Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

ARBINET CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

|  |

PROPOSED MERGER — YOUR VOTE IS VERY IMPORTANT

The boards of directors of Primus Telecommunications Group, Incorporated, or Primus, and Arbinet Corporation, or Arbinet, have each approved an Agreement and Plan of Merger, dated as of November 10, 2010, as amended by Amendment No. 1 dated December 14, 2010, by and among Primus, Arbinet and PTG Investments, Inc., or the merger agreement, pursuant to which PTG Investments, Inc., a wholly owned subsidiary of Primus referred to as Merger Sub, will merge with and into Arbinet with Arbinet surviving the merger as a wholly owned subsidiary of Primus.

Primus and Arbinet will each hold a special meeting of its stockholders in connection with the proposed merger. At the Primus special meeting, Primus stockholders will be asked to consider and vote on a proposal to approve the issuance of shares of Primus common stock pursuant to the merger agreement and to approve the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended. At the Arbinet special meeting, Arbinet stockholders will be asked to consider and vote on a proposal to approve and adopt the merger agreement.

If the merger is completed, each share of Arbinet common stock (other than shares subject to perfected appraisal rights) will be converted into the right to receive the number of shares of Primus common stock equal to an exchange ratio, which will be calculated as follows: (i) $28,000,000, which may be increased by the net proceeds of a sale of Arbinet’s patents and associated rights to a third party for cash, divided by (ii) the number of shares of Arbinet common stock issued and outstanding immediately prior to the consummation of the merger plus shares that may become issuable as Primus common stock at or after the closing of the merger in connection with Primus’s assumption of Arbinet’s outstanding warrants, options, stock appreciation rights and other equity awards (but excluding any issuable shares that are subject to Arbinet’s stock options and stock appreciation rights as of the closing of the merger and for which the exercise price or base price, respectively, is greater than the greater of (x) $6.05 per share of Arbinet common stock and (y) the closing stock price per share of Arbinet common stock on the day prior to the closing of the merger, and, with respect to Arbinet’s stock appreciation rights, including only the net number of shares of Arbinet common stock that will be issuable as calculated using the closing price of Arbinet common stock on the day prior to the closing of the merger),divided by (iii) $9.5464.

The actual exchange ratio cannot be determined until just before closing of the merger; however, assuming (i) the $28,000,000 base price is not increased in connection with any sale of patents and (ii) there are an aggregate of 5,722,267 shares of Arbinet common stock issued and outstanding and shares of Arbinet common stock issuable subject to Arbinet warrants and equity awards that meet the requirements described in the preceding paragraph (assuming a per share price of Arbinet common stock of $8.44 and that no shares are subject to a perfected appraisal process), the exchange ratio, as of January 7, 2011, would be expected to be 0.5126 or approximately one share of Primus common stock for 2.02 shares of Arbinet common stock owned. The actual exchange ratio may vary significantly from the ratio determined based on the assumptions above.

Primus stockholders will continue to own their existing shares of Primus common stock following the merger. We anticipate that, immediately following completion of the merger, and based on the same assumptions as described in the immediately preceding paragraph, Arbinet stockholders (by virtue of holding Arbinet common stock immediately prior to the effective time of the merger) would own approximately 22% of the outstanding shares of Primus common stock.

Primus’s common stock is currently quoted on the OTC Bulletin Board under the symbol “PMUG.” In connection with the merger, Primus is to use its reasonable best efforts to have its common stock listed for trading on the NASDAQ. Primus has submitted an application to list its common stock on the NASDAQ. However, there can be no assurances that such listing will be effected.

Arbinet’s common stock is currently listed on the NASDAQ Global Market under the symbol “ARBX.”

This document is a prospectus relating to shares of Primus common stock to be issued pursuant to the merger and a joint proxy statement for Primus and Arbinet to solicit proxies for their respective special meetings of stockholders. It contains answers to frequently asked questions and a summary of the important terms of the merger, the merger agreement and related matters, followed by a more detailed discussion.

For a discussion of certain significant matters that you should consider before voting on the proposed transaction, see “Risk Factors” beginning on page38.

Neither the Securities and Exchange Commission, which is referred to as the SEC, nor any state securities regulatory authority has approved or disapproved of the merger or the securities to be issued under this joint proxy statement/prospectus or has passed upon the adequacy or accuracy of the disclosure in this joint proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This joint proxy statement/prospectus is dated January 19, 2011, and is first being mailed to stockholders of Primus and Arbinet on or about January 25, 2011.

Table of Contents

PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED

7901 Jones Branch Drive, Suite 900

McLean, VA 22102

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS OF

PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED

TO BE HELD ON FEBRUARY 25, 2011

To the Stockholders of Primus Telecommunications Group, Incorporated:

We will hold a special meeting of the stockholders of Primus on February 25, 2011 at 9:00 a.m., Eastern time, at the Hilton McLean Tysons Corner located at 7920 Jones Branch Drive, McLean, VA 22102, for the following purposes:

| 1. | to consider and vote upon a proposal to approve the issuance of shares of Primus common stock pursuant to the Agreement and Plan of Merger, dated as of November 10, 2010, as amended by Amendment No. 1 thereto dated December 14, 2010, by and among Primus, PTG Investments, Inc., a wholly owned subsidiary of Primus referred to as Merger Sub, and Arbinet Corporation, as it may be amended from time to time, which provides for, among other things, the merger of Merger Sub with and into Arbinet with Arbinet surviving the merger as a wholly owned subsidiary of Primus; |

| 2. | to consider and vote upon a proposal to approve the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended; and |

| 3. | to consider and vote upon a proposal to adjourn the special meeting, if necessary or appropriate, to permit the solicitation of additional proxies if there are not sufficient votes at the time of the special meeting to approve either of the foregoing proposals. |

In addition, Primus will transact any other business that may properly come before the special meeting, or any adjournment or postponement thereof, by or at the discretion of the board of directors of Primus.

Only holders of record of Primus common stock at the close of business on January 12, 2011, the record date for the special meeting, are entitled to receive this notice and to vote their shares at the special meeting or at any adjournment or postponement (to the extent permitted by law) of the special meeting. All stockholders of record are cordially invited to attend the special meeting in person.

The approval of each of the proposals to issue shares of Primus common stock pursuant to the merger agreement and to approve the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended, requires the affirmative vote of a majority of the total votes cast at the special meeting. Even if you plan to attend the special meeting in person, Primus requests that you complete, sign, date and return the enclosed proxy (or cast your vote by telephone or over the Internet by following the instructions on your proxy card) prior to the special meeting to ensure that your shares will be represented at the special meeting if you are unable to attend.

For more information about the merger, the other transactions contemplated by the merger agreement (including the issuance of shares of Primus common stock), and the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended, please review the accompanying joint proxy statement/prospectus, including the merger agreement attached to it as Annex A, and the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended, attached to it as Annex E.

Table of Contents

Primus’s board of directors unanimously recommends that Primus stockholders vote “FOR” the proposal to approve the issuance of shares of Primus common stock pursuant to the merger agreement, “FOR” the proposal to approve the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended, and “FOR” the adjournment of the Primus special meeting, if necessary or appropriate, to permit the solicitation of additional proxies.

By Order of the Board of Directors, |

Thomas D. Hickey |

General Counsel and Secretary |

Dated: January 19, 2011

IMPORTANT

Your vote is important. Whether or not you plan to attend the special meeting, please complete, sign and date the enclosed proxy and return it promptly in the enclosed postage-paid envelope. You may also cast your vote by telephone or over the Internet by following the instructions on your proxy card. If you vote by telephone or over the Internet, you do not need to submit your proxy card.Remember, your vote is important, so please act today.

Table of Contents

ARBINET CORPORATION

460 Herndon Parkway, Suite 150

Herndon, Virginia 20170

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS OF

ARBINET CORPORATION

TO BE HELD ON FEBRUARY 25, 2011

To the Stockholders of Arbinet Corporation:

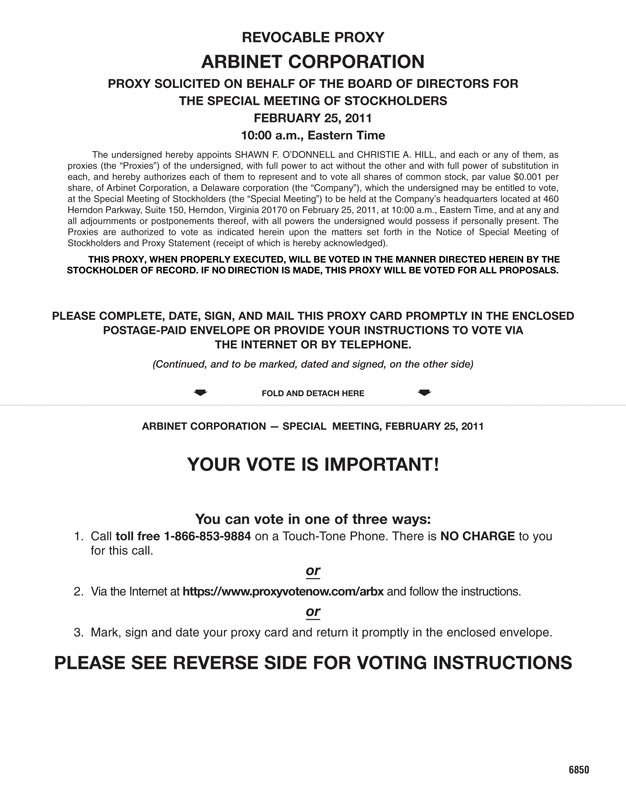

We will hold a special meeting of the stockholders of Arbinet on February 25, 2011 at 10:00 a.m., Eastern time, at Arbinet’s headquarters located at 460 Herndon Parkway, Suite 150, Herndon, VA 20170, for the following purposes:

| 1. | to consider and vote upon a proposal to approve and adopt the Agreement and Plan of Merger, dated as of November 10, 2010, as amended by Amendment No. 1 thereto dated December 14, 2010, by and among Primus Telecommunications Group, Incorporated, PTG Investments, Inc., a wholly owned subsidiary of Primus referred to as Merger Sub, and Arbinet, as it may be amended from time to time, which provides for, among other things, the merger of Merger Sub with and into Arbinet with Arbinet surviving the merger as a wholly owned subsidiary of Primus; and |

| 2. | to consider and vote upon a proposal to adjourn the special meeting, if necessary or appropriate, to permit the solicitation of additional proxies if there are not sufficient votes at the time of the special meeting to approve the proposal to approve and adopt the merger agreement. |

In addition, Arbinet will transact any other business that may properly come before the special meeting, or any adjournment or postponement thereof, by or at the direction of the board of directors of Arbinet.

Only holders of record of Arbinet common stock at the close of business on January 12, 2011, the record date for the special meeting, are entitled to receive this notice and to vote their shares at the special meeting or at any adjournment or postponement of the special meeting. All stockholders of record are cordially invited to attend the special meeting in person.

The approval and adoption of the merger agreement requires the affirmative vote of the holders of a majority of the outstanding shares of Arbinet common stock entitled to vote thereon. Even if you plan to attend the special meeting in person, Arbinet requests that you complete, sign, date and return the enclosed proxy (or cast your vote by telephone or over the Internet by following the instructions on your proxy card) prior to the special meeting to ensure that your shares will be represented at the special meeting if you are unable to attend. If you fail to attend the special meeting in person or by proxy, your shares will not be counted for purposes of determining whether a quorum is present at the meeting and it will have the same effect as a vote against the approval and adoption of the merger agreement, but will not affect the outcome of the vote regarding the proposal to adjourn the special meeting.

Attendance at the special meeting is limited to stockholders. If you hold shares in “street name” (that is, through a bank, broker, custodian or other nominee) and would like to attend the special meeting, you will need to bring an account statement or other acceptable evidence of ownership of shares of Arbinet common stock as of the record date. In addition, if you would like to attend the special meeting and vote in person, in order to vote, you must contact the person in whose name your shares are registered, obtain a proxy from that person and bring it to the special meeting. The use of cell phones, PDAs, pagers, recording and photographic equipment, camera phones and/or computers is not permitted in the meeting rooms at the special meeting.

For more information about the merger and the other transactions contemplated by the merger agreement, please review the accompanying joint proxy statement/prospectus and the merger agreement attached to it as Annex A.

Arbinet’s board of directors unanimously recommends that Arbinet’s stockholders vote “FOR” the approval and adoption of the merger agreement, which provides for, among other things, the merger of Merger Sub with and into Arbinet with Arbinet surviving the merger as a wholly owned subsidiary of

Table of Contents

Primus, and “FOR” the adjournment of the Arbinet special meeting, if necessary or appropriate, to permit the solicitation of additional proxies. In considering the recommendation of Arbinet’s board of directors, stockholders of Arbinet should be aware that members of Arbinet’s board of directors and its executive officers have agreements and arrangements that provide them with interests in the merger that may be different from, or in addition to, those of Arbinet stockholders. See “The Merger — Interests of Certain Persons in the Merger that May be Different from Your Interests” beginning on page123.

By Order of the Board of Directors, |

Shawn F. O’Donnell |

Chief Executive Officer and President |

Dated: January 19, 2011

IMPORTANT

Your vote is important. Whether or not you plan to attend the special meeting, please complete, sign and date the enclosed proxy and return it promptly in the enclosed postage-paid envelope. You may also cast your vote by telephone or over the Internet by following the instructions on your proxy card. If you vote by telephone or over the Internet, you do not need to submit your proxy card.Please do not send any stock certificates at this time.Remember, your vote is important, so please act today.

Table of Contents

ADDITIONAL INFORMATION

This joint proxy statement/prospectus incorporates by reference important business and financial information about Primus from other documents filed with the Securities and Exchange Commission, or the SEC, that are not included or delivered with this joint proxy statement/prospectus. See “Incorporation of Certain Documents by Reference” and “Where You Can Find More Information” beginning on pages 182 and 183, respectively, of this joint proxy statement/prospectus.

Documents incorporated by reference are available to you without charge through the SEC’s web site (http://www.sec.gov) or by requesting them in writing or by telephone from Primus at the following address and telephone number:

Primus Telecommunications Group, Incorporated

Attention: Investor Relations

7901 Jones Branch Drive, Suite 900

McLean, Virginia 22012

(703) 748-8050

www.primustel.com

You will not be charged for any of these documents that you request. Primus and Arbinet stockholders requesting documents should do so no later than February 18, 2011 in order to receive timely delivery of the requested documents in advance of their respective special meeting.

VOTING BY TELEPHONE, INTERNET OR MAIL

Primus stockholders of record may submit their proxies by:

Telephone. You can vote by telephone by calling the toll-free number 1-800-690-6903 in the United States, Canada or Puerto Rico on a touch-tone telephone. You will then be prompted to enter the control number printed on your proxy card and to follow the subsequent instructions. Telephone voting is available 24 hours a day until 11:59 p.m., New York time, on February 24, 2011. If you vote by telephone, you do not need to return your proxy card or voting instruction card.

Internet. You can vote over the Internet by accessing the web site athttp://www.proxyvote.comand following the instructions on the secure web site. Internet voting is available 24 hours a day until 11:59 p.m., New York time, on February 24, 2011. If you vote over the Internet, you do not need to return your proxy card or voting instruction card.

Mail. You can vote by mail by completing, signing, dating and mailing your proxy card or voting instruction card in the postage-paid envelope included with this joint proxy statement/prospectus.

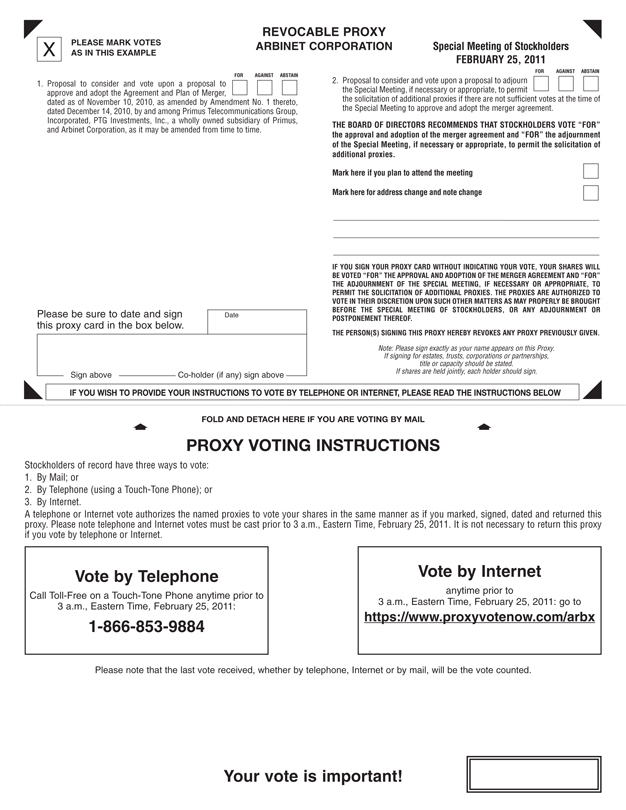

Arbinet stockholders of record may submit their proxies by:

Telephone. You can vote by telephone by calling the toll-free number 1-866-853-9884 in the United States, Canada or Puerto Rico on a touch-tone telephone. You will then be prompted to enter the control number printed on your proxy card and to follow the subsequent instructions. Telephone voting is available 24 hours a day until 3:00 a.m., New York time, on February 25, 2011. If you vote by telephone, you do not need to return your proxy card or voting instruction card.

Internet. You can vote over the Internet by accessing the web site athttp://www.proxyvotenow.com/arbx and following the instructions on the secure web site. Internet voting is available 24 hours a day until 3:00 a.m., New York time, on February 25, 2011. If you vote over the Internet, you do not need to return your proxy card or voting instruction card.

Mail. You can vote by mail by completing, signing, dating and mailing your proxy card or voting instruction card in the postage-paid envelope included with this joint proxy statement/prospectus.

If you hold your Primus or Arbinet shares through a bank, broker, custodian or other nominee:

Please refer to your proxy card or voting instruction form or the information forwarded by your bank, broker, custodian or other nominee to see which voting methods are available to you.

Table of Contents

| 1 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

Potential Spin-off or Sale of Patents by Arbinet and Benefit to Arbinet’s Stockholders | 11 | |||

Treatment of Arbinet Warrants, Stock Options, Restricted Stock and other Equity Awards | 12 | |||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

Board of Directors and Management of Primus Following the Merger | 14 | |||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

Interests of Certain Persons in the Merger that May be Different from Your Interests | 20 | |||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 29 | ||||

Summary Unaudited Pro Forma Combined Financial Data of Primus | 31 | |||

| 33 | ||||

Comparative Primus and Arbinet Market Price and Dividend Data | 35 | |||

| 38 | ||||

| 38 | ||||

| 43 | ||||

| 45 | ||||

| 45 | ||||

| 55 | ||||

INFORMATION ABOUT PRIMUS AND MERGER SUB | 58 | |||

| 59 | ||||

ARBINET’S MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 71 | |||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| 74 | ||||

| 84 | ||||

| 86 |

i

Table of Contents

| 87 | ||||

| 87 | ||||

| 88 | ||||

| 88 | ||||

| 89 | ||||

| 90 | ||||

| 90 | ||||

| 102 | ||||

| 105 | ||||

| 107 | ||||

| 110 | ||||

| 117 | ||||

| 123 | ||||

| 123 | ||||

Restrictions on Sales of Shares of Primus Common Stock Received in the Merger | 123 | |||

Board of Directors and Management of Primus Following the Merger | 123 | |||

Interests of Certain Persons in the Merger that May be Different from Your Interests | 123 | |||

| 128 | ||||

| 132 | ||||

| 132 | ||||

| 133 | ||||

| 133 | ||||

| 133 | ||||

| 134 | ||||

| 134 | ||||

Treatment of Arbinet Warrants, Options, Restricted Stock and other Equity Awards | 135 | |||

| 136 | ||||

| 137 | ||||

| 138 | ||||

| 138 | ||||

| 140 | ||||

| 142 | ||||

| 147 | ||||

| 149 | ||||

| 152 | ||||

| 152 | ||||

| 153 | ||||

| 153 | ||||

| 154 | ||||

| 155 | ||||

| 159 | ||||

| 159 | ||||

| 159 | ||||

| 160 | ||||

| 160 | ||||

| 161 | ||||

| 162 | ||||

| 162 | ||||

| 163 | ||||

| 163 | ||||

| 164 | ||||

| 164 |

ii

Table of Contents

iii

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE MERGER

The following are answers to common questions that you may have regarding the merger and your special meeting. Primus and Arbinet urge you to read carefully the remainder of this joint proxy statement/prospectus because the information in this section may not provide all the information that might be important to you in determining how to vote. Additional important information is also contained in the annexes to, and the documents incorporated by reference in, this joint proxy statement/prospectus. See “Incorporation of Certain Documents By Reference” and “Where You Can Find More Information” beginning on pages 182 and 183, respectively.

| Q: | What will happen in the merger? |

| A: | The proposed merger will combine the businesses of Primus and Arbinet. At the effective time of the merger, a wholly owned subsidiary of Primus, referred to as Merger Sub, will merge with and into Arbinet. As a result of the merger, Arbinet will survive as a wholly owned subsidiary of Primus and Primus will continue as a public company. Promptly after the effective time of the merger, Primus intends to contribute Arbinet, as the surviving entity of the merger, to Primus Telecommunications Holding, Inc., a wholly owned subsidiary of Primus. |

| Q: | Why am I receiving this document? |

| A: | You are receiving this joint proxy statement because you are a stockholder of Primus or Arbinet. This joint proxy statement is being used by both the Primus and Arbinet boards of directors to solicit proxies of Primus and Arbinet stockholders, respectively, in connection with each entity’s special meeting of stockholders. In addition, this document is a prospectus being delivered to Arbinet stockholders because Primus is offering shares of its common stock to Arbinet stockholders in exchange for shares of Arbinet common stock in connection with the merger. |

| Q: | What are holders of Primus common stock being asked to vote on? |

| A: | Holders of Primus common stock are being asked to vote on the following proposals: |

| • | approve the issuance of shares of Primus common stock pursuant to the merger agreement; |

| • | approve the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended; and |

| • | approve the adjournment of the special meeting, if necessary or appropriate, to permit the solicitation of additional proxies if there are insufficient votes at the time of the special meeting to approve either of the foregoing proposals. |

| Q: | What are holders of Arbinet common stock being asked to vote on? |

| A: | Holders of Arbinet common stock are being asked to vote on the following proposals: |

| • | approve and adopt the merger agreement; and |

| • | approve the adjournment of the special meeting, if necessary or appropriate, to permit the solicitation of additional proxies if there are insufficient votes at the time of the special meeting to approve and adopt the merger agreement. |

| Q: | Why have Primus and Arbinet decided to merge? |

| A: | Primus and Arbinet believe that the merger will provide strategic and financial benefits to stockholders, customers and employees, including: |

| • | increased scale in a rapidly consolidating global telecommunications market; |

| • | increased cross-selling opportunities; |

1

Table of Contents

| • | the potential to produce meaningful cost savings and operational synergies resulting primarily from the elimination of duplicative expenses related to maintaining public company status, compliance and exchange listing fees, as well as from other selling, general and administrative savings, headcount reductions and a reduction in the telecommunications costs of sales; |

| • | allowing customers access to more global rates at enhanced prices; and |

| • | access to additional traffic streams, enhanced voice traffic routing and termination, the increased ability to manage multiple segments of carrier customers, and additional market opportunities in the carrier services market. |

| For a more complete description of Primus’s and Arbinet’s reasons for the merger, see “The Merger — Reasons for the Merger — Arbinet” and “The Merger — Reasons for the Merger — Primus” beginning on pages 102 and 105, respectively. |

| Q: | What does the Primus board of directors recommend? |

Primus’s board of directors unanimously recommends that Primus stockholders vote “FOR” the proposal to approve the issuance of shares of Primus common stock pursuant to the merger agreement, “FOR” the proposal to approve the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended, and “FOR” the adjournment of the Primus special meeting, if necessary or appropriate, to permit the solicitation of additional proxies. See “The Merger — Reasons for the Merger — Primus” and “Approval of the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended” beginning on pages 105 and 165, respectively.

| Q: | What does the Arbinet board of directors recommend? |

Arbinet’s board of directors unanimously recommends that Arbinet stockholders vote “FOR” the approval and adoption of the merger agreement and “FOR” the adjournment of the Arbinet special meeting, if necessary or appropriate, to permit the solicitation of additional proxies. For a more complete description of the recommendation of the Arbinet board of directors, see “The Merger — Reasons for the Merger — Arbinet” beginning on page 102.

| Q: | Why is my vote important? |

| A: | If you do not return your proxy card by mail or submit your proxy by telephone or over the Internet or vote in person at your special meeting, it may be difficult for Primus or Arbinet to obtain the necessary quorum to transact business at its respective special meeting. |

In connection with the Primus special meeting, abstentions and broker non-votes (a broker non-vote is an unvoted proxy submitted by a bank, broker, custodian or other nominee on a stockholder’s behalf) will be considered in determining the presence of a quorum. However, because abstentions and broker non-votes are not considered votes cast, they will not have any effect on the outcome of the vote with respect to each of the proposals to approve the issuance of shares of Primus common stock pursuant to the merger agreement and the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended. With respect to the proposal to adjourn the Primus special meeting, if necessary or appropriate, to permit the solicitation of additional proxies, abstentions will have the same effect as a vote “AGAINST” any such proposal, and broker non-votes, because they are not considered voting power present, will have no effect on approval of such proposal.

In connection with the Arbinet special meeting, abstentions and broker non-votes will be considered in determining the presence of a quorum and will have the same effect as votes cast “AGAINST” the approval and adoption of the merger agreement. For any proposal to adjourn the special meeting, if necessary or appropriate, to permit the solicitation of additional proxies, abstentions will have the same effect as a vote “AGAINST” any such proposal if a quorum is not present, but will have no effect on such proposal if a quorum is present, and broker non-votes will have no effect on such proposal.

No matter how many shares you own, you are encouraged to vote.

2

Table of Contents

| Q: | When and where are the special meetings? |

| A: | The Primus special meeting will take place on February 25, 2011 at 9:00 a.m., Eastern time, at the Hilton McLean Tysons Corner located at 7920 Jones Branch Drive, McLean, VA 22102. |

The Arbinet special meeting will take place on February 25, 2011 at 10:00 a.m., Eastern time, at Arbinet’s headquarters located at 460 Herndon Parkway, Suite 150, Herndon, VA 20170.

For additional information relating to the Primus and Arbinet special meetings, see “The Stockholder Meetings” beginning on page 159.

| Q: | What will I receive in the merger in exchange for my shares of Arbinet common stock? |

| A: | If the merger is completed, each share of Arbinet common stock (other than shares subject to perfected appraisal rights and other than any shares of Arbinet held by Primus, Arbinet or any of their respective direct or indirect wholly owned subsidiaries, in each case except for any such shares held on behalf of third parties) will be converted into the right to receive the number of shares of Primus common stock equal to an exchange ratio, which will be calculated as follows: (i) $28,000,000, which may be increased by the net proceeds of a sale of Arbinet’s patents and associated rights to a third party for cash, divided by (ii) the number of shares of Arbinet common stock issued and outstanding immediately prior to the consummation of the merger plus shares that may become issuable as Primus common stock at or after the closing of the merger in connection with Primus’s assumption of Arbinet’s outstanding warrants, options, stock appreciation rights and other equity awards (but excluding any issuable shares that are subject to Arbinet’s stock options and stock appreciation rights as of the closing of the merger and for which the exercise price or base price, respectively, is greater than the greater of (x) $6.05 per share of Arbinet common stock and (y) the closing stock price per share of Arbinet common stock on the day prior to the closing of the merger, and, with respect to Arbinet’s stock appreciation rights, including only the net number of shares of Arbinet common stock that will be issuable as calculated using the closing price of Arbinet common stock on the day prior to the closing of the merger),divided by (iii) $9.5464. Throughout this joint proxy statement/prospectus, unless otherwise stated, “exchange ratio” refers to the exchange ratio as calculated in this paragraph. For a more complete description of what Arbinet stockholders will be entitled to receive pursuant to the merger, see “Terms of the Merger Agreement — Per Share Merger Consideration” beginning on page 134. |

The actual exchange ratio cannot be determined until just before closing of the merger; however, assuming (i) the $28,000,000 base price is not increased in connection with any sale of patents and (ii) there are an aggregate of 5,722,267 shares of Arbinet common stock issued and outstanding and shares of Arbinet common stock issuable subject to Arbinet warrants and equity awards that meet the requirements described in the preceding paragraph (assuming a per share price of Arbinet common stock of $8.44 and that no shares are subject to a perfected appraisal process), the exchange ratio, as of January 7, 2011, would be expected to be 0.5126 or approximately one share of Primus common stock for 2.02 shares of Arbinet common stock owned. The actual exchange ratio may vary significantly from the ratio determined based on the assumptions above.

| Q: | Are Arbinet stockholders entitled to appraisal rights? |

| A: | Arbinet stockholders may, under certain circumstances, be entitled to appraisal rights under Section 262 of the General Corporation Law of the State of Delaware, or the DGCL. However, if the Primus common stock to be issued in the merger is listed on the NASDAQ, then Primus and Arbinet believe and Primus will take the position that Arbinet stockholders will not be entitled to appraisal rights. Primus’s common stock is currently quoted on the OTC Bulletin Board under the symbol “PMUG.” In connection with the merger, Primus is to use its reasonable best efforts to have its common stock listed for trading on the NASDAQ. Primus has submitted an application to list its common stock on the NASDAQ. However, there can be no assurances that such listing will be effected. |

If appraisal rights are available, holders of Arbinet common stock who do not vote in favor of the merger will have the right to seek appraisal of the fair value of their shares, but only if they submit a written

3

Table of Contents

demand for such an appraisal before the vote on the merger and comply with other Delaware law procedures. For more information regarding appraisal rights, see “The Merger — Appraisal Rights” beginning on page 128. In addition, a copy of Section 262 of the DGCL is attached to this joint proxy statement/prospectus as Annex D.

| Q: | Can Arbinet sell its patents and thereby increase the merger consideration? |

| A: | Arbinet may, but is not required to, spin-off its patents and associated rights to its stockholders or sell such patents and associated rights to a third party for cash, referred to as an IP Sale, provided that any spin-off or IP Sale may not result in any residual liability to Arbinet or any of its subsidiaries (other than for costs, fees and expenses and tax liabilities) and all transaction costs, fees and expenses (which exclude the appraiser’s fees relating to an appraisal of the applicable patents and associated rights) and the gross tax liabilities of Arbinet (except to the extent offset by net operating losses) attributable to any such spin-off or IP Sale may not exceed $350,000 in the aggregate. In addition, prior to the consummation of any such spin-off or IP Sale, Arbinet must first grant Primus a royalty-free, worldwide, assignable (on a non-exclusive basis) and perpetual license to all of Arbinet’s patents and associated rights. The amount of any proceeds from an IP Sale, after deducting related transaction costs, fees and expenses and gross tax liabilities, may, at Arbinet’s discretion, be distributed to Arbinet’s stockholders prior to closing of the merger or added, dollar for dollar, to the $28,000,000 base merger consideration. There can be no assurance that Arbinet will effect any such spin-off of patents or IP Sale. For more information regarding a potential spin-off or IP Sale, see “Terms of the Merger Agreement — Potential Spin-off or Sale of Patents by Arbinet” beginning on page 134. |

| Q: | What vote is required to approve the merger agreement and related matters? |

| A: | For Primus, the affirmative vote of a majority of the total votes cast at the special meeting is required to approve each of the issuance of the shares of Primus common stock pursuant to the merger agreement and the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended. |

For Arbinet, the affirmative vote of a majority of its shares of common stock outstanding and entitled to vote as of the record date is required to approve and adopt the merger agreement.

Concurrently with the execution of the merger agreement, a significant stockholder of both Arbinet and Primus entered into a Stockholder Support and Voting Agreement with each of Primus and Arbinet, respectively (referred to as a Voting Agreement). Pursuant to the Voting Agreement with Primus, the stockholder has agreed, in its capacity as a stockholder of Arbinet, among other things, to vote its shares of Arbinet common stock in favor of the approval and adoption of the merger agreement. Pursuant to the Voting Agreement with Arbinet, the stockholder has agreed, in its capacity as a stockholder of Primus, among other things, to vote its shares of Primus common stock in favor of the issuance of shares of Primus common stock pursuant to the merger agreement. The shares subject to the Voting Agreement with Arbinet represent an aggregate of approximately 9.5% of the Primus common stock outstanding as of January 7, 2011, and the shares subject to the Voting Agreement with Primus represent an aggregate of approximately 23.1% of the Arbinet common stock outstanding as of January 7, 2011.

For additional information on the vote required to approve the merger and related matters, see “The Stockholder Meetings” beginning on page 159.

| Q: | Is the consummation of the merger subject to any conditions other than the approval of the stockholders of Primus and Arbinet? |

| A: | Yes. In addition to stockholder approval, the consummation of the merger is contingent upon the following: |

| • | the absence of any governmental order or other legal restraint prohibiting, preventing or otherwise enjoining the consummation of the merger; |

| • | the effectiveness of the registration statement on Form S-4, of which this joint proxy statement/prospectus is a part, and no pending stop order or proceeding seeking a stop order relating thereto; |

4

Table of Contents

| • | subject to some exceptions, the receipt of any required approvals or authorizations of the merger from applicable governmental authorities, including the U.S. Federal Communications Commission; |

| • | the receipt of tax opinions from counsel for each of Primus and Arbinet to the effect that the merger will be treated as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (which is referred to as the Code in this joint proxy statement/prospectus), and that each of Primus and Arbinet will be a party to the reorganization within the meaning of Section 368(b) of the Code; provided any permitted sale or spin-off of Arbinet’s patents and associated rights would not render it impossible for such counsels to provide such opinions; and |

| • | other customary conditions, including the absence of a material adverse effect on Primus or Arbinet. |

Among other potential material adverse effects, a material adverse effect with respect to Arbinet will be deemed to have occurred if the sum of the cash and cash equivalents of Arbinet as of a defined determination date before closing of the merger, less (i) all indebtedness then outstanding and (ii) all unpaid transaction costs, fees and expenses and gross tax liabilities of Arbinet (except to the extent offset by net operating losses) attributable to an IP Sale or any spin-off of Arbinet’s patents and associated rights to its stockholders, is less than $9.5 million, which will be reduced by the actual transaction costs, fees and expenses and gross tax liabilities of Arbinet (except to the extent offset by net operating losses) attributable to such IP Sale or such spin-off that have been incurred and paid (provided that this reduction may not be greater than $350,000 in the aggregate), and which will exclude costs incurred by Arbinet in connection with the merger and the transactions contemplated by the merger agreement, which include the appraiser’s fees for the appraisal of Arbinet’s patents and associated rights.

In addition, the obligations of Primus to complete the merger are subject to:

| • | the number of appraisal shares not exceeding 10% of the outstanding shares of Arbinet common stock; and |

| • | Arbinet having taken actions under its 2004 Stock Incentive Plan to cancel certain Arbinet stock options and stock appreciation rights. |

| Q: | When do Primus and Arbinet expect the merger to be consummated? |

| A: | Each of Primus and Arbinet is working to complete the merger as quickly as possible. Primus and Arbinet currently anticipate the merger to be completed by the end of February 2011, subject to obtaining stockholder approval and satisfying all the other closing conditions contained in the merger agreement. |

| Q: | What will happen to Arbinet’s warrants, stock options, restricted stock and other equity awards in the merger? |

| A: | At the effective time of the merger, each outstanding warrant and option to purchase shares of Arbinet common stock will be converted into a warrant or option, respectively, to acquire, on the same terms and conditions applicable to each share of Arbinet common stock, shares of Primus common stock with appropriate adjustments to be made to the number of shares and the exercise prices based on the exchange ratio and otherwise as set forth in the merger agreement. Each outstanding restricted stock award under Arbinet’s equity compensation plans will be converted into a restricted stock award relating to shares of Primus common stock, based on the exchange ratio in the merger agreement, on the same terms and conditions applicable to each share of Arbinet common stock. Similarly, each outstanding stock appreciation right, or SAR, under Arbinet’s equity compensation plans will be converted into an SAR to acquire, on the same terms and conditions applicable under such Arbinet SAR, shares of Primus common stock based on the exchange ratio in the merger agreement, on the same terms and conditions applicable to each share of Arbinet common stock. Immediately prior to the effective time of the merger, the performance targets under any outstanding performance share award of Arbinet for which the measurement date has not occurred will be deemed to have been achieved at the target performance level, and each share of restricted stock represented by such performance share award will be deemed to have been issued, and such |

5

Table of Contents

performance share restricted stock award will be converted into a restricted stock award relating to shares of Primus common stock, based on the exchange ratio in the merger agreement. Each converted performance share restricted stock award will be subject to the same terms and conditions as were applicable under the award immediately prior to the effective time of the merger. Immediately prior to the effective time of the merger, each performance share award for which the measurement date has occurred and for which Arbinet has not issued the performance share restricted stock awards will be converted into a performance share award relating to the number of shares of Primus common stock equal to the product of (x) the number of shares of Arbinet common stock relating to such performance share award immediately prior to the effective time of the merger multiplied by (y) the exchange ratio, rounded down to the nearest whole share. Each such converted performance share award will be subject to the same terms, conditions and restrictions as were applicable under such performance share award immediately prior to the effective time of the merger. |

For more information, see “Terms of the Merger Agreement — Treatment of Arbinet Warrants, Options, Restricted Stock and other Equity Awards” on page 135.

| Q: | Why is approval of the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended, being proposed? |

| A: | Primus common stockholders will vote at the Primus special meeting on a proposal to approve the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended, which includes plan amendments to (1) increase from 1,000,000 to 2,000,000 the number of shares of Primus common stock available for issuance, (2) provide for individual limits of cash awards, (3) amend the share counting provisions for awards paid out in cash or exercised with share withholding or share delivery features, (4) provide for an annual grant of 10,000 non-qualified stock options and 5,000 restricted stock units to non-employee directors, (5) provide that awards shall be made using the closing price of Primus common stock on the date of grant and (6) make certain conforming and updating changes. The Primus board of directors has approved the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended, and has recommended that Primus stockholders approve at the Primus special meeting the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended. As of January 7, 2011, 120,240 shares of Primus common stock remained available for issuance under the Primus Telecommunications Group, Incorporated Management Compensation Plan. For more detail, see “Approval of Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended” beginning on page 165. |

| Q: | What do I need to do now? |

| A: | After reading and considering carefully the information contained in this joint proxy statement/prospectus, please vote promptly by calling the toll-free number listed on your proxy card, accessing the Internet web site listed on your proxy card or completing, signing, dating and returning your proxy card in the enclosed postage-paid envelope. If you hold your stock in “street name” through a bank, broker, custodian or other nominee, you must direct your bank, broker, custodian or other nominee to vote in accordance with the instructions you have received from your bank, broker, custodian or other nominee. Submitting your proxy by telephone, Internet or mail or directing your bank, broker, custodian or other nominee to vote your shares will ensure that your shares are represented and voted at your special meeting. For additional information on voting procedures, see “The Stockholder Meetings” beginning on page 159. |

| Q: | How will my proxy be voted? |

| A: | If you vote by telephone, over the Internet or by completing, signing, dating and returning your signed proxy card, your proxy will be voted in accordance with your instructions. The proxy confers discretionary authority to the named proxies. Accordingly, if you complete, sign, date and return your proxy card and do not indicate how you want to vote, your shares will be voted as follows: |

| • | in the case of Primus, “FOR” approval of the issuance of Primus common stock pursuant to the merger agreement, “FOR” approval of the Primus Telecommunications Group, Incorporated Management |

6

Table of Contents

Compensation Plan, as Amended, and “FOR” the adjournment of the Primus special meeting, if necessary or appropriate, to permit the solicitation of additional proxies; and |

| • | in the case of Arbinet, “FOR” the approval and adoption of the merger agreement and “FOR” the adjournment of the Arbinet special meeting, if necessary or appropriate, to permit the solicitation of additional proxies. |

For additional information on voting procedures, see “The Stockholder Meetings” beginning on page 159.

| Q: | If my bank, broker, custodian or other nominee holds my shares in “street name,” will my bank, broker, custodian or other nominee automatically vote my shares for me? |

| A: | No. If you do not provide your bank, broker, custodian or other nominee with instructions on how to vote your “street name” shares, your bank, broker, custodian or other nominee will not be permitted to vote them on your behalf. Therefore, you should be sure to provide your bank, broker, custodian or other nominee with instructions on how to vote your shares, following the directions your bank, broker, custodian or other nominee provides to you. Please check the voting form used by your bank, broker, custodian or other nominee to see if the broker offers telephone or Internet voting. |

| Q: | What if I fail to instruct my bank, broker, custodian or other nominee? |

| A: | If you are a Primus stockholder and you fail to instruct your bank, broker, custodian or other nominee to vote your shares and the bank, broker, custodian or other nominee submits an unvoted proxy, referred to as a broker non-vote, the broker non-vote will be counted toward a quorum at the Primus special meeting, but will not be considered a vote cast with respect to, and thus have no effect on, the proposal to approve the issuance of shares of Primus common stock pursuant to the merger agreement and the proposal to approve the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended. The broker non-vote also will not be considered voting power present and thus will have no effect on the proposal to adjourn the Primus special meeting, if necessary or appropriate, to permit the solicitation of additional proxies. |

If you are an Arbinet stockholder and you fail to instruct your bank, broker, custodian or other nominee to vote your shares and the bank, broker, custodian or other nominee submits a broker non-vote, the broker non-vote will be counted toward a quorum at the Arbinet special meeting, and effectively will be treated as a vote “AGAINST” the proposal to approve and adopt the merger agreement; however, such broker non-vote will have no effect upon the proposal to adjourn the Arbinet special meeting, if necessary or appropriate, to permit the solicitation of additional proxies.

| Q: | What does it mean if I receive more than one set of materials? |

| A: | This means you own shares of both Primus and Arbinet or you own shares of Primus or Arbinet that are registered under different names. For example, you may own some shares directly as a stockholder of record and other shares through a broker, or you may own shares through more than one broker. In these situations, you will receive multiple sets of proxy materials. You must complete, sign, date and return all of the proxy cards or follow the instructions for any alternative voting procedures on each of the proxy cards you receive in order to vote all of the shares you own. Each proxy card you receive will come with its own postage-paid return envelope; if you vote by mail, make sure you return each proxy card in the return envelope that accompanied that proxy card. |

7

Table of Contents

| Q: | What can I do if I want to change or revoke my vote? |

| A: | Regardless of the method you used to cast your vote, you may revoke your proxy or change your vote at any time before your proxy is voted at your special meeting. If you are a stockholder of record, you can do this by: |

| • | sending a written notice stating that you revoke your proxy to (i) the Secretary of Arbinet at 460 Herndon Parkway, Suite 150, Herndon, VA 20170, with respect to proxies submitted for the Arbinet special meeting, or (ii) the Secretary of Primus at 7901 Jones Branch Drive, Suite 900, McLean, VA 22102, with respect to proxies submitted for the Primus special meeting, as applicable, and in each case such written notice must bear a date later than the date of any proxy previously submitted and must be received prior to the applicable special meeting; |

| • | submitting a valid, later-dated proxy by mail, telephone or Internet that is received prior to the date of your special meeting (if a later-dated proxy is submitted and received in a timely manner according to the foregoing, any proxies previously submitted will be deemed revoked and only the later-dated proxy will be counted); or |

| • | attending your special meeting and voting by ballot in person (your attendance at the special meeting will not, by itself, revoke any proxy that you have previously given). |

If you hold your shares in “street name” and wish to change or revoke your vote, please refer to the information on the voting instruction form included with these materials and forwarded to you by your bank, broker, custodian or other nominee to see your voting options.

For additional information on changing your vote, see “The Stockholder Meetings — Revocation of Proxies” beginning on page 163.

| Q: | If I am a holder of Arbinet common stock with shares represented by stock certificates, should I send in my Arbinet stock certificates now? |

| A: | No. Please do not send in your Arbinet stock certificates with your proxy card. If the merger is completed, an exchange agent appointed by Primus will mail to you a letter of transmittal that will specify that Primus stock certificates will be delivered to you upon surrender of your Arbinet stock certificates to the exchange agent. Additional information on the procedures for exchanging certificates representing shares of Arbinet common stock is set forth under “Terms of the Merger Agreement — Surrender of Shares of Arbinet Common Stock” on page 137. If your shares of Arbinet common stock are held in “street name” by your broker or other nominee, you should follow your broker’s or nominee’s instructions as to how to surrender your “street name” shares and receive shares of Primus common stock issued in the merger. |

| Q: | Are there any risks in the merger that I should consider? |

| A: | Yes. There are risks associated with all business combinations, including the proposed merger. We have described certain of these risks and other risks in more detail under “Risk Factors” beginning on page 38. |

| Q: | Will Primus stockholders receive any shares as a result of the merger? |

| A: | No. Primus stockholders will continue to hold the Primus shares they currently own. |

| Q: | Where can I find more information about the companies? |

| A: | Both Primus and Arbinet file periodic reports and other information with the SEC. You may read and copy this information at the SEC’s public reference facility. Please call the SEC at 1-800-SEC-0330 for information about this facility. This information is also available through the SEC’s web site athttp://www.sec.gov and, with respect to Arbinet, at the offices of the NASDAQ. Both companies also maintain web sites. You can obtain Primus’s SEC filings athttp://www.primustel.com and you can obtain Arbinet’s SEC filings athttp://www.arbinet.com. We do not intend for information contained on or |

8

Table of Contents

accessible through our respective web sites to be part of this joint proxy statement/prospectus, other than the documents that Primus files with the SEC that are incorporated by reference into this joint proxy statement/prospectus. |

In addition, you may obtain some of this information directly from the companies. For a more detailed description of the information available, see “Where You Can Find More Information” beginning on page 183.

| Q: | Whom should I contact if I have questions about the special meeting or the merger? |

| A: | If you are a Primus or Arbinet stockholder and have any questions about the merger or how to submit your proxy, or if you need additional copies of this joint proxy statement/prospectus, the enclosed proxy card or voting instruction forms, you should contact the following information agent/proxy solicitor: |

Georgeson Inc.

199 Water Street, 26th Floor

New York, NY 10038

Banks and Brokers call collect (212) 440-9800

Primus stockholders call toll-free (866) 219-9786

Arbinet stockholders call toll-free (877) 507-1756

If you have more questions about the merger, please call the Investor Relations Department of Primus at (703) 748-8050 or the Investor Relations Department of Arbinet at (703) 456-4100.

9

Table of Contents

This summary highlights selected information from this document and may not contain all of the information that is important to you. To understand the merger fully and for a more complete description of the terms of the merger, you should read carefully this entire document and the other available information referred to under “Incorporation of Certain Documents By Reference” and “Where You Can Find More Information” beginning on pages182 and183, respectively. We encourage you to read the merger agreement, the legal document governing the merger, which is included as Annex A to this document and incorporated by reference herein. We have included page references in the discussion below to direct you to more complete descriptions of the topics presented in this summary.

The Companies (See pages 58 and 59)

Primus Telecommunications Group, Incorporated

Primus, a Delaware corporation incorporated in 1994, is an integrated facilities-based communications services provider offering a portfolio of international and domestic voice, wireless, Internet, VoIP, data, collocation, data center and outsourced managed services to customers located primarily in Australia, Canada, the United States and Brazil. Primus’s largest and primary markets are Australia and Canada where the company has deployed significant network infrastructure. Primus targets customers with significant telecommunications needs, including small- and medium-sized enterprises, multinational corporations, residential customers, and other telecommunication carriers and resellers, and provides these customers with services over Primus’s global, facilities-based network of IP soft switches, media-gateways, hosted IP/SIP platforms, broadband infrastructure, fiber capacity, and data centers located in Australia, Canada, the United States and Brazil. Leveraging this global network, Primus is one of the largest providers of international wholesale voice termination services to other telecommunications carriers and resellers.

Primus’s common stock is currently quoted on the OTC Bulletin Board under the symbol “PMUG.” In connection with the merger, Primus is to use its reasonable best efforts to have its common stock listed for trading on the NASDAQ.

Primus’s principal executive offices are located at 7901 Jones Branch Drive, Suite 900, McLean, Virginia 22102, its telephone number is (703) 902-2800 and its web site iswww.primustel.com.

Arbinet Corporation

Arbinet, a Delaware corporation incorporated in 1996, is a provider of international voice, data and managed communications services for fixed, mobile and wholesale carriers. Arbinet offers these communication services through three primary voice-product offerings, including a spot exchange, a wholesale product called “Carrier Services” and a PrivateExchange product, which allows customers to create virtual connections with other customers.

Arbinet’s common stock is listed on the NASDAQ Global Market and trades under the symbol “ARBX.”

Arbinet’s principal executive offices are located at 460 Herndon Parkway, Suite 150, Herndon, Virginia 20170, its telephone number is (703) 456-4100 and its web site iswww.arbinet.com.

PTG Investments, Inc.

PTG Investments, Inc., which is sometimes referred to as Merger Sub, is a Delaware corporation and a wholly owned subsidiary of Primus. Merger Sub was formed solely for the purpose of entering into the merger agreement. Merger Sub has not carried on any activities to date, except for activities incidental to its formation and activities undertaken in connection with the merger.

Merger Sub’s principal executive offices are located at 7901 Jones Branch Drive, Suite 900, McLean, Virginia 22102 and its telephone number is (703) 902-2800.

10

Table of Contents

Primus, Merger Sub and Arbinet have entered into the merger agreement. Subject to the terms and conditions of the merger agreement and in accordance with Delaware law, Merger Sub will be merged with and into Arbinet, with Arbinet continuing as the surviving entity and a wholly owned subsidiary of Primus. Upon completion of the merger, Arbinet common stock will no longer be publicly traded.

If the merger is completed, each share of Arbinet common stock (other than shares subject to perfected appraisal rights and other than any shares of Arbinet held by Primus, Arbinet or any of their respective direct or indirect wholly owned subsidiaries, in each case except for any such shares held on behalf of third parties) will be converted into the right to receive the number of shares of Primus common stock equal to an exchange ratio, which will be calculated as follows: (i) $28,000,000, which may be increased by the net proceeds of a sale of Arbinet’s patents and associated rights to a third party for cash, divided by (ii) the number of shares of Arbinet common stock issued and outstanding immediately prior to the consummation of the merger plus shares that may become issuable as Primus common stock at or after the closing of the merger in connection with Primus’s assumption of Arbinet’s outstanding warrants, options, stock appreciation rights and other equity awards (but excluding any issuable shares that are subject to Arbinet’s stock options and stock appreciation rights as of the closing of the merger and for which the exercise price or base price, respectively, is greater than the greater of (x) $6.05 per share of Arbinet common stock and (y) the closing stock price per share of Arbinet common stock on the day prior to the closing of the merger, and, with respect to Arbinet’s stock appreciation rights, including only the net number of shares of Arbinet common stock that will be issuable as calculated using the closing price of Arbinet common stock on the day prior to the closing of the merger),divided by (iii) $9.5464.

The actual exchange ratio cannot be determined until just before closing of the merger; however, assuming (i) the $28,000,000 base price is not increased in connection with any sale of patents and (ii) there are an aggregate of 5,722,267 shares of Arbinet common stock issued and outstanding and shares of Arbinet common stock issuable subject to Arbinet warrants and equity awards that meet the requirements described in the preceding paragraph (assuming a per share price of Arbinet common stock of $8.44 and that no shares are subject to a perfected appraisal process), the exchange ratio, as of January 7, 2011 would be expected to be 0.5126 or approximately one share of Primus common stock for 2.02 shares of Arbinet common stock owned. The actual exchange ratio may vary significantly from the ratio determined based on the assumptions above.

The market value of the merger consideration ultimately received by Arbinet stockholders will depend on the closing price of Primus common stock on the day the merger is consummated. Because the market price of Primus common stock will fluctuate, Arbinet stockholders cannot be sure of the aggregate value of the merger consideration they will receive. See “Risk Factors — Risks Relating to the Merger — The calculation of the merger consideration is subject to adjustment for factors that may take place or will be measured at a time that is subsequent to the vote of the Arbinet stockholders, and thus Arbinet stockholders cannot be sure of the aggregate value of the merger consideration that they will receive.”

The merger agreement is attached as Annex A to this joint proxy statement/prospectus and is incorporated by reference.You should read the merger agreement in its entirety because it is the legal document that governs the merger.

Potential Spin-off or Sale of Patents by Arbinet and Benefit to Arbinet’s Stockholders (See page 134)

Arbinet may, but is not required to, spin-off its patents and associated rights to its stockholders or sell such patents and associated rights to a third party for cash, referred to as an IP Sale, provided that any spin-off or IP Sale may not result in any residual liability to Arbinet or any of its subsidiaries (other than for costs, fees and expenses and tax liabilities) and all transaction costs, fees and expenses (which exclude the appraiser’s fees relating to an appraisal of the applicable patents and associated rights) and the gross tax liabilities of Arbinet

11

Table of Contents

(except to the extent offset by net operating losses) attributable to any such spin-off or IP Sale may not exceed $350,000 in the aggregate. In addition, prior to the consummation of any such spin-off or IP Sale, Arbinet must first grant Primus a royalty-free, worldwide, assignable (on a non-exclusive basis) and perpetual license to all of Arbinet’s patents and their associated rights. The amount of any proceeds from an IP Sale, after deducting related transaction costs, fees and expenses and gross tax liabilities, may, at Arbinet’s discretion, be distributed to Arbinet’s stockholders prior to closing of the merger or added, dollar for dollar, to the $28,000,000 base merger consideration. There can be no assurance that Arbinet will effect any such spin-off of patents or IP Sale.

If, after the mailing date of this joint proxy statement/prospectus and before the closing of the merger, Arbinet elects to proceed with the spin-off of its patents and associated rights to its stockholders, then Arbinet would create a new wholly owned subsidiary, a Delaware corporation, into which Arbinet (including, to the extent applicable, through subsidiaries that may be holding patents) would contribute its patents and associated rights and a reasonable amount of cash to maintain the patents and associated rights. Arbinet would then proceed to mail to its stockholders an information statement containing the details of the new subsidiary and the spin-off transaction, which generally would include the separation of the patents and associated rights into the new subsidiary and the distribution of the shares of the new subsidiary by Arbinet to Arbinet’s stockholders as a pro-rata dividend. Arbinet does not currently intend that a public trading market develop in the shares of the new subsidiary that would be distributed to Arbinet’s stockholders in the spin-off. Rather, the shares of the new subsidiary would bear restrictions on transfer and resale, which will be strictly enforced to ensure that no public trading market in the shares develops, unless such stock is at some point in the future registered under Section 12 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The separation would result in the new subsidiary operating as an independent entity with the primary purpose of holding the patents and associated rights it receives from Arbinet, which would be described more fully in the information statement. It is anticipated that Arbinet would not have any ownership or other form of interest in the new subsidiary following the separation. Approval by Arbinet’s stockholders is not required as a condition to the completion of the spin-off transaction.

Treatment of Arbinet Warrants, Stock Options, Restricted Stock and other Equity Awards (See page 135)

Arbinet will have taken all actions necessary under its 2004 Stock Incentive Plan to cancel, as of the effective time of the merger: (a) all outstanding stock options to purchase shares of Arbinet common stock with an exercise price that is, as of the effective time of the merger, in excess of the greater of (i) $6.05 and (ii) the closing stock price of Arbinet common stock on the NASDAQ on the last trading day immediately prior to the closing date of the merger; and (b) all outstanding stock appreciation rights with a base price that is, as of the effective time of the merger, in excess of the greater of (i) $6.05 and (ii) the closing stock price of Arbinet common stock on the NASDAQ on the last trading day immediately prior to the closing date of the merger.

At the effective time of the merger, each outstanding warrant and option to purchase shares of Arbinet common stock will be converted into a warrant or option, respectively, to acquire, on the same terms and conditions applicable to each share of Arbinet common stock, shares of Primus common stock with appropriate adjustments to be made to the number of shares and the exercise prices based on the exchange ratio and otherwise as set forth in the merger agreement. Each outstanding restricted stock award under Arbinet’s equity compensation plans will be converted into a restricted stock award relating to shares of Primus common stock, based on the exchange ratio in the merger agreement, on the same terms and conditions applicable to each share of Arbinet common stock. Similarly, each outstanding stock appreciation right, or SAR, under Arbinet’s equity compensation plans will be converted into an SAR to acquire, on the same terms and conditions applicable under such Arbinet SAR, shares of Primus common stock based on the exchange ratio in the merger agreement, on the same terms and conditions applicable to each share of Arbinet common stock. Immediately prior to the effective time of the merger, the performance targets under any outstanding performance share award of Arbinet for which the measurement date has not occurred will be deemed to have been achieved at the target performance level, and

12

Table of Contents

each share of restricted stock represented by such performance share award will be deemed to have been issued, and such performance share restricted stock award will be converted into a restricted stock award relating to shares of Primus common stock, based on the exchange ratio in the merger agreement. Each converted performance share restricted stock award will be subject to the same terms and conditions as were applicable under the award immediately prior to the effective time of the merger. Immediately prior to the effective time of the merger, each performance share award for which the measurement date has occurred and for which Arbinet has not issued the performance share restricted stock awards will be converted into a performance share award relating to the number of shares of Primus common stock equal to the product of (x) the number of shares of Arbinet common stock relating to such performance share award immediately prior to the effective time of the merger multiplied by (y) the exchange ratio, rounded down to the nearest whole share. Each such converted performance share award will be subject to the same terms, conditions and restrictions as were applicable under such performance share award immediately prior to the effective time of the merger.

Recommendation of the Primus Board of Directors (See page 105)

The Primus board of directors has determined that the terms and provisions of the merger agreement and the transactions contemplated by the merger agreement are advisable and in the best interests of the Primus stockholders, and has approved the merger agreement and the transactions contemplated by the merger agreement.The Primus board of directors unanimously recommends that Primus stockholders vote “FOR” the proposal to approve the issuance of shares of Primus common stock pursuant to the merger agreement, “FOR” the proposal to approve the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended, and “FOR” the adjournment of the Primus special meeting, if necessary or appropriate, to permit the solicitation of additional proxies.

Recommendation of the Arbinet Board of Directors (See page 102)

The Arbinet board of directors has determined that the terms and provisions of the merger agreement and the transactions contemplated by the merger agreement are advisable and in the best interests of Arbinet and its stockholders, and has approved the merger agreement and the transactions contemplated by the merger agreement.The Arbinet board of directors unanimously recommends that Arbinet stockholders vote “FOR” the proposal to approve and adopt the merger agreement and “FOR” the adjournment of the Arbinet special meeting, if necessary or appropriate, to permit the solicitation of additional proxies.

Opinion of Arbinet’s Financial Advisor (See page 110)

The Bank Street Group LLC, or Bank Street, rendered its opinion to Arbinet’s board of directors and special committee of the board of directors that, as of November 10, 2010, based upon and subject to the assumptions made, matters considered, qualifications and limitations set forth in its written opinion, the exchange ratio pursuant to the merger agreement is fair, from a financial point of view, to the holders of Arbinet common stock (other than Primus, Merger Sub, Karen Singer and any of their respective affiliates).

The full text of the written opinion of Bank Street, dated November 10, 2010, which sets forth assumptions made, matters considered, qualifications and limitations on the review undertaken in connection with the opinion, is attached as Annex B to this joint proxy statement/prospectus. Bank Street provided its opinion for the information and assistance of Arbinet’s board of directors and special committee of the board of directors in connection with their consideration of the merger. The Bank Street opinion is not a recommendation as to how any holder of Arbinet’s common stock should vote with respect to the merger, adoption of the merger agreement or any other matter. The summary of the opinion of Bank Street set forth in this joint proxy statement/prospectus is qualified in its entirety by reference to the full text of the opinion.

13

Table of Contents

Opinion of Primus’s Financial Advisor (See page 117)

On November 10, 2010, Houlihan Lokey Capital, Inc., or Houlihan Lokey, rendered its oral opinion to Primus’s board of directors (which opinion was confirmed in writing by delivery of Houlihan Lokey’s written opinion dated November 10, 2010), as to the fairness, from a financial point of view, to Primus, as of November 10, 2010, of the exchange ratio provided for in the merger pursuant to the merger agreement, based upon and subject to the procedures followed, assumptions made, qualifications and limitations on the review undertaken and other matters considered by Houlihan Lokey in preparing its opinion.

Houlihan Lokey’s opinion was directed to Primus’s board of directors and only addressed the fairness from a financial point of view to Primus, as of November 10, 2010, of the exchange ratio provided for in the merger pursuant to the merger agreement and did not address any other aspect or implication of the merger. The summary of Houlihan Lokey’s opinion in this joint proxy statement/prospectus is qualified in its entirety by reference to the full text of its written opinion, which is included as Annex C to this joint proxy statement/prospectus and sets forth the procedures followed, assumptions made, qualifications and limitations on the review undertaken and other matters considered by Houlihan Lokey in preparing its opinion. However, neither Houlihan Lokey’s opinion nor the summary of its opinion and the related analyses set forth in this joint proxy statement/prospectus are intended to be, and do not constitute, a recommendation to Primus’s board of directors or any stockholder as to how to act or vote with respect to the merger or related matters.

Board of Directors and Management of Primus Following the Merger (See page 123)

Primus’s board of directors and executive officers will remain the same following the merger as they are immediately before the merger becomes effective.

The Primus Special Meeting (See page 159)

Date, Time and Place

The Primus special meeting will be held onFebruary 25, 2011 at 9:00 a.m., Eastern time, at the Hilton McLean Tysons Corner located at 7920 Jones Branch Drive, McLean, VA 22102.

Purpose

The purpose of the Primus special meeting is as follows:

| • | to consider and vote upon a proposal to approve the issuance of shares of Primus common stock pursuant to the merger agreement, as it may be amended from time to time; |

| • | to consider and vote upon the Primus Telecommunications Group, Incorporated Management Compensation Plan, as Amended; and |

| • | to consider and vote upon a proposal to adjourn the special meeting, if necessary or appropriate, to permit the solicitation of additional proxies if there are not sufficient votes at the time of the special meeting to approve either of the foregoing proposals. |