- ZBH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Zimmer Biomet (ZBH) DEF 14ADefinitive proxy

Filed: 26 Mar 02, 12:00am

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

| Check the appropriate box: | |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

| ZIMMER HOLDINGS, INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

ZIMMER HOLDINGS, INC.

March 26, 2002

Dear Fellow Stockholder:

You are cordially invited to attend the first Annual Meeting of Stockholders of Zimmer Holdings, Inc. at The Peninsula Hotel Chicago, 108 East Superior Street at North Michigan Avenue, Chicago, Illinois on Thursday, May 9, 2002, at 10:00 a.m.

This booklet includes the Notice of Annual Meeting and the Proxy Statement. The Proxy Statement describes the business to be transacted at the meeting and provides other information about the company that you should know when you vote your shares.

The principal business of the Annual Meeting will be the election of directors and approval of the Zimmer Holdings, Inc. Employee Stock Purchase Plan. We will also review the status of the company’s business at the meeting.

It is important that your shares be represented whether or not you attend the meeting. Registered stockholders can vote their shares via the Internet or by using a toll-free telephone number. Instructions for using these convenient services appear on the proxy card. You can also vote your shares by marking your votes on the proxy card, signing and dating it and mailing it promptly using the envelope provided.

We have provided space on the proxy card for comments. We urge you to use it to let us know your feelings about the company or to bring a particular matter to our attention. If you hold your shares through an intermediary, please feel free to write directly to us.

| |

| J. RAYMOND ELLIOTT | |

| Chairman, President and Chief Executive Officer |

ZIMMER HOLDINGS, INC.

NOTICE OF ANNUAL MEETING

Notice is hereby given that the Annual Meeting of Stockholders will be held at The Peninsula Hotel Chicago, 108 East Superior Street at North Michigan Avenue, Chicago, Illinois, on Thursday, May 9, 2002, at 10:00 a.m. for the following purposes as set forth in the accompanying Proxy Statement:

to elect directors;

to approve the Zimmer Holdings, Inc. Employee Stock Purchase Plan; and

to transact such other business as may properly come before the meeting or any adjournments thereof.

Holders of record of the company’s common stock at the close of business on March 12, 2002, will be entitled to vote at the meeting.

| By Order of the Board of Directors | |

| |

| PAUL D. SCHOENLE | |

| Secretary |

Dated: March 26, 2002

YOUR VOTE IS IMPORTANT

REGARDLESS OF THE NUMBER OF SHARES YOU OWN, YOUR VOTE IS IMPORTANT.

IF YOU DO NOT ATTEND THE ANNUAL MEETING TO VOTE IN PERSON, YOUR VOTE WILL NOT BE COUNTED UNLESS A PROXY REPRESENTING YOUR SHARES IS PRESENTED AT THE MEETING.

TO ENSURE THAT YOUR SHARES WILL BE VOTED AT THE MEETING, PLEASE VOTE IN ONE OF THESE WAYS:

| (1) | GO TO THE WEBSITE SHOWN ON YOUR PROXY CARD AND VOTE VIA THE INTERNET; |

OR

| (2) | USE THE TOLL-FREE TELEPHONE NUMBER SHOWN ON YOUR PROXY CARD (THIS CALL IS TOLL-FREE IN THE UNITED STATES); |

OR

| (3) | MARK, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE POSTAGE-PAID ENVELOPE. |

IF YOU DO ATTEND THE ANNUAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE BY BALLOT.

ZIMMER HOLDINGS, INC.

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors for use at the Annual Meeting of Stockholders on May 9, 2002.

This Proxy Statement is being sent to all stockholders of record as of the close of business on March 12, 2002 for delivery beginning March 26, 2002. Although the Annual Report and Proxy Statement are being mailed together, the Annual Report should not be deemed to be part of this Proxy Statement.

Stockholders Entitled to Vote

Holders of record of the company’s $0.01 par value common stock at the close of business on March 12, 2002 will be entitled to vote at the 2002 Annual Meeting. Each share is entitled to one vote on each matter properly brought before the meeting. Proxies are solicited to give all stockholders who are entitled to vote on the matters that come before the meeting the opportunity to do so whether or not they attend the meeting in person.

Proxies and Voting

If you are a registered stockholder, you can simplify your voting and save the company expense by voting via the Internet or calling the toll-free number listed on the proxy card. Internet and telephone voting information is provided on the proxy card. A control number, located on the lower right of the proxy card, is designated to verify a stockholder’s identity and allow the stockholder to vote the shares and confirm that the voting instructions have been recorded properly. If you vote via the Internet or by telephone, please do not return a signed proxy card.

If you choose to vote by mail, mark your proxy card enclosed with the Proxy Statement, date and sign it, and mail it in the postage-paid envelope. The shares represented will be voted according to your directions. You can specify how you want your shares voted on each proposal by marking the appropriate boxes on the proxy card. Please review the voting instructions on the proxy card and read the entire text of the proposals and the positions of the Board of Directors in the Proxy Statement prior to marking your vote. If your proxy card is signed and returned without specifying a vote or an abstention on any proposal, it will be voted according to the recommendation of the Board of Directors on that proposal. That recommendation is shown for each proposal on the proxy card.

If you are a beneficial stockholder, you must provide instructions on voting to your nominee holder.

For the reasons set forth in more detail later in the Proxy Statement, the Board of Directors recommends a vote “FOR” the election of directors and “FOR” approval of the Zimmer Holdings, Inc. Employee Stock Purchase Plan.

The Board of Directors of Zimmer Holdings, Inc. knows of no other matters that may be brought before the meeting. However, if any other matters are properly presented for action, it is the intention of the named proxies to vote on them according to their best judgment.

A plurality of the votes cast at the meeting is required to elect directors. The affirmative vote of a majority of the shares of stock present in person or by proxy is required for approval of the Zimmer Holdings, Inc. Employee Stock Purchase Plan.

In accordance with the laws of the State of Delaware and the company’s Restated Certificate of Incorporation and By-Laws (1) for the election of directors, which requires a plurality of the votes cast, only proxies and ballots indicating votes “FOR all nominees,” “WITHHELD for all nominees” or specifying that votes be withheld for one or more designated nominees are counted to determine the total number of votes cast; broker non-votes are not counted, and (2) for the adoption of all other proposals, which are decided by a majority of the shares of the stock of the company present in person or by proxy and entitled to vote, only proxies and ballots indicating votes “FOR,” “AGAINST” or “ABSTAIN” on the proposals or providing the designated proxies with the right to vote in their judgment and discretion on the proposals are counted to determine the number of shares present and entitled to vote; broker non-votes are not counted.

If you are a registered stockholder and wish to give your proxy to someone other than the individuals named on the proxy card, you may do so by crossing out the names appearing on the proxy card and inserting the name of another person. The signed card must be presented at the meeting by the person you have designated on the proxy card. You may revoke your proxy at any time before it is voted at the meeting by taking one of the following three actions: (1) by giving timely written notice of the revocation to the Secretary of the company; (2) by executing and delivering a proxy with a later date; or (3) by voting in person at the meeting.

If you are a beneficial holder and wish to vote in person at the meeting, you must obtain from the record holder a proxy issued in your name.

Tabulation of proxies and the votes cast at the meeting will be conducted by an independent agent and certified to by independent inspectors of election. Any information that identifies the stockholder or the particular vote of a stockholder will be kept confidential.

Costs of Proxy Solicitation

Employees of the company may solicit proxies on behalf of the Board of Directors through the mail, in person, and by telecommunications. The cost thereof will be borne by the company. In addition, management has retained Georgeson Shareholder Communications, Inc. to assist in soliciting proxies for a fee of $7,500, plus out-of-pocket expenses. The company will, upon request, reimburse brokerage firms and others for their reasonable expenses incurred for forwarding solicitation material to beneficial owners of stock.

List of Stockholders

In accordance with Delaware law, a list of stockholders entitled to vote at the meeting will be available at the meeting and for ten days prior to the meeting, between the hours of 8:00 a.m. and 5:00 p.m., at our offices at 345 East Main Street, Warsaw, Indiana by contacting the Secretary of the company.

At the close of business on March 12, 2002, there were 194,068,120 shares of $0.01 par value common stock outstanding and entitled to vote.

2

The following table sets forth certain information concerning each person (including any group) known to us to beneficially own more than five percent (5%) of the common stock of the company as of February 15, 2002. Unless otherwise noted shares are owned directly or indirectly with sole voting and investment power.

| Name and Address | Total Number of | Percent | ||||||

| of Beneficial Owner | Shares Owned | of Class | ||||||

| FMR Corp.(1) | 25,558,180 | 13.187% | ||||||

| 82 Devonshire Street Boston, MA 02109 | ||||||||

| Putnam Investments, LLC(2) | 12,453,720 | 6.4% | ||||||

| One Post Office Square Boston, MA 02109 | ||||||||

| (1) | Based solely on information provided by FMR Corp. in an amended Schedule 13G filed with the Securities and Exchange Commission on February 14, 2002. Of the total shares reported, Fidelity Management & Research Company beneficially owns 24,158,772 shares; Fidelity Management Trust Company beneficially owns 676,433 shares; Strategic Advisers, Inc. beneficially owns 260,668 shares; Edward C. Johnson 3d beneficially owns 109,680 shares; Abigail P. Johnson beneficially owns 30 shares; and Fidelity International Limited beneficially owns 352,597 shares. The reporting persons have sole power to dispose of 25,558,180 shares. |

| (2) | Based solely on information provided by Marsh & McLennen Companies, Inc. (“Marsh”) in a Schedule 13G filed with the Securities and Exchange Commission on February 15, 2002. Putnam Investments, LLC, a wholly-owned subsidiary of Marsh, wholly owns two registered investment advisors: Putnam Investment Management, LLC (“PIM”) and The Putnam Advisory Company, LLC (“PAC”). PIM reports shared power to dispose of 10,260,183 shares; PAC reports shared power to dispose of 2,193,537 shares and shared power to vote 1,633,555 shares. |

3

The following table sets forth, as of January 15, 2002, beneficial ownership of shares of common stock of the company by each director, each of the executives named in the Summary Compensation Table and all directors and executive officers as a group. None of these individuals beneficially owns greater than 1% of the outstanding shares of common stock.

Unless otherwise noted, such shares are owned directly or indirectly with sole voting and investment power.

| Total | Shares | Deferred | ||||||||||

| Shares | Acquirable in | Share | ||||||||||

| Name | Owned(1) | 60 Days(2) | Units | |||||||||

| Roy D. Crowninshield, Ph.D. | 203,743 | 195,087 | 0 | |||||||||

| J. Raymond Elliott | 235,596 | 161,186 | 0 | |||||||||

| Larry C. Glasscock | 51,050 | (3) | 50,000 | (4) | 1,010 | (5) | ||||||

| Regina E. Herzlinger, D.B.A. | 50,759 | (6) | 50,000 | (4) | 719 | (5) | ||||||

| John S. Loveman-Krelle | 77,744 | 65,828 | 0 | |||||||||

| Sam R. Leno | 50,904 | 0 | 0 | |||||||||

| John L. McGoldrick | 61,907 | 50,000 | (4) | 428 | (5) | |||||||

| Bruno A. Melzi | 42,921 | 31,916 | 0 | |||||||||

| Bruce E. Peterson | 141,625 | 110,313 | 0 | |||||||||

| Augustus A. White, III, M.D., Ph.D. | 50,428 | 50,000 | (4) | 428 | (5) | |||||||

| All directors and executive officers as a group (11 persons) | 791,422 | 592,080 | 2,585 | |||||||||

| (1) | Includes direct and indirect ownership of shares, stock options that are currently exercisable and stock options that will be exercisable within 60 days, deferred share units and the following restricted shares, which are subject to vesting requirements: Dr. Crowninshield — 2,105; Mr. Elliott — 71,249; Mr. Loveman-Krelle — 10,405; Mr. Leno — 50,904; Mr. McGoldrick — 3,000; Mr. Melzi — 11,005; Mr. Peterson — 18,893; and all directors and executive officers as a group — 170,561. |

| (2) | Includes stock options that are currently exercisable and stock options that will be exercisable within 60 days. |

| (3) | Includes 40 shares held in a trust, the voting and investment decisions with respect to which require Mr. Glasscock’s consent. |

| (4) | Represents shares underlying stock options granted to non-employee directors in three installments during 2001. Such options become fully exercisable on the third anniversary of the date of grant of the first installment, or upon the director’s retirement from the Board of Directors. |

| (5) | Amounts credited to directors’ accounts in the 2001 Deferred Compensation Plan for Non-Employee Directors as deferred share units which are valued according to the market value and stockholder return on equivalent shares of company common stock. |

| (6) | Includes 40 shares owned jointly by Dr. Herzlinger and her spouse over which she exercises shared voting and investment power. |

Under Section 16(a) of the Securities Exchange Act of 1934, the company’s directors, executive officers and the beneficial holders of more than 10% of the company’s common stock are required to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Based on our records and other information, the company believes that during 2001 all applicable Section 16(a) filing requirements were met.

4

The business of the company is managed under the direction of the Board of Directors. It has responsibility for establishing broad corporate policies and for the overall performance of the company. The Board meets on a regularly scheduled basis during the year to review significant developments affecting the company and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between scheduled meetings. Members of senior management regularly attend Board meetings to report on and discuss their areas of responsibility. In 2001, there were three meetings of the Board. During the period in 2001 for which he or she served as a director, no director attended fewer than 75% of the total meetings of the Board of Directors and each committee on which he or she served.

Committees of the Board

The company’s Restated By-Laws specifically provide that the Board may delegate responsibility to committees. During 2001, the Board had four standing committees, an Audit Committee, a Compensation and Management Development Committee, a Governance Committee and a Science and Technology Committee. The membership of the Audit Committee, the Compensation and Management Development Committee and the Governance Committee is composed entirely of non-employee directors. In addition, the members of the Audit Committee are “independent” as that term is defined in the listing standards of the New York Stock Exchange. The membership of the Science and Technology Committee is composed of one non-employee director and two employee representatives, including the company’s chief scientific officer.

In 2001, the committees of the Board held a total of four meetings: the Audit Committee met one time, the Compensation and Management Development Committee met two times and the Governance Committee met one time. The Science and Technology Committee did not meet during 2001.

The table below provides membership information for each Board committee.

| Compensation | ||||||||||||||||

| and | Science | |||||||||||||||

| Management | and | |||||||||||||||

| Name | Audit | Development | Governance | Technology | ||||||||||||

| Larry C. Glasscock | X | * | X | |||||||||||||

| Regina E. Herzlinger, D.B.A. | X | X | X | * | ||||||||||||

| John L. McGoldrick | X | * | ||||||||||||||

| Augustus A. White, III, M.D., Ph.D. | X | X | X | * | ||||||||||||

| * | Chair |

Audit Committee

The principal functions of the Audit Committee include:

| • | Annually evaluating the outside auditor and making recommendations to the Board of Directors regarding appointment of the outside auditor; | |

| • | Reviewing with the outside auditor and with management the proposed scope of the annual audit, past audit experience, the company’s program for the internal examination and verification of its accounting records and the results of recently completed internal examinations; | |

| • | Reviewing any significant disagreements between management and the outside auditor in connection with the preparation of the financial statements; and | |

| • | Discussing the quality and adequacy of the company’s internal controls with management, the internal auditors and the outside auditor. |

The Board of Directors has adopted a written charter for the Audit Committee. A copy of the Audit Committee Charter currently in effect is attached as Appendix A to this Proxy Statement.

The report of the Audit Committee appears on pages 6-7.

5

Compensation and Management Development Committee

The duties of the Compensation and Management Development Committee include:

| • | administering the company’s annual incentive, long-term incentive and stock option plans; | |

| • | adopting and reviewing major compensation plans; | |

| • | adopting and reviewing the company’s management development programs and procedures; and | |

| • | approving compensation of executive officers and certain senior management. |

The report of the Compensation and Management Development Committee appears on pages 10-11.

Governance Committee

The duties of the Governance Committee include:

| • | developing criteria for selection of non-employee directors; | |

| • | reviewing director candidates suggested by stockholders in accordance with the procedures contained in the company’s Restated By-Laws (see “2003 PROXY PROPOSALS” for more information on these procedures); | |

| • | recommending director candidates to the Board of Directors; | |

| • | periodically reviewing both employee and non-employee director performance; and | |

| • | monitoring the company’s performance in environmental, safety and health areas as it affects employees, communities and customers. |

Science and Technology Committee

The duties of the Science and Technology Committee include:

| • | advising the Board on matters involving the company’s new science and advanced technology programs, including major internal projects, interactions with academic and independent research organizations and the acquisition of technologies; and | |

| • | reviewing and recommending to the Board major technology positions and strategies relative to emerging concepts of therapy, new trends in health care, and changing market requirements. |

The Audit Committee is responsible for overseeing and monitoring the quality of the company’s accounting and auditing practices. Management is responsible for planning and conducting audits and ensuring that the company’s financial statements are prepared in accordance with generally accepted accounting principles.

In this context, the Committee has met and held discussions with management and the independent accountants. Management has represented to the Committee that the company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The Committee has discussed with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

Further, the Audit Committee has received written disclosures and a letter from the independent accountants required by Independence Standards Board Standard No. 1, as amended to date, and has discussed with the independent accountants their independence from management. The Committee has also considered whether the independent accountants’ provision of information technology and other non-audit services is compatible with their independence.

6

Based on the review and discussion described above, the Audit Committee recommended to the Board of Directors, and the Board has approved that the audited financial statements be included in the company’s Annual Report on Form 10-K for the year ended December 31, 2001, for filing with the Securities and Exchange Commission.

The Committee has also confirmed there have been no new circumstances or developments since their respective appointments to the Audit Committee that would impair any member’s ability to act independently.

| The Audit Committee | |

| Larry C. Glasscock | |

| Regina E. Herzlinger, D.B.A. | |

| Augustus A. White, III, M.D., Ph.D. |

Compensation of Directors

Non-employee directors of the company receive an annual retainer of $50,000 ($25,000 for 2001), and an additional fee of $1,500 for attending each Board meeting and each Board committee meeting not held on the same day as a Board meeting. Beginning in 2002, non-employee directors will receive an additional fee of $1,500 for attending the Annual Meeting of Stockholders. Also beginning in 2002, each non-employee director will receive 500 deferred share units at each Annual Meeting of Stockholders and Committee Chairs will receive an annual fee of $5,000. The company also provides non-employee directors with travel accident insurance when on company business.

Under the provisions of the Zimmer Holdings, Inc. 2001 Deferred Compensation Plan for Non-Employee Directors, the company requires that 50% of the annual retainer be deferred and credited to a deferred compensation account in the form of deferred share units, the value of which account is determined by the value of company common stock, until certain ownership guidelines are attained. Non-employee directors may elect to defer the remainder of their annual retainer or convert all or a portion of the remainder into stock options using a ratio of three stock options to one share unit. Deferred share units are immediately vested and payable upon separation from service.

The Zimmer Holdings, Inc. Stock Plan for Non-Employee Directors provides that non-employee directors may receive stock options, restricted stock and restricted stock units. Under this plan, each non-employee director received options to purchase 50,000 shares of the company’s common stock in three installments during 2001 (the “Founder’s Options”). The Founder’s Options have an exercise price equal to the fair market value of the common stock on the date of grant and become fully exercisable on the third anniversary of the date of grant of the first installment of the optionee’s Founder’s Options, or upon retirement from the Board.

Directors and Nominees

The Board of Directors is divided into three classes whose terms expire at successive annual meetings. Two directors will be elected at the Annual Meeting to serve for a term expiring in 2005. Both of the nominees for director named below are currently directors of the company. After the election of two directors at the meeting, the company will have five directors, including the three directors whose present terms extend beyond the meeting. In the interim between Annual Meetings, the Board has the authority to increase or decrease the size of the Board and fill vacancies. Listed first below are the nominees for election, followed by the directors whose terms expire in 2003 and 2004, with information including their principal occupation and other business affiliations, the year each was first elected as a director, the Board committee memberships of each and each director’s age.

7

Nominees For Director

| J. Raymond Elliott Director Since 2001  | Chairman, President and Chief Executive Officer of the company since August 2001. President, Chief Executive Officer and Director since March 20, 2001. Mr. Elliott was appointed President of Zimmer, Inc., the company’s predecessor (“Zimmer, Inc.”), in November 1997. Concurrently, Mr. Elliott served as a corporate Vice President of the company’s former parent prior to the distribution, from November 1997 until the separation. Mr. Elliott has approximately 30 years of experience in orthopaedics, medical devices and consumer products. Prior to joining Zimmer, Inc., he served as President and Chief Executive Officer of Cybex, Inc., a publicly traded medical rehabilitation and cardiovascular products company, from September 1995 to June 1997, and previously as President and Chief Executive Officer of J.R. Elliott & Associates, a privately held M&A firm. During this time, Mr. Elliott successfully completed several M&A and turnaround projects for the federal government and numerous healthcare firms, including the role of Chairman and Chief Executive Officer for Cablecom Inc. Mr. Elliott has also served as Chairman and President of various divisions of Southam, Inc., a communications group, and as Group President of five divisions of food and beverage leader John Labatt, Inc. He began his career in the healthcare industry with American Hospital Supply Corporation (later Baxter International), where he gained 15 years experience in sales, marketing, operations, business development and general management, leading to his appointment as President of the Far East divisions, based in Tokyo, Japan. Mr. Elliott has served as a director on more than 15 business-related boards in the U.S., Canada, Japan and Europe and has served on three occasions as Chairman. He is currently a director of the State of Indiana Workplace Development Board, a director of AdvaMed and a trustee of the Orthopaedic Research and Education Foundation (“OREF”). He holds a bachelor’s degree from the University of Western Ontario, Canada. Age 52. | |

| Dr. Regina E. Herzlinger Director Since 2001  | The Nancy R. McPherson Professor of Business Administration Chair at the Harvard Business School. She was the first woman to be tenured and chaired at Harvard Business School and the first to serve on a number of corporate boards. She has written many articles and books in the fields of management control and healthcare. Her research has been profiled in industry journals and business publications such asBusiness Week,The Economist,Forbes, andFortuneand has been recognized for excellence by the American College of Healthcare Executives three times.Managed Healthcarehas named her as one of health care’s top ten thinkers. Dr. Herzlinger received her Bachelor’s Degree from Massachusetts Institute of Technology and her Doctorate from the Harvard Business School. Dr. Herzlinger is a director of C.R. Bard, Inc., Nanogen, Inc., Noven Pharmaceuticals, Inc. and Schering-Plough Corporation. Board Committees: Audit Committee, Compensation and Management Development Committee and Governance Committee (Chair). Age 58. | |

8

| Continuing Directors Whose Present Terms Extend Beyond the Meeting | ||

| Larry C. Glasscock Director Since 2001  | President and Chief Executive Officer of Anthem Insurance Companies, Inc. (“Anthem Insurance”), the Blue Cross and Blue Shield licensee for Indiana, Kentucky, Ohio, Connecticut, New Hampshire, Maine, Colorado and Nevada, since October 1999 and President and Chief Executive Officer of Anthem, Inc., the publicly-held parent of Anthem Insurance, since July 2001. Mr. Glasscock joined Anthem Insurance in April 1998 as Senior Executive Vice President and Chief Operating Officer. He was named President and Chief Operating Officer in April 1999. Prior to joining Anthem Insurance, Mr. Glasscock served as Chief Operating Officer of CareFirst, Inc. from January through April 1998 and he served as President and Chief Executive Officer of Group Hospitalization & Medical Services, Inc., which did business as Blue Cross and Blue Shield of the National Capital Area, from September 1993 to January 1998. From 1991 to 1993, he served as President, Chief Operating Officer and Director of First American Bank, N.A. Mr. Glasscock is a director of Anthem, Inc. Board Committees: Audit Committee (Chair) and Compensation and Management Development Committee. Age 53. | |

| John L. McGoldrick Director Since 2001  | Executive Vice President and General Counsel of Bristol-Myers Squibb since January 2000; Senior Vice President, General Counsel and President, Medical Devices Group from December 1998 to January 2000 and Senior Vice President and General Counsel from 1995 to December 1998. Senior director of the Board of the New Jersey Transit Corporation and member of the board of AdvaMed, the medical device industry’s trade association. He has served on several governmental reform commissions in New Jersey. He is an invited participant of The Aspen Institute on the World Economy and the World Economic Forum (Davos). Before joining Bristol-Myers Squibb, Mr. McGoldrick was a senior partner and executive committee member of the law firm of McCarter & English. He is a graduate of Harvard College and the Harvard Law School. Board Committees: Compensation and Management Development Committee (Chair). Age 60. | |

9

| Continuing Directors Whose Present Terms Extend Beyond the Meeting (continued) | ||

| Augustus A. White, III, M.D., Ph.D Director Since 2001  | Master of the Oliver Wendell Holmes Society and the Ellen and Melvin Gordon Professor of Medical Education, Harvard Medical School; Professor of Orthopaedic Surgery at the Harvard Medical School and the Harvard-MIT Division of Health Sciences and Technology; and Orthopaedic Surgeon-in-Chief, Emeritus, at the Beth Israel Deaconess Medical Center in Boston. He previously served as the Chief of Spine Surgery at Beth Israel and is Director of the Daniel E. Hogan Spine Fellowship Program. He is a graduate of the Stanford University Medical School, holds a Ph.D. from the Karolinska Institute in Stockholm, and graduated from the Advanced Management Program at the Harvard Business School. Dr. White is a recipient of the Bronze Star, which he earned while stationed as a Captain in the U.S. Army Medical Corps in Vietnam. He is an internationally known and widely published authority on biomechanics of the spine, fracture healing and surgical and non-surgical care of the spine. He is nationally recognized for his work in medical education, diversity, and issues of health care disparities. Dr. White is a director of Orthologic Corp. Board Committees: Audit Committee, Compensation and Management Development Committee and Science and Technology Committee (Chair). Age 65. | |

Compensation and Management Development Committee Report on Executive Compensation

The Committee began its work by reviewing the executive compensation and benefits program that was established at the time of the separation of the company from Bristol-Myers Squibb. The initial program had three primary objectives: (1) adjust executive salaries, bonus and long-term incentive programs to levels that would be competitive for the management of an independent company; (2) maintain certain policies and benefit programs similar to those of Bristol-Myers Squibb to provide for a smooth transition after the separation; and (3) align the interests of employees with stockholders through a broad stock option grant.

Compensation Philosophy

The company’s compensation philosophy is to make a financial investment in people who will deliver the innovative solutions necessary for the company to become the global leader in products that enhance the quality of life for orthopaedic patients. The company’s compensation program is intended to deliver cash, annual incentive and long-term compensation at levels competitive with other companies in the medical device and biotech industry as well as other competitors for talent generally. The company encourages and recognizes superior performance. Annual incentive and long-term incentive programs provide a significant additional compensation opportunity based upon the achievement of performance objectives. To complete the total compensation package and to reward employees who demonstrate their commitment to achieving our business objectives, the company also provides a package of health, welfare and retirement benefit programs that it believes is superior to programs provided by most similarly-sized companies.

Compensation Components

The major components of compensation are the same for executives and other employees. All executives and employees receive a salary, annual incentive opportunities, stock option grants and health, welfare and retirement benefits. The Committee reviewed the elements of compensation with the help of a major international compensation and benefits consulting firm. A review of executive salaries, bonus and long-term compensation was completed in December 2001. Based on this review, the Committee concluded that executive salaries and annual incentive targets were competitive for a company of its current sales size. However, the Committee was advised that long-term incentives were below the median grant level of the company’s peer group for several executive positions. As a result, some executive officers received a one-time

10

The Executive Performance Incentive Plan provides an additional incentive to enhance stockholder value. The plan provides that 50% of the award will be based on the achievement of an earnings-per-share target. The remaining 50% will be based on achieving earnings, profitability and cash flow targets related to an employee’s area of responsibility.

Management has commissioned a study of the competitive position of the company’s global compensation and benefits program. The Committee will use the results of this study to determine modifications to the program.

The Committee believes that the company’s compensation program, with its emphasis on long-term compensation, focuses the efforts of executives and employees on the attainment of a sustained high rate of company growth and profitability for the benefit of the company’s stockholders.

CEO Compensation

The compensation for Mr. Elliott was initially established by the Board based on data provided by Bristol-Myers Squibb prior to the separation. Mr. Elliott’s compensation was also reviewed as part of the December executive compensation study. The study indicated that Mr. Elliott’s current salary of $600,000 and bonus target of 100% of salary were at a competitive level.

The December study indicated that the long-term incentive opportunity provided to Mr. Elliott was below the competitive level of a peer group of medical device and biotech companies. Based on this data, in January 2002 the Committee granted Mr. Elliott 450,000 options, consisting of a 250,000 annual grant and an additional one-time grant of 200,000 options, as well as a grant of 20,000 shares of restricted stock. The Committee believes these actions bring Mr. Elliott’s long-term incentive compensation to a level consistent with the reward opportunities for long-term increases in stockholder value that are provided by other growth companies in the company’s industry.

Deductibility of Compensation Over $1 Million

In 1993, the Omnibus Budget Reconciliation Act of 1993 (the “Act”) was enacted. The Act includes potential limitations on the deductibility of compensation in excess of $1 million paid to the company’s five highest paid officers. Based on the regulations issued by the Internal Revenue Service to implement the Act, the company has taken the necessary actions to ensure the deductibility of payments under the Executive Performance Incentive Plan and the 2001 Stock Incentive Plan. The company will continue to take the necessary actions to maintain the deductibility of payments under both plans.

Compensation and Management Development Committee

| John L. McGoldrick, Chair | |

| Larry C. Glasscock | |

| Regina E. Herzlinger, D.B.A. | |

| Augustus A. White, III, M.D., Ph.D. |

Executive Officer Compensation Tables and Notes

The following tables set forth information regarding compensation paid by us and Bristol-Myers Squibb to our Chief Executive Officer, each of our four other most highly compensated executive officers who were serving as executive officers as of December 31, 2001, and one additional officer who served as an executive officer during 2001 but whose designation was changed before the end of the year, all based on salary and bonus earned during 2001.

11

Prior to our separation from Bristol-Myers Squibb on August 6, 2001, we were a wholly-owned subsidiary of Bristol-Myers Squibb with no material activities as a separate corporate entity. Accordingly, prior to the separation, the compensation of the individuals named below was determined in accordance with policies established by Bristol-Myers Squibb.

SUMMARY COMPENSATION TABLE

| Long-Term Compensation | |||||||||||||||||||||||||||||||||

| Awards | Payouts | ||||||||||||||||||||||||||||||||

| Annual Compensation | Securities | ||||||||||||||||||||||||||||||||

| Restricted | Underlying | ||||||||||||||||||||||||||||||||

| Other | Stock | Options/ | LTIP | All Other | |||||||||||||||||||||||||||||

| Salary | Bonus | Annual | Awards | SARS | Payouts | Compensation | |||||||||||||||||||||||||||

| Name/Title/Year | Year | ($) | ($) | Compensation | ($)(1) | (#)(2) | ($) | ($) | |||||||||||||||||||||||||

| J. Raymond Elliott | 2001 | 547,399 | 690,678 | — | 300,000 | 404,685 | — | — | |||||||||||||||||||||||||

| Chairman, President and | 2000 | 348,096 | 213,073 | — | — | 118,758 | 100,000 | (3) | 15,664 | ||||||||||||||||||||||||

| Chief Executive Officer | |||||||||||||||||||||||||||||||||

| Bruce E. Peterson | 2001 | 263,956 | 199,569 | — | 60,000 | 129,650 | — | 10,914 | (4) | ||||||||||||||||||||||||

| President — Americas | 2000 | 223,149 | 97,068 | — | — | 35,429 | — | 10,042 | |||||||||||||||||||||||||

| Bruno A. Melzi | 2001 | 255,526 | 181,817 | — | 60,000 | 104,457 | — | — | |||||||||||||||||||||||||

| President — Europe | 2000 | 179,870 | 58,552 | — | — | 25,350 | — | 25,506 | |||||||||||||||||||||||||

| John S. Loveman-Krelle | 2001 | 233,877 | 107,339 | 276,189 | (5) | 60,000 | 91,527 | — | 58,344 | (6) | |||||||||||||||||||||||

| President — Asia Pacific | 2000 | 185,423 | 64,813 | 139,781 | (7) | — | 40,112 | — | 41,023 | ||||||||||||||||||||||||

| Sam R. Leno | 2001 | 181,923 | 167,958 | — | 1,306,000 | 176,092 | — | 23,114 | (8) | ||||||||||||||||||||||||

| Senior Vice President and | 2000 | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Chief Financial Officer | |||||||||||||||||||||||||||||||||

| Roy D. Crowninshield, Ph.D. | 2001 | 274,383 | 151,936 | — | 60,000 | 104,915 | — | 12,285 | (4) | ||||||||||||||||||||||||

| Senior Vice President, Chief | 2000 | 263,700 | 145,817 | — | — | 72,486 | 80,000 | (3) | 11,867 | ||||||||||||||||||||||||

| Scientific Officer | |||||||||||||||||||||||||||||||||

| (1) | The number and market value of shares of restricted stock held by each of these executives at December 31, 2001, based upon the closing price of company common stock as reported by the New York Stock Exchange of $30.54, were: Mr. Elliott— 51,249 and $1,565,444; Mr. Peterson— 8,893 and $271,592; Mr. Melzi— 2,105 and $64,287; Mr. Loveman-Krelle— 2,105 and $64,287; Mr. Leno— 50,904 and $1,554,608; and Dr. Crowninshield— 2,105 and $64,287. |

| (2) | Includes options granted prior to the separation with respect to Bristol-Myers Squibb common stock. The amounts shown with respect to such options represent the number of shares of the company’s common stock resulting from the replacement on August 7, 2001 of each Bristol-Myers Squibb award with an option to acquire company common stock which was intended to preserve the economic value of the options at the time of the separation. The number of shares of the company’s common stock covered by replacement options was calculated by multiplying the number of shares of Bristol-Myers Squibb common stock under the original options by a factor of 2.03614, and the exercise price of the options was decreased by dividing the original exercise price by the same factor. |

| (3) | Represents payouts by Bristol-Myers Squibb from long-term performance awards granted in 1998 and earned over the three-year performance period from 1998 through 2000. The payouts were based on total stockholder return ranking versus peer companies of Bristol-Myers Squibb. The awards were paid at 80% of target. |

| (4) | Consists of matching contributions to the Zimmer Holdings, Inc. Savings and Investment Program and the Benefits Equalization Plan for the Zimmer Holdings, Inc. Savings and Investment Program as follows: Mr. Peterson— $6,686 and $4,228, respectively; and Dr. Crowninshield— $7,588 and $4,697, respectively. |

| (5) | Includes a net housing allowance of $149,730 as well as a cost of living adjustment of $91,870, both paid in connection with an overseas assignment, in addition to other annual compensation including perquisites and amounts reimbursed for payment of taxes. |

| (6) | Consists of matching contributions to the Zimmer Holdings, Inc. Savings and Investment Program of $7,650 and $50,694 paid in connection with a relocation. |

12

| (7) | Includes a housing allowance of $87,087 as well as a cost of living adjustment of $34,175, both paid in connection with an overseas assignment, in addition to other annual compensation including perquisites and amounts reimbursed for payment of taxes. |

| (8) | Represents amounts paid in connection with a relocation. |

| Individual Grants | ||||||||||||||||||||

| Number of | % of Total | |||||||||||||||||||

| Securities | Options/SARS | Exercise | ||||||||||||||||||

| Underlying | Granted to | or Base | Grant Date | |||||||||||||||||

| Options/SARS | Employees in | Price(2) | Expiration | Present | ||||||||||||||||

| Name | Granted(#)(1) | Fiscal Year | ($/SH) | Date | Value($)(3) | |||||||||||||||

| J. Raymond Elliott | 101,807 | (4) | 2.7% | $ | 35.45 | 01/02/11 | 1,731,376 | |||||||||||||

| 68,880 | 1.8% | $ | 29.35 | 08/06/11 | 971,462 | |||||||||||||||

| 233,998 | 6.1% | $ | 27.30 | 09/05/11 | 3,039,026 | |||||||||||||||

| Bruce E. Peterson | 38,178 | (4) | 1.0% | $ | 30.88 | 03/05/11 | 566,520 | |||||||||||||

| 15,701 | 0.4% | $ | 29.35 | 08/06/11 | 221,442 | |||||||||||||||

| 75,771 | 2.0% | $ | 27.30 | 09/05/11 | 984,068 | |||||||||||||||

| Bruno A. Melzi | 36,651 | (4) | 1.0% | $ | 30.88 | 03/05/11 | 543,861 | |||||||||||||

| 12,092 | 0.3% | $ | 29.35 | 08/06/11 | 170,542 | |||||||||||||||

| 55,714 | 1.5% | $ | 27.30 | 09/05/11 | 723,580 | |||||||||||||||

| John S. Loveman-Krelle | 30,542 | (4) | 0.8% | $ | 30.88 | 03/05/11 | 453,210 | |||||||||||||

| 15,300 | 0.4% | $ | 29.35 | 08/06/11 | 215,786 | |||||||||||||||

| 45,685 | 1.2% | $ | 27.30 | 09/05/11 | 593,329 | |||||||||||||||

| Sam R. Leno | 101,807 | (4) | 2.7% | $ | 25.73 | 07/15/11 | 1,261,081 | |||||||||||||

| 74,285 | 2.0% | $ | 27.30 | 09/05/11 | 964,769 | |||||||||||||||

| Roy D. Crowninshield, Ph.D. | 40,723 | (4) | 1.1% | $ | 30.88 | 03/05/11 | 604,285 | |||||||||||||

| 18,507 | 0.5% | $ | 29.35 | 08/06/11 | 261,017 | |||||||||||||||

| 45,685 | 1.2% | $ | 27.30 | 09/05/11 | 593,329 | |||||||||||||||

| (1) | Unless otherwise noted, individual grants vest in installments of 25% per year on each of the first through the fourth anniversaries of the grant date. |

| (2) | All options were made at 100% of fair market value as of the date of the grant. |

| (3) | In accordance with Securities and Exchange Commission rules, the Black-Scholes option pricing model was chosen to estimate the grant date present value of the options set forth in this table. The company does not believe that the Black-Scholes model, or any other model, can accurately determine the value of an option. Accordingly, there is no assurance that the value realized by an executive, if any, will be at or near the value estimated by the Black-Scholes model. Future compensation resulting from option grants is based solely on the performance of the company’s stock price. The Black-Scholes ratios were determined using the following assumptions: a volatility of 41.7%, a historic average dividend yield of 0.00%, a risk-free interest rate of 4.8% on the grant date and a seven year option term. Additionally, award values are adjusted to reflect the impact of forfeiture risk due to vesting criteria. |

| (4) | This option was granted prior to the separation with respect to Bristol-Myers Squibb common stock, and the number of underlying shares and exercise price shown represent the replacement on August 7, 2001 of the Bristol-Myers Squibb option with a Zimmer option which was intended to preserve the economic value of the option at the time of the distribution. The number of shares covered by the replacement option was calculated by multiplying the number of Bristol-Myers Squibb shares under the original option by a factor of 2.03614, and the exercise price of the option was decreased by dividing the original exercise price by the same factor. With respect to Mr. Elliott, Mr. Peterson, Mr. Melzi, Mr. Loveman-Krelle and Dr. Crowninshield, the option becomes exercisable to the extent of one-eighth of the grant on |

13

| the first through fourth anniversaries of the grant date and becomes exercisable to the extent of the remaining one-half of the grant on the eighth anniversary of the grant date. With respect to Mr. Leno, the option becomes exercisable to the extent of one-fourth of the grant on the first through fourth anniversaries of the grant date. In addition to these time vesting criteria, a portion of these awards have price thresholds which must be attained for these awards to become exercisable prior to the ninth year of the award term. One-half of the award requires that the company’s stock price exceed the option exercise price by 30%. This price level must be met for 15 consecutive trading days. In the ninth and tenth years of the award term, the awards become fully exercisable without regard to these price thresholds. The Black-Scholes values of these awards have been adjusted to recognize these thresholds. |

AGGREGATED OPTIONS/SAR EXERCISES IN LAST FISCAL YEAR

| Number of Securities | Value of Unexercised | |||||||||||||||||||||||

| Underlying Unexercised | “In the Money” | |||||||||||||||||||||||

| Options/SARS at | Options/SARS at | |||||||||||||||||||||||

| Shares | Fiscal Year-End(#)(2) | Fiscal Year-End($)(3) | ||||||||||||||||||||||

| Acquired | Value | |||||||||||||||||||||||

| Name | on Exercise(#) | Realized($) | Exercisable | Unexercisable | Exercisable | Unexercisable(4) | ||||||||||||||||||

| J. Raymond Elliott | — | — | 95,966 | 605,640 | $ | 587,235 | $ | 1,671,827 | ||||||||||||||||

| Bruce E. Peterson | — | — | 87,886 | 199,667 | $ | 909,793 | $ | 514,133 | ||||||||||||||||

| Bruno A. Melzi | — | — | 19,775 | 160,579 | $ | 99,486 | $ | 355,614 | ||||||||||||||||

| John S. Loveman-Krelle | — | — | 41,204 | 169,537 | $ | 267,313 | $ | 460,277 | ||||||||||||||||

| Sam R. Leno | — | — | — | 176,092 | — | $ | 730,375 | |||||||||||||||||

| Roy D. Crowninshield, Ph.D. | — | — | 156,172 | 235,431 | $ | 1,512,144 | $ | 667,549 | ||||||||||||||||

| (1) | All options were granted at 100% of fair market value. Optionees may satisfy the exercise price by submitting other shares owned for at least six months and/or cash. Minimum income tax withholding obligations may be satisfied by electing to have the company withhold shares otherwise issuable under the option with a fair market value equal to such obligations. |

| (2) | Includes options granted prior to the separation with respect to Bristol-Myers Squibb common stock. The amounts shown with respect to such options represent the number of shares of the company’s common stock resulting from the replacement on August 7, 2001 of each Bristol-Myers Squibb award with an option to acquire company common stock which was intended to preserve the economic value of the options at the time of the separation. The number of shares of the company’s common stock covered by replacement options was calculated by multiplying the number of shares of Bristol-Myers Squibb common stock under the original options by a factor of 2.03614, and the exercise price of the options was decreased by dividing the original exercise price by the same factor. |

| (3) | The closing price of the company’s common stock as reported by the New York Stock Exchange on December 31, 2001 was $30.54. Value is calculated on the basis of the difference between the exercise price and $30.54, multiplied by the number of shares of the company’s common stock underlying “in-the-money” options. |

| (4) | For all listed executive officers, the value of “Unexercisable” stock options includes the year-end value of stock options which have price thresholds for exercisability above the exercise price. They may exercise these options and potentially realize the portion of the listed value relating to these stock options once those price thresholds are attained. |

14

Pension Benefits

Most of our U.S. non-union employees, including executive officers, were participants in the Bristol-Myers Squibb Company Retirement Income Plan, a non-contributory pension plan. Effective as of the time of the separation, we adopted a retirement income plan, the Zimmer Holdings, Inc. Retirement Income Plan, that replicates, in all material respects, the benefit formula under the Bristol-Myers Squibb plan. We also adopted a non-contributory supplemental pension plan that replicates, in all material respects, the benefit formula under Bristol-Myers Squibb’s supplemental pension plan. Our retirement income plan and supplemental pension plan provide all Zimmer participants with credit for their service years with Bristol-Myers Squibb. Our obligations under our plans are reduced, however, because Bristol-Myers Squibb provided these employees with all benefits accrued under its corresponding retirement plans prior to the separation, which benefits became fully vested under the Bristol-Myers Squibb plans after the separation occurred.

The following table sets forth the aggregate annual benefit payable upon retirement at normal retirement age for each level of remuneration specified at the listed years of service.

| Years of Service | ||||||||||||||||||||||

| Remuneration | 15 | 20 | 25 | 30 | 35 | |||||||||||||||||

| $ | 200,000 | $ | 60,000 | $ | 80,000 | $ | 100,000 | $ | 120,000 | $ | 140,000 | |||||||||||

| 500,000 | 150,000 | 200,000 | 250,000 | 300,000 | 350,000 | |||||||||||||||||

| 1,000,000 | 300,000 | 400,000 | 500,000 | 600,000 | 700,000 | |||||||||||||||||

| 1,500,000 | 450,000 | 600,000 | 750,000 | 900,000 | 1,050,000 | |||||||||||||||||

| 2,000,000 | 600,000 | 800,000 | 1,000,000 | 1,200,000 | 1,400,000 | |||||||||||||||||

Pension benefits are determined by final average annual compensation where annual compensation is the sum of the amounts shown in the columns labeled “Salary” and “Bonus” in the Summary Compensation Table. Benefit amounts shown are straight-life annuities before the deduction for Social Security benefits. The executive officers named in the Summary Compensation Table have the following years of credited service for pension plan purposes: Mr. Elliott— 10.00 years; Mr. Peterson— 9.18 years; Mr. Loveman-Krelle— 6.00 years; Mr. Leno— 1.00 year; and Dr. Crowninshield— 19.00 years.

The company has granted Mr. Elliott additional age and service credit for purposes of calculating his pension benefits from the company and determining his eligibility for retiree health and life insurance benefits. For purposes of determining the extent of any early retirement pension subsidies, Mr. Elliott will be deemed to have attained age 55 as of August 6, 2001, the date of the separation from Bristol-Myers Squibb, and he will be entitled to those subsidies upon the commencement of his company pension benefits at or after his actual attainment of age 55. Also, for purposes of calculating the amount of his pension benefits and determining his eligibility for retiree health and life insurance benefits, Mr. Elliott will be deemed to have accumulated 10 years of service and 10 years of credited service with the company as of August 6, 2001. These additional pension benefits will be paid from the company’s general assets pursuant to the company’s supplemental pension plan or a similar unfunded, nonqualified pension benefit arrangement, and will be offset by the supplemental pension benefits paid to Mr. Elliott by Bristol-Myers Squibb. The additional pension benefits from the company will be paid at the same time and in the same form as the other supplemental benefits payable to Mr. Elliott under the company’s supplemental pension plan.

The following is a summary of the terms of our retirement income plan and our supplemental pension plan as those plans apply to management employees, including individuals named in the Summary Compensation Table.

Participants are given full credit under our retirement income plan for service and compensation accrued under the Bristol-Myers Squibb plan. Under our retirement income plan, pension benefits are determined by final average annual compensation where annual compensation is the sum of the amounts shown in the columns labeled “Salary” and “Bonus” in the Summary Compensation Table. The normal retirement benefit

15

Federal laws place limitations on compensation amounts that may be included under our retirement income plan. Pension amounts based on our retirement income plan formula which exceed the applicable limitations will be paid under the Benefit Equalization Plan of the Zimmer Holdings, Inc. Retirement Income Plan. The purpose of this benefit equalization plan is to provide benefits for certain employees participating in our retirement income plan whose funded benefits under that plan are or will be limited by application of the Employee Retirement Income Security Act of 1974, as amended (ERISA) and the Internal Revenue Code of 1986, as amended (the “Code”). Our benefit equalization plan is intended to be an “excess benefit plan,” as that term is defined under ERISA with respect to those participants whose benefits under our retirement income plan have been limited by Section 415 of the Code, and a “top hat” plan meeting the requirements of the appropriate sections of ERISA with respect to those participants whose benefits under our retirement income plan have been limited by Section 401(a)(17) of the Code. As with the retirement income plan, benefits payable under the benefits equalization plan will be offset by the value of benefits payable to the recipient under the Bristol-Myers Squibb plan.

Retention Agreements

In February 2001, in anticipation of the separation from Bristol-Myers Squibb, we entered into retention agreements with Mr. Elliott, Dr. Crowninshield, Mr. Peterson, Mr. Melzi and Mr. Loveman-Krelle. The retention agreements generally provide that executives who remained in our employment through the separation date received a retention bonus paid in the form of our stock options and our restricted shares. The agreements also provide that if the executive is involuntarily terminated during the one-year period after the separation, the executive will receive a severance payment equal to one year of base salary (the severance payment for Mr. Elliott is equal to two years of base salary). As a condition to receipt of such benefits, each executive agreed not to work for any competitor of the company for a period of one year following the separation from Bristol-Myers Squibb.

In addition, pursuant to a retention agreement entered into with Mr. Elliott in February 2001 in anticipation of the separation from Bristol-Myers Squibb, Mr. Elliott was awarded 17,544 phantom deferred share units. At the time of Mr. Elliott’s retirement or termination of employment, his units will be distributed to him in the form of a lump sum cash payment equal to the number of units awarded multiplied by the fair market value of company common stock at the time of his retirement or termination, plus the sum of any dividends credited on shares of company common stock from the date of the award to his retirement or termination date.

Change in Control Arrangements

In March 2002, we entered into change in control agreements with thirteen executives including each of the executive officers named in the Summary Compensation Table in this proxy statement. The agreements are intended to provide for continuity of management in the event of a change in control of the company. By their terms, the agreements are in effect through December 31, 2003, and will be automatically extended, beginning on January 1, 2004, in one-year increments, unless either the company or the executive gives prior notice of termination or a change in control shall have occurred prior to January 1 of such year. If a change in control occurs during the term of the agreement, the agreement shall continue in effect for a period of not less than 36 (in the case of Mr. Elliott) or 24 (in the case of the other executives) months beyond the month in which such change in control occurred.

16

The agreements provide that the executives could be entitled to certain severance benefits following a change in control of the company and termination of employment. Under each agreement, a change in control would include any of the following events: (1) a “person,” as defined in the Securities Exchange Act of 1934, as amended, acquires 20% or more of the combined voting power of the company’s then outstanding securities; (2) a majority of the company’s directors are replaced during a two-year period; or (3) the stockholders approve a merger of consolidation of the company (unless the stockholders of the company own 75% of the surviving entity) or approve a plan of complete liquidation of the company.

If, following a change in control, the executive is terminated by the company for any reason other than for cause (as defined in the agreement), or death, or by the executive for good reason (as defined in the agreement), the covered executive would be entitled to a lump sum severance payment equal to three (in the case of Mr. Elliott), two (in the case of Messrs. Leno, Loveman-Krelle, Melzi and Peterson and one other executive officer, the “tier 2 executives”) or one (in the case of Dr. Crowninshield and six other executives, the “tier 3 executives”) times the sum of the executive’s base salary and target bonus under the company’s Executive Performance Plan. In addition, the executive would receive a payout of any unpaid incentive compensation which has been allocated or awarded to the executive for the completed calendar year preceding the date of termination and a pro rata portion to the date of termination of the aggregate value of all contingent incentive compensation awards to the executive for the current calendar year.

Further, all outstanding stock options granted to the executive would become immediately vested and exercisable and all restrictions on restricted stock awards would lapse, unless otherwise provided for under a written stock award agreement. The executive would receive a cash amount equal to the unvested portion, if any, of the company’s matching contributions (and attributable earnings) credited to the executive under the Savings and Investment Program. The executive would receive a cash amount or the additional benefit to which the executive would have been entitled had he or she been fully vested and credited with three (Mr. Elliott), two (the tier 2 executives) or one (the tier 3 executives) additional years of service and age for the purpose of calculating his or her tax-qualified and nonqualified pension benefits. For a three (Mr. Elliott), two (the tier 2 executives) or one (the tier 3 executives)-year period after the date of termination, the executive would receive life and health insurance benefits and perquisites substantially similar to those that the executive is receiving immediately prior to the notice of termination. Thereafter, in the case of Mr. Elliott, the executive will be eligible to participate in the company’s retiree medical and dental plans.

In the event that any payments made to Mr. Elliott or a tier 2 executive in connection with a change in control and termination of employment would be subject to excise tax as excess parachute payments under the Code, the company will “gross up” the executive’s compensation to fully offset such excise taxes provided the payments exceed 110% of the maximum total payment which could be made without triggering the excise taxes. If the aggregate parachute payments exceed such maximum amount but do not exceed 110% of such maximum amount, then the parachute payments would be automatically reduced so that no portion of the parachute payments is subject to excise tax and no gross-up payment would be made.

In consideration for receiving one of these agreements, each executive signed an agreement not to work for any competitor of the company for a period of one year following termination. Also, to receive the severance benefits provided under the agreements, an executive must sign a general release of claims.

17

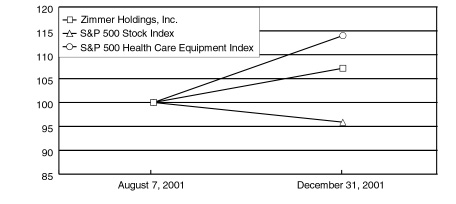

Performance Graph

The following graph compares the performance of the company common stock for the periods indicated with the performance of the S&P 500 Stock Index and the S&P 500 Health Care Equipment Index.

| August 7, 2001 | December 31, 2001 | |||||||

| Zimmer Holdings, Inc. | 100 | 107.16 | ||||||

| S&P 500 Stock Index | 100 | 95.88 | ||||||

| S&P 500 Health Care Equipment Index | 100 | 113.99 | ||||||

Assumes $100 was invested on August 7, 2001 (the first date the company common stock was traded on the New York Stock Exchange) in company common stock and each index. Values are as of December 31 assuming dividends are reinvested. No cash dividends have been declared or paid on company common stock. Returns over the indicated period should not be considered indicative of future returns.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation and Management Development Committee during 2001 was an officer, employee or former officer of the company or had any relationship requiring disclosure herein pursuant to SEC regulations. No executive officer of the company served as a member of a compensation committee or a director of another entity under circumstances requiring disclosure under SEC regulations.

Two directors are to be elected at the meeting for three-year terms ending at the 2005 Annual Meeting. J. Raymond Elliott and Dr. Regina E. Herzlinger, who are both presently directors of the company, have been nominated by the Board of Directors for election at this Annual Meeting. The accompanying proxy will be voted for the Board of Directors’ nominees, except where authority to so vote is withheld. Should any nominee be unable to serve, the proxy will be voted for such person as shall be designated by the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE TWO NOMINEES FOR DIRECTORS.

18

| Proposal 2. | Approval and Adoption of the Zimmer Holdings, Inc. Employee Stock Purchase Plan |

On February 25, 2002, the Board of Directors approved and adopted the Zimmer Holdings, Inc. Employee Stock Purchase Plan (the “ESPP”), subject to approval by stockholders within 12 months of Board approval. If approved by the stockholders, the ESPP will authorize the issuance and purchase by employees of up to 3,000,000 shares of the company’s common stock. At the Annual Meeting, you are being asked to approve the ESPP for the purpose of qualifying such shares for special tax treatment under Section 423 of the Code.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE ZIMMER HOLDINGS, INC. EMPLOYEE STOCK PURCHASE PLAN AND THE RESERVATION OF SHARES FOR ISSUANCE UNDER THE ESPP.

Summary of the ESPP

General. The purpose of the ESPP is to provide employees of the company and its designated subsidiaries with an opportunity to purchase shares of common stock and, therefore, to have an additional incentive to enhance the value of the company. The ESPP will further align the interests of employees with those of stockholders through increased stock ownership.

Administration. The ESPP will be administered by a committee appointed by the Board (the “Committee”). The Committee may establish rules for administration of the ESPP, interpret the ESPP, supervise its administration, make determinations about ESPP entitlements, adopt sub-plans, and take other actions consistent with the delegation from the Board. The decisions by the Board and the Committee are final and binding upon all participants.

Eligibility. Any employee of the company or any company subsidiary designated by the Committee who is employed on an Offering Date (defined below) is eligible to participate in the ESPP during the Offering Period (defined below) beginning on that Offering Date, subject to administrative rules established by the Committee. The Committee has authority to limit Plan participation to full-time employees (defined in accordance with Code Section 423), impose an eligibility requirement (no longer than 2 years) as of any prospective Offering Date, and exclude some or all highly compensated employees from participation in the Plan. An employee is not eligible to participate in the ESPP to the extent that, immediately after the grant, the employee would have owned 5% of either the voting power or the value of the company’s common stock. Additionally, an employee’s rights to purchase common stock pursuant to the ESPP may not accrue at a rate that exceeds $25,000 per calendar year. Eligible employees become participants in the ESPP by filing the required enrollment documents with Zimmer by a date set by the Committee prior to the applicable Offering Date. Zimmer projects that, as of January 1, 2003, approximately 3,300 employees, including six executive officers, would be eligible to participate in the ESPP. In certain international locations, local tax or exchange control regulations make certain features of the ESPP impracticable. The ESPP authorizes the grant of options and issuance of common stock to employees participating in a sub-plan, which is not designed to qualify under Section 423 of the Code, in order to achieve the desired tax or other objectives in particular locations outside the United States.

Participation in an Offering. The ESPP will be implemented by purchase periods lasting six months or other periods as determined by the Committee (an “Offering Period”). Common stock will be purchased under the ESPP at the end of each Offering Period, unless the participant withdraws or terminates employment earlier. The ESPP will be implemented at different dates in different countries, as determined by the Committee. The initial Offering Period in the first locations is anticipated to begin on January 1, 2003. The company anticipates that employees will begin to enroll in the ESPP during December 2002. To participate in the ESPP, each eligible employee must authorize payroll deductions from his or her after-tax pay by completing a subscription agreement. The payroll deductions will be subject to the limitations discussed above, as well as any other limits or conditions imposed by the Committee that are not inconsistent with the terms of the ESPP. In countries where payroll deductions are not feasible, the Committee may allow

19

Purchase Price, Shares Purchased. Employees who choose to participate in the ESPP will receive an option to purchase shares of company common stock at a discount. Under the option, the purchase price of the shares will be not less than 85% of the fair market value of the common stock on (i) the Offering Date or (ii) the last trading day of the Offering Period, whichever is less. The Offering Date is the first trading day of the Offering Period. The fair market value as of any trading day will be the closing price of common stock on the New York Stock Exchange on that day. On March 12, 2002, the closing price of a share of the company’s common stock was $34.41. At the end of an Offering Period, a participant’s option will be exercised automatically to purchase the number of shares of common stock that the participant’s accumulated payroll deduction will buy at the purchase price. The number of shares of common stock a participant purchases in each Offering Period is determined by dividing the total amount of payroll deductions withheld from the participant’s compensation during that Offering Period by the purchase price.

Termination of Employment. If a participant dies or terminates employment for any reason, the participant will immediately cease to participate in the ESPP. In that event, all of the common stock purchased by the participant under the ESPP will be distributed to him or her (or, in the case of the participant’s death, to the participant’s beneficiary), and any payroll deductions credited to the participant’s account will be returned without interest to him or her (or, in the case of a participant’s death, to the participant’s beneficiary).

Adjustments Upon Changes in Capitalization or Corporate Transactions. In the event that company common stock is changed by reason of any stock split, stock dividend, combination, recapitalization, a Corporate Transaction (defined below) in which the company is the surviving corporation, or similar changes to the company’s capital structure, the Committee will appropriately adjust the number of shares of stock subject to the ESPP, the number of shares of stock to be purchased pursuant to an option, and the price per share of common stock covered by an option, and other relevant provisions of the ESPP. The Committee’s determination will be conclusive and binding on all persons. In the event of a Corporate Transaction in which the company is not the surviving corporation, the Committee may take such actions with respect to the ESPP that the Committee deems appropriate, which could be a determination that each option issued under the ESPP will be assumed by, or an equivalent option substituted by, the successor company or its affiliates, that the purchase date will be accelerated, or that all outstanding options will terminate and accumulated payroll deductions will be refunded. For purposes of the ESPP, a Corporate Transaction is a sale of all or substantially all of the company’s assets, or a merger, consolidation, or other capital reorganization of the company with or into another corporation.

Transferability. Options under the ESPP cannot be voluntarily or involuntarily assigned. The shares of common stock acquired under the ESPP will be freely transferable, except as otherwise determined by the Committee. The Committee may require that shares purchased under the Plan be retained with the Plan’s designated broker for a designated period of time and may restrict dispositions during that period.

Amendment and Termination of the Plan. The Board may terminate or amend the ESPP at any time, except that it may not increase the number of shares subject to the ESPP other than as described in the ESPP.

Withdrawal. Generally a participant may withdraw from the ESPP during an Offering Period subject to any requirements established by the Committee. If a participant elects to withdraw, all of the payroll deductions credited to the participant’s account will be returned to the participant, and the participant may not make any further contributions under the ESPP for the purchase of common stock during that Offering Period. A participant’s voluntary withdrawal during and Offering Period will not have any effect on the participant’s eligibility to participate in the ESPP during a subsequent Offering Period.

New Plan Benefits. Because benefits under the ESPP will depend on employees’ elections to participate and the fair market value of the company’s common stock at various future dates, it is not possible to determine the benefits that will be received by executive officers and other employees if the ESPP is approved by the stockholders. Non-employee directors are not eligible to participate in the ESPP.

20

Federal Income Tax Consequences

If the stockholders approve this proposal, the ESPP, and the right of participants to make purchases under the ESPP, should qualify under the provisions of Sections 421 and 423 of the Code. Under these provisions, no income will be taxable to a participant until the shares purchased under the ESPP are sold or otherwise disposed of. Upon sale or other disposition of the shares, the participant will generally be subject to tax, and the amount of the tax will depend upon the holding period. If the shares are sold or otherwise disposed of more than two years after the beginning of the Offering Period in which the shares were purchased and more than one year from the date of transfer of the shares to the participant, then the participant generally will recognize ordinary income measured as the lesser of (1) the actual gain (the amount by which the fair market value of the shares at the time of the sale or disposition exceeds the purchase price), or (2) an amount equal to 15% of the fair market value of the shares as of the Offering Date, if the shares were purchased at no less than 85% of the fair market value of the shares on the Offering Date. Any additional gain should be treated as long-term capital gain. If the shares are sold or otherwise disposed of before the expiration of this holding period, the participant will recognize ordinary income generally measured as the excess of the fair market value of the shares on the date the shares are purchased over the purchase price. Any additional gain or loss on the sale or disposition will be long-term or short-term capital gain or loss, depending on the holding period.

The company is not entitled to a deduction for amounts taxed as ordinary income or capital gain to a participant, except to the extent ordinary income is recognized by participants upon a sale or disposition of shares prior to the expiration of the holding period(s) described above. In all other cases, no deduction is allowed to the company.

The foregoing is only a summary of the effect of federal income taxation upon the participant and the company with respect to the shares purchased under the ESPP. It does not purport to be complete, and it does not discuss the tax consequences arising in the context of a participant’s death or the income tax laws of any municipality, state or foreign country in which the participant’s income or gain may be taxable.

Incorporation by Reference

The above description is only a summary of the ESPP and is qualified in its entirety by reference to its full text, a copy of which is included in this Proxy Statement as Appendix B.

PricewaterhouseCoopers, LLP (“PwC”) served as the company’s independent accountants for 2001. At the time of printing of the Proxy Statement, the Audit Committee and the Board of Directors have not made any determination on the selection of independent accountants for 2002.

| Aggregate fees billed by PwC to the company for the fiscal year ended 2001 are as follows: | |