Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Combination of Fidelity National Information Services, Inc. and Certegy, Inc.

September 15, 2005

[LOGO]

Forward-Looking Disclosure

This presentation contains statements related to future events and expectations, which include statements about revenue and cost synergies and earnings accretion and, as such, constitutes forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of FIS and Certegy to be different from those expressed or implied within this presentation. FNF and Certegy expressly disclaim any duty to update or revise forward-looking statements. The risks and uncertainties which forward-looking statements are subject to include, but are not limited to, the effect of governmental regulations, the economy, competition, the risk that the merger may fail to achieve beneficial synergies or that it may take longer than expected to do so, the risk of reduction in revenue from the elimination of existing and potential customers due to consolidation in the banking, retail and financial services industries, potential overdependence on a limited number of customers due to consolidation in the banking, retail and financial services industries, failure to adapt to changes in technology or in the marketplace and other risks detailed from time to time in the Form 10-K and other reports and filings made by FIS and Certegy with the Securities and Exchange Commission.

1

Legal Disclosure

In connection with the proposed Merger, Certegy will file a proxy statement with the Securities and Exchange Commission (“SEC”). The proxy statement will be mailed to the shareholders of Certegy. CERTEGY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the proxy statement (when available) and other documents filed by Certegy with the SEC at the SEC’s web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Certegy by going to Certegy’s Investor Relations page on its corporate website at www.certegy.com.

Certegy, FNF, and their respective officers and directors may be deemed, under SEC rules, to be participants in the solicitation of proxies from Certegy’s shareholders with respect to the Merger. A description of any interests that any such participant may have in the Merger will be available in the proxy statement. Information concerning FNF’s directors and executive officers is set forth in FNF’s proxy statement for its 2005 annual meeting of stockholders, which was filed with the SEC on April 28, 2005, and its annual report on Form 10-K filed with the SEC on March 16, 2005. These documents are available free of charge at the SEC’s web site www.sec.gov or by going to FNF’s Investor Relations page on its corporate website at www.fnf.com.

2

Introduction

• Fidelity National Information Services (“FIS”) and Certegy (“CEY”) have entered into a merger agreement

• Tax-free, stock for stock merger, under which each share of FIS common stock will be exchanged for 0.6396 shares of CEY common stock

• Current FIS shareholders will own approximately 67.5% of the combined entity with CEY shareholders owning approximately 32.5%

• CEY will also pay a $3.75 special cash dividend to its shareholders prior to closing

• FIS is a leading provider of core financial institution (“FI”) processing, mortgage loan processing and related information products and outsourcing services to financial institutions, mortgage lenders and real estate professionals

• CEY is a leading provider of card issuer services to financial institutions, principally Community Banks (“CBs”) and Credit Unions (“CUs”), and risk management solutions

3

• The combined company, to be called Fidelity National Information Services, or FIS (“NewFIS”), will be uniquely positioned to offer a broad suite of data processing, payment and risk management services to financial institutions and retailers

• Summary pro forma financial implications are compelling

• Approaching $4 billion in combined revenue

• Approaching $1 billion in combined EBITDA

• Strong organic growth track record and future potential

• Significant and unique revenue synergies

• $50 million in expected cost synergies

• Accretive to Cash Earnings(1)

• De-leveraging impact on NewFIS

• Combined Senior Management Team

• Chairman of the Board—FNF Chairman and CEO Bill Foley

• Chief Executive Officer—CEY Chairman and CEO Lee Kennedy

• Executive Vice President & CFO—FNF CFO Al Stinson

• Senior Business Group Management—Combined senior leadership from FIS and CEY

(1) Cash EPS defined as GAAP net income plus tax affected purchase intangible amortization.

4

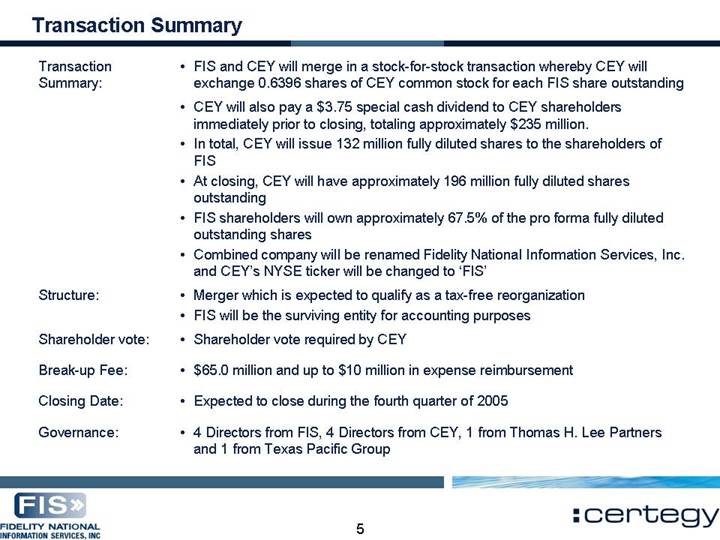

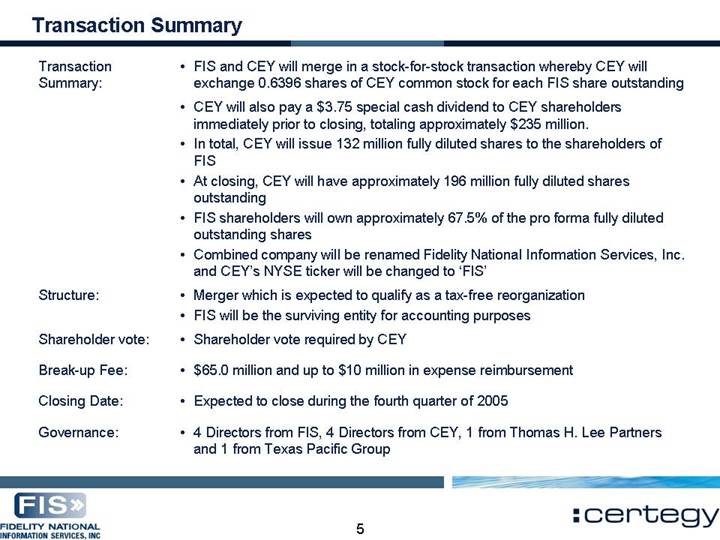

Transaction Summary

Transaction Summary: | | • FIS and CEY will merge in a stock-for-stock transaction whereby CEY will exchange 0.6396 shares of CEY common stock for each FIS share outstanding |

| | • CEY will also pay a $3.75 special cash dividend to CEY shareholders immediately prior to closing, totaling approximately $235 million. |

| | • In total, CEY will issue 132 million fully diluted shares to the shareholders of FIS |

| | • At closing, CEY will have approximately 196 million fully diluted shares outstanding |

| | • FIS shareholders will own approximately 67.5% of the pro forma fully diluted outstanding shares |

| | • Combined company will be renamed Fidelity National Information Services, Inc. and CEY’s NYSE ticker will be changed to ‘FIS’ |

Structure: | | • Merger which is expected to qualify as a tax-free reorganization |

| | • FIS will be the surviving entity for accounting purposes |

Shareholder vote: | | • Shareholder vote required by CEY |

Break-up Fee: | | • $65.0 million and up to $10 million in expense reimbursement |

Closing Date: | | • Expected to close during the fourth quarter of 2005 |

Governance: | | • 4 Directors from FIS, 4 Directors from CEY, 1 from Thomas H. Lee Partners and 1 from Texas Pacific Group |

5

Strategic Rationale

• Combination creates one of the largest financial institution technology processing and services companies in the world

• Significant strategic and financial benefits for FIS and CEY shareholders

• Nearly $4 billion of diversified, run-rate revenue and $1 billion of run-rate EBITDA from market leading businesses

• Broad, complementary range of unique products and services will enhance each company’s respective growth rate

• Core bank processing for large banks, community banks, credit unions and other financial institutions

• Mortgage loan and consumer loan processing

• Card issuer services

• Risk management solutions

• Information products and outsourcing services for financial institutions, mortgage lenders and real estate professionals

• Significant revenue and cost synergy opportunities

• Revenue is recurring in nature, with the majority under long-term, multi-year contracts

6

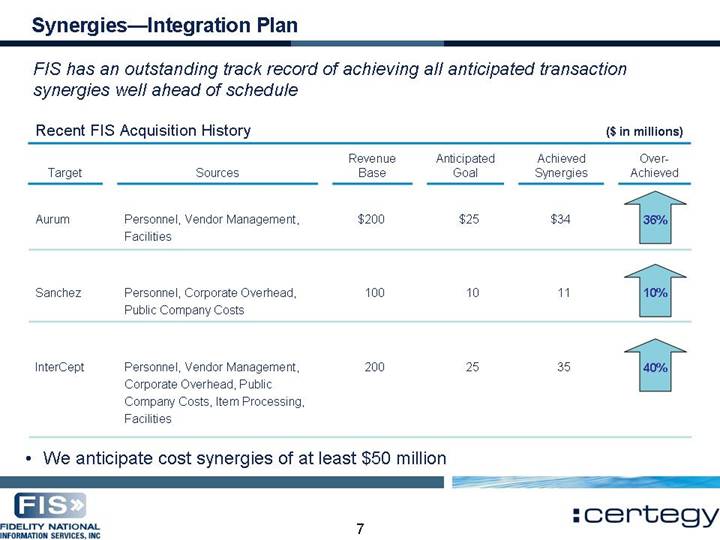

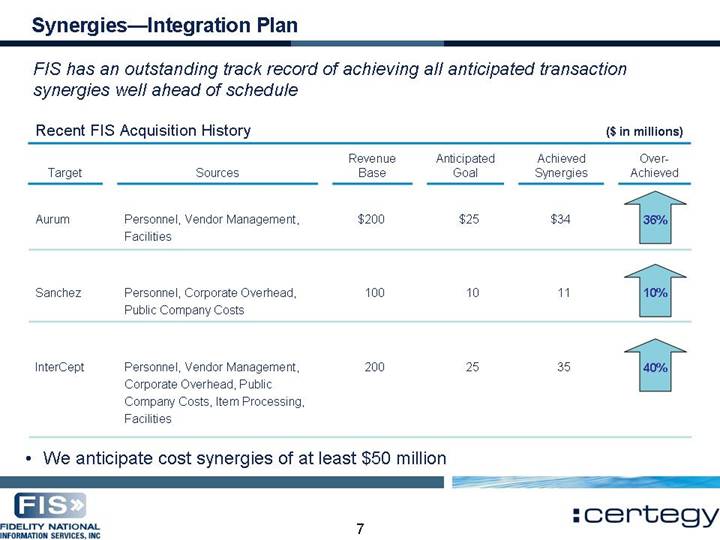

Synergies—Integration Plan

FIS has an outstanding track record of achieving all anticipated transaction synergies well ahead of schedule

Recent FIS Acquisition History | | | | | | | | ($ in millions) | |

Target | | Sources | | Revenue

Base | | Anticipated

Goal | | Achieved

Synergies | | Over-

Achieved | |

| | | | | | | | | | | |

Aurum | | Personnel, Vendor Management, Facilities | | $ | 200 | | $ | 25 | | $ | 34 | | 36 | % |

| | | | | | | | | | | |

Sanchez | | Personnel, Corporate Overhead, Public Company Costs | | 100 | | 10 | | 11 | | 10 | % |

| | | | | | | | | | | |

InterCept | | Personnel, Vendor Management, Corporate Overhead, Public Company Costs, Item Processing, Facilities | | 200 | | 25 | | 35 | | 40 | % |

| | | | | | | | | | | | | | |

• We anticipate cost synergies of at least $50 million

7

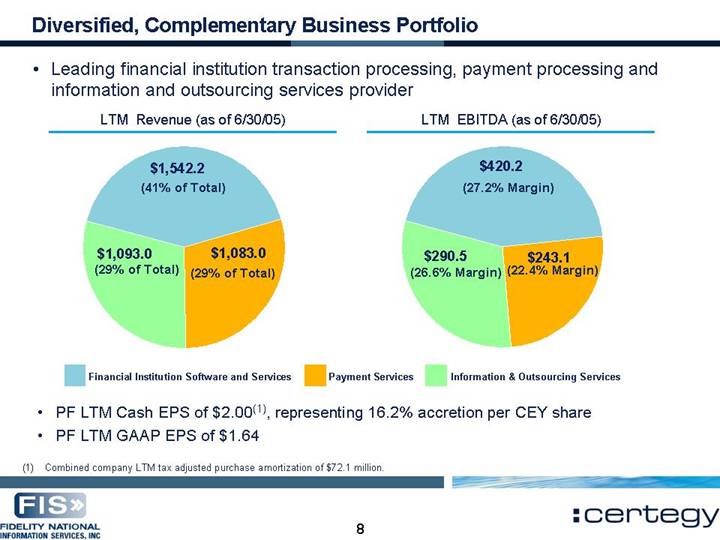

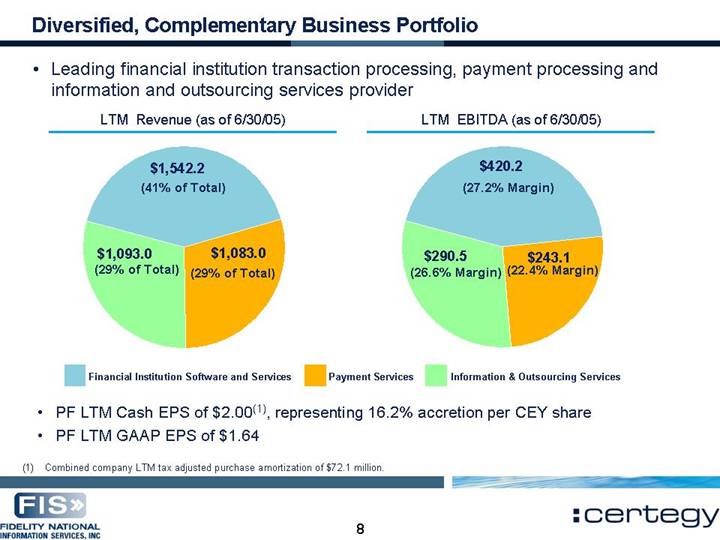

Diversified, Complementary Business Portfolio

• Leading financial institution transaction processing, payment processing and information and outsourcing services provider

LTM Revenue (as of 6/30/05) | | LTM EBITDA (as of 6/30/05) |

| | |

[CHART] | | [CHART] |

• PF LTM Cash EPS of $2.00(1), representing 16.2% accretion per CEY share

• PF LTM GAAP EPS of $1.64

(1) Combined company LTM tax adjusted purchase amortization of $72.1million.

8

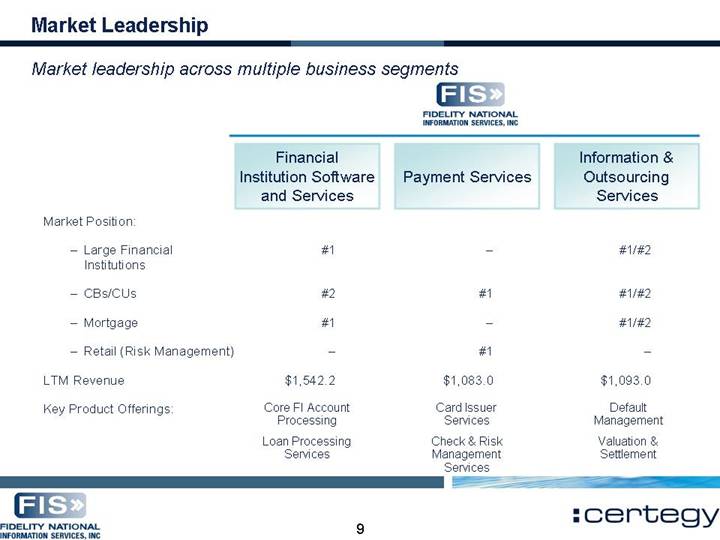

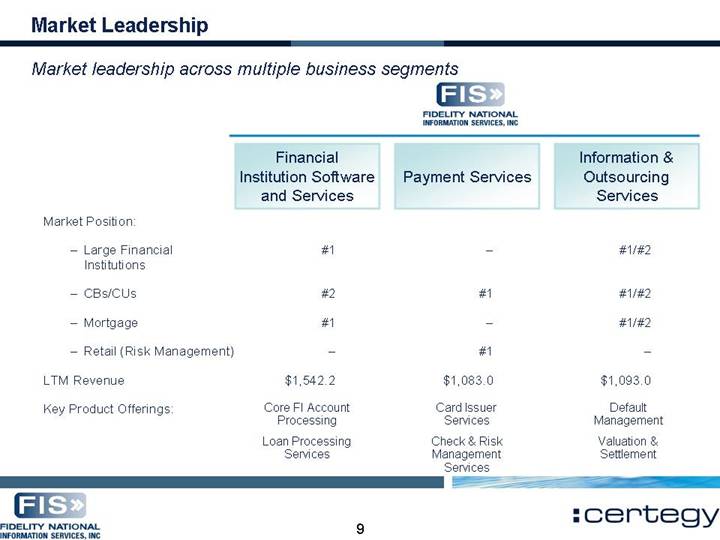

Market Leadership

Market leadership across multiple business segments

| | [LOGO] | |

| | | | | | | |

| | Financial

Institution Software

and Services | | Payment Services | | Information &

Outsourcing

Services | |

Market Position: | | | | | | | |

• Large Financial Institutions | | #1 | | — | | #1/#2 | |

• CBs/CUs | | #2 | | #1 | | #1/#2 | |

• Mortgage | | #1 | | — | | #1/#2 | |

• Retail (Risk Management) | | — | | #1 | | — | |

LTM Revenue | | $ | 1,542.2 | | $ | 1,083.0 | | $ | 1,093.0 | |

| | | | | | | |

Key Product Offerings: | | Core FI Account

Processing | | Card Issuer

Services | | Default

Management | |

| | Loan Processing

Services | | Check & Risk

Management

Services | | Valuation &

Settlement | |

| | | | | | | | | | |

9

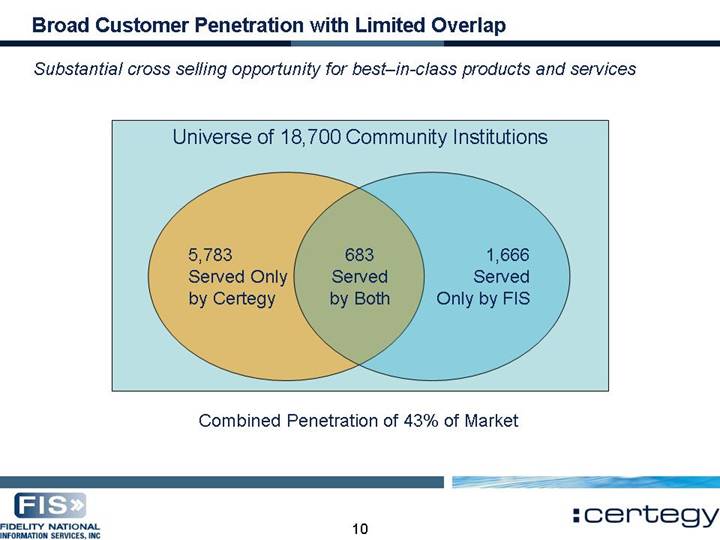

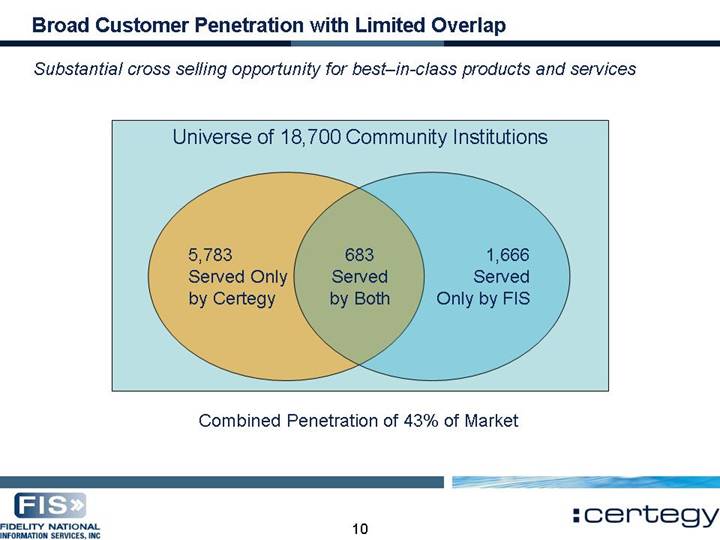

Broad Customer Penetration with Limited Overlap

Substantial cross selling opportunity for best–in-class products and services

Universe of 18,700 Community Institutions

Combined Penetration of 43% of Market

10

Growth Opportunities through Cross Selling

Complementary Products, Services and Customers

| | | | | | Mortgage/Real | | | |

| | Large Banks | | CB’s/CU’s | | Estate Sector | | Retailers | |

Core FI Processing | | | |

| | | | | |

Mortgage Loan Processing | | | |

| | | | | |

Card Issuer Services | |

| |

| | | | | |

Check and Risk Management Services | |

| |

| |

| |

| |

Information & Outsourcing Services | | | |

| | | | | |

International | |

| |

| |

| |

| |

Cross-selling Opportunities

Cross-selling Opportunities

11

Enhanced Domestic Competitive Position

NewFIS will offer the widest suite of products of any of its competitors

| | NewFIS | | FISV | | JKHY | | FDC | | TSYS | |

| | | | | | | | | | | |

Core Processing | |

| |

| |

| |

| |

| |

Card Transaction Services | |

| |

| |

| |

| |

| |

Full Service Card Services | |

| |

| |

| |

| |

| |

Mortgage Processing | |

| |

| |

| |

| |

| |

Lender Services | |

| |

| |

| |

| |

| |

POS Services | | | | | | | | | | | |

• Card Processing | |

| |

| |

| |

| |

| |

• Check Risk Management | |

| |

| |

| |

| |

| |

Internet Banking/ Bill Pay | |

| |

| |

| |

| |

| |

Leadership

Leadership

Presence

Presence

Not Served

Not Served

12

Stronger International Presence

Superior ability to leverage international growth opportunities.

| | NewFIS | | FISV | | JKHY | | FDC | | TSYS | |

| | | | | | | | | | | |

Core Processing | |

| |

| |

| |

| |

| |

Card Transaction Services | |

| |

| |

| |

| |

| |

Full Service Card Services | |

| |

| |

| |

| |

| |

POS Services | | | | | | | | | | | |

• Card Processing | |

| |

| |

| |

| |

| |

• Check Risk Management | |

| |

| |

| |

| |

| |

Leadership

Leadership

Presence

Presence

Not Served

Not Served

13

Combined Global Footprint

Broad Reach in Key Geographic Regions

[GRAPHICS]

14

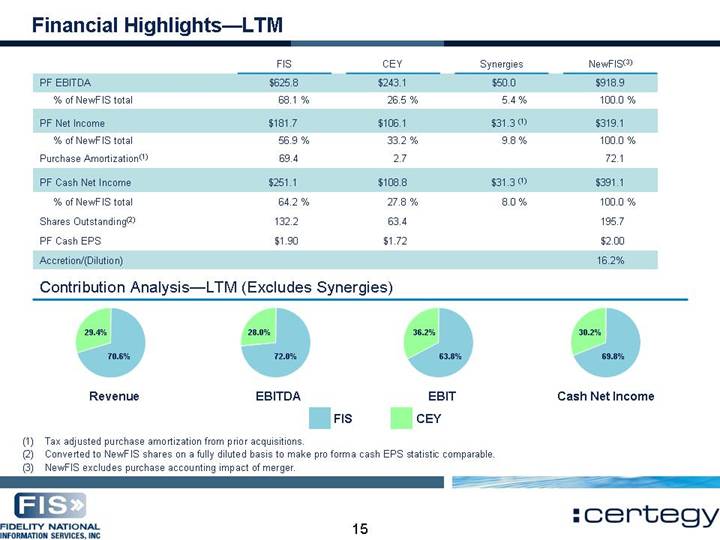

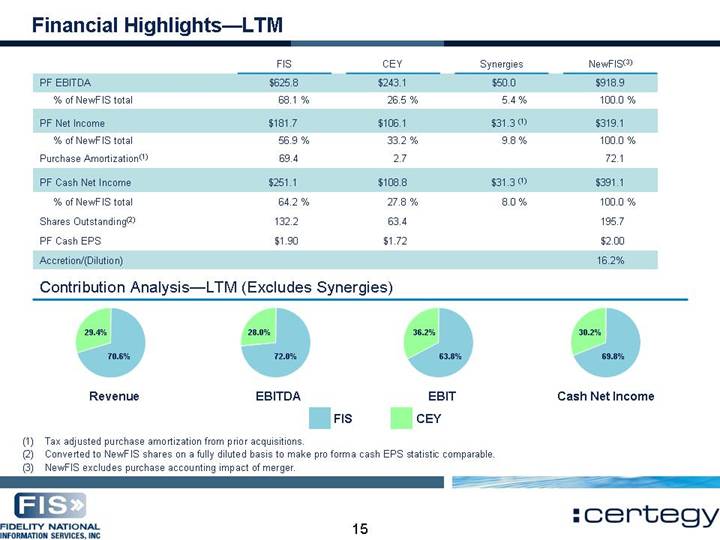

Financial Highlights—LTM

| | FIS | | CEY | | Synergies | | NewFIS(3) | |

PF EBITDA | | $ | 625.8 | | $ | 243.1 | | $ | 50.0 | | $ | 918.9 | |

| | | | | | | | | |

% of NewFIS total | | 68.1 | % | 26.5 | % | 5.4 | % | 100.0 | % |

| | | | | | | | | |

PF Net Income | | $ | 181.7 | | $ | 106.1 | | $ | 31.3 | (1) | $ | 319.1 | |

| | | | | | | | | |

% of NewFIS total | | 56.9 | % | 33.2 | % | 9.8 | % | 100.0 | % |

| | | | | | | | | |

Purchase Amortization(1) | | 69.4 | | 2.7 | | | | 72.1 | |

| | | | | | | | | |

PF Cash Net Income | | $ | 251.1 | | $ | 108.8 | | $ | 31.3 | (1) | $ | 391.1 | |

| | | | | | | | | |

% of NewFIS total | | 64.2 | % | 27.8 | % | 8.0 | % | 100.0 | % |

| | | | | | | | | |

Shares Outstanding(2) | | 132.2 | | 63.4 | | | | 195.7 | |

| | | | | | | | | |

PF Cash EPS | | $ | 1.90 | | $ | 1.72 | | | | $ | 2.00 | |

| | | | | | | | | |

Accretion/(Dilution) | | | | | | | | 16.2 | % |

Contribution Analysis—LTM (Excludes Synergies)

[CHART] | | [CHART] | | [CHART] | | [CHART] |

| | | | | | |

Revenue | | EBITDA | | EBIT | | Cash Net Income |

(1) Tax adjusted purchase amortization from prior acquisitions.

(2) Converted to NewFIS shares on a fully diluted basis to make pro forma cash EPS statistic comparable.

(3) NewFIS excludes purchase accounting impact of merger.

15

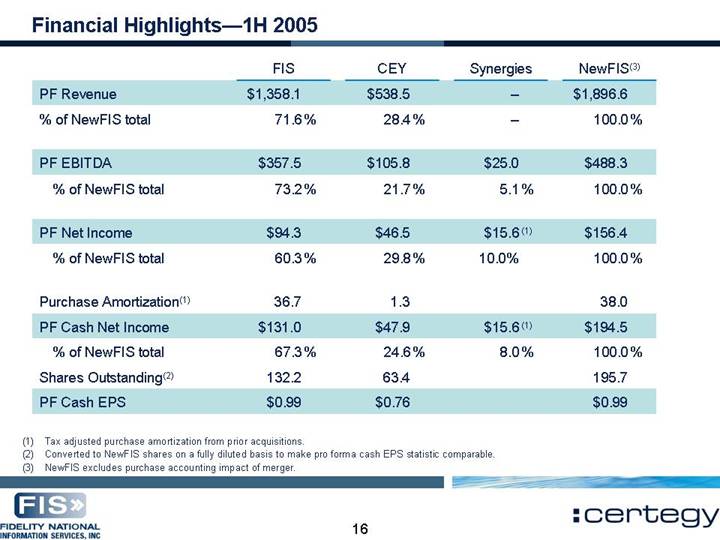

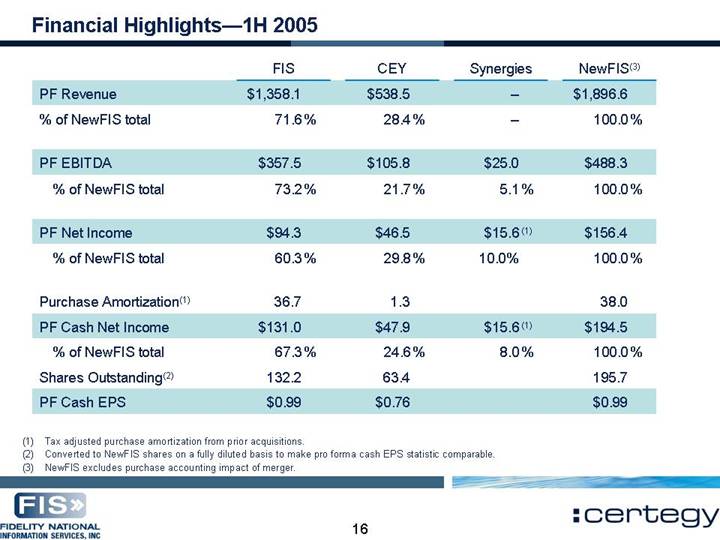

Financial Highlights—1H 2005

| | FIS | | CEY | | Synergies | | NewFIS(3) | |

PF Revenue | | $ | 1,358.1 | | $ | 538.5 | | — | | $ | 1,896.6 | |

% of NewFIS total | | 71.6 | % | 28.4 | % | — | | 100.0 | % |

| | | | | | | | | |

PF EBITDA | | $ | 357.5 | | $ | 105.8 | | $ | 25.0 | | $ | 488.3 | |

% of NewFIS total | | 73.2 | % | 21.7 | % | 5.1 | % | 100.0 | % |

| | | | | | | | | |

PF Net Income | | $ | 94.3 | | $ | 46.5 | | $ | 15.6 | (1) | $ | 156.4 | |

% of NewFIS total | | 60.3 | % | 29.8 | % | 10.0 | % | 100.0 | % |

| | | | | | | | | |

Purchase Amortization(1) | | 36.7 | | 1.3 | | | | 38.0 | |

PF Cash Net Income | | $ | 131.0 | | $ | 47.9 | | $ | 15.6 | (1) | $ | 194.5 | |

% of NewFIS total | | 67.3 | % | 24.6 | % | 8.0 | % | 100.0 | % |

Shares Outstanding(2) | | 132.2 | | 63.4 | | | | 195.7 | |

PF Cash EPS | | $ | 0.99 | | $ | 0.76 | | | | $ | 0.99 | |

(1) Tax adjusted purchase amortization from prior acquisitions.

(2) Converted to NewFIS shares on a fully diluted basis to make pro forma cash EPS statistic comparable.

(3) NewFIS excludes purchase accounting impact of merger.

16

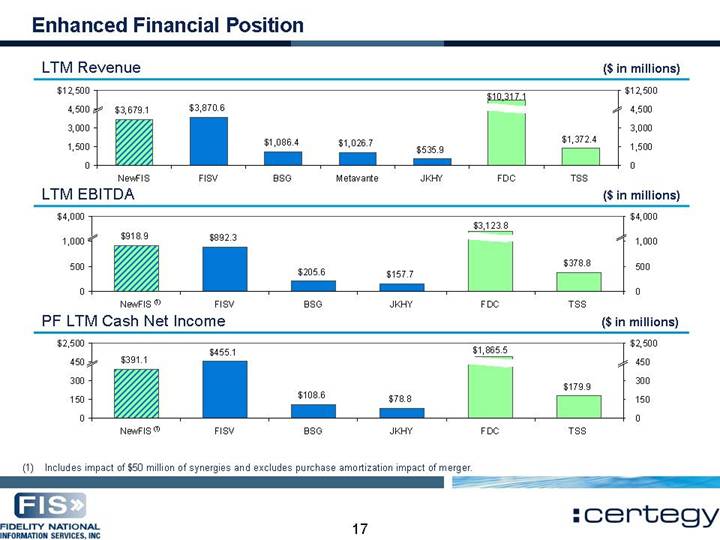

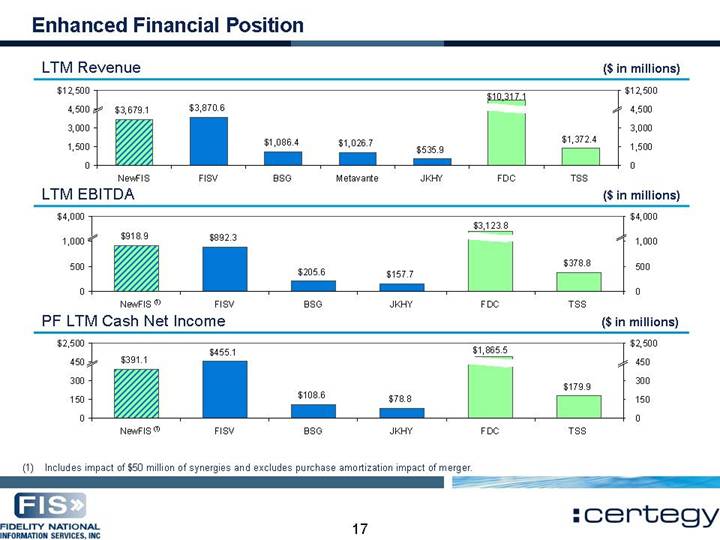

Enhanced Financial Position

LTM Revenue

[CHART]

LTM EBITDA

[CHART]

PF LTM Cash Net Income

[CHART]

(1) Includes impact of $50 million of synergies and excludes purchase amortization impact of merger.

17

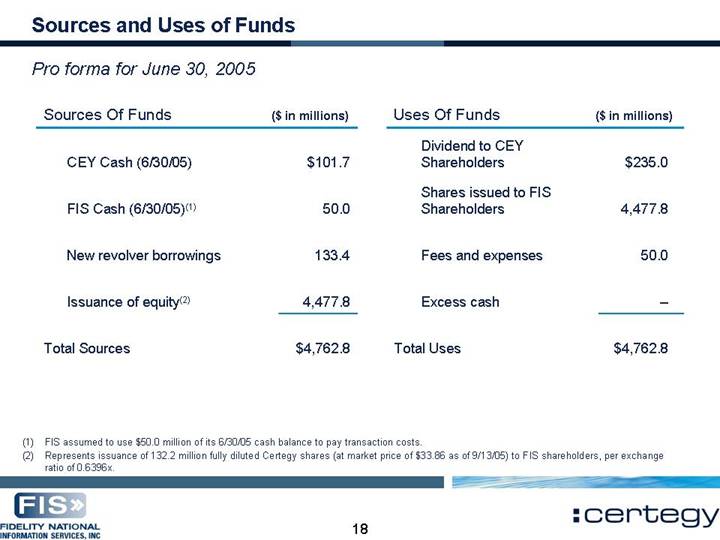

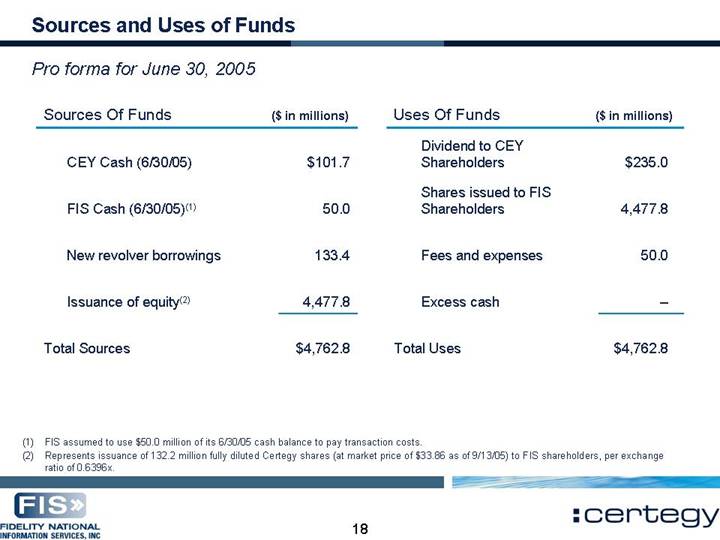

Sources and Uses of Funds

Pro forma for June 30, 2005 | | | |

| | ($ in millions) | |

| | | |

Sources Of Funds | | | |

| | | |

CEY Cash (6/30/05) | | $ | 101.7 | |

| | | |

FIS Cash (6/30/05)(1) | | 50.0 | |

| | | |

New revolver borrowings | | 133.4 | |

| | | |

Issuance of equity(2) | | 4,477.8 | |

| | | |

Total Sources | | $ | 4,762.8 | |

| | | |

Uses Of Funds | | | |

| | | |

Dividend to CEY Shareholders | | $ | 235.0 | |

| | | |

Shares issued to FIS Shareholders | | 4,477.8 | |

| | | |

Fees and expenses | | 50.0 | |

| | | |

Excess cash | | — | |

| | | |

Total Uses | | $ | 4,762.8 | |

(1) FIS assumed to use $50.0 million of its 6/30/05 cash balance to pay transaction costs.

(2) Represents issuance of 132.2 million fully diluted Certegy shares (at market price of $33.86 as of 9/13/05) to FIS shareholders, per exchange ratio of 0.6396x.

18

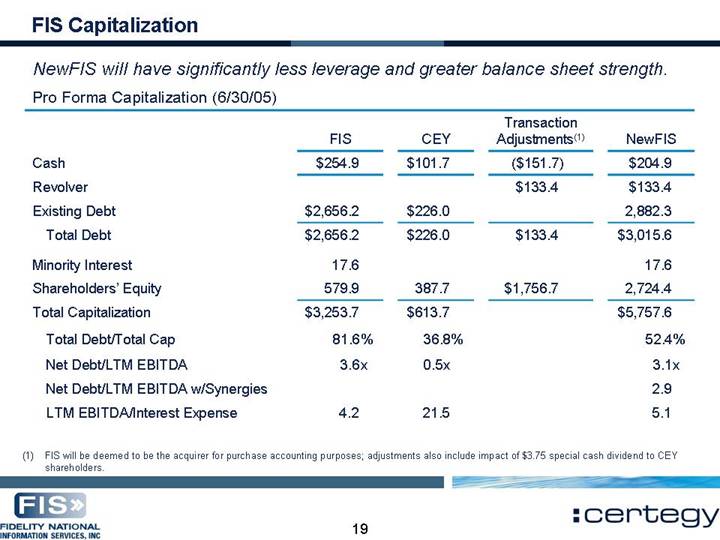

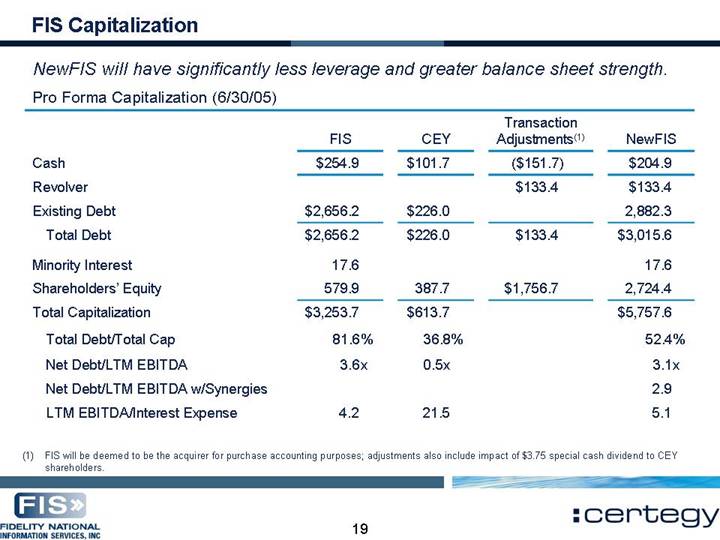

FIS Capitalization

NewFIS will have significantly less leverage and greater balance sheet strength.

Pro Forma Capitalization (6/30/05)

| | | | | | Transaction | | | |

| | FIS | | CEY | | Adjustments(1) | | NewFIS | |

Cash | | $ | 254.9 | | $ | 101.7 | | $ | (151.7 | ) | $ | 204.9 | |

Revolver | | | | | | $ | 133.4 | | $ | 133.4 | |

Existing Debt | | $ | 2,656.2 | | $ | 226.0 | | | | 2,882.3 | |

Total Debt | | $ | 2,656.2 | | $ | 226.0 | | $ | 133.4 | | $ | 3,015.6 | |

| | | | | | | | | |

Minority Interest | | 17.6 | | | | | | 17.6 | |

Shareholders’ Equity | | 579.9 | | 387.7 | | $ | 1,756.7 | | 2,724.4 | |

Total Capitalization | | $ | 3,253.7 | | $ | 613.7 | | | | $ | 5,757.6 | |

| | | | | | | | | |

Total Debt/Total Cap | | 81.6 | % | 36.8 | % | | | 52.4 | % |

Net Debt/LTM EBITDA | | 3.6 | x | 0.5 | x | | | 3.1 | x |

Net Debt/LTM EBITDA w/Synergies | | | | | | | | 2.9 | |

LTM EBITDA/Interest Expense | | 4.2 | | 21.5 | | | | 5.1 | |

(1) FIS will be deemed to be the acquirer for purchase accounting purposes; adjustments also include impact of $3.75 special cash dividend to CEY shareholders.

19

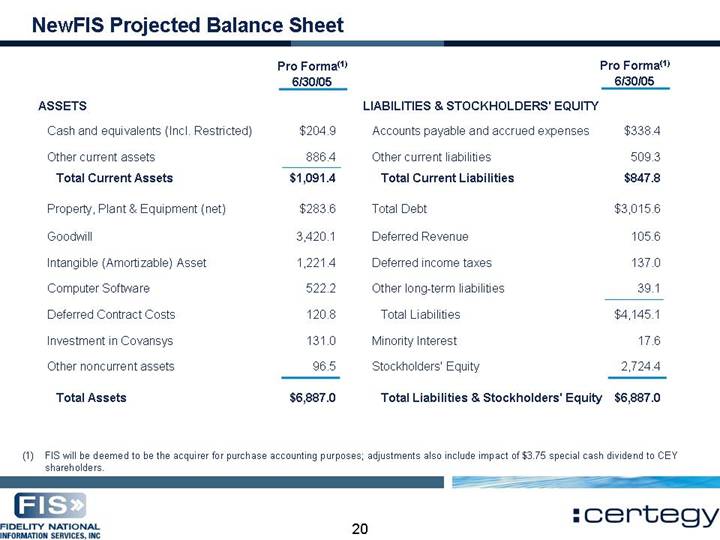

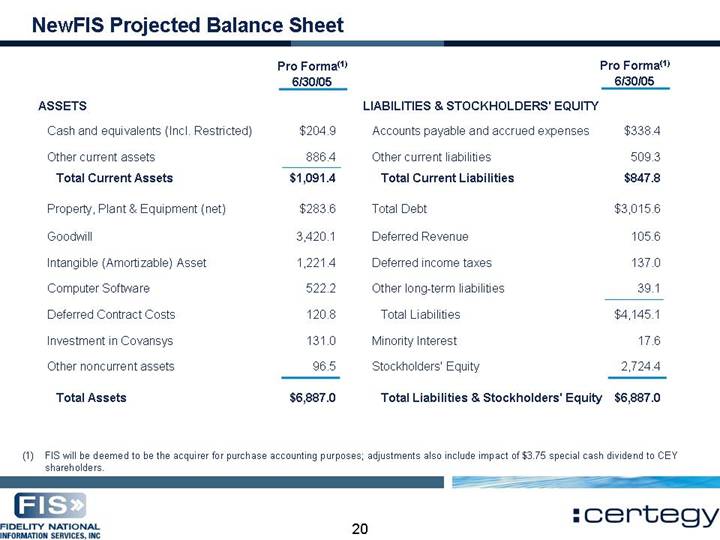

NewFIS Projected Balance Sheet

| | Pro Forma(1) | |

| | 6/30/05 | |

ASSETS | | | |

| | | |

Cash and equivalents (Incl. Restricted) | | $ | 204.9 | |

| | | |

Other current assets | | 886.4 | |

Total Current Assets | | $ | 1,091.4 | |

| | | |

Property, Plant & Equipment (net) | | $ | 283.6 | |

| | | |

Goodwill | | 3,420.1 | |

| | | |

Intangible (Amortizable) Asset | | 1,221.4 | |

| | | |

Computer Software | | 522.2 | |

| | | |

Deferred Contract Costs | | 120.8 | |

| | | |

Investment in Covansys | | 131.0 | |

| | | |

Other noncurrent assets | | 96.5 | |

| | | |

Total Assets | | $ | 6,887.0 | |

| | | |

LIABILITIES & STOCKHOLDERS’ EQUITY | | | |

| | | |

Accounts payable and accrued expenses | | $ | 338.4 | |

| | | |

Other current liabilities | | 509.3 | |

| | | |

Total Current Liabilities | | $ | 847.8 | |

| | | |

Total Debt | | $ | 3,015.6 | |

| | | |

Deferred Revenue | | 105.6 | |

| | | |

Deferred income taxes | | 137.0 | |

| | | |

Other long-term liabilities | | 39.1 | |

Total Liabilities | | $ | 4,145.1 | |

| | | |

Minority Interest | | 17.6 | |

| | | |

Stockholders’ Equity | | 2,724.4 | |

| | | |

Total Liabilities & Stockholders’ Equity | | $ | 6,887.0 | |

(1) FIS will be deemed to be the acquirer for purchase accounting purposes; adjustments also include impact of $3.75 special cash dividend to CEY shareholders.

20

Summary

• Combination creates one of the largest financial institution technology processing and services companies in the world

• Nearly $4 billion of diversified revenue and $1 billion of EBITDA from market leading businesses

• Broad, complementary range of unique products and services will enhance each company’s respective growth rate

• Significant revenue and cost synergy opportunities

• Revenue is recurring in nature, with the majority under long-term, multi-year contracts

21