UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ]Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under §240.14a-12

| Eco-Stim Energy Solutions, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per share price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

ECO-STIM ENERGY SOLUTIONS, INC.

2930 W. Sam Houston Pkwy N., Suite 275,

Houston, Texas 77043

June 2, 2015

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Eco-Stim Energy Solutions, Inc.:

Notice is hereby given that the Eco-Stim Energy Solutions, Inc. 2015 annual meeting of stockholders (the “Annual Meeting”) will be held on June 30, 2015 at 9:00 AM Central Standard Time, at Vinson & Elkins LLP, 1001 Fannin St., Suite 2500, Houston, Texas 77002. The Annual Meeting is being held for the following purposes:

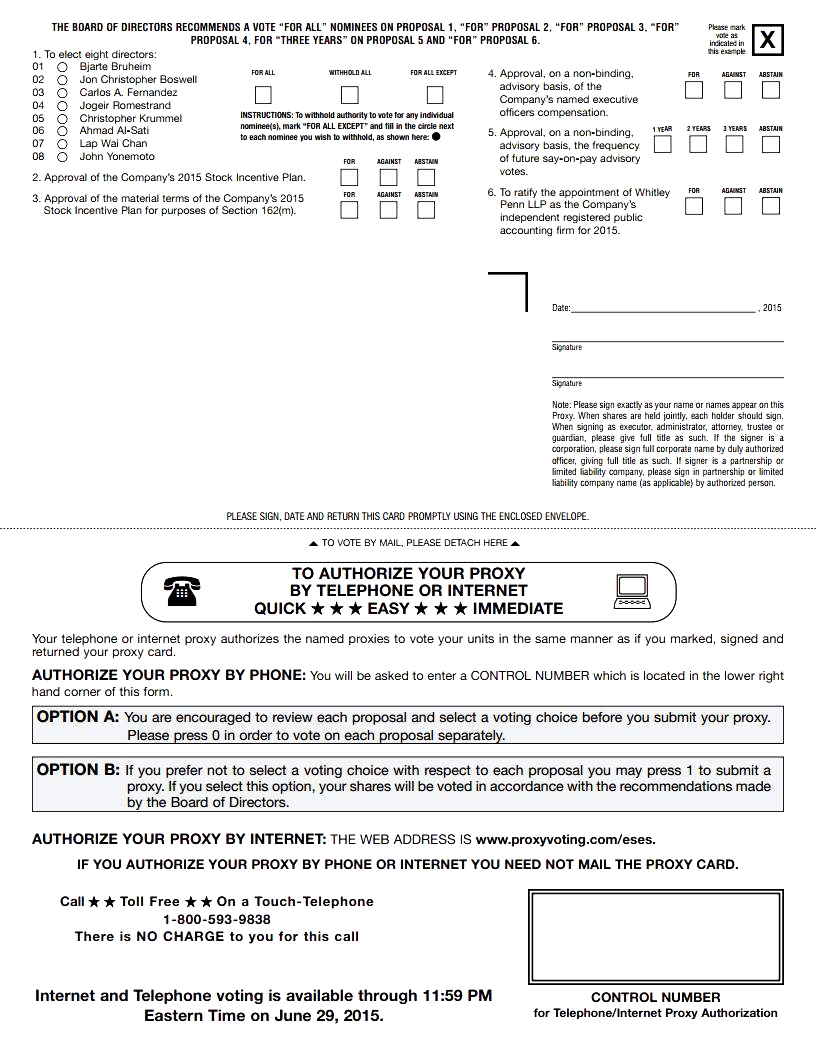

| 1. | To elect eight (8) directors to serve until the next annual meeting of stockholders; |

| | | |

| | 2. | To approve the Company’s 2015 Stock Incentive Plan; |

| | | |

| | 3. | To approve the material terms of the Company’s 2015 Stock Incentive Plan for purposes of Section 162(m); |

| | | |

| | 4. | To approve, on a non-binding advisory basis, the Company’s named executive officer compensation; |

| | | |

| | 5. | To approve, on a non-binding advisory basis, the frequency of future say-on-pay advisory votes; |

| | | |

| | 6. | To ratify the appointment of Whitley Penn LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2015; and |

| | | |

| | 7. | To transact other such business as may properly come before the meeting and any adjournment or postponement thereof. |

These proposals are described in the accompanying proxy materials. You will be able to vote at the Annual Meeting only if you were a stockholder of record at the close of business on May 29, 2015, the record date for the meeting.

Your vote is very important. We would like you to attend the Annual Meeting. However, whether or not you plan to attend the Annual Meeting, it is important for your shares to be represented at the Annual Meeting. We urge you to promptly vote by Internet, by telephone, or by submitting your marked, signed and dated proxy card. You will retain the right to revoke your proxy at any time before the vote or to vote personally if you attend the Annual Meeting. Voting by Internet, by telephone or by submitting a proxy card will not prevent you from attending the Annual Meeting and voting in person. Please note, however, that if you hold your shares through a broker or other nominee and you wish to vote in person at the Annual Meeting, you must obtain from your broker or other nominee a proxy issued in your name.

On or about June 5, 2015, we intend to commence mailing this Proxy Statement, the Notice of 2015 Annual Meeting of Stockholders, the accompanying proxy card and the 2014 Annual Report to Stockholders to all stockholders entitled to vote at the Annual Meeting.

| | By Order of the Board of Directors, |

| | | |

| | | /s/ Jon Christopher Boswell |

| | | Jon Christopher Boswell |

| | | President and Chief Executive Officer |

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 30, 2015

This Notice of Annual Meeting, a copy of this Proxy Statement, the form of proxy and the 2014 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2014, are available on our website free of charge atwww.ecostim-es.comin the “SEC Filings” subsection of the “Investors” section.

YOUR VOTE IS IMPORTANT

Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

TABLE OF CONTENTS

ECO-STIM ENERGY SOLUTIONS, INC.

2930 W. Sam Houston Pkwy N., Suite 275,

Houston, Texas 77043

PROXY STATEMENT

2015 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Eco-Stim Energy Solutions, Inc. for use at the Eco-Stim Energy Solutions, Inc. 2015 annual meeting of stockholders (the “Annual Meeting”). In this Proxy Statement, references to “EcoStim,” “Eco-Stim,” the “Company,” “we,” “us,” “our” and similar expressions refer to Eco-Stim Energy Solutions, Inc., unless the context of a particular reference provides otherwise. The Board requests your proxy for the Annual Meeting that will be held on June 30, 2015 at 9:00 AM Central Standard Time, at Vinson & Elkins, LLP, 1001 Fannin St., Suite 2500, Houston, Texas 77002. By granting a proxy, you authorize the persons named in the proxy to represent you and vote your shares at the Annual Meeting or any adjournment or postponement thereof.

If you attend the Annual Meeting, you may vote in person. If you are not present at the Annual Meeting, your shares may be voted only by a person to whom you have given a proper proxy.

Brokers are not permitted to vote your shares for non-discretionary matters, which include the election of directors, the approval of the Company’s 2015 Stock Incentive Plan, the approval of the material terms of the Company’s 2015 Stock Incentive Plan for purposes of Section 162(m), the advisory vote on the Company’s named executive officer compensation and the advisory vote on the frequency of future say-on-pay votes, without your instructions as to how to vote. Please return your proxy card so that your vote can be counted.

Delivery of Proxy Materials

Mailing Date. We intend to commence mailing this Proxy Statement, the Notice of 2015 Annual Meeting of Stockholders (the “Notice of Annual Meeting”), the accompanying proxy card and the 2014 Annual Report to Stockholders to all stockholders entitled to vote at the Annual Meeting on or about June 5, 2015.

Stockholders Sharing an Address. We may send a single set of proxy materials and other stockholder communications to any household at which two or more stockholders reside unless we have received contrary instructions from those stockholders. This process is called “householding.” This reduces duplicate mailings and saves printing and postage costs as well as natural resources. The proxy materials and other stockholder communications may be householded based on your prior express or implied consent. If you wish to receive a separate copy of our proxy materials for each stockholder sharing your address in the future, please contact Eco-Stim Energy Solutions, Inc., 2930 W. Sam Houston Pkwy N., Suite 275, Houston, Texas 77043, Attn: Secretary or by calling 281-531-7200, and we will promptly deliver to you the requested material. You may also contact us in the same manner if you received multiple copies of the proxy materials and would prefer to receive a single copy in the future.

If your shares are held in “street name” (that is, in the name of a bank, broker or other holder of record), you may have consented to reduce the number of copies of materials delivered to your address. In the event that you wish to revoke a “householding” consent you previously provided to a broker, you must contact that broker to revoke your consent. If your household is receiving multiple copies of the proxy materials and you wish to request delivery of a single copy, you should contact your broker directly.

Internet Availability of Proxy Materials. The Notice of Annual Meeting, the Proxy Statement, the form of proxy and the Company’s 2014 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission (the “SEC”) on March 18, 2015 (the “Form 10-K”), are available free of charge atwww.ecostim-es.com in the “SEC Filings” subsection under the “Investors” section.

Quorum and Voting

Voting Stock. The Company’s common stock, par value $0.001 per share, is the only outstanding class of the Company’s securities that entitles holders to vote at meetings of the Company’s stockholders. Each share of common stock outstanding on the record date entitles the holder to one vote at the Annual Meeting.

Record Date. The record date for stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on May 29, 2015. As of the record date, 6,789,649 shares of common stock were outstanding and entitled to be voted at the Annual Meeting.

Quorum. A quorum of stockholders is necessary to have a valid meeting of stockholders. A majority of the shares entitled to vote, represented in person or by proxy, is a quorum at a shareholders’ meeting, unless or except to the extent that the presence of a larger number may be required by law. Where separate vote by a class or classes is required, a majority of the shares of such class or classes present in person or represented by proxy shall constitute a quorum entitled to take action with respect to that vote on that matter. If a quorum is not present, the Annual Meeting may be postponed from time to time by the vote of a majority of the shares, the holders of which are either present in person or represented by proxy.

Stockholder List. In accordance with the Company’s bylaws, the Company will maintain at its corporate offices in Houston, Texas a list of the stockholders entitled to vote at the Annual Meeting. The list will be open to the inspection of any stockholder, for purposes germane to the Annual Meeting, during normal business hours for 10 business days before the Annual Meeting. The list will also to be available throughout the Annual Meeting for inspection by any stockholder present at the meeting.

Vote Required. Only stockholders of record at the close of business on May 29, 2015 have the right to vote at the Annual Meeting. The affirmative vote of a majority of the shares entitled to vote and present, in person or by proxy, at the Annual Meeting with respect to the subject proposal is required to approve each of Proposal One—Election of Directors, Proposal Two—Approval of the Company’s 2015 Stock Incentive Plan, Proposal Three— Approval of the Material Terms of the Company’s 2015 Stock Incentive Plan for Purposes of Section 162(m), Proposal Four—Advisory Vote to Approve Named Executive Officer Compensation at the Annual Meeting, and Proposal Six—Ratification of Appointment of Whitley Penn LLP. Approval of Proposal Five—Advisory Vote on the Frequency of Future Say-on-pay Votes requires the affirmative vote of the holders of a majority of the votes of our common stock, present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. However, because this vote is advisory and non-binding, if none of the frequency options receive a majority vote of our common stock present in person or by proxy at the Annual Meeting and entitled to vote, the option receiving the greatest number of votes will be considered the frequency recommended by our stockholders.

Cumulative voting is not permitted.

Broker Non-votes and Abstentions. Brokers who hold shares in street name for customers are required to vote shares in accordance with instructions received from the beneficial owners. The NASDAQ Stock Market LLC (the “NASDAQ”) Rule 2251 restricts when brokers who are record holders of shares may exercise discretionary authority to vote those shares in the absence of instructions from beneficial owners. Brokers are not permitted to vote on non-discretionaryitems such as director election, executive compensation and other significant matters absent instructions from the beneficial owner. As a result, if you do not vote your proxy and your shares are held in street name, your brokerage firm may either vote your shares on discretionarymatters, such as the ratification of the appointment of our independent registered public accounting firm (Proposal Six), or leave your shares unvoted. On non-discretionarymatters, if the brokerage firm has not received voting instructions from you, the brokerage firm cannot vote your shares on that proposal, which is considered a “broker non-vote.” Although any broker non-vote would be counted as present at the Annual Meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionarymatters.

If you are a street name stockholder, and you do not give voting instructions, the holder of record will not be permitted to vote your shares with respect to Proposal One—Election of Directors, Proposal Two—Approval of the Company’s 2015 Stock Incentive Plan, Proposal Three— Approval of the Material Terms of the Company’s 2015 Stock Incentive Plan for Purposes of Section 162(m), Proposal Four—Advisory Vote to Approve Named Executive Officer Compensation, or Proposal Five—Advisory Vote on the Frequency of Future Say-on-pay Votes, and your shares will be considered “broker non-votes” with respect to these proposals. Although any broker non-vote would be counted as present at the Annual Meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to each of Proposals One, Three, Four, Five and Six. If you are a street name stockholder, and you do not give voting instructions, the record holder will nevertheless be entitled to vote your shares with respect to Proposal Six—Ratification of the Appointment of Whitley Penn LLP in its discretion.

Abstentions occur when stockholders are present at the Annual Meeting but fail to vote or voluntarily withhold their vote for any of the matters upon which the stockholders are voting. Abstentions will be included for purposes of determining whether a quorum is present at the Annual Meeting and will be treated as votes against the proposals.

Default Voting. A proxy that is properly completed and returned will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and return a proxy, but do not indicate any contrary voting instructions, your shares will be voted in accordance with the Board’s recommendations, which are as follows:

| | ● | FOR ALL the election of the eight persons named in this Proxy Statement as the Board’s nominees for election of directors; |

| | | |

| | ● | FOR the approval of the Company’s 2015 Stock Incentive Plan; |

| | | |

| | ● | FOR the approval of the material terms of the Company’s 2015 Stock Incentive Plan for purposes of Section 162(m); |

| | | |

| | ● | FOR the advisory vote to approve the Company’s named executive officer compensation; |

| | | |

| | ● | FOR “THREE YEARS” on the advisory vote on the frequency of future say-on-pay votes; and |

| | | |

| | ● | FOR the ratification of the selection of Whitley Penn LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2015. |

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted at the discretion of the holders of the proxy. As of the date hereof, the Board is not aware of any matters, other than those previously stated herein, to be presented for consideration at the Annual Meeting.

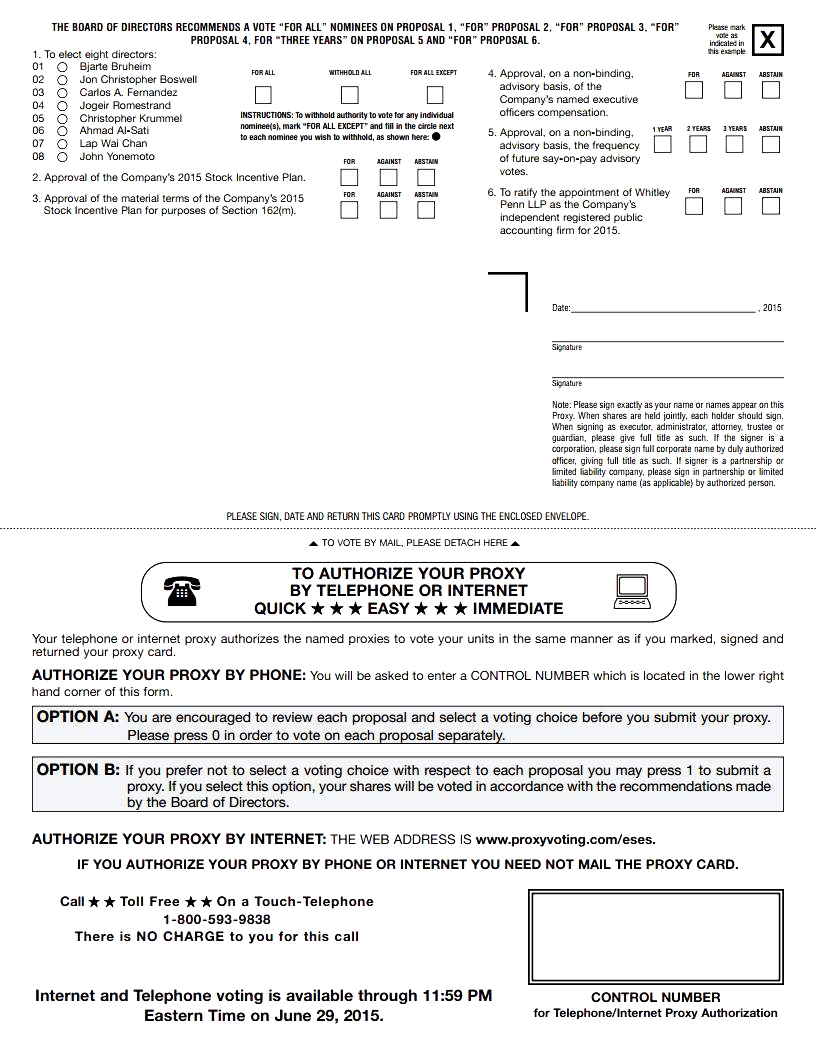

Voting Procedures. If you are a registered stockholder, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

| | ● | By Internet. You may submit a proxy electronically via the Internet by following the instructions provided on the Notice of Annual Meeting. Internet voting facilities will close and no longer be available on the date and time specified on the Notice of Annual Meeting. |

| | | |

| | ● | By Telephone. You may submit a proxy by telephone using the toll-free number listed on the Notice of Annual Meeting. Please have the proxy card in hand when you call. Telephone voting facilities will close and no longer be available on the date and time specified on the Notice of Annual Meeting. |

| | | |

| | ● | By Mail. If you received or requested printed proxy materials, you may submit a proxy by signing, dating and returning your proxy card in the provided pre-addressed envelope according to the enclosed instructions. We encourage you to sign and return the proxy or voter instruction card even if you plan to attend the meeting. In this way, your shares will be voted even if you are unable to attend the meeting. |

| | | |

| | ● | In Person. If you plan to attend the Annual Meeting and vote in person, we will provide you with a ballot at the meeting. You may vote in person at the Annual Meeting by completing a ballot; however, attending the meeting without completing a ballot will not count as a vote. |

If your shares are held in street name, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Internet and/or telephone voting will also be offered to stockholders owning shares through most banks and brokers.

Revoking Your Proxy. You may revoke your proxy in writing at any time before it is exercised at the Annual Meeting by: (i) delivering to the Secretary of the Company, at Eco-Stim Energy Solutions, Inc., 2930 W. Sam Houston Pkwy N., Suite 275, Houston, Texas 77043, a written notice of the revocation; (ii) signing, dating and returning a proxy bearing a later date; (iii) timely submitting a proxy with new voting instructions using the Internet or telephone voting system; or (iv) attending the Annual Meeting and voting your shares in person. Your attendance at the Annual Meeting will not revoke your proxy unless you give written notice of revocation to the Secretary of the Company before your proxy is exercised or unless you vote your shares in person at the Annual Meeting before your proxy is exercised.

Solicitation Expenses. We will bear all costs incurred in the solicitation of proxies, including the preparation, printing and mailing of the Notice of Annual Meeting and Proxy Statement and the related materials. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally or by telephone, e-mail, facsimile or other means, without additional compensation, but such directors, officers and employees may be reimbursed for their reasonable expenses in forwarding solicitation material. We have also retained the firm of Morrow & Co., LLC, 470 West Ave., Stamford, Connecticut 06902, to assist in the solicitation of proxies for a fee estimated at $5,500 plus expenses. In addition, the Company may request brokers, custodians, nominees and fiduciaries to forward proxy materials to stockholders of the Company and will reimburse any reasonable expenses incurred by them.

PROPOSAL ONE: ELECTION OF DIRECTORS

The eight (8) nominees for election at the Annual Meeting are Bjarte Bruheim, Jon Christopher Boswell, Carlos A. Fernandez, Jogeir Romestrand, Christopher Krummel, Ahmad Al-Sati, Lap Wai Chan and John Yonemoto. If elected, they will each serve as a director until either they are re-elected or their successors are elected and qualified or until their earlier resignation or removal.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for election of all of the director nominees, all of whom currently serve as directors. In the event the nominees are unable or decline to serve as a director at the time of the annual meeting, the proxies will be voted for any nominee who shall be designated by the present Board to fill the vacancy. We are not aware that any nominee will be unable or will decline to serve as a director. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as to assure the election of the nominees listed above.

Information Concerning the Nominees and Incumbent Directors

Biographical information of each of the above-listed nominees is contained in “Directors and Executive Officers” below. Information as to the stock ownership of each of our directors and all of our current directors and executive officers as a group is set forth below under “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

Vote Required and Board of Director’s Recommendation

The nominees receiving the votes of the majority of shares present and entitled to vote at the Annual Meeting will be elected as directors.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTEFOR ALL THE ELECTION OF ALL NOMINEES.

DIRECTORS AND EXECUTIVE OFFICERS

Set forth below is certain information, as of the date of this Proxy Statement, regarding the Company’s directors and executive officers:

| Name | | Age | | Positions |

| Bjarte Bruheim | | 59 | | Chairman of the Board |

| Jon Christopher Boswell | | 54 | | Director, President and Chief Executive Officer |

| Jogeir Romestrand | | 53 | | Director |

| Carlos A. Fernandez | | 58 | | Director, Executive Vice President-Global

Business Development and General Manager-Latin America |

| John Yonemoto | | 51 | | Director |

| Christopher Krummel | | 47 | | Director |

| Ahmad Al-Sati | | 42 | | Director |

| Lap Wai Chan | | 49 | | Director |

| Bobby Chapman | | 58 | | Chief Operating Officer |

| Alexander Nickolatos | | 37 | | Chief Financial Officer and Assistant Secretary |

| Craig Murrin | | 61 | | Secretary and General Counsel |

Bjarte Bruheim. Mr. Bruheim has served as Chairman of the Board of our Company and its predecessors, FracRock International, Inc., a Delaware corporation (“FRI”) since October 2013, and FracRock International, Inc., a British Virgin Islands company (“FRIBVI”) since December 2011. Mr. Bruheim has over 30 years of international management experience and is also a serial entrepreneur. He has spent the majority of his career introducing technologies that reduce risk and improve efficiencies in the oil and gas business. Such companies include oilfield services companies such as Petroleum Geo-Services ASA (“PGS”) which he co-founded in 1991, Electromagnetic Geoservices ASA (“EMGS”) where he was an early venture investor and Executive Chairman starting in 2004 and became Chief Executive Officer in January 2015, Geo-Texture Technologies, Inc. (“Geo-Texture”), which he co-founded in 2005, and ODIM ASA (“ODIM”) which he worked to turn around and later sell. PGS and EMGS remain public companies and are leaders in their industry while ODIM was sold to Rolls Royce and the intellectual property of Geo-Texture was sold to Eco-Stim. In addition to the oilfield service companies, Mr. Bruheim was a co-founder in Spinnaker Exploration Company using PGS technology, an early venture investor in Spring Energy using EMGS technology and co-founder of a small exploration and production company operating in the Eagle Ford field in Texas using Geo-Texture. Spinnaker was later sold to Statoil, Spring Energy was sold to Tullow Oil and the small exploration and production company in the Eagle Ford play was sold to Chesapeake. Mr. Bruheim is currently the Chief Executive Officer and Chairman of the Board for EMGS and has been involved at the board level in value creation for many energy and energy service related companies. He started his career as an executive with Schlumberger after graduating with a master’s degree in Physics and Electronics from the Norwegian University of Science & Technology in Trondheim, Norway.

Jon Christopher Boswell. Mr. Boswell has served as President and Chief Executive Officer and a Director of our Company and its predecessors, FRI and FRIBVI, since October 2013 and December 2011, respectively. He also served as a Director during the same time period. Prior to FRI, from 2009 to 2011, Mr. Boswell served as Chief Financial Officer for NEOS GeoSolutions, a Silicon Valley backed oilfield technology company (“NEOS”). Prior to NEOS, from August 2003 to January 2009, he served as Chief Financial Officer for Particle Drilling Technologies, an oilfield services and technology company (“Particle”). Subsequent to Mr. Boswell’s departure from Particle in January 2009 as a result of disagreements with the chief executive officer regarding the strategic direction of the company, the remaining management of the company elected to restructure the company and Particle filed for bankruptcy protection in May 2009. Particle secured financing and emerged successfully from bankruptcy on August 28, 2009. Prior to Particle, he served as Senior Vice President and Chief Financial Officer of PGS from December 1995 until October 2002. PGS grew from a small enterprise in 1994 when Mr. Boswell joined the company to a $1 billion annual revenue enterprise with a peak enterprise value of $6 billion. In all, during his tenure as CFO at PGS, Mr. Boswell directed financings for over $3 billion of capital expenditures to facilitate PGS’ growth. Additionally during 1995, Mr. Boswell and other senior executives at PGS developed the concept to create a unique oil and gas company using a non-exclusive license in PGS’ seismic data library as seed capital. This company became Spinnaker Exploration Company, which was then sold to Statoil for approximately $2.5 billion. Mr. Boswell began his career at Arthur Andersen & Co. and later served in management positions with Price Waterhouse in Houston, Texas. Mr. Boswell is a 1985 graduate of the University of Texas at Austin.

Jogeir Romestrand. Mr. Romestrand has served as a Director of our Company and its predecessor FRI since October 2013. He is the owner and director of the Norwegian private investment firm Rome AS. Mr. Romestrand served as an independent member of the board of directors of Polarcus Ltd from September 2009 until April 2012. He also served as a member of Polarcus Ltd’s audit committee. He has over 20 years of experience within marine technology and previously worked in various management capacities within the ODIM Group, most recently as Chief Executive Officer and President of ODIM ASA.

Carlos A. Fernandez. Mr. Fernandez has served as a member of the Board of our Company and its predecessors since December 2011. Mr. Fernandez has 35 years of experience in the oil and gas industry and over 30 years of experience in various executive management and sales positions. From January 2010 to present, he has worked as General Manager – Latin America for NEOS. From April 2006 to November 2009, he served as Senior Vice President Business Development for 3D-Geo. While at 3D-Geo, Mr. Fernandez led the formation of the Kaleidoscope seismic imaging project, a partnership among Repsol, 3D-Geo, Stanford University, IBM, and the Barcelona Supercomputing Center. From 1996 to March 2006, he served as General Manager – Latin America for Paradigm Geophysical. From 1990 to 1995, Mr. Fernandez served as President of Petroleum Information Argentina. From 1979 through 1990, he held various leadership positions with seismic technology and computing companies such as Silicon Graphics. Mr. Fernandez received his degree in geophysics with honors from the National University of La Plata in Argentina. Mr. Fernandez has taught at the University for more than 10 years, contributing to the education of a significant number of geophysicists, currently working in the oil and gas industry in Latin America and around the world.

John Yonemoto. Mr. Yonemoto was designated by ACM to serve on our Board in July 2014, pursuant to a stockholder rights agreement (the “Stockholder Rights Agreement”) entered into by and among the Company, ACM and certain management stockholders. He is the Chief Investment Officer and Chair of the Investment Committee of Albright Capital Management LLC (“Albright”), which acts as the general partner of and investment adviser to ACM Emerging Markets Master Fund I, L.P. (“ACM”). He has been with Albright since its founding in March 2005. Mr. Yonemoto has over 25 years of experience in both institutional capital markets and alternative asset management. Mr. Yonemoto earned a BA in Economics from the University of Chicago in 1986. From 1988 to 1994, Mr. Yonemoto worked with ING Groep in various roles in emerging markets trading, analytics, and sales. From 1994 to 1999, he was Global Head of Emerging Markets Proprietary Trading for ING Barings. In this role, Mr. Yonemoto directed an interdisciplinary investment team across fixed income, currency and equity investments and served on the management team of the Emerging Markets and High Yield Division of ING Groep. Most recently, from 1999 until January 2005, he was Managing Director and lead public markets portfolio manager for Darby Overseas Investments, Ltd., a wholly-owned subsidiary of Franklin Templeton Investments.

Christopher Krummel. Mr. Krummel joined our Board in January 2014. Mr. Krummel currently serves as the Chief Financial Officer and Vice President for EnTrans International LLC (“EnTrans”), a portfolio company of American Industrial Partners LLC. Previously he served as Vice President, Controller and Chief Accounting Officer for Cameron International Corporation (“Cameron”), where he was responsible for all accounting functions, including consolidated financial reporting and SEC filings. He served at Cameron from October 2007 until August 2014 and joined EnTrans in September 2014. Previously he was with Enventure Global Technology (“Enventure”), a private equity backed startup, serving as Chief Financial Officer. Prior to Enventure, he held financial leadership roles with PGS and PriceWaterhouse. He holds an undergraduate degree in accounting from Creighton University and an MBA from The Wharton School of the University of Pennsylvania. In addition to our Board, Mr. Krummel is a director of Rebuilding Together Houston.

Ahmad Al-Sati. Mr. Al-Sati is a Managing Director of Albright, and was designated by ACM to serve on our Board in May 2014, pursuant to the Stockholder Rights Agreement. Mr. Al-Sati is an investor and restructuring professional with over 12 years of direct experience in private equity, lending transactions and other special situations in almost 20 different jurisdictions in Africa, Europe, Asia and the Americas. Prior to joining Albright in September 2012, Al-Sati was a Managing Director at Plainfield Asset Management where, most recently, he was responsible for the firm’s energy and international portfolios in industries that included consumer products, specialty finance, building products, steel, E&P Cleantech and energy. Mr. Al-Sati was also Chairman of two renewable energy companies in Peru and Greece. Mr. Al-Sati began his career as an attorney with Schulte Roth & Zabel LLP, representing hedge funds and private equity firms in privately negotiated transactions. In 2003, Mr. Al-Sati joined MatlinPatterson Global Advisers LLC (“MatlinPatterson”). At MatlinPatterson, he was initially responsible for the transactional legal work, private debt trading and tax structuring and worked on a variety of private equity transactions during his time there. Mr. Al-Sati received a BA, with honors, double majoring in Economics and History from Wesleyan University in 1995, a J.D. from Columbia Law School in 2000 and an M.B.A. from the Stern School of Business in 2008.

Lap Wai Chan. Mr. Chan was designated by ACM to serve on our Board in July 2014, pursuant to the Stockholder Rights Agreement. Mr. Chan has been actively investing for over 20 years, including investment experience in Asia, Latin America, North America and Oceana. Mr. Chan joined Albright in 2011. Prior to joining Albright in 2011, Mr. Chan was the Managing Partner and international portfolio manager for MatlinPatterson Global Opportunities Funds from inception to September 2009. Prior to July 2002, Mr. Chan was a Managing Director at Credit Suisse’s Distressed Group in Hong Kong, which he established in 1997. Mr. Chan began his career at ING Barings Ltd (“ING”), most recently as Director of Asian Special Investments for ING Barings Securities (HK) Ltd, in Hong Kong from 1995 to 1997. From 1993 to 1995, he focused on South American emerging markets finance as head of EMG sales in the Tokyo office of ING, and from 1987 to 1993 he served as Vice President of EMG corporate finance, sales and trading in ING’s New York office. Mr. Chan obtained a BA with Honors from the University of Chicago in 1987. Until May 2014, Mr. Chan served as an independent board member and Chairman of the special committee of Harbinger Group Inc. He currently works exclusively with Albright on emerging markets transactions.

Bobby Chapman. Mr. Chapman was appointed our Chief Operating Officer in December 2013. Mr. Chapman started his career with Halliburton, where he was involved in drilling and completions operations, sales, engineering, and management in offshore Gulf of Mexico and broad US land operations as well as assignments internationally offshore West Africa. His experience includes high pressure / high temperature well cementing, stimulation engineering (matrix acidizing and well stimulation ) as well as completion design including complex, extended reach, deep water well completion designs. He was author of several SPE technical papers on the use of high perm well stimulation techniques and processes. In 1998, Mr. Chapman joined Weatherford International where he spent seven years working in management positions involving all types of artificial lift and general business planning. He was responsible for the organic startup of Weatherford’s well stimulation business. Later after leaving Weatherford, he started Liberty Pressure Pumping (“Liberty”), a startup business focused on well stimulation of unconventional resources. He was involved in all phases of the business including strategic planning, financial planning, equipment design, sales, engineering and management. Liberty’s niche was supplying well stimulation operations to the Barnett Shale but later expanding to other unconventional basins in the United States. In 2007, Liberty was sold to Trican Well Service (“Trican”) for in excess of $200 million. Mr. Chapman was retained by Trican to serve as President of the United States region. He resigned from Trican in September 2012. During this time Trican grew to add several operating regions and also expanded product line offerings to include cementing services and coil-tubing services. Mr. Chapman is a 1979 graduate of Louisiana State University with a B.S. degree in Petroleum Engineering.

Alexander Nickolatos. Mr. Nickolatos became our Chief Financial Officer in December 2013 and was appointed in July 2014 as our Assistant Secretary. Prior to being appointed our Chief Financial Officer, Mr. Nickolatos has served as Controller of the Company’s predecessors, FRI and FRIBVI, since July 2012. From March, 2006 until June 2012, Mr. Nickolatos served as the Director of Financial Planning and Analysis at NEOS. During his time at NEOS, he also served as Controller and Treasurer, and oversaw oil and gas accounting and finance operations in over seven countries, including Argentina. In conjunction with this role, he helped to raise and manage over $500 million from private investors, including Bill Gates, Kleiner Perkins, and Goldman Sachs. He was instrumental in implementing the company’s subsidiary exploration activities in Argentina, eventually forming an assignment of two concessions to ExxonMobil. Prior to joining NEOS, he worked for Arthur Andersen and PricewaterhouseCoopers. Mr. Nickolatos is a Certified Public Accountant, and holds a BBA degree, summa cum laude, from Walla Walla University.

Craig Murrin. Mr. Murrin joined us in April 2014 and was elected Secretary and General Counsel and designated as our Compliance Officer in May 2014. He served as an attorney for SandRidge Energy Offshore, LLC (formerly “Dynamic Offshore Resources”) from February 2009 until February 2014. He was Vice President, Secretary and General Counsel of Global Geophysical Services, Inc. (“GGS”) from May 2005, when it commenced business, until October 2008. He helped GGS raise over USD 100 million in private equity and USD 180 million of secured debt, establish an international operating company in the Cayman Islands, establish an FCPA compliance program, and enter the geophysical service business in Algeria, Argentina, Georgia, India, Oman and Peru. He was Vice President-Legal of various subsidiaries of PGS from 1997 until 2003 and served as its chief compliance officer from 2000 to 2003, helping it to enter the geophysical service business in Kazakhstan, Mexico and Saudi Arabia. From 1988 to 1995 he served as Senior Counsel and Assistant Secretary of The Western Company of North America, where he helped it enter the pressure-pumping and offshore drilling businesses in Argentina, Brazil, Colombia, China, Hungary, Indonesia, Malaysia, Nigeria and Russia. He obtained his law degree from Stanford University, where he served on the Law Review. He served on the council of the international section of the Houston Bar Association from 2003 through 2009.

Director Qualifications

Mr. Bruheim has significant operational experience in the oilfield services industry and brings both a practical understanding of the industry as well as hands-on experience at building companies in this sector. He currently serves on several other boards of directors and as Chief Executive Officer of companies operating in our industry and brings experience with young growing companies to our Board, which adds significant value. Mr. Boswell also has a track record as an executive officer in this industry and has been part of starting and building multiple companies with this oilfield service sector. He also brings a strong financial background to our Board. Mr. Romestrand has operated as an executive and as a successful Chief Executive Officer in the high tech oilfield equipment sector for many years and has successfully built multiple companies while generating very strong returns for his investors. He also brings an international viewpoint to our Board. Mr. Fernandez has significant experience at starting and growing oilfield service companies with a particular emphasis on the Latin American market and specifically in Argentina. His experience at navigating cross border business agreements and relationships is of particular value to our Board. Mr. Krummel has significant financial experience in the industry with previous roles as Chief Financial Officer and Chief Accounting Officer with public companies where he was responsible for all accounting functions, including consolidated financial reporting and SEC filings. Mr. Al-Sati is an investor and restructuring professional with over 12 years of direct experience in private equity, lending transactions and other special situations in almost 20 different jurisdictions in Africa, Europe, Asia and the Americas. Mr. Chan has extensive investment experience, including investment experience in Asia, Latin America, North America and Oceana. His experience in and understanding of emerging markets transactions in an international context should add significant value to our Board. Mr. Yonemoto has significant experience in emerging markets alternative asset management in general, and has particular experience investing in certain of the Company’s target markets. His various roles in emerging markets trading and analytics, as well as his role as an executive officer at an emerging markets investment advisory firm, should make him a valuable member of our Board.

Attendance at Annual Meetings

The Board encourages all directors to attend the annual meetings of stockholders, if practicable.

Board Leadership Structure and Role in Risk Oversight

Our Chief Executive Officer does not serve as the Chairman of our Board. Our Board believes that having an outside director serve as the Chairman helps to ensure that the non-employee directors take an active leadership role on our Board, and that this leadership structure is beneficial to the Company.

In the normal course of its business, the Company is exposed to a variety of risks, including market risks relating to changes in commodity prices, interest rates, technical risks affecting the Company’s resource base, political risks and credit and investment risk. The Board oversees the strategic direction of the Company, and in doing so considers the potential rewards and risks of the Company’s business opportunities and challenges, and monitors the development and management of risks that impact the Company’s strategic goals. The Audit Committee assists the Board in fulfilling its oversight responsibilities by monitoring the effectiveness of the Company’s systems of financial reporting, auditing, internal controls and legal and regulatory compliance. The Nominating Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for our directors and executive officers and corporate governance. The Compensation Committee assists the Board in fulfilling its oversight responsibilities by overseeing the Company’s compensation policies and practices.

Shareholder Communications with the Board

Our Board welcomes communications from our stockholders and other interested parties. Stockholders and any other interested parties may send communications to our Board, any committee of our Board, the Chairman of our Board or to any director in particular, by writing to:

Eco-Stim Energy Solutions, Inc.

2930 W. Sam Houston Pkwy N., Suite 275

Houston, Texas 77043

Attn: General Counsel

Stockholders and any other interested parties should mark the envelope containing each communication as “Stockholder Communication with Directors” and clearly identify the intended recipient(s) of the communication.

Our General Counsel will review each communication received from stockholders and other interested parties and will forward the communications, as expeditiously as reasonably practicable, to the addressees if: (1) the communication complies with the requirements of any applicable policy adopted by our Board relating to the subject matter of the communication and (2) the communication falls within the scope of matters generally considered by our Board.

Director Independence

As required under the NASDAQ Marketplace Rules, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the Board. Our Board considered certain relationships between our directors and us when determining each director’s status as an “independent director” under Rule 5605(a)(2) of the NASDAQ Marketplace Rules. Based upon such definition and SEC regulations, we have determined that Messrs. Bjarte Bruheim, Christopher Krummel, Jogeir Romestrand, John Yonemoto, Ahmad Al-Sati and Lap Wai Chan are “independent” under the standards of the NASDAQ.

There are no family relationships between any of the executive officers and directors.

Compensation of Directors

In October 2013, Mr. Bruheim was granted 75,000 options to purchase shares of FRI’s (a predecessor of the Company) common stock at a price of $6.00 per share, vesting in four equal semi-annual installments over two years. Also, in October 2013, each of Mr. Fernandez, Mr. Hardisty and Mr. Romestrand was granted 10,000 options to purchase shares of FRI’s common stock at a price of $6.00 per share, vesting in four equal semi-annual installments over two years. In January 2014, Mr. Krummel received a similar grant of options to purchase our common stock at a price of $7.00 per share. In connection with the merger by and among Eco-Stim f/k/a Vision Global Solutions, Inc. (“Vision”), FRI Merger Sub, Inc., a newly formed wholly owned Delaware subsidiary of Eco-Stim, and FRI (the “Merger”), options to purchase shares of FRI’s common stock were exchanged for options to purchase the same number of shares of our common stock. As a result, Mr. Fernandez, Mr. Hardisty, Mr. Krummel, and Mr. Romestrand each hold 10,000 options to purchase shares of our common stock and Mr. Bruheim holds 75,000 options to purchase shares of our common stock. We do not anticipate that Mr. Al-Sati, Mr. Yonemoto or Mr. Chan will receive any compensation from us for serving on our Board.

Other than the aforementioned options, our other directors currently do not receive any compensation specifically for their services as a director; however we do reimburse these directors for any travel or other business expenses related to their service as a director.

Board and Committee Meetings

The Board held five meetings during the fiscal year ended December 31, 2014. No director attended fewer than 75% of the meetings of the Board and of the committees of the Board on which that director served.

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominating Committee.

Audit Committee

Mr. Christopher Krummel has served as chairman of the Audit Committee since January 2014, and Messrs. Jogeir Romestrand and Bjarte Bruheim are also current members of the Audit Committee. As required by the rules of the SEC and listing standards of the NASDAQ, the Audit Committee consists solely of independent directors. In addition, our Board has determined that Mr. Krummel qualifies as an “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K.

The Audit Committee oversees, reviews, acts on and reports on various auditing and accounting matters to the Company’s Board, including:

| | ● | overseeing the accounting and financial reporting processes of the Company and audits of the Company’s financial statements; |

| | | |

| | ● | overseeing the quality, integrity and reliability of the financial statements and other financial information the Company provides to any governmental body or the public; |

| | | |

| | ● | overseeing the independent auditors’ qualifications, independence and performance; |

| | | |

| | ● | overseeing the Company’s systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; and |

| | | |

| | ● | providing an open avenue of communication among the independent auditors, financial and senior management, and the Board, always emphasizing that the independent auditors are accountable to the Audit Committee. |

The Company has an Audit Committee Charter defining the committee’s primary duties, which is available on the Company’s website atwww.ecostim-es.com in the “Corporate Governance” subsection in the “Investors” section. The Audit Committee held six meetings during the fiscal year ended December 31, 2014.

Compensation Committee

Mr. Christopher Krummel has served as chairman of the Compensation Committee since March 2015, and Mr. Ahmad Al-Sati is also a current member of the Compensation Committee. Our Board has determined that all members of the Compensation Committee meet the non-employee director definition of Rule 16b-3 promulgated under Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the outside director definition of Section 162(m) of the Internal Revenue Code of 1986, as amended, and the independence standards of the applicable NASDAQ Stock Market Rules.

The Compensation Committee assists our Board in carrying out its responsibilities with respect to (i) employee compensation, benefit plans, and employee stock programs and (ii) matters relating to the compensation of persons serving as senior management and the Chief Executive Officer of the Company. The Compensation Committee determines and approves the total compensation of the Chief Executive Officer and senior management based on its evaluation of the performance the Chief Executive Officer and senior management in light of certain goals and objectives as well as input from the Nominating Committee, and with respect to senior management, the Compensation Committee also considers input from the Chief Executive Officer. The Compensation Committee has broad delegating authority, including the authority to delegate to subcommittees as it deems appropriate, to delegate to one or more executive officers to approve equity compensation awards under established equity compensation plans of the Company to employees and officers of the Company other than those subject to Section 16 of the Exchange Act and to delegate any non-discretionary administrative authority under Company compensation and benefit plans consistent with any limitations specified in the applicable plans.

The Company has a Compensation Committee Charter defining the committee’s primary duties, which is available on the Company’s website atwww.ecostim-es.com in the “Corporate Governance” subsection in the “Investors” section. The Compensation Committee held three meetings during the fiscal year ended December 31, 2014.

Nominating Committee

Mr. Jogeir Romestrand has served as the chairman of the Nominating Committee since October, 2014, and Messrs. Bjarte Bruheim and John Yonemoto are also current members of the Nominating Committee.

The Nominating Committee identifies, evaluates and nominates qualified candidates for appointment or election to the Company’s Board. In identifying, evaluating and recommending director nominees to the Board, the Nominating Committee indentifies persons who possess the integrity, leadership skills and competency required to direct and oversee the Company’s management in the best interests of its shareholders, customers, employees, communities it serves and other affected parties. A candidate must be willing to regularly attend Board meetings and if applicable, committee meetings, to participate in Board development programs, to develop a strong understanding of the Company, its businesses and its requirements, to contribute his or her time and knowledge to the Company and to be prepared to exercise his or her duties with skill and care. While the Board does not have a formal policy on diversity, in selecting nominees, the Nominating Committee seeks to have a Board that represents a diverse range of perspectives and experience relevant to the Company.

The Company has a Nominating Committee Charter defining the committee’s primary duties, which is available on the Company’s website atwww.ecostim-es.com in the “Corporate Governance” subsection in the “Investors” section. The functions of the Nominating Committee, which are discussed in detail in its charter, include (i) developing a pool of potential directorial candidates for consideration in the event of a vacancy on the Board, (ii) screening directorial candidates in accordance with certain guidelines and criteria set forth in its charter and (iii) recommending nominees to the Board. The Nominating Committee held no meetings during the fiscal year ended December 31, 2014.

The Nominating Committee seeks recommendations from our existing directors to identify potential candidates to fill vacancies on our Board. The Nominating Committee will also consider nominee recommendations properly submitted by stockholders in accordance with the procedures outlined in our bylaws, on the same basis as candidates recommended by the Board and other sources. For stockholder nominations of directors for the Annual Meeting, nominations must be made in writing and delivered to the Secretary of the Company at 2930 W. Sam Houston Pkwy N., Suite 275, Houston, Texas 77043. Nominations must be received by the Secretary of the Company no later than the earlier of the close of business on the tenth (10th) day following the day on which such notice of the date of the Annual Meeting was mailed or such public disclosure was made, whichever first occurs, or (b) two (2) days prior to the date of the Annual Meeting.

PROPOSAL TWO: APPROVAL OF THE COMPANY’S 2015 STOCK INCENTIVE PLAN

At the Annual Meeting, the stockholders will be asked to approve the amendment and restatement (the “Amendment and Restatement”) of the Eco-Stim Energy Solutions, Inc. 2014 Stock Incentive Plan (the “Plan”). In connection with the Amendment and Restatement, the Plan will be renamed the Eco-Stim Energy Solutions, Inc. 2015 Stock Incentive Plan. We believe approval of the Amendment and Restatement of the Plan is advisable in order to (i) ensure that we have an adequate number of shares of common stock available in connection with its compensation programs, (ii) ensure that we have the ability to grant incentive stock options that comply with Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), (iii) provide for the grant of awards under the Plan that are designed as “performance-based compensation” pursuant to Section 162(m) of the Code (which, for the avoidance of doubt, shall also require the approval of “Proposal Three—Approval of the Material Terms of the Eco-Stim Energy Solutions, Inc. 2015 Stock Incentive Plan for Purposes of Section 162(m)”) and (iv) make certain other clarifying changes to the Plan.

Background and Purpose of the Proposal

In July 2014, our board of directors (the “Board”) adopted the Plan. The Plan became effective on July 9, 2014. The purpose of the Amendment and Restatement is to (i) increase the number of shares of common stock (the “Common Stock”) that may be issued under the Plan by 500,000 shares, (ii) revise the material terms of the Plan so that awards granted under the Plan that are intended to qualify as “performance-based compensation” under Section 162(m) of the Code will be fully deductible by us and (iii) make certain other clarifying changes to the Plan. The Board unanimously acted on May 14, 2015 to amend and restate the Plan consistent with the preceding sentence. If the Amendment and Restatement is not approved by stockholders, then the Plan will continue in effect in its present form. If the Amendment and Restatement is approved by stockholders, we intend to file, pursuant to the Securities Act of 1933, as amended, a registration statement on Form S-8 to register the additional shares of Common Stock available for issuance under the Plan.

We believe that approval of the Amendment and Restatement will give us the flexibility to make stock-based awards and other awards permitted under the Plan over the next three years in amounts determined appropriate by the Committee (as defined below); however, this timeline is simply an estimate used to determine the number of additional common shares requested under the Amendment and Restatement and future circumstances may require a change to expected equity grant practices. These circumstances include but are not limited to the future price of our Common Stock, award levels and amounts provided by our competitors and our hiring activity over the next few years. The closing market price of our shares of Common Stock as of May 29, 2015 was $7.48 per share, as reported on the NASDAQ.

As of June 1, 2015, the total number of outstanding shares of Common Stock was 6,789,649. Our current dilution (which is the number of shares of Common Stock available for grant under the Plan, divided by the total number of shares of Common Stock outstanding) is approximately 2.8%. If the Amendment and Restatement is approved, the potential dilution from issuances authorized under the Plan will increase to approximately 10.1%. While we are aware of the potential dilutive effect of compensatory equity awards, we also recognize the significant motivational and performance benefits that may be achieved from making such awards.

Consequences of Failing to Approve the Proposal

Failure of our stockholders to approve this proposal will mean that (i) we will continue to grant equity awards under the terms of the Plan, in its current form, until the shares of Common Stock available for issuance thereunder are exhausted, which we estimate will occur in 2015, based on current expected equity grant practices, (ii) we will not have the ability to grant incentive stock options that comply with Section 422 of the Code and (iii) we will not be able to grant awards under the Plan that are fully deductible by us as “performance-based compensation” under Section 162(m) of the Code. If the Amendment and Restatement is not approved by stockholders, the Plan will remain in effect in its current form.

Description of the Eco-Stim Energy Solutions, Inc. 2015 Stock Incentive Plan

A summary description of the material features of the Plan, as amended to reflect the proposed Amendment and Restatement, is set forth below. The following summary does not purport to be a complete description of all the provisions of the Plan and is qualified in its entirety by reference to (i) the Plan, a copy of which is incorporated by reference to Exhibit 4.5 to our Post-Effective Amendment No. 1 to Form S-8 (File No. 333-202182), filed on February 20, 2015 and (ii) the Plan, as modified by the Amendment and Restatement, which is attached asAppendix A to this proxy statement and incorporated by reference in its entirety.

Purpose of the 2015 Stock Incentive Plan

The purpose of the Plan is provide a means through which the Company may attract and retain able persons to serve as senior executives of the Company and to provide a means whereby those individuals upon whom the responsibilities of the successful administration and management of the Company and its affiliates rest, and whose present and potential contributions to the Company and its affiliates are of importance, can acquire and maintain stock ownership or other awards, thereby strengthening their concern for the welfare of the Company and its affiliates and their desire to remain employed by, or continue providing services to, the Company and its affiliates. A further purpose of the Plan is to enhance the profitable growth of the Company and its affiliates. The Company seeks to achieve the Plan’s purpose primarily by providing grants of a variety of awards (collectively referred to as “Awards”), including but not limited to:

| | ● | incentive stock options qualified as such under U.S. federal income tax laws (“Incentive Options”); |

| | | |

| | ● | stock options that do not qualify as incentive stock options (“Nonstatutory Options” and, together with Incentive Options, “Options”); |

| | | |

| | ● | restricted stock awards (“Restricted Stock”); |

| | | |

| | ● | phantom stock (“Phantom Stock”), which may be settled in Common Stock or in cash, as determined by the Committee (as defined below); |

| | | |

| | ● | awards that are subject to or contingent upon certain performance measures (“Performance Awards”); |

| | | |

| | ● | stock appreciation rights (“SARs”), either in connection with an award of Options or independently as a Phantom Stock award; and |

| | | |

| | ● | awards of Common Stock (“Bonus Stock”). |

The Plan, in part, is intended to qualify under the provisions of Section 422 of the Code, which governs Incentive Options. The Plan is not subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended. No awards may be granted under the Plan after 10 years from the date the Plan was approved by the Board. The Plan shall remain in effect until all Awards granted under the Plan have been exercised, satisfied, forfeited or expired.

Administration of the Long Term Incentive Plan

Unless the Board appoints another committee, the Compensation Committee of the Board (the “Committee”) administers the Plan. The Committee shall be comprised solely of two or more directors who are both “nonemployee directors” within the meaning of Rule 16b-3 and “outside directors” within the meaning of Section 162(m). Subject to the terms and conditions of the Plan, the Committee shall have the power from time to time to:

| | ● | determine which Eligible Individuals shall receive an Award; |

| | | |

| | ● | the time or times when such Award shall be made; |

| | | |

| | ● | the type of Award that shall be made; and |

| | | |

| | ● | the number of shares of Common Stock to be subject to, or the value of, an Award. |

The Committee shall have such additional powers as are delegated to it by the other provisions of the Plan. Subject to the express provisions of the Plan, this shall include the power to construe the Plan and the respective agreements executed thereunder, to prescribe, amend, suspend or waive rules and regulations relating to the Plan, to determine the terms, restrictions and provisions of the agreement relating to each Award and to make all other determinations necessary or advisable for administering the Plan. The Board may alter or amend the Plan or any part thereof from time to time; provided that no change in the Plan may be made that would materially impair the rights of a participant with respect to an Award theretofore granted without the consent of the participant, and provided, further, that the Board may not, without the approval of our stockholders, amend the Plan to increase the aggregate maximum number of shares of Common Stock that may be issued under the Plan, increase the aggregate maximum number of shares of Common Stock that may be issued under the Plan through Incentive Stock Options, or change the class of individuals eligible to receive Awards under the Plan.

Shares Subject to the Long Term Incentive Plan

The Amendment and Restatement would increase the number of shares of Common Stock available for Awards under the Plan from the number authorized to be issued under the Plan by 500,000 shares. Accordingly, the maximum aggregate number of shares of Common Stock that may be granted for any and all Awards under the Plan, and the aggregate maximum number of shares of Common Stock that may be issued under the Plan through Incentive Options, may not exceed 1,000,000 shares of Common Stock. In addition, the Plan also includes individual limitations on the amounts of Awards that may be awarded. Specifically, (i) the maximum number of shares of Common Stock that may be subject to Awards denominated in shares of Common Stock granted under the Plan to any one individual during any 12-month period may not exceed 200,000 shares (subject to adjustment from time to time in accordance with the provisions of the Plan), and (ii) the maximum amount of compensation that may be paid under all Performance Awards that are not denominated in shares of Common Stock (including the fair market value of any shares of Common Stock paid in satisfaction of such Performance Awards) granted to any one individual during any 12-month period may not exceed $1,000,000.

As of June 1, 2015, there are (i) 310,000 shares of Common Stock already issued pursuant to Awards, specifically (a) 250,500 shares of Common Stock subject to Awards of Restricted Stock and (b) 59,500 shares of Common Stock subject to Awards of Nonstatutory Options, and (ii) 190,000 shares of Common Stock remaining available for future Awards.

To the extent that an Award lapses or the rights of its holder terminate, any shares of Common Stock subject to such Award shall again be available for the grant of an Award under the Plan. In addition, shares issued under the Plan and forfeited back to the Plan, shares surrendered in payment of the exercise price or purchase price of an Award and shares withheld for payment of applicable employment taxes and/or withholding obligations associated with an Award shall again be available for the grant of an Award under the Plan. The shares of Common Stock issued under the Plan may be, in whole or in part, authorized but unissued Common Stock or Common Stock previously issued and outstanding and reacquired by the Company. As long as the shares of Common Stock remain listed for trading on the NASDAQ, the fair market value of the shares of Common Stock on a given date will be the value equal to the closing price of a share of Common Stock as reported on the NASDAQ on that date (or on the last preceding date on which there was such a closing price).

Persons Who May Participate in the Long Term Incentive Plan

Individuals eligible to receive Awards, or “Eligible Individuals,” under the Plan are employees and consultants that provide services to the Company or one of the Company’s affiliates and members of the Board or members of the board of directors of an affiliate of the Company. Eligible Individuals to whom an Award is granted under the Plan are referred to as “Participants.” As of June 1, 2015, the Company anticipates having approximately six outside directors, five executive officers, and 20 other employees and consultants who will be eligible to participate in the Plan.

Awards under the Long Term Incentive Plan

Stock Options. The Company may grant Options to Eligible Individuals including (i) Incentive Options (only to employees of the Company or one of its subsidiaries) that comply with Section 422 of the Code; and (ii) Nonstatutory Options. With respect to Incentive Options, a Participant must be an employee of the Company or one of its subsidiaries on the date of grant. The exercise price of each Option granted under the Plan shall be determined by the Committee; however, the exercise price for an Option must not be less than the fair market value per share of Common Stock as of the date of grant (or 110% of the fair market value per share of Common Stock in the case of an Incentive Option granted to a Participant that owns shares of Common Stock equal to more than 10% of the total combined voting power or value of all classes of shares of the Company or a subsidiary of the Company). Options may be exercised as the Committee determines, but not later than ten years from the date of grant (or five years from the date of grant in the case of an Incentive Option granted to a Participant that owns shares of Common Stock equal to more than 10% of the total combined voting power or value of all classes of shares of the Company or a subsidiary of the Company). The vested portion of an Option may be exercised, in whole or in part, at any time after becoming exercisable until its expiration or termination. To the extent that the aggregate fair market value (determined as of the date of grant) of shares of Common Stock with respect to which Incentive Options granted under the Plan are exercisable by a Participant for the first time during any calendar year exceeds $100,000, the Incentive Option shall be treated as a Nonstatutory Option.

An Option agreement may provide, on such terms and conditions as the Committee in its sole discretion may prescribe, for the grant of an SAR in connection with the grant of an Option and, in such case, the exercise of the SAR shall result in the surrender of the right to purchase a number of shares under the Option equal to the number of shares with respect to which the SAR is exercised (and vice versa). In the case of any SAR that is granted in connection with an Incentive Option, such right shall be exercisable only when the fair market value of the Common Stock exceeds the exercise price specified therefor in the Option or the portion thereof to be surrendered.

Except as permitted under the Plan in connection with a recapitalization or other Corporate Change (as defined in the Plan), Options and SARs may not be amended without the approval of the stockholders of the Company so as to (i) reduce the option price of any outstanding Options or SARs, (ii) grant a new Option, SAR or other Award in substitution for, or upon the cancellation of, any previously granted Option or SAR that has the effect of reducing the exercise price thereof, (iii) exchange any Option or SAR for other consideration when the exercise price per share of Common Stock under such Option or SAR exceeds the fair market value of the underlying shares or (iv) take any other action that would be considered a “repricing” of an Option or SAR under the listing standards of the NASDAQ. Notwithstanding the foregoing, the Committee shall have the authority, without the approval of the stockholders of the Company, to amend any outstanding Option or SAR to increase the per share exercise price or replace any Option or SAR with the grant of Options or SARs having a per share exercise price that is equal to or greater than the per share exercise price of the original Award.

Restricted Stock Awards. A Restricted Stock Award is a grant of shares of Common Stock subject to restrictions, terms and conditions imposed by the Committee in its discretion. Unless the Committee determines otherwise, upon the issuance of Restricted Stock, a Participant shall have all of the rights of a stockholder with respect to the shares of Common Stock represented by the Restricted Stock, including the right to vote such shares of Common Stock and to receive all dividends or other distributions made with respect to the shares of Common Stock. Dividends shall be paid no later than the end of the calendar year in which the dividends are paid to stockholders of such class of shares or, if later, the fifteenth day of the third month following the date the dividends are paid to stockholders of such class of shares.

Phantom Stock. A Phantom Stock Award represents the right to receive shares of Common Stock (or the fair market value thereof), or rights to receive an amount equal to any appreciation or increase in the fair market value of Common Stock over a specified period of time, which vest over a period of time as established by the Committee. Each Award of Phantom Stock will contain restrictions, terms and conditions imposed by the Committee in its discretion. Awards of Phantom Stock may be paid in shares of Common Stock, cash or a combination thereof. A Phantom Stock Award may include, without limitation, an SAR that is granted independently of an Option; provided, however, that the exercise price per share of Common Stock subject to the SAR shall be determined by the Committee but such exercise price shall not be less than the fair market value of a share of Common Stock on the date such SAR is granted.

Performance Awards. Performance Awards may be granted to Eligible Individuals on terms and conditions determined by the Committee and set forth in an Award agreement. A Performance Award shall be awarded to a participant contingent upon one or more performance measures established by the Committee. Please see “Proposal Three—Approval of the Material Terms of the Eco-Stim Energy Solutions, Inc. 2015 Stock Incentive Plan for Purposes of Section 162(m)” for additional information regarding the potential performance measures for Performance Awards intended to constitute “performance-based compensation” within the meaning of Section 162(m). The Committee, in its sole discretion, may provide for an adjustable Performance Award value based upon the level of achievement of the performance measure(s). Following the end of the performance period, the holder of a Performance Award shall be entitled to receive payment of an amount not exceeding the number of shares of Common Stock subject to, or the maximum value of, the Performance Award, based on the achievement of the performance measure(s) for such performance period, as determined and certified in writing by the Committee. The Committee, in its sole discretion, may provide for a reduction in the value of a Participant’s Performance Award during the performance period. Payment of a Performance Award may be made in cash, Common Stock or a combination thereof, as determined by the Committee.

Bonus Stock. The Committee may grant an Award of unrestricted shares of Common Stock to an Eligible Individual on such terms and conditions as the Committee may determine at the time of grant. Awards of Common Stock may be made as additional compensation for services rendered by the Eligible Individual or may be in lieu of cash or other compensation to which the Eligible Individual is entitled from the Company.

Other Provisions

Transferability of Awards. The Plan generally restricts the transfer of Awards, except for (1) transfer by will or the laws of descent and distribution, (2) pursuant to a qualified domestic relations order or (3) with the consent of the Committee. Incentive Options will not, under any circumstances, be transferable other than by will or the laws of descent and distribution.

Changes in Capitalization. In the event of a subdivision or consolidation of Common Stock, the number of shares of Common Stock with respect to which an Award theretofore granted may thereafter be exercised or satisfied, as applicable, shall (i) in the event of an increase in the number of outstanding shares, be proportionately increased and the purchase price per share, if any, shall be proportionately reduced and (ii) in the event of a reduction in the number of outstanding shares, be proportionately reduced, and the purchase price per share, if any, shall be proportionately increased.

Recapitalizations and Corporate Changes. If the Company recapitalizes, reclassifies its capital stock, or another change or event occurs that constitutes an “equity restructuring” pursuant to Accounting Standards Codification Topic 718 or any successor accounting standard, (1) the Committee shall equitably adjust the number and class of shares of Common Stock (or other securities or property) covered by each outstanding Award and the terms and conditions, including the exercise price and performance criteria (if any), of such Award to equitably reflect such recapitalization and shall adjust the number and class of shares of Common Stock (or other securities or property) with respect to which Awards may be granted after such recapitalization and (2) the Committee shall make a corresponding and proportionate adjustment with respect to the maximum number of shares of Common Stock (or other securities) that may be delivered with respect to Awards under the Plan, the individual Award limitations under the Plan and the class of shares of Common Stock (or other securities) available for grant under the Plan. Upon a Corporate Change (as defined in the Plan), the Committee, acting in its sole discretion without the consent or approval of any Participant, shall effect one or more of the following alternatives in an equitable and appropriate manner to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan, which alternatives may vary among individual Participants and which may vary among Options or SARs held by any individual Participant: (1) accelerate the time at which Options or SARs then outstanding may be exercised, (2) require the mandatory surrender to the Company by all or selected Participants of some or all of the outstanding Options or SARs held by such Participants, in which event the Committee shall thereupon cancel such Awards and the Company shall pay (or cause to be paid) to each Participant an amount of cash per share equal to the excess, if any, of the Change of Control Value (as defined in the Plan) of the shares subject to such Awards over the exercise price(s) under such Awards for such shares, or (3) make such adjustments to Options or SARs then outstanding as the Committee deems appropriate to reflect such Corporate Change.

Other Changes in the Common Stock. In the event of changes in the outstanding Common Stock by reason of recapitalizations, reorganizations, mergers, consolidations, combinations, split-ups, split-offs, spin-offs, exchanges, or other relevant changes in capitalization or distributions (other than ordinary dividends) to the holders of Common Stock occurring after the date of the grant of any Award and not otherwise provided for by the Plan, such Award and any agreement evidencing such Award shall be subject to adjustment by the Committee at its sole discretion.

Termination and Amendment. The Board may terminate the Plan at any time and from time to time alter or amend the Plan; provided that no such change may be made that would materially impair the rights of a Participant with respect to an Award theretofore granted without the consent of such Participant; provided, further, that the Board may not, without approval of the stockholders of the Company, amend the Plan to increase the aggregate maximum number of shares of Common Stock that may be issued under the Plan, increase the aggregate maximum number of shares of Common Stock that may be issued under the Plan through Incentive Options or change the class of individuals eligible to receive Awards under the Plan.

Clawback. Any portion of the payments and benefits provided under the Plan or the sale of shares of Common Stock shall be subject to a clawback or other recovery by the Company to the extent necessary to comply with applicable law including, without limitation, the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 or any Securities and Exchange Commission rule.