Filed by Primus Telecommunications Group, Incorporated

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Arbinet Corporation

Commission File No.: 000-51063

1 Investor Presentation December 2010 ************************ ************************ ********************** |

2 Safe Harbor Important Information and Where to Find It In connection with the proposed merger, Primus Telecommunications Group, Incorporated (“Primus”) will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include a preliminary proxy statement of Primus and Arbinet Corporation (“Arbinet”) that also constitutes a preliminary prospectus of Primus. A definitive joint proxy statement/prospectus will be sent to security holders of both Arbinet and Primus seeking their approval with respect to the proposed merger. Primus and Arbinet also plan to file other documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus (when it becomes available) and other documents filed by Primus and Arbinet with the SEC, without charge, at the SEC’s web site at www.sec.gov. Copies of the joint proxy statement/prospectus, once available, and each company’s SEC filings that will be incorporated by reference in the joint proxy statement/prospectus may also be obtained for free by directing a request to: (i) Primus 703-748-8050, or (ii) Arbinet (Andrea Rose/Jed Repko Joele Frank, Wilkinson Brimmer Katcher (212) 355-4449). Participants in the Solicitation Arbinet, Primus, and their respective directors, executive officers and other members of their management and employees may be deemed to be “participants” in the solicitation of proxies from their respective security holders in connection with the proposed merger. Investors and security holders may obtain information regarding the names, affiliations and interests of Primus’s directors, executive officers and other members of its management and employees in Primus’s Annual Report on Form 10-K for the year ended December 31, 2009, which was filed with the SEC on April 5, 2010, and amended in a Form 10-K/A filed with the SEC on April 28, 2010, Primus’s proxy statement for its 2010 annual meeting, which was filed with the SEC on June 14, 2010, and any subsequent statements of changes in beneficial ownership on file with the SEC. Investors and security holders may obtain information regarding the names, affiliations and interests of Arbinet’s directors, executive officers and other members of their management and employees in Arbinet’s Annual Report on Form 10-K for the year ended December 31, 2009, which was filed with the SEC on March 17, 2010, Arbinet’s proxy statement for its 2010 annual meeting, which was filed with the SEC on April 30, 2010, and any subsequent statements of changes in beneficial ownership on file with the SEC. These documents can be obtained free of charge from the sources listed above. Additional information regarding the interests of these individuals will also be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Forward-Looking Statements This document and related verbal statements include “forward-looking statements” as defined by the Securities and Exchange Commission. All statements, other than statements of historical fact, included herein that address activities, events or developments that Arbinet or Primus expects, believes or anticipates will or may occur in the future, including anticipated benefits and other aspects of the proposed merger, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially. Risks and uncertainties that could affect forward-looking statements include, but are not limited to, the following: the risk that the acquisition of Arbinet may not be consummated for reasons including that the conditions precedent to the completion of the acquisition may not be satisfied; the possibility that the expected synergies from the proposed merger will not be realized, or will not be realized within the anticipated time period; the risk that Primus’s and Arbinet’s businesses will not be integrated successfully; the possibility of disruption from the merger making it more difficult to maintain business and operational relationships; any actions taken by either of the companies, including, but not limited to, restructuring or strategic initiatives (including capital investments or asset acquisitions or dispositions); the ability to service substantial indebtedness; the risk factors or uncertainties described from time to time in Arbinet’s filings with the Securities and Exchange Commission; and the risk factors or uncertainties described from time to time in Primus’s filings with the Securities and Exchange Commission (including, among others, those listed under captions titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Short- and Long-Term Liquidity Considerations and Risks;” “— Special Note Regarding Forward-Looking Statements;” and “Risk Factors” in Primus’s annual report on Form 10-K and quarterly reports on Form 10-Q) that cover matters and risks including, but not limited to: (a) a continuation or worsening of global recessionary economic conditions, including the effects of such conditions on our customers and our accounts receivables and revenues; (b) the general fluctuations in the exchange rates of currencies, particularly any strengthening of the United States dollar relative to foreign currencies of the countries where we conduct our foreign operations; (c) the possible inability to raise additional capital or refinance indebtedness when needed, or at all, whether due to adverse credit market conditions, our credit profile or otherwise; (d) a continuation or worsening of turbulent or weak financial and capital market conditions; (e) adverse regulatory rulings or changes in the regulatory schemes or requirements and regulatory enforcement in the markets in which we operate and uncertainty regarding the nature and degree of regulation relating to certain services; and (f) successful implementation of cost reduction efforts. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. Except as required by law, neither Arbinet nor Primus intends to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise. |

Primus Today U.S. headquartered international business with operations in Canada, Australia, the U.S., and Brazil Provider of voice and data communication services to residential, business and carrier customers Growth services: broadband, IP-based voice, on-net local, data and data center services Traditional businesses: domestic and international long-distance, off-network local, prepaid cards and dial-up internet services Wholesale services: Inter-continental IP and TDM wholesale access and transport Global reach provided by extensive IP-based network assets Revenue well distributed by geography, product and customer type Leading global provider of advanced facilities-based communication solutions |

Primus Investment Highlights Drive profitable growth in areas of long-term sustainable advantage Scale Canada, Australia, and Global Wholesale Feed growth businesses: IP- and data- based services for enterprises, consumers Harvest cash flows in traditional businesses Executing asset portfolio strategy through strategic alternatives Arbinet doubles wholesale business and creates unique product set, significant synergies Exiting unproductive, non-scalable businesses Evaluating other M&A opportunities Generating free cash flow, growing cash balance Focused on balanced sheet transformation through cash generation, proceeds of any divestitures Management team with extensive telco, cable, and data center experience |

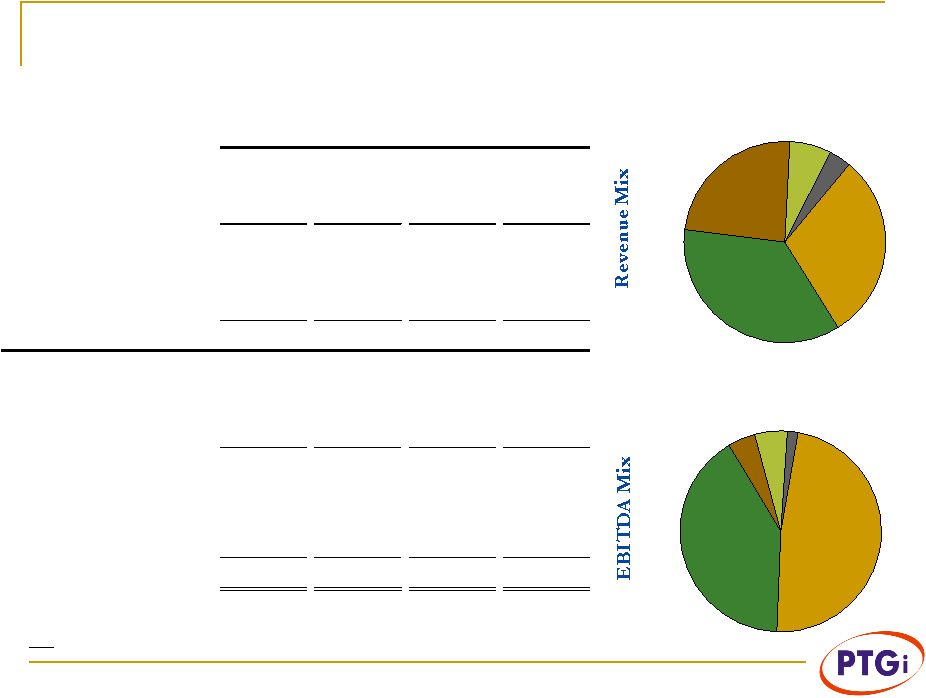

The Primus Portfolio – Sum of the Parts Adjusted Adjusted EBITDA (US$ 000s) Revenue EBITDA (1) Capex less Capex Canada $172.4 $34.9 $7.3 $27.6 Australia 205.7 29.8 7.6 22.2 Global Wholesale 137.6 3.2 0.1 3.1 Sub-Total $515.7 $67.9 $15.0 $52.9 US Retail $38.8 $4.1 $0.8 $3.3 Brazil 21.3 1.3 0.8 0.4 Corporate / India - (7.6) - (7.6) $575.8 $65.7 $16.7 $49.0 Discontinued Operations 36.4 (0.4) 0.3 (0.8) Severance - (6.1) - (6.1) Total $612.2 $59.2 $17.1 $42.2 YTD Q310 Total before Discontinued Operations Canada 30% Australia 35% Wholesale 24% US 7% Brazil 4% 5 Canada 48% Australia 41% Wholesale 4% US 5% Brazil 2% Notes: 1. A non-GAAP financial measure. Definitions and reconciliations between non-GAAP measures and relevant GAAP measures are available in the Appendix and in the Company’s periodic SEC filings. |

Primus Canada Highlights 6 • Headquartered in Toronto, Ontario • C$240M revenue in annualized revenue • 800 employees • Data centers and sales offices in BC, Alberta, and Ontario • 450K customers across the country • 70 DSLAMs (primarily in Ontario & Quebec) • Provide on-net equal access to ~90% of population • Call centers in Ontario (Ottawa) and New Brunswick |

Primus Australia Highlights 7 • Headquartered in Melbourne • A$305 million in annualized revenue • 575 employees • 3 Data Centers in Melbourne and Sydney • Offices in Melbourne, Sydney, Adelaide, Brisbane and Perth • 250K customers located in all territories • 5 carrier-grade voice switches and 66 points of interconnect • 281 DSLAMs primarily in major cities and surrounding suburbs • Central business district metro fiber in Sydney and Melbourne |

Global Wholesale Services Key Combination Considerations: • Increased scale in carrier services market • Benefits of thexchange TM – Arbinet’s world-class telecommunications trading platform • Added products and services and enhanced access to certain international routes • Complementary market presence • Synergy potential of $3 million to $7 million (when fully integrated) • Consolidation benefits for network and facilities 8 Combined PRIMUS Before (all figures in millions and annualized, except customers) Carrier Arbinet Synergies Revenue (1) $183.4 $330.0 $513.4 Gross Margin (1) $10.8 $25.0 $35.8 Gross Margin % 5.9% 7.6% 7.0% Customers 262 1,237 Minutes of Use 4,340 12,667 (1) Revenue and Gross Margin are presented net of Bad Debt allowance. YTD Q310 Annualized |

Q3 and YTD 2010 Highlights 9 Notes: All results of operations exclude Discontinued Operations and severance unless otherwise specified. 1. EBITDA excludes impact of severance expenses, $4.2 million in Q310 and $1.8 million in Q110 and is a non-GAAP financial measure. Definitions and reconciliations between non-GAAP measures and relevant GAAP measures are available in the Appendix and in the Company’s periodic SEC filings. 2. Free Cash Flow is defined as Cash Flow from Operating Activities less Capital Expenditures. (US$ 000s) Q309 Q310 Change Q309 Q310 Change Revenue $194.9 $188.2 ($6.7) $560.2 $575.8 $15.6 Gross Margin 68.1 67.3 (0.8) 196.4 209.0 12.6 Gross Margin % 34.9% 35.8% 0.9% 35.1% 36.3% 1.2% Adjusted EBITDA (1) $21.2 $20.0 ($1.2) $60.7 $65.7 $5.1 EBITDA % 10.9% 10.6% -0.3% 10.8% 11.4% 0.6% Capex 3.9 6.4 2.5 9.5 16.7 7.2 Free Cash Flow (2) 9.1 14.5 5.4 30.3 20.3 (10.0) Cash Balance $41.9 $49.6 $7.7 $41.9 $49.6 $7.7 Quarter ended YTD |

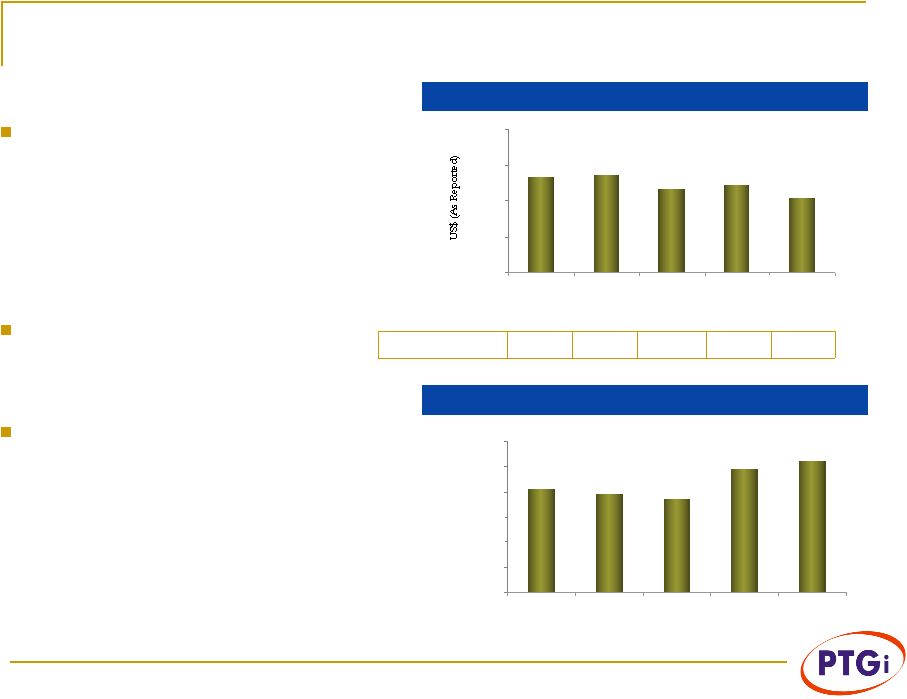

Financial Summary Revenue Adjusted EBITDA (1) (2) Capital Expenditures Free Cash Flow (1) ($ Millions) 10 (1) A non-GAAP financial measure. Definitions and reconciliations between non-GAAP measures and relevant GAAP measures are available in the Appendix and in the Company’s periodic SEC filings. (2) Adjusted EBITDA excludes impact of severance charges in Q109 ($1.8 million) and Q310 ($4.2 million). $195 $203 $193 $195 $188 $0 $50 $100 $150 $200 $250 Q309 Q409 Q110 Q210 Q310 -3.3% % Sequential Change 5.9 % 4.0% -4.7% 0.8% 3.4% % of Revenue 2.0% 2.7% 2.5% 3.0% 10.6% % of Revenue 10.7% 10.8% 11.8% 11.7% $14 ($7) $13 $6 $9 -$10 -$5 $0 $5 $10 $15 $20 Q309 Q409 Q110 Q210 Q310 $21 $22 $23 $23 $20 $0 $5 $10 $15 $20 $25 Q309 Q409 Q110 Q210 Q310 $6 $6 $5 $6 $4 $0 $2 $4 $6 $8 $10 Q309 Q409 Q110 Q210 Q310 7.4% % of Revenue 4.7% 3.0% 6.7% (3.6)% Note: All results of operations exclude Discontinued Operations unless otherwise specified. |

11 Canada Overview Net Revenue Adjusted EBITDA (1) $56.9 $58.0 $57.5 $58.7 $57.4 $0 $25 $50 $75 Q309 Q409 Q110 Q210 Q310 (1) A non-GAAP financial measure. Definitions and reconciliations between non-GAAP measures and relevant GAAP measures are available in the Appendix and in the Company’s periodic SEC filings. (0.8)% 59.1 (CAD$) $63.1 $62.1 $59.8 $59.6 Sequential Change (2.0)% (1.6)% (3.6)% (0.4)% 20.0% (3.3)% $11.8 (CAD$) $12.8 $11.8 $12.1 $12.2 Sequential Change (7.9)% (7.8)% 2.5% 0.8% % of Revenue 20.3% 19.1% 20.2% 20.5% $11.3 $12.0 $11.6 $11.2 $11.6 $0 $5 $10 $15 $20 Q309 Q409 Q110 Q210 Q310 ($Millions) ($Millions) Most profitable business unit in the portfolio Stable EBITDA averaging 20% of net revenue despite declining revenues 40% and 7% growth year- over-year in Hosted IP/PBX and data center revenues, respectively Effective cost controls helped offset the impact of declining revenues on EBITDA and free cash flow |

12 Australia Overview Net Revenue Adjusted EBITDA (1) (0.8)% $75.8 (AUS$) $76.5 $75.9 $77.3 $76.4 Sequential Change (0.9)% (0.8)% 1.9% (1.2)% (1) A non-GAAP financial measure. Definitions and reconciliations between non-GAAP measures and relevant GAAP measures are available in the Appendix and in the Company’s periodic SEC filings. 13.2% (2.9)% $10.0 (AUS$) $9.8 $9.7 $12.9 $10.3 Sequential Change (10.1)% (1.0)% 33.0% (20.2)% % of Revenue 12.9% 12.8% 16.6% 13.5% $68.4 $69.9 $63.7 $69.0 $67.5 $60 $64 $68 $72 Q309 Q409 Q110 Q210 Q310 $9.0 $9.1 $11.6 $8.8 $8.2 $0 $2 $4 $6 $8 $10 $12 $14 Q309 Q409 Q110 Q210 Q310 ($Millions) ($Millions) Stable revenue stream Declining residential revenue replaced by higher margin business revenue 46% growth year-over-year in data center revenues and 6% growth for business revenues in aggregate Adjusted EBITDA of 13.2% of net revenue in Q310 versus 12.9% in Q309 |

Global Wholesale Overview Net Revenue Gross Margin % (1) $53.6 $54.9 $46.5 $49.2 $41.9 $0 $20 $40 $60 $80 Q309 Q409 Q110 Q210 Q310 4.1% 3.9% 3.7% 4.9% 5.2% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Q309 Q409 Q110 Q210 Q310 (1) A non-GAAP financial measure. Gross Margin % is defined as Net Revenue less costs of revenue divided by Net Revenue. (14.9)% Sequential Change 6.5% 2.5% (15.3)% 5.8% ($Millions) ($Millions) Gross margins, as a percentage of net revenue, improved 110 basis points to 5.2% in Q310 versus Q309 as we focused on higher margin US domestic terminations Summer seasonality in Europe had expected effect on quarterly traffic Focus on profitability vs. Revenue drove decision to prune less profitable traffic 13 |

Primus’ Other Businesses United States: Net Revenue for the quarter decreased $4.1 million year over year to $12.1 million Adjusted EBITDA for the quarter decreased $1.6 million year over year to $0.9 million Brazil: Net Revenue for the quarter increased BRR 8.2 million year over year to BRR 15.9 million Adjusted EBITDA for the quarter remained flat year over year as the significant increase in revenue was derived from low-margin reseller voice services Europe Retail: All European retail operations classified as “Discontinued Operations” in the financial statements $6.2 million (non-cash) impairment charge for goodwill and long-lived assets, primarily intangibles established as part of fresh start accounting Adjusted EBITDA of (€2K) and (€71K) for the third quarters 2010 and 2009, respectively |

15 Foreign Currency Effects More than 80% of revenue generated outside US Natural in-country currency hedge Revenue and costs are largely denominated in each country’s local currency Impact of currency fluctuations driven by US dollar remittances from foreign units to service debt .5688 0.9617 0.9023 Q310 0.5536 0.9602 0.9036 Q110 0.5559 0.9731 0.8835 Q210 0.5800 0.9900 0.9900 As of 11/15/10 Q309 Q409 AUD $ 0.8323 0.9087 CAN $ 0.9097 0.9460 BRR 0.5335 0.5728 Average Exchange Rate to US$ |

16 Balance Sheet ($US Millions) (1) A non-GAAP financial measure. Definitions and reconciliations between non-GAAP measures and relevant GAAP measures are available in the Appendix and in the Company’s periodic SEC filings. Q309 Q409 Q110 Q210 Q310 Total Debt / LTM Adjusted EBITDA 3.30x 3.15x 2.99x 2.79x 2.81x Net Debt / LTM Adjusted EBITDA 2.76x 2.63x 2.38x 2.40x 2.24x Interest Coverage Ratio 2.50x 1.77x 2.45x 2.69x 2.31x Note: All results of operations exclude Discontinued Operations and severance unless otherwise specified. Cash balance of $49.6 million at September 30, 2010 Principal amount of total debt at 9/30/10 was $245.9 million compared to $246.3 million at 6/30/10 Improving leverage ratios |

Primus Investment Highlights Drive profitable growth in areas of long-term sustainable advantage Scale Canada, Australia, and Global Wholesale Feed growth businesses: IP- and data- based services for enterprises, consumers Harvest cash flows in traditional businesses Executing asset portfolio strategy through strategic alternatives Arbinet doubles wholesale business and creates unique product set, significant synergies Exiting unproductive, non-scalable businesses Evaluating other M&A opportunities Generating free cash flow, growing cash balance Focused on balanced sheet transformation through cash generation, proceeds of any divestitures |

Competitive Landscape Alog, Diveo, UOL, Locaweb, Transit, GVT, Datora Telstra, Optus, AAPT, iiNet, TPG Bell Canada, Telus, MTS Allstream, Rogers, COGECO, Shaw, Globalive, Videotron Wholesale units of major carriers Pure plays: Arbinet, Phonetime, Vonage, Cbeyond, XO, Paetec, Verizon, AT&T Quality Value Strong brand identity Extensive sales staff Quality of service Value Customer care Strong brand identity Value Quality of service Strong managed services team Largest geographical internet data center coverage Depth of network facilities Inter-connections Pricing Quality of service Quality of IP-PBX Platform Value Geography Primary Services Primary Competitors PRIMUS’ Advantages Data-hosting VoIP services Broadband access Tier 1 international carriers, emerging multi national carriers, cable companies and Global ISPs Residential Voice, VOIP Business Voice, IP-PBX services Brazil Australia Canada Wholesale U.S. Residential – Value Provider Voice, Broadband, IP, wireless, local Business – Full Solution Provider Voice, broadband, IP, hosting, data, wireless MVNO Residential – Value Provider Voice, broadband, local, wireless MVNO Business – Full Solution Provider with SME Focus Voice, broadband, IP, local, wireless, hosting services |

19 Adjusted EBITDA Adjusted EBITDA, as defined by us, consists of net income (loss) before reorganization items, net, share-based compensation expense, depreciation and amortization, asset impairment expense, gain (loss) on sale or disposal of assets, interest expense, amortization or accretion on debt discount or premium, gain (loss) on early extinguishment or restructuring of debt, interest income and other income (expense), gain (loss) from contingent value rights valuation, foreign currency transaction gain (loss), income tax benefit (expense), income (expense) attributable to the non-controlling interest, income (loss) from discontinued operations, net of tax, and income (loss) from sale of discontinued operations, net of tax. Our definition of Adjusted EBITDA may not be similar to Adjusted EBITDA measures presented by other companies, is not a measurement under generally accepted accounting principles in the United States, and should be considered in addition to, but not as a substitute for, the information contained in our statements of operations. We believe Adjusted EBITDA is an important performance measurement for our investors because it gives them a metric to analyze our results exclusive of certain non- cash items and items which do not directly correlate to our business of selling and provisioning telecommunications services. We believe Adjusted EBITDA provides further insight into our current performance and period to period performance on a qualitative basis and is a measure that we use to evaluate our results and performance of our management team. Free Cash Flow Free Cash Flow, as defined by us, consists of net cash provided by (used in) operating activities before reorganization items less net cash used in the purchase of property and equipment. Free Cash Flow, as defined above, may not be similar to Free Cash Flow measures presented by other companies, is not a measurement under generally accepted accounting principles in the United States, and should be considered in addition to, but not as a substitute for, the information contained in our consolidated statements of cash flows. We believe Free Cash Flow provides a measure of our ability, after purchases of capital and other investments in our infrastructure, to meet scheduled debt principal payments. We use Free Cash Flow to monitor the impact of our operations on our cash reserves and our ability to generate sufficient cash flow to fund our scheduled debt maturities and other financing activities, including discretionary refinancings and retirements of debt. Because Free Cash Flow represents the amount of cash generated or used in operating activities less amounts used in the purchase of property and equipment before deductions for scheduled debt maturities and other fixed obligations (such as capital leases, vendor financing and other long-term obligations), you should not use it as a measure of the amount of cash available for discretionary expenditures. Non-GAAP Measures Note: All results of operations excluded Discontinued Operations unless otherwise specified. Three Months Three Months Three Months Ended Ended Ended September 30, June 30, September 30, 2010 2010 2009 NET INCOME (LOSS) ATTRIBUTABLE TO PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED 5,080 $ (13,038) $ 2,165 $ Reorganization items, net - - 307 Share-based compensation expense (12) 117 307 Depreciation and amortization 13,641 18,194 18,740 (Gain) loss on sale or disposal of assets - (189) 36 Interest expense 8,602 8,733 8,747 Accretion (amortization) on debt premium/discount, net 46 45 - (Gain) loss on early extinguishment of debt - (164) - Interest and other (income) expense (254) (153) (160) (Gain) loss from Contingent Value Rights valuation (33) 382 4,229 Foreign currency transaction (gain) loss (14,006) 9,623 (13,448) Income tax (benefit) expense (3,238) (1,883) (2,121) Income (expense) attributable to the non-controlling interest 74 (106) 210 (Income) loss from discontinued operations, net of tax 5,464 1,528 2,110 (Gain) loss from sale of discontinued operations, net of tax 389 (193) 110 ADJUSTED EBITDA 15,753 $ 22,896 $ 21,232 $ NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES BEFORE REORGANIZATION ITEMS 20,865 $ (1,140) $ 12,992 $ Net cash used in purchase of property and equipment (6,410) (5,824) (3,886) FREE CASH FLOW 14,455 $ (6,964) $ 9,106 $ |