Imagistics is a direct sales, service and marketing organization

providing document imaging solutions in the U.S., Canada and

the U.K., with annual revenues of approximately $600 million.

The Imagistics served market of document imaging is large -

projected to grow to $28 billion by 2007.

Imagistics provides its customers “best of breed” products,

superior service, technological innovation and value.

Imagistics has an extensive nationwide sales and service

organization to provide a superior customer experience.

Imagistics is profitable, has a strong balance sheet, is

conservatively capitalized, generates strong positive cash flow

and has been growing EPS over 20% annually.

Management has a demonstrated track record of execution.

Imagistics – Who We Are

2

Highlights

3

4

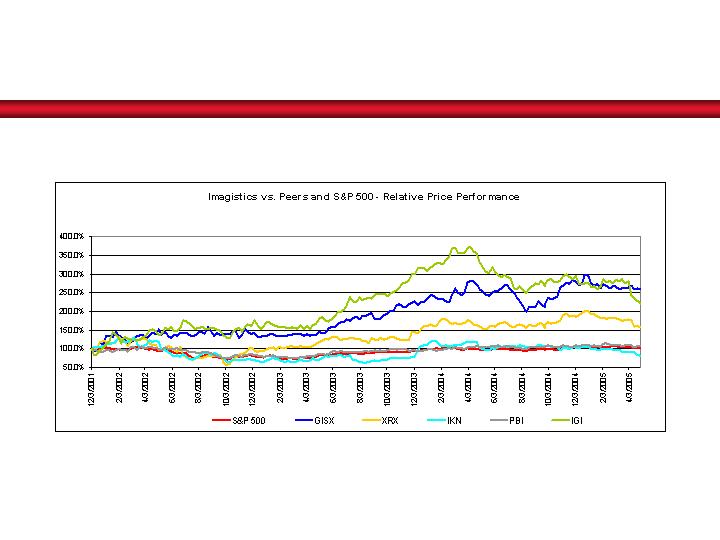

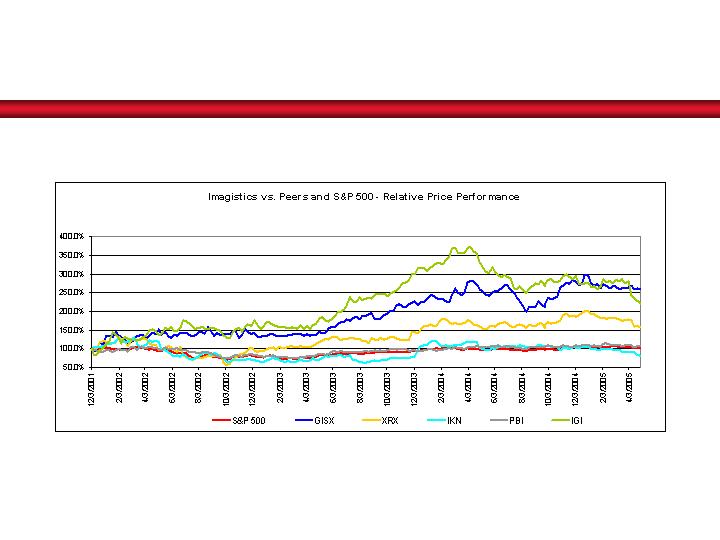

Strong Stock Performance Since Spin-Off

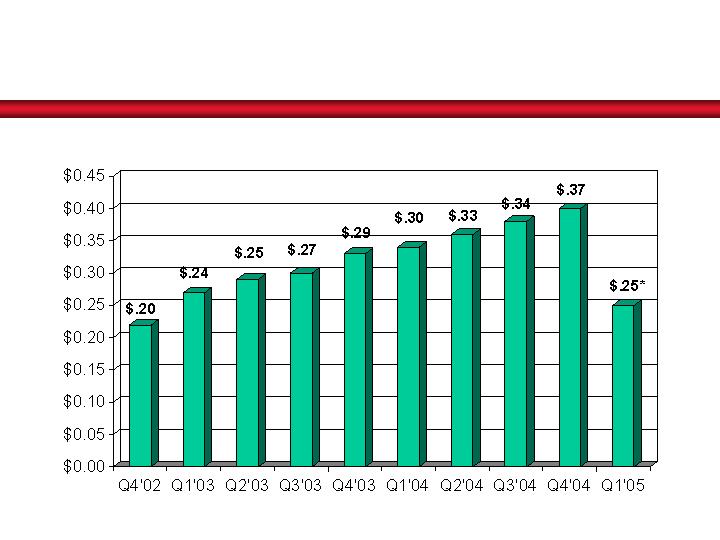

History of Strong Profitability

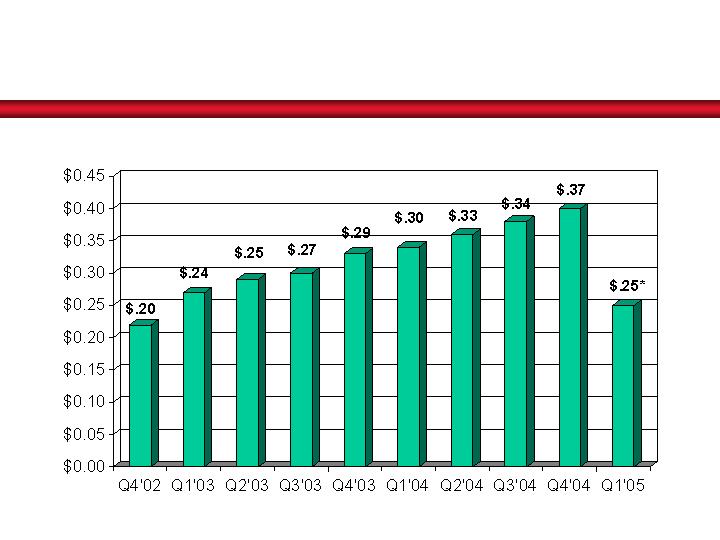

Diluted EPS

5

All periods restated for expensing stock options. *Q1’05 excludes $0.12 in charges for restructuring and severance

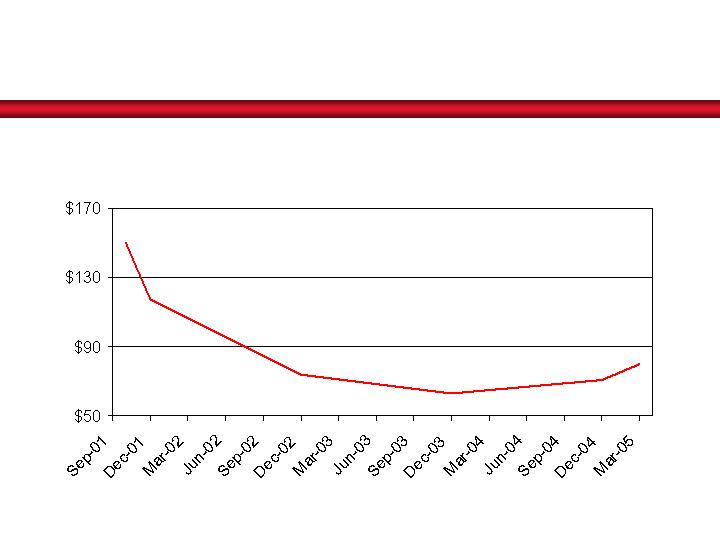

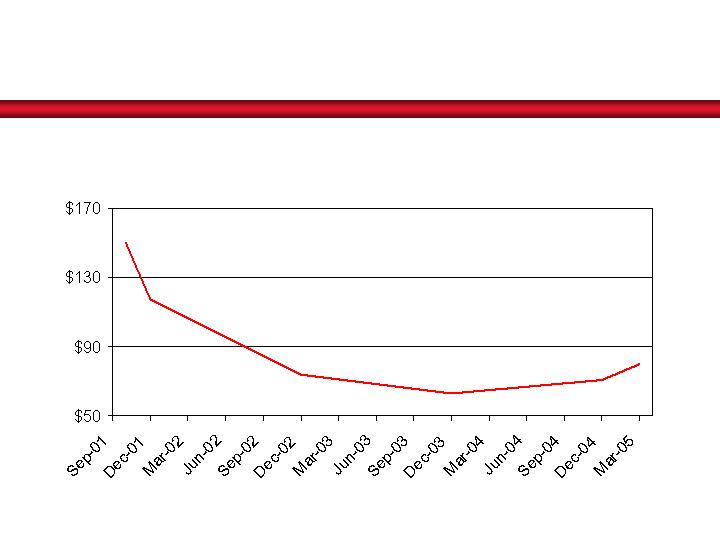

Significant Debt Reduction

(Dollars in millions)

$150

$117

$74

$63

$80

6

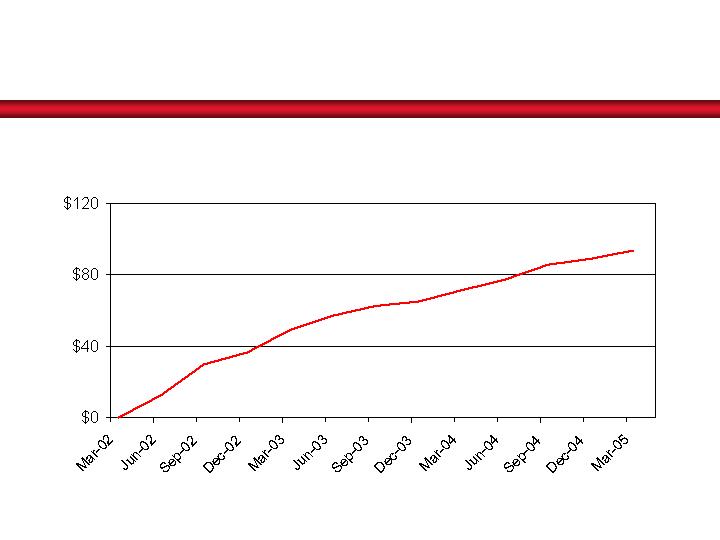

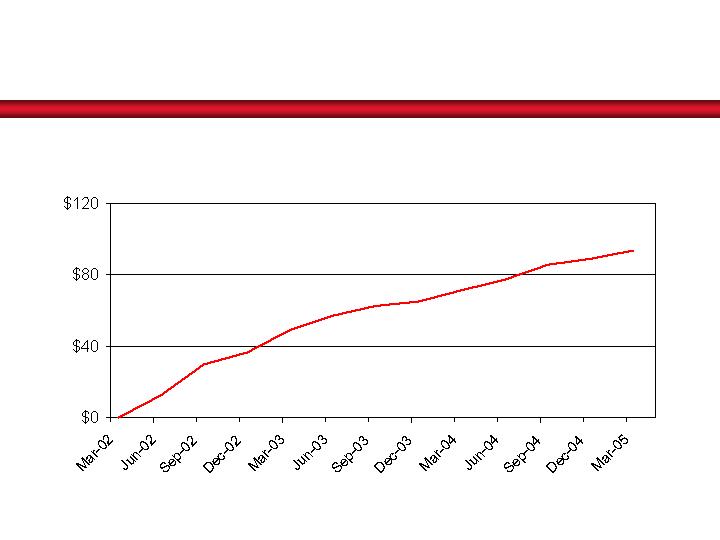

Stock Repurchases Continue

(Cumulative repurchases, dollars in millions)

7

$13

$30

$37

$49

$57

$63

$65

$71

$77

$85

$89

$93

Strategy

8

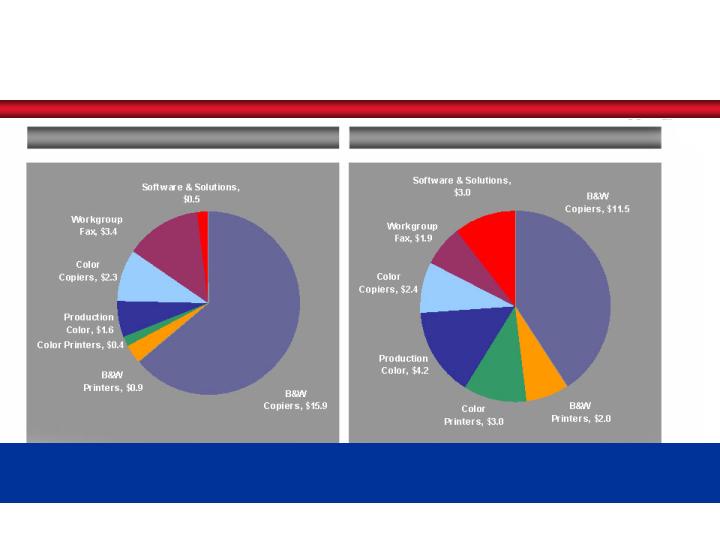

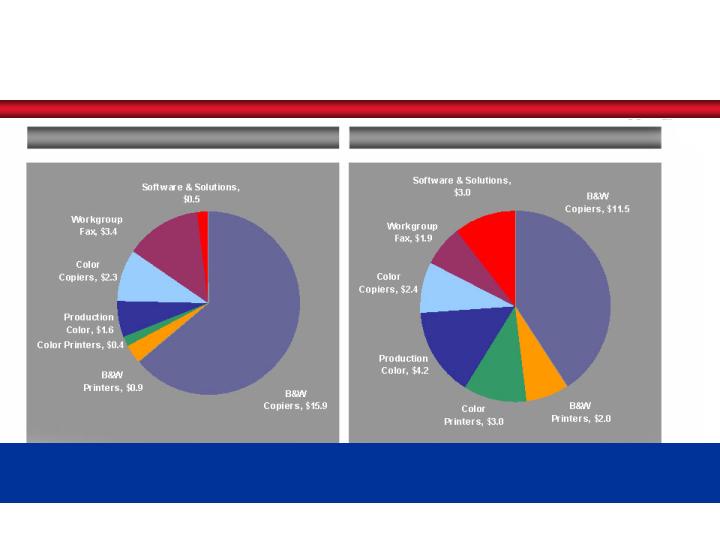

Transitioning to Copier/MFP

9

Solid Growth of Copier/MFP Revenue

2001

Q1’05

Distribution of total revenue

Leverage our product and marketplace

strengths to drive market share

Pursue opportunistic expansion to broaden

our sales and service capabilities

Growth Strategy

14

10

Our Market

11

Imagistics Served Markets

(Equipment, Supplies and Service)

Source: CAP Ventures

Imagistics has a small share of a huge market

2002: $25 Billion

2007: $28 Billion

12

Capabilities

13

World Class Products

“Best of Breed” sourcing strategy

Imagistics uses various third party

suppliers to provide the latest features

and technology

no R&D or manufacturing expense

Testing lab ensures highest reliability

Complete Segment 1-5 Document Solutions

Meets both workgroup and departmental

needs

Multifunctional copiers, printers and facsimile

13 to 85 ppm

1,000 to 750,000 prints per month

B&W and Color

Buyers Laboratory Inc.

History of awards since 1997

“2003 Line of the Year”

Individual product awards in 2004

Better Buys For Business

“2003 Editor’s Choice” awards

“2005 Editor’s Choice” award for DL 850

14

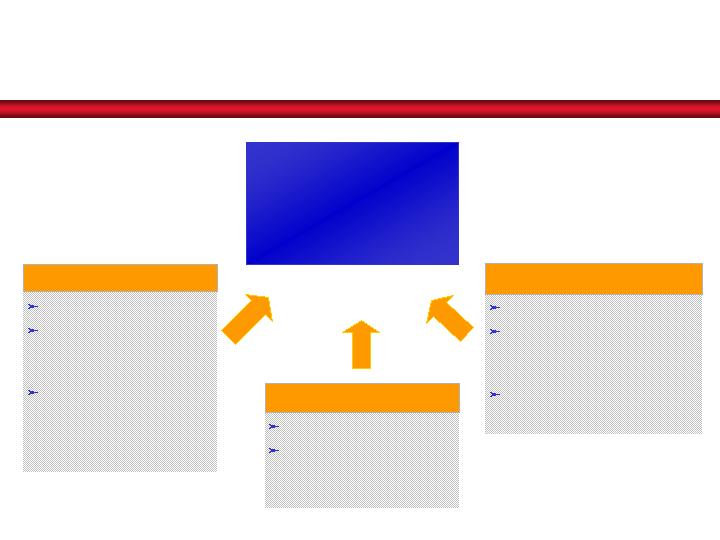

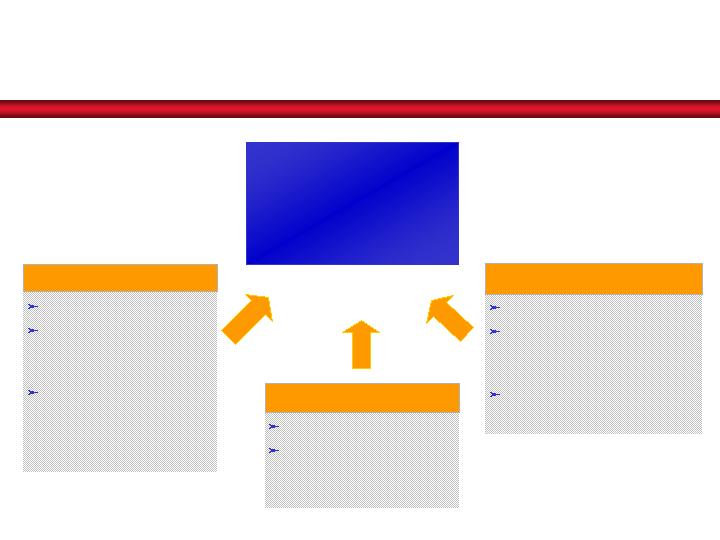

Sales force of 200

Major national and

international

corporations

Large governmental

and educational

organizations

National Accounts

Sales force of 275

Acquired businesses

covering secondary

geographic markets

Local, national and

commercial accounts

Business Product Centers

Imagistics has an

extensive direct sales

force

Sales force of 750

Mid-size and regional

businesses

Commercial Accounts

Extensive Sales Force

15

Strong Service Capabilities

Direct service - approximately 1200

professionals

National Call Center

24/7 network support

Immediate dispatch via hand-held

wireless devices

Promotes on-site arrival times

Value Added Maintenance System

(VAMS)

Ensures consistent copy quality

via systematic diagnostics and preventive

steps to maintain

optimal performance

16

Award Winning Customer Satisfaction

J.D. Power and Associates, a

globally recognized marketing

information firm, represents the

voice of the customer

Satisfaction measured on three key

factors that define the customer

experience: product, sales and

service

Imagistics Delivers…

“Best of Breed” products

Nationwide sales and service

support

17

Finances

18

Strong operating performance and financial

position supports strategic initiatives

Diversified revenue stream is 72% recurring

Strong annual EPS growth

Strong positive cash flow

Strong balance sheet, conservatively

capitalized at 22% debt to total capital

Credit rating upgraded twice in 2004 by

Moody’s

Strong Financial Position

13

19

Recurring revenue represents 72% of Total Q1 2005 Revenues

Total Q1 2005 Revenues

Total Q1 2005 Revenues

North

America

Copier/MFP

North

America

Fax

U.K.

Copier/MFP

& Fax

Supply

Sales

Support Services

Equipment

Rentals

$142.1 Million

$142.1 Million

Equipment

Sales

Recurring Revenue

Components

Revenue Sources – Q1’ 05

16

20

Summary Income Statement –

First Quarter

21

(Dollars in millions, except EPS)

(Unaudtied)

2005

2004

B/(W)

Copier/MFP

103.8

$

97.8

$

6%

Facsimile

36.2

50.4

(28%)

PB Canada

2.1

10.1

(79%)

Total revenue

142.1

158.3

(10%)

Cost of sales and rentals

56.5

64.7

13%

Selling, service and administrative expenses

80.8

83.6

3%

Operating income

4.8

10.0

(52%)

Interest expense, net

1.1

0.9

(21%)

Income before income taxes

3.7

9.1

(60%)

Provision for income taxes

1.6

3.9

61%

Net income

2.1

$

5.2

$

(59%)

Diluted EPS

0.13

$

0.30

$

(57%)

Diluted EPS without restructuring

and severance charges*

$0.25

$0.30

(17%)

The Company adopted SFAS No. 123(R), effective January 1, 2005. Accordingly, certain previously reported amounts

have been restated. * Q1'05 restructuring and severance charges were $0.12, reported diluted EPS was $0.13.

March 31,

Three months ended

Summary Income Statement –

Full Year

22

(Dollars in millions, except EPS)

(Unaudited)

2004

2003

B/(W)

Copier/MFP

414.6

$

380.8

$

9%

Facsimile

179.0

212.5

(16%)

PB Canada

15.5

28.9

(46%)

Total revenue

609.1

622.2

(2%)

Cost of sales and rentals

230.5

265.1

13%

Selling, service and administrative expenses

335.4

316.8

(6%)

Operating income

43.2

40.3

7%

Interest expense, net

3.7

8.4

56%

Income before income taxes

39.5

31.9

24%

Provision for income taxes

16.8

13.7

(23%)

Net income

22.7

$

18.2

$

25%

Diluted EPS

1.35

$

1.05

$

29%

The Company adopted SFAS No. 123(R), effective January 1, 2005. Accordingly, certain previously reported amounts

have been restated.

Condensed Balance Sheets

23

(Dollars in millions)

(Unaudited)

3/31/2005

12/31/04

3/31/04

3/31/2005

12/31/04

3/31/04

Cash

13.4

$

12.8

$

12.5

$

Payables and accrued liabilities

57.3

$

80.3

$

67.1

$

Receivables, net

99.7

105.7

119.8

Advance billings

14.3

14.8

15.2

Accrued billings

30.8

29.0

22.2

Current long-term debt

0.5

0.5

0.5

Inventories

89.0

94.7

83.6

Total current

72.1

95.6

82.8

Other current

28.9

31.4

32.5

Total current

261.8

273.6

270.6

Long-term debt

79.2

70.4

77.8

Other liabilities

17.6

18.2

15.3

P, P&E, net

59.5

60.3

53.5

Total liabilities

168.9

184.2

175.9

Rental assets, net

60.1

62.8

63.2

Other assets

70.3

70.8

63.2

Equity

282.8

283.3

274.6

Total assets

451.7

$

467.5

$

450.5

$

Total liabilities & equity

451.7

$

467.5

$

450.5

$

The Company adopted SFAS No. 123(R), "Share-Based Payment," as of January 1, 2005. Accordingly, certain previously reported amounts have been restated.

Condensed Cash Flow Summaries –

First Quarter

24

(Dollars in millions)

(Unaudited)

2005

2004

Net income

2.1

$

5.2

$

Depreciation and amortization

15.3

17.1

Provision for bad debt

2.0

2.4

Reserve for inventory obsolescence

1.4

1.4

Stock-based compensation expense

0.5

1.0

Excess tax benefits from stock-based compensation

(0.5)

(0.5)

Deferred taxes on income

3.0

(3.0)

Non-cash restructuring impairment charges

0.5

-

Net working capital

(16.0)

(28.9)

Other, net

(2.3)

0.9

Net cash provided by (used in) operating activities

6.0

(4.4)

Expenditures for rental equipment assets

(9.4)

(9.8)

Expenditures for property, plant and equipment

(2.1)

(2.8)

Acquisitions, net of cash acquired

-

(3.8)

Net cash used in investing activities

(11.5)

(16.4)

Purchase of treasury stock

(4.7)

(6.3)

Net loan (repayments) borrowings

8.9

14.9

Exercises of stock options and ESPP

1.6

1.1

Excess tax benefits from stock-based compensation

0.5

0.5

Net cash (used in) provided by financing activities

6.3

10.2

Effect of exchange rates on cash

(0.2)

0.2

Increase (decrease) in cash

0.6

$

(10.4)

$

The Company adopted SFAS No. 123(R), "Share-Based Payment," as of January 1, 2005. Accordingly, certain previously

reported amounts have been restated, and certain previously reported amounts have been reclassified to conform to the

current year presentation.

March 31,

Three months ended

Condensed Cash Flow Summaries –

Full Year

25

(Dollars in millions)

(Unaudited)

2004

2003

Net income

22.7

$

18.2

$

Depreciation and amortization

65.8

74.5

Provision for bad debt

12.4

6.7

Reserve for inventory obsolescence

2.4

7.5

Stock-based compensation expense

3.9

4.1

Excess tax benefits from stock-based compensation

(0.9)

(0.1)

Deferred taxes on income

2.1

(2.8)

Net working capital

(29.2)

(29.7)

Other, net

(1.4)

4.5

Net cash provided by operating activities

77.8

82.9

Expenditures for rental equipment assets

(46.4)

(34.9)

Expenditures for property, plant and equipment

(17.0)

(16.1)

Acquisitions, net of cash acquired

(12.9)

(4.1)

Net cash used in investing activities

(76.3)

(55.1)

Purchase of treasury stock

(23.9)

(28.3)

Net loan (repayments) borrowings

7.5

(10.7)

Exercises of stock options and ESPP

3.2

2.7

Excess tax benefits from stock-based compensation

0.9

0.1

Net cash (used in) financing activities

(12.3)

(36.2)

Effect of exchange rates on cash

0.7

-

Increase (decrease) in cash

(10.1)

$

(8.4)

$

The Company adopted SFAS No. 123(R), "Share-Based Payment," as of January 1, 2005. Accordingly, certain previously

reported amounts have been restated, and certain previously reported amounts have been reclassified to conform to the

current year presentation.

Targeting EPS in the $1.61-$1.66 range, up 19-

23% over 2004

Expect copier/MFP revenue growth in the mid-

single digit percent range

Expect facsimile revenue decline in the mid-to-high

twenty percent range

Selling, service and administrative expenses and

accounts receivable balance expected to continue

to decline

Accelerated cost reduction actions to offset greater

than anticipated fax revenue decline

Guidance for 2005

13

26

Outlook

Targeting 15-20% average

annual growth

Targeting continuous

productivity improvements

resulting in a decline in SS&A

expenses as a percent of

revenue

Significant reduction

expected as ERP

implementation is completed

in 2005

Operating Expenses

Targeting $1.61-$1.66 for

2005

EPS

Significant cash flow generation will be used to:

1.

Finance copier rental asset base

2.

Acquire independent dealerships

3.

Repurchase IGI stock

Cash Flow

Targeting mid-to-high single

digit percent growth in

copier/MFP revenue and mid-to-

high single digit percent decline

in facsimile revenue

Growth of copier/MFP

revenue is expected to

exceed the decline in fax

Revenue

Long Term

Short Term

27

Summary

28

An Investment With Imagistics

is Compelling

For Our Customers:

We provide the best of breed products from the best manufacturers

around the world.

We test our products for superior quality, reliability and

functionality so the customer can focus on their business.

We provide a complete office document solution – from facsimile to

networked multifunctional copy/scan/fax/print/email – black & white

to color.

We have extensive national sales and service organizations to

provide a superior sales and customer service experience.

We are nationally recognized by J.D. Power and Associates as the

“#1 Copier/Multifunction Product in Overall Customer Satisfaction

Among Business Users, Two Years in a Row, Tied in 2003”.

29

For Our Shareholders:

We have a proven business model with superior growth

potential in the huge office document market.

Our core copier/MFP business continues its solid growth.

We are focused on profitability and cash generation.

We have a strong balance sheet and are conservatively

capitalized.

We use our substantial cash flow to finance the rental asset

base, further grow through selective acquisitions, and

repurchase shares.

We have a strong management team with a demonstrated

track record of successfully executing our business plan.

We have provided superior shareholder returns since

inception.

30

An Investment With Imagistics

is Compelling

For Our Employees:

Our work environment stresses integrity and can be summed

up by PRIDE, our winning principles:

- Profitable growth

- Respect

- Imaginative solutions

- Delivery of commitments

- Excellence of operations

31

An Investment With Imagistics

is Compelling