UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under §240.14a-12 |

Eco-Stim Energy Solutions, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| [X] | No fee required. |

| | | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per share price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

ECO-STIM ENERGY SOLUTIONS, INC.

2930 W. Sam Houston Pkwy N., Suite 275,

Houston, Texas 77043

, 2018

To the Stockholders of Eco-Stim Energy Solutions, Inc. (the “Company”):

Notice is hereby given that the Eco-Stim Energy Solutions, Inc. 2018 annual meeting of stockholders (the “Annual Meeting”) will be held on June ___, 2018 at 9:00 AM Central Time, at Vinson & Elkins L.L.P., 1001 Fannin St., Suite 2500, Houston, Texas 77002. The Annual Meeting is being held for the following purposes:

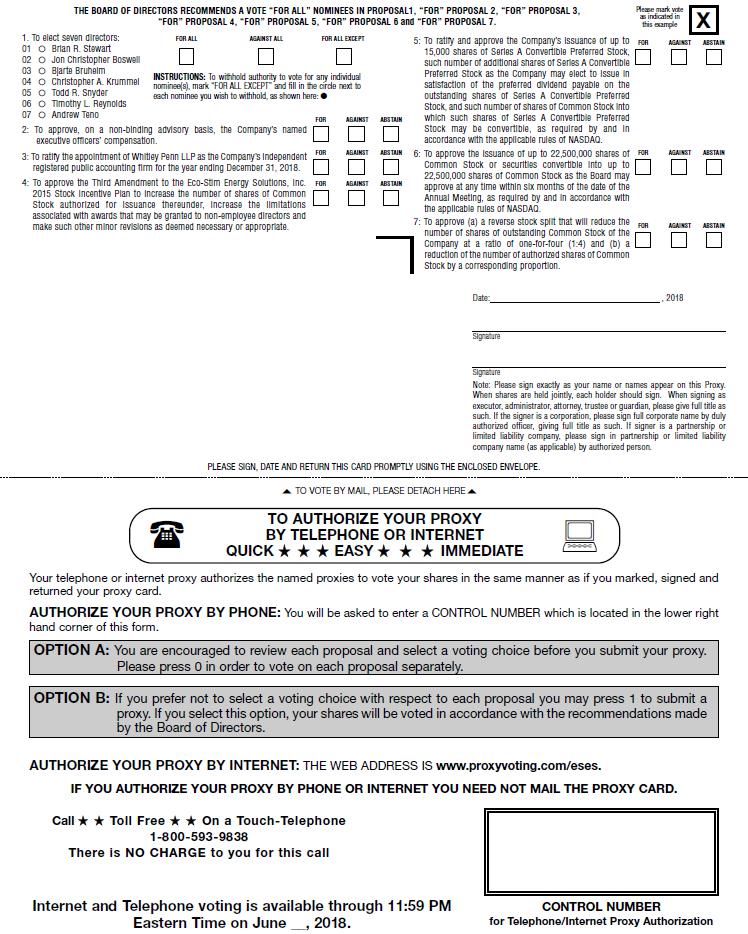

| | 1. | To elect the seven (7) director nominees named in this Proxy Statement to serve until the next annual meeting of stockholders and the election and qualification of their respective successors; |

| | | |

| | 2. | To approve, on a non-binding advisory basis, the Company’s named executive officers’ compensation; |

| | | |

| | 3. | To ratify the appointment of Whitley Penn LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2018; |

| | | |

| | 4. | To approve the Third Amendment (the “Third Amendment”) to the Eco-Stim Energy Solutions, Inc. 2015 Stock Incentive Plan (as amended from time to time, the “Plan”) to: (a) increase the number of shares of Common Stock authorized for issuance thereunder; (b) increase the limitations associated with awards that may be granted to non-employee directors during any single calendar year from $500,000 (measured in terms of aggregate grant date fair value), or $600,000 in the first year an individual becomes a non-employee director, to $1.2 million with respect to any non-employee director that serves as the Chairman of the Board during the applicable year; and (c) make such other minor revisions as deemed necessary or appropriate; |

| | | |

| | 5. | To ratify and approve the Company’s issuance of (a) up to 15,000 shares of Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred”), pursuant to the Securities Purchase Agreement entered into by and among the Company and four private investment funds under management by Fir Tree Partners on March 29, 2018, (b) such number of additional shares of Series A Preferred as the Company may elect to issue in satisfaction of the preferred dividend payable on the outstanding shares of Series A Preferred in accordance with the terms and conditions of the Certificate of Designation of Preferences, Rights and Limitations of the Series A Convertible Preferred Stock of the Company filed with the Nevada Secretary of State on March 29, 2018 (the “PIK Shares”), and (c) such number of shares of Common Stock into which such shares of Series A Preferred (including any PIK Shares) may from time to time be convertible pursuant to the Certificate of Designation, in each case, as required by and in accordance with the applicable rules of NASDAQ, which proposal we collectively refer to as the “Series A Preferred Issuance Proposal”; |

| | | |

| | 6. | To approve the issuance of up to 22,500,000 shares of Common Stock or securities convertible into up to 22,500,000 shares of Common Stock as the Board may approve at any time, and from time to time, within six months of the date of the Annual Meeting, as required by and in accordance with the applicable rules of NASDAQ (the “Future Share Issuance Proposal”); |

| | | |

| | 7. | To approve (a) a reverse stock split that will reduce the number of shares of outstanding Common Stock of the Company at a ratio of one-for-four (1:4) (the “Reverse Stock Split Proposal”) to be effected at the discretion of the Board (with the Board reserving the right not to effect the reverse stock split) and (b) a reduction of the number of authorized shares of Common Stock by a corresponding proportion; and |

| | | |

| | 8. | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

These proposals are described in the accompanying proxy materials. You will be able to vote at the Annual Meeting only if you were a stockholder of record at the close of business on May 9, 2018, the Record Date for the Annual Meeting.

Your vote is very important. We would like you to attend the Annual Meeting. However, whether or not you plan to attend the Annual Meeting, it is important for your shares to be represented at the Annual Meeting. We urge you to promptly vote by Internet, by telephone, or by submitting your marked, signed and dated proxy card. You will retain the right to revoke your proxy at any time before the vote at the Annual Meeting or to vote personally if you attend the Annual Meeting. Voting by Internet, by telephone or by submitting a proxy card will not prevent you from attending the Annual Meeting and voting in person. Please note, however, that if you hold your shares through a broker or other nominee and you wish to vote in person at the Annual Meeting, you must obtain from your broker or other nominee a proxy issued in your name.

Beginning on , 2018, we intend to commence mailing this Proxy Statement, the Notice of 2018 Annual Meeting of Stockholders, the accompanying proxy card and our Annual Report on Form 10-K for the year ended December 31, 2017 to all stockholders entitled to notice and to vote at the Annual Meeting.

| | By Order of the Board of Directors, |

| | |

| | /s/ Jon Christopher Boswell |

| | Jon Christopher Boswell |

| | President and Chief Executive Officer |

| IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE , 2018 |

| |

| This Notice of Annual Meeting, a copy of this Proxy Statement, the form of proxy and our Annual Report on Form 10-K for the year ended December 31, 2017, are available on our website free of charge atwww.ecostim-es.com in the “SEC Filings” subsection of the “Investors” section. |

YOUR VOTE IS IMPORTANT

Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

TABLE OF CONTENTS

ECO-STIM ENERGY SOLUTIONS, INC.

2930 W. Sam Houston Pkwy N., Suite 275,

Houston, Texas 77043

PROXY STATEMENT

2018 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

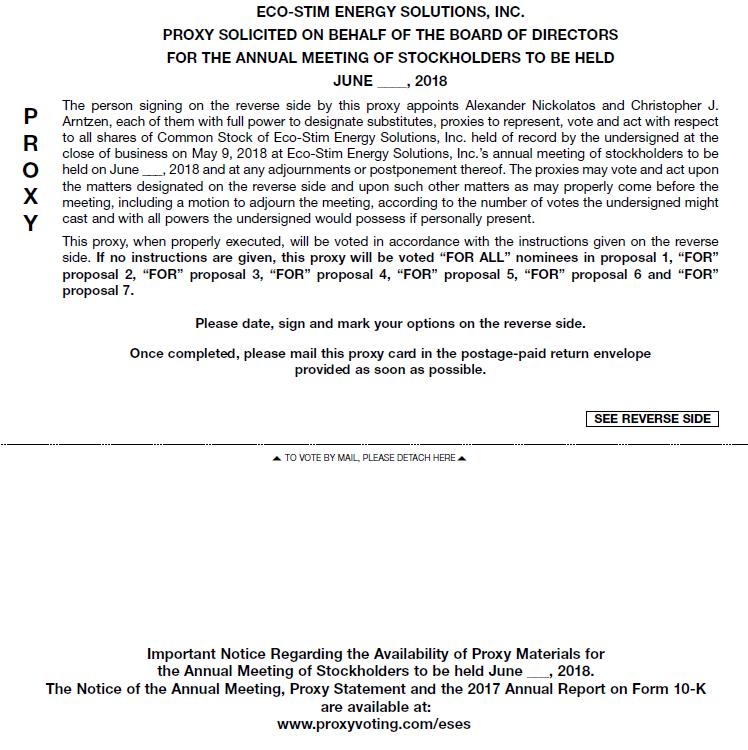

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Eco-Stim Energy Solutions, Inc. for use at the Annual Meeting. In this Proxy Statement, references to “EcoStim,” “Eco-Stim,” the “Company,” “we,” “us,” “our” and similar expressions refer to Eco-Stim Energy Solutions, Inc., unless the context of a particular reference provides otherwise. The Board requests your proxy for the Annual Meeting that will be held on June ___, 2018 at 9:00 AM Central Time, at Vinson & Elkins L.L.P., 1001 Fannin St., Suite 2500, Houston, Texas 77002. By granting a proxy, you authorize the persons named in the proxy to represent you and vote your shares at the Annual Meeting or any adjournment or postponement thereof.

If you are a record holder and you attend the Annual Meeting, you may vote in person. If you are not present at the Annual Meeting, your shares may be voted only by a person to whom you have given a proper proxy.

Note that if you hold your shares through a broker or other nominee, brokers are not permitted to vote your shares for non-discretionary matters, which include: (i) the election of directors; (ii) the advisory vote on the Company’s named executive officers’ compensation; (iii) the approval of the Third Amendment to the Plan; (iv) the approval of the Series A Preferred Issuance Proposal, (v) the approval of the Future Share Issuance Proposal; and (vi) the approval of the Reverse Stock Split Proposal, without your instructions as to how to vote. The only discretionary matter to be voted on is the ratification of the appointment of Whitley Penn LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2018.

Delivery of Proxy Materials

Mailing Date. We intend to commence mailing this Proxy Statement, the Notice of 2018 Annual Meeting of Stockholders (the “Notice of Annual Meeting”), the accompanying proxy card, and our Annual Report on Form 10-K for the year ended December 31, 2017 to all stockholders entitled to vote at the Annual Meeting beginning on , 2018.

Stockholders Sharing an Address. We may send a single set of proxy materials and other stockholder communications to any household at which two or more stockholders reside unless we have received contrary instructions from those stockholders. This process is called “householding.” This reduces duplicate mailings and saves printing and postage costs as well as natural resources. The proxy materials and other stockholder communications may be householded based on your prior express or implied consent. If you wish to receive a separate copy of our proxy materials for each stockholder sharing your address in the future, please contact: Eco-Stim Energy Solutions, Inc., 2930 W. Sam Houston Pkwy N., Suite 275, Houston, Texas 77043, Attn: Secretary or by calling 281-531-7200, and we will promptly deliver to you the requested material. You may also contact us in the same manner if you received multiple copies of the proxy materials and would prefer to receive a single copy in the future.

If your shares are held in “street name” (that is, in the name of a bank, broker or other holder of record), you may have consented to reduce the number of copies of materials delivered to your address. In the event you wish to revoke a “householding” consent you previously provided to a broker, you must contact that broker to revoke your consent. If your household is receiving multiple copies of the proxy materials and you wish to request delivery of a single copy, you should contact your broker directly.

Internet Availability of Proxy Materials. The Notice of Annual Meeting, the Proxy Statement, the form of proxy and the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 filed with the Securities and Exchange Commission (the “SEC”) on March 19, 2018, are available free of charge atwww.ecostim-es.com in the “SEC Filings” subsection under the “Investors” section.

Quorum and Voting

Voting Stock. The Company’s Common Stock, par value $0.001 per share (“Common Stock”), and Series A Convertible Preferred Stock, par value $0.001 per share (“Series A Preferred”), are the only outstanding classes of the Company’s securities that entitle holders to vote at meetings of the Company’s stockholders. Each share of Common Stock outstanding on the record date entitles the holder to one vote at the Annual Meeting. Each share of Series A Preferred outstanding on the record date entitles the holder to 869.5652 votes at the Annual Meeting.

Record Date. The record date for stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on May 9, 2018 (the “Record Date”). As of the Record Date, 74,873,477 shares of the Company’s Common Stock and 10,000 shares of the Company’s Series A Preferred were outstanding and entitled to be voted at the Annual Meeting.

Quorum. A quorum of stockholders is necessary to have a valid meeting of stockholders. A majority of the shares of Common Stock and Series A Preferred entitled to vote, counted together as a single class and on an as-converted to Common Stock basis, represented at the commencement of the meeting in person or by proxy, is a quorum at a stockholders’ meeting, unless or except to the extent that the presence of a larger number may be required by law. If a quorum is not present, the Annual Meeting may be postponed from time to time by the vote of a majority of the shares of Common Stock and Series A Preferred, voting together as a single class and on an as-converted to Common Stock basis, the holders of which are either present in person or represented by proxy.

Stockholder List. In accordance with the Company’s bylaws, the Company will maintain at its corporate offices in Houston, Texas and at the place of the Annual Meeting a list of the stockholders entitled to vote at the Annual Meeting. The list will be open to the inspection of any stockholder, for purposes germane to the Annual Meeting, during normal business hours for 10 business days before the Annual Meeting. The list will also to be available throughout the Annual Meeting for inspection by any stockholder present at the meeting.

Vote Required. Only stockholders of record at the close of business on May 9, 2018 have the right to vote at the Annual Meeting. The affirmative vote of a majority of the shares of Common Stock and Series A Preferred entitled to vote and then present in person or represented by proxy at the Annual Meeting with respect to the subject proposal, voting together as a single class and on as-converted to Common Stock basis, is required to approve each of Proposal One—Election of Directors; Proposal Two—Non-Binding Advisory Vote to Approve the Company’s Named Executive Officers’ Compensation; Proposal Three—Ratification of Selection of Independent Registered Public Accounting Firm; Proposal Four—Approval of the Third Amendment to the Plan; and Proposal Six—Approval of the Future Share Issuance Proposal. The affirmative vote by a majority of the shares of Common Stock entitled to vote and then present in person or represented by proxy at the Annual Meeting is required to approve Proposal Five—Approval of the Series A Preferred Issuance Proposal. The affirmative vote by a majority of the shares of Common Stock and Series A Preferred entitled to vote (regardless of whether present) at the Annual Meeting, voting together as a single class and on an as-converted to Common Stock basis, is required to approve Proposal Seven—Approval of the Reverse Stock Split Proposal. For the avoidance of doubt, pursuant to NASDAQ Listing Rule 5635(d), the shares of Series A Preferred (or shares of Common Stock issued upon conversion thereof, if any) are not entitled to vote on Proposal Five—Approval of the Series A Preferred Issuance Proposal.

The Fir Tree Partners (together with its affiliated funds, “Fir Tree”) currently holds a majority of the voting power entitled to vote at the Annual Meeting. As of the Record Date, Fir Tree held approximately 70.3% of the voting power entitled to vote at the Annual Meeting (consisting of 66.8% of the Common Stock and 100% of the Series A Preferred (which entitles the holder thereof to 8,695,652 votes at the Annual Meeting) outstanding and entitled to vote at the Annual Meeting). As of the Record Date, the directors and executive officers of the Company controlled approximately 2.1% of the voting power entitled to vote at the Annual Meeting.

Cumulative voting is not permitted.

Broker Non-votes and Abstentions. Brokers who hold shares in street name for customers are required to vote shares in accordance with instructions received from the beneficial owners. Applicable rules restrict when brokers who are record holders of shares may exercise discretionary authority to vote those shares in the absence of instructions from beneficial owners. Brokers are not permitted to vote on non-discretionary items such as director election, executive compensation and other significant matters absent instructions from the beneficial owner. As a result, if you do not vote your proxy and your shares are held in street name, your brokerage firm may either vote your shares on discretionary matters, such as the ratification of the appointment of our independent registered public accounting firm (Proposal Three), or leave your shares unvoted. On non-discretionary matters, if the brokerage firm has not received voting instructions from you, the brokerage firm cannot vote your shares on that proposal, which is considered a “broker non-vote.” Although any broker non-vote would be counted as present at the Annual Meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

If you are a street name stockholder and you do not give voting instructions to the holder of record (i.e., your broker or bank), the holder of record will not be permitted to vote your shares with respect to Proposal One—Election of Directors; Proposal Two—Non-Binding Advisory Vote to Approve the Company’s Named Executive Officers’ Compensation; Proposal Four—Approval of the Third Amendment to the Plan; Proposal Five—Approval of the Series A Preferred Issuance Proposal; Proposal Six—Approval of the Future Share Issuance Proposal; or Proposal Seven—Approval of the Reverse Stock Split Proposal, and your shares will be considered “broker non-votes” with respect to these proposals. Although any broker non-vote would be counted as present at the Annual Meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to each of Proposals One, Two, Four, Five and Six. For Proposal Seven, any broker non-vote will have the effect of a vote against the proposal. If you are a street name stockholder, and you do not give voting instructions, the record holder will nevertheless be entitled to vote your shares with respect to Proposal Three—Ratification of Selection of Independent Registered Public Accounting Firm.

Abstentions occur when stockholders are present at the Annual Meeting but fail to vote or voluntarily withhold their vote for any of the matters upon which the stockholders are voting. Abstentions will be included for purposes of determining whether a quorum is present at the Annual Meeting and will be treated as votes against the proposals.

Default Voting. A proxy that is properly completed and returned will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and return a proxy, but do not indicate any contrary voting instructions, your shares will be voted in accordance with the Board’s recommendations, which are as follows:

| | ● | FOR ALL the election of the seven persons named in this Proxy Statement as the Board’s nominees for election of directors; |

| | | |

| | ● | FOR the approval, on an advisory basis, of the Company’s named executive officers’ compensation; |

| | | |

| | ● | FOR the ratification of the selection of Whitley Penn LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018; |

| | | |

| | ● | FOR the approval of the Third Amendment to the Plan to (i) increase the number of shares of Common Stock authorized for issuance thereunder; (ii) increase the limitations associated with awards that may be granted to non-employee directors during any single calendar year from $500,000 (measured in terms of aggregate grant date fair value), or $600,000 in the first year an individual becomes a non-employee director, to $1.2 million with respect to any non-employee director that serves as the Chairman of the Board during the applicable year; and (iii) make such other minor revisions as deemed necessary or appropriate |

| | | |

| | ● | FOR the approval of the Series A Preferred Issuance Proposal; |

| | | |

| | ● | FOR the approval of the Future Share Issuance Proposal; and |

| | | |

| | ● | FOR the approval of the Reverse Stock Split Proposal. |

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted at the discretion of the holders of the proxy. As of the date hereof, the Board is not aware of any matters, other than those previously stated herein, to be presented for consideration at the Annual Meeting.

Voting Procedures. You may vote your shares or submit a proxy to have your shares voted by one of the following methods:

| | ● | By Internet. You may submit a proxy electronically via the Internet by following the instructions provided on the proxy card, if you are a registered holder, or on the voter instruction form (“VIF”), if you are a beneficial holder. If you are a registered holder, internet voting facilities will close and no longer be available on the date and time specified on the Notice of Annual Meeting. If you are a beneficial holder, you should follow the instructions on the VIF to understand the voting timing requirements. |

| | | |

| | ● | By Telephone. You may submit a proxy by telephone using the toll-free number listed on the proxy card, if you are a registered holder, or on the VIF, if you are a beneficial holder. Please have the proxy card or VIF in hand when you call. If you are a registered holder, telephone voting facilities will close and no longer be available on the date and time specified on the Notice of Annual Meeting. If you are a beneficial holder, you should follow the instructions on the VIF to understand the voting timing requirements. |

| | | |

| | ● | By Mail. If you are a registered holder, you may submit a proxy by signing, dating and returning your proxy card in the provided pre-addressed envelope according to the enclosed instructions. We encourage you to sign and return the proxy or voter instruction card even if you plan to attend the meeting. In this way, your shares will be voted even if you are unable to attend the meeting. |

| | | |

| | ● | In Person. If you are a registered holder and plan to attend the Annual Meeting and vote in person, we will provide you with a ballot at the meeting. You may vote in person at the Annual Meeting by completing a ballot; however, attending the meeting without completing a ballot will not count as a vote. If your shares are held in the street name and you attend the Annual Meeting, you may only vote if you have obtained a legal proxy from the holder of record (i.e., your broker or bank). |

If your shares are held in street name, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Internet and/or telephone voting will also be offered to stockholders owning shares through most banks and brokers.

Revoking Your Proxy. If you are a registered holder, you may revoke your proxy in writing at any time before it is exercised at the Annual Meeting by: (i) delivering to the Secretary of the Company, at Eco-Stim Energy Solutions, Inc., 2930 W. Sam Houston Pkwy N., Suite 275, Houston, Texas 77043, a written notice of the revocation; (ii) signing, dating and returning a proxy bearing a later date; (iii) timely submitting a later dated proxy with new voting instructions using the Internet or telephone voting system; or (iv) attending the Annual Meeting and voting your shares in person. Your attendance at the Annual Meeting will not revoke your proxy unless you give written notice of revocation to the Secretary of the Company before your proxy is exercised or unless you vote your shares in person at the Annual Meeting before your proxy is exercised. If your shares are held in street name, you should follow the instructions provided by your bank or broker to revoke your shares.

Solicitation Expenses. We will bear all costs incurred in the solicitation of proxies, including the preparation, printing and mailing of the Notice of Annual Meeting and Proxy Statement and the related materials. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally or by telephone, e-mail, facsimile or other means, without additional compensation, but such directors, officers and employees may be reimbursed for their reasonable expenses in forwarding solicitation material. We have also retained the firm of Morrow Sodali LLC, 470 West Ave., Stamford, Connecticut 06902, to assist in the solicitation of proxies for a fee estimated at $5,500 plus expenses. In addition, the Company may request brokers, custodians, nominees and fiduciaries to forward proxy materials to stockholders of the Company and will reimburse any reasonable expenses incurred by them.

PROPOSAL ONE: ELECTION OF DIRECTORS

Based on the recommendations from its Nominating and Governance Committee, the Board has nominated the following seven (7) nominees for election as directors of the Company at the Annual Meeting:

Brian R. Stewart

Jon Christopher Boswell

Bjarte Bruheim

Christopher A. Krummel

Todd R. Snyder

Timothy L. Reynolds

Andrew Teno

If elected, they will each serve as a director until either they are re-elected at the Company’s next annual meeting or their successors are elected and qualified or until their earlier death, resignation or removal.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the election of all the director nominees, all of whom currently serve as directors. In the event the nominees are unable or decline to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board to fill the vacancy. We are not aware that any nominee will be unable or will decline to serve as a director. In the event additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as to assure the election of the nominees listed above.

Information Concerning the Nominees and Incumbent Directors

Biographical information of each of the above-listed nominees is contained under “Directors and Executive Officers” below. Information as to the stock ownership of each of our directors and all of our current directors and executive officers as a group is set forth below under “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

Vote Required and Board of Directors’ Recommendation

The nominees receiving the votes of the majority of the shares of Common Stock and Series A Preferred entitled to vote and then present in person or represented by proxy at the Annual Meeting, voting together as a single class and on an as-converted to Common Stock basis, will be elected as directors.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF THE SEVEN NOMINEES LISTED ABOVE.

DIRECTORS AND EXECUTIVE OFFICERS

Set forth below is certain information, as of the date of this Proxy Statement, regarding the Company’s directors, nominees and executive officers:

| Name | | Age | | Position |

| Brian R. Stewart | | 62 | | Chairman |

| Jon Christopher Boswell | | 57 | | Director, President and Chief Executive Officer |

| Barry B. Ekstrand | | 60 | | Chief Operating Officer |

| Carlos A. Fernandez | | 61 | | Executive Vice President-Corporate Business Development and General Manager-Latin America |

| Alexander Nickolatos | | 40 | | Chief Financial Officer and Assistant Secretary |

| Bjarte Bruheim | | 62 | | Director |

| Christopher A. Krummel | | 50 | | Director |

| Timothy L. Reynolds | | 39 | | Director |

| Todd R. Snyder | | 55 | | Director |

| Andrew Teno | | 33 | | Director |

Brian R. Stewart. Mr. Stewart was designated by Fir Tree to serve on our Board in October 2017 pursuant to the Amended and Restated Stockholder Rights Agreement dated as of March 3, 2017, by and among the Company and the parties named therein, as amended (the “A&R Stockholder Rights Agreement”). Mr. Stewart was appointed as Chairman of our Board in December 2017. Mr. Stewart retired from Devon Energy Corporation (“Devon”) in June 2012 after 35 years of service. During a portion of his tenure, he served as Devon’s Chief Engineer responsible for the development and integration of company-wide best practices for horizontal drilling, frac design, and well control. During his last five years at Devon, Mr. Stewart served as the Vice President of Well Engineering for the Offshore Division. Beginning in June 2012 following his retirement from Devon, Mr. Stewart served as President and Chief Executive Officer of U.S. Well Services (“USWS”), a provider of fracturing services in the Appalachian Basin (Marcellus and Utica Shales). Mr. Stewart retired from the day to day operations of USWS on December 31, 2015 but remained on USWS’s Board of Directors until it was recapitalized in February 2017. Mr. Stewart received a BS degree in Petroleum Engineering from Louisiana State University and a MS degree in Engineering Management from the University of Southwestern Louisiana (now UL-Lafayette).

Jon Christopher Boswell. Mr. Boswell has served as President and Chief Executive Officer and a Director of our Company and its predecessors, FracRock International Inc. (“FRI”) and FRIBVI, since December 2011. Prior to FRI, from 2009 to 2011, Mr. Boswell served as Chief Financial Officer for NEOS GeoSolutions, a Silicon Valley backed oilfield technology company (“NEOS”). Prior to NEOS, from August 2003 to January 2009, he served as Chief Financial Officer for Particle Drilling Technologies, an oilfield services and technology company (“Particle”). Prior to Particle, he served as Senior Vice President and Chief Financial Officer of Petroleum Geo-Services ASA (“PGS”) from December 1995 until October 2002. Mr. Boswell began his career at Arthur Andersen & Co. and later served in management positions with PriceWaterhouse, LLP in Houston, Texas. Mr. Boswell is a 1985 graduate of the University of Texas at Austin.

Barry B. Ekstrand. Mr. Ekstrand joined our Company in March 2017, and has served as Senior Vice President of Operations – North America from March 2017 through July 2017 and as Chief Operating Officer since August 2017. Prior to joining our Company and since January 2016, Mr. Ekstrand served as an Executive-in-Residence at Republic Chemical Technologies (“RCT”), a portfolio company of the CSL Energy Fund, focusing on the application of chemical technologies and services in the energy industry. Mr. Ekstrand served as a freelance consultant in the energy services industry from October 2015 to January 2016. From May 2015 to October 2015, Mr. Ekstrand served as President of the Chemical Services Division of Chem Rock Technologies, a supplier of chemical products and services to the oil and gas industry, including additives and frac chemical for well fracturing and coiled tubing fluid. From October 2014 to May 2015, Mr. Ekstrand worked as a freelance consultant in the energy services industry. From May 2012 to October 2014, Mr. Ekstrand served first as Vice President – Coiled Tubing, and then as Sr. Vice President, Completion Services, for Key Energy Services, a company providing an array of onshore energy production services and solutions (“Key Energy”). Prior to Key Energy, from 2010 to 2012 Mr. Ekstrand served as President of CRS Proppants, a provider of resin coated sands for oil and gas well fracturing applications. He also served in various positions with Weatherford International from 2002 to 2010, including as its Global Vice President, Reservoir Stimulation & Pressure Pumping Business Unit. Mr. Ekstrand began his career with Halliburton Energy Services, where he served in various positions from 1980 to 2002, including as Global Strategic Business Manager and Country Manager. Mr. Ekstrand received an MBA from California State University, Bakersfield (1993), a BS in Chemical Engineering from California State Polytechnic University, Pomona (1980), and is named as an inventor of eight U.S. patents.

Carlos A. Fernandez. Mr. Fernandez has served as our Executive Vice President-Corporate Business Development and General Manager-Latin America since July 2014. He served as a member of the Board of our Company and its predecessors from December 2011 to March 2017. Mr. Fernandez has over 35 years of experience in the oil and gas industry and over 30 years of experience in various executive management and sales positions. From January 2010 to present, he has worked as General Manager – Latin America for NEOS. From April 2006 to November 2009, he served as Senior Vice President Business Development for 3D-Geo. While at 3D-Geo, Mr. Fernandez led the formation of the Kaleidoscope seismic imaging project, a partnership among Repsol, 3D-Geo, Stanford University, IBM, and the Barcelona Supercomputing Center. From 1996 to March 2006, he served as General Manager – Latin America for Paradigm Geophysical. From 1990 to 1995, Mr. Fernandez served as President of Petroleum Information Argentina. From 1979 through 1990, he held various leadership positions with seismic technology and computing companies such as Silicon Graphics. Mr. Fernandez received his degree in geophysics with honors from the National University of La Plata in Argentina.

Alexander Nickolatos. Mr. Nickolatos has served as our Chief Financial Officer since December 2013 and was appointed in July 2014 as our Assistant Secretary. Prior to being appointed our Chief Financial Officer, Mr. Nickolatos served as Controller of the Company’s predecessors, FRI and FRIBVI, since July 2012. From March 2006 until June 2012, Mr. Nickolatos served as the Director of Financial Planning and Analysis at NEOS. During his time at NEOS, he also served as Controller and Treasurer, and oversaw oil and gas accounting and finance operations in over seven countries, including Argentina. Prior to joining NEOS, he worked for Arthur Andersen and PricewaterhouseCoopers. Mr. Nickolatos is a Certified Public Accountant and holds a BBA degree, summa cum laude, from Walla Walla University.

Bjarte Bruheim. Mr. Bruheim has served as a Director our Company and its predecessors since December 2011 and served as Chairman of our Board from 2012 to 2017. He has over 30 years of international management experience and is also a serial entrepreneur. He has spent the majority of his career introducing technologies that reduce risk and improve efficiencies in the oil and gas business. Such companies include oilfield services companies such as PGS, which he co-founded in 1991; Electromagnetic Geoservices ASA (“EMGS”), where he was an early venture investor and Executive Chairman starting in 2004 and became Chief Executive Officer in January 2015 serving until August 2015; Geo-Texture Technologies, Inc. (“Geo-Texture”), which he co-founded in 2005; and ODIM ASA (“ODIM”), which he worked to turn around and later sell. In addition to the oilfield service companies, Mr. Bruheim was a co-founder in Spinnaker Exploration Company using PGS technology, an early venture investor in Spring Energy using EMGS technology, and co-founder of a small exploration and production (“E&P”) company operating in the Eagle Ford field in Texas using Geo-Texture technology. Mr. Bruheim is also a founder of Axxis Geo Solutions AS and has served as executive chairman of that company since 2017. Mr. Bruheim started his career as an executive with WesternGeco, now Schlumberger, after graduating with a master’s degree in Physics and Electronics from the Norwegian University of Science & Technology in Trondheim, Norway.

Christopher A. Krummel. Mr. Krummel joined our Board in January 2014. Mr. Krummel serves as Vice President of Finance and Chief Accounting Officer of McDermott International Inc. (“McDermott”), responsible for all accounting functions including consolidated financial reporting, SEC filings and financial planning and analysis. Prior to joining McDermott, he provided advisory services to American Industrial Partners LLC (“AIP”), and other companies focused on the global energy industry. Prior to AIP, he served as the Vice President and Chief Financial Officer for EnTrans International LLC, a portfolio company of AIP. Prior to September of 2014, he served as Vice President-Finance, Controller and Chief Accounting Officer for Cameron International Corporation (“Cameron”), where he was responsible for all accounting functions including consolidated financial reporting and SEC filings. He started at Cameron in October 2007 and previously served as Chief Financial Officer for Enventure Global Technology, a private equity backed startup. Prior to Enventure, he held financial leadership roles with PGS and PriceWaterhouse LLP. He holds a BSBA in accounting from Creighton University and an MBA from The Wharton School of the University of Pennsylvania. In addition to our Board, Mr. Krummel is a director of Rebuilding Together Houston.

Timothy L. Reynolds. Mr. Reynolds joined our Board in August 2017. Mr. Reynolds serves as Co-CEO of Dakota Midstream, an independent midstream energy company in the Bakken shale formation. Prior to founding Dakota Midstream in July 2014, Mr. Reynolds led the acquisition of Mesa Oil Services, a salt water disposal operator in the Bakken in April 2014. Previously, Mr. Reynolds worked at Highstar Capital, an infrastructure investment firm from 2008 to March 2014, most recently as Principal and Director of Corporate Affairs. Earlier in his career, he worked at the White House, serving first with the National Economic Council from 2002 to 2004, and then in the Office of the Chief of Staff for the President from 2004 to 2006. In the former position, he focused on energy, health care, and social security policy formation and implementation. Mr. Reynolds is a graduate of the University of North Carolina at Chapel Hill (2001), and earned his MBA from the Stanford Graduate School of Business (2008).

Todd R. Snyder. Mr. Snyder was designated by Fir Tree to serve on our Board in October 2017 pursuant to the A&R Stockholder Rights Agreement. Mr. Snyder is the founder and Senior Managing Director of TRS Advisors LLC, an investment banking and financial advisory firm. Mr. Snyder has also served as a director of Midstates Petroleum Company, Inc. since October 2016. Prior to founding TRS Advisors LLC in late 2017, for seventeen years, Mr. Snyder was an executive vice chairman of Rothschild & Co. Before joining Rothschild & Co. in March 2000, Mr. Snyder was a Managing Director at Peter J. Solomon Company. Prior to joining Peter J. Solomon Company, Mr. Snyder was a Managing Director at KPMG Peat Marwick in the Corporate Recovery group where he was also National Director of the Corporate Recovery Practice for Government Enterprises (regulated and privatizing industries). Prior to his move to investment banking, Mr. Snyder practiced law at Weil, Gotshal & Manges. Mr. Snyder received a B.A. degree from Wesleyan University and a J.D. from the University of Pennsylvania Law School.

Andrew Teno. Mr. Teno was designated by Fir Tree to serve on our Board in March 2017, pursuant to the A&R Stockholder Rights Agreement. Mr. Teno has worked at Fir Tree Partners out of the Miami office since July 2011 and is currently a Director. He is focused on international value investing across capital structures, industries and geographies. Prior to Fir Tree, he worked at Crestview Partners from July 2009 to July 2011 as an associate in their Private Equity business. Prior to Crestview, Mr. Teno worked at Gleacher Partners, an M&A boutique, from July 2007 to July 2009. Mr. Teno received an undergraduate business degree from the Wharton School at the University of Pennsylvania in 2007.

Director Qualifications

Mr. Stewart has significant operational and executive experience in the oil and gas industry, including serving in roles of increasing responsibility at a large independent oil and gas exploration and production company and as the chief executive officer of an oilfield services company. Mr. Boswell is the President and Chief Executive Officer of our Company, has an extensive track record as an executive officer in the energy industry and has been part of starting and building multiple companies within the oilfield services sector. He also brings a strong financial background to our Board. Mr. Bruheim has significant operational experience in the oilfield services industry and brings both a practical understanding of the industry as well as hands-on experience at building companies in this sector. He currently serves on several boards of directors of private companies in the oil and gas industry and as Chief Executive Officer of companies operating in our industry and brings experience with young growing companies to our Board, which adds significant value. Mr. Krummel has significant financial experience in the industry with current and previous roles as Chief Financial Officer and Chief Accounting Officer with public companies where he was responsible for all accounting functions, including consolidated financial reporting and SEC filings. Mr. Reynolds has extensive experience serving as an executive in the energy sector and has relationships with many E&P companies, including companies operating in the U.S. and Argentina. Mr. Snyder has significant expertise in corporate finance and experience serving as a public company director, and he enhances the financial expertise of our Board. Mr. Teno has experience investing globally across asset classes, including public equities and credit including high yield and investment grade bonds and loans, as well as private equity. He also has experience in corporate advisory including mergers and acquisitions and fairness opinions.

Board Leadership Structure and Role in Risk Oversight

Our Chief Executive Officer does not serve as the Chairman of our Board. Our Board believes that having an outside director serve as the Chairman helps to ensure that the non-employee directors take an active leadership role on our Board and that this leadership structure is beneficial to the Company.

In the normal course of its business, the Company is exposed to a variety of risks, including market risks relating to changes in commodity prices, interest rates, technical risks affecting the Company’s operations, political risks and credit and investment risk. The Board oversees the strategic direction of the Company, and in doing so considers the potential rewards and risks of the Company’s business opportunities and challenges, and monitors the development and management of risks that impact the Company’s strategic goals. The Audit Committee assists the Board in fulfilling its oversight responsibilities by monitoring the effectiveness of the Company’s systems of financial reporting, auditing, internal controls and legal and regulatory compliance. The Nominating and Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for our directors and executive officers and corporate governance. The Compensation Committee assists the Board in fulfilling its oversight responsibilities by overseeing the Company’s compensation policies and practices.

Stockholder Communications with the Board

Our Board welcomes communications from our stockholders and other interested parties. Stockholders and any other interested parties may send communications to our Board, any committee of our Board, the Chairman of our Board or to any director in particular, by writing to:

Eco-Stim Energy Solutions, Inc.

2930 W. Sam Houston Pkwy N., Suite 275

Houston, Texas 77043

Attn: General Counsel

Stockholders and any other interested parties should mark the envelope containing each communication as “Stockholder Communication with Directors” and clearly identify the intended recipient(s) of the communication.

We will review communications received from our stockholders and other interested parties and will forward the communications, as expeditiously as reasonably practicable, to the applicable addressees if: (1) the communication complies with the requirements of any applicable policy adopted by our Board relating to the subject matter of the communication and (2) the communication falls within the scope of matters generally considered by our Board.

Director Independence

The members of the Audit Committee, namely Messrs. Krummel, Reynolds and Bruheim, the members of the Nominating and Governance Committee, namely Messrs. Bruheim and Teno, and the members of the Compensation Committee, namely Messrs. Krummel, Reynolds and Teno, have been determined to be independent under the applicable NASDAQ Stock Market Rules and rules of the SEC. In addition, Messrs. Stewart and Snyder were each determined to be independent by the Board in March 2018, and former Directors Messrs. Ahmad Al-Sati, Lap Wai Chan, Andrew Colvin, Leonel Narea, David Proman and Donald Stoltz were each determined to be independent prior to their departure. Messrs. Al-Sati, Chan, Narea resigned from the Board effective March 6, 2017. Mr. Stoltz resigned from the Board effective August 25, 2017. Messrs. Colvin and Proman resigned from the Board effective October 13, 2017. Messrs. Stewart and Snyder were nominated for appointment to the Board by funds affiliated with Fir Tree pursuant to the A&R Stockholder Rights Agreement to fill the vacancies created by the resignations of Messrs. Colvin and Proman. The Board appointed Mr. Reynolds to fill the vacancy created by the resignation of Mr. Stoltz.

There are no family relationships between any of the executive officers and directors.

Attendance at Annual Meetings

The Board encourages all directors to attend the annual meetings of stockholders, if practicable. Two Board members, Messrs. Boswell and Bruheim, attended the 2017 annual meeting of stockholders held on June 15, 2017.

Board and Committee Meetings

The Board held six meetings during the fiscal year ended December 31, 2017. No director attended fewer than 75% of the meetings of the Board and of the committees of the Board on which that director served, during the period of time such director served on the Board and its committees.

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee.

Audit Committee

The Audit Committee of our Board currently consists of Messrs. Bruheim, Krummel and Reynolds. Mr. Krummel has served as chairman of the Audit Committee since January 2014. Previously, Mr. Narea served on the Audit Committee from March 2016 to his resignation in March 2017. Our Board determined in March 2018 that all members of the Audit Committee meet the independence standards of the applicable NASDAQ Stock Market Rules and the heightened standards applicable to audit committee members (to the extent relevant to the Audit Committee). In addition, our Board has determined that Mr. Krummel qualifies as an “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K.

The Audit Committee oversees, reviews, acts on and reports on various auditing and accounting matters to our Board, including:

| | ● | overseeing the accounting and financial reporting processes of our company and audits of our financial statements; |

| | | |

| | ● | overseeing the quality, integrity and reliability of our financial statements and other financial information we provide to any governmental body or the public; |

| | | |

| | ● | overseeing our compliance with legal and regulatory requirements; |

| | | |

| | ● | overseeing our independent auditors’ qualifications, independence and performance; |

| | | |

| | ● | overseeing our systems of internal controls regarding finance, accounting, legal compliance and ethics that management and our Board have established; and |

| | | |

| | ● | providing an open avenue of communication among our independent auditors, financial and senior management, and our Board, always emphasizing that the independent auditors are accountable to the Audit Committee. |

We have an Audit Committee Charter that outlines the primary duties of the Audit Committee, which is available on our website in the “Corporate Governance” subsection in the “Investors” section. The Audit Committee held seven meetings during the fiscal year ended December 31, 2017.

Compensation Committee

The Compensation Committee of our Board currently consists of Messrs. Krummel, Reynolds and Teno. Mr. Krummel has served as chairman of the Compensation Committee since March 2015. Previously, Mr. Al-Sati served on the Compensation Committee from March 2015 to his resignation in March 2017, and Mr. Donald Stoltz served on the Compensation Committee from March 2016 to his resignation in August 2017. Our Board determined in March 2018 that all members of the Compensation Committee meet the independence standards of the applicable NASDAQ Stock Market Rules. In March 2018, our Board also determined that Messrs. Krummel and Reynolds each satisfy the requirements of non-employee directors under Rule 16b-3(b)(3) of the Exchange Act.

The Compensation Committee assists our Board in carrying out its responsibilities with respect to (i) employee compensation, benefit plans, and employee stock programs and (ii) matters relating to the compensation of persons serving as senior management and the Chief Executive Officer of the Company. The Compensation Committee determines and approves the total compensation of the Chief Executive Officer and senior management based on its evaluation of the performance of the Chief Executive Officer and senior management in light of certain goals and objectives as well as input from the Nominating and Governance Committee, and with respect to senior management, the Compensation Committee also considers input from the Chief Executive Officer. The Compensation Committee has broad delegating authority, including the authority to delegate to subcommittees as it deems appropriate, to delegate to one or more executive officers the authority to approve equity compensation awards under established equity compensation plans of the Company to employees and officers of the Company other than those subject to Section 16 of the Exchange Act and to delegate any non-discretionary administrative authority under Company compensation and benefit plans consistent with any limitations specified in the applicable plans.

We have a Compensation Committee Charter that outlines the primary duties of the Compensation Committee, which is available on our website in the “Corporate Governance” subsection in the “Investors” section. The Compensation Committee held two meetings during the fiscal year ended December 31, 2017.

Nominating and Governance Committee

The Nominating and Governance Committee of our Board currently consists of Messrs. Bruheim and Teno. Mr. Bruheim has served as chairman of the Nominating and Governance Committee since March 2016. Previously, Mr. Al-Sati served on the Nominating and Governance Committee from March 2016 to his resignation in March 2017, and Mr. Stoltz served on the Nominating and Governance Committee from March 2016 to his resignation in August 2017. In addition, Mr. David Proman served on the Nominating and Governance Committee from March 2017 to his resignation in October 2017.

The Nominating and Governance Committee identifies, evaluates and nominates qualified candidates for appointment or election to the Company’s Board. In identifying, evaluating and recommending director nominees to the Board, the Nominating and Governance Committee identifies persons who possess the integrity, leadership skills and competency required to direct and oversee the Company’s management in the best interests of its stockholders, customers, employees, communities it serves and other affected parties. A candidate must be willing to regularly attend Board meetings and, if applicable, committee meetings, to participate in Board development programs, to develop a strong understanding of the Company, its businesses and its requirements, to contribute his or her time and knowledge to the Company and to be prepared to exercise his or her duties with skill and care. While the Board does not have a formal policy on diversity, in selecting nominees, the Nominating and Governance Committee seeks to have a Board that represents a diverse range of perspectives and experience relevant to the Company.

The Company has a Nominating and Governance Committee Charter defining the committee’s primary duties, which is available on the Company’s website atwww.ecostim-es.com in the “Corporate Governance” subsection in the “Investors” section. The functions of the Nominating and Governance Committee, which are discussed in detail in its charter, include (i) developing a pool of potential directorial candidates for consideration in the event of a vacancy on the Board, (ii) screening directorial candidates in accordance with certain guidelines and criteria set forth in its charter and (iii) recommending nominees to the Board. The Nominating and Governance Committee held one meeting during the fiscal year ended December 31, 2017.

The Nominating and Governance Committee seeks recommendations from our existing directors to identify potential candidates to fill vacancies on our Board. The Nominating and Governance Committee will also consider nominee recommendations properly submitted by stockholders in accordance with the procedures outlined in our bylaws, on the same basis as candidates recommended by the Board and other sources. Recommendations must be received by the Secretary of the Company no later than the earlier of (a) the close of business on the tenth (10th) day following the day on which such notice of the date of the Annual Meeting was mailed or such public disclosure was made, whichever first occurs, or (b) two (2) days prior to the date of the Annual Meeting. For stockholder recommendations, recommendations must be made in writing and delivered to the Secretary of the Company at 2930 W. Sam Houston Pkwy N., Suite 275, Houston, Texas 77043.

PROPOSAL TWO: NON-BINDING ADVISORY VOTE TO APPROVE THE COMPANY’S NAMED EXECUTIVE OFFICERS’ COMPENSATION

In accordance with Section 14A of the Exchange Act and Rule 14a-21(a) promulgated thereunder, we are asking our stockholders to approve, in a non-binding advisory vote, the compensation of our named executive officers, as such compensation is disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K, including under the heading “Executive Compensation and Other Information.” This advisory vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the principles, policies and practices of the compensation described in this Proxy Statement.

The Compensation Committee believes that our named executive officers should be compensated in a manner that is commensurate with their success in maintaining the growth and high level of performance necessary for the Company to produce ongoing and sustained growth in value for our stockholders. Our executive compensation program is designed to link our executive officers’ compensation as closely as possible with our performance while also aligning our executive officers’ interests with those of our stockholders. We continually monitor our executive compensation program and modify it as needed to strengthen the link between compensation and performance and to maintain our competitive position within the oil and gas service industry with respect to the search for and retention of highly capable executive personnel. We encourage stockholders to read the section of this Proxy Statement entitled “Executive Compensation and Other Information,” including the compensation tables and accompanying narrative disclosures, which discuss in greater detail the compensation of our named executive officers.

Based on the above, we request that you indicate your support for our executive compensation practices by voting in favor of the following resolution:

“RESOLVED, that the stockholders hereby approve, on an advisory basis, the compensation of Eco-Stim Energy Solutions, Inc.’s named executive officers, as disclosed in the Proxy Statement for Eco-Stim Energy Solutions, Inc.’s 2018 Annual Meeting of Stockholders pursuant to Item 402 of Regulation S-K, including the disclosure contained in “Executive Compensation and Other Information” and the compensation tables and other narrative executive compensation disclosures contained therein.”

This is an advisory vote and is not binding on the Company, the Compensation Committee or the Board. However, because we value the views of our stockholders, our Compensation Committee, which is comprised solely of independent directors and is responsible for, among other things, designing and administering the Company’s executive compensation program, will carefully consider the results of this advisory vote, along with all other expressions of stockholder views it receives on specific policies and desirable actions, when considering future decisions with respect to executive compensation.

Vote Required and Board of Directors’ Recommendation

The affirmative vote by a majority of the shares of Common Stock and Series A Preferred entitled to vote and then present in person or by proxy at the Annual Meeting, voting together as a single class an on an as-converted to Common Stock basis, is required to approve this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICERS’ COMPENSATION.

PROPOSAL THREE: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected Whitley Penn LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2018. Whitley Penn LLP has served in this capacity since 2013. The Board is submitting the selection of Whitley Penn LLP for ratification at the Annual Meeting. The submission of this matter for ratification by stockholders is not legally required, but the Board and the Audit Committee believe the submission provides an opportunity for stockholders through their vote to communicate with the Board and the Audit Committee about an important aspect of corporate governance. If the stockholders do not ratify the selection of Whitley Penn LLP, the Audit Committee will reconsider, but will not be required to rescind, the selection of that firm as the Company’s independent registered public accounting firm. We currently expect that representatives of Whitley Penn LLP will attend the Annual Meeting. If Whitley Penn LLP attends the Annual Meeting, they will have an opportunity to make a statement if they desire to do so and would be available to respond to appropriate questions.

The Audit Committee has the sole authority and responsibility to retain, compensate, evaluate and replace the Company’s independent registered public accounting firm. The stockholders’ ratification of the appointment of Whitley Penn LLP does not limit the authority of the Audit Committee to change the Company’s independent registered public accounting firm, as it deems necessary or appropriate, at any time.

Principal Accountant Fees and Services

The following table presents fees for professional audit services performed by Whitley Penn LLP for the audit of our annual financial statements for the fiscal year ended December 31, 2017 and 2016.

| | | 2017 | | | 2016 | |

| Audit Fees (1) | | $ | 170,000 | | | $ | 107,843 | |

| Audit-Related Fees | | | — | | | | — | |

| Tax Fees(2) | | | 13,787 | | | | — | |

| All Other Fees | | | — | | | | — | |

| Total Fees | | $ | 183,787 | | | $ | 107,843 | |

| (1) | Audit fees include professional services rendered for (i) the audit of our annual financial statements for the fiscal years ended December 31, 2017 and 2016, and (ii) the reviews of the financial statements included in our quarterly reports on Form 10-Q for such years and (iii) the review of the S-3 filed during 2017. |

| | |

| (2) | Tax fees include professional services rendered in connection with the preparation of our U.S. federal income tax return. |

Pre-Approval Policies

The charter of the Audit Committee requires that the Audit Committee review and pre-approve the Company’s independent registered public accounting firm’s fees for audit, audit-related, tax and other services. The Audit Committee pre-approved all services, audit and non-audit, provided to us by Whitley Penn LLP for 2016 and 2017.

Vote Required and Board of Directors’ Recommendation

The affirmative vote by a majority of the shares of Common Stock and Series A Preferred entitled to vote and then present in person or by proxy at the Annual Meeting, voting together as a single class an on an as-converted to Common Stock basis, is required to approve this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE RATIFICATION OF THE SELECTION OF WHITLEY PENN LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE YEAR ENDING DECEMBER 31, 2018.

PROPOSAL FOUR: APPROVAL OF THE THIRD AMENDMENT TO THE ECO-STIM ENERGY SOLUTIONS, INC. 2015 STOCK INCENTIVE PLAN

At the Annual Meeting, stockholders will be asked to approve the Third Amendment to the Plan which:

| | ● | increases the number of shares of Common Stock available under the Plan by 3,000,000 shares (from 6,200,000 shares to 9,200,000 shares) (without giving effect to the Reverse Stock Split); |

| | | |

| | ● | increases the limitations associated with awards that may be granted under the Plan to non-employee directors during any single calendar year from $500,000 (measured in terms of aggregate grant date fair value), or $600,000 in the first year an individual becomes a non-employee director, to $1.2 million with respect to any non-employee director that serves as the Chairman of the Board during the applicable year; and |

| | | |

| | ● | make such other minor revisions to the Plan as deemed necessary or appropriate. |

As explained in greater detail below, we believe approval of the Third Amendment to the Plan is advisable in order to ensure that we have an adequate number of shares available under the Plan for our compensation programs.

Background and Purpose of the Proposal

The Board originally adopted the Plan, effective as of July 9, 2014. The Plan was amended and restated in its current form, and approved by our stockholders, effective as of May 14, 2015. The Plan was further amended (i) effective as of June 30, 2016, pursuant to the First Amendment to increase the number of shares of Common Stock that we may grant under the Plan by 200,000 shares; and (ii) effective as of June 15, 2017, pursuant to the Second Amendment to increase the number of shares of Common Stock that we may grant under the Plan by 5,000,000 shares and make certain other changes.

Any shares covered by the Plan shall also be adjusted to reflect any stock or reverse stock splits that may be approved by our stockholders and take effect, including the Reverse Stock Split (if effected). For example, if the stockholders approve the Third Amendment and also approve the Reverse Stock Split Proposal, the number of additional shares approved under the Third Amendment for awards under the Plan would be 750,000 shares if the Reverse Stock Split Proposal is subsequently effected (instead of the 3,000,000 shares described in this Proposal Four).

On May 9, 2018, the Board unanimously approved the Third Amendment, effective as of the date of the Annual Meeting, subject to and conditioned upon stockholder approval of this Proposal Four. If this Proposal Four is not approved by stockholders, the Plan will continue in effect in its present form.

We believe that approval of the Third Amendment is necessary in order to give us the flexibility to make stock-based awards and other awards permitted under the Plan over the next two years in amounts determined appropriate by the Committee (as defined below); however, this timeline is simply an estimate used to determine the number of additional shares of Common Stock requested pursuant to the Third Amendment, and future circumstances may require a change to expected equity grant practices. These circumstances include but are not limited to the future price of our Common Stock, award levels and amounts provided by our competitors and our hiring activity over the next two years. The closing market price of our shares of Common Stock as of _______, 2018 was $___ per share, as reported on the NASDAQ.

As of April 30, 2018, the total number of outstanding shares of Common Stock was 74,596,116 and the total number of outstanding shares of Series A Preferred was 10,000, which were convertible into 8,695,652 shares of Common Stock as of such date. The current potential dilution (which is the number of shares of Common Stock available for grant under the Plan together with the number of shares of Common Stock available for grant under the Eco-Stim Energy Solutions, Inc. 2013 Stock Incentive Plan (as amended from time to time, the “2013 Plan” and, together with the Plan, the “Incentive Plans”), divided by the total number of shares of Common Stock outstanding, assuming the conversion of all outstanding shares of Series A Preferred) is approximately 0.7%. Approximately 5,090,958 of the aggregate grants under the 2013 Plan and the Plan were in the form of stock options, and of these, 980,500 or over 19.26% have a strike price of $3.00 or higher and therefore are currently not dilutive. If the Third Amendment is approved by our stockholders under this Proposal Four, it would cause the potential dilution from issuances authorized under the Plan together with issuances authorized under the 2013 Plan to be increased to approximately 4.3%. While we are aware of the potential dilutive effect of compensatory equity awards, we also recognize the significant motivational and performance benefits that may be achieved from making such awards.

In addition, we believe that increasing the dollar limitations associated with awards that may be granted under the Plan to non-employee directors who serve in the capacity as the Chairman of the Board is both (i) appropriate, since the Chairman position involves a substantial commitment of time over and above regular service as a Board member and member of committees of the Board; and (ii) desirable in order to provide the Company with greater flexibility to offer equity awards to attract and retain qualified candidates to serve in the role of the Chairman of the Board.

Finally, the Third Amendment makes other minor revisions to the Plan deemed necessary or appropriate, including the elimination of certain restrictions on the amounts of Awards intended to qualify as “performance-based” compensation as a result of the repeal of the performance-based compensation exception under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and the regulations thereunder (“Section 162(m)”) (as discussed below).

Consequences of Failing to Approve the Proposal

Failure of our stockholders to approve this Proposal Four will mean that we will continue to grant equity awards under the terms of the Plan and the 2013 Plan, in their current form, until the shares of Common Stock available for issuance thereunder are exhausted, which we estimate will occur in the fourth quarter of 2018, based on current expected equity grant practices and plans. If this Proposal Four is not approved by stockholders, the Plan will remain in effect in its current form, and awards will continue to be made under the Plan as currently in effect until all shares currently available for awards and issuance have been issued pursuant to such awards.

Description of the Eco-Stim Energy Solutions, Inc. 2015 Stock Incentive Plan

A summary description of the material features of the Plan, as amended to reflect the Third Amendment, is set forth below. The following summary does not purport to be a complete description of all the provisions of the Plan and is qualified in its entirety by reference to (i) the Plan, a copy of which is incorporated by reference to Exhibit 4.1 to our Form S-8 (File No. 333-207094), filed on September 23, 2015, (ii) the First Amendment, a copy of which is incorporated by reference to Exhibit 4.1 to our Form S-8 (File No. 333-213549), filed on September 9, 2016, (iii) the Second Amendment, a copy of which is incorporated by reference to Exhibit 4.1 to our Form S-8 (File No. 333-219453), filed on July 26, 2017 and (iv) the Third Amendment, which is attached as Appendix A to this proxy statement and incorporated by reference in its entirety.

Purpose of the 2015 Stock Incentive Plan

The purpose of the Plan is to provide a means through which the Company may attract and retain able persons to serve as directors, consultants or employees of the Company and its affiliates and to provide a means whereby those individuals upon whom the responsibilities of the successful administration and management of the Company and its affiliates rest, and whose present and potential contributions to the Company and its affiliates are of importance, can acquire and maintain stock ownership or other awards, thereby strengthening their concern for the welfare of the Company and its affiliates and their desire to remain employed by, or continue providing services to, the Company and its affiliates. A further purpose of the Plan is to enhance the profitable growth of the Company and its affiliates. The Company seeks to achieve the Plan’s purpose primarily by providing grants of a variety of awards (collectively referred to as “Awards”), including but not limited to:

| | ● | incentive stock options qualified as such under U.S. federal income tax laws (“Incentive Options”); |

| | | |

| | ● | stock options that do not qualify as incentive stock options (“Nonstatutory Options” and, together with Incentive Options, “Options”); |

| | | |

| | ● | restricted stock awards (“Restricted Stock”); |

| | ● | phantom stock (“Phantom Stock”), which may be settled in Common Stock or in cash, as determined by the Committee (as defined below); |

| | | |

| | ● | awards that are subject to or contingent upon certain performance measures (“Performance Awards”); |

| | | |

| | ● | stock appreciation rights (“SARs”), either in connection with an award of Options or independently as a Phantom Stock award; and |

| | | |

| | ● | awards of Common Stock (“Bonus Stock”). |

The Plan, in part, is intended to qualify under the provisions of Section 422 of the Code, which governs Incentive Options. The Plan is not subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended. No awards may be granted under the Plan after 10 years (May 14, 2025) from the date the Plan was approved by the Board. The Plan shall remain in effect until all Awards granted under the Plan have been exercised, satisfied, forfeited or expired.

The Plan was originally designed to allow the Company to provide “performance-based compensation” that was tax deductible by the Company without regard to the limits of Section 162(m). However, the performance-based compensation exception under Section 162(m) was eliminated by the Tax Cuts and Jobs Act of 2017. Accordingly, certain provisions of the Plan that are no longer required under Section 162(m) are being eliminated in the Third Amendment.

Administration of the Long Term Incentive Plan

The Plan is administered by a committee (the “Committee”) appointed by the Board. Unless the Board appoints another committee, the Compensation Committee of the Board administers the Plan. Subject to the terms and conditions of the Plan, the Committee shall have the power from time to time to:

| | ● | determine which Eligible Individuals (as defined below) shall receive an Award; |

| | | |

| | ● | the time or times when such Award shall be made; |

| | | |

| | ● | the type of Award that shall be made; and |

| | | |

| | ● | the number of shares of Common Stock to be subject to, or the value of, an Award. |

The Committee shall have such additional powers as are delegated to it by the other provisions of the Plan. Subject to the express provisions of the Plan, this shall include the power to construe the Plan and the respective agreements executed thereunder, to prescribe, amend, suspend or waive rules and regulations relating to the Plan, to determine the terms, restrictions and provisions of the agreement relating to each Award and to make all other determinations necessary or advisable for administering the Plan. The Committee may correct any defect or supply any omission or reconcile any inconsistence in the Plan or any agreement in the manner and to the extent it deems expedient to carry the Plan or any such agreement into effect. All determinations and decisions made by the Committee on such matters and in construing the provisions of the Plan are conclusive. The Committee may delegate to the CEO the administration (or interpretation of any provision) of the Plan and the right to grant Awards under the Plan, provided such administration, interpretation and power to grant awards relates to persons who are not then subject to Section 16 of the Exchange Act. In the event of any conflict in a determination or interpretation under the Plan as between the Committee and the CEO, the determination or interpretation of the Committee shall be conclusive.

Shares Subject to the Long Term Incentive Plan

The Third Amendment would increase the number of shares of Common Stock available for Awards under the Plan by 3,000,000 shares to 9,200,000 shares (without giving effect to the Reverse Stock Split Proposal). Accordingly, after giving effect to the Third Amendment, the maximum aggregate number of shares of Common Stock that may be granted for any and all Awards under the Plan, and the aggregate maximum number of shares of Common Stock that may be issued under the Plan through Incentive Options, may not exceed 9,200,000 shares of Common Stock (without giving effect to the Reverse Stock Split Proposal), which is inclusive of shares of Common Stock issued pursuant to Existing Awards and shares of Common Stock that may be issuable in the future under the Plan or the 2013 Plan.

As noted above, the Plan was originally designed to allow the Company to provide “performance-based compensation” that was tax deductible by the Company without regard to the limits of Section 162(m). However, the performance-based compensation exception under Section 162(m) was eliminated by the Tax Cuts and Jobs Act of 2017. As a result, the Third Amendment eliminates the restrictions on the amounts of Awards intended to qualify as “performance-based” compensation under Section 162(m) that may be awarded. Instead, if the Third Amendment is approved by the Stockholders, the Committee will be permitted to establish any performance criteria it deems appropriate in its discretion.

Without giving effect to the Third Amendment, 6,200,000 shares of Common Stock are authorized for issuance under the Plan and 1,000,000 shares of Common Stock are authorized for issuance under the 2013 Plan, for a total of 7,200,000 shares of Common Stock authorized for issuance under the Plan and the 2013 Plan. As of April 30, 2018, there were (i) a total of 6,616,161 shares of Common Stock already issued pursuant to awards under the Plan and the 2013 Plan (the “Existing Awards”) and (ii) a total of 583,839 shares of Common Stock remaining available for future awards under the Plan and the 2013 Plan.

To the extent that an Award lapses or the rights of its holder terminate, any shares of Common Stock subject to such Award shall again be available for the grant of an Award under the Plan. In addition, shares issued under the Plan and forfeited back to the Plan, shares surrendered in payment of the exercise price or purchase price of an Award and shares withheld for payment of applicable employment taxes and/or withholding obligations associated with an Award shall again be available for the grant of an Award under the Plan. The shares of Common Stock issued under the Plan may be, in whole or in part, authorized but unissued Common Stock or Common Stock previously issued and outstanding and reacquired by the Company. As long as the shares of Common Stock remain listed for trading on the NASDAQ, the fair market value of the shares of Common Stock on a given date will be the value equal to the closing price of a share of Common Stock as reported on the NASDAQ on that date (or if no closing price is reported on that date, on the last preceding date on which there was such a closing price).

Persons Who May Participate in the Long Term Incentive Plan