3rd Quarter Earnings Conference Call

October 29, 2010

1

Some of the statements contained in today’s presentation are forward-looking statements within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by the Private Securities Litigation

Reform Act of 1995. These statements include declarations regarding Pepco Holdings’ intents, beliefs and current expectations. In

some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms or other comparable

terminology. Any forward-looking statements are not guarantees of future performance, and actual results could differ materially

from those indicated by the forward-looking statements. Forward-looking statements involve estimates, assumptions, known and

unknown risks, uncertainties and other factors that may cause PHI’s actual results, levels of activity, performance or achievements

to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such

forward-looking statements. The forward-looking statements contained herein are qualified in their entirety by reference to the

following important factors, which are difficult to predict, contain uncertainties, are beyond Pepco Holdings’ control and may cause

actual results to differ materially from those contained in forward-looking statements: prevailing governmental policies and

regulatory actions affecting the energy industry, including allowed rates of return, industry and rate structure, acquisition and

disposal of assets and facilities, operation and construction of transmission and distribution facilities, and the recovery of

purchased power expenses; changes in and compliance with environmental and safety laws and policies; weather conditions;

population growth rates and demographic patterns; general economic conditions, including potential negative impacts resulting

from an economic downturn; changes in tax rates or policies or in rates of inflation; changes in accounting standards or practices;

changes in project costs; unanticipated changes in operating expenses and capital expenditures; the ability to obtain funding in

the capital markets on favorable terms; rules and regulations imposed by Federal and/or state regulatory commissions, PJM, the

North American Electric Reliability Corporation and other applicable electric reliability organizations; legal and administrative

proceedings (whether civil or criminal) and settlements that influence PHI’s business and profitability; pace of entry into new

markets; volatility in customer demand for electricity and natural gas; interest rate fluctuations and credit and capital market

conditions; and effects of geopolitical events, including the threat of domestic terrorism. Any forward-looking statements speak

only as to the date of this presentation and Pepco Holdings undertakes no obligation to update any forward-looking statements to

reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated

events. New factors emerge from time to time, and it is not possible for Pepco Holdings to predict all such factors, nor can Pepco

Holdings assess the impact of any such factor on Pepco Holdings’ business or the extent to which any factor, or combination of

factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing review of

factors should not be construed as exhaustive. Readers are referred to the most recent reports filed with the Securities and

Exchange Commission.

the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by the Private Securities Litigation

Reform Act of 1995. These statements include declarations regarding Pepco Holdings’ intents, beliefs and current expectations. In

some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms or other comparable

terminology. Any forward-looking statements are not guarantees of future performance, and actual results could differ materially

from those indicated by the forward-looking statements. Forward-looking statements involve estimates, assumptions, known and

unknown risks, uncertainties and other factors that may cause PHI’s actual results, levels of activity, performance or achievements

to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such

forward-looking statements. The forward-looking statements contained herein are qualified in their entirety by reference to the

following important factors, which are difficult to predict, contain uncertainties, are beyond Pepco Holdings’ control and may cause

actual results to differ materially from those contained in forward-looking statements: prevailing governmental policies and

regulatory actions affecting the energy industry, including allowed rates of return, industry and rate structure, acquisition and

disposal of assets and facilities, operation and construction of transmission and distribution facilities, and the recovery of

purchased power expenses; changes in and compliance with environmental and safety laws and policies; weather conditions;

population growth rates and demographic patterns; general economic conditions, including potential negative impacts resulting

from an economic downturn; changes in tax rates or policies or in rates of inflation; changes in accounting standards or practices;

changes in project costs; unanticipated changes in operating expenses and capital expenditures; the ability to obtain funding in

the capital markets on favorable terms; rules and regulations imposed by Federal and/or state regulatory commissions, PJM, the

North American Electric Reliability Corporation and other applicable electric reliability organizations; legal and administrative

proceedings (whether civil or criminal) and settlements that influence PHI’s business and profitability; pace of entry into new

markets; volatility in customer demand for electricity and natural gas; interest rate fluctuations and credit and capital market

conditions; and effects of geopolitical events, including the threat of domestic terrorism. Any forward-looking statements speak

only as to the date of this presentation and Pepco Holdings undertakes no obligation to update any forward-looking statements to

reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated

events. New factors emerge from time to time, and it is not possible for Pepco Holdings to predict all such factors, nor can Pepco

Holdings assess the impact of any such factor on Pepco Holdings’ business or the extent to which any factor, or combination of

factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing review of

factors should not be construed as exhaustive. Readers are referred to the most recent reports filed with the Securities and

Exchange Commission.

Safe Harbor Statement

2

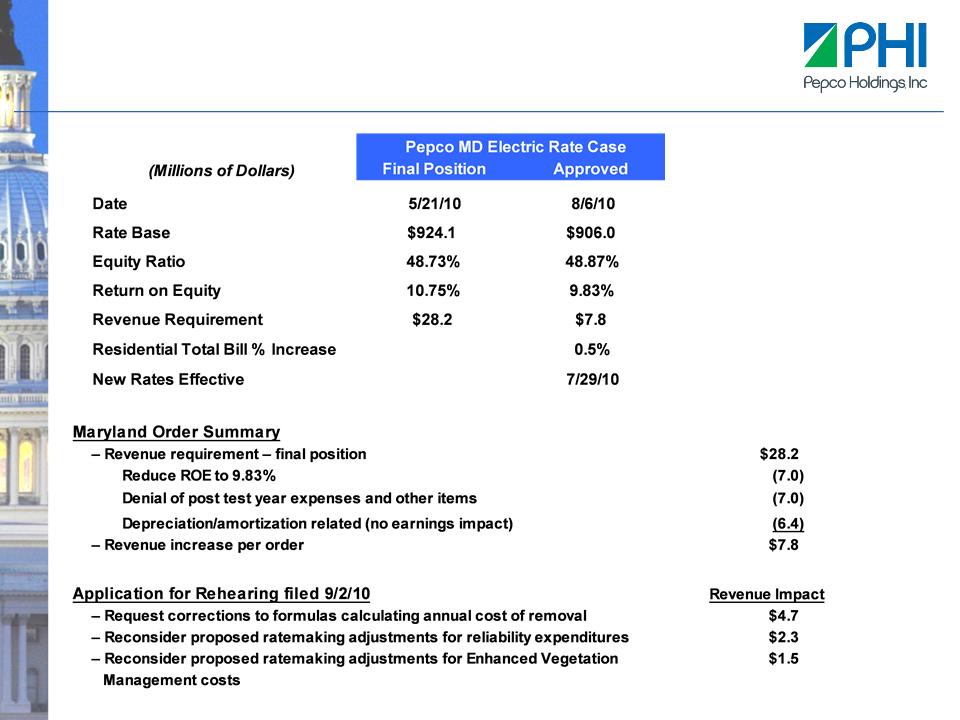

Distribution Rate Case -

Pepco Maryland Decision

Pepco Maryland Decision

3

Note: See Safe Harbor Statement at the beginning of today’s presentation.

(1) Brief filing position

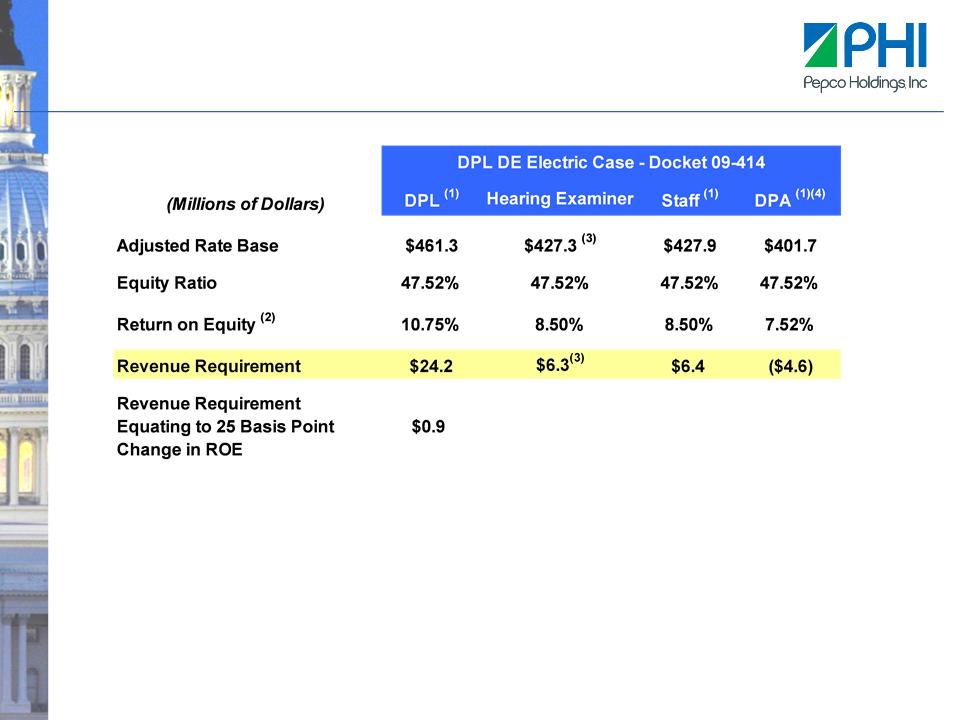

(2) Recommended return on equity without revenue decoupling is 11.00% for DPL, 9.50% for Hearing

Examiner and Staff and 9.58% for DPA

Examiner and Staff and 9.58% for DPA

(3) Company calculation

(4) Division of Public Advocate

Commission expected to consider case at

meeting scheduled for November 10, 2010

Distribution Rate Cases - Pending

Delmarva Power - Electric

Delmarva Power - Electric

4

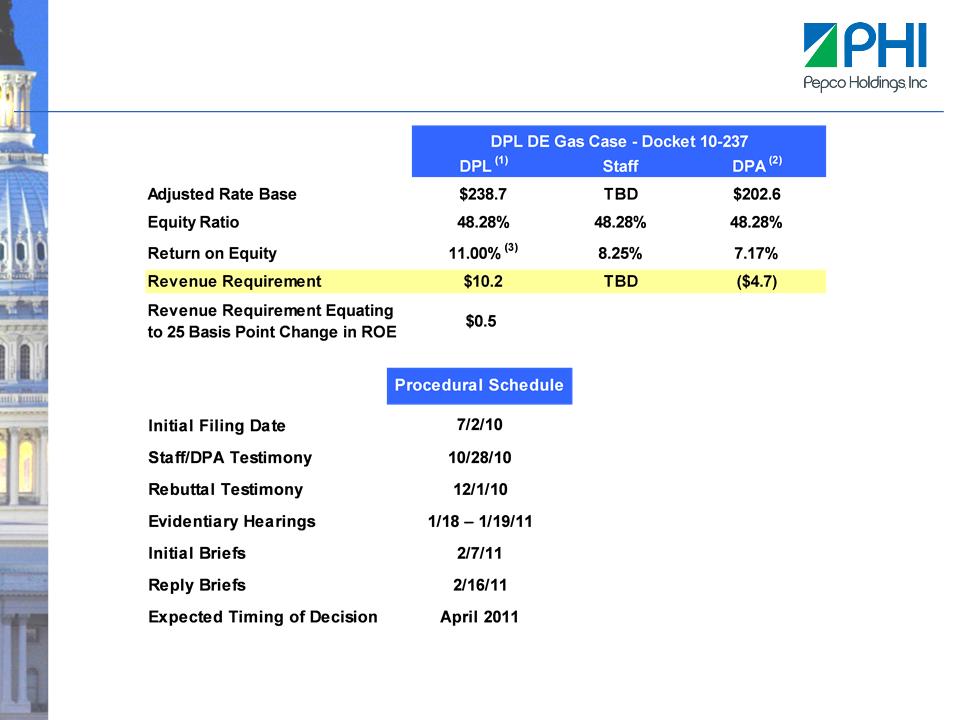

Note: See Safe Harbor Statement at the beginning of today’s presentation.

(1) Current filed position as of 10/11/10

(2) Division of Public Advocate

(3) Recommended return on equity position without revenue decoupling is 11.25%

• Interim rate increase of $2.5 million

put into effect August 31, 2010,

subject to refund

put into effect August 31, 2010,

subject to refund

• Balance of requested increase may

be put into effect February 2, 2011,

subject to refund

be put into effect February 2, 2011,

subject to refund

Distribution Rate Cases - Pending

Delmarva Power - Gas

Delmarva Power - Gas

5

Distribution Rate Cases -

The Next Cycle

The Next Cycle

Note: See Safe Harbor Statement at the beginning of today’s presentation.

• Preliminary Filing Cycle Tentative Filing Date

– Delmarva Power MD Late 2010/Early 2011

– Pepco MD Spring 2011

– Pepco DC Summer 2011

– Atlantic City Electric NJ Summer 2011

– Delmarva Power DE - Electric Summer 2011

– Delmarva Power DE - Gas Early 2012

• Filing cycle may be altered by financial projections and other

considerations

considerations

6

(Millions of Dollars)

(1) Reflects current June 2015 in-service date

(2) Shift of $183 million of construction expenditures from Delmarva Power to Pepco in the current forecast is

based on the final route selected for the Chesapeake Bay crossing

based on the final route selected for the Chesapeake Bay crossing

Note: See Safe Harbor Statement at the beginning of today’s presentation.

MAPP Construction Expenditures -

Revised for 2015 In-Service Date

Revised for 2015 In-Service Date

7

Combines smart grid technology with energy efficiency programs to help customers

control their energy use and cost, while providing earnings potential for the Company

control their energy use and cost, while providing earnings potential for the Company

* DPL - DE Gas decoupling to be implemented following base rate case decision expected in April 2011

Note: See Safe Harbor Statement at the beginning of today’s presentation.

Blueprint - Project Status by Jurisdiction

8

BWI Thurgood Marshall Airport Project

• Project

– PES will implement 13 energy conservation

measures

measures

– The scope covers 30 airport buildings, including the

main terminal (9 million square feet)

main terminal (9 million square feet)

– Installation of more than 1 acre of solar power

generation equipment

generation equipment

• Construction schedule

– Construction began in September 2010; estimated

completion is December 2011

completion is December 2011

PES signed a $21 million energy performance contract

with the Maryland Aviation Administration (MAA) for the

BWI Thurgood Marshall Airport in Maryland

with the Maryland Aviation Administration (MAA) for the

BWI Thurgood Marshall Airport in Maryland

The project allows MAA to beat its 15% energy

reduction goal set by the EmPOWER Maryland Initiative

reduction goal set by the EmPOWER Maryland Initiative

Note: See Safe Harbor Statement at the beginning of today’s presentation.

9

Net Earnings from Continuing Operations (Millions of dollars) | Three Months Ended September 30, | Nine Months Ended September 30, | ||||

2010 | 2009 | 2010 | 2009 | |||

Reported (GAAP) Net Earnings from Continuing Operations | $21 | $104 | $125 | $184 | ||

Special Items: | ||||||

· | Debt extinguishment costs, including treasury lock hedge | 81 | - | 81 | - | |

· | Restructuring charge | 8 | - | 8 | - | |

· | Effects of Pepco divestiture-related claims | 6 | - | 6 | - | |

· | Mirant bankruptcy settlement (net of customer sharing) | - | (16) | - | (24) | |

· | Maryland income tax benefit, net of fees | - | (11) | - | (11) | |

Net Earnings from Continuing Operations, Excluding Special Items | $116 | $77 | $220 | $149 | ||

Earnings per Share from Continuing Operations | Three Months Ended September 30, | Nine Months Ended September 30, | ||||

2010 | 2009 | 2010 | 2009 | |||

Reported (GAAP) Earnings per Share from Continuing Operations | $0.09 | $0.47 | $0.56 | $0.84 | ||

Special Items: | ||||||

· | Debt extinguishment costs, including treasury lock hedge | 0.36 | - | 0.36 | - | |

· | Restructuring charge | 0.04 | - | 0.04 | - | |

· | Effects of Pepco divestiture-related claims | 0.03 | - | 0.03 | - | |

· | Mirant bankruptcy settlement (net of customer sharing) | - | (0.07) | - | (0.11) | |

· | Maryland income tax benefit, net of fees | - | (0.05) | - | (0.05) | |

Earnings per Share from Continuing Operations, Excluding Special Items | $0.52 | $0.35 | $0.99 | $0.68 | ||

Reconciliation of GAAP Earnings to

Earnings Excluding Special Items

Earnings Excluding Special Items

10

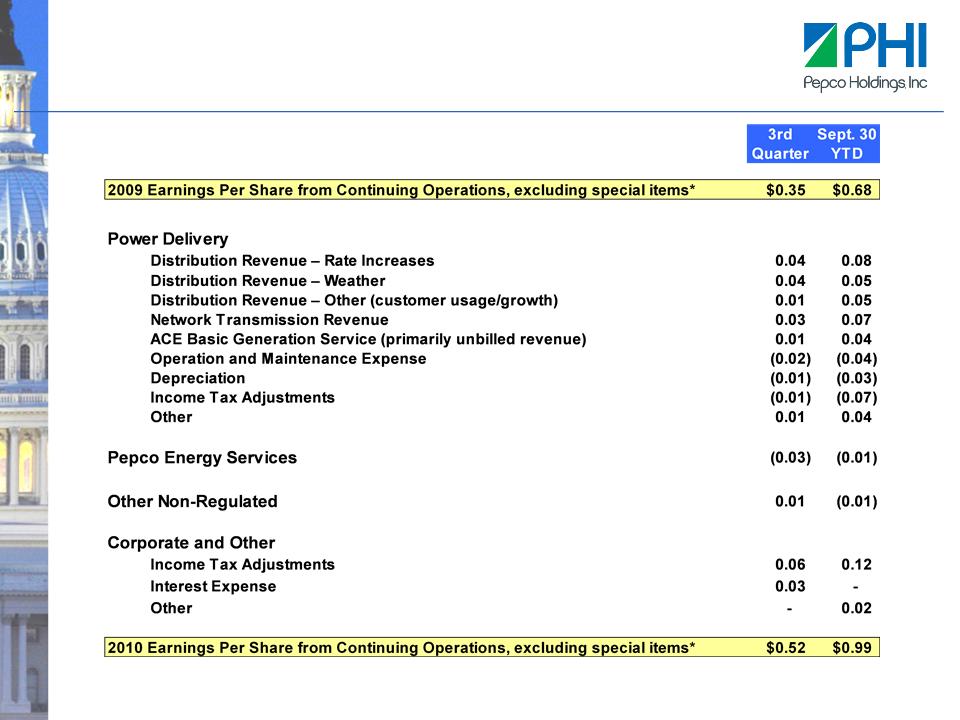

* See GAAP reconciliation on slide 9

Financial Performance - Drivers

11

Earnings Guidance and Outlook

Earnings Per Share Ranges

$1.10 - $1.30

$0.80 - $0.95

Original

Guidance

Outlook

Reflects earnings per share from ongoing operations

(GAAP results excluding special, unusual or extraordinary items)

Note: See Safe Harbor Statement at the beginning of today’s presentation.

$1.00 - $1.10

Revised

Guidance

The revised guidance range represents:

• Strong Power Delivery operating

performance through the first nine

months of 2010

performance through the first nine

months of 2010

• The impact of hot summer weather on

electric distribution revenue in certain

jurisdictions

electric distribution revenue in certain

jurisdictions

• Partially offset by the effects of a

much higher level of storm activity in

2010, compared to 2009

much higher level of storm activity in

2010, compared to 2009

12

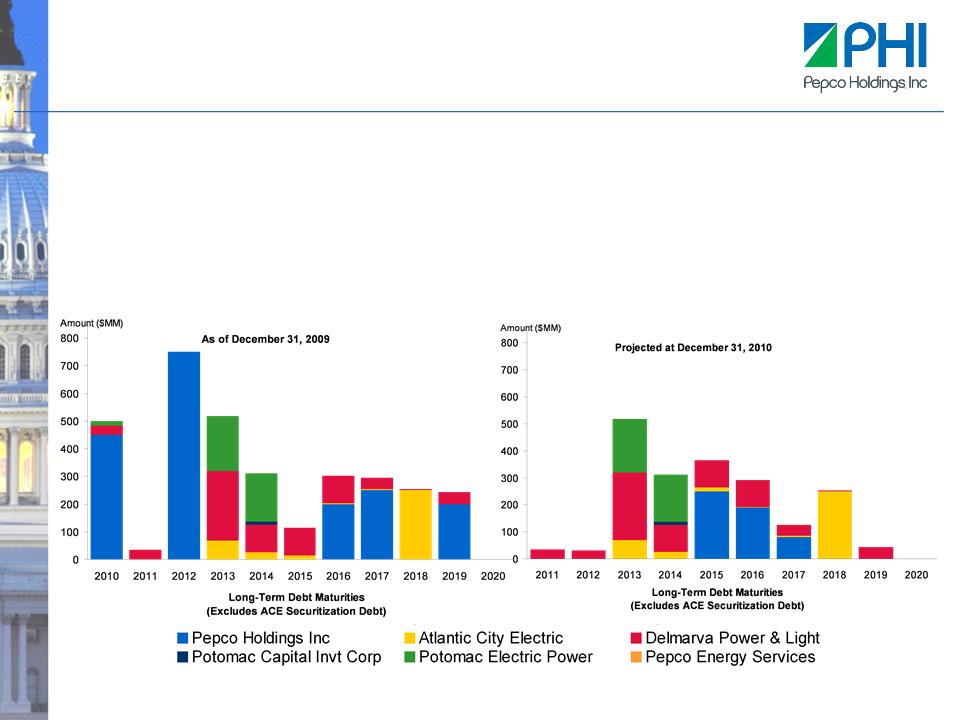

Note: See Safe Harbor Statement at the beginning of today’s presentation.

PHI Debt Refinancing

• On October 1, 2010, PHI issued $250 million of 2.7% notes due October 1, 2015

• A portion of proceeds was used on October 13, 2010 to repurchase $40 million of 6.125% notes due

2017

2017

• Remaining proceeds will be used in November 2010 to redeem $200 million of 6.0% notes due 2019

and $10 million of 5.9% notes due 2016

and $10 million of 5.9% notes due 2016

• Annual earnings impact, beginning in 2011, is lower interest expense of approximately $0.02 per share