We are pleased to present this semi-annual report for the industry exchange-traded funds (ETFs) of the Market Vectors ETF Trust for the period ended March 31, 2012.

Our equity ETF products now consist of Hard Assets ETFs, International ETFs and Industry ETFs.

| |

| n Improving U.S. economic data. In March 2012, the unemployment rate dropped to 8.2%, down from 9.0% in the same month of 2011. In the first quarter 2012, total U.S. non-farm employment increased by 635,000 jobs, the most for any quarter since Q1 2006, according to the Bureau of Labor Statistics. |

| n Positive steps in resolving Europe’s debt dilemma. Although much uncertainty still exists, European Central Bank action paired with austerity measures have managed to subdue global trepidation over Europe’s economic future. |

| n Continued low interest rates globally. Twice during the six-month period, 10-year U.S. Treasury yields showed upward momentum, reaching 2.40% in October and 2.38% in March. But in both cases the surge was short-lived, as yields eventually fell back toward the 2.0% level. Low interest rates have helped U.S. homeowners refinance mortgages and have boosted demand for housing. |

| n Moderate levels of inflation in most goods (except gasoline). Inflationary pressures, which showed signs of heating up in the second and third quarters of 2011, moderated over the six months. In March, the U.S. Department of Labor reported that the seasonally adjusted 12-month increase in the Consumer Price Index was 2.7%, compared to 3.9% at the start of the six-month period. Moderate inflation is positive for equities and also increases consumer confidence and spending power. The only place inflation seemed worrisome for consumers was at the gas pump, where prices increased at an annualized rate of about 12% over the six months, according to the U.S. Department of Labor. |

|

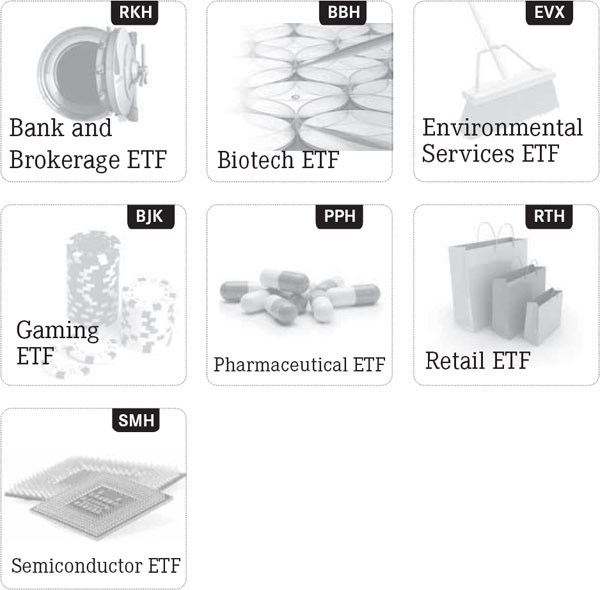

MARKET VECTORS INDUSTRY ETFs |

| |

Industry Sectors

Bank and Brokerage

The banking and brokerage industries are components of the Financials sector, the top-performing of all S&P 500 Index sectors for the six-month period. Banking and brokerage stocks have been beneficiaries of low interest rates and a continuation of central bank stimulus. Large banks also are taking advantage of less industry competition in the aftermath of 2008-09. Although earnings have been modestly strong recently in Financials, some analysts remain concerned about the sector’s long-term vulnerability to increased regulation and global de-risking.

Biotechnology

The biotechnology industry is one of the bright spots in the Health Care sector, which has lived with uncertainties of the U.S. health care reform initiative for the past two years, since passage of the Patient Protection and Affordable Care Act in March of 2010. In fiscal year 2011, the U.S. Food and Drug Administration approved 35 new medicines, a number surpassed only once in the past decade (37 in 2009). In 24 cases, new drugs were approved in the U.S. before any other country in the world, indicating expedited government approval processes.3

Since the biotechnology industry often has wide performance gaps between winners and losers, an ETF of biotech stocks may offer portfolio diversification benefits in allocating assets to this industry.

Environmental Services

The environmental services industry is using technology and innovation to produce benefits for the global environment, including sanitary and safe waste disposal, cleaner drinking water and controls over the impacts of industrialization and urbanization. According to the U.K. Centre for Economic and Environmental Development, the global market for environmental goods and services is expected to grow to about $800 billion by 2015, representing a 45% cumulative growth rate over a 10-year period.4

Gaming

Analysts believe gaming industry revenues are a good barometer for consumer confidence and discretionary spending. Some also think revenue potential has only begun to be tapped in two expansion markets, Macau (China) and Indonesia, representing two of the four largest nations in the world by population. Internet gaming, which until recently has been strictly regulated by many jurisdictions (including the U.S.), also gives this industry expansion potential.

Pharmaceutical

A symbol of the pharmaceutical industry’s challenges occurred on November 30, 2011, when the patent expired for Pfizer’s Lipitor®, the top-selling prescription drug. Although drugs like Lipitor can continue to generate sales as “generics” after patents expire, analysts are concerned that major pharmaceutical companies have a thin pipeline of new products and patents, at a time when other blockbuster drugs will soon follow Lipitor’s arc. As a result, pharmaceutical stocks have significantly lagged both broad equity indices and the Health Care sector recently.

Retail

Although U.S. retailers have taken advantage of an improving economy in the short term, they continue to face the challenges of new consumer spending habits. With 42% of U.S. consumers now owning smart phones, according to Deloitte, shopping has become more convenient and price comparisons are only a few seconds away. During the six-month period, retailers took advantage of a strong 2011 holiday season, with chain discount store sales up 7% and online sales up 15% over prior-year levels. Both high end retailers and most

2

price-competitive discounters and online merchants reportedly performed well, while retailers “in the middle” struggled to hold share. Total consumer credit outstanding has been sluggish, with revolving credit remaining virtually flat over the six-month period, despite low interest rates.

Semiconductor

The global semiconductor industry grew revenues by an estimated 1.25% in 2011, according to HS iSuppli Market Research, which disappointed some analysts. However, consumer demand for electronic devices is expected to stimulate modestly higher demand for chips in 2012. Semiconductor equipment makers are concerned about lack of demand for new fabrication capacity and flat chip-maker budgets for capital equipment. As a result of these trends, the industry has significantly underperformed the broader equity market and Information Technology sector in recent months.

Summary

The period covered by this semi-annual report to shareholders was a rewarding time for most equity investors, across virtually all sectors, and it demonstrated the benefits of having a long-term focus and well diversified portfolio, capable of riding through the market’s rough spots. During this period, Market Vectors initiated an expansion in our industry ETF family with the launch of five new funds in mid-December, all of which began their lives with strong performance in their first full quarters.

I want to thank you for your participation in the Market Vectors ETF Trust. If you have any questions, please contact us at 1.888.MKT.VCTR or visit marketvectorsetfs.com

We value your ongoing confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

Trustee and President

Market Vectors ETF Trust

April 30, 2012

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

| |

1 | Standard & Poor’s® (S&P) 500 Index, calculated with dividends reinvested, consists of 500 widely held common stocks covering industrial, utility, financial and transportation sectors. |

| |

2 | Morgan Stanley Capital International (MSCI) Europe, Australasia, Far East (EAFE) Index is an unmanaged capitalization-weighted index containing approximately 1,100 equity securities of companies located in Europe, Australasia and the Far East. |

| |

3 | U.S. Food and Drug Administration, news release 11/3/11 http://www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/ucm278383.htm |

| |

4 | Global Environmental Services Report; www.reportlinker.com/ci01329/Environmental-services.html |

3

|

MARKET VECTORS BANK AND BROKERAGE ETF (RKH) |

| |

PERFORMANCE COMPARISON |

March 31, 2012 (unaudited) |

| | | | | | | | | | |

Total Return | | Share Price1 | | NAV | | MVRKHTR2 | |

| | | | | | | | |

Life* | | 26.87 | % | | 25.65 | % | | 25.76 | % | |

| | | | | | | | | | | |

*since 12/20/11 | | | | | | | | | | |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (12/20/11) to the first day of secondary market trading in shares of the Fund (12/21/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf.

Gross Expense Ratio 0.82% / Net Expense Ratio 0.35%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.35% of the average daily net assets per year until at least May 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind.

Market Vectors US Listed Bank and Brokerage 25 Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| |

2 | Market Vectors US Listed Bank and Brokerage 25 Index (MVRKHTR) is a rules-based index intended to track the overall performance of 25 of the largest U.S. listed, publicly traded bank and brokerage companies. |

4

|

MARKET VECTORS BIOTECH ETF (BBH) |

| |

PERFORMANCE COMPARISON |

March 31, 2012 (unaudited) |

| | | | | | | | | | |

Total Return | | Share Price1 | | NAV | | MVBBHTR2 | |

| | | | | | | | |

Life* | | 26.24 | % | | 25.85 | % | | 26.02 | % | |

| | | | | | | | | | | |

*since 12/20/11 | | | | | | | | | | |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (12/20/11) to the first day of secondary market trading in shares of the Fund (12/21/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf.

Gross Expense Ratio 0.51% / Net Expense Ratio 0.35%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.35% of the average daily net assets per year until at least May 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind.

Market Vectors US Listed Biotech 25 Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| |

2 | Market Vectors US Listed Biotech 25 Index (MVBBHTR) is a rules-based index intended to track the overall performance of 25 of the largest U.S. listed, publicly traded biotech companies. |

5

|

MARKET VECTORS ENVIRONMENTAL SERVICES ETF (EVX) |

| |

PERFORMANCE COMPARISON |

March 31, 2012 (unaudited) |

| | | | | | | | | | |

Total Return | | Share Price1 | | NAV | | AXENV2 | |

| | | | | | | | |

Three Months | | 13.24 | % | | 13.49 | % | | 13.63 | % | |

| | | | | | | | | | | |

Six Months | | 17.94 | % | | 20.00 | % | | 20.34 | % | |

| | | | | | | | | | | |

One Year | | (0.54 | )% | | (0.35 | )% | | 0.23 | % | |

| | | | | | | | | | | |

Five Year | | 4.05 | % | | 4.10 | % | | 4.64 | % | |

| | | | | | | | | | | |

Life* (annualized) | | 6.26 | % | | 6.31 | % | | 6.86 | % | |

| | | | | | | | | | | |

Life* (cumulative) | | 39.37 | % | | 39.74 | % | | 43.79 | % | |

| | | | | | | | | | | |

*since 10/10/06. Also, effective January 1, 2012, please be advised the Fund changed its fiscal year end from December 31 to September 30. |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (10/10/06) to the first day of secondary market trading in shares of the Fund (10/16/06), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf.

Gross Expense Ratio 0.87% / Net Expense Ratio 0.55%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.55% of the average daily net assets per year until at least May 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind.

NYSE Arca Environmental Services Index (the “Index”) is a trademark of NYSE Euronext or its affiliates (NYSE Euronext), is licensed for use by Van Eck Associates Corporation. NYSE Euronext neither sponsors nor endorses the Fund and makes no representation as to the accuracy and/or completeness of the Index or results to be obtained by any person from using the Index in connection with trading of the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| |

2 | NYSE Arca Environmental Services Index (AXENV) is a modified equal dollar-weighted index comprised of publicly traded companies that are involved in the management, removal and storage of consumer waste and industrial byproducts and related environmental services. |

6

|

MARKET VECTORS GAMING ETF (BJK) |

| |

PERFORMANCE COMPARISON |

March 31, 2012 (unaudited) |

| | | | | | | | | | |

Total Return | | Share Price1 | | NAV | | WAGRT2 | |

| | | | | | | | |

Three Months | | 19.16 | % | | 19.09 | % | | 19.06 | % | |

| | | | | | | | | | | |

Six Months | | 31.82 | % | | 31.25 | % | | 30.66 | % | |

| | | | | | | | | | | |

One Year | | 13.69 | % | | 14.39 | % | | 14.91 | % | |

| | | | | | | | | | | |

Life* (annualized) | | (0.28 | )% | | (0.18 | )% | | 0.92 | % | |

| | | | | | | | | | | |

Life* (cumulative) | | (1.16 | )% | | (0.74 | )% | | 3.92 | % | |

| | | | | | | | | | | |

*since 1/22/08. Also, effective January 1, 2012, please be advised the Fund changed its fiscal year end from December 31 to September 30. |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (1/22/08) to the first day of secondary market trading in shares of the Fund (1/24/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf.

Gross Expense Ratio 0.72% / Net Expense Ratio 0.65%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.65% of the average daily net assets per year until at least May 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind.

S-Network Global Gaming IndexSM (the “Index”), a trademark of Stowe Global Indexes LLC, is licensed for use by Van Eck Associates Corporation. Stowe Global Indexes LLC neither sponsors or endorses the Fund and makes no representation as to the accuracy and/or completeness of the Index or results to be obtained by any person using the Index in connection with trading the Fund. The Index is calculated and maintained by Standard & Poor’s Custom Indices, which neither sponsors nor endorses the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| |

2 | S-Network Global Gaming IndexSM (WAGRT) is a rules-based, modified capitalization-weighted, float-adjusted index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the global gaming industry. |

7

|

MARKET VECTORS PHARMACEUTICAL ETF (PPH) |

| |

PERFORMANCE COMPARISON |

March 31, 2012 (unaudited) |

| | | | | | | | | | |

Total Return | | Share Price1 | | NAV | | MVPPHTR2 | |

| | | | | | | | |

Life* | | 8.12 | % | | 7.16 | % | | 7.04 | % | |

| | | | | | | | | | | |

*since 12/20/11 | | | | | | | | | | |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (12/20/11) to the first day of secondary market trading in shares of the Fund (12/21/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf.

Gross Expense Ratio 0.42% / Net Expense Ratio 0.35%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.35% of the average daily net assets per year until at least May 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind.

Market Vectors US Listed Pharmaceutical 25 Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| |

2 | Market Vectors US Listed Pharmaceutical 25 Index (MVPPHTR) is a rules-based index intended to track the overall performance of 25 of the largest U.S. listed, publicly traded pharmaceutical companies. |

8

|

MARKET VECTORS RETAIL ETF (RTH) |

| |

PERFORMANCE COMPARISON |

March 31, 2012 (unaudited) |

| | | | | | | | | | |

Total Return | | Share Price1 | | NAV | | MVRTHTR2 | |

| | | | | | | | |

Life* | | 13.47 | % | | 12.31 | % | | 12.32 | % | |

| | | | | | | | | | | |

*since 12/20/11 | | | | | | | | | | |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (12/20/11) to the first day of secondary market trading in shares of the Fund (12/21/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf.

Gross Expense Ratio 0.56% / Net Expense Ratio 0.35%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.35% of the average daily net assets per year until at least May 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind.

Market Vectors US Listed Retail 25 Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| |

2 | Market Vectors US Listed Retail 25 Index (MVRTHTR) is a rules-based index intended to track the overall performance of 25 of the largest U.S. listed, publicly traded retail companies. |

9

|

MARKET VECTORS SEMICONDUCTOR ETF (SMH) |

| |

PERFORMANCE COMPARISON |

March 31, 2012 (unaudited) |

| | | | | | | | | | |

Total Return | | Share Price1 | | NAV | | MVSMHTR2 | |

| | | | | | | | |

Life* | | 19.21 | % | | 19.60 | % | | 19.58 | % | |

| | | | | | | | | | | |

*since 12/20/11 | | | | | | | | | | |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (12/20/11) to the first day of secondary market trading in shares of the Fund (12/21/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf.

Gross Expense Ratio 0.41% / Net Expense Ratio 0.35%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.35% of the average daily net assets per year until at least May 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind.

Market Vectors US Listed Semiconductor 25 Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| |

2 | Market Vectors US Listed Semiconductor 25 Index (MVSMHTR) is a rules-based index intended to track the overall performance of 25 of the largest U.S. listed, publicly traded semiconductor companies. |

10

|

MARKET VECTORS ETF TRUST |

| |

EXPLANATION OF EXPENSES |

(unaudited) |

|

Hypothetical $1,000 investment at beginning of period |

As a shareholder of a Fund, you incur operating expenses, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with the ongoing costs of investing in other mutual funds. |

|

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, October 1, 2011 to March 31, 2012. |

|

Actual Expenses |

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period. |

|

Hypothetical Example for Comparison Purposes |

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on your Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. |

|

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as program fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. |

| | | | | | | | | | | | | | | | | | | | | |

| | | | Beginning

Account

Value

October 1, 2011 | | Ending

Account

Value

March 31, 2012 | | Annualized

Expense

Ratio

During Period | | Expenses Paid

During the Period*

October 1, 2011-

March 31, 2012 | |

| | | | | | | | | | | | |

Bank & Brokerage ETF*** | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 1,228.50 | | | 0.35 | % | | | $ | 1.97 | | |

| Hypothetical** | | | $ | 1,000.00 | | | | $ | 1,023.44 | | | 0.35 | % | | | $ | 1.79 | | |

| | | | | | | | | | | | |

Biotech ETF*** | | | | | | | | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 1,217.80 | | | 0.35 | % | | | $ | 1.96 | | |

| Hypothetical** | | | $ | 1,000.00 | | | | $ | 1,023.44 | | | 0.35 | % | | | $ | 1.79 | | |

| | | | | | | | | | | | |

Environmental Services ETF | | | | | | | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 1,200.00 | | | 0.55 | % | | | $ | 3.05 | | |

| Hypothetical** | | | $ | 1,000.00 | | | | $ | 1,022.43 | | | 0.55 | % | | | $ | 2.80 | | |

| | | | | | | | | | | | |

Gaming ETF | | | | | | | | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 1,312.50 | | | 0.65 | % | | | $ | 3.79 | | |

| Hypothetical** | | | $ | 1,000.00 | | | | $ | 1,021.93 | | | 0.65 | % | | | $ | 3.31 | | |

| | | | | | | | | | | | |

Pharmaceutical ETF*** | | | | | | | | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 1,060.10 | | | 0.35 | % | | | $ | 1.82 | | |

| Hypothetical** | | | $ | 1,000.00 | | | | $ | 1,023.44 | | | 0.35 | % | | | $ | 1.79 | | |

| | | | | | | | | | | | |

Retail ETF*** | | | | | | | | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 1,125.00 | | | 0.35 | % | | | $ | 1.87 | | |

| Hypothetical** | | | $ | 1,000.00 | | | | $ | 1,023.44 | | | 0.35 | % | | | $ | 1.79 | | |

| | | | | | | | | | | | |

Semiconductor ETF*** | | | | | | | | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 1,177.10 | | | 0.35 | % | | | $ | 1.92 | | |

| Hypothetical** | | | $ | 1,000.00 | | | | $ | 1,023.44 | | | 0.35 | % | | | $ | 1.79 | | |

| | | | | | | | | | | | |

| |

* | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended March 31, 2012) multiplied by the average account value over the period, multiplied by 183 and divided by 366 (to reflect the one-half year period). |

** | Assumes annual return of 5% before expenses |

*** | Expenses are equal to the Fund’s annualized expense ratio (for the period from December 20, 2011 to March 31, 2012) multiplied by the average account value over the period, multiplied by 102 and divided by 366 (to reflect the one-half year period). |

11

|

BANK & BROKERAGE ETF |

| |

SCHEDULE OF INVESTMENTS |

March 31, 2012 (unaudited) |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| |

COMMON STOCKS: 100.1% | |

Brazil: 6.5% | |

| 52,782 | | Banco Bradesco S.A. (ADR) | | $ | 923,685 | |

| 20,546 | | Banco Santander S.A. (ADR) | | | 188,407 | |

| 63,623 | | Itau Unibanco Holding S.A. (ADR) | | | 1,220,925 | |

| | | | | | | |

| | | | | | 2,333,017 | |

| | | | | | | |

Canada: 17.4% | | | | |

| 18,221 | | Bank of Montreal (USD) | | | 1,082,692 | |

| 29,203 | | Bank of Nova Scotia (USD) | | | 1,636,536 | |

| 30,613 | | Royal Bank of Canada (USD) | | | 1,777,085 | |

| 21,293 | | Toronto-Dominion Bank (USD) | | | 1,808,840 | |

| | | | | | | |

| | | | | | 6,305,153 | |

| | | | | | | |

Germany: 3.4% | | | | |

| 24,596 | | Deutsche Bank AG (USD) | | | 1,224,635 | |

| | | | | | | |

India: 0.2% | | | | |

| 2,296 | | ICICI Bank Ltd. (ADR) | | | 80,062 | |

| | | | | | | |

Japan: 4.2% | | | | |

| 308,533 | | Mitsubishi UFJ Financial Group,

Inc. (ADR) | | | 1,536,494 | |

| | | | | | | |

Netherlands: 2.2% | | | | |

| 93,759 | | ING Groep N.V. (ADR) * | | | 780,075 | |

| | | | | | | |

Spain: 7.7% | | | | |

| 139,515 | | Banco Bilbao Vizcaya Argentaria S.A.

(ADR) † | | | 1,114,725 | |

| 217,087 | | Banco Santander S.A. (ADR) | | | 1,665,057 | |

| | | | | | | |

| | | | | | 2,779,782 | |

| | | | | | | |

Switzerland: 6.3% | | | |

| 31,352 | | Credit Suisse Group AG (ADR) † | | | 893,845 | |

| 98,134 | | UBS AG (USD) * | | | 1,375,839 | |

| | | | | | | |

| | | | | | 2,269,684 | |

| | | | | | | |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | |

United Kingdom: 10.9% | | | | |

| 66,833 | | Barclays Plc (ADR) † | | $ | 1,012,520 | |

| 66,051 | | HSBC Holdings Plc (ADR) | | | 2,932,004 | |

| | | | | | | |

| | | | | | 3,944,524 | |

| | | | | | | |

United States: 41.3% | | | | |

| 213,297 | | Bank of America Corp. | | | 2,041,252 | |

| 30,748 | | Charles Schwab Corp. | | | 441,849 | |

| 51,463 | | Citigroup, Inc. | | | 1,880,973 | |

| 13,096 | | Goldman Sachs Group, Inc. | | | 1,628,749 | |

| 69,320 | | JPMorgan Chase & Co. | | | 3,187,334 | |

| 40,536 | | Morgan Stanley | | | 796,127 | |

| 53,756 | | U.S. Bancorp | | | 1,702,990 | |

| 95,758 | | Wells Fargo & Co. | | | 3,269,178 | |

| | | | | | | |

| | | | | | 14,948,452 | |

| | | | | | | |

Total Common Stocks | | | | |

(Cost: $32,475,029) | | | 36,201,878 | |

| | | | | | | |

SHORT-TERM INVESTMENT HELD AS COLLATERAL

FOR SECURITIES LOANED: 4.0% | | | | |

(Cost: $1,429,317) | | | | |

| 1,429,317 | | Bank of New York Overnight

Government Fund | | | 1,429,317 | |

| | | | | | | |

Total Investments: 104.1% | | | | |

(Cost: $33,904,346) | | | 37,631,195 | |

Liabilities in excess of other assets: (4.1)% | | | (1,470,226) | |

| | | | |

NET ASSETS: 100.0% | | $ | 36,160,969 | |

| | | | |

| |

| | |

ADR | American Depositary Receipt |

USD | United States Dollar |

* | Non-income producing |

† | Security fully or partially on loan. Total market value of securities on loan is $1,383,721. |

| | | | | | | | | | |

Summary of Investments by

Sector Excluding Collateral for

Securities Loaned (unaudited) | | | % of Investments | | Value | |

| | | | | | | |

Commercial Banking Institution | | | | 31.8 | % | | $ | 11,498,014 | |

Diversified Banking Institution | | | | 51.1 | | | | 18,509,772 | |

Finance - Investment Banker / Broker | | | | 1.2 | | | | 441,849 | |

Life & Health Insurance | | | | 2.2 | | | | 780,075 | |

Super-Regional Banks | | | | 13.7 | | | | 4,972,168 | |

| | | | | | | | | |

| | | | 100.0 | % | | $ | 36,201,878 | |

| | | | | | | | | |

The summary of inputs used to value the Fund’s investments as of March 31, 2012 is as follows:

| | | | | | | | | | | | | | | | | |

| | Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Value | |

| | | | | | | | | | |

Common Stocks* | | $ | 36,201,878 | | | $ | — | | | | $ | — | | | $ | 36,201,878 | |

Money Market Fund | | | 1,429,317 | | | | — | | | | | — | | | | 1,429,317 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 37,631,195 | | | $ | — | | | | $ | — | | | $ | 37,631,195 | |

| | | | | | | | | | | | | | | | | |

* See Schedule of Investments for security type and geographic sector breakouts.

See Notes to Financial Statements

12

|

BIOTECH ETF |

| |

SCHEDULE OF INVESTMENTS |

March 31, 2012 (unaudited) |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | | |

COMMON STOCKS: 100.0% | | | | |

Netherlands: 3.2% | | | | |

| 223,694 | | Qiagen N.V. (USD) * † | | $ | 3,482,916 | |

| | | | | | | |

United States: 96.8% | | | | |

| 36,891 | | Acorda Therapeutics, Inc. * | | | 979,456 | |

| 60,780 | | Alexion Pharmaceuticals, Inc. * | | | 5,644,031 | |

| 247,186 | | Amgen, Inc. | | | 16,806,176 | |

| 156,816 | | Amylin Pharmaceuticals, Inc. * | | | 3,914,127 | |

| 74,561 | | Biogen Idec, Inc. * | | | 9,392,449 | |

| 112,201 | | BioMarin Pharmaceutical, Inc. * | | | 3,842,884 | |

| 137,053 | | Celgene Corp. * | | | 10,624,349 | |

| 47,192 | | Charles River Laboratories

International, Inc. * | | | 1,703,159 | |

| 62,006 | | Cubist Pharmaceuticals, Inc. * | | | 2,681,759 | |

| 148,474 | | Dendreon Corp. * † | | | 1,581,990 | |

| 143,275 | | Exelixis, Inc. * | | | 742,165 | |

| 44,107 | | Gen-Probe, Inc. * | | | 2,929,146 | |

| 234,167 | | Gilead Sciences, Inc. * | | | 11,439,058 | |

| 196,003 | | Human Genome Sciences, Inc. * † | | | 1,615,065 | |

| 90,899 | | Illumina, Inc. * | | | 4,782,196 | |

| 107,868 | | Incyte Corp. * † | | | 2,081,852 | |

| 63,713 | | InterMune, Inc. * | | | 934,670 | |

| 100,191 | | Life Technologies Corp. * | | | 4,891,325 | |

| 82,196 | | Myriad Genetics, Inc. * | | | 1,944,757 | |

| 62,485 | | Onyx Pharmaceuticals, Inc. * | | | 2,354,435 | |

| 43,721 | | Regeneron Pharmaceuticals, Inc. * | | | 5,098,743 | |

| 113,473 | | Seattle Genetics, Inc. * † | | | 2,312,580 | |

| 46,483 | | United Therapeutics Corp. * | | | 2,190,744 | |

| 112,614 | | Vertex Pharmaceuticals, Inc. * | | | 4,618,300 | |

| | | | | | | |

| | | | | | 105,105,416 | |

| | | | | | | |

Total Common Stocks | | | | |

(Cost: $94,104,865) | | | 108,588,332 | |

| | | | |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | | |

MONEY MARKET FUND: 0.1% | | | | |

(Cost: $97,756) | | | | |

| 97,756 | | Dreyfus Government Cash

Management Fund | | $ | 97,756 | |

| | | | |

| | | | | | | |

Total Investments Before Collateral for

Securities Loaned: 100.1% | | | | |

(Cost: $94,202,621) | | | 108,686,088 | |

| | | | |

SHORT-TERM INVESTMENT HELD AS

COLLATERAL FOR SECURITIES LOANED: 8.6% | | | |

(Cost: $9,387,308) | | | | |

| 9,387,308 | | Bank of New York Overnight

Government Fund | | | 9,387,308 | |

| | | | | | | |

Total Investments: 108.7% | | | | |

(Cost: $103,589,929) | | | 118,073,396 | |

Liabilities in excess of other assets: (8.7)% | | | (9,437,245) | |

| | | | |

NET ASSETS: 100.0% | | $ | 108,636,151 | |

| | | | |

| |

| | |

USD | United States Dollar |

* | Non-income producing |

† | Security fully or partially on loan. Total market value of securities on loan is $9,112,540. |

| | | | | | | | | | |

Summary of Investments by

Sector Excluding Collateral for

Securities Loaned (unaudited) | | | % of Investments | | Value | |

| | | | | | | |

Diagnostic Equipment | | | | 2.7 | % | | $ | 2,929,146 | |

Diagnostic Kits | | | | 3.2 | | | | 3,482,916 | |

Medical - Biomedical / Genetics | | | | 88.3 | | | | 95,978,951 | |

Therapeutics | | | | 5.7 | | | | 6,197,319 | |

Money Market Fund | | | | 0.1 | | | | 97,756 | |

| | | | | | | | | |

| | | | 100.0 | % | | $ | 108,686,088 | |

| | | | | | | | | |

The summary of inputs used to value the Fund’s investments as of March 31, 2012 is as follows:

| | | | | | | | | | | | | | | | | |

| | Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Value | |

| | | | | | | | | | |

Common Stocks* | | $ | 108,588,332 | | | $ | — | | | | $ | — | | | $ | 108,588,332 | |

Money Market Funds | | | 9,485,064 | | | | — | | | | | — | | | | 9,485,064 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 118,073,396 | | | $ | — | | | | $ | — | | | $ | 118,073,396 | |

| | | | | | | | | | | | | | | | | |

* See Schedule of Investments for security type and geographic sector breakouts.

See Notes to Financial Statements

13

|

ENVIRONMENTAL SERVICES ETF |

| |

SCHEDULE OF INVESTMENTS |

March 31, 2012 (unaudited) |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | | |

COMMON STOCKS: 100.0% | | | | |

Canada: 4.5% | | | | |

| 54,749 | | Progressive Waste Solutions Ltd. (USD) | | $ | 1,186,958 | |

| | | | | | | |

France: 9.9% | | | | |

| 158,034 | | Veolia Environnement S.A. (ADR) † | | | 2,609,141 | |

| | | | | | | |

United States: 85.6% | | | | |

| 77,170 | | Calgon Carbon Corp. * | | | 1,204,624 | |

| 82,148 | | Casella Waste Systems, Inc. * | | | 511,782 | |

| 17,592 | | Clean Harbors, Inc. * | | | 1,184,469 | |

| 73,796 | | Covanta Holding Corp. | | | 1,197,709 | |

| 68,746 | | Darling International, Inc. * | | | 1,197,555 | |

| 95,327 | | Fuel Tech, Inc. * | | | 520,485 | |

| 55,985 | | Layne Christensen Co. * | | | 1,245,666 | |

| 122,097 | | Metalico, Inc. * | | | 521,354 | |

| 147,324 | | Newpark Resources, Inc. * | | | 1,206,584 | |

| 330,115 | | Perma-Fix Environmental Services, Inc. * | | | 524,883 | |

| 570,621 | | Rentech, Inc. * | | | 1,186,892 | |

| 87,355 | | Republic Services, Inc. | | | 2,669,569 | |

| 38,512 | | Shaw Group, Inc. * | | | 1,221,216 | |

| 31,285 | | Stericycle, Inc. * | | | 2,616,677 | |

| 46,532 | | Tetra Tech, Inc. * | | | 1,226,584 | |

| 24,839 | | US Ecology, Inc. | | | 540,000 | |

| 37,490 | | Waste Connections, Inc. | | | 1,219,550 | |

| 75,706 | | Waste Management, Inc. | | | 2,646,682 | |

| | | | | | | |

| | | | | | 22,642,281 | |

| | | | | | | |

Total Common Stocks | | | | |

(Cost: $28,532,829) | | | 26,438,380 | |

| | | | |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | | |

MONEY MARKET FUND: 0.2% | | | | |

(Cost: $53,948) | | | | |

| 53,948 | | Dreyfus Government Cash

Management Fund | | $ | 53,948 | |

| | | | | | | |

Total Investments Before Collateral

for Securities Loaned: 100.2% | | | | |

(Cost: $28,586,777) | | | 26,492,328 | |

| | | | |

SHORT-TERM INVESTMENT HELD AS

COLLATERAL FOR SECURITIES LOANED: 1.2% | | | | |

(Cost: $317,396) | | | | |

| 317,396 | | Bank of New York Overnight

Government Fund | | | 317,396 | |

| | | | | | | |

Total Investments: 101.4% | | | | |

(Cost: $28,904,173) | | | 26,809,724 | |

Liabilities in excess of other assets: (1.4)% | | | (361,374) | |

| | | | |

NET ASSETS: 100.0% | | $ | 26,448,350 | |

| | | | |

| |

| | |

ADR | American Depositary Receipt

USD United States Dollar |

* | Non-income producing |

† | Security fully or partially on loan. Total market value of securities on loan is $309,058. |

| | | | | | | | | | |

Summary of Investments by Sector Excluding

Collateral for Securities Loaned (unaudited) | | | % of Investments | | Value | |

| | | | | | | |

Alternative Waste Technology | | | | 13.5 | % | | $ | 3,589,071 | |

Building & Construction | | | | 4.7 | | | | 1,245,666 | |

Engineering / R&D Services | | | | 4.6 | | | | 1,221,216 | |

Environment Consulting & Engineering | | | | 4.6 | | | | 1,226,584 | |

Hazardous Waste Disposal | | | | 18.4 | | | | 4,866,029 | |

Non-Hazardous Waste Disposal | | | | 35.6 | | | | 9,432,250 | |

Oil-Field Services | | | | 4.6 | | | | 1,206,584 | |

Pollution Control | | | | 2.0 | | | | 520,485 | |

Recycling | | | | 2.0 | | | | 521,354 | |

Water | | | | 9.8 | | | | 2,609,141 | |

Money Market Fund | | | | 0.2 | | | | 53,948 | |

| | | | | | | | | |

| | | | 100.0 | % | | $ | 26,492,328 | |

| | | | | | | | | |

The summary of inputs used to value the Fund’s investments as of March 31, 2012 is as follows:

| | | | | | | | | | | | | | | | | |

| | Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Value | |

| | | | | | | | | | |

Common Stocks* | | $ | 26,438,380 | | | $ | — | | | | $ | — | | | $ | 26,438,380 | |

Money Market Funds | | | 371,344 | | | | — | | | | | — | | | | 371,344 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 26,809,724 | | | $ | — | | | | $ | — | | | $ | 26,809,724 | |

| | | | | | | | | | | | | | | | | |

* See Schedule of Investments for security type and geographic sector breakouts.

See Notes to Financial Statements

14

|

GAMING ETF |

| |

SCHEDULE OF INVESTMENTS |

March 31, 2012 (unaudited) |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | |

COMMON STOCKS: 100.0% | | | | |

Australia: 7.9% | | | | |

| 301,371 | | Aristocrat Leisure Ltd. # | | $ | 941,375 | |

| 101,426 | | Consolidated Media Holdings Ltd. # | | | 306,450 | |

| 249,650 | | Crown Ltd. # | | | 2,253,150 | |

| 413,946 | | TABCORP Holdings Ltd. # | | | 1,166,763 | |

| 797,168 | | Tatts Group Ltd. # | | | 2,042,634 | |

| | | | | | | |

| | | | | | 6,710,372 | |

| | | | | | | |

Canada: 1.5% | | | | |

| 35,420 | | Great Canadian Gaming Corp. * | | | 285,642 | |

| 28,328 | | MI Developments, Inc. | | | 979,271 | |

| | | | | | | |

| | | | | | 1,264,913 | |

| | | | | | | |

China / Hong Kong: 20.8% | | | | |

| 1,329,240 | | Galaxy Entertainment Group Ltd. * # | | | 3,656,319 | |

| 188,508 | | Melco Crown Entertainment

Ltd. (ADR) * † | | | 2,565,594 | |

| 376,000 | | Nagacorp Ltd. # | | | 170,990 | |

| 1,444,800 | | Sands China Ltd. # | | | 5,642,576 | |

| 1,490,000 | | SJM Holdings Ltd. # | | | 3,037,299 | |

| 868,800 | | Wynn Macau Ltd. † # | | | 2,539,769 | |

| | | | | | | |

| | | | | | 17,612,547 | |

| | | | | | | |

Germany: 0.2% | | | | |

| 2,700 | | Tipp24 SE * # | | | 140,879 | |

| | | | | | | |

Greece: 1.5% | | | | |

| 127,245 | | OPAP S.A. # | | | 1,234,600 | |

| | | | | | | |

Ireland: 1.9% | | | | |

| 26,189 | | Paddy Power Plc # | | | 1,646,704 | |

| | | | | | | |

Italy: 0.9% | | | | |

| 41,938 | | Lottomatica S.p.A. * # | | | 795,028 | |

| | | | | | | |

Japan: 2.7% | | | | |

| 23,808 | | Heiwa Corp. # | | | 481,281 | |

| 30,273 | | Sankyo Co. Ltd. # | | | 1,498,411 | |

| 12,500 | | Universal Entertainment Corp. # | | | 282,397 | |

| | | | | | | |

| | | | | | 2,262,089 | |

| | | | | | | |

Malaysia: 9.2% | | | | |

| 441,451 | | Berjaya Sports Toto Bhd # | | | 630,266 | |

| 1,354,538 | | Genting Bhd # | | | 4,795,424 | |

| 1,807,598 | | Genting Malaysia Bhd # | | | 2,315,384 | |

| | | | | | | |

| | | | | | 7,741,074 | |

| | | | | | | |

New Zealand: 1.3% | | | | |

| 347,584 | | Sky City Entertainment Group Ltd. # | | | 1,121,873 | |

| | | | | | | |

South Africa: 2.3% | | | | |

| 57,266 | | Sun International Ltd. | | | 623,061 | |

| 543,731 | | Tsogo Sun Holdings Ltd. # | | | 1,292,526 | |

| | | | | | | |

| | | | | | 1,915,587 | |

| | | | | | | |

South Korea: 2.3% | | | | |

| 74,206 | | Kangwon Land, Inc. # | | | 1,648,486 | |

| 34,413 | | Paradise Co. Ltd. # | | | 267,148 | |

| | | | | | | |

| | | | | | 1,915,634 | |

| | | | | | | |

Sweden: 1.1% | | | | |

| 18,488 | | Betsson A.B. * # | | | 541,874 | |

| 14,995 | | Unibet Group Plc # | | | 419,164 | |

| | | | | | | |

| | | | | | 961,038 | |

| | | | | | | |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | |

United Kingdom: 7.8% | | | | |

| 429,115 | | Bwin.Party Digital Entertainment Plc # | | $ | 1,063,818 | |

| 219,528 | | IG Group Holdings Plc # | | | 1,578,943 | |

| 548,695 | | Ladbrokes Plc # | | | 1,403,079 | |

| 104,142 | | Playtech Ltd. | | | 606,086 | |

| 332,771 | | Sportingbet Plc # | | | 200,937 | |

| 424,213 | | William Hill Plc # | | | 1,771,312 | |

| | | | | | | |

| | | | | | 6,624,175 | |

| | | | | | | |

United States: 38.6% | | | | |

| 19,865 | | Ameristar Casinos, Inc. | | | 370,085 | |

| 25,933 | | Bally Technologies, Inc. * | | | 1,212,368 | |

| 32,969 | | Boyd Gaming Corp. * | | | 258,477 | |

| 7,580 | | Churchill Downs, Inc. | | | 423,722 | |

| 39,176 | | Global Cash Access Holdings, Inc. * | | | 305,573 | |

| 179,801 | | International Game Technology | | | 3,018,859 | |

| 243,560 | | Las Vegas Sands Corp. | | | 14,021,749 | |

| 215,670 | | MGM Mirage * | | | 2,937,425 | |

| 16,372 | | Multimedia Games Holding Co. Inc. * | | | 179,437 | |

| 39,192 | | Penn National Gaming, Inc. * | | | 1,684,472 | |

| 37,561 | | Pinnacle Entertainment, Inc. * | | | 432,327 | |

| 35,235 | | Scientific Games Corp. * | | | 410,840 | |

| 33,212 | | Shuffle Master, Inc. * | | | 584,531 | |

| 33,430 | | WMS Industries, Inc. * | | | 793,294 | |

| 47,998 | | Wynn Resorts Ltd. | | | 5,993,990 | |

| | | | | | | |

| | | | | | 32,627,149 | |

| | | | | | | |

Total Common Stocks | | | | |

(Cost: $61,181,301) | | | 84,573,662 | |

| | | | | | | |

MONEY MARKET FUND: 0.0% | | | | |

(Cost: $67) | | | | |

| 67 | | Dreyfus Government Cash

Management Fund | | | 67 | |

| | | | | | | |

Total Investments Before Collateral

for Securities Loaned: 100.0% | | | | |

(Cost: $61,181,368) | | | 84,573,729 | |

| | | | | | | |

SHORT-TERM INVESTMENT HELD AS

COLLATERAL FOR SECURITIES LOANED: 2.2% | | | | |

(Cost: $1,866,242) | | | | |

| 1,866,242 | | Bank of New York Overnight

Government Fund | | | 1,866,242 | |

| | | | | | | |

Total Investments: 102.2% | | | | |

(Cost: $63,047,610) | | | 86,439,971 | |

Liabilities in excess of other assets: (2.2)% | | | (1,849,155 | ) |

| | | | |

NET ASSETS: 100.0% | | $ | 84,590,816 | |

| | | | |

See Notes to Financial Statements

15

|

GAMING ETF |

| |

SCHEDULE OF INVESTMENTS |

(continued) |

| |

ADR | American Depositary Receipt |

* | Non-income producing |

† | Security fully or partially on loan. Total market value of securities on loan is $1,795,164. |

# | Indicates a fair valued security which has not been valued utilizing an independent quote, but has been valued pursuant to guidelines established by the Board of Trustees. The aggregate value of fair valued securities is $46,886,859 which represents 55.4% of net assets. |

| | | | | | | | | | |

Summary of Investments by

Sector Excluding Collateral for

Securities Loaned (unaudited) | | | % of Investments | | Value | |

| | | | | | | |

Casino Hotels | | | | 65.3 | % | | $ | 55,244,177 | |

Casino Services | | | | 6.9 | | | | 5,857,788 | |

Commercial Services - Finance | | | | 0.4 | | | | 305,573 | |

Computer Software | | | | 0.7 | | | | 606,086 | |

Finance - Other Services | | | | 1.9 | | | | 1,578,943 | |

Gambling (Non-Hotel) | | | | 13.1 | | | | 11,100,165 | |

Internet Gambling | | | | 2.6 | | | | 2,225,793 | |

Leisure & Recreation Products | | | | 0.9 | | | | 793,294 | |

Lottery Services | | | | 4.1 | | | | 3,467,928 | |

Multimedia | | | | 0.4 | | | | 306,450 | |

Racetracks | | | | 2.5 | | | | 2,108,194 | |

Real Estate Operation / Development | | | | 1.2 | | | | 979,271 | |

Money Market Fund | | | | 0.0 | | | | 67 | |

| | | | | | | | | |

| | | | 100.0 | % | | $ | 84,573,729 | |

| | | | | | | | | |

The summary of inputs used to value the Fund’s investments as of March 31, 2012 is as follows:

| | | | | | | | | | | | | | | |

| | Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Value | |

| | | | | | | | | |

Common Stocks | | | | | | | | | | | | | |

Australia | | $ | — | | $ | 6,710,372 | | | $ | — | | | $ | 6,710,372 | |

Canada | | | 1,264,913 | | | — | | | | — | | | | 1,264,913 | |

China / Hong Kong | | | 2,565,594 | | | 15,046,953 | | | | — | | | | 17,612,547 | |

Germany | | | — | | | 140,879 | | | | — | | | | 140,879 | |

Greece | | | — | | | 1,234,600 | | | | — | | | | 1,234,600 | |

Ireland | | | — | | | 1,646,704 | | | | — | | | | 1,646,704 | |

Italy | | | — | | | 795,028 | | | | — | | | | 795,028 | |

Japan | | | — | | | 2,262,089 | | | | — | | | | 2,262,089 | |

Malaysia | | | — | | | 7,741,074 | | | | — | | | | 7,741,074 | |

New Zealand | | | — | | | 1,121,873 | | | | — | | | | 1,121,873 | |

South Africa | | | 623,061 | | | 1,292,526 | | | | — | | | | 1,915,587 | |

South Korea | | | — | | | 1,915,634 | | | | — | | | | 1,915,634 | |

Sweden | | | — | | | 961,038 | | | | — | | | | 961,038 | |

United Kingdom | | | 606,086 | | | 6,018,089 | | | | — | | | | 6,624,175 | |

United States | | | 32,627,149 | | | — | | | | — | | | | 32,627,149 | |

Money Market Funds | | | 1,866,309 | | | — | | | | — | | | | 1,866,309 | |

| | | | | | | | | | | | | | | |

Total | | $ | 39,553,112 | | $ | 46,886,859 | | | $ | — | | | $ | 86,439,971 | |

| | | | | | | | | | | | | | | |

Transfers of securities from Level 2 to Level 1 during the period were $606,086. Transfers resulted primarily from changes in certain foreign securities valuation methodologies between the last close of the securities’ primary market (Level 1) and valuation by a pricing service (Level 2), which takes into account market direction or events occurring before the Fund’s pricing time but after the last local close, as described in the Notes to Financial Statements.

See Notes to Financial Statements

16

|

PHARMACEUTICAL ETF |

| |

SCHEDULE OF INVESTMENTS |

March 31, 2012 (unaudited) |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | |

COMMON STOCKS: 100.0% | | | | |

Canada: 4.3% | | | | |

| 208,949 | | Valeant Pharmaceuticals International,

Inc. (USD) * | | $ | 11,218,472 | |

| | | | | | | |

Denmark: 4.3% | | | | |

| 81,693 | | Novo-Nordisk A.S. (ADR) | | | 11,331,636 | |

| | | | | | | |

France: 5.0% | | | | |

| 339,981 | | Sanofi S.A. (ADR) | | | 13,174,264 | |

| | | | | | | |

Ireland: 7.2% | | | | |

| 389,630 | | Elan Corp. Plc (ADR) * | | | 5,848,346 | |

| 110,637 | | Shire Plc (ADR) | | | 10,482,856 | |

| 154,300 | | Warner Chilcott Plc (USD) * | | | 2,593,783 | |

| | | | | | | |

| | | | | | 18,924,985 | |

| | | | | | | |

Israel: 4.4% | | | | |

| 253,408 | | Teva Pharmaceutical Industries

Ltd. (ADR) | | | 11,418,564 | |

| | | | | | | |

Switzerland: 6.5% | | | | |

| 305,964 | | Novartis A.G. (ADR) | | | 16,953,465 | |

| | | | | | | |

United Kingdom: 10.4% | | | | |

| 283,457 | | AstraZeneca Plc (ADR) | | | 12,611,002 | |

| 323,252 | | GlaxoSmithKline Plc (ADR) | | | 14,517,247 | |

| | | | | | | |

| | | | | | 27,128,249 | |

| | | | | | | |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | | | | |

United States: 57.9% | | | | |

| 224,861 | | Abbott Laboratories | | $ | 13,781,731 | |

| 125,614 | | Allergan, Inc. | | | 11,987,344 | |

| 350,542 | | Bristol-Myers Squibb Co. | | | 11,830,793 | |

| 292,991 | | Eli Lilly & Co. | | | 11,798,748 | |

| 93,797 | | Endo Pharmaceuticals Holdings, Inc. * | | | 3,632,758 | |

| 211,271 | | Forest Laboratories, Inc. * | | | 7,328,991 | |

| 132,399 | | Hospira, Inc. * | | | 4,950,399 | |

| 351,613 | | Johnson & Johnson | | | 23,192,394 | |

| 42,604 | | Medicis Pharmaceutical Corp. | | | 1,601,484 | |

| 389,903 | | Merck & Co., Inc. | | | 14,972,275 | |

| 339,691 | | Mylan, Inc. * | | | 7,965,754 | |

| 69,920 | | Perrigo Co. | | | 7,223,435 | |

| 965,599 | | Pfizer, Inc. | | | 21,880,473 | |

| 45,850 | | Salix Pharmaceuticals Ltd. * | | | 2,407,125 | |

| 100,157 | | Watson Pharmaceuticals, Inc. * | | | 6,716,528 | |

| | | | | | | |

| | | | | | 151,270,232 | |

| | | | | | | |

Total Common Stocks | | | | |

(Cost: $252,972,100) | | | 261,419,867 | |

Liabilities in excess of other assets: (0.0)% | | | (125,796 | ) |

| | | | | | | |

NET ASSETS: 100.0% | | $ | 261,294,071 | |

| | | | |

| |

| | |

ADR | American Depositary Receipt |

USD | United States Dollar |

* | Non-income producing |

| | | | | | | | | | |

Summary of Investments

by Sector (unaudited) | | | % of Investments | | Value | |

| | | | | | | |

Medical - Drugs | | | | 84.4 | % | | $ | 220,551,404 | |

Medical - Generic Drugs | | | | 12.7 | | | | 33,324,281 | |

Medical Products | | | | 1.9 | | | | 4,950,399 | |

Therapeutics | | | | 1.0 | | | | 2,593,783 | |

| | | | | | | | | |

| | | | 100.0 | % | | $ | 261,419,867 | |

| | | | | | | | | |

The summary of inputs used to value the Fund’s investments as of March 31, 2012 is as follows:

| | | | | | | | | | | | | | | | | |

| | Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Value | |

| | | | | | | | | |

Common Stocks* | | $ | 261,419,867 | | | $ | — | | | | $ | — | | | $ | 261,419,867 | |

| | | | | | | | | | | | | | | | | |

* See Schedule of Investments for security type and geographic sector breakouts.

See Notes to Financial Statements

17

|

RETAIL ETF |

| |

SCHEDULE OF INVESTMENTS |

March 31, 2012 (unaudited) |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | | | | |

COMMON STOCKS: 100.0% | | | | |

United States: 100.0% | | | | |

| 28,483 | | Amazon.com, Inc. * | | $ | 5,768,092 | |

| 38,772 | | AmerisourceBergen Corp. | | | 1,538,473 | |

| 35,545 | | Bed Bath & Beyond, Inc. * | | | 2,337,795 | |

| 42,037 | | Best Buy Co., Inc. | | | 995,436 | |

| 51,458 | | Cardinal Health, Inc. | | | 2,218,354 | |

| 38,294 | | Costco Wholesale Corp. | | | 3,477,095 | |

| 100,636 | | CVS Caremark Corp. | | | 4,508,493 | |

| 117,927 | | Home Depot, Inc. | | | 5,932,907 | |

| 20,111 | | JC Penney Co., Inc. | | | 712,533 | |

| 33,491 | | Kohl’s Corp. | | | 1,675,555 | |

| 82,067 | | Kroger Co. | | | 1,988,484 | |

| 116,579 | | Lowe’s Cos., Inc. | | | 3,658,249 | |

| 36,912 | | Ltd Brands, Inc. | | | 1,771,776 | |

| 63,769 | | MACY’S, Inc. | | | 2,533,542 | |

| 36,490 | | McKesson Corp. | | | 3,202,727 | |

| 8,165 | | Netflix, Inc. * | | | 939,302 | |

| 40,301 | | Safeway, Inc. † | | | 814,483 | |

| 104,377 | | Staples, Inc. | | | 1,688,820 | |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | |

United States: (continued) | | | | |

| 88,794 | | Sysco Corp. | | $ | 2,651,389 | |

| 59,421 | | Target Corp. | | | 3,462,462 | |

| 45,245 | | The Gap, Inc. | | | 1,182,704 | |

| 81,514 | | TJX Cos., Inc. | | | 3,236,921 | |

| 92,378 | | Walgreen Co. | | | 3,093,739 | |

| 137,607 | | Wal-Mart Stores, Inc. | | | 8,421,548 | |

| 27,424 | | Whole Foods Market, Inc. | | | 2,281,677 | |

| | | | | | | |

Total Common Stocks | | | | |

(Cost: $67,307,955) | | | 70,092,556 | |

| | | | | | | |

SHORT-TERM INVESTMENT HELD AS | | | | |

COLLATERAL FOR SECURITIES LOANED: 0.2% | | | | |

(Cost: $126,336) | | | | |

| 126,336 | | Bank of New York Overnight

Government Fund | | | 126,336 | |

| | | | | | | |

Total Investments: 100.2% | | | | |

(Cost: $67,434,291) | | | 70,218,892 | |

Liabilities in excess of other assets: (0.2)% | | | (166,237 | ) |

| | | | |

NET ASSETS: 100.0% | | $ | 70,052,655 | |

| | | | |

| |

| | |

|

* | Non-income producing |

† | Security fully or partially on loan. Total market value of securities on loan is $123,208. |

| | | | | | | | | | |

Summary of Investments by

Sector Excluding Collateral for

Securities Loaned (unaudited) | | | % of Investments | | Value | |

| | | | | | | |

E-Commerce / Products | | | | 9.6 | % | | $ | 6,707,394 | |

Food - Retail | | | | 7.3 | | | | 5,084,644 | |

Food - Wholesale / Distribution | | | | 3.8 | | | | 2,651,389 | |

Medical - Wholesale Drug Distributors | | | | 9.9 | | | | 6,959,554 | |

Retail - Apparel / Shoes | | | | 4.2 | | | | 2,954,480 | |

Retail - Bedding | | | | 3.3 | | | | 2,337,795 | |

Retail - Building Products | | | | 13.7 | | | | 9,591,156 | |

Retail - Consumer Electronics | | | | 1.4 | | | | 995,436 | |

Retail - Discount | | | | 21.9 | | | | 15,361,105 | |

Retail - Drug Store | | | | 10.9 | | | | 7,602,232 | |

Retail - Major Department Store | | | | 5.6 | | | | 3,949,454 | |

Retail - Office Supplies | | | | 2.4 | | | | 1,688,820 | |

Retail - Regional Department Store | | | | 6.0 | | | | 4,209,097 | |

| | | | | | | | | |

| | | | 100.0 | % | | $ | 70,092,556 | |

| | | | | | | | | |

The summary of inputs used to value the Fund’s investments as of March 31, 2012 is as follows:

| | | | | | | | | | | | | | | | | |

| | Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Value | |

| | | | | | | | | |

Common Stocks * | | $ | 70,092,556 | | | $ | — | | | | $ | — | | | $ | 70,092,556 | |

Money Market Fund | | | 126,336 | | | | — | | | | | — | | | | 126,336 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 70,218,892 | | | $ | — | | | | $ | — | | | $ | 70,218,892 | |

| | | | | | | | | | | | | | | | | |

* See Schedule of Investments for security type and geographic sector breakouts.

See Notes to Financial Statements

18

|

SEMICONDUCTOR ETF |

| |

SCHEDULE OF INVESTMENTS |

March 31, 2012 (unaudited) |

| | �� | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | | | | |

COMMON STOCKS: 100.0% | | | | |

Bermuda: 2.4% | | | | |

| 490,206 | | Marvell Technology Group Ltd. (USD) * | | $ | 7,710,940 | |

| | | | | | | |

Netherlands: 5.2% | | | | |

| 328,787 | | ASML Holding N.V. (USD) | | | 16,485,380 | |

| | | | | | | |

Singapore: 2.8% | | | | |

| 227,863 | | Avago Technologies Ltd. (USD) | | | 8,879,821 | |

| | | | | | | |

Taiwan: 12.7% | | | | |

| 2,645,333 | | Taiwan Semiconductor

Manufacturing Co. Ltd. (ADR) | | | 40,420,688 | |

| | | | | | | |

United Kingdom: 4.2% | | | | |

| 465,157 | | ARM Holdings Plc (ADR) | | | 13,159,292 | |

| | | | | | | |

United States: 72.7% | | | | |

| 601,124 | | Advanced Micro Devices, Inc. * | | | 4,821,014 | |

| 330,286 | | Altera Corp. | | | 13,151,989 | |

| 299,036 | | Analog Devices, Inc. | | | 12,081,054 | |

| 1,116,161 | | Applied Materials, Inc. | | | 13,885,043 | |

| 452,761 | | Atmel Corp. * | | | 4,464,223 | |

| 426,795 | | Broadcom Corp. * | | | 16,773,044 | |

| 115,386 | | Cree, Inc. * † | | | 3,649,659 | |

| 2,230,560 | | Intel Corp. | | | 62,701,042 | |

| 170,825 | | KLA-Tencor Corp. | | | 9,296,297 | |

| 121,586 | | Lam Research Corp. * † | | | 5,425,167 | |

| 213,482 | | Linear Technology Corp. | | | 7,194,343 | |

| 295,951 | | Maxim Integrated Products, Inc. | | | 8,461,239 | |

| 190,870 | | Microchip Technology, Inc. † | | | 7,100,364 | |

| 981,703 | | Micron Technology, Inc. * | | | 7,951,794 | |

| 594,353 | | NVIDIA Corp. * | | | 9,147,093 | |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

| | | | |

United States: (continued) | | | | |

| 458,605 | | ON Semiconductor Corp. * | | $ | 4,132,031 | |

| 191,114 | | Skyworks Solutions, Inc. * | | | 5,284,302 | |

| 189,125 | | Teradyne, Inc. * | | | 3,194,321 | |

| 671,719 | | Texas Instruments, Inc. | | | 22,576,476 | |

| 268,264 | | Xilinx, Inc. | | | 9,772,858 | |

| | | | | | | |

| | | | | | 231,063,353 | |

| | | | | | | |

Total Common Stocks | | | | |

(Cost: $304,570,793) | | | 317,719,474 | |

| | | | | | | |

MONEY MARKET FUND: 0.0% | | | | |

(Cost: $153,558) | | | | |

| 153,558 | | Dreyfus Government Cash

Management Fund | | | 153,558 | |

| | | | | | | |

Total Investments Before Collateral

for Securities Loaned: 100.0% | | | | |

(Cost: $304,724,351) | | | 317,873,032 | |

| | | | |

SHORT-TERM INVESTMENT HELD AS

COLLATERAL FOR SECURITIES LOANED: 4.8% | | | | |

(Cost: $15,214,532) | | | | |

| 15,214,532 | | Bank of New York Overnight

Government Fund | | | 15,214,532 | |

| | | | | | | |

Total Investments: 104.8% | | | | |

(Cost: $319,938,883) | | | 333,087,564 | |

Liabilities in excess of other assets: (4.8)% | | | (15,343,252 | ) |

| | | | |

NET ASSETS: 100.0% | | $ | 317,744,312 | |

| | | | |

| |

| | |

| |

ADR | American Depositary Receipt |

USD | United States Dollar |

* | Non-income producing |

† | Security fully or partially on loan. Total market value of securities on loan is $14,895,144. |

| | | | | | | | | | |

Summary of Investments by

Sector Excluding Collateral for

Securities Loaned (unaudited) | | | % of Investments | | Value | |

| | | | | | | |

Electronic Component - Semiconductors | | | | 59.5 | % | | $ | 189,100,779 | |

Semiconductor Component - Integrated Circuits | | | | 25.3 | | | | 80,332,487 | |

Semiconductor Equipment | | | | 15.2 | | | | 48,286,208 | |

Money Market Fund | | | | 0.0 | | | | 153,558 | |

| | | | | | | | | |

| | | | 100.0 | % | | $ | 317,873,032 | |

| | | | | | | | | |

The summary of inputs used to value the Fund’s investments as of March 31, 2012 is as follows:

| | | | | | | | | | | | | | | | | |

| | Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Value | |

| | | | | | | | | |

Common Stocks* | | $ | 317,719,474 | | | $ | — | | | | $ | — | | | $ | 317,719,474 | |

Money Market Funds | | | 15,368,090 | | | | — | | | | | — | | | | 15,368,090 | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 333,087,564 | | | $ | — | | | | $ | — | | | $ | 333,087,564 | |

| | | | | | | | | | | | | | | | | |

* See Schedule of Investments for security type and geographic sector breakouts.

See Notes to Financial Statements

19

|

MARKET VECTORS ETF TRUST |

| |

STATEMENTS OF ASSETS AND LIABILITIES |

March 31, 2012 (unaudited) |

| | | | | | | | | | | | | |

| | Bank &

Brokerage

ETF * | | Biotech

ETF * | | Environmental

Services

ETF | |

| | | | | | | |

Assets: | | | | | | | | | | |

Investments, at value (1) (2) | | $ | 36,201,878 | | $ | 108,686,088 | | | $ | 26,492,328 | | |

Short term investment held as collateral for securities loaned (3) | | | 1,429,317 | | | 9,387,308 | | | | 317,396 | | |

Receivables: | | | | | | | | | | | | |

Shares sold | | | — | | | — | | | | 549,266 | | |

Due from Adviser | | | 56 | | | — | | | | — | | |

Dividends | | | 70,781 | | | 12,812 | | | | 48,329 | | |

Prepaid expenses | | | — | | | — | | | | 300 | | |

| | | | | | | | | | | | |

Total assets | | | 37,702,032 | | | 118,086,208 | | | | 27,407,619 | | |

| | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | |

Payables: | | | | | | | | | | | | |

Investment securities purchased | | | 72,356 | | | — | | | | — | | |

Collateral for securities loaned | | | 1,429,317 | | | 9,387,308 | | | | 317,396 | | |

Line of credit | | | — | | | — | | | | — | | |

Shares redeemed | | | — | | | — | | | | 582,662 | | |

Due to Adviser | | | — | | | 19,127 | | | | 4,008 | | |

Due to custodian | | | 1,431 | | | — | | | | — | | |