EXHIBIT 99.1

Charter Financial Corporation Annual Meeting

February 26, 2003

| 1. | | Title/Logo (for guidance only … slide titles not intended to be read) |

Good morning ladies and gentleman and thank you for joining us today for the Charter Financial Corporation annual meeting.

Before we get started, I’d like to remind you that some of the ground we will cover today may include forward-looking statements that are based on our best assessments of the situation and probable future outcomes.

I won’t read all of the cautions included on this slide, but I strongly recommend that you consider the risks and assumptions outlined in the annual report you have received today and our regular filings with the Securities and Exchange Commission.

Today I’m going to review the past year—our first as a publicly traded company—and some of the factors that contributed to our results.

Curt Kollar, our chief financial officer, will follow that with a brief discussion of our financial data.

Then I’ll return with some brief closing comments before we take any questions.

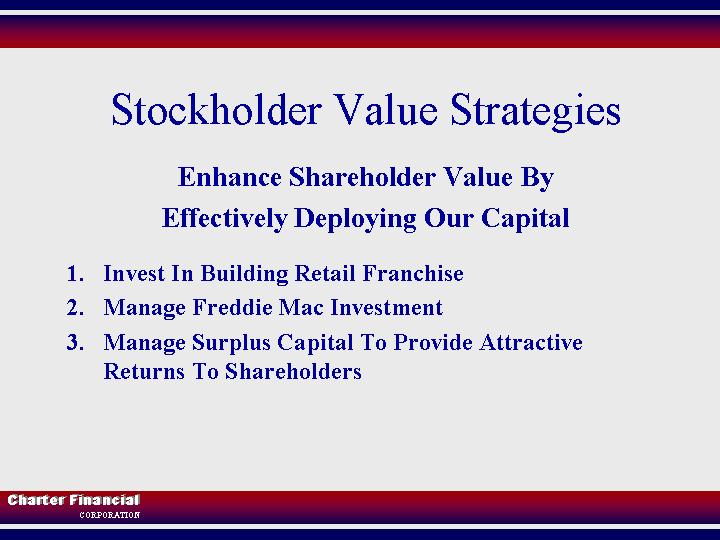

| 3. | | Stockholder Value Strategies |

Our focus at Charter Financial Corporation is to enhance shareholder value.

We aim to do this through effective deployment of our capital on three fronts:

| | • | | By expanding our retail franchise to ultimately create a higher level of ongoing earnings |

| | • | | By managing our substantial investment in Freddie Mac common stock |

| | • | | And by managing our surplus capital—some of it the result of our initial public offering—to provide the attractive returns to our shareholders |

I will cover each of these in greater depth shortly, but first I’d like to take a look at our ownership structure and some of the unique advantages it gives us in executing our strategy.

| 5. | | Ownership Structure (organization chart) |

As you’ll note, Charter Financial Corporation is the parent company of CharterBank, our principal operating subsidiary.

The corporation’s stock is owned by you, our shareholders, and by First Charter, MHC, a Mutual Holding Company.

| 6. | | Ownership Structure (text) |

The Mutual holding company owns 80 percent of the outstanding shares of Charter Financial.

It has waived its right to receive dividends since the first one beginning last June.

It also has indicated it will continue to do so subject to the board’s duties to the MHC membership. When the MHC waives its dividend you, the 20 percent owners, receive the benefit of the cash dividend.

Both Charter Financial and CharterBank have strong capital structures.

| 7. | | Stockholder Value Strategies (retail bank) |

As I mentioned, deploying that capital is the key to our strategy of enhancing shareholder value. One element of that strategy is to build our retail franchise through acquisitions and opening new branches. Ultimately, we expect the franchise to throw off higher earnings. However, over the near term we will push for growth rather than current earnings.

We believe CharterBank is well positioned for growth because of our emphasis is on providing the products, convenience and service that is highly valued by our customers. Our service philosophy is built on respecting the value of our customers’ time.

| 9. | | An Entirely new banking experience |

Our challenge is to make each customer interaction a pleasing experience from the customer’s perspective.

Growth through the acquisition route is a relatively sure path. The just-completed acquisition of EBA BancShares, the parent company of Eagle Bank of Alabama, is an excellent example of how we plan to employ that avenue to grow our retail franchise.

For 8.4 million dollars, we acquired three branches and $62 million in deposits—and the corresponding customer relationships—and furthered our expansion in the important and growing Auburn-Opelika area. Purchase accounting will result in about $6 million of intangible assets as a result of the transaction.

| 11. | | Access & Customer Experience (branch map) |

We now have eight full-service branches along our I-85 corridor market area. There is a significant crossing of markets with customers living in one market and working or shopping in another.

| 12. | | Market Area Demographics |

While we have been the dominant player in our traditional base of “The Valley,” this market is declining.

The area has been dependant on textile manufacturing, which is traditionally a low-wage industry and is facing fierce foreign competition.

That is why we are concentrating on expanding to new, more vibrant markets such as Auburn-Opelika.

The Eagle Bank acquisition builds on the momentum we have established by opening a de novo branch in Auburn a little over a year ago.

| 13. | | Retail Strategy (text & TFC photo) |

In all our markets, we continue to concentrate on building business around the teller counter by promoting core deposit products like Totally Free Checking, savings accounts and money market accounts. On the lending Side, we maintain our traditional focus on 1-4 real estate based lending while strengthening the commercial real estate side.

| 14. | | Retail Strategy (outstanding convenience) |

We also provide our customers unmatched convenience with

| | • | | Extended lobby and drive-in hours |

| | • | | 24-hour telephone banking |

| | • | | And conveniently located ATMs |

| | • | | And our “spinning penny” coin counter has been a hit for young and mature customers alike. When penny starts spinning and running the tally, the lobby gets festive whether its kid’s piggy bank or an oldtimer’s pickle jar everyone gets a kick out of watching someone’s pocket change realize a dream. |

All these things are aimed at providing outstanding convenience and time-valuing service and a good experience for our customer.

| 15. | | Stockholder Valuation Strategies (manage FRE) |

The second element in our strategy of building shareholder value is to effectively manage our sizeable investment in Freddie Mac stock.

Charter Financial and its subsidiaries own a total of about 4.66 million shares of Freddie Mac, which is traded on the New York Stock Exchange asF-R-E. The MHC owns an additional 400,000 shares.

At the end of the first quarter on December 31, we had an unrealized gain of nearly 165 million dollars on that investment. When I talk about gains I am referring to the after tax gain.

Freddie Mac currently pays an annual dividend of 88 cents a share, equivalent to about 21 cents for each Charter Financial share.

| 17. | | Stock Performance (FRE chart) |

We have owned stock in Freddie Mac for about 16 years and, over the past 10 years; it has delivered an annual rate of return of 17.5%. This chart graphically illustrates the Price performance of our Freddie Mac stock over the past 10 years.

| 18. | | Manage Freddie Mac Investment |

Our long-term strategy with our Freddie Mac investment is to gradually diversify it as needed to further implement our growth plan.

In doing so, we expect to balance the potential growth in value of the Freddie Mac stock with the income we could realize by partially cashing it out and investing in other income producing operations.

| 19. | | Stockholder Valuation Strategies (manage surplus capital) |

The third leg of our shareholder value enhancement strategy is to manage and deploy our surplus capital.

Cash dividends are one means we use to realize the twin goals of managing our capital and rewarding shareholders.

As I mentioned earlier, First Charter MHC has waived its right to dividends and has indicated it will continue to do so as long as waiving meshes with the interests of the MHC and its depositors.

We instituted our first quarterly dividend of 10 cents a share last June.

The first two payouts were equivalent to about 25.3% percent of net income and about a 1.3% annual yield on the stock price of $31.08 on December 31.

| 21. | | Stock Purchases and Buybacks |

Stock purchases and buybacks are another tactic in our stockholder value strategy.

We recently completed purchases of 158,000 shares to fund our restricted stock plan.

With your approval today, we will be looking to purchase another shares 125,000 for that plan.

We also will evaluate stock buybacks against other capital management strategies as a means of managing shares outstanding thereby increasing the value of remaining shares and future dividends to minority shareholders.

| 22. | | $216 Million In Surplus Capital |

Our legal and financial structure presents enormous opportunity for shareholders but there are numerous financial, tax and regulatory issues to be considered.

We have about 216 million dollars in surplus capital between Charter Financial and the bank.

Charter financial has 15 million dollars in cash plus an unrealized gain of 74 million dollars in Freddie Mac stock.

CharterBank’s capital, review, is 37 million dollars above the regulatory “well-capitalized” level.

The bank also has an unrealized gain in Freddie Mac stock totaling about 90 million dollars.

The overall capital exceeds any foreseeable retail franchise needs.

| 23. | | Capital Management Goals |

As we consider our capital management options, we have three primary goals in mind:

To use the Mutual Holding Company dividend waiver to maximize returns to minority shareholders

To minimize share dilution to minority shareholders

And to build stock liquidity

| 24. | | Stock Performance (vs. Nasdaq) |

The soundness of our strategy, the potential of our structure and our success to date apparently has been recognized by the investment community, as our stock’s performance since the Initial Public Offering indicates.

During the period following our first trading day of October 17, 2001—when we closed at $14.25/share, already up substantially from the 10-dollar IPO price—our stock has appreciated more than 120 percent.

That far outstrips the Nasdaq Composite, which is in negative territory over that period.

| 25. | | Stock Performance (SNL chart) |

We have outperformed other mutual holding companies over the past year as well. You can see from this slide that MHC’s generally found favor with investors last year.

| 26. | | Charter Financial Among Top 10… |

As a sidebar Charter Financial was selected by the Atlanta Journal Constitution as one of the Top 10 performing stocks in Georgia during 2002.

At this point I’d like to recognize some of the people who contributed to our success over the years.

First, among my fellow directors—and I’ll ask each of you to stand when I call your name—are:

| | • | | Bubber Johnson, my father, chairman of the board, who has been a director and a guiding force since the bank’s inception in 1954. |

Among my fellow executive officers are:

| | • | | Lee Washam, Executive Vice President |

| | • | | Curt Kollar, Chief Financial Officer, who will be speaking to you shortly |

| | • | | Bill Gladden, Vice President and Corporate Secretary |

We also have several vice presidents who offer valuable insight and guidance in our quest for excellence:

| | • | | Phyllis Boyett, Vice President, Director of Human Resources |

| | • | | Patrick Crews, Regional Vice President in Lagrange |

| | • | | Tom Cyphers, Vice President, Real Estate Division |

| | • | | Linda Drummond, Regional Vice President here in the valley |

| | • | | John Harrell, Regional Vice President in Lee County-Auburn/Opelika |

| | • | | Mike Trimeloni, Vice President, Credit Administration |

| | • | | Donna Williams, Vice President, Director of Marketing |

And here are our other officers who supervise the day-to-day operations at our offices and generally make it possible for us to perform on plan.

I’d also like to take a moment to mention the Charter Foundation, the charitable arm of CharterBank of which we are especially proud.

The foundation, which was created in 1994, now has about $6.7 million dollars in assets. For each of the last couple of years it has awarded about $400,000 in grants in support of our local communities. By the end of 2003, the cumulative grants will exceed $2 million.

| 32. | | Financial Performance |

With that I’d like to turn meeting over to our chief financial officer, Curt Kollar, for a review of our financial performance.

Curt…

(Financial Performance Slide Remains Up)

Thank you Bob.

Rather than recap all the numbers, I’m going to cover some of the key points in our performance.

As you know, with rapidly declining interest rates and low economic growth, this has not been the best economic climate for many banks.

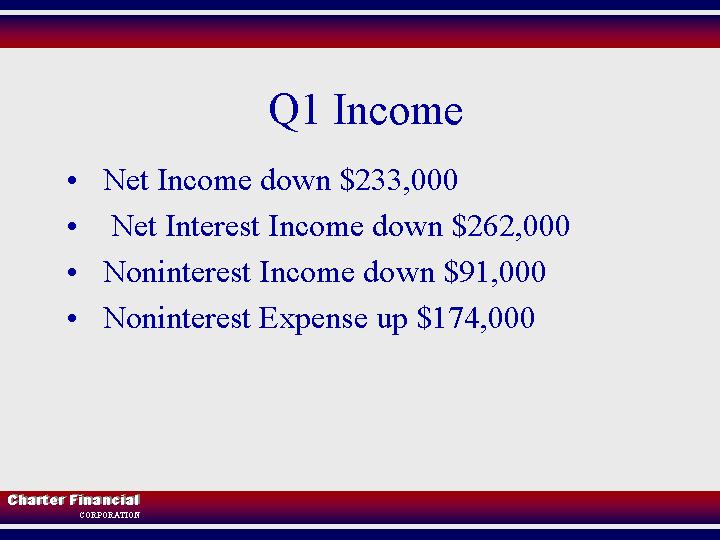

Our net income for fiscal 2002 was 2.9 million dollars, which is about 1.9 million dollars less than the prior year.

This was the result primarily of lower net interest income and increased noninterest expense. I will talk more about our net income after discussing a couple balance sheet changes.

Total assets are up 87.6 million dollars, reflecting the increase in leverage using mortgage-related securities and borrowings.

The Realized stockholders’ equity—or equity excluding the unrealized gains or losses on securities—is up 37 million dollars, most of which consisted of proceeds from the stock offering.

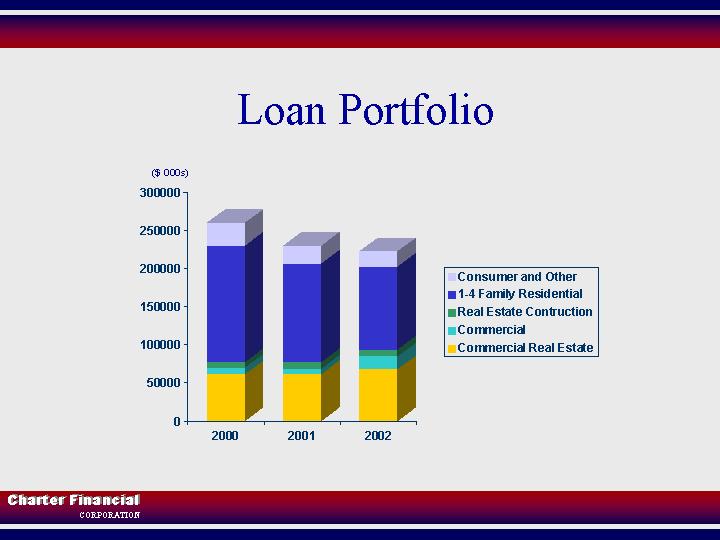

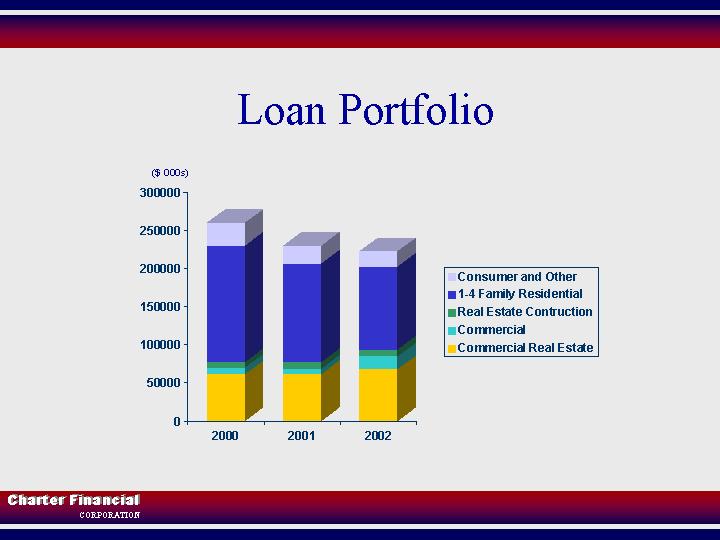

The loan portfolio decreased primarily as a result of runoff in one-to-four family residential mortgages,

We purposefully are shifting our loan mix toward commercial real estate from single family residential but the single family REFI boom made this happen faster than we intended.

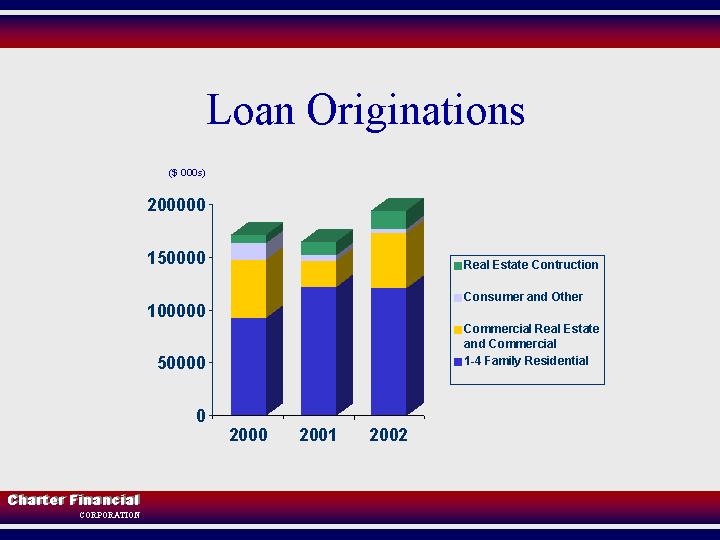

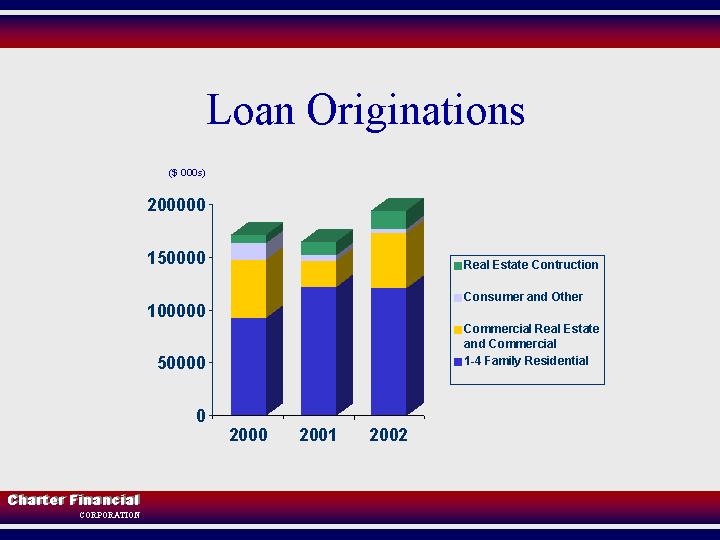

Loan originations were strong, including commercial real estate lending.

One-to-four family originations were also strong BUT MOST of the loans were sold into the secondary market. retained single family loans did not offset the runoff from the portfolio.

Core deposits continued to grow as a result of our market expansion, improved convenience such as extended hours and our investment in marketing initiatives to attract new checking accounts.

Along with the checking account growth came a corresponding increase in deposit fees.

| 39. | | Mortgage Banking Revenue |

Mortgage banking revenue continued an upward trend because of record-levels of activity, primarily refinancing.

We do not, however, believe we can maintain this level as the refinancing wave may have peaked.

| 40. | | Yields And Margin w/o FRE |

Excluding our Freddie Mac investment, margins were compressed by low rates and the wholesale leverage.

Back in the March 2001 quarter, rates looked low by historical standards so we locked in fixed-rate Federal Home Loan Bank advances to reduce our liability sensitivity.

These advances, with rates between 6.22 % and 5.4%, became expensive, as rates continued their downward path.

We also have a couple of floating rate advances with periodic floors that have hurt our interest margin.

Restructuring these borrowings is expensive at current rates due to market-based prepayment penalties, but Restructuring is something we are evaluating.

We’ve also been affected by refinancing in one-to-four family loans, which have shrunk our loan portfolio and reduced margin and interest income.

Rates are so low that we have not been able to reduce deposit rates to the same extent that yields on assets have come down. Building the retail franchise will allow us to reduce the proportion of wholesale leverage and thus increase the net interest margin.

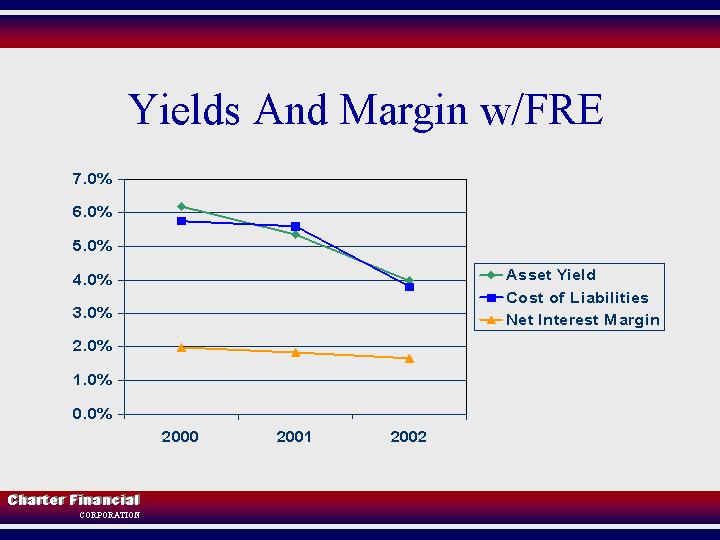

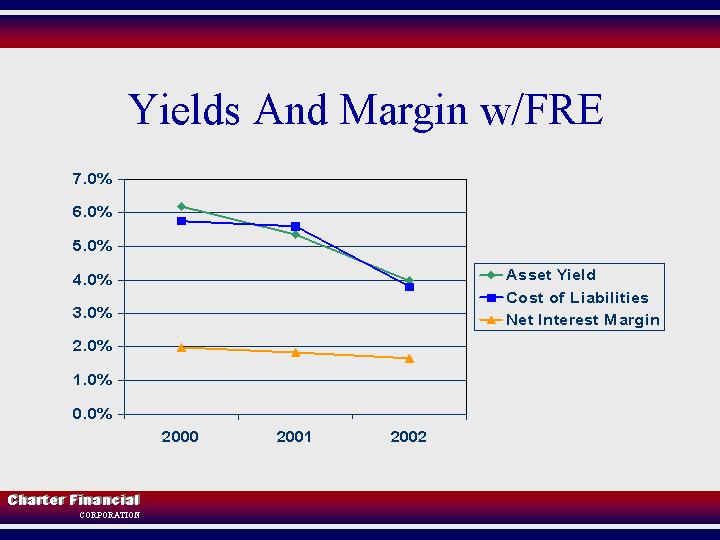

| 41. | | Yields and margin w/ Freddie |

When you add the effects of owning Freddie Mac stock, with a dividend yield on Freddie Mac stock of 1 to 1.5 percent, that reduces our asset yield and gives us a relatively low spread.

While this is the accepted methodology, we feel that looking at the margin and spread without the Freddie Mac stock provides more meaningful information and a more meaningful comparison with other financial institutions.

Components of the increase in non-interest expense between 2001 and 2002 include:

| | • | | The cost of Stock-based compensation |

| | • | | Marketing the high performance checking program, extending branch hours and opening a branch in Auburn market. |

| | • | | Building our commercial loan credit capabilities. |

| | • | | New expenses, including professional fees, associated with being a public company. |

This higher level of expenses reflects our decision to invest in building the retail franchise knowing that it will lower current earnings and build future value.

As these points illustrate, similar income trends continued into the first quarter.

Net interest income and margin compression continued, exaggerated by the amortization of premiums on mortgage securities.

Noninterest income was down 91,000 dollars, but the prior-year quarter included 300 thousand dollars more in gains on sale of securities.

Deposit fees and the gain on the sale of loans increased.

Higher compensation expense was the most significant factor in the increase in noninterest expense.

| 44. | | Title/Logo (looking ahead) |

Now Bob will provide an overview of what to look for the balance of this year.

Bob …

Thank you Curt

As we look forward to the balance of fiscal 2003, we expect the second half of the year to show improvements, barring any dramatic changes to current trends.

As THE REFINANCING wave subsides, we expect the margin pressure to ease somewhat.

We have every reason to believe Freddie Mac sometime in the next few weeks will increase its cash dividend, as the company has for 10 consecutive years.

We also expect to continue growing core deposits and the corresponding fee income.

Gains on sales of loans, however, may diminish as refinancing activity decreases.

| 46. | | Stockholder Valuation Strategies |

A key part of our capital deployment strategy is to build our retail bank franchise, a goal that remains at the forefront.

We also plan to replace low-return wholesale products with retail products and to control noninterest expense.

As to our excess capital, we are continually examining means of trading that for earnings, such as with retail expansion.

We also will consider sales of Freddie Mac stock to fund acquisitions and build earnings.

The level of dividends, as well as buybacks, will be a strong consideration as we go forward.

We believe continuing to execute our three-prong strategy will help us achieve higher shareholder value.

Curt and I thank you for your attention and our entire management team looks forward to delivering on our goal of building the value of your investment in Charter Financial.

At this time we’ll take any questions you may have.