UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 333-123257

MARKET VECTORS ETF TRUST

(Exact name of registrant as specified in charter)

335 Madison Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

335 MADISON AVENUE, NEW YORK, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: APRIL 30

Date of reporting period: OCTOBER 31, 2012

ITEM 1. REPORT TO SHAREHOLDERS

|

|

|

|

| SEMI-ANNUAL REPORT |

| O C T O B E R 3 1 , 2 0 1 2 |

|

|

MARKET VECTORS |

|

MUNICIPAL INCOME ETFs |

|

|

|

CEF Municipal Income ETF | XMPT |

|

|

High-Yield Municipal Index ETF | HYD |

|

|

Intermediate Municipal Index ETF | ITM |

|

|

Long Municipal Index ETF | MLN |

|

|

Pre-Refunded Municipal Index ETF | PRB® |

|

|

Short Municipal Index ETF | SMB |

|

|

TABLE OF CONTENTS |

|

|

|

| |

| |

Management Discussion | 1 |

Performance Record |

|

5 | |

6 | |

7 | |

8 | |

9 | |

10 | |

11 | |

| |

12 | |

14 | |

25 | |

45 | |

52 | |

55 | |

64 | |

66 | |

68 | |

| |

71 | |

71 | |

72 | |

73 | |

74 | |

75 | |

76 | |

83 |

|

Dear Shareholder:

We are pleased to present this semi-annual report for the municipal income exchange-traded funds of the Market Vectors ETF Trust for the six months ended October 31, 2012.

During this period, bond exchange-traded funds (ETFs) continued to benefit from low interest rates and investors’ appetite for yield. According to the Investment Company Institute, 205 bond ETFs were traded on U.S. exchanges as of October, and they held $238.7 billion in total assets. The number of bond ETFs increased by 25.0% year-over-year and their assets grew by 37.0%. Bond ETFs now account for 17.2% of total ETFs and 18.8% of total ETF assets.1

In total, including equity ETFs, Market Vectors has grown into the fifth largest ETF family in the U.S. based on assets, with $28.0 billion invested in 50 funds.2

Two municipal bond ETFs that have seen substantial investor interest over the past six-month period and throughout 2012:

|

|

• | HYD offers investors targeted exposure to the highest yielding securities in municipal bond market. As of the end of October, the fund’s assets had grown by 171% since the beginning of 2012. |

|

|

• | ITM is designed to replicate an index of medium-duration bonds with a nominal maturity of 6-17 years. As of the end of October, the fund’s assets had grown by 83% since the beginning of 2012. |

Market Review

During this period, investors continued to search for yield, and net inflows stayed strong in virtually all segments of the bond fund market, especially tax-exempt municipals. Once again, a major driver was action taken by the Federal Reserve Bank (the “Fed”) to maintain exceptionally low interest rates, while also adding to the mountainous pile of securities it is buying.

On September 13, Fed Chairman Ben Bernanke announced a third round of aggressive bond buying (quantitative easing (QE 3)), while also promising to maintain low short-term rates through 2015. The Fed will buy $40 billion of mortgage-backed securities per month until it believes U.S. economic conditions have improved. When QE3 is combined with ongoing interest reinvestment on Fed holdings and the “Operation Twist” maturity extension program, the Fed’s bond-buying demand will total $85 billion per month through the end of 2012.

Although the Fed’s actions did not greatly exceed analysts’ expectations, the combination of the 2015 low-rate extension and a bottomless well of bond buying is expected to sustain investors demand for most types of debt instruments. By explicitly linking the duration of QE3 to the outlook for labor market improvement, the Fed made a more open-ended commitment than in its predecessor programs.

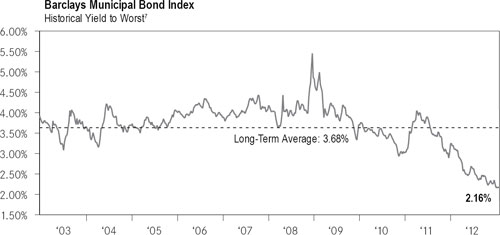

Throughout 2012, strong investor demand for tax-exempt bonds and moderate new issuance has worked in tandem with Fed easing to drive municipal yields lower. In October, the yield-to-worst on the Barclays Municipal Bond Index fell to 2.16%, its lowest level in ten years. However, this was still above Treasury yields, which also continued on a downward slope. As of October 31, the ratio of 10-year municipal investment grade general obligation (GO) yields to Treasuries was at 104.0%.3

|

|

| |

Yield-to-Worst measures the lowest of either yield-to-maturity or yield-to-call date on every possible call date. | |

1

|

MARKET VECTORS MUNICIPAL INCOME ETFs |

|

Market Fundamentals Push Yields to Lowest Level in Ten Years |

|

|

| Source: FactSet. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. |

During the 2012 election season, political debates over federal income tax rates helped to remind high-income investors of municipal bonds’ tax benefits. For example:

|

|

• | As of October 23, 2012, 10-year U.S. Treasuries were yielding 1.76%, compared to 2.16% for the Barclays Municipal Index. For an investor in today’s top federal bracket (35%), the municipal index produces a taxable equivalent yield (TEY) of 3.32%. However, if the “Bush tax cuts” expire for this investor, as President Obama vowed to accomplish during the election, the top federal rate would go to 39.6% and TEY would rise to 3.58%. |

|

|

• | Under existing law, a new Unearned Income Medicare Contributions Tax (UIMCT) will take effect on January 1, 2013. This 3.8% surtax on unearned income will apply on net investment income in excess of modified adjusted gross incomes of $200,000 for single filers or $250,000 for joint filers. Since municipal bond interest is excluded from the UIMCT calculation (while Treasury interest is included), TEY calculators will change for high-income taxpayers. In the above example, the TEY for a taxpayer subject to UIMCT would increase from 3.58% to 3.82%.4 |

The flipside of these tax benefits is their potential vulnerability to tax reform proposals to increase federal revenues. In October, the nonpartisan Congressional Committee on Taxation included in its revenue-raising analysis a repeal of the interest exclusion on municipal bonds issued after December 31, 2012. Coincidentally, this report came only a few days before Hurricane Sandy devastated the Northeast corridor of the U.S., potentially adding billions of dollars of clean-up and infrastructure repair costs to municipal budgets. Any actions taken in Washington to limit or cap municipal interest tax-exemption would greatly increase municipalities’ cost of financing, at a tenuous time.

In 2011, Harrisburg, PA, was the only municipal general obligation (GO) issuer to default, among 9,700 issues rated by Moody’s.5 In 2012, three California communities–San Bernardino, Stockton and Mammoth Lakes–filed for bankruptcy in late June and early July. A month later, Moody’s indicated that it would review the ratings of 93 community development districts in California due to concerns over rising credit risks. Then, in October, Moody’s clarified that its primary focus was just on 30 California cities that are candidates for downgrades.

|

|

| |

Yield-to-Worst is generally defined as being the lowest yield that a buyer can expect to receive. | |

2

|

While these developments are meaningful, they overshadow a more important storyline in the $3.7 trillion municipal securities market, where the SEC recently reported that 75% of assets are held by individual “retail” investors.6 As the U.S. economy has continued its steady recovery in 2012, municipal bond credit ratings have stabilized overall. Since the onset of the financial crisis in 2008, despite loud and dire warnings about municipalities’ solvency, defaults in this market have trended to and likely below long-term historic averages in number or dollar amounts. Now, the market’s overall credit health appears to be gradually improving almost everywhere, even in most parts of California, due to the steady recovery of the U.S. economy and state/local tax revenues.

Today’s municipal market is characterized by healthy inflows balanced against new bond issuance, which only recently has accelerated and approached the normal historic pattern. Recently, we have seen municipals attracting more institutional demand, in addition to the always–dependable retail investors. Re-investable cash–in the form of called bonds, reinvested coupons and maturing bonds–has propelled muni performance through the third quarter and should continue to drive demand into 2013.

Along the full spectrum of market participants, ranging from professional analysts to the investing public, we are seeing a general awareness that municipal credit quality has been strong enough to survive a big downturn in the U.S. economy and then rebound impressively, without series credit impairments or widespread defaults. This experience has added strength to the market and made it worthy of inclusion as an asset class in millions of portfolios.

Interested in receiving a weekly blog on the municipal bond market? Call 888.MKT.VCTR to receive a complimentary subscription to Muni Nation, written Jim Colby, portfolio manager and senior municipal strategist.

On the following pages, you will find the performance record of each of the funds for the six-month period ended October 31, 2012. You will also find their financial statements and portfolio information. We value your ongoing confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

Trustee and President

Market Vectors ETF Trust

December 4, 2012

3

|

MARKET VECTORS MUNICIPAL INCOME ETFs |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

|

|

1 | Exchange-Traded Fund Data, September 2012, Investment Company Institute: |

2 | ETF League Table as of 11/26/12: http://www.indexuniverse.com/sections/news/15251-etf-league-table-as-of-nov-26-2012.html?utm_source=newsletter&utm_medium=email&utm_campaign=DailyEmailBlast |

3 | SIFMA Municipal Bond Credit Report Third Quarter 2012: www.sifma.org/WorkArea/DownloadAsset.aspx?id=17179869197 |

4 | Tax Equivalent Yield (TEY) represents the yield a taxable bond would have to earn in order to match – after taxes –the yield available on a tax-exempt municipal bond and is calculated as follows: Tax Equivalent Yield = Tax Free Municipal Bond Yield/(1 -Tax Rate). |

5 | Bloomberg, 3/7/12: http://www.bloomberg.com/news/2012-03-07/u-s-municipal-bond-defaults-rose-in-past-two-years-moody-s-report-says.html |

6 | SEC Recommends Improvements to Help Investors in Municipal Securities Market 7/31/12: http://www.sec.gov/news/press/2012/2012-147.htm |

7 | Yield to Worst is generally defined as being the lowest yield that a buyer can expect to receive. Figures based on yield to worst of The Barclays Municipal Bond Index. Indexes are unmanaged and are not securities in which an investment can be made. |

4

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| CEFMXTR2 |

| |||

Six Months |

| 8.48 | % |

| 8.77 | % |

| 8.95 | % |

|

One Year |

| 20.90 | % |

| 21.04 | % |

| 21.57 | % |

|

Life* (annualized) |

| 19.57 | % |

| 19.39 | % |

| 19.85 | % |

|

Life* (cumulative) |

| 26.24 | % |

| 26.00 | % |

| 26.69 | % |

|

*since 7/12/11 |

|

|

|

|

|

|

|

|

|

|

Commencement date for the Market Vectors CEF Municipal Income ETF was 7/12/11.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/12/11) to the first day of secondary market trading in shares of the Fund (7/13/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 1.32% / Net Expense Ratio 0.40%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes, extraordinary expenses and Acquired Fund Fees and Expenses) from exceeding 0.40% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | S-Network Municipal Bond Closed-End Fund IndexSM (CEFMXTR) is composed of shares of municipal closed-end funds listed in the United States that are principally engaged in asset management processes designed to produce federally tax-exempt annual yield. |

|

|

| S-Network Municipal Bond Closed-End Fund IndexSM is calculated and maintained by S-Network Global Indexes, LLC. S-Network does not sponsor, endorse, or promote the Fund and bears no liability with respect to the Fund or any security. |

5

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| LMEHTR2 |

| |||

| ||||||||||

Six Months |

| 6.98 | % |

| 7.07 | % |

| 6.91 | % |

|

| ||||||||||

One Year |

| 16.94 | % |

| 17.72 | % |

| 16.41 | % |

|

| ||||||||||

Life* (annualized) |

| 13.94 | % |

| 13.89 | % |

| 14.69 | % |

|

| ||||||||||

Life* (cumulative) |

| 62.86 | % |

| 62.56 | % |

| 66.95 | % |

|

| ||||||||||

*since 2/4/09 |

|

|

|

|

|

|

|

|

|

|

Commencement date for the Market Vectors High-Yield Municipal Index ETF was 2/4/09.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (2/4/09) to the first day of secondary market trading in shares of the Fund (2/5/09), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Annual Fund Operating Expenses 0.35%

The Investment Management Agreement between Market Vectors ETF Trust and Van Eck Associates Corporation (the “Adviser”) provides that the Adviser will pay all expenses of the Fund, except for the fee payment under the Investment Management Agreement, interest expense, offering costs, trading expenses, taxes and extraordinary expenses.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | Barclays Municipal Custom High Yield Composite Index (LMEHTR) is made up of a 25%/75% blend of investment grade triple-B and non-investment grade munis, and draws 75% of its holdings from bonds issued as part of transaction sizes of $100 million or more. To be included in the Index, bonds must have an outstanding par value of at least $3 million for non-investment grade and $7 million for investment grade; 25% of index in investment-grade triple-B bonds issued as part of transaction sizes of at least $100 million in value; 50% of index in non-investment grade bonds issued as part of transaction of at least $100 million; 25% of index in non-investment grade bonds issued as part of transaction of $20–$100 million in size; fixed rate; nominal maturity of greater than one year; dated-date after 12/31/1990. |

|

|

| Barclays Inc. does not sponsor, endorse, or promote the Fund and bears no liability with respect to any such Funds or security. |

6

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| LMT2TR2 |

| |||

Six Months |

| 3.33 | % |

| 3.34 | % |

| 3.64 | % |

|

One Year |

| 9.84 | % |

| 9.81 | % |

| 10.41 | % |

|

Life* (annualized) |

| 6.21 | % |

| 6.18 | % |

| 7.01 | % |

|

Life* (cumulative) |

| 34.42 | % |

| 34.24 | % |

| 39.47 | % |

|

*since 12/4/07 |

|

|

|

|

|

|

|

|

|

|

Commencement date for the Market Vectors Intermediate Municipal Index ETF was 12/4/07.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (12/4/07) to the first day of secondary market trading in shares of the Fund (12/6/07), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Annual Fund Operating Expenses 0.24%

The Investment Management Agreement between Market Vectors ETF Trust and Van Eck Associates Corporation (the “Adviser”) provides that the Adviser will pay all expenses of the Fund, except for the fee payment under the Investment Management Agreement, interest expense, offering costs, trading expenses, taxes and extraordinary expenses.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | Barclays AMT-Free Intermediate Continuous Municipal Index (LMT2TR) is comprised of bonds that must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, S&P, Fitch. If only two of the three agencies rate the security, the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment-grade. They must have an outstanding par value of at least $7 million and be issued as part of a transaction of at least $75 million. The bonds must be fixed rate, have a dated-date within the last five years, and must be at least six years but less than seventeen years from their maturity date. Remarketed issues, taxable municipal bonds, AMT municipal bonds, bonds with floating rates, and derivatives, are excluded from the benchmark. |

|

|

| Barclays Inc. does not sponsor, endorse, or promote the Fund and bears no liability with respect to any such Fund or security. |

7

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| LMT3TR2 |

| |||

Six Months |

| 5.36 | % |

| 5.37 | % |

| 5.47 | % |

|

One Year |

| 13.79 | % |

| 13.38 | % |

| 13.89 | % |

|

Life* (annualized) |

| 4.93 | % |

| 4.88 | % |

| 6.62 | % |

|

Life* (cumulative) |

| 26.14 | % |

| 25.86 | % |

| 36.29 | % |

|

*since 1/2/08 |

|

|

|

|

|

|

|

|

|

|

Commencement date for the Market Vectors Long Municipal Index ETF was 1/2/08.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (1/2/08) to the first day of secondary market trading in shares of the Fund (1/7/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Annual Fund Operating Expenses 0.24%

The Investment Management Agreement between Market Vectors ETF Trust and Van Eck Associates Corporation (the “Adviser”) provides that the Adviser will pay all expenses of the Fund, except for the fee payment under the Investment Management Agreement, interest expense, offering costs, trading expenses, taxes and extraordinary expenses.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | Barclays AMT-Free Long Continuous Municipal Index (LMT3TR) is comprised of bonds that must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, S&P, Fitch. If only two of the three agencies rate the security, the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment-grade. They must have an outstanding par value of at least $7 million and be issued as part of a transaction of at least $75 million. The bonds must be fixed rate, have a dated-date within the last five years, and must be at least seventeen years from their maturity date. Remarketed issues, taxable municipal bonds, AMT municipal bonds, bonds with floating rates, and derivatives, are excluded from the benchmark. |

|

|

| Barclays Inc. does not sponsor, endorse, or promote the Fund and bears no liability with respect to any such Fund or security. |

8

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| LMPETR2 |

| |||

Six Months |

| 1.60 | % |

| 1.24 | % |

| 0.66 | % |

|

One Year |

| 3.68 | % |

| 3.02 | % |

| 2.17 | % |

|

Life* (annualized) |

| 2.20 | % |

| 2.18 | % |

| 2.34 | % |

|

Life* (cumulative) |

| 8.49 | % |

| 8.40 | % |

| 9.04 | % |

|

*since 2/2/09 |

|

|

|

|

|

|

|

|

|

|

Commencement date for the Market Vectors Pre-Refunded Municipal Index ETF was 2/2/09.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (2/2/09) to the first day of secondary market trading in shares of the Fund (2/3/09), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Annual Fund Operating Expenses 0.24%

The Investment Management Agreement between Market Vectors ETF Trust and Van Eck Associates Corporation (the “Adviser”) provides that the Adviser will pay all expenses of the Fund, except for the fee payment under the Investment Management Agreement, interest expense, offering costs, trading expenses, taxes and extraordinary expenses.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | Barclays Municipal Pre-Refunded–Treasury-Escrowed Index (LMPETR) is comprised of pre-refunded and escrowed-to-maturity municipal securities secured by an escrow or trust account containing obligations that are directly issued or unconditionally guaranteed by the U.S. government. The escrowed securities consist solely of U.S. Treasury obligations. To be included in the Index, bonds must have a nominal maturity of 1–30 years; outstanding par value of at least $7 million; issued as part of transaction of at least $75 million in value; fixed rate coupon and denominated in U.S. dollars. |

|

|

| Barclays Inc. does not sponsor, endorse, or promote the Fund and bears no liability with respect to any such Fund or security. |

9

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| LMT1TR2 |

| |||

Six Months |

| 1.07 | % |

| 1.18 | % |

| 1.33 | % |

|

One Year |

| 3.20 | % |

| 3.32 | % |

| 3.97 | % |

|

Life* (annualized) |

| 3.90 | % |

| 3.86 | % |

| 4.42 | % |

|

Life* (cumulative) |

| 19.68 | % |

| 19.43 | % |

| 22.51 | % |

|

*since 2/22/08 |

|

|

|

|

|

|

|

|

|

|

Commencement date for the Market Vectors Short Municipal Index ETF was 2/22/08.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (2/22/08) to the first day of secondary market trading in shares of the Fund (2/26/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Annual Fund Operating Expenses 0.20%

The Investment Management Agreement between Market Vectors ETF Trust and Van Eck Associates Corporation (the “Adviser”) provides that the Adviser will pay all expenses of the Fund, except for the fee payment under the Investment Management Agreement, interest expense, offering costs, trading expenses, taxes and extraordinary expenses.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | Barclays AMT-Free Short Continuous Municipal Index (LMT1TR) is comprised of bonds that must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, S&P, Fitch. If only two of the three agencies rate the security, the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment-grade. They must have an outstanding par value of at least $7 million and be issued as part of a transaction of at least $75 million. The bonds must be fixed rate, have a dated-date within the last five years, and must be at least one year but less than six years from their maturity date. Remarketed issues, taxable municipal bonds, AMT municipal bonds, bonds with floating rates, and derivatives, are excluded from the benchmark. |

|

|

| Barclays Inc. does not sponsor, endorse, or promote the Fund and bears no liability with respect to any such Fund or security. |

10

|

MARKET VECTORS ETF TRUST |

(unaudited) |

As a shareholder of a Fund, you incur operating expenses, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, May 1, 2012 to October 31, 2012.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as fees on purchase payments. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning |

| Ending |

| Annualized |

| Expenses Paid |

| ||||||||||

CEF Municipal Income ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Actual |

|

| $ | 1,000.00 |

|

|

| $ | 1,087.70 |

|

| 0.40 | % |

|

| $ | 2.10 |

|

|

| Hypothetical** |

|

| $ | 1,000.00 |

|

|

| $ | 1,023.19 |

|

| 0.40 | % |

|

| $ | 2.04 |

|

|

High-Yield Municipal Index ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Actual |

|

| $ | 1,000.00 |

|

|

| $ | 1,070.70 |

|

| 0.35 | % |

|

| $ | 1.83 |

|

|

| Hypothetical** |

|

| $ | 1,000.00 |

|

|

| $ | 1,023.44 |

|

| 0.35 | % |

|

| $ | 1.79 |

|

|

Intermediate Municipal Index ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Actual |

|

| $ | 1,000.00 |

|

|

| $ | 1,033.40 |

|

| 0.24 | % |

|

| $ | 1.23 |

|

|

| Hypothetical** |

|

| $ | 1,000.00 |

|

|

| $ | 1,024.00 |

|

| 0.24 | % |

|

| $ | 1.22 |

|

|

Long Municipal Index ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Actual |

|

| $ | 1,000.00 |

|

|

| $ | 1,053.70 |

|

| 0.24 | % |

|

| $ | 1.24 |

|

|

| Hypothetical** |

|

| $ | 1,000.00 |

|

|

| $ | 1,024.00 |

|

| 0.24 | % |

|

| $ | 1.22 |

|

|

Pre-Refunded Municipal Index ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Actual |

|

| $ | 1,000.00 |

|

|

| $ | 1,012.40 |

|

| 0.24 | % |

|

| $ | 1.22 |

|

|

| Hypothetical** |

|

| $ | 1,000.00 |

|

|

| $ | 1,024.00 |

|

| 0.24 | % |

|

| $ | 1.22 |

|

|

Short Municipal Index ETF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Actual |

|

| $ | 1,000.00 |

|

|

| $ | 1,011.80 |

|

| 0.20 | % |

|

| $ | 1.01 |

|

|

| Hypothetical** |

|

| $ | 1,000.00 |

|

|

| $ | 1,024.20 |

|

| 0.20 | % |

|

| $ | 1.02 |

|

|

|

|

* | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended October 31, 2012) multiplied by the average account value over the period, multiplied by 184 and divided by 365 (to reflect the one-half year period). |

** | Assumes annual return of 5% before expenses |

11

|

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

|

Number |

|

|

|

| Value |

| |

|

|

|

|

| |||

CLOSED-END FUNDS: 99.8% |

|

|

|

| |||

| 8,823 |

| Alliance Bernstein National Municipal Income Fund, Inc. |

| $ | 142,580 |

|

| 5,383 |

| BlackRock Investment Quality Municipal Trust, Inc. |

|

| 92,103 |

|

| 4,323 |

| BlackRock Long-Term Municipal Advantage Trust |

|

| 56,458 |

|

| 14,935 |

| BlackRock Muni Intermediate Duration Fund, Inc. |

|

| 261,362 |

|

| 16,030 |

| BlackRock MuniAssets Fund, Inc. |

|

| 225,702 |

|

| 5,030 |

| BlackRock Municipal 2018 Term Trust |

|

| 86,818 |

|

| 8,077 |

| BlackRock Municipal 2020 Term Trust |

|

| 135,774 |

|

| 3,342 |

| BlackRock Municipal Bond Trust |

|

| 59,053 |

|

| 8,482 |

| BlackRock Municipal Income Quality Trust |

|

| 139,529 |

|

| 14,015 |

| BlackRock Municipal Income Trust |

|

| 229,005 |

|

| 7,416 |

| BlackRock Municipal Income Trust II |

|

| 127,926 |

|

| 12,676 |

| BlackRock MuniEnhanced Fund, Inc. |

|

| 159,844 |

|

| 4,425 |

| BlackRock MuniHoldings Fund II, Inc. |

|

| 78,323 |

|

| 4,408 |

| BlackRock MuniHoldings Fund, Inc. |

|

| 85,163 |

|

| 15,216 |

| BlackRock MuniHoldings Investment Quality Fund |

|

| 258,368 |

|

| 8,913 |

| BlackRock MuniHoldings Quality Fund II, Inc. |

|

| 136,815 |

|

| 5,168 |

| BlackRock MuniHoldings Quality Fund, Inc. |

|

| 86,667 |

|

| 5,646 |

| BlackRock MuniVest Fund II, Inc. |

|

| 102,531 |

|

| 19,610 |

| BlackRock MuniVest Fund, Inc. |

|

| 221,593 |

|

| 14,645 |

| BlackRock MuniYield Fund, Inc. |

|

| 248,819 |

|

| 5,397 |

| BlackRock MuniYield Investment Fund |

|

| 92,613 |

|

| 8,930 |

| BlackRock MuniYield Quality Fund II, Inc. |

|

| 134,843 |

|

| 26,748 |

| BlackRock MuniYield Quality Fund III, Inc. |

|

| 426,631 |

|

| 9,654 |

| BlackRock MuniYield Quality Fund, Inc. |

|

| 171,938 |

|

| 6,416 |

| Dreyfus Municipal Income, Inc. |

|

| 72,372 |

|

| 14,882 |

| Dreyfus Strategic Municipal Bond Fund, Inc. |

|

| 141,825 |

|

| 19,007 |

| Dreyfus Strategic Municipals, Inc. |

|

| 187,979 |

|

| 10,591 |

| DWS Municipal Income Trust |

|

| 156,323 |

|

| 27,315 |

| Eaton Vance Municipal Bond Fund |

|

| 395,248 |

|

| 8,556 |

| Invesco Municipal Income Opportunities Trust |

|

| 64,427 |

|

| 19,842 |

| Invesco Quality Municipal Income Trust |

|

| 286,717 |

|

| 15,977 |

| Invesco Value Municipal Income Trust |

|

| 259,946 |

|

| 13,617 |

| Invesco Van Kampen Advantage Municipal Income Trust II |

|

| 187,915 |

|

| 17,580 |

| Invesco Van Kampen Municipal Opportunity Trust |

|

| 267,040 |

|

| 12,394 |

| Invesco Van Kampen Municipal Trust |

|

| 183,555 |

|

| 16,959 |

| Invesco Van Kampen Trust for Investment Grade Municipals |

|

| 268,800 |

|

| 8,569 |

| MFS High Income Municipal Trust |

|

| 49,186 |

|

| 11,158 |

| MFS Municipal Income Trust |

|

| 87,144 |

|

| 5,820 |

| Neuberger Berman Intermediate Municipal Fund, Inc. |

|

| 96,030 |

|

| 9,712 |

| Nuveen AMT-Free Municipal Income Fund |

|

| 153,450 |

|

| 5,073 |

| Nuveen AMT-Free Municipal Value Fund |

|

| 94,662 |

|

| 17,660 |

| Nuveen Dividend Advantage Municipal Fund |

|

| 278,322 |

|

| 13,213 |

| Nuveen Dividend Advantage Municipal Fund 2 |

|

| 206,519 |

|

| 14,727 |

| Nuveen Dividend Advantage Municipal Income Fund |

|

| 232,981 |

|

| 47,495 |

| Nuveen Insured Municipal Opportunity Fund, Inc. |

|

| 737,597 |

|

| 17,391 |

| Nuveen Insured Quality Municipal Fund, Inc. |

|

| 269,387 |

|

| 14,295 |

| Nuveen Investment Quality Municipal Fund, Inc. |

|

| 237,869 |

|

| 19,732 |

| Nuveen Municipal Advantage Fund |

|

| 309,200 |

|

| 9,064 |

| Nuveen Municipal High Income Opportunity Fund |

|

| 129,162 |

|

| 7,192 |

| Nuveen Municipal High Income Opportunity Fund 2 |

|

| 94,287 |

|

| 20,769 |

| Nuveen Municipal Market Opportunity Fund, Inc. |

|

| 309,873 |

|

| 80,805 |

| Nuveen Municipal Value Fund |

|

| 837,948 |

|

| 26,679 |

| Nuveen Performance Plus Municipal Fund |

|

| 438,603 |

|

| 8,077 |

| Nuveen Premier Insured Municipal Income Fund, Inc. |

|

| 127,213 |

|

| 9,011 |

| Nuveen Premier Municipal Income Fund, Inc. |

|

| 139,310 |

|

| 32,101 |

| Nuveen Premium Income Municipal Fund 2, Inc. |

|

| 499,492 |

|

| 17,306 |

| Nuveen Premium Income Municipal Fund 4, Inc. |

|

| 250,591 |

|

| 28,515 |

| Nuveen Premium Income Municipal Fund, Inc. |

|

| 443,693 |

|

| 16,585 |

| Nuveen Premium Income Municipal Opportunity Fund 2 |

|

| 247,116 |

|

| 24,187 |

| Nuveen Quality Income Municipal Fund, Inc. |

|

| 382,396 |

|

| 13,905 |

| Nuveen Select Quality Municipal Fund |

|

| 228,042 |

|

| 5,120 |

| Nuveen Select Tax Free |

|

| 82,381 |

|

| 5,607 |

| Nuveen Select Tax Free 2 |

|

| 80,236 |

|

| 4,127 |

| Nuveen Select Tax Free 3 |

|

| 63,143 |

|

| 5,407 |

| PIMCO Municipal Income Fund |

|

| 88,783 |

|

| 16,828 |

| PIMCO Municipal Income Fund II |

|

| 223,308 |

|

| 7,056 |

| PIMCO Municipal Income Fund III |

|

| 91,305 |

|

| 5,079 |

| Pioneer Municipal High Income Advantage Trust |

|

| 81,010 |

|

| 5,994 |

| Pioneer Municipal High Income Trust |

|

| 95,964 |

|

| 18,469 |

| Putnam Managed Municipal Income Trust |

|

| 154,586 |

|

| 19,310 |

| Putnam Municipal Opportunities Trust |

|

| 259,333 |

|

| 13,190 |

| Western Asset Managed Municipals Fund, Inc. |

|

| 194,421 |

|

| 3,883 |

| Western Asset Municipal Defined Opportunity Trust, Inc. |

|

| 95,483 |

|

| 6,556 |

| Western Asset Municipal High Income Fund, Inc. |

|

| 55,529 |

|

|

|

|

|

| |||

Total Closed-End Funds |

|

| 14,678,160 |

| |||

|

| ||||||

MONEY MARKET FUND: 0.2% |

|

|

|

| |||

| 35,296 |

| Dreyfus Government Cash Management Fund |

|

| 35,296 |

|

|

|

|

|

| |||

|

|

|

|

| |||

Total Investments: 100.0% |

|

| 14,713,456 |

| |||

Liabilities in excess of other assets: (0.0)% |

|

| (4,598 | ) | |||

|

| ||||||

NET ASSETS: 100.0% |

| $ | 14,708,858 |

| |||

|

| ||||||

See Notes to Financial Statements

12

|

|

|

|

|

|

|

|

|

|

Summary of Investments by Sector (unaudited) |

| % of Investments |

| Value |

| |||

|

|

| ||||||

Financial |

|

| 99.8 | % |

| $ | 14,678,160 |

|

Money Market Fund |

|

| 0.2 |

|

|

| 35,296 |

|

|

|

|

|

|

| |||

|

|

| 100.0 | % |

| $ | 14,713,456 |

|

|

|

|

|

|

| |||

The summary of inputs used to value the Fund’s investments as of October 31, 2012 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Level 1 |

| Level 2 |

| Level 3 |

| Value |

| ||||||||

|

|

|

|

|

| ||||||||||||

Closed-End Funds |

| $ | 14,678,160 |

|

| $ | — |

|

|

| $ | — |

|

| $ | 14,678,160 |

|

Money Market Fund |

|

| 35,296 |

|

|

| — |

|

|

|

| — |

|

|

| 35,296 |

|

|

|

|

|

|

|

|

|

|

| ||||||||

Total |

| $ | 14,713,456 |

|

| $ | — |

|

|

| $ | — |

|

| $ | 14,713,456 |

|

|

|

|

|

|

|

|

|

|

| ||||||||

See Notes to Financial Statements

13

|

SCHEDULE OF INVESTMENTS |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

| ||

|

|

|

|

| |||

MUNICIPAL BONDS: 98.0% |

|

|

|

| |||

Alabama: 0.9% |

|

|

|

| |||

$ | 5,795,000 |

| Alabama Industrial Development Authority, Solid Waste Disposal, Pine City Fiber Company Project (RB) 6.45%, 12/03/12 (c) |

| $ | 5,794,536 |

|

| 2,500,000 |

| Colbert County, Alabama Health Care Authority (RB) 5.75%, 06/01/13 (c) |

|

| 2,456,375 |

|

|

|

|

|

| |||

|

|

|

|

|

| 8,250,911 |

|

|

|

|

|

| |||

Arizona: 1.7% |

|

|

|

| |||

| 2,775,000 |

| Arizona Health Facilities Authority, Phoenix Children’s Hospital, Series A (RB) 5.00%, 02/01/22 (c) |

|

| 2,974,134 |

|

| 5,860,000 |

| Arizona Health Facilities Authority, The Beatitudes Campus Project (RB) 5.10%, 10/01/16 (c) |

|

| 5,850,683 |

|

| 2,000,000 |

| Arizona Health Facilities Authority, The Beatitudes Campus Project (RB) 5.20%, 10/01/16 (c) |

|

| 1,840,340 |

|

| 1,000,000 |

| Pima County, Arizona Industrial Development Authority, Charter School Projects, Series A (RB) 5.50%, 07/01/17 (c) |

|

| 1,003,990 |

|

| 1,400,000 |

| Pima County, Arizona Industrial Development Authority, Tucson Electric Power Company Project, Series A (RB) 5.25%, 10/01/20 (c) |

|

| 1,527,470 |

|

| 1,000,000 |

| Tempe, Arizona Industrial Development Authority, Friendship Village of Tempe, Series A (RB) 6.25%, 12/01/21 (c) |

|

| 1,085,670 |

|

| 1,500,000 |

| Tucson, Arizona University Medical Center Corp., Hospital Revenue (RB) 5.00%, 07/01/15 (c) |

|

| 1,532,430 |

|

|

|

|

|

| |||

|

|

|

|

|

| 15,814,717 |

|

|

|

|

|

| |||

California: 9.3% |

|

|

|

| |||

| 1,000,000 |

| California Municipal Finance Authority Revenue, Eisenhower Medical Center, Series A (RB) 5.75%, 07/01/20 (c) |

|

| 1,093,670 |

|

| 4,000,000 |

| California Statewide Communities Development Authority, Valleycare Health System, Series A (RB) 5.13%, 07/15/17 (c) |

|

| 4,073,960 |

|

| 1,050,000 |

| California Statewide Community Development Authority, Daughters of Charity Health System, Series A (RB) 5.00%, 07/01/15 (c) |

|

| 1,061,634 |

|

| 2,410,000 |

| California Statewide Community Development Authority, Daughters of Charity Health System, Series A (RB) 5.25%, 07/01/15 (c) |

|

| 2,512,835 |

|

| 3,210,000 |

| California Statewide Community Development Authority, Daughters of Charity Health System, Series A (RB) 5.25%, 07/01/15 (c) |

|

| 3,273,462 |

|

| 750,000 |

| California Statewide Community Development Authority, Educational Facilities—Huntington Park Charter School Project-A (RB) 5.15%, 07/01/17 (c) |

|

| 693,398 |

|

| 500,000 |

| California Statewide Community Development Authority, Educational Facilities—Huntington Park Charter School Project-A (RB) 5.25%, 07/01/17 (c) |

|

| 445,760 |

|

| 1,750,000 |

| California Statewide Community Development Authority, Thomas Jefferson Law School, Series A (RB) 7.00%, 10/01/26 144A |

|

| 1,897,805 |

|

| 2,000,000 |

| California Statewide Community Development Authority, Thomas Jefferson Law School, Series A (RB) 7.25%, 10/01/18 (c) 144A |

|

| 2,056,660 |

|

| 5,000,000 |

| California Statewide Community Development Authority, Thomas Jefferson Law School, Series A (RB) 7.25%, 10/01/18 (c) 144A |

|

| 5,117,200 |

|

| 6,000,000 |

| California Statewide Financing Authority, Pooled Tobacco Securitization Program (RB) 6.00%, 12/03/12 (c) |

|

| 6,000,060 |

|

| 23,845,000 |

| Golden State Tobacco Securitization Corp., California Tobacco Settlement, Series A-1 (RB) 4.50%, 06/01/17 (c) |

|

| 21,254,718 |

|

| 13,000,000 |

| Golden State Tobacco Securitization Corp., California Tobacco Settlement, Series A-1 (RB) 5.00%, 06/01/17 (c) |

|

| 11,145,810 |

|

| 9,480,000 |

| Golden State Tobacco Securitization Corp., California Tobacco Settlement, Series A-1 (RB) 5.13%, 06/01/17 (c) |

|

| 7,671,880 |

|

| 235,000 |

| Hesperia Community Redevelopment Agency, Refinancing and Redevelopment Projects, Series A (TA) (XLCA) 5.00%, 09/01/15 (c) |

|

| 228,481 |

|

| 800,000 |

| Hesperia Public Financing Authority, Redevelopment and Housing Projects, Series A (TA) (XLCA) 5.00%, 09/01/17 (c) |

|

| 744,576 |

|

| 3,170,000 |

| Hesperia Public Financing Authority, Redevelopment and Housing Projects, Series A (TA) (XLCA) 5.00%, 09/01/17 (c) |

|

| 2,776,128 |

|

| 405,000 |

| Hesperia Public Financing Authority, Redevelopment and Housing Projects, Series A (TA) (XLCA) 5.00%, 09/01/17 (c) |

|

| 338,872 |

|

| 2,415,000 |

| Hesperia Public Financing Authority, Redevelopment and Housing Projects, Series A (TA) (XLCA) 5.50%, 09/01/17 (c) |

|

| 2,272,467 |

|

See Notes to Financial Statements

14

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

| ||

|

|

|

|

| |||

California: (continued) |

|

|

|

| |||

$ | 3,455,000 |

| Inland Empire Tobacco Securitization Authority, Inland Empire Tobacco Securitization Corp., Series A (RB) 4.63%, 06/01/17 (c) |

| $ | 3,188,067 |

|

| 235,000 |

| Inland Empire Tobacco Securitization Authority, Inland Empire Tobacco Securitization Corp., Series B (RB) 5.75%, 06/01/21 (c) |

|

| 206,520 |

|

| 500,000 |

| Sacramento, California Municipal Utility District Financing Authority, Cosumnes Project (RB) (NATL) 5.00%, 07/01/16 (c) |

|

| 559,360 |

|

| 3,600,000 |

| San Buenaventura, California Community Memorial Health System (RB) 7.50%, 12/01/21 (c) |

|

| 4,473,000 |

|

| 310,000 |

| San Joaquin Hills Transportation Corridor Agency, Toll Road Refunding Revenue, Series A (RB) (NATL) 5.38%, 12/03/12 (c) |

|

| 310,040 |

|

| 1,570,000 |

| San Joaquin Hills Transportation Corridor Agency, Toll Road Refunding Revenue, Series A (RB) 5.50%, 12/03/12 (c) |

|

| 1,574,098 |

|

| 60,000 |

| San Joaquin Hills, California Transportation Corridor Agency, Senior Lien Toll Road (RB) 5.00%, 12/03/12 (c) |

|

| 59,770 |

|

| 1,000,000 |

| Thousand Oaks, California Community Facilities Special Tax, District No. 1994–1 (ST) 5.38%, 09/01/22 (c) |

|

| 1,003,330 |

|

|

|

|

|

| |||

|

|

|

|

|

| 86,033,561 |

|

|

|

|

|

| |||

Colorado: 1.8% |

|

|

|

| |||

| 2,045,000 |

| Colorado Health Facilities Authority, Covenant Retirement Communities, Inc. (RB) 4.00%, 12/01/22 (c) |

|

| 2,042,771 |

|

| 1,500,000 |

| Colorado Health Facilities Authority, Health & Residential, Volunteers of America Care Facilities (RB) 5.20%, 07/01/14 (c) |

|

| 1,513,575 |

|

| 3,300,000 |

| Colorado Health Facilities Authority, Health & Residential, Volunteers of America Care Facilities (RB) 5.30%, 07/01/14 (c) |

|

| 3,202,584 |

|

| 1,000,000 |

| Colorado Health Facilities Authority, Senior Residences Project (RB) 6.75%, 06/01/22 (c) |

|

| 1,070,490 |

|

| 1,500,000 |

| Colorado Health Facilities Authority, Senior Residences Project (RB) 7.00%, 06/01/22 (c) |

|

| 1,610,205 |

|

| 5,250,000 |

| Denver, Colorado Special Facilities Airport Revenue, United Air Lines Project, Series A (RB) 5.25%, 10/01/17 (c) |

|

| 5,347,335 |

|

| 2,000,000 |

| Denver, Colorado Special Facilities Airport Revenue, United Air Lines Project, Series A (RB) 5.75%, 10/01/17 (c) |

|

| 2,089,180 |

|

|

|

|

|

| |||

|

|

|

|

|

| 16,876,140 |

|

|

|

|

|

| |||

Connecticut: 0.4% |

|

|

|

| |||

| 1,580,000 |

| Connecticut Resources Recovery Authority (RB) 6.45%, 12/03/12 (c) |

|

| 1,581,138 |

|

| 1,250,000 |

| Harbor Point Infrastructure Improvement District, Harbor Point Project, Series A (TA) 7.00%, 04/01/20 (c) |

|

| 1,395,700 |

|

| 1,000,000 |

| Harbor Point Infrastructure Improvement District, Harbor Point Project, Series A (TA) 7.88%, 04/01/20 (c) |

|

| 1,144,760 |

|

|

|

|

|

| |||

|

|

|

|

|

| 4,121,598 |

|

|

|

|

|

| |||

Delaware: 1.0% |

|

|

|

| |||

| 8,400,000 |

| Delaware Economic Development Authority, Exempt Facility (RB) 5.38%, 10/01/20 (c) |

|

| 9,211,692 |

|

|

|

|

|

| |||

District of Columbia: 0.1% |

|

|

| ||||

| 1,500,000 |

| Metropolitan Washington Airports Authority, Dulles Toll Road, Second Senior Lien, Series B (RB) 6.13%, 10/01/28 (c) |

|

| 1,302,345 |

|

|

|

|

|

| |||

Florida: 5.2% |

|

|

|

| |||

| 1,490,000 |

| Alachua County, Florida Health Facilities Authority, Oak Hammock at the University of Florida Project, Series A (RB) 8.00%, 10/01/22 (c) |

|

| 1,780,863 |

|

| 1,530,000 |

| Alachua County, Florida Health Facilities Authority, Terraces at Bonita Springs Project, Series A (RB) 8.00%, 11/15/21 (c) |

|

| 1,811,260 |

|

| 1,000,000 |

| Alachua County, Florida Health Facilities Authority, Terraces at Bonita Springs Project, Series A (RB) 8.13%, 11/15/21 (c) |

|

| 1,173,130 |

|

| 2,000,000 |

| Callaway, Florida Capital Improvement Revenue, Special Capital Extension Project (RB) (ACA) 5.25%, 08/01/17 (c) |

|

| 1,966,060 |

|

| 3,000,000 |

| County of Alachua, Florida Retirement Village, Inc. Project, Series A (RB) 5.63%, 11/15/17 (c) |

|

| 3,029,310 |

|

| 4,000,000 |

| Florida Development Finance Corp., Renaissance Charter School, Inc. Projects, Series A (RB) 7.63%, 06/15/21 (c) |

|

| 4,651,040 |

|

| 1,000,000 |

| Greater Orlando Aviation Authority, JetBlue Airways Corp. Project (RB) 6.38%, 05/15/13 (c) |

|

| 1,018,370 |

|

| 4,925,000 |

| Greater Orlando Aviation Authority, JetBlue Airways Corp. Project (RB) 6.50%, 05/15/13 (c) |

|

| 5,016,063 |

|

| 3,000,000 |

| Hillsborough County, Florida Industrial Development Authority Revenue (RB) 7.13%, 12/03/12 (c) |

|

| 3,000,480 |

|

| 7,000,000 |

| Lee County Industrial Development Authority, Industrial Development, Community Charter Schools, LLC Projects, Series A (RB) 5.25%, 06/15/17 (c) |

|

| 7,148,890 |

|

See Notes to Financial Statements

15

|

HIGH-YIELD MUNICIPAL INDEX ETF |

SCHEDULE OF INVESTMENTS |

(continued) |

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

| ||

|

|

|

| ||||

Florida: (continued) |

|

|

| ||||

$ | 2,500,000 |

| Lee County Industrial Development Authority, Industrial Development, Community Charter Schools, LLC Projects, Series A (RB) 5.38%, 06/15/17 (c) |

| $ | 2,528,800 |

|

| 1,000,000 |

| Lee County Industrial Development Authority, Industrial Development, Community Charter Schools, LLC Projects, Series A (RB) 5.75%, 06/15/22 (c) |

|

| 1,012,450 |

|

| 335,000 |

| Lee County, Florida Industrial Development Authority Health Care Facilities, Shell Point/Alliance Obligation Group (RB) 5.13%, 11/15/16 (c) |

|

| 335,054 |

|

| 1,200,000 |

| Midtown Miami Community Development District, Infrastructure Project, Series B (SA) 6.50%, 05/01/14 (c) |

|

| 1,217,952 |

|

| 1,000,000 |

| Midtown Miami Community Development District, Parking Garage Project, Series A (SA) 6.25%, 05/01/14 (c) |

|

| 1,014,710 |

|

| 1,200,000 |

| Orange County, Florida Health Facilities Authority, Orlando Lutheran Towers, Inc. (RB) 5.50%, 07/01/17 (c) |

|

| 1,223,064 |

|

| 3,750,000 |

| Orange County, Florida Health Facilities Authority, Orlando Lutheran Towers, Inc. (RB) 5.50%, 07/01/17 (c) |

|

| 3,808,087 |

|

| 1,100,000 |

| Orange County, Florida Health Facilities Authority, Orlando Lutheran Towers, Inc. (RB) 5.70%, 07/01/15 (c) |

|

| 1,124,607 |

|

| 485,000 |

| Sumter County, Florida Village Community Development District No. 8, Phase II (SA) 6.13%, 05/01/20 (c) |

|

| 572,436 |

|

| 1,000,000 |

| Sumter County, Florida Village Community Development District No. 9, Special Assessment Revenue (SA) 5.50%, 05/01/22 (c) |

|

| 1,087,810 |

|

| 2,945,000 |

| Tavares, Florida Osprey Lodge at Lakeview Crest, Series A (RB) 8.75%, 07/01/16 (c) |

|

| 3,123,143 |

|

|

|

|

|

| |||

|

|

|

|

|

| 47,643,579 |

|

|

|

|

|

| |||

Georgia: 0.6% |

|

|

|

| |||

| 4,100,000 |

| DeKalb County, Georgia Hospital Authority, DeKalb Medical Center, Inc. Project (RB) 6.13%, 09/01/20 (c) |

|

| 4,833,736 |

|

| 1,000,000 |

| Fulton County Residential Care Facilities for the Elderly Authority, Series B (RB) 5.00%, 07/01/17 (c) |

|

| 1,004,470 |

|

|

|

|

|

| |||

|

|

|

|

|

| 5,838,206 |

|

|

|

|

|

| |||

Guam: 1.1% |

|

|

|

| |||

| 2,750,000 |

| Guam Government Department of Education, John F. Kennedy Project, Series A (CP) 6.88%, 12/01/20 (c) |

|

| 3,019,967 |

|

| 1,000,000 |

| Guam Government General Obligation, Series A (GO) 6.75%, 11/15/19 (c) |

|

| 1,117,040 |

|

| 1,200,000 |

| Guam Government Limited Obligation, Series A (RB) 5.63%, 12/01/19 (c) |

|

| 1,337,028 |

|

| 3,850,000 |

| Guam Government Waterworks Authority, Water & Wastewater System (RB) 5.88%, 07/01/15 (c) |

|

| 4,048,775 |

|

| 250,000 |

| Guam Power Authority, Series A (RB) 5.50%, 10/01/20 (c) |

|

| 272,363 |

|

|

|

|

|

| |||

|

|

|

|

|

| 9,795,173 |

|

|

|

|

|

| |||

Hawaii: 0.3% |

|

|

|

| |||

| 3,000,000 |

| Kuakini, Hawaii Health System, Special Purpose Revenue, Series A (RB) 6.30%, 12/03/12 (c) |

|

| 3,005,010 |

|

|

|

|

|

| |||

Illinois: 6.2% |

|

|

| ||||

| 1,300,000 |

| Cook County, Illinois Recovery Zone Facility, Navistar International Corp. Project (RB) 6.50%, 10/15/20 (c) |

|

| 1,353,859 |

|

| 5,500,000 |

| Illinois Finance Authority, Greenfields of Geneva Project, Series A (RB) 8.13%, 02/15/20 (c) |

|

| 5,954,630 |

|

| 4,000,000 |

| Illinois Finance Authority, Greenfields of Geneva Project, Series A (RB) 8.25%, 02/15/20 (c) |

|

| 4,342,280 |

|

| 2,175,000 |

| Illinois Finance Authority, Navistar International Corp. Project (RB) 6.50%, 10/15/20 (c) |

|

| 2,265,110 |

|

| 470,000 |

| Illinois Finance Authority, Park Place of Elmhurst Project, Series A (RB) 8.00%, 05/15/15 (c) |

|

| 487,945 |

|

| 610,000 |

| Illinois Finance Authority, Park Place of Elmhurst Project, Series A (RB) 8.00%, 05/15/20 (c) |

|

| 662,265 |

|

| 5,125,000 |

| Illinois Finance Authority, Park Place of Elmhurst Project, Series A (RB) 8.13%, 05/15/20 (c) |

|

| 5,554,270 |

|

| 4,000,000 |

| Illinois Finance Authority, Park Place of Elmhurst Project, Series A (RB) 8.25%, 05/15/20 (c) |

|

| 4,356,840 |

|

| 575,000 |

| Illinois Finance Authority, Resurrection Health Care Corp. (RB) 6.13%, 05/15/19 (c) |

|

| 669,317 |

|

| 2,000,000 |

| Illinois Finance Authority, Roosevelt University Project (RB) 6.50%, 10/01/19 (c) |

|

| 2,270,600 |

|

| 6,710,000 |

| Illinois Finance Authority, Sherman Health System, Series A (RB) 5.50%, 08/01/17 (c) |

|

| 7,340,002 |

|

| 4,070,000 |

| Illinois Finance Authority, Swedish Covenant Hospital, Series A (RB) 6.00%, 02/15/20 (c) |

|

| 4,590,268 |

|

See Notes to Financial Statements

16

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

| ||

|

|

|

|

| |||

Illinois: (continued) |

|

|

|

| |||

$ | 1,565,000 |

| Illinois Finance Authority, The Admiral At The Lake Project, Series A (RB) 8.00%, 05/15/20 (c) |

| $ | 1,846,810 |

|

| 8,500,000 |

| Illinois Finance Authority, The Admiral At The Lake Project, Series A (RB) 8.00%, 05/15/20 (c) |

|

| 10,013,170 |

|

| 1,500,000 |

| Illinois Finance Authority, The Admiral At The Lake Project, Series D-1 (RB) 7.00%, 11/23/12 (c) |

|

| 1,528,470 |

|

| 4,000,000 |

| Southwestern Illinois Development Authority, United States Steel Corp. Project (RB) 5.75%, 08/01/22 (c) |

|

| 3,937,960 |

|

|

|

|

|

| |||

|

|

|

|

|

| 57,173,796 |

|

|

|

|

|

| |||

Indiana: 2.6% |

|

|

|

| |||

| 1,000,000 |

| City of Carmel, Indiana, Series A (RB) 7.13%, 11/15/22 (c) |

|

| 1,030,640 |

|

| 2,000,000 |

| Indiana Finance Authority, Environmental Improvement Revenue, United States Steel Corp. Project (RB) 6.00%, 12/01/19 |

|

| 2,158,560 |

|

| 1,475,000 |

| Indiana Finance Authority, King’s Daughters’ Hospital & Health Services (RB) 5.13%, 08/15/20 (c) |

|

| 1,594,106 |

|

| 8,345,000 |

| Indiana Finance Authority, King’s Daughters’ Hospital & Health Services (RB) 5.50%, 08/15/20 (c) |

|

| 9,139,027 |

|

| 2,000,000 |

| Indiana Finance Authority, Ohio Valley Electric Corp. Project, Series A (RB) 5.00%, 06/01/22 (c) |

|

| 2,156,060 |

|

| 500,000 |

| Indiana Finance Authority, Ohio Valley Electric Corp. Project, Series A (RB) 5.00%, 06/01/22 (c) |

|

| 532,055 |

|

| 1,320,000 |

| Indiana Health Facility Financing Authority, Hospital Revenue, The Methodist Hospitals, Inc. (RB) 5.50%, 12/03/12 (c) |

|

| 1,320,317 |

|

| 2,000,000 |

| Vigo County, Indiana Hospital Authority, Union Hospital, Inc. (RB) 5.70%, 09/01/17 (c) 144A |

|

| 2,049,700 |

|

| 3,000,000 |

| Vigo County, Indiana Hospital Authority, Union Hospital, Inc. (RB) 5.75%, 09/01/17 (c) 144A |

|

| 3,070,620 |

|

| 1,160,000 |

| Vigo County, Indiana Hospital Authority, Union Hospital, Inc. (RB) 5.80%, 09/01/17 (c) 144A |

|

| 1,188,756 |

|

|

|

|

|

| |||

|

|

|

|

|

| 24,239,841 |

|

|

|

|

|

| |||

Iowa: 1.2% |

|

|

| ||||

| 10,000,000 |

| Iowa Finance Authority, Alcoa, Inc. Project (RB) 4.75%, 08/01/22 (c) |

|

| 10,186,800 |

|

| 1,500,000 |

| Iowa Finance Authority, Senior Living Facilities, Deerfield Retirement Community, Series A (RB) 5.50%, 11/15/17 (c) |

|

| 1,327,530 |

|

|

|

|

|

| |||

|

|

|

|

|

| 11,514,330 |

|

|

|

|

|

| |||

Kansas: 0.3% |

|

|

|

| |||

| 3,000,000 |

| Manhattan, Kansas Health Care Facility Revenue, Meadowlark Hills Retirement Community, Series A (RB) 5.00%, 05/15/17 (c) |

|

| 3,015,670 |

|

|

|

|

|

| |||

Kentucky: 0.3% |

|

|

|

| |||

| 1,325,000 |

| Kentucky Economic Development Finance Authority, Owensboro Medical Health System, Inc. Series A (RB) 6.38%, 06/01/20 (c) |

|

| 1,577,399 |

|

| 1,000,000 |