- Company Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

-

Shorts

-

8-K Filing

Pepco 8-KRegulation FD Disclosure

Filed: 8 Nov 13, 12:00am

Exhibit 99

48thEEI Financial Conference

Investing Today for a Brighter Tomorrow

November 10 – 12, 2013

Orlando, FL

Safe Harbor Statement/Regulation G Information

Some of the statements contained in today’s presentation with respect to Pepco Holdings, Pepco, Delmarva Power and Atlantic City Electric, including each of their respective subsidiaries, are forward-looking statements within the meaning of the U.S. federal securities laws and are subject to the safe harbor created thereby under the Private Securities Litigation Reform Act of 1995. These statements include declarations regarding the intents, beliefs and current expectations of one or more of PHI, Pepco, DPL or ACE (each, a Reporting Company) or their subsidiaries. In some cases you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “could,” “expects,” “intends,” “assumes,” “seeks to,” “plans,” “antici pates,” “believes,” “projects,” “estimates,” “predicts,” “p otential,” “future,” “goal,” “objective,” or “continue”, the negative or other var iations of such terms, or comparable terminology, or by discussions of strategy that involve risks and uncertainties. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause one or more Reporting Companies’ or their subsidiaries’ actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Therefore, forward-looking statements are not guarantees or assurances of future performance, and actual results could differ materially from those indicated by the forward-looking statements. These forward-looking statements are qualified in their entirety by, and should be read together with, the risk factors included in the “Risk Factors” section and other statements in each Reporting Company’s annual report on Form 10-K for the year ended December 31, 2012 filed on March 1, 2013 and in other Securities and Exchange Commission (SEC) filings, and investors should refer to these risk factor sections and such other statements. All such factors are difficult to predict, contain uncertainties, are beyond each Reporting Company’s or its subsidiaries’ control and may cause actual results to differ materially from those contained in the forward-looking statements. Any forward-looking statements speak only as of the date of this presentation and none of the Reporting Companies undertakes any obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for a Reporting Company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on such Reporting Company’s or its subsidiaries’ business (viewed independently or together with the business or businesses of some or all of the other Reporting Companies or their subsidiaries) or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any specific factors that may be provided should not be construed as exhaustive.

PHI routinely makes available important information with respect to each Reporting Company, including copies of each Reporting Company’s annual, quarterly and current reports filed with or furnished to the SEC under the Securities Exchange Act of 1934, on PHI’s website at http://www.pepcoholdings.com/investors. PHI recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with each Reporting Company’s disclosure obligations under SEC Regulation FD.

PHI discloses net income from continuing operations and related per share data (both as historical information and earnings guidance) excluding certain items (non-GAAP financial information) because management believes that these items are not representative of PHI’s ongoing business operations. Management uses this information, and believes that such information is useful to investors, in evaluating PHI’s period-over-period performance. The inclusion of this disclosure is intended to complement, and should not be considered as an alternative to, PHI’s reported net income from continuing operations and related per share data in accordance with accounting principles generally accepted in the United States (GAAP).

1

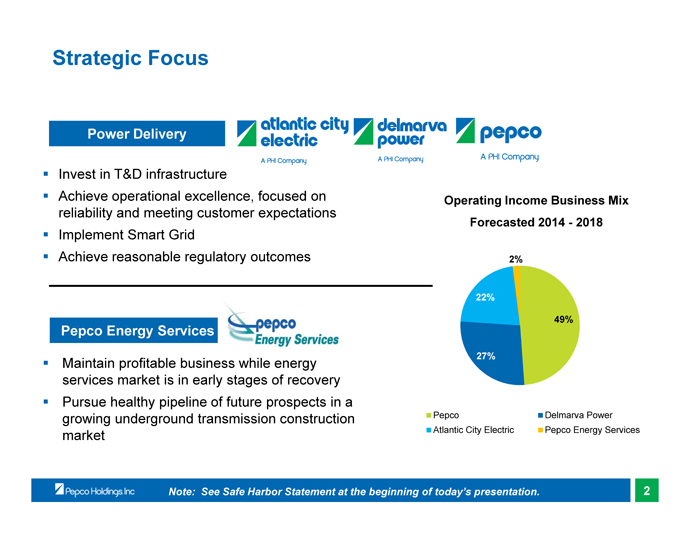

Strategic Focus

Power Delivery

· Invest in T&D infrastructure

• Achieve operational excellence, focused on reliability and meeting customer expectations

• Implement Smart Grid

• Achieve reasonable regulatory outcomes

Pepco Energy Services

• Maintain profitable business while energy services market is in early stages of recovery

• Pursue healthy pipeline of future prospects in a growing underground transmission construction market

Operating Income Business Mix

Forecasted 2014 - 2018

Note: See Safe Harbor Statement at the beginning of today’s presentation.2

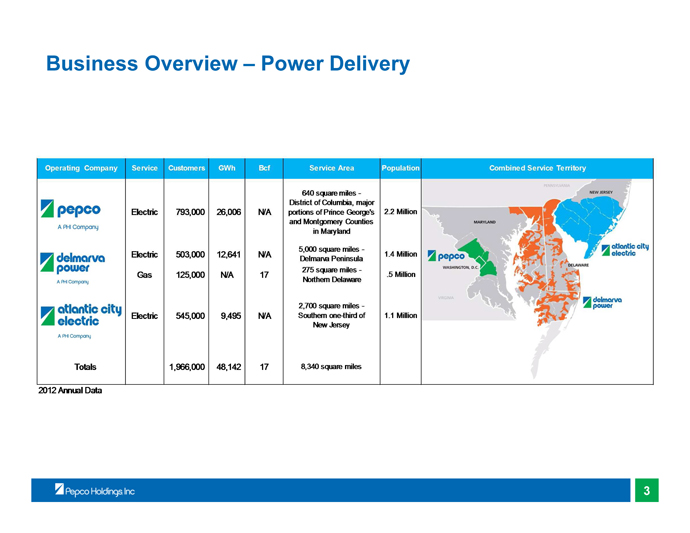

Business Overview – Power Delivery

3

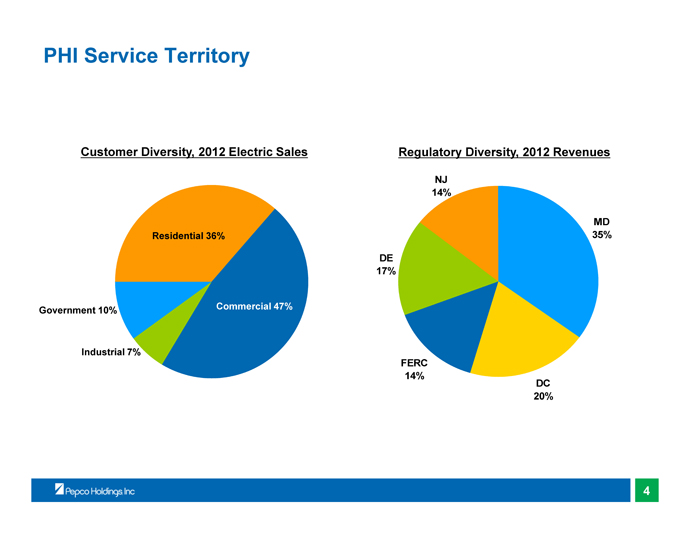

PHI Service Territory

Customer Diversity, 2012 Electric Sales Regulatory Diversity, 2012 Revenues

4

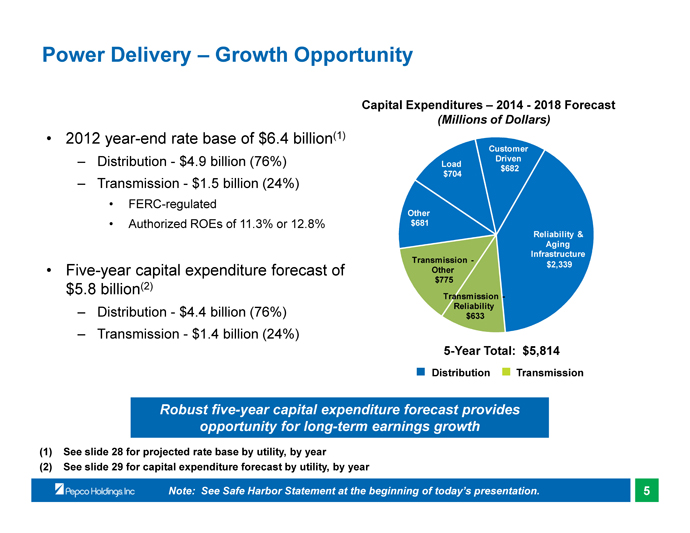

Power Delivery – Growth Opportunity

• 2012 year-end rate base of $6.4 billion(1)

– Distribution - $4.9 billion (76%) – Transmission - $1.5 billion (24%)

• FERC-regulated

• Authorized ROEs of 11.3% or 12.8%

• Five-year capital expenditure forecast of $5.8 billion(2)

– Distribution - $4.4 billion (76%) – Transmission - $1.4 billion (24%)

Capital Expenditures – 2014 - 2018 Forecast

(Millions of Dollars)

Robust five-year capital expenditure forecast provides opportunity for long-term earnings growth

(1) See slide 28 for projected rate base by utility, by year

(2) See slide 29 for capital expenditure forecast by utility, by year

Note: See Safe Harbor Statement at the beginning of today’s presentation.5

Power Delivery Construction Expenditure Forecast

(Millions of Dollars)20142015201620172018Total

Distribution:

Customer Driven (new service connections,$129$129$143$145$136 $682

meter installations, highw ay relocations)

Reliability and Aging Infrastructure 5024674514504692,339

(facility replacem ents/upgrades for system reliability)

Load143 111 177134139704

(new /upgraded facilities to support load grow th)

Advanced Metering Infrastructure (AMI)(1)2---810

Transmission:

Customer Driven 6248828

Reliability 15514614011973633

(facility replacem ents/upgrades for system reliability)

Load and Other 157 142116128204747

Gas Delivery 2928282829142

Information Technology6633242122166

Corporate Support and Other(2)10169757543363

Total Power Delivery$ 1,290$1,127$1,158$1,108$1,131$5,814

(1) Installation of AMI in New Jersey is contingent on regulatory approval

(2) Corporate Support and Other category includes facilities, communications and other capital expenditures supporting the PHI utilities

Note: See Safe Harbor Statement at the beginning of today’s presentation. 6

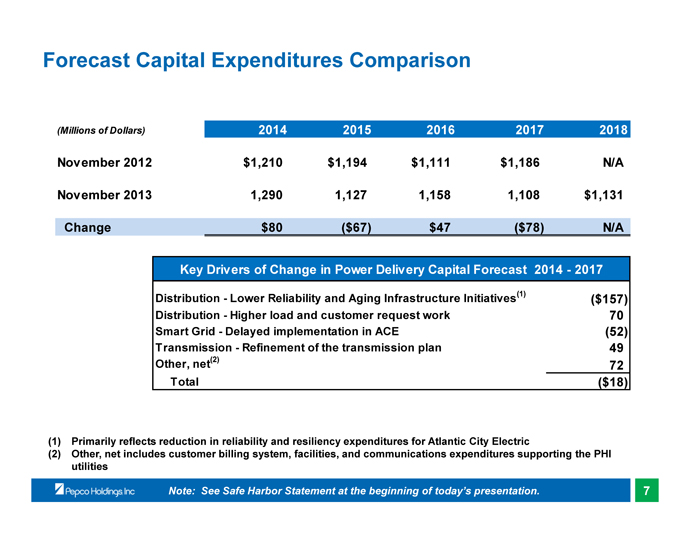

Forecast Capital Expenditures Comparison

(Millions of Dollars)20142015201620172018

November 2012 $1,210 $1,194$1,111$1,186N/A

November 2013 1,290 1,1271,1581,108$1,131

Change$80($67) $47($78)N/A

Key Drivers of Change in Power Delivery Capital Forecast 2014 - 2017

Distribution - Lower Reliability and Aging Infrastructure Initiatives(1)($157)

Distribution - Higher load and customer request work70

Smart Grid - Delayed implementation in ACE(52)

Transmission - Refinement of the transmission plan49

Other, net(2)

72

Total($18)

(1) Primarily reflects reduction in reliability and resiliency expenditures for Atlantic City Electric

(2) Other, net includes customer billing system, facilities, and communications expenditures supporting the PHI utilities

Note: See Safe Harbor Statement at the beginning of today’s presentation. 7

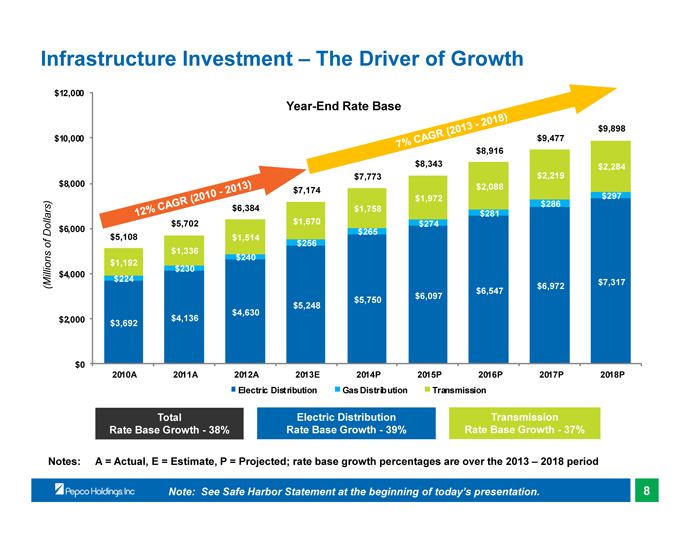

Infrastructure Investment – The Driver of Growth

Note: See Safe Harbor Statement at the beginning of today’s presentation.8

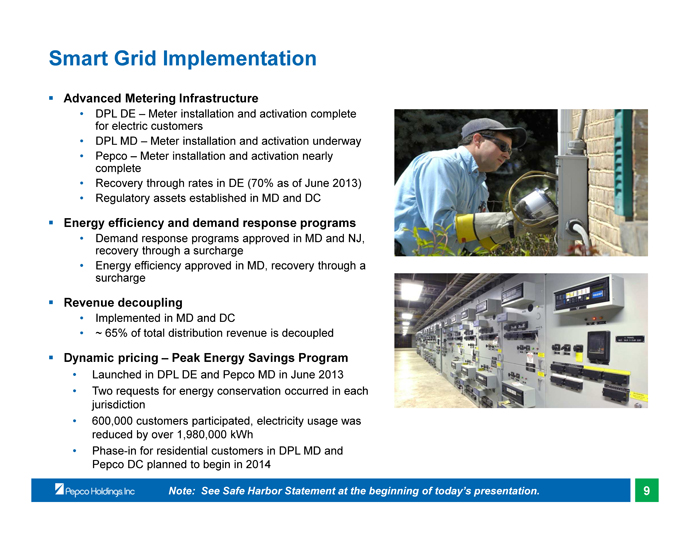

Smart Grid Implementation

Advanced Metering Infrastructure

• DPL DE – Meter installation and activation complete for electric customers

• DPL MD – Meter installation and activation underway

• Pepco – Meter installation and activation nearly complete

• Recovery through rates in DE (70% as of June 2013)

• Regulatory assets established in MD and DC

•Energy efficiency and demand response programs

• Demand response programs approved in MD and NJ, recovery through a surcharge

• Energy efficiency approved in MD, recovery through a surcharge

•Revenue decoupling

• Implemented in MD and DC

• ~ 65% of total distribution revenue is decoupled

•Dynamic pricing – Peak Energy Savings Program

• Launched in DPL DE and Pepco MD in June 2013

• Two requests for energy conservation occurred in each jurisdiction

• 600,000 customers participated, electricity usage was reduced by over 1,980,000 kWh

• Phase-in for residential customers in DPL MD and Pepco DC planned to begin in 2014

Note: See Safe Harbor Statement at the beginning of today’s presentation.9

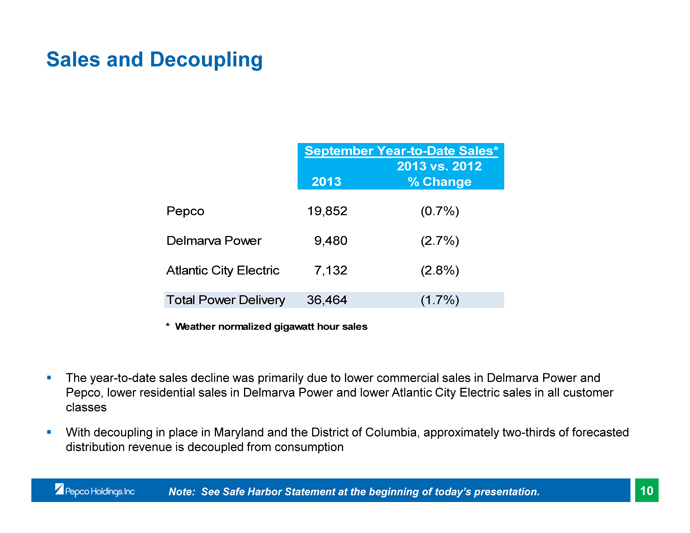

Sales and Decoupling

September Year-to-Date Sales*

2013 vs. 2012

2013% Change

Pepco 19,852 (0.7%)

Delmarva Power 9,480 (2.7%)

Atlantic City Electric 7,132 (2.8%)

Total Power Delivery 36,464 (1.7%)

*Weather normalized gigawatt hour sales

• The year-to-date sales decline was primarily due to lower commercial sales in Delmarva Power and Pepco, lower residential sales in Delmarva Power and lower Atlantic City Electric sales in all customer classes

• With decoupling in place in Maryland and the District of Columbia, approximately two-thirds of forecasted distribution revenue is decoupled from consumption

Note: See Safe Harbor Statement at the beginning of today’s presentation.10

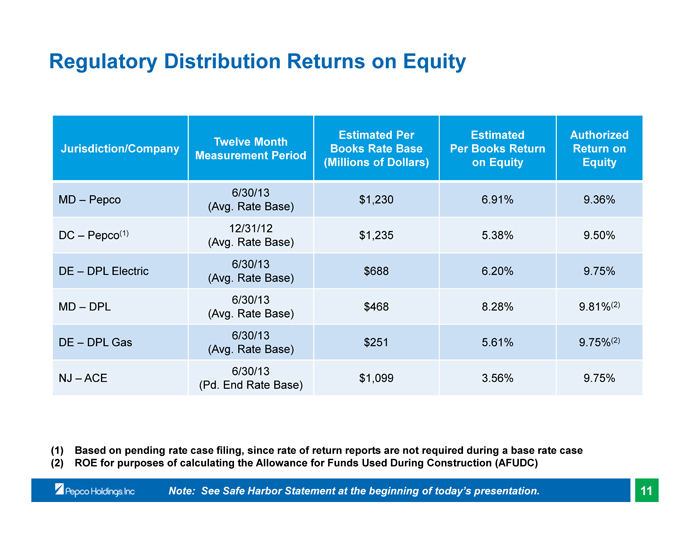

Regulatory Distribution Returns on Equity

Twelve Month Estimated PerEstimatedAuthorized

Jurisdiction/Company Books Rate BasePer Books ReturnReturn on

Measurement Period

(Millions of Dollars)on EquityEquity

MD – Pepco 6/30/13 $1,230 6.91% 9.36%

(Avg. Rate Base)

DC – Pepco(1)12/31/12 $1,235 5.38% 9.50%

(Avg. Rate Base)

DE – DPL Electric 6/30/13 $688 6.20% 9.75%

(Avg. Rate Base)

MD – DPL 6/30/13 $468 8.28% 9.81%(2)

(Avg. Rate Base)

DE – DPL Gas 6/30/13 $251 5.61% 9.75%(2)

(Avg. Rate Base)

NJ – ACE 6/30/13 $1,099 3.56% 9.75%

(Pd. End Rate Base)

(1) Based on pending rate case filing, since rate of return reports are not required during a base rate case

(2) ROE for purposes of calculating the Allowance for Funds Used During Construction (AFUDC)

Note: See Safe Harbor Statement at the beginning of today’s presentation.11

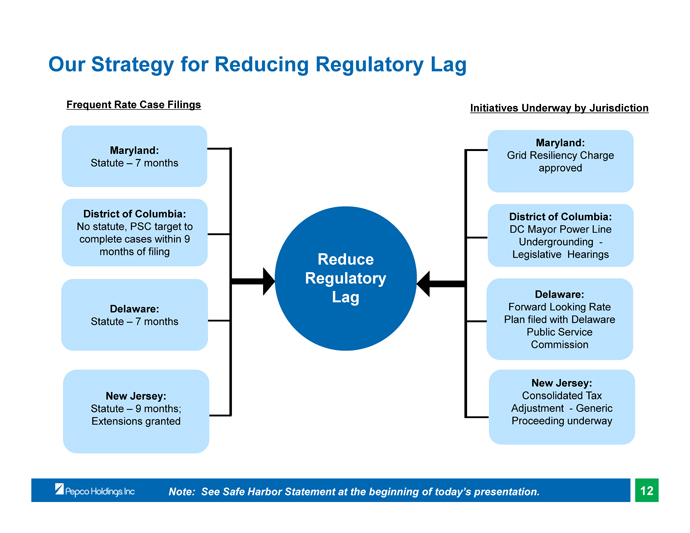

Our Strategy for Reducing Regulatory Lag

Frequent Rate Case Filings

Maryland:

Statute – 7 months

District of Columbia:

No statute, PSC target to complete cases within 9 months of filing

Delaware:

Statute – 7 months

New Jersey:

Statute – 9 months;

Extensions granted

Reduce

Regulatory

Lag

Initiatives Underway by Jurisdiction

Maryland:

Grid Resiliency Charge

approved

District of Columbia:

DC Mayor Power Line

Undergrounding -

Legislative Hearings

Delaware:

Forward Looking Rate

Plan filed with Delaware

Public Service

Commission

New Jersey:

Consolidated Tax

Adjustment - Generic

Proceeding underway

Note: See Safe Harbor Statement at the beginning of today’s presentation.12

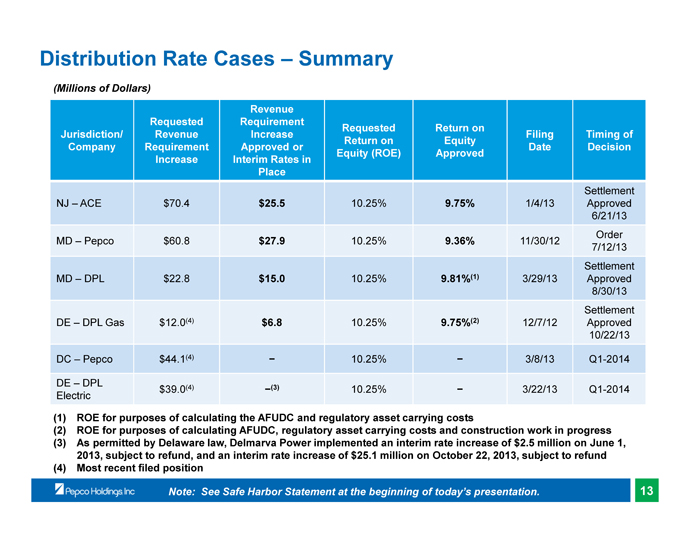

Distribution Rate Cases – Summary

(Millions of Dollars)

Jurisdiction/ Company Requested Revenue Requirement Increase Revenue Requirement Increase Approved or Interim Rates in Place Requested Return on Equity (ROE) Return on Equity Approved Filing Date Timing of Decision

Settlement

NJ – ACE $70.42. 10.25%.5 1/4/13 Approved

6/21/13

MD – Pepco $60.82.10.25%.6 11/30/12 Order

7/12/13

Settlement

MD – DPL $22.81. 10.25%.1(1) 3/29/13 Approved

8/30/13

Settlement

DE – DPL Gas $12.0(4)68 10.25%.5(2) 12/7/12 Approved

10/22/13

DC – Pepco $44.1(4)10.25% 3/8/13 Q1-2014

DE – DPL $39.0(4) (3) 10.25% 3/22/13 Q1-2014

Electric

(1) ROE for purposes of calculating the AFUDC and regulatory asset carrying costs

(2) ROE for purposes of calculating AFUDC, regulatory asset carrying costs and construction work in progress

(3) As permitted by Delaware law, Delmarva Power implemented an interim rate increase of $2.5 million on June 1,

2013, subject to refund, and an interim rate increase of $25.1 million on October 22, 2013, subject to refund

(4) Most recent filed position

Note: See Safe Harbor Statement at the beginning of today’s presentation.13

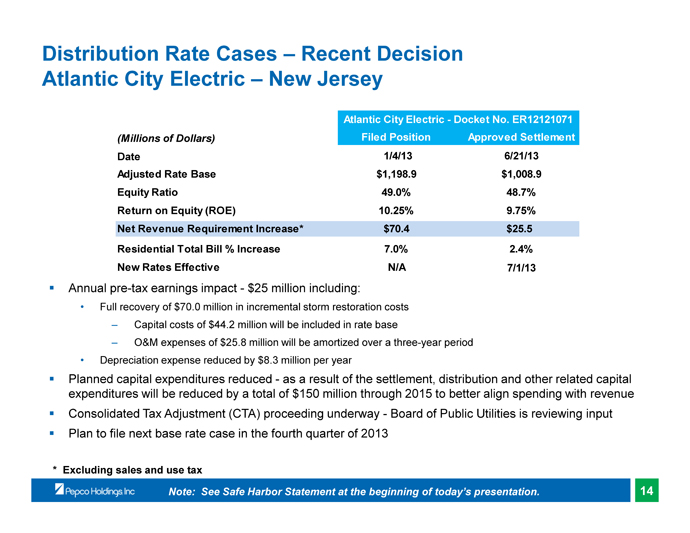

Distribution Rate Cases – Recent Decision

Atlantic City Electric – New Jersey

Atlantic City Electric - Docket No. ER12121071

(Millions of Dollars)Filed PositionApproved Settlement

Date1/4/13 6/21/13

Adjusted Rate Base$1,198.9 $1,008.9

Equity Ratio 49.0% 48.7%

Return on Equity (ROE)10.25%9.75%

Net Revenue Requirement Increase* $70.4$25.5

Residential Total Bill % Increase 7.0%2.4%

New Rates EffectiveN/A 7/1/13

• Annual pre-tax earnings impact - $25 million including:

• Full recovery of $70.0 million in incremental storm restoration costs – Capital costs of $44.2 million will be included in rate base

– O&M expenses of $25.8 million will be amortized over a three-year period

• Depreciation expense reduced by $8.3 million per year

• Planned capital expenditures reduced - as a result of the settlement, distribution and other related capital expenditures will be reduced by a total of $150 million through 2015 to better align spending with revenue

• Consolidated Tax Adjustment (CTA) proceeding underway - Board of Public Utilities is reviewing input

• Plan to file next base rate case in the fourth quarter of 2013

*Excluding sales and use tax

Note: See Safe Harbor Statement at the beginning of today’s presentation.14

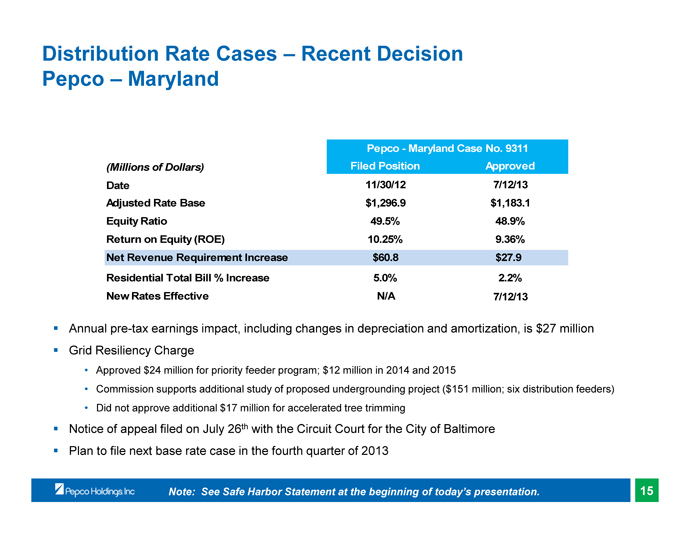

Distribution Rate Cases – Recent Decision

Pepco – Maryland

Pepco - Maryland Case No. 9311

(Millions of Dollars)Filed PositionApproved

Date11/30/12 7/12/13

Adjusted Rate Base$1,296.9 $1,183.1

Equity Ratio 49.5% 48.9%

Return on Equity (ROE)10.25%9.36%

Net Revenue Requirement Increase $60.8$27.9

Residential Total Bill % Increase 5.0%2.2%

New Rates EffectiveN/A 7/12/13

• Annual pre-tax earnings impact, including changes in depreciation and amortization, is $27 million

• Grid Resiliency Charge

• Approved $24 million for priority feeder program; $12 million in 2014 and 2015

• Commission supports additional study of proposed undergrounding project ($151 million; six distribution feeders)

• Did not approve additional $17 million for accelerated tree trimming

• Notice of appeal filed on July 26th with the Circuit Court for the City of Baltimore

• Plan to file next base rate case in the fourth quarter of 2013

Note: See Safe Harbor Statement at the beginning of today’s presentation.15

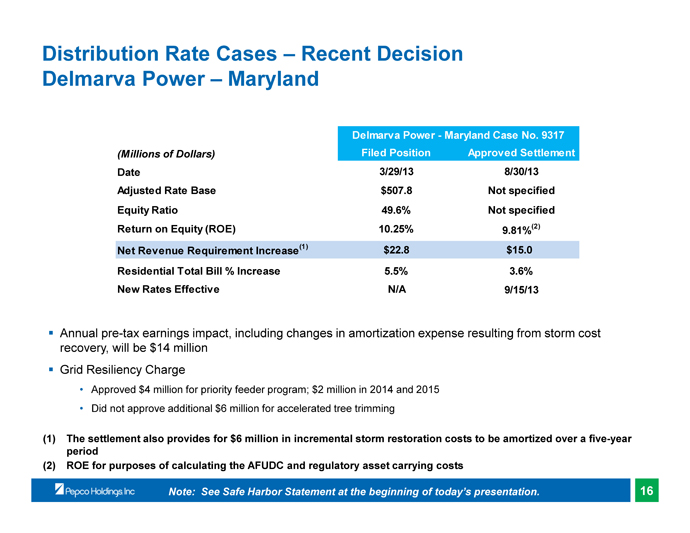

Distribution Rate Cases – Recent Decision

Delmarva Power – Maryland

Delmarva Power - Maryland Case No. 9317

(Millions of Dollars)Filed PositionApproved Settlement

Date3/29/13 8/30/13

Adjusted Rate Base$507.8 Not specified

Equity Ratio 49.6% Not specified

Return on Equity (ROE)10.25%(2)

9.81%

Net Revenue Requirement Increase(1)$22.8$15.0

Residential Total Bill % Increase 5.5%3.6%

New Rates EffectiveN/A 9/15/13

• Annual pre-tax earnings impact, including changes in amortization expense resulting from storm cost recovery, will be $14 million

• Grid Resiliency Charge

• Approved $4 million for priority feeder program; $2 million in 2014 and 2015

• Did not approve additional $6 million for accelerated tree trimming

(1) The settlement also provides for $6 million in incremental storm restoration costs to be amortized over a five-year period

(2) ROE for purposes of calculating the AFUDC and regulatory asset carrying costs

Note: See Safe Harbor Statement at the beginning of today’s presentation.16

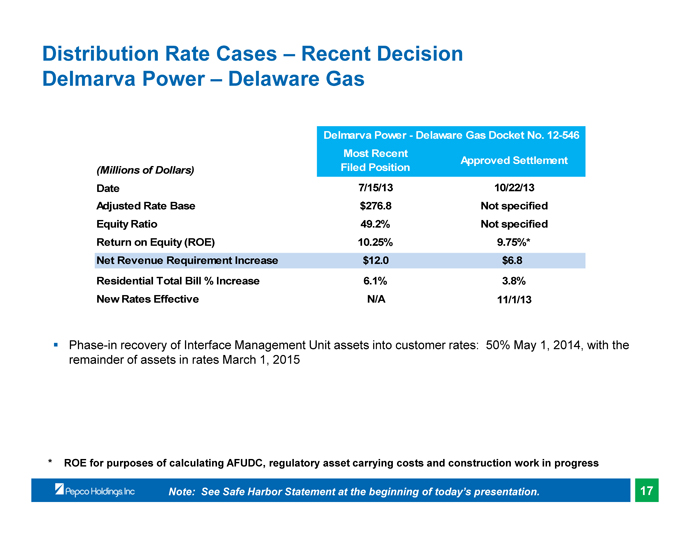

Distribution Rate Cases – Recent Decision

Delmarva Power – Delaware Gas

Delmarva Power - Delaware Gas Docket No. 12-546

Most Recent Approved Settlement

(Millions of Dollars)Filed Position

Date7/15/13 10/22/13

Adjusted Rate Base$276.8 Not specified

Equity Ratio 49.2% Not specified

Return on Equity (ROE)10.25%9.75%*

Net Revenue Requirement Increase $12.0$6.8

Residential Total Bill % Increase 6.1%3.8%

New Rates EffectiveN/A 11/1/13

• Phase-in recovery of Interface Management Unit assets into customer rates: 50% May 1, 2014, with the remainder of assets in rates March 1, 2015

* ROE for purposes of calculating AFUDC, regulatory asset carrying costs and construction work in progress

Note: See Safe Harbor Statement at the beginning of today’s presentation.17

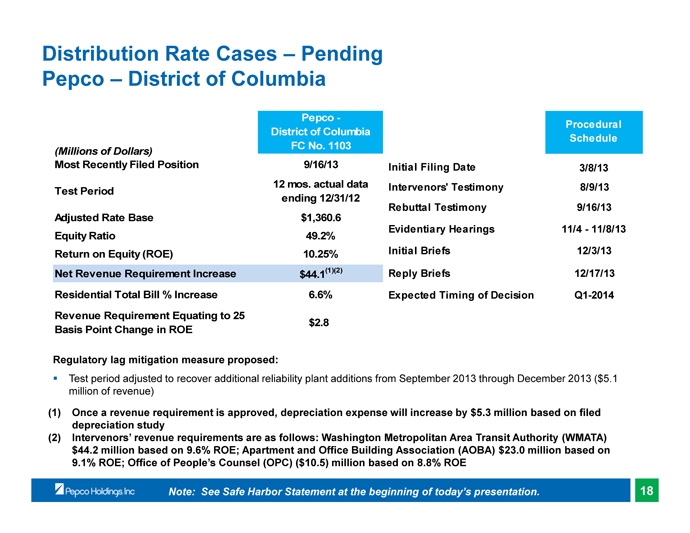

Distribution Rate Cases – Pending

Pepco – District of Columbia

Pepco -Procedural

District of Columbia

Schedule

FC No. 1103

(Millions of Dollars)

Most Recently Filed Position 9/16/13Initial Filing Date3/8/13

Test Period 12 mos. actual dataIntervenors' Testimony8/9/13

ending 12/31/12

Rebuttal Testimony 9/16/13

Adjusted Rate Base$1,360.6

Evidentiary Hearings11/4 - 11/8/13

Equity Ratio 49.2%

Return on Equity (ROE)10.25%Initial Briefs12/3/13

Net Revenue Requirement Increase (1)(2)Reply Briefs12/17/13

$44.1

Residential Total Bill % Increase 6.6%Expected Timing of DecisionQ1-2014

Revenue Requirement Equating to 25

$2.8

Basis Point Change in ROE

Regulatory lag mitigation measure proposed:

• Test period adjusted to recover additional reliability plant additions from September 2013 through December 2013 ($5.1 million of revenue)

(1) Once a revenue requirement is approved, depreciation expense will increase by $5.3 million based on filed depreciation study

(2) Intervenors’ revenue requirements are as follows: Washington Metropolitan Area Transit Authority (WMATA) $44.2 million based on 9.6% ROE; Apartment and Office Building Association (AOBA) $23.0 million based on 9.1% ROE; Office of People’s Counsel (OPC) ($10.5) million based on 8.8% ROE

Note: See Safe Harbor Statement at the beginning of today’s presentation.18

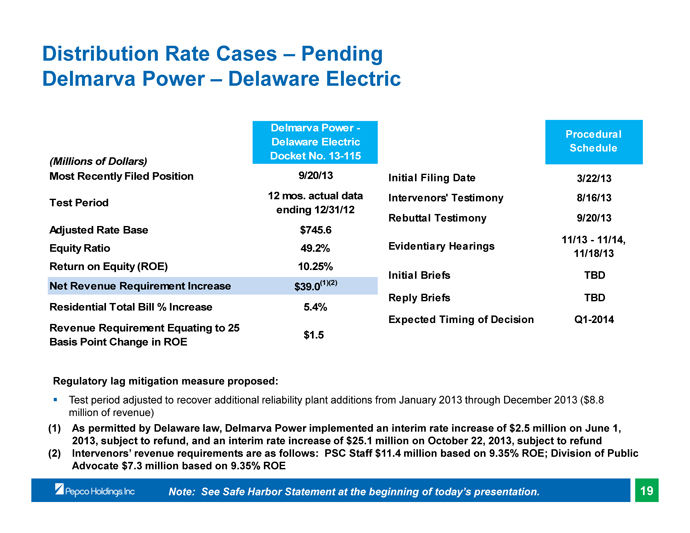

Distribution Rate Cases – Pending

Delmarva Power – Delaware Electric

Delmarva Power -

Delaware Electric

(Millions of Dollars)Docket No. 13-115

Most Recently Filed Position 9/20/13

Test Period 12 mos. actual data

ending 12/31/12

Adjusted Rate Base$745.6

Equity Ratio 49.2%

Return on Equity (ROE)10.25%

Net Revenue Requirement Increase$39.0(1)(2)

Residential Total Bill % Increase 5.4%

Revenue Requirement Equating to 25$1.5

Basis Point Change in ROE

Regulatory lag mitigation measure proposed:

Procedural

Schedule

Initial Filing Date3/22/13

Intervenors' Testimony8/16/13

Rebuttal Testimony 9/20/13

Evidentiary Hearings11/13 - 11/14,

11/18/13

Initial Briefs TBD

Reply Briefs TBD

Expected Timing of Decision Q1-2014

• Test period adjusted to recover additional reliability plant additions from January 2013 through December 2013 ($8.8 million of revenue)

(1) As permitted by Delaware law, Delmarva Power implemented an interim rate increase of $2.5 million on June 1, 2013, subject to refund, and an interim rate increase of $25.1 million on October 22, 2013, subject to refund

(2) Intervenors’ revenue requirements are as follows: PSC Staff $11.4 million based on 9.35% ROE; Division of Public Advocate $7.3 million based on 9.35% ROE

Note: See Safe Harbor Statement at the beginning of today’s presentation.19

Proposed Forward Looking Rate Plan Filing – Delmarva Power – Delaware Electric

• In our November 2012 Delmarva Power Delaware Electric settlement (Docket No. 11-528), Delmarva Power, the Delaware Public Service Commission (DPSC) Staff and the

Division of the Public Advocate agreed to meet to discuss:

• Establishment of metrics to help customers understand the benefits of infrastructure investment

• Alternative regulatory mechanisms, including multi-year rate plans

• On October 2, 2013, Delmarva Power filed a unique Forward Looking Rate Plan (FLRP) in Delaware (electric)

• Filing proposes annual rate increases over a four-year period

• FLRP provides the opportunity for Delmarva Power to earn the proposed allowed ROE of 9.75%

• The FLRP also proposes stricter reliability standards, with bill credits to customers in the event that minimum reliability standards are not met

• On October 22, 2013, the DPSC opened Docket No. 13-384 to review the details of the FLRP

• Delmarva Power will update and re-file the FLRP after the completion of the pending base rate case

The adoption of the FLRP would reduce regulatory lag while moving the Company towards a more efficient and performance based framework

Note: See Safe Harbor Statement at the beginning of today’s presentation.20

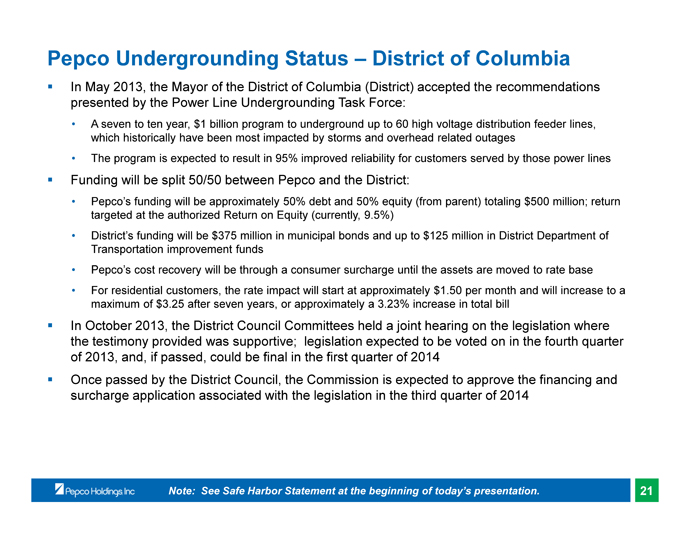

Pepco Undergrounding Status – District of Columbia

• In May 2013, the Mayor of the District of Columbia (District) accepted the recommendations presented by the Power Line Undergrounding Task Force:

• A seven to ten year, $1 billion program to underground up to 60 high voltage distribution feeder lines, which historically have been most impacted by storms and overhead related outages

• The program is expected to result in 95% improved reliability for customers served by those power lines

• Funding will be split 50/50 between Pepco and the District:

• Pepco’s funding will be approximately 50% debt and 50% equity (from parent) totaling $500 million; return targeted at the authorized Return on Equity (currently, 9.5%)

• District’s funding will be $375 million in municipal bonds and up to $125 million in District Department of Transportation improvement funds

• Pepco’s cost recovery will be through a consumer surcharge until the assets are moved to rate base

• For residential customers, the rate impact will start at approximately $1.50 per month and will increase to a maximum of $3.25 after seven years, or approximately a 3.23% increase in total bill

• In October 2013, the District Council Committees held a joint hearing on the legislation where the testimony provided was supportive; legislation expected to be voted on in the fourth quarter of 2013, and, if passed, could be final in the first quarter of 2014

• Once passed by the District Council, the Commission is expected to approve the financing and surcharge application associated with the legislation in the third quarter of 2014

Note: See Safe Harbor Statement at the beginning of today’s presentation.21

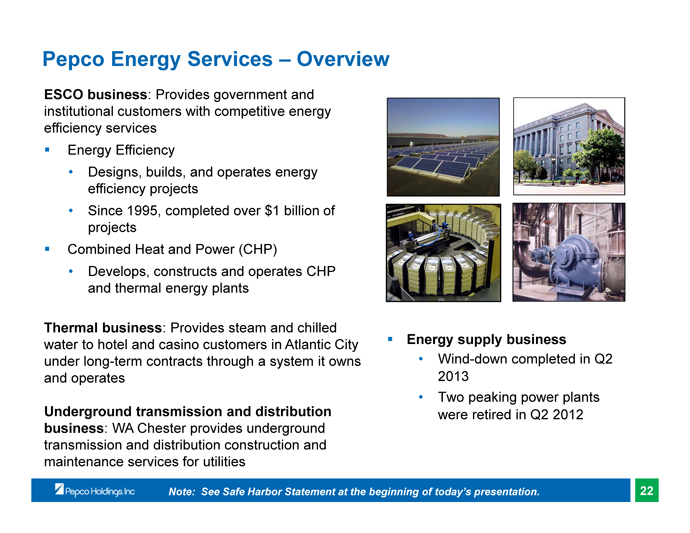

Pepco Energy Services – Overview

ESCO business: Provides government andinstitutional customers with competitive energy efficiency services

• Energy Efficiency

• Designs, builds, and operates energy efficiency projects

• Since 1995, completed over $1 billion of projects

• Combined Heat and Power (CHP)

• Develops, constructs and operates CHP and thermal energy plants

Thermal business: Provides steam and chilledwater to hotel and casino customers in Atlantic City under long-term contracts through a system it owns and operates

Underground transmission and distribution business: WA Chester provides undergroundtransmission and distribution construction and maintenance services for utilities

•Energy supply business

• Wind-down completed in Q2 2013

• Two peaking power plants were retired in Q2 2012

Note: See Safe Harbor Statement at the beginning of today’s presentation.22

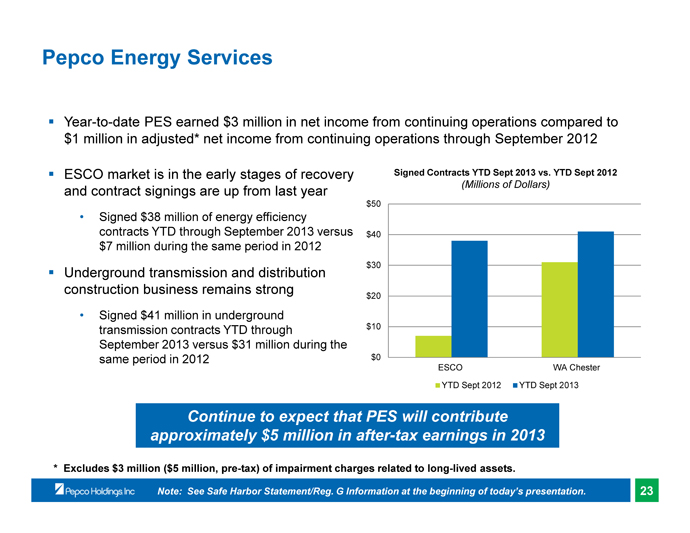

Pepco Energy Services

• Year-to-date PES earned $3 million in net income from continuing operations compared to $1 million in adjusted* net income from continuing operations through September 2012

• ESCO market is in the early stages of recovery and contract signings are up from last year

• Signed $38 million of energy efficiency contracts YTD through September 2013 versus $7 million during the same period in 2012

• Underground transmission and distribution construction business remains strong

• Signed $41 million in underground transmission contracts YTD through September 2013 versus $31 million during the same period in 2012

Signed Contracts YTD Sept 2013 vs. YTD Sept 2012

(Millions of Dollars)

Continue to expect that PES will contribute approximately $5 million in after-tax earnings in 2013

* Excludes $3 million ($5 million, pre-tax) of impairment charges related to long-lived assets.

Note: See Safe Harbor Statement/Reg. G Information at the beginning of today’s presentation.23

Recent Financings

Credit Facility

·On August 1, 2013, PHI and its utility subsidiaries extended the expiration date of the $1.5 billion credit facility by one year to August 1, 2018; the terms and conditions of the credit facility otherwise remained unchanged

Delmarva Power Bond Issuance

• Delmarva Power priced $300 million first mortgage bonds on November 7, 2013

• Coupon – 3.50%

• Maturity Date - November 15, 2023

• Closing - November 15, 2013

• Proceeds, net of fees and expenses - $297 million

• Use of Proceeds - Repay $250 million first mortgage bonds at maturity on December 1, 2013, repay outstanding commercial paper and for general corporate purposes

Given the net proceeds from the early termination of the cross-border energy lease investments, next anticipated equity issuance will be beyond 2015

Note: See Safe Harbor Statement at the beginning of today’s presentation.24

2013 Earnings Guidance

• Pepco Holdings 2013 earnings guidance range is narrowed to $1.08 - $1.18 per share from $1.05 - $1.20 per share

• The guidance range excludes:

• The results of discontinued operations and the impact of any special, unusual or extraordinary items, and

• The guidance range assumes:

• Normal weather conditions for the fourth quarter of 2013

Note: See Safe Harbor Statement/Reg. G Information at the beginning of today’s presentation.25

PHI Value Proposition –

Poised for Above Average Total Return

Key Rate base growth

Earnings Regulatory lag reduction

Drivers Manageable financing requirements

• Current yield is higher than the average yield for S&P 500 Electric

Attractive Utilities

Dividend Committed to the current dividend

• Long-term dividend payout ratio targeted to align with utility peers

Above

Average

Total

Return

Note: See Safe Harbor Statement at the beginning of today’s presentation.26

Appendix

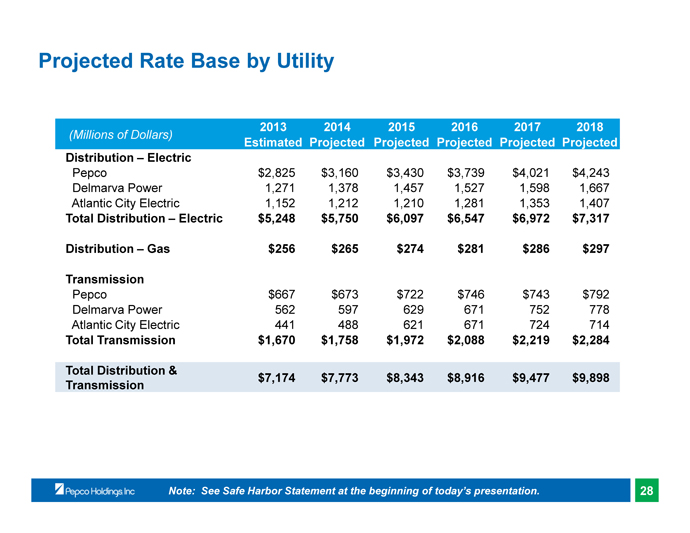

Projected Rate Base by Utility

(Millions of Dollars)201320142015201620172018

Estimated Projected Projected Projected Projected Projected

Distribution – Electric

Pepco $2,825 $3,160 $3,430 $3,739 $4,021 $4,243

Delmarva Power 1,271 1,378 1,457 1,527 1,598 1,667

Atlantic City Electric 1,152 1,212 1,210 1,281 1,353 1,407

Total Distribution – Electric$5,248$5,750$6,097$ 6,547$6,972$7,317

Distribution – Gas$256$265$274$281$286$297

Transmission

Pepco $667 $673 $722 $746 $743 $792

Delmarva Power 562 597 629 671 752 778

Atlantic City Electric 441 488 621 671 724 714

Total Transmission $1,670 $1,758$1,972$2,088$2,219$2,284

Total Distribution &$7,174$7,773$8,343$8,916$9,477$9,898

Transmission

Note: See Safe Harbor Statement at the beginning of today’s presentation.28

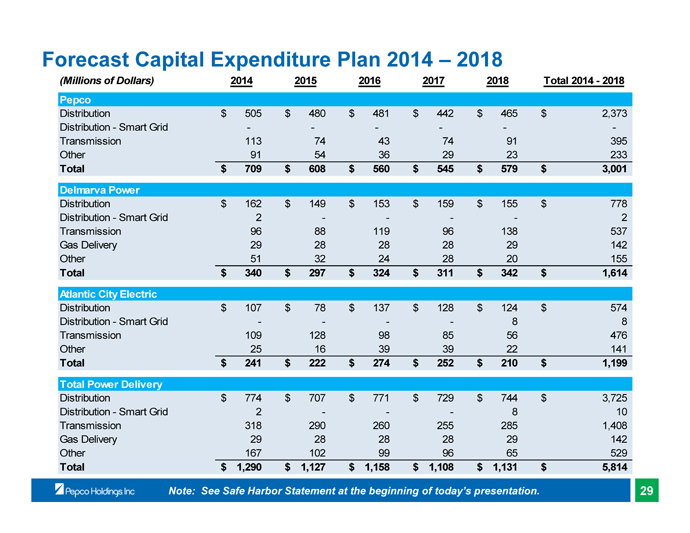

Forecast Capital Expenditure Plan 2014 – 2018

(Millions of Dollars)20142015201620172018Total 2014 - 2018

Pepco

Distribution $ 505 $ 480 $ 481 $ 442 $ 465 $ 2,373

Distribution - Smart Grid - - - - - -

Transmission 113 74 43 74 91 395

Other 91 54 36 29 23 233

Total$709 $608$560$545$579$3,001

Delmarva Power

Distribution $ 162 $ 149 $ 153 $ 159 $ 155 $ 778

Distribution - Smart Grid 2 - - - - 2

Transmission 96 88 119 96 138 537

Gas Delivery 29 28 28 28 29 142

Other 51 32 24 28 20 155

Total$340 $297$324$311$342$1,614

Atlantic City Electric

Distribution $ 107 $ 78 $ 137 $ 128 $ 124 $ 574

Distribution - Smart Grid - - - - 8 8

Transmission 109 128 98 85 56 476

Other 25 16 39 39 22 141

Total$241 $222$274$252$210$1,199

Total Power Delivery

Distribution $ 774 $ 707 $ 771 $ 729 $ 744 $ 3,725

Distribution - Smart Grid 2 - - - 8 10

Transmission 318 290 260 255 285 1,408

Gas Delivery 29 28 28 28 29 142

Other 167 102 99 96 65 529

Total$1,290 $1,127$1,158$1,108$1,131$5,814

Note: See Safe Harbor Statement at the beginning of today’s presentation.29

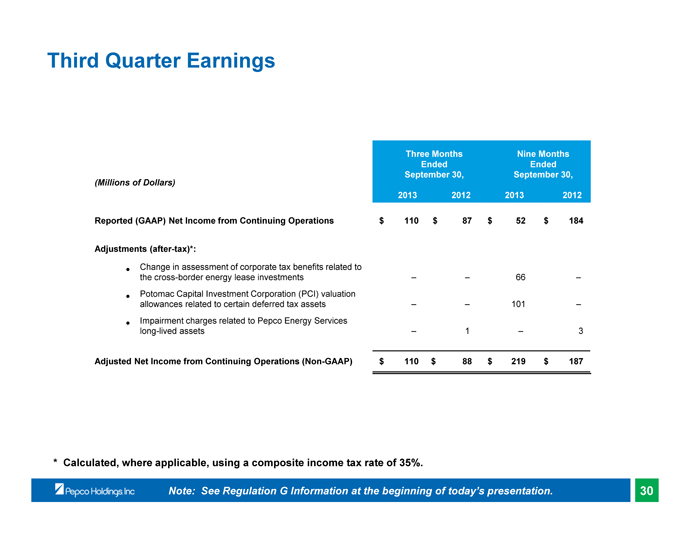

Third Quarter Earnings

Three Months Nine Months

EndedEnded

(Millions of Dollars)September 30,September 30,

20132012 2013 2012

Reported (GAAP) Net Income from Continuing Operations$110$87$52$184

Adjustments (after-tax)*:

·Change in assessment of corporate tax benefits related to

the cross-border energy lease investments – – 66 –

·Potomac Capital Investment Corporation (PCI) valuation

allowances related to certain deferred tax assets – – 101 –

·Impairment charges related to Pepco Energy Services

long-lived assets – 1 – 3

Adjusted Net Income from Continuing Operations (Non-GAAP)$110$88$219$187

* Calculated, where applicable, using a composite income tax rate of 35%.

Note: See Regulation G Information at the beginning of today’s presentation.30

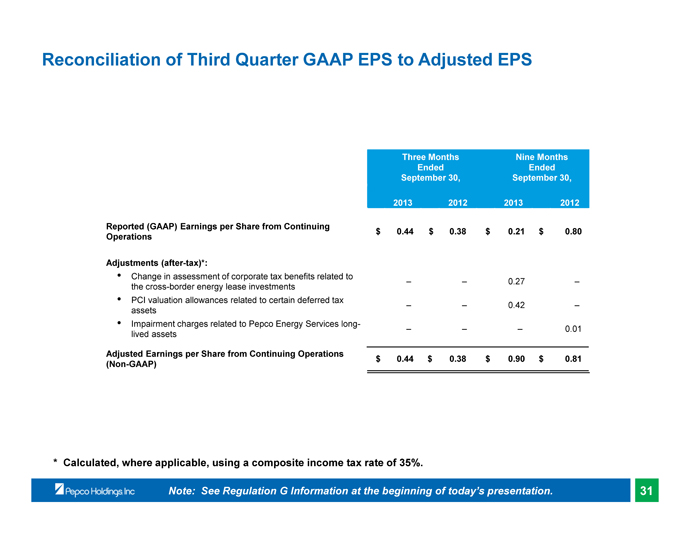

Reconciliation of Third Quarter GAAP EPS to Adjusted EPS

Three Months Nine Months

Earnings per Share from Continuing OperationsEndedEnded

September 30,September 30,

20132012 2013 2012

Reported (GAAP) Earnings per Share from Continuing$0.44$0.38$0.21$0.80

Operations

Adjustments (after-tax)*:

·Change in assessment of corporate tax benefits related to – – 0.27 –

the cross-border energy lease investments

·PCI valuation allowances related to certain deferred tax – – 0.42 –

assets

·Impairment charges related to Pepco Energy Services long- – – – 0.01

lived assets

Adjusted Earnings per Share from Continuing Operations

$0.44 $0.38$0.90$0.81

(Non-GAAP)

* Calculated, where applicable, using a composite income tax rate of 35%.

Note: See Regulation G Information at the beginning of today’s presentation.31

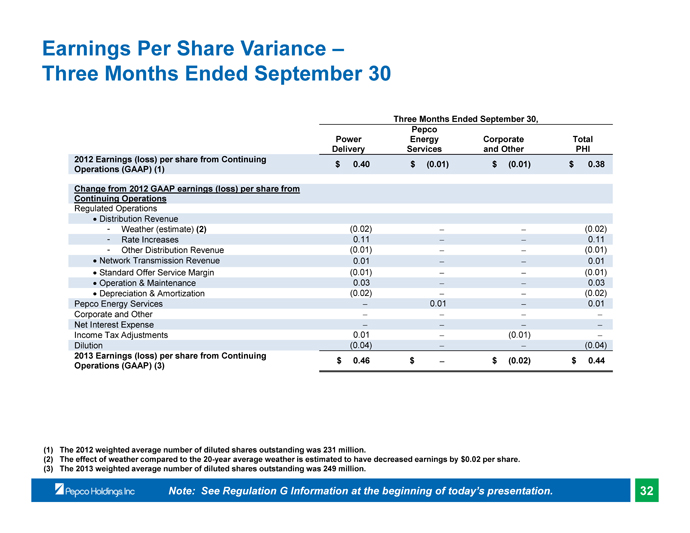

Earnings Per Share Variance –

Three Months Ended September 30

Three Months Ended September 30,

Pepco

2012 Earnings (loss) per share from Continuing Operations (GAAP) (1)

PowerEnergyCorporate Total

DeliveryServicesand OtherPHI

$0.40 $(0.01)$(0.01)$0.38

Change from 2012 GAAP earnings (loss) per share from

Continuing Operations

Regulated Operations

·Distribution Revenue

- Weather (estimate)(2) (0.02) – – (0.02)

- Rate Increases 0.11 –– –– 0.11

- Other Distribution Revenue (0.01) – – (0.01)

·Network Transmission Revenue 0.01 – – 0.01

· Standard Offer Service Margin (0.01) – – (0.01)

0.03 – 0.03

·Operation & Maintenance –

·Depreciation & Amortization (0.02) – – (0.02)

0.01 – 0.01

Pepco Energy Services –

Corporate and Other – – – –

Net Interest Expense – – – –

Income Tax Adjustments 0.01 – (0.01) –

(0.04) – (0.04)

Dilution – –

2013 Earnings (loss) per share from Continuing$0.46$ –$(0.02)$0.44

Operations (GAAP) (3)

(1) The 2012 weighted average number of diluted shares outstanding was 231 million.

(2) The effect of weather compared to the 20-year average weather is estimated to have decreased earnings by $0.02 per share.

(3) The 2013 weighted average number of diluted shares outstanding was 249 million.

Note: See Regulation G Information at the beginning of today’s presentation.32

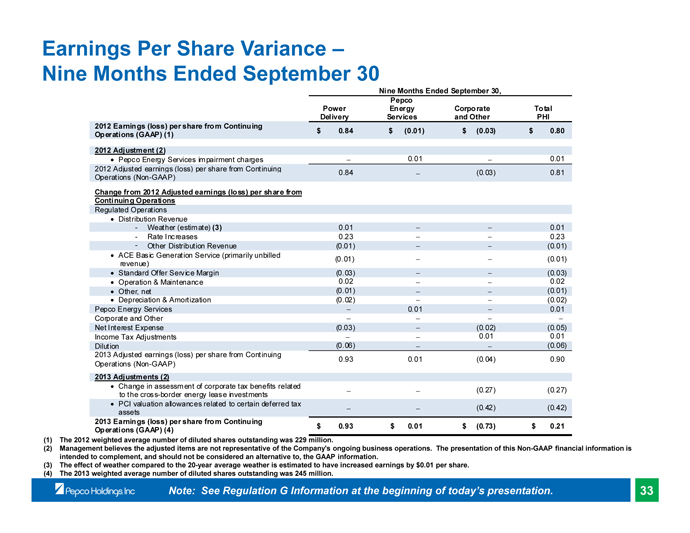

Earnings Per Share Variance –

Nine Months Ended September 30

Nine Months Ended September 30,

Pepco

PowerEnergyCorporate Total

DeliveryServicesand OtherPHI

2012 Earnings (loss) per share from Continuing$0.84$(0.01)$(0.03)$0.80

Operations (GAAP) (1)

2012 Adjustment (2) 0.01 0.01

·Pepco Energy Services impairment charges – –

2012 Adjusted earnings (loss) per share from Continuing 0.84 – (0.03) 0.81

Operations (Non-GAAP)

Change from 2012 Adjusted earnings (loss) per share from

Continuing Operations

Regulated Operations

·Distribution Revenue – –

- Weather (estimate)(3) 0.01 0.01

- Rate Increases 0.23 – – 0.23

- Other Distribution Revenue (0.01) – – (0.01)

·ACE Basic Generation Service (primarily unbilled (0.01) – – (0.01)

revenue)

·Standard Offer Service Margin (0.03) – – (0.03)

·Operation & Maintenance 0.02 – – 0.02

(0.01) (0.01)

· Other, net – –

·Depreciation & Amortization (0.02) – – (0.02)

Pepco Energy Services – 0.01 – 0.01

Corporate and Other – – – –

Net Interest Expense (0.03) – (0.02) (0.05)

Income Tax Adjustments – – 0.01 0.01

(0.06) (0.06)

Dilution – –

2013 Adjusted earnings (loss) per share from Continuing 0.93 0.01 (0.04) 0.90

Operations (Non-GAAP)

2013 Adjustments (2)

·Change in assessment of corporate tax benefits related – – (0.27) (0.27)

to the cross-border energy lease investments

· PCI valuation allowances related to certain deferred tax – – (0.42) (0.42)

assets

2013 Earnings (loss) per share from Continuing$ 0.93$0.01$(0. 73)$0.21

Operations (GAAP) (4)

(1) The 2012 weighted average number of diluted shares outstanding was 229 million.

(2) Management believes the adjusted items are not representative of the Company's ongoing business operations. The presentation of this Non-GAAP financial information is intended to complement, and should not be considered an alternative to, the GAAP information.

(3) The effect of weather compared to the 20-year average weather is estimated to have increased earnings by $0.01 per share.

(4) The 2013 weighted average number of diluted shares outstanding was 245 million.

Note: See Regulation G Information at the beginning of today’s presentation.33

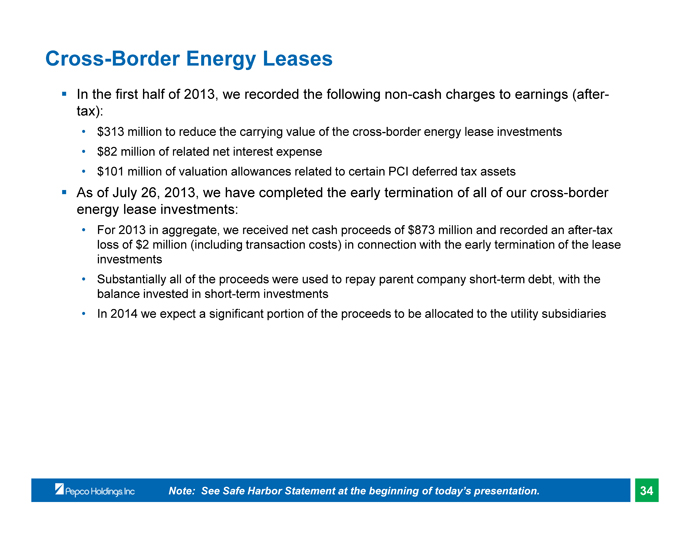

Cross-Border Energy Leases

• In the first half of 2013, we recorded the following non-cash charges to earnings (after-tax):

• $313 million to reduce the carrying value of the cross-border energy lease investments

• $82 million of related net interest expense

• $101 million of valuation allowances related to certain PCI deferred tax assets

• As of July 26, 2013, we have completed the early termination of all of our cross-border energy lease investments:

• For 2013 in aggregate, we received net cash proceeds of $873 million and recorded an after-tax loss of $2 million (including transaction costs) in connection with the early termination of the lease investments

• Substantially all of the proceeds were used to repay parent company short-term debt, with the balance invested in short-term investments

• In 2014 we expect a significant portion of the proceeds to be allocated to the utility subsidiaries

Note: See Safe Harbor Statement at the beginning of today’s presentation.34

FERC Filing Challenging Our Transmission Rates

• On February 27, 2013, the public service commissions and public advocates in all four of our jurisdictions made a Section 206 filing with FERC challenging the transmission rates of each of our three utilities

• Two primary issues were included in the filing:

• Request to reduce the base ROE to 8.7% based on a zone of reasonableness between 6.78% and 10.33%

• Request to modify the formula rate protocols in order to require additional data and identification and justification of costs

• The impact of a 100 basis-point change in the transmission ROE is approximately $7 million in after-tax earnings

• On April 3, we filed a response to the complaint requesting that FERC dismiss the complaint on the grounds that it failed to meet the required burden to demonstrate that the existing rates and protocols are unjust and unreasonable

• Complaint is pending FERC review

Note: See Safe Harbor Statement at the beginning of today’s presentation.35

MAPP Abandoned Cost Recovery

• On February 28, 2013, FERC issued an order concluding that the MAPP project was canceled for reasons beyond the Company’s control and granted recovery of prudently incurred costs

• Key elements of the Order:

• Established a hearing to review the prudence of the $87.5 million abandonment costs and the requested 5 year amortization period

• Disallowed the incentive and RTO membership adders, which reduce the project’s ROE from 12.8% to 10.8%

• Denied 50% recovery of the $4 million of costs incurred prior to November 1, 2008 (the date of the MAPP incentive order)

• The Company filed a rehearing request on April 1 challenging the disallowance of the ROE adders as well as the denial of 50% of the costs incurred prior to November 1, 2008

• In the first quarter 2013, the $2 million of costs that were denied recovery were charged to expense

• Proceeding is before a settlement judge; several settlement conferences and rounds of informal data requests have occurred

Note: See Safe Harbor Statement at the beginning of today’s presentation.36