- ZBH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Zimmer Biomet (ZBH) DEF 14ADefinitive proxy

Filed: 2 Apr 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

☐

| Preliminary Proxy Statement

| |

☐

| Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2))

| |

☑

| Definitive Proxy Statement

| |

☐

| Definitive Additional Materials

| |

☐

| Soliciting Material Under Rule14a-12

| |

Zimmer Biomet Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | ||

☑

| No fee required.

| |

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. | |

1) Title of each class of securities to which transaction applies: | ||

2) Aggregate number of securities to which transaction applies: | ||

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

4) Proposed maximum aggregate value of transaction: | ||

5) Total fee paid: | ||

☐

| Fee paid previously with preliminary materials:

| |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

1) Amount previously paid: | ||

2) Form, Schedule or Registration Statement No.: | ||

3) Filing Party: | ||

4) Date Filed: | ||

| ||

Our Purpose

Restore mobility, alleviate pain and improve the quality of life for patients around the world.

Our Mission

Lead the industry in delivering value to healthcare providers, patients and stockholders, while embracing our broader social responsibilities.

Our Values

| ||||

|  | |||

|  | |||

|  | |||

April 2, 2018

LETTER FROM THE INDEPENDENT DIRECTORS

TO OUR SHAREHOLDERS

As you, our investors, know, Zimmer Biomet is helping to restore lives worldwide. Our global team designs, manufactures and markets effective, innovative solutions that support physicians and healthcare organizations in restoring mobility, alleviating pain and improving the quality of life for patients around the world. Our musculoskeletal technologies and a wide range of related products and services make us valuable partners to healthcare providers in more than 100 countries.

As directors, we strive to govern Zimmer Biomet in a transparent manner that helps the Company achieve sustainable operating and financial performance and deliver long-term shareholder value. We also seek to foster a culture that embraces the highest standards of integrity in the day-to-day conduct of the business.

Chief Executive Officer Succession

This year, we, your independent directors, performed one of the key functions a board of directors has: we oversaw a CEO succession. In July 2017, we asked the Company’s Chief Financial Officer, Dan Florin, to assume the role of Interim CEO while we performed a timely and thorough CEO search process. With the assistance of a leading executive search firm, we carefully identified, evaluated and interviewed a number of highly-qualified candidates and concluded that Bryan Hanson was an ideal fit to lead the Company. We are pleased that Bryan joined Zimmer Biomet as President and Chief Executive Officer in December 2017. Bryan was also elected to the Company’s Board of Directors. Bryan brings a remarkable strategic and operational track record in leading medical device organizations that aligns with Zimmer Biomet’s commitment to growth and enhancing shareholder value. This leadership appointment comes at an important time in the Company’s history, and we look forward to working closely with Bryan to further leverage Zimmer Biomet’s leading portfolio of technologies, solutions and personalized services to drive long-term shareholder value.

Near-Term Business Priorities

In 2017, Zimmer Biomet reported net sales of $7.824 billion, an increase of 1.8% over 2016, and announced a number of exciting new products that enhance the Company’s core large joint business and expand its influence in a number of fast-growing segments within the broader musculoskeletal market. Still, there is no way around it – 2017 was a challenging year operationally for Zimmer Biomet in the U.S. Importantly, under Bryan’s leadership, the Company’s priorities for 2018 have a deliberate emphasis on rebuilding revenue momentum, addressing certain near-term challenges and setting the stage for enhanced shareholder value creation. Priorities include achieving key quality remediation milestones at the Warsaw North Campus, supporting the Company’s world-class sales organization with greater supply readiness of impacted brands, executing exciting new product introductions and building a cohesive culture within Zimmer Biomet. This Board is confident in management’s plan and ability to rebuild revenue momentum and enhance execution.

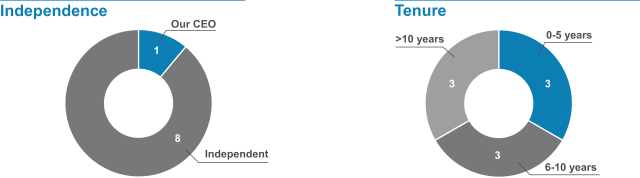

Board Skills, Diversity and Refreshment

Just as a seamless management succession is critical to Zimmer Biomet’s success, our approach to the Board is to ensure that it comprises independent thinkers with high integrity and the right mix of qualifications and experience to oversee the Company and represent the interests of shareholders. We have a Non-Executive Chairman, Larry Glasscock, and a diverse, steadily refreshed and annually elected Board. Over the past six years, six individuals joined the Zimmer Biomet Board, and we expect the Board to continue to evolve as the needs of the Company evolve. We invite you to read pages 10-14 of the proxy statement, which detail our Director qualifications.

| 1 |

Importance of Shareholders’ Views

A priority for this Board has always been and will continue to be listening to the views of shareholders and considering these views as we make decisions in the boardroom. We believe that two-way dialogue is constructive and promotes transparency and accountability. We encourage you to share your opinions, suggestions, interests and concerns with us. You can do so by contacting us as described on page 19 of the proxy statement.

As always, thank you for your investment in Zimmer Biomet. We have a dedicated team that is committed to our mission of alleviating pain and improving the quality of life for patients around the world. We will continue to work for you, our shareholders, and value the trust that you have placed in us.

|  |  | ||

| Christopher B. Begley | Betsy J. Bernard | Gail K. Boudreaux | ||

|  |  | ||

| Michael J. Farrell | Larry C. Glasscock | Robert A. Hagemann | ||

|  |  | ||

| Arthur J. Higgins | Michael W. Michelson | Cecil B. Pickett | ||

| ||||

| Jeffrey K. Rhodes | ||||

| 2 | Zimmer Biomet |

April 2, 2018

DEAR FELLOW SHAREHOLDERS:

We look forward to your attendance either in person or by proxy at the 2018 Annual Meeting of Shareholders of Zimmer Biomet Holdings, Inc. We will hold the meeting at 8:00 a.m. Eastern Time on Tuesday, May 15, 2018 at The Conrad Indianapolis, 50 West Washington Street, Indianapolis, Indiana 46204.

You will find information regarding the matters to be voted on in the attached Notice of Annual Meeting of Shareholders and Proxy Statement. We are sending many of our shareholders a notice regarding the availability of this proxy statement, our 2017 Annual Report and other proxy materials via the Internet. This electronic process gives you fast, convenient access to the materials, reduces the impact on the environment and reduces our printing and mailing costs. A paper copy of these materials can be requested using one of the methods described in the materials.

Your vote is important. Whether or not you plan to attend the meeting in person, it is important that your shares be represented. Please vote as soon as possible.

Sincerely,

| ||

| ||

Bryan C. Hanson President and Chief Executive Officer

Zimmer Biomet Holdings, Inc. 345 East Main Street Warsaw, Indiana 46580 |

| 3 |

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements included in this proxy statement, including in the “Letter from the Independent Directors to our Shareholders” and in the section entitled “Executive Compensation – Compensation Discussion and Analysis – Executive Summary – 2017 Performance and 2018 Priorities,” regarding future financial performance, results of operations, expectations, plans, strategies, priorities and other statements that are not historical facts are forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are based upon current beliefs, expectations and assumptions and are subject to significant risks, uncertainties and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017. Readers of this proxy statement are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| 4 | Zimmer Biomet |

ZIMMER BIOMET HOLDINGS, INC.

345 East Main Street

Warsaw, Indiana 46580

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF ZIMMER BIOMET HOLDINGS, INC.

To Be Held May 15, 2018

TIME AND DATE

8:00 a.m. Eastern Time on Tuesday, May 15, 2018

PLACE

The Conrad Indianapolis, 50 West Washington Street, Indianapolis, Indiana 46204

ITEMS OF BUSINESS

| ● | Elect nine directors to serve until the 2019 annual meeting of shareholders |

| ● | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2018 |

| ● | Approve, on anon-binding advisory basis, named executive officer compensation (“Say on Pay”) |

| ● | Transact such other business as may properly come before the meeting and any postponement(s) or adjournment(s) thereof |

RECORD DATE

March 16, 2018

By Order of the Board of Directors

Chad F. Phipps

Senior Vice President, General Counsel and

Secretary

April 2, 2018

Your Vote Is Important. You are cordially invited to attend the annual meeting in person. To ensure your shares will be voted at the meeting, however, we strongly urge you to review the proxy statement and vote your shares as soon as possible.

INTERNET

| www.ProxyVote.com | |

TELEPHONE

| 1-800-690-6903 | |

| Mail your proxy card / vote instruction form | |

IN PERSON

| Vote in person at the meeting |

ANNUAL REPORT

This booklet contains our Notice of Annual Meeting of Shareholders and Proxy Statement. Our 2017 Annual Report, which includes our Annual Report on Form10-K for the year ended December 31, 2017, accompanies this booklet. Our 2017 Annual Report is not a part of our proxy solicitation materials.

| 5 |

We are providing this proxy statement in connection with the solicitation of proxies by our Board of Directors for use at our 2018 annual meeting of shareholders to be held on Tuesday, May 15, 2018. The Notice of Annual Meeting of Shareholders and related proxy materials, or a Notice of Internet Availability, were first sent to shareholders on or about April 2, 2018. This summary highlights information contained elsewhere in this proxy statement. It does not contain all of the information you should consider, and we urge you to read the entire proxy statement, as well as our 2017 Annual Report, before voting.

MATTERS FOR SHAREHOLDER VOTING

|

Our Board recommends a voteFOR each nominee.

● Our Board is committed to independent oversight of Zimmer Biomet ● Eight of our nine director nominees are independent and our Board is led by an independent Chairman ● Key information regarding all of our director nominees is summarized in the table below

See pages9-14 for further information. |

Director Nominees

| Nominee | Age | Director Since | Principal Occupation | Independent | Other Public | Committee Memberships | ||||||||||||||||

| A | C&MD | CG | QR&T | |||||||||||||||||||

| Christopher B. Begley | 65 | 2012 | Retired Executive Chairman & CEO Hospira, Inc. | ✓ | 1 | ✓ | ✓ | |||||||||||||||

| Betsy J. Bernard | 62 | 2009 | Retired President AT&T Corp. | ✓ | 1 | ✓ | Chair | |||||||||||||||

| Gail K. Boudreaux | 57 | 2012 | President & CEO Anthem, Inc. | ✓ | 1 | ✓ | ✓ | |||||||||||||||

| Michael J. Farrell | 45 | 2014 | CEO ResMed Inc. | ✓ | 1 | ✓ | ✓ | |||||||||||||||

| Larry C. Glasscock« | 69 | 2001 | Retired Chairman, President & CEO Anthem, Inc. | ✓ | 2 | ✓ | ✓ | |||||||||||||||

| Robert A. Hagemann | 61 | 2008 | Retired Senior VP & CFO Quest Diagnostics Incorporated | ✓ | 2 | Chair | ✓ | |||||||||||||||

| Bryan C. Hanson | 51 | 2017 | President & CEO Zimmer Biomet Holdings, Inc. | 0 | ||||||||||||||||||

| Arthur J. Higgins | 62 | 2007 | President & CEO Depomed, Inc. | ✓ | 2(1) | Chair | ✓ | |||||||||||||||

| Michael W. Michelson | 66 | 2015 | Senior Advisory Partner, KKR Management LLC, the general partner of KKR & Co. L.P. | ✓ | 1 | ✓ | ✓ | |||||||||||||||

| A | Audit |

| C&MD | Compensation & Management Development |

| CG | Corporate Governance |

| QR&T | Quality, Regulatory & Technology |

| « | Chairman of the Board |

| (1) | See “Limit on Other Directorships” on page 17. |

| 6 | Zimmer Biomet |

PROXY STATEMENT SUMMARY

Corporate Governance Highlights

Independent Chairman of the Board | ✓ | |

Fully Independent Board Committees | ✓ | |

Annual Board and Committee Evaluations | ✓ | |

Annual Election of All Directors by Majority Vote in Uncontested Director Elections | ✓ | |

Robust Succession Planning and Risk Oversight | ✓ | |

Independent Directors Regularly Meet Without Management Present | ✓ | |

Independent Director Equity-Based Compensation Not Paid Out Until Cessation of Service | ✓ | |

Single Class Voting Structure (One Share, One Vote) | ✓ | |

Code of Business Conduct and Ethics for Directors, Officers and Employees | ✓ | |

Independent Director Mandatory Retirement Age | 72 | |

Supermajority Voting Requirements | X | |

Shareholder Rights Plan (Poison Pill) | X |

Board (Director Nominees) Composition and Skills

| Skills and Qualifications

| |||

| Current or Former CEO or CFO | ||||

| Significant Global Operations Experience | ||||

| Industry Experience | ||||

| FDA/Regulatory | ||||

| Research and Development | ||||

| Strategic Planning (Including M&A) | ||||

| Finance and Capital Allocation | ||||

| Healthcare Payment/Reimbursement | ||||

| Risk Management |

| 7 |

PROXY STATEMENT SUMMARY

|

Our Board recommends a voteFOR this proposal.

See page 27 for further information.

|

|

Our Board recommends a vote FOR this proposal.

See page 31 for further information. |

Executive Compensation Best Practices

What We Do | ||

| ✓ | Pay for performance | |

| ✓ | Establish challenging performance goals in incentive plans | |

| ✓ | Require robust stock ownership guidelines | |

| ✓ | Require termination of employment in addition to a change in control for accelerated equity vesting (double trigger) | |

| ✓ | Requirenon-competition agreement for equity award eligibility | |

| ✓ | Require shares received upon equity award vesting to be retained in accordance with stock ownership guidelines | |

| ✓ | Provide limited executive perquisites | |

| ✓ | Subject executives’ cash and equity-based incentives to clawback, including in the event of a violation of our Code of Business Conduct and Ethics or other conduct deemed detrimental to the interests of the company (equity-based incentives) | |

What We Don’t Do | ||

| X | Offer employment contracts to our executives | |

| X | Pay dividends or accrue dividend equivalents on unearned performance-based equity awards | |

| X | Provide excise taxgross-ups in new change in control severance agreements (since 2009) | |

| X | Allow hedging or pledging of company securities | |

| X | Reprice or exchange underwater stock options without shareholder approval | |

| X | Use the same performance measures in short- and long-term incentive plans | |

| 8 | Zimmer Biomet |

CORPORATE GOVERNANCE

At Zimmer Biomet, it’s not just what we make. It’s what we make possible. Simply put, we are in the business of changing people’s lives. We are humbled by that fact and take our responsibility seriously. Because of this, the way we conduct our business is critically important. We are committed to effective corporate governance, adhere to the highest ethical standards and act as a responsible member of our communities.

Our business is managed under the direction of our Board of Directors. The Board has responsibility for establishing broad corporate policies and for our overall performance.

Based upon the recommendation of the Corporate Governance Committee, the Board has nominated nine directors for election at the annual meeting to hold office until the 2019 annual meeting and the election of their successors. All of the nominees currently are serving as our directors. Each nominee agreed to be named in this proxy statement and to serve if elected. All of the nominees are expected to attend the 2018 annual meeting.

Cecil B. Pickett, Ph.D., a member of the Board since 2008 whose term expires at the annual meeting, has not been nominated for reelection due to our Board of Directors’ retirement policy. Jeffrey K. Rhodes, a member of the Board since 2015 whose term expires at the annual meeting, also has not been nominated for reelection after discussion with Mr. Rhodes regarding his future anticipated other professional commitments and responsibilities. The Corporate Governance Committee and the Board took into account information provided by Mr. Rhodes regarding his future anticipated other professional commitments and responsibilities in determining the directors to nominate for reelection to the Board.

The Board wishes to express its sincere gratitude to Dr. Pickett and Mr. Rhodes for their many significant contributions and years of dedicated service to Zimmer Biomet and our shareholders. The Board intends to reduce its size to nine members effective upon the expiration of Dr. Pickett’s and Mr. Rhodes’ terms as directors. Proxies cannot be voted for a greater number of persons than nine, which is the number of nominees named in this proxy statement.

Unless otherwise instructed, the persons named as proxies will vote all proxies received for the election of each of the nominees.

Our Board recommends a voteFOR each nominee for director.

|

| 9 |

CORPORATE GOVERNANCE

|

| |||

Executive Chairman of the Board of Hospira, Inc. from May 2007 until his retirement in January 2012. Mr. Begley also served as Chief Executive Officer from April 30, 2004, when Hospira was spun off from Abbott Laboratories, to March 2011. Prior to that, Mr. Begley served in various positions with Abbott between 1986 and 2004, most recently as Senior Vice President of Abbott’s Hospital Products division. He earned a bachelor’s degree from Western Illinois University and an MBA from Northern Illinois University.

Other Public Board Memberships ● Hanger, Inc. ● Past director andNon-Executive Chairman of Adtalem Global Education Inc. (formerly known as DeVry Education Group Inc.) (until November 2017) ● Past director andNon-Executive Chairman of The Hillshire Brands Company (until August 2014) ● Past director of Sara Lee Corporation (until June 2012) ● Past director and Executive Chairman of Hospira, Inc. (until January 2012) Other Relevant Experience ● Past director of the Advanced Medical Technology Association (“AdvaMed”), the medical device industry’s trade association ● Past director of the National Center for Healthcare Leadership

Skills and Qualifications

Christopher B. Begley’s past experience as the Chairman and CEO of Hospira, Inc., a leading provider of injectable drugs and infusion technologies, and previously as the senior vice president of two Abbott divisions, has provided him with extensive management experience at two multinational, publicly traded healthcare companies. In these senior leadership roles, Mr. Begley gainedin-depth knowledge of the healthcare industry and strategies for developing and marketing products in this highly regulated area. He also gained significant experience in strategic planning, risk management and financial management. Mr. Begley serves, and has served for more than 10 years, as a director of other public companies, including service as chairman of the board. |

President of AT&T Corp. from October 2002 until her retirement in December 2003. From April 2001 to October 2002, Ms. Bernard was Chief Executive Officer of AT&T Consumer. Prior to joining AT&T, Ms. Bernard held senior executive positions with Qwest Communications International Inc., US WEST, Inc., AVIRNEX Communications Group and Pacific Bell. Ms. Bernard received a B.A. degree from St. Lawrence University, an MBA from Fairleigh Dickenson University and an M.S. in management from Stanford University’s Sloan Fellowship Program.

Other Public Board Memberships ● Principal Financial Group, Inc. ● Past director of SITO Mobile, Ltd. (until June 2017) ● Past director of Telular Corporation (until June 2013)

Skills and Qualifications

Betsy J. Bernard’s past experience in senior executive roles with leading global telecommunications companies, including her service as President of AT&T Corp., has provided her with expertise in financial management, brand management, marketing, enterprise sales, customer care, operations, product management, electronic commerce, executive compensation, strategic planning and mergers and acquisitions. Ms. Bernard’s experience has led our Board to determine that she is an “audit committee financial expert” as that term is defined in Securities and Exchange Commission (“SEC”) rules. She serves, and has served for more than 15 years, as a director of other public companies, including service as chairman of the board and lead independent director, and she has experience chairing the nominating and governance committees of several public company boards, including ours. |

| 10 | Zimmer Biomet |

CORPORATE GOVERNANCE

|

| |||

President and Chief Executive Officer, Anthem, Inc. since November 2017. Previously, Ms. Boudreaux served as Chief Executive Officer and Founder, GKB Global Health, LLC from 2015 to November 2017. Prior to that, she served as Chief Executive Officer of UnitedHealthcare from January 2011 to November 2014 and Executive Vice President of UnitedHealth Group from May 2008 to February 2015. From 2005 to 2008, Ms. Boudreaux served as Executive Vice President, External Operations for Health Care Services Corporation (“HCSC”), and prior to that served as President of Blue Cross and Blue Shield of Illinois, a division of HCSC. Before joining HCSC, Ms. Boudreaux held various positions at Aetna, including Senior Vice President, Aetna Group Insurance. Ms. Boudreaux earned a bachelor’s degree in psychology from Dartmouth College and an MBA from Columbia Business School.

Other Public Board Memberships ● Anthem, Inc. ● Past director of Xcel Energy Inc. (until December 2017) ● Past director of Novavax, Inc. (until November 2017)

Skills and Qualifications

Gail K. Boudreaux’s service as the President and CEO of Anthem, Inc., a Fortune 50 company and leading health benefits provider, and her past service as the CEO of UnitedHealthcare, provide her with significant experience in managing large, highly complex regulated enterprises with a focus on strategic growth, corporate culture and operational effectiveness. Through more than three decades of service in key leadership and senior management positions in the healthcare industry, Ms. Boudreaux has developed expertise in corporate strategy, financial analysis, risk management and governance. Ms. Boudreaux’s experience has led our Board to determine that she is an “audit committee financial expert” as that term is defined in SEC rules. She serves, and has served for more than 10 years, as a director of other public companies as well as a director of several nonprofit, educational and healthcare organizations. |

Chief Executive Officer of ResMed Inc. since March 2013. Prior to that appointment, Mr. Farrell served as President – Americas for ResMed from 2011 to 2013. He was previously Senior Vice President of the global business unit for sleep apnea therapeutic and diagnostic devices from 2007 to 2011, and before that he held various senior roles in marketing and business development. Before joining ResMed in September 2000, Mr. Farrell worked in management consulting, biotechnology, chemicals and metals manufacturing at Arthur D. Little, Genzyme Corporation, The Dow Chemical Company and BHP Billiton. Mr. Farrell holds a bachelor of engineering, with first-class honors, from the University of New South Wales, a master of science in chemical engineering from the Massachusetts Institute of Technology and an MBA from the MIT Sloan School of Management.

Other Public Board Memberships ● ResMed Inc. Other Relevant Experience ● Director of AdvaMed

Skills and Qualifications

Michael J. Farrell’s service as CEO of ResMed Inc., a global leader in the development, manufacturing, distribution and marketing of medical products for the diagnosis, treatment and management of respiratory disorders, provides him with significant experience leading a highly regulated, global medical device company. Mr. Farrell is spearheading the company’s expansion into emerging markets and its investments in connected care and digital health, major growth initiatives for ResMed that fit well with our own plans for global growth. In his prior roles, Mr. Farrell led ResMed’s M&A and alliance creation activities, as well as the marketing function. In addition, during his tenure with ResMed, Mr. Farrell has gained domestic and international P&L experience, first as head of the company’s major global business unit, and then as President – Americas. Mr. Farrell’s experience has given him a strong understanding of key aspects of leading a highly regulated, global healthcare company such as ours, including financial management, business integration, strategic planning, operations, product innovation, new product launches and international expansion. |

| 11 |

CORPORATE GOVERNANCE

|

| |||

Chairman of WellPoint, Inc. (now Anthem, Inc.) from 2005 until 2010. Mr. Glasscock also served as President and Chief Executive Officer of WellPoint, Inc. from 2004 to 2007. Mr. Glasscock served as Chairman, President and Chief Executive Officer of Anthem, Inc. from 2003 to 2004 and served as President and Chief Executive Officer of Anthem, Inc. from 2001 to 2003. Mr. Glasscock earned a B.B.A. from Cleveland State University. He also completed the Commercial Bank Management Program at Columbia University.

Other Public Board Memberships ● Simon Property Group, Inc. (Lead Independent Director) ● Sysco Corporation ● Past director of Sprint Nextel Corporation (until July 2013) ● Past director and Chairman of Anthem, Inc. (until March 2010)

Skills and Qualifications

Larry C. Glasscock’s past experience as Chairman and CEO of Anthem, Inc. has provided him within-depth knowledge of the healthcare industry and healthcare payment and reimbursement processes. He also gained significant experience in strategic planning, risk management, financial management and business integration. His executive experience includes completing multiple acquisitions, developing and implementing turnaround and growth strategies, designing enterprise risk management processes and developing talent and participating in successful leadership transitions. In addition, Mr. Glasscock also worked in financial services for over 20 years, where he developed financial and marketing skills, and in human resources for four years, where he gained a strong understanding of, and skills related to, compensation and benefits. Mr. Glasscock’s experience has led our Board to determine that he is an “audit committee financial expert” as that term is defined in SEC rules. He serves, and has served for more than 10 years, as a director of other public companies, including service as chairman of the board and lead independent director. |

Senior Vice President and Chief Financial Officer of Quest Diagnostics Incorporated until his retirement in July 2013. Mr. Hagemann joined Corning Life Sciences, Inc., a subsidiary of Quest Diagnostics’ former parent company, Corning Incorporated, in 1992, and held roles of increasing responsibility before being appointed Chief Financial Officer of Quest Diagnostics in 1998. Prior to joining Corning, Mr. Hagemann held senior financial positions at Prime Hospitality, Inc. and Crompton & Knowles, Inc. He was also previously employed by Arthur Young & Co., a predecessor company to Ernst & Young. Mr. Hagemann holds a B.S. in accounting from Rider University and an MBA from Seton Hall University.

Other Public Board Memberships ● Graphic Packaging Holding Company ● Ryder System, Inc.

Skills and Qualifications

Robert A. Hagemann’s past experience as the CFO of Quest Diagnostics Incorporated, a leading provider of diagnostic testing information services, has given him financial management expertise, as well as significant experience in strategic planning, business development, business integration, operations, talent management and information technology. His experience as an executive in the healthcare industry and his financial acumen enable him to evaluate and understand the impact of business decisions on our financial statements and capital structure. Mr. Hagemann’s experience has led our Board to determine that he is an “audit committee financial expert” as that term is defined in SEC rules. He also serves as a director of other public companies. |

| 12 | Zimmer Biomet |

CORPORATE GOVERNANCE

|

| |||

President and Chief Executive Officer and a member of the Board of Directors of the company since December 2017. Previously, Mr. Hanson served as Executive Vice President and President, Minimally Invasive Therapies Group of Medtronic plc from January 2015 until joining Zimmer Biomet. Prior to that, he was Senior Vice President and Group President, Covidien of Covidien plc from October 2014 to January 2015; Senior Vice President and Group President, Medical Devices and United States of Covidien from October 2013 to September 2014; Senior Vice President and Group President of Covidien for the Surgical Solutions business from July 2011 to October 2013; and President of Covidien’s Energy-based Devices business from July 2006 to June 2011. Mr. Hanson held several other positions of increasing responsibility in sales, marketing and general management with Covidien from October 1992 to July 2006. Mr. Hanson holds a Bachelor of Science degree in Finance from Florida State University. He also completed the Kellogg School of Management Finance for Executives program in 2010 and the Harvard Executive Education in Leadership program in 2013.

Other Relevant Experience ● Director of Americares, an emergency response and global health organization committed to saving lives and building healthier futures for people in crisis

Skills and Qualifications

Bryan C. Hanson’s service as our President and CEO and his past service in Group President roles with Medtronic and Covidien have given him extensive experience in the medical device industry leading, growing and transforming large, highly regulated global enterprises. Mr. Hanson has significant experience in financial management, strategic planning, mergers and acquisitions, business integration, risk management and in dealing with the many regulatory aspects of our business. His knowledge and understanding of the medical device industry in general, and our global businesses in particular, enable him to provide crucial insight to our Board into strategic, management and operational matters. Mr. Hanson provides an essential link between management and the Board on management’s business perspectives. |

President, Chief Executive Officer and a member of the board of directors of Depomed, Inc. since March 2017. Consultant, Blackstone Healthcare Partners of The Blackstone Group since June 2010. Previously, Mr. Higgins served as Chairman of the Board of Management of Bayer HealthCare AG from January 2006 to May 2010 and Chairman of the Bayer HealthCare Executive Committee from July 2004 to May 2010. Prior to joining Bayer HealthCare in 2004, Mr. Higgins served as Chairman, President and Chief Executive Officer of Enzon Pharmaceuticals, Inc. from 2001 to 2004. Prior to that, Mr. Higgins spent 14 years with Abbott Laboratories, most recently as President of the Pharmaceutical Products Division from 1998 to 2001. He graduated from Strathclyde University, Scotland and holds a B.S. in biochemistry.

Other Public Board Memberships(1) ● Depomed, Inc. ● Ecolab Inc. ● Past director of Endo International plc (until March 2017) ● Past director of Resverlogix Corp. (until February 2014) Other Relevant Experience ● Past director of the Pharmaceutical Research and Manufacturers of America ● Past member of the Council of the International Federation of Pharmaceutical Manufacturers and Associations ● Past president of the European Federation of Pharmaceutical Industries and Associations

Skills and Qualifications

Arthur J. Higgins has extensive senior leadership experience in the global healthcare market. Through leadership positions with large healthcare developers and manufacturers in both the U.S. and Europe, he has gained deep knowledge of the healthcare market and the strategies for developing and marketing products in this highly regulated area. His knowledge and industry background allow him to provide valuable insight to our business. In addition, his perspective gained from years of operating global businesses and his background in working with high growth companies provide him experiences from which to draw to advise us on strategies for sustainable growth. Through his current and past executive positions, he has also gained significant exposure to enterprise risk management as well as quality and operating risk management necessary in a highly regulated industry such as healthcare. |

| (1) | See “Limit on Other Directorships” on page 17. |

| 13 |

CORPORATE GOVERNANCE

| ||||

Senior Advisory Partner, KKR Management LLC, a private equity investment manager and the general partner of KKR & Co. L.P., since January 2018. Previously, Member, KKR Management LLC since October 2009. Before that, Mr. Michelson was a member of the limited liability company that served as the general partner of Kohlberg Kravis Roberts & Co. L.P. since 1996. He joined KKR in 1981. Mr. Michelson has played a significant role in the development of KKR’s portfolio companies. He began his professional career with the law firm of Latham & Watkins in Los Angeles, where he was involved in a broad corporate practice while specializing in management buyouts. He earned an A.B. from Harvard College and a J.D. from Harvard Law School.

Other Public Board Memberships ● HCA Healthcare, Inc. Other Relevant Experience ● Served as a director of Biomet prior to the merger of Zimmer and Biomet

Skills and Qualifications

Michael W. Michelson has significant experience in corporate finance, strategic business planning activities, operations, risk management and issues involving stakeholders more generally from his involvement in KKR’s investments in numerous portfolio companies, and he has played an active role in overseeing many healthcare companies. He serves and has served as a director of other public and private healthcare companies, and he served as a director of Biomet prior to the merger of Zimmer and Biomet. |

| 14 | Zimmer Biomet |

CORPORATE GOVERNANCE

OUR BOARD OF DIRECTORS AND CORPORATE

GOVERNANCE FRAMEWORK

DIRECTOR CRITERIA, QUALIFICATIONS AND

EXPERIENCE

We are a global leader in musculoskeletal healthcare. We design, manufacture and market orthopaedic reconstructive products; sports medicine, biologics, extremities and trauma products; office based technologies; spine, craniomaxillofacial and thoracic products; dental implants; and related surgical products. We have operations in more than 25 countries around the world and sell products in more than 100 countries. We operate in markets characterized by rapidly evolving technologies, complex regulatory requirements and significant competition. The Corporate Governance Committee is responsible for reviewing and assessing with the Board, on an annual basis, the experience, qualifications, attributes and skills sought of Board members in the context of our business and the then-current membership of the Board. The committee looks for current and potential directors collectively to have a mix of experience, skills and qualifications, some of which are described below:

● Experience as a CEO or global business head | ● Government / regulatory affairs / health economics experience | |

● Business operations experience | ● Research and development experience | |

● Healthcare industry experience | ● Brand / marketing experience | |

● Medical device industry experience | ● Mergers and acquisitions experience | |

● International experience | ● Financial expertise | |

● FDA / regulatory experience | ● Public company board experience |

In evaluating director candidates and considering incumbent directors for nomination to the Board, the committee considers a variety of factors. These include each candidate’s character and integrity, reputation for working constructively in a collegial environment and availability to devote sufficient time to Board matters. Diversity of background and diversity of gender, race, ethnicity, national origin and age are also relevant factors in the selection process. The committee also considers whether a candidate can meet the independence standards for directors and members of key committees under applicable stock exchange and SEC rules. With respect to incumbent directors, the committee considers the director’s past performance on the Board and contributions to the committees on which he or she serves.

While the Board has not formally adopted a policy regarding director diversity, the committee actively considers diversity in director recruitment and nomination and believes that the diversity of the current Board members, including as to gender, race, ethnicity, national origin, international work experience and age, provides significant benefits to the Board and to the company.

One of the key responsibilities of the Board is to have a leadership structure that allows it to provide effective oversight of management and maximize the contributions of its members. Currently, the Board is led by anon-executive Chairman of the Board selected from among the independent directors. Thenon-executive Chairman leads the meetings and activities of the Board, while our CEO leads the management, operations and employees of the company and is responsible for executing the company’s strategy. The Board adopted this leadership structure in 2007. The Board believes that this leadership structure allows the Board to function efficiently and effectively and that it continues to be appropriate. However, the Board evaluates its leadership structure on an ongoing basis and is not opposed in concept to combining these roles. Prior to 2007, the positions of Chairman and CEO were held by the same person. The Board believes it should maintain the flexibility to change its leadership structure as circumstances warrant.

Larry Glasscock, who has served as one of our independent directors since 2001, has served asnon-executive Chairman since 2013.

| 15 |

CORPORATE GOVERNANCE

Thenon-executive Chairman of the Board has the following duties and responsibilities:

| ● | presiding at meetings of the Board and shareholders; |

| ● | approving the agendas for meetings of the full Board, as prepared by the CEO; |

| ● | presiding at executive sessions of the independent directors; |

| ● | coordinating the activities of the independent directors; and |

| ● | serving as the liaison between the CEO and the rest of the Board. |

If the Board decides in the future to combine the positions of Chairman and CEO, the independent directors will designate one of themselves as “Lead Independent Director.” The Lead Independent Director would have duties and responsibilities similar to the currentnon-executive Chairman, except for the duty to preside at meetings of the Board and shareholders.

| BOARD’S ROLE IN RISK OVERSIGHT |

The Board of Directors oversees the risk management processes that have been designed and are implemented by our executives to determine whether those processes are functioning as intended and are consistent with our business and strategy. The Board executes its oversight responsibility for risk management directly and through its committees.

The Audit Committee is specifically tasked with overseeing our compliance with legal and regulatory requirements, discussing our risk assessment and risk management processes with management, and receiving information on certain material legal and regulatory matters, including litigation, as well as on information technology and data privacy and security matters. Our head of internal audit, who reports directly to the committee, coordinates our global risk assessment process. We use this process to identify, assess and prioritize internal and external risks, to develop processes for responding to, mitigating and monitoring risks and to inform the development of our internal audit plan, our annual operating plan and our long-term strategic plan. The committee receives detailed reports regarding our enterprise risk assessment process and the committee’s meeting agendas include discussions of individual risk areas throughout the year. Members of our management who have responsibility for designing and implementing our risk management processes regularly meet with the committee. The committee discusses our major financial risk exposures with our CFO and Chief Accounting Officer. The committee receives regular reports from our Chief Compliance Officer on our Corporate Compliance Program, which is designed to address risks related to, among other matters, anti-corruption and anti-kickback laws in the countries where we do business. The committee also receives reports from our General Counsel, Chief Information Officer, Global Privacy Officer and other persons who are involved in our risk management processes.

The Board’s other committees oversee risks associated with their respective areas of responsibility. For example, the Compensation and Management Development Committee oversees risks relating to our executive compensation programs and practices. In addition, in conjunction with the full Board, the Compensation and Management Development Committee oversees risks relating to senior management succession planning. The Quality, Regulatory and Technology Committee oversees risks relating to our compliance with laws and regulations enforced by the U.S. Food and Drug Administration (“FDA”) and comparable foreign government regulators, including product quality and safety.

The Board receives detailed regular reports from members of our executive leadership team and other personnel that include discussions of the risks and exposures involved with their respective areas of responsibility. Further, the Board is routinely informed of developments that could affect our risk profile or other aspects of our business. Primary areas of risk oversight for the full Board include, but are not limited to, general commercial risks in the musculoskeletal healthcare industry, such as competition, pricing pressures and the reimbursement landscape; risks associated with our strategic plan and annual operating plan; risks related to our capital structure; and risks pertaining to mergers and acquisitions integration.

| 16 | Zimmer Biomet |

CORPORATE GOVERNANCE

| POLICIES ON CORPORATE GOVERNANCE |

We are committed to maintaining the highest standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving shareholders well and maintaining our integrity in the marketplace. Our Board has adopted Corporate Governance Guidelines, which, in conjunction with our Restated Certificate of Incorporation, RestatedBy-Laws, Board committee charters and key Board policies, form the framework for our governance. Our Board regularly reviews corporate governance developments and modifies its Corporate Governance Guidelines, committee charters and key practices as warranted.

The current versions of the following documents are available in the Investor Relations/Corporate Governance section of our website, www.zimmerbiomet.com:

| ● | Code of Business Conduct and Ethics, which applies to all directors, officers and employees; |

| ● | Code of Ethics for Chief Executive Officer and Senior Financial Officers (the “finance code of ethics”), which applies to our CEO, CFO, Chief Accounting Officer/Corporate Controller and other finance organization employees; |

| ● | Corporate Governance Guidelines; |

| ● | Audit Committee Charter; |

| ● | Compensation and Management Development Committee Charter; |

| ● | Corporate Governance Committee Charter; |

| ● | Quality, Regulatory and Technology Committee Charter; |

| ● | Board Policy on Ratification of Independent Registered Public Accounting Firm; and |

| ● | Board Policy on Stockholder Rights Plans. |

If we make any substantive amendments to the finance code of ethics or grant any waiver, including any implicit waiver, from a provision of the code to our CEO, CFO, or Chief Accounting Officer/Corporate Controller, we will disclose the nature of that amendment or waiver in the Investor Relations section of our website.

| LIMIT ON OTHER DIRECTORSHIPS |

Under our Corporate Governance Guidelines, ournon-employee directors who are not executive officers of other public companies are limited to serving on a total of four public company boards, including ours, and ournon-employee directors who serve as executive officers of other public companies are limited to serving on a total of three public company boards, including their own company’s board and our Board. Further, our Audit Committee members are limited to serving on a total of three public company audit committees, including ours.

Our Board is aware that certain of our investors, in recognition of the increased time required of boards of directors, have recently updated their policies to limit directors who are CEOs of public companies to a total of two public company boards. While our Board recognizes that directors who are employed full-time, whether as executives of public companies or in other positions, naturally have greater demands placed on their time than directors who have retired from full-time employment, our Board has chosen not to adopt the more restrictivetwo-board limit for ournon-employee directors who serve as public company executives so that our Board has more flexibility to assess the potential impact of directors’ additional commitments as they arise.

Arthur J. Higgins has served as a director of ours since 2007 and as a director of Ecolab Inc. since 2010. From 2010 to March 2017, Mr. Higgins’ principal occupation was serving as a Consultant to Blackstone Healthcare Partners, the dedicated healthcare team of The Blackstone Group. Prior to that, Mr. Higgins gained more than two decades of healthcare experience serving in executive positions with Bayer HealthCare AG, Enzon Pharmaceuticals, Inc. and Abbott Laboratories. In March 2017, Mr. Higgins was named President, CEO and a member of the board of directors of Depomed, Inc., a specialty pharmaceutical company. Zimmer Biomet and Ecolab are headquartered in the Midwest and Depomed will be headquartered in the Midwest beginning inmid-2018.

Mr. Higgins has remained fully committed to his duties as our director since his appointment as CEO of Depomed a year ago. He continues to bring high levels of engagement, focus and energy to our Board and its committees, as well as significant global healthcare industry expertise, and our Board has seen no decline in his attendance at, or participation in, our Board and committee meetings or his level of preparedness therefor. In deciding to nominate Mr. Higgins for reelection to our Board for an additionalone-year term, our Corporate Governance Committee and full

| 17 |

CORPORATE GOVERNANCE

Board considered the foregoing factors, as well as the diversity of skills, perspective and background that Mr. Higgins contributes to our Board, and determined that it is in the best interests of our company and our shareholders for Mr. Higgins to continue to serve as our director.

| BOARD SELF-EVALUATION PROCESS |

Pursuant to New York Stock Exchange requirements, the Board’s Corporate Governance Guidelines and the charters of each of the Board’s committees, the Board and each of its committees are required to conduct self-evaluations of their performance. The Board recognizes that a robust and constructive evaluation process is an essential component of good corporate governance. These self-evaluations, which are conducted annually, are intended to facilitate a candid assessment and discussion by the Board and each committee of its effectiveness as a group in fulfilling its responsibilities, evaluating its performance and identifying areas for improvement. The Chair of the Corporate Governance Committee oversees the annual self-evaluation process. Each director is expected to participate and provide feedback on a range of topics, including: the Board and committee agendas; meetings; practices and dynamics; Board refreshment; committee structure, membership and leadership; the flow of information to and from the Board and its committees; management succession planning; and shareholder engagement. Director feedback is solicited on an individual basis through written questionnaires/assessments, individual director interviews and/or group discussions. From time to time, the Board retains a third party experienced in corporate governance matters to act as a facilitator for the self-evaluation process, including preparing and reviewing the written questionnaires/assessments and conducting individual director interviews. The Chair of the Corporate Governance Committee, along with the third party facilitator (when one is retained) reviews the feedback from the self-evaluation process and makes recommendations for areas with respect to which the Board and its committees should consider improvements. These areas are further discussed at a meeting led by the Chair of the Corporate Governance Committee and the third party facilitator (when one is retained) at which all Board members are present. At the conclusion of this meeting, the Chair of the Corporate Governance Committee, working with the senior management team, develops action plans for any items that requirefollow-up.

| DIRECTOR INDEPENDENCE |

The Board’s Corporate Governance Guidelines, which are available on our website as described above, include criteria adopted by the Board to assist it in making determinations regarding the independence of its members. The criteria are consistent with the New York Stock Exchange listing standards regarding director independence. To be considered independent, the Board must determine that a director has no material relationship, directly or indirectly, with us. In assessing independence, the Corporate Governance Committee and the Board consider a wide range of relevant facts and circumstances. The Board has determined that each of ournon-employee directors, Christopher B. Begley, Betsy J. Bernard, Gail K. Boudreaux, Michael J. Farrell, Larry C. Glasscock, Robert A. Hagemann, Arthur J. Higgins, Michael W. Michelson, Cecil B. Pickett, Ph.D. and Jeffrey K. Rhodes, meets these standards and is independent. The remaining director, Bryan C. Hanson, is our President and CEO and is not independent.

In making its determination with respect to Ms. Boudreaux, the Board considered her position as President and Chief Executive Officer of Anthem, Inc. With more than 73 million people served by its affiliated companies, including more than 40 million within its family of health plans, Anthem is one of the nation’s leading health benefits companies and serves as the third party claims processor of our self-funded group health plan for our U.S.-based employees and reinsurer of catastrophic claims under the plan. During 2017, the amount we paid Anthem exceeded $1 million, but represented only eight thousandths of one percent (0.008%) of Anthem’s total revenues. After reviewing the terms of these transactions, the Board determined that Ms. Boudreaux does not have a direct or indirect material interest in the transactions, that Ms. Boudreaux does not have a material relationship, directly or indirectly, with us and that our business relationship with Anthem does not diminish the ability of Ms. Boudreaux to exercise her independent judgment on issues affecting our business.

Anthem does not provide any services to us that would be characterized as professional services or advisory in nature (plan design consulting services are provided by Willis Towers Watson). Anthem does not have access to sensitive company information or to our strategic decision-making, and its services are generally provided for a monthly fee

| 18 | Zimmer Biomet |

CORPORATE GOVERNANCE

based upon the number of employees enrolled in our health plan. Anthem’s services to us are limited to administrative services, including claims processing, utilization of Anthem’s provider network, Employee Assistance Programs, customer service, disease management programs, and stop-loss coverage.

MAJORITY VOTE STANDARD FOR ELECTION OF DIRECTORS |

Our RestatedBy-Laws require directors to be elected by the majority of the votes cast with respect to that director in uncontested elections (the number of shares voted “for” a director must exceed the number of votes cast “against” that director). In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors. If a nominee who is serving as a director is not elected at the annual meeting, under Delaware law the director would continue to serve on the Board as a “holdover director.” However, under our RestatedBy-Laws, any director who fails to be elected must tender his or her resignation to the Board. The Corporate Governance Committee would then make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified. The director who tenders his or her resignation will not participate in the Board’s decision. If a nominee who was not already serving as a director is not elected at the annual meeting, under Delaware law that nominee would not become a director and would not serve on the Board as a “holdover director.” All nominees for election as directors at the 2018 annual meeting are currently serving on the Board.

| NOMINATIONS FOR DIRECTORS |

The Corporate Governance Committee screens candidates and recommends candidates for nomination to the full Board. In seeking and evaluating director candidates, the committee considers individuals in accordance with the criteria described above under “Director Criteria, Qualifications and Experience.” Director candidates may be recommended by Board members, a third-party search firm or shareholders.

The committee considers candidates proposed by shareholders and evaluates them using the same criteria as for other candidates. A shareholder who wishes to recommend a director candidate for consideration by the committee should send such recommendation to our Corporate Secretary at Zimmer Biomet Holdings, Inc., 345 East Main Street, Warsaw, Indiana 46580, who will then forward it to the committee. Any such recommendation should include a description of the candidate’s qualifications for board service, the candidate’s written consent to be considered for nomination and to serve if nominated and elected, and addresses and telephone numbers for contacting the shareholder and the candidate for more information. A shareholder who wishes to nominate an individual as a candidate for election, rather than recommend the individual to the committee as a nominee, must comply with the advance notice requirements set forth in our RestatedBy-Laws. (See “What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 2019 annual meeting of shareholders?” on page 83 for more information on these procedures.)

| COMMUNICATIONS WITH DIRECTORS |

Shareholders or other interested parties may contact our directors by writing to them either individually or as a group or partial group (such as all independent directors), c/o Corporate Secretary, Zimmer Biomet Holdings, Inc., 345 East Main Street, Warsaw, Indiana 46580. If you wish your communication to be treated confidentially, please write the word “CONFIDENTIAL” prominently on the envelope and address it to the director by name so that it can be forwarded without being opened. Communications addressed to multiple recipients, such as to “Board of Directors,” “Audit Committee,” “Independent Directors,” etc. will necessarily have to be opened and copied by the Office of the Corporate Secretary in order to forward them, and hence cannot be treated confidentially.

| 19 |

CORPORATE GOVERNANCE

BOARD MEETINGS, ATTENDANCE AND EXECUTIVE SESSIONS |

The Board meets on a regularly scheduled basis during the year to review significant developments affecting us and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between scheduled meetings. Members of senior management regularly attend meetings of the Board and its committees to report on and discuss their areas of responsibility. Directors are expected to attend Board meetings, meetings of committees on which they serve and shareholder meetings. Directors are expected to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. During 2017, the Board held 12 meetings and the standing committees of the Board held a total of 30 meetings. All directors attended 75% or more of the meetings of the Board and committees on which they served, except Jeffrey K. Rhodes, who attended 73% of such meetings. All current directors then in office attended the 2017 annual meeting of shareholders.

Each regularly scheduled Board meeting normally begins with a session between the CEO and the independent directors. This provides a platform for discussions outside the presence of thenon-Board management attendees, as well as an opportunity for the independent directors to go into executive session (without the CEO) if requested by any director. The independent directors may meet in executive session, without the CEO, at any time, and are scheduled for such independent executive sessions at each regularly scheduled Board meeting. Larry Glasscock, in his capacity asnon-executive Chairman, presides at these executive sessions.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS |

On an annual basis, each director and executive officer is obligated to complete a director and officer questionnaire which requires disclosure of any transactions with us in which the director or executive officer, or any member of his or her immediate family, has an interest. Under our Audit Committee’s charter, which is available on our website at www.zimmerbiomet.com, our Audit Committee must review and approve all related person transactions in which any executive officer, director, director nominee or more than 5% shareholder of the company, or any of their immediate family members, has a direct or indirect material interest. The Audit Committee may not approve a related person transaction unless (1) it is in or not inconsistent with our best interests and (2) where applicable, the terms of such transaction are at least as favorable to us as could be obtained from an unrelated third party.

Under our Code of Business Conduct and Ethics, which is available on our website at www.zimmerbiomet.com, our Human Resources Department, in consultation with our Legal Department and Compliance Office, is charged with reviewing and approving any conflict of interest involving any other employee.

In February 2018, we entered into an aircraft time sharing agreement with Bryan C. Hanson, our President and CEO. Both the Audit Committee and the Compensation and Management Development Committee of our Board of Directors authorized entry into the agreement. Under the agreement, Mr. Hanson is permitted to reimburse us for the incremental costs of his personal use of corporate aircraft consistent with Federal Aviation Administration regulations. Pursuant to his offer letter, Mr. Hanson is permitted personal use of corporate aircraft, for which he is not required to reimburse us, up to a maximum incremental cost to us of $200,000 per calendar year. The agreement is intended to cover any personal use in excess of the $200,000 annual limit.

| COMMITTEES OF THE BOARD |

Our RestatedBy-Laws provide that the Board may delegate certain of its responsibilities to committees. During 2017, the Board had four standing committees: an Audit Committee; a Compensation and Management Development Committee; a Corporate Governance Committee; and a Quality, Regulatory and Technology Committee. Each of the standing committees is composed entirely of independent directors. In addition, the members of the Audit Committee and the Compensation and Management Development Committee meet the heightened standards of independence required by SEC rules and New York Stock Exchange listing standards.

| 20 | Zimmer Biomet |

CORPORATE GOVERNANCE

The table below shows the current membership of each standing Board committee and the number of meetings held during 2017.

STANDING COMMITTEE ASSIGNMENTS

| Director | Audit Committee | Compensation and Management Development Committee | Corporate Governance Committee | Quality, Regulatory and Technology Committee | ||||

Christopher B. Begley | ✓ | ✓ | ||||||

Betsy J. Bernard | ✓ | Chair | ||||||

Gail K. Boudreaux | ✓ | ✓ | ||||||

Michael J. Farrell | ✓ | ✓ | ||||||

Larry C. Glasscock | ✓ | ✓ | ||||||

Robert A. Hagemann | Chair | ✓ | ||||||

Bryan C. Hanson | ||||||||

Arthur J. Higgins | Chair | ✓ | ||||||

Michael W. Michelson | ✓ | ✓ | ||||||

Cecil B. Pickett, Ph.D. | ✓ | Chair | ||||||

Jeffrey K. Rhodes | ✓ | ✓ | ||||||

2017 Meetings | 13 | 7 | 6 | 4 |

| Audit Committee |

Robert A. Hagemann, Chair

Betsy J. Bernard

Gail K. Boudreaux

Larry C. Glasscock

Jeffrey K. Rhodes

The Audit Committee is directly responsible for the appointment, retention, compensation and oversight of our independent registered public accounting firm, including the review and approval of audit fees. The principal functions of the Audit Committee include:

| ● | pre-approving all auditing services and permissiblenon-audit services provided to us by our independent registered public accounting firm; |

| ● | reviewing with our independent registered public accounting firm and with management the proposed scope of the annual audit, past audit experience, our program for the internal examination and verification of our accounting records and the results of recently completed internal examinations; |

| ● | reviewing and discussing with management and our independent registered public accounting firm our quarterly and annual financial statements prior to their public release; |

| ● | reviewing major issues as to the adequacy of our internal controls; and |

| ● | overseeing our compliance with certain legal and regulatory requirements and aspects of our risk management processes. |

The Board of Directors has determined that Mses. Bernard and Boudreaux and Messrs. Glasscock, Hagemann and Rhodes qualify as “audit committee financial experts” as defined by SEC rules. Shareholders should understand that this designation is an SEC disclosure requirement related to these directors’ experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon these directors any duties, obligations or liabilities that are greater than those that are generally imposed on them as members of the Audit Committee and the Board, and their designation as audit committee financial experts pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board.

See also the “Audit Committee Matters” section of this proxy statement for additional information about the Audit Committee’s responsibilities and actions and the Audit Committee Report.

| 21 |

CORPORATE GOVERNANCE

| Compensation and Management Development Committee |

Arthur J. Higgins, Chair

Christopher B. Begley

Michael J. Farrell

Michael W. Michelson

Cecil B. Pickett, Ph.D.

The Compensation and Management Development Committee has overall responsibility for approving and evaluating the executive compensation plans, policies and programs of the company. The duties of the Compensation and Management Development Committee include:

| ● | reviewing corporate goals and objectives relevant to CEO compensation and evaluating the CEO’s performance in light of those goals and objectives; |

| ● | reviewing and discussing with the CEO the performance of the company’s other executive officers; |

| ● | reviewing and approving the base salary, annual and long-term incentive compensation and other compensation, perquisites or special or supplemental benefits to be paid or awarded to the CEO and other executive officers; |

| ● | approving and authorizing the company to enter into any severance arrangements, change in control agreements or provisions or other compensation-related agreements, in each case as, when and if appropriate with executive officers of the company; |

| ● | reviewing and making recommendations to the Board with respect to incentive compensation and equity-based plans; |

| ● | administering the company’s incentive compensation and equity-based plans, including making awards under such plans; |

| ● | monitoring compliance by executive officers with the company’s stock ownership guidelines; |

| ● | reviewing all proposed new or amended employee benefit plans; |

| ● | overseeing the process for identifying and addressing any material risks relating to the company’s compensation policies and practices; |

| ● | overseeing management development and succession planning matters; |

| ● | reviewing and discussing with management the Compensation Discussion and Analysis required by SEC regulations and, if appropriate, recommending its inclusion in our Annual Report on Form10-K and proxy statement; and |

| ● | reviewing the results ofnon-binding advisory votes on executive compensation and determining whether changes should be made to our executive compensation policies and programs to address shareholder concerns. |

None of the members of the Compensation and Management Development Committee during 2017 or as of the date of this proxy statement is or has been our officer or employee or had any relationship requiring disclosure under Item 404 of RegulationS-K of the Exchange Act. None of our executive officers served on the compensation committee or board of any company that employed any member of the Compensation and Management Development Committee or the Board or otherwise under circumstances requiring disclosure under Item 404 of RegulationS-K.

The report of the Compensation and Management Development Committee appears on page 55.

| Compensation Risk Assessment |

At the request of the Compensation and Management Development Committee, Willis Towers Watson, the committee’s compensation consultant, conducted anin-depth qualitative review of the potential risks associated with our executive compensation program in 2015, and it updated its assessment in each of 2016 and 2017. The components of our executive compensation program are part of our global compensation structure, and the majority of the compensation policies or practices that apply to other levels of our employees or to any of our subsidiaries or divisions are included in our executive compensation program. For 2017, Willis Towers Watson found that our executive compensation program is in alignment with current market practices, contains an appropriate balance of risk versus rewards and incorporates appropriate risk mitigating factors. Consistent with prior years, Willis Towers Watson found no design features in our executive compensation practices that pose a significant concern from the perspective of motivating senior officers to knowingly expose us to excessive enterprise risk. We believe that our compensation policies and practices do not encourage excessive risk-taking and are not reasonably likely to have a material adverse effect on us.

| 22 | Zimmer Biomet |

CORPORATE GOVERNANCE

| Corporate Governance Committee |

Betsy J. Bernard, Chair

Gail K. Boudreaux

Michael J. Farrell

Larry C. Glasscock

Jeffrey K. Rhodes

The Corporate Governance Committee oversees the Board’s corporate governance policies and practices. The duties of the Corporate Governance Committee include:

| ● | developing and recommending to the Board criteria for selection ofnon-management directors; |

| ● | recommending to the Board director nominees for election at the next annual or special meeting of shareholders at which directors are to be elected or to fill any vacancies or newly-created directorships that may occur between such meetings; |

| ● | recommending directors for appointment to Board committees; |

| ● | analyzing information relevant to the Board’s determination as to whether a director is independent; |

| ● | overseeing the annual self-evaluation process for the Board and its committees; |

| ● | periodically reviewing the Board’s leadership structure and recommending any proposed changes to the Board for approval; |

| ● | monitoring emerging corporate governance trends and recommending to the Board any proposed changes in the company’s corporate governance policies; |

| ● | periodically reassessing the Board’s Corporate Governance Guidelines and recommending any proposed changes to the Board for approval; and |

| ● | periodically reviewing, in cooperation with the Compensation and Management Development Committee, the form and amount ofnon-employee director compensation and recommending any proposed changes to the Board for approval. |

| Quality, Regulatory and Technology Committee |

Cecil B. Pickett, Ph.D., Chair

Christopher B. Begley

Robert A. Hagemann

Arthur J. Higgins

Michael W. Michelson

The Quality, Regulatory and Technology (“QRT”) Committee assists the Board in its oversight of product quality and safety and our research, innovation and technology initiatives in the context of our overall corporate strategy, goals and objectives. In its oversight of risk management, the QRT Committee reviews and considers, among other items, the following:

| ● | our overall quality strategy; |

| ● | processes in place to monitor and control product quality and safety; |

| ● | results of product quality and quality system assessments by the company and external regulators; and |

| ● | any significant product quality issues that may arise. |

In overseeing our research, innovation and technology initiatives, the QRT Committee reviews and considers, among other items, the following as it deems appropriate:

| ● | the strategic goals, objectives and direction of our research programs and the alignment of those programs with our portfolio of businesses and our long-term business objectives and strategic goals; |

| ● | the relationship of our strategic research plan to our overall approach to technical and commercial innovation and technology acquisition; |

| ● | our product development pipeline; |

| ● | our major technology positions and strategies relative to emerging technologies, emerging concepts of therapy and healthcare, and changing market requirements; |

| ● | the processes for identifying and prioritizing, and, as applicable, the development of, innovative technologies that arise from within and outside the company; |

| 23 |

CORPORATE GOVERNANCE

| ● | our ability to internally develop technology being, or proposed to be, developed, or to access and maintain such technology from third parties through acquisitions, licensing, collaborations, alliances, investments or otherwise; and |

| ● | the potential impact on us in the event that technology being, or proposed to be, developed is not developed or accessed by us. |

| COMPENSATION OFNON-EMPLOYEE DIRECTORS |

The Board believes that providing competitive compensation is necessary to attract and retain qualifiednon-employee directors. The key components of director compensation include annual retainers, committee chair annual fees and equity-based awards. It is the Board’s practice to provide a mix of cash and equity-based compensation to more closely align the interests of directors with our shareholders.

The following table sets forth information regarding the compensation we paid to ournon-employee directors for 2017. Bryan C. Hanson, Daniel P. Florin and David C. Dvorak are not included in this table because they received no additional compensation for their service as directors.

2017 Director Compensation Table

| Name | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) | ||||||||||||

| (a) | (b) | (c) | (g) | (h) | ||||||||||||

Christopher B. Begley | 95,000 | 190,870 | 6,683 | 292,553 | ||||||||||||

Betsy J. Bernard | 108,500 | 190,870 | 7,742 | 307,112 | ||||||||||||

Paul M. Bisaro(4) | 23,750 | 23,750 | 1,433 | 48,933 | ||||||||||||

Gail K. Boudreaux | 95,000 | 190,870 | 6,272 | 292,142 | ||||||||||||

Michael J. Farrell | 47,500 | 238,370 | 3,320 | 289,190 | ||||||||||||

Larry C. Glasscock | 245,000 | 190,870 | 19,287 | 455,157 | ||||||||||||

Robert A. Hagemann | 111,000 | 190,870 | 14,778 | 316,648 | ||||||||||||

Arthur J. Higgins | 108,500 | 190,870 | 19,209 | 318,579 | ||||||||||||

Michael W. Michelson | 47,500 | 238,370 | 2,434 | 288,304 | ||||||||||||

Cecil B. Pickett | 108,500 | 190,870 | 7,173 | 306,543 | ||||||||||||

Jeffrey K. Rhodes | 47,500 | 238,370 | 1,566 | 287,436 | ||||||||||||

| (1) | Amounts include fees that were paid in cash plus fees that were voluntarily deferred at each director’s election under our Restated Deferred Compensation Plan forNon-Employee Directors. As explained more fully below, compensation that a director elects to defer is credited to the director’s deferred compensation account as either treasury units, dollar units or deferred share units (“DSUs”), and will be paid in cash following the director’s retirement or other termination of service from the Board. |

| (2) | Represents the grant date fair value of the stock awards determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC 718”). For a discussion of the assumptions made in the valuation, see Note 4 to the Consolidated Financial Statements included in our Annual Report on Form10-K for the year ended December 31, 2017 (“2017 Form10-K”). All stock awards to directors are fully vested on the date of grant but are subject to mandatory deferral of settlement until the director’s termination of service from the Board, or later, as explained more fully below. |

| The following table sets forth the grant date fair value of annual grants of restricted stock units (“RSUs”) and DSUs awarded to each director elected orre-elected at the 2017 annual meeting of shareholders, as well as DSUs granted during 2017 pursuant to the mandatory deferral provisions of the Restated Deferred Compensation Plan forNon-Employee Directors. |

| 24 | Zimmer Biomet |

CORPORATE GOVERNANCE