SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the registrant x

Filed by a party other than the registrant o

Check the appropriate box:

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| | Preliminary proxy statement |

| | Definitive proxy statement |

| | Definitive additional materials |

| o | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

REGIONAL BANKSHARES, INC. |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than Registrant) |

Payment of filing fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement no.: |

| Regional Bankshares, Inc. |

REGIONAL BANKSHARES, INC.

206 South Fifth Street

Hartsville, South Carolina 29550

(843) 383-0570

October 15, 2007

Dear Shareholder:

You are cordially invited to attend a special meeting of shareholders, which will be held at 3:00 p.m. on November 8, 2007, at our Operations Center located at 125 Westfield Street, Hartsville, South Carolina 29550. I hope that you will be able to attend the meeting, and I look forward to seeing you.

At the meeting, shareholders will vote on an Agreement and Plan of Reorganization (the “Plan”). The Plan provides for the merger of a newly created “shell” corporation, Regional Interim Corporation, with and into Regional Bankshares, Inc. (“Regional”), with Regional surviving the merger (the “Reorganization”). Under the terms of the Plan, any shareholder who is the record holder of 126 or fewer shares of Regional common stock will receive $14.50 in cash in exchange for each share of common stock that he or she owns and any shareholder who is the record holder of more than 126 shares but fewer than 631 shares of Regional common stock will receive one share of our newly created class of Series A Preferred Stock for each share of common stock that he or she owns. All other shares of Regional common stock will remain outstanding and be unaffected by the Reorganization. A copy of the Plan is attached as Appendix A to the enclosed proxy statement.

Dissenters’ rights are available to all shareholders, and shareholders who exercise those rights properly as described in the enclosed proxy statement will be entitled to receive cash for their shares. Unless they properly exercise dissenters’ rights, shareholders receiving Series A Preferred Stock will not receive cash in exchange for their shares—only shares of Series A Preferred Stock will be issued to such shareholders. Similarly, shareholders receiving cash in exchange for their shares will not receive shares of Series A Preferred Stock.

Although the Series A Preferred Stock has limited voting rights, it has dividend and liquidation rights and preferences generally equal to or in excess of similar rights and preferences of our common stock and will participate equally with the common stock on a sale or change in control of our company. All of these features are described in detail in Appendix B to the enclosed proxy statement.

The primary effect of the Reorganization will be to reduce our total number of record holders of common stock to below 300. As a result, we will terminate the registration of our common stock under federal securities laws, which will allow us to realize significant cost savings resulting from the termination of our reporting obligations under the Securities Exchange Act of 1934 (the “Securities Exchange Act”).

Our principal reasons for effecting the Reorganization are the estimated direct and indirect cost savings of approximately $75,000 per year, plus an additional $75,000 in annual costs relating to compliance with Section 404 of the Sarbanes-Oxley Act beginning in 2007, that we expect to experience as a result of the deregistration of our common stock under the Securities Exchange Act. Although our shareholders will lose the benefits of holding registered stock, such as a reduction in the amount of publicly available information about our company and the elimination of certain corporate governance safeguards resulting from the Sarbanes-Oxley Act, we believe these benefits are outweighed by the costs relating to the registration of our common stock. These costs and benefits are described in more detail in the enclosed proxy statement.

We plan to effect the Reorganization by filing articles of merger with the South Carolina Secretary of State as soon as possible after we obtain shareholder approval of the Plan. The articles of merger will specify an effective date that is either the same as or shortly after the filing date. The effective date specified in the articles of merger will also serve as the record date for determining the ownership of shares for purposes of the Reorganization.

The board of directors has established September 28, 2007 as the record date for determining shareholders who are entitled to notice of the special meeting and to vote on the matters presented at the meeting. Whether or not you plan to attend the special meeting, please complete, sign and date the proxy card and return it in the envelope provided in time for it to be received by November 7, 2007. If you attend the meeting, you may vote in person, even if you have previously returned your proxy card.

The board of directors has determined that the Reorganization is fair to our unaffiliated shareholders and has voted in favor of the approval of the Plan. On behalf of the board of directors, I urge you to vote FOR approval of the Plan.

| | Sincerely, |

| | |

| | |

| | /s/ Curtis A. Tyner, Sr. |

| | President and Chief Executive Officer |

REGIONAL BANKSHARES, INC.

206 South Fifth Street

Hartsville, South Carolina 29550

(843) 383-0570

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 8, 2007

A special meeting of shareholders of Regional Bankshares, Inc. will be held at 3:00 p.m. on November 8, 2007, at our Operations Center located at 125 Westfield Street, Hartsville, South Carolina 29550, for the following purposes:

| (1) | To vote on an Agreement and Plan of Reorganization (the “Plan”) providing for the merger of Regional Interim Corporation with and into Regional Bankshares, Inc. (“Regional”), with Regional surviving the merger, and (a) the holders of 126 or fewer shares of Regional common stock receiving $14.50 in cash in exchange for each of their shares of such stock; (b) holders of more than 126 shares but fewer than 631 shares of Regional common stock receiving one share of Series A Preferred Stock in exchange for each of their shares of Regional common stock; and (c) holders of 631 or more shares of Regional common stock retaining their shares. The Plan is attached as Appendix A to the enclosed proxy statement; and |

| (2) | To transact any other business as may properly come before the meeting or any adjournment of the meeting. |

The board of directors recommends that you vote FOR the above proposal.

Statutory dissenters’ rights will be available for this transaction. If our shareholders approve the Plan, shareholders who elect to dissent from the Plan are entitled to receive the “fair value” of their shares of common stock if they comply with the provisions of Section 33-13 of the South Carolina Business Corporation Act (the “South Carolina Code”). We have attached a copy of Section 33-13 as Appendix C to the enclosed proxy statement.

The board of directors has set the close of business on September 28, 2007 as the record date for determining the shareholders who are entitled to notice of, and to vote at, the meeting or any adjournment of the meeting.

We hope that you will be able to attend the meeting. We ask, however, whether or not you plan to attend the meeting, that you mark, date, sign, and return the enclosed proxy card as soon as possible. Promptly returning your proxy card will help ensure the greatest number of shareholders are present whether in person or by proxy.

If you attend the meeting in person, you may revoke your proxy at the meeting and vote your shares in person. You may revoke your proxy at any time before the proxy is exercised.

| | By Order of the Board of Directors, |

| | |

| | |

| | /s/ Curtis A. Tyner, Sr. |

| | President and Chief Executive Officer |

October 15, 2007

REGIONAL BANKSHARES, INC.

206 South Fifth Street

Hartsville, South Carolina 29550

(843) 383-0570

PROXY STATEMENT

For the Special Meeting of Shareholders

To Be Held on November 8, 2007

The board of directors of Regional Bankshares, Inc. (“Regional” or the “Company”) is furnishing this proxy statement in connection with its solicitation of proxies for use at a special meeting of shareholders. At the meeting, shareholders will be asked to vote on an Agreement and Plan of Reorganization (the “Plan”). The Plan provides for the merger of Regional Interim Corporation (“Interim”) with and into Regional, with Regional surviving the merger (the “Reorganization”). Under the terms of the Plan, holders of 126 or fewer shares of Regional common stock will receive $14.50 in cash in exchange for each of their shares of such stock (the “Cash-out Price”) and holders of more than 126 shares but fewer than 631 shares will receive one share of the newly created class of Series A Preferred Stock for each of their shares of Regional common stock. All other shares of Regional common stock will remain outstanding and be unaffected by the Reorganization. Because Securities and Exchange Commission (“SEC”) rules classify the Reorganization as a “Rule 13e-3 transaction,” we will sometimes use that term in referring to this transaction.

The Reorganization is designed to reduce our number of common shareholders of record to below 300, which will allow us to terminate the registration of our common stock under the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”). The board has determined that it is in the best interests of Regional and its shareholders to effect the Reorganization because Regional will realize significant cost savings as a result of the termination of its reporting obligations under the Securities Exchange Act. The board believes these cost savings and the other benefits of deregistration described in this proxy statement outweigh the loss of the benefits of registration to our shareholders, such as a reduction in publicly available information about the Company and the elimination of certain corporate governance safeguards resulting from the Sarbanes-Oxley Act.

We plan to effect the Reorganization by filing articles of merger with the South Carolina Secretary of State as soon as possible after we obtain shareholder approval of the Plan. The articles of merger will specify an effective date that is either the same as or shortly after the filing date. We will refer to this effective date as the “effective date of the Reorganization.” The type of consideration (cash, Series A Preferred Stock or retention of your common stock) that you receive in exchange for your shares of Regional common stock in the Reorganization will depend on the number of shares of Regional common stock you hold of record on the effective date of the Reorganization.

Dissenters’ rights are available to all shareholders, and shareholders who exercise those rights as described on page 58 and in Appendix C will be entitled to receive cash for their shares. Unless they properly exercise dissenters’ rights, shareholders receiving Series A Preferred Stock will not receive cash in exchange for their shares—only shares of Series A Preferred Stock will be issued to such shareholders. Similarly, shareholders receiving cash in exchange for their shares will not receive shares of Series A Preferred Stock.

Although the Series A Preferred Stock has limited voting rights, it has dividend and liquidation rights and preferences generally equal to or in excess of similar rights and preferences of our common stock and will participate equally with the common stock on a sale or change in control of the Company. See “Terms of the Series A Preferred Stock to be issued in the Reorganization” on page [INSERT PAGE NUMBER] for a detailed description of these features.

This proxy statement provides you with detailed information about the proposed Reorganization. We encourage you to read this entire document carefully.

The board of directors has determined that the Rule 13e-3 Transaction is fair to Regional’s unaffiliated shareholders and has approved the Plan. The transaction cannot be completed, however, unless the Plan is approved by the holders of two-thirds of the votes entitled to be cast on the Plan. Our current directors and executive officers beneficially own approximately 61.45% of our outstanding shares of common stock and have indicated that they intend to vote their shares in favor of the Plan.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the Reorganization or the transactions contemplated thereby or has determined if this proxy statement is truthful or complete. The SEC has not passed upon the fairness or merits of the Reorganization or the transactions contemplated thereby, nor upon the accuracy or adequacy of the information contained in this proxy statement. Any representation to the contrary is a criminal offense.

The date of this proxy statement is October 15, 2007. We first mailed this proxy statement to our shareholders on or about October 15, 2007.

| | Page |

| 1 |

| | |

| 8 |

| | |

| 8 |

| 10 |

| 11 |

| 13 |

| 15 |

| 17 |

| 20 |

| 22 |

| 23 |

| 33 |

| 33 |

| 44 |

| 48 |

| 48 |

| |

| QUESTIONS AND ANSWERS | 50 |

| | |

| 53 |

| | |

| 53 |

| 53 |

| 53 |

| 53 |

| 53 |

| 53 |

| 54 |

| 54 |

| | |

| 55 |

| | |

| 55 |

| 58 |

| | |

| 58 |

| | |

| 62 |

| | |

| 62 |

| 62 |

| 62 |

| 64 |

| 64 |

| 65 |

| 65 |

| 66 |

| 66 |

| 66 |

| | |

| 67 |

| | |

| 68 |

| | |

| 71 |

| | |

| 73 |

***

The following is a summary of the material terms of the Reorganization. We urge you, however, to review the entire proxy statement and accompanying materials carefully.

| v | Structure of the Reorganization. In the Reorganization, shareholders who are the record holders of 126 or fewer shares of Regional common stock will be entitled to receive cash in the amount of $14.50 per share for each share of common stock they own as of the effective date of the Reorganization and shareholders who are the record holders of more than 126 shares but fewer than 631 shares of Regional common stock will receive one share of Series A Preferred Stock for each share of common stock they own as of the effective date of the Reorganization. All other shares of Regional common stock will remain outstanding and will be unaffected by the Reorganization. |

Dissenters’ rights are available to all shareholders, and shareholders who exercise those rights as described in this proxy statement and in Appendix C will be entitled to receive cash for their shares. Unless they properly exercise dissenters’ rights, shareholders receiving Series A Preferred Stock will not receive cash in exchange for their shares—only shares of Series A Preferred Stock will be issued to such shareholders. Similarly, shareholders receiving cash in exchange for their shares will not receive shares of Series A Preferred Stock. See page 58 for additional information.

We selected this structure principally because it presented a means by which a significant proportion of our shareholders could retain an equity interest in the Company, while enabling us to use excess capital efficiently and reduce our common shareholder base to the extent necessary to permit us to terminate our registered status with the SEC. See page 10 for a discussion of the structural alternatives we considered.

| v | Terms of the Series A Preferred Stock to be Issued in the Reorganization. Our board has designated 500,000 shares of our authorized stock as Series A Preferred Stock. The terms of the Series A Preferred Stock are set forth in Appendix B and provide principally as follows: |

| · | Rank: The Series A Preferred Stock ranks senior to our common stock with respect to dividend rights and rights upon liquidation, dissolution or winding up of the Company as more fully described below. The relative rights and preferences of the Series A Preferred Stock may be subordinated to the relative rights and preferences of holders of subsequent issues of other series or classes of stock and equity securities designated by the board of directors. The Series A Preferred Stock is junior to indebtedness issued from time to time by the Company, including notes and debentures. |

| · | Voting Rights. Unlike the common stock, the Series A Preferred Stock will not have voting rights except under very limited circumstances. Except as provided by law, holders of Series A Preferred Stock are entitled to vote only upon proposals for a business combination resulting in the transfer of a majority of our outstanding common stock or of all or substantially all of the Company’s assets (a “Change in Control”) and upon which holders of our common stock are entitled to vote. For those matters on which holders of Series A Preferred Stock are entitled to vote, such holders have the right to one vote for each share held and are entitled to receive notice of any shareholders’ meeting held to act upon such matters in accordance with our bylaws. When voting on a proposed Change in Control, the holders of Series A Preferred Stock will vote together with the holders of common stock and not as a separate class. |

| · | Dividend Rights: Holders of Series A Preferred Stock are entitled to receive, when and if declared and paid by Regional, out of funds at the time legally available for payment as dividends, an annual dividend in the amount of $0.20 per share, with any amounts in excess of $0.20 per share being payable at the discretion of the board of directors. The shares of Series A Preferred Stock will be non-cumulative with respect to dividends, and any unpaid dividends will not bear or accrue interest. |

| · | Treatment Upon a Change in Control: Holders of Series A Preferred Stock will have the right to receive the same type and amount of consideration as is received by each holder of common stock in the event of a Change in Control, with the amount being calculated as if the holder had converted his or her shares of Series A Preferred Stock to an equal number of shares of common stock immediately prior to the effectiveness of the Change in Control. |

| · | Liquidation Rights: Holders of Series A Preferred Stock are entitled to a preference in the distribution of assets of Regional in the event of any liquidation, dissolution or winding-up of Regional, whether voluntary or involuntary, equal to the greater of the net book value per share of the Series A Preferred Stock or the common stock, in each case as of the end of the calendar quarter preceding the effective date of the liquidation, for each share of Series A Preferred Stock. |

| · | Perpetual Stock: The Series A Preferred Stock is perpetual stock, which means stock that does not have a maturity date, cannot be redeemed at the option of the holder, and has no other provisions that will require future redemption of the issue. |

| · | No Preemptive Rights: Holders of Series A Preferred Stock do not have any preemptive rights to purchase any additional shares of Series A Preferred Stock or shares of any other class of capital stock that we may issue in the future. |

| · | Antidilution Adjustments: If the number of our outstanding shares of common stock is increased or decreased or changed into or exchanged for a different number or kind of shares or other securities of the Company or any other company, by reason of any merger, consolidation, liquidation, reclassification, recapitalization, stock split, combination of shares or stock dividend, an appropriate corresponding adjustment shall be made by the board of directors in the number and relative terms of the Series A Preferred Stock. |

| · | No Redemption Rights: Holders of Series A Preferred Stock have no right to require that we redeem their shares. |

See page 57 for more detailed information regarding the terms of the Series A Preferred Stock.

| v | Series A Preferred Stock Issued in Reliance on Exemption from Registration. We are issuing the shares of Series A Preferred Stock without registration under the Securities Act of 1933 in reliance on an exemption under Section 3(a)(9) of the Securities Act for the exchange by a company of any security with its existing shareholders exclusively, where no commission or other remuneration is paid or given directly or indirectly for soliciting the exchange. We believe this exemption is available for the Reorganization because we are only issuing the Series A Preferred Stock to our holders of common stock and to no other persons or entities. Further, we are not paying any commission or other remuneration for soliciting the exchange. |

| v | Determination of Shares “Held of Record.” Because SEC rules require that we count “record holders” for purposes of determining our reporting obligations, the Reorganization is based on shares held of record without regard to the ultimate control of the shares. A shareholder “of record” is the shareholder whose name is listed on the front of the stock certificate, regardless of who ultimately has the power to vote or sell the shares. For example, if a shareholder holds separate certificates individually, as a joint tenant with someone else, as trustee, and in an IRA, those four certificates represent shares held by four different record holders, even if a single shareholder controls the voting or disposition of those shares. Similarly, shares held by a broker in “street name” on a shareholder’s behalf are held of record by the broker, with the individual shareholder being the “beneficial owner” of the shares. Therefore, if that broker is the record shareholder for one or more accounts representing collectively 631 or more shares, then all of the stock registered in that broker’s name will be completely unaffected by the Reorganization. Similarly, if that broker is the record shareholder for one or more accounts representing collectively more than 126 but fewer than 631 shares, then all of the stock registered in the broker’s name will be exchanged for Series A Preferred Stock. Because the Reorganization only affects record shareholders, it does not matter whether any of the underlying beneficial owners with a given broker owns fewer than the applicable threshold number of shares. |

| In any case, any cash or shares of Series A Preferred Stock that a beneficial owner is entitled to receive will be calculated by the broker that holds the shares of record based on that beneficial owner’s individual stock ownership and distributed to the beneficial owner after the broker receives such cash or shares. For example, if you own 100 shares of Regional common stock in “street name” and your broker holds 1,000 shares on your behalf and that of other beneficial owners, you will continue to retain your 100 shares of Regional common stock as a result of the Reorganization. On the other hand, if your broker owns only 500 shares, you will receive 100 shares of Series A Preferred Stock out of the 500 shares of such stock that your broker receives in the Reorganization, and if your broker owns 125 shares, you will receive $1,450 in cash out of the $1,812.50 that your broker receives in the Reorganization. If you hold your shares in “street name,” you should talk to your broker, nominee or agent to determine how they expect the Reorganization to affect you. Because other “street name” holders who hold through your broker, agent or nominee may adjust their holdings prior to the effective time of the Reorganization, you may have no way of knowing whether you will be cashed out or receive Series A Preferred Stock in the transaction until it is completed. However, because we think it is likely that many brokerage firms or other nominees will hold more than 631 shares in their “street name” accounts, we think it is likely that “street name” holders will remain continuing shareholders. |

| v | Avoiding Receipt of Cash or Series A Preferred Stock by Consolidation or “Street Name” Ownership. In view of the SEC’s shareholder-counting rules described above, a single shareholder with 631 or more shares held in various accounts could receive cash or Series A Preferred Stock for his or her shares in the Reorganization if those accounts individually hold fewer than 631 shares. To avoid this, the shareholder may either consolidate his or her record ownership into a single form of ownership representing more than 126 shares, in order to avoid receiving cash, or 631 or more shares, in order to avoid receiving shares of Series A Preferred Stock, or acquire additional shares in the market prior to the effective date of the Reorganization. Alternatively, as is described more fully in “Determination of Shares Held of Record” above, a shareholder who holds 126 or fewer shares of common stock may place his or her shares into “street name” with a broker holding more than 126 shares of our common stock in such accounts and thereby avoid receiving cash for his or her shares, and a shareholder who holds more than 126 shares but fewer than 631 shares of common stock may place his or her shares into “street name” with a broker holding at least 631 shares of our common stock in such accounts and thereby avoid receiving Series A Preferred Stock for his or her shares. To ensure that the record ownership of the shares will be reflected appropriately on our transfer agent’s records on the effective date of the Reorganization, shareholders should initiate any transfers of their shares at least three business days prior to our special shareholders’ meeting, as we intend to effect the Reorganization promptly thereafter and it will take into account only those transfers that have settled by the effective date. |

| v | Effects of the Reorganization. As a result of the Reorganization: |

| ● | Our number of common shareholders of record, measured as of August 15, 2007, will be reduced from approximately 872 to approximately 166, and the number of outstanding shares of Regional common stock will decrease from approximately 744,671 to approximately 579,679, resulting in a decrease in the number of shares of our common stock that will be available for purchase and sale in the market. |

| ● | We estimate that approximately 125,478 shares of Series A Preferred Stock will be issued to approximately 344 shareholders of record in connection with the Reorganization. |

| ● | We will be entitled to terminate the registration of our common stock under the Securities Exchange Act, which will mean that we will no longer be required to file reports with the SEC or be classified as a public company. This will greatly reduce the amount of information that is publicly available about the Company and will eliminate certain corporate governance safeguards resulting from the Sarbanes-Oxley Act, such as the requirement for an audited report on our internal controls and disclosure requirements relating to our audit committee composition, code of ethics and director nomination process. Additionally, beginning 90 days after the effective date of the Reorganization, our executive officers, directors and other affiliates will no longer be subject to many of the reporting requirements and restrictions of the Securities Exchange Act, including the reporting and short-swing profit provisions of Section 16, and information about their compensation and stock ownership will not be publicly available. |

| ● | We will eliminate the direct and indirect costs and expenses associated with our registration under the Securities Exchange Act, which we estimate will be a approximately $75,000 per year, plus an additional $75,000 in annual costs relating to compliance with Section 404 of the Sarbanes-Oxley Act beginning in 2007. |

| ● | We estimate that professional fees and other expenses related to the Reorganization will be approximately $110,000, which we intend to pay with existing working capital. |

| ● | Basic earnings per share will increase 6.06% from $0.66 per share on a historical basis to $0.70 per share on a pro forma basis for the year ended December 31, 2006 and from $0.14 per share on a historical basis to $0.15 per share on a pro forma basis for the six months ended June 30, 2007. Diluted earnings per share will increase from $0.64 per share on a historical basis to $0.67 per share on a pro forma basis for the year ended December 31, 2006 and will increase from $0.13 per share on a historical basis to $0.14 per share on a pro forma basis for the six months ended June 30, 2007. |

| ● | Book value per common equivalent share, which includes the Series A Preferred Stock, will decrease from $8.48 on a historical basis to $7.99 on a pro forma basis as of June 30, 2007. |

| | The percentage ownership of Regional common stock beneficially owned by our executive officers and directors as a group will increase from approximately 61.50% to 78.21%. Each of J. Richard Jones, Jr., Shannon R. Morrison, Randolph G. Rogers, Curtis A. Tyner, Sr. and Patricia M. West will receive Series A Preferred Stock for some of his or her common stock in the Reorganization. |

| | The decrease in the number of shares of common stock outstanding and the relatively small number of shares of Series A Preferred Stock that will be outstanding after the Reorganization will further reduce the already limited liquidity of our common stock. |

For a more detailed description of these effects and the effects of the Reorganization on our affiliates and shareholders generally, including those receiving cash, those receiving Series A Preferred Stock and those retaining common stock, see pages 17 through 23.

| v | Reasons for the Reorganization. Our principal reasons for effecting the Reorganization are: |

| ● | The direct and indirect cost savings of approximately $75,000 per year, plus an additional $75,000 in annual costs relating to compliance with Section 404 of the Sarbanes-Oxley Act beginning in 2007, that we expect to experience as a result of the deregistration of our common stock under the Securities Exchange Act, together with the anticipated decrease in expenses relating to servicing a relatively large number of shareholders holding small positions in our common stock; and |

| | Our belief that our shareholders have not benefited proportionately from the costs relating to the registration of our common stock, principally as a result of the thin trading market for our stock. |

See page 14 for more detailed information.

| v | Fairness of the Reorganization. Based on a careful review of the facts and circumstances as described beginning on page 14, our board of directors and each of our affiliates believe that the terms and provisions of the Rule 13e-3 Transaction and the Series A Preferred Stock are substantively and procedurally fair to our unaffiliated shareholders, including those receive cash, those receiving Series A Preferred Stock and those retaining common stock. Our board of directors unanimously approved, and recommends that shareholders vote in favor of, the Reorganization. |

Our affiliates are listed on page 33 and include all of our directors and executive officers. Because of our affiliates’ positions with Regional, each is deemed to be engaged in the Rule 13e-3 Transaction and has a conflict of interest with respect to the transaction because he or she is in a position to structure it in a way that benefits his or her interests differently from the interests of unaffiliated shareholders. At present, each of our directors beneficially owns more than 631 shares of common stock, and we anticipate that they will retain the shares of common stock they beneficially own in the transaction. After the transaction, we anticipate that our directors and executive officers will beneficially own approximately 78.21% of our outstanding shares. See “—Stock Ownership by Affiliates” on page 62 for more information regarding stock owned by our affiliates.

In the course of determining that the Rule 13e-3 Transaction is fair to and in the best interests of our unaffiliated shareholders, including unaffiliated shareholders who will continue to hold shares of common stock, unaffiliated shareholders who will receive shares of Series A Preferred Stock for their shares of common stock, and unaffiliated shareholders who will receive cash for their shares of common stock, the board and each of our affiliates considered a number of positive and negative factors affecting these groups of shareholders in making their determinations. The principal factors considered by the board include:

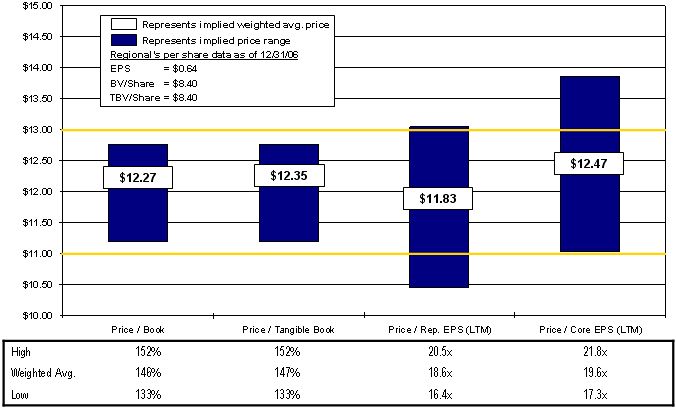

| · | The report delivered by Howe Barnes Hoefer & Arnett, Inc. (“Howe Barnes”), our independent financial advisor, to the board of directors that a range of $11.50 to $13.70 per share represents the range of fair market value of the Regional common stock to be exchanged for cash in the Reorganization and its opinion that the price of $14.50 per share chosen by the board to be paid in the Reorganization is fair, from a financial point of view, to Regional’s shareholders; |

| · | The comparable relationship of the 11% premium over the most recent trading price of our common stock on March 8, 2007 of $13.00 being paid to shareholders receiving cash in the Reorganization to other premiums paid in similar transactions as reported to our board by Howe Barnes and described more fully under “-Opinion of Independent Financial Advisor” on pages 32 to 40. |

| · | Shareholders who own more than 126 shares of common stock will continue to hold an equity interest in Regional; |

| · | Shareholders will have the right to vote on the Plan, and the plan must be approved by two-thirds of the shares entitled to vote; |

| · | Shareholders not entitled to receive cash for their shares under the Plan but who wish to liquidate their holdings may do so through the exercise of dissenters’ rights; |

| · | Shareholders receiving cash for their shares will not incur brokerage fees or commissions in connection with the liquidation of their holdings; |

| · | Shareholders have the opportunity to retain their common stock or receive Series A Preferred Stock by transferring or consolidating their shares or placing them in (or removing them from) “street name” accounts as described above in “Avoiding Receipt of Cash or Series A Preferred Stock by Consolidation or ‘Street Name’ Ownership;” |

| · | The board’s belief that the advantages and disadvantages of the rights, preferences and limitations of the Series A Preferred Stock will balance in comparison to the relative rights of our common stock, given that the decreased value associated with the loss of voting rights is offset by the increased value represented by the fixed dividend on the Series A Preferred Stock and that the Series A Preferred Stock is entitled to vote and share equally in the proceeds with the common stock in the event of a change in control of Regional; |

| · | The board’s belief that the Reorganization should not be taxable to shareholders receiving Series A Preferred Stock or retaining their common stock under the Plan and that, except with respect to shareholders who have acquired their shares within the prior 12 months, the cash consideration offered in the Reorganization would be taxed as a capital gain; |

| · | Diluted earnings per share will increase approximately 4.69% from $0.64 on a historical basis to $0.67 on a pro forma basis for the year ended December 31, 2006 and will increase approximately 7.69% from $0.13 on a historical basis to $0.14 on a pro forma basis for the six months ended June 30, 2007; and |

| · | Book value per common equivalent share will decrease approximately 5.77% from $8.48 on a historical basis to $7.99 on a pro forma basis as of June 30, 2007. |

| v | Effectiveness of the Reorganization. The Reorganization will not be effected unless and until the Plan is approved by two-thirds of the votes entitled to be cast on the Plan. Assuming the shareholders approve the Plan, as shortly thereafter as is practicable, Regional will file an amendment to its articles of incorporation containing the Series A Preferred Stock terms and articles of merger with the South Carolina Secretary of State and thereby effect the Reorganization. The articles of merger will specify an effective date that is either the same as or shortly after the filing date. |

Notwithstanding shareholder approval, however, at any time prior to the effective date of the Reorganization, the board of directors may abandon the Reorganization without any further shareholder action. If at any time prior to the effective date of the Reorganization the board determines that (1) the estimated cost of payments to dissenting shareholders or legal expenses makes the Reorganization inadvisable or (2) the number of shareholders dissenting from or voting against the Plan reflects a material negative reaction among a significant portion of the shareholders, the board may elect to abandon the Reorganization.

We anticipate that the Reorganization will be effected in the fourth quarter of 2007. See page 56 for more detailed information.

| v | Conditions and Regulatory Approvals. Aside from shareholder approval of the Plan, the Reorganization is not subject to any conditions or regulatory approvals. |

| v | Dissenters’ Rights. Regional shareholders are entitled to dissent from the Reorganization under Article 13 of the South Carolina Code. If you dissent, you are entitled to the statutory rights and remedies of dissenting shareholders provided in Article 13 of the South Carolina Code as long as you comply with the procedures of Article 13. Article 13 provides that a dissenting shareholder is entitled to receive cash in an amount equal to the “fair value” of his or her shares. |

To perfect dissenters’ rights, among other things, you must give Regional written notice of your intent to dissent from the Plan prior to the vote of the shareholders at the special meeting and you must not vote your shares in favor of the Plan. Any shareholder who returns a signed proxy but fails to provide instructions as to the manner in which his or her shares are to be voted will be deemed to have voted in favor of the proposal and will not be entitled to assert dissenters’ rights.

Generally, under Article 13 of the South Carolina Code, Regional will make an initial offer of payment to dissenting shareholders, if any, of an amount it estimates to be the “fair value” of the common stock. If a dissenting shareholder believes the payment offer is less than the fair value of the common stock, he or she may notify Regional of his or her estimate of fair value. If Regional and the dissenting shareholder cannot settle the amount of fair value, fair value will be determined in a court proceeding in the Court of Common Pleas of Darlington County, South Carolina.

See page 58 and Appendix C for additional information regarding procedures for asserting dissenters’ rights and the determination of “fair value” of the common stock.

Purpose of the Reorganization

The primary purpose of the Reorganization is to enable us to terminate the registration of our common stock under Section 12(g) of the Securities Exchange Act. Although we intend to keep our common and Series A Preferred shareholders informed as to our business and financial status after the Reorganization as described below, we anticipate that deregistration will enable us to save significant legal, accounting and administrative expenses relating to our public disclosure and reporting requirements under the Securities Exchange Act. As a secondary matter, it is likely to decrease the administrative expense we incur in connection with soliciting proxies for routine annual meetings of shareholders because the Series A Preferred Stock will have limited voting rights.

After the Reorganization, we intend to keep our common and Series A Preferred shareholders informed about our business and financial condition by delivering annual audited financial statements to them. Moreover, our business operations are primarily conducted through our banking subsidiary, Heritage Community Bank, which is required to file quarterly financial reports with the FDIC. These reports are available online at www.fdic.gov.

Although we will still be required to file quarterly financial information with the FDIC and will continue to provide annual financial information to our shareholders, as a non-SEC registered company our auditing expenses will decrease significantly because we and our auditors will not be required to comply with standards prescribed by the SEC and the Public Company Accounting Oversight Board with respect to our audit and because our auditors will not be required to review the information we must include in our periodic SEC reports as described more fully below. Our other reporting processes will also be significantly simplified because we will no longer be required to comply with disclosure and reporting requirements under the Securities Exchange Act and the Sarbanes-Oxley Act. These requirements include preparing and filing current and periodic reports with the SEC regarding our business, financial condition, board of directors and management team, having these reports reviewed by outside counsel and independent auditors, and, commencing in 2007, documenting, testing and reporting on our internal control structure.

In particular, after we have deregistered our stock with the SEC, we will no longer be required to file annual reports on Form 10-KSB, quarterly reports on Form 10-QSB or proxy statements with the SEC. The SEC’s periodic reporting and proxy statement rules require detailed disclosures regarding executive compensation, corporate governance and management stock ownership that are not required in our financial reports to the FDIC or our audited financial statements. Additionally, we will no longer be required to include management’s discussion and analysis of our financial results in annual reports to shareholders or financial reports to the FDIC. Currently, our attorneys and external auditors perform detailed reviews of management’s discussion and analysis of our financial results to assure consistency with audited financial statements and to ensure we are in compliance with applicable disclosure requirements.

We also incur substantial costs in management time and legal and accounting fees related to the preparation, review and filing of our periodic reports and proxy statements. Unlike the periodic reports that we currently file with the SEC, the quarterly financial information that we file with the FDIC does not require the review of either our independent accountants or legal counsel. As a result of the elimination of the disclosure and reporting requirements under the Securities Exchange Act, we estimate that we will save approximately $25,000 per year in management time and $40,000 per year in legal and accounting fees before taking into account the effects of the increased internal controls reporting and auditing standards described below. We also expect to save approximately $10,000 annually in administrative costs related to soliciting proxies for routine annual meetings, including printing and mailing costs and transfer agent fees related to the proxy solicitation.

After we have deregistered our stock with the SEC, we will not be required to comply with Section 404 of the Sarbanes-Oxley Act, which would require that we document, test and assess our internal control structure beginning in 2007 and that our external auditors report on management’s assessment of our internal control structure for 2008 and subsequent years. As a result of our limited personnel resources, we anticipate that we would need to engage an outside consultant and hire an additional experienced accountant to assist management in documenting and testing our internal control structure. Additionally, we estimate that our external audit fees will increase as a result of Section 404 because our external auditors will be required to perform additional audit procedures in order to report on management’s assessment of our internal control structure. We also anticipate we would incur additional legal fees for advice related to compliance with Section 404. We estimate that we would incur approximately $75,000 annually in consulting, compensation, accounting and legal expenses related to compliance with Section 404 of the Sarbanes-Oxley Act in addition to a one-time consulting charge of approximately $45,000 for our first year of required compliance relating to the initial implementation of the necessary procedures. If our SEC reporting obligations cease before we are required to comply with Section 404 of the Sarbanes-Oxley Act, we will not need to incur these expenses.

We are required to comply with many of the same securities law requirements that apply to large public companies with substantial compliance resources. Our resources are more limited, however, and as is shown above, these compliance activities represent a significant administrative and financial burden to a company of our relatively small size and market capitalization. We also incur less tangible but nonetheless significant expenditure of management’s time and attention that could otherwise be deployed toward revenue-enhancing activities.

In summary, our estimated cost of compliance with the Securities Exchange Act and the Sarbanes-Oxley Act is substantial, representing an estimated direct and indirect annual cost to us of approximately $175,000, including the expected effect of Section 404 of the Sarbanes-Oxley Act. Our anticipated cost savings are also summarized under “—Reasons for the Reorganization.”

As of August 15, 2007, we had approximately 872 common shareholders of record, but approximately 5.31% of the outstanding shares as of that date were held by approximately 362 shareholders. Additionally, of our 872 common shareholders, approximately 706 shareholders hold fewer than 631 shares, or an aggregate of approximately 22.16% of our outstanding common stock as of July 1, 2007. Our common stock is not traded on any established market. Trading is infrequent, the trading volume is low and the board of directors believes there is little likelihood that a more active market will develop. However, because we have more than 300 shareholders of record and our common stock is registered under Section 12(g) of the Securities Exchange Act, we are required to comply with the disclosure and reporting requirements under the Securities Exchange Act and the Sarbanes-Oxley Act.

In light of the limited market for our common stock, we believe the termination of our status as an SEC-registered company will not have a significant impact on any future efforts by the Company to raise additional capital or to acquire other business entities. We believe the Reorganization will provide a more efficient means of using our capital to benefit our shareholders by allowing us to save significant administrative, accounting, and legal expenses incurred in complying with the disclosure, reporting and compliance requirements described above. Moreover, we believe that our limited trading market and the resulting inability of our shareholders to realize the full value of their investment in our common stock through an efficient market has resulted in little relative benefit for our shareholders as compared to the costs of maintaining our registration. Finally, the Reorganization will give shareholders owning more than 126 shares the opportunity to retain an equity interest in Regional and therefore to participate in any future growth and earnings of the Company and in any future value received as a result of the sale of the Company.

In making our decision to proceed with the Reorganization, we considered other alternatives. We rejected these alternatives because we believed the Reorganization would be the simplest and most cost-effective manner in which to achieve the purposes described above. These alternatives included:

Cash-out Merger Without Share Reclassification. Our board of directors considered a cash-out merger in which holders of fewer than 631 shares would receive cash in exchange for their shares. The capital cost of such a transaction would be much higher than that of the proposed Reorganization, however. Assuming that all of the 164,992 shares held of record by shareholders owning fewer than 631 shares as of August 15, 2007 were exchanged for $14.50 in cash, the capital cost of the transaction would be $2.39 million, as compared to the current anticipated capital cost of approximately $573,000. Additionally, issuing shares of preferred stock instead of cash to a portion of our shareholders will enable those shareholders to continue to retain an equity interest in our company.

Share Reclassification Creating Two Classes of Preferred Stock. The board also considered a share reclassification transaction in which some of our shareholders would retain their common stock, some would receive shares of a newly created series of preferred stock (Series A), and some would receive shares of another newly created series of preferred stock (Series B), with each series having different voting and dividend provisions. The transaction would be similar to the proposed Reorganization, except that the shareholders receiving cash in the Reorganization would receive shares of Series B preferred stock instead. The board decided not to pursue this alternative because of the additional financial and administrative expenses that would be associated with maintaining and paying dividends on an additional class of preferred stock. It also considered the availability of excess capital to fund a repurchase of a portion of its outstanding shares and the potential increase in earnings per share and reduction in shareholder-servicing expenses that would likely result from a reduction in the total number of shareholders of record and outstanding shares of common stock and common stock equivalents.

Reverse Stock Split. The board considered declaring a reverse stock split at a ratio of 1-for-631, with cash payments to shareholders who would hold less than a whole share on a post-split basis. This alternative would also have the effect of reducing the number of shareholders, but would require us either to account for outstanding fractional shares after the transaction or engage in a subsequent forward stock split at the reverse split ratio. It would also require a capital expenditure that would be approximately equal to that involved in the cash-out merger scenario described above. A reverse stock split is also less flexible than a cash-out merger, which permits the company to make special provisions for the treatment of certain shares, if desired. Although the Plan does not contain any provisions that are materially inconsistent with the effects of a reverse stock split, we believed it was important to select a structure at the outset that would permit flexibility to address specific situations to the extent consistent with the purpose of the Reorganization. In view of these issues, the board determined that the Reorganization would be a more effective method of reducing the number of shareholders and rejected the reverse stock split alternative.

Alternatively, it would be possible to combine a 1-for-126 cash-out reverse stock split with a share reclassification in which holders of more than 126 but fewer than 631 shares would receive Series A Preferred Stock in exchange for their shares. The board rejected this form of transaction based principally on the relative simplicity of accomplishing all of the desired actions with respect to outstanding shares in a single merger transaction as opposed to the series of charter amendments that would be required for a share reclassification and reverse stock split.

Issuer Tender Offer. The board also considered an issuer tender offer to repurchase shares of our outstanding common stock. The results of an issuer tender offer would be unpredictable, however, due to its voluntary nature, and the number of shares we would need to repurchase would result in a significant capital cost as described in “—Cash-out Merger Without Share Reclassification” above. Even if sufficient capital were available, we were uncertain as to whether this alternative would result in shares being tendered by a sufficient number of shareholders so as to result in our common stock being held by fewer than 300 shareholders of record. As a result, the board also rejected this alternative.

Expense Reductions in Other Areas. While we might be able to offset the expenses relating to SEC registration by reducing expenses in other areas, we have not pursued such an alternative because there are no areas in which we could achieve comparable savings without adversely affecting a vital part of our business or impeding our opportunity to grow. Our most significant area of potential savings would involve personnel costs, and we are already thinly staffed. We believe the expense savings that the Reorganization would enable us to accomplish will not adversely affect our ability to execute our business plan, but will instead position us to execute it more efficiently. For these reasons, we did not analyze cost reductions in other areas as an alternative to the Reorganization.

Business Combination. We have neither sought nor received any proposals from third parties for any business combination transactions such as a merger, consolidation, or sale of all or substantially all of our assets. Our board did not seek any such proposals because these types of transactions are inconsistent with the narrower purpose of the proposed transaction, which is to discontinue our SEC reporting obligations. The board believes that by implementing a deregistration transaction, our management will be better positioned to focus its attention on our customers and the communities in which we operate and expenses will be reduced.

Maintaining the Status Quo. The board considered maintaining the status quo. In that case, we would continue to incur the significant expenses, as outlined in “—Reasons for the Reorganization” below, of being an SEC-reporting company without the expected commensurate benefits. Thus, the board considered maintaining the status quo not to be in the best interests of the Company or its unaffiliated shareholders.

In October 2006, Curtis Tyner met with our independent auditors and discussed generally the application of the increased internal control requirements under Section 404 of the Sarbanes-Oxley Act, which will begin to apply to the Company with respect to the 2007 fiscal year. Our auditors described the nature and amount of work that would be required in order for management and the auditors to deliver the required certifications. In view of the extensive nature of the compliance undertaking and our limited personnel and economic resources, the auditors mentioned deregistration of our stock as a possible alternative. They recommended that Mr. Tyner discuss the idea with management, counsel and the other members of the board of directors. Based on this recommendation and on a recommendation from a community bank executive whose institution had recently deregistered with the SEC, our President and Chief Executive Officer, Curtis Tyner, invited representatives of the law firms Haynsworth Sinkler Boyd, PA and Powell Goldstein LLP to meet with the executive committee of our board of directors to discuss our options for reducing our shareholder base.

On November 2, 2006, the executive committee met with a representative of Haynsworth Sinkler Boyd, PA to discuss deregeistration. Then on November 6, 2006, the executive committee met with representatives of Powell Goldstein and discussed whether a deregistration transaction would be appropriate for the Company. The discussion at both meetings focused on the relative costs and benefits of being a public company as described in “—Purpose of the Reorganization” and the principal types of transactional alternatives available to the Company as described in “—Alternatives Considered” above. The committee met again on November 13, 2006 and decided to recommend SEC deregistration to the full board and to engage Powell Goldstein as legal counsel for the transaction.

The board met on November 16, 2006 and decided that SEC deregistration would be in the Company’s best interests for the reasons described in “—Purpose of the Reorganization” above. The board directed management and the executive committee to submit proposed stock ownership thresholds and capital cost projections for the board’s further consideration.

On December 4, 2006, the executive committee met with a community bank executive whose institution had recently deregistered with the SEC. The committee asked questions about the institution’s experience during the deregistration process as well as its effect on the bank after completion of the transaction. The executive also noted the lack of negative perception of the transaction in the bank’s community.

Between November 16 and December 21, 2006, management prepared models illustrating the effects of various stock ownership thresholds and cash-out prices in the context of a single cash-out transaction, a share reclassification, and a combined share reclassification and cash-out transaction. The single cash-out transaction required a large amount of capital due to the number of shareholders that would have to be cashed out, and the share reclassification by itself would not result in a large enough reduction in the number of shareholders to allow deregistration. The model showed that the third transaction structure, a combined share reclassification and cash-out transaction, would require less capital and would result in the number of holders of common stock dropping below 300, enabling the Company to deregister its common stock.

On December 21, 2006, the board met and considered the stock ownership and financial information described above. Although it did not decide on a specific transaction structure, cash-out price or preferred stock terms, it did authorize management to contact potential independent financial advisors and voted to proceed with a deregistration transaction.

Between late December 2006 and early January 2007, management discussed the terms of a potential engagement with three financial advisory firms and selected Howe Barnes. Representatives of Howe Barnes met with management on January 26, 2007 and presented an overview of deregistration transactions including all of the transaction structure options available to Regional.

On March 6, 2007, representatives of Powell Goldstein and Howe Barnes met with management and the board. In addition to the factors discussed in “—Purpose of the Reorganization” above, the group discussed the relationship of the proposed Reorganization to the Company’s strategic plan, potential community and investor reactions to the transaction, and the availability of capital to repurchase a portion of the Company’s outstanding shares. It also reviewed the potential transaction structures described in “—Alternatives Considered” above, with a focus on share reclassification transactions and the possible features of the preferred stock to be issued in a reclassification transaction. Specifically, the group discussed the following four scenarios:

| (1) | Issuance of one series of preferred stock (Series A) to holders of more than 126 but less than either 630 or 631 shares of common stock and issuance of another series of preferred stock (Series B) to holders of 126 or fewer shares of common stock. |

| (2) | The same transaction as is described in paragraph (1) above, except with the holders of 100 to 126 shares of common stock receiving Series B preferred stock and the holders of fewer than 100 shares of common stock receiving cash for their shares. |

| (3) | The same transaction as is described in paragraph (1) above, except with the holders of 126 or fewer shares of common stock receiving cash for their shares. |

| (4) | A cash-out merger with holders of fewer than 630 shares receiving cash in the following amounts per share, resulting in the corresponding capital costs to the Company: |

| Price per Share | | | Total Cost | |

| $ | 12.00 | | | $ | 1,979,904 | |

| | 13.00 | | | | 2,144,896 | |

| | 14.00 | | | | 2,309,888 | |

| | 15.00 | | | | 2,474,880 | |

| | 16.00 | | | | 2,639,872 | |

The board elected to pursue a transaction in the form of the Reorganization (paragraph (3) above) and directed Howe Barnes to prepare an independent valuation of the Company’s common stock for consideration at its next meeting.

On March 22, 2007, the board met with management and a representative of Howe Barnes to further discuss the proposed preferred stock terms, the appropriate individual stock ownership thresholds for reclassification into preferred stock or for receiving cash in the merger and the cash-out price to be established. Management presented the proposed 126-share and 631-share thresholds, respectively, which they had concluded represented the optimal division points based on the relative record ownership of the Company’s shareholders and the need to reduce the number of common shareholders of record below 300 and generate fewer than 500 preferred shareholders of record while leaving room for expansion in each class and expanding an appropriate amount of capital. Howe Barnes also presented its valuation indicating a fair market value of the Regional common stock of $11.50 to $13.70 per share and discussed with the board an appropriate premium for the cash portion of the consideration as described in more detail in “—Opinion of Independent Financial Advisor” below.

Following this discussion, the board approved the Plan as presented in this proxy statement and discussed and affirmed the substantive and procedural fairness of the terms of the Reorganization to unaffiliated shareholders receiving cash, those receive Series A Preferred Stock and those retaining common stock as described in “—Recommendation of the Board of Directors; Fairness of the Reorganization.”

On April 6, 2007, we mailed a letter to our shareholders announcing our intent to effect the Reorganization on the terms described in this proxy statement and filed a copy of the letter with the SEC.

The board is not aware of any material contracts, negotiations or transactions, other than in conjunction with the Reorganization as described herein, during the preceding two years for (1) the merger or consolidation of Regional into or with another person or entity; (2) the sale or other transfer of all or any substantial part of the assets of Regional; (3) a tender offer for any outstanding shares of Regional common stock; or (4) the election of directors to our board.

Reasons for the Reorganization

As described above in “—Purpose of the Reorganization,” the Reorganization will allow us to save significant costs related to the preparation, review and filing of our periodic reports and annual proxy statement. We also expect to experience savings in proxy solicitation costs, including printing and mailing costs. We expect printing and mailing costs to be lower because we will have fewer shareholders who are entitled to vote and because the financial and proxy statements that we deliver to shareholders after the Reorganization will not include many of the disclosures required under the proxy or periodic reporting rules, such as disclosures regarding executive compensation, corporate governance and management ownership, and management’s discussion and analysis of our financial results. Additionally, we plan to deregister before we are required to take substantial steps toward compliance with Section 404 of the Sarbanes-Oxley Act so that we will save additional anticipated costs, related to documenting, testing and reporting on our internal control structure beginning in 2007.

For 2007 and subsequent years, we expect to save the following fees and expenses related to the preparation, review and filing of periodic reports on Form 10-KSB and Form 10-QSB and annual proxy statements. These fees and expenses do not reflect Section 404 compliance expenses, which are described in a separate table below.

| Legal Fees (including Edgar conversion) | | $ | 25,000 | |

| Independent Auditor Fees | | | 15,000 | |

| Proxy Solicitation, Printing and Mailing Costs | | | 10,000 | |

| Management and Staff Time | | | 25,000 | |

| Total Annual Non-404 Savings | | $ | 75,000 | |

We also expect to save the following fees and expenses related to compliance with the requirements under Section 404 of the Sarbanes Oxley Act beginning in 2007:

| Annual Consulting Fees | | $ | 50,000 | |

| Legal Fees | | | 5,000 | |

| Independent Auditor Fees | | | 5,000 | |

| Management and Staff Time | | | 60,000 | |

| | | | | |

| Total Estimated Annual Savings | | $ | 75,000 | |

| | | | | |

| Additional 2007 One-Time Consulting Fee for First Year of Required Compliance | | $ | 45,000 | |

Beginning in 2008, we would expect to incur an additional $25,000 per year in independent auditor fees in connection with the Section 404 audit.

As is noted above, we incur substantial indirect costs in management time spent on securities compliance activities. Although it is impossible to quantify these costs specifically, we estimate that our management and staff currently spend an average of approximately 12.69% of their time on activities directly related to compliance with federal securities laws, such as preparing and reviewing SEC-compliant financial statements and periodic reports, maintaining and overseeing disclosure and internal controls, monitoring and reporting transactions and other data relating to insiders’ stock ownership, and consulting with external auditors and counsel on compliance issues. Based on a combined annual salary of $197,000 for the officers principally involved in our SEC reporting activities, this represents an annual cost savings of $25,000, or 12.69% of their combined salaries. In addition, if we do not deregister our common stock, we estimate our management and staff will spend approximately an additional 7.61% of their time on activities related to compliance with Section 404 of the Sarbanes-Oxley Act and that we will need to hire an additional staff person at a salary of approximately $45,000 per year for that purpose beginning in 2007, for a total additional annual cost of $60,000.

In addition, our common stock is not listed on an exchange and has historically been very thinly traded. We do not enjoy sufficient market liquidity to enable our shareholders to trade their shares easily. We also do not have sufficient liquidity in our common stock to enable us to use it as potential acquisition currency. As a result, we do not believe that the registration of our common stock under the Securities Exchange Act has benefited our shareholders in proportion to the costs we have incurred, and expect to incur, as a result of this registration.

Effects of the Reorganization on Regional

The Reorganization is designed to reduce the number of Regional common shareholders of record below 300, which will allow us to terminate the registration of our common stock under the Securities Exchange Act. Based on information as of August 15, 2007, we believe that the Reorganization will reduce our number of common shareholders of record from approximately 872 to approximately 166. We estimate that approximately 39,514 shares held by approximately 362 common shareholders of record will be exchanged for cash in the Reorganization, that approximately 125,478 shares held by approximately 344 common shareholders of record will be exchanged for Series A Preferred Stock in the Reorganization, and that approximately 579,678 shares of our common stock held by approximately 166 shareholders of record will be issued and outstanding after the Reorganization. In addition to the exchange of shares of our common stock for cash or shares of our Series A Preferred Stock, we believe the Reorganization will have the following effects on Regional:

Positive Effects

| · | Elimination of Securities Exchange Act Registration. After the Reorganization, we will not be subject to the periodic reporting requirements under the Securities Exchange Act. Additionally, beginning 90 days after the Reorganization, we will not be subject to the proxy, tender offer or short-swing profit reporting and recovery provisions of the Securities Exchange Act. We plan to maintain our existing internal control procedures and continue to evaluate them for potential improvements but will not be required to document, test and report on our internal control structure as required by Section 404 of the Sarbanes-Oxley Act. We expect to eliminate direct and indirect costs and expenses associated with the Securities Exchange Act registration, which we estimate would be up to approximately $75,000 on an annual basis, plus an additional $75,000 in annual costs related to compliance with Section 404 of the Sarbanes-Oxley Act beginning in 2007. Additionally, as a non-SEC reporting company, we believe our management team, which currently spends a significant amount of time on activities related to compliance with the Securities Exchange Act, will have significantly more time to devote to business development and revenue-enhancing activities. See “—Background of the Reorganization” and “—Reasons for the Reorganization” for a discussion of the nature of the information we will no longer be required to provide. |

| · | Improved Earnings Per Share. Basic earnings per share will increase 6.06% from $0.66 per share on a historical basis to $0.70 per share on a pro forma basis for the year ended December 31, 2006 and 7.14% from $0.14 per share on a historical basis to $0.15 per share on a pro forma basis for the six months ended June 30, 2007. Diluted earnings per share will increase 4.69% from $0.64 per share on a historical basis to $0.67 per share on a pro forma basis for the year ended December 31, 2006 and increase from 7.69% from $0.13 per share on a historical basis to $0.14 per share on a pro forma basis for the six months ended June 30, 2007. In each case, pro forma earnings per share have been calculated without regard to estimated transaction expenses or anticipated expense savings resulting from the Reorganization. |

| · | Elimination of Liability Under Section 18 of the Securities Exchange Act. Because the Company will no longer be required to file any reports under the Securities Exchange Act, it will no longer be subject to liability under Section 18 of the Securities Exchange Act. Generally, Section 18 provides that if the Company makes a false or misleading statement with respect to any material fact in any of its filings pursuant to the Securities Exchange Act, in light of the circumstances at the time the statement was made, the Company will be liable to any person who purchases or sells a security at a price that is affected by the statement. |

Negative Effects:

| · | Effect on Market for Shares. Our common stock is not currently traded on an exchange or automated quotation system, and only approximately 20,000 shares (representing approximately 2.8% of the outstanding common stock) traded, to management’s knowledge, on 15 different trading days between March 2006 and March 2007. Following the Reorganization, the number of outstanding shares of common stock available for purchase will decrease by approximately 22.16%, resulting in a further loss of liquidity. Only approximately 125,478 shares of Series A Preferred Stock will be outstanding and available for purchase after the Reorganization, which results in a limited third-party market for the shares. As a result, holders of both common and Series A Preferred Stock will lose liquidity in their current investment in the Company, which could decrease the market value of their stock. |

| · | Decrease in Book Value Per Common Equivalent Share. Book value per common equivalent share, which includes the Series A Preferred Stock, will decrease 5.77% from $8.48 on a historical basis to $7.99 on a pro forma basis as of June 30, 2007. |

| · | Financial Effects of the Reorganization. We estimate that professional fees and other expenses related to the transaction will total approximately $110,000. We estimate these expenses will be as follows: |

| SEC filing fees | | $ | 240 | |

| Legal fees | | | 65,000 | |

| Accounting Fees | | | 6,500 | |

| Financial Advisor | | | 35,000 | |

| Printing and mailing costs | | | 2,500 | |

| Miscellaneous | | | 760 | |

Total | | $ | 110,000 | |

We plan to pay these fees and expenses out of our existing working capital and a line of credit and do not expect that the payment of these expenses will have a material adverse effect on our capital adequacy, liquidity, results of operations or cash flow.

| · | Elimination of Protection Under Section 16 of the Securities Exchange Act. Because neither our common stock nor Series A Preferred Stock will be registered under the Securities Exchange Act, beginning 90 days after the effectiveness of the Reorganization, the Company will no longer be entitled under Section 16 of the Securities Exchange Act to any “short-swing” profits realized by its directors, officers or 10% shareholders on purchases and sales of the Company’s securities that occur within a six-month period. |

Other Effects:

| · | Conduct of Business After the Reorganization. We expect our business and operations to continue as they are currently being conducted and, except as disclosed below and for the additional management and staff time that will be available for non-SEC-related activities, the transaction is not anticipated to have any effect upon the conduct of our business. |

| · | Raising Additional Capital and Obtaining Financing After the Reorganization. In light of the limited market for our common stock and the availability of capital from sources other than public markets, we believe the termination of our status as an SEC-registered company will not have a significant impact on any future efforts to raise additional capital. If we need to raise additional capital to support growth in the future, we have several financing alternatives that will not be affected by our deregistration, including raising additional equity through private offerings, issuing trust preferred securities or borrowing funds from a correspondent bank. |

| · | Plans or Proposals. Other than as described in this proxy statement, we do not have any current plans or proposals to effect any extraordinary corporate transaction such as a merger, reorganization or liquidation; to sell or transfer any material amount of our assets; to change our board of directors or management; to change materially our indebtedness or capitalization; or otherwise to effect any material change in our corporate structure or business. As stated throughout this proxy statement, we believe there are significant advantages in effecting the Reorganization and becoming a non-reporting company. Although management has neither the intention at present to enter into any of the transactions described above nor is involved with negotiations relating to any such transaction, there is always a possibility that we may enter into such an arrangement or transaction in the future, including, but not limited to, entering into a merger or acquisition transaction, making a public or private offering of our shares, or any other arrangement or transaction we may deem appropriate. We will disclose the terms of such a transaction at the appropriate time upon advice of counsel. |

Effects of the Reorganization on Shareholders Generally

The Reorganization will have the following effects on shareholders regardless of whether they are affiliated or unaffiliated shareholders. We expect, however, that no shares held by our affiliates will be cashed out because none of our affiliates will likely hold 126 or fewer shares of common stock of record at the effective time of the Reorganization. The effects will vary depending on whether the shareholder receives cash or Series A Preferred Stock for some or all of his or her shares of Regional common stock or continues to hold his or her common stock following the Reorganization. Because a shareholder may own shares in more than one capacity (for example, individually and through an individual retirement account), a shareholder may receive cash or Series A Preferred Stock for some of his or her shares of common stock while retaining ownership of other shares of common stock following the Reorganization.