Leverage Product and Marketplace

Strengths to Drive Market Share

24

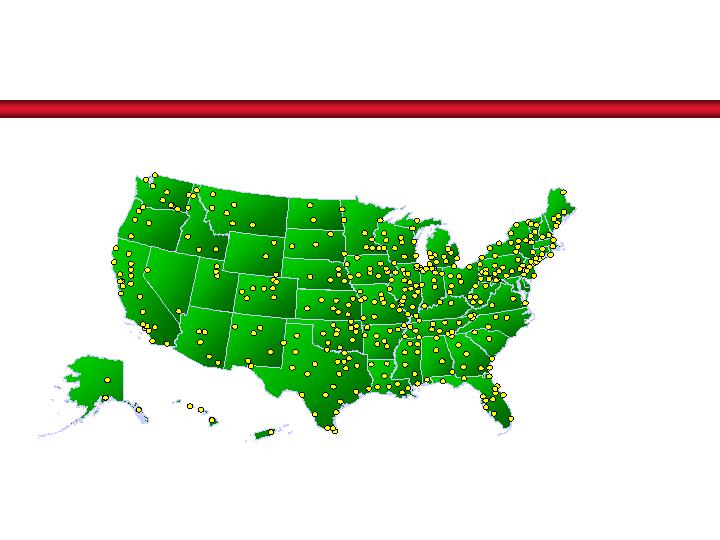

Unique national direct sales force

–

Over 1100 direct sales representatives

–

Customer-centric sales force since October 2000

–

Ensures single customer contact and uniform support

Unique product sourcing strategy

–

“Best of Breed” product families

–

Fewer platforms optimizes sales productivity and working capital (i.e., inventory,

parts)

–

Leverages industry R&D and market creation investments

–

An incremental private brand distribution channel

–

Minimizes technological obsolescence

–

Earned “Most Outstanding MFP Line of the Year Award” from Buyers Laboratory

(July 2003)

Proven brand name and recognition

–

“#1 Copier/Multifunction Product in Overall Customer Satisfaction Among Business

Users Two Years in a Row, Tied in 2003,” according to the J. D. Power and

Associates 2003-2004 Studies

Leverage Strengths in Customer

Support to Drive Customer Loyalty

25

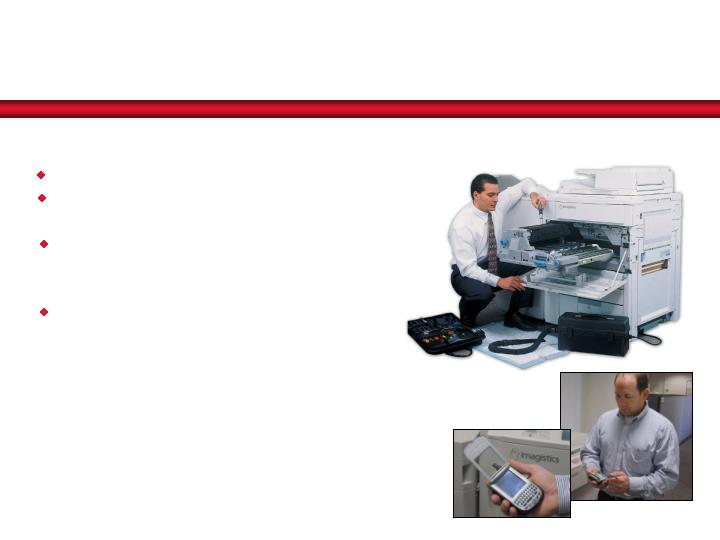

National direct service and support coverage

–

1,200 direct service professionals

–

Proactive service enables 98% uptime

–

24/7 diagnostic hot-line support

–

Uniform level of service nationwide

–

J.D. Power award

Centralized, integrated customer administration system

–

National scope

–

Ensures billing accuracy and understanding

–

Enables customer consolidated billing/customized management

reports

Achieve Operational Excellence

and Benchmark Productivity

26

Implement greater standardization in sales practices

Focus compensation plan on higher margin business

to drive profitability

Institute strict adherence to pricing standardization

and disciplines

Make major investments in infrastructure

Implement ERP to provide significant long term

benefits

Investing in billing, logistics and service systems –

developing world class capabilities over the long term

Pursue Opportunistic

Expansion and Investments

14

27

Increase participation in faster growing market segments

Expand geographic presence

–

Acquire additional Business Product Centers

–

Broaden direct distribution in Canada

–

Grow copier business in U.K.

–

Entry into Europe

Pursue potential strategic alliances, partnerships and

acquisitions

Explore long-term potential for offering other office

products

Our Finances

28

Strong Financial Position

29

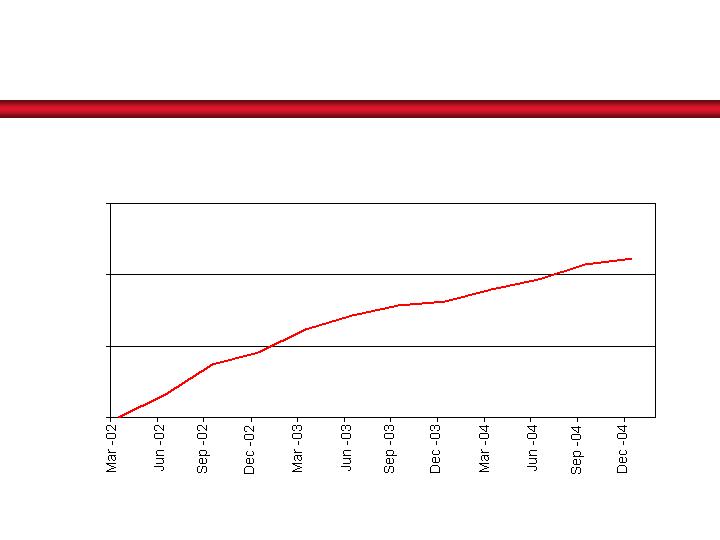

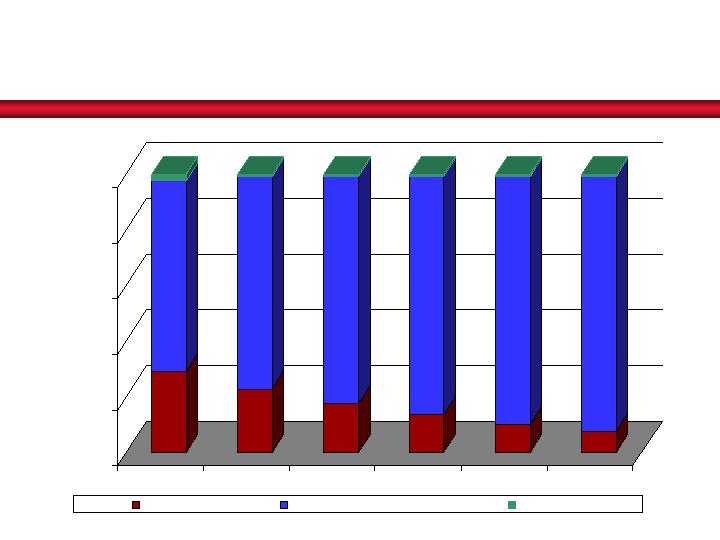

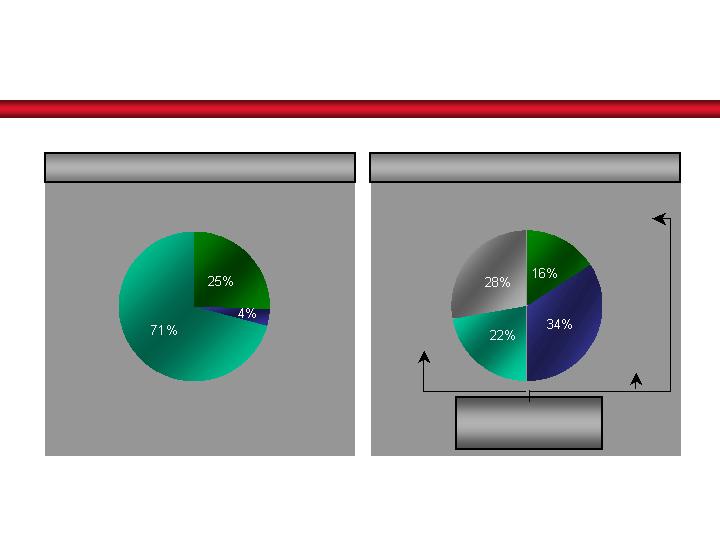

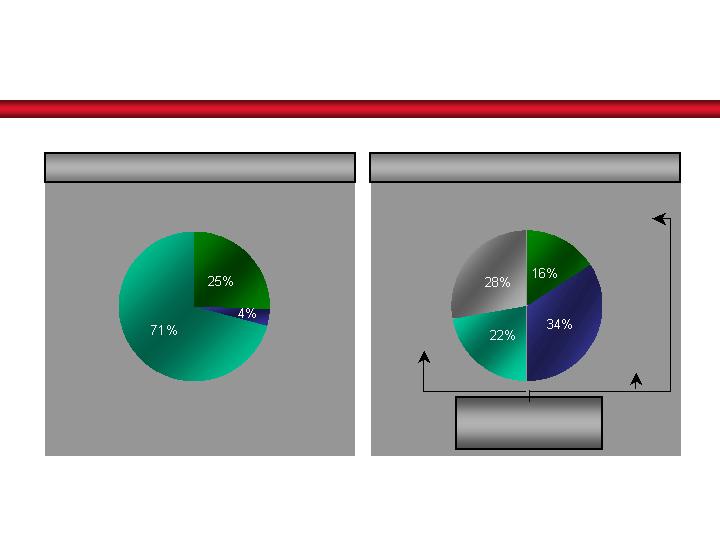

Diversified revenue stream is 70+% recurring

Growing EPS 20+% annually

Strong cash flow supports strategic initiatives

Strong balance sheet, conservatively

capitalized

Credit rating upgraded twice in 2004 by

Moody’s

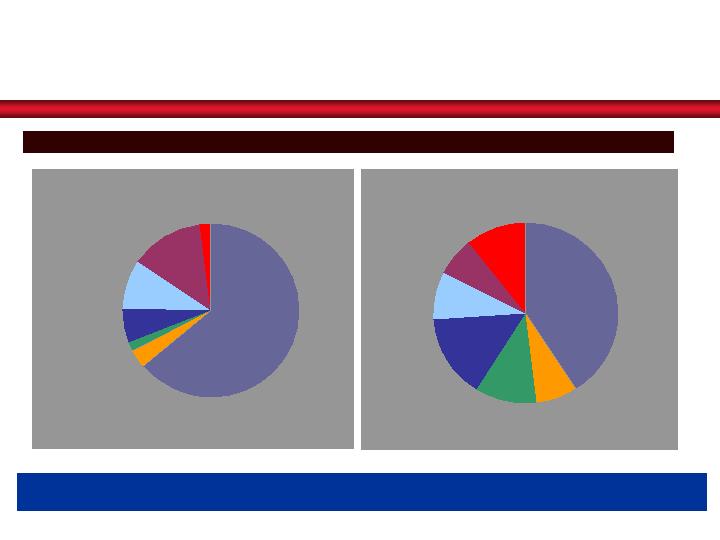

Recurring revenue represents 72% of Total Q4 2004 Revenues

Total Q4 2004 Revenues

Total Q4 2004 Revenues

North

America

Copier/MFP

North

America

Fax

U.K.

Copier/MFP

& Fax

Supply

Sales

Support Services

Equipment

Rentals

$146.1 Million

$146.1 Million

Equipment

Sales

Recurring Revenue

Components

Revenue Sources - Q4 04

30

Summary Income Statement – Q4

(Dollars in millions, except EPS)

(Unaudited)

Q4 2004

Q4 2003

B/(W)

Sales

73.2

$

79.8

$

(8%)

Rentals

49.7

54.8

(9%)

Support services

23.2

21.2

9%

Total revenue

146.1

155.8

(6%)

Cost of sales

38.9

47.0

17%

Cost of rentals

13.8

16.5

16%

Selling, service and administrative expenses

80.8

81.2

-

Operating income

12.6

11.1

14%

Interest expense, net

1.0

0.9

(8%)

Income before income taxes

11.6

10.2

14%

Provision for income taxes

4.9

4.7

(7%)

Net income

6.7

$

5.5

$

21%

Diluted EPS

0.40

$

0.33

$

21%

31

Summary Income Statement – Full Year

(Dollars in millions, except EPS)

2004

2003

B/(W)

Sales

310.6

316.0

(2%)

Rentals

209.5

222.2

(6%)

Support services

89.0

84.0

6%

Total revenue

609.1

622.2

(2%)

Cost of sales

171.4

192.8

11%

Cost of rentals

59.1

72.3

18%

Selling, service and administrative expenses

331.5

312.7

(6%)

Operating income

47.1

44.4

6%

Interest expense, net

3.7

8.4

56%

Income before income taxes

43.4

36.0

21%

Provision for income taxes

18.5

15.5

(19%)

Net income

24.9

20.5

22%

Diluted EPS

1.48

1.19

$

24%

Certain previously reported amounts have been reclassified to conform to the current year

presentation.

32

$

$

$

$

$

Supplemental Revenue Schedule –

Q4 and Full Year

(Dollars in millions)

Growth

Growth

Growth

Growth

Revenue

Rate

Revenue

Rate

Revenue

Rate

Revenue

Rate

Sales

Copier/MFP products

55.2

$

3%

53.5

$

8%

222.7

$

9%

203.5

$

7%

Facsimile products

15.9

(15%)

18.8

(24%)

72.4

(13%)

83.6

(14%)

Pitney Bowes of Canada

2.1

(72%)

7.5

(22%)

15.5

(46%)

28.9

4%

Total sales

73.2

(8%)

79.8

(5%)

310.6

(2%)

316.0

-

Rentals

Copier/MFP products

28.0

7%

26.1

8%

110.3

9%

101.2

7%

Facsimile products

21.7

(24%)

28.7

(12%)

99.2

(18%)

121.0

(12%)

Total rentals

49.7

(9%)

54.8

(3%)

209.5

(6%)

222.2

(4%)

Support services

Copier/MFP products

21.1

8%

19.6

9%

81.6

7%

76.1

4%

Facsimile products

2.1

22%

1.6

(18%)

7.4

(6%)

7.9

(16%)

Total support services

23.2

9%

21.2

6%

89.0

6%

84.0

1%

Total revenue

146.1

$

(6%)

155.8

$

(3%)

609.1

$

(2%)

622.2

$

(1%)

Revenue

Copier/MFP products

104.3

$

5%

99.2

$

8%

414.6

$

9%

380.8

$

6%

Facsimile products

39.7

(19%)

49.1

(17%)

179.0

(16%)

212.5

(13%)

Revenue excluding

Pitney Bowes of Canada

144.0

(3%)

148.3

(2%)

593.6

-

593.3

(1%)

Pitney Bowes of Canada

2.1

(72%)

7.5

(22%)

15.5

(46%)

28.9

4%

Total revenue

146.1

$

(6%)

155.8

$

(3%)

609.1

$

(2%)

622.2

$

(1%)

2004

2003

2004

2003

December 31,

December 31,

Three months ended

Year ended

33

Condensed Balance Sheets

(Dollars in millions)

(Unaudited)

12/31/04

9/30/04

6/30/04

3/31/04

12/31/03

12/31/04

9/30/04

6/30/04

3/31/04

12/31/03

Cash

12.8

$

12.3

$

10.7

$

12.5

$

22.9

$

Payables and accrued liabilities

80.3

$

87.7

$

74.5

$

67.1

$

79.3

$

Receivables, net

105.7

111.1

119.8

119.8

107.7

Advance billings

14.8

15.3

14.6

15.2

16.3

Accrued billings

29.0

27.8

24.7

22.2

20.9

Current long-term debt

0.5

0.5

0.5

0.5

0.5

Inventories

94.7

91.2

81.5

83.6

86.1

Total current

95.6

103.5

89.6

82.8

96.1

Other current

31.4

33.0

32.0

32.5

29.0

Total current

273.6

275.4

268.7

270.6

266.6

Long-term debt

70.4

71.5

72.6

77.8

62.9

Other liabilities

24.5

23.3

22.4

21.2

20.3

P, P&E, net

60.3

57.8

55.2

53.5

53.2

Total liabilities

190.5

198.3

184.6

181.8

179.3

Rental assets, net

62.8

63.6

62.8

63.2

67.2

Other assets

70.8

70.9

68.0

63.2

59.7

Equity

277.0

269.4

270.1

268.7

267.4

Total assets

467.5

$

467.7

$

454.7

$

450.5

$

446.7

$

Total liabilities & equity

467.5

$

467.7

$

454.7

$

450.5

$

446.7

$

34

Condensed Cash Flow Summaries

(Dollars in millions)

(Unaudited)

2004

2003

2004

2003

Net income

6.7

$

5.5

$

24.9

$

20.5

$

Depreciation and amortization

16.0

18.0

65.8

74.5

Provision for bad debt

2.0

1.0

12.4

6.7

Reserve for obsolete inventory

(0.4)

2.3

2.4

7.5

Deferred taxes on income

5.1

(5.1)

2.9

(0.9)

Net working capital

(8.2)

(24.9)

(29.2)

(29.7)

Other, net

0.8

1.9

0.2

4.5

Net cash provided by (used in) operating activities

22.0

(1.3)

79.4

83.1

Expenditures for rental equipment assets

(11.6)

(6.9)

(46.4)

(34.9)

Expenditures for property, plant and equipment

(5.4)

(2.4)

(17.0)

(16.1)

Acquisitions, net of cash acquired

(0.8)

-

(12.9)

(4.1)

Net cash used in investing activities

(17.8)

(9.3)

(76.3)

(55.1)

Purchase of treasury stock

(3.4)

(2.2)

(23.9)

(28.4)

Net loan (repayments) borrowings

(1.1)

9.9

7.5

(10.7)

Exercises of stock options, including sales

under employee stock purchase plan

0.8

0.7

3.2

2.7

Net cash (used in) provided by financing activities

(3.7)

8.4

(13.2)

(36.4)

Increase (decrease) in cash

0.5

$

(2.2)

$

(10.1)

$

(8.4)

$

Year ended

December 31,

Three months ended

December 31,

35

Our Outlook

36

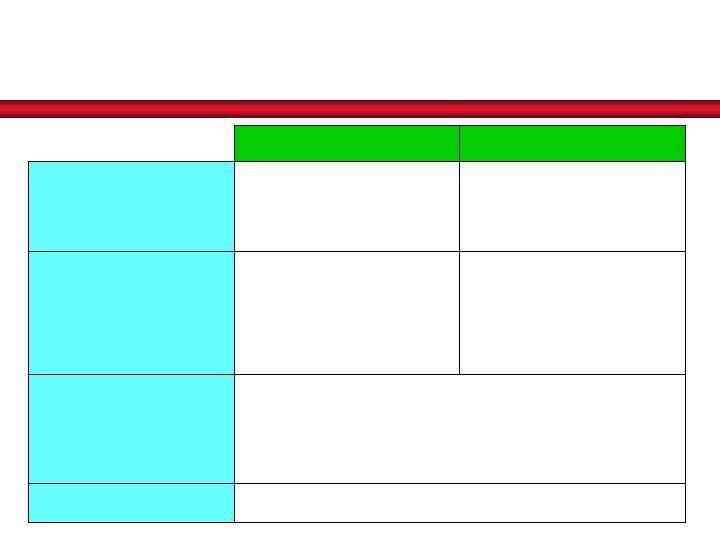

Outlook

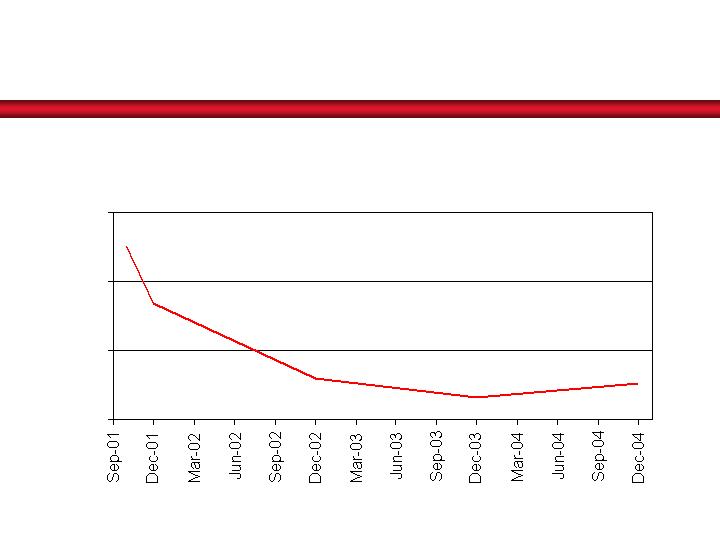

Targeting continuous

productivity improvements

resulting in a 600-800 basis

point decline in SS&A

expenses as a percent of

revenue

Significant reduction

expected as ERP

implementation is completed

in 2005

Operating Expenses

Targeting 20+% average annual growth

EPS

1.

Finance copier rental asset base

2.

Acquire independent dealerships

3.

Repurchase IGI stock

4.

Reduce debt

Cash Flow

Targeting mid-to-high single

digit percent revenue growth

At inflection point where

growth of copier/MFP is

expected to exceed decline in

fax

Revenue

Long Term

Short Term

37

Significant cash flow generation will be used to:

Summary

38

An Investment With Imagistics

is Compelling

39

We provide the best of breed products from the best manufacturers

around the world.

We test our products for superior quality, reliability and

functionality so the customer can focus on their business.

We provide a complete office document solution – from facsimile to

networked multifunctional copy/scan/fax/print/email – black & white

to color.

We have extensive national sales and service organizations to

provide a superior sales and customer service experience.

We are nationally recognized by J.D. Power and Associates as the

“#1 Copier/Multifunction Product in Overall Customer Satisfaction

Among Business Users, Two Years in a Row, Tied in 2003”.

For Our Customers:

40

An Investment With Imagistics

is Compelling

For Our Shareholders:

We have a unique business model with superior growth potential

in the huge office document market.

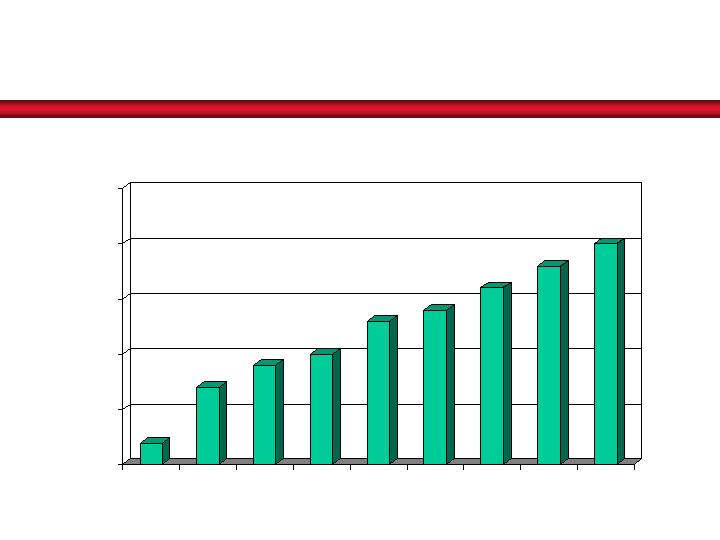

Our core copier/MFP business is growing 8-10% annually.

We are focused on profitability and cash generation, and are

growing EPS by 20+% annually.

We have a strong balance sheet and are conservatively

capitalized, with a debt to total capital ratio of 20%.

We use our substantial cash flow to finance the rental asset base,

further grow through selective acquisitions, repurchase shares

and reduce debt.

We have a strong management team with a demonstrated track

record of successfully executing our business plan.

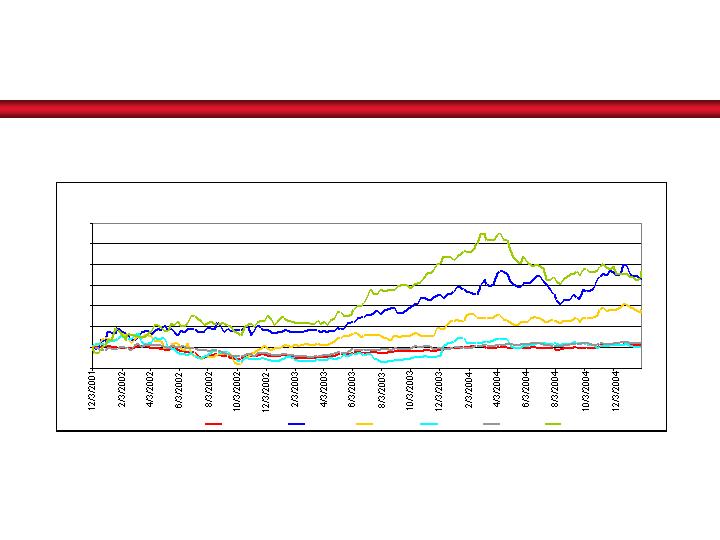

We have provided superior shareholder returns since inception.

41

An Investment With Imagistics

is Compelling

For Our Employees:

Our work environment stresses integrity and can be summed

up by PRIDE, our winning principles:

- Profitable growth

- Respect

- Imaginitive solutions

- Delivery of commitments

- Excellence of operations

Our Management Team

42

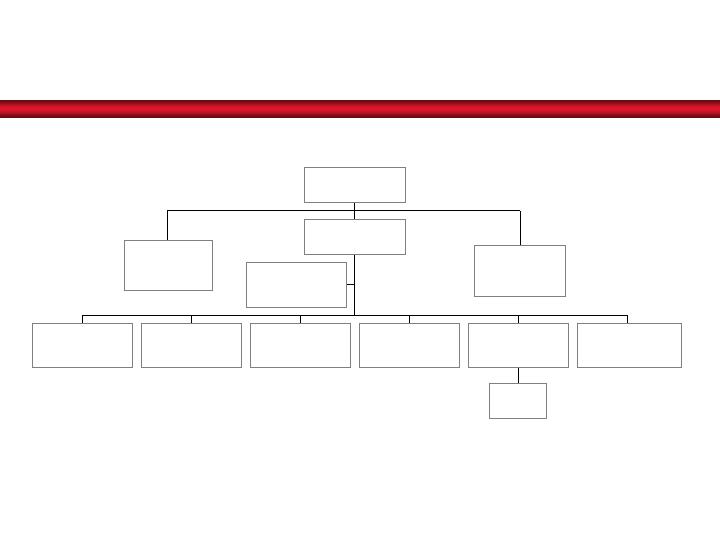

Tina Allen

Chief

Human Resources

Officer

Mark Flynn

Vice President, Secretary

and General Counsel

Marguerite Boss

Administrative Assistant

to CEO/COO

John Chillock

Vice President

Customer Service

Operations

George Clark

Vice President & GM

Business Products

Centers

Tim Coyne

Chief Financial Officer

Chris Dewart

Vice President

Sales

John Reilly

Vice President

Marketing

Nat Gifford

Vice President

Product Development

and Marketing

Bill Midgley

Chief Administrative Officer

Joseph Skrzypczak

President and

Chief Operating Officer

Marc Breslawsky

Chairman and

Chief Executive Officer

Proven Leadership Team

43

Proven Leadership Team

Marc C.

Breslawsky

Chairman and

Chief Executive

Officer

44

With a distinguished career in the office products industry, Mr. Breslawsky oversees the

operations of one of the largest direct sales, service and marketing organizations

offering enterprise office imaging and document solutions in the United States and

Europe. In 1996, Mr. Breslawsky was elected to the position of President and Chief

Operating Officer of Pitney Bowes Inc. In 1994, Mr. Breslawsky was elected Vice

Chairman of Pitney Bowes Inc. and a member of the Corporate Management Committee.

Mr. Breslawsky joined Pitney Bowes Business Systems in 1980 as Vice President, Market

Development, and was named Vice President and General Manager, Facsimile Systems in

1982. In 1985, he became Pitney Bowes’ Vice President, Finance and Administration,

and had executive responsibility for Pitney Bowes Facsimile Systems. He was appointed

President and Chief Executive Officer of Dictaphone in 1987, and Chief Executive Officer

of Pitney Bowes Copier Systems Division in 1990. Subsequently, in 1990, he was

appointed President, Pitney Bowes Office Systems, with responsibility for Dictaphone

Corporation, Pitney Bowes Facsimile Systems Division and Pitney Bowes Copier Systems

Division.

Mr. Breslawsky is on the Board of Directors of the United Illuminating Company, C.R.

Bard, Inc., The Brinks Company, and the Connecticut Business and Industry Association.

He serves as Vice Chairman of the Governor's Council on Economic Competitiveness and

Technology, the State of Connecticut Red Cross Disaster Relief Cabinet, and is a Trustee

for Norwalk Hospital.

Mr. Breslawsky received a Bachelor’s degree from New York University and is a Certified

Public Accountant.

Proven Leadership Team

Joseph D.

Skrzypczak

President and Chief

Operating Officer

45

Mr. Skrzypczak oversees the direct management of all operating units, including sales,

service, marketing, product procurement, finance, administration and information

technology. Mr. Skrzypczak has previously served as Imagistics CFO and head of

International and Business Product Centers operations since the inception of

Imagistics in 2001.

Prior to joining Imagistics in 2001, Mr. Skrzypczak served as COO of Dictaphone

Corporation. Under Mr. Skrzypczak’s leadership, Dictaphone became a leader in the

development, manufacture, marketing, service and support of Integrated Voice and

Data Management systems and software, including dictation, voice processing, records

management and communications recording. At that time Dictaphone had a marketing,

sales and service organization of more than 1,300 representatives in 160 cities in

North America and Europe, with revenues of $360 million. Mr. Skrzypczak played an

integral role in doubling Dictaphone's 1999 cash flows and recording the company’s

best revenue growth in ten years.

Prior to Dictaphone’s spin-off from Pitney Bowes in 1995, Mr. Skrzypczak was Vice

President, Finance for Pitney Bowes Office Systems, which included Dictaphone, Copier

Systems and Facsimile Systems, where he was directly responsible for all financial,

administrative and information technology activities.

Mr. Skrzypczak joined Pitney Bowes, Inc. in 1981 and held increasingly responsible

financial and operational positions. Prior to Pitney Bowes, Mr. Skrzypczak worked for

Revlon and Price Waterhouse. Mr. Skrzypczak is a Certified Public Accountant in New

York, and a graduate of Fordham University.

Proven Leadership Team

Timothy E. Coyne

Chief Financial

Officer

46

Timothy E. Coyne is responsible for Imagistics accounting, treasury, tax and investor

relations activities.

Mr. Coyne has served as the Vice President and Corporate Controller of Imagistics since

its inception in 2001. Prior to joining Imagistics, Mr. Coyne was the Chief Financial

Officer of TransPro, Inc. from 1998 to 2001. TransPro, a New York Stock Exchange listed

company, manufactures and distributes automotive, truck and industrial heat transfer

and temperature control products to the aftermarket and OEMs. Mr. Coyne also served as

Vice President and Corporate Controller of TransPro from 1996 to 1998.

From 1990 through 1996, Mr. Coyne served as the Vice President of Finance and

Administration at Keene Corporation, a NASDAQ listed manufacturer of advance

composite components for a variety of aerospace and industrial applications. He also

served as a Director at Keene from 1993 to 1996. Mr. Coyne was the Vice President,

Finance and Administration, Treasurer and Secretary of Kasco Corp., a subsidiary of

Bairnco Corp., a New York Stock Exchange listed diversified multi-national company,

from 1986 through 1990. From 1979 through 1986, Mr. Coyne held a variety of financial

positions with The Coca-Cola Bottling Company of New York, including Vice President and

Corporate Controller from 1984 to 1986.

Mr. Coyne began his career at Peat Marwick Mitchell & Co. in New York. He received a

Bachelor of Science degree in accounting from Herbert H. Lehman College of the City

University of New York.

Proven Leadership Team

Tina Allen

Chief Human

Resources

Officer

47

Tina Allen is the Chief Human Resources Officer, responsible for the Human Resources

function, which provides support for 3,300 employees nationwide while creating Human

Resources strategies that will support the businesses' long-term strategic goals. Ms. Allen

brings over 25 years of executive human resources leadership experience from the retail

and financial services arenas.

Ms. Allen joined Imagistics International Inc. from The Hartford where she was most

recently the Vice President of Human Resources. Ms. Allen was responsible for the

development and implementation of broad human resources strategies, including the

organization's executive leadership development, for the 13 commercial lines businesses.

Ms. Allen started her career with Macy's New York in 1973; she progressed through the

organization and was appointed the Personnel Director for Macy's Herald Square in 1983.

In 1985, Ms. Allen joined Caldor as the Director, Training and Development. In 1986, Ms.

Allen assumed the position of Operating Vice President, Executive Development for

Abraham & Straus. In 1988, Ms. Allen joined The Walden Book Company, a nationwide

specialty retailer, as Vice President of Human Resources.

Ms. Allen received a Bachelor's degree from Bucknell University.

Proven Leadership Team

John C. Chillock

Vice President,

Customer Service

Operations

48

John C. Chillock is responsible for Customer Service, Product Remanufacturing,

Technical Support and Training, the National Diagnostic Center, Customer Call

Dispatch, Material Management for Parts and Supplies, Finished Goods Distribution,

Field Facilities and Real Estate, and Global Supply Chain Operational Management. In

this role Mr. Chillock has responsibility for improving the operational and financial

performance of the organization by identifying opportunities to streamline business

processes, implement technological enhancements, and maintain a loyal customer

base.

Prior to joining Pitney Bowes Office Systems in 1998, Mr. Chillock was Director of

Operations for Intellisys Electronic Commerce, a Division of Chase Manhattan Bank. In

this position, he was responsible for building a complete service and support strategy

for the new B2B marketplace, and working with the newly formed Open Buying On the

Internet Consortium to insure compliance.

From 1977 to 1997 Mr. Chillock worked for the Dictaphone Corporation and served as

Regional Vice President, Customer Service. During his career at Dictaphone, he was

responsible for Customer Product Maintenance, the computer aided dispatch launch,

training strategy development and implementation to facilitate the analog to digital

migration, and oversight of the largest single customer order in the history of the

organization.

Mr. Chillock is a graduate of the Ohio Institute of Technology in Columbus, Ohio. He is

an active member of American Field Service Management International, the Sound

Keeper Organization which is an environmental support agency, and local civic and

charitable groups.

Proven Leadership Team

George E. Clark

Vice President and

General Manager,

Business Products

Centers

49

George E. Clark is responsible for the operation and general management of our

Business Products Centers and the ongoing acquisition and integration of new

operations. The BPC Operations overall are composed of a group of 36 former

independent dealers that have been acquired over the past five years. These

independent dealers support the Imagistics distribution of copier, fax and printer

products in secondary and tertiary geographical markets and support our major

and national account customers with installations and service within these

geographical areas.

Mr. Clark had formerly been with Pitney Bowes since 1975 when he was first

employed as a sales representative in the Boston Branch. His experience has been

in Pitney Bowes Marketing from 1978 to 1982, and in field positions of increasing

responsibility from 1982 through 1990. In 1990, Mr. Clark was appointed Vice

President of Marketing for Pitney Bowes Copier Systems and was responsible for

the marketing initiatives for the Copier Systems Division until the fall of 1998

when he assumed his current position.

Mr. Clark has been responsible for formulating many of the initiatives within

Pitney Bowes Office Systems/Imagistics for acquiring and integrating dealer

operations into a cohesive organization with increasing revenues and

contributions to the Corporation.

Proven Leadership Team

Chris C. Dewart

Vice President, Sales

50

Chris C. Dewart manages the direct sales channel for Imagistics, covering National,

Commercial and State Government Accounts throughout the U.S. and U.K. markets.

In this capacity, Mr. Dewart is instrumental in driving growth in revenue, and

profitability for Imagistics.

Mr. Dewart has held various positions with Imagistics, including most recently VP

of Sales – Commercial Markets. Prior to that he was Vice President of Sales, U.S.

Facsimile, where he managed the direct sales channel for facsimile product sales to

Fortune 1000 accounts. In addition, Mr. Dewart has served as Vice President and

General Manager, Canadian Operations and Vice President, Facsimile for Europe,

Middle East and Africa Group based in the United Kingdom.

Prior to joining Pitney Bowes in 1983 as a Senior Account Executive, Mr. Dewart

held sales positions with Monroe Division of Litton industries and General Electric

Data Communications Division.

Mr. Dewart received a Bachelor of Arts from the University of Windsor, Windsor,

Ontario, Canada and an MBA from The University of New Haven.

Proven Leadership Team

Mark S. Flynn

Vice President,

General Counsel

and Secretary

51

Mark S. Flynn manages the legal affairs of the company and provides advice and counsel

on a range of related issues including corporate governance and regulatory compliance.

Prior to joining Imagistics, Mr. Flynn was a partner with the firm Wiggin & Dana in the

Business Practice Group, from 1999 to 2001. Mr. Flynn's practice centered on business

transactions and general corporate representation. His many years of experience include

general counsel and other senior corporate counsel positions, most recently as Senior

Deputy General Counsel of Olin Corporation, a diversified chemicals and materials

company. He has also served as general counsel to public and private companies in the

chemicals and health care industries. Mr. Flynn's experience includes a broad range of

business transactions including acquisitions and divestitures, joint ventures, securities

offerings and corporate finance as well as antitrust and compliance counseling.

Mr. Flynn is a member of the Advisory Board of Integra Ventures, a Seattle-based venture

capital fund, specializing in healthcare and life sciences. He is also a member of the Board

of Directors of Stamford Theatre Works, a not-for-profit professional theatre resident in

Stamford, Connecticut. His professional associations include the American Bar

Association, the American Corporate Counsel Association and the American Society of

Corporate Secretaries.

Mr. Flynn received a Bachelor of Science degree from Fordham University College of

Business Administration in 1976, and a Juris Doctor from Fordham University School of

Law in 1980, where he served on the staff of the Fordham Law Review and the Fordham

International Law Journal.

Proven Leadership Team

Nathaniel M. Gifford

Vice President,

Product Development

and Marketing

52

Nathaniel M. Gifford’s responsibilities include strategic, market and product

planning, product development, sourcing, marketing, sales training, quality

assurance, and the global supply chain. In this capacity, he has a key role in

determining new and emerging customer document output needs, in developing

and delivering profitable and innovative solutions, and in improving supply chain

operational efficiencies.

Prior to his current assignment, Mr. Gifford was Vice President, Copier Product

Operations, which encompassed many of his current product related activities. He

was appointed to this position in 1989. He launched the company's first digital

copier/printer and the company's first color copier/printer in 1996 and

successfully led the company through the technology transition of standalone

analog copiers to digitally based multifunctional products.

Mr. Gifford joined Pitney Bowes in 1978 in the Corporate Planning Department and

held various positions including Director, Strategic Planning before joining the

Copier Division in 1983 as Director, Copier Strategic Business Unit. Prior to joining

Pitney Bowes, Mr. Gifford worked at Travelers Insurance Company and Cititrust

Bank in the area of securities analysis and investments. Mr. Gifford is a graduate of

Trinity College in Hartford, Connecticut, where he earned a Bachelor of Arts in Economics.

Proven Leadership Team

William Midgley

Chief

Administrative

Officer

53

William Midgley is responsible for Imagistics worldwide administration,

information technology, operational effectiveness and logistics functions.

Mr. Midgley joined Imagistics in 2003 as Vice President, Global Supply Chain,

responsible for the logistics function, which includes forecasting, purchasing

and the delivery of finished goods, parts and supplies throughout the

Imagistics network.

Prior to working for Imagistics, he was Vice President, Supply Chain, for PSS

World Medical, Inc. Before joining PSS World Medical, he held a variety of

financial, operations and business process positions at Sony Electronics.

While at Sony Electronics, Mr. Midgley was responsible for order

management, inventory control, billing, collections and accounts receivable,

improving the effectiveness of those functions through several reengineering

initiatives.

Mr. Midgley received an MBA in accounting from Pace University and a BS in

computer science from Florida Metropolitan University. He is trained in ISO

9000 and Six Sigma.

Forward-Looking Statement

The statements contained in this presentation that are not purely historical are forward-

looking statements, within the meaning of the Private Securities Litigation Reform Act of

1995, that are based on management's beliefs, certain assumptions and current

expectations. These statements may be identified by their use of forward-looking

terminology such as the words "expects," "projects," "anticipates," "intends" and other

similar words. Such forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from those projected. These risks and

uncertainties include, but are not limited to, general economic, business and market

conditions, competitive pricing pressures, timely development and acceptance of new

products, our reliance on third party suppliers, potential disruptions affecting the

international shipment of goods, potential disruptions in implementing information

technology systems, our ability to create brand recognition under our new name and

currency and interest rate fluctuations. For a more complete discussion of certain of the

risks and uncertainties that could cause actual results to differ from those contained in

the forward-looking statements, see "Risk Factors" in the Imagistics 2003 Form 10-K

and other SEC filings. The forward-looking statements contained in this presentation

are made as of the date hereof, and we do not undertake any obligation to update any

forward-looking statements, whether as a result of future events, new informati

on or otherwise.

54