UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 333-123257

MARKET VECTORS ETF TRUST

(Exact name of registrant as specified in charter)

335 Madison Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

335 MADISON AVENUE, NEW YORK, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: APRIL 30

Date of reporting period: OCTOBER 31, 2012

ITEM 1. REPORT TO SHAREHOLDERS

|

|

|

|

| SEMI-ANNUAL REPORT |

| O C T O B E R 3 1 , 2 0 1 2 |

| ( u n a u d i t e d ) |

|

|

|

MARKET VECTORS |

|

|

CORPORATE BOND ETFs |

|

|

|

|

|

Fallen Angel High Yield Bond ETF | ANGL |

|

Investment Grade Floating Rate ETF | FLTR® |

|

|

|

|

MARKET VECTORS |

|

|

EQUITY INCOME ETFs |

|

|

|

|

|

Mortgage REIT Income ETF | MORT |

|

Preferred Securities ex Financials ETF | PFXF |

|

|

|

|

MARKET VECTORS |

|

|

INTERNATIONAL BOND ETFs |

|

|

|

|

|

Emerging Markets High Yield Bond ETF | HYEM |

|

Emerging Markets Local Currency Bond ETF | EMLC |

|

International High Yield Bond ETF | IHY |

|

LatAm Aggregate Bond ETF | BONO |

|

Renminbi Bond ETF | CHLC |

|

|

|

TABLE OF CONTENTS |

|

|

|

| |

|

|

Management Discussion | 1 |

Performance Record |

|

6 | |

7 | |

8 | |

9 | |

10 | |

11 | |

12 | |

13 | |

14 | |

15 | |

| |

17 | |

21 | |

25 | |

27 | |

32 | |

33 | |

35 | |

36 | |

38 | |

40 | |

42 | |

44 | |

| |

48 | |

48 | |

49 | |

49 | |

50 | |

50 | |

51 | |

51 | |

52 | |

53 | |

61 |

|

Dear Shareholder:

We are pleased to present this semi-annual report for income-oriented exchange-traded funds of the Market Vectors ETF Trust for the six months ended October 31, 2012.

During this period, income-oriented exchange-traded funds (ETFs) continued to benefit from low interest rates and investors’ appetite for yield. According to the Investment Company Institute, 205 bond ETFs were traded on U.S. exchanges as of October 2012, and they held $238.7 billion in total assets. The number of bond ETFs increased by 25.0% year-over-year and their assets grew by 37.0%. Bond ETFs now account for 17.2% of total ETFs and 18.8% of total ETF assets.1

In total, including equity ETFs, Market Vectors has grown into the fifth largest ETF family in the U.S. based on assets, with $28.0 billion invested in 50 funds.2

Two new ETFs were launched during this six-month period:

|

|

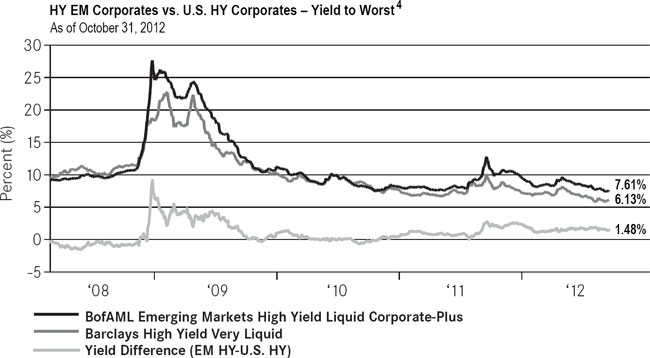

§ | HYEM is the first ETF designed to focus solely on the U.S. dollar-denominated non-sovereign segment of emerging market high-yield bonds, a segment that has grown to 10% of the global high-yield corporate bond market. These bonds are currently out-yielding and have displayed lower historical default rates than U.S. high-yield corporate bonds3. |

|

|

| Source: FactSet. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. |

|

|

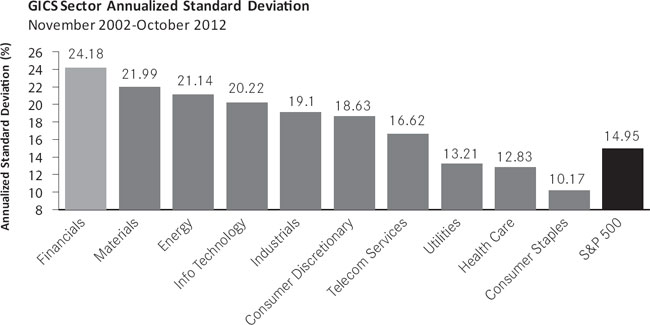

§ | PFXF offers investors access to the income potential of preferred securities without the volatility of the financial sector, which accounts for a large percentage of total portfolio weight in competitive index funds. The financial sector has exhibited the highest volatility, as measured by standard deviation, over the past 10 years. |

|

|

| |

Yield-to-Worst is generally defined as being the lowest yield that a buyer can expect to receive. | |

1

|

MARKET VECTORS INCOME ETFs |

|

|

| Source: FactSet. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. |

Market Review

During this period, investors continued to search for yield, and net inflows stayed strong in virtually all segments of the fixed income market. Once again, a major driver of flows was action taken by the Federal Reserve Bank (the “Fed”) to maintain exceptionally low interest rates, while also adding to the mountainous pile of securities it is buying.

On September 13, Fed Chairman Ben Bernanke announced a third round of aggressive bond-buying (quantitative easing (QE3)), while also promising to maintain low short-term rates through 2015. The Fed will buy $40 billion of mortgage-backed securities per month until it believes U.S. economic conditions have improved. When QE3 is combined with ongoing interest reinvestment on Fed holdings and the “Operation Twist” maturity extension program, the Fed’s bond-buying demand will total $85 billion per month through the end of 2012.

Although the Fed’s actions did not greatly exceed analysts’ expectations, the combination of the 2015 low-rate extension and a bottomless well of bond buying is expected to sustain investors demand for high-yield debt. By explicitly linking the duration of QE3 to the outlook for labor market improvement, the Fed made a more open-ended commitment than its predecessor programs.

In September, the Bureau of Labor Statistics announced that the U.S. Civilian Unemployment Rate fell to 7.8%, its lowest level since January of 2009.5 Third-quarter U.S. gross domestic product (GDP) increased at an annual rate of 2.7%, based on the Bureau of Economic Analysis’ revised estimate.6 This was stronger than the second quarter’s 1.3% GDP increase, and suggested that economic recovery in the U.S. is on a better pace than in other developed markets. The European Union reported that real GDP contracted by 0.1% during the third quarter in its 17-nation sphere,7 and Japan’s third-quarter GDP contracted by 0.9% from the previous quarter.8

To prevent defaults and revive economic growth in the Eurozone, the European Central Bank (ECB) announced on August 2 that it would launch its own version of QE, which it called Outright Monetary Transactions (OMT). Although its bond buying will be limited to sovereign debt with short maturities (1-3 year), the ultimate goal is to reduce the cost of borrowing for troubled nations out to about 10 years on the yield curve.

Meanwhile, the world’s other major economic power, China, cut its key central bank rate twice over the summer to revive economic growth. All over the world, central bankers have grown more emboldened to “step on the monetary policy gas” whenever they feel a tremor of economic weakness. For investors who must generate yield to meet current income needs (e.g., pension plans, endowments and retirees), the search for yield has become not an option or short-term contingency but rather a continuing necessity. This powerful demand is driving innovation and expanded choices across diverse sectors of high-yield investments.

2

|

|

EQUITY INCOME |

Mortgage REITs

Mortgage real estate investment trusts (REITs) have been huge beneficiaries of the Fed’s low-interest rate policies and resulting “flight to yield.” From 2008 through year-end 2011, the number of U.S. mortgage REITs increased from 20 to 30 and their market capitalization grew from $14.3 billion to $43.0 billion, according to the National Association of Real Estate Investment Trusts (NAREIT).9

The basic recipe for mortgage REIT success depends on a steep yield curve, with a wide yield spread between short-term debt borrowed and long-term investment. The Fed’s announcement in September that it will buy $40 billion per month of mortgage-backed securities for an indefinite period has lowered long-term rates, which has had a negative impact on this model. In turn, this is causing mortgage REIT leaders to seek opportunities to diversify into other models.

Another concern for this sector is rising mortgage prepayments in today’s ultra-low mortgage rate market. Prepayments require the reinvestment of returned principal at lower interest rates, reducing mortgage REIT yields.

Preferred Securities

Preferred securities have captured the attention of yield-hungry investors, especially in the ETF space. However, until Market Vectors launched Preferred Securities ex Financials ETF (PFXF), none of the preferred securities ETFs expressly avoided the largest sector of this market–financials. Historically, non-financial preferred securities have provided about the same yield as financials, at far lower standard deviation.

Since 2002, preferred securities have yielded 2.83% more than 30-year Treasuries10. Although preferred issues technically are stocks, they share bonds’ price vulnerability to rising interest rates.

INTERNATIONAL BOND

Latin American Bonds

Latin America offers investors diverse opportunities to participate in investment-grade and high-yield sovereign and corporate bonds. Recently, investors have been attracted to the current yields of these bonds, especially the sovereign debt of Latin America’s two largest countries and economies–Mexico and Brazil. During this period, Venezuela’s market achieved greater stability due to the closure of a Presidential election cycle, and Argentina’s bonds lost value due to an unfavorable U.S. Appeals Court ruling involving the country’s 2001 default.

Renminbi Bonds

The “dim sum bond market” consists of Chinese Renminbi-denominated bonds issued and traded in markets outside China. Since June of this year, the storyline in China was slowing economic growth and lower rates of dim sum bond issuance. The Wall Street Journal estimated that dim sum issuance declined from a peak of $2.58 billion issued in June to just $600 million in October. Analysts attributed part of the decline to temporary weakness in the renminbi (also know as “yuan”) vs. the dollar.

Now, signs are pointing toward a revival of growth in both the Chinese economy and dim sum bond issuance. Going forward, issuers are expected to offer higher yields to attract investors to the market. For example, Caterpillar sold $160 million of dim sum bonds in November at an interest rate of 3.35%, compared to a 2% coupon on similar bonds the same company issued in this market two years ago.11 Perhaps most importantly, the Chinese government has shown continued interest in promoting foreign investment keeping its currency modestly strong. Investors’ key concern in this market is the Chinese government’s heavy control over both currency value and financial markets.

International High Yield Bonds

As an asset class, international high-yield bonds are capturing interest from investors who wish to diversify among non-investment grade bonds issued outside the U.S., while benefitting from their relatively high yield. From 1981 through 2011, the median annual default rate on high-yield corporate bonds was about twice as high in the U.S. and tax havens, compared to Europe and emerging markets.

Compared to the U.S. high-yield corporate market, emerging markets recently have experienced a low supply of new issues, due mainly to fallout from the European debt crisis. During the second quarter of 2012, high-yield issuance in emerging markets was $30 billion below the prior year’s pace.12 In addition to credit risk, high-yield emerging bond investors are exposed to political, currency and liquidity risks.

|

|

| |

Standard deviation is the statistical measure of the historical volatility of a portfolio. | |

3

|

MARKET VECTORS INCOME ETFs |

Emerging Markets

Throughout 2012, emerging market bonds have continued to capture assets of investors who wish to diversify bond holdings, increase yield and reduce vulnerability to the U.S. dollar (by holding local currency issues). Although all emerging bond markets have some exposure to global macro events–e.g., the European debt crisis and the “fiscal cliff” outcome in the U.S.–performance in these markets has diverged based on regional and local market nuances. Emerging market bonds in Eastern Europe and Latin America were relatively strong during this period based on improving economic fundamentals. Selected Asian emerging markets, such as Malaysia, also performed well.

Although emerging market bonds have captured the attention of yield-seeking investors recently, they generally have less trading depth and liquidity and greater price volatility than developed bond markets.

CORPORATE BOND

Floating Rate Investment Grade Bonds

Floating rate debt is a segment of the investment-grade debt universe that may be attractive to investors who believe interest rates are bottoming, with no place to go but up. For U.S. investors, the core of this market consists of dollar-denominated floating-rate notes issued by corporate issuers. The combination of a low average duration, typically in the 2-3 year range, and floating interest rates creates the potential for relatively low price fluctuations. As interest rates rise, portfolio securities reset to higher yields.

Since this asset class is not limited to U.S. issuers, it also offers the opportunities for global diversification.

Fallen Angel Bonds

Fallen angel bonds give investors access to debt instruments of companies that have dropped below investment-grade tiers due to downgrades. Fallen angels currently account for about 15% of the U.S. dollar-denominated high-yield bond universe3. One healthy trend of 2012 has been the conversion of fallen angels into “rising stars,” which happens when credit ratings “re-ascend” to investment grade.

Defaults in this segment are well below the 4.5% historical average for all U.S. high yields, and yields remain attractive in comparison with broader high-yield markets. Like other high-yield bonds, fallen angels could be vulnerable to rising risk of defaults or downgrades if the U.S. economy enters a deep or lengthy recession.

* * *

In summary, during this six-month period, Market Vectors income-oriented ETFs helped investors access a broader range of choices for generating yield and maintaining fixed income allocations. Our menu of income-oriented ETFs also was well positioned to meet investors’ growing appetite for ETF variety this year.

On the following pages, you will find the performance record of each of the funds for the six-month period ended October 31, 2012. You will also find their financial statements and portfolio information. We value your ongoing confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

Trustee and President

Market Vectors ETF Trust

Van Eck Global

December 3, 2012

4

|

|

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. |

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

|

|

1 | Exchange-Traded Fund Data, September 2012, Investment Company Institute: http://www.ici.org/research/stats/etf/etfs_09_12 |

2 | ETF League Table as of 11/26/12: http://www.indexuniverse.com/sections/news/15251-etf-league-table-as-of-nov-26-2012.html?utm_source=newsletter&utm_medium=email&utm_campaign=DailyEmailBlast |

3 | As represented by The BofA Merrill Lynch Global High Yield Index for global high-yield corporate bonds, The BofA Merrill Lynch High Yield US Emerging Markets Liquid Corporate Plus Index for USD-denominated EM high-yield corporate bonds, The BofA Merrill Lynch USD Emerging Markets Sovereigns Index for USD-denominated EM high-yield sovereign bonds and The BofA Merrill Lynch U.S. High Yield Master Index II for U.S. high-yield corporate bonds. Default data from Standard & Poor’s Global Fixed Income Research and Standard & Poor’s CreditPro®; 2011 Annual Global Corporate Default Study and Rating Transitions. |

4 | Yield to Worst is is generally defined as being the lowest yield that a buyer can expect to receive. Figures based on yield to worst of The BofA Merrill Lynch Emerging Markets High Yield Liquid Corporate Plus Index and The Barclays High Yield Very Liquid Index. Indexes are unmanaged and are not securities in which an investment can be made. |

5 | Civilian Unemployment Rate, U.S. Department of Labor, Bureau of Labor Statistics: http://research.stlouisfed.org/fred2/data/UNRATE.txt |

6 | Gross Domestic Product: Third Quarter 2012 advanced estimate, Bureau of Economic Analysis: http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm |

7 | Bloomberg Business 11/15/12: http://www.businessweek.com/news/2012-11-15/german-growth-slowed-less-than-forecast-in-third-quarter |

8 | Reuters 11/12/12: http://www.reuters.com/article/2012/11/11/japan-economy-gdp-idUST9E8M902T20121111 |

9 | U.S. REIT Industry Market Capitalization: http://www.reit.com/DataAndResearch/US-REIT-Industry-MarketCap.aspx |

10 | Source: FactSet. Preferred securities are represented by The Bank of America Merrill Lynch Preferred Securities Fixed Rate Index. 30-Year Treasuries represented by The Bank of America Merrill Lynch U.S. Treasuries Current (30Y) Index. U.S. Treasuries, are guaranteed by the full faith and credit of the United States government. Preferred securities are not guaranteed by the full faith and credit of the United States and carry the credit risk of the issuer. |

11 | The Wall Street Journal Deal Journal 11/21/12: http://blogs.wsj.com/deals/2012/11/21/hewlett-packards-unusual-ma-chain-of-command |

12 | Van Eck Press Release, 7/23/12: http://www.vaneck.com/uploadedImages/About_Van_Eck/Press_Room/ Trans-pdf-icon.gif |

5

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

Total Return | Share Price1 | NAV | EMHY2 |

Life* (cumulative) | 7.93% | 7.36% | 7.92% |

*since 5/8/12 |

|

|

|

Commencement date for the Market Vectors Emerging Markets High Yield Bond ETF (HYEM) was 5/8/12.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (5/8/12) to the first day of secondary market trading in shares of the Fund (5/9/12), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.89% / Net Expense Ratio 0.40%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.40% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | The BofA Merrill Lynch High Yield US Emerging Markets Liquid Corporate Plus Index (EMHY) is comprised of U.S. dollar denominated bonds issued by non-sovereign emerging market issuers that are rated BB1 or lower (based on an average of Moody’s, S&P and Fitch) and that are issued in the major domestic and Eurobond markets. |

|

|

| Merrill Lynch, Pierce, Fenner & Smith Incorporated and its affiliates (“BofA Merrill Lynch”) indices and related information, the name “BofA Merrill Lynch,” and related trademarks, are intellectual property licensed from BofA Merrill Lynch, and may not be copied, used, or distributed without BofA Merrill Lynch’s prior written approval. The licensee’s products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by BofA Merrill Lynch. BOFA MERRILL LYNCH MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS). |

6

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

Total Return | Share Price1 | NAV | GBIEMCOR2 | |||

Six Months | 3.43 | % | 2.98 | % | 3.55 | % |

One Year | 8.03 | % | 6.88 | % | 7.95 | % |

Life* (annualized) | 7.59 | % | 7.15 | % | 8.23 | % |

Life* (cumulative) | 18.13 | % | 17.02 | % | 19.76 | % |

*since 7/22/10 |

|

|

| |||

Commencement date for the Market Vectors Emerging Markets Local Currency Bond ETF was 7/22/10.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/22/10) to the first day of secondary market trading in shares of the Fund (7/23/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.44% / Net Expense Ratio 0.44%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.47% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | J.P. Morgan Government Bond Index–Emerging Markets Global Core (GBIEMCOR) is designed to track the performance of bonds issued by emerging market governments and denominated in the local currency of the issuer. The Index is designed to be investible and includes only those countries that are accessible by most of the international investor base. |

|

|

| Market Vectors Emerging Markets Local Currency Bond ETF (EMLC) is not sponsored, endorsed, sold or promoted by J.P. Morgan and J.P. Morgan makes no representation regarding the advisability of investing in EMLC. J.P. Morgan does not warrant the completeness or accuracy of the J.P. Morgan GBI- EMG Core Index. “J.P. Morgan” is a registered service mark of JPMorgan Chase & Co. © 2011. JPMorgan Chase & Co. All rights reserved. |

7

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

Total Return | Share Price1 | NAV | H0FA2 | |||

Six Months | 7.78 | % | 9.82 | % | 10.47 | % |

Life* (cumulative) | 10.15 | % | 10.70 | % | 11.62 | % |

*since 4/10/12 |

|

|

|

|

|

|

Commencement date for the Market Vectors Fallen Angel High Yield Bond ETF (ANGL) was 4/10/12.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (4/10/12) to the first day of secondary market trading in shares of the Fund (4/11/12), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 1.27% / Net Expense Ratio 0.40%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.40% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | The BofA Merrill Lynch US Fallen Angel High Yield Index (H0FA) is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance. |

|

|

| Merrill Lynch, Pierce, Fenner & Smith Incorporated and its affiliates (“BofA Merrill Lynch”) indices and related information, the name “BofA Merrill Lynch,” and related trademarks, are intellectual property licensed from BofA Merrill Lynch, and may not be copied, used, or distributed without BofA Merrill Lynch’s prior written approval. The licensee’s products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by BofA Merrill Lynch. BOFA MERRILL LYNCH MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS). |

8

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

Total Return | Share Price1 | NAV | HXUS2 | |||

Six Months | 7.73 | % | 7.36 | % | 7.74 | % |

Life * (cumulative) | 8.51 | % | 7.24 | % | 7.80 | % |

*since 4/2/12 |

|

|

|

|

|

|

Commencement date for the Market Vectors International High Yield Bond ETF was 4/2/12.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (4/2/12) to the first day of secondary market trading in shares of the Fund (4/3/12), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.72% / Net Expense Ratio 0.40%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.40% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | The BofA Merrill Lynch Global Ex-US Issuers High Yield Constrained Index (HXUS) tracks the performance of below investment grade debt issued by corporations located throughout the world (which may include emerging market countries) excluding the United States denominated in Euros, U.S. dollars, Canadian dollars or pound sterling issued in the major domestic or eurobond markets. |

|

|

| Merrill Lynch, Pierce, Fenner & Smith Incorporated and its affiliates (“BofA Merrill Lynch”) indices and related information, the name “Bank of America Merrill Lynch,” and related trademarks, are intellectual property licensed from BofA Merrill Lynch, and may not be copied, used, or distributed without BofA Merrill Lynch’s prior written approval. The licensee’s products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by BofA Merrill Lynch. BOFA MERRILL LYNCH MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS). |

9

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

Total Return | Share Price1 | NAV | MVFLTR2 | |||

Six Months | 5.53 | % | 2.47 | % | 2.77 | % |

One Year | 7.75 | % | 5.08 | % | 5.48 | % |

Life* (annualized) | 1.65 | % | 0.68 | % | 1.29 | % |

Life* (cumulative) | 2.52 | % | 1.04 | % | 1.96 | % |

*since 4/25/11 |

|

|

|

|

|

|

Commencement date for the Market Vectors Investment Grade Floating Rate ETF (FLTR) was 4/25/11.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (4/25/11) to the first day of secondary market trading in shares of the Fund (4/26/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 2.09% / Net Expense Ratio 0.19%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.19% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | Market Vectors Investment Grade Floating Rate Index (MVFLTR®) is comprised of U.S. dollar-denominated floating rate notes issued by corporate issuers or similar commercial entities that are public reporting companies in the U.S. and rated investment grade by at least one of three rating services: Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Rating Services (“S&P”) or Fitch International Rating Agency (“Fitch”). Investment grade securities are those rated Baa3 or higher by Moody’s or rated BBB- or higher by S&P or Fitch. |

Market Vectors Investment Grade Floating Rate Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties. Market Vectors Investment Grade Floating Rate ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

10

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

Total Return | Share Price1 | NAV | LATS2 | |||

Six Months | 6.59 | % | 3.50 | % | 5.69 | % |

One Year | 12.14 | % | 8.44 | % | 13.00 | % |

Life* (annualized) | 8.38 | % | 6.52 | % | 10.18 | % |

Life* (cumulative) | 12.59 | % | 9.76 | % | 15.39 | % |

*since 5/11/11 |

|

|

|

|

|

|

Commencement date for the Market Vectors LatAm Aggregate Bond ETF was 5/11/11.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (5/11/11) to the first day of secondary market trading in shares of the Fund (5/12/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 2.01% / Net Expense Ratio 0.49%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.49% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | The BofA Merrill Lynch Broad Latin America Bond Index (LATS) is composed of external and local currency Latin American sovereign debt and the external debt of non- sovereign Latin American issuers denominated in USD or Euros. |

|

|

| Merrill Lynch, Pierce, Fenner & Smith Incorporated and its affiliates (“BofA Merrill Lynch”) indices and related information, the name “Bank of America Merrill Lynch,” and related trademarks, are intellectual property licensed from BofA Merrill Lynch, and may not be copied, used, or distributed without BofA Merrill Lynch’s prior written approval. The licensee’s products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by BofA Merrill Lynch. BOFA MERRILL LYNCH MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS). |

11

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

Total Return | Share Price1 | NAV | MVMORTTR2 | |||

Six Months | 11.52 | % | 11.62 | % | 9.90 | % |

One Year | 27.87 | % | 28.14 | % | 24.35 | % |

Life* (annualized) | 19.46 | % | 19.30 | % | 15.30 | % |

Life* (cumulative) | 23.97 | % | 23.76 | % | 18.82 | % |

*since 8/16/11 |

|

|

|

|

|

|

Commencement date for the Market Vectors Mortgage REIT Income ETF was 8/16/11.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (8/16/11) to the first day of secondary market trading in shares of the Fund (8/17/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.57% / Net Expense Ratio 0.41%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.40% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | Market Vectors Global Mortgage REITs Index (MVMORTTR) is a rules-based index intended to give investors a means of tracking the overall performance of publicly traded U.S. and non-U.S. mortgage REITs that derive at least 50% of their revenues from mortgage-related activity. |

|

|

| Market Vectors Global Mortgage REITs Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties. Market Vectors Mortgage REIT Income ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund. |

12

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

Total Return | Share Price1 | NAV | WHPSL2 |

Life * (cumulative) | 4.52% | 3.87% | 3.89% |

*since 7/16/12 |

|

|

|

Commencement date for the Market Vectors Preferred Securities ex Financials ETF was 7/16/12.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/16/12) to the first day of secondary market trading in shares of the Fund (7/17/12), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.56% / Net Expense Ratio 0.40%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.40% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | Wells Fargo® Hybrid and Preferred Securities ex Financials Index (WHPSL) is designed to track the performance of convertible or exchangeable and non-convertible preferred securities listed on U.S. exchanges. |

|

|

| The Fund is not issued, sponsored, endorsed or advised by Wells Fargo & Company, Wells Fargo Securities, LLC or their subsidiaries and affiliates (collectively, “Wells Fargo”). Wells Fargo makes no representation or warranty, express or implied, to the Fund’s investors or any member of the public regarding the advisability of investing in securities generally or in the Fund particularly or the ability of any data supplied by Wells Fargo or the Index to track financial instruments comprising the Index or any trading market. Wells Fargo’s only relationship to the Adviser is the licensing of certain trademarks and trade names of Wells Fargo and of the data supplied by Wells Fargo that is determined, composed and calculated by Wells Fargo or a third party index calculator, without regard to the Fund or its shareholders. Wells Fargo has no obligation to take the needs of the Fund or the Fund’s shareholders into consideration when determining, composing or calculating the data. Wells Fargo has no obligation or liability in connection with the administration, marketing or trading of the Fund. |

13

|

PERFORMANCE COMPARISON |

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

Total Return | Share Price1 | NAV | MVCHLC®2 | |||

Six Months | 0.55 | % | 1.97 | % | 2.02 | % |

One Year | (0.49 | )% | 4.06 | % | 4.28 | % |

Life* (annualized) | 4.56 | % | 5.35 | % | 4.61 | % |

Life* (cumulative) | 4.82 | % | 5.65 | % | 4.88 | % |

*since 10/11/11 |

|

|

|

|

|

|

Commencement date for the Market Vectors Renminbi Bond ETF was 10/11/11.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (10/11/11) to the first day of secondary market trading in shares of the Fund (10/12/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 2.30% / Net Expense Ratio 0.39%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.39% of the Fund’s average daily net assets per year until at least September 1, 2013. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

|

|

2 | Market Vectors Renminbi Bond Index (MVCHLC®) is designed to track the performance of fixed-rate, Chinese Renminbi (“RMB”)-denominated bonds that are available to market participants outside of mainland China issued by Chinese or non-Chinese corporate, governmental, quasi-governmental or supranational issuers (“RMB Bonds”). |

|

|

| Market Vectors Renminbi Bond Index is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties. Market Vectors Renminbi Bond ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund. |

14

|

MARKET VECTORS ETF TRUST |

(unaudited) |

As a shareholder of a Fund, you incur operating expenses, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, May 1, 2012 to October 31, 2012.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as fees on purchase payments. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

|

|

|

|

|

| Beginning | Ending | Annualized | Expenses Paid | |

Emerging Markets High Yield Bond ETF*** |

|

|

|

| |

| Actual | $1,000.00 | $1,073.60 | 0.40% | $2.00 |

| Hypothetical** | $1,000.00 | $1,022.18 | 0.40% | $1.95 |

Emerging Markets Local Currency Bond ETF* |

|

|

|

| |

| Actual | $1,000.00 | $1,029.80 | 0.44% | $2.25 |

| Hypothetical** | $1,000.00 | $1,022.99 | 0.44% | $2.24 |

Fallen Angel High Yield Bond ETF* |

|

|

|

| |

| Actual | $1,000.00 | $1,098.20 | 0.40% | $2.12 |

| Hypothetical** | $1,000.00 | $1,023.19 | 0.40% | $2.04 |

International High Yield Bond ETF* |

|

|

|

| |

| Actual | $1,000.00 | $1,067.70 | 0.40% | $2.08 |

| Hypothetical** | $1,000.00 | $1,023.19 | 0.40% | $2.04 |

Investment Grade Floating Rate ETF* |

|

|

|

| |

| Actual | $1,000.00 | $1,024.70 | 0.19% | $0.97 |

| Hypothetical** | $1,000.00 | $1,024.25 | 0.19% | $0.97 |

LatAm Aggregate Bond ETF* |

|

|

|

| |

| Actual | $1,000.00 | $1,035.00 | 0.49% | $2.51 |

| Hypothetical** | $1,000.00 | $1,022.74 | 0.49% | $2.50 |

Mortgage REIT Income ETF* |

|

|

|

| |

| Actual | $1,000.00 | $1,116.20 | 0.41% | $2.19 |

| Hypothetical** | $1,000.00 | $1,023.14 | 0.41% | $2.09 |

15

|

MARKET VECTORS ETF TRUST |

EXPLANATION OF EXPENSES |

(continued) |

|

|

|

|

|

|

|

| Beginning | Ending | Annualized | Expenses Paid |

Preferred Securities ex Financials ETF**** |

|

|

|

| |

| Actual | $1,000.00 | $1,034.70 | 0.40% | $1.19 |

| Hypothetical** | $1,000.00 | $1,013.48 | 0.40% | $1.18 |

Renminbi Bond ETF* |

|

|

|

| |

| Actual | $1,000.00 | $1,019.70 | 0.39% | $1.99 |

| Hypothetical** | $1,000.00 | $1,023.24 | 0.39% | $1.99 |

|

|

* | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended October 31, 2012) multiplied by the average account value over the period, multiplied by 184 and divided by 365 (to reflect the one- half year period). |

** | Assumes annual return of 5% before expenses |

*** | Expenses are equal to the Fund’s annualized expense ratio (for the period from May 8, 2012 to October 31, 2012) multiplied by the average account value over the period, multiplied by 176 and divided by 365 (to reflect the one-half year period). |

**** | Expenses are equal to the Fund’s annualized expense ratio (for the period from July 16, 2012 to October 31, 2012) multiplied by the average account value over the period, multiplied by 107 and divided by 365 (to reflect the one-half year period). |

16

|

October 31, 2012 (unaudited) |

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

| ||

| |||||||

CORPORATE BONDS: 96.5% |

|

|

|

| |||

Argentina: 2.0% |

|

|

|

| |||

$ | 125,000 |

| City of Buenos Aires, Argentina 12.50%, 04/06/15 Reg S |

| $ | 119,375 |

|

|

|

| Provincia de Buenos Aires, Argentina |

|

|

|

|

| 125,000 |

| 10.88%, 01/26/21 Reg S |

|

| 83,750 |

|

| 275,000 |

| 11.75%, 10/05/15 Reg S |

|

| 218,625 |

|

|

|

|

|

| |||

|

|

|

|

|

| 421,750 |

|

|

|

|

|

| |||

Austria: 2.9% |

|

|

|

| |||

| 450,000 |

| OGX Austria GmbH 8.50%, 06/01/15 (c) 144A |

|

| 394,875 |

|

| 200,000 |

| Sappi Papier Holding GmbH 8.38%, 06/15/15 (c) 144A |

|

| 211,750 |

|

|

|

|

|

| |||

|

|

|

|

|

| 606,625 |

|

|

|

|

|

| |||

Barbados: 0.7% |

|

|

|

| |||

| 125,000 |

| Columbus International, Inc. 11.50%, 11/20/14 (c) Reg S |

|

| 141,250 |

|

|

|

|

|

| |||

Bermuda: 3.0% |

|

|

|

| |||

| 100,000 |

| Alliance Oil Co. Ltd. 9.88%, 03/11/15 Reg S |

|

| 107,265 |

|

| 150,000 |

| China Oriental Group Co. Ltd. 8.00%, 08/18/15 144A |

|

| 145,125 |

|

|

|

| Digicel Group Ltd. |

|

|

|

|

| 200,000 |

| 8.25%, 09/30/16 (c) 144A |

|

| 216,500 |

|

| 150,000 |

| 10.50%, 04/15/14 (c) Reg S |

|

| 167,250 |

|

|

|

|

|

| |||

|

|

|

|

|

| 636,140 |

|

|

|

|

|

| |||

Brazil: 2.6% |

|

|

|

| |||

| 450,000 |

| Banco do Brasil S.A. 9.25%, 04/15/23 (c) Reg S |

|

| 555,750 |

|

|

|

|

|

| |||

British Virgin Islands: 2.5% |

|

|

|

| |||

| 250,000 |

| CITIC Resources Finance 2007 Ltd. 6.75%, 05/15/14 (c) Reg S |

|

| 264,312 |

|

| 100,000 |

| RKI Finance 2010 Ltd. 9.50%, 09/21/13 (c) |

|

| 104,967 |

|

| 150,000 |

| Star Energy Geothermal Wayang Windu Ltd. 11.50%, 02/12/13 (c) Reg S |

|

| 163,695 |

|

|

|

|

|

| |||

|

|

|

|

|

| 532,974 |

|

|

|

|

|

| |||

Canada: 1.7% |

|

|

|

| |||

|

|

| Novelis, Inc. |

|

|

|

|

| 150,000 |

| 8.38%, 12/15/13 (c) |

|

| 163,875 |

|

| 175,000 |

| 8.75%, 12/15/15 (c) |

|

| 193,813 |

|

|

|

|

|

| |||

|

|

|

|

|

| 357,688 |

|

|

|

|

|

| |||

Cayman Islands: 13.4% |

|

|

|

| |||

| 400,000 |

| Agile Property Holdings Ltd. 8.88%, 04/28/14 (c) Reg S |

|

| 421,520 |

|

| 100,000 |

| China Shanshui Cement Group Ltd. 10.50%, 04/27/15 (c) Reg S |

|

| 109,750 |

|

| 350,000 |

| Country Garden Holdings Co. Ltd. 11.13%, 02/23/15 (c) Reg S |

|

| 396,375 |

|

| 200,000 |

| Emaar Sukuk Ltd. 6.40%, 07/18/19 Reg S |

|

| 217,500 |

|

| 275,000 |

| Evergrande Real Estate Group Ltd. 13.00%, 01/27/15 (c) Reg S |

|

| 286,687 |

|

|

|

| Fibria Overseas Finance Ltd. |

|

|

|

|

| 150,000 |

| 6.75%, 03/03/16 (c) Reg S |

|

| 167,250 |

|

| 100,000 |

| 7.50%, 05/04/15 (c) 144A |

|

| 111,250 |

|

| 100,000 |

| Jafz Sukuk Ltd. 7.00%, 06/19/19 Reg S |

|

| 110,900 |

|

| 125,000 |

| JBS Finance II Ltd. 8.25%, 01/29/15 (c) 144A |

|

| 131,563 |

|

| 200,000 |

| Longfor Properties Co. Ltd. 9.50%, 04/07/14 (c) Reg S |

|

| 222,500 |

|

| 100,000 |

| Marfrig Overseas Ltd. 9.50%, 05/04/15 (c) 144A |

|

| 89,000 |

|

| 100,000 |

| MCE Finance Ltd. 10.25%, 05/15/14 (c) |

|

| 114,500 |

|

| 100,000 |

| Minerva Overseas II Ltd. 10.88%, 11/15/15 (c) Reg S |

|

| 116,500 |

|

| 100,000 |

| Nile Finance Ltd. 5.25%, 08/05/15 Reg S |

|

| 101,250 |

|

|

|

| Shimao Property Holdings Ltd. |

|

|

|

|

| 100,000 |

| 8.00%, 12/03/12 (c) Reg S |

|

| 102,250 |

|

| 100,000 |

| 9.65%, 08/03/14 (c) Reg S |

|

| 106,684 |

|

|

|

|

|

| |||

|

|

|

|

|

| 2,805,479 |

|

|

|

|

|

| |||

Chile: 1.2% |

|

|

|

| |||

| 100,000 |

| Automotores Gildemeister S.A. 8.25%, 05/24/16 (c) 144A |

|

| 109,000 |

|

| 140,334 |

| Inversiones Alsacia S.A. 8.00%, 02/18/15 (c) Reg S |

|

| 148,024 |

|

|

|

|

|

| |||

|

|

|

|

|

| 257,024 |

|

|

|

|

|

| |||

China / Hong Kong: 3.5% |

|

|

|

| |||

| 250,000 |

| China Resources Power East Foundation Co. Ltd. 7.25%, 05/09/16 (c) |

|

| 259,317 |

|

| 450,000 |

| Citic Pacific Ltd. 6.88%, 01/21/18 Reg S |

|

| 476,576 |

|

|

|

|

|

| |||

|

|

|

|

|

| 735,893 |

|

|

|

|

|

| |||

Colombia: 3.0% |

|

|

|

| |||

| 125,000 |

| Bancolombia S.A. 6.13%, 07/26/20 |

|

| 140,625 |

|

| 200,000 |

| Colombia Telecomunicaciones S.A. E.S.P. 5.38%, 09/27/17 (c) 144A |

|

| 205,000 |

|

| 250,000 |

| Transportadora de Gas Internacional S.A. E.S.P. 5.70%, 03/20/17 (c) Reg S |

|

| 280,000 |

|

|

|

|

|

| |||

|

|

|

|

|

| 625,625 |

|

|

|

|

|

| |||

India: 0.5% |

|

|

|

| |||

| 100,000 |

| ICICI Bank Ltd. 6.38%, 04/30/17 (c) Reg S |

|

| 101,500 |

|

|

|

|

|

| |||

Indonesia: 3.9% |

|

|

|

| |||

| 125,000 |

| Adaro Indonesia PT 7.63%, 10/22/14 (c) 144A |

|

| 139,375 |

|

| 600,000 |

| Perusahaan Listrik Negara PT 5.50%, 11/22/21 Reg S |

|

| 679,500 |

|

|

|

|

|

| |||

|

|

|

|

|

| 818,875 |

|

|

|

|

|

| |||

Ireland: 6.2% |

|

|

|

| |||

| 450,000 |

| Alfa Bank OJSC Via Alfa Bond Issuance Plc 7.88%, 09/25/17 Reg S |

|

| 492,750 |

|

| 100,000 |

| Bank of Moscow via BOM Capital PL 6.70%, 03/11/15 Reg S |

|

| 107,150 |

|

| 100,000 |

| Gazprombank OJSC Via GPB Eurobond Finance Plc 7.25%, 05/03/19 Reg S |

|

| 106,165 |

|

See Notes to Financial Statements

17

|

EMERGING MARKETS HIGH YIELD BOND ETF |

SCHEDULE OF INVESTMENTS |

(continued) |

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

| ||

| |||||||

Ireland: (continued) |

|

|

|

| |||

$ | 450,000 |

| Raspadskaya OJSC Via Raspadskaya Securities Ltd. 7.75%, 04/27/17 144A |

| $ | 471,285 |

|

| 100,000 |

| Vimpel Communications Via VIP Finance Ireland Ltd. OJSC 9.13%, 04/30/18 Reg S |

|

| 117,603 |

|

|

|

|

|

| |||

|

|

|

|

|

| 1,294,953 |

|

|

|

|

|

| |||

Israel: 2.9% |

|

|

|

| |||

| 550,000 |

| Israel Electric Corp. Ltd. 7.25%, 01/15/19 (c) Reg S |

|

| 610,199 |

|

|

|

|

|

| |||

Kazakhstan: 2.1% |

|

|

|

| |||

| 100,000 |

| ATF Bank JSC 9.00%, 05/11/16 Reg S |

|

| 100,470 |

|

|

|

| Halyk Savings Bank of Kazakhstan JSC |

|

|

|

|

| 100,000 |

| 7.25%, 05/03/17 Reg S |

|

| 106,250 |

|

| 100,000 |

| 9.25%, 10/16/13 Reg S |

|

| 105,480 |

|

| 150,000 |

| Kazkommertsbank JSC 7.50%, 11/29/16 Reg S |

|

| 132,188 |

|

|

|

|

|

| |||

|

|

|

|

|

| 444,388 |

|

|

|

|

|

| |||

Luxembourg: 5.5% |

|

|

|

| |||

| 250,000 |

| ALROSA Finance S.A. 7.75%, 11/03/20 Reg S |

|

| 287,200 |

|

| 200,000 |

| Evraz Group S.A. 7.40%, 04/24/17 (c) Reg S |

|

| 208,560 |

|

|

|

| MHP S.A. |

|

|

|

|

| 100,000 |

| 10.25%, 04/29/15 (c) Reg S |

|

| 103,250 |

|

| 125,000 |

| 10.25%, 04/29/15 (c) 144A |

|

| 129,063 |

|

| 100,000 |

| Severstal OAO Via Steel Capital S.A. 6.70%, 10/25/17 Reg S |

|

| 107,485 |

|

| 200,000 |

| TMK OAO Via TMK Capital S.A. 7.75%, 01/27/18 Reg S |

|

| 207,000 |

|

| 100,000 |

| Yapi ve Kredi Bankasi Via Unicredit Luxembourg S.A. 5.19%, 10/13/15 Reg S |

|

| 103,500 |

|

|

|

|

|

| |||

|

|

|

|

|

| 1,146,058 |

|

|

|

|

|

| |||

Mexico: 4.1% |

|

|

|

| |||

| 100,000 |

| Axtel S.A.B. de C.V. 9.00%, 09/22/14 (c) Reg S |

|

| 57,000 |

|

|

|

| Cemex S.A.B. de C.V. |

|

|

|

|

| 100,000 |

| 9.00%, 01/11/15 (c) † 144A |

|

| 104,250 |

|

| 200,000 |

| 9.50%, 06/15/16 (c) 144A |

|

| 212,028 |

|

| 125,000 |

| Desarrolladora Homex S.A.B. de C.V. 9.75%, 03/25/16 (c) 144A |

|

| 126,875 |

|

| 100,000 |

| Empresas ICA S.A.B. de C.V. 8.90%, 02/04/16 (c) Reg S |

|

| 109,000 |

|

| 150,000 |

| Grupo Elektra S.A. de C.V. 7.25%, 08/06/15 (c) Reg S |

|

| 154,125 |

|

| 100,000 |

| Urbi Desarrollos Urbanos S.A.B. de C.V. 9.50%, 01/21/15 (c) Reg S |

|

| 93,000 |

|

|

|

|

|

| |||

|

|

|

|

|

| 856,278 |

|

|

|

|

|

| |||

Mongolia: 0.5% |

|

|

|

| |||

| 100,000 |

| Development Bank of Mongolia, LLC 5.75%, 03/21/17 Reg S |

|

| 107,630 |

|

|

|

|

|

| |||

Netherlands: 8.6% |

|

|

|

| |||

| 100,000 |

| DTEK Finance B.V. 9.50%, 04/28/15 Reg S |

|

| 101,560 |

|

| 125,000 |

| GT 2005 Bonds B.V. 8.00%, 12/03/12 (c) |

|

| 125,313 |

|

| 450,000 |

| GTB Finance B.V. 7.50%, 05/19/16 Reg S |

|

| 489,375 |

|

| 100,000 |

| Indosat Palapa Co. B.V. 7.38%, 07/29/15 (c) 144A |

|

| 114,500 |

|

| 100,000 |

| Intergas Finance B.V. 6.38%, 05/14/17 Reg S |

|

| 114,813 |

|

| 100,000 |

| Majapahit Holding B.V. 8.00%, 08/07/19 Reg S |

|

| 127,500 |

|