UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

May 17, 2013

Commission File Number: 1-15174

Siemens Aktiengesellschaft

(Translation of registrant’s name into English)

Wittelsbacherplatz 2

80333 Munich

Federal Republic of Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-Fx Form 40-F¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes¨ Nox

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes¨ Nox

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes¨ Nox

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

| Siemens AG | ||||||

| Wittelsbacherplatz 2 | ||||||

| 80333 Munich | ||||||

| Germany | ||||||

| contact@siemens.com | ||||||

Dear shareholders,

On 28 November 2012 the Management Board of Siemens AG has resolved with the approval of the Supervisory Board to make the former OSRAM division independent and to list it on the stock exchange by way of a spin-off to Siemens AG shareholders pursuant to the German Transformation Act (“Umwandlungsgesetz”, “UmwG”).

This decision was approved by a vast majority of the Siemens AG shareholders (98.2 percent) at the annual shareholders meeting on 23 January 2013. According to the decision, Siemens AG shareholders will receive shares of OSRAM Licht AG. The allocation ratio was fixed to 10:1; i.e. for ten Siemens AG shares you will receive one share of OSRAM Licht AG (please also refer to page 4 regarding options).

Siemens does not intend to completely separate itself from OSRAM in connection with the spin-off. Upon the spin-off taking effect, Siemens AG will, as a key shareholder, retain a stake of 17.0 percent of the share capital in the future listed company. Moreover, Siemens Pension Trust will retain a stake of 2.5 percent in OSRAM Licht AG. The remaining 80.5 percent will be proportionately allocated to the Siemens AG shareholders’ securities accounts, according to the allocation ratio. The first day of trading for the OSRAM Licht AG shares is expected for beginning of July 2013.

Who is OSRAM Licht AG?

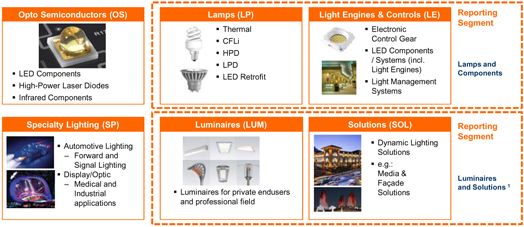

OSRAM is one of the leading lighting companies globally in terms of revenues and the OSRAM brand looks back on a history of more than 100 years. OSRAM’s product portfolio comprises vertically integrated solutions across all relevant steps of the lighting value chain from light sources (LED components, infrared-lights and laser components) to electronic control gears and LED systems and from complete luminaires, light management systems and lighting solutions to value-added services. OSRAM is organised in six business units, which are summarized under four reporting segments for external reporting purposes, as shown in the chart below.

Source: OSRAM

Siemens Aktiengesellschaft:

Chairman of Supervisory Board: Gerhard Cromme; Management Board: Peter Löscher, Chairman; Roland Busch,

Brigitte Ederer, Klaus Helmrich, Joe Kaeser, Barbara Kux, Hermann Requardt, Siegfried Russwurm, Peter Y. Solmssen,

Michael Süß

Registered Office: Berlin and Munich, Germany; Registry court: Berlin Charlottenburg, HRB 12300, Munich, HRB 6684;

WEEE-Reg.-Nr. DE 23691322

1

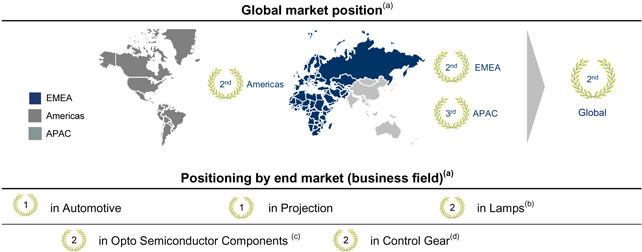

With its six business units OSRAM is among the leading suppliers in all core segments of the lighting market.

| (a) | Based on revenue (2011 data) |

| (b) | Including LED retrofits |

| (c) | SSL = Solid State Lighting, which includes LED, Infrared-light and Laser technologies |

| (d) | For General Illumination |

Source: Frost & Sullivan – LED Revolution (July 2011), IMS Research Oct 2012, OSRAM estimates

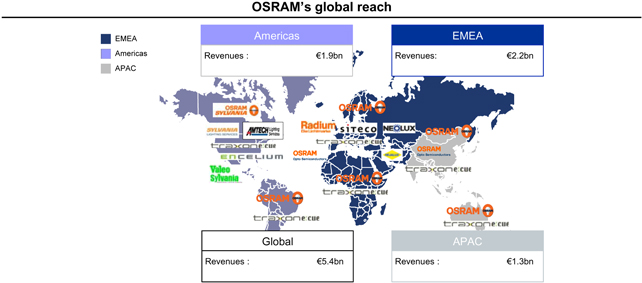

OSRAM operates a global distribution platform, has a diversified brand portfolio and is present in every important market. Moreover, the company operates production, research & development centres around the globe.

Source: OSRAM data, FY 2012 (year end)

The global lighting market in which OSRAM is active is currently changing fundamentally. While formerly technologies dominated, which required an exchange of lighting products on a regular basis, the lighting market currently is undergoing a technology shift towards products that are based on LEDs (lighting emitted diodes). Because of the significantly longer lifetime of LED-based products which exceed the lifetime of traditional lighting products by multiple times, it is expected that the original equipment manufacturer business (e.g. initial installation of LED based lighting solutions) will play a more significant role in this fast growing segment than in the formerly replacement business dominated lighting market for traditional technologies. OSRAM sees itself in its own estimate well positioned to take advantage of the opportunities of this development. First, OSRAM is among the product and technology leaders in the lighting market today and is well positioned in the expected future growth areas. Secondly, according to market studies it is expected that the lighting market overall will likely grow significantly.

2

Why a spin-off?

Against this background, the business requirements are changing for OSRAM as one of the leading companies which focuses exclusively on the lighting market. From the point of view of the managing boards of Siemens AG and OSRAM Licht AG, the separation from the Siemens Group will give OSRAM the necessary entrepreneurial flexibility to directly adjust the strategic focus and business model to the changing circumstances in the market. Furthermore, the direct access to the capital market will give OSRAM the benefit of additional sources of financing. The separation of OSRAM Licht AG from Siemens has in our view for both companies and thereby for you as shareholder many advantages:

Advantages for OSRAM | ||

n |

The current technology transformation in the lighting market requires that OSRAM is able to react flexible and efficient. This shall be achievable as an independent company | |

| n | Direct access to the capital market will give OSRAM the possibility to independently procure financing in a manner appropriate for its situation (independent from the internal allocation of financial resources within the Siemens Group) | |

| n | The regular reporting and the investor relations work involved by a listing will allow OSRAM to better define the profile of the business and the perception in the public domain | |

| n | A listing permits the introduction of stock-based compensation programs and employee participation programs which are directly linked to OSRAM’s business success | |

Advantages for Siemens | ||

n |

Further focusing the Siemens portfolio on the identified core business activities | |

| n | An independent capital market access of OSRAM will allow Siemens to more efficiently allocate capital resources within the Siemens group according to the strategic focus | |

| n | Ongoing strengthening of the investment and risk profile of the Siemens share | |

| n | A significant loss of synergies within Siemens Group is not expected | |

Following the by default participation in the OSRAM Licht AG in the course of the spin-off, you as a shareholder of Siemens AG will have the opportunity to participate in the further development of the OSRAM Licht AG. By means of the spin-off OSRAM will receive the opportunity to secure and expand its leading position in the lighting market. In the context of this structure, OSRAM will be able to focus exclusively on its own market and to more efficiently address its customers’ needs in a fundamentally changing market environment. As a result OSRAM will be able to comprehensively meet the changing requirements in the lighting market and to optimally pursue the opportunities related to this change. Shareholders of OSRAM Licht AG will be able to participate in this potential with their participation in the company.

|

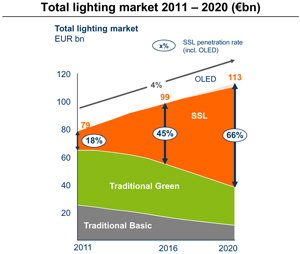

The total lighting market is expected to grow by 4 percent annually from €79bn in 2011 to approximately €113bn in 2020 (Source: Estimates by OSRAM based on the McKinsey Lighting Market Report 2012).

The developments in the global lighting industry are significantly impacted by several trends such as population growth and ongoing electrification, urbanisation, demographic change, energy efficiency as well as decarbonisation, digitalisation and emotionalisation of light. |

Source: Estimates by OSRAM based on the McKinsey Lighting Market Report 2012; the category SSL includes LED-, Infrared-light and Laser products as well as OLEDs

3

It is expected that this development will mainly benefit LED products (SSL(a)), which are placed primarily in the high pricing segment. These products are expected to be the main driver of growth in the lighting market with expected growth rates of more than 20 percent over the coming years. OSRAM plans to particularly participate in this development given that it is already today in the middle of the transformation process from a component-based to an integrated SSL(a) producer. As per fiscal year 2012 SSL products make up 25 percent of OSRAM’s total revenues already.

| (a) | Solid State Lighting |

Next steps

Following the coming into effect of the spin-off, all Siemens AG shareholders will to the same extent remain invested in Siemens AG. In the course of the spin-off, all Siemens AG shareholders will automatically receive OSRAM Licht AG shares in accordance with the allocation ratio of 10:1.

In the context of the spin-off all shareholders of Siemens AG have the option to either keep or sell their allocated OSRAM Licht AG shares. Fractional shares, which will be booked into a separate securities identification number, can be either completed to full shares by purchase of additional fractions or sold. In general, every shareholder has different options at the timing of the spin-off. You will be contacted accordingly by your depositary bank in due course.

Overview of options for shareholders of Siemens AG

| Passive reaction/ no action | The shareholder will receive OSRAM Licht AG shares in accordance with the allocation ratio of 10:1. Residual amounts and fractions will be sold automatically by the depositary bank following the announced instruction period by the depositary bank and in absence of any instruction by the shareholder. The respective proceeds will be credited into the shareholder’s account. | |||

| Purchase of fractional shares | The shareholder has the option to complete fractional rights to full shares by the purchase of additional fractions. To this end, an explicit instruction to the depositary bank is required. The respective purchase price will be debited into the shareholder’s account. | |||

| Disposal of fractional shares | The shareholder has the option to sell fractional rights ahead of the above mentioned time period. Therefore, an explicit instruction to the depositary bank is required. The respective proceeds will be credited into the shareholder’s account. |

The publication of the allocation ratio(a) of the tax relevant values (acquisition costs) on shares of Siemens AG and OSRAM Licht AG will take place around two weeks following the spin-off/first day of trading of OSRAM Licht AG shares. Therefore, it might be possible that, following a disposal of shares of Siemens AG- and/or OSRAM Licht AG within the time from spin-off/first day of trading of the new shares of OSRAM Licht AG to final consideration of the published allocation ratio by the depositary banks, subsequent adjustments relating to tax relevant data and bookings have to be made by the depository banks. Those possible (corrections) result from the ex post maintenance of the allocation ratio of the relevant tax values (acquisition costs) in the settlement systems of the depositary banks.

| (a) | Following the methodologies described in VIII 2.) of the Joint Spin-off Report of the Managing Boards of Siemens AG, Berlin and Munich, and OSRAM Licht AG, Munich, on the Spin-off of a Majority Participation in OSRAM |

Detailed information on OSRAM Licht AG will be included in the securities prospectus, which will be published on the website www.osram.com after the approval by the Federal Supervisory Authority for Securities Trading (“Bundesanstalt für Finanzdienstleistungsaufsicht”) (BaFin) which is expected for 21 June 2013. The above information only provides a short company description. A detailed description regarding potential risks in connection with an investment in OSRAM Licht AG shares is included in the securities prospectus.

Please contact us in case of further questions.

With kind regards,

Your Siemens AG

Siemens Investor Relations

Siemens AG

Wittelsbacherplatz 2

80333 Munich, Germany

investorrelations@siemens.com

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SIEMENS AKTIENGESELLSCHAFT | ||||||

| Date: May 17, 2013 | /s/ | MARIEL VON DRATHEN | ||||

| Name: | Mariel von Drathen | |||||

| Title: | Head of Investor Relations | |||||

| /s/ | TOBIAS ATZLER | |||||

| Name: | Tobias Atzler | |||||

| Title: | Manager Investor Relations | |||||