Second Quarter 2013 Earnings Call August 7, 2013 Exhibit 99.2

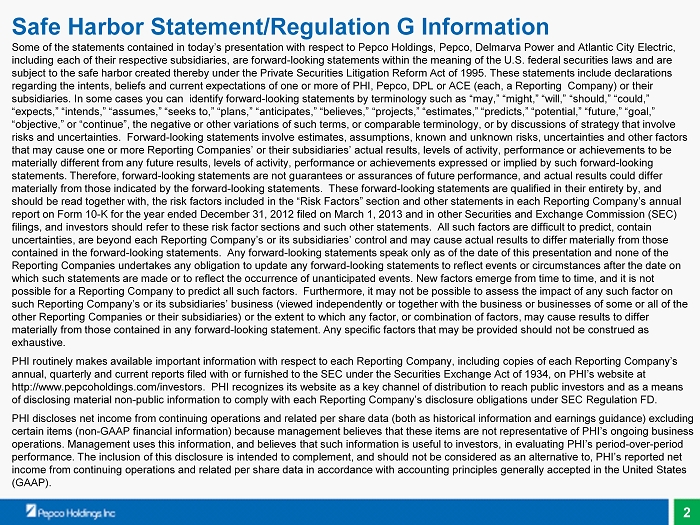

2 Safe Harbor Statement/Regulation G Information Some of the statements contained in today’s presentation with respect to Pepco Holdings, Pepco, Delmarva Power and Atlantic C ity Electric, including each of their respective subsidiaries, are forward - looking statements within the meaning of the U.S. federal securitie s laws and are subject to the safe harbor created thereby under the Private Securities Litigation Reform Act of 1995. These statements include declarations regarding the intents, beliefs and current expectations of one or more of PHI, Pepco, DPL or ACE ( each, a Reporting Company) or their subsidiaries. In some cases you can identify forward - looking statements by terminology such as “may,” “might,” “will,” “should, ” “could,” “expects,” “intends,” “assumes,” “seeks to,” “plans,” “anticipates,” “believes,” “projects,” “estimates,” “predicts,” “potent ial ,” “future,” “goal,” “objective,” or “continue”, the negative or other variations of such terms, or comparable terminology, or by discussions of s tra tegy that involve risks and uncertainties. Forward - looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause one or more Reporting Companies’ or their subsidiaries’ actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such fo rwa rd - looking statements. Therefore, forward - looking statements are not guarantees or assurances of future performance, and actual results cou ld differ materially from those indicated by the forward - looking statements. These forward - looking statements are qualified in their enti rety by, and should be read together with, the risk factors included in the “Risk Factors” section and other statements in each Reporting Com pany’s annual report on Form 10 - K for the year ended December 31, 2012 filed on March 1, 2013 and in other Securities and Exchange Commission (SEC) filings , and investors should refer to these risk factor sections and such other statements. All such factors are difficult to predict, contain uncertainties, are beyond each Reporting Company’s or its subsidiaries’ control and may cause actual results to differ materially from those contained in the forward - looking statements. Any forward - looking statements speak only as of the date of this presentation and none of the Reporting Companies undertakes any obligation to update any forward - looking statements to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, an d i t is not possible for a Reporting Company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on such Reporting Company’s or its subsidiaries’ business (viewed independently or together with the business or businesses of some or all of the other Reporting Companies or their subsidiaries) or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward - looking statement. Any specific factors that may be provided should not be construed as exhaustive. PHI routinely makes available important information with respect to each Reporting Company, including copies of each Reportin g C ompany’s annual, quarterly and current reports filed with or furnished to the SEC under the Securities Exchange Act of 1934, on PHI’s website at http://www.pepcoholdings.com/investors. PHI recognizes its website as a key channel of distribution to reach public investor s a nd as a means of disclosing material non - public information to comply with each Reporting Company’s disclosure obligations under SEC Regulatio n FD. PHI discloses net income from continuing operations and related per share data (both as historical information and earnings guida nce ) excluding certain items (non - GAAP financial information) because management believes that these items are not representative of PHI’s ongo ing business operations. Management uses this information, and believes that such information is useful to investors, in evaluating PHI’s per iod - over - period performance. The inclusion of this disclosure is intended to complement, and should not be considered as an alternative to, P HI’ s reported net income from continuing operations and related per share data in accordance with accounting principles generally accepted in t he United States (GAAP).

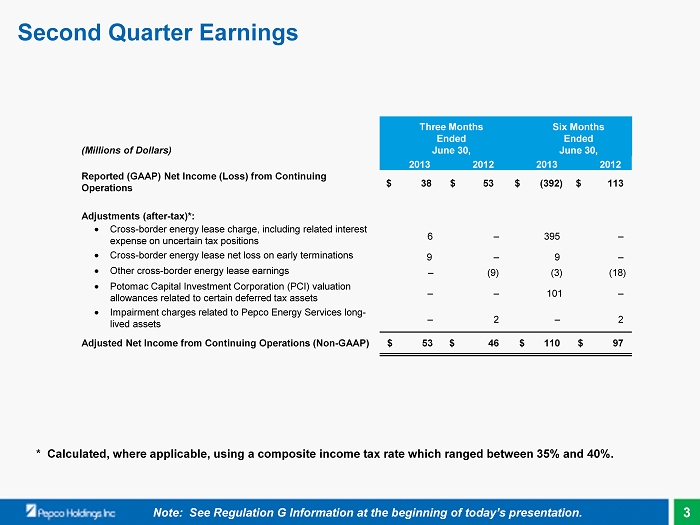

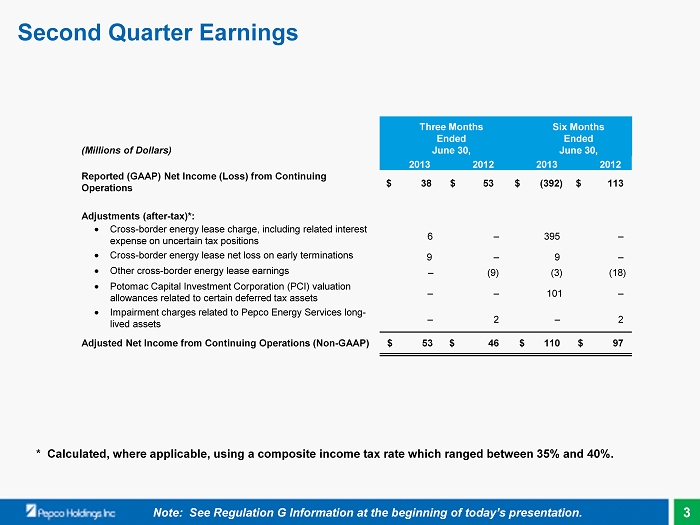

3 Second Quarter Earnings (Millions of Dollars) Three Months Ended June 30, Six Months Ended June 30, 2013 2012 2013 2012 Reported (GAAP) Net Income (Loss) from Continuing Operations $ 38 $ 53 $ (392) $ 113 Adjustments (after - tax )*: • Cross - border energy lease charge, including related interest expense on uncertain tax positions 6 – 395 – • Cross - border energy lease net loss on early terminations 9 – 9 – • Other cross - border energy lease earnings – (9) ( 3) (18) • Potomac Capital Investment Corporation (PCI) valuation allowances related to certain deferred tax assets – – 101 – • Impairment charges related to Pepco Energy Services long - lived assets – 2 – 2 Adjusted Net Income from Continuing Operations (Non - GAAP) $ 53 $ 46 $ 110 $ 97 * Calculated, where applicable, using a composite income tax rate which ranged between 35% and 40%. Note: See Regulation G Information at the beginning of today’s presentation.

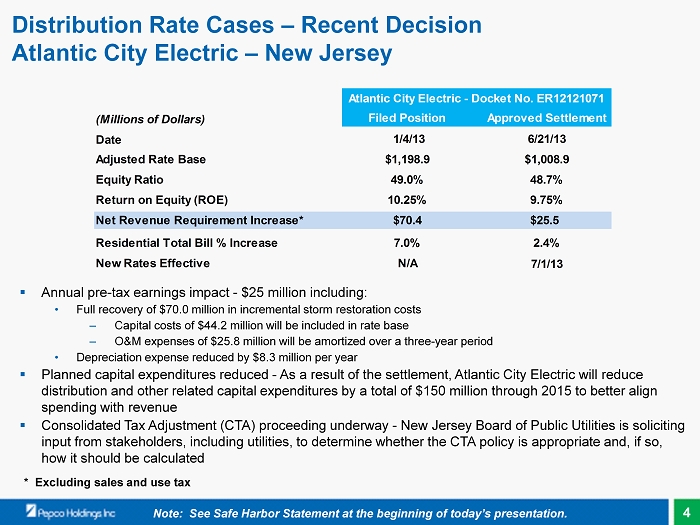

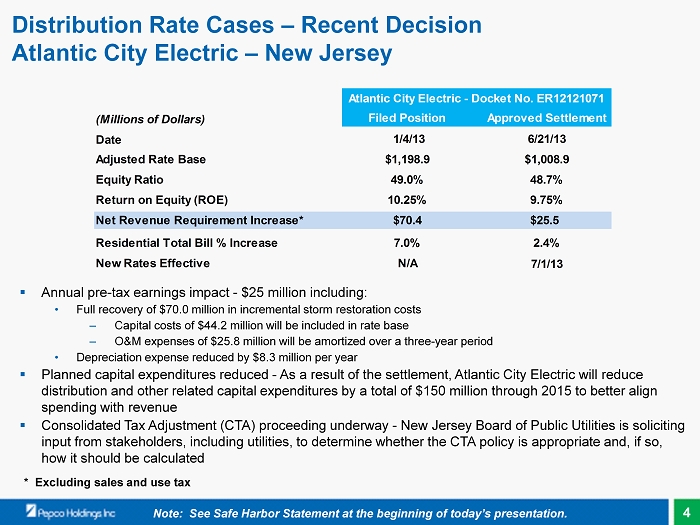

4 Distribution Rate Cases – Recent Decision Atlantic City Electric – New Jersey (Millions of Dollars) Filed Position Approved Settlement Date 1/4/13 6/21/13 Adjusted Rate Base $1,198.9 $1,008.9 Equity Ratio 49.0% 48.7% Return on Equity (ROE) 10.25% 9.75% Net Revenue Requirement Increase* $70.4 $25.5 Residential Total Bill % Increase 7.0% 2.4% New Rates Effective N/A 7/1/13 Atlantic City Electric - Docket No. ER12121071 * Excluding sales and use tax ▪ Annual pre - tax earnings impact - $25 million including: • Full recovery of $70.0 million in incremental storm restoration costs – Capital costs of $44.2 million will be included in rate base – O&M expenses of $25.8 million will be amortized over a three - year period • Depreciation expense reduced by $8.3 million per year ▪ Planned capital expenditures reduced - As a result of the settlement, Atlantic City Electric will reduce distribution and other related capital expenditures by a total of $150 million through 2015 to better align spending with revenue ▪ Consolidated Tax Adjustment (CTA) p roceeding underway - New Jersey Board of Public Utilities is soliciting input from stakeholders, including utilities, to determine whether the CTA policy is appropriate and, if so, how it should be calculated Note: See Safe Harbor Statement at the beginning of today’s presentation.

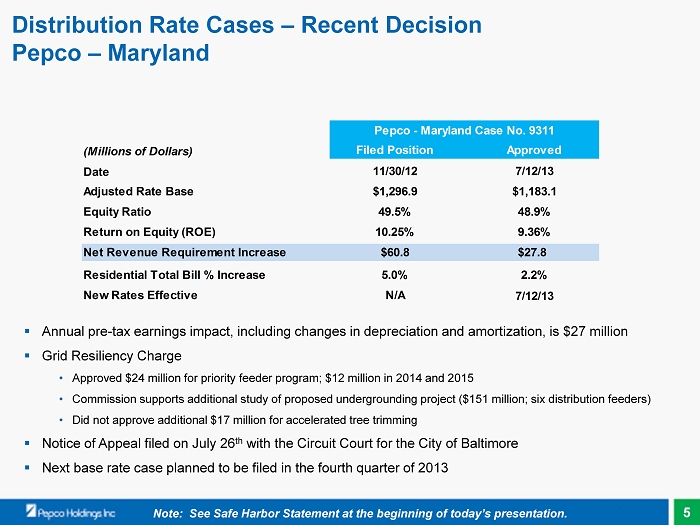

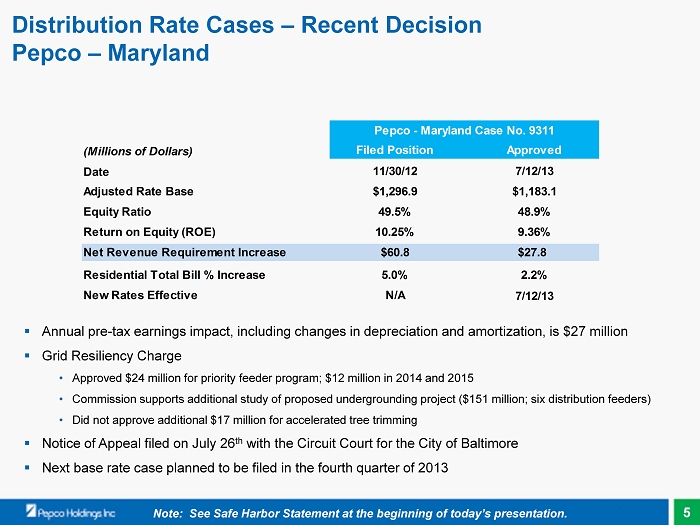

5 Distribution Rate Cases – Recent Decision Pepco – Maryland (Millions of Dollars) Filed Position Approved Date 11/30/12 7/12/13 Adjusted Rate Base $1,296.9 $1,183.1 Equity Ratio 49.5% 48.9% Return on Equity (ROE) 10.25% 9.36% Net Revenue Requirement Increase $60.8 $27.8 Residential Total Bill % Increase 5.0% 2.2% New Rates Effective N/A 7/12/13 Pepco - Maryland Case No. 9311 Note: See Safe Harbor Statement at the beginning of today’s presentation. ▪ Annual pre - tax earnings impact, including changes in depreciation and amortization, is $27 million ▪ Grid Resiliency Charge • Approved $24 million for priority feeder program; $12 million in 2014 and 2015 • Commission supports additional study of proposed undergrounding project ($151 million; six distribution feeders) • Did not approve additional $17 million for accelerated tree trimming ▪ Notice of Appeal filed on July 26 th with the Circuit Court for the City of Baltimore ▪ Next base rate case planned to be filed in the fourth quarter of 2013

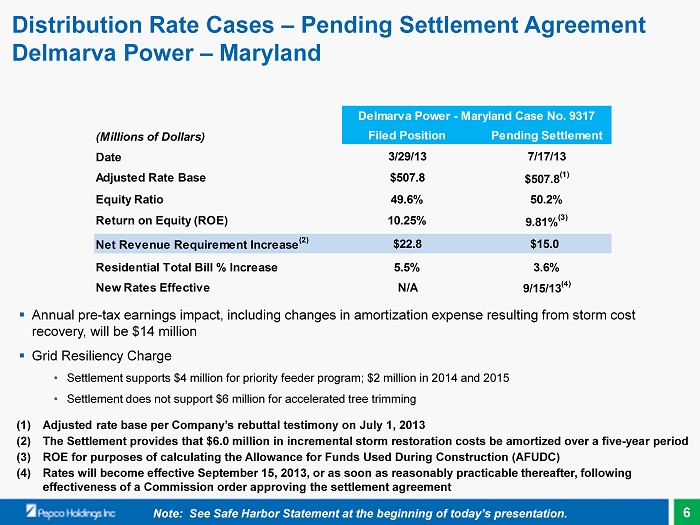

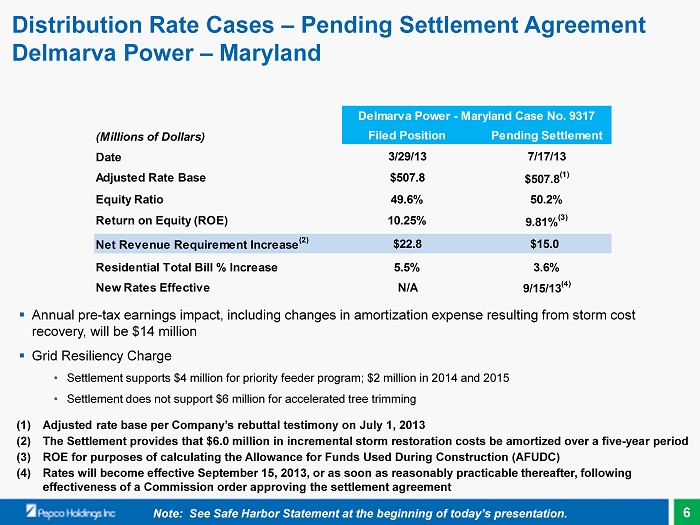

6 Distribution Rate Cases – Pending Settlement Agreement Delmarva Power – Maryland (Millions of Dollars) Filed Position Pending Settlement Date 3/29/13 7/17/13 Adjusted Rate Base $507.8 $507.8 (1) Equity Ratio 49.6% 50.2% Return on Equity (ROE) 10.25% 9.81% (3) Net Revenue Requirement Increase (2) $22.8 $15.0 Residential Total Bill % Increase 5.5% 3.6% New Rates Effective N/A 9/15/13 (4) Delmarva Power - Maryland Case No. 9317 (1) Adjusted rate base per Company’s rebuttal testimony on July 1, 2013 (2) The Settlement provides that $6.0 million in incremental storm restoration costs be amortized over a five - year period (3) ROE for purposes of calculating the Allowance for Funds U sed During Construction (AFUDC) (4) Rates will become effective September 15, 2013, or as soon as reasonably practicable thereafter, following effectiveness of a Commission order approving the settlement agreement Note: See Safe Harbor Statement at the beginning of today’s presentation. ▪ Annual pre - tax earnings impact, including changes in amortization expense resulting from storm cost recovery, will be $14 million ▪ Grid Resiliency Charge • Settlement supports $4 million for priority feeder program; $2 million in 2014 and 2015 • Settlement does not support $6 million for accelerated tree trimming

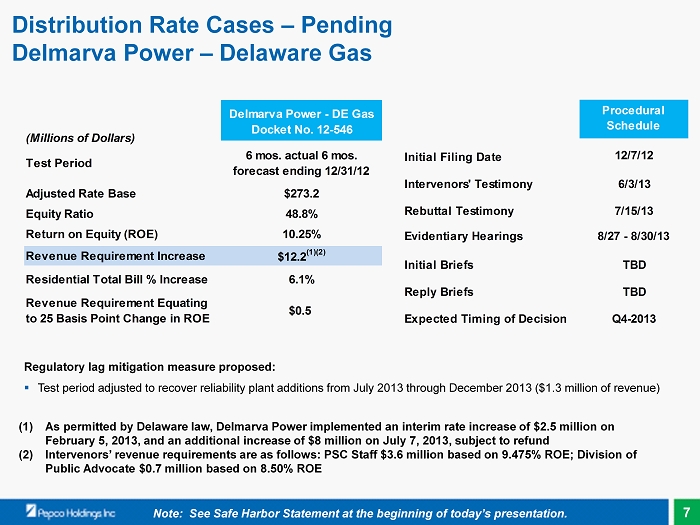

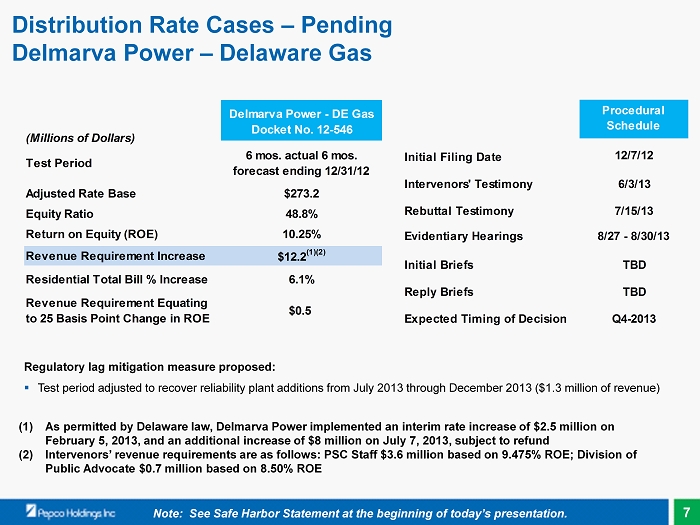

7 Distribution Rate Cases – Pending Delmarva Power – Delaware Gas Test Period 6 mos. actual 6 mos. forecast ending 12/31/12 Adjusted Rate Base $273.2 Equity Ratio 48.8% Return on Equity (ROE) 10.25% Revenue Requirement Increase $12.2 (1)(2) Residential Total Bill % Increase 6.1% Revenue Requirement Equating to 25 Basis Point Change in ROE $0.5 Delmarva Power - DE Gas Docket No. 12-546 (Millions of Dollars) (1) As permitted by Delaware law, Delmarva Power implemented an interim rate increase of $2.5 million on February 5, 2013, and an additional increase of $8 million on July 7, 2013, subject to refund (2) Intervenors’ revenue requirements are as follows: PSC Staff $3.6 million based on 9.475% ROE; Division of Public Advocate $0.7 million based on 8.50% ROE Regulatory lag mitigation measure proposed: ▪ Test period adjusted to recover reliability plant additions from July 2013 through December 2013 ($1.3 million of revenue) Note: See Safe Harbor Statement at the beginning of today’s presentation. Procedural Schedule Initial Filing Date 12/7/12 Intervenors' Testimony 6/3/13 Rebuttal Testimony 7/15/13 Evidentiary Hearings 8/27 - 8/30/13 Initial Briefs TBD Reply Briefs TBD Expected Timing of Decision Q4-2013

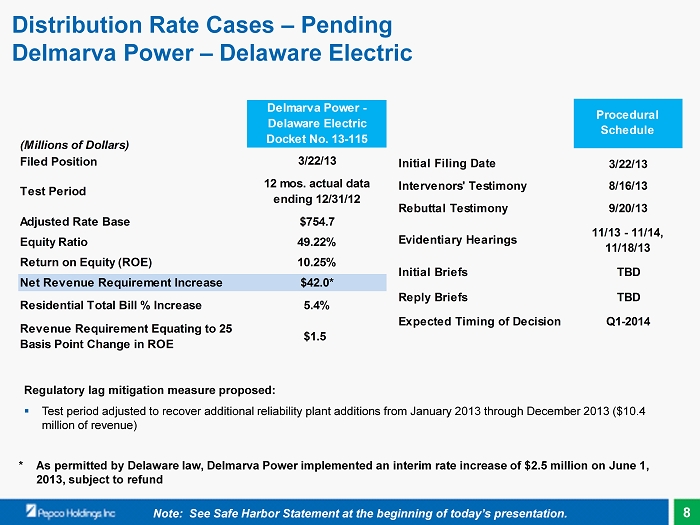

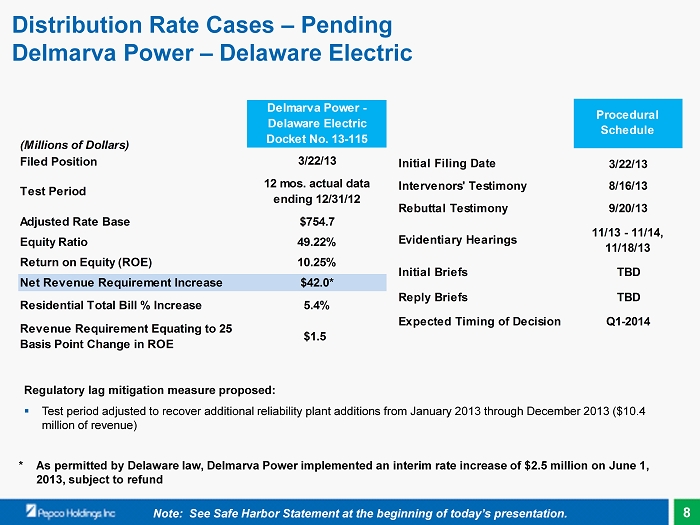

8 Distribution Rate Cases – Pending Delmarva Power – Delaware Electric Filed Position 3/22/13 Test Period 12 mos. actual data ending 12/31/12 Adjusted Rate Base $754.7 Equity Ratio 49.22% Return on Equity (ROE) 10.25% Net Revenue Requirement Increase $42.0* Residential Total Bill % Increase 5.4% Revenue Requirement Equating to 25 Basis Point Change in ROE $1.5 (Millions of Dollars) Delmarva Power - Delaware Electric Docket No. 13-115 Regulatory lag mitigation measure proposed: ▪ Test period adjusted to recover additional reliability plant additions from January 2013 through December 2013 ($10.4 million of revenue) Note: See Safe Harbor Statement at the beginning of today’s presentation. * As permitted by Delaware law, Delmarva Power implemented an interim rate increase of $2.5 million on June 1, 2013, subject to refund Procedural Schedule Initial Filing Date 3/22/13 Intervenors' Testimony 8/16/13 Rebuttal Testimony 9/20/13 Evidentiary Hearings 11/13 - 11/14, 11/18/13 Initial Briefs TBD Reply Briefs TBD Expected Timing of Decision Q1-2014

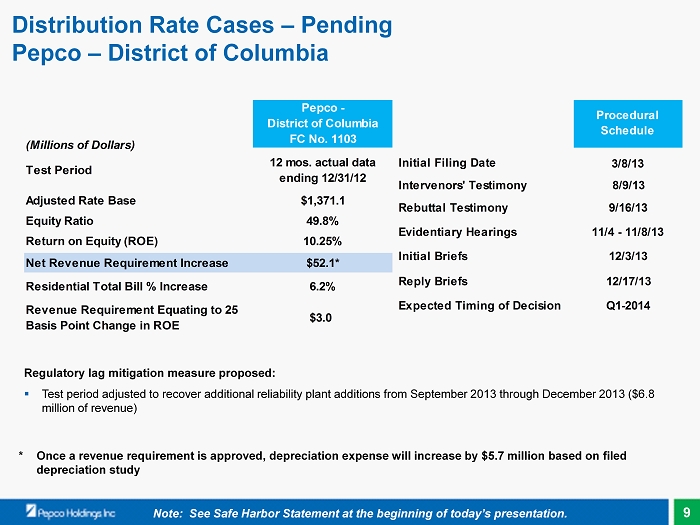

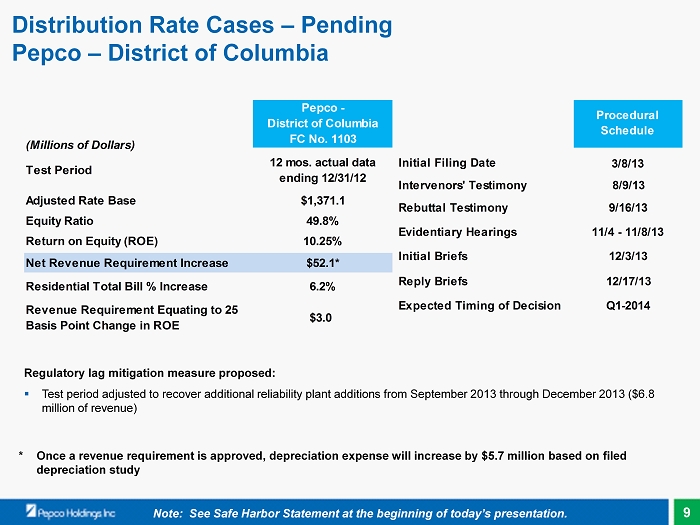

9 Distribution Rate Cases – Pending Pepco – District of Columbia Test Period 12 mos. actual data ending 12/31/12 Adjusted Rate Base $1,371.1 Equity Ratio 49.8% Return on Equity (ROE) 10.25% Net Revenue Requirement Increase $52.1* Residential Total Bill % Increase 6.2% Revenue Requirement Equating to 25 Basis Point Change in ROE $3.0 (Millions of Dollars) Pepco - District of Columbia FC No. 1103 Regulatory lag mitigation measure proposed: ▪ Test period adjusted to recover additional reliability plant additions from September 2013 through December 2013 ($6.8 million of revenue) * Once a revenue requirement is approved, depreciation expense will increase by $5.7 million based on filed depreciation study Note: See Safe Harbor Statement at the beginning of today’s presentation. Procedural Schedule Initial Filing Date 3/8/13 Intervenors' Testimony 8/9/13 Rebuttal Testimony 9/16/13 Evidentiary Hearings 11/4 - 11/8/13 Initial Briefs 12/3/13 Reply Briefs 12/17/13 Expected Timing of Decision Q1-2014

10 Pepco Undergrounding Status – District of Columbia ▪ On May 15, 2013, the Mayor of the District of Columbia accepted the recommendations in an interim report presented by the Power Line Undergrounding Task Force (established in August 2012): • A seven year , $1 billion program to underground up to 60 high voltage distribution feeder lines, which historically have been most impacted by storms and overhead related outages • The implementation of the recommendations is expected to result in 95% improved reliability for customers served by those power lines ▪ Funding will be split 50/50 between Pepco and the District of Columbia (District ): • Pepco’s funding will be approximately 50% debt and 50% equity (from parent) totaling $500 million • District’s funding will be $375 million in municipal bonds and up to $125 million in District Department of Transportation improvement funds • Pepco’s cost recovery will be through a consumer surcharge until the assets are moved to rate base • For residential customers, the rate impact will start at approximately $1.50 per month and will increase to a maximum of $3.25 after seven years, or approximately a 3.23% increase in total bill ▪ On July 10, 2013, legislation was introduced in the District Council providing for implementation of the program, expected to be voted on by the fourth quarter of 2013, and if passed, could be final in the first quarter of 2014: • Authorizing the municipal financing mechanism • Directing the Public Service Commission (PSC) to establish a surcharge to recover debt payments associated with the municipal bonds • Directing the PSC to establish a surcharge to allow Pepco timely recovery of costs associated with the undergrounding work ▪ The PSC is expected to approve the financing and surcharge application associated with the legislation in the second quarter of 2014 Note: See Safe Harbor Statement at the beginning of today’s presentation.

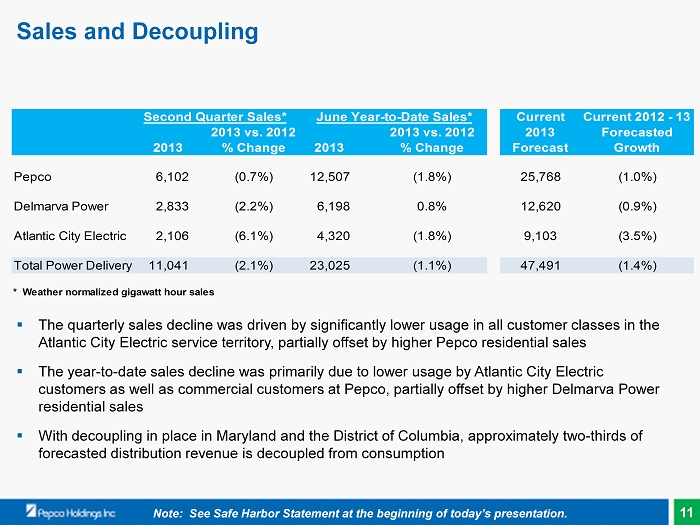

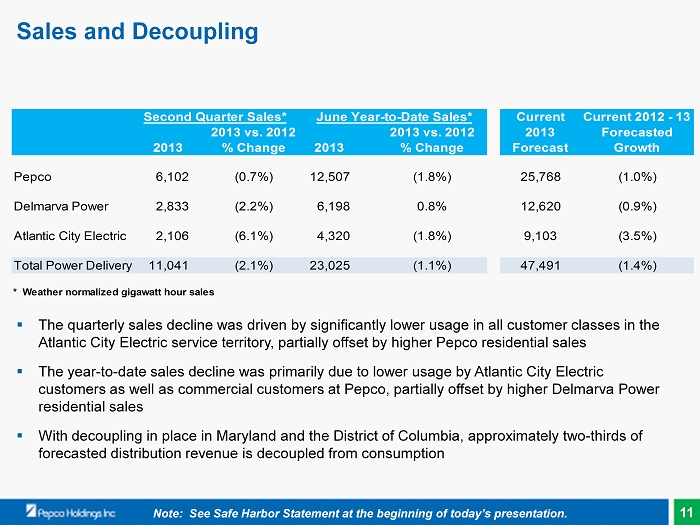

11 Sales and Decoupling ▪ The quarterly sales decline was driven by significantly lower usage in all customer classes in the Atlantic City Electric service territory, partially offset by higher Pepco residential sales ▪ The year - to - date sales decline was primarily due to lower usage by Atlantic City Electric customers as well as commercial customers at Pepco, partially offset by higher Delmarva Power residential sales ▪ With decoupling in place in Maryland and the District of Columbia, approximately two - thirds of forecasted distribution revenue is decoupled from consumption 2013 vs. 2012 2013 vs. 2012 2013 % Change 2013 % Change Pepco 6,102 (0.7%) 12,507 (1.8%) 25,768 (1.0%) Delmarva Power 2,833 (2.2%) 6,198 0.8% 12,620 (0.9%) Atlantic City Electric 2,106 (6.1%) 4,320 (1.8%) 9,103 (3.5%) Total Power Delivery 11,041 (2.1%) 23,025 (1.1%) 47,491 (1.4%) * Weather normalized gigawatt hour sales Second Quarter Sales* June Year-to-Date Sales* Current 2013 Forecast Current 2012 - 13 Forecasted Growth Note: See Safe Harbor Statement at the beginning of today’s presentation.

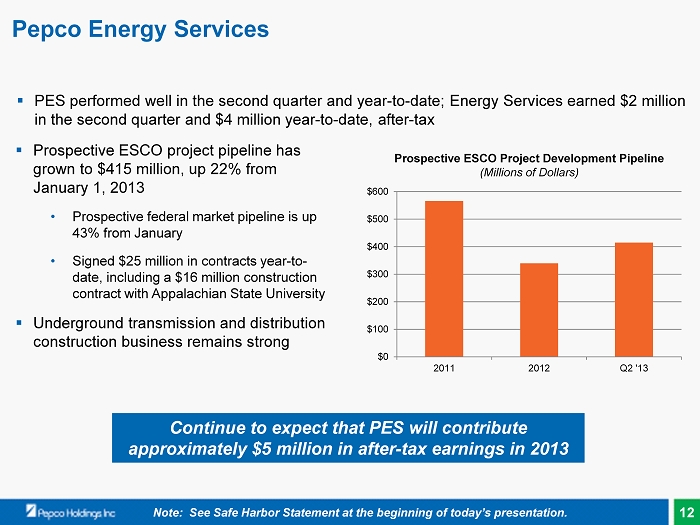

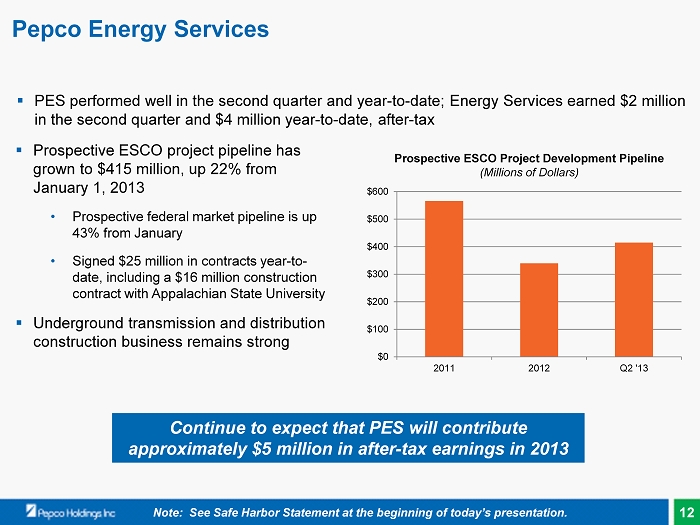

12 Pepco Energy Services Note: See Safe Harbor Statement at the beginning of today’s presentation. ▪ Prospective ESCO project pipeline has grown to $415 million, up 22% from January 1, 2013 • Prospective federal market pipeline is up 43% from January • Signed $25 million in contracts year - to - date, including a $16 million construction contract with Appalachian State University ▪ Underground transmission and distribution construction business remains strong Prospective ESCO Project Development Pipeline (Millions of Dollars) Continue to expect that PES will contribute approximately $5 million in after - tax earnings in 2013 $0 $100 $200 $300 $400 $500 $600 2011 2012 Q2 '13 ▪ PES performed well in the second quarter and year - to - date; Energy Services earned $2 million in the second quarter and $4 million year - to - date, after - tax

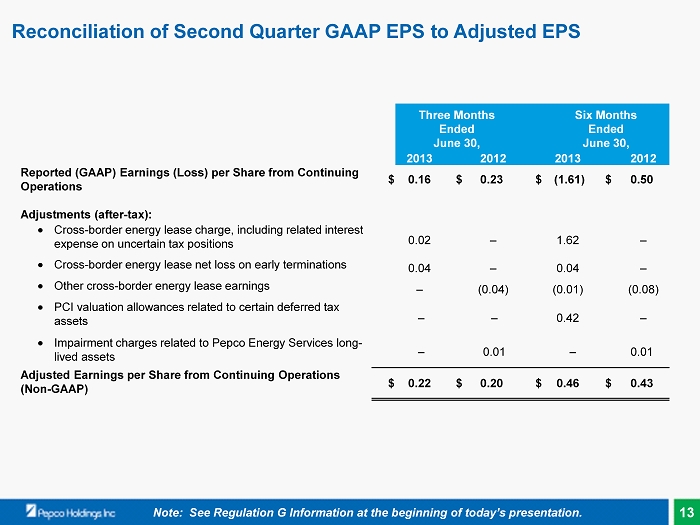

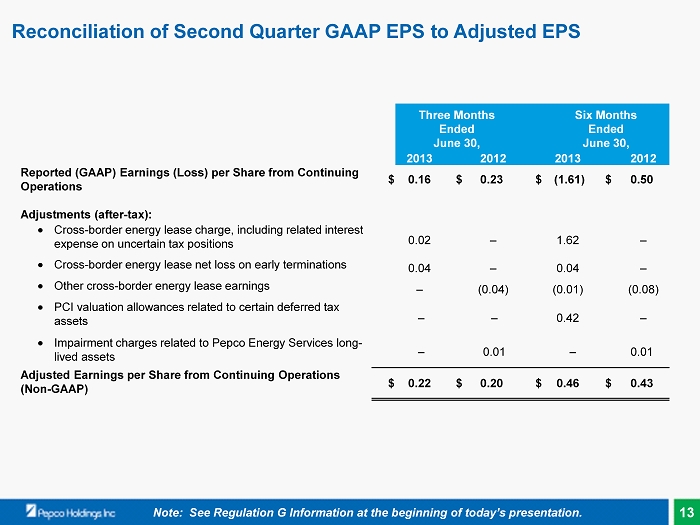

13 Three Months Ended June 30, Six Months Ended June 30, 2013 2012 2013 2012 Reported (GAAP) Earnings (Loss) per Share from Continuing Operations $ 0.16 $ 0.23 $ ( 1.61) $ 0.50 Adjustments (after - tax): • Cross - border energy lease charge, including related interest expense on uncertain tax positions 0.02 – 1.62 – • Cross - border energy lease net loss on early terminations 0.04 – 0.04 – • Other c ross - border energy lease earnings – (0.04) ( 0.01) (0.08) • PCI valuation allowances related to certain deferred tax assets – – 0.42 – • Impairment charges related to Pepco Energy Services long - lived assets – 0.01 – 0.01 Adjusted Earnings per Share from Continuing Operations (Non - GAAP) $ 0.22 $ 0.20 $ 0.46 $ 0.43 Reconciliation of Second Quarter GAAP EPS to Adjusted EPS Note: See Regulation G Information at the beginning of today’s presentation.

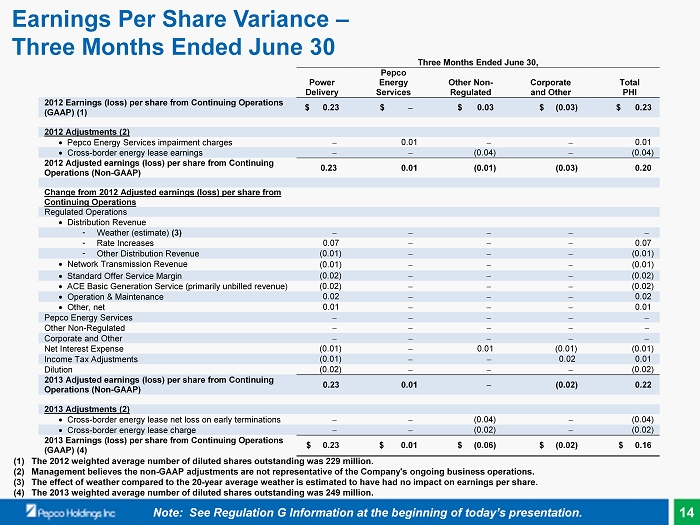

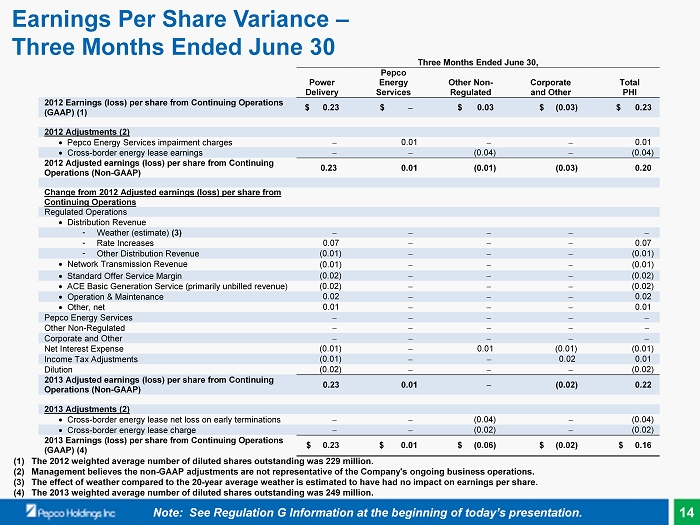

14 Earnings Per Share Variance – Three Months Ended June 30 ( 1) The 2012 weighted average number of diluted shares outstanding was 229 million. (2) Management believes the non - GAAP adjustments are not representative of the Company's ongoing business operations . ( 3) The effect of weather compared to the 20 - year average weather is estimated to have had no impact on earnings per share. ( 4) The 2013 weighted average number of diluted shares outstanding was 249 million. Note: See Regulation G Information at the beginning of today’s presentation. Three Months Ended June 30, Power Pepco Energy Other Non- Corporate Total Delivery Services Regulated and Other PHI 2012 Earnings (loss) per share from Continuing Operations (GAAP) (1) $ 0.23 $ – $ 0.03 $ (0.03) $ 0.23 2012 Adjustments (2) • Pepco Energy Services impairment charges – 0.01 – – 0.01 • Cross-border energy lease earnings – – (0.04) – (0.04) 2012 Adjusted earnings (loss) per share from Continuing Operations (Non-GAAP) 0.23 0.01 (0.01) (0.03) 0.20 Change from 2012 Adjusted earnings (loss) per share from Continuing Operations Regulated Operations • Distribution Revenue - Weather (estimate) (3) – – – – – - Rate Increases 0.07 – – – 0.07 - Other Distribution Revenue (0.01) – – – (0.01) • Network Transmission Revenue (0.01) – – – (0.01) • Standard Offer Service Margin (0.02) – – – (0.02) • ACE Basic Generation Service (primarily unbilled revenue) (0.02) – – – (0.02) • Operation & Maintenance 0.02 – – – 0.02 • Other, net 0.01 – – – 0.01 Pepco Energy Services – – – – – Other Non-Regulated – – – – – Corporate and Other – – – – – Net Interest Expense (0.01) – 0.01 (0.01) (0.01) Income Tax Adjustments (0.01) – – 0.02 0.01 Dilution (0.02) – – – (0.02) 2013 Adjusted earnings (loss) per share from Continuing Operations (Non-GAAP) 0.23 0.01 – (0.02) 0.22 2013 Adjustments (2) • Cross-border energy lease net loss on early terminations – – (0.04) – (0.04) • Cross-border energy lease charge – – (0.02) – (0.02) 2013 Earnings (loss) per share from Continuing Operations (GAAP) (4) $ 0.23 $ 0.01 $ (0.06) $ (0.02) $ 0.16

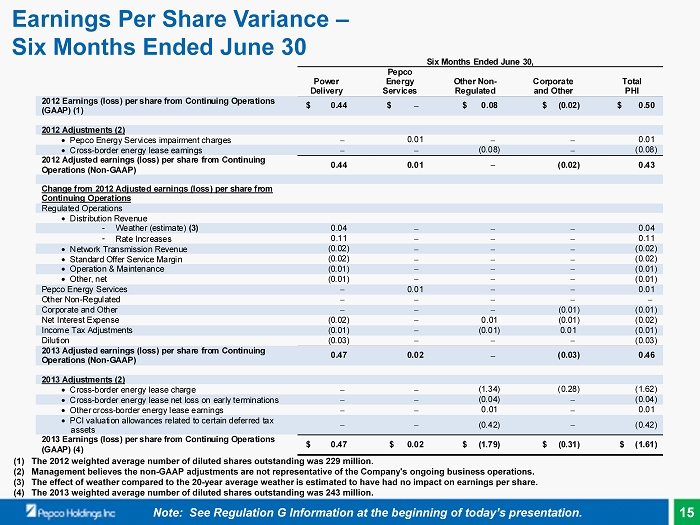

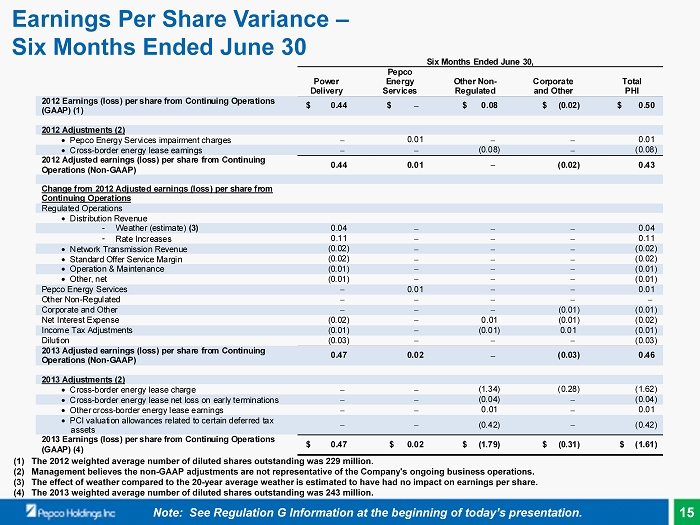

15 Earnings Per Share Variance – Six Months Ended June 30 ( 1) The 2012 weighted average number of diluted shares outstanding was 229 million. (2) Management believes the non - GAAP adjustments are not representative of the Company's ongoing business operations . ( 3) The effect of weather compared to the 20 - year average weather is estimated to have had no impact on earnings per share. ( 4) The 2013 weighted average number of diluted shares outstanding was 243 million. Note: See Regulation G Information at the beginning of today’s presentation. Six Months Ended June 30, Power Pepco Energy Other Non- Corporate Total Delivery Services Regulated and Other PHI 2012 Earnings (loss) per share from Continuing Operations (GAAP) (1) $ 0.44 $ – $ 0.08 $ (0.02) $ 0.50 2012 Adjustments (2) • Pepco Energy Services impairment charges – 0.01 – – 0.01 • Cross-border energy lease earnings – – (0.08) – (0.08) 2012 Adjusted earnings (loss) per share from Continuing Operations (Non-GAAP) 0.44 0.01 – (0.02) 0.43 Change from 2012 Adjusted earnings (loss) per share from Continuing Operations Regulated Operations • Distribution Revenue - Weather (estimate) (3) 0.04 – – – 0.04 - Rate Increases 0.11 – – – 0.11 • Network Transmission Revenue (0.02) – – – (0.02) • Standard Offer Service Margin (0.02) – – – (0.02) • Operation & Maintenance (0.01) – – – (0.01) • Other, net (0.01) – – – (0.01) Pepco Energy Services – 0.01 – – 0.01 Other Non-Regulated – – – – – Corporate and Other – – – (0.01) (0.01) Net Interest Expense (0.02) – 0.01 (0.01) (0.02) Income Tax Adjustments (0.01) – (0.01) 0.01 (0.01) Dilution (0.03) – – – (0.03) 2013 Adjusted earnings (loss) per share from Continuing Operations (Non-GAAP) 0.47 0.02 – (0.03) 0.46 2013 Adjustments (2) • Cross-border energy lease charge – – (1.34) (0.28) (1.62) • Cross-border energy lease net loss on early terminations – – (0.04) – (0.04) • Other cross-border energy lease earnings – – 0.01 – 0.01 • PCI valuation allowances related to certain deferred tax assets – – (0.42) – (0.42) 2013 Earnings (loss) per share from Continuing Operations (GAAP) (4) $ 0.47 $ 0.02 $ (1.79) $ (0.31) $ (1.61)

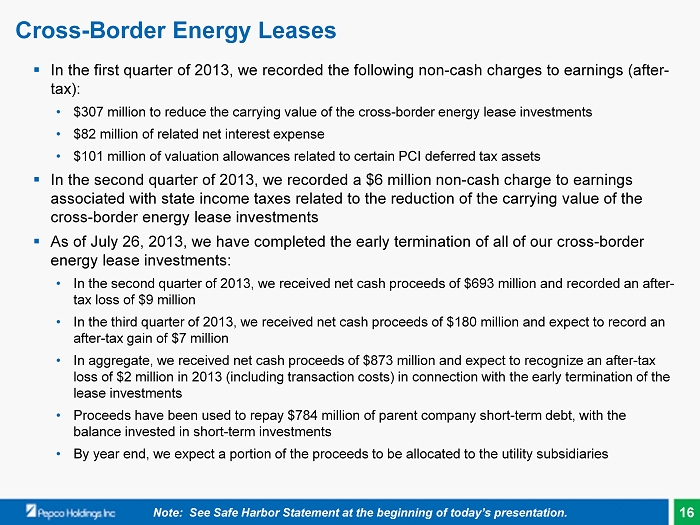

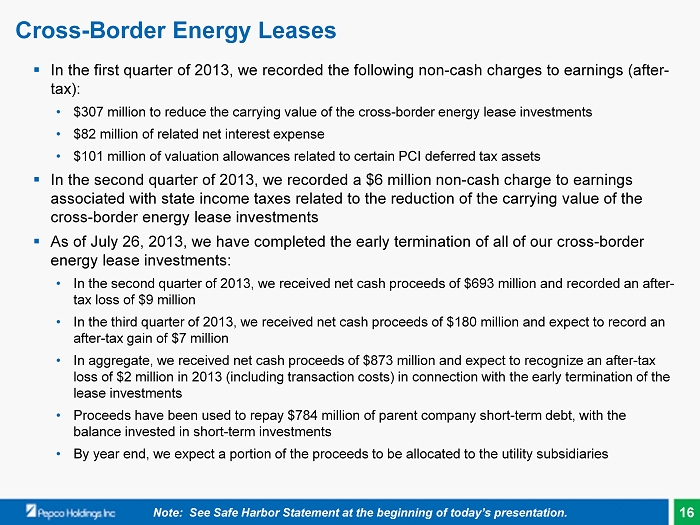

16 Cross - Border Energy Leases ▪ In the first quarter of 2013, we recorded the following non - cash charges to earnings (after - tax): • $307 million to reduce the carrying value of the cross - border energy lease investments • $82 million of related net interest expense • $101 million of valuation allowances related to certain PCI deferred tax assets ▪ In the second quarter of 2013, we recorded a $6 million non - cash charge to earnings associated with state income taxes related to the reduction of the carrying value of the cross - border energy lease investments ▪ As of July 26, 2013, we have completed the early termination of all of our cross - border energy lease investments: • In the second quarter of 2013, we received net cash proceeds of $ 693 million and recorded an after - tax loss of $9 million • In the third quarter of 2013, we received net cash proceeds of $180 million and expect to record an after - tax gain o f $7 million • In aggregate, we received net cash proceeds of $873 million and expect to recognize an after - tax loss of $ 2 million in 2013 (including transaction costs) in connection with the early termination of the lease investments • Proceeds have been used to repay $784 million of parent company short - term debt, with the balance invested in short - term investments • By year end, we expect a portion of the proceeds to be allocated to the utility subsidiaries Note: See Safe Harbor Statement at the beginning of today’s presentation.

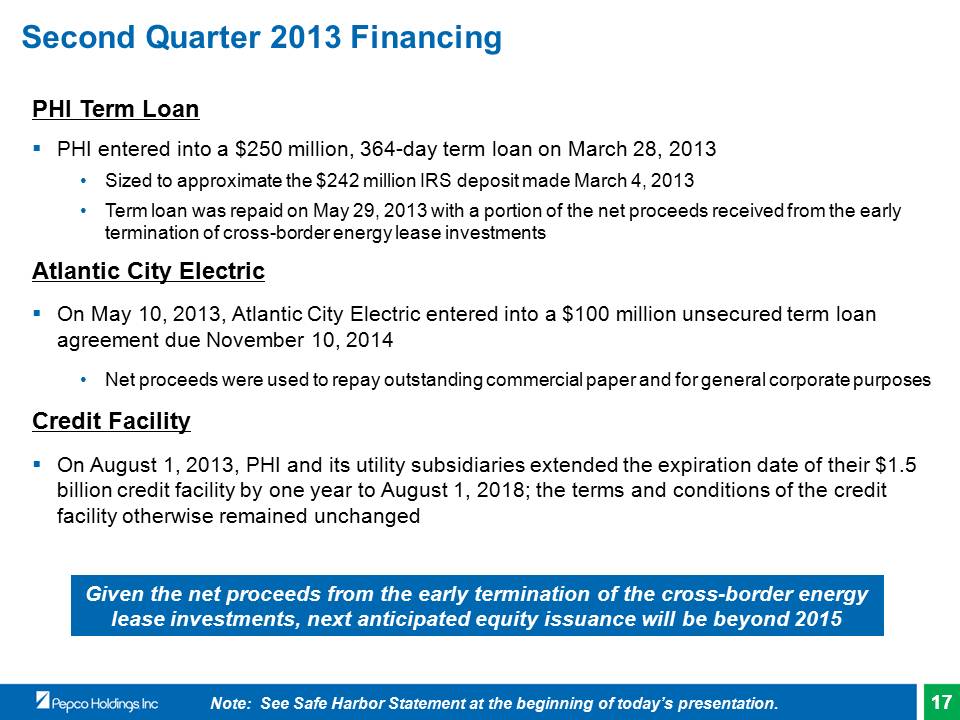

17 PHI Term Loan ▪ PHI entered into a $250 million, 364 - day term loan on March 28, 2013 • Sized to approximate the $242 million IRS deposit made March 4, 2013 • Term loan was repaid on May 29, 2013 with a portion of the net proceeds received from the early termination of cross - border energy lease investments Atlantic City Electric ▪ On May 10, 2013, Atlantic City Electric entered into a $100 million unsecured term loan agreement due November 10, 2014 • Net proceeds were used to repay outstanding commercial paper and for general corporate purposes Credit Facility ▪ On August 1, 2013, PHI and its utility subsidiaries extended the expiration date of their $1.5 billion credit facility by one year to August 1, 2018; the terms and conditions of the credit facility otherwise remained unchanged Second Quarter 2013 Financing 17 Given the net proceeds from the early termination of the cross - border energy lease investments, next anticipated equity issuance will be beyond 2015

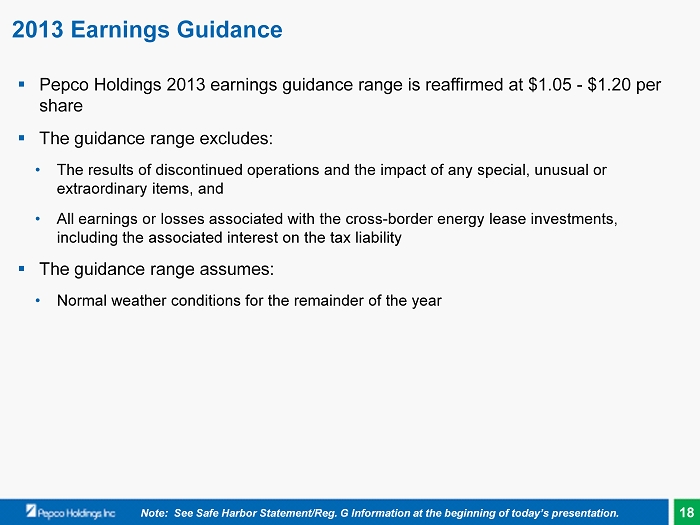

18 2013 Earnings Guidance ▪ Pepco Holdings 2013 earnings guidance range is reaffirmed at $1.05 - $1.20 per share ▪ The guidance range excludes: • The results of discontinued operations and the impact of any special, unusual or extraordinary items, and • All earnings or losses associated with the cross - border energy lease investments, including the associated interest on the tax liability ▪ The guidance range assumes: • Normal weather conditions for the remainder of the year Note: See Safe Harbor Statement/Reg. G Information at the beginning of today’s presentation.