UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10325

VANECK VECTORS ETF TRUST

(Exact name of registrant as specified in charter)

666 Third Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

666 Third Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: SEPTEMBER 30

Date of reporting period: MARCH 31, 2017

ITEM 1. REPORT TO SHAREHOLDERS

| SEMI-ANNUAL REPORT March 31, 2017 (unaudited) |

| | |

| VANECK VECTORS® | |

| | |

| Biotech ETF | BBH |

| | |

| Environmental Services ETF | EVX® |

| | |

| Gaming ETF | BJK® |

| | |

| Generic Drugs ETF | GNRX |

| | |

| Pharmaceutical ETF | PPH® |

| | |

| Retail ETF | RTH® |

| | |

| Semiconductor ETF | SMH® |

The information contained in the management discussion represents the opinions of VanEck Vectors ETFs and may differ from other persons. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. The information contained herein regarding each index has been provided by the relevant index provider. Also, unless otherwise specifically noted, any discussion of the Funds’ holdings and the Funds’ performance, and the views of VanEck Vectors ETFs are as of March 31, 2017, and are subject to change.

VANECK VECTORS ETFs

(unaudited)

Dear Shareholder:

We are pleased to present this semi-annual report for the seven industry exchange-traded funds (ETFs) of the VanEck Vectors® ETF Trust for the six-month period ended March 31, 2017.

The top performing fund in our suite of industry ETFs was the VanEck Vectors Semiconductor ETF (NYSE Arca: SMH) which returned 15.83% for the period under review. Much of its notable performance was attributable to the predominance of U.S. listed companies in its portfolio.

The semiconductor industry ended 2016 on a high: global sales of $338.9 billion for the year; its highest ever.1 Sales in December 2016 of $31.0 billion bettered sales in December 2015 by 12.3%.2 According to John Neuffer, president and CEO of the Semiconductor Industry Association, “market growth was driven by macroeconomic factors, industry trends, and the ever increasing amount of semiconductor technology in devices the world depends on for working, communicating, manufacturing, treating illness, and countless other applications. We expect modest growth to continue in 2017 and beyond.”3

The industry started 2017 on a solid footing. While on a month-on-month basis, sales in February 2017 were a little softer than they were in January, year-to-year growth was the global market’s largest since October 2010.4 Fourth quarter earnings from several of the large chipmakers, reported in the first quarter of 2017, were particularly solid.5

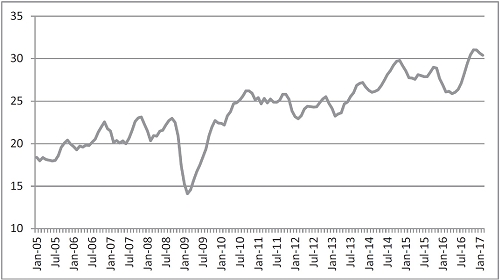

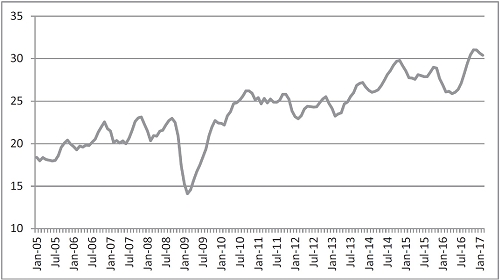

Semiconductors – Worldwide Market Billings: 3-Month Moving Averages ($B)

Source: Semiconductor Industry Association. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

Large-capitalization stocks continued to be key drivers of SMH’s returns. NVIDIA (5.3% of Fund net assets†), for example, was the best performing company in the Fund with its ”... GPU [Graphics Processing Units] computing platform is enjoying rapid adoption in artificial intelligence, cloud computing, gaming, and autonomous vehicles.”6 The advantage of GPUs is their speed. The company launched the world’s fastest gaming GPU (containing 12 billion transistors), the GeForce GTX 1080 TI, in March this year.7

Only two companies in the Fund’s portfolio, both U.S., detracted from performance, Intel (11.4% of Fund net assets† and with the highest weighting) and Qualcomm (6.1% of Fund net assets†). Late in 2016 Qualcomm made an offer for NXP Semiconductors (4.3% of Fund net assets†). However by the end of the reporting period, acceptance of the offer by NXP shareholders was far from certain. By early April, shortly after the period under review, owners of only just over 16.3% of NXP Semiconductors had tendered their shares and the offer from Qualcomm was extended.8

VANECK VECTORS ETFs

(unaudited)

We will, as always, continue to seek out and evaluate the most attractive opportunities for you as a shareholder. We encourage you to stay in touch with us through the videos, email subscriptions, and blogs available on our website, vaneck.com. And should you have any questions, please contact us at 800.826.2333 or visit vaneck.com.

Thank you for participating in the VanEck Vectors ETF Trust. On the following pages, you will find the performance record of each of the funds for the six months ended March 31, 2017. You will also find their financial statements. We value your continuing confidence in us and look forward to helping you meet your investment goals in future.

Jan F. van Eck

Trustee and President

VanEck Vectors ETF Trust

April 18, 2017

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

| † | All Fund assets referenced are total net assets as of March 31, 2017. |

| | |

| 1 | Semiconductor Industry Association: Global Semiconductor Sales Reach $339 Billion in 2016, https://www.semiconductors.org/news/2017/02/02/global_sales_report_2015/global_semiconductor_sales_reach_339_billion_in_2016/ |

| | |

| 2 | Ibid. |

| | |

| 3 | Ibid. |

| | |

| 4 | Semiconductor Industry Association: Global Semiconductor Sales Up 16.5 Percent Year-to-Year, https://www.semiconductors.org/news/2017/04/03/global_sales_report_2017/global_semiconductor_sales_up_16.5_percent_year_to_year/ |

| | |

| 5 | Zacks: Semiconductor ETFs Riding High on Q4 Earnings, http://finance.yahoo.com/news/semiconductor-etfs-riding-high-q4-140002875.html |

| | |

| 6 | NVIDIA: NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2017, http://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-fourth-quarter-and-fiscal-2017 |

| | |

| 7 | VR-VOICE: NVIDIA Launches World’s Fastest Gaming GPU (4K VR Ready), https://vrvoice.co/nvidia-launches-worlds-fastest-gaming-gpu-4k-vr-ready/ |

| | |

| 8 | NASDAQ: Qualcomm Extends Tender Offer For NXP Semiconductors Until May 2, http://www.nasdaq.com/article/qualcomm-extends-tender-offer-for-nxp-semiconductors-until-may-2-20170404-00349 |

Management Discussion (unaudited)

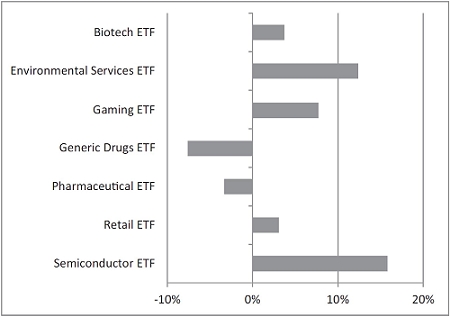

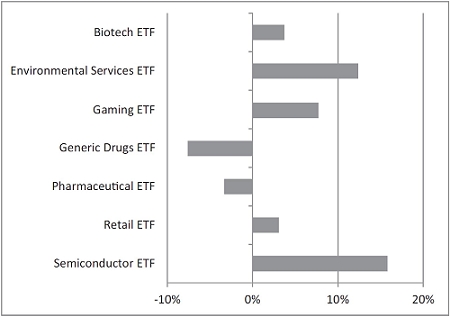

Five of the seven VanEck Vectors Industry ETFs realized positive performance in the six months ended March 31, 2017. VanEck Vectors Semiconductor ETF (NYSE Arca: SMH) posted an impressive total return of 15.83%, with VanEck Vectors Environmental Services ETF NYSE Arca: EVX) not far behind, providing a total return of 12.37%. Both funds easily outperformed the S&P 500® Index’s‡ 10.12% gain over the same period.

October 1, 2016 through March 31, 2017

VanEck Vectors Industry ETFs Total Return

Source: VanEck. Returns based on NAV. The performance data quoted represent past performance. Past performance is not a guarantee of future results. Performance information for the Funds reflects temporary waivers of expenses and/or fees. Had the Funds incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Funds will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

Biotech – possible pricing pressures

After some significant movements both before and following the U.S. presidential election at the beginning of November, biotech companies ended 2016 down slightly from the start of the fourth quarter. Thereafter, they rose during most of the first quarter of 2017, to end the six-month period up 3.71%. As with the pharmaceutical and generic drugs industries, the biotech industry was not helped by President Trump’s use of his Twitter account to protest against the price of drugs. Positive contributions to the Fund’s performance came mainly from three companies: Celgene (11.4% of Fund net assets†), Incyte (4.5% of Fund net assets†), and Vertex Pharmaceuticals (5.4% of Fund net assets†). The company that detracted most from performance was Gilead Sciences (10.4% of Fund net assets†).

Environmental Services – still in demand

Historically, growth in the construction and home-building industries has benefitted environmental services companies. Due in part to significant upticks in both construction1 and home-building2 in the U.S. in the first quarter of 2017, the Fund returned notable performance, gaining 12.37% over the six-month period under review. While U.S. stocks accounted for the vast majority of the Fund’s healthy positive total return, the single Canadian stock in the Fund (Waste Connections, 10.0% of Fund net assets†) was the second best performing company over the period. The best performing company with the top individual weighting in the Fund was U.S. company Republic Services (9.9% of Fund net assets†). Only three companies detracted from performance over the period under review, CECO Environmental (2.0% of Fund net assets†), Advanced Disposal Services (3.8% of Fund net assets†), and STERIS (3.8% of Fund net assets†).

VANECK VECTORS ETFs

(unaudited)

Gaming – Macau recovering

The Fund posted a rise of 7.71% for the six-month period. The fourth quarter of 2016 was particularly tumultuous, with the Fund dropping fast and far in December and ending 2016 well below the level at which it started the quarter. However, during the first quarter of 2017, gaming stocks followed an upward trajectory and ended the six-month period significantly higher than they started the year. In Macau, China, the world’s biggest gaming hub, there was a notable improvement in the gaming industry’s fortunes. In each month of the period under review, the gross revenue from “Games of Fortune” (as the Macau authorities3 describe them) was higher than that recorded in the same month in the prior year. In March 2017, it was 18.1% higher than in March 2016.4 This marked the eighth consecutive month of year-on-year improvement. In Nevada, following a couple of lackluster months in the fourth quarter of 2016, January was a particularly encouraging month for the gaming industry. At nearly $1.04 billion, the state’s “win revenue” for the month was the highest recorded since February 2013.5 However, the figure of $945.6 million for February was less encouraging.6 Perhaps because of this, gaming companies operating in Macau were the most significant contributors to the Fund’s overall performance, with those in the U.S. providing the next largest returns from any territory. The other major contributors were companies in Malaysia and Australia. Gaming businesses in Ireland, New Zealand, and Sweden were the main detractors from the Fund’s overall positive performance.

Generic Drugs – troubled times

The Fund had a challenging and disappointing six months ending the period down 7.62%. The industry continued to be overshadowed by a wide-ranging criminal investigation by the U.S. Department of Justice into the pricing of generic drugs.7 The market environment also remained challenging with memories still raw from the controversies surrounding both Valeant Pharmaceuticals and Turing Pharmaceuticals (neither owned by the Fund during the period). On March 13, 2017, William Ackman’s firm, Pershing Square Capital Management, sold its stake in Valeant for a loss of $4 billion.8 The pharmaceuticals sector detracted the most from the Fund’s performance, while positive performance was only provided by the chemicals sector and the global specialty chemicals company Albemarle (3.8% of Fund net assets†) within it. In terms of individual companies, Teva Pharmaceutical Industries (7.7% of Fund net assets†) was the single largest detractor from performance. The company was affected by a number of different factors, including an uninspiring earnings report and outlook in November 2016 and concerns about both generic competition for the company’s multiple sclerosis drug Copaxone and integration issues following its acquisition of Actavis.9

Pharmaceutical – possible pricing pressures

Pharmaceutical stocks followed much the same trajectory as biotechnology stocks during the six-month period. However, unlike biotech stocks, they were not able to recoup the losses they suffered between the end of September and early November, with the Fund ending the period under review down 3.33%. As with the biotech and generic drug industries, pharmaceuticals were not helped by President Trump’s use of his Twitter account to protest against the price of drugs. While companies in France and Switzerland were positive contributors to the Fund’s overall performance, their contributions were too small to offset the negative performance of companies in all other countries, in particular, those in the U.S and Israel, the countries that detracted most from the performance of the Fund.

Retail – stressed by Amazon and online

The Fund returned 3.07% for the six-month period under review. Retail sales (excluding automobiles, gasoline stations, and restaurants) in the U.S. over the last three months of 2016 proved to be solid. In November and December, they increased 4% over 2015 to reach $658.3 billion.10 This included some $122.9 billion of non-store sales, up 12.6% over 2015.11 Retail sales (excluding automobiles, gasoline stations, and restaurants) continued to hold up well over the first two months of 2017. January sales recorded a 0.4% rise and, in February, grew another 0.2%.12 There were, however, several high profile retail store bankruptcies in the first three months of 2017 including The Limited, American Apparel, and Wet Seal. While stores involved in internet and catalog retailing, together with specialty retailers, contributed by far the most to the positive performance of the Fund, food and staples retailing companies also made useful contributions to performance. Most multi-line retailers, for example, Target (4.6% of Fund net assets†) and Macy’s (1.5% of Fund net assets†), were detractors from performance.

Semiconductor – solid sales and earnings

The Fund was the best performing ETF in the suite, returning 15.83% for the six-month period under review. With global semiconductor sales in 2016 of $338.9 billion, the industry recorded its highest ever annual sales.13 Sales in December of $31.0 billion bettered sales in December 2015 by 12.3%.14 According to John Neuffer, president and CEO of the Semiconductor Industry Association, “[m]arket growth was driven by macroeconomic factors, industry trends, and the ever-increasing amount of semiconductor technology in devices the world depends on for working, communicating, manufacturing, treating illness, and countless other applications. We expect modest growth to continue in 2017 and beyond.”15 While, on a month-on-month basis, sales in February 2017 were a little softer than they were in January, year-to-year growth was the global market’s largest since October 2010.16 The industry demonstrated strong sales in the first two months of 2017 with memory products such as NAND flash and DRAM “leading the way.”17 Fourth quarter earnings from several of the large chipmakers were particularly solid.18 Companies in the U.S. contributed by far the most to the Fund’s positive performance. NVIDIA (5.3% of Fund net assets†) and Micron Technology (5.0% of Fund net assets†), both in the U.S., were the two best performing companies. Despite, or, perhaps because of, its offer to buy NXP Semiconductors (4.3% of Fund net assets†), Qualcomm (6.1% of Fund net assets†) was the company to detract most from the Fund’s performance. In early April, shortly after the period under review, owners of only just over 16.3% of NXP Semiconductors had tendered their shares and the offer from Qualcomm was extended.19

| † | All Fund assets referenced are Total Net Assets as of March 31, 2017. |

| | |

| ‡ | S&P 500® Index consists of 500 widely held common stocks covering the industrial, utility, financial, and transportation sectors |

| 1 | Board of Governors of the Federal Reserve System: Industrial Production and Capacity Utilization - G.17, http://www.federalreserve.gov/releases/g17/Current/ |

| | |

| 2 | U.S. Census Bureau News: New Residential Construction in March 2017, https://www.census.gov/construction/nrc/pdf/newresconst.pdf |

| | |

| 3 | Gaming Inspection and Coordination Bureau, Macao SAR: Monthly Gross Revenue from Games of Fortune, http://www.dicj.gov.mo/web/en/information/DadosEstat_mensal/2017/index.html |

| | |

| 4 | Ibid. |

| | |

| 5 | Las Vegas Sun: Nevada gaming revenue up 12 percent in January, eclipses $1 billion, https://lasvegassun.com/news/2017/feb/28/nevada-gaming-revenue-up-12-percent-in-january-ecl/ |

| | |

| 6 | Nevada Gaming Control Board: Win Revenue Summary - February 2017, http://gaming.nv.gov/modules/showdocument.aspx?documentid=11930 |

| | |

| 7 | Bloomberg: Perrigo Joins Firms With Generic Drugs Under U.S. Glare, https://www.bloomberg.com/news/articles/2017-03-03/perrigo-joins-list-of-firms-with-generic-drugs-under-u-s-glare |

| | |

| 8 | The New York Times: William Ackman Sells Pershing Fund’s Stake in Valeant, https://www.nytimes.com/2017/03/13/business/dealbook/william-ackman-valeant-pershing-square.html?_r=0 |

| | |

| 9 | The Motley Fool: The Sole Reason Teva Pharmaceutical Industries Ltd. Sank 12% in November, https://www.fool.com/investing/2016/12/02/the-sole-reason-teva-pharmaceutical-industries-ltd.aspx |

| | |

| 10 | National Retail Federation: Holiday retail sales increased 4 percent in 2016, https://nrf.com/news/holiday-retail-sales-increased-4-percent-2016 |

| | |

| 11 | Ibid. |

| | |

| 12 | National Retail Federation: Economy, https://nrf.com/news/retail-sales |

| | |

| 13 | Semiconductor Industry Association: Global Semiconductor Sales Reach $339 Billion in 2016, https://www.semiconductors.org/news/2017/02/02/global_sales_report_2015/global_semiconductor_sales_reach_339_billion_in_2016/ |

| | |

| 14 | Ibid. |

| | |

| 15 | Ibid. |

| | |

| 16 | Semiconductor Industry Association: Global Semiconductor Sales Up 16.5 Percent Year-to-Year, https://www.semiconductors.org/news/2017/04/03/global_sales_report_2017/global_semiconductor_sales_up_16.5_percent_year_to_year/ |

| | |

| 17 | Ibid. |

| | |

| 18 | Zacks: Semiconductor ETFs Riding High on Q4 Earnings, http://finance.yahoo.com/news/semiconductor-etfs-riding-high-q4-140002875.html |

| | |

| 19 | NASDAQ: Qualcomm Extends Tender Offer For NXP Semiconductors Until May 2, http://www.nasdaq.com/article/qualcomm-extends-tender-offer-for-nxp-semiconductors-until-may-2-20170404-00349 |

PERFORMANCE COMPARISON

March 31, 2017 (unaudited)

VANECK VECTORS BIOTECH ETF

| | | Average Annual Total Returns | | Cumulative Total Returns | |

| | | Share Price | | NAV | | MVBBHTR1 | | | Share Price | | NAV | | MVBBHTR1 | |

| Six Months | | | 3.64 | % | | | 3.71 | % | | | 3.73 | % | | | | 3.64 | % | | | 3.71 | % | | | 3.73 | % | |

| One Year | | | 15.17 | % | | | 15.21 | % | | | 15.29 | % | | | | 15.17 | % | | | 15.21 | % | | | 15.29 | % | |

| Five Year | | | 21.97 | % | | | 22.05 | % | | | 22.23 | % | | | | 169.98 | % | | | 170.86 | % | | | 172.79 | % | |

| Life* | | | 26.14 | % | | | 26.15 | % | | | 26.35 | % | | | | 240.82 | % | | | 240.88 | % | | | 243.75 | % | |

| * | Commencement of Fund: 12/20/11; First Day of Secondary Market Trading: 12/21/11. |

| 1 | MVISTM US Listed Biotech 25 Index (MVBBHTR) is a rules-based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of the largest and the most liquid common stocks and depositary receipts of U.S. exchange-listed companies that derive at least 50% of their revenues from biotechnology, which includes companies engaged primarily in research and development as well as production, marketing and sales of drugs based on genetic analysis and diagnostic equipment (excluding pharmacies). |

VANECK VECTORS ENVIRONMENTAL SERVICES ETF

| | | Average Annual Total Returns | | Cumulative Total Returns | |

| | | Share Price | NAV | | AXENV1 | | | Share Price | | NAV | | AXENV1 | |

| Six Months | | | 12.06 | % | | | 12.37 | % | | | 12.67 | % | | | | 12.06 | % | | | 12.37 | % | | | 12.67 | % | |

| One Year | | | 21.02 | % | | | 21.34 | % | | | 21.97 | % | | | | 21.02 | % | | | 21.34 | % | | | 21.97 | % | |

| Five Year | | | 9.35 | % | | | 9.33 | % | | | 9.88 | % | | | | 56.34 | % | | | 56.20 | % | | | 60.15 | % | |

| Ten Year* | | | 6.67 | % | | | 6.68 | % | | | 7.23 | % | | | | 90.66 | % | | | 90.96 | % | | | 100.94 | % | |

| * | Commencement of Fund: 10/10/06; First Day of Secondary Market Trading: 10/16/06. |

| 1 | NYSE Arca Environmental Services Index (AXENV) is a modified equal dollar-weighted index comprised of publicly traded companies that engage in business activities that may benefit from the global increase in demand for consumer waste disposal, removal and storage of industrial by-products, and the management of associated resources. |

VANECK VECTORS GAMING ETF

| | | Average Annual Total Returns | | Cumulative Total Returns | |

| | | Share Price | | NAV | | MVBJKTR1 | | | Share Price | | NAV | | MVBJKTR1 | |

| Six Months | | | 7.10 | % | | | 7.71 | % | | | 8.15 | % | | | | 7.10 | % | | | 7.71 | % | | | 8.15 | % | |

| One Year | | | 14.28 | % | | | 14.56 | % | | | 14.90 | % | | | | 14.28 | % | | | 14.56 | % | | | 14.90 | % | |

| Five Year | | | 4.47 | % | | | 4.38 | % | | | 4.78 | % | | | | 24.43 | % | | | 23.88 | % | | | 26.32 | % | |

| Life* | | | 2.28 | % | | | 2.28 | % | | | 3.01 | % | | | | 22.99 | % | | | 22.97 | % | | | 31.28 | % | |

| * | Commencement of Fund: 1/22/08; First Day of Secondary Market Trading: 1/24/08. |

| Index data prior to September 24, 2012 reflects that of the S-Network Global Gaming Index (WAGRT). From September 24, 2012, forward, the index data reflects that of the Fund’s underlying index, VanEck Vectors Global Gaming Index (MVBJKTR). Index history which includes periods prior to September 24, 2012 reflects a blend of the performance of WAGRT and MVBJKTR and is not intended for third party use. |

| 1 | MVISTM Global Gaming Index (MVBJKTR) is a rules-based index intended to give investors a means of tracking the overall performance of the largest and most liquid companies in the global gaming industry that generate at least 50% of their revenues from casinos and hotels, sports betting (including internet gambling and racetracks) and lottery services as well as gaming services, gaming technology and gaming equipment. |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 9 for more information.

VANECK VECTORS GENERIC DRUGS ETF

| | | Average Annual Total Returns | | Cumulative Total Returns | |

| | | Share Price | | NAV | | IGNRXT1 | | | Share Price | | NAV | | IGNRXT1 | |

| Six Months | | | (7.35 | )% | | | (7.62 | )% | | | (6.81 | )% | | | | (7.35 | )% | | | (7.62 | )% | | | (6.81 | )% | |

| One Year | | | (5.81 | )% | | | (6.12 | )% | | | (5.28 | )% | | | | (5.81 | )% | | | (6.12 | )% | | | (5.28 | )% | |

| Life* | | | (8.42 | )% | | | (8.92 | )% | | | (8.00 | )% | | | | (10.14 | )% | | | (10.74 | )% | | | (9.64 | )% | |

| * | Commencement of Fund: 1/12/16; First Day of Secondary Market Trading: 1/13/16. |

| 1 | Indxx Global Generics & New Pharma Index (IGNRXT) a rules-based, modified capitalization weighted index. The Index includes exchange-listed companies, on a global basis, that derive a significant proportion (as determined by Indxx, LLC) of their revenues (or that have the potential to derive a significant proportion of their revenues) from the generic drug industry, or that have a primary business focus on the generic drug industry. |

VANECK VECTORS PHARMACEUTICAL ETF

| | | Average Annual Total Returns | | Cumulative Total Returns | |

| | | Share Price | | NAV | | MVPPHTR1 | | | Share Price | | NAV | | MVPPHTR1 | |

| Six Months | | | (3.42 | )% | | | (3.33 | )% | | | (3.32 | )% | | | | (3.42 | )% | | | (3.33 | )% | | | (3.32 | )% | |

| One Year | | | (1.99 | )% | | | (1.94 | )% | | | (1.83 | )% | | | | (1.99 | )% | | | (1.94 | )% | | | (1.83 | )% | |

| Five Year | | | 9.95 | % | | | 9.94 | % | | | 9.90 | % | | | | 60.66 | % | | | 60.62 | % | | | 60.29 | % | |

| Life* | | | 11.00 | % | | | 10.81 | % | | | 10.77 | % | | | | 73.51 | % | | | 71.92 | % | | | 71.57 | % | |

| * | Commencement of Fund: 12/20/11; First Day of Secondary Market Trading: 12/21/11. |

| 1 | MVISTM US Listed Pharmaceutical 25 Index (MVPPHTR) is a rules-based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of the largest and the most liquid common stocks and depositary receipts of U.S. exchange-listed companies that derive at least 50% of their revenues from pharmaceuticals, which includes companies engaged primarily in research and development as well as production, marketing and sales of pharmaceuticals. |

VANECK VECTORS RETAIL ETF

| | | Average Annual Total Returns | | Cumulative Total Returns | |

| | | Share Price | | NAV | | MVRTHTR1 | | | Share Price | | NAV | | MVRTHTR1 | |

| Six Months | | | 3.17 | % | | | 3.07 | % | | | 2.98 | % | | | | 3.17 | % | | | 3.07 | % | | | 2.98 | % | |

| One Year | | | 4.27 | % | | | 4.24 | % | | | 4.09 | % | | | | 4.27 | % | | | 4.24 | % | | | 4.09 | % | |

| Five Year | | | 15.21 | % | | | 15.19 | % | | | 15.00 | % | | | | 102.95 | % | | | 102.78 | % | | | 101.12 | % | |

| Life* | | | 17.13 | % | | | 16.88 | % | | | 16.69 | % | | | | 130.39 | % | | | 127.83 | % | | | 125.91 | % | |

| * | Commencement of Fund: 12/20/11; First Day of Secondary Market Trading: 12/21/11. |

| 1 | MVISTM US Listed Retail 25 Index (MVRTHTR) is a rules-based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of the largest and the most liquid common stocks and depositary receipts of U.S. exchange-listed companies that derive at least 50% of their revenues from retail, which includes companies engaged primarily in retail distribution; wholesalers; online, direct mail and TV retailers; multi-line retailers; specialty retailers, such as apparel, automotive, computer and electronics, drug, home improvement and home furnishing retailers; and food and other staples retailers. |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 9 for more information.

PERFORMANCE COMPARISON

March 31, 2017 (unaudited) (continued)

VANECK VECTORS SEMICONDUCTOR ETF

| | | Average Annual Total Returns | | Cumulative Total Returns | |

| | | Share Price | | NAV | | MVSMHTR1 | | | Share Price | | NAV | | MVSMHTR1 | |

| Six Months | | | 15.64 | % | | | 15.83 | % | | | 15.83 | % | | | | 15.64 | % | | | 15.83 | % | | | 15.83 | % | |

| One Year | | | 45.86 | % | | | 45.91 | % | | | 46.03 | % | | | | 45.86 | % | | | 45.91 | % | | | 46.03 | % | |

| Five Year | | | 19.18 | % | | | 19.17 | % | | | 19.09 | % | | | | 140.48 | % | | | 140.36 | % | | | 139.50 | % | |

| Life* | | | 22.08 | % | | | 22.14 | % | | | 22.05 | % | | | | 186.69 | % | | | 187.47 | % | | | 186.38 | % | |

| * | Commencement of Fund: 12/20/11; First Day of Secondary Market Trading: 12/21/11. |

| 1 | MVISTM US Listed Semiconductor 25 Index (MVSMHTR) is a rules-based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of the largest and the most liquid common stocks and depositary receipts of U.S. exchange-listed companies that derive at least 50% of their revenues from semiconductors, which includes the production of semiconductors and semiconductor equipment. |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

See “About Fund Performance” on page 9 for more information.

VANECK VECTORS ETF TRUST

ABOUT FUND PERFORMANCE

(unaudited)

The price used to calculate market return (Share Price) is determined by using the closing price listed on its primary listing exchange. Since the shares of each Fund did not trade in the secondary market until after each Fund’s commencement, for the period from commencement to the first day of secondary market trading in shares of each Fund, the NAV of each Fund is used as a proxy for the secondary market trading price to calculate market returns.

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for each Fund reflects temporary waivers of expenses and/or fees. Had each Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of each Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund returns reflect reinvestment of dividends and capital gains distributions. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a VanEck Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. VanEck Vectors ETF investors should not expect to buy or sell fund shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

The Biotech Index, Gaming Index, Pharmaceutical Index, Retail Index, and Semiconductor Index are published by MV Index Solutions GmbH (MVIS), which is a wholly owned subsidiary of the Adviser, Van Eck Associates Corporation. The Environmental Services Index is published by NYSE Arca, Inc. The Generic Drugs Index is published by Indxx.

MVIS, Indxx, and NYSE are referred to herein as the “Index Providers.” The Index Providers do not sponsor, endorse, or promote the Funds and bear no liability with respect to the Funds or any security.

Premium/discount information regarding how often the closing trading price of the Shares of each Fund were above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund for each of the four previous calendar quarters and the immediately preceding five years (if applicable) can be found at www.vaneck.com.

VANECK VECTORS ETF TRUST

EXPLANATION OF EXPENSES

(unaudited)

Hypothetical $1,000 investment at beginning of period

As a shareholder of a Fund, you incur operating expenses, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, October 1, 2016 to March 31, 2017.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on your Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as program fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value

October 1, 2016 | | Ending

Account

Value

March 31, 2017 | | Annualized

Expense

Ratio

During Period | | Expenses Paid

During the Period*

October 1, 2016-

March 31, 2017 |

| Biotech ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,037.10 | | | | 0.35 | % | | $ | 1.78 | |

| Hypothetical** | | $ | 1,000.00 | | | $ | 1,023.19 | | | | 0.35 | % | | $ | 1.77 | |

| Environmental Services ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,123.70 | | | | 0.55 | % | | $ | 2.91 | |

| Hypothetical** | | $ | 1,000.00 | | | $ | 1,022.19 | | | | 0.55 | % | | $ | 2.77 | |

| Gaming ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,077.10 | | | | 0.66 | % | | $ | 3.42 | |

| Hypothetical** | | $ | 1,000.00 | | | $ | 1,021.64 | | | | 0.66 | % | | $ | 3.33 | |

| Generic Drugs ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | | $923.80 | | | | 0.58 | % | | $ | 2.78 | |

| Hypothetical** | | $ | 1,000.00 | | | $ | 1,022.04 | | | | 0.58 | % | | $ | 2.92 | |

| Pharmaceutical ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | | $966.70 | | | | 0.35 | % | | $ | 1.72 | |

| Hypothetical** | | $ | 1,000.00 | | | $ | 1,023.19 | | | | 0.35 | % | | $ | 1.77 | |

| Retail ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,030.70 | | | | 0.35 | % | | $ | 1.77 | |

| Hypothetical** | | $ | 1,000.00 | | | $ | 1,023.19 | | | | 0.35 | % | | $ | 1.77 | |

| Semiconductor ETF | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,158.30 | | | | 0.35 | % | | $ | 1.88 | |

| Hypothetical** | | $ | 1,000.00 | | | $ | 1,023.19 | | | | 0.35 | % | | $ | 1.77 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended March 31, 2017) multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year divided by the number of days in the fiscal year (to reflect the one-half year period). |

| ** | Assumes annual return of 5% before expenses |

VANECK VECTORS BIOTECH ETF

SCHEDULE OF INVESTMENTS

March 31, 2017 (unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| |

| COMMON STOCKS: 100.0% | | | | |

| Ireland: 1.7% | | | | |

| | 192,403 | | | Alkermes Plc (USD) * | | $ | 11,255,576 | |

| Netherlands: 2.3% | | | | |

| | 539,805 | | | QIAGEN NV (USD) | | | 15,638,151 | |

| Spain: 2.0% | | | | |

| | 711,514 | | | Grifols SA (ADR) | | | 13,429,827 | |

| United States: 94.0% | | | | |

| | 213,572 | | | ACADIA Pharmaceuticals, Inc. † | | | 7,342,605 | |

| | 243,718 | | | Alexion Pharmaceuticals, Inc. | | | 29,548,370 | |

| | 243,845 | | | Allergan Plc | | | 58,259,447 | |

| | 102,777 | | | Alnylam Pharmaceuticals, Inc. * † | | | 5,267,321 | |

| | 515,359 | | | Amgen, Inc. | | | 84,554,951 | |

| | 157,085 | | | Biogen Idec, Inc. * | | | 42,950,181 | |

| | 332,783 | | | BioMarin Pharmaceutical, Inc. * | | | 29,211,692 | |

| | 54,227 | | | Bluebird Bio, Inc. * † | | | 4,929,234 | |

| | 623,205 | | | Celgene Corp. * | | | 77,545,398 | |

| | 130,506 | | | Charles River Laboratories International, Inc. * | | | 11,739,015 | |

| | 1,035,017 | | | Gilead Sciences, Inc. | | | 70,298,355 | |

| | 188,882 | | | Illumina, Inc. * | | | 32,230,824 | |

| | 228,324 | | | Incyte Corp. * | | | 30,520,069 | |

| | 25,550 | | | Intercept Pharmaceuticals, Inc. * † | | | 2,889,705 | |

| | 225,907 | | | Ionis Pharmaceuticals, Inc. * † | | | 9,081,461 | |

| | 176,376 | | | Neurocrine Biosciences, Inc. * | | | 7,637,081 | |

| | 392,420 | | | Quintiles Transnational Holdings, Inc. * | | | 31,601,583 | |

| | 81,423 | | | Regeneron Pharmaceuticals, Inc. * | | | 31,552,227 | |

| | 151,345 | | | Seattle Genetics, Inc. * † | | | 9,513,547 | |

| | 80,096 | | | TESARO, Inc. * † | | | 12,324,372 | |

| | 92,525 | | | United Therapeutics Corp. * | | | 12,526,034 | |

| | 336,864 | | | Vertex Pharmaceuticals, Inc. * | | | 36,836,078 | |

| | | | | | | | 638,359,550 | |

Total Common Stocks

(Cost: $735,717,637) | | | 678,683,104 | |

| MONEY MARKET FUND: 0.0% | | | | |

| (Cost: $449,385) | | | | |

| | 449,385 | | | Dreyfus Government Cash Management Fund | | | 449,385 | |

Total Investments Before Collateral for Securities Loaned: 100.0%

(Cost: $736,167,022) | | 679,132,489 | |

| Principal | | | | | | |

| Amount | | | | | Value | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS HELD AS COLLATERAL FOR SECURITIES LOANED: 5.0% | | | | |

| Repurchase Agreements: 5.0% | | | | |

| $ | 8,053,286 | | | Repurchase agreement dated 3/31/17 with Citigroup Global Markets, Inc., 0.81%, due 4/3/17, proceeds $8,053,830; (collateralized by various U.S. government and agency obligations, 0.00% to 11.50%, due 4/1/17 to 6/1/52, valued at $8,214,352 including accrued interest) | | $ | 8,053,286 | |

| | 8,053,286 | | | Repurchase agreement dated 3/31/17 with Daiwa Capital Markets America, Inc., 0.82%, due 4/3/17, proceeds $8,053,836; (collateralized by various U.S. government and agency obligations, 0.00% to 6.50%, due 5/11/17 to 12/1/51, valued at $8,214,352 including accrued interest) | | | 8,053,286 | |

| | 1,694,672 | | | Repurchase agreement dated 3/31/17 with HSBC Securities USA, Inc., 0.77%, due 4/3/17, proceeds $1,694,781; (collateralized by various U.S. government and agency obligations, 0.00% to 2.13%, due 5/15/25 to 11/15/45, valued at $1,728,566 including accrued interest) | | | 1,694,672 | |

| | 8,053,286 | | | Repurchase agreement dated 3/31/17 with Merrill Lynch, Pierce, Fenner & Smith, Inc., 0.83%, due 4/3/17, proceeds $8,053,843; (collateralized by various U.S. government and agency obligations, 1.84% to 7.00%, due 5/1/17 to 12/1/46, valued at $8,214,352 including accrued interest) | | | 8,053,286 | |

| | 8,053,286 | | | Repurchase agreement dated 3/31/17 with Nomura Securities International, Inc., 0.81%, due 4/3/17, proceeds $8,053,830; (collateralized by various U.S. government and agency obligations, 0.00% to 7.50%, due 4/19/17 to 2/20/67, valued at $8,214,352 including accrued interest) | | | 8,053,286 | |

Total Short-Term Investments Held as Collateral for Securities Loaned

(Cost: $33,907,816) | | | 33,907,816 | |

| Total Investments: 105.0% | | | | |

| (Cost: $770,074,838) | | | 713,040,305 | |

| Liabilities in excess of other assets: (5.0)% | | | (34,190,856 | ) |

| NET ASSETS: 100.0% | | $ | 678,849,449 | |

See Notes to Financial Statements

VANECK VECTORS BIOTECH ETF

SCHEDULE OF INVESTMENTS

March 31, 2017 (unaudited) (continued)

| ADR | American Depositary Receipt |

| USD | United States Dollar |

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $33,186,847. |

Summary of Investments by Sector Excluding

Collateral for Securities Loaned (unaudited) | | % of Investments | | Value | |

| Biotechnology | | | 69.1 | % | | $ | 469,202,183 | |

| Health Care | | | 22.0 | | | | 149,872,931 | |

| Life Sciences Tools & Services | | | 8.8 | | | | 59,607,990 | |

| Money Market Fund | | | 0.1 | | | | 449,385 | |

| | | | 100.0 | % | | $ | 679,132,489 | |

The summary of inputs used to value the Fund’s investments as of March 31, 2017 is as follows:

| | | | | | Level 2 | | Level 3 | | | |

| | | Level 1 | | | Significant | | Significant | | | |

| | | Quoted | | | Observable | | Unobservable | | | |

| | | Prices | | | Inputs | | Inputs | | Value | |

| Common Stocks* | | $ | 678,683,104 | | | $ | — | | | $ | — | | | $ | 678,683,104 | |

| Money Market Fund | | | 449,385 | | | | — | | | | — | | | | 449,385 | |

| Repurchase Agreements | | | — | | | | 33,907,816 | | | | — | | | | 33,907,816 | |

| Total | | $ | 679,132,489 | | | $ | 33,907,816 | | | $ | — | | | $ | 713,040,305 | |

* See Schedule of Investments for security type and geographic sector breakouts.

There were no transfers between levels during the period ended March 31, 2017.

See Notes to Financial Statements

VANECK VECTORS ENVIRONMENTAL SERVICES ETF

SCHEDULE OF INVESTMENTS

March 31, 2017 (unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| |

| COMMON STOCKS: 100.0% | | | | |

| Canada: 10.0% | | | | |

| | 22,019 | | | Waste Connections, Inc. (USD) | | $ | 1,942,516 | |

| United Kingdom: 3.8% | | | | |

| | 10,770 | | | Steris Plc (USD) | | | 748,084 | |

| United States: 86.2% | | | | |

| | 16,948 | | | ABM Industries, Inc. | | | 738,933 | |

| | 32,381 | | | Advanced Disposal Services Inc * | | | 731,811 | |

| | 53,506 | | | Calgon Carbon Corp. | | | 781,188 | |

| | 9,769 | | | Cantel Medical Corp. | | | 782,497 | |

| | 27,562 | | | Casella Waste Systems, Inc. * | | | 388,900 | |

| | 36,125 | | | Ceco Environmental Corp. | | | 379,674 | |

| | 13,342 | | | Clean Harbors, Inc. * | | | 742,082 | |

| | 48,243 | | | Covanta Holding Corp. † | | | 757,415 | |

| | 51,197 | | | Darling International, Inc. * | | | 743,380 | |

| | 16,345 | | | Donaldson Company, Inc. | | | 744,024 | |

| | 48,735 | | | Layne Christensen Co. * † | | | 430,817 | |

| | 50,009 | | | Newpark Resources, Inc. * | | | 405,073 | |

| | 30,542 | | | Republic Services, Inc. | | | 1,918,343 | |

| | 18,662 | | | Schnitzer Steel Industries, Inc. | | | 385,370 | |

| | 23,316 | | | Stericycle, Inc. * | | | 1,932,663 | |

| | 10,384 | | | Tennant Co. | | | 754,398 | |

| | 11,771 | | | Tenneco, Inc. | | | 734,746 | |

| | 18,324 | | | Tetra Tech, Inc. | | | 748,535 | |

| | 15,687 | | | US Ecology, Inc. | | | 734,936 | |

| | 26,362 | | | Waste Management, Inc. | | | 1,922,317 | |

| | | | | | | | 16,757,102 | |

Total Common Stocks

(Cost: $16,450,233) | | | 19,447,702 | |

| Number | | | | | | |

| of Shares | | | | | Value | |

| |

| MONEY MARKET FUND: 0.0% | | | | |

| (Cost: $500) | | | | |

| | 500 | | | Dreyfus Government Cash Management Fund | | $ | 500 | |

Total Investments Before Collateral for Securities Loaned: 100.0%

(Cost: $16,450,733) | | 19,448,202 | |

| | | | | | | | | |

| Principal | | | | | | | |

| Amount | | | | | | | |

SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES LOANED: 3.7%

(Cost: $713,132) | | | |

| Repurchase Agreement: 3.7% | | | | |

| | $713,132 | | | Repurchase agreement dated 3/31/17 with Nomura Securities International, Inc., 0.81%, due 4/3/17, proceeds $713,180; (collateralized by various U.S. government and agency obligations, 0.00% to 7.50%, due 4/19/17 to 2/20/67, valued at $727,395 including accrued interest) | | | 713,132 | |

Total Investments: 103.7%

(Cost: $17,163,865) | | | 20,161,334 | |

| Liabilities in excess of other assets: (3.7)% | | | (722,546 | ) |

| NET ASSETS: 100.0% | | $ | 19,438,788 | |

| USD | United States Dollar |

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $696,696. |

Summary of Investments by Sector Excluding

Collateral for Securities Loaned (unaudited) | | % of Investments | | Value | |

| Consumer Discretionary | | | 3.8 | % | | $ | 734,746 | |

| Consumer Staples | | | 3.8 | | | | 743,380 | |

| Energy | | | 2.1 | | | | 405,073 | |

| Health Care | | | 7.9 | | | | 1,530,581 | |

| Industrials | | | 76.4 | | | | 14,867,364 | |

| Materials | | | 6.0 | | | | 1,166,558 | |

| Money Market Fund | | | 0.0 | | | | 500 | |

| | | | 100.0 | % | | $ | 19,448,202 | |

The summary of inputs used to value the Fund’s investments as of March 31, 2017 is as follows:

| | | | | Level 2 | | Level 3 | | | |

| | | Level 1 | | Significant | | Significant | | | |

| | | Quoted | | Observable | | Unobservable | | | |

| | | Prices | | Inputs | | Inputs | | Value | |

| Common Stocks* | | $ | 19,447,702 | | | $ | — | | | | $ | — | | | $ | 19,447,702 | |

| Money Market Fund | | | 500 | | | | — | | | | | — | | | | 500 | |

| Repurchase Agreement | | | — | | | | 713,132 | | | | | — | | | | 713,132 | |

| Total | | $ | 19,448,202 | | | $ | 713,132 | | | | $ | — | | | $ | 20,161,334 | |

* See Schedule of Investments for security type and geographic sector breakouts.

There were no transfers between levels during the period ended March 31, 2017.

See Notes to Financial Statements

VANECK VECTORS GAMING ETF

SCHEDULE OF INVESTMENTS

March 31, 2017 (unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| |

| COMMON STOCKS: 96.7% | | | | |

| Australia: 15.6% | | | | |

| | 83,720 | | | Aristocrat Leisure Ltd. # | | $ | 1,147,455 | |

| | 67,854 | | | Crown Ltd. # | | | 611,196 | |

| | 88,526 | | | Star Entertainment Group Ltd. # | | | 369,319 | |

| | 120,384 | | | TABCORP Holdings Ltd. # | | | 436,200 | |

| | 201,328 | | | Tatts Group Ltd. # | | | 680,227 | |

| | | | | | | | 3,244,397 | |

| Canada: 0.7% | | | | |

| | 8,187 | | | Amaya, Inc. (USD) * † | | | 139,179 | |

| China / Hong Kong: 22.7% | | | | |

| | 275,240 | | | Galaxy Entertainment Group Ltd. # | | | 1,507,533 | |

| | 26,806 | | | Melco Crown Entertainment Ltd. (ADR) | | | 496,983 | |

| | 146,900 | | | MGM China Holdings Ltd. # | | | 306,326 | |

| | 360,800 | | | Sands China Ltd. # | | | 1,672,521 | |

| | 378,000 | | | SJM Holdings Ltd. # | | | 307,656 | |

| | 200,800 | | | Wynn Macau Ltd. # | | | 408,974 | |

| | | | | | | | 4,699,993 | |

| Greece: 1.4% | | | | |

| | 31,959 | | | OPAP SA # | | | 298,191 | |

| Ireland: 5.9% | | | | |

| | 11,376 | | | Paddy Power Betfair Plc # | | | 1,226,476 | |

| Japan: 4.6% | | | | |

| | 10,000 | | | Heiwa Corp. # | | | 249,022 | |

| | 8,079 | | | Sankyo Co. Ltd. # | | | 270,362 | |

| | 32,800 | | | Sega Sammy Holdings, Inc. # | | | 440,765 | |

| | | | | | | | 960,149 | |

| Malaysia: 3.4% | | | | |

| | 130,267 | | | Berjaya Sports Toto Bhd | | | 85,657 | |

| | 508,098 | | | Genting Malaysia Bhd # | | | 625,627 | |

| | | | | | | | 711,284 | |

| Malta: 1.7% | | | | |

| | 34,381 | | | Unibet Group Plc # | | | 357,422 | |

| New Zealand: 1.2% | | | | |

| | 84,871 | | | Sky City Entertainment Group Ltd. # | | | 246,098 | |

| Singapore: 3.5% | | | | |

| | 993,400 | | | Genting Singapore Plc # | | | 725,224 | |

| South Africa: 0.7% | | | | |

| | 70,075 | | | Tsogo Sun Holdings Ltd. # | | | 144,054 | |

| South Korea: 3.4% | | | | |

| | 17,296 | | | Kangwon Land, Inc. # | | | 591,197 | |

| | 8,951 | | | Paradise Co. Ltd. # | | | 110,445 | |

| | | | | | | | 701,642 | |

| Sweden: 2.1% | | | | |

| | 19,753 | | | Betsson AB # | | | 172,503 | |

| | 32,298 | | | NetEnt AB # | | | 260,173 | |

| | | | | | | | 432,676 | |

| Number | | | | | | |

| of Shares | | | | | Value | |

| |

| United Kingdom: 6.3% | | | | |

| | 39,295 | | | GVC Holdings Plc # | | $ | 360,370 | |

| | 181,715 | | | Ladbrokes Plc # | | | 293,574 | |

| | 29,004 | | | Playtech Ltd. # | | | 337,744 | |

| | 84,426 | | | William Hill Plc # | | | 307,285 | |

| | | | | | | | 1,298,973 | |

| United States: 23.5% | | | | |

| | 10,531 | | | Boyd Gaming Corp. * | | | 231,787 | |

| | 1,588 | | | Churchill Downs, Inc. | | | 252,254 | |

| | 17,314 | | | International Game Technology Plc | | | 410,342 | |

| | 29,009 | | | Las Vegas Sands Corp. | | | 1,655,544 | |

| | 49,545 | | | MGM Mirage | | | 1,357,533 | |

| | 10,543 | | | Penn National Gaming, Inc. * | | | 194,307 | |

| | 6,808 | | | Wynn Resorts Ltd. | | | 780,265 | |

| | | | | | | | 4,882,032 | |

Total Common Stocks

(Cost: $21,735,880) | | | 20,067,790 | |

REAL ESTATE INVESTMENT TRUST: 3.3%

(Cost: $687,577) | | | | |

| United States: 3.3% | | | | |

| | 20,814 | | | Gaming and Leisure Properties, Inc. | | | 695,604 | |

Total Investments Before Collateral for Securities Loaned: 100.0%

(Cost: $22,423,457) | | 20,763,394 | |

| | | | | |

| Principal | | | | | | | |

| Amount | | | | | | | |

SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES LOANED: 0.1%

(Cost: $15,995) | | | |

| | | | |

| Repurchase Agreement: 0.1% | | | | |

| | $15,995 | | | Repurchase agreement dated 3/31/17 with Nomura Securities International, Inc., 0.81%, due 4/3/17, proceeds $15,996; (collateralized by various U.S. government and agency obligations, 0.00% to 7.50%, due 4/19/17 to 2/20/67, valued at $16,315 including accrued interest) | | | 15,995 | |

Total Investments: 100.1%

(Cost: $22,439,452) | | | 20,779,389 | |

| Liabilities in excess of other assets: (0.1)% | | | (19,590 | ) |

| NET ASSETS: 100.0% | | $ | 20,759,799 | |

See Notes to Financial Statements

| ADR | American Depositary Receipt |

| USD | United States Dollar |

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $15,300. |

| # | Indicates a fair valued security which has been valued in good faith pursuant to guidelines established by the Board of Trustees. The aggregate value of fair valued securities is $14,463,939 which represents 69.7% of net assets. |

Summary of Investments by Sector Excluding

Collateral for Securities Loaned (unaudited) | | % of Investments | | Value | |

| Consumer Discretionary | | | 93.8 | % | | $ | 19,469,873 | |

| Information Technology | | | 2.9 | | | | 597,917 | |

| Real Estate | | | 3.3 | | | | 695,604 | |

| | | | 100.0 | % | | $ | 20,763,394 | |

The summary of inputs used to value the Fund’s investments as of March 31, 2017 is as follows:

| | | | | | Level 2 | | Level 3 | | | |

| | | Level 1 | | | Significant | | Significant | | | |

| | | Quoted | | | Observable | | Unobservable | | | |

| | | Prices | | | Inputs | | Inputs | | Value | |

| Common Stocks | | | | | | | | | | | | | | | | | |

| Australia | | | $ | — | | | $ | 3,244,397 | | | $ | — | | | $ | 3,244,397 | |

| Canada | | | | 139,179 | | | | — | | | | — | | | | 139,179 | |

| China / Hong Kong | | | | 496,983 | | | | 4,203,010 | | | | — | | | | 4,699,993 | |

| Greece | | | | — | | | | 298,191 | | | | — | | | | 298,191 | |

| Ireland | | | | — | | | | 1,226,476 | | | | — | | | | 1,226,476 | |

| Japan | | | | — | | | | 960,149 | | | | — | | | | 960,149 | |

| Malaysia | | | | 85,657 | | | | 625,627 | | | | — | | | | 711,284 | |

| Malta | | | | — | | | | 357,422 | | | | — | | | | 357,422 | |

| New Zealand | | | | — | | | | 246,098 | | | | — | | | | 246,098 | |

| Singapore | | | | — | | | | 725,224 | | | | — | | | | 725,224 | |

| South Africa | | | | — | | | | 144,054 | | | | — | | | | 144,054 | |

| South Korea | | | | — | | | | 701,642 | | | | — | | | | 701,642 | |

| Sweden | | | | — | | | | 432,676 | | | | — | | | | 432,676 | |

| United Kingdom | | | | — | | | | 1,298,973 | | | | — | | | | 1,298,973 | |

| United States | | | | 4,882,032 | | | | — | | | | — | | | | 4,882,032 | |

| Real Estate Investment Trust | | | | | | | | | | | | | | | | | |

| United States | | | | 695,604 | | | | — | | | | — | | | | 695,604 | |

| Repurchase Agreement | | | | — | | | | 15,995 | | | | — | | | | 15,995 | |

| Total | | | $ | 6,299,455 | | | $ | 14,479,934 | | | $ | — | | | $ | 20,779,389 | |

During the period ended March 31, 2017, transfers of securities from Level 1 to Level 2 were $388,946. These transfers resulted primarily from changes in certain foreign securities valuation methodologies between the last close of the securities’ primary market (Level 1) and valuation by a pricing service (Level 2), which takes into account market direction or events occurring before the Fund’s pricing time but after the last local close, as described in the Notes to Financial Statements.

See Notes to Financial Statements

VANECK VECTORS GENERIC DRUGS ETF

SCHEDULE OF INVESTMENTS

March 31, 2017 (unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | |

| COMMON STOCKS: 99.8% | | | | |

| Belgium: 4.8% | | | | |

| | 2,792 | | | UCB SA # | | $ | 217,129 | |

| China / Hong Kong: 7.5% | | | | |

| | 86,000 | | | CSPC Pharmaceutical Group Ltd. # | | | 112,670 | |

| | 2,400 | | | Guangzhou Baiyunshan Pharmaceutical Holdings Co. Ltd. # | | | 7,076 | |

| | 5,500 | | | Shanghai Fosun Pharmaceutical Group Co. Ltd. # § | | 20,241 | |

| | 11,100 | | | Shanghai Pharmaceuticals Holding Co. Ltd. # | | | 29,078 | |

| | 106,000 | | | Sino Biopharmaceutical Ltd. # | | | 87,291 | |

| | 16,800 | | | Sinopharm Group Co. Ltd. # | | | 77,994 | |

| | | | | | | | 334,350 | |

| Finland: 1.7% | | | | |

| | 1,480 | | | Orion OYJ # | | | 77,402 | |

| Germany: 1.2% | | | | |

| | 894 | | | Stada Arzneimittel AG # | | | 54,896 | |

| Hungary: 1.4% | | | | |

| | 2,675 | | | Richter Gedeon Nyrt # | | | 60,870 | |

| India: 23.6% | | | | |

| | 8,397 | | | Aurobindo Pharma Ltd. # | | | 87,317 | |

| | 2,870 | | | Biocon Ltd. # | | | 50,049 | |

| | 14,689 | | | Cadila Healthcare Ltd. # | | | 99,987 | |

| | 11,542 | | | Cipla Ltd. # | | | 105,403 | |

| | 2,377 | | | Dr. Reddy’s Laboratories Ltd. (ADR) | | | 95,437 | |

| | 4,048 | | | Glenmark Pharmaceuticals Ltd. # | | | 53,120 | |

| | 6,479 | | | Lupin Ltd. # | | | 144,207 | |

| | 34,225 | | | Sun Pharmaceuticals Industries Ltd. # | | | 362,716 | |

| | 2,428 | | | Torrent Pharmaceuticals Ltd. # | | | 58,058 | |

| | | | | | | | 1,056,294 | |

| Indonesia: 1.7% | | | | |

| | 672,600 | | | Kalbe Farma Tbk PT # | | | 77,729 | |

| Ireland: 7.3% | | | | |

| | 2,189 | | | Alkermes Plc (USD) * | | | 128,057 | |

| | 782 | | | ICON Plc (USD) * | | | 62,341 | |

| | 2,057 | | | Perrigo Co. Plc (USD) | | | 136,564 | |

| | | | | | | | 326,962 | |

| Israel: 9.2% | | | | |

| | 589 | | | Taro Pharmaceutical Industries Ltd. (USD) * † | | | 68,689 | |

| | 10,760 | | | Teva Pharmaceutical Industries Ltd. (ADR) | | | 345,288 | |

| | | | | | | | 413,977 | |

| Japan: 7.1% | | | | |

| | 1,400 | | | Hisamitsu Pharmaceutical Co., Inc. # | | | 80,082 | |

| | 8,200 | | | Kyowa Hakko Kirin Co. Ltd. # | | | 130,182 | |

| | 1,300 | | | Taisho Pharmaceutical Holdings Co. Ltd. # | | | 105,756 | |

| | | | | | | | 316,020 | |

| Number | | | | | | |

| of Shares | | | | | Value | |

| |

| Jordan: 1.9% | | | | |

| | 3,442 | | | Hikma Pharmaceuticals Plc (GBP) # | | $ | 85,330 | |

| South Africa: 3.0% | | | | |

| | 6,549 | | | Aspen Pharmacare Holdings Ltd. # | | | 134,063 | |

| South Korea: 4.2% | | | | |

| | 1,757 | | | Celltrion, Inc. * # | | | 141,541 | |

| | 894 | | | Hanmi Science Co. Ltd. * # | | | 46,674 | |

| | | | | | | | 188,215 | |

| Switzerland: 3.5% | | | | |

| | 830 | | | Lonza Group AG # | | | 156,997 | |

| United States: 21.7% | | | | |

| | 1,614 | | | Albemarle Corp. | | | 170,503 | |

| | 679 | | | Charles River Laboratories International, Inc. * | | | 61,076 | |

| | 1,503 | | | Mallinckrodt Plc * | | | 66,989 | |

| | 7,178 | | | Mylan NV * | | | 279,870 | |

| | 8,009 | | | Opko Health, Inc. * † | | | 64,072 | |

| | 884 | | | PRA Health Sciences, Inc. * | | | 57,663 | |

| | 3,385 | | | Quintiles Transnational Holdings, Inc. * | | | 272,594 | |

| | | | | | | | 972,767 | |

Total Common Stocks

(Cost: $4,598,536) | | | 4,473,001 | |

MONEY MARKET FUND: 10.7%

(Cost: $479,744) | | | | |

| | 479,744 | | | Dreyfus Government Cash Management Fund | | | 479,744 | |

Total Investments Before Collateral for Securities Loaned: 110.5%

(Cost: $5,078,280) | | 4,952,745 | |

| | | | | |

| Principal | | | | | | | |

| Amount | | | | | | | |

SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES LOANED: 2.1%

(Cost: $92,280) | | | |

| Repurchase Agreement: 2.1% | | | | |

| | $92,280 | | | Repurchase agreement dated 3/31/17 with Citigroup Global Markets, Inc., 0.81%, due 4/3/17, proceeds $92,286; (collateralized by various U.S. government and agency obligations, 0.00% to 11.50%, due 4/1/17 to 6/1/52, valued at $94,126 including accrued interest) | | | 92,280 | |

Total Investments: 112.6%

(Cost: $5,170,560) | | | 5,045,025 | |

| Liabilities in excess of other assets: (12.6)% | | | (564,450 | ) |

| NET ASSETS: 100.0% | | $ | 4,480,575 | |

See Notes to Financial Statements

| ADR | American Depositary Receipt |

| GBP | British Pound |

| USD | United States Dollar |

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $89,319. |

| # | Indicates a fair valued security which has been valued in good faith pursuant to guidelines established by the Board of Trustees. The aggregate value of fair valued securities is $2,663,858 which represents 59.5% of net assets. |

| § | Illiquid Security — the aggregate value of illiquid securities is $20,241 which represents 0.5% of net assets. |

Summary of Investments by Sector Excluding

Collateral for Securities Loaned (unaudited) | | % of Investments | | Value | |

| Biotechnology | | | 7.8 | % | | $ | 383,719 | |

| Health Care Distributors | | | 2.2 | | | | 107,072 | |

| Life Sciences Tools & Services | | | 12.3 | | | | 610,671 | |

| Pharmaceuticals | | | 64.6 | | | | 3,201,036 | |

| Specialty Chemicals | | | 3.4 | | | | 170,503 | |

| Money Market Fund | | | 9.7 | | | | 479,744 | |

| | | | 100.0 | % | | $ | 4,952,745 | |

The summary of inputs used to value the Fund’s investments as of March 31, 2017 is as follows:

| | | | | | Level 2 | | Level 3 | | | |

| | | Level 1 | | | Significant | | Significant | | | |

| | | Quoted | | | Observable | | Unobservable | | | |

| | | Prices | | | Inputs | | Inputs | | Value | |

| Common Stocks | | | | | | | | | | | | | | | | | | |

| Belgium | | | $ | — | | | | $ | 217,129 | | | $ | — | | | $ | 217,129 | |

| China / Hong Kong | | | | — | | | | | 334,350 | | | | — | | | | 334,350 | |

| Finland | | | | — | | | | | 77,402 | | | | — | | | | 77,402 | |

| Germany | | | | — | | | | | 54,896 | | | | — | | | | 54,896 | |

| Hungary | | | | — | | | | | 60,870 | | | | — | | | | 60,870 | |

| India | | | | 95,437 | | | | | 960,857 | | | | — | | | | 1,056,294 | |

| Indonesia | | | | — | | | | | 77,729 | | | | — | | | | 77,729 | |

| Ireland | | | | 326,962 | | | | | — | | | | — | | | | 326,962 | |

| Israel | | | | 413,977 | | | | | — | | | | — | | | | 413,977 | |

| Japan | | | | — | | | | | 316,020 | | | | — | | | | 316,020 | |

| Jordan | | | | — | | | | | 85,330 | | | | — | | | | 85,330 | |

| South Africa | | | | — | | | | | 134,063 | | | | — | | | | 134,063 | |

| South Korea | | | | — | | | | | 188,215 | | | | — | | | | 188,215 | |

| Switzerland | | | | — | | | | | 156,997 | | | | — | | | | 156,997 | |

| United States | | | | 972,767 | | | | | — | | | | — | | | | 972,767 | |

| Money Market Fund | | | | 479,744 | | | | | — | | | | — | | | | 479,744 | |

| Repurchase Agreement | | | | — | | | | | 92,280 | | | | — | | | | 92,280 | |

| Total | | | $ | 2,288,887 | | | | $ | 2,756,138 | | | $ | — | | | $ | 5,045,025 | |

There were no transfers between levels during the period ended March 31, 2017.

See Notes to Financial Statements

VANECK VECTORS PHARMACEUTICAL ETF

SCHEDULE OF INVESTMENTS

March 31, 2017 (unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | | |

| COMMON STOCKS: 99.6% | | | | |

| Denmark: 4.7% | | | | |

| | 454,049 | | | Novo-Nordisk AS (ADR) | | $ | 15,564,800 | |

| France: 5.2% | | | | |

| | 384,526 | | | Sanofi SA (ADR) | | | 17,399,802 | |

| Ireland: 7.1% | | | | |

| | 197,960 | | | Endo International Plc (USD) * | | | 2,209,234 | |

| | 60,049 | | | Jazz Pharmaceuticals Plc (USD) * | | | 8,714,911 | |

| | 189,746 | | | Perrigo Co. Plc (USD) † | | | 12,597,237 | |

| | | | | | | | 23,521,382 | |

| Israel: 4.4% | | | | |

| | 456,126 | | | Teva Pharmaceutical Industries Ltd. (ADR) | | | 14,637,083 | |

| Switzerland: 5.9% | | | | |

| | 263,466 | | | Novartis AG (ADR) | | | 19,567,620 | |

| United Kingdom: 11.5% | | | | |

| | 565,740 | | | AstraZeneca Plc (ADR) † | | | 17,617,144 | |

| | 404,531 | | | GlaxoSmithKline Plc (ADR) | | | 17,055,027 | |

| | 29,557 | | | GW Pharmaceuticals Plc (ADR) * † | | | 3,574,624 | |

| | | | | | | | 38,246,795 | |

| United States: 60.8% | | | | |

| | 259,409 | | | AbbVie, Inc. | | | 16,903,090 | |

| | 116,718 | | | Akorn, Inc. | | | 2,810,569 | |

| | 168,103 | | | AmerisourceBergen Corp. | | | 14,877,116 | |

| | 291,290 | | | Bristol-Myers Squibb Co. | | | 15,840,350 | |

| | 179,531 | | | Eli Lilly & Co. | | | 15,100,352 | |

| | 236,739 | | | Johnson & Johnson | | | 29,485,843 | |

| | 122,867 | | | Mallinckrodt Plc * | | | 5,476,182 | |

| | 101,296 | | | McKesson Corp. | | | 15,018,145 | |

| | 252,864 | | | Merck and Co., Inc. | | | 16,066,979 | |

| | 344,481 | | | Mylan NV * | | | 13,431,314 | |

| | 102,515 | | | Patterson Cos, Inc. † | | | 4,636,753 | |

| | 519,300 | | | Pfizer, Inc. | | | 17,765,253 | |

| | 84,127 | | | Shire Plc (ADR) | | | 14,657,447 | |

| | 497,272 | | | Valeant Pharmaceuticals International, Inc. * † | | | 5,484,910 | |

| | 282,540 | | | Zoetis, Inc. | | | 15,079,160 | |

| | | | | | | | 202,633,463 | |

Total Common Stocks

(Cost: $400,880,624) | | | 331,570,945 | |

MONEY MARKET FUND: 0.0%

(Cost: $85,039) | | | | |

| | 85,039 | | | Dreyfus Government Cash Management Fund | | | 85,039 | |

Total Investments Before Collateral for Securities Loaned: 99.6%

(Cost: $400,965,663) | | 331,655,984 | |

| Principal Amount | | | | | Value | |

| | | | | |

| SHORT-TERM INVESTMENTS HELD AS COLLATERAL FOR SECURITIES LOANED: 9.5% | | | | |

| Repurchase Agreements: 9.5% | | | | |

| $ | 7,540,381 | | | Repurchase agreement dated 3/31/17 with Citigroup Global Markets, Inc., 0.81%, due 4/3/17, proceeds $7,540,890; (collateralized by various U.S. government and agency obligations, 0.00% to 11.50%, due 4/1/17 to 6/1/52, valued at $7,691,189 including accrued interest) | | $ | 7,540,381 | |

| | 7,540,381 | | | Repurchase agreement dated 3/31/17 with Daiwa Capital Markets America, Inc., 0.82%, due 4/3/17, proceeds $7,540,896; (collateralized by various U.S. government and agency obligations, 0.00% to 6.50%, due 5/11/17 to 12/1/51, valued at $7,691,189 including accrued interest) | | | 7,540,381 | |

| | 1,586,801 | | | Repurchase agreement dated 3/31/17 with HSBC Securities USA, Inc., 0.77%, due 4/3/17, proceeds $1,586,903; (collateralized by various U.S. government and agency obligations, 0.00% to 2.13%, due 5/15/25 to 11/15/45, valued at $1,618,538 including accrued interest) | | | 1,586,801 | |

| | 7,540,381 | | | Repurchase agreement dated 3/31/17 with Merrill Lynch, Pierce, Fenner & Smith, Inc., 0.83%, due 4/3/17, proceeds $7,540,903; (collateralized by various U.S. government and agency obligations, 1.84% to 7.00%, due 5/1/17 to 12/1/46, valued at $7,691,189 including accrued interest) | | | 7,540,381 | |

| | 7,540,381 | | | Repurchase agreement dated 3/31/17 with Nomura Securities International, Inc., 0.81%, due 4/3/17, proceeds $7,540,890; (collateralized by various U.S. government and agency obligations, 0.00% to 7.50%, due 4/19/17 to 2/20/67, valued at $7,691,189 including accrued interest) | | | 7,540,381 | |

Total Short-Term Investments Held as Collateral for Securities Loaned

(Cost: $31,748,325) | | | 31,748,325 | |

Total Investments: 109.1%

(Cost: $432,713,988) | | | 363,404,309 | |

| Liabilities in excess of other assets: (9.1)% | | | (30,269,642 | ) |

| NET ASSETS: 100.0% | | $ | 333,134,667 | |

See Notes to Financial Statements

| ADR | American Depositary Receipt |

| USD | United States Dollar |

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $30,837,658. |

Summary of Investments by Sector Excluding

Collateral for Securities Loaned (unaudited) | | % of Investments | | Value | |

| Health Care | | | 19.8 | % | | $ | 65,729,045 | |

| Pharmaceuticals | | | 80.2 | | | | 265,841,900 | |

| Money Market Fund | | | 0.0 | | | | 85,039 | |

| | | | 100.0 | % | | $ | 331,655,984 | |

The summary of inputs used to value the Fund’s investments as of March 31, 2017 is as follows:

| | | | | | Level 2 | | | Level 3 | | | |

| | | Level 1 | | | Significant | | | Significant | | | |

| | | Quoted | | | Observable | | | Unobservable | | | |

| | | Prices | | | Inputs | | | Inputs | | Value | |

| Common Stocks* | | $ | 331,570,945 | | | $ | — | | | | $ | — | | | $ | 331,570,945 | |

| Money Market Fund | | | 85,039 | | | | — | | | | | — | | | | 85,039 | |

| Repurchase Agreements | | | — | | | | 31,748,325 | | | | | — | | | | 31,748,325 | |

| Total | | $ | 331,655,984 | | | $ | 31,748,325 | | | | $ | — | | | $ | 363,404,309 | |

* See Schedule of Investments for security type and geographic sector breakouts.

There were no transfers between levels during the period ended March 31, 2017.

See Notes to Financial Statements

VANECK VECTORS RETAIL ETF

SCHEDULE OF INVESTMENTS

March 31, 2017 (unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | | | | |

| COMMON STOCKS: 100.1% | | | | |

| China / Hong Kong: 4.4% | | | | |

| | 109,000 | | | JD.com, Inc. (ADR) * | | $ | 3,390,990 | |

| United States: 95.7% | | | | |

| | 14,576 | | | Amazon.com, Inc. * | | | 12,922,207 | |

| | 19,441 | | | AmerisourceBergen Corp. | | | 1,720,529 | |

| | 2,526 | | | AutoZone, Inc. | | | 1,826,424 | |

| | 16,948 | | | Bed Bath & Beyond, Inc. † | | | 668,768 | |

| | 27,634 | | | Best Buy Co., Inc. | | | 1,358,211 | |

| | 32,895 | | | Cardinal Health, Inc. | | | 2,682,587 | |

| | 22,880 | | | Costco Wholesale Corp. | | | 3,836,747 | |

| | 47,115 | | | CVS Caremark Corp. | | | 3,698,527 | |

| | 29,338 | | | Dollar General Corp. | | | 2,045,739 | |

| | 40,844 | | | Home Depot, Inc. | | | 5,997,125 | |

| | 18,801 | | | Kohl’s Corp. † | | | 748,468 | |

| | 105,062 | | | Kroger Co. | | | 3,098,278 | |

| | 26,945 | | | L Brands, Inc. | | | 1,269,110 | |

| | 46,809 | | | Lowe’s Cos., Inc. | | | 3,848,168 | |

| | 38,362 | | | MACY’S, Inc. | | | 1,137,050 | |

| | 22,719 | | | McKesson Corp. | | | 3,368,319 | |

| | 40,510 | | | Ross Stores, Inc. | | | 2,668,394 | |

| | 63,759 | | | Sysco Corp. | | | 3,310,367 | |

| | 63,393 | | | Target Corp. | | | 3,498,660 | |

| | 30,968 | | | The Gap, Inc. † | | | 752,213 | |

| | 43,811 | | | TJX Cos., Inc. | | | 3,464,574 | |

| | 44,846 | | | Walgreens Boots Alliance, Inc. | | | 3,724,460 | |

| | 63,381 | | | Wal-Mart Stores, Inc. | | | 4,568,502 | |

| | 39,506 | | | Whole Foods Market, Inc. | | | 1,174,118 | |

| | | | | | | | 73,387,545 | |

Total Common Stocks

(Cost: $83,376,370) | | | 76,778,535 | |

| Principal | | | | | | |

| Amount | | | | | Value | |

| | | | | | | |

| SHORT-TERM INVESTMENTS HELD AS COLLATERAL FOR SECURITIES LOANED: 1.7% | | | | |

| Repurchase Agreements: 1.7% | | | | |

| $ | 303,849 | | | Repurchase agreement dated 3/31/17 with Citigroup Global Markets, Inc., 0.81%, due 4/3/17, proceeds $303,870; (collateralized by various U.S. government and agency obligations, 0.00% to 11.50%, due 4/1/17 to 6/1/52, valued at $309,926 including accrued interest) | | $ | 303,849 | |

| | 1,000,000 | | | Repurchase agreement dated 3/31/17 with Nomura Securities International, Inc., 0.81%, due 4/3/17, proceeds $1,000,068; (collateralized by various U.S. government and agency obligations, 0.00% to 7.50%, due 4/19/17 to 2/20/67, valued at $1,020,000 including accrued interest) | | | 1,000,000 | |

Total Short-Term Investments Held as Collateral for Securities Loaned

(Cost: $1,303,849) | | | 1,303,849 | |

Total Investments: 101.8%

(Cost: $84,680,219) | | | 78,082,384 | |

| Liabilities in excess of other assets: (1.8)% | | | (1,349,124 | ) |

| NET ASSETS: 100.0% | | $ | 76,733,260 | |

| | |

| ADR | American Depositary Receipt |

| * | Non-income producing |

| † | Security fully or partially on loan. Total market value of securities on loan is $1,261,366. |

Summary of Investments by Sector Excluding

Collateral for Securities Loaned (unaudited) | | % of Investments | | Value | |

| Consumer Discretionary | | | 59.4 | % | | $ | 45,596,101 | |

| Consumer Staples | | | 30.5 | | | | 23,410,999 | |

| Health Care | | | 10.1 | | | | 7,771,435 | |

| | | | 100.0 | % | | $ | 76,778,535 | |

The summary of inputs used to value the Fund’s investments as of March 31, 2017 is as follows:

| | | | | | Level 2 | | Level 3 | | | |

| | | Level 1 | | | Significant | | Significant | | | |

| | | Quoted | | | Observable | | Unobservable | | | |

| | | Prices | | | Inputs | | Inputs | | Value | |

| Common Stocks* | | $ | 76,778,535 | | | | $ | — | | | | $ | — | | | $ | 76,778,535 | |

| Repurchase Agreements | | | — | | | | | 1,303,849 | | | | | — | | | | 1,303,849 | |

| Total | | $ | 76,778,535 | | | | $ | 1,303,849 | | | | $ | — | | | $ | 78,082,384 | |

* See Schedule of Investments for security type and geographic sector breakouts.

There were no transfers between levels during the period ended March 31, 2017.

See Notes to Financial Statements

VANECK VECTORS SEMICONDUCTOR ETF

SCHEDULE OF INVESTMENTS

March 31, 2017 (unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | | | | |

| COMMON STOCKS: 100.0% | | | | |

| Bermuda: 1.6% | | | | |

| | 725,654 | | | Marvell Technology Group Ltd. (USD) | | $ | 11,073,480 | |

| Netherlands: 9.1% | | | | |

| | 257,622 | | | ASML Holding NV (USD) | | | 34,212,202 | |

| | 299,516 | | | NXP Semiconductors NV (USD) * | | | 30,999,906 | |

| | | | | | | | 65,212,108 | |

| Taiwan: 12.2% | | | | |

| | 2,662,122 | | | Taiwan Semiconductor Manufacturing Co. Ltd. (ADR) | | | 87,424,086 | |

| United States: 77.1% | | | | |

| | 1,345,000 | | | Advanced Micro Devices, Inc. * † | | | 19,569,750 | |

| | 372,678 | | | Analog Devices, Inc. | | | 30,540,962 | |

| | 929,463 | | | Applied Materials, Inc. | | | 36,156,111 | |

| | 157,365 | | | Broadcom Ltd. | | | 34,456,640 | |

| | 351,412 | | | Cadence Design Systems, Inc. * | | | 11,034,337 | |

| | 99,753 | | | Cavium, Inc. * | | | 7,148,300 | |

| | 2,259,609 | | | Intel Corp. | | | 81,504,097 | |

| | 223,903 | | | KLA-Tencor Corp. | | | 21,286,458 | |

| | 239,488 | | | Lam Research Corp. | | | 30,740,680 | |

| | 392,021 | | | Maxim Integrated Products, Inc. | | | 17,625,264 | |

| | 313,752 | | | Microchip Technology, Inc. | | | 23,148,623 | |

| | 1,225,770 | | | Micron Technology, Inc. * | | | 35,424,753 | |

| | 162,319 | | | Microsemi Corp. * | | | 8,364,298 | |

| | 350,702 | | | NVIDIA Corp. | | | 38,201,969 | |

| | 643,579 | | | ON Semiconductor Corp. * | | | 9,969,039 | |

| | 148,791 | | | Qorvo, Inc. * | | | 10,201,111 | |

| | 758,192 | | | Qualcomm, Inc. | | | 43,474,729 | |

| | 279,751 | | | Skyworks Solutions, Inc. | | | 27,410,003 | |

| | 294,573 | | | Teradyne, Inc. | | | 9,161,220 | |

| | 435,677 | | | Texas Instruments, Inc. | | | 35,098,139 | |

| | 355,662 | | | Xilinx, Inc. | | | 20,589,273 | |

| | | | | | | | 551,105,756 | |

Total Common Stocks

(Cost: $717,211,843) | | | 714,815,430 | |

MONEY MARKET FUND: 0.0%

(Cost: $246,004) | | | | |

| | 246,004 | | | Dreyfus Government Cash Management Fund | | | 246,004 | |

Total Investments Before Collateral for Securities

Loaned: 100.0%

(Cost: $717,457,847) | | | 715,061,434 | |

| Principal | | | | | | |

| Amount | | | | | Value | |

| | | | | | | |

| SHORT-TERM INVESTMENTS HELD AS COLLATERAL FOR SECURITIES LOANED: 2.2% | | | | |

| Repurchase Agreements: 2.2% | | | | |

| | $3,724,474 | | | Repurchase agreement dated 3/31/17 with Citigroup Global Markets, Inc., 0.81%, due 4/3/17, proceeds $3,724,725; (collateralized by various U.S. government and agency obligations, 0.00% to 11.50%, 4/1/17 to 6/1/52, valued at $3,798,963 including accrued interest) | | $ | 3,724,474 | |

| | 3,724,474 | | | Repurchase agreement dated 3/31/17 with Daiwa Capital Markets America, Inc., 0.82%, due 4/3/17, proceeds $3,724,729; (collateralized by various U.S. government and agency obligations, 0.00% to 6.50%, due 5/11/17 to 12/1/51, valued at $3,798,964 including accrued interest) | | | 3,724,474 | |

| | 783,764 | | | Repurchase agreement dated 3/31/17 with HSBC Securities USA, Inc., 0.77%, due 4/3/17, proceeds $783,814; (collateralized by various U.S. government and agency obligations, 0.00% to 2.13%, due 5/15/25 to 11/15/45, valued at $799,440 including accrued interest) | | | 783,764 | |

| | 3,724,474 | | | Repurchase agreement dated 3/31/17 with Merrill Lynch, Pierce, Fenner & Smith, Inc., 0.83%, due 4/3/17, proceeds $3,724,732; (collateralized by various U.S. government and agency obligations, 1.84% to 7.00%, due 5/1/17 to 12/1/46, valued at $3,798,963 including accrued interest) | | | 3,724,474 | |

| | 3,724,474 | | | Repurchase agreement dated 3/31/17 with Nomura Securities International, Inc., 0.81%, due 4/3/17, proceeds $3,724,725; (collateralized by various U.S. government and agency obligations, 0.00% to 7.50%, due 4/19/17 to 2/20/67, valued at $3,798,964 including accrued interest) | | | 3,724,474 | |

Total Short-Term Investments Held as Collateral for Securities Loaned

(Cost: $15,681,660) | | | 15,681,660 | |

Total Investments: 102.2%

(Cost: $733,139,507) | | | 730,743,094 | |

| Liabilities in excess of other assets: (2.2)% | | | (15,711,901 | ) |