UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

November 7, 2013

Commission File Number: 1-15174

Siemens Aktiengesellschaft

(Translation of registrant’s name into English)

Wittelsbacherplatz 2

80333 Munich

Federal Republic of Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-Fx Form 40-F¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes¨ Nox

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes¨ Nox

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes¨ Nox

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

Key figures Q4 and fiscal 20131, 2

(preliminary and unaudited; in millions of€, except where otherwise stated)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Volume | | Q4 2013 | | | Q4 2012 | | | Actual | | | % Change

Adjusted3 | | | FY 2013 | | | FY 2012 | | | Actual | | | % Change

Adjusted3 | |

| | Continuing operations | | | | | | | | | | | | | | | | | | | | | | | | |

| | Orders | | | 21,011 | | | | 21,251 | | | | (1 | )% | | | 3 | % | | | 82,351 | | | | 75,939 | | | | 8 | % | | | 10 | % |

| | Revenue | | | 21,168 | | | | 21,444 | | | | (1 | )% | | | 3 | % | | | 75,882 | | | | 77,395 | | | | (2 | )% | | | (1 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Profitability and Capital efficiency | | Q4 2013 | | | Q4 2012 | | | | | | % Change | | | FY 2013 | | | FY 2012 | | | | | | % Change | |

| | Total Sectors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Adjusted EBITDA | | | 2,311 | | | | 2,634 | | | | | | | | (12 | )% | | | 8,141 | | | | 9,329 | | | | | | | | (13 | )% |

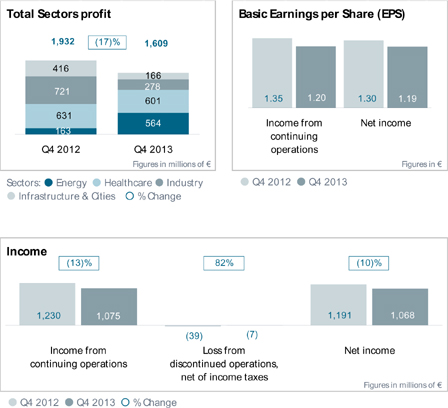

| | Total Sectors profit | | | 1,609 | | | | 1,932 | | | | | | | | (17 | )% | | | 5,788 | | | | 7,266 | | | | | | | | (20 | )% |

| | in % of revenue (Total Sectors) | | | 7.5 | % | | | 8.9 | % | | | | | | | | | | | 7.5 | % | | | 9.3 | % | | | | | | | | |

| | Continuing operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Adjusted EBITDA | | | 2,195 | | | | 2,568 | | | | | | | | (15 | )% | | | 8,215 | | | | 9,613 | | | | | | | | (15 | )% |

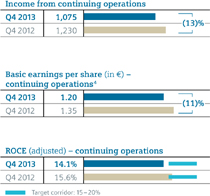

| | Income from continuing operations | | | 1,075 | | | | 1,230 | | | | | | | | (13 | )% | | | 4,212 | | | | 4,642 | | | | | | | | (9 | )% |

| | Basic earnings per share (in€ )4 | | | 1.20 | | | | 1.35 | | | | | | | | (11 | )% | | | 4.85 | | | | 5.15 | | | | | | | | (6 | )% |

| | Continuing and discontinued operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net income | | | 1,068 | | | | 1,191 | | | | | | | | (10 | )% | | | 4,409 | | | | 4,282 | | | | | | | | 3 | % |

| | Basic earnings per share

(in€ )4 | | | 1.19 | | | | 1.30 | | | | | | | | (9 | )% | | | 5.08 | | | | 4.74 | | | | | | | | 7 | % |

| | Continuing operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

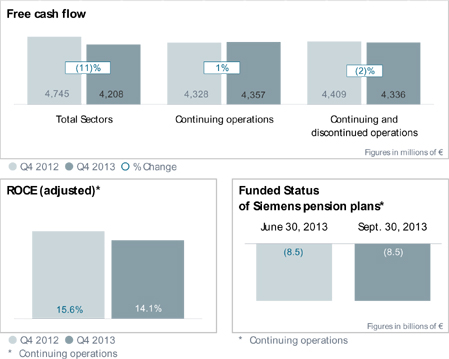

| | Return on capital employed (ROCE (adjusted)) | | | 14.1 | % | | | 15.6 | % | | | | | | | | | | | 13.8 | % | | | 15.5 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | Capital structure and Liquidity | | September 30, 2013 | | | | | | September 30, 2012 | |

| | Cash and cash equivalents | | | | | | | | | | | | | | | | | | | 9,190 | | | | | | | | | | | | 10,891 | |

| | Total equity (Shareholders of Siemens AG) | | | | | | | | | | | | | | | | | | | 28,111 | | | | | | | | | | | | 30,855 | |

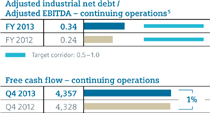

| | Adjusted industrial net debt | | | | | | | | | | | | | | | | | | | 2,805 | | | | | | | | | | | | 2,271 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Free cash flow-continuing operations | | | | | Q4 2013 | | | | | | Q4 2012 | | | | | | FY 2013 | | | | | | FY 2012 | |

| | Continuing operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Free cash flow | | | | | | | 4,357 | | | | | | | | 4,328 | | | | | | | | 5,257 | | | | | | | | 4,727 | |

| | Continuing and discontinued operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Free cash flow | | | | | | | 4,336 | | | | | | | | 4,409 | | | | | | | | 5,328 | | | | | | | | 4,700 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | September 30, 2013 | | | September 30, 2012 | |

| | | Employees | | | | | Continuing operations | | | | | | Total6 | | | | | | Continuing operations | | | | | | Total6 | |

| | Employees(in thousands) | | | | | | | 362 | | | | | | | | 367 | | | | | | | | 366 | | | | | | | | 410 | |

| | Germany | | | | | | | 118 | | | | | | | | 119 | | | | | | | | 119 | | | | | | | | 130 | |

| | Outside Germany | | | | | | | 244 | | | | | | | | 248 | | | | | | | | 247 | | | | | | | | 280 | |

| 1 | Orders; Adjusted or organic growth rates of revenue and orders; Total Sectors profit; ROCE (adjusted); Free cash flow; Adjusted EBITDA; Adjusted industrial net debt are or may be non-GAAP financial measures. Definitions of these supplemental financial measures, a discussion of the most directly comparable IFRS financial measures, information regarding the usefulness of Siemens’ supplemental financial measures, the limitations associated with these measures and reconciliations to the most comparable IFRS financial measures are available on our Investor Relations website under WWW.SIEMENS.COM/NONGAAP. WWW.SIEMENS.COM/NONGAAP. |

| 2 | July 1 – September 30, 2013 and October 1, 2012 – September 30, 2013. |

| 3 | Adjusted for portfolio and currency translation effects. |

| 4 | Basic earnings per share – attributable to shareholders of Siemens AG. For fiscal 2013 and 2012 weighted average shares outstanding (basic) (in thousands) for the fourth quarter amounted to 843,138 and 871,814 and for the fiscal year to 843,819 and 876,053 shares,respectively. |

| 5 | Calculated by dividing adjusted industrial net debt as of September 30, 2013 and 2012 by adjusted EBITDA. |

| 6 | Continuing and discontinued operations. |

Solid Close to Fiscal 2013

Joe Kaeser, President and Chief

Executive Officer of Siemens AG

| | |

| | “With a solid fourth quarter, we completed an eventful year in fiscal 2013. Now we’re looking ahead and concentrating on measures aimed at improving our profitability, which we are implementing rigorously and prudently. With realignment of the regions, we’ve made the first strategic moves.” |

Financial Highlights*:

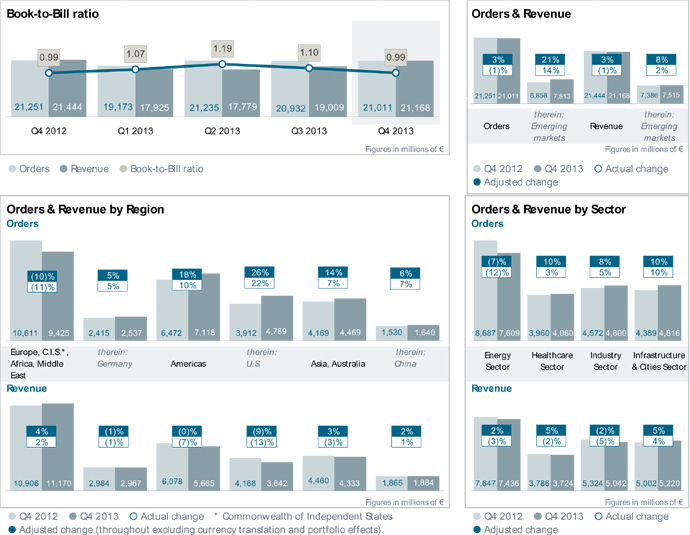

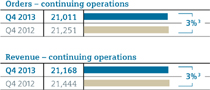

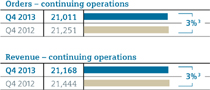

| • | | Orders and revenue for the fourth quarter came in 1% lower year-over-year, at€21.011 billion and€21.168 billion, respectively. On an organic basis, excluding currency translation and portfolio effects, orders and revenue both rose 3%. |

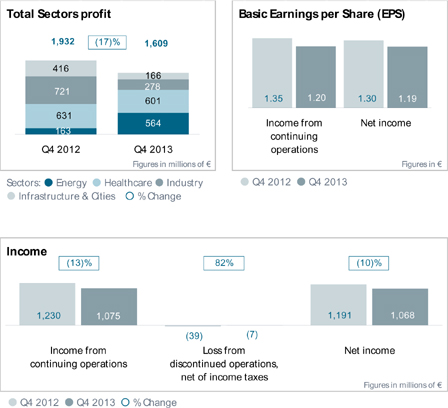

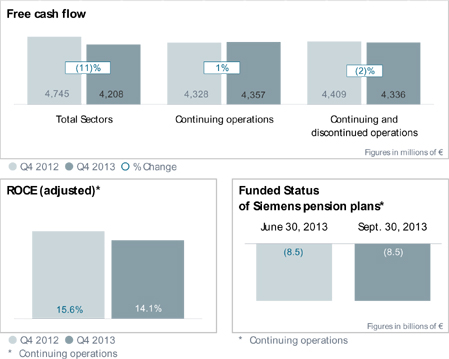

| • | | Total Sectors Profit declined to€1.609 billion, due mainly to€688 million in charges for the “Siemens 2014” program. The prior-year period also included substantial burdens on Total Sectors Profit. |

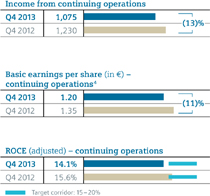

| • | | Income from continuing operations for the quarter was€1.075 billion and basic EPS was€1.20. |

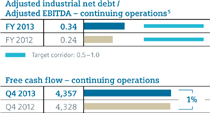

| • | | Free cash flow from continuing operations was€4.357 billion, above the high level in the fourth quarter a year earlier. |

| • | | For fiscal 2013, orders rose 8% year-over-year, to€82.351 billion, due to a higher volume from large orders compared to the prior year, while revenue came in 2% lower, at€75.882 billion. Total Sectors Profit was€5.788 billion, including€1.276 billion in charges related to “Siemens 2014.” Income from continuing operations was€4.212 billion. Siemens proposes a dividend of €3.00 per share, unchanged from fiscal 2012. |

Media Relations:

Alexander Becker

Phone: +49 89 636-36558

E-mail: becker.alexander@siemens.com

Wolfram Trost

Phone: +49 89 636-34794

E-mail: wolfram.trost@siemens.com

Siemens AG,

80333 Munich, Germany

*Effective during the fourth quarter of fiscal 2013, Siemens’ Water Technologies Business Unit was classified as discontinued operations. Prior-period results are presented on a comparable basis.

| | |

Earnings Release Q4 2013 July 1 to September 30, 2013 Munich, Germany, November 7, 2013 | |  |

Siemens 2

Orders and Revenue

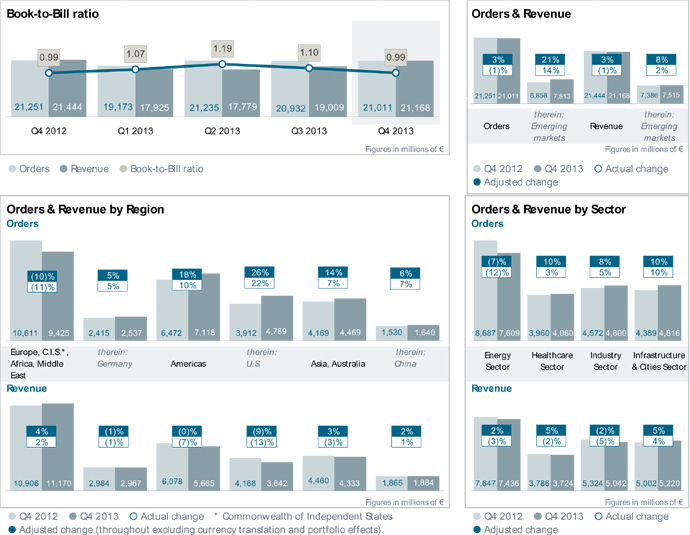

Stable volume despite currency headwinds

Orders and revenue for the fourth quarter came in slightly below their respective prior-year levels. On an organic basis, excluding currency translation and portfolio effects, orders and revenue both rose 3%. In particular, negative currency translation effects took six percentage points from order growth and five percentage points from revenue growth in the quarter. The book-to-bill ratio for Siemens overall was 0.99. The order backlog (defined as the sum of the order backlogs of the Sectors) was€100 billion at the end of the quarter.

Strong order growth in emerging markets

Infrastructure & Cities, Healthcare and Industry took in higher orders year-over-year, particularly including large orders at Infrastructure & Cities. In contrast, Energy’s orders declined due to a significantly lower volume from large orders.

Orders in the Americas and Asia, Australia showed clear growth. Orders in the region comprising Europe, the Commonwealth of Independent States, Africa and the Middle East (Europe/CAME) declined significantly, due mainly to the lower volume from large orders. Emerging markets on a global basis grew 14% year-over-year, reaching€7.813 billion and accounting for 37% of total orders. Organic orders in emerging markets rose 21% compared to the prior-year period.

Mixed picture on revenue development

Infrastructure & Cities’ revenue increased moderately on growth year-over-year at Transportation &

Logistics. The other Sectors posted single-digit revenue declines. On an organic basis, only Industry had lower fourth-quarter revenue than a year earlier.

Among the regions, Europe/CAME reported 2% revenue growth year-over-year while currency headwinds resulted in declines in the Americas and Asia, Australia. Emerging markets on a global basis grew 2% year-over-year, and accounted for€7.515 billion, or 36%, of total revenue for the quarter. Organic revenue growth in emerging markets was 8% for the quarter.

Siemens 3

Income and Profit

Progress with “Siemens 2014”

leads to substantial charges

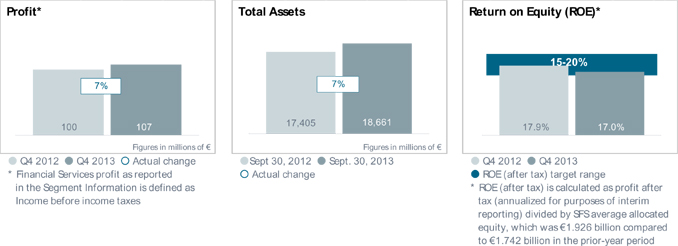

Total Sectors profit of€1.609 billion included€688 million in charges to Sector profit, associated with successful execution of the company-wide “Siemens 2014” productivity improvement program. The Sectors reached important milestones with initiatives to improve regional footprints, adjust capacities and increase process efficiency. This enabled them to book charges totaling€255 million in Infrastructure & Cities,€232 million in Industry,€151 million in Energy, and€49 million in Healthcare. For comparison, Total Sectors profit of€1.932 billion in the same period a year ago was also burdened by substantial charges, primarily including€716 million in Energy. These impacts were only partly offset by€127 million in gains in the Sectors related to other post-employment benefits (OPEB) in the U.S.

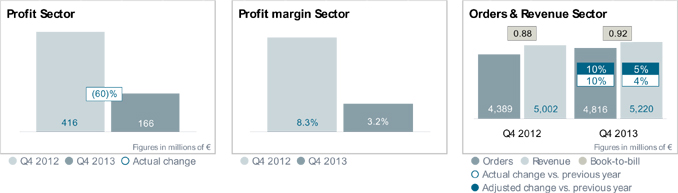

Healthcare led all Sectors with€601 million in profit. Energy’s profit rose to€564 million from a low base a year ago, when profit was burdened by the€716 million in charges, including substantial effects related to Iran and Olkiluoto as well as impairment charges in the solar business. Industry profit was€278 million, a sharp drop from the prior-year level including the substantial “Siemens 2014” charges noted above, project charges of€52 million, and the influence of lower revenue in its short-cycle businesses. While profit of€166 million at Infrastructure & Cities was also lower than in the prior-year period, the decline was due primarily to the “Siemens 2014” charges mentioned above which included impairment charges of€76 million related to portfolio optimization.

Improved results

outside the Sectors

Income from continuing operations came in at€1.075 billion, down from€1.230 billion a year earlier. Corresponding basic EPS was€1.20 in the current period, down from€1.35 a year earlier. The main factor was lower Total Sectors profit year-over-year. This was partly offset by an overall improvement in results outside the Sectors. In particular, higher profit at Equity Investments in the current quarter included a€76 million gain from the sale of Siemens’ equity share in Nokia Siemens Networks B.V. (NSN) during the current quarter. Fourth-quarter net income was€1.068 billion and corresponding basic EPS was€1.19. A year earlier, net income was€1.191 billion with a corresponding EPS of€1.30.

Siemens 4

Cash, Return on Capital Employed (ROCE), Pension Funded Status

Strong year-end

cash performance

As in previous years, the fourth quarter included an outstanding cash performance, with substantial conversion of income into cash. Free cash flow from continuing operations was€4.357 billion, above the high level of the prior-year period. The current period included cash inflows of€1.7 billion from a decrease in operating net working capital, due to lower inventories, a decrease in outstanding customer payments, and an increase in trade payables. Energy led all Sectors in reducing operating net working

capital, particularly with higher collection of customer payments in connection with wind-farm projects. Free cash flow of€4.208 billion at the Sector level included cash outflows of€0.2 billion corresponding to charges to income taken for the “Siemens 2014” program.

During the quarter Siemens took in€1.7 billion in cash related to the sale of its stake in NSN. This amount was included in investing activities and was not part of Free cash flow.

Pension plan underfunding

remains unchanged

The underfunding of Siemens’ pension plans amounted to€8.5 billion, as of September 30, 2013 and as of the end of the third quarter.

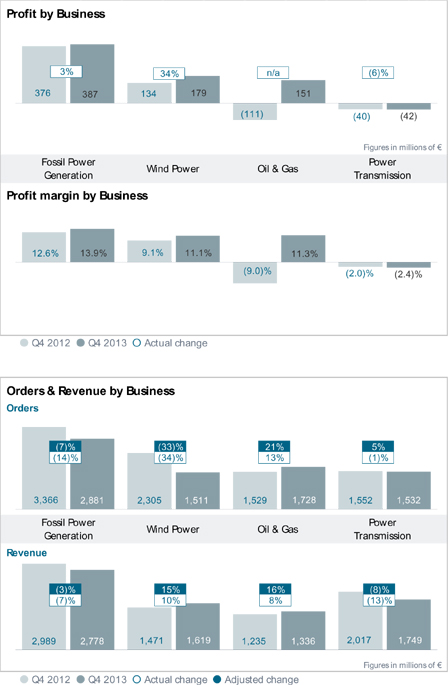

Sectors 5

Energy Sector

Profit bounces back

on lower charges

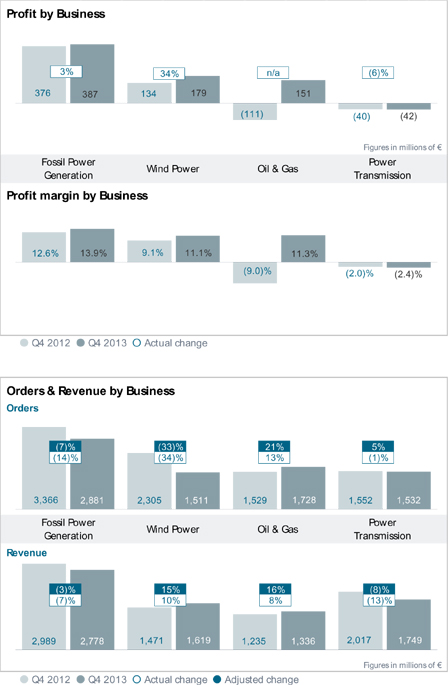

In the fourth quarter theEnergySector contributed€564 million to Sector profit, led by Fossil Power Generation. Wind Power and Oil & Gas delivered outstanding year-end profit performances. Power Transmission posted a loss including€37 million in charges related to grid connections to offshore wind-farms. The Sector took€151 million in “Siemens 2014” charges, primarily for reducing its cost structure, adjusting capacity and improving its regional footprint. The Sector’s solar business posted a loss of€30 million and Energy also recorded€39 million for impairments at its tidal hydro power business.

A year earlier, fourth-quarter profit was held back by€327 million in impacts related to Iran, charges totaling€133 million at Power Transmission, and a€106 million impact associated with the Olkiluoto project in Finland. Also in the prior-year period, the solar business posted a loss of€182 million, including impairment charges of€150 million. Energy’s portion of the OPEB gain in the prior-year period was€19 million.

Sector revenue declined 3% year-over-year, as reported declines in the Americas and Asia, Australia offset growth in Europe/CAME. On an organic basis, revenue rose 2%. Reported orders came in 12% lower year-over-year, due mainly to a significantly lower volume from major orders in Europe/CAME. The Americas and Asia, Australia reported increases. On an organic basis, orders came in 7% lower. Energy’s book-to-bill ratio was 1.02 and its order backlog was€54 billion at the end of the quarter.

Effective with the beginning of fiscal 2014, the Fossil Power Generation Division and the Oil & Gas Division were combined into a single Division under the name Power Generation.

Profit stable, revenue

and orders come in lower

Fossil Power Generation delivered€387 million in profit in a highly competitive environment, after€61 million in “Siemens 2014” charges. For comparison, profit in the prior-year period included the€106 million impact related to Olkiluoto and€33 million of the Iran impacts mentioned above. In the current period, profit was held back by lower revenue in the products and solutions businesses, following weak order development for both businesses in prior periods. This factor was partially offset by an increased contribution from the service business. Revenue for the Division overall was down 7% compared to the fourth quarter a year ago. Orders came in 14% below the prior-year-period, which included a significantly higher volume from large orders. On a geographic basis, revenue declines in Europe/CAME and the Americas more than offset growth in Asia, Australia. Orders fell sharply in Europe/CAME due to a lower volume from large orders in the region, and also declined in Asia, Australia while the Americas posted an increase.

Sectors 6

Profit up on strong

off-shore performance

Wind Power generated€179 million in profit in a seasonally strong fourth quarter that coincides with the summer months of the northern hemisphere. The Division increased its installation of offshore wind-farms in Europe and raised the contribution from its service business. As a result, fourth-quarter revenue rose 10% year-over-year due primarily to growth in Europe/CAME. Revenue in the

Americas region continued to show the effects of an order gap in the U.S. in 2012, which was caused by uncertainty regarding tax incentives. In the current period, orders in the Americas rose sharply from the low base a year earlier. In contrast, Europe/CAME and Asia, Australia saw a much smaller volume from large orders, and orders for the Division overall came in substantially lower year-over-year.

Strong year-end quarter

for Oil & Gas

Oil & Gas delivered a strong quarter to close the year. Fourth-quarter profit reached€151 million, after€11 million in “Siemens 2014” charges. For comparison, the Division’s loss in the prior-year period was due mainly to impacts totaling€275 million related to adjustments for long-term construction and service contracts with customers in Iran, mainly as a result of a revenue reduction of€282 million. Revenue for the current period was up 8% from the low basis in the prior-year period, which affected Europe/CAME in particular. Fourth-quarter orders came in 13% higher year-over-year due to strong demand in the Asia, Australia region.

Challenges and charges

again result in loss

Power Transmission posted a loss of€42 million in the fourth quarter, including€76 million in “Siemens 2014” charges. Profit was also held back by project execution challenges, including the€37 million in charges related to grid connections to offshore wind-farms. A year earlier, the Division’s loss of€40 million included€67 million in charges related to wind-farm connections,€66 million in charges related to the transformers business, and€19 million of the Sector’s impacts related to Iran. Revenue in the current period came in 13% lower year-over-year, including declines in all three reporting regions, due in part to selective order intake in recent quarters. While the Division has reached material milestones with respect to one of the grid connection projects in Germany, it expects challenges to continue in coming quarters.

Sectors 7

Healthcare Sector

Strong profit performance

on organic growth

In a strong year-end quarter,Healthcare delivered profit of€601 million, near the peak level of the fourth quarter a year earlier. For comparison, that prior-year period benefited from€49 million of the OPEB gain in the U.S. mentioned earlier. Both periods included charges related to the Sector’s Agenda 2013 initiative, totaling€49 million in the current period and€40 million in the same quarter a year ago. Healthcare intends to maintain the achievements of the initiative going forward, including improvements in cost position and competitiveness.

Profit at Diagnostics came in at€82 million compared to€86 million in the prior-year period, which benefited from€9 million of the OPEB gain mentioned above. In addition, charges associated with Agenda 2013 were higher year-over-year, totaling€21 million compared to€14 million in the fourth quarter a year ago. Purchase price allocation (PPA) effects related to past acquisitions at Diagnostics were€42 million in the fourth quarter. A year earlier, Diagnostics recorded€44 million in PPA effects.

Reported revenue for Healthcare was 2% lower than in the prior-year period, while fourth-quarter orders rose 3% year-over-year, due mainly to a large order in the U.S. On an organic basis, excluding strong negative currency translation effects, Healthcare revenue rose 5% and orders climbed 10% compared to the prior-year period. On a geographic basis, revenue was up in Europe/CAME compared to the prior-year period, while Asia, Australia and the Americas posted declines. The Sector’s order growth was attributable to the Americas. The book-to bill ratio was 1.09, and Healthcare’s order backlog was€7 billion at the end of the quarter.

The Diagnostics business reported revenue of€1.026 billion in the fourth quarter, 3% below€1.055 billion a year earlier. This decline was primarily due to strong negative currency translation effects in Diagnostics’ large U.S. market which led to a moderate decline in the Americas. On an organic basis, Diagnostics revenue for the fourth quarter rose 4% year-over-year.

Sectors 8

Industry Sector

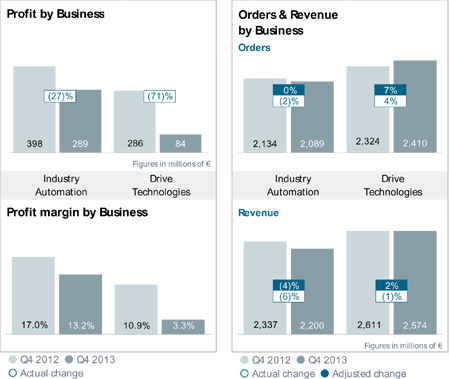

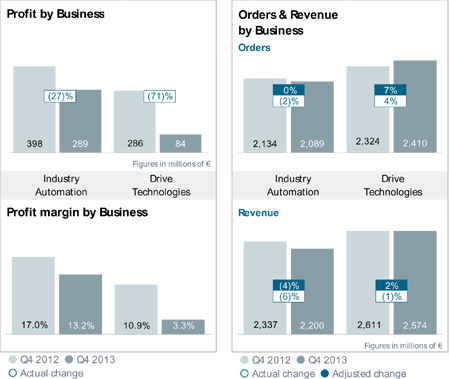

Q4 profit impacted by substantial charges for “Siemens 2014”

Fourth-quarter profit inIndustry fell to€278 million due primarily to “Siemens 2014” initiatives to improve the Sector’s global footprint and reduce costs associated with administrative processes. Associated charges totaled€232 million. Due in part to these charges, profit was lower at Industry Automation and Drive Technologies. The metals technologies business took€52 million in charges related to two projects and€37 million of the Sector’s “Siemens 2014” charges. For comparison, profit in the prior-year period included Industry’s€30 million portion of the OPEB gain mentioned earlier and a gain of€22 million from a settlement related to a supplier warranty, which more than offset€28 million in charges related to severance programs. In addition, Sector profit in the current quarter was held back by lower revenue compared to the prior-year period.

Market conditions for Industry showed further signs of stabilizing in the fourth quarter. Orders increased 5% compared to the same period a year earlier on the basis of a number of large orders in the Sector’s long-cycle business. Revenue was 5% below the prior-year level, due mainly to continuing softness in the Sector’s short-cycle markets. On a regional basis, order growth came from the Americas and Europe/CAME, while revenue was lower in all three reporting regions. The Sector’s book-to-bill ratio was 0.95 and its order backlog at the end of the quarter was€10 billion.

Effective during the fourth quarter of fiscal 2013, Industry Automation’s Water Technologies Business Unit was classified as discontinued operations. Prior-period results are presented on a comparable basis. After the close of the quarter, Industry Automation announced the signing of an agreement to sell the Business Unit, subject to customary closing conditions.

Sectors 9

“Siemens 2014” charges and lower revenue hold back profit

Fourth-quarter profit atIndustry Automation declined to€289 million, due in part to€42 million in “Siemens 2014” charges. Profit was held back also by lower revenue which led to lower capacity utilization. Effects related to LMS International NV (LMS), which was acquired in the second quarter of fiscal 2013, totaled€15 million for deferred revenue adjustments and inventory step-ups. The Division also recorded PPA effects of€11 million related to long-lived assets of LMS. PPA effects related to the acquisition of UGS Corp. in fiscal 2007 were€36 million in the current period, down from€39 million a year earlier.

Orders for the Division declined 2% compared to the fourth quarter a year earlier, due to lower demand in the Americas and Asia, Australia. On an organic basis, orders were level with the prior-year period. Revenue was 6% lower due to declines in Europe/CAME and the Americas. On an organic basis, revenue came in 4% lower year-over-year.

“Siemens 2014” charges hit profit, large orders drive growth

Fourth-quarter profit atDrive Technologies fell sharply to€84 million, due mainly to€147 million in “Siemens 2014” charges. Profit was held back further by a less favorable revenue mix compared to the same period a year earlier, related mainly to the Division’s short-cycle activities. For comparison, profit in the prior-year period included the€22 million settlement gain mentioned above for the Sector. Fourth-quarter orders rose 4% year-over-year, on growth in the Americas and Europe/CAME including a number of large orders. Revenue declined slightly due to lower demand in the Americas. On an organic basis, fourth-quarter revenue increased 2% and orders were up 7% year-over-year.

Sectors 10

Infrastructure & Cities Sector

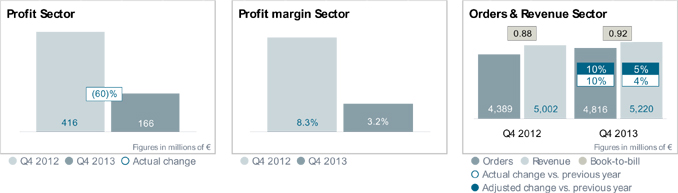

Strong year-end quarter despite “Siemens 2014” charges

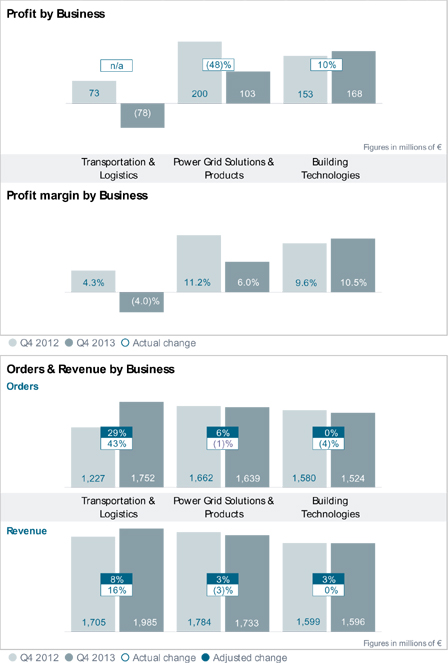

Fourth-quarter profit atInfrastructure & Cities declined year-over-year to€166 million. The main factor was€255 million in “Siemens 2014” charges, taken primarily to improve the Sector’s cost efficiency and regional footprint. These charges also included a goodwill impairment of€46 million related to its airport and postal logistics business and impairments of long-lived assets totaling€30 million. The Sector’s “Siemens 2014” charges resulted in a loss for the Transportation & Logistics business and sharply cut the profit at the Power Grid Solutions & Products business compared to the prior-year period. Building Technologies was still able to increase its fourth-quarter profit year-over-year. For comparison, profit for Infrastructure & Cities in the prior-year period was burdened by€34 million in charges related to severance programs and an impact of€20 million related to Iran. These factors were largely offset by the Sector’s€30 million portion of the OPEB gain mentioned earlier and a positive contribution from the Sector’s interest in AtoS S.A. (AtoS).

Fourth-quarter orders and revenue for Infrastructure & Cities rose 10% and 4%, respectively, on growth year-over-year at Transportation & Logistics. On a regional basis, orders and revenue for the Sector rose in Asia, Australia

and Europe/CAME and remained nearly level in the Americas compared to the fourth quarter a year ago. The Sector’s book-to-bill ratio was 0.92 and its order backlog at the end of the quarter was€29 billion.

Loss due to “Siemens 2014” charges, volume growth benefits from Invensys Rail

Transportation & Logistics recorded a loss of€78 million in the current period compared to a profit of€73 million a year earlier. The largest factor in the change was€149 million in “Siemens 2014” charges. This includes the goodwill impairment of€46 million on the airport logistics and postal automation business, which Transportation & Logistics intends to divest. Profit was held back also by effects related to the third-quarter acquisition of Invensys Rail, including€34 million in transaction and integration costs and PPA effects of€12 million. For comparison, profit in the prior-year period was burdened by the€20 million impact related to Iran. Fourth-quarter revenue for Transportation & Logistics climbed 16% year-over-year. Orders rose 43%, due mainly to a larger volume from major orders. Both revenue and order growth benefited from the acquisition of Invensys Rail.

Sectors 11

“Siemens 2014” charges impact profit , volume declines slightly

Profit atPower Grid Solutions & Products declined to€103 million, due mainly to€74 million in “Siemens 2014” charges. These charges included the€30 million in impairments of long-lived assets mentioned above for the Sector. Profit development was also held back by a 3% decline in revenue compared to the prior-year quarter. Reported orders for the Business

declined slightly. On an organic basis, excluding strong negative currency translation effects, revenue and orders rose 3% and 6%, respectively. On a regional basis, Asia, Australia reported double-digit increases in both revenue and orders, while the other regions posted declines compared to the fourth quarter a year ago.

Improved business mix and cost position lift profit

Building Technologies increased its fourth-quarter profit to€168 million despite€29 million in “Siemens 2014” charges. The main reasons for the increase were a more favorable business mix, following more selective order intake in prior periods and an improved cost position year-over-year. Revenue for the Division remained stable year-over-year, as lower revenue in the Americas was offset by an increase in Europe/CAME. Orders came in 4% lower year-over-year, including declines in all three reporting regions.

Equity Investments and Financial Services 12

Equity Investments and Financial Services

Gain from NSN sale lifts profit

Following the spin-off of OSRAM Licht AG (OSRAM) at the beginning of the fourth quarter, we present our remaining 17.0% stake in OSRAM, which is accounted for as available-for-sale financial assets, withinEquityInvestments. During the fourth quarter, Siemens closed the sale of its 50% share in NSN to NSN’s other shareholder, Nokia Corporation.

In the current period, Equity Investments posted a profit of€110 million, up from€44 million a year earlier. This improvement was due mainly to a gain of€76 million from the sale of Siemens’ equity share in NSN mentioned above. For comparison, profit in the prior-year period included equity investment income of€28 million related to the stake in NSN.

Due to a change in management responsibility related to Siemens’ shares in AtoS, the shares are included within Equity Investments effective with the beginning of fiscal 2014.

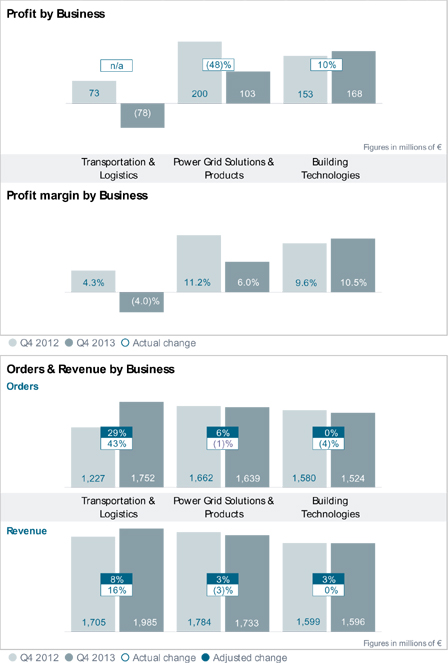

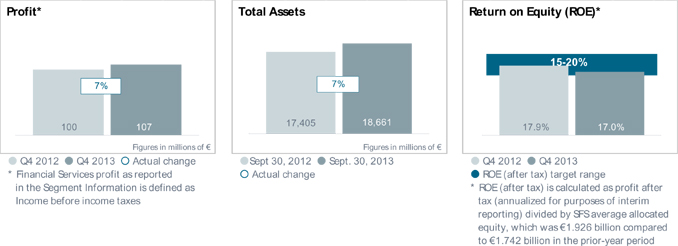

Higher income from Financial Services

Profit for the fourth quarter inFinancial Services (SFS) rose to€107 million including lower credit hits. Despite substantial early terminations of financings and negative currency translation effects, SFS continued to

successfully execute its growth strategy. Total assets rose from€17.405 billion at the end of fiscal 2012 to€18.661 billion at the end of fiscal 2013.

Corporate Activities and Outlook 13

Corporate Activities

Corporate items and pensions stable year-over-year

Corporate items and pensions reported a loss of€396 million in the fourth quarter compared to a loss of€386 million in the same period a year earlier. Within these figures, the loss at Corporate items was€295 million compared to a loss of€276 million in the prior-year period. Centrally carried pension expense for the fourth quarter totaled€101 million compared to€110 million a year earlier.

Higher gains from disposal of real estate

Income before income taxes atSiemens Real Estate was€112 million in the fourth quarter, compared to€88 million in the same period a year ago. The increase was due mainly to higher income from real estate disposals.

Outlook

We expect our markets to remain challenging in fiscal 2014. Our short-cycle businesses are not anticipating a recovery until late in the fiscal year. We expect orders to exceed revenue, for a book-to-bill ratio above 1. Assuming that revenue on an organic basis remains level year-over-year, we expect basic earnings per share (Net Income) for fiscal 2014 to grow by at least 15% from€5.08 in fiscal 2013.

This outlook is based on shares outstanding of 843 million as of September 30, 2013. Furthermore, it excludes impacts related to legal and regulatory matters.

Notes and Forward-Looking Statements 14

Notes and Forward-Looking Statements

All figures are preliminary and unaudited.

Financial Publications are available for download at:www.siemens.com/irg Publications & Calendar.

This document includes supplemental financial measures that are or may be non-GAAP financial measures. Orders and order backlog; adjusted or organic growth rates of revenue and orders; book-to-bill ratio; Total Sectors profit; return on equity (after tax), or ROE (after tax); return on capital employed (adjusted), or ROCE (adjusted); Free cash flow, or FCF; adjusted EBITDA; adjusted EBIT; adjusted EBITDA margins, earnings effects from purchase price allocation, or PPA effects; net debt and adjusted industrial net debt are or may be such non-GAAP financial measures. These supplemental financial measures should not be viewed in isolation as alternatives to measures of Siemens’ financial condition, results of operations or cash flows as presented in accordance with IFRS in its Consolidated Financial Statements.

Other companies that report or describe similarly titled financial measures may calculate them differently. Definitions of these supplemental financial measures, a discussion of the most directly comparable IFRS financial measures, information regarding the usefulness of Siemens’ supplemental financial measures, the limitations associated with these measures and reconciliations to the most comparable IFRS financial measures are available on Siemens’ Investor Relations website atwww.siemens.com/nonGAAP. For additional information, see supplemental financial measures and the related discussion in Siemens’ most recent annual report on Form 20-F, which can be found on our Investor Relations website or via the EDGAR system on the website of the United States Securities and Exchange Commission.

Starting today at 9.00 a.m. CET, we will provide a live video webcast of the annual press conference with CEO Joe Kaeser and CFO Ralf Thomas. You can access the webcast atwww.siemens.com/pressconference.

The accompanying slide presentation can also be viewed here, and a recording of the conference will subsequently be made available as well.

Also today at 3.30 p.m. CET, you can follow a conference in English with analysts and investors live on the Internet by going towww.siemens.com/analystconference.

This document contains statements related to our future business and financial performance and future events or developments involving Siemens that may constitute forward-looking statements. These statements may be identified by words such as “expects,” “looks forward to,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “project” or words of similar meaning. We may also make forward-looking statements in other reports, in presentations, in material delivered to shareholders and in press releases. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Siemens’ management, and are, therefore, subject to certain risks and uncertainties. A variety of factors, many of which are beyond Siemens’ control, affect Siemens’ operations, performance, business strategy and results and could cause the actual results, performance or achievements of Siemens to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements or anticipated on the basis of historical trends. These factors include in particular, but are not limited to, the matters described in Item 3: Key information—Risk factors of our most recent annual report on Form 20-F filed with the SEC, in the chapter “Risks” of our most recent annual report prepared in accordance with the German Commercial Code, and in the chapter “Report on risks and opportunities” of our most recent interim report.

Further information about risks and uncertainties affecting Siemens is included throughout our most recent annual and interim reports, as well as our most recent earnings release, which are available on the Siemens website,www.siemens.com, and

throughout our most recent annual report on Form 20-F and in our other filings with the SEC, which are available on the Siemens website,www.siemens.com, and on the SEC’s website,www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results, performance or achievements of Siemens may vary materially from those described in the relevant forward-looking statement as being expected, anticipated, intended, planned, believed, sought, estimated or projected. Siemens neither intends, nor assumes any obligation, to update or revise these forward-looking statements in light of developments which differ from those anticipated.

Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

SIEMENS

CONSOLIDATED STATEMENTS OF INCOME (preliminary and unaudited)

For the three months and the fiscal years ended September 30, 2013 and 2012

(in millions of€, per share amounts in€)

| | | | | | | | | | | | | | | | |

| | | Three months ended

September 30, | | | Fiscal years ended

September 30, | |

| | | 2013 | | | 2012(1) | | | 2013 | | | 2012(1) | |

Revenue | | | 21,168 | | | | 21,444 | | | | 75,882 | | | | 77,395 | |

Cost of sales | | | (15,645 | ) | | | (15,548 | ) | | | (55,053 | ) | | | (55,470 | ) |

| | | | | | | | | | | | | | | | |

Gross profit | | | 5,523 | | | | 5,896 | | | | 20,829 | | | | 21,925 | |

Research and development expenses | | | (1,187 | ) | | | (1,125 | ) | | | (4,291 | ) | | | (4,245 | ) |

Selling and general administrative expenses | | | (3,065 | ) | | | (3,060 | ) | | | (11,286 | ) | | | (11,043 | ) |

Other operating income | | | 230 | | | | 203 | | | | 503 | | | | 523 | |

Other operating expenses | | | (180 | ) | | | (194 | ) | | | (427 | ) | | | (364 | ) |

Income (loss) from investments accounted for using the equity method, net | | | 159 | | | | 60 | | | | 510 | | | | (333 | ) |

Interest income | | | 239 | | | | 234 | | | | 948 | | | | 939 | |

Interest expenses | | | (211 | ) | | | (185 | ) | | | (789 | ) | | | (760 | ) |

Other financial income (expenses), net | | | (52 | ) | | | (93 | ) | | | (154 | ) | | | (5 | ) |

| | | | | | | | | | | | | | | | |

Income from continuing operations before income taxes | | | 1,456 | | | | 1,737 | | | | 5,843 | | | | 6,636 | |

Income tax expenses | | | (381 | ) | | | (507 | ) | | | (1,630 | ) | | | (1,994 | ) |

| | | | | | | | | | | | | | | | |

Income from continuing operations | | | 1,075 | | | | 1,230 | | | | 4,212 | | | | 4,642 | |

Income (loss) from discontinued operations, net of income taxes | | | (7 | ) | | | (39 | ) | | | 197 | | | | (360 | ) |

| | | | | | | | | | | | | | | | |

Net income | | | 1,068 | | | | 1,191 | | | | 4,409 | | | | 4,282 | |

| | | | | | | | | | | | | | | | |

Attributable to: | | | | | | | | | | | | | | | | |

Non-controlling interests | | | 62 | | | | 53 | | | | 126 | | | | 132 | |

Shareholders of Siemens AG | | | 1,006 | | | | 1,138 | | | | 4,284 | | | | 4,151 | |

Basic earnings per share | | | | | | | | | | | | | | | | |

Income from continuing operations | | | 1.20 | | | | 1.35 | | | | 4.85 | | | | 5.15 | |

Income (loss) from discontinued operations | | | (0.01 | ) | | | (0.04 | ) | | | 0.23 | | | | (0.41 | ) |

| | | | | | | | | | | | | | | | |

Net income | | | 1.19 | | | | 1.30 | | | | 5.08 | | | | 4.74 | |

| | | | | | | | | | | | | | | | |

Diluted earnings per share | | | | | | | | | | | | | | | | |

Income from continuing operations | | | 1.19 | | | | 1.33 | | | | 4.80 | | | | 5.10 | |

Income (loss) from discontinued operations | | | (0.01 | ) | | | (0.04 | ) | | | 0.22 | | | | (0.41 | ) |

| | | | | | | | | | | | | | | | |

Net income | | | 1.18 | | | | 1.29 | | | | 5.03 | | | | 4.69 | |

| | | | | | | | | | | | | | | | |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (preliminary and unaudited) For the three months and the fiscal years ended September 30, 2013 and 2012 (in millions of€) | |

| | |

| | | Three months ended

September 30, | | | Fiscal years ended

September 30, | |

| | | 2013 | | | 2012(1) | | | 2013 | | | 2012(1) | |

Net income | | | 1,068 | | | | 1,191 | | | | 4,409 | | | | 4,282 | |

Items that will not be reclassified to profit or loss: | | | | | | | | | | | | | | | | |

Remeasurements of defined benefit plans | | | 45 | | | | (594 | ) | | | 394 | | | | (1,787 | ) |

Items that may be reclassified subsequently to profit or loss: | | | | | | | | | | | | | | | | |

Currency translation differences | | | (443 | ) | | | (207 | ) | | | (1,062 | ) | | | 855 | |

Available-for-sale financial assets | | | 141 | | | | 87 | | | | 183 | | | | 209 | |

Derivative financial instruments | | | (38 | ) | | | 139 | | | | 45 | | | | 63 | |

| | | | | | | | | | | | | | | | |

| | | (340 | ) | | | 19 | | | | (834 | ) | | | 1,127 | |

| | | | | | | | | | | | | | | | |

Other comprehensive income, net of income taxes(2) | | | (295 | ) | | | (575 | ) | | | (440 | ) | | | (661 | ) |

| | | | | | | | | | | | | | | | |

Total comprehensive income | | | 773 | | | | 615 | | | | 3,969 | | | | 3,622 | |

| | | | | | | | | | | | | | | | |

Attributable to: | | | | | | | | | | | | | | | | |

Non-controlling interests | | | 37 | | | | 33 | | | | 81 | | | | 128 | |

Shareholders of Siemens AG | | | 736 | | | | 582 | | | | 3,888 | | | | 3,494 | |

| (1) | Adjusted for effects of adopting IAS 19R. |

| (2) | Includes income (expenses) resulting from investments accounted for using the equity method of€(131) million and€26 million, respectively, for the three months ended September 30, 2013 and 2012, and€(257) million and€28 million, respectively, for the fiscal years ended September 30, 2013 and 2012. |

Thereof€(4) million and€(10) million, respectively, for the three months ended September 30, 2013 and 2012, and€(121) million and€(99) million, respectively, for the fiscal years ended September 30, 2013 and 2012, are attributable to items that will not be reclassified to profit or loss.

Due to rounding, numbers presented may not add up precisely to totals provided.

SIEMENS

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (preliminary and unaudited)

As of September 30, 2013 and 2012

(in millions of€)

| | | | | | | | |

| | | 9/30/13 | | | 9/30/12(1) | |

ASSETS | | | | | | | | |

Cash and cash equivalents | | | 9,190 | | | | 10,891 | |

Available-for-sale financial assets | | | 601 | | | | 524 | |

Trade and other receivables | | | 14,853 | | | | 15,220 | |

Other current financial assets | | | 3,250 | | | | 2,901 | |

Inventories | | | 15,560 | | | | 15,679 | |

Current income tax assets | | | 794 | | | | 836 | |

Other current assets | | | 1,297 | | | | 1,277 | |

Assets classified as held for disposal | | | 1,393 | | | | 4,799 | |

| | | | | | | | |

Total current assets | | | 46,937 | | | | 52,128 | |

| | | | | | | | |

Goodwill | | | 17,883 | | | | 17,069 | |

Other intangible assets | | | 5,057 | | | | 4,595 | |

Property, plant and equipment | | | 9,815 | | | | 10,763 | |

Investments accounted for using the equity method | | | 3,022 | | | | 4,436 | |

Other financial assets | | | 15,117 | | | | 14,666 | |

Deferred tax assets | | | 3,234 | | | | 3,748 | |

Other assets | | | 872 | | | | 846 | |

| | | | | | | | |

Total non-current assets | | | 54,999 | | | | 56,123 | |

| | | | | | | | |

Total assets | | | 101,936 | | | | 108,251 | |

| | | | | | | | |

| | |

LIABILITIES AND EQUITY | | | | | | | | |

Short-term debt and current maturities of long-term debt | | | 1,944 | | | | 3,826 | |

Trade payables | | | 7,599 | | | | 8,036 | |

Other current financial liabilities | | | 1,515 | | | | 1,460 | |

Current provisions | | | 4,485 | | | | 4,750 | |

Current income tax liablities | | | 2,151 | | | | 2,204 | |

Other current liabilities | | | 19,701 | | | | 20,302 | |

Liabilities associated with assets classified as held for disposal | | | 473 | | | | 2,049 | |

| | | | | | | | |

Total current liabilities | | | 37,868 | | | | 42,627 | |

| | | | | | | | |

Long-term debt | | | 18,509 | | | | 16,880 | |

Post-employment benefits | | | 9,265 | | | | 9,801 | |

Deferred tax liabilities | | | 504 | | | | 494 | |

Provisions | | | 3,907 | | | | 3,908 | |

Other financial liabilities | | | 1,184 | | | | 1,083 | |

Other liabilities | | | 2,074 | | | | 2,034 | |

| | | | | | | | |

Total non-current liabilities | | | 35,443 | | | | 34,200 | |

| | | | | | | | |

Total liabilities | | | 73,312 | | | | 76,827 | |

| | | | | | | | |

Equity | | | | | | | | |

Issued capital, no par value(2) | | | 2,643 | | | | 2,643 | |

Capital reserve | | | 5,484 | | | | 6,173 | |

Retained earnings | | | 22,663 | | | | 22,877 | |

Other components of equity | | | 268 | | | | 1,058 | |

Treasury shares, at cost(3) | | | (2,946 | ) | | | (1,897 | ) |

| | | | | | | | |

Total equity attributable to shareholders of Siemens AG | | | 28,111 | | | | 30,855 | |

| | | | | | | | |

Non-controlling interests | | | 514 | | | | 569 | |

| | | | | | | | |

Total equity | | | 28,625 | | | | 31,424 | |

| | | | | | | | |

Total liabilities and equity | | | 101,936 | | | | 108,251 | |

| | | | | | | | |

| (1) | Adjusted for effects of adopting IAS 19R. |

| (2) | Authorized: 1,084,600,000 and 1,084,600,000 shares, respectively. Issued: 881,000,000 and 881,000,000 shares, respectively. |

| (3) | 37,997,595 and 24,725,674 shares, respectively. |

Due to rounding, numbers presented may not add up precisely to totals provided.

SIEMENS

CONSOLIDATED STATEMENTS OF CASH FLOWS (preliminary and unaudited)

For the three months ended September 30, 2013 and 2012

(in millions of€)

| | | | | | | | |

| | | Three months

ended September 30, | |

| | | 2013 | | | 2012(1) | |

Cash flows from operating activities | | | | | | | | |

Net income | | | 1,068 | | | | 1,191 | |

Adjustments to reconcile net income to cash flows from operating activities — continuing operations | | | | | | | | |

(Income) loss from discontinued operations, net of income taxes | | | 7 | | | | 39 | |

Amortization, depreciation and impairments | | | 873 | | | | 847 | |

Income tax expenses | | | 381 | | | | 507 | |

Interest (income) expenses, net | | | (28 | ) | | | (50 | ) |

(Gains) losses on disposals of assets related to investing activities, net(2) | | | (247 | ) | | | (107 | ) |

Other (income) losses from investments(2) | | | — | | | | (63 | ) |

Other non-cash (income) expenses | | | 204 | | | | 69 | |

Change in assets and liabilities | | | | | | | | |

Inventories | | | 737 | | | | 1,469 | |

Trade and other receivables | | | 613 | | | | 746 | |

Trade payables | | | 746 | | | | 488 | |

Other assets and liabilities | | | 910 | | | | 82 | |

Additions to assets leased to others in operating leases | | | (82 | ) | | | (111 | ) |

Income taxes paid | | | (390 | ) | | | (324 | ) |

Dividends received | | | 101 | | | | 111 | |

Interest received | | | 213 | | | | 197 | |

| | | | | | | | |

Cash flows from operating activities — continuing operations | | | 5,106 | | | | 5,094 | |

Cash flows from operating activities — discontinued operations | | | (12 | ) | | | 160 | |

| | | | | | | | |

Cash flows from operating activities — continuing and discontinued operations | | | 5,095 | | | | 5,253 | |

Cash flows from investing activities | | | | | | | | |

Additions to intangible assets and property, plant and equipment | | | (749 | ) | | | (766 | ) |

Acquisitions of businesses, net of cash acquired | | | (74 | ) | | | (41 | ) |

Purchase of investments(2) | | | (123 | ) | | | (35 | ) |

Purchase of current available-for-sale financial assets | | | (114 | ) | | | (47 | ) |

Change in receivables from financing activities | | | (1,048 | ) | | | (1,144 | ) |

Disposal of investments, intangibles and property, plant and equipment(2) | | | 2,040 | | | | 288 | |

Disposal of businesses, net of cash disposed | | | 6 | | | | 9 | |

Disposal of current available-for-sale financial assets | | | 14 | | | | 51 | |

| | | | | | | | |

Cash flows from investing activities — continuing operations | | | (48 | ) | | | (1,686 | ) |

Cash flows from investing activities — discontinued operations | | | (30 | ) | | | (90 | ) |

| | | | | | | | |

Cash flows from investing activities — continuing and discontinued operations | | | (78 | ) | | | (1,776 | ) |

Cash flows from financing activities | | | | | | | | |

Purchase of treasury shares | | | — | | | | (1,721 | ) |

Other transactions with owners | | | — | | | | 37 | |

Issuance of long-term debt | | | — | | | | 2,640 | |

Repayment of long-term debt (including current maturities of long-term debt) | | | (774 | ) | | | (24 | ) |

Change in short-term debt and other financing activities | | | (976 | ) | | | (2,268 | ) |

Interest paid | | | (150 | ) | | | (96 | ) |

Dividends attributable to non-controlling interests | | | (18 | ) | | | (28 | ) |

Financing discontinued operations(3) | | | 265 | | | | 61 | |

| | | | | | | | |

Cash flows from financing activities — continuing operations | | | (1,654 | ) | | | (1,400 | ) |

Cash flows from financing activities — discontinued operations | | | 42 | | | | (70 | ) |

| | | | | | | | |

Cash flows from financing activities — continuing and discontinued operations | | | (1,612 | ) | | | (1,471 | ) |

Effect of deconsolidation of OSRAM on cash and cash equivalents | | | (476 | ) | | | — | |

Effect of changes in exchange rates on cash and cash equivalents | | | (65 | ) | | | (53 | ) |

Change in cash and cash equivalents | | | 2,863 | | | | 1,954 | |

Cash and cash equivalents at beginning of period | | | 6,370 | | | | 8,996 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | | 9,234 | | | | 10,950 | |

Less: Cash and cash equivalents of assets classified as held for disposal and discontinued operations at end of period | | | 44 | | | | 59 | |

| | | | | | | | |

Cash and cash equivalents at end of period (Consolidated Statements of Financial Position) | | | 9,190 | | | | 10,891 | |

| | | | | | | | |

| (1) | Adjusted for effects of adopting IAS 19R. |

| (2) | Investments include equity instruments either classified as non-current available-for-sale financial assets, accounted for using the equity method or classified as held for disposal. Purchase of investments includes certain loans to investments accounted for using the equity method. |

| (3) | Discontinued operations are financed generally through Corporate Treasury. |

Due to rounding, numbers presented may not add up precisely to totals provided.

SIEMENS

CONSOLIDATED STATEMENTS OF CASH FLOWS (preliminary and unaudited)

For the fiscal years ended September 30, 2013 and 2012

(in millions of€)

| | | | | | | | |

| | | 2013 | | | 2012(1) | |

Cash flows from operating activities | | | | | | | | |

Net income | | | 4,409 | | | | 4,282 | |

Adjustments to reconcile net income to cash flows from operating activities — continuing operations | | | | | | | | |

(Income) loss from discontinued operations, net of income taxes | | | (197 | ) | | | 360 | |

Amortization, depreciation and impairments | | | 2,888 | | | | 2,818 | |

Income tax expenses | | | 1,630 | | | | 1,994 | |

Interest (income) expenses, net | | | (159 | ) | | | (178 | ) |

(Gains) losses on disposals of assets related to investing activities, net(2) | | | (292 | ) | | | (345 | ) |

Other (income) losses from investments(2) | | | (326 | ) | | | 424 | |

Other non-cash (income) expenses | | | 674 | | | | 110 | |

Change in assets and liabilities | | | | | | | | |

Inventories | | | (218 | ) | | | (89 | ) |

Trade and other receivables | | | (293 | ) | | | 104 | |

Trade payables | | | (217 | ) | | | 199 | |

Other assets and liabilities | | | 576 | | | | (2,078 | ) |

Additions to assets leased to others in operating leases | | | (377 | ) | | | (375 | ) |

Income taxes paid | | | (2,166 | ) | | | (1,445 | ) |

Dividends received | | | 356 | | | | 301 | |

Interest received | | | 837 | | | | 842 | |

| | | | | | | | |

Cash flows from operating activities — continuing operations | | | 7,126 | | | | 6,923 | |

Cash flows from operating activities — discontinued operations | | | 214 | | | | 188 | |

| | | | | | | | |

Cash flows from operating activities — continuing and discontinued operations | | | 7,340 | | | | 7,110 | |

Cash flows from investing activities | | | | | | | | |

Additions to intangible assets and property, plant and equipment | | | (1,869 | ) | | | (2,195 | ) |

Acquisitions of businesses, net of cash acquired | | | (2,801 | ) | | | (1,295 | ) |

Purchase of investments(2) | | | (346 | ) | | | (252 | ) |

Purchase of current available-for-sale financial assets | | | (157 | ) | | | (182 | ) |

Change in receivables from financing activities | | | (2,175 | ) | | | (2,087 | ) |

Disposal of investments, intangibles and property, plant and equipment(2) | | | 2,463 | | | | 753 | |

Disposal of businesses, net of cash disposed | | | (27 | ) | | | 87 | |

Disposal of current available-for-sale financial assets | | | 76 | | | | 142 | |

| | | | | | | | |

Cash flows from investing activities — continuing operations | | | (4,836 | ) | | | (5,029 | ) |

Cash flows from investing activities — discontinued operations | | | (240 | ) | | | (656 | ) |

| | | | | | | | |

Cash flows from investing activities — continuing and discontinued operations | | | (5,076 | ) | | | (5,685 | ) |

Cash flows from financing activities | | | | | | | | |

Purchase of treasury shares | | | (1,394 | ) | | | (1,721 | ) |

Other transactions with owners | | | (15 | ) | | | 158 | |

Issuance of long-term debt | | | 3,772 | | | | 5,113 | |

Repayment of long-term debt (including current maturities of long-term debt) | | | (2,927 | ) | | | (3,218 | ) |

Change in short-term debt and other financing activities | | | 3 | | | | (62 | ) |

Interest paid | | | (479 | ) | | | (503 | ) |

Dividends paid to shareholders of Siemens AG | | | (2,528 | ) | | | (2,629 | ) |

Dividends attributable to non-controlling interests | | | (152 | ) | | | (155 | ) |

Financing discontinued operations(3) | | | 298 | | | | (506 | ) |

| | | | | | | | |

Cash flows from financing activities — continuing operations | | | (3,422 | ) | | | (3,523 | ) |

Cash flows from financing activities — discontinued operations | | | 26 | | | | 468 | |

| | | | | | | | |

Cash flows from financing activities — continuing and discontinued operations | | | (3,396 | ) | | | (3,055 | ) |

Effect of deconsolidation of OSRAM on cash and cash equivalents | | | (476 | ) | | | — | |

Effect of changes in exchange rates on cash and cash equivalents | | | (108 | ) | | | 68 | |

Change in cash and cash equivalents | | | (1,717 | ) | | | (1,561 | ) |

Cash and cash equivalents at beginning of period | | | 10,950 | | | | 12,512 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | | 9,234 | | | | 10,950 | |

Less: Cash and cash equivalents of assets classified as held for disposal and discontinued operations at end of period | | | 44 | | | | 59 | |

| | | | | | | | |

Cash and cash equivalents at end of period (Consolidated Statements of Financial Position) | | | 9,190 | | | | 10,891 | |

| | | | | | | | |

| (1) | Adjusted for effects of adopting IAS 19R. |

| (2) | Investments include equity instruments either classified as non-current available-for-sale financial assets, accounted for using the equity method or classified as held for disposal. Purchase of investments includes certain loans to investments accounted for using the equity method. |

| (3) | Discontinued operations are financed generally through Corporate Treasury. |

Due to rounding, numbers presented may not add up precisely to totals provided.

SIEMENS

SEGMENT INFORMATION (continuing operations — preliminary and unaudited)

As of and for the three months ended September 30, 2013 and 2012

(in millions of€)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Orders(1) | | | External

revenue | | | Intersegment

revenue | | | Total

revenue | | | Profit(2) | | | Assets(3) | | | Free

cash flow(4) | | | Additions to

intangible assets

and property, plant

and equipment | | | Amortization,

depreciation

and

impairments(5) | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 9/30/13 | | | 9/30/12 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Sectors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Energy | | | 7,609 | | | | 8,687 | | | | 7,373 | | | | 7,583 | | | | 63 | | | | 64 | | | | 7,436 | | | | 7,647 | | | | 564 | | | | 163 | | | | 1,621 | | | | 1,116 | | | | 1,514 | | | | 2,301 | | | | 196 | | | | 209 | | | | 177 | | | | 201 | |

Healthcare | | | 4,060 | | | | 3,960 | | | | 3,716 | | | | 3,778 | | | | 9 | | | | 8 | | | | 3,724 | | | | 3,786 | | | | 601 | | | | 631 | | | | 11,023 | | | | 11,757 | | | | 885 | | | | 851 | | | | 100 | | | | 106 | | | | 160 | | | | 174 | |

Industry | | | 4,800 | | | | 4,572 | | | | 4,574 | | | | 4,884 | | | | 468 | | | | 440 | | | | 5,042 | | | | 5,324 | | | | 278 | | | | 721 | | | | 6,549 | | | | 6,479 | | | | 830 | | | | 975 | | | | 176 | | | | 167 | | | | 187 | | | | 149 | |

Infrastructure & Cities | | | 4,816 | | | | 4,389 | | | | 4,985 | | | | 4,738 | | | | 235 | | | | 265 | | | | 5,220 | | | | 5,002 | | | | 166 | | | | 416 | | | | 5,694 | | | | 4,012 | | | | 978 | | | | 618 | | | | 90 | | | | 99 | | | | 116 | | | | 76 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Sectors | | | 21,285 | | | | 21,608 | | | | 20,649 | | | | 20,983 | | | | 775 | | | | 776 | | | | 21,423 | | | | 21,759 | | | | 1,609 | | | | 1,932 | | | | 24,886 | | | | 23,364 | | | | 4,208 | | | | 4,745 | | | | 562 | | | | 581 | | | | 640 | | | | 600 | |

Equity Investments | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 110 | | | | 44 | | | | 1,767 | | | | 2,715 | | | | (1 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Financial Services (SFS) | | | 347 | | | | 247 | | | | 303 | | | | 239 | | | | 44 | | | | 8 | | | | 347 | | | | 247 | | | | 107 | | | | 100 | | | | 18,661 | | | | 17,405 | | | | 278 | | | | 129 | | | | 15 | | | | 8 | | | | 53 | | | | 69 | |

Reconciliation to Consolidated Financial Statements | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Centrally managed portfolio activities | | | 77 | | | | 70 | | | | 74 | | | | 65 | | | | 3 | | | | 4 | | | | 77 | | | | 69 | | | | (47 | ) | | | (24 | ) | | | (267 | ) | | | (448 | ) | | | (7 | ) | | | 42 | | | | 2 | | | | — | | | | 1 | | | | 1 | |

Siemens Real Estate (SRE) | | | 657 | | | | 655 | | | | 88 | | | | 81 | | | | 570 | | | | 573 | | | | 657 | | | | 654 | | | | 112 | | | | 88 | | | | 4,747 | | | | 5,018 | | | | (47 | ) | | | (51 | ) | | | 141 | | | | 156 | | | | 101 | | | | 83 | |

Corporate items and pensions | | | 96 | | | | 116 | | | | 55 | | | | 75 | | | | 41 | | | | 42 | | | | 96 | | | | 118 | | | | (396 | ) | | | (386 | ) | | | (11,252 | ) | | | (11,693 | ) | | | 5 | | | | (172 | ) | | | 31 | | | | 22 | | | | 19 | | | | 19 | |

Eliminations, Corporate Treasury and other reconciling items | | | (1,450 | ) | | | (1,445 | ) | | | — | | | | — | | | | (1,431 | ) | | | (1,404 | ) | | | (1,431 | ) | | | (1,404 | ) | | | (39 | ) | | | (16 | ) | | | 63,393 | | | | 71,889 | | | | (79 | ) | | | (366 | ) | | | (3 | ) | | | (1 | ) | | | (8 | ) | | | (10 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Siemens | | | 21,011 | | | | 21,251 | | | | 21,168 | | | | 21,444 | | | | — | | | | — | | | | 21,168 | | | | 21,444 | | | | 1,456 | | | | 1,737 | | | | 101,936 | | | | 108,251 | | | | 4,357 | | | | 4,328 | | | | 749 | | | | 766 | | | | 805 | | | | 762 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | This supplementary information on Orders is provided on a voluntary basis. It is not part of the Consolidated Financial Statements subject to the audit opinion. |

| (2) | Profit of the Sectors as well as of Equity Investments and Centrally managed portfolio activities is earnings before financing interest, certain pension costs and income taxes. Certain other items not considered performance indicative by Management may be excluded. Profit of SFS and SRE is Income before income taxes. |

| (3) | Assets of the Sectors as well as of Equity Investments and Centrally managed portfolio activities is defined as Total assets less income tax assets, less non-interest bearing liabilities other than tax liabilities. Assets of SFS and SRE is Total assets. |

| (4) | Free cash flow represents Cash flows from operating activities less Additions to intangible assets and property, plant and equipment. Free cash flow of the Sectors, Equity Investments and Centrally managed portfolio activities primarily exclude income tax, financing interest and certain pension related payments and proceeds. Free cash flow of SFS, a financial services business, and of SRE includes related financing interest payments and proceeds; income tax payments and proceeds of SFS and SRE are excluded. |

| (5) | Amortization, depreciation and impairments contains amortization and impairments, net of reversals of impairments, of intangible assets other than goodwill as well as depreciation and impairments of property, plant and equipment, net of reversals of impairments. |

Due to rounding, numbers presented may not add up precisely to totals provided.

SIEMENS

SEGMENT INFORMATION (continuing operations — preliminary and unaudited)

As of and for the fiscal years ended September 30, 2013 and 2012

(in millions of€)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Orders(1) | | | External

revenue | | | Intersegment

revenue | | | Total

revenue | | | Profit(2) | | | Assets(3) | | | Free

cash flow(4) | | | Additions to

intangible assets

and property, plant

and equipment | | | Amortization,

depreciation

and

impairments(5) | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 9/30/13 | | | 9/30/12 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Sectors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Energy | | | 28,797 | | | | 26,930 | | | | 26,386 | | | | 27,501 | | | | 252 | | | | 235 | | | | 26,638 | | | | 27,736 | | | | 1,955 | | | | 1,901 | | | | 1,621 | | | | 1,116 | | | | 1,595 | | | | 2,142 | | | | 425 | | | | 547 | | | | 587 | | | | 549 | |

Healthcare | | | 13,950 | | | | 13,806 | | | | 13,598 | | | | 13,600 | | | | 24 | | | | 42 | | | | 13,621 | | | | 13,642 | | | | 2,048 | | | | 1,815 | | | | 11,023 | | | | 11,757 | | | | 2,238 | | | | 1,861 | | | | 291 | | | | 354 | | | | 638 | | | | 726 | |

Industry | | | 18,417 | | | | 18,962 | | | | 16,943 | | | | 17,772 | | | | 1,643 | | | | 1,637 | | | | 18,586 | | | | 19,409 | | | | 1,478 | | | | 2,448 | | | | 6,549 | | | | 6,479 | | | | 2,070 | | | | 2,123 | | | | 395 | | | | 417 | | | | 657 | | | | 553 | |

Infrastructure & Cities | | | 21,894 | | | | 17,150 | | | | 17,128 | | | | 16,731 | | | | 750 | | | | 853 | | | | 17,879 | | | | 17,585 | | | | 306 | | | | 1,102 | | | | 5,694 | | | | 4,012 | | | | 384 | | | | 737 | | | | 239 | | | | 290 | | | | 332 | | | | 276 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Sectors | | | 83,057 | | | | 76,848 | | | | 74,055 | | | | 75,605 | | | | 2,669 | | | | 2,767 | | | | 76,724 | | | | 78,372 | | | | 5,788 | | | | 7,266 | | | | 24,886 | | | | 23,364 | | | | 6,288 | | | | 6,863 | | | | 1,350 | | | | 1,608 | | | | 2,215 | | | | 2,104 | |

Equity Investments | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 396 | | | | (549 | ) | | | 1,767 | | | | 2,715 | | | | 114 | | | | 100 | | | | — | | | | — | | | | — | | | | — | |

Financial Services (SFS) | | | 1,072 | | | | 908 | | | | 960 | | | | 859 | | | | 112 | | | | 48 | | | | 1,072 | | | | 908 | | | | 409 | | | | 479 | | | | 18,661 | | | | 17,405 | | | | 857 | | | | 528 | | | | 69 | | | | 31 | | | | 230 | | | | 270 | |

Reconciliation to Consolidated Financial Statements | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Centrally managed portfolio activities | | | 296 | | | | 283 | | | | 264 | | | | 281 | | | | 10 | | | | 11 | | | | 274 | | | | 292 | | | | (12 | ) | | | (29 | ) | | | (267 | ) | | | (448 | ) | | | (58 | ) | | | 12 | | | | 7 | | | | 3 | | | | 3 | | | | 6 | |

Siemens Real Estate (SRE) | | | 2,510 | | | | 2,434 | | | | 301 | | | | 325 | | | | 2,210 | | | | 2,121 | | | | 2,512 | | | | 2,447 | | | | 171 | | | | 115 | | | | 4,747 | | | | 5,018 | | | | (108 | ) | | | (231 | ) | | | 365 | | | | 453 | | | | 314 | | | | 327 | |

Corporate items and pensions | | | 470 | | | | 508 | | | | 302 | | | | 325 | | | | 170 | | | | 184 | | | | 472 | | | | 509 | | | | (839 | ) | | | (668 | ) | | | (11,252 | ) | | | (11,693 | ) | | | (431 | ) | | | (910 | ) | | | 83 | | | | 103 | | | | 91 | | | | 67 | |

Eliminations, Corporate Treasury and other reconciling items | | | (5,055 | ) | | | (5,041 | ) | | | — | | | | — | | | | (5,172 | ) | | | (5,132 | ) | | | (5,172 | ) | | | (5,132 | ) | | | (70 | ) | | | 23 | | | | 63,393 | | | | 71,889 | | | | (1,405 | ) | | | (1,634 | ) | | | (4 | ) | | | (4 | ) | | | (34 | ) | | | (41 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Siemens | | | 82,351 | | | | 75,939 | | | | 75,882 | | | | 77,395 | | | | — | | | | — | | | | 75,882 | | | | 77,395 | | | | 5,843 | | | | 6,636 | | | | 101,936 | | | | 108,251 | | | | 5,257 | | | | 4,727 | | | | 1,869 | | | | 2,195 | | | | 2,819 | | | | 2,732 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | This supplementary information on Orders is provided on a voluntary basis. It is not part of the Consolidated Financial Statements subject to the audit opinion. |

| (2) | Profit of the Sectors as well as of Equity Investments and Centrally managed portfolio activities is earnings before financing interest, certain pension costs and income taxes. Certain other items not considered performance indicative by Management may be excluded. Profit of SFS and SRE is Income before income taxes. |

| (3) | Assets of the Sectors as well as of Equity Investments and Centrally managed portfolio activities is defined as Total assets less income tax assets, less non-interest bearing liabilities other than tax liabilities. Assets of SFS and SRE is Total assets. |

| (4) | Free cash flow represents Cash flows from operating activities less Additions to intangible assets and property, plant and equipment. Free cash flow of the Sectors, Equity Investments and Centrally managed portfolio activities primarily exclude income tax, financing interest and certain pension related payments and proceeds. Free cash flow of SFS, a financial services business, and of SRE includes related financing interest payments and proceeds; income tax payments and proceeds of SFS and SRE are excluded. |

| (5) | Amortization, depreciation and impairments contains amortization and impairments, net of reversals of impairments, of intangible assets other than goodwill as well as depreciation and impairments of property, plant and equipment, net of reversals of impairments. |

Due to rounding, numbers presented may not add up precisely to totals provided.

SUPPLEMENTAL DATA

SIEMENS

ADDITIONAL INFORMATION (I) (continuing operations — preliminary and unaudited)

Orders, Revenue, Profit, Profit margin developments and growth rates for Sectors

For the three months ended September 30, 2013 and 2012

(in millions of€)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Orders | | | Revenue | | | Profit(1) | | | Profit

margin | |

| | | 2013 | | | 2012 | | | % Change | | | therein | | | 2013 | | | 2012 | | | % Change | | | therein | | | 2013 | | | 2012 | | | % Change | | | 2013 | | | 2012 | |

| | | | | | | | | Actual | | | Adjus-

ted(2) | | | Cur-

rency | | | Port-

folio | | | | | | | | | Actual | | | Adjus-

ted(2) | | | Cur-

rency | | | Port-

folio | | | | | | | | | | | | | | | | |

Sectors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Energy Sector | | | 7,609 | | | | 8,687 | | | | (12 | )% | | | (7 | )% | | | (6 | )% | | | 0 | % | | | 7,436 | | | | 7,647 | | | | (3 | )% | | | 2 | % | | | (5 | )% | | | 0 | % | | | 564 | | | | 163 | | | | >200 | % | | | 7.6 | % | | | 2.1 | % |

therein: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fossil Power

Generation | | | 2,881 | | | | 3,366 | | | | (14 | )% | | | (7 | )% | | | (7 | )% | | | 0 | % | | | 2,778 | | | | 2,989 | | | | (7 | )% | | | (3 | )% | | | (4 | )% | | | 0 | % | | | 387 | | | | 376 | | | | 3 | % | | | 13.9 | % | | | 12.6 | % |

Wind Power | | | 1,511 | | | | 2,305 | | | | (34 | )% | | | (33 | )% | | | (4 | )% | | | 2 | % | | | 1,619 | | | | 1,471 | | | | 10 | % | | | 15 | % | | | (6 | )% | | | 1 | % | | | 179 | | | | 134 | | | | 34 | % | | | 11.1 | % | | | 9.1 | % |

Oil & Gas | | | 1,728 | | | | 1,529 | | | | 13 | % | | | 21 | % | | | (7 | )% | | | (1 | )% | | | 1,336 | | | | 1,235 | | | | 8 | % | | | 16 | % | | | (7 | )% | | | (1 | )% | | | 151 | | | | (111 | ) | | | n/a | | | | 11.3 | % | | | (9.0 | )% |

Power

Transmission | | | 1,532 | | | | 1,552 | | | | (1 | )% | | | 5 | % | | | (6 | )% | | | 0 | % | | | 1,749 | | | | 2,017 | | | | (13 | )% | | | (8 | )% | | | (5 | )% | | | 0 | % | | | (42 | ) | | | (40 | ) | | | (6 | )% | | | (2.4 | )% | | | (2.0 | )% |

Healthcare Sector | | | 4,060 | | | | 3,960 | | | | 3 | % | | | 10 | % | | | (7 | )% | | | 0 | % | | | 3,724 | | | | 3,786 | | | | (2 | )% | | | 5 | % | | | (7 | )% | | | 0 | % | | | 601 | | | | 631 | | | | (5 | )% | | | 16.1 | % | | | 16.7 | % |

therein: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Diagnostics | | | 1,026 | | | | 1,054 | | | | (3 | )% | | | 4 | % | | | (7 | )% | | | 0 | % | | | 1,026 | | | | 1,055 | | | | (3 | )% | | | 4 | % | | | (7 | )% | | | 0 | % | | | 82 | | | | 86 | | | | (5 | )% | | | 8.0 | % | | | 8.2 | % |

Industry Sector | | | 4,800 | | | | 4,572 | | | | 5 | % | | | 8 | % | | | (4 | )% | | | 1 | % | | | 5,042 | | | | 5,324 | | | | (5 | )% | | | (2 | )% | | | (4 | )% | | | 1 | % | | | 278 | | | | 721 | | | | (61 | )% | | | 5.5 | % | | | 13.5 | % |

therein: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Industry Automation | | | 2,089 | | | | 2,134 | | | | (2 | )% | | | 0 | % | | | (4 | )% | | | 2 | % | | | 2,200 | | | | 2,337 | | | | (6 | )% | | | (4 | )% | | | (4 | )% | | | 2 | % | | | 289 | | | | 398 | | | | (27 | )% | | | 13.2 | % | | | 17.0 | % |

Drive Technologies | | | 2,410 | | | | 2,324 | | | | 4 | % | | | 7 | % | | | (4 | )% | | | 0 | % | | | 2,574 | | | | 2,611 | | | | (1 | )% | | | 2 | % | | | (3 | )% | | | 0 | % | | | 84 | | | | 286 | | | | (71 | )% | | | 3.3 | % | | | 10.9 | % |

Infrastructure & Cities Sector | | | 4,816 | | | | 4,389 | | | | 10 | % | | | 10 | % | | | (5 | )% | | | 5 | % | | | 5,220 | | | | 5,002 | | | | 4 | % | | | 5 | % | | | (5 | )% | | | 4 | % | | | 166 | | | | 416 | | | | (60 | )% | | | 3.2 | % | | | 8.3 | % |

therein: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Transportation &

Logistics | | | 1,752 | | | | 1,227 | | | | 43 | % | | | 29 | % | | | (6 | )% | | | 19 | % | | | 1,985 | | | | 1,705 | | | | 16 | % | | | 8 | % | | | (4 | )% | | | 13 | % | | | (78 | ) | | | 73 | | | | n/a | | | | (4.0 | )% | | | 4.3 | % |

Power Grid Solutions &

Products | | | 1,639 | | | | 1,662 | | | | (1 | )% | | | 6 | % | | | (7 | )% | | | 0 | % | | | 1,733 | | | | 1,784 | | | | (3 | )% | | | 3 | % | | | (6 | )% | | | 0 | % | | | 103 | | | | 200 | | | | (48 | )% | | | 6.0 | % | | | 11.2 | % |

Building

Technologies | | | 1,524 | | | | 1,580 | | | | (4 | )% | | | 0 | % | | | (3 | )% | | | 0 | % | | | 1,596 | | | | 1,599 | | | | 0 | % | | | 3 | % | | | (3 | )% | | | 0 | % | | | 168 | | | | 153 | | | | 10 | % | | | 10.5 | % | | | 9.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Sectors | | | 21,285 | | | | 21,608 | | | | (1 | )% | | | 3 | % | | | (6 | )% | | | 1 | % | | | 21,423 | | | | 21,759 | | | | (2 | )% | | | 2 | % | | | (5 | )% | | | 1 | % | | | 1,609 | | | | 1,932 | | | | (17 | )% | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Profit is earnings before financing interest, certain pension costs and income taxes. Certain other items not considered performance indicative by Management may be excluded. |

| (2) | Excluding currency translation and portfolio effects. |

Due to rounding, numbers presented may not add up precisely to totals provided.

SUPPLEMENTAL DATA

SIEMENS

ADDITIONAL INFORMATION (I) (continuing operations — preliminary and unaudited)

Orders, Revenue, Profit, Profit margin developments and growth rates for Sectors

For the fiscal year ended September 30, 2013 and 2012

(in millions of€)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Orders | | | Revenue | | | Profit(1) | | | Profit

margin | |

| | | 2013 | | | 2012 | | | % Change | | | therein | | | 2013 | | | 2012 | | | % Change | | | therein | | | 2013 | | | 2012 | | | % Change | | | 2013 | | | 2012 | |

| | | | | | | | | Actual | | | Adjus-

ted(2) | | | Cur-

rency | | | Port-

folio | | | | | | | | | Actual | | | Adjus-

ted(2) | | | Cur-

rency | | | Port-

folio | | | | | | | | | | | | | | | | |

Sectors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Energy Sector | | | 28,797 | | | | 26,930 | | | | 7 | % | | | 8 | % | | | (2 | )% | | | 1 | % | | | 26,638 | | | | 27,736 | | | | (4 | )% | | | (3 | )% | | | (2 | )% | | | 0 | % | | | 1,955 | | | | 1,901 | | | | 3 | % | | | 7.3 | % | | | 6.9 | % |

therein: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fossil Power Generation | | | 10,682 | | | | 11,116 | | | | (4 | )% | | | (2 | )% | | | (2 | )% | | | 0 | % | | | 10,239 | | | | 11,161 | | | | (8 | )% | | | (7 | )% | | | (1 | )% | | | 0 | % | | | 1,693 | | | | 1,933 | | | | (12 | )% | | | 16.5 | % | | | 17.3 | % |

Wind Power | | | 6,593 | | | | 4,932 | | | | 34 | % | | | 34 | % | | | (2 | )% | | | 1 | % | | | 5,174 | | | | 5,066 | | | | 2 | % | | | 4 | % | | | (2 | )% | | | 1 | % | | | 306 | | | | 304 | | | | 1 | % | | | 5.9 | % | | | 6.0 | % |