Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

ARBINET-THEXCHANGE, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

May 6, 2005

Dear Arbinet Stockholder:

It is my pleasure to invite you to the 2005 Annual Meeting of Stockholders of Arbinet-thexchange, Inc. We will hold the meeting on Wednesday, June 15, 2005 at 10:00 a.m., local time, at the Hyatt Regency New Brunswick, Two Albany Street, New Brunswick, New Jersey 08901.

During the Annual Meeting, we will discuss each item of business described in the Notice of Annual Meeting and Proxy Statement that follows, update you on important developments in our business and respond to any questions that you may have about the Company.

Whether or not you expect to attend the meeting, please vote your shares using any of the following methods: vote by telephone or the Internet, as described on the instructions on the proxy card; sign and return the proxy card in the enclosed envelope; or vote in person at the meeting.

On behalf of your Board of Directors, thank you for your continued support and interest in Arbinet. I look forward to seeing you at the meeting on June 15, 2005.

Very truly yours,

J. Curt Hockemeier

President and Chief Executive Officer

Table of Contents

ARBINET-THEXCHANGE, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on June 15, 2005

TO THE STOCKHOLDERS OF ARBINET-THEXCHANGE, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of ARBINET-THEXCHANGE, INC. (the “Company”) will be held at the Hyatt Regency New Brunswick, Two Albany Street, New Brunswick, New Jersey 08901, on Wednesday, June 15, 2005 at 10:00 a.m. local time. At the meeting, the holders of the Company’s outstanding Common Stock will act upon the following matters:

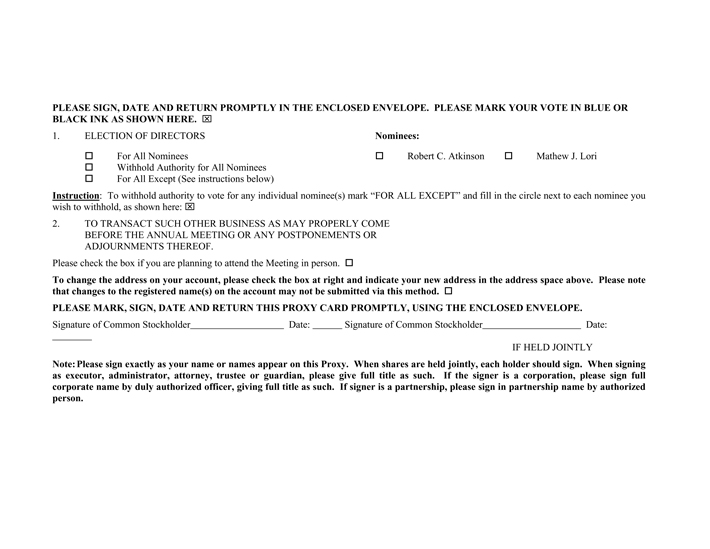

1. To elect two Class I directors; and

2. To transact such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

All stockholders of record as of the close of business on April 20, 2005 are entitled to notice of the Annual Meeting and to vote at the Annual Meeting and any postponements or adjournments thereof. A list of stockholders of the Company entitled to vote at the Annual Meeting will be available for inspection by any stockholder at the Annual Meeting and during normal business hours at the Company’s corporate offices during the 10-day period immediately prior to the date of the Annual Meeting.

By Order of the Board of Directors,

CHI K. ENG

Secretary

New Brunswick, New Jersey

May 6, 2005

EACH STOCKHOLDER IS URGED TO COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES, OR OTHERWISE VOTE VIA THE INTERNET OR BY TELEPHONE IN THE MANNER DESCRIBED ON THE PROXY CARD. IF A STOCKHOLDER DECIDES TO ATTEND THE MEETING, HE OR SHE MAY, IF SO DESIRED, REVOKE THE PROXY AND VOTE THE SHARES IN PERSON.

OUR 2004 ANNUAL REPORT ACCOMPANIES THE PROXY STATEMENT.

Table of Contents

| Page | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 5 | ||

| 6 | ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 7 | |

| 10 | ||

| 10 | ||

| 11 | ||

Affirmative Determination Regarding Director Independence and Other Corporate Governance Matters | 11 | |

| 11 | ||

| 13 | ||

| 13 | ||

| 14 | ||

| 14 | ||

| 15 | ||

| 15 | ||

| 16 | ||

| 18 | ||

| 19 | ||

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS | 20 | |

| 22 | ||

| 24 | ||

| 24 | ||

| 25 | ||

i

Table of Contents

| Page | ||

| 26 | ||

| 26 | ||

| 26 | ||

| 26 | ||

| 26 | ||

Stockholder Proposals to be Presented at the Next Annual Meeting | 27 | |

| 27 | ||

APPENDIX A—Charter of the Audit Committee of the Board of Directors | A-1 | |

ii

Table of Contents

ARBINET-THEXCHANGE, INC.

120 ALBANY STREET; TOWER II; SUITE 450

NEW BRUNSWICK, NEW JERSEY 08901

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Arbinet-thexchange, Inc. (the “Company” or “Arbinet”), for use at the 2005 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Hyatt Regency New Brunswick, Two Albany Street, New Brunswick, New Jersey 08901, on Wednesday, June 15, 2005 at 10:00 a.m., local time, and any postponements or adjournments thereof. This proxy statement and the accompanying proxy card are being distributed on or about May 6, 2005.

Matter for Consideration at the Annual Meeting

At the Annual Meeting, stockholders will be asked to consider and to vote to elect two Class I directors. The Board of Directors of the Company (the “Board”) has nominated the following candidates:

Robert C. Atkinson and Mathew J. Lori

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE FOREGOING PROPOSAL.

Persons Making the Solicitation

Execution and return of the enclosed proxy card are being solicited by and on behalf of the Board for the purposes set forth in the foregoing notice of meeting. The costs incidental to the solicitation and obtaining of proxies, including the cost of reimbursing banks and brokers for forwarding proxy materials to their principals, will be borne by the Company. Proxies may be solicited, without extra compensation, by officers and employees of the Company, both in person and by mail, telephone, telefax and other methods of communication.

The Annual Report to Stockholders for the fiscal year ended December 31, 2004, including consolidated financial statements and other information with respect to the Company and its subsidiaries, is being mailed to stockholders with this Proxy Statement. Such Annual Report is not part of this Proxy Statement.

Voting Securities of the Company

Only stockholders of record at the close of business on April 20, 2005 are entitled to notice of the Annual Meeting and to vote at the Annual Meeting. As of that date, the Company had outstanding 24,604,799 shares of Common Stock. The holders of a majority of such shares, represented in person or by proxy, shall constitute a

1

Table of Contents

quorum at the Annual Meeting. A quorum is necessary before business may be transacted at the Annual Meeting except that, even if a quorum is not present, the stockholders present in person or by proxy shall have the power to adjourn the meeting from time to time until a quorum is present. Each stockholder entitled to vote shall have the right to one vote for each share of Common Stock outstanding in such stockholder’s name.

The shares of Common Stock represented by each properly executed proxy card will be voted at the Annual Meeting in the manner directed therein by the stockholder signing such proxy card. The proxy card provides spaces for a stockholder to vote for the Board’s nominees, or to withhold authority to vote for either or both of such nominees, for election as directors. Directors are to be elected by a plurality of the votes cast at the Annual Meeting. With respect to any other matter that may properly be brought before the Annual Meeting, the affirmative vote of a majority of the votes cast by stockholders entitled to vote thereon is required to take action, unless a greater percentage is required either by law or by the Company’s certificate of incorporation or bylaws. In determining the number of votes cast with respect to any voting matter, only those cast “for” or “against” are included. Abstentions will be considered present and entitled to vote at the Annual Meeting but will not be counted as votes cast. Accordingly, abstentions will have no effect on the vote. Similarly, where brokers submit proxies but are prohibited and thus refrain from exercising discretionary authority in voting shares on certain matters for beneficial owners who have not provided voting instructions with respect to such matters (commonly referred to as “broker non-votes”), those shares will be considered present and entitled to vote at the Annual Meeting but will not be counted as votes cast as to such matters and thus will have no effect on the vote.

If a signed proxy card is returned and the stockholder has given no direction regarding a voting matter, the shares will be voted with respect to that matter by the proxy agents as recommended by the Board. Execution and return of the enclosed proxy card will not affect a stockholder’s right to attend the Annual Meeting and vote in person. Any stockholder that executes and returns a proxy card has the right to revoke it by giving notice of revocation to the Secretary of the Company at any time before the proxy is voted.

Our certificate of incorporation provides for a Board consisting of three classes, with each class serving for a staggered three-year term. Our Board currently consists of eight directors. Our Class I directors currently are Michael L. DeRosa and Mathew J. Lori. Our Class II directors are Deborah D. Rieman, Roland A. Van der Meer and William G. Kingsley. Our Class III directors are J. Curt Hockemeier, Anthony L. Craig and Michael J. Ruane.

Each Class I director elected at the Annual Meeting will serve until the 2008 annual meeting of stockholders and until such director’s successor has been elected and qualified, except in the event of such director’s earlier death, resignation or removal. The terms of office of the Class II and Class III directors will expire at the annual meetings of stockholders to be held in 2006 and 2007, respectively, upon the election and qualification of their successors.

Mr. DeRosa has informed the Board that he does not intend to stand for reelection to our Board. There is no disagreement between Mr. DeRosa and the Company on any matter relating to our operations, policies or practices. Accordingly, upon the recommendation of our Nominating and Corporate Governance Committee, the Board has nominated Robert C. Atkinson and Mathew J. Lori for election as the Class I directors. Mr. Atkinson is not currently a director of the Company. The persons named as proxy agents in the enclosed proxy card intend (unless instructed otherwise by a stockholder) to vote for the election of Robert C. Atkinson and Mathew J. Lori as the Class I directors. In the event that a nominee should become unable to accept nomination or election (a circumstance that the Board does not expect), the proxy agents intend to vote for any alternate nominee designated by the Board or, in the discretion of the Board, the position may be left vacant.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR EACH CLASS I NOMINEE.

2

Table of Contents

Vote Required for the Election of Directors

The affirmative vote by the holders of a plurality of the shares of Common Stock present and voting at the Annual Meeting is required to elect each of the nominees for director. Each share of Common Stock which is represented, in person or by proxy, at the Annual Meeting will be accorded one vote on each nominee for director. For purposes of this vote, abstentions and broker non-votes will in effect not be counted. The Board recommends that stockholders vote FOR the election of each of the nominees named above.

Set forth below is certain information with respect to each nominee for director and each other person currently serving as a director of the Company, including those directors whose term of office will continue after the Annual Meeting. The class and term of office of each such person is also set forth below. This information has been provided by each nominee and director at the request of the Company. None of the directors or nominees for director are related to each other or any executive officer of the Company.

Name | Age | Position | ||

J. Curt Hockemeier | 56 | President and Chief Executive Officer and Class III Director | ||

Anthony L. Craig | 59 | Chairman of the Board and Class III Director | ||

Michael L. DeRosa(1)(5) | 33 | Class I Director | ||

William G. Kingsley(2)(3) | 46 | Class II Director | ||

Mathew J. Lori(1) | 41 | Class I Director and Nominee for Class I Director | ||

Deborah D. Rieman, Ph.D.(2)(3) | 55 | Class II Director | ||

Michael J. Ruane(1)(2) | 51 | Class III Director | ||

Roland A. Van der Meer(3) | 44 | Class II Director | ||

Robert C. Atkinson(4) | 48 | Nominee for Class I Director |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Nominating and Corporate Governance Committee. |

| (3) | Member of the Compensation Committee. |

| (4) | If elected to the Board, the nominee has agreed to serve as a Member of the Audit Committee. |

| (5) | Mr. DeRosa has informed the Board that he is not standing for reelection. |

3

Table of Contents

Class I—Director Nominees for Term Continuing until 2008

Robert C. Atkinson is a nominee to serve as a Class I Director. Since June 2000, Mr. Atkinson has served as Director of Policy Research with the Columbia Institute for Tele-Information at Columbia University which conducts academic research related to telecommunication regulation and public policy. Prior to that, from January 1999 until June 2000, Mr. Atkinson was a Deputy Bureau Chief at the Federal Communications Commission in the Common Carrier Bureau. Mr. Atkinson received his BA degree from the University of Virginia and his JD degree from the Georgetown University Law Center.

Mathew J. Lori is a nominee to serve as a Class I Director. He has been a director since May 2001. Mr. Lori has been a principal at JPMorgan Partners, LLC since 1998 and in various other positions since 1993, where he has focused primarily on management buyouts and growth equity investments for media, industrial, and consumer product companies. Prior to 1993, Mr. Lori held various positions at Ernst & Young LLP. Mr. Lori currently serves as a Director of Ascend Media, Doane Pet Care, and Berry Plastics Corporation. Mr. Lori received a B.S. degree from University of Windsor and an M.B.A. degree from the Kellogg Graduate School of Management at Northwestern University.

Class II—Directors with Term Continuing until 2006

Deborah D. Rieman, Ph.D. has been a director since March 2004. Dr. Rieman has served as an investment manager since January 2000, managing a private investment portfolio. From June 1995 to December 1999, she served as the President and Chief Executive Officer for Check Point Software Technologies, Inc., an internet security software company. Prior to that, she served in various executive and marketing positions with Adobe Systems Inc., Sun Microsystems, Inc. and Xerox Corp. Dr. Rieman is a member of the board of directors of Corning Incorporated, Keynote Systems, Inc., Tumbleweed Communications, Inc. and Kintera, Inc. Dr. Rieman received a B.A. degree from Sarah Lawrence College and a Ph.D. degree from Columbia University.

Roland A. Van der Meer has been a director since April 1999. Mr. Van der Meer has served as a Partner with ComVentures, Inc., a venture capital firm, since June 1997. From 1993 to 1997, he served as a partner with Partech International. Prior to that, he co-founded and served as a partner for Communications Ventures. Mr. Van der Meer also served as interim Chief Executive Officer of PairGain and worked at Hambrecht & Quist Venture Partners, where he focused on communications investments. Mr. Van der Meer received a B.S.E.E. degree from the University of Pennsylvania and a B.S.E. degree from the Wharton School of the University of Pennsylvania.

William G. Kingsley has been a director since August 2001. Mr. Kingsley has served as a Managing Director of EnerTech Capital, a venture capital firm focused on energy technology, clean technology and related markets, since May 2000. From August 1999 to May 2000, he served as Vice President-Broadband & Internet Services for Lucent Technologies, where he focused on bringing products and services to the cable industry. Prior to that, from June 1993 to October 1998, he served in various capacities for Comcast Corporation, where he was part of the founding team of Sprint PCS and managed Comcast’s investment in various partnerships associated with Teleport Communications Group. Mr. Kingsley previously worked for GTE Mobile Communications and Contel Corporation. Mr. Kingsley also serves on the boards of Advent Solar, Inc., Cablematrix Technologies, Inc., Circadiant Systems, Inc., INVIDI Technologies, Corp, OEwaves, Inc., Schema, Ltd., Valaran Corporation. Mr. Kingsley received his B.S. degree from Lynchburg College and his M.A. degree from George Washington University.

4

Table of Contents

Class III—Directors with Term Continuing until 2007

J. Curt Hockemeier has been a director since April 2000 and our President and Chief Executive Officer since August 2000. From April 2000 to August 2000, he served as our President and Chief Operating Officer. Before joining us, from June 1999 to April 2000, Mr. Hockemeier served as Executive Vice President and Chief Operating Officer of Telephony Operations for AT&T Broadband Services. Prior to that, from January 1993 to June 1999 he served as a Senior Vice President, for Teleport Communications Group, Inc., where he was responsible for affiliate services, construction of its newly developing markets and relationships with the cable industry. Mr. Hockemeier received a B.J. degree from the University of Missouri. He completed the Program for Management Development at Harvard Business School.

Anthony L. Craighas been a director since December 1999 and has been our Chairman of the Board since October 2001. Mr. Craig has served as President and Chief Executive Officer of Safeguard Scientifics, Inc., a diversified technology and services company, since October 2001. From December 1999 to August 2000, he served as our company’s President and Chief Executive Officer. Prior to that, from January 1997 to May 1999, he served as President and Chief Executive Officer of Global Knowledge Network, a premier provider of technology learning services. Mr. Craig is a member of the board of directors of Safeguard Scientifics, Inc., Clarient, Inc., Nextone Communications, Mantas, Inc., Pacific Title & Art Studio and Alliance Consulting. Mr. Craig received a B.S. degree from Dalhousie University.

Michael J. Ruanehas been a director since March 2004. Mr. Ruane has served as Senior Vice President-Finance and Chief Financial Officer for SunGard Data Systems, Inc., a provider of integrated financial services applications and availability services, since February 2001. From April 1994 to February 2001, he served as Vice President and Chief Financial Officer for SunGard Data Systems, Inc. Prior to that from September 1992 to April 1994, he served as Vice President-Finance and Chief Financial Officer for SunGard Trading Systems. From 1990 to September 1992, he served as Vice President and Controller for SunGard Data Systems. Mr. Ruane received a B.S. degree from LaSalle College and his M.B.A. from the University of Pittsburgh.

5

Table of Contents

The following table identifies our current executive officers:

Name | Age | Position | ||

J. Curt Hockemeier | 56 | President and Chief Executive Officer and Director | ||

John J. Roberts | 38 | Chief Financial Officer | ||

Peter P. Sach | 45 | Chief Information Officer and Senior Vice President of Operations | ||

Chi K. Eng | 46 | General Counsel and Secretary |

| (1) | J. Curt Hockemeier has been a director since April 2000 and our President and Chief Executive Officer since August 2000. From April 2000 to August 2000, he served as our President and Chief Operating Officer. Before joining us, from June 1999 to April 2000, Mr. Hockemeier served as Executive Vice President and Chief Operating Officer of Telephony Operations for AT&T Broadband Services. Prior to that, from January 1993 to June 1999, he served as a Senior Vice President for Teleport Communications Group, Inc., where he was responsible for affiliate services, construction of its newly developing markets and relationships with the cable industry. Mr. Hockemeier received a B.J. degree from the University of Missouri. He completed the Program for Management Development at Harvard Business School. |

| (2) | John J. Roberts has been our Chief Financial Officer since April 2004. From March 2003 to April 2004, Mr. Roberts served in various private consulting roles. From April 2000 to February 2003, he served as Chief Financial Officer of Razorfish, Inc., a provider of services designed to enhance communications and commerce through the use of digital technologies. Prior to that, from July 1988 to April 2000, Mr. Roberts served in various positions at PricewaterhouseCoopers LLP, including the position of Audit Partner from July 1998 to April 2000. Mr. Roberts received a B.S. degree from Boston College. |

| (3) | Peter P. Sach has been our Chief Information Officer and Senior Vice President of Operations since April 2004. From July 2001 to April 2004, he served as our Chief Administrative Officer and Treasurer. From March 2001 to July 2001, he served as Managing Director for Reo Consulting Group, LLC, a management consulting company. Prior to that, from March 2000 to March 2001, he served as Chief Operating Officer for OnTera Broadband, Inc., where he was responsible for day to day operations and geographic development. From June 1999 to March 2000, he served as Senior Vice President, Systems Development and Administration for AT&T Broadband Services, where he was responsible for all information technology operations, developments and business administration. From August 1998 to June 1999, Mr. Sach was the Vice President Strategic Sales for AT&T Business Services where he was responsible for the sale and delivery of integrated telecommunications solutions to Fortune 100 accounts. Prior to that, from August 1986 to August 1998, Mr. Sach held various positions at Teleport Communications Group. Mr. Sach received a B.S. degree from State University College of New York at Fredonia. |

| (4) | Chi K. Eng has been our General Counsel since October 2002 and our Corporate Secretary since November 2001. From April 2000 to October 2002, he served as our Deputy Counsel for Intellectual Property and Patent Licensing. Prior to joining Arbinet, from April 1994 to April 2000, he was an associate at the law firm of Cohen, Pontani, Lieberman & Pavane. Prior to that, from February 1983 to August 1990 Mr. Eng served as an engineer at AT&T Bell Labs developing communications systems. Mr. Eng received a B.S. degree and an M.S. degree from State University of New York at Buffalo and a J.D. degree from Fordham Law School. |

6

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

There are, as of March 31, 2005, approximately 304 holders of record and 3,017 beneficial holders of our Common Stock. The following table sets forth certain information, as of March 31, 2005, with respect to holdings of each class of our Common Stock by (i) each person known by us to beneficially own more than 5% of the total number of shares of each class of Common Stock outstanding as of such date, (ii) each of our Directors and Nominees, (iii) each of our Named Executives, and (iv) all Directors and executive officers as a group. This information is based upon information furnished to us by each such person and/or based upon public filings with the Securities and Exchange Commission. Unless otherwise indicated, the address for the individuals below is our address.

The number of shares beneficially owned by each stockholder is determined under rules issued by the Securities and Exchange Commission. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and includes any shares that an individual or entity has the right to acquire beneficial ownership of within 60 days of March 31, 2005 through the exercise of any warrant, stock option or other right. Each of the stockholders listed has sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject to community property laws where applicable.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class(1) | ||||

Holders of more than 5% of our voting securities: | ||||||

Communications Ventures III, L.P., ComVentures IV, L.P. and related entities | 5,459,230 | (2) | 22.2 | % | ||

EnerTech Capital Partners and related entities 435 Devon Drive, 700 Building | 2,410,701 | (3) | 9.8 | |||

J.P. Morgan and related entities 1221 Avenue of the Americas, 39th Floor | 1,815,764 | (4) | 7.4 | |||

The Eureka Interactive Fund Limited and related entities The Adelphi, 13th Floor 1/11 John Adam Street London WC2N 6HT | 1,258,000 | (5) | 5.1 | |||

Directors, Nominees and Named Executives: | ||||||

J. Curt Hockemeier | 791,421 | (6) | 3.2 | |||

John J. Roberts | 40,469 | (7) | * | |||

Peter P. Sach | 160,953 | (8) | * | |||

Chi K. Eng | 45,977 | (9) | * | |||

Anthony L. Craig | 642,292 | (10) | 2.6 | |||

Roland A. Van der Meer | 5,459,230 | (11) | 22.2 | |||

William G. Kingsley | 2,410,701 | (12) | 9.8 | |||

Michael L. DeRosa | 1,500 | * | ||||

Mathew J. Lori | — | (4) | * | |||

Deborah D. Rieman | 62,951 | (13) | * | |||

Michael J. Ruane | 15,625 | (14) | * | |||

Robert C. Atkinson | 4,376 | * | ||||

All directors, nominees and Named Executives as a group (12 persons) | 9,635,495 | (15) | 39.2 | % | ||

7

Table of Contents

| * | Represents beneficial ownership of less than one percent of common stock. |

| (1) | Our calculation of the percentage of shares beneficially owned is based on the 24,604,665 shares of our common stock outstanding as of March 31, 2005. |

| (2) | Consists of (a) 1,007,249 shares of common stock held by Communications Ventures III, L.P. (b) 50,350 shares of common stock held by Communications Ventures III CEO & Entrepreneurs’ Fund L.P., (c) 4,032,332 shares of common stock held by ComVentures IV, L.P., (d) 312,216 shares of common stock owned by ComVentures IV CEO Fund, L.P., and (e) 57,083 shares of common stock owned by Comventures IV Entrepreneurs’ Fund, L.P. ComVen III, L.L.C. is the general partner of Communications Ventures III, L.P. and Communications Ventures III CEO & Entrepreneurs’ Fund. Roland Van der Meer, Clifford Higgerson, Michael Rolnick and Laura Gwosden are the members of ComVen III, L.L.C. and exercise shared voting, investment, and dispositive rights with respect to the shares of stock held by Communications Ventures III, L.P. and Communications Ventures III CEO & Entrepreneurs’ Fund, L.P. Each of Roland Van der Meer, Clifford Higgerson, Michael Rolnick and Laura Gwosden disclaims beneficial ownership of the shares identified in this footnote except to the extent of his or her respective proportionate pecuniary interest in such shares. ComVen IV, L.L.C. is the general partner of ComVentures IV, L.P., ComVentures IV CEO Fund, L.P. and ComVentures IV Entrepreneurs’ Fund, L.P. Roland Van der Meer, Clifford Higgerson, Michael Rolnick and Laura Gwosden are the members of ComVen IV, L.L.C. and exercise shared voting, investment, and dispositive rights with respect to the shares of stock held by ComVentures IV, L.P., ComVentures IV CEO Fund, L.P. and ComVentures IV Entrepreneurs’ Fund, L.P. Each of Roland Van der Meer, Clifford Higgerson, Michael Rolnick and Laura Gwosden disclaims beneficial ownership of the shares identified in this footnote except to the extent of his or her respective proportionate pecuniary interest in such shares. |

| (3) | Consists of (a) 2,322,124 shares of common stock held by EnerTech Capital Partners II, L.P. (“ECP II”) and (b) 88,577 shares of common stock held by ECP II Interfund L.P. (“Interfund II”). ECP II Management L.P. (“Management II LP”), the general partner of ECP II, ECP 11 Management LLC (“Management II LLC”), the general partner of Management II LP and Interfund II, and William G. Kingsley, Scott B. Ungerer, David F. Lincoln, Bonfield Fund Management, L.P., Robert E. Keith, Jr., and Mark J. DeNino, the members of the board of managers of Management II LCC, share voting and investment control over the shares in this footnote held by ECP II and Interfund II, and such entities and persons may be deemed to beneficially own the shares held by ECP II and Interfund II, but disclaim beneficial ownership of such shares except to the extent of their pecuniary interest therein. |

| (4) | Consists of (a) 1,320,958 shares of common stock held by J.P. Morgan Partners (23A SBIC), L.P., (b) 394,218 shares of common stock held by JP Morgan SBIC LLC, and (c) 100,588 shares of common stock held by Sixty Wall Street SBIC Fund, L.P. The general partner of J.P. Morgan Partners (23A SBIC), L.P. (“JPMP-23A SBIC”), is J.P. Morgan Partners (23A SBIC Manager), Inc. (“JPM-23A Manager”), a wholly owned subsidiary of JPMorgan Chase Bank (“JPM Bank”). The sole member of J.P. Morgan SBIC LLC (“JPM-SBIC”) is JP Morgan SBIC Holdings, LLC (“JPM-Holdings”), the sole member of which is J.P. Morgan Capital, L.P. (“JPM-Capital”), the general partner of which is J.P. Morgan Capital Management Company, L.P. (“JPM-Management LP”), the general partner of which is J.P. Morgan Capital Management Company, L.L.C (“JPM-Management LLC”). The general partner of Sixty Wall Street SBIC Fund, L.P. (“60WS-SBIC”), is Sixty Wall Street SBIC Corporation (“60WS-Corp”), a wholly owned subsidiary of Sixty Wall Street Fund, L.P. (“60WS-Fund”), the general partner of which is Sixty Wall Street Management Company, L.P. (“60WS-Management LP”), and the general partner of which is Sixty Wall Street Management Company, LLC (“60WS-Management LLC”). The sole member of JPM-Management LLC and the sole stockholder of 60WS-Management LLC is J.P. Morgan Investment Partners, L.P. (“JPMIP”), of which JPMP Capital LLC (“JPMP Capital”) is the general partner. Each of JPM Bank and JPMP Capital is a wholly owned subsidiary of J.P. Morgan Chase & Co. (“JPMC”), a publicly traded company. Each of JPM-23A Manager, JPM-Holdings, JPM-Capital, JPM-Management LP, JPM-Management LLC. 60WS-Corp, 60WS-Fund, 60S-Management LP, 60S-Management LLC, JPMIP, JPMP Capital, JPM Bank, and JPMC may be deemed beneficial owners of the shares held by JPMP-23A SBIC, JPM-SBJC and 60S-SBIC, however, each disclaims beneficial ownership except to the extent of its |

8

Table of Contents

pecuniary interest. Mr. Mathew J. Lori is a Principal of JPM-SBIC, JPM-23A Manager, JPMP Capital, and J.P. Morgan Partners, LLC, an affiliate of JPMP-23A SBIC, JPM-SBIC and 60WS-SBIC, a limited partner of JPMP Master Fund Manager, L.P. (“MFM”) and JPMP Master Fund Manager II, L.P. (“MFMII”), entities that have a carried interest in investments of JPMP-23A SBIC, and a Principal of JPMP Capital Corp., the general partner of MFM and MFMII. While Mr. Lori does not have beneficial ownership of the shares held by JPMP-23A SBIC under Section 13(d) of the Securities Act of 1934, as amended, and the rules and regulations of the Securities and Exchange Commission thereunder because he does not have the ability to control the voting or investment power of MFM, MFMII or JPMP Capital Corp., he does have an indirect pecuniary interest in the shares held by JPMP-23A SBIC as a result of his status as a limited partner of MFM and MFMII. Mr. Lori disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. The actual pecuniary interest which may be attributable to Mr. Lori is not readily determinable because it is subject to several variables, including, without limitation, the internal rate of return and vesting of JPMP-23A SBIC. |

| (5) | As disclosed on a Schedule 13G filed with the Securities and Exchange Commission on April 7, 2005, assuming such information was the same at March 31, 2005 and no changes in beneficial ownership since such filing. According to such Schedule 13G, Eureka Interactive Fund Limited shared power to vote or direct the vote and shared power to dispose or direct the disposition of 1,258,000 shares of common stock with each of Marshall Wace LLP, Marshall Wace Asset Management Limited, Paul Marshall, Ian Wace, Mark Hawtin and Duncan Ford. |

| (6) | Includes (a) 235,893 shares which Mr. Hockemeier has the right to acquire within 60 days after March 31, 2005 (b) 93,750 shares of restricted common stock, 70,312 of which remain subject to a repurchase right by us pursuant to a restricted stock agreement between us and Mr. Hockemeier, (c) 21,875 shares of common stock held by the William T. Hockemeier Irrevocable Trust, (d) 21,875 shares of common stock held by the Beverly G. Hockemeier Irrevocable Trust, and (e) 21,875 shares of common stock held by the Abby S. Hockemeier Irrevocable Trust. |

| (7) | Consists of 40,469 shares which Mr. Roberts has the right to acquire within 60 days after March 31, 2005. |

| (8) | Consists of 160,953 shares which Mr. Sach has the right to acquire within 60 days after March 31, 2005. |

| (9) | Includes (a) 32,712 shares which Mr. Eng has the right to acquire within 60 days after March 31, 2005 and (b) 10,265 shares of restricted common stock, 7,699 of which remain subject to a repurchase right by us pursuant to a restricted stock agreement between us and Mr. Eng. |

| (10) | Includes (a) 16,721 shares of common stock held in the name of Mr. Craig’s spouse, and (b) 150,259 shares which Mr. Craig has the right to acquire within 60 days after March 31, 2005. |

| (11) | See footnote 2 above. |

| (12) | See footnote 3 above. |

| (13) | Consists of (a) 47,326 shares of common stock held by the Peter Rieman and Deborah Rieman Living Trust Agreement, (b) 15,625 shares of restricted common stock, 9,115 of which remain subject to a repurchase right by us pursuant to a restricted stock agreement between us and Dr. Rieman. |

| (14) | Consists of 15,625 shares of restricted common stock, 9,115 of which remain subject to a repurchase right by us pursuant to a restricted stock agreement between us and Mr. Ruane. |

| (15) | See footnotes 2-4 and 6-14 above. |

9

Table of Contents

BOARD STRUCTURE AND COMPENSATION

Board of Directors’ Meetings and Committees

The Board has an Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, each of which operates under a charter that has been approved by the Board. Our Audit Committee Charter is attached hereto as Appendix A and each of our charters are posted on our website at www.arbinet.com. During fiscal year 2004, the Board held ten meetings, the Audit Committee held six meetings, the Compensation Committee held five meetings and the Nominating and Corporate Governance Committee held one meeting. During 2004, each director attended at least 75% of the aggregate number of meetings of the Board and of the Board committee or committees on which he or she served during the year.

Audit Committee.The members of our Audit Committee are Messrs. Ruane, Lori and DeRosa. Mr. Ruane chairs the committee. If elected by our stockholders at the 2005 Annual Meeting, Mr. Atkinson has agreed to serve on our Audit Committee in lieu of Mr. DeRosa. Our Audit Committee assists our Board in its oversight of our financial reporting and accounting processes. Management has the primary responsibility for the preparation of financial statements and the reporting processes, including the system of internal controls. Our independent registered public accountants are responsible for auditing our annual financial statements and issuing a report on the financial statements. In this context, the oversight function of our Audit Committee includes:

| • | a review of the audits of our financial statements, including the integrity of our financial statements; |

| • | a review of our compliance with legal and regulatory requirements; |

| • | a review of the performance of our independent registered public accountants, including the engagement of the independent registered public accountants and the monitoring of the independent registered public accountants’ qualifications and independence; |

| • | the preparation of the report required to be included in our annual proxy statement in accordance with Securities and Exchange Commission rules and regulations; and |

| • | a review of the quarterly and annual reports filed with the Securities and Exchange Commission. |

Compensation Committee.The members of our Compensation Committee are Messrs. Kingsley, Van der Meer and Dr. Rieman. Mr. Kingsley chairs the committee. The purpose of our Compensation Committee is to discharge the responsibilities of our Board relating to compensation of our executive officers. Specific responsibilities of our Compensation Committee include:

| • | establishing and periodically reviewing our compensation philosophy and the adequacy of compensation plans and programs for our executive officers and other employees; |

| • | establishing compensation arrangements and incentive goals for our executive officers and administering compensation plans; |

| • | reviewing the performance of our executive officers and awarding incentive compensation and adjusting compensation arrangements as appropriate based upon performance; |

| • | reviewing and monitoring our management development and succession plans and activities; and |

| • | preparing our report on executive compensation for inclusion in our annual proxy statement in accordance with Securities and Exchange Commission rules and regulations. |

Nominating and Corporate Governance Committee.The members of our Nominating and Corporate Governance Committee are Dr. Rieman and Messrs. Ruane and Kingsley. Dr. Rieman chairs the committee. Our Nominating and Corporate Governance Committee assists our Board in:

| • | identifying individuals qualified to serve as directors, recommending to our Board the director nominees for the next annual meeting of stockholders and recommending to our Board individuals to fill vacancies on the Board; |

10

Table of Contents

| • | recommending to our Board the responsibilities of each Board committee, the structure and operation of each Board committee, and the director nominees for assignment to each Board committee; |

| • | overseeing our Board’s annual evaluation of its performance and the performance of other Board committees; and |

| • | periodically reviewing corporate governance guidelines applicable to us. |

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the Board or Compensation Committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our Board or Compensation Committee. None of the members of our Compensation Committee has ever been our employee.

Affirmative Determination Regarding Director Independence and

Other Corporate Governance Matters

The Company operates within a comprehensive plan of corporate governance for the purpose of defining director independence, assigning Board responsibilities, setting high standards of professional and personal conduct for directors, officers and employees and assuring compliance with such responsibilities and standards. The Company regularly monitors developments in the area of corporate governance.

The Board has determined that the following directors, constituting six of the Company’s eight directors, are each an “independent director” as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers (the “NASD”): Dr. Rieman and Messrs. DeRosa, Kingsley, Lori, Ruane and Van der Meer. If elected to the Board, it is anticipated that Mr. Atkinson shall qualify under such definition as an independent director. The Board also has determined that each member and prospective member of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee meets the independence requirements applicable to those committees as prescribed by the NASD, the Securities and Exchange Commission, the Internal Revenue Service and applicable committee charters. The Board has further determined that each of Mr. Ruane and Mr. Lori, who serves on the Audit Committee, is an “audit committee financial expert” as such term is defined in Item 401(h) of Regulation S-K promulgated by the Securities and Exchange Commission.

Each non-employee member of our Board receives certain directors’ fees as follows: $5,000 annual retainer for each director, $5,000 annual retainer for each committee chair; $1,500 per meeting of the Board; $1,000 for each committee meeting attended in person and not held on the day of a Board meeting; and $350 for each committee meeting that is attended by teleconference and not held on the day of a Board meeting. In addition, we reimburse the members of the Board who are not employees for all reasonable expenses incurred in connection with their attendance at directors’ meetings. Directors who are also our officers or employees do not receive compensation for their services as directors.

In November 2004, our Board approved our 2004 stock incentive plan pursuant to which each non-employee director will automatically receive an option to purchase 25,000 shares of our common stock upon his or her appointment to our board of directors. In April 2005, our Board modified the initial grant to new non-employee directors under our 2004 stock incentive plan. Each newly elected non-employee director shall have the choice of receiving (i) no shares of restricted stock and options to purchase 25,000 shares; (ii) 1,000 shares of restricted stock and options to purchase 22,000 shares; (iii) 2,000 shares of restricted stock and options

11

Table of Contents

to purchase 19,000 shares; or (iv) 3,000 shares of restricted stock and options to purchase 16,000 shares. The options and restricted stock shall vest during the period of and subject to the non-employee director’s continued service as a director.

Subject to an annual evaluation, which evaluation shall be overseen by our Nominating and Corporate Governance Committee, each non-employee director will automatically receive an annual grant of an option to purchase no more than 10,000 shares of our common stock at each year’s annual meeting after which he or she will continue to serve as a director. These options will vest as the Board shall determine, subject to the non-employee director’s continued service as a director. Each non-employee director stock option will terminate on the earlier of ten years from the date of grant and three months after the recipient ceases to serve as a director, except in the case of death or disability, in which event the option will terminate three months from the date of the director’s death or disability. The exercise price of all of these options will equal the fair market value of our common stock on the date of grant.

During 2004, we granted restricted common stock under our amended and restated 1997 stock incentive plan to the following non-employee directors:

Name of Director | Number of Shares | Date of Grant | ||

Michael J. Ruane(1) | 15,625 | 2/29/04 | ||

Deborah D. Rieman, Ph.D.(2) | 15,625 | 2/29/04 |

| (1) | Such shares of restricted common stock are subject to a right of repurchase by us pursuant to a restricted stock agreement between us and Mr. Ruane. The restrictions on these shares of restricted stock lapsed as to one-third of the shares on February 28, 2005 and lapse in 24 equal installments thereafter. |

| (2) | Such shares of restricted common stock are subject to a right of repurchase by us pursuant to a restricted stock agreement between us and Dr. Rieman. The restrictions on these shares of restricted stock lapsed as to one-third of the shares on February 28, 2005 and lapse in 24 equal monthly installments thereafter. |

12

Table of Contents

INFORMATION ABOUT EXECUTIVE COMPENSATION

The following summary compensation table sets forth information concerning compensation for services rendered in all capacities during the years ended December 31, 2002, 2003 and 2004 awarded to, earned by or paid to our chief executive officer and our other most highly compensated executive officers whose salary and bonus exceeded $100,000 for the year ended December 31, 2004. We refer to these persons as our named executive officers.

Summary Compensation Table

| Annual Compensation | Long-Term Compensation Awards | |||||||||||||||

Name and Principal Position (a) | Year (b) | Salary (c) | Bonus (d) | Other Annual (e) | Restricted Stock Awards ($) | Securities (#) (g) | All Other (i) | |||||||||

J. Curt Hockemeier President and Chief | 2004 2003 2002 | 400,000 400,000 400,000 | 87,400 75,000 75,000 | 21,195 22,076 — | (1) (1) | — 171,000 — | 23,437 25,000 264,586 | 8,200 17,200 54,881 | (5) (2) (3) | |||||||

John J. Roberts(4) Chief Financial Officer | 2004 2003 2002 | 181,000 — — | 85,000 — — | — — — | | — — — | 157,500 — — | 5,417 — — | (5) | |||||||

Peter P. Sach Chief Information | 2004 2003 2002 | 250,000 250,000 250,000 | 80,000 100,000 100,000 | — — — | | — — — | 29,643 27,994 62 | 8,200 5,240 — | (5) (5) | |||||||

Chi K. Eng General Counsel and | 2004 2003 2002 | 165,000 160,000 150,000 | 50,000 60,000 55,000 | — — — | | 18,725 — — | 28,421 — 28,187 | 5,200 3,138 — | (5) (5) | |||||||

| (1) | Represents principal and interest relating to a portion of a loan to Mr. Hockemeier forgiven by us. |

| (2) | Represents amounts paid by us for a company apartment on behalf of Mr. Hockemeier. |

| (3) | Consists of $5,281 contributed to Mr. Hockemeier’s 401(k) plan account and $49,600 for a company apartment paid by us on behalf of Mr. Hockemeier. |

| (4) | Mr. Roberts joined the Company as Chief Financial Officer in April 2004. Mr. Roberts’ annual base salary in 2004 was $250,000. |

| (5) | Represents amounts contributed by us to these executive officers’ 401(k) plans. |

13

Table of Contents

The following table contains information regarding grants of options to purchase shares of our common stock to our named executive officers during the year ended December 31, 2004.

Amounts in the following table represent potential realizable gains that could be achieved for the options if exercised at the end of the option term. The 5% and 10% assumed annual rates of compounded stock price appreciation are calculated based on the requirements of the Securities and Exchange Commission and do not represent an estimate or projection of our future common stock prices. These amounts represent certain assumed rates of appreciation in the value of our common stock from the fair market value on the date of grant. Actual gains, if any, on stock option exercises depend on the future performance of the common stock and overall stock market conditions. The amounts reflected in the following table may not necessarily be achieved.

Option Grants in Last Fiscal Year

| Individual Grants | |||||||||||||||||

Name (a) | Number of (#) (b) | Percent of (%) (c) | Exercise Price ($/SH) (d) | Expiration (e) | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation For Option Term(3) | ||||||||||||

5%($) (f) | 10%($) (g) | ||||||||||||||||

J. Curt Hockemeier | 23,437 | (4) | 2.6 | % | $ | 8.32 | 1/8/14 | $ | 708,748 | $ | 1,180,052 | ||||||

John J. Roberts | 45,000 112,500 | (5) (6) | 4.9 12.3 | % % | $ $ | 15.04 18.56 | 11/10/14 5/31/14 | $ $ | 1,130,673 2,333,554 | $ $ | 2,182,338 4,762,791 | ||||||

Peter P. Sach | 9,331 20,312 | (4) (5) | 1.0 2.2 | % % | $ $ | 8.32 15.04 | 1/8/14 11/10/14 | $ $ | 282,175 510,360 | $ $ | 469,815 985,059 | ||||||

Chi K. Eng | 3,421 25,000 | (6) (5) | 0.4 2.7 | % % | $ $ | 8.32 15.04 | 1/8/14 11/10/14 | $ $ | 103,453 628,151 | $ $ | 172,247 1,212,410 | ||||||

| (1) | Based on an aggregate of 912,228 shares subject to options granted to our employees in 2004, including the named executive officers. |

| (2) | The exercise price per share was determined to be equal to the fair market value per share of our common stock as valued by our board of directors on the date of grant. |

| (3) | The dollar amounts under these columns are the result of calculations at rates set by the Securities and Exchange Commission and, therefore, are not intended to forecast possible future appreciation, if any, in the price of the underlying common stock. The potential realizable values are calculated using the closing price of $24.83 per share of our common stock as quoted on the NASDAQ National Market on the last day of the fiscal year, or December 31, 2004, and assuming that the market price appreciates from this price at the indicated rate for the entire term of each option and that each option is exercised and sold on the last day of its term at the assumed appreciated price. |

| (4) | Options vest 1/48 per month over a four year period. |

| (5) | Options vest 1/36 per month over a three year period. |

| (6) | Options vest 1/4 after one year and then 1/36 per month over the subsequent three year period. |

14

Table of Contents

Option Exercises and Year-End Option Values

The following table provides information regarding the exercise of stock options during the fiscal year ended December 31, 2004 and the number and value of unexercised options to purchase our common stock held as of December 31, 2004 by our named executive officers. As permitted by the rules of the Securities and Exchange Commission, we have calculated the value of the unexercised in-the-money options at fiscal year end on the basis of the closing price of $24.83 per share of our common stock as quoted on the NASDAQ National Market on the last day of the fiscal year, or December 31, 2004, less the applicable exercise price multiplied by the number of shares which may be acquired on exercise. We have calculated the value realized of exercised options based on the difference between the per share option exercise price and the fair market value per share of our common stock on the date of exercise, multiplied by the number of shares for which the option was exercised.

Aggregated Fiscal Year-End Option Values

Name (a) | Shares (b) | Value (c) | Number of (#) Exercisable/ (d) | Value of Unexercised In-the-Money Options at Fiscal Year-End ($) Exercisable/ Unexercisable (e) | ||||

J. Curt Hockemeier | — | — | 235,893/295,880 | $5,447,359/$2,546,235 | ||||

John J. Roberts | — | — | 40,469/157,031 | $264,466/$811,459 | ||||

Peter P. Sach | — | — | 160,953/81,857 | $3,811,938/$766,419 | ||||

Chi K. Eng | — | — | 32,712/42,646 | $709,125/$434,346 | ||||

Equity Compensation Plan Information

The following table sets forth certain information as of the end of the Company’s fiscal year ended December 31, 2004 with respect to the Company’s compensation plans under which equity securities are authorized for issuance.

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||

| (a) | (b) | (c) | |||||

Equity compensation plans approved by security holders | 2,189,574 | $ | 6.54 | 1,346,250 | |||

Equity compensation plans not approved by security holders | — | — | — | ||||

Total | 2,189,574 | $ | 6.54 | 1,346,250 | |||

15

Table of Contents

J. Curt Hockemeier.We entered into a letter agreement with Mr. Hockemeier, our chief executive officer, dated April 4, 2000. Mr. Hockemeier currently receives an annual base salary of $400,000, subject to an annual increase upon review by the compensation committee of our board of directors.

Under the terms of the letter agreement, either we or Mr. Hockemeier may terminate his employment at any time upon 60 days’ notice. If Mr. Hockemeier’s employment is terminated without cause or for good reason, we are required to continue to pay his salary for a period of one year, reimburse him for certain COBRA payments, pay him an amount equal to potential employer contributions to our retirement plan for one year and also pay him his accrued and unpaid salary and vacation time. In addition, if Mr. Hockemeier is terminated without cause or for good reason, certain of his options to buy shares of our common stock will vest on an accelerated basis.

Mr. Hockemeier’s agreement also contains nondisclosure, noncompetition and nonsolicitation provisions. The nondisclosure provisions provide for protection of our confidential information. The noncompetition and nonsolicitation provisions of Mr. Hockemeier’s agreement prevent Mr. Hockemeier from competing with us or soliciting our employees for a period of two years, if his employment is terminated by us for cause or by him without good reason, or for a period of one year, if his employment is terminated for any other reason.

John J. Roberts.We entered into a letter agreement with Mr. Roberts, our chief financial officer, dated March 31, 2004. Mr. Roberts currently receives an annual base salary of $250,000, subject to an annual increase upon review by our board of directors. The agreement also provides that Mr. Roberts is eligible for a 35% target bonus, based upon the achievement of assigned performance goals and subject to the approval of our board of directors. If Mr. Roberts’ employment is terminated without cause, we are required to continue to pay his salary for a period of six months, reimburse him for certain COBRA payments for a period of six months, pay him an amount equal to potential employer contributions to our retirement plan for a period of six months and also pay him his accrued and unpaid salary and vacation time. In addition, if Mr. Roberts is terminated without cause in the 12 months following a change in control of Arbinet, which does not include an initial public offering or a private equity financing, any remaining unvested options will immediately vest.

Mr. Roberts’ letter agreement also contains noncompetition and nonsolicitation provisions. The noncompetition and nonsolicitation provisions of Mr. Roberts’ employment letter prevent Mr. Roberts from competing with us or soliciting our customers, suppliers or employees for a period of six months following the termination of his employment.

Mr. Roberts has also entered into our standard nondisclosure agreement with provides for protection of our confidential information.

Peter P. Sach.We entered into a letter agreement with Mr. Sach, our chief information officer, dated July 12, 2001. Mr. Sach currently receives an annual base salary of $275,000, subject to an annual increase upon review by our board of directors. The agreement also provides that Mr. Sach is eligible for a 40% target bonus, based upon the achievement of assigned performance goals and subject to the approval of our board of directors. If Mr. Sach’s employment is terminated without cause in the one year period following a change of control, which does not include an initial public offering or a private equity financing, Mr. Sach’s unvested options to purchase shares of our common stock will fully vest.

Under the agreement, either we or Mr. Sach may terminate his employment at any time upon 60 days’ notice. If Mr. Sach’s employment is terminated without cause, we are required to continue to pay his salary for a period of one year, reimburse him for certain COBRA payments, pay him an amount equal to potential employer contributions to our retirement plan for one year and also pay him his accrued and unpaid salary and vacation time.

16

Table of Contents

Mr. Sach’ s agreement also contains nondisclosure, noncompetition and nonsolicitation provisions. The nondisclosure provisions provide for protection of our confidential information. The noncompetition and nonsolicitation provisions of Mr. Sach’s agreement prevent Mr. Sach from competing with us or soliciting our employees for a period of one year following the termination of his employment.

Chi K. Eng.We entered into a letter agreement with Mr. Eng, our general counsel and secretary, effective October 11, 2002. Mr. Eng currently receives an annual base salary of $170,000. The agreement also provides that Mr. Eng is eligible to receive bonuses, based upon the achievement of certain individualized performance goals and in the event that we meet financial objectives. Under the agreement, either we or Mr. Eng may terminate his employment at any time for any reason without notice. If Mr. Eng’s employment is terminated without cause, we are required to continue to pay his salary for a period of six months, reimburse him for certain COBRA payments for a period of six months, pay him an amount equal to potential employer contributions to our retirement plan for a period of six months and also pay him his accrued and unpaid salary and vacation time.

Mr. Eng’s agreement also contains noncompetition and nonsolicitation provisions. The noncompetition and nonsolicitation provisions of Mr. Eng’s agreement prevent Mr. Eng from competing with us for a period of six months following the termination of his employment or soliciting our customers, suppliers or employees for a period of one year following the termination of his employment.

17

Table of Contents

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Certain Relationships

Agreement with Anthony L. Craig

On February 6, 2003, we entered into an agreement with Anthony L. Craig, the chairman of our board of directors, pursuant to which Mr. Craig performed certain business consulting services relating to his role as the chairman of our board of directors for us. Under the terms of the consulting agreement, we compensated Mr. Craig at a rate of $6,250 per month for services that he provided to us. This agreement terminated on December 31, 2004.

Loans to Executive Officers and Directors

J. Curt Hockemeier. On May 17, 2002, we loaned Mr. Hockemeier $74,206.61 under a promissory note in connection with his exercise of options to purchase shares of common stock granted to Mr. Hockemeier, under two stock option agreements dated August 3, 2001. The promissory note bore interest at a rate of 4.75% per annum. The note was secured by shares of our capital stock held by Mr. Hockemeier pursuant to the terms of a pledge agreement. The promissory note was due on the earlier of four years from the date of the execution of the note, six months after an initial public offering or other change in control event, whichever occurred earlier, or the day after a change in control event where the consideration consists of cash or equity. During 2003, we forgave $22,076.00 of the outstanding principal and interest of the promissory note. This loan has been repaid in full pursuant to the terms of a settlement and release agreement between Mr. Hockemeier and us dated July 8, 2004. The settlement and release agreement provided that Mr. Hockemeier repay his outstanding loan in full by surrendering to us an aggregate of 2,013 shares of our common stock that were pledged to us in connection with the loan. The number of shares was determined by dividing the aggregate amount of outstanding principal and interest due to us under the promissory note of $37,354.39 by $18.56, the last exercise price of options granted by us in June 2004 to our employees.

Anthony L. Craig. On February 28, 2000, we loaned Mr. Craig $291,361.11 and $72,840.34 under two separate promissory notes in connection with his purchase of our common stock. These promissory notes bore interest at a rate of 8% per annum. The promissory notes were amended on February 6, 2003 extending the maturity date on the notes to March 31, 2004. Pursuant to this amendment, Mr. Craig was required to repay $180,000 no later than February 8, 2003, which was to be applied against the accrued interest on the promissory notes, with any remaining amount to be applied toward the principal. These loans were secured by shares of our capital stock held by Mr. Craig. These loans have been repaid in full.

On March 6, 2001, we provided a loan to Mr. Craig in the aggregate principal amount of $750,000 evidenced by a promissory note. This promissory note bore interest at a rate of 6.5% per annum. The amount outstanding under the promissory note is due on the earlier of March 6, 2006, six months after an initial public offering or other change in control event, whichever occurs earlier, the day after a change in control in which the consideration consists of cash or equity or upon our request if we can show that our then-available cash and cash equivalents are less than three times our monthly burn rate. This loan is secured by shares of our capital stock held by Mr. Craig. The promissory note was amended on February 6, 2003 to, among other things, grant us a security interest in additional shares of our capital stock held by Mr. Craig. This loan has been repaid in full pursuant to the terms of a settlement and release agreement between Mr. Craig and us dated July 30, 2004. The settlement and release agreement provided that Mr. Craig repay his outstanding loan in full by surrendering to us an aggregate of 47,671 shares of our common stock that were pledged to us in connection with the loan. The number of shares was determined by dividing the aggregate amount of outstanding principal and interest due to us under the promissory note of $884,767.12 by $18.56, the last exercise price of options granted by us in June 2004 to our employees.

18

Table of Contents

Director Compensation

Please see “Director Compensation” for a discussion of options and restricted stock granted to our directors.

Executive Compensation and Employment Agreements

Please see “Information about Executive Compensation” for a discussion of additional information on compensation of our executive officers. Information regarding employment agreements with our executive officers is set forth under “Information about Executive Compensation—Employment Agreements.”

The Board has adopted a Code of Conduct applicable to all directors, officers and employees of the Company. Violations of the Code of Conduct, including those involving accounting, internal accounting controls or auditing matters may be reported to the Company’s General Counsel, who the Board has designated as the compliance officer for the implementation and administration of the Code of Conduct. A copy of the Code of Conduct can be obtained from the Company’s Internet web site at www.arbinet.com, without charge.

19

Table of Contents

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Compensation Committee has furnished the following report:

Our executive compensation policy is designed to attract and retain highly qualified individuals for our executive positions and to provide incentives for such executives to achieve maximum Company performance by aligning the executives’ interest with that of stockholders by basing a portion of compensation on corporate performance.

The Compensation Committee reviews and determines base salary levels for our executive officers on an annual basis and determines actual bonuses after the end of the fiscal year based upon Company and individual performance. Additionally, the Compensation Committee oversees all of our stock incentive plans.

Our executive officer compensation program is comprised of base salary, discretionary annual cash bonuses, stock awards and various other benefits, including health insurance and a 401(k) Plan, which are generally available to all of our employees.

Bonuses are paid on an annual basis and are discretionary. The amount of bonus is based on criteria designed to effectively measure a particular executive’s attainment of goals which relate to his or her duties and responsibilities as well as overall Company performance. In general, the annual incentive bonus is based on specific financial and non-financial objectives and the executive’s individual performance in meeting the designated objectives.

The stock option program is designed to relate executives’ and certain middle managers’ and other key personnel’s long-term interests to stockholders’ long-term interests. The option grants are designed to align the interests of each executive officer with those of the Company’s stockholders and provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business. Each grant allows the individual to acquire shares of the Company’s Common Stock at a fixed price per share (the closing market price on the grant date) over a specified period of time (up to 10 years). Each option generally vests and becomes exercisable in installments over the executive officer’s continued employment with the Company. Accordingly, the option will provide a return to the executive officer only if the executive officer remains employed by the Company during the applicable vesting period, and then only if the market price of the underlying shares appreciates over the option term.

The number of shares subject to each option grant is set at a level intended to create a meaningful opportunity for stock ownership based on the officer’s current position with the Company, the size of comparable awards made to individuals in similar positions within the industry, the individual’s potential for increased responsibility and promotion over the option term, and the individual’s personal performance in recent periods. The Compensation Committee also takes into account the number of unvested options held by the executive officer in order to maintain an appropriate level of equity incentive for that individual. However, the Compensation Committee does not adhere to any specific guidelines as to the relative option holdings of the Company’s executive officers.

CEO Compensation. The Committee established the Chief Executive Officer’s total annual compensation based on the size, complexity and historical performance of our business and the specific challenges faced by us during the year and other industry factors. No specific weight was assigned to any of the criteria relative to the Chief Executive Officer’s compensation.

With respect to the Chief Executive Officer’s base salary, it is the Compensation Committee’s intent to provide him with a level of stability and certainty each year and not have this particular component of compensation affected to any significant degree by corporate performance factors. The Chief Executive Officer was also eligible for a cash bonus for the 2004 fiscal year which was conditioned in part on the Company’s attainment of specified performance goals tied to, among other things, the same sales and income targets in effect

20

Table of Contents

for the Company’s other executive officers for the 2004 fiscal year and in part upon his contribution to the attainment of those goals. Based on the Company’s performance for the 2004 fiscal year, a cash bonus of $87,400 was awarded to the Chief Executive Officer.

Tax Considerations

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public companies for certain compensation in excess of $1 million paid to our CEO and the four other most highly compensated executive officers. Certain compensation, including qualified performance-based compensation, will not be subject to the deduction limit if certain requirements are met. The Compensation Committee reviews the potential effect of Section 162(m) periodically and uses its judgment to authorize compensation payments that may be subject to the limit when the Compensation Committee believes such payments are appropriate and in our best interests and the best interest of our stockholders, after taking into consideration changing business conditions and the performance of our employees. The Compensation Committee believes it is important to maintain cash and equity incentive compensation at the requisite level to attract and retain the executive officers essential to the Company’s growth and financial success, even if all or part of that compensation may not be deductible by reason of the Section 162(m) limitation. However, for the 2004 fiscal year, the total amount of compensation paid by the Company (whether in the form of cash payments or upon the exercise or vesting of equity awards) should be deductible and not affected by the Section 162(m) limitation.

By the Compensation Committee of the Board of Directors.

William G. Kingsley

Roland A. Van der Meer

Deborah D. Rieman

21

Table of Contents

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee has furnished the following report:

To the Board of Directors of Arbinet-thexchange, Inc.:

The Audit Committee of our board of directors is currently composed of three members and acts under a written charter adopted on December 16, 2004. The current members of the Audit Committee are independent directors, as defined by its charter and the rules of the NASDAQ Stock Market, Inc., and possess the financial sophistication required by such charter and rules. The Audit Committee held six meetings during fiscal 2004.

Management is responsible for our financial reporting process including its system of internal controls and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Audit Committee is not providing any expert or special assurance as to the financial statements. Our independent registered public accounting firm is responsible for auditing those financial statements. The Audit Committee’s responsibility is to monitor and review these processes. As appropriate, the Audit Committee reviews and evaluates, and discusses with our management and our independent registered public accounting firm, the following:

| • | the plan for, and the independent registered public accounting firm’s report on, each audit of our financial statements; |

| • | the independent registered public accounting firm’s review of our unaudited interim financial statements; |

| • | our financial disclosure documents, including all financial statements and reports filed with the Securities and Exchange Commission or sent to stockholders; |

| • | our management’s selection, application and disclosure of critical accounting policies; |

| • | changes in our accounting practices, principles, controls or methodologies; |

| • | significant developments or changes in accounting rules applicable to us; and |

| • | the adequacy of our internal controls and accounting and financial personnel. |

The Audit Committee reviewed and discussed with our management our audited financial statements for the year ended December 31, 2004. The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards No. 61, 89 and 90 (Communication with Audit Committees) with our independent registered public accounting firm. The Audit Committee is not providing any professional certification as to the work product of the independent registered public accounting firm. These standards require our independent registered public accounting firm to discuss with our Audit Committee, among other things, the following:

| • | methods used to account for significant unusual transactions; |

| ��� | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| • | the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and |

| • | disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements. |

Our independent registered public accounting firm also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that, in the auditor’s professional opinion, may reasonably be thought to bear on

22

Table of Contents

independence, confirm their perceived independence and engage in a discussion of independence. In addition, the Audit Committee discussed with our independent registered public accounting firm their independence from the Company. The Audit Committee also considered whether our independent registered public accounting firm’s provision of certain other non-audit related services to the Company is compatible with maintaining our auditors’ independence.

Based on our discussions with management and our independent registered public accounting firm, and our review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to our board of directors that the audited financial statements referred to above be included in our Annual Report on Form 10-K for the year ended December 31, 2004.

By the Audit Committee of the Board of Directors.

Michael J. Ruane

Mathew J. Lori

Michael L. DeRosa

23

Table of Contents

Fees paid to Ernst & Young LLP for each of the last two fiscal years are listed in the following table:

Year ended December 31, | Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | ||||||||

2004 | $ | 669,375 | $ | — | $ | 21,850 | $ | — | ||||

2003 | $ | 287,150 | $ | — | $ | — | $ | — | ||||

Audit Fees

Audit fees include fees for professional services rendered for the audit of our annual financial statements, review of our financial statements on a quarterly basis and statutory audits required internationally. In 2004, audit fees included $395,000 related to the Company’s initial public offering.

Tax Fees

Tax fees consist of services performed by our independent registered public accounting firm’s tax division, except those related to the audit and include fees for international tax compliance.

All Other Fees

There were no fees billed in fiscal year 2004 or 2003 for professional services rendered by Ernst & Young LLP for products and services, which are not disclosed above.

AUDIT COMMITTEE PRE-APPROVAL OF AUDIT AND

PERMISSIBLE NON-AUDIT SERVICES OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services.

24

Table of Contents

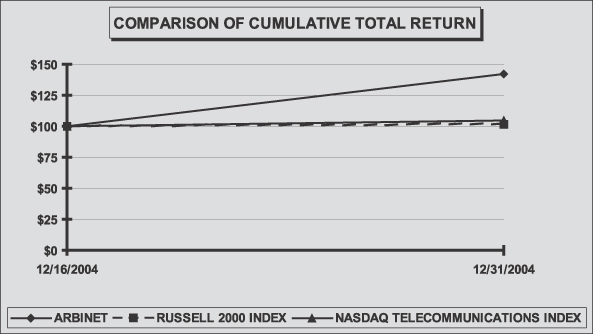

The following line graph compares the change in the cumulative total stockholder return on the Common Stock since the Company’s initial public offering with the cumulative total return of the Russell 2000 Index (“Russell”) and the NASDAQ Telecommunications Index (“NASDAQ Telecom”). The graph assumes that $100 was invested at December 16, 2004, the date of Company’s initial public offering, in our Common Stock, the Russell and the NASDAQ Telecom. Dividend reinvestment has been assumed and, with respect to companies in the NASDAQ Telecom, the returns of such companies have been weighted at each measurement point to reflect relative stock market capitalization.

ASSUMES $100 INVESTED ON DECEMBER 16, 2004

ASSUMES DIVIDENDS REINVESTED

THROUGH FISCAL YEAR ENDING DECEMBER 31, 2004

| 12/16/2004 | 12/31/2004 | |||

Arbinet-thexchange, Inc. | 100 | 141.89 | ||

Russell | 100 | 101.55 | ||

NASDAQ Telecom | 100 | 104.43 |

25

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance