administrative proceedings.

23

THE EXCHANGE OFFER

Purpose of the Exchange Offer