Exhibit 99.11

Script for the

Webcast to Imagistics Employees

Tender by Océ

September 16, 2005

| | Slide 1 | |

================================================================================

Marc Breslawsky

Chairman and CEO

September 16, 2005

|  | |

Introduction by Tina Allen and Joan Malay.

Marc Breslawsky:

| | Slide 2 | |

Exciting News

================================================================================

[X] Today, Oce N.V., a Netherlands based, global leader in the copier, printer

and document management industry, has launched a friendly tender offer to

buy all of the outstanding Imagistics common shares.

What This Means:

[X] Should the tender offer be successful, Oce will acquire Imagistics.

[X] We will then become a wholly owned subsidiary of Oce, with greater scale, a

broader product line, and better access to capital to execute our growth

strategy.

2

|  | |

Welcome. We have exciting news. Today, Océ N.V., a Netherlands based, global leader in the copier, printer and

Page 2

document management industry, has launched a friendly tender offer to buy all of the outstanding Imagistics common shares.

What this means is that Océ will acquire Imagistics if the tender offer is successful. We will then become a subsidiary of Océ, with greater scale, a broader product line, a global customer base, and better access to capital to execute our growth strategy.

Océ clearly recognizes the great work that has been done by Imagistics employees since the spin-off. We believe they are attracted to the quality of our people, our business model, and our excellent results over the past three and one half years. We believe that is why they are offering a premium to our shareholders.

| | Slide 3 | |

What is a Tender Offer

================================================================================

A tender is an offer to purchase a company's shares at a

certain price for a limited period of time.

[X] Oce has agreed to offer $42 in cash per Imagistics share, a premium of more

than 25% over the recent stock price.

[X] The offer will be outstanding for 20 business days.

[X] With a tender offer, shareholders decide whether they want to accept the

offer and tender their shares.

[X] We believe the premium is very attractive and should be a strong economic

incentive for shareholders to accept the offer.

[X] The Imagistics board of directors has approved the transaction.

[X] The transaction is expected to close immediately following the expiration

of the tender offer.

[X] It should be noted that our agreement preserves the ability of our board of

directors to respond to competing offers.

3

|  | |

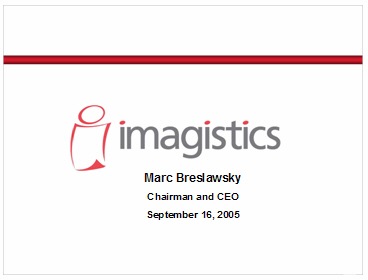

Many of you may not know what a tender offer is, so let me give you a simple definition - a tender is an offer to purchase a company’s shares at a certain price for a limited period of time.

Page 3

In this case, Océ has agreed to offer $42 in cash per Imagistics share, which represents a premium of more than 25% over the recent stock price. The offer will be outstanding for 20 business days.

With a tender offer, shareholders decide whether they want to accept the offer and tender their shares. We believe the premium is very attractive and should be a strong incentive for our shareholders. The Imagistics board of directors has approved the transaction, and it is expected to close immediately following the expiration of the tender offer. It should be noted that our agreement preserves the ability of our board to respond to competing offers.

| | Slide 4 | |

Who is Oce

================================================================================

[X] Oce is a global leader in the copier, printer and document management

industry, based in Venlo, The Netherlands.

[X] It has direct sales and service capabilities in 31 countries, indirect

sales in 50 countries, and 21,300 employees worldwide.

[X] Oce primarily serves the high speed production and wide format copier

markets, provides document management services, and has a limited presence

in the high end of the office market. They primarily serve segment 5 and

higher.

[X] The company had 2004 revenue of approximately $3.2 billion, with 35% of

that from their US businesses.

[X] Oce's current Executive Board is composed of their 3 most senior

executives:

4

|  | |

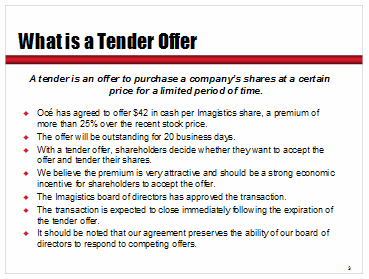

Some of you may be familiar with Océ, but my guess is that most of you are not. So, who is Océ?

Page 4

Océ is a global leader in the copier, printer and document management industry, based in Venlo, The Netherlands.

They have direct sales and service capabilities in 31 countries and indirect sales in 50 countries.

Océ primarily serves the high speed production and wide format copier markets, provides facilities management services, and has a limited presence at the high end of the office market.

| | Slide 5 | |

Who is Oce

================================================================================

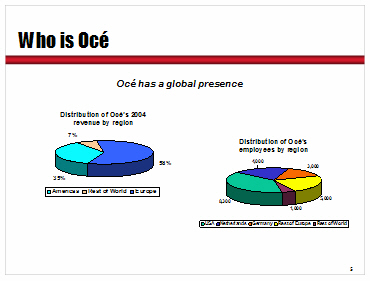

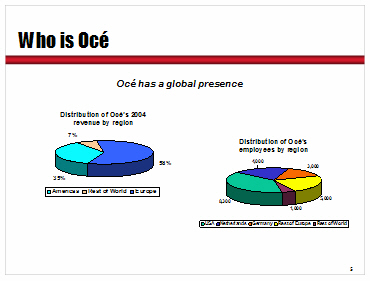

Oce has a global presence

5

|  | |

Océ had 2004 revenue of approximately $3.2 billion, with 35% of that from their business in the United States. Of their 21,300 worldwide employees, 8,300 of those are in the US.

Page 5

| | Slide 6 | |

Who is Oce

================================================================================

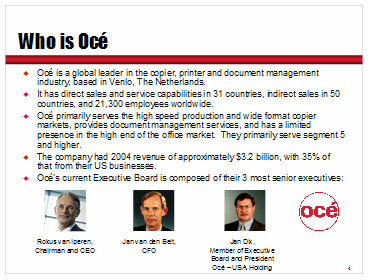

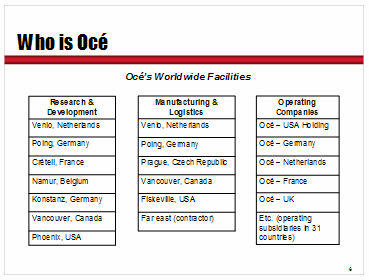

Oce's Worldwide Facilities

Research & Manufacturing & Operating Companies

Development Logistics Oce - USA Holding

Venlo, Netherlands Venlo, Netherlands Oce - Germany

Poing, Germany Poing, Germany Oce - Netherlands

Creteil, France Prague, Czech Republic Oce - France

Namur, Belgium Vancouver, Canada Oce - UK

Konstanz, Germany Fiskeville, USA Etc. (operating subsidiaries

Vancouver, Canada Far east (contractor) in 31 countries)

Phoenix, USA

6

|  | |

They have research & development, manufacturing and logistics facilities in North America and Europe, and also contract some production in Asia. Their operating companies are all over the world.

| | Slide 7 | |

Oce's Culture and Core Values

================================================================================

Oce's culture and core values are very similar to those of

Imagistics. Their success has been built on:

[X] Customer focus:

- Direct sales and service.

- Focus on long term relationships.

- Ownership of customer issues.

[X] Innovation:

- Driven by market demand.

- Focus on high quality, reliability and low cost of ownership.

[X] Corporate culture:

- High integrity to all stakeholders (customers, employees, shareholders,

suppliers, communities).

- Entrepreneurial and result driven.

- High regard for human value.

7

|  | |

So, how compatible are we and Océ?

The culture and core values of the two companies are very similar. The success of both Océ and Imagistics is based on a sharp focus on the customer, innovation and a culture which

Page 6

demands integrity, encourages an entrepreneurial spirit, and values its people. We plan to get along very well.

| | Slide 8 | |

Rationale for the Combination

================================================================================

What Oce brings:

[X] Excellent wide format, commercial and corporate printing, and facilities

management businesses.

[X] Product coverage in segments 5-6 high speed production market.

[X] An in house leasing source in the US.

[X] Strong market position globally.

Oce's strengths:

[X] Very strong in European markets.

[X] Leading technology in segment 5 and higher.

[X] Has a facilities management business which Oce calls "Business Services."

[X] Leading technology.

[X] Direct sales organization.

[X] Customer loyalty.

[X] Excellent service performance.

What Oce needs:

[X] A broader product offering in segments 1-5.

[X] Greater distribution (both sales and service) in the US market.

[X] Improved growth prospects in the US office market.

8

|  | |

Let’s now discuss why this combination makes sense for both companies.

Océ brings an excellent wide format, commercial and corporate printing, and facilities management business. They have leading edge technology, great products in the segments 5-6 high speed production market, and a strong market position globally, especially in Europe. Their products and markets complement ours perfectly. They also bring an in house leasing source in the US.

They need a broader product offering in segments 1-5 and greater distribution in the United States to improve their growth prospects - that’s where Imagistics comes in.

Page 7

| | Slide 9 | |

Rationale for the Combination

================================================================================

What Imagistics brings:

[X] Excellent US office business with strong growth prospects.

[X] Product coverage in segments 1-5 office market.

[X] Large customer base in United States, presence in Canada and the UK.

[X] Valued employees, proven management team committed to making the merger

a success.

Our strengths:

[X] Best-of-breed product line.

[X] Broad national direct sales and service capabilities in the US.

[X] Developed infrastructure in the US.

What we need:

[X] Larger scale, global presence.

[X] Product offering for the high volume production and wide format markets.

[X] Entry into the facilities management business.

[X] Additional leasing options.

9

|  | |

Imagistics brings many things to the table. We have an excellent US office business with strong growth prospects. Our products cover segments 1-5 in the office market. We bring a large customer base in the United States, and a presence in Canada and the United Kingdom. Most importantly, we bring our valued employees and a management team that has a proven track record of delivering solid results.

What we need is the additional scale, global presence, products for the production and wide format markets, the facilities management business and additional leasing options that Océ has.

| | Slide 10 | |

Powerful Combination

================================================================================

Together, Oce and Imagistics will:

[X] Comprehensively offer a complete line of products and services for our

customers from one company:

- Continue the best of breed strategy for our products in segments 1-5,

complemented by Oce's high volume products in segments 5-6.

- Provide business services (facilities management).

- Provide an in house leasing source.

- Improved software offerings.

[X] Achieve greater scale in the US and Europe, and have a better competitive

position globally.

[X] Leverage our direct sales and service capabilities.

[X] Have superior growth prospects.

Oce and Imagistics will become a major force in

the US office market.

10

|  | |

Page 8

Together, Océ and Imagistics will make a powerful combination.

We will have comprehensive product coverage in segments 1-6, offering customers a complete line of products and services, all from one company. We will continue our best of breed strategy for our products in segments 1-5, complemented by Océ’s high volume products in segments 5-6. We will provide facilities management, have an in house leasing source, and improved software offerings.

We will achieve greater scale in the United States and Europe, and enhance our competitive position globally. We will be able to offer multinational companies a complete document management solution. Together, we expect that Océ and Imagistics will become a major force in the United States office market, with superior growth prospects in the United States and globally.

| | Slide 11 | |

Imagistics Place in the Oce Organization

================================================================================

[X] Imagistics will be named: "Oce Imagistics" and will be the largest Oce

operating company in North America.

[X] Marc Breslawsky, Jan Dix, and Joe Skrzypczak will complete the calendar

year 2005 in their current capacity and work on integration plans.

Effective January 1, 2006:

- Marc Breslawsky will lead Oce's entire North America business and will

be elected to Oce's Executive Board.

- Joe Skrzypczak will lead Oce Imagistics, which will serve the office

market in the United States and be headquartered in Trumbull,

Connecticut.

11

|  | |

Page 9

So, where will Imagistics fit in Océ’s global organization?

Assuming the tender is successful, Imagistics will be named “Océ Imagistics” and will be the largest Océ operating company in North America.

Jan Dix, Joe Skrzypczak and I will complete the calendar year 2005 in our current positions and work on integration plans.

Effective January 1, 2006, I will lead Océ’s entire North American business and will be elected to Océ’s Executive Board.

Joe Skrzypczak will lead Océ Imagistics, which will serve the office market in the United States and will be headquartered in the existing Imagistics offices in Trumbull, Connecticut.

| | Slide 12 | |

Imagistics Place in the Oce Organization

================================================================================

Effective January 1, 2006:

12

|  | |

Page 10

Here you can see a proposed organization chart, effective January 1, 2006, which I just described.

| | Slide 13 | |

What This Means to You

================================================================================

From a business perspective:

[X] For our direct sales and service force - a broader product line - including

printers and facilities management, access to a global market, continuing

focus on the customer.

[X] For our support staff - near term we expect little change, longer term we

need to examine the opportunities presented by combining the companies and

adjust where it makes sense.

[X] For our headquarters staff - will remain in Trumbull and support Oce

Imagistics.

From a personal perspective:

[X] For the overwhelming number of Imagistics employees, we do not anticipate

major changes.

[X] We do not anticipate significant changes to compensation or benefits.

[X] Oce Imagistics will be headquartered in Trumbull.

13

|  | |

Of course, what is foremost in all of your minds right now is what this means to you.

From a business perspective, it means our sales and service force will have a broader product line and access to a global market. For our support staff, near term we expect little change, and longer term we need to examine the opportunities presented by combining the companies and adjust where it makes sense. Our headquarters staff will remain in Trumbull and support Océ Imagistics.

From a personal perspective, for the overwhelming number of Imagistics employees, we do not anticipate major changes. We do not anticipate significant changes to compensation or benefits.

Page 11

And, as I mentioned, the combined Océ Imagistics business will be headquartered in Trumbull.

| | Slide 14 | |

Summary

================================================================================

[X] The two companies have a common culture and the combination is highly

complementary.

[X] We believe this transaction is in the best interests of Imagistics

employees, customers, suppliers and shareholders.

[X] Our employees benefit by being part of a larger organization, with access

to a broader base of products and services, customers, technology, capital

and other resources.

[X] Our customers benefit by Oce Imagistics being able to offer a wider array

of products and services to serve all of their copying, printing and

document management needs, worldwide.

[X] Our suppliers benefit by access to a global customer base.

[X] Our shareholders benefit from the cash premium Oce is offering.

[X] I invite you to visit Oce's website at www.oce.com to learn more about

their company, culture and products.

[X] All in all, we believe this is a great fit.

Thank you. Now we will take your questions.

14

|  | |

To summarize, the two companies have a common culture and their products and markets complement each other perfectly. We believe this transaction is in the best interests of Imagistics employees, customers, suppliers and shareholders.

Our employees benefit by being part of a larger organization, with access to a broader base of products and services, customers, technology, capital and other resources.

Our customers benefit by Océ Imagistics being able to offer a wider array of products and services to serve all of their copying, printing, and document management needs, worldwide.

Our suppliers benefit by access to a global customer base.

Page 12

Our shareholders benefit from the cash premium that Océ is offering.

Since many of you are our primary contact with customers and vendors, we encourage you to work with your managers and notify key customers and vendors about this merger. We have posted on the employee portal talking points and sample letters for you to use with those key constituents. Please be sure to emphasize that the combined company will be stronger – from financial, product, sales and service perspectives.

I invite you to visit Océ’s website at www.oce.com to learn more about their company, culture and products. All in all, we believe this is a great fit.

Thank you, and now we will take your questions.

| | Slide 15 | |

The statements contained in this presentation that are not purely historical are

forward-looking statements, within the meaning of the Private Securities

Litigation Reform Act of 1995, that are based on management's beliefs, certain

assumptions and current expectations. These statements may be identified by

their use of forward-looking terminology such as the words "expects,"

"projects," "anticipates," "intends" and other similar words. Such

forward-looking statements involve risks and uncertainties that could cause

actual results to differ materially from those projected. These risks and

uncertainties include, but are not limited to, general economic, business and

market conditions, competitive pricing pressures, timely development and

acceptance of new products, our reliance on third party suppliers, potential

disruptions in implementing information technology systems, including the recent

ERP implementation, potential disruptions affecting the international shipment

of goods, our ability to create brand recognition and currency and interest rate

fluctuations. For a more complete discussion of certain of the risks and

uncertainties that could cause actual results to differ from those contained in

the forward-looking statements, see "Risk Factors" in the Imagistics 2004 Form

10-K and other SEC filings. The forward-looking statements contained in this

news release are made as of the date hereof, and we do not undertake any

obligation to update any forward-looking statements, whether as a result of

future events, new information or otherwise.

-------------------------------------------------------------

This announcement does not constitute an offer to purchase or a solicitation of

an offer to sell any securities. The tender offer for the outstanding shares of

Imagistics common stock described in this announcement has not commenced. Any

offers to purchase or solicitation of offers to sell will be made only pursuant

to a tender offer statement and a solicitation/recommendation statement filed

with the Securities and Exchange Commission. The tender offer statement

(including an offer to purchase, a letter of transmittal and other offer

documents) and the solicitation/recommendation statement will contain important

information and should be read carefully before any decision is made with

respect to the tender offer. Those materials will be made available to all

shareholders of Imagistics at no expense to them. In addition, all of those

materials (and all other offer documents filed with the SEC) will be available

at no charge on the SEC's web site (http://www.sec.gov).

15

|  | |

This announcement does not constitute an offer to purchase or a solicitation of an offer to sell any securities. The tender offer for the outstanding shares of Imagistics common stock described in this announcement has not commenced. Any offers to purchase or solicitation of offers to sell will be made only pursuant to a tender offer statement and a solicitation/recommendation statement filed with the Securities and Exchange Commission. The tender offer statement (including an offer to purchase, a letter of transmittal and other offer documents) and the solicitation/recommendation statement will contain important information and should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to all shareholders of Imagistics at no expense to them. In addition, all of those materials (and all other offer documents filed with the SEC) will be available at no charge on the SEC’s web site (http://www.sec.gov).