UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

VISION GLOBAL SOLUTIONS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Vision Global Solutions, Inc.

20400 Stevens Creek Blvd., Suite 700

Cupertino, California 95014

Dear Shareholders:

The Proxy Statement originally filed with the Securities and Exchange Commission (the “SEC”) on October 16, 2013 was not mailed to shareholders.

Since the filing of our Proxy Statement, the sole member of the board of directors of Vision Global Solutions, Inc. (the “Company”) has changed the record date to October 21, 2013 and has changed the special meeting date to November 21, 2013. Accordingly, we have filed an Amended Proxy Statement with the SEC that reflects these changes in the record date and special meeting date. The Amended Proxy Statement also expressly incorporates by reference historical information filed by the Company with the SEC. The Amended Proxy Statement will be mailed to shareholders on or about October 23, 2013.

| | Sincerely, Todd Waltz President and Chief Executive Officer Vision Global Solutions, Inc. |

VISION GLOBAL SOLUTIONS, INC.

20400 Stevens Creek Blvd., Suite 700

Cupertino, California 95014

Dear Shareholders:

You are cordially invited to attend a special meeting of the shareholders of Vision Global Solutions, Inc. to be held at 9 a.m., local time, on November 21 , 2013 at Vinson & Elkins, LLP, 1001 Fannin St., Suite 2500, Houston, Texas 77002.

At the special meeting, our shareholders will be asked to:

(1) Approve an agreement and plan of reorganization, dated as of September 18, 2013 (the “merger agreement”), by and among Vision Global Solutions, Inc. (“Vision,” “VIGS,” or the “Company”), FRI Merger Sub, Inc., a newly formed wholly owned Delaware subsidiary of the Company (“MergerCo”), and FracRock International, Inc., a Delaware corporation (“FRI”), pursuant to which MergerCo will be merged with and into FRI, with FRI being the surviving entity and becoming a wholly owned subsidiary of VIGS (page 30). Further, VIGS had no business activities prior to the acquisition of FRI. As a result, any reference to the Company’s prior business activities, financial results and the associated risk factors are those of FRI.

(2) Approve a one-for-480 (1:480) reverse stock split of our outstanding common stock in our amended and restated articles of incorporation, pursuant to which each shareholder will receive one share of common stock for every 480 shares of common stock such shareholder owns (page 48).

(3) Approve the change in the name of the Company to “Eco-Stim Energy Solutions, Inc.” in our amended and restated articles of incorporation (page 50).

(4) Approve the increase in our authorized preferred stock from 5,000,000 shares to 50,000,000 shares in our amended and restated articles of incorporation (page 51).

(5) Transact such other business as may properly come before the special meeting or any adjournment(s) thereof.

If the proposed merger is completed, (1) each outstanding share of FRI common stock will be converted into one share of our common stock, and (2) each outstanding option to purchase shares of FRI common stock will be exchanged for an option to purchase the same number of shares of our common stock on the same terms. Immediately following the merger, FRI’s existing shareholders will own approximately 97.2% of our outstanding common stock, assuming 5,472,648 shares of our common stock are issued to FRI’s existing shareholders in connection with the merger. The changes to our articles of incorporation are necessary in order to consummate the transactions contemplated by the merger agreement.

As explained in the attached proxy statement, following the completion of the merger, we will be engaged in the oil and gas services business. We will hold all of the equity interests of the surviving company of the merger, which will hold all of the assets and liabilities of FRI.

Completion of the merger is subject to the satisfaction of a number of important closing conditions, including the approval of the merger agreement, the reverse stock split and the name change by our shareholders at the special meeting. Each of the merger proposal, the name change proposal and the reverse stock split proposal is cross-conditioned upon the approval of the other, and none of those proposals will be deemed approved unless all are approved.

After careful consideration, the sole member of our board of directors has determined that the approval of the merger agreement and the amended and restated articles of incorporation, including the reverse stock split, the name change and the increase in authorized preferred stock, are advisable, and that such documents are fair to and in the best interests of our shareholders, and has resolved to recommend the approval and adoption of the merger agreement and the amended and restated articles of incorporation by our shareholders. The sole member of our board of directors recommends that you vote “FOR” the approval of (1) the merger agreement, (2) the reverse stock split, (3) the name change, and (4) the increase in authorized preferred stock. The attached proxy statement provides detailed information about the merger agreement, the amended and restated articles of incorporation and the special meeting. Please carefully review the proxy statement, including its appendices. In particular, you should carefully review the section entitled “Risk Factors” beginning on page 15, which describes risk factors relating to the merger and to the post-merger operation of FRI’s business.

Your vote is very important. We would like you to attend the special meeting. However, whether or not you plan to attend the special meeting, it is important for your shares to be represented at the special meeting. We urge you to promptly vote by telephone, or by submitting your marked, signed and dated proxy card. You will retain the right to revoke your proxy at any time before the vote or to vote personally if you attend the special meeting. Voting by telephone or by submitting a proxy card will not prevent you from attending the special meeting and voting in person. Please note, however, that if you hold your shares through a broker or other nominee and you wish to vote in person at the special meeting, you must obtain from your broker or other nominee a proxy issued in your name. Remember, failing to vote has the same effect as a vote against the approval of the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock.

This proxy statement is dated October 22, 2013 and, together with the accompanying proxy card, is first being mailed or otherwise distributed to shareholders of Vision Global Solutions, Inc. on or about October 23 , 2013.

| | Sincerely, Todd Waltz President and Chief Executive Officer Vision Global Solutions, Inc. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 21 , 2013

The Notice of Special Meeting of Shareholders and the Proxy Statement for the Special Meeting of Shareholders are available at www.iproxydirect.com/VIGS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the merger or the merger agreement, passed upon the merits or fairness of the merger agreement or the transactions contemplated thereby, including the proposed merger, or passed upon the adequacy or accuracy of the information contained in this document. Any representation to the contrary is a criminal offense.

VISION GLOBAL SOLUTIONS, INC.

20400 Stevens Creek Blvd., Suite 700

Cupertino, California 95014

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held On November 21 , 2013

Notice is hereby given that a special meeting of the shareholders of Vision Global Solutions, Inc. (the “Company”) is to be held at 9:00 a.m., local time, on November 21 , 2013 at Vinson & Elkins, LLP, 1001 Fannin St., Suite 2500, Houston, Texas 77002, for the following purposes:

(1) Approve an agreement and plan of reorganization, dated as of September 18, 2013 (the “merger agreement”), by and among Vision Global Solutions, Inc. (“Vision,” “VIGS,” or the “Company”), FRI Merger Sub, Inc., a newly formed wholly owned Delaware subsidiary of the Company (“MergerCo”), and FracRock International, Inc., a privately-held Delaware corporation (“FRI”), pursuant to which MergerCo will be merged with and into FRI, with FRI being the surviving entity and becoming a wholly owned subsidiary of VIGS (page 30).

(2) Approve a one-for-480 (1:480) reverse stock split of our outstanding common stock in our amended and restated articles of incorporation, pursuant to which each shareholder will receive one share of common stock for every 480 shares of common stock such shareholder owns (page 48).

(3) Approve the change in the name of the Company to “Eco-Stim Energy Solutions, Inc.” in our amended and restated articles of incorporation (page 50).

(4) Approve the increase in our authorized preferred stock from 5,000,000 shares to 50,000,000 shares in our amended and restated articles of incorporation (page 51).

(5) Transact such other business as may properly come before the special meeting or any adjournment(s) thereof.

The merger agreement and the amended and restated articles of incorporation, including the reverse stock split, the name change and the increase in authorized preferred stock, are described more fully in the attached proxy statement. You are encouraged to review the entire proxy statement carefully, including the appendices that are attached to the proxy statement. A copy of the merger agreement is attached as Appendix A to the proxy statement and the amended and restated articles of incorporation are attached as Appendix B to the proxy statement.

The sole member of our board of directors has approved (1) the merger agreement and (2) the amended and restated articles of incorporation, including the reverse stock split, the name change and the increase in authorized preferred stock, and recommends that shareholders vote “FOR” the proposal to approve the merger agreement, “FOR” the proposal to approve the reverse stock split, “FOR” the proposal to approve the name change, and “FOR” the proposal to approve the increase in authorized preferred stock. Each of the merger proposal, the name change proposal and the reverse stock split proposal is cross-conditioned upon the approval of the other, and none of those proposals will be deemed approved unless all are approved.

Only shareholders of record of our common stock at the close of business on October 21 , 2013 are entitled to notice of and to vote at the special meeting and at any adjournment of the special meeting. All shareholders of record are invited to attend the special meeting in person.

We anticipate that our Chief Executive Officer and sole director, who beneficially owns approximately 5.30% of our outstanding common stock, will vote in favor of the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock.

Approval of the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock requires the approval of the holders, as of the close of business on the record date, of a majority of the shares entitled to vote and represented, in person or by proxy, at the special meeting. The Company, as the sole shareholder of MergerCo, approved the merger, the merger agreement and the amended and restated articles of incorporation on September 16, 2013.

Regardless of whether or not you plan to attend the special meeting, please vote as soon as possible. If you hold stock in your name as a shareholder of record, please complete, sign, date and return the accompanying proxy card in the enclosed envelope. If you hold your stock in “street name” through a broker, bank, or other nominee, please direct the broker, bank or other nominee how to vote your shares in accordance with the instructions that you have received, or will receive, from that person.

If you sign, date and mail your proxy card without indicating how you wish to vote, your proxy will be voted in favor of the approval of the merger agreement and in favor of the approval of the reverse stock split, the name change and the increase in authorized preferred stock. If you fail to return your proxy card and do not vote in person at the special meeting, it will have the same effect as a vote against the approval of the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock. Any shareholder attending the special meeting may vote in person even if he or she has returned a proxy card. Such a vote at the special meeting will revoke any proxy previously submitted.

| October 22 , 2013 | By Order of the Board of Directors, TODD WALTZ President and Chief Executive Officer |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 21 , 2013 |

The Notice of Special Meeting of Shareholders and the Proxy Statement for the Special Meeting of Shareholders are available at www.iproxydirect.com/VIGS.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. IN ORDER TO ENSURE THAT YOUR SHARES ARE VOTED, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE. IF GIVEN, YOU MAY REVOKE YOUR PROXY BY FOLLOWING THE INSTRUCTIONS IN THE PROXY STATEMENT.

VISION GLOBAL SOLUTIONS, INC.

20400 Stevens Creek Blvd., Suite 700

Cupertino, California 95014

PROXY STATEMENT

Special Meeting Of Shareholders To Be Held On November 21 , 2013

This proxy statement is being furnished to the shareholders of Vision Global Solutions, Inc. in connection with the solicitation of proxies by the sole member of our board of directors for use at the special meeting of our shareholders to be held on November 21 , 2013, and at any adjournments or postponements thereof.

This proxy statement and the accompanying proxy card are first being mailed to our shareholders on or about October 23 , 2013.

The purpose of the special meeting is to consider and vote upon the following:

(1) Approve an agreement and plan of reorganization, dated as of September 18, 2013 (the “merger agreement”), by and among Vision Global Solutions, Inc. (“Vision,” “VIGS,” or the “Company”), FRI Merger Sub, Inc., a newly formed wholly owned Delaware subsidiary of the Company (“MergerCo”), and FracRock International, Inc., a privately-held Delaware corporation (“FRI”), pursuant to which MergerCo will be merged with and into FRI, with FRI being the surviving entity and becoming a wholly owned subsidiary of VIGS (page 30).

(2) Approve a one-for-480 (1:480) reverse stock split of our outstanding common stock in our amended and restated articles of incorporation, pursuant to which each shareholder will receive one share of common stock for every 480 shares of common stock such shareholder owns (page 48).

(3) Approve the change in the name of the Company to “Eco-Stim Energy Solutions, Inc.” in our amended and restated articles of incorporation (page 50).

(4) Approve the increase in our authorized preferred stock from 5,000,000 shares to 50,000,000 shares in our amended and restated articles of incorporation (page 51).

(5) Transact such other business as may properly come before the special meeting or any adjournment(s) thereof.

Record Date; Shares Entitled To Vote; Vote Required To Approve The Transaction

Our sole director has fixed the close of business on October 21 , 2013, as the date for the determination of shareholders entitled to vote at the special meeting. On the record date, 75,493,885 shares of our common stock were outstanding, each entitled to one vote per share. No shares of preferred stock were outstanding on the record date.

The presence at the special meeting, in person or by proxy, of the holders of a majority of the issued and outstanding shares of our common stock entitled to vote on the record date is necessary to constitute a quorum for the transaction of business at the special meeting. In the absence of a quorum, the special meeting may be postponed from time to time until shareholders holding the requisite number of shares of our common stock are represented in person or by proxy. “Broker non-votes” and abstentions will be counted towards a quorum at the special meeting and will be treated as votes against the proposals. If you return the attached proxy card with no voting decision indicated, the proxy will be voted “FOR” the approval of all proposals made at the meeting. Each holder of record of shares of our common stock is entitled to cast, for each share registered in his, her or its name, one vote on each proposal as well as on each other matter presented to a vote of shareholders at the special meeting.

Solicitation, Voting and Revocation of Proxies

This solicitation of proxies is being made by the sole member of our board of directors, and we will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communications by directors, officers and employees of the Company, who will not receive any additional compensation for such solicitation activities. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders.

Shares of our common stock represented by a proxy properly signed and received at or prior to the special meeting, unless properly revoked, will be voted in accordance with the instructions on the proxy. If a proxy is signed and returned without any voting instructions, shares of our common stock represented by the proxy will be voted “FOR” each proposal and in accordance with the determination of our sole director as to any other matter which may properly come before the special meeting, including any adjournment or postponement thereof. A shareholder may revoke any proxy given pursuant to this solicitation by: (i) delivering to our chief executive officer, prior to or at the special meeting, a written notice revoking the proxy; (ii) delivering to our chief executive officer, at or prior to the special meeting, a duly executed proxy relating to the same shares and bearing a later date; or (iii) voting in person at the special meeting. Attendance at the special meeting will not, in and of itself, constitute a revocation of a proxy. All written notices of revocation and other communications with respect to the revocation of a proxy should be addressed to:

Vision Global Solutions, Inc.

20400 Stevens Creek Blvd., Suite 700

Cupertino, California 95014

The sole member of our board of directors is not aware of any business to be acted upon at the special meeting other than consideration of the proposals described herein.

TABLE OF CONTENTS

| SUMMARY OF THE PROXY STATEMENT | | | 1 | |

| | Parties to the Merger | | | 1 | |

| | Summary of the Merger | | | 2 | |

| | The Special Meeting of Our Shareholders | | | 2 | |

| | Risk Factors | | | 3 | |

| | Reasons for the Merger | | | 3 | |

| | Recommendation of Our Sole Director | | | 3 | |

| | Interests in the Merger of Our Sole Director and Executive Officer and Other Related Persons | | | 3 | |

| | Material United States Federal Income Tax Consequences of the Merger | | | 4 | |

| | Effects of the Merger and Amended and Restated Articles of Incorporation on our Current Shareholders | | | 4 | |

| | Conditions to Closing the Merger | | | 4 | |

| | Changes in Directors and Management | | | 4 | |

| QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING | | | 9 | |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION | | | 14 | |

| RISK FACTORS | | | 15 | |

| | Risks Associated with the Merger | | | 15 | |

| | Risks Related to Vision and its Business | | | 16 | |

| | Risks Related to FRI and its Business | | | 18 | |

| THE SPECIAL MEETING OF OUR SHAREHOLDERS | | | 27 | |

| PROPOSAL I – APPROVAL OF THE MERGER AGREEMENT AND MERGER | | | 30 | |

| BUSINESS OF FRACROCK INTERNATIONAL | | | 33 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FRACROCK INTERNATIONAL | | | 39 | |

| THE MERGER AGREEMENT | | | 44 | |

| PROPOSAL II – APPROVAL OF THE REVERSE STOCK SPLIT | | | 48 | |

| PROPOSAL III – APPROVAL OF THE NAME CHANGE | | | 50 | |

| PROPOSAL IV – APPROVAL OF THE INCREASE IN AUTHORIZED PREFERRED STOCK | | | 51 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS | | | 55 | |

| OTHER MATTERS | | | 57 | |

| HOUSEHOLDING | | | 57 | |

| WHERE YOU CAN FIND MORE INFORMATION | | | 57 | |

| INCORPORATION BY REFERENCE | | | 57 | |

| | | | | | |

| FINANCIAL STATEMENTS OF FRAC ROCK INTERNATIONAL | | | F-1 | |

| APPENDIX A – MERGER AGREEMENT | | | A-1 | |

| APPENDIX B – AMENDED AND RESTATED ARTICLES OF INCORPORATION | | | B-1 | |

SUMMARY OF THE PROXY STATEMENT

This summary highlights selected information from this proxy statement and may not contain all of the information that is important to you. To understand the merger agreement and the amended and restated articles of incorporation, including the reverse stock split, the name change and the increase in authorized preferred stock, more fully, you should carefully read this entire proxy statement, including its appendixes. The merger agreement is attached as Appendix A to this proxy statement and the amended and restated articles of incorporation is attached as Appendix B to this proxy statement. We encourage you to read the merger agreement and the amended and restated articles of incorporation completely, as those documents, and not this summary, are the legal documents that govern the merger and your rights as a shareholder. Each item in this summary includes a page reference directing you to a more complete description in this proxy statement of that topic. You may obtain the information incorporated by reference in this proxy statement without charge by following the instructions under Where You Can Find More Information beginning on page 57.

Parties to the Merger (page 30)

VISION GLOBAL SOLUTIONS, INC.

History and Development of Vision Global Solutions, Inc.

Outer Edge Holdings, Inc. (“Outer Edge”) was incorporated under laws of the Province of Ontario as “Consumer General Inc.” on September 9, 1988. On March 29, 1999, Outer Edge amalgamated with 1345166 Ontario Inc. to form and continue under the name “Outer Edge Holdings Inc.” Outer Edge had no subsidiaries or affiliates. In November 2003, we began the process to change our incorporation domicile from Ontario, Canada to Nevada. Vision Global Solutions Inc., a Nevada corporation (the “Company”, “Vision Global” or “VIGS”), was formed on November 20, 2003 to reincorporate the Company as a Nevada corporation. On January 7, 2005, VIGS completed its redomestication with the filing of its articles of domestication.

The Company’s Status As A Shell Company

The Company has no business operations and nominal assets and liabilities. The Company is a “shell” company as that term is defined in Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 12b-2 of the Exchange Act of 1934, as amended (the “Exchange Act”), as well as SEC Release Number 33-8407. The term “shell company” means a registrant, other than an asset-backed issuer, that has no or nominal operations, and either: (i) no or nominal assets; (ii) assets consisting solely of cash and cash equivalents; or (iii) assets consisting of any amount of cash and cash equivalents and nominal other assets.

As a shell company, we seek to identify and pursue a business combination transaction with private business enterprises that might have a desire to take advantage of the Company’s status as a public corporation through a capital stock exchange, merger, asset acquisition or other similar business combination, which such transactions sometimes are referred to as “reverse acquisitions” or “reverse mergers.” We have no full-time employees and do not own or lease any property.

Our common stock is traded on the Over the Counter Bulletin Board (“OTCBB “) under the symbol “VIGS.OB.” In addition to OTCBB, our stock trades on the OTC Market as an OTCQB tier stock. Until recently, most small, fully-reporting issuers were listed exclusively on the OTCBB. However, many fully-reporting issuers, including us, are now traded on what is commonly referred to as the “OTC Pink Sheets” or “OTC Markets”, which are owned and controlled by Pink OTC Markets, Inc., a privately-held, non-governmental entity.

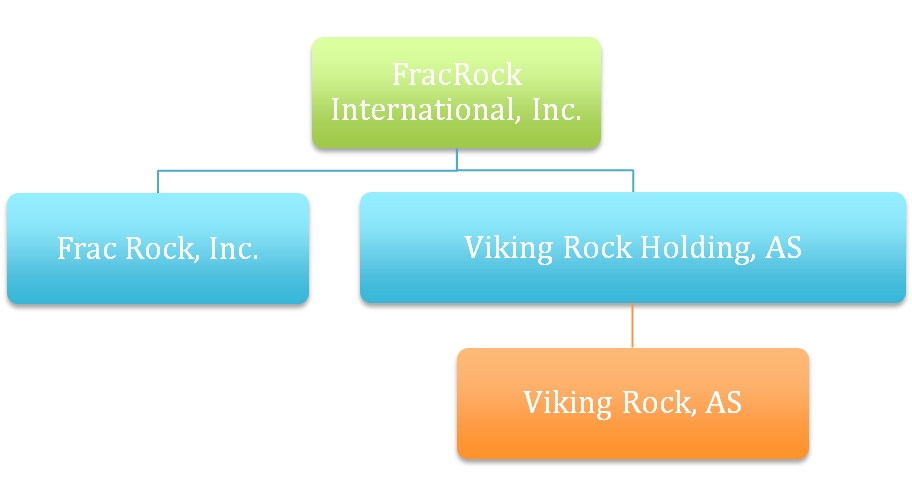

FRACROCK INTERNATIONAL, INC.

FracRock International, Inc. (“FRI”) is a Delaware corporation engaged in the business of oil and gas services related primarily to international shale oil and gas development and secondarily conventional oil and gas service opportunities outside the United States. FRI plans to utilize its strategic relationships for oilfield service business development in the Latin American countries, with a particular focus in Mexico, Argentina, Colombia and Brazil. FRI’s principal executive offices are located at 2930 West Sam Houston Parkway North, Suite 275, Houston, Texas 77043. The phone number for FRI is (281) 531-7200.

FRI had no business activities prior to the acquisition of Frac Rock International, Inc., a company incorporated in British Virgin Islands (“FRIBVI”). As a result, references to FRI’s prior business activities, financial results and associated risk factors are those of FRIBVI.

There is no established public trading market for any of FRI’s securities.

If the merger is completed, FRI will become a wholly owned subsidiary of Vision. Vision will change its name to Eco-Stim Energy Solutions, Inc. and Vision and FRI will combine their respective business operations.

Summary of the Merger (page 44)

The merger agreement provides that MergerCo (a wholly owned subsidiary of Vision) will be merged with and into FRI, which will continue as the surviving corporation under the name “FracRock International, Inc.” In the merger, (1) each outstanding share of FRI common stock will be exchanged for one share of our common stock; and (2) each outstanding option to purchase shares of common stock of FRI will be exchanged for an option to purchase the same number of shares of our common stock on the same terms, each after effecting the reverse stock split described below. After the merger, FRI will become our wholly owned subsidiary. In the merger, and after taking into account a one-for-480 reverse stock split, we currently anticipate issuing up to 5,472,648 shares of our common stock to existing holders of common stock of FRI and options to purchase 127,301 shares of our common stock to existing holders of options to purchase common stock of FRI.

Immediately following the merger (and taking into account the reverse stock split and other transactions contemplated by our amended and restated articles of incorporation), FRI’s existing shareholders will own an estimated approximately 97.2% of our outstanding common stock, assuming 5,472,648 share of our common stock are issued to FRI’s existing shareholders in connection with the merger.

FRI is currently engaged in a private placement of its common stock, which is expected to close before the merger occurs at an issue price of $6.00 per share. The private placement could result in the issuance of 333,333 to 2,500,000 additional shares of common stock of FRI. For purposes of this proxy statement, it is assumed that 2,500,000 shares of common stock of FRI will be issued in connection with the private placement, and thus there will be a total of 5,472,648 shares of common stock of FRI outstanding immediately prior to the merger. The securities offered pursuant to the private placement have not and will not be registered under the Securities Act, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

The Special Meeting of Our Shareholders (page 27)

Time, Date and Place. The special meeting will be held on November 21 , 2013, beginning at 9:00 a.m., local time, at Vinson & Elkins, LLP, 1001 Fannin St., Suite 2500, Houston, Texas 77002, and at any adjournment or postponement of the special meeting.

Purpose. The purpose of the special meeting is to consider and vote upon proposals to approve the merger agreement and the amended and restated articles of incorporation, including the reverse stock split, the increase in the number of authorized shares of our preferred stock and the name change.

Record Date and Quorum. We have fixed the close of business on October 21 , 2013 as the record date for the special meeting, and only shareholders of record on the record date are entitled to vote at the special meeting. You may vote all shares of our common stock that you owned of record as of the close of business on the record date. The presence at the special meeting, in person or by proxy, of the holders of shares of voting stock representing at least a majority of the total voting power of the shares of voting stock that are eligible to be voted on the record date is necessary to constitute a quorum for the transaction of business at the special meeting.

Vote Required. Approval of the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock requires the approval of the holders, as of the record date, of a majority of the outstanding shares of our common stock entitled to vote and represented, in person or by proxy, at the special meeting. Cumulative voting is not permitted. Each of the merger proposal, the name change proposal and the reverse stock split proposal is cross-conditioned upon the approval of the other, and none of those proposals will be deemed approved unless all are approved.

Voting and Proxies. If you hold stock in your name as a shareholder of record, you may vote in person at the meeting, vote by telephone, or by returning the accompanying proxy card in the enclosed envelope. If you hold your stock through a broker, bank or other nominee, you must direct the broker, bank or other nominee how to vote your shares in accordance with the instructions that you have received, or will receive, from that person.

Right to Revoke Proxies. If you hold stock in your name as a shareholder of record, you have the right to change or revoke your proxy at any time before the vote is taken at the special meeting by: (1) attending the special meeting in person and voting; (2) submitting a later-dated proxy card; or (3) notifying us that you are revoking your proxy by delivering a later-dated written statement to that effect to us at Vision Global Solutions, Inc., 20400 Stevens Creek Blvd., Suite 700, Cupertino, California 95014, Attention: Chief Executive Officer.

Risk Factors (page 15)

In evaluating the merger and the merger agreement and before deciding how to vote your shares, you should carefully review the section of this proxy statement entitled “Risk Factors,” which describes risk factors relating to the merger and to the post-merger operations of FRI’s business.

Reasons for the Merger (page 31)

In August 2013, the management of FRI contacted the shareholders of Vision due to their interest in providing liquidity to their existing shareholders and increasing their ability to raise additional capital through the public markets.

In reaching the decision to merge with FRI, the sole member of our board of directors also considered the following factors:

● our current lack of liquidity and our outstanding liabilities;

● the collective experience of the management of FRI in the capital markets and in the global pressure pumping business; and

● the benefits of merging with an operating entity.

The foregoing discussion of the information and factors considered by the sole member of our board of directors is not intended to be exhaustive, but includes the material factors considered. In view of the variety of factors considered in connection with its evaluation of the transaction, the sole member of our board of directors did not find it practicable to, and did not, quantify or otherwise assign relative weight to the specific factors considered in reaching its determinations and recommendations.

Based on these and other factors, the sole member of our board of directors believes that the merger represents the best available option for us to continue as a going concern and the business combination provides the best existing alternative for our common stockholders to receive value on their investment.

Recommendation of Our Sole Director (page 47, page 49, page 50 and page 51)

The sole member of our board of directors has determined that the merger, the merger agreement and the amended and restated articles of incorporation, including the reverse stock split, the name change and the increase in authorized preferred stock, are advisable, and that such documents are fair to and in the best interests of our shareholders, has approved and authorized in all respects the merger agreement and the amended and restated articles of incorporation and recommends that you vote “FOR” (1) the approval of the merger agreement, (2) the approval of the reverse stock split, (3) the approval of the name change and (4) the approval of the increase in the number of authorized shares of our preferred stock.

Interests in the Merger of Our Sole Director and Executive Officer and Other Related Persons (page 31)

As of the record date, our sole director and executive officer beneficially owned approximately 5.30% of our outstanding common stock. Our sole director and executive officer beneficially owns 41,667 shares of FRI. Other than his interest as a shareholder, he has no direct or indirect interest in the merger, the merger agreement, the reverse stock split, the name change or the increase in authorized preferred stock.

Material United States Federal Income Tax Consequences of the Merger (page 32)

Neither our Company nor our shareholders will recognize any gain or loss or income as a result of the merger or the reverse stock split.

Effects of the Merger, the Reverse Stock Split and the Increase in Authorized Preferred Stock on our Current Shareholders (page 45, page 48 and page 51)

While the merger itself will not affect any of our currently outstanding shares of stock, the issuance of our shares in the merger will decrease our existing shareholders’ percentage equity ownership. Furthermore, the amended and restated articles of incorporation, which must be filed prior to the merger as a condition to closing the merger, will affect the rights of our shareholders. When the amended and restated articles of incorporation are filed, our common stock will undergo a one-for-480 reverse stock split. The reverse stock split shall not immediately affect any of our shareholder’s proportional equity interest, nor will it change any of the rights of the existing holders of our common stock. However, after the reverse stock split is effectuated, our current shareholders will own fewer shares than they presently own (a number equal to one-480th the number of shares owned immediately prior to the reverse stock split). Furthermore, because of the reverse stock split, more authorized shares of common stock will be available for issuance; the reverse stock split will not decrease the 200,000,000 shares of our common stock authorized under the amended and restated articles of incorporation. If these shares are issued, they will decrease our existing shareholders’ percentage equity ownership and, will be dilutive to our existing shareholders.

The amended and restated articles of incorporation also increase the number of authorized shares of preferred stock. When we issue these shares of preferred stock, such issuances will also decrease our existing shareholders’ percentage equity ownership and could be dilutive.

Conditions to Closing the Merger (page 46)

Before the merger can be completed, a number of closing conditions must be satisfied by both parties, including the approval of the merger agreement, the reverse stock split and the name change by our shareholders.

Changes in Directors and Management (page 45)

After the merger, the board of directors of FRI will become the board of directors of the surviving company. Also, at the closing of the merger, our sole director will increase the number of directors on our board of directors from one to five, appoint the five persons designated by FRI to serve on our board of directors and resign as a director and officer. FRI has advised us that it intends to designate Bjarte Bruheim, Jon Chris Boswell, Thomas E. Hardisty, Carlos A. Fernandez and Jogeir Romestrand to our board of directors.

SUMMARY PRO FORMA INFORMATION

The unaudited pro forma information of the Company set forth below gives effect to the merger of FRI if it had been consummated as of the beginning of the applicable period. The unaudited pro forma information has been derived from the historical consolidated financial statements of the Company and FRI. The unaudited pro forma information is for illustrative purposes only. You should not rely on the unaudited pro forma financial information as being indicative of the historical results that would have been achieved had the acquisition occurred in the past or the future financial results that the Company will achieve after the acquisition.

Vision Global Solutions, Inc.

Pro Forma Combined Condensed Statements of Operations

Year Ended December 31, 2012

(unaudited)

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Revenue | | $ | — | | | $ | 10,660 | | | $ | — | | | $ | 10,660 | |

Cost of sales | | | — | | | | 5,341 | | | | — | | | | 5,341 | |

Gross profit | | | — | | | | 5,319 | | | | — | | | | 5,319 | |

Selling, general and administrative expenses | | | 35,825 | | | | 2,407,868 | | | | — | | | | 2,443,693 | |

Loss before provision for income taxes | | | (35,825 | ) | | | (2,402,549 | ) | | | | | | | (2,438,374 | ) |

Provision for income taxes | | | — | | | | — | | | | — | | | | — | |

Net loss | | $ | (35,825 | ) | | $ | (2,402,549 | ) | | $ | — | | | $ | (2,438,374 | ) |

| Net loss per common share – basic and diluted | | $ | (0.00 | ) | | $ | (35.69 | ) | | | — | | | $ | (0.43 | ) |

| Weighted average number of common shares outstanding – basic and diluted | | | 75,493,885 | | | | 67,316 | | | | (69,931,274 | )(1) | | | 5,629,927 | |

| (1) | To reflect reverse stock split, conversion of preferred shares and convertible debt. |

Vision Global Solutions, Inc.

Pro Forma Combined Condensed Balance Sheet

June 30, 2013

(unaudited)

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| ASSETS | | | | | | | | | | | | | | |

| CURRENT ASSETS | | | | | | | | | | | | | | |

Cash | | $ | 11,209 | | | $ | 855,523 | | | $ | 13,950,000 | | (1 | ) | | $ | 14,816,732 | |

Accounts receivables | | | — | | | | 29,897 | | | | | | | | | | 29,897 | |

Prepaid expenses | | | — | | | | 149,344 | | | | | | | | | | 149,344 | |

Total Current Assets | | | 11,209 | | | | 1,034,764 | | | | 13,950,000 | | | | | | 14,995,973 | |

| | | | | | | | | | | | | | | | | | | |

Equipment, net | | | — | | | | 24,937 | | | | — | | | | | | 24,937 | |

| | | | | | | | | | | | | | | | | | | |

TOTAL ASSETS | | $ | 11,209 | | | $ | 1,059,701 | | | $ | 13,950,000 | | | | | $ | 15,020,910 | |

| | | | | | | | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | | | | | | | | | |

Accounts payable | | $ | 7,325 | | | $ | 421,479 | | | $ | (44,825 | ) | (2 | ) | | $ | 383,979 | |

Advances payable – related party | | | 165,959 | | | | — | | | | (165,959 | ) | (2 | ) | | | — | |

Line of credit – related party | | | 124,502 | | | | — | | | | (124,502 | ) | (2 | ) | | | — | |

Convertible note payable | | | — | | | | 1,000,000 | | | | (1,000,000 | ) | (4 | ) | | | — | |

Total Current Liabilities | | $ | 297,786 | | | $ | 1,421,479 | | | $ | (1,335,286 | ) | | | | $ | 383,979 | |

| | | | | | | | | | | | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | | | | | | | | | | | |

| STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | | | | | | | | | | | |

Series A preferred stock | | $ | — | | | $ | 3,496,500 | | | $ | (3,496,500 | ) | (3 | ) | | $ | — | |

Common stock | | | 75,494 | | | | 673 | | | | (70,837 | ) | (3 | ) | | | 5,630 | |

| | | | | | | | | | | | 300 | | (4 | ) | | | | |

Additional paid-in capital | | | 4,525,605 | | | | 126,292 | | | | 13,950,000 | | (1 | ) | | | 18,616,544 | |

| | | | | | | | | | | | 335,286 | | (2 | ) | | | | |

| | | | | | | | | | | | 3,567,337 | | (3 | ) | | | | |

| | | | | | | | | | | | 999,700 | | (4 | ) | | | | |

| | | | | | | | | | | | (4,887,676 | ) | (5 | ) | | | | |

Accumulated deficit | | | (4,887,676 | ) | | | (3,985,243 | ) | | | 4,887,676 | | (5 | ) | | | (3,985,243 | ) |

| Total Stockholders’ Equity (deficit) | | | (286,577 | ) | | | (361,778 | ) | | | 15,285,286 | | | | | | 14,636,931 | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | $ | 11,209 | | | $ | 1,059,701 | | | $ | 13,950,000 | | | | | $ | 15,020,910 | |

| (1) | To adjust for equity raise net of 7% of commission paid. |

| (2) | To eliminate liabilities in accordance with merger agreement, including $37,500 accrued interest converted to common stock related to FRI convertible note payable. |

| (3) | To convert preferred stock to common stock and to reflect the reverse stock split. |

| (4) | To reflect the conversion of the convertible note payable in accordance with merger agreement. |

| (5) | To eliminate accumulated deficit in accordance with merger agreement and reverse stock split. |

Vision Global Solutions, Inc.

Pro Forma Combined Condensed Statements of Operations

Six Month Period Ended June 30, 2013

(unaudited)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Revenue | | $ | — | | | $ | 4,800 | | | $ | — | | | $ | 4,800 | |

Cost of sales | | | — | | | | 2,400 | | | | — | | | | 2,400 | |

Gross profit | | | — | | | | 2,400 | | | | — | | | | 2,400 | |

Selling, general and administrative expenses | | | 20,021 | | | | 1,565,597 | | | | — | | | | 1,585,618 | |

Loss before provision for income taxes | | | (20,021 | ) | | | (1,563,197 | ) | | | — | | | | (1,583,218 | ) |

Provision for income taxes | | | — | | | | — | | | | — | | | | — | |

Net loss | | $ | (20,021 | ) | | $ | (1,563,197 | ) | | $ | — | | | $ | (1,583,218 | ) |

| Net loss per common share – basic and diluted | | $ | (0.00 | ) | | $ | (23.22 | ) | | | — | | | $ | (0.28 | ) |

| Weighted average number of common shares outstanding – basic and diluted | | | 75,493,885 | | | | 67,316 | | | | (69,931,274 | )(1) | | | 5,629,927 | |

| (1) | To reflect reverse stock split, conversion of preferred shares and convertible debt. |

UNAUDITED COMPARATIVE PER SHARE INFORMATION

The table below sets forth historical and unaudited pro forma combined per share information of VIGS and FRI.

| | | As of and for the Six Months Ended June 30, 2013 | | | As of and for the Year Ended December 31, 2012 | |

| Historical – FracRock International, Inc. | | | | | | |

Income (loss) from continuing operations per share | | | (23.22 | ) | | | (35.63 | ) |

| Diluted income (loss) from continuing operations per share | | | (23.22 | ) | | | (35.69 | ) |

Book value per share | | | (5.37 | ) | | | 16.80 | |

| | | | | | | | | |

| | | As of and for the Six Months Ended June 30, 2013 | | | As of and for the Year Ended December 31, 2013 | |

| Historical – Vision Global Solutions, Inc. | | | | | | | | |

Income (loss) from continuing operations per share | | | — | | | | — | |

| Diluted income (loss) from continuing operations per share | | | — | | | | — | |

Book value per share | | | — | | | | — | |

| | | | | | | | | |

| Pro Forma Combined | | | | | | | | |

Income (loss) from continuing operations per share | | | (0.28 | ) | | | (0.43 | ) |

| Diluted income (loss) from continuing operations per share | | | (0.28 | ) | | | (0.43 | ) |

Book value per share | | | 2.60 | | | | 2.68 | |

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

The following questions and answers address briefly some questions you may have regarding the special meeting, the proposed merger and the proposed amended and restated articles of incorporation, including the reverse stock split, the name change and the increase in authorized preferred stock. These questions and answers may not address all questions that may be important to you as a shareholder of the Company. Please refer to the more detailed information contained elsewhere in this proxy statement, including the appendices to this proxy statement.

| Q: | Why am I receiving this proxy statement and the proxy card? |

| A: | You are being asked to approve the merger agreement between the Company and MergerCo, on the one hand, and FRI, on the other hand. In connection with the transactions contemplated by the merger agreement, you are also being asked to approve the amended and restated articles of incorporation, which will effectuate a one-for-480 reverse stock split, an increase in the number of our authorized preferred stock from 5,000,000 shares to 50,000,000 shares and a change in our name. You have been sent this proxy statement and the enclosed proxy card because the sole member of our board of directors is soliciting your proxy to vote at the special meeting of shareholders called for the purpose of voting on the foregoing matters. |

| Q: | What is the proposed transaction? |

| A: | The proposed transaction is the filing of the amended and restated articles of incorporation, which will effectuate a one-for-480 reverse stock split, a change in our name and an increase in the number of our authorized preferred stock from 5,000,000 shares to 50,000,000 shares, followed by the merger of MergerCo into FRI. As a result of the merger, the Company (through its ownership of MergerCo) will succeed to all of the rights, assets, and liabilities of FRI, and FRI will become our wholly owned subsidiary. |

| Q: | Why is our sole director proposing the merger with FRI? |

| A: | As a shell company, we have been pursuing a business combination transaction with an existing private enterprise that might have a desire to take advantage of our status as a public corporation. Our sole director believes it is in the best interest of our existing shareholders to effectuate a business combination transaction through which we may have an operating business in order to potentially increase shareholder value and the marketability and liquidity of our common stock. |

| Q: | Why is our sole director proposing the reverse stock split and the name change in the amended and restated articles of incorporation? |

| A: | The proposed changes made to our articles of incorporation are necessary for us to comply with the terms of the merger agreement. If the reverse stock spilt and name change in the amended and restated articles of incorporation are not approved, the merger will not be completed. Similarly, since our articles of incorporation are being amended and restated to facilitate the merger, if the merger is not approved, we will not proceed with the amended and restated articles of incorporation. |

| Q: | Why is our sole director proposing the increase in our preferred stock in the amended and restated articles of incorporation? |

| A: | The proposed increase in our preferred stock is for capital raising purposes to support the Company’s growth. In particular, while no transaction is currently contemplated, the preferred stock could be issued at a premium to our common stock price and could be less restrictive than collateralized debt. Further, in difficult capital markets, it is possible that the only capital available to finance the Company’s growth may come from investors requiring a preferred security. The sole member of the board of directors believes that in a capital intensive business, the management team should be equipped with as many tools as possible to adequately finance the Company. We currently have no specific plans or understandings with respect to the issuance of any preferred stock. |

| Q: | Are there any conditions to the completion of the merger? |

| A: | Yes. The merger agreement specifies various important closing conditions, including, but not limited to (1) approval of the merger agreement by both our shareholders and FRI’s shareholders, (2) approval of the reverse stock split and (3) approval of the name change. These are described in greater detail below under “Closing Conditions” (page 46). |

| Q: | What will happen if our shareholders approve the proposals? |

| A: | If our shareholders approve the transaction with FRI, then shortly following the special meeting, we will file the amended and restated articles of incorporation with the Secretary of State of Nevada to effectuate the reverse stock split, the increase in the number of authorized preferred stock and the name change. Immediately thereafter, subject to the satisfaction of certain conditions set out in the merger agreement, we will file a short-form certificate of merger with the Secretary of State of Delaware and issue shares of our common stock to the shareholders of FRI in exchange for all of the outstanding shares of common stock of FRI, and FRI will become our wholly owned subsidiary. |

| Q: | What will happen if our shareholders do not approve the merger, the reverse stock split, the name change or the increase in authorized preferred stock? |

| A: | If the merger, the reverse stock split or the name change are not approved by our shareholders, the merger agreement will be terminated and we will continue to seek out and pursue a business combination transaction with an existing private business enterprise. If we do not consummate the merger, we also will not proceed with the reverse stock split or the name change, regardless of whether or not they have been approved by our shareholders. |

| Q: | How will my shares of stock be affected by the reverse stock split and the increase in authorized preferred stock? |

| A: | If the merger, the reverse stock split, the name change and the increase in authorized preferred stock are approved, the amended and restated articles of incorporation will be filed and become effective immediately prior to the closing of the merger. When the amended and restated articles of incorporation become effective, our shares of common stock will undergo a one-for-480 reverse stock split. The reverse stock split will not affect any of our shareholder’s proportional equity interests in the Company, nor will it change any of the rights of the existing holders of our common stock. Shareholders should recognize, however, that after the reverse stock split is effectuated, they will own fewer shares than they presently own (a number equal to the number of shares owned immediately prior to the reverse stock split divided by 480). Furthermore, because of the reverse stock split, more authorized shares of common stock will be available for issuance; the reverse stock split will not decrease the 200,000,000 shares of our common stock authorized under the amended and restated articles of incorporation. If these shares are issued, they will decrease our existing shareholders’ percentage equity ownership and, depending on the price at which they are issued, could be dilutive to our existing shareholders. |

The amended and restated articles of incorporation also increase the number of authorized shares of preferred stock. When we issue these shares of preferred stock, such issuances will also decrease our existing shareholders’ percentage equity ownership and could be dilutive.

| Q: | How will my shares of stock be affected by the merger? |

| A: | Our existing shareholders will not be affected by the merger other than the dilutive effects of the issuance of additional shares of the Company to the shareholders of FRI and the resulting effects of the amended and restated articles of incorporation as previously described. If the proposed merger is completed, (1) each outstanding share of common stock of FRI will be exchanged for one share of our common stock and (2) each outstanding option to purchase shares of common stock of FRI will be exchanged for an option to purchase the same number of shares of our common stock on the same terms. |

| Q: | Will I have dissenters’ rights as a result of the merger or the amended and restated articles of incorporation, including the reverse stock split, the name change and the increase in authorized preferred stock? |

| A: | No. Under Nevada law, dissenters’ rights only apply in limited circumstances or as otherwise provided in a corporation’s governing documents. Since these circumstances are not applicable to the merger or the amended and restated articles of incorporation, no dissenters’ rights are available. |

| Q: | What type of business will the Company conduct after the merger? |

| A: | After the merger, FRI will be our wholly owned subsidiary. FRI is an environmentally conscious oilfield service and technology company focused on providing the latest well stimulation and completion techniques to international unconventional markets currently being developed. Through the Company’s unique EcoStimSM Solutions, the Company will deliver “ecologically friendly” well stimulation services. |

| Q: | When and where is the special meeting? |

| A: | The special meeting will be held on November 21 , 2013 at 9:00 a.m., local time, at Vinson & Elkins, LLP, 1001 Fannin Street, Suite 2500 Houston, TX 77002. |

| Q: | Who is soliciting my proxy? |

| A: | The sole member of the board of directors of the Company is sending you this proxy statement in connection with its solicitation of proxies for use at our special meeting of shareholders. |

| Q: | Are all shareholders as of the record date entitled to vote at the special meeting? |

| A: | Yes. All shareholders who own our common stock at the close of business on October 21 , 2013, the record date for the special meeting, are entitled to receive notice of the special meeting and to vote the shares of our common stock that they hold on the record date at the special meeting, or at any adjournment or postponement of the special meeting. |

| Q: | Are all shareholders as of the record date entitled to attend the special meeting? |

| A: | Yes. All of our shareholders as of the record date, or their legally authorized proxies named in the proxy card, may attend the special meeting. Cameras, recording devices and other electronic devices will not be permitted at the meeting. If your shares are held in the name of a broker, bank or other nominee, you should bring a proxy or letter from the broker, bank or other nominee confirming your beneficial ownership of the shares and authorizing you to vote such shares at the meeting. |

| Q: | What vote of our shareholders is required to approve the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock? |

| A: | Approval of the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock requires the approval of the holders, as of the record date of October 21 , 2013, of a majority of the outstanding shares of our common stock entitled to vote and represented, in person or by proxy, at the special meeting. Accordingly, failure to vote or abstaining from voting will have the same effect as a vote against approval of the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock. The Company as the sole shareholder of MergerCo, approved the merger and merger agreement on September 16, 2013. Each of the merger proposal, the name change proposal and the reverse stock split proposal is cross-conditioned upon the approval of the other, and none of those proposals will be deemed approved unless all are approved. |

| Q: | Does our sole director recommend that our shareholders vote “FOR” the approval of the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock? |

| A: | Yes. After careful consideration, our sole director recommends that you vote: |

FOR approval of the merger agreement;

FOR approval of the reverse stock split;

FOR approval of the name change; and

FOR approval of the increase in authorized preferred stock.

| Q: | How do I cast my vote if I hold my shares in my name? |

| A: | We urge you to read this proxy statement carefully, including its appendices. You can then ensure that your shares are voted at the special meeting by completing, signing, dating and returning the accompanying proxy card in the enclosed postage-paid envelope. Alternatively, you may vote your shares at the meeting or by phone as disclosed on the attached proxy card. |

If you properly transmit your proxy but do not indicate how you want to vote, your proxy will be voted:

FOR approval of the merger agreement;

FOR approval of the reverse stock split;

FOR approval of the name change; and

FOR approval of the increase in authorized preferred stock.

| Q: | How do I cast my vote if my shares are held by my broker, bank or other nominee? |

| A: | Your broker, bank or other nominee will not vote your shares on your behalf unless you provide instructions on how to vote. You should follow the directions provided by your broker, bank or other nominee regarding how to provide voting instructions. Without those instructions, your shares will not be voted, which will have the same effect as voting against approval of the merger agreement, the reverse stock split, the name change and the increase in authorized preferred stock.. |

| Q: | How can I revoke or change my vote? |

| A: | You have the right to change or revoke your proxy at any time before the vote is taken at the special meeting by: (1) attending the special meeting in person and voting; (2) submitting a later-dated proxy card; or (3) notifying us that you are revoking your proxy by delivering a later-dated written statement to that effect to us at Vision Global Solutions, Inc., 20400 Stevens Creek Blvd., Suite 700, Cupertino, California 95014, which must be received at least one day prior to the date of the meeting. Simply attending the special meeting, however, will not be sufficient to revoke your proxy. Furthermore, if you have instructed a broker, bank or other nominee to vote your shares, these options for changing your vote do not apply, and instead you must follow the instructions received from your broker, bank or other nominee to change your vote. |

| Q: | What does it mean if I get more than one proxy card or vote instruction card? |

| A: | If your shares are registered differently and are in more than one account, you will receive more than one proxy card or, if your shares are held in the name of a broker, bank or other nominee, more than one vote instruction card from your broker, bank or other nominee. Please sign, date and return all of the proxy cards and vote instruction cards that you receive to ensure that all of your shares are voted. |

| Q: | What happens if I sell my shares before the special meeting? |

| A: | The record date for the special meeting is earlier than the date of the special meeting and is earlier than the date that the merger, if approved, will be completed. If you transfer your shares of common stock after the record date but before the special meeting, you will retain your right to vote those shares. |

| Q: | When do you expect the merger to be completed and the amended and restated articles of incorporation to become effective? |

| A: | We are working toward completing the merger as quickly as possible and we anticipate that the amended and restated articles of incorporation, including the reverse stock split, the name change and the increase in authorized preferred stock, will become effective and the merger will be completed promptly after the special meeting, assuming satisfaction or waiver of all of the conditions to the merger that are specified in the merger agreement. Because the merger is subject to certain conditions, the exact timing of the completion of the merger and the likelihood of the consummation of the merger cannot be predicted with certainty. If any of the conditions in the merger agreement are not satisfied or waived, the merger agreement may terminate as a result. In addition, if the merger is not completed by November 15, 2013, the merger agreement may be terminated at the discretion of either the Company or FRI. (See “Risk Factors−Risks Related to FRI and Its Business” and “−Risks Associated with the Merger”) |

| Q: | Who will bear the cost of this proxy solicitation? |

| A: | The expenses of preparing, printing and mailing this proxy statement and the proxies solicited by this proxy statement will be borne by us. Upon request, we will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses for forwarding material to the beneficial owners of shares held of record by others. |

| Q: | Who can help answer my other questions? |

| A: | If you have more questions about the merger, need assistance in submitting your proxy or voting your shares or need additional copies of the proxy statement or the enclosed proxy card, you can call (408) 517-3311 or email toddwaltzVIGS@gmail.com. If your broker, bank or other nominee holds your shares, you should call that person for additional information. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

We caution you that this proxy statement contains forward-looking statements regarding, among other things, the proposed merger and the anticipated consequences and benefits of such transaction, and other financial, business, and operational items relating to the parties to the merger agreement.

Forward-looking statements involve known and unknown risks, assumptions, uncertainties, and other factors. Statements made in the future tense, and statements using words such as “may,” “can,” “will,” “could,” “should,” “predict,” “aim,” “potential,” “continue,” “opportunity,” “intend,” “goal,” “estimate,” “expect,” “expectations,” “project,” “projections,” “plans,” “anticipates,” “believe,” “think,” “confident , ” “scheduled” or similar expressions are intended to identify forward-looking statements. Forward-looking statements are not a guarantee of performance and are subject to a number of risks and uncertainties, many of which are difficult to predict and are beyond our control. These risks and uncertainties could cause actual results to differ materially from those expressed in or implied by the forward-looking statements, and therefore should be carefully considered. We caution you not to place undue reliance on the forward-looking statements, which speak only as of the date of this proxy statement. We disclaim any obligation to update any of these forward-looking statements as a result of new information, future events, or otherwise, except as expressly required by law.

You should review the section of this proxy statement entitled “Risk Factors” for a discussion of the factors that could cause actual results to differ materially from those discussed in the forward-looking statements.

RISK FACTORS

In addition to the other information included in this proxy statement, including the matters addressed in the section entitled “Cautionary Statement Regarding Forward-Looking Information,” you should carefully consider the following risks before deciding whether to vote for the proposal to approve the merger and the proposals to approve and adopt the amended and restated articles of incorporation, including the reverse stock split, the name change and the increase in authorized preferred stock. In addition, you should read and consider the risks associated with the businesses of FRI because these risks will also affect the combined company following the merger. You should also read and consider the other information in this proxy statement.

Risks Associated with the Merger

If the merger is not completed, we may be forced to discontinue our operations.

The merger is subject to a number of conditions that are outside of our control. We cannot assure you that these conditions will be satisfied or waived. Accordingly, if the merger is terminated, we will need to identify and consummate another strategic transaction or financing opportunity. Failure to do so in a timely manner could result in the resignation of our sole director thus causing us to lose our listing status.

If the costs associated with the merger exceed the benefits, the post-merger company may experience adverse financial results, including increased losses.

Our Company and FRI will incur significant transaction costs as a result of the merger, including legal and accounting fees. Actual transaction costs may substantially exceed our current estimates and may adversely affect the post-merger company’s financial condition and operating results. If the benefits of the merger do not exceed the costs associated with the merger, the post-merger Company’s financial results could be adversely affected, resulting in, among other things, increased losses.

Consummation of the merger will result in significant dilution to our existing shareholders.

Upon consummation of the merger, our existing shareholders will hold, in total, only approximately 2.8% of the total number of outstanding shares of our capital stock. After the merger, we may need to issue additional shares of capital stock to fund our business, which could lead to further dilution of our existing shareholders’ ownership interests.

Following the merger, the existing shareholders of FRI will control our company.

Following the merger, the existing shareholders of FRI will own a total of approximately 97.2% of the total outstanding shares of our common stock, assuming FRI’s existing shareholders hold 5,472,648 common shares of FRI immediately prior to the merger. In addition, pursuant to the merger agreement, the current FRI board of directors will remain as the board of directors of the surviving company and FRI will appoint all of the members of our newly formed five-member board of directors. This means that the existing management and shareholders of FRI will have the right, if they were to act together, to exercise control over us, including making decisions with respect to issuing additional shares, entering into mergers, asset sales, and other fundamental transactions, and further amending the terms of our amended and restated articles of incorporation.

We cannot assure you that a market will exist for our common stock after the merger.

Although our common stock is quoted on the OTC markets, a regular trading market for our securities may not be sustained in the future. Quotes for stocks listed on the OTC markets are not listed in the financial sections of newspapers and newspapers generally have very little coverage of stocks quoted solely on the OTC markets. Accordingly, prices for and coverage of securities quoted solely on the OTC markets may be difficult to obtain. In addition, stock quoted solely on the OTC markets tend to have a limited number of market makers and a larger spread between the bid and ask prices than those listed on the NYSE, AMEX or NASDAQ exchanges. All of these factors may cause holders of our common stock to be unable to resell their securities at or near their original offering price or at any price. Market prices for our common stock will be influenced by a number of factors, including:

| ● | changes in interest rates and the price of oil and natural gas; |

| ● | competitive developments, including announcements by competitors of new products or services or significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; |

| ● | variations in quarterly operating results; |

| ● | changes in financial estimates by securities analysts; |

| ● | the depth and liquidity of the market for our common stock; |

| ● | investor perceptions of our company after the merger with FRI; and |

| ● | general economic and other national and international conditions. |

In the event the merger does not close, an alternative to the merger may not be available to us and, if available and completed, may be less attractive to our equity holders than the merger. The company may be forced to file for bankruptcy or cease filing reports with the SEC.

We believe that the completion of the merger is critical to our continuing viability. If the merger is not completed, an alternative transaction or restructuring arrangement may not be available, or if available, may not be on terms as favorable to our equity holders as the terms of the merger. As such, we may be forced to cease filing reports with the SEC. In such case, an investment in our Company will likely decline in value or become worthless and shareholders of our Company may lose their entire investment.

The current officers and directors of FRI exercise significant voting control over FRI and will therefore exercise significant voting control over Vision subsequent to the merger, including all corporate decisions and the appointment of directors.

Following the merger, the officers and directors of FRI will be able to vote an aggregate of 1,084,650 voting shares, equal to 19.8% of our then outstanding voting stock. The officers and directors of FRI will therefore exercise significant control in determining the outcome of all corporate transactions or other matters, including the election of directors, mergers, consolidations, the sale of all or substantially all of our assets, as well as the power to effectively prevent or cause a change in control. Any investor who purchases shares in our Company will be a minority shareholder and as such will have little to no say in the direction of our Company and the election of directors. Additionally, it will be difficult if not impossible for investors to remove our directors, which will enable such directors to control who serves as officers of our Company as well as any changes in our board of directors.

Risks Related to Vision and its Business

Because our common stock is considered a “penny stock,” certain rules may impede the development of increased trading activity and could affect the liquidity for stockholders.

Our common stock is subject to the SEC “penny stock rules.” These rules impose additional sales practice requirements on broker-dealers who sell penny stock securities to persons other than established customers and accredited investors. For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of penny stock securities and have received the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the “penny stock rules” require the delivery, prior to the transaction, of a disclosure schedule relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities, and, monthly statements must be sent disclosing recent price information on the limited market in penny stocks. These rules may restrict the ability of broker-dealers to sell our securities and may have the effect of reducing the level of trading activity of our common stock in the secondary market. In addition, the penny-stock rules could have an adverse effect on our ability to raise capital in the future from offerings of our common stock.

On July 7, 2005, the SEC approved amendments to the penny stock rules. The amendments provide that broker-dealers are required to enhance their disclosure schedule to investors who purchase penny stocks, and that those investors have an explicit “cooling-off period” to rescind the transaction. These amendments could place further constraints on broker-dealers’ ability to sell our securities.

We have incurred, and expect to continue to incur, increased costs and risks as a result of being a public company.

As a public company, we are required to comply with the Sarbanes-Oxley Act of 2002, or SOX, as well as rules and regulations implemented by the SEC. Changes in the laws and regulations affecting public companies, including the provisions of SOX and rules adopted by the SEC, have resulted in, and will continue to result in, increased costs to us as we respond to these requirements. Given the risks inherent in the design and operation of internal controls over financial reporting, the effectiveness of our internal controls over financial reporting is uncertain. If our internal controls are not designed or operating effectively, we may not be able to issue an evaluation of our internal control over financial reporting as required or we or our independent registered public accounting firm may determine that our internal control over financial reporting was not effective. In addition, our registered public accounting firm may either disclaim an opinion as it relates to management’s assessment of the effectiveness of our internal controls or may issue an adverse opinion on the effectiveness of our internal controls over financial reporting. Investors may lose confidence in the reliability of our financial statements, which could cause the market price of our common stock to decline and which could affect our ability to run our business as we otherwise would like to. New rules could also make it more difficult or more costly for us to obtain certain types of insurance, including directors’ and officers’ liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the coverage that is the same or similar to our current coverage. The impact of these events could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees, and as executive officers. We cannot predict or estimate the total amount of the costs we may incur or the timing of such costs to comply with these rules and regulations.

Compliance with Section 404 of the SOX will continue to strain our limited financial and management resources.