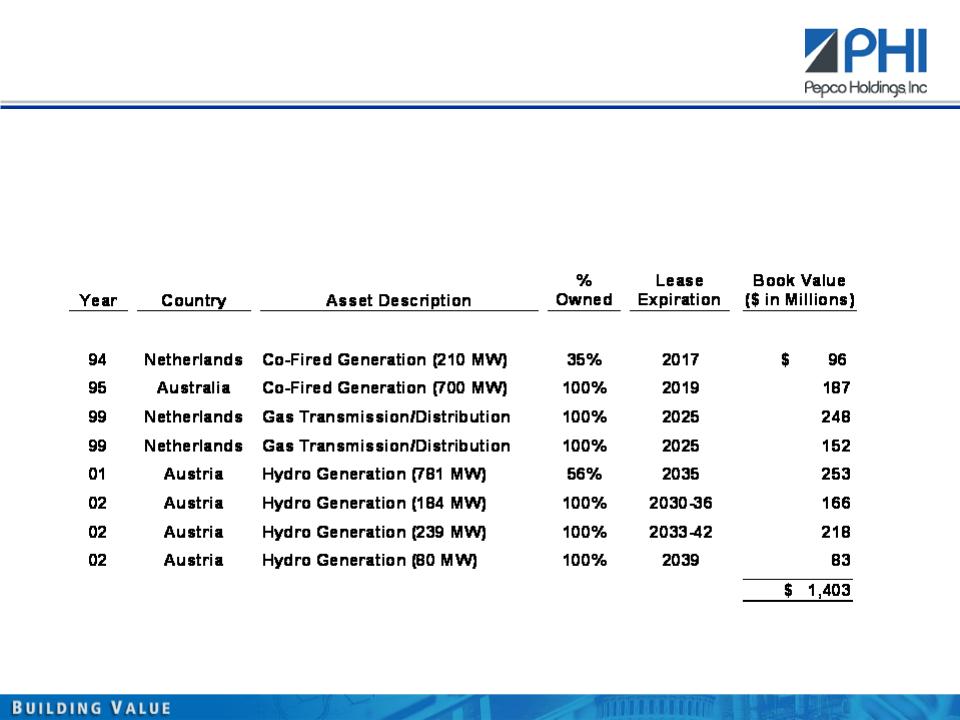

52

Cross-Border Leases - Status

· Current Status - IRS Audit

† PHI’s leveraged lease portfolio under audit generates approximately $62 million per year in tax benefits

and is a major component of PHI Investments’ annual earnings of approximately $35 million.

† The IRS is challenging tax benefits associated with certain sale-leaseback transactions with tax-

indifferent parties. Tax benefits derived from the leases under review are $362 million as of March 31,

2008

† On June 9, 2006, the IRS issued its final Revenue Agent’s Report (RAR) for its audit of PHI’s 2001 and

2002 income tax returns which disallows the tax benefits claimed by PHI for these tax years.

† PHI filed a protest letter in August 2006 against the proposed adjustments. We anticipate an appeals

meeting in 2008. We believe the issue will likely take several years to resolve.

† Leased assets are energy properties similar to our core business operations and provide adequate pre-

tax returns.

† Based on the facts relevant to these investments, we believe our tax position is appropriate.

· Current Status - Proposed Tax Legislation

† On December 14, 2007, the U.S. Senate passed its version of the Farm bill which contains a provision that

would apply passive loss limitation rules to leases with foreign tax indifferent parties.

† On July 27, 2007, the U.S. House of Representatives passed its version of the bill which does not include

any provision that would modify the current treatment of leases with tax indifferent parties.

† The U.S. House of Representatives and the U.S. Senate both passed a reconciled bill which does not

include the tax leasing provision noted above. The bill will be forwarded to the President for signature.