Joseph M. Rigby Chairman of the Board President Chief Executive Officer | | 701 Ninth Street, NW Washington, DC 20068 202-872-2219 202-331-6485 Fax joe.rigby@pepcoholdings.com |

| | | |

| | November 14, 2014 | |

VIA EDGAR

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

| Attention: | William H. Thompson |

Re: Pepco Holdings, Inc.

Form 10-K for the Fiscal Year Ended December 31, 2013

Filed February 28, 2014

Response dated October 14, 2014

File No. 1-31403

Dear Mr. Thompson:

This letter is submitted by Pepco Holdings, Inc. (“PHI” or the “Company”) in response to the comment letter of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated October 30, 2014, relating to the above-referenced Form 10-K (the “2013 Form 10-K”) and Response dated October 14, 2014 filed by PHI pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). For convenience of reference, the Staff’s comment in its October 30 letter is restated below in italics, followed by the Company’s response.

Item 8. Financial Statements and Supplementary Data, page 132

Notes to Consolidated Financial Statements, page 142

(2) Significant Accounting Policies, page 144

Reclassifications and Adjustments, page 152

| 1. | We note your response to our prior comment 2 regarding your assessment of prior period errors and the related internal control over financial reporting implications. You state that six of the seven errors were the result of significant deficiencies in internal controls and one was the result of a deficiency. Please address the following: |

| · | For each of the six-significant deficiencies and one control deficiency tell us the following: (a) the cause of the error or reason for the control failure (e.g. person performing control lacked the appropriate level of skill); (b) the year it was a deficiency or significant deficiency; (c) whether it was a design or operating deficiency; and (d) the COSO component to which the control deficiency relates. |

| · | Discuss how you considered aggregation of deficiencies in each year. |

| · | Please describe in greater detail how you considered the numerous deficiencies in evaluating the monitoring and risk assessment components of COSO. Specifically, we continue to question whether one or more deficiencies exist in the risk assessment or monitoring component that enabled the development of “transactional level control deficiencies” in each of the last three years and whether one or more such unidentified deficiencies represent a material weakness. |

Company Response:

Summary

PHI management performed its assessment of the effectiveness of internal control over financial reporting as of December 31, 2013 based on the framework inInternal Control—Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”), and, based on its assessment, concluded that PHI’s internal control over financial reporting was effective. PHI management also confirmed that its assessments of the effectiveness of internal control over financial reporting for prior years (2012 and 2011) did not change based on deficiencies associated with certain prior period errors identified in 2013, which were disclosed in PHI’s 2013 Form 10-K. In concluding that PHI’s internal control over financial reporting was effective, PHI management considered deficiencies in internal control over financial reporting, individually and in the aggregate, by consolidated financial statement line item or disclosure, and considered the business unit or segment impacted by the deficiencies, and relevant financial statement assertions. PHI management concluded that none of the deficiencies were the result of a material weakness in internal control over financial reporting. In arriving at this conclusion, PHI management considered the following:

| · | Two deferred tax liability errors were corrected during 2013, butPHI management concluded that theseerrors, in the aggregate, were not the result of a material weakness because the root causes of the two errors were significantly different, the two errors impacted different business units, and the magnitude of the potential misstatements which were reasonably possible was not material. The Potomac Capital Investment Corporation (“PCI”) deferred tax liabilityerror occurred in 1999 and internal controls had been established subsequent to that date to preventa similarerror from occurring.PCI entered into a limited number of tax structured transactions in the past, and no such transactions have been entered into since 2002. In a review of all tax structured transactions previously entered into by PCI and its subsidiaries, PHI management determined that there were no other errors related to tax structured transactions, other than the error that was corrected and disclosed during 2013. The Potomac Electric Power Company (“Pepco”) deferred tax liability error was not material to PHI’s deferred tax balances. PHI management also concluded that the magnitude of potential errors associated with the Pepco deferred tax liability deficiency was not material due to compensating controls, and the annual performance of applicable controls in prior periods. |

| · | An error related to the accounting for default electricity supply service of Delmarva Power & Light Company (“DPL”) was corrected in 2011. PHI management concluded that the magnitude of other potential errors associated with this deficiency was limited due to the error being identified by an entity-level compensating control, which prevented the error from being material to PHI’s consolidated operating results, and due to the immaterial annual operating margins associated with such service. |

| · | All other errors corrected during 2012 and 2011 impacted various consolidated financial statement line items and business units, and these immaterial errors aggregated to less than 1.5 percent of consolidated net income for each year. When considering control deficiencies associated with these errors, PHI management concluded that the deficiencies were not the result of a material weakness in internal control over financial reporting. PHI management evaluated the magnitude of any other potential errors related to these deficiencies in the aggregate and concluded that they would not be material to PHI’s consolidated operating results. |

| · | Errors related to transactional-level controls were evaluated by PHI management based on materiality at the subsidiary level, which is substantially lower than the PHI consolidated level of materiality, and PHI management concluded on the severity of the deficiencies at the subsidiary level. Certain errors, which were considered significant deficiencies at the subsidiary level, were not significant to PHI’s consolidated operating results and would not aggregate to a material weakness at the PHI consolidated level; however, these errors were disclosed and reported to PHI’s executive management and the Audit Committee as significant deficiencies based on the materiality at the subsidiary level. |

PHI management also evaluated deficiencies in internal control over financial reporting, in the aggregate, and evaluated recent trends of the deficiencies, to conclude on the effectiveness of other COSO components of internal control, such as risk assessment and monitoring. PHI management has ongoing processes in place for the risk assessment and monitoring components of COSO in addition to the control activities established at the transaction level. The risk assessment process includes consideration of transactions impacting significant accounts, vulnerability to fraudulent activity, and other risk factors such as changes in the operating environment, new business transactions, turnover of personnel, and new technology or software. The monitoring process includes monitoring of control activities, as well as entity-level monitoring activities including the reporting of deficiencies to management and the Audit Committee. All of the control deficiencies associated with errors disclosed were reported timely to PHI management and to the Audit Committee, and the status of remediation efforts made by PHI to address these deficiencies was, and continues to be, actively monitored by PHI management and the Audit Committee.

To evaluate the effectiveness of PHI’s risk assessment and monitoring processes as of December 31, 2013, PHI management considered the root cause of each control deficiency, and considered whether deficiencies with similar root causes were an indicator of ineffective risk assessment or monitoring processes. PHI management considered all deficiencies that were not remediated as of each reporting date, but also considered recent trends in deficiencies when performing this evaluation. As detailed in the section entitled “Summary Evaluation of Risk Assessment and Monitoring Components of COSO” below, PHI management concluded that its risk assessment and monitoring processes were effective as of December 31, 2013, after consideration of deficiencies in the aggregate. In arriving at this conclusion, PHI management considered the following:

| · | The deficiencies associated with the errors did not relate to any risks not previously identified by PHI’s risk assessment process, |

| · | No trends were identified indicating that the number of design or operating deficiencies was increasing over time, |

| · | Operating deficiencies were identified by PHI’s monitoring process or by compensating controls, which prevented the errors from becoming material, and |

| · | PHI management’s response to deficiencies identified was evident and timely. Of the seven deficiencies, six were remediated as of December 31, 2013. |

PHI management has provided further information below regarding each of its assessments of internal control over financial reporting as of December 31, 2011, 2012, and 2013.

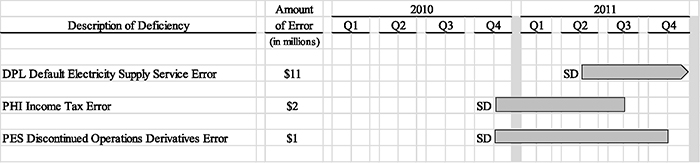

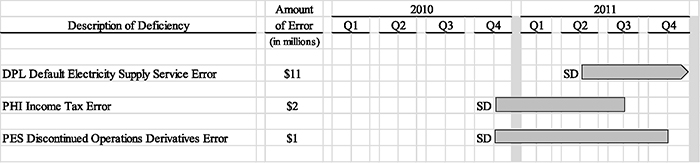

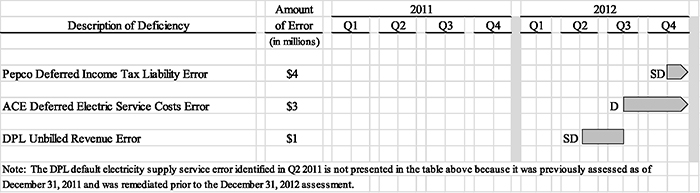

Assessment of Internal Control over Financial Reporting as of December 31, 2011

The following chart depicts the three deficiencies associated with errors that were considered in PHI management’s assessment of the effectiveness of PHI’s internal control over financial reporting as of December 31, 2011. Deficiencies remediated during 2011 were excluded from PHI management’s assessment of internal control over financial reporting as of December 31, 2011, but were included in the evaluation of deficiencies in the aggregate to conclude on the effectiveness of PHI’s risk assessment and monitoring processes. The bars indicate the life cycle of each deficiency, from the period the deficiency was identified to the period it was remediated, with the arrows indicating any such deficiencies that were not remediated as of the reporting date.

| · | DPL Default Electricity Supply Service Error ($11 million error corrected in 2011) |

Cause of error/reason for control failure: This review control of manual procedures relied heavily on the diligence and expertise of the individuals performing the control. Errors in the manual calculations were not identified by the review being performed. This error was identified by an entity-level compensating control.

Year: Significant deficiency identified in Q2 2011, remediated in Q4 2012.

Design or operating deficiency: Operating deficiency.

COSO component: This deficiency relates to the control activities component. Controls related to the accounting for default electricity supply service were in place and operating, and the error was identified by an entity-level compensating control. However, PHI management concluded that a deficiency existed related to the operating effectiveness of a transactional-level control as of December 31, 2011.

| · | PHI Income Tax Error ($2 million error corrected in 2011) |

Cause of error/reason for control failure: This error was caused by the failure of a review control to detect errors in manual procedures implemented in Q3 2010 associated with the calculation of interest on uncertain tax positions. The deficiency resulted in an unadjusted difference as of December 31, 2010, which was identified prior to the issuance of the PHI 2010 consolidated financial statements, was determined to be immaterial to the PHI 2010 consolidated operating results, and was corrected in Q1 2011.

Year: Significant deficiency identified in Q4 2010, remediated in Q3 2011.

Design or operating deficiency: Operating deficiency.

COSO component: This deficiency relates to the control activities component. To address newly identified risks related to a tax law change that impacted the calculation of interest on uncertain tax positions, PHI management implemented a new control in Q3 2010. However, PHI management concluded that a deficiency existed related to the operating effectiveness of this control as of December 31, 2010.

| · | Pepco Energy Services, Inc. (“PES”) Discontinued Operations Derivatives Error ($1 million error corrected in 2011) |

Cause of error/reason for control failure: The error occurred when changes in the business that occurred during 2010 impacting the accounting for derivative transactions were not considered when performing the control. This error was identified by the performance of improved control procedures implemented during 2010. These improved control procedures identified an unadjusted difference as of December 31, 2010, which was identified prior to the issuance of the PHI 2010 consolidated financial statements, was determined to be immaterial to the PHI 2010 consolidated operating results, and was corrected in Q1 2011.

Year: Significant deficiency identified in Q4 2010, remediated in Q4 2011.

Design or operating deficiency: Operating deficiency.

COSO component: This deficiency relates to the control activities component. Controls related to accounting for derivative transactions were in place, which led to the identification of an error. However, PHI management concluded that a deficiency existed related to the operating effectiveness of this control as of December 31, 2010.

Aggregation Considerations

PHI management contemporaneously evaluated and documented the severity of the deficiencies in internal control over financial reporting related to the above errors in the aggregate, and concluded that no aggregated material weakness existed as of December 31, 2011. In arriving at this conclusion, PHI management considered that the significant deficiencies impacted different financial statement line items, disclosures, and business units (the DPL default electricity service supply error overstated other operations and maintenance expense in the Power Delivery segment, the PHI income tax error impacted income tax expense for the Power Delivery segment, and the PES discontinued operations derivatives error impacted net loss from discontinued operations), and considered that two of the three significant deficiencies associated with these errors were remediated as of December 31, 2011.

The significant deficiency related to the accounting for DPL default electricity supply service was not remediated as of December 31, 2011. To evaluate whether this deficiency was the result of a material weakness in internal control over financial reporting, PHI management considered the following:

| · | Other deficiencies did not impact other operations and maintenance expense, |

| · | The nature of the transaction/error was isolated to deferred revenues and costs associated with default electricity supply service, and the annual operating margins related to such service are not material to PHI’s consolidated operating results, and |

| · | The error was identified by an entity-level compensating control, which prevented the error from becoming material. |

In addition to the assessment of internal control over financial reporting as of December 31, 2011, PHI management, taking into account the same factors described above, assessed internal control over financial reporting in each quarter of 2011 and concluded that no material weakness existed in the aggregate.

Evaluation of Risk Assessment and Monitoring Components of COSO

As of December 31, 2011, a significant deficiency related to DPL’s accounting for default electricity supply service was not remediated. Significant deficiencies related to the PHI income tax error and the PES discontinued operations derivatives error were considered remediated as of December 31, 2011. Details of PHI management’s evaluation of these deficiencies, and its conclusions as to the effectiveness of PHI’s risk assessment and monitoring components of COSO, are provided below:

In determining whether PHI’s risk assessment processes were effective, PHI management considered whether the risks had been identified and whether the appropriate focus and resources had been committed to the performance of the related internal controls. Risks related to the accounting for default electricity supply service, the calculation of interest on uncertain tax positions, and the accounting for derivative transactions had previously been identified by PHI management, and applicable control activities were in place and operating to address the identified risks, including compensating controls.

In determining whether PHI’s monitoring processes were effective, PHI management considered whether PHI’s monitoring identified each operating deficiency timely as follows:

| · | With respect to the deficiency related to DPL’s default electricity supply service,PHI management concluded that an entity-level compensating monitoring control identified the error and the related deficiency, and prevented the error from becoming material to PHI’s consolidated operating results. |

| · | With respect to the deficiencies related to the calculation of interest on uncertain tax positions and the accounting for derivative transactions, PHI’s monitoring process identified these deficiencies timely. The errors identified in 2010 were immaterial to PHI’s 2010 consolidated operating results, and PHI management recorded the related adjustments in Q1 2011. |

With respect to these deficiencies, considered individually and in the aggregate with other deficiencies not associated with errors, PHI management concluded that PHI’s risk assessment and monitoring processes were effective as of December 31, 2011.

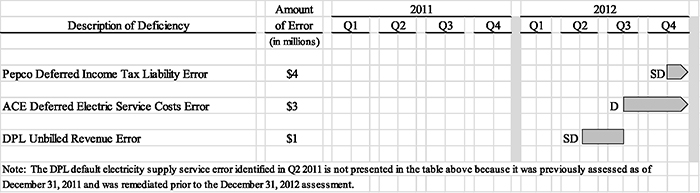

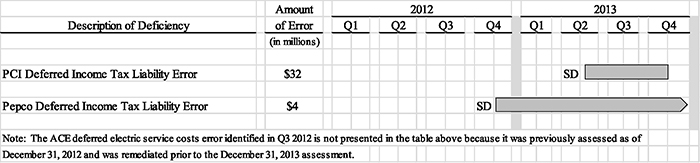

Assessment of Internal Control over Financial Reporting as of December 31, 2012

The following chart depicts the three deficiencies associated with errors that were considered in PHI management’s assessment of the effectiveness of PHI’s internal control over financial reporting as of December 31, 2012. Deficiencies remediated during 2012 were excluded from PHI management’s assessment of internal control over financial reporting as of December 31, 2012, but were included in the evaluation of deficiencies in the aggregate to conclude on the effectiveness of PHI’s risk assessment and monitoring components of COSO. The bars indicate the life cycle of each deficiency, from the period the deficiency was identified to the period the deficiency was remediated, with the arrows indicating any such deficiencies that were not remediated as of the reporting date.

| · | Pepco Deferred Income Tax Liability Error ($4 million error corrected in 2013) |

Cause of error/reason for control failure: The reconciliation of deferred tax balances relied heavily upon manual procedures and the adequate performance of review controls. In Q4 2012, PHI management identified a deficiency in the operating effectiveness of controls related to the reconciliation of deferred tax balances. During remediation in Q4 2013, an error was identified by the execution of improved internal control procedures. Controls related to the deferred tax reconciliation are performed annually, and the effectiveness of these controls is also assessed annually.

Year: Significant deficiency identified in Q4 2012, remediation of the deficiency is continuing in 2014.

Design or operating deficiency: Operating deficiency.

COSO component: This deficiency relates to the control activities component. Controls related to the reconciliation of deferred tax balances have been in place and operating annually. However, PHI management concluded that a deficiency existed related to the operating effectiveness of these control activities as of December 31, 2012.

| · | Atlantic City Electric Company (“ACE”) Deferred Electric Service Costs Error ($3 million error corrected in 2012) |

Cause of error/reason for control failure: This review control of manual procedures relied heavily on the diligence and expertise of the individuals performing the control. Errors in the manual calculations with respect to affiliate revenues were not identified by the review being performed. This error was identified by an entity-level compensating control.

Year: Deficiency identified in Q3 2012, remediated in Q4 2013.

Design or operating deficiency: Operating deficiency.

COSO component: This deficiency relates to the control activities component. Controls related to deferred electric service costs were in place and operating, and the error was identified by an entity-level compensating control. However, PHI management concluded a deficiency existed related to the operating effectiveness of a transactional-level control as of December 31, 2012.

| · | DPL Unbilled Revenue Error ($1 million error corrected in 2012) |

Cause of error/reason for control failure: This error was identified by a compensating control that is designed to assess the reasonableness of DPL’s estimated natural gas unbilled revenue. Two existing control activities were associated with the calculation of unbilled revenue. One control activity was over the detailed calculation of unbilled revenue, and a higher level control, which identified the error, was designed to assess the reasonableness of the unbilled revenue calculation. As designed in this reasonableness test, once the cumulative variances exceeded PHI management’s de minimis thresholds, a comprehensive review of the calculation and its inputs was performed. This review identified an error that was primarily caused by a control design that was not revised appropriately to ensure accounting was in accordance with the applicable operating agreement once certain pipeline assets had been sold to a third party.

Year: Significant deficiency identified in Q2 2012, remediated in Q3 2012.

Design or operating deficiency: Design deficiency. The compensating control was operating effectively; however, a deficiency existed in a transactional-level control related to the calculation.

COSO component:The deficiency relates to the control activities component.Controls related to estimated natural gas revenues and unbilled revenue calculations were in place, and this error was identified through the performance of a compensating control, which operated as designed. However, PHI management concluded that a deficiency existed related to the design of the estimated unbilled revenue calculation control.

Aggregation Considerations

PHI management contemporaneously evaluated and documented the severity of the deficiencies in internal control over financial reporting related to these errors in the aggregate, and concluded that no aggregated material weakness existed as of December 31, 2012. In arriving at this conclusion, PHI management considered that the deficiencies impacted different financial statement line items and disclosures (the Pepco deferred income tax liability error impacted deferred tax balances, the ACE deferred electric service costs error impacted deferred electric service costs, and the DPL unbilled revenue estimates error impacted operating revenue), and considered that one of the three deficiencies associated with these errors was remediated as of December 31, 2012.

The deficiencies related to Pepco’s deferred tax balances and the accounting for ACE’s deferred electric service costs were not remediated as of December 31, 2012. To evaluate whether these deficiencies were the result of a material weakness in internal control over financial reporting, PHI management considered the following:

| · | The unremediated deficiencies impacted different consolidated financial statement line items, |

| · | The nature of the transaction/error associated with the ACE deficiency was isolated to deferred revenues and costs associated with default electricity supply service, and the annual operating margins related to such service are not material to PHI’s consolidated operating results, and |

| · | Compensating controls and other factors limited the potential magnitude of any errors associated with the deficiencies. The ACE deficiency was identified by an entity-level compensating control and was limited to one affiliate revenue transaction that was immaterial to PHI’s consolidated operating results. The magnitude of potential errors associated with the Pepco deferred tax liability deficiency was not material due to compensating controls, and the annual performance of applicable controls in prior periods. |

In addition to the assessment of internal control over financial reporting as of December 31, 2012, PHI management, taking into account the same factors described above, assessed internal control over financial reporting in each quarter of 2012, and concluded that no material weakness existed in the aggregate.

Evaluation of Risk Assessment and Monitoring Components of COSO

As of December 31, 2012, a significant deficiency related to Pepco’s deferred tax reconciliation and a deficiency related to ACE’s understatement of deferred electric service costs were not remediated. The significant deficiency related to DPL’s unbilled revenue was identified and remediated within the year. Details of PHI management’s evaluation of these deficiencies, and its conclusions as to the effectiveness of PHI’s risk assessment and monitoring components of COSO are provided below:

In determining whether PHI’s risk assessment processes were effective, PHI management considered whether the risks had been identified and whether the appropriate focus and resources had been committed to the performance of the related internal controls. Risks related to the reconciliation of deferred tax balances, the accounting for default electricity supply service, and unbilled revenue had previously been identified by PHI management and controls were in place and operating to address the identified risks. Recognizing the inherent complexities and judgmental estimates related to the accounting for deferred taxes, PHI management had, in prior years, taken steps to improve controls and procedures related to the process. Further, with a focus toward reducing future risk, PHI management has undertaken an initiative, which is currently under way, to update PHI’s tax software and automate portions of the reconciliation process to place less reliance on manual procedures and review controls.

In determining whether PHI’s monitoring processes were effective, PHI management considered whether PHI’s monitoring process identified each operating deficiency timely. PHI management concluded that its monitoring process identified these deficiencies in a timely manner. During the annual 2012 performance of controls related to the reconciliation of deferred tax balances, the monitoring process identified that improvements in the execution of the annual controls was required. The ACE deferred electric service costs deficiency was identified by an entity-level compensating control, and the normal performance of a compensating control also identified the deficiency related to a transactional-level control for DPL’s estimated unbilled revenue when the variances associated with the reasonableness test exceeded PHI management’s de minimis thresholds.

With respect to these deficiencies, considered individually and in the aggregate with other deficiencies not associated with errors, PHI management concluded that PHI’s risk assessment and monitoring processes were effective as of December 31, 2012.

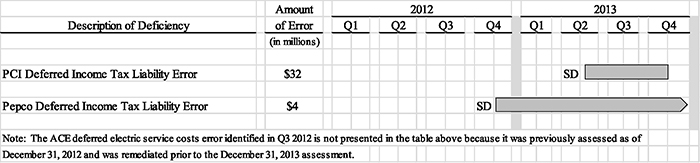

Assessment of Internal Control over Financial Reporting as of December 31, 2013

The following chart depicts the two deficiencies associated with errors that were considered in PHI management’s assessment of the effectiveness of PHI’s internal control over financial reporting as of December 31, 2013. Deficiencies remediated during 2013 were excluded from PHI management’s assessment of internal control over financial reporting as of December 31, 2013, but were included in the evaluation of deficiencies in the aggregate to conclude on the effectiveness of PHI’s risk assessment and monitoring processes. The bars indicate the life cycle of each deficiency, from the period the deficiency was identified to the period the deficiency was remediated, with the arrows indicating any such deficiencies that were not remediated as of the reporting date.

| · | PCI Deferred Income Tax Liability/Tax Structured Transaction Error ($32 million error reflected in 2013 as an adjustment to opening shareholders’ equity in 2011) |

Cause of error/reason for control failure: The error occurred in 1999 and was not identified until 2013 due to PHI management’s reliance on historical accounting conclusions related to a specific tax structured transaction. Controls were established subsequent to 1999 related to the evaluation of new tax laws or guidance; however, these controls were not designed to re-evaluate historical accounting conclusions periodically for tax structured transactions.

Year: Significant deficiency identified in Q2 2013, remediated in Q4 2013.

Design or operating deficiency: Design deficiency.

COSO component: This deficiency relates to the control activities component. PHI management ensured controls related to the evaluation of new tax laws or guidance were in place and operating. However, these controls did not require the periodic re-evaluation of all previous tax laws and accounting conclusions for tax structured transactions, and did not identify an error that occurred in 1999.

| · | Pepco Deferred Income Tax Liability Error ($4 million error corrected in 2013) –as described above in the section entitled “Assessment of Internal Control over Financial Reporting as of December 31, 2012.” |

Aggregation Considerations

PHI management contemporaneously evaluated and documented the severity of the deficiencies in internal control over financial reporting related to these errors in the aggregate, and concluded that no aggregated material weakness existed as of December 31, 2013. In arriving at this conclusion, PHI management considered that the business units impacted by the errors differed (the Pepco deferred tax liability error impacted the Power Delivery segment, and the PCI tax structured transactions error impacted the Other Non-Regulated segment), and the root causes of the deficiencies differed. PHI management also considered that the PCI deficiency was limited to a specific tax structured transaction. PCI had entered into a limited number of these transactions in the past, and had entered into no such transactions since 2002. In a review of all tax structured transactions previously entered into by PCI and its subsidiaries, no other errors were identified. The PCI deferred tax liability error occurred in 1999 and, subsequent to that date, controls had been established to prevent a similar error from occurring. PHI management also considered that one of the two significant deficiencies associated with these errors was remediated as of December 31, 2013.

The significant deficiency related to Pepco’s deferred tax balances was not remediated as of December 31, 2013. To evaluate whether this deficiency was the result of a material weakness in internal control over financial reporting, PHI management considered that the magnitude of potential errors associated with the Pepco deferred tax liability deficiency was not material due to compensating controls, and the annual performance of applicable controls in prior periods.

In addition to the assessment of internal control over financial reporting as of December 31, 2013, PHI management, taking into account the same factors described above, assessed internal control over financial reporting in each quarter of 2013, and concluded that no material weakness existed in the aggregate.

Evaluation of Risk Assessment and Monitoring Components of COSO

As of December 31, 2013, the significant deficiency identified in 2012 related to Pepco’s deferred tax reconciliation was not remediated. A significant deficiency related to a deferred income tax liability adjustment at PCI was identified and remediated within the year. Details of PHI management’s evaluation of these deficiencies, and its conclusions as to the effectiveness of PHI’s risk assessment and monitoring components of COSO are provided below:

In determining whether PHI’s risk assessment processes were effective, PHI management considered whether the risks had been identified and whether the appropriate focus and resources had been committed to the performance of the related internal controls. With respect to PCI’s tax structured transaction error, PHI management had recognized in prior years the risk related to changes in tax laws, and controls had been established to evaluate the impact of new tax guidance. PHI management concluded that, although an error occurred in 1999, its risk assessment process was effective in 2013. PHI’s risk assessment process appropriately and timely identified risks related to (i) the change in PCI’s tax position in the first quarter of 2013 with respect to the tax benefits associated with the cross-border energy lease investments, (ii) PHI’s resulting decision in March 2013 to begin to pursue the early termination of the cross-border energy lease investments, and (iii) a desire by PHI management to wind up the affairs of PCI and its subsidiaries and move toward a path of dissolution of some or all of the PCI entities. To address risks related to these decisions, PHI management concluded that it would be appropriate to re-evaluate all remaining tax attributes and the deferred tax asset and liability balances of PCI and its subsidiaries. PHI management evaluated

the design deficiency, and concluded that this deficiency was not an indicator of an ineffective risk assessment process. Risks related to the reconciliation of Pepco’s deferred tax balances had previously been identified by PHI management, and remediation plans were implemented during 2013 to improve the operating effectiveness of the control activities related to the reconciliation of deferred tax balances due to the identification of a deficiency in these controls in 2012. The execution of improved internal controls related to deferred tax balances was effective in that it identified the error corrected in 2013.

In determining whether PHI’s monitoring processes were effective, PHI management considered whether PHI’s monitoring process identified each operating deficiency timely. PHI management concluded that the deficiency related to the reconciliation of Pepco’s deferred tax balances was identified timely by PHI’s monitoring process in 2012. Although improvements had been made related to the controls as evidenced by the identification of a prior period error in the performance of the control, the monitoring process identified that further evidence of the consistent execution of the annual controls was required before concluding the deficiency was fully remediated. With respect to the PCI tax structured transactions deficiency, control activities were implemented to mitigate the risks identified in the first quarter of 2013, and the design deficiency was identified during the performance of these controls and related monitoring procedures.

With respect to these deficiencies, considered individually and in the aggregate with other deficiencies not associated with errors, PHI management concluded that PHI’s risk assessment and monitoring processes were effective as of December 31, 2013.

Summary Evaluation of Risk Assessment and Monitoring Components of COSO

As of December 31, 2013, PHI management performed an assessment of internal control over financial reporting, and also confirmed that assessments of internal control for prior years (2011 and 2012) did not change based on deficiencies identified during 2013 that may have existed in 2011 and 2012. PHI management concluded that these deficiencies, individually and in the aggregate, were not the result of a material weakness, and that PHI management’s conclusions in regards to internal control over financial reporting at each year-end date would not have changed.

PHI management also evaluated the deficiencies associated with errors in the aggregate to conclude on the effectiveness of its risk assessment and monitoring processes. Of the seven errors disclosed during 2011, 2012, and 2013, five were the result of operating deficiencies and two were the result of design deficiencies. PHI management concluded that the deficiencies, when considered in the aggregate, did not indicate that PHI’s risk assessment or monitoring processes were ineffective. In arriving at this conclusion, PHI management considered the following:

| · | The two design deficiencies (PCI Tax Structured Transaction error, DPL Unbilled Revenue error) were the result of different root causes. One error occurred in 1999, and the other was identified timely by the operation of a compensating control. |

| · | Four of the five operating deficiencies (PES Discontinued Operations Derivatives error, PHI Income Tax Error, DPL Default Electricity Supply Service error, ACE Deferred Electric Service Costs error, Pepco Deferred Income Tax Liability error) were remediated as of December 31, 2013, and were the result of operating ineffectiveness in applicable controls. However, three of the operating deficiencies (PES Discontinued Operations Derivatives error, PHI Income Tax error, and Pepco Deferred Income Tax Liability error) were identified timely by PHI management’s operating effectiveness testing, which evidenced the effectiveness of PHI’s monitoring process. Two of the operating deficiencies (DPL Default Electric Supply Service error, ACE Deferred Electric |

Service Costs error) were identified by entity-level compensating controls, which prevented the errors from becoming material to PHI’s consolidated operating results.

| · | PHI management evaluated each of the deficiencies, and how each deficiency was identified, and concluded that these deficiencies were not indicative of a trend or a pervasive issue with respect to the effectiveness of PHI’s risk assessment or monitoring processes. |

| · | With respect to the deficiency related to Pepco’s deferred tax reconciliation, remediation efforts continued into 2014. During the annual 2013 performance of controls related to the reconciliation of deferred tax balances, the monitoring process identified a prior period error, and PHI management concluded that further evidence of the consistent execution of the annual controls was required before concluding the deficiency was fully remediated. |

Summary of Assessment

As discussed above in the sections of this letter entitled “Summary” and “Summary Evaluation of Risk Assessment and Monitoring Components of COSO,” PHI management concluded in its assessment of internal control over financial reporting as of December 31, 2013, that the errors disclosed were not the result of a material weakness. PHI management also evaluated the deficiencies associated with these errors, individually and in the aggregate, and concluded that PHI’s risk assessment and monitoring processes were operating effectively.

*************

In connection with the foregoing responses, the Company acknowledges that:

| · | the Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

| · | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| · | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions regarding this response, please do not hesitate to call me at (202) 872-2219, Ronald K. Clark, Vice President and Controller, at (202) 872-2249, or Jane K. Storero, Vice President – Corporate Governance and Secretary, at (202) 872-3487.

| | Sincerely, |

| | |

| | /s/Joseph M. Rigby |

| | Joseph M. Rigby |

| | Chairman of the Board, President |

| | and Chief Executive Officer of PHI |