Exhibit 99.1

Charter Financial Corporation

Annual Meeting PowerPoint Presentation Script

March 16, 2005

| 1. | Good morning, ladies and gentlemen and thank you for joining us today. |

| 2. | Before I begin, I need to remind you that some of the ground we’ll be covering today may include forward looking statements that are based on our best assessment of the situation and probable future outcomes. I won’t read all the cautions included in this slide, but I strongly recommend that you consider the risk and assumptions outlined in the annual report and our regular filings with the Securities and Exchange Commission. Today we are going to review the past year, which was our third full year as a public company, along with some of the factors that contributed to our results. |

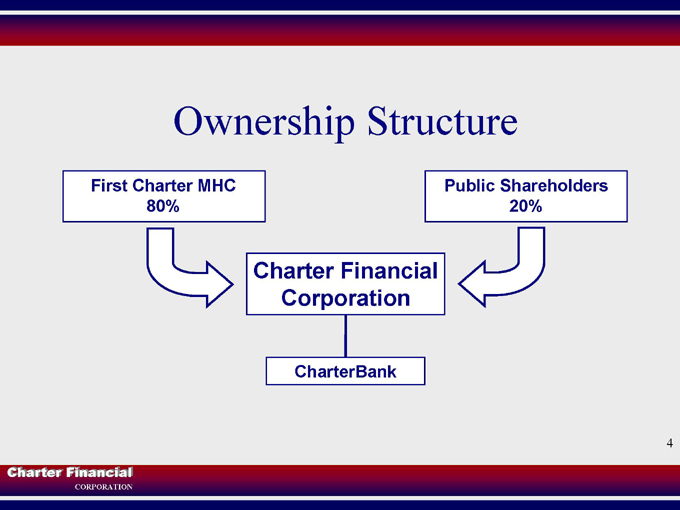

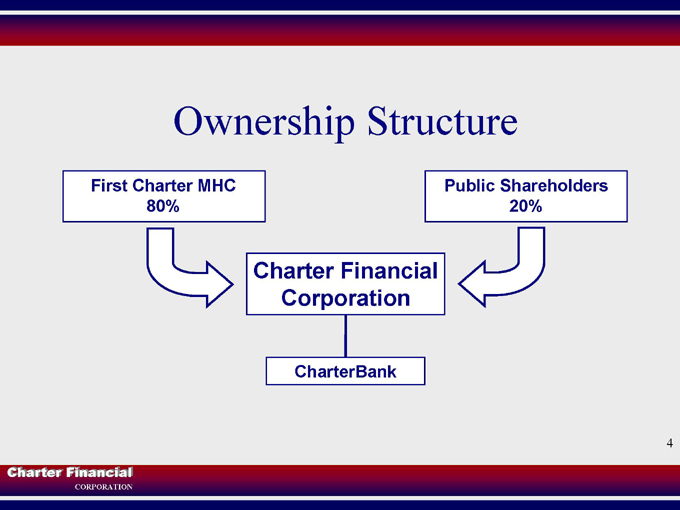

| 3. | Here are some key facts about our company: First our legal and corporate structure is relatively unusual. Although Charter Financial has 19.8 million shares outstanding, only 20% of those shares are owned by public shareholders. The other 80% of the shares are controlled by First Charter, MHC. First Charter, MHC is a mutual holding company that is owned by the depositors of CharterBank. Second, our earnings and our earnings structure are improving as we add loans and core deposits to our balance sheet. Third, we are regulated by the Office of Thrift Supervision. Fourth, we are very strongly capitalized. Much of that strong capital position is due to a very large unrealized gain in Freddie Mac stock, which we purchased in the middle 1980’s. |

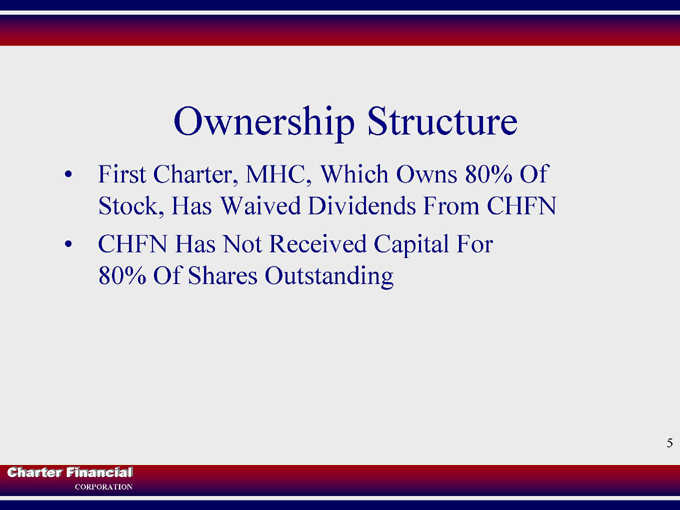

| 4. | Our ownership structure is illustrated on this slide. First Charter, MHC owns 80% of Charter Financial Corporation shares and the other 20% are owned by public shareholders. Charter Financial Corporation owns CharterBank. |

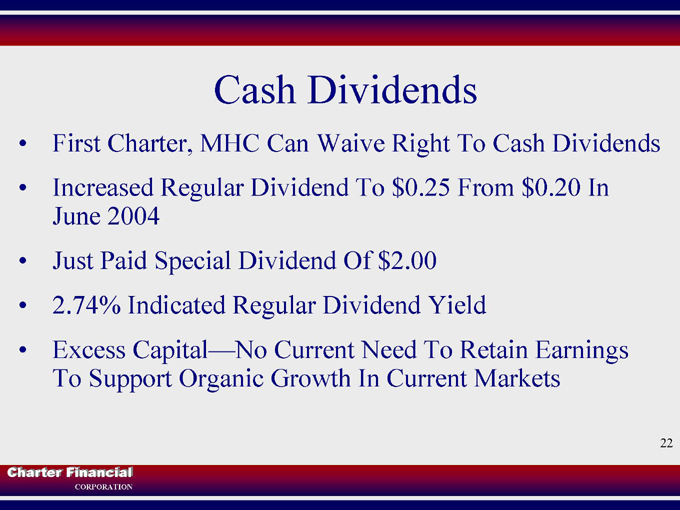

| 5. | A key benefit of our mutual holding company ownership structure is the ability of the 80% owner, the mutual holding company, to waive its receipt of dividends from Charter Financial. So far, the mutual holding company has done that. It can do that because it has not contributed any capital to Charter Financial for its stock, its uses for cash are limited, and it benefits from a high Charter Financial stock price. |

| 6. | Our value results from: (1) the security of investing in a very highly capitalized and conservatively managed savings institution; (2) upside capacity to grow bank earnings; (3) future appreciation in the Freddie Mac stock; (4) the unique capital management opportunities that arise from our mutual holding company structure; (5) our cash dividend that we expect will rise as earnings from operations and Freddie Mac dividends grow. |

| 7. | Our stock recently traded above $40 per share. Insiders own 3.4% of the total shares outstanding and 17.5% of shares owned by the public. Our market capitalization, at $721 million on March 14, placed us in the top 100 financial services companies traded on the NASDAQ. Our total assets topped one billion dollars. |

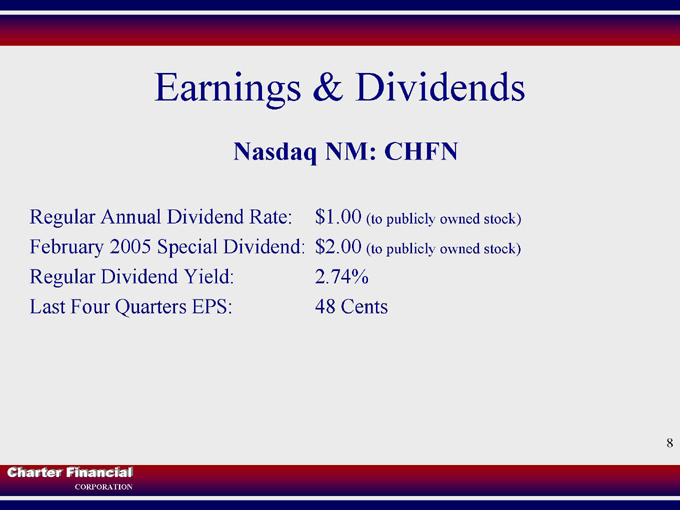

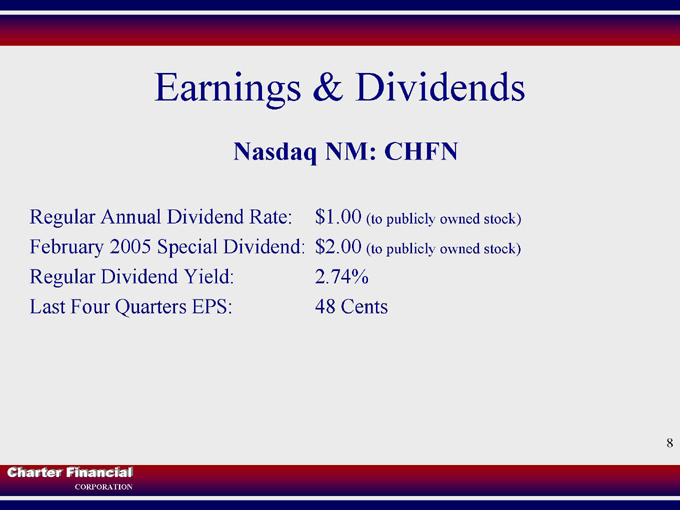

| 8. | We are currently paying a regular annualized dividend of $1.00 a share to the public stockholders. On February 1st we paid a $2.00 special dividend. Our dividend yield is currently 2.74%, excluding the special. Over the last 4 quarters, we earned 48 cents per share; last quarter 15 cents per share. |

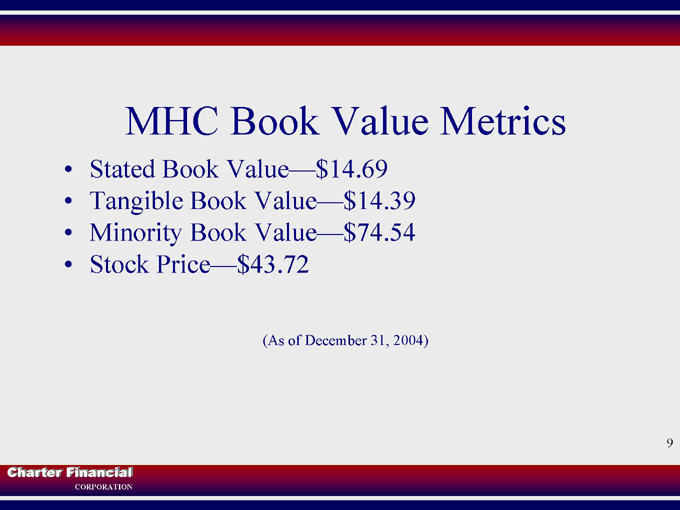

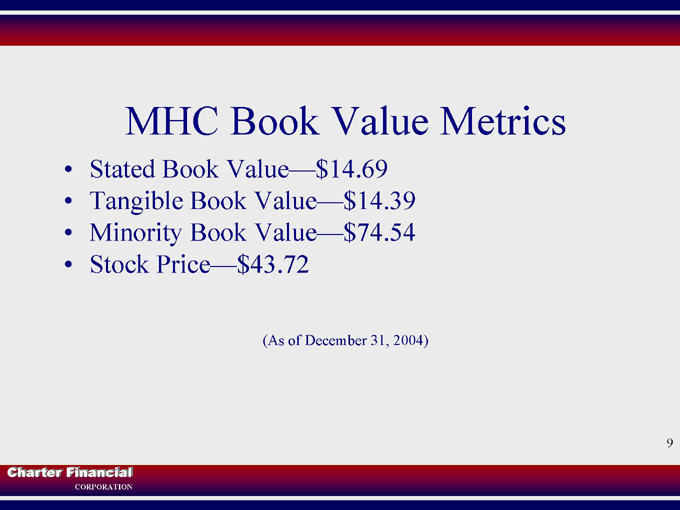

| 9. | Many bank investors look at the book value of bank stocks. Because of our mutual holding company structure, some investors and analysts look at an additional book value measure. The traditional measure of book value, what we call “stated book,” equals $14.69 per share, and it is calculated by dividing total capital of $290.2 million by total shares outstanding, of 19.8 million. “Tangible” book value is stated book adjusted for the goodwill and deposit premium from our last acquisition. The non-traditional measure, what we call “minority book value,” is calculated by dividing our total equity capital of $290.2 million by the 3.9 million shares owned by the public. This works out to a minority book value of $74.54. Our stock price seems to have settled into a range about midway between stated book and minority book value. |

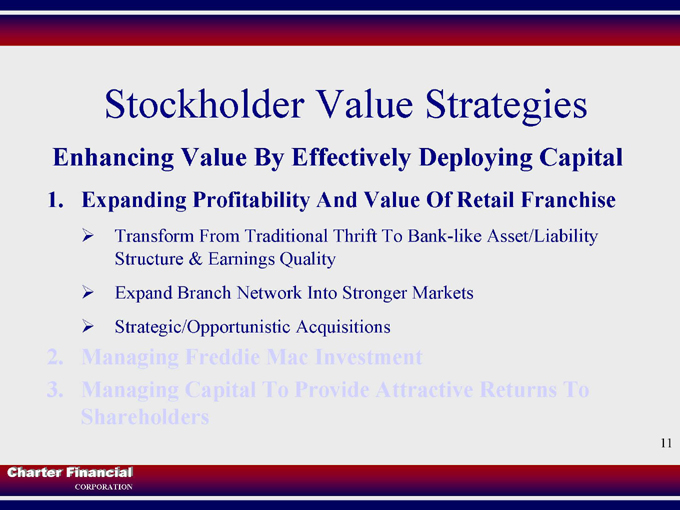

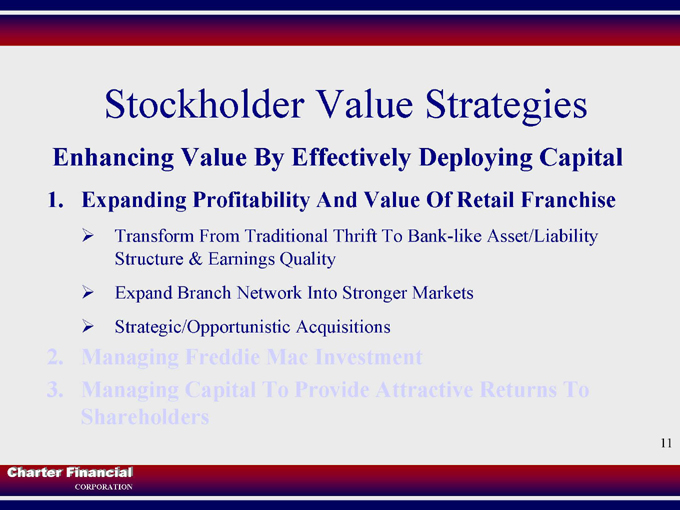

| 10. | We have a three-part strategy for effectively deploying our capital and creating shareholder value. The first strategy is to make our community bank franchise more profitable and valuable. The second is to manage the 4.57 million share investment in Freddie Mac stock, which last Friday was valued at $295.5 million, before taxes. The third strategy is to use our capital efficiently. |

| 11. | Our first shareholder value creation strategy is to increase the profitability and the value of our community bank franchise. Charter’s strong capital base gives us a lot of room to grow and improve balance sheet earnings potential. More specifically, through organic growth and de novo branching we hope to build-up market share in our better growth markets and continue to diversify the balance sheet. Over time, we want to add more loans and core deposits and shed a few securities and reverse repurchase agreements. In addition, we feel that acquisitions can help us build our bank more quickly. We are willing to look beyond our current footprint for both acquisitions and de novo growth opportunities. |

| 12. | Gaining market share in better markets and focusing our product growth onto core deposits and commercial real estate loans increases the value of the community bank franchise. It improves the diversity of our customer base and decreases the volatility associated with residential mortgage finance. Like most community banks, part of our customer value proposition is to provide great service. Our tactics are to deliver banking services with accuracy, speed, friendliness and great convenience. We work continuously to improve our customers’ banking experiences. Last month we completed a computer systems conversion with that goal foremost in mind. |

| 13. | Improving operating efficiency is another goal. We recently acquired a new 19,000 square foot operations building and we will consolidate operations and corporate personnel from five buildings into one. The first wave of people will move into the CharterBank Corporate Center this weekend. |

| 14. | The Interstate-85 corridor, where it crosses the state line between Alabama and Georgia, present some interesting competitive dynamics. The interstate highway links three distinct trade areas and 4 counties economically. These four counties have a population of 240,000 people and have grown at nearly 2% per year since 1990. However, we appear to be unusual in defining a cross-state line market since we are the only bank with significant aspirations in all three markets. We have nine branches and four loan production offices straddling this Interstate highway corridor. Charter has a 13% share of the market. |

| 15. | This map gives you some indication of our market reach and of our opportunity. Note the proximity of the Atlanta MSA to the northeast, the Columbus MSA to the south and the Auburn MSA to the west. Interestingly Troup County, Georgia and Chambers County, Alabama were included in the AtlantaMicropolitan Statistical Area for the 2000 US Census. This means that at least 15% of the workers from these counties commute to the Atlanta MSA to work. The Auburn market is the fastest growing MSA in Alabama and the 19th fastest growing MSA in the US. The county has been growing at a 3.2% constant annual rate over the last decade. Having success penetrating these growing markets is a key to building our franchise and putting our capital to work. |

| 16. | Last Friday we opened a new branch in Lagrange. We have also acquired property to replace two branches in the Auburn-Opelika market. |

| 17. | Our second stockholder value strategy is to manage our Freddie Mac stock effectively. |

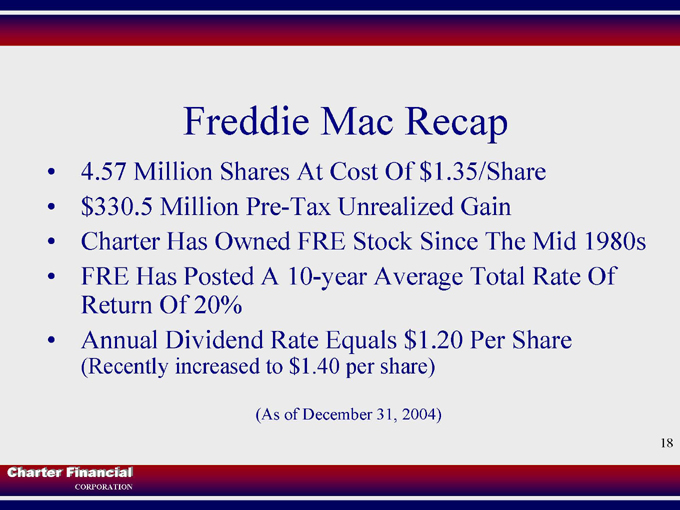

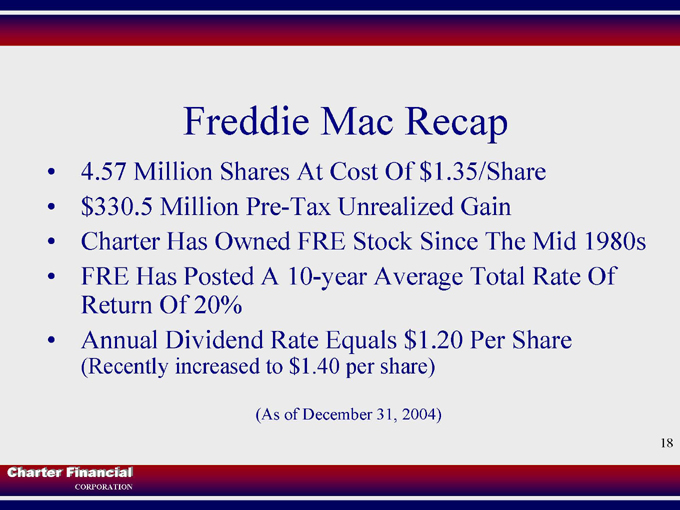

| 18. | To recap our Freddie Mac position, we currently have 4.57 million shares of Freddie Mac stock in Charter Financial and in the companies it owns. These shares were purchased in the middle 1980’s for an average price $1.35 per share. It closed last Friday at $64.70 so the value of the shares was $295.5 million. On our balance sheet, we hold it net of taxes that we would pay were we to sell it. The price of the stock has been volatile at times. It closed last September 30, 2004 at $65.24 and reached an all time high December 31st at $73.70 but pulled back to $60.11 on February 23rd on big sister, Fannie Mae’s, accounting problems. Freddie Mac recently increased their dividend to $1.40 per share annually. Over the last 10 calendar years, Freddie Mac has posted an average rate of return of almost 21%. |

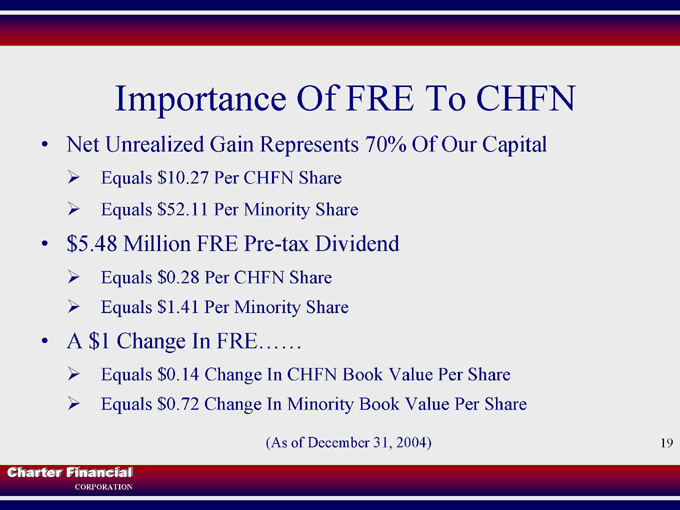

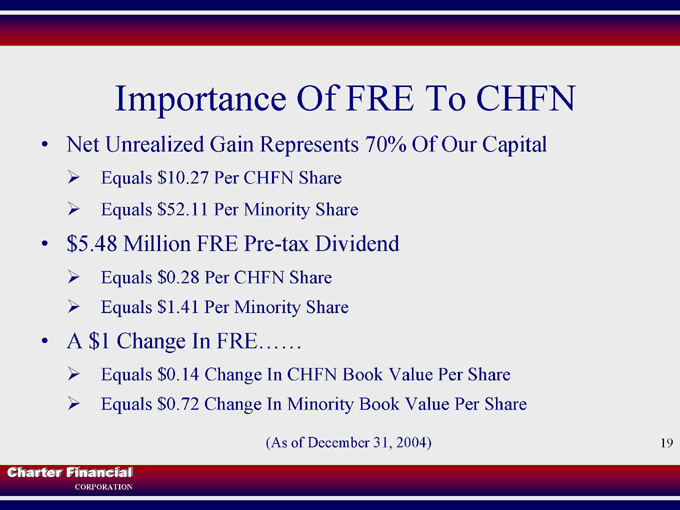

| 19. | Freddie Mac is important to Charter Financial: the unrealized, after-tax gain represents 70% of our total capital or $10.27 per share on total shares outstanding and $52.11 per minority share. Its $5.48 million pre-tax dividend is equal to 28 cents per Charter Financial share and $1.41 per minority share. When Freddie Mac’s price changes by $1, Charter Financial’s book value per share, total outstanding, changes by 14 cents and by 72 cents per minority share. |

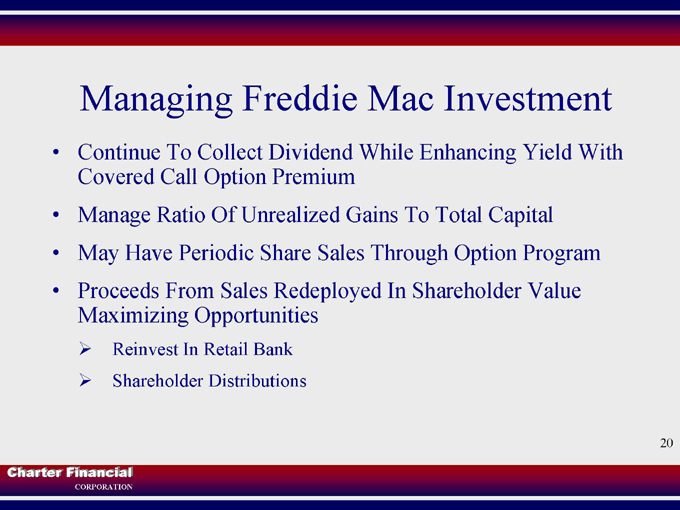

| 20. | Last fall we increased our covered call program to write covered call options against up to 400,000 shares of our Freddie Mac stock. Our goal is to enhance the stock’s yield by collecting premium income from writing call options against the stock in addition to regular dividends. We think the call writing program can also give us a tool to manage the growth in the ratio of unrealized equity to total equity which is currently 70%. When Freddie Mac |

| | is moving higher, we could see some options exercised and proceeds realized from stock sales. These sales proceeds can be reinvested into earning assets or paid out to shareholders. |

| 21. | The third stockholder value strategy is capital management. |

| 22. | Our key capital management strategy is to pay an attractive dividend to shareholders. Up to now, First Charter, MHC with the concurrence of the Office of Thrift Supervision, has waived its rights to cash dividends paid by Charter Financial. A few weeks ago we paid a $2.00 per share special dividend. Our regular quarterly dividend of $0.25 per share indicates a 2.74% dividend yield. With excess capital at CharterBank and Charter Financial, there’s no current need to retain earnings to fund organic growth, however, future dividends will be dependent on future cash needs and core operating earnings. |

| 23. | During fiscal 2004 we paid out less than half our earnings in dividends. |

| 24. | We regularly evaluate all the capital management tools. |

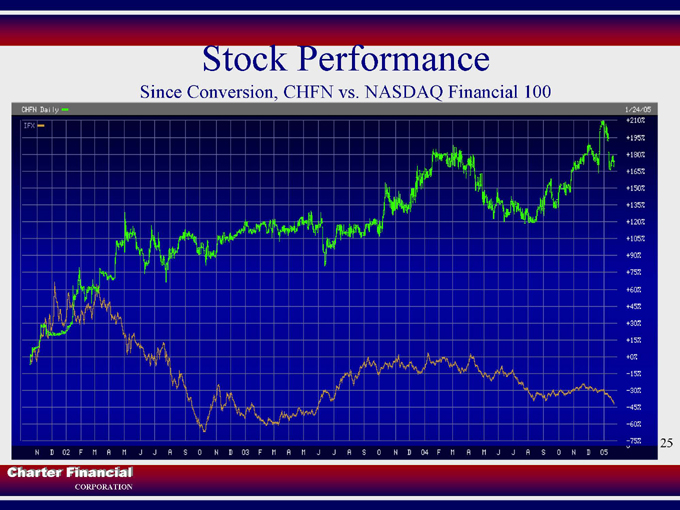

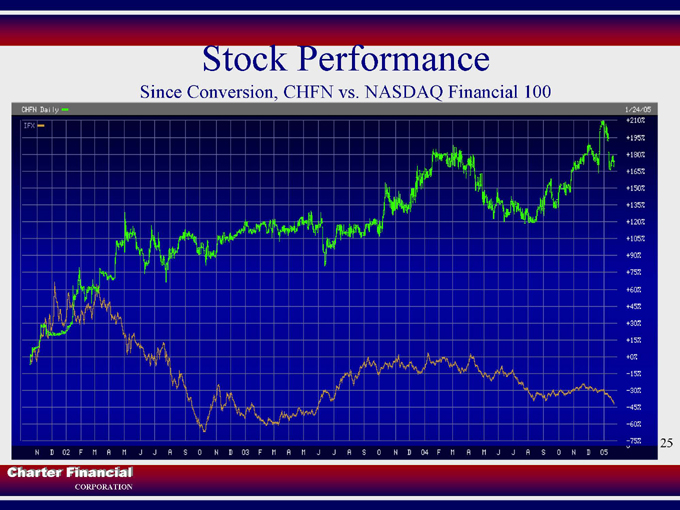

| 25. | This slide shows the performance of Charter Financial versus the NASDAQ 100 Financial Companies since we came onto the market. Our stock has done quite well. In summary, our capital management goals are to use the MHC dividend waiver to enhance returns to public shareholders, when it’s appropriate. When we have good investment opportunities, excess capital will be used to acquire and build core earnings. |

| 26. | Charter Financial logo. I’d like to ask Curt to step up for a moment and talk about our financial performance. |

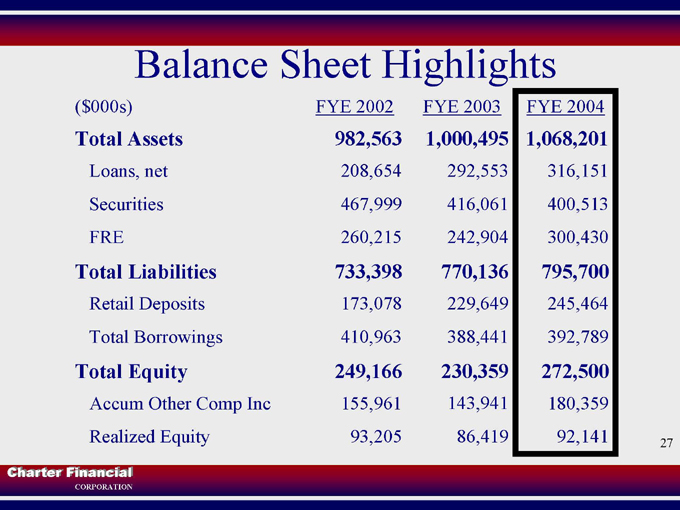

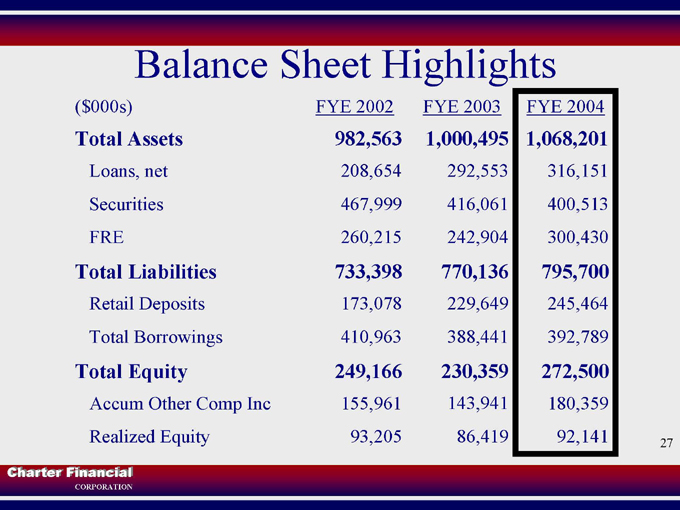

| 27. | Thank you Bob. Good morning. I would like to cover our financial position. Let’s look at some of the key balance sheet items. |

| | a. | At year-end our total assets were up $68 million over the prior year with our Freddie Mac stock accounting for $58 million of the increase. |

| | b. | The price of Freddie Mac was also the primary reason our accumulated other Comprehensive income and thus total equity were up $42 million |

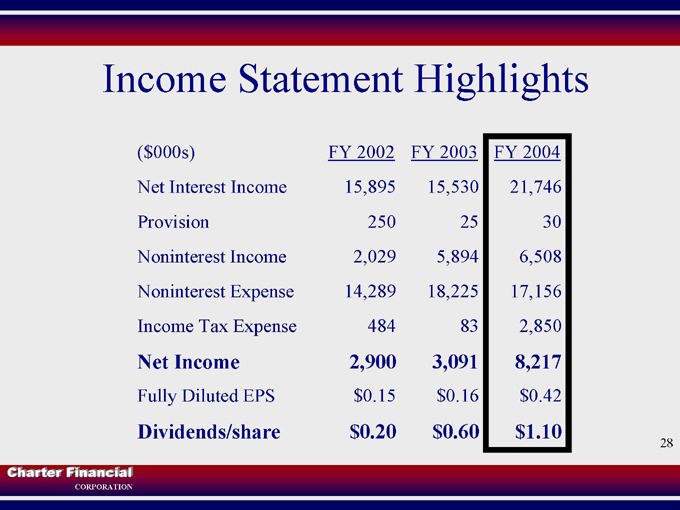

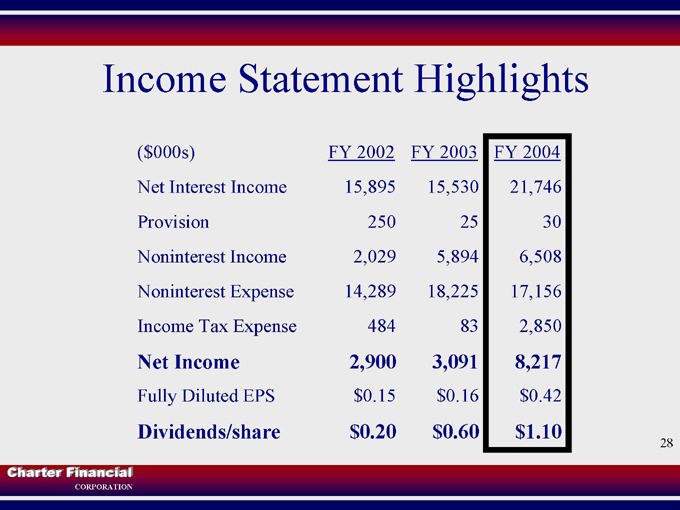

| 28. | Now let’s look at our income. Net income was up $5.1 million primarily due to increases in net interest income. Net interest income was up due to higher loan and core deposit balances and improved yield on mortgage securities. Future improvements will be dependent on improving our mix with continued loan and core deposit growth. We also had improvements in noninterest income and noninterest expense which were pretty much offset by increased income taxes. Our earnings per share were 42 cents and, through use of the dividend waiver, we were able to pay dividends of $1.10 and still retain about 54% of our earnings. |

| 29. | Our revenue drivers are retail banking activities, interest on mortgage securities and our Freddie Mac stock. |

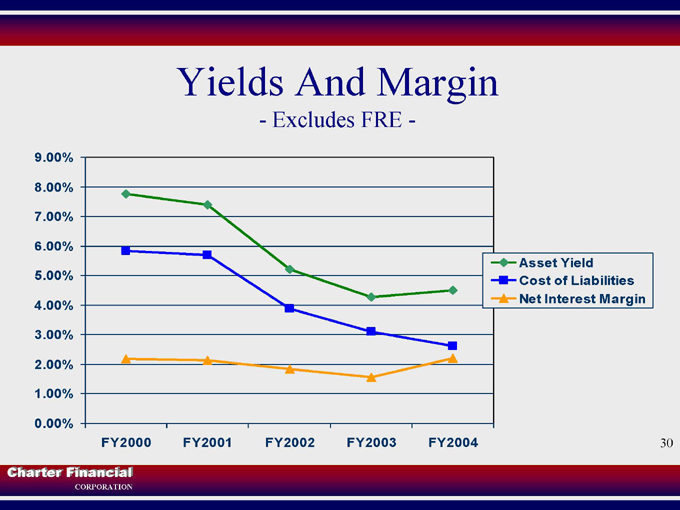

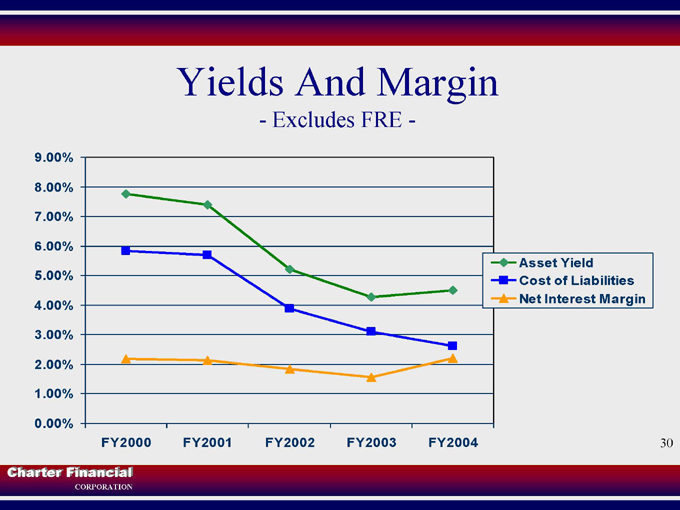

| 30. | Our net interest margin improved as our cost of liabilities declined while we increased our yield on assets. The low rates on 1-4 family mortgages in 2003 lowered our yield, primarily on mortgage securities for that year. |

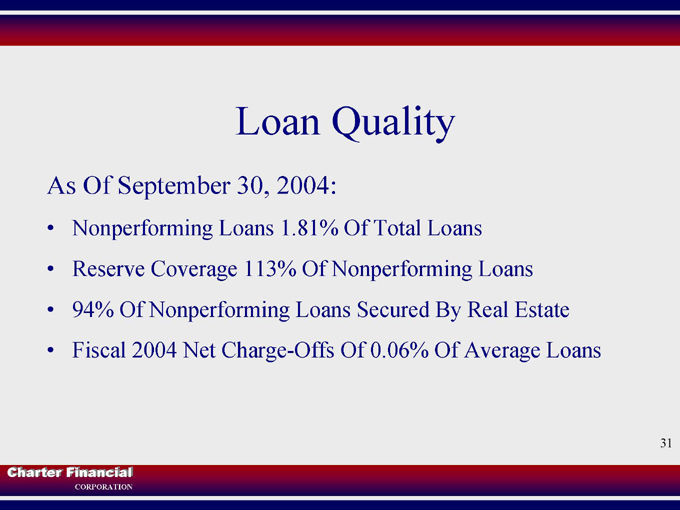

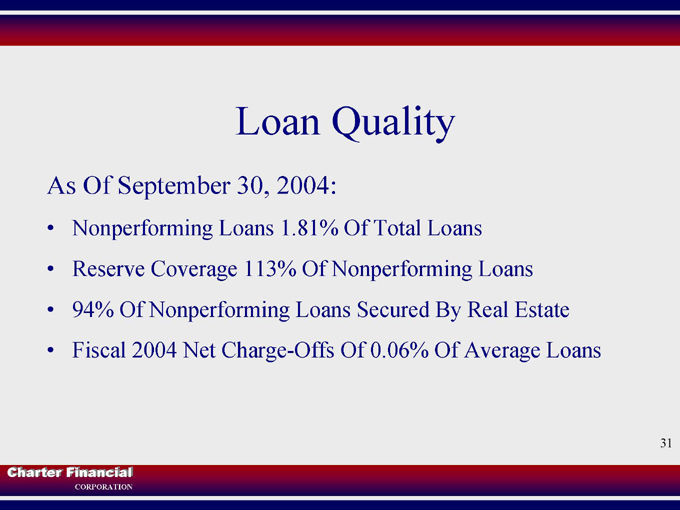

| 31. | Our non-performing assets are relatively high. We are less troubled by these levels than we would be if fewer of the non-performing assets were secured by real estate. 94% of our non-performing loan balances are secured by real estate. Also, 42% of our nonaccrual loans are one month or less past due but the borrowers have not yet demonstrated a consistent pattern of payments to allow us to remove them from nonaccrual status. |

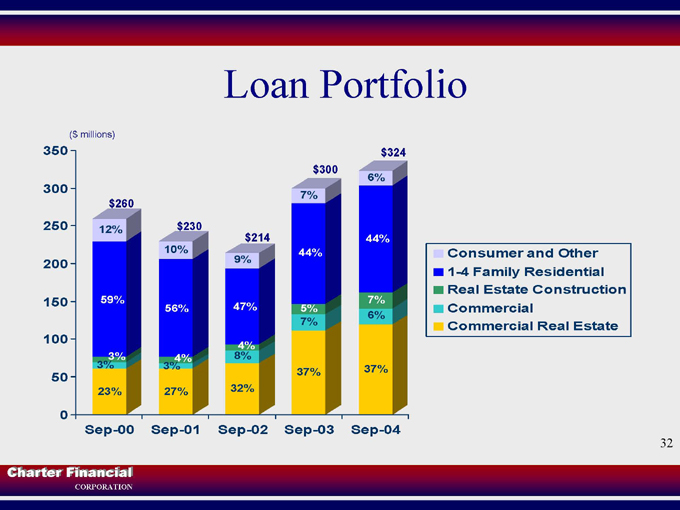

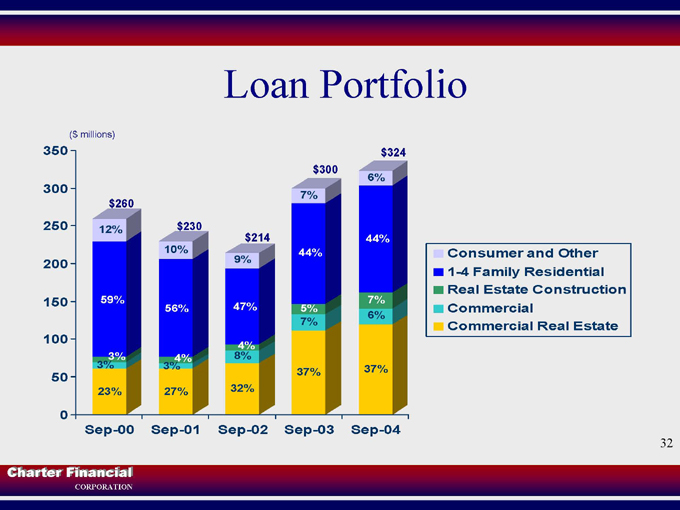

| 32. | We grew our loan portfolio by $24 million this year. In 2003 we brought in $55 million in loans in the Eagle Bank acquisition. |

| 33. | We continued our strong originations of commercial real estate loans while our 1-4 family originations dropped. The mortgage industry achieved all time highs in originations in 2003 as homeowners refinanced their mortgages to take advantage of low rates. In 2004 both the industry and Charter had lower levels of mortgage originations. |

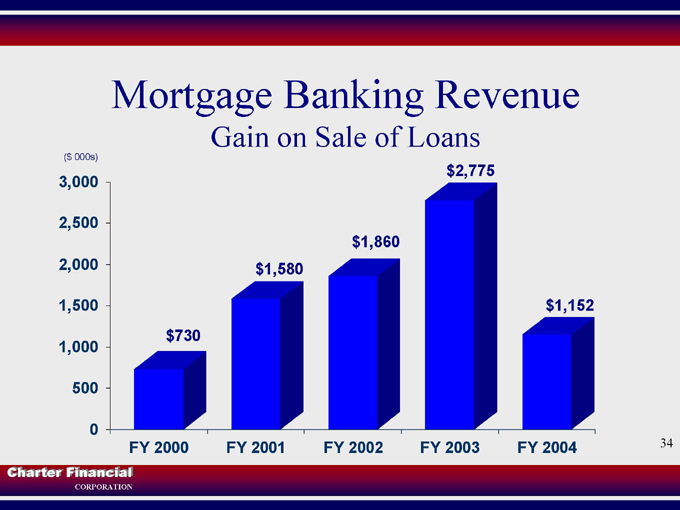

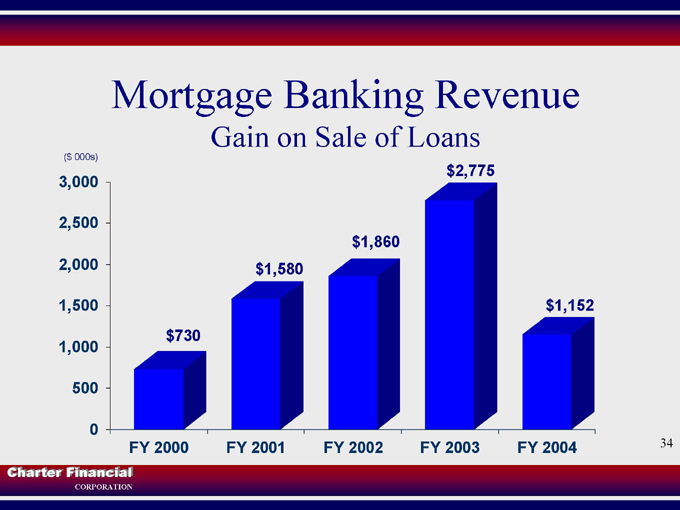

| 34. | With the lower level of mortgage originations, our gain on sale of 1-4 family loans has gone down. |

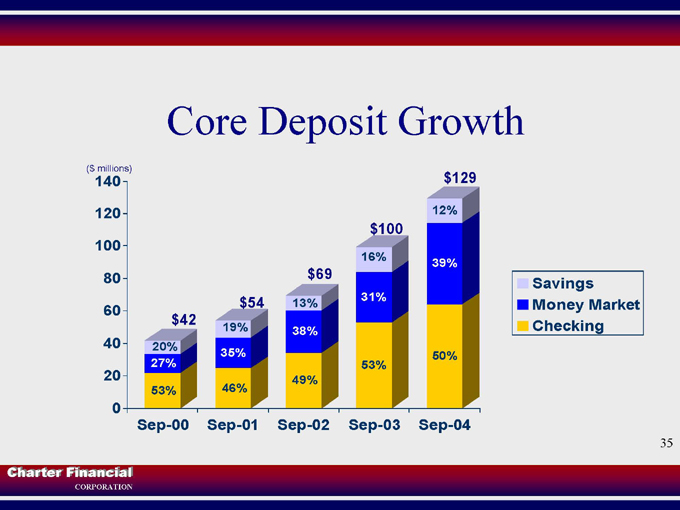

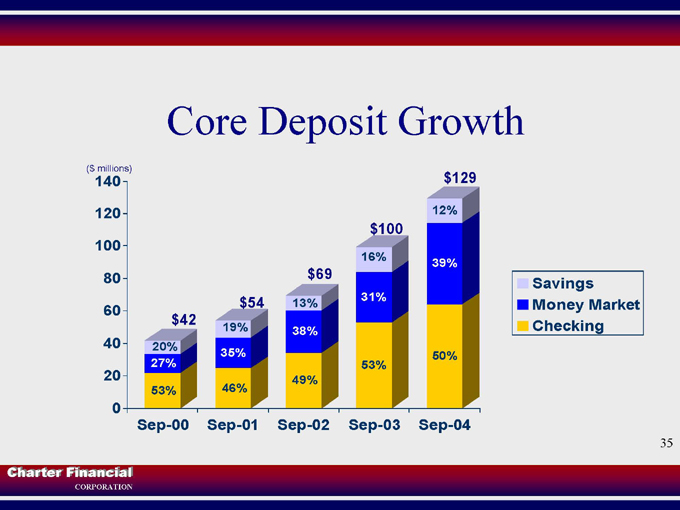

| 35. | Core deposits (which we define as checking, money market and savings accounts, but not time deposits) went up $29 million. A significant portion of our growth in core deposits this year was in money markets which were helped by the acquisition of some public funds. |

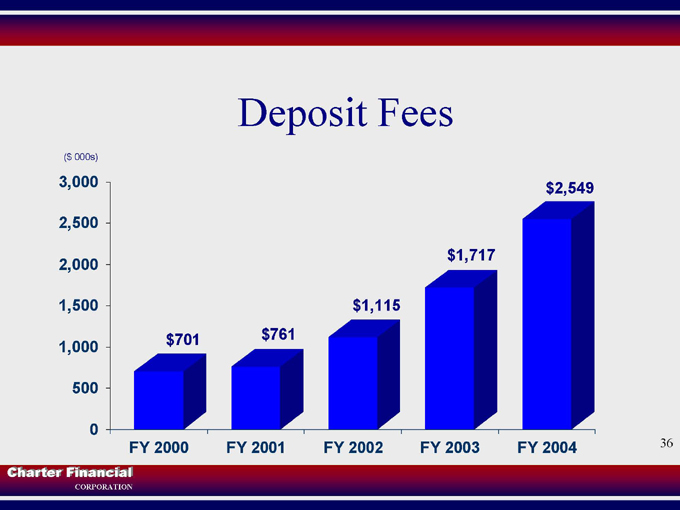

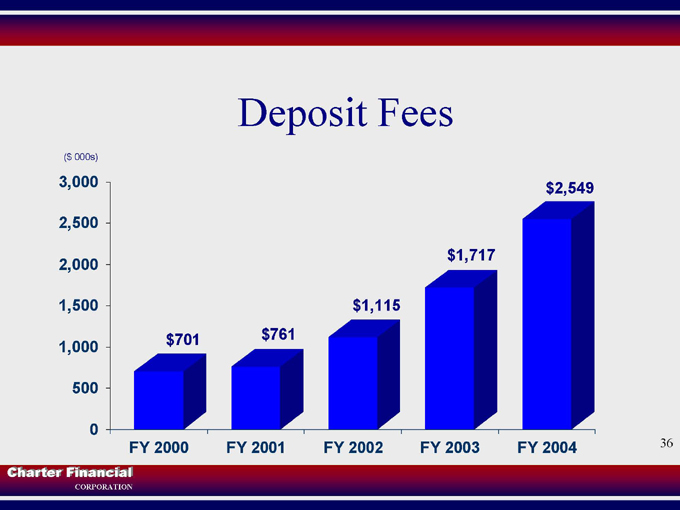

| 36. | Deposit fees, which are generated from checking accounts, have increased significantly over the past several years. |

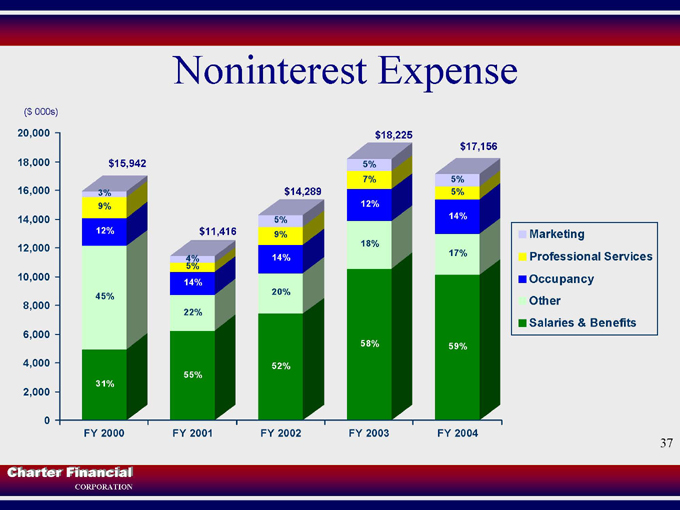

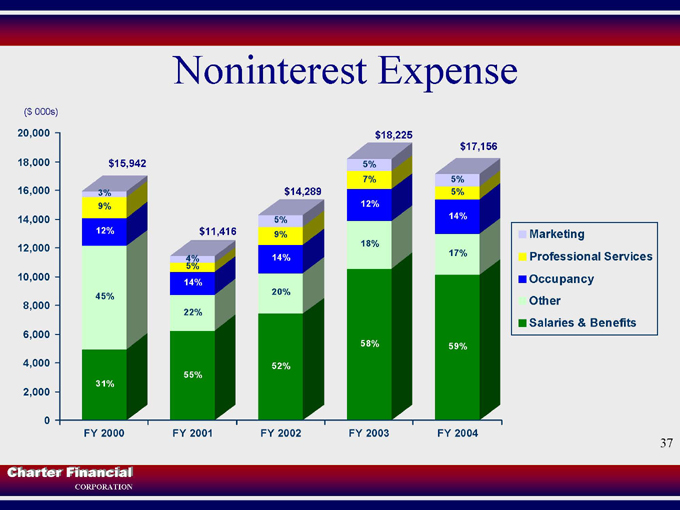

| 37. | After the Eagle acquisition in 2003 we were able to reduce our noninterest expense in several areas. Now Bob will talk about our outlook for 2005. |

| 38. | Thank you, Curt. In summary, I’ll take you back to this slide to remind you that our strategy to reward shareholders rests on three legs: (1) to build earnings in the community bank; (2) to manage our Freddie Mac stock investment effectively; and (3) to make our capital work hard for shareholders. |

In that vein, I want to leave you with a few thoughts about how we expect to implement that strategy through the remainder of 2005.

In late February we converted to a new data processing platform. Systems conversions are always trying for banks but we weathered it fairly well. Our goal is to use our new data processing systems to provide a better service experience for our customers and to be more efficient operationally. This weekend we will move our back-office operations into a building we recently purchased in the West Point Technology Park. This will help us become more focused and efficient in serving our front line people. Our new LaGrange branch opened last week to help us grow in that market. And we are moving ahead with plans to re-locate and upgrade two of our banking offices in Lee County. On the retail and

operations end, 2005 will be a year when we get accustomed to a new systems and customer service platform and continue the drive to create greater core earnings from our banking operations.

Finally, much of our capital management strategy in 2005 will continue to revolve around the dividend opportunity that our mutual holding company structure makes possible. As we have in the past, we expect to continue to pay a relatively high proportion of our earnings in dividends.

| 39. | At this point, I’ll take your questions. |

Annual Shareholders’ Meeting

March 16, 2005

1

Forward Looking Statement

This presentation and the accompanying commentary may contain “forward-looking statements” that may be identified by use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” and “potential.” Examples of forward-looking statements include, but are not limited to, estimates with respect to our financial condition and results of operation and business that are subject to various factors that could cause actual results to differ materially from these estimates. These factors include but are not limited to general and local economic conditions; changes in interest rates, deposit flows, demand for mortgages and other loans, real estate values, and competition; changes in accounting principles, policies, or guidelines; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products, and services. Any or all forward-looking statements in this release and in any other public statements we make may turn out to be wrong. They can be affected by inaccurate assumptions we might make or known or unknown risks and uncertainties.

Consequently, no forward-looking statements can be guaranteed. The Company disclaims any obligation to subsequently revise any forward- looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Charter Financial

CORPORATION

2

Key Facts

20% Mutual Holding Company Structure Improving Earnings/Earnings Structure Regulated By The Office Of Thrift Supervision Overcapitalized With Large Portfolio Of Freddie Mac Stock

3

Charter Financial

CORPORATION

Ownership Structure

First Charter MHC

80%

Public Shareholders 20%

Charter Financial Corporation

CharterBank

Charter Financial

CORPORATION

4

Ownership Structure

First Charter, MHC, Which Owns 80% Of Stock, Has Waived Dividends From CHFN CHFN Has Not Received Capital For 80% Of Shares Outstanding

Charter Financial

CORPORATION

5

Our Value Grows Out Of Our

SECURITY: Dividend Yield, Strong Capital Base, Profitable GROWTH: Build Retail Bank, Manage & Diversify Freddie Mac Stock

CAPITAL MANAGEMENT: Use Capital

For Acquisitions, Organic Growth, Dividend Payments or Stock Buybacks

Charter Financial

CORPORATION

6

Market Profile

Nasdaq NM: CHFN

Recent Price (3/14/05): $36.52

Shares Outstanding: 19.8 Million

Insider Ownership (12/31/04):

3.4% of total & 17.5% of minority shares

(80.3% owned by Mutual Holding Company)

Market Capitalization (3/14/05): $721.344 Million Total Assets (12/31/04): $1.127 Billion

Charter Financial

CORPORATION

7

Earnings & Dividends

Nasdaq NM: CHFN

Regular Annual Dividend Rate: $1.00 (to publicly owned stock) February 2005 Special Dividend: $2.00 (to publicly owned stock) Regular Dividend Yield: 2.74% Last Four Quarters EPS: 48 Cents

Charter Financial

CORPORATION

8

MHC Book Value Metrics

Stated Book Value—$14.69 Tangible Book Value—$14.39 Minority Book Value—$74.54 Stock Price—$43.72

(As of December 31, 2004)

Charter Financial

CORPORATION

9

Stockholder Value Strategies

Enhancing Value By Effectively Deploying Capital

1. Expanding Profitability And Value Of Retail Franchise

2. Managing 4.57 Million Share Freddie Mac Investment

3. Managing Capital To Provide Attractive Returns To Shareholders

Charter Financial

CORPORATION

10

Stockholder Value Strategies

Enhancing Value By Effectively Deploying Capital

1. Expanding Profitability And Value Of Retail Franchise

Transform From Traditional Thrift To Bank-like Asset/Liability Structure & Earnings Quality Expand Branch Network Into Stronger Markets Strategic/Opportunistic Acquisitions

2. Managing Freddie Mac Investment

3. Managing Capital To Provide Attractive Returns To Shareholders

Charter Financial

CORPORATION

11

Retail Strategy

Diversify & Upgrade Earnings Potential

Core Deposits

Commercial Real Estate Lending Cost effectively provide service

Provide Outstanding Convenience And Customer Service (ACE)

Accurate Spirited Competent Responsive

Charter Financial

CORPORATION

12

CharterBank Corporate Center

Charter Financial

CORPORATION

13

Our Markets

Auburn – Opelika, AL West Point, GA – Valley, AL LaGrange, GA

No. 2 In Deposit Market Share Across All 3 Markets at 13%

Charter Financial

CORPORATION

14

Birmingham MSA Atlanta MSA Montgomery MSA Columbus MSA Auburn-Opelika MSA

Full Service Branch Loan Production Office

Newnan La Grange (2) Phenix City

Monroeville

Auburn (2) Opelika (2)

West Point Valley (2)

St. Mary’s

Charter Financial

CORPORATION

15

New LaGrange Branch

Charter Financial

CORPORATION

16

Stockholder Value Strategies

Enhancing Value By Effectively Deploying Capital

1. Expanding Profitability And Value Of Retail Franchise

2. Managing Freddie Mac Investment

3. Managing Capital To Provide Attractive Returns To Shareholders

Charter Financial

CORPORATION

17

Freddie Mac Recap

4.57 Million Shares At Cost Of $1.35/Share $330.5 Million Pre-Tax Unrealized Gain

Charter Has Owned FRE Stock Since The Mid 1980s FRE Has Posted A 10-year Average Total Rate Of Return Of 20% Annual Dividend Rate Equals $1.20 Per Share

(Recently increased to $1.40 per share)

(As of December 31, 2004)

Charter Financial

CORPORATION

18

Importance Of FRE To CHFN

Net Unrealized Gain Represents 70% Of Our Capital

Equals $10.27 Per CHFN Share Equals $52.11 Per Minority Share $5.48 Million FRE Pre-tax Dividend

Equals $0.28 Per CHFN Share Equals $1.41 Per Minority Share

A $1 Change In FRE. . . . .

Equals $0.14 Change In CHFN Book Value Per Share Equals $0.72 Change In Minority Book Value Per Share

(As of December 31, 2004)

Charter Financial

CORPORATION

19

Managing Freddie Mac Investment

Continue To Collect Dividend While Enhancing Yield With Covered Call Option Premium Manage Ratio Of Unrealized Gains To Total Capital May Have Periodic Share Sales Through Option Program Proceeds From Sales Redeployed In Shareholder Value Maximizing Opportunities

Reinvest In Retail Bank Shareholder Distributions

Charter Financial

CORPORATION

20

Stockholder Value Strategies

Enhancing Value By Effectively Deploying Capital

1. Expanding Profitability And Value Of Retail Franchise

2. Managing Freddie Mac Investment

3. Managing Capital To Provide Attractive Returns To Shareholders

Charter Financial

CORPORATION

21

Cash Dividends

First Charter, MHC Can Waive Right To Cash Dividends Increased Regular Dividend To $0.25 From $0.20 In June 2004 Just Paid Special Dividend Of $2.00 2.74% Indicated Regular Dividend Yield Excess Capital—No Current Need To Retain Earnings To Support Organic Growth In Current Markets

Charter Financial

CORPORATION

22

Cash Dividends

Future Level Of Dividends Dependent On Cash Needs And Primarily Core Operating Earnings Total Dividends Paid Of $3.8 million Were 46% Of Net Income Of $8.2 million

Charter Financial

CORPORATION

23

Capital Management Goals

Enhance Returns To Minority Shareholders with the MHC Dividend Waiver Use Excess Capital To Make Acquisitions, Build Franchise & Earnings Minimize Dividend Dilution Of Minority Shareholders MHC Structure Can Tap Additional Capital Needed for Major Acquisition

Charter Financial

CORPORATION

24

Stock Performance

Since Conversion, CHFN vs. NASDAQ Financial 100

Charter Financial

CORPORATION

25

Financial Performance

26

Balance Sheet Highlights

($ 000s) FYE 2002 FYE 2003 FYE 2004

Total Assets 982,563 1,000,495 1,068,201

Loans, net 208,654 292,553 316,151 Securities 467,999 416,061 400,513 FRE 260,215 242,904 300,430

Total Liabilities 733,398 770,136 795,700

Retail Deposits 173,078 229,649 245,464 Total Borrowings 410,963 388,441 392,789

Total Equity 249,166 230,359 272,500

Accum Other Comp Inc 155,961 143,941 180,359 Realized Equity 93,205 86,419 92,141

Charter Financial

CORPORATION

27

Income Statement Highlights

($000s) FY 2002 FY 2003 FY 2004 Net Interest Income 15,895 15,530 21,746 Provision 250 25 30 Noninterest Income 2,029 5,894 6,508 Noninterest Expense 14,289 18,225 17,156 Income Tax Expense 484 83 2,850

Net Income 2,900 3,091 8,217

Fully Diluted EPS $0.15 $0.16 $0.42

Dividends/share $0.20 $0.60 $1.10

Charter Financial

CORPORATION

28

Revenue Drivers

Retail Banking Activities

Core Deposits

1-4 Single Family Mortgages Commercial Real Estate Mortgages

Mortgage Securities Portfolio Freddie Mac Stock

Dividends

29

Charter Financial

CORPORATION

Yields And Margin

- Excludes FRE -

9.00% 8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00%

0.00%

FY2000 FY2001 FY2002 FY2003 FY2004

Asset Yield Cost of Liabilities Net Interest Margin

Charter Financial

CORPORATION

30

Loan Quality

As Of September 30, 2004:

Nonperforming Loans 1.81% Of Total Loans Reserve Coverage 113% Of Nonperforming Loans 94% Of Nonperforming Loans Secured By Real Estate Fiscal 2004 Net Charge-Offs Of 0.06% Of Average Loans

31

Charter Financial

CORPORATION

Loan Portfolio

($ millions)

350 $324 $300

6%

300

7% $260 250 12% $230 $214 44% 10% 44%

200 9%

150 59% 7% 56% 47% 5% 6% 7%

100

4% 8%

3% 3% 3% 4% 37%

50 37% 23% 27% 32%

0

Sep-00 Sep-01 Sep-02 Sep-03 Sep-04

Consumer and Other 1-4 Family Residential Real Estate Construction Commercial Commercial Real Estate

Charter Financial

CORPORATION

32

Loan Originations

($ millions)

350 $329

300

250 $186 $192 200 $171 $165

150 100 50

0

FY 2000 FY 2001 FY 2002 FY 2003 FY 2004

Real Estate Construction

Consumer and Other

Commercial Real Estate and Commercial 1-4 Family Residential

Charter Financial

CORPORATION

33

Mortgage Banking Revenue

Gain on Sale of Loans

($ 000s)

$2,775 3,000

2,500 $1,860 2,000 $1,580

1,500 $1,152 $730 1,000

500

0

FY 2000 FY 2001 FY 2002 FY 2003 FY 2004

34

Charter Financial

CORPORATION

Core Deposit Growth

($ millions)

140 $129

120 12% $100

100

16%

39%

80$ 69

31%

$54 13%

60 $42

19% 38%

40 20%

35% 50% 27% 53%

20 49% 53% 46%

0

Sep-00 Sep-01 Sep-02 Sep-03 Sep-04

Savings Money Market Checking

Charter Financial

CORPORATION

35

Deposit Fees

($ 000s)

3,000 $2,549 2,500 $1,717 2,000

1,500 $1,115 $701 $761 1,000

500

0

FY 2000 FY 2001 FY 2002 FY 2003 FY 2004

Charter Financial

CORPORATION

36

Noninterest Expense

($ 000s)

20,000 $18,225 $17,156 18,000 $15,942 5%

7% 5%

16,000 3% $14,289 5%

9% 12%

14,000 5% 14% 12% $11,416 9%

12,000 18%

17%

4% 14% 5%

10,000

14%

20% 45%

8,000

22%

6,000

58% 59%

4,000 52% 55% 31%

2,000

0

FY 2000 FY 2001 FY 2002 FY 2003 FY 2004

Marketing

Professional Services Occupancy Other Salaries & Benefits

Charter Financial

CORPORATION

37

Stockholder Value Strategies

Enhancing Value By Effectively Deploying Capital

1. Expanding Profitability And Value Of Retail Franchise

2. Managing Freddie Mac Investment

3. Managing Capital To Provide Attractive Returns To Shareholders

Charter Financial

CORPORATION

38

Outlook For 2005

Strong Focus On Creating Efficient & Cost Effective Support Structure

Major Systems Upgrade

Internal Reorganization Of Support Structure

New Corporate Office Consolidating Corporate Support Staff Into One Building From Five Buildings

New Branch In LaGrange Market

Covered Call Program To Manage Freddie Mac Stock Dividend Is Central To Capital Management Plans

39

Charter Financial

CORPORATION

Charter Financial

CORPORATION