- ZBH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Zimmer Biomet (ZBH) DEF 14ADefinitive proxy

Filed: 27 Mar 24, 5:00pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

CHECK THE APPROPRIATE BOX: | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Under §240.14a-12 |

Zimmer Biomet Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

OUR MISSION |

Alleviate pain and improve the quality of life for people around the world. |

GUIDING PRINCIPLES |

● Respect and show gratitude for the contributions and diverse perspectives of others. |

● Commit to the highest standards of patient safety, quality and integrity. |

● Focus our resources in areas where we will make a difference. |

● Ensure the company’s return is equivalent to the value we provide our customers and patients. |

● Give back to our communities and people in need. |

COMMITMENT TO DIVERSITY, EQUITY AND INCLUSION Consistent with our Guiding Principles, in 2023 we continued our commitment to community groups, business platforms and other organizations united to driving meaningful change and sustained social justice. In that spirit, we advanced several change initiatives, including continued investment in Movement is Life, Inc., a nonprofit multidisciplinary coalition seeking to eliminate racial, ethnic and gender disparities in muscle and joint health. Additionally, to further the commitment of closing health care disparities outlined in our Diversity, Equity and Inclusion strategy, we established a new Health Equity Platform in 2023 to increase access to quality care within underserved communities while leveraging innovation to improve patient outcomes in the orthopedic industry and beyond. The Zimmer Biomet Foundation, Inc., in partnership with our employee resource groups, has identified multiple non-profit organizations that represent and support the diverse populations in and around the communities where Zimmer Biomet operates. Our efforts have led to achieving recognition among the Forbes America’s Best Large Employers, and Newsweek America’s Greatest Workplaces for Diversity, and we were recognized as a Human Rights Campaign Equality 100 Leader in LGBTQ+ Workplace Inclusion. |

SHAREHOLDER ENGAGEMENT AND ENVIRONMENTAL, SOCIAL AND GOVERNANCE PRIORITIES We proactively engage with our shareholders, conducting ongoing discussions and sharing information, including the comprehensive disclosures featured in our annual Sustainability Report. In 2023, we reached out to institutional shareholders representing approximately 63% of our outstanding shares and engaged in discussions on a variety of subjects, including shareholder feedback relating to our executive compensation, Board of Directors and executive succession planning, and product safety and quality matters, which are discussed further in the Compensation Discussion and Analysis section of this proxy statement. We also discussed various environmental, social and governance (“ESG”) topics that were of interest to shareholders. Please look for more information on our ESG priorities in our next Sustainability Report, which we expect to release this spring. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS The statements included in this proxy statement, including in the “Letter from Our President and Chief Executive Officer,” “Letter from Our Chairman to our Shareholders,” and in the section entitled “Executive Compensation – Compensation Discussion and Analysis – Executive Summary,” regarding future financial performance, results of operations, expectations, plans, strategies, goals, priorities and other statements that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are based upon current beliefs, expectations and assumptions and are subject to significant risks, uncertainties and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks, uncertainties and changes in circumstances that could cause actual results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 (“2023 Form 10-K”). Readers of this proxy statement are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. |

March 27, 2024

letter from our Chairman TO OUR SHAREHOLDERS:

Dear Fellow Shareholders,

On behalf of my fellow directors, I want to thank you for your interest in Zimmer Biomet. Your investments make it possible for Zimmer Biomet to deliver innovative products and solutions to achieve our corporate mission to “alleviate pain and improve the quality of life for people around the world.”

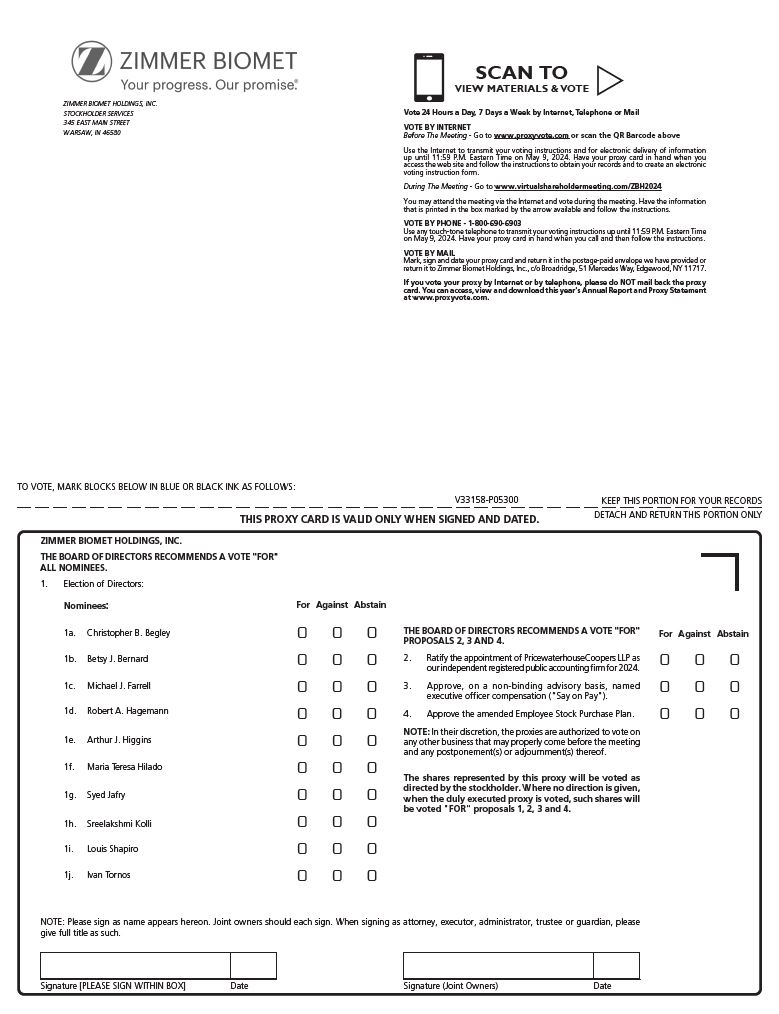

Shareholders will be voting on four matters at our 2024 annual meeting – election of directors, ratification of the appointment of PricewaterhouseCoopers LLP, approval, on an advisory basis, of the compensation of our named executive officers and approval of the amended Employee Stock Purchase Plan. I encourage you to read the pages that follow and ask for your support on these matters.

This letter highlights some of the actions we have taken as a Board of Directors over the past year to move Zimmer Biomet forward and represent your interests as shareholders.

Innovation to Improve Lives

Zimmer Biomet continued to innovate and advance our mission in 2023. We are extremely proud of the company’s recent accomplishments, including:

Chief Executive Officer Succession

In August 2023, we, your independent directors, performed one of the most critical functions of a Board of Directors: we oversaw a CEO succession. After leading a meaningful five-year transformation of Zimmer Biomet, Bryan Hanson, our previous Chairman, President and CEO, resigned to take on another position. The Board led a rigorous and comprehensive process to identify and appoint a new President and CEO. We unanimously determined that Ivan Tornos, then serving as Chief Operating Officer of Zimmer Biomet, was the preferred candidate based on a variety of considerations, including his critical role in the company’s strategic transformation, turnaround and continuing positive business momentum.

The Board engaged and consulted with a reputable executive search firm to identify qualified external candidates, who were then fully evaluated along with Mr. Tornos. We ultimately concluded that Ivan was a highly qualified and well-prepared candidate both for the

President and CEO position and for the role as a member of the Board, meeting the Board’s rigorous expectations and selection criteria for such roles. Importantly, this appointment was the result of the company’s and the Board’s ongoing focus on and attention to leadership development and executive succession planning. The COO role and Ivan’s broad and extensive global responsibilities were previously created and designed in part to fully prepare, groom, equip and qualify him as a strong and natural succession candidate. I’m pleased to report that the succession planning and CEO transition processes were successful and we are excited to continue to work closely with Ivan as he leads Zimmer Biomet forward, delivering new innovation, accelerating growth and driving long-term shareholder value.

Experienced Leaders with a Commitment to Diversity

We continue to focus on building and maintaining a diverse Board skill set as we expect the highest standards of integrity and fiduciary responsibility and prioritize the interests of Zimmer Biomet stakeholders.

We are pleased to have recently added another exceptional director who complements our skills, experiences and attributes:

Executive Compensation Alignment with Shareholder Interests

As described in the following pages, in 2023 our Compensation and Management Development Committee implemented important shareholder feedback to more closely align our executive compensation with our shareholders’ input. Our shareholder engagement continues to provide us valuable insights to better align executive compensation with your feedback.

The Board is focused on driving robust corporate performance and total shareholder return, while encouraging critical leadership retention and enhancing employee engagement. Our strategy is reflected in all of our incentive structures and we are pleased with the significant progress Zimmer Biomet has made over the past year.

We remain committed to serving your interests in 2024 and beyond, and are confident in the future of Zimmer Biomet.

On behalf of the entire Board of Directors, thank you for your continued support of Zimmer Biomet.

| Sincerely, |

|

|

|

|

Christopher Begley Chairman of the Board Zimmer Biomet Holdings, Inc. 345 East Main Street Warsaw, Indiana 46580 |

March 27, 2024

letter from our president and chief executive officer:

Dear Fellow Shareholders:

I am very proud of the meaningful progress and growth driven by the Zimmer Biomet team in 2023. It was a year of significant achievements, all aimed toward serving our customers and creating shareholder value, and ultimately guided by our Mission to “alleviate pain and improve the quality of life for people around the world.”

In the letter to shareholders included in our 2023 Annual Report, I discuss key milestones in the year just completed, as well as key initiatives that will continue to guide us in the months and years ahead.

We remain committed to delivering on our near- and long-term corporate strategy and on the innovation and execution necessary to achieve it. Thank you for your continuing support of Zimmer Biomet.

Annual Meeting Matters

On behalf of the Board of Directors, it is my pleasure to invite you to attend the 2024 annual meeting of shareholders on May 10, 2024 at 8:00 a.m. Eastern Time. This year’s annual meeting will be conducted virtually, via webcast.

You will be able to attend the annual meeting online by visiting www.virtualshareholdermeeting.com/ZBH2024. You will be able to vote your shares electronically during the meeting by logging in using the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card or on the voting instruction form accompanying the proxy materials.

We continue to embrace the latest technology to provide expanded access, improved communication and cost savings for our shareholders and the company. As we’ve learned, hosting a virtual meeting enables increased shareholder participation from locations around the world. In addition, the online format allows us to communicate more effectively via a pre-meeting forum that you can enter by visiting www.proxyvote.com with your control number. We encourage you to log on and ask any questions you may have, which we will try to answer during the meeting. We recommend that you log in a few minutes before the meeting on May 10, 2024 to ensure you are logged in when the meeting starts.

The following Notice of Annual Meeting of Shareholders outlines the business to be conducted at the meeting. Only shareholders of record at the close of business on March 11, 2024 will be entitled to notice of and to vote at the meeting. Further details about how to attend the meeting online and the business to be conducted at the meeting are included in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement.

We are again providing access to our proxy materials online under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to many of our shareholders a Notice of Internet Availability instead of a paper copy of this proxy statement and our 2023 Annual Report. This electronic process gives shareholders fast, convenient access to the materials, reduces the impact on the environment and reduces our printing and mailing costs. The Notice of Internet Availability contains instructions on how to access documents online. It also contains instructions on how shareholders can receive a paper copy of our materials, including this proxy statement, our 2023 Annual Report and a form of proxy card or voting instruction form.

Your vote is important. Regardless of whether you plan to attend the virtual annual meeting, we hope you vote as soon as possible. You may vote by proxy online or by phone, or, if you received paper copies of the proxy materials by mail, you may also vote by mail by following the instructions on the proxy card or voting instruction form. Additionally, if you attend the virtual annual meeting, you may vote your shares during the meeting via the Internet even if you previously voted your proxy. Voting online or by phone, by written proxy or by voting instruction form ensures your representation at the annual meeting regardless of whether or not you attend the virtual meeting.

| Sincerely, |

|

|

|

|

Ivan Tornos President and Chief Executive Officer Zimmer Biomet Holdings, Inc. 345 East Main Street Warsaw, Indiana 46580 |

TABLE OF CONTENTS |

1 |

|

|

| ||

|

|

| 41 | ||

| 1 |

| 41 | ||

|

|

|

| 46 | |

2-4 |

|

| 48 | ||

| 2 |

| 50 | ||

|

|

|

| 52 | |

5-24 |

|

| 54 | ||

| 5 |

| 55 | ||

6 |

| 58 | |||

11 |

| 60 | |||

11 |

| 62 | |||

12 |

| 62 | |||

13 |

| 63 | |||

| 13 | Board's Role in Executive Succession Planning and Development |

| 66 | |

14 |

| 69 70 | |||

14 |

| ||||

15 |

| 70 | |||

15 |

| 71 | |||

15 |

| 74 | |||

16 |

| 75 | Equity Compensation Plan Information

| ||

16 |

| ||||

17 17 | 77-81 |

| |||

17 | Stock Trading Policy and Prohibition on Pledging and Hedging |

| 77 | Proposal 4 – Approval of the Amended Employee Stock Purchase Plan | |

| 19 |

|

|

| |

22 |

|

|

| ||

|

|

| 82-83 |

| |

25-27 |

|

| 82 | ||

| 25

| Proposal 2 — Ratification of the Appointment of the Independent Registered Public Accounting Firm |

| 83 | |

| 25 26 |

|

|

| |

| 26 | Audit Committee Pre-Approval of Services of Independent Registered Public Accounting Firm | 84-88 |

| |

| 27 27 |

| 84 | ||

|

|

|

| 87 | |

28-76 |

|

| 88 88 | ||

| 28 |

| 88 | ||

|

|

|

|

| |

29 29 | A1-A2 | A-1 | Appendix A — Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures | ||

| 36 37 |

|

|

| |

| 39 | B1-B7 | B-1 | ||

|

|

|

|

|

|

ZIMMER BIOMET HOLDINGS, INC.

345 East Main Street

Warsaw, Indiana 46580

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF ZIMMER BIOMET HOLDINGS, INC.

To Be Held May 10, 2024 |

|

|

|

|

TIME AND DATE |

|

|

| |

8 a.m. Eastern Time on Friday, May 10, 2024 |

| |||

PLACE This year’s meeting will be held virtually via webcast at www.virtualshareholdermeeting.com/ZBH2024. |

| Your Vote Is Important. Even if you plan to attend the virtual annual meeting, we urge you to review the proxy statement and vote your shares as soon as possible. |

| |

ITEMS OF BUSINESS |

| VOTE IN ADVANCE OF THE MEETING: |

| |

• Elect 10 directors to serve until the 2025 annual meeting of shareholders • Ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for 2024 • Approve, on a non-binding advisory basis, named executive officer compensation (“Say on Pay”) • Approve the amended Employee Stock Purchase Plan • Transact such other business as may properly come before the meeting and any postponement(s) or adjournment(s) thereof

RECORD DATE March 11, 2024

By Order of the Board of Directors

Chad F. Phipps Senior Vice President, General Counsel and Secretary March 27, 2024 |

|

| ||

| INTERNET |

|

| |

|

| Visit www.proxyvote.com |

| |

| TELEPHONE |

|

| |

|

| Call 1-800-690-6903 |

| |

|

|

| ||

|

| Mark, sign, date and promptly mail your proxy card or voting instruction form |

| |

| VOTE ONLINE DURING THE MEETING: |

| ||

|

| |||

|

| |||

| INTERNET |

|

| |

|

| Vote through the virtual meeting platform during the meeting |

| |

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on May 10, 2024: |

| ||

| This Notice of Annual Meeting, the Proxy Statement and the 2023 Annual Report are available at www.proxyvote.com. |

| ||

Zimmer Biomet 1

Proxy Statement SUMMARY

PROXY STATEMENT SUMMARY

We are providing this proxy statement in connection with the solicitation of proxies by our Board of Directors for use at our 2024 annual meeting of shareholders to be held on Friday, May 10, 2024. The Notice of Annual Meeting of Shareholders and related proxy materials, or a Notice of Internet Availability, were first sent to shareholders on or about March 27, 2024. This summary highlights information contained elsewhere in this proxy statement. It does not contain all of the information you should consider, and we urge you to read the entire proxy statement, as well as our 2023 Annual Report, before voting.

voting matters and board recommendations

Voting Matter | Board Vote | See | |

Proposal 1 | Election of directors | ✓ FOR | 5 |

Proposal 2 | Ratification of the appointment of PwC as our independent registered public accounting firm for 2024 | ✓ FOR | 25 |

Proposal 3 | Advisory vote to approve named executive officer compensation | ✓ FOR | 28 |

Proposal 4 | Approval of the amended Employee Stock Purchase Plan | ✓ FOR | 77 |

Proposal 1 – Election of Directors |

Our Board recommends a vote FOR each nominee |

Our Director Nominees

The following table provides summary information about each of the 10 director nominees. Each director is elected annually by a majority of votes cast.

Name | Age | Director | Independent | Other | Committee Memberships | |||

|

|

|

|

| A | C&MD | CG | QR&T |

Christopher B. Begley + Retired Executive Chairman & CEO, Hospira, Inc. | 71 | 2012 | ✓ | — |

|

| ✓ | ✓ |

Betsy J. Bernard Retired President, AT&T Corp. | 68 | 2009 | ✓ | — | ✓ |

| Chair |

|

Michael J. Farrell Chair and CEO, ResMed Inc. | 51 | 2014 | ✓ | 1 |

| Chair |

| ✓ |

Robert A. Hagemann Retired Senior VP & CFO, Quest Diagnostics Incorporated | 67 | 2008 | ✓ | 2 | Chair |

| ✓ |

|

Arthur J. Higgins Operating Advisor to Abu Dhabi Investment Authority | 68 | 2007 | ✓ | 1 |

| ✓ |

| ✓ |

Maria Teresa Hilado Retired Executive VP & CFO, Allergan plc | 59 | 2018 | ✓ | 1 | ✓ |

| ✓ |

|

Syed Jafry Retired SVP & President, Regions, Thermo Fisher Scientific Inc. | 60 | 2018 | ✓ | — | ✓ | ✓ | ||

Sreelakshmi Kolli EVP, Chief Product and Digital Officer, Align Technology, Inc. | 49 | 2021 | ✓ | 1 | ✓ |

|

| Chair |

Louis A. Shapiro Senior Advisor, General Atlantic Retired President & CEO, Hospital for Special Surgery | 64 | 2024 | ✓ | — | ✓ |

|

| ✓ |

Ivan Tornos President & CEO, Zimmer Biomet Holdings, Inc. | 48 | 2023 | x | 1 |

|

|

|

|

+: Chairman of the Board

A: Audit | C&MD: Compensation & Management Development | CG: Corporate Governance | QR&T: Quality, Regulatory & Technology |

Zimmer Biomet 2

Proxy Statement SUMMARY

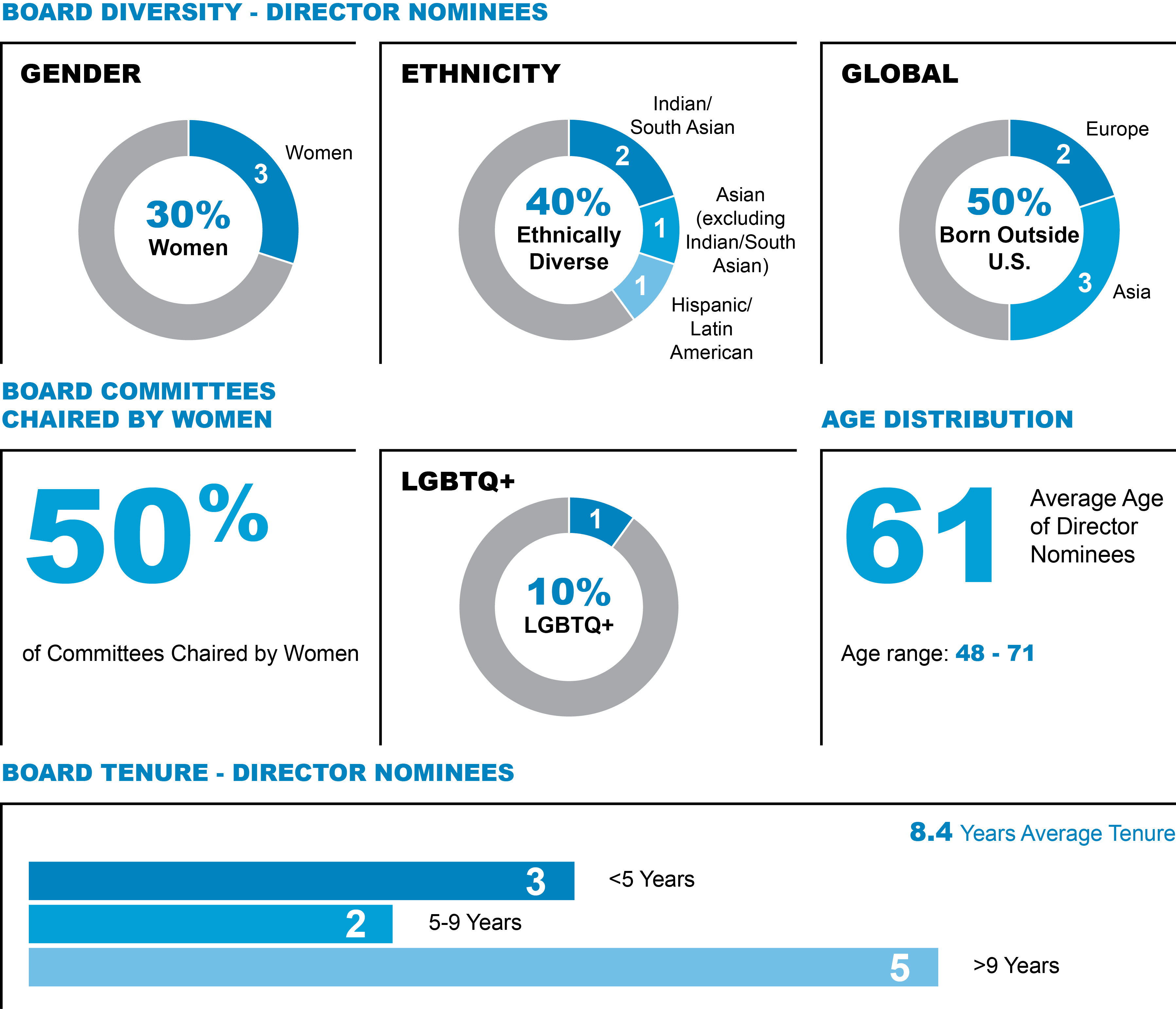

Race, ethnicity, gender and LGBTQ+ status are self-reported by directors in their annual directors’ and officers’ questionnaires. Diversity, equity and inclusion data is not standardized and director responses are not required.

Corporate Governance Strengths

Board Composition |

| Board Oversight and Stock Ownership | ||

✓ | Diverse Board with effective mix of skills, experiences and perspectives |

| ✓ | Robust Board and executive succession planning and risk oversight |

✓ | Active Board refreshment and average Board tenure of 8.4 years |

| ✓ | Rigorous stock ownership guidelines for directors and executives |

✓ | Effective annual Board and Board committee evaluation process |

| ✓ | Directors and executives prohibited from hedging and pledging our stock under our insider trading policy |

✓ | Majority voting and director resignation policy in uncontested director elections |

| ✓ | Independent director equity-based compensation not paid out until cessation of service |

Board Structure and Independence |

| Shareholder Rights and Accountability | ||

✓ | 100% independent director nominees, except CEO |

| ✓ | Annual election of all directors |

✓ | Independent Chairman of the Board |

| ✓ | Proxy access right for shareholders |

✓ | 100% independent Board committees |

| ✓ | Single class voting structure (one share, one vote) |

✓ | Independent directors regularly meet without management present |

| X | No supermajority voting requirements |

✓ | Robust Code of Business Conduct and Ethics applicable to directors, officers and employees |

| ✓ | Charter permits shareholders to call a special meeting |

|

|

| X | No poison pill |

Zimmer Biomet 3

Proxy Statement SUMMARY

Proposal 2 – Ratification of the Appointment of PwC | |

Our Board recommends a vote FOR this proposal | |

● | PwC’s report contained in our 2023 Annual Report is unqualified |

● | Audit and audit-related fees represent 94% of total fees paid to PwC for 2023 |

Proposal 3 – Advisory Vote to Approve Named Executive Officer Compensation | |

Our Board recommends a vote FOR this proposal | |

Executive Compensation Best Practices | |

What We Do | |

✓ | Pay for performance |

✓ | Require robust stock ownership guidelines |

✓ | Require termination of employment in connection with a change in control for accelerated equity vesting (double trigger) |

✓ | Require non-competition agreement for equity award eligibility |

✓ | Require shares received upon equity award vesting to be retained in accordance with stock ownership guidelines |

✓ | Subject executives’ cash and equity-based incentives to clawback, including in the event of: - an accounting restatement due to material noncompliance with financial reporting requirements under the securities laws (as to performance-based cash bonuses and equity-based incentives) - certain violations of our Code of Business Conduct and Ethics or other conduct deemed detrimental to the interests of the company (as to equity-based incentives) |

What We Don’t Do | |

x | Offer employment contracts to our executives, except as required in non-U.S. jurisdictions |

x | Pay dividends or accrue dividend equivalents on unearned performance-based equity awards |

x | Provide excise tax gross-ups in new change in control severance agreements (since 2009) |

x | Allow hedging or pledging of company securities |

x | Reprice or exchange underwater stock options without shareholder approval |

Proposal 4 – Approval of the Amended Employee Stock Purchase Plan |

Our Board recommends a vote FOR this proposal |

● Amendments would increase the number of shares available for awards by 10,000,000 shares |

Zimmer Biomet 4

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

Every day, the Zimmer Biomet team works towards our mission of alleviating pain and improving quality of life for people around the world. We are committed to effective corporate governance, adhere to world-class integrity and ethical business practices and strive for the highest standards of patient safety and quality in our products and services.

Our business is managed under the direction of our Board of Directors. The Board has responsibility for establishing broad corporate policies and for our overall performance.

Proposal 1 – Election of Directors |

Based upon the recommendation of the Corporate Governance Committee, the Board has nominated 10 directors for election at the annual meeting to hold office until the 2025 annual meeting and the election of their successors. All of the nominees currently are serving as our directors. Each nominee agreed to be named in this proxy statement and to serve if elected. All of the nominees are expected to attend the 2024 annual meeting.

Each of the director nominees was elected as a director at our 2023 annual meeting, other than Mr. Shapiro and Mr. Tornos. Mr. Shapiro was appointed as a director by our Board of Directors, effective as of January 5, 2024, was identified by Mr. Tornos based on their prior working relationship, and was assessed by the Board's third-party search firm, RSR Partners. Mr. Tornos was appointed as a director by our Board of Directors on August 22, 2023, as discussed elsewhere in this proxy statement.

Michael W. Michelson, a member of the Board since 2015, whose term expires at the annual meeting, is not eligible for nomination by the Board for election as a director at the annual meeting due to the Board’s mandatory retirement policy. The Board wishes to express its sincere gratitude to Mr. Michelson for his many significant contributions and years of dedicated service to Zimmer Biomet and our shareholders. The Board has taken action to reduce its size to 10 members effective upon the expiration of Mr. Michelson’s term as a director. Proxies cannot be voted for a greater number of persons than 10, which is the number of nominees named in this proxy statement. Unless otherwise instructed, the persons named as proxies will vote all proxies received for the election of each of the nominees. Our Board recommends a vote FOR each nominee for director. |

Zimmer Biomet 5

CORPORATE GOVERNANCE

DIRECTOR NOMINEES

|

| |

Chairman of the Board of the company since August 2023; served as Lead Independent Director of the company from May 2021 to August 2023. Executive Chairman of the Board of Hospira, Inc. from May 2007 until his retirement in January 2012. Mr. Begley also served as Chief Executive Officer from April 30, 2004, when Hospira was spun off from Abbott Laboratories, to March 2011. Prior to that, Mr. Begley served in various positions with Abbott between 1986 and 2004, most recently as Senior Vice President of Abbott’s Hospital Products division. He earned a bachelor’s degree from Western Illinois University and an MBA from Northern Illinois University.

Other Public Board Memberships • Past director and Non-Executive Chairman of Hanger, Inc. (until October 2022) • Past director and Non-Executive Chairman of Adtalem Global Education Inc. (formerly known as DeVry Education Group Inc.) (until November 2017) Other Relevant Experience • Past director of the Advanced Medical Technology Association (“AdvaMed”), the medical device industry’s trade association

Skills and Qualifications

Christopher B. Begley’s past experience as the Chairman and CEO of Hospira, Inc., a leading provider of injectable drugs and infusion technologies, and previously as the senior vice president of two Abbott divisions, has provided him with extensive management experience at two multinational, publicly traded healthcare companies. In these senior leadership roles, Mr. Begley gained in-depth knowledge of the healthcare industry and strategies for developing and marketing products in this highly regulated area. He also gained significant experience in strategic planning, risk management and financial management. Mr. Begley served for more than 15 years as a director of other public companies, including service as chairman of the board. |

President of AT&T Corp. from October 2002 until her retirement in December 2003. From April 2001 to October 2002, Ms. Bernard was Chief Executive Officer of AT&T Consumer. Prior to joining AT&T, Ms. Bernard held senior executive positions with Qwest Communications International Inc., US WEST, Inc., AVIRNEX Communications Group and Pacific Bell. Ms. Bernard received a B.A. degree from St. Lawrence University, an MBA from Fairleigh Dickenson University and an M.S. in management from Stanford University’s Sloan Fellowship Program.

Other Public Board Memberships • Past director of Principal Financial Group, Inc. (until June 2020) • Past director of SITO Mobile, Ltd. (until June 2017) Other Relevant Experience • Director of LEAP Guarantee

Skills and Qualifications Betsy J. Bernard’s past experience in senior executive roles with leading global telecommunications companies, including her service as President of AT&T Corp., has provided her with expertise in financial management, brand management, marketing, enterprise sales, customer care, operations, product management, electronic commerce, executive compensation, strategic planning and mergers and acquisitions. Ms. Bernard’s experience has led our Board to determine that she is an “audit committee financial expert” as that term is defined in SEC rules. She has served for more than 20 years as a director of other public companies, including service as chairman of the board and lead independent director, and she has experience chairing the nominating and governance committees of several public company boards, including ours. |

Zimmer Biomet 6

CORPORATE GOVERNANCE

|

| |

Chief Executive Officer of ResMed Inc. since March 2013 and Chairman of ResMed Inc. since January 2023. Prior to his appointment as Chief Executive Officer, Mr. Farrell served as President, Americas for ResMed from 2011 to 2013. He was previously Senior Vice President of the global business unit for sleep apnea therapeutic and diagnostic devices from 2007 to 2011, and before that he held various senior roles in marketing and business development. Before joining ResMed in September 2000, Mr. Farrell worked in management consulting, biotechnology, chemicals and metals manufacturing at Arthur D. Little, Sanofi Genzyme, Dow Chemical and BHP. Mr. Farrell holds a bachelor of engineering, with first-class honors, from the University of New South Wales, a master of science in chemical engineering from the Massachusetts Institute of Technology and an MBA from the MIT Sloan School of Management.

Other Public Board Memberships • ResMed Inc. Other Relevant Experience • Director of AdvaMed

Skills and Qualifications

Michael J. Farrell’s service as Chairman and CEO of ResMed Inc., a global leader in the development, manufacturing, distribution and marketing of medical products for the diagnosis, treatment and management of respiratory disorders, provides him with significant experience leading a highly regulated, global medical device company. Mr. Farrell is spearheading the company’s expansion into emerging markets and its investments in connected health and digital health, major growth initiatives for ResMed that fit well with our own plans for global growth. In his prior roles, Mr. Farrell led ResMed’s M&A and alliance creation activities, as well as the marketing function. In addition, during his tenure with ResMed, Mr. Farrell has gained domestic and international P&L experience, first as head of the company’s major global business unit, and then as President, Americas. Mr. Farrell’s experience has given him a strong understanding of key aspects of leading a highly regulated, global healthcare company such as ours, including financial management, business integration, strategic planning, operations, technology assessment and management, product innovation, new product launches and international expansion. |

Senior Vice President and Chief Financial Officer of Quest Diagnostics Incorporated until his retirement in July 2013. Mr. Hagemann joined Corning Life Sciences, Inc., a subsidiary of Quest Diagnostics’ former parent company, Corning Incorporated, in 1992, and held roles of increasing responsibility before being appointed Chief Financial Officer of Quest Diagnostics in 1998. Prior to joining Corning, Mr. Hagemann held senior financial positions at Prime Hospitality, Inc. and Crompton & Knowles, Inc. He was also previously employed by Arthur Young & Co., a predecessor company to Ernst & Young. Mr. Hagemann holds a B.S. in accounting from Rider University and an MBA from Seton Hall University.

Other Public Board Memberships • Graphic Packaging Holding Company • Ryder System, Inc.

Skills and Qualifications Robert A. Hagemann’s past experience as the CFO of Quest Diagnostics Incorporated, a leading provider of diagnostic testing information services, has given him financial management expertise, as well as significant experience in strategic planning, business development, business integration, operations, talent management and information technology. His experience as an executive in the healthcare industry and his financial acumen enable him to evaluate and understand the impact of business decisions on our financial statements and capital structure. Mr. Hagemann’s experience has led our Board to determine that he is an “audit committee financial expert” as that term is defined in SEC rules. He also serves, and has served for approximately ten years, as a director of other public companies. |

Zimmer Biomet 7

CORPORATE GOVERNANCE

|

| |

Operating Advisor to the Abu Dhabi Investment Authority since June 2021, and Deputy Chairman of the Board of UNION therapeutics A/S since July 2021. Previously, Consultant, Blackstone Healthcare Partners of The Blackstone Group from June 2010 until June 2021. Mr. Higgins served as non-executive chairman of the board of Assertio Holdings, Inc., successor issuer to Assertio Therapeutics, Inc., from May 2020 until December 2020. Prior to that, he served as President, Chief Executive Officer and a member of the board of directors of Assertio Therapeutics, Inc. from March 2017 until its merger with Zyla Life Sciences in May 2020. Previously, Mr. Higgins served as Chairman of the Board of Management of Bayer HealthCare AG from January 2006 to May 2010 and Chairman of the Bayer HealthCare Executive Committee from July 2004 to May 2010. Prior to joining Bayer HealthCare in 2004, Mr. Higgins served as Chairman, President and Chief Executive Officer of Enzon Pharmaceuticals, Inc. from 2001 to 2004. Prior to that, Mr. Higgins spent 14 years with Abbott Laboratories, most recently as President of the Pharmaceutical Products Division from 1998 to 2001. He graduated from Strathclyde University, Scotland and holds a B.S. in biochemistry.

Other Public Board Memberships • Ecolab Inc. • Past director of Assertio Holdings, Inc. (until December 2020) • Past director of Assertio Therapeutics, Inc. (until May 2020) • Past director of Endo International plc (until March 2017)

Skills and Qualifications Arthur J. Higgins has extensive senior leadership experience in the global healthcare market. Through leadership positions with large healthcare developers and manufacturers in both the U.S. and Europe, he has gained deep knowledge of the healthcare market and the strategies for developing and marketing products in this highly regulated area. His knowledge and industry background allow him to provide valuable insight to our business. In addition, his perspective gained from years of operating global businesses and his background in working with high growth companies provide him experiences from which to draw to advise us on strategies for sustainable growth. Through his past executive positions, he has also gained significant exposure to enterprise risk management as well as quality and operating risk management necessary in a highly regulated industry such as healthcare.

|

Executive Vice President and Chief Financial Officer of Allergan plc, a global pharmaceutical company, from December 2014 until her retirement in February 2018. Prior to joining Allergan, Ms. Hilado served as Senior Vice President, Finance and Treasurer of PepsiCo Inc. from 2009 until 2014. She previously served as Vice President and Treasurer for Schering-Plough Corp. from 2008 to 2009 and spent more than 17 years with General Motors Co. in leadership roles of increasing responsibility, including Assistant Treasurer from 2006 to 2008 and Chief Financial Officer, GMAC Commercial Finance LLC from 2001 to 2005. She began her career with Far East Bank and Trust Co. in Manila, Philippines. Ms. Hilado earned a Bachelor’s degree in Management Engineering from Ateneo de Manila University in the Philippines and an MBA from the University of Virginia Darden School of Business.

Other Public Board Memberships • Campbell Soup Company • Past director of H.B. Fuller Company (until December 2021) • Past director of PPD, Inc. (until December 2021) Other Relevant Experience • Director, Galderma SA • Director, Curia Global, Inc. • Director, Simtra (Baxter Pharmaceutical LLC)

Skills and Qualifications

Maria Teresa (Tessa) Hilado has more than three decades of demonstrated financial expertise in leading roles at several large, global corporations, including her past experience as CFO of Allergan plc, a global pharmaceutical company. She has extensive experience in global finance, treasury, tax, mergers and acquisitions, business development and investor relations, as well as experience in the healthcare, consumer packaged goods and automotive industries. Ms. Hilado’s experience has led our Board to determine that she is an “audit committee financial expert” as that term is defined in SEC rules. She has also served as a director of other public companies.

|

Zimmer Biomet 8

CORPORATE GOVERNANCE

|

| |

Retired Senior Vice President and President, Regions of Thermo Fisher Scientific Inc. from September 2017 through his retirement in March 2022. Mr. Jafry was responsible for all business geographies outside the U.S. He joined Thermo Fisher Scientific in March 2005 and served in numerous roles of increasing responsibility prior to being appointed to his last position. Mr. Jafry started his career at Glaxo Pharmaceuticals in London. Prior to joining Thermo Fisher Scientific, he served for 18 years at General Electric, where he held commercial, product management and general management roles in the U.S., Netherlands, Switzerland and China, most recently serving as President of GE Sensing Asia. He joined the board of directors of GTCR, LLC, a private equity firm, in 2022. Mr. Jafry holds a Bachelor’s degree in Mechanical Engineering from Lahore University in Pakistan, a Master’s degree in Mechanical Engineering from the University of Massachusetts and a Master’s certificate in Marketing and Management from Harvard University Extension School.

Other Relevant Experience • Director, GTCR, LLC

Skills and Qualifications Syed Jafry has more than three decades of global operations and management experience in executive roles at several large, global organizations, including as Senior Vice President and President, Regions of Thermo Fisher Scientific Inc., a world leader in serving science, supporting customers in pharmaceuticals, biotech, healthcare and other industries. Mr. Jafry’s experience has given him a strong understanding of key aspects of leading a global, highly regulated business such as ours, including expansion into emerging markets, financial management, strategic planning, operations, product innovation, new product launches and business integration. His knowledge and industry background allow him to provide valuable insight to our business. |

Executive Vice President, Chief Product and Digital Officer of Align Technology, Inc., a global medical device company (“Align”), since December 2023. Ms. Kolli is responsible for Align's product lifecycle, from product ideation and innovation, to engineering, product launch and product performance. This includes leading the product and engineering teams and defining the technology strategy and development of product software, consumer, customer, manufacturing and enterprise applications enabling the Align Digital Platform. Ms. Kolli has led Align’s global business transformation initiative aimed at delivering platforms and technology to support customer experience and simplified business processes across the company. She joined Align in June 2003 and has held positions of increasing responsibility, leading and transforming business operations and engineering. She was promoted to Vice President, Information Technology in December 2012, to Senior Vice President, Global Information Technology in February 2018, to Senior Vice President – Chief Digital Officer in April 2020, and to Executive Vice President, Chief Digital Officer, in February 2022. Prior to joining Align, Ms. Kolli held technical lead positions with Citadon and Accenture. She is a member of the board of directors of Intuitive Surgical, Inc. Ms. Kolli earned an M.S. degree in Computer Applications at the National Institute of Technology in Trichy, India and is a graduate of the Stanford Executive Program offered by the Stanford Graduate School of Business in California.

Other Public Board Memberships • Intuitive Surgical, Inc.

Skills and Qualifications Sreelakshmi Kolli’s service as Executive Vice President and Chief Product and Digital Officer of Align Technology, Inc., a publicly traded company that designs, manufactures and offers the Invisalign® clear aligner system, intraoral scanners and services, and exocad CAD/CAM software, has provided her with significant experience in a highly regulated global medical device company. In her senior leadership roles, Ms. Kolli has gained deep knowledge of digital and emerging technologies, operations, strategic planning, marketing, product innovation, financial management and data privacy trends. Her knowledge and industry background allow her to provide valuable insight to our business as we expand our portfolio of integrated digital and robotic technologies that leverage data, machine learning and artificial intelligence. |

Zimmer Biomet 9

CORPORATE GOVERNANCE

|

| |

Senior Advisor, General Atlantic since October 2023. President and Chief Executive Officer of the Hospital for Special Surgery (“HSS”), a leading academic medical center focused on musculoskeletal health, from October 2006 until his retirement in October 2023. Prior to joining HSS, Mr. Shapiro worked at Geisinger Health System from 2002 to 2006, serving in roles with increasing leadership scope and ultimately advancing to Executive Vice President and Chief Operating Officer of the Clinical Enterprise. He served as a senior healthcare expert and consultant at McKinsey & Co. from 1999 to 2002 and held positions in other hospitals and health systems from 1983 through 1999. Mr. Shapiro has a Bachelor of Science degree in psychology from the University of Pittsburgh and a Master’s degree in health administration from the University of Pittsburgh Graduate School of Public Health. Mr. Shapiro also has extensive healthcare and nonprofit board service, including serving as a founding member of the board of directors of RightMove Health, as President of Medical Indemnify Assurance Company, and as the board chairman of the Greater New York Hospital Association.

Other Relevant Experience • Director, Jewish Healthcare Foundation • Chairman of the Board of Directors, PT Solutions Physical Therapy • Venture Chair, Redesign Health

Skills and Qualifications Louis Shapiro led all strategic and operational aspects of HSS for over 17 years, leading its transformation from a boutique New York provider to a musculoskeletal healthcare system with more than 20 locations in four states that treats nearly 200,000 patients annually from all 50 states and more than 80 countries. Mr. Shapiro’s expertise spans from strategic innovation and service line development to technology integration, employee engagement and patient experience. He has served for more than 15 years as a director of not-for-profit and healthcare organizations, including service as Chairman of the Board.

|

President and Chief Executive Officer of the company and member of the company's Board of Directors since August 2023. Previously, Mr. Tornos served as the Chief Operating Officer of the company since March 2021, as the company’s Group President, Global Businesses and the Americas from December 2019 until March 2021, and as Group President, Orthopedics from joining the company in November 2018 until December 2019. Prior to joining the company, Mr. Tornos served as Worldwide President of the Global Urology, Medical and Critical Care Divisions of Becton, Dickinson and Company (“BD”) (and previously, C. R. Bard, Inc. (“Bard”)) from June 2017 until October 2018. From June 2017 until BD’s acquisition of Bard in December 2017, Mr. Tornos also continued to serve as President, EMEA of Bard, a position to which he was appointed in September 2013. Mr. Tornos joined Bard in August 2011 and, prior to his appointment as President, EMEA, served as Vice President and General Manager with leadership responsibility for Bard’s business in Southern Europe, Central Europe and the Emerging Markets Region of the Middle East and Africa. Before joining Bard, Mr. Tornos served as Vice President and General Manager of the Americas Pharmaceutical and Medical/Imaging Segments of Covidien International from April 2009 to August 2011. Before that, he served as International Vice President, Business Development and Strategy with Baxter International Inc. from July 2008 to April 2009 and, prior to that, Mr. Tornos spent 11 years with Johnson & Johnson in positions of increasing responsibility.

Other Public Board Memberships • PHC Holdings Corporation

Skills and Qualifications Ivan Tornos' service as our President and CEO, his prior service as our Chief Operating Officer, our Group President, Global Businesses and the Americas, and our Group President, Orthopedics, together with his past service as Worldwide President of the Global Urology, Medical and Critical Care Divisions of BD and Bard, have given him extensive experience in the medical device industry delivering transformative growth and leadership for large, highly regulated global enterprises. Mr. Tornos has significant experience in financial management, strategic planning, mergers and acquisitions, business integration, risk management and in dealing with the many regulatory aspects of our business. His deep knowledge and understanding of the medical device industry in general, and our global businesses in particular, enable him to provide crucial insight to our Board into strategic, management and operational matters. Mr. Tornos provides an essential link between management and the Board on management’s business perspectives. |

Zimmer Biomet 10

CORPORATE GOVERNANCE

OUR BOARD OF DIRECTORS AND CORPORATE

GOVERNANCE FRAMEWORK

DIRECTOR CRITERIA, QUALIFICATIONS AND

EXPERIENCE

We are a global leader in musculoskeletal healthcare. We design, manufacture and market orthopedic reconstructive products; sports medicine, biologics, extremities and trauma products; craniomaxillofacial and thoracic products; surgical products; and a suite of integrated digital and robotic technologies that leverage data, data analytics and artificial intelligence. We have operations in more than 25 countries around the world and sell products in more than 100 countries. We operate in markets characterized by rapidly evolving technologies, complex regulatory requirements and significant competition.

The Corporate Governance Committee is responsible for reviewing and assessing with the Board, on an annual basis, the experience, qualifications, attributes and skills sought of Board members in the context of our business and the then-current membership of the Board. The director skills matrix below identifies some of the key skills and experiences the Board has identified as being important to its responsibilities and reflects how the directors nominees, individually and in the aggregate, reflect these skills.

2024 Director Nominees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sitting CEO of Medical Device Company |

|

| ● |

|

|

|

|

|

| ● |

Sitting CEO or Global Business Head |

|

| ● |

|

|

|

|

|

| ● |

Prior CEO or Global Business Head | ● | ● |

|

| ● |

| ● |

| ● |

|

Operations Experience | ● | ● | ● | ● | ● |

| ● | ● | ● | ● |

Healthcare Industry Experience | ● |

| ● | ● | ● | ● | ● | ● | ● | ● |

Medical Device Industry Experience | ● |

| ● | ● | ● |

|

| ● |

| ● |

International Expertise | ● |

| ● |

| ● | ● | ● | ● | ● | ● |

FDA Experience | ● |

| ● | ● | ● |

|

| ● | ● | ● |

R&D Experience | ● |

| ● |

| ● |

|

| ● |

| ● |

Government / Regulatory Affairs / Health Economics Experience | ● | ● | ● | ● | ● |

| ● | ● | ● | ● |

Brand / Marketing Experience | ● | ● | ● |

| ● |

| ● | ● | ● | ● |

M&A Experience | ● | ● | ● | ● | ● | ● | ● |

|

| ● |

Financial Expertise | ● | ● | ● | ● | ● | ● | ● |

| ● | ● |

Digital Technology Expertise |

|

| ● |

|

|

|

| ● |

|

|

Cybersecurity Expertise |

|

| ● |

|

|

|

| ● |

|

|

Demographics |

|

|

|

|

|

|

|

|

|

|

Gender | M | F | M | M | M | F | M | F | M | M |

Racially/Ethnically Diverse |

|

|

|

|

| ● | ● | ● |

| ● |

LGBTQ+ |

| ● |

|

|

|

|

|

|

|

|

Race, ethnicity, gender and LGBTQ+ status are self-reported by directors in their annual directors’ and officers’ questionnaires. Diversity, equity and inclusion data is not standardized and director responses are not required.

A mark indicates a specific area of focus or expertise that the director brings to our Board. The matrix above does not encompass all of the knowledge, skills and experience of our directors, and the fact that a particular knowledge, skill or experience is not listed does not mean that a director does not possess it. In addition, the absence of a particular knowledge, skill or experience with respect to any of our directors does not mean the director in question is unable to contribute to the decision-making process in that area.

The Corporate Governance Committee looks for current and potential directors collectively to have a mix of experience, skills and qualifications, including those identified in the matrix. In evaluating director candidates and considering incumbent directors for

Zimmer Biomet 11

CORPORATE GOVERNANCE

nomination to the Board, the committee considers a variety of factors. These include each candidate’s experiences, skills and qualifications, character and integrity, reputation for working constructively in a collegial environment and availability to devote sufficient time to Board matters. Diversity of background and diversity of gender, race, ethnicity, national origin, disability status and age are also relevant factors in the selection process. The committee also considers whether a candidate can meet the independence standards for directors and members of key committees under applicable stock exchange and SEC rules. With respect to incumbent directors, the committee considers the director’s past performance on the Board and contributions to the committees on which he or she serves.

While the Board has not formally adopted a policy regarding director diversity, the committee actively considers diversity in director recruitment and nomination. In conducting its most recent search for new directors, the Board utilized a process that required the final pool of candidates to include potential directors who would increase the Board’s ethnic and/or gender diversity. We anticipate utilizing a similar process in future searches for Board candidates. The Board believes that the diversity of the current Board members, including as to gender, race, ethnicity, national origin, international work experience, disability status and age, provides significant benefits to the Board and to the company. In response to feedback from shareholders, above we provide enhanced disclosure regarding our Board’s skills and diversity.

BOARD LEADERSHIP STRUCTURE |

One of the key responsibilities of the Board is to have a leadership structure that allows it to provide effective oversight of management and maximize the contributions of its members. Our Board believes that it is important that it retain flexibility to make the determination as to whether the interests of the company and our shareholders are best served by having the same individual serve as both CEO and Chairman or whether the roles should be separated based on the circumstances at any given time, and our Corporate Governance Guidelines and Restated Bylaws provide this flexibility. Under our Corporate Governance Guidelines, the Board appoints a Lead Independent Director when the CEO and Chairman roles are combined. At different times in the past, the Board has used both approaches, selecting the approach which it believes best serves the interests of the company and our shareholders at that time.

Currently, the Board is led by a non-executive Chairman of the Board selected from among the independent directors. The non-executive Chairman leads the meetings and activities of the Board, while our CEO leads the management, operations and employees of the company and is responsible for executing the company’s strategy. The Board adopted this leadership structure in August 2023 when Mr. Tornos became CEO. At that time, the Board appointed Mr. Begley, who had served as the Lead Independent Director since May 2021, as Chairman. The Board currently believes that this leadership structure allows the Board to function efficiently and effectively and that it continues to be appropriate. However, the Board evaluates its leadership structure on an ongoing basis and is not opposed in concept to combining these roles in the future.

The Chairman provides leadership to the Board and works with the Board to define its structure and activities in the fulfillment of its responsibilities. In discharging his or her duties, the non-executive Chairman will:

Zimmer Biomet 12

CORPORATE GOVERNANCE

BOARD’S ROLE IN RISK OVERSIGHT |

Our Board of Directors oversees the risk management processes that have been designed and are implemented by our executives to determine whether those processes are consistent with our strategy and risk appetite, are functioning as intended, and that necessary steps are taken to foster a culture that recognizes and appropriately escalates and addresses risk-taking beyond our determined risk appetite. The Board executes its oversight responsibility for risk management directly and through its committees.

The Audit Committee is specifically tasked with overseeing our compliance with legal and regulatory requirements, including oversight of our Corporate Compliance Program, discussing our risk assessment and risk management processes with management, and receiving information on certain material legal and regulatory matters, including litigation, as well as on information technology, data privacy, business continuity and cybersecurity-related matters. Our Vice President, Internal Audit Services, who reports directly to the committee, coordinates our global risk assessment process. We use this process to identify, assess and prioritize internal and external risks, to develop processes for responding to, mitigating and monitoring risks and to inform the development of our internal audit plan, our annual operating plan and our long-term strategic plan. We also maintain an internal risk committee made up of members of senior management that has responsibility for overseeing the execution of enterprise risk management activities.

The Audit Committee receives detailed reports regarding our enterprise risk assessment process and its meeting agendas include discussions of individual risk areas throughout the year. Members of our management who have responsibility for designing and implementing our risk management processes regularly meet with the committee. The committee discusses our major financial risk exposures with our CFO and Chief Accounting Officer. The committee receives regular reports from our Chief Compliance Officer on our Corporate Compliance Program, which is designed to address risks related to, among other matters, anti-corruption and anti-kickback laws in the countries where we do business. The committee receives regular reports from our Chief Information Officer and our Chief Information Security Officer regarding cybersecurity risks and threats. The committee also receives reports from our General Counsel, Global Privacy Officer and other persons who are involved in our risk management processes.

The Board’s other committees oversee risks associated with their respective areas of responsibility. For example, the Compensation and Management Development Committee oversees risks relating to our executive compensation programs and practices. In addition, in conjunction with the full Board, the Compensation and Management Development Committee oversees risks relating to human capital management. The Corporate Governance Committee oversees risks relating to environmental, social and governance matters. The Quality, Regulatory and Technology Committee oversees risks relating to our compliance with laws and regulations enforced by the U.S. Food and Drug Administration (“FDA”) and comparable foreign government regulators, including product quality and safety. The Board receives detailed regular reports from members of our executive leadership team and other personnel that include discussions of the risks and exposures involved with their respective areas of responsibility. Further, the Board is routinely informed of developments that could affect our risk profile or other aspects of our business. Primary areas of risk oversight for the full Board include, but are not limited to, general commercial risks in the musculoskeletal healthcare industry, such as competition, pricing pressures and the reimbursement landscape; risks associated with our strategic plan and annual operating plan; risks related to our capital structure; and risks pertaining to mergers, acquisitions, divestitures and other complex transactions.

BOARD’S ROLE IN Executive Succession Planning and Development |

The Board and its Compensation and Management Development Committee oversee executive succession planning for the company as part of building a high-performing, diverse and inclusive workforce. On an annual basis, the Board and committee evaluate the company's leadership team succession planning. Additionally, other Board committees receive annual talent review updates from relevant management teams, such as the Audit Committee receiving the Finance and Internal Audit teams’ talent reviews, and the Quality, Regulatory and Technology Committee receiving the Quality Affairs and Regulatory Affairs teams’ talent reviews. Additionally, Board members interact with internal succession candidates through candidates' participation in Board and committee meetings and other contacts, and high-potential individuals are often positioned to interact more frequently with our Board and its committees as part of our succession planning processes. During 2022, we introduced Global Leadership Competencies, behaviors that are informed by our culture promises, support our mission and enable successful outcomes aligned to our strategic pillars to help build a pipeline of talent who can fill future leadership roles.

The annual Board and committee review of leadership team succession planning represents the culmination of an ongoing process in which each member of the President and CEO's leadership team, in collaboration with our Human Resources Department, develops detailed succession plans designed to ensure the continuing strength and success of each function. These detailed succession plans identify high-performing internal and external candidates for leadership roles and are intended to develop and enhance well-rounded and experienced leaders. Among other factors, our executive succession planning processes:

Zimmer Biomet 13

CORPORATE GOVERNANCE

We seek to continually improve our executive succession planning programs. For example, the executive leadership changes we undertook in August and September 2023 demonstrated successful operation of these processes, as well as provided valuable experience to inform further enhancements.

POLICIES ON CORPORATE GOVERNANCE |

We are committed to maintaining the highest standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving shareholders well and maintaining our integrity in the marketplace. Our Board has adopted Corporate Governance Guidelines, which, in conjunction with our Restated Certificate of Incorporation, Restated Bylaws, Board committee charters and key Board policies, form the framework for our governance. Our Board regularly reviews corporate governance developments and modifies its Corporate Governance Guidelines, committee charters and key policies as warranted.

The current versions of the following documents are available in the Investor Relations/Corporate Governance section of our website, www.zimmerbiomet.com:

If we make any substantive amendments to the finance code of ethics or grant any waiver, including any implicit waiver, from a provision of the code to our CEO, CFO, or Chief Accounting Officer/Corporate Controller, we will disclose the nature of that amendment or waiver in the Investor Relations section of our website.

LIMIT ON OTHER DIRECTORSHIPS |

Under our Corporate Governance Guidelines, our non-employee directors who are not executive officers of other public companies are limited to serving on a total of four public company boards, including ours, and our non-employee directors who serve as executive officers of other public companies are limited to serving on a total of three public company boards, including their own company’s board and our Board. Further, our Audit Committee members are limited to serving on a total of three public company audit committees, including ours.

Our Board is aware that certain of our investors, in recognition of the increased time required of boards of directors, have policies to limit directors who are CEOs of public companies to a total of two public company boards. While our Board recognizes that directors who are employed full-time, whether as executives of public companies or in other positions, naturally have greater demands placed on their time than directors who have retired from full-time employment, our Board has chosen not to adopt the more restrictive two-board limit for our non-employee directors who serve as public company executives so that our Board has more flexibility to assess the potential impact of directors’ additional commitments as they arise.

Zimmer Biomet 14

CORPORATE GOVERNANCE

BOARD SELF-EVALUATION PROCESS |

1 | Preparation Review self-evaluation process and prepare questionnaires/assessments |

| Pursuant to New York Stock Exchange requirements, the Board’s Corporate Governance Guidelines and the charters of each of the Board’s committees, the Board and each of its committees are required to conduct self-evaluations of their performance. The Board recognizes that a robust and constructive evaluation process is an essential component of good corporate governance. These self-evaluations, which are conducted annually, are intended to facilitate a candid assessment and discussion by the Board and each committee of its effectiveness as a group in fulfilling its responsibilities, evaluating its performance and identifying areas for improvement. The Chair of the Corporate Governance Committee oversees the annual self-evaluation process. Each director is expected to participate and provide feedback on a range of topics, including: Board and committee agendas; meetings; practices and dynamics; Board refreshment; committee structure, membership and leadership; the flow of information to and from the Board and its committees; management succession planning; and shareholder engagement. Director feedback is solicited on an individual basis through written questionnaires and group discussions. From time to time, the Board retains a third party experienced in corporate governance matters to act as a facilitator for the self-evaluation process, including preparing and reviewing the written questionnaires/assessments and conducting individual director interviews. The Chair of the Corporate Governance Committee, along with the third-party facilitator (when one is retained), reviews the feedback from the self-evaluation process and makes recommendations for areas with respect to which the Board and its committees should consider improvements. These areas are further discussed at a meeting led by the Chair of the Corporate Governance Committee and the third-party facilitator (when one is retained) at which all Board members are present. At the conclusion of this meeting, the Chair of the Corporate Governance Committee, working with the senior management team, develops action plans for any items that require follow-up. |

|

| ||

2 | Questionnaires Distribute and complete questionnaires | ||

|

| ||

3 | Analyze Feedback Review feedback and make recommendations for improvement | ||

|

| ||

4 | Review Findings Meeting to discuss findings with the entire Board | ||

|

| ||

5 | Follow-Up Plans of action developed with senior management for any items that require follow-up |

DIRECTOR INDEPENDENCE |

The Board’s Corporate Governance Guidelines, which are available on our website at www.zimmerbiomet.com, include criteria adopted by the Board to assist it in making determinations regarding the independence of its members. The criteria are consistent with the New York Stock Exchange listing standards regarding director independence. To be considered independent, the Board must determine that a director has no material relationship, directly or indirectly, with us. In assessing independence, the Corporate Governance Committee and the Board consider a wide range of relevant facts and circumstances. The Board has determined that each of our non-employee directors, Christopher Begley, Betsy Bernard, Michael Farrell, Robert Hagemann, Arthur Higgins, Maria Teresa Hilado, Syed Jafry, Sreelakshmi Kolli, Michael Michelson and Louis Shapiro, meets these standards and is independent. The remaining director, Ivan Tornos, is our CEO and is not independent.

In making its determination with respect to Mr. Shapiro, the Board considered his position as former President and Chief Executive Officer of the Hospital for Special Surgery ("HSS"). From January 1, 2023 through October 31, 2023, HSS purchased approximately $12 million in products from us, but the amount HSS purchased represented only seven tenths of one percent (0.7%) of HSS's reported revenue in 2022. After reviewing the terms of these transactions, the Board determined that Mr. Shapiro does not have a direct or indirect material interest in the transactions, that Mr. Shapiro does not have a material relationship, directly or indirectly, with us and that our business relationship with HSS does not diminish the ability of Mr. Shapiro to exercise his independent judgment on issues affecting our business.

MAJORITY VOTE STANDARD FOR ELECTION OF DIRECTORS |

Our Restated Bylaws require directors to be elected by the majority of the votes cast with respect to that director in uncontested elections (the number of shares voted “for” a director must exceed the number of votes cast “against” that director). In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of

Zimmer Biomet 15

CORPORATE GOVERNANCE

directors will be a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors.

If a nominee who is serving as a director is not elected at the annual meeting, under Delaware law the director would continue to serve on the Board as a “holdover director.” However, under our Restated Bylaws, any director who fails to be elected must tender his or her resignation to the Board. The Corporate Governance Committee would then make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified. The director who tenders his or her resignation will not participate in the Board’s decision. Furthermore, pursuant to an amendment to our Corporate Governance Guidelines that the Board adopted to secure the withdrawal of a shareholder proposal received for the 2024 annual meeting, our Corporate Governance Guidelines provide that, if an incumbent director fails to be elected in an uncontested election, and regardless of the Board's decision with respect to the related tendered resignation, the Board will not nominate such person to be a candidate for election as a director at the next annual shareholder meeting. For further information about our engagement with the shareholder proponent, the adoption of the amendment to the Corporate Governance Guidelines, and the subsequent withdrawal of the shareholder proposal, please see below in the Compensation Discussion and Analysis section of this proxy statement.

If a nominee who was not already serving as a director is not elected at the annual meeting, under Delaware law that nominee would not become a director and would not serve on the Board as a “holdover director.” All nominees for election as directors at the 2024 annual meeting are currently serving on the Board.

NOMINATIONS FOR DIRECTORS |

The Corporate Governance Committee screens candidates and recommends candidates for nomination to the full Board. In seeking and evaluating director candidates, the committee considers individuals in accordance with the criteria described above under “Director Criteria, Qualifications and Experience.” Director candidates may be recommended by Board members, a third-party search firm or shareholders.

The committee considers candidates proposed by shareholders and evaluates them using the same criteria as for other candidates. A shareholder who wishes to recommend a director candidate for consideration by the committee should send such recommendation to our Corporate Secretary at Zimmer Biomet Holdings, Inc., 345 East Main Street, Warsaw, Indiana 46580, who will then forward it to the committee. Any such recommendation should include a description of the candidate’s qualifications for board service, the candidate’s written consent to be considered for nomination and to serve if nominated and elected, and addresses and telephone numbers for contacting the shareholder and the candidate for more information.

A shareholder who wishes to nominate an individual as a candidate for election, rather than recommend the individual to the committee as a nominee, but does not intend to have the candidate included in our proxy materials, must comply with the advance notice requirements set forth in our Restated Bylaws. (See “What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 2025 annual meeting of shareholders? – Notice Requirements for Other Director Nominees or Shareholder Proposals to Be Brought Before the 2025 Annual Meeting of Shareholders” on page 87 for more information.) In addition, in 2019, our Board adopted “proxy access,” which permits eligible shareholders to nominate and include in our proxy materials director nominees if certain requirements are met. (See “What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 2025 annual meeting of shareholders? – Requirements for Director Nominees to Be Considered for Inclusion in our Proxy Materials (“Proxy Access”)” on page 87 for more information.) Further, shareholders who intend to solicit proxies in support of director nominees other than our nominees must comply with Rule 14a-19 under the Exchange Act. (See “What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 2025 annual meeting of shareholders? – Notice Requirements under Universal Proxy Rules” on page 87 for more information.)

COMMUNICATIONS WITH DIRECTORS |

Shareholders or other interested parties may contact our directors by writing to them either individually or as a group or partial group (such as all independent directors), c/o Corporate Secretary, Zimmer Biomet Holdings, Inc., 345 East Main Street, Warsaw, Indiana 46580. If you wish your communication to be treated confidentially, please write the word “CONFIDENTIAL” prominently on the envelope and address it to the director by name so that it can be forwarded without being opened. Communications addressed to multiple recipients, such as to “Board of Directors,” “Audit Committee,” “Independent Directors,” etc., will necessarily have to be opened and copied by the Office of the Corporate Secretary in order to forward them, and hence cannot be treated confidentially.

Zimmer Biomet 16

CORPORATE GOVERNANCE

BOARD MEETINGS, ATTENDANCE AND EXECUTIVE SESSIONS |

The Board meets on a regularly scheduled basis during the year to review significant developments affecting us and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between scheduled meetings. Members of senior management regularly attend meetings of the Board and its committees to report on and discuss their areas of responsibility. Directors are expected to attend Board meetings, meetings of committees on which they serve and shareholder meetings. Directors are expected to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. During 2023, the Board held six meetings and the standing committees of the Board held a total of 23 meetings. All directors attended 75% or more of the meetings of the Board and committees on which they served. All current directors then standing for election attended the 2023 annual meeting of shareholders.

Each regularly scheduled Board meeting normally begins with a session between the CEO and the independent directors. This provides a platform for discussions outside the presence of the non-Board management attendees, as well as an opportunity for the independent directors to go into executive session (without the CEO) if requested by any director. The independent directors may meet in executive session, without the CEO, at any time, and are scheduled for such independent executive sessions at each regularly scheduled Board meeting. Currently, Mr. Begley, in his capacity as non-executive Chairman, also presides at these executive sessions.

On an annual basis, each director and executive officer is obligated to complete a director and officer questionnaire which requires disclosure of any transactions with us in which the director or executive officer, or any member of his or her immediate family, has an interest. Under our Audit Committee’s charter, which is available on our website at www.zimmerbiomet.com, our Audit Committee must review and approve all related person transactions in which any executive officer, director, director nominee or more than 5% shareholder of the company, or any of their immediate family members, has a direct or indirect material interest. The Audit Committee may not approve a related person transaction unless (1) it is in or not inconsistent with our best interests and (2) where applicable, the terms of such transaction are at least as favorable to us as could be obtained from an unrelated third party.

Under our Code of Business Conduct and Ethics, which is available on our website at www.zimmerbiomet.com, and related policies and procedures, actual or potential conflicts of interest involving any other employee must be disclosed to and resolved by our Human Resources Department, in consultation with our Compliance Office.